united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22153

Dunham Funds

(Exact name of registrant as specified in charter)

10251 Vista Sorrento Pkwy, Ste. 200, San Diego, CA 92121

(Address of principal executive offices) (Zip code)

Richard Malinowski

Gemini Fund Services, LLC., 4221 N 203rd St., Suite 100, Elkhorn, NE 68022

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period: 4/30/20

Item 1. Reports to Stockholders.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Dunham Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Dunham Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Dunham Funds electronically by calling (888)-3DUNHAM (338-6426) or contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Dunham Funds or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling (888)-3DUNHAM (338-6426) or contacting your financial intermediary. Your election to receive reports in paper will apply to all Dunham Funds held by you or through your financial intermediary.

| This Semi-Annual Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those preceded by, followed by or that include the words “believes”, “expects”, “anticipates” or similar expressions. Such statements should be viewed with caution. Actual results or experience could differ materially from the forward-looking statements as a result of many factors. Each Fund makes no commitments to disclose any revisions to forward-looking statements, or any facts, events or circumstances after the date hereof that may bear upon forward-looking statements. In addition, prospective purchasers of the Funds should consider carefully the information set forth herein and the applicable fund’s prospectus. Other factors and assumptions not identified above may also have been involved in the derivation of these forward-looking statements, and the failure of these other assumptions to be realized may also cause actual results to differ materially from those projected. |

Dear Fellow Shareholders:

Remember your life pre-virus? Considering what our life was like before the coronavirus changed so much seems akin to traveling back to another age in civilization. Before the pandemic permeated every facet of our lives, corporate strength and economic prowess were in the fovea of most investors and economists, not the efficacy of various vaccines. While scrutinized intensely, corporate earnings were generally positive and the first phase of a trade deal with China had been signed. However, from beyond the periphery, the virus that had at first appeared innocuous when considered from a global perspective, suddenly and with impartiality impacted every citizen of the world. Markets were celebrating new all-time highs in mid-February before the self-induced shutdown, followed-up by investor panic, culminated into a decline in the S&P 500 of more than 33 percent in 33 days. Despite the invention and implementation of circuit breakers for the markets, the evacuation from equities eerily resembled the 1987 turmoil from which the constraints were birthed. In the 50 days following the peak, the S&P 500 fluctuated 24 times outside of a 3 percent trading band. There were 9 days where the S&P 500 experienced a swing greater than 5 percent. For perspective, in the 10-year period leading up to the February 19 market high, there were only 12 days (out of 2,516 trading days) that the S&P 500 moved more than 3 percent - and zero days that saw a move greater than 5 percent, let alone a circuit breaker tripped.

Market casualties appeared to pile rapidly, and similar to the virus, the sell-off was predominately indiscriminate. Foreign equities (both developed markets and emerging) and bonds (both investment-grade and high-yield) joined in the maelstrom that brought the world into the depths of a bear market. A two-week period in March marked the pinnacle of the pandemonium – particularly between March 6 and March 20. During this two-week period, bonds rated AAA and high-yield bonds dropped 16 percent and 17 percent, respectively. Although many U.S. Treasury bonds survived the Global Financial Crisis unscathed, the BofA Merrill Lynch 10-Year Treasury Bond Index posted a decline of 2 percent and the BofA Merrill Lynch 30-Year Treasury Bond Index a fall of 7 percent amidst March’s madness. Foreign equity markets saw the stocks of developed countries decline more than emerging markets, as developed market stocks fell 23 percent and emerging markets stocks toppled 21 percent. The synchronicity of the declines across the broad spectrum of asset classes evidenced the investor panic to escape to the exits with little regard to price, value, or quality – unproductively selling what they could, not what they wanted to sell.

Although parallels to previous markets may be identified in the decline, the response from central banks during the calamity was hearty and fast, sending a direct message of urgency and support. Central banks had clearly learned from the Global Financial Crisis that an impaired liquidity chain would exacerbate losses and hinder any recovery. Therefore, the Federal Open Market Committee quickly slashed interest rates to zero (the Fed Funds Rate stood at 150 basis points before March) and broadcasted that trillions would be spent (borrowed from our children and grandchildren) to support liquidity in the bond markets. Essentially, the key components that were implemented over the course of months and years during and after the Global Financial Crisis were deployed in just a couple of weeks.

Of course, no pandemic that leads to a global shutdown is exciting enough on its own – an oil price-war between Russia and Saudi Arabia compounded with the sudden disappearance of demand for oil (as sheltering in place obliterated fuel-based travel). This led to records being broken and unchartered territory suddenly unveiled as oil futures contracts not only traded at $0, but proceeded to slide deeply negative as participants who never had any intention (nor storage capacity) of taking delivery of the barrels scrambled to dump millions of barrels of oil contracts before maturity. While suburban households whimsically contemplated how many barrels they could store in their swimming pools, the drillers, frackers, refiners, and all entities up and down the supply chain reassessed their businesses amidst a seemingly impossible reality. From February 19 through March 23, the S&P 500 Energy Sector Index had spilled nearly 56 percent.

Such a storyboard, with each pane depicting a similar if not more gruesome image than the one before it, cannot coalesce to a pleasing tale. However, the overall conclusion of the fiscal period dramatically improved the results. Globally, as numerous countries announced reopening plans and light could be seen at the end of a long tunnel, the markets broadly roared back and some equity markets achieved their best April performance on record. Therefore, as investors examine this semi-annual period as a whole, the beginning-to-end percentage declines obscure the pitfall in the center. Specifically, the 3.2 percent overall decline in the S&P 500 nor the 13.2 percent decline in the MSCI All Country World ex U.S. Index appear anywhere near as dire as the story would suggest. In addition, there have been pockets of strength uncovered in the erosion, with the chaotic work-from-home environment rewarding many technology-oriented businesses. Many other companies have restructured balance sheets and some have sought to pay down debts. Another silver lining includes the extremely low interest rates and the related impact on broad borrowing rates, which has allowed many struggling businesses to effectively “buy time” to weather this storm at remarkably low financing rates. Nonetheless, most investors are looking ahead to a better conclusion that will be told in the months and quarters to come.

As I have personally invested alongside many of you during both calm and turbulent markets, such as the one we are weathering today, I am confident that we at Dunham have the tools and the discipline to navigate through this storm. While the specific attributes of this particular market environment may be unique, you can rely on us to continue to apply a rational and unemotional approach.

We thank you for your continued trust and the confidence you have placed in us. We take that trust very seriously. We look forward to servicing the investment needs for you and your family for generations to come.

Sincerely,

Jeffrey A. Dunham

President

Dunham & Associates

April 30, 2020

| Dunham Corporate/Government Bond Fund (Unaudited) |

| Message from the Sub-Adviser (Newfleet Asset Management, LLC) |

Asset Class Recap

Since the beginning of the fiscal year through the beginning of March, broad U.S. investment-grade bonds, as measured by the Barclays U.S. Aggregate Bond Index, had experienced a fairly steady increase. This was primarily promoted by an accommodative and reassuring Federal Open Market Committee, low default rates, and a strong economic backdrop. As the virus reached pandemic status and investors around the globe panicked into a rampant selling spree, nearly every asset class saw declines during the most negative two- week period in March that spanned from March 6 through March 20. Within the fixed income markets, that two- week period left little unscathed as broad U.S. investment-grade bonds fell 5.4 percent. Within that investment-grade basket, Treasury and government agency bonds, as measured by the BofA Merrill Lynch U.S. Treasury & Agency Index, declined 1.5 percent, while U.S. corporate bonds, as measured by the BofA Merrill Lynch U.S. Corporate Index, plummeted 15.1 percent. Outside of the investment-grade bond market, high- yield bonds, as measured by the BofA Merrill Lynch U.S. Cash Pay High-Yield Index, declined 17.1 percent, within close earshot to their investment-grade corporate bond counterparts, signaling that sellers were showing little regard to credit quality. When assessing the entire six-month period, broad U.S. investment-grade bonds posted a positive 4.9 percent return, which was primarily attributable to the 8.1 percent gain in Treasury and government agency bonds. U.S. investment-grade corporate bonds were slightly positive, up 1.5 percent, while high- yield bonds remained in negative territory, down 7.6 percent. The Treasury and government agency bonds, which tended to have longer durations, were greatly benefitted by the Fed’s actions in March where it decreased interest rates by 150 basis points and committed trillions of dollars to backstop liquidity markets, massively buoying the highly-interest-rate-sensitive Treasuries and agency securities.

Allocation Review

Broad U.S. investment-grade bonds in the benchmark index have more than 90 percent allocated to Treasury and government agency bonds and U.S. investment-grade corporate bonds. During the semi-annual period, the Fund maintained a similar exposure as the benchmark index to U.S. investment-grade corporate bonds, as it had an approximate 24 percent allocation. As this was one of the less negative bond sectors during the six-month period, the weighting neither detracted nor contributed toward relative returns. However, the Fund’s significant underweight to Treasury and government agency bonds, which comprise more than 40 percent of the benchmark index, significantly detracted from relative performance, as the Fund held less than a third of the benchmark index’s 70 percent allocation to these bond sectors. Therefore, where the Fund was most overweight versus the benchmark index was in residential mortgage-backed securities, corporate high- yield bonds, and asset-backed securities. While all three of these asset classes suffered negative performance in the Fund during the six-month period, the worst-performing was the high-yield bond exposure, albeit the total allocation in the Fund to high-yield bonds was less than 10 percent. The Fund did not have any exposure to derivatives during the semi-annual period that meaningfully affected performance.

Holdings Insights

As the investment-grade corporate bond exposure in the Fund was similar to the benchmark index, the security selection within the sector generally lagged during the six-month period. For example, one of the holdings that was directly in the crossfire of industries most affected by the global shutdown was Aviation Capital Group LLC. The Fund held the bond maturing in 2027 (05369AAA9) (holding weight*: 0.30 percent). Aviation Capital Group is an aircraft lessor, and with the coronavirus effectively shutting down the air travel industry, many investors expect that airlines, Aviation Capital Group’s primary customers, will seek lease deferrals and in some cases file for bankruptcy. This sentiment resulted in the sell-off of these bonds, as they declined 25.7 percent since the start of the fiscal year through April.

Despite the high-yield bond sector exhibiting some of the worst overall performance during the broad bond sell-off in March, some of the Fund’s holdings held up rather well. For example, the Fund held the Par Pharmaceutical, Inc. bond maturing in 2027 (69888XAA7) (holding weight*: 0.10 percent). After the company posted strong fourth quarter results, Par Pharmaceutical’s ties to the generic drug industry cause it to be minimally impacted by the COVID-19 crisis. During the six-month period, the Par Pharmaceutical bond increased 10.0 percent. Not faring quite as well within the high-yield bond space was the Fund’s holding in the Patterson UTI Energy Inc. bond maturing in 2029 (703481AC5) (holding weight*: 0.11 percent). Patterson UTI provides contract drilling and pressure pumping services to domestic companies. Demand for both services has plummeted with the decline in oil prices (pressure pumping declining more rapidly than the more publicized rig count due to shorter contracts) and while the company benefits from what the Sub- Adviser considers as a favorable liquidity position, the bonds traded down 35.7 percent in the second fiscal quarter given the poor industry outlook.

The Fund also held some municipal bonds, including a taxable municipal bond, the Texas State municipal bond maturing in 2044 (882724QP5) (holding weight*: 1.27 percent). As the long-maturity on the bond generally translated to higher interest-rate sensitivity, the extreme drop in long-term Treasury yields greatly benefitted this bond, as it increased 6.8 percent since it was purchased in November. The Fund also held some foreign bonds, including the Petroleos Mexicanos SA bond maturing in 2050 (71654QCW0) (holding weight*: 0.15 percent). Petroleos Mexicanos (aka Pemex) was impacted mainly by the sharp drop in oil prices which is estimated to result in a $15 to $20 billion funding gap in 2020. While the Sub- Adviser expects the Mexican government will ultimately step in and provide adequate support, there has been no comprehensive plan announced at this juncture. The Pemex bonds declined 29.6 percent during the six-month period.

Sub-Adviser Outlook

While nearly all technical indicators that the Sub- Adviser follows are negative across most of the bond sectors, the Sub-Adviser believes that valuations are highly attractive in many of those same sectors. While fundamentals have been shaken and may be tested further, the Sub- Adviser is optimistic that there are many opportunities that have been exposed during the recent sell-off. Therefore, the Sub-Adviser is confident that bond sector positioning and security selection will become increasingly more relevant in the months and quarters ahead.

| * | Holdings percentage(s) of total investments, excluding collateral for securities loaned, as of 4/30/2020. |

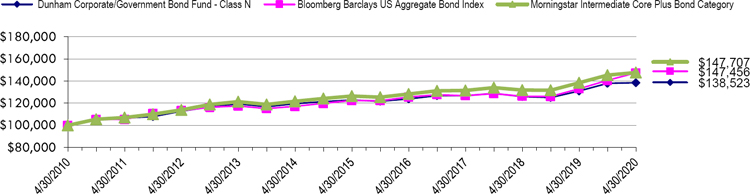

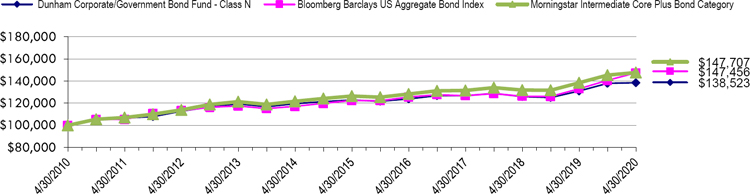

Growth of $100,000 Investment

| Total Returns (a) as of April 30, 2020 |

| | Six | | Annualized | Annualized |

| | Months | One Year | Five Years | Ten Years |

| Class N | 0.38% | 5.68% | 2.42% | 3.31% |

| Class C | (0.04)% | 4.89% | 1.66% | 2.55% |

| Class A with load of 4.50% | (4.27)% | 0.72% | 1.23% | 2.58% |

| Class A without load | 0.25% | 5.43% | 2.16% | 3.05% |

| Bloomberg Barclays US Aggregate Bond Index | 4.86% | 10.84% | 3.80% | 3.96% |

| Morningstar Intermediate Core Plus Bond Category | 1.59% | 6.67% | 3.16% | 3.98% |

| (a) | Total Returns are calculated based on traded NAVs. |

The Bloomberg Barclays US Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

The Morningstar Intermediate Core Plus Bond Category is generally representative of intermediate-term bond mutual funds that primarily invest in corporate and other investment-grade U.S. fixed-income securities and typically have durations of 3.5 to 6.0 years. Funds in this category also invest in high-yield and foreign bonds.

| As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses, including underlying funds, are 1.20% for Class N, 1.95% for Class C and 1.45% for Class A. Class A shares are subject to a sales load of 4.50% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of Fund shares or Fund distributions. For performance information current to the most recent month- end, please call 1-800-442-4358 or visit our website www.dunham.com. |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| CORPORATE BONDS & NOTES - 64.5% | | | | | | | | | | | | | | |

| AEROSPACE / DEFENSE - 0.6% | | | | | | | | | | | | | | |

| Boeing Co/The | | | | $ | 33,000 | | | 5.805 | | 5/1/2050 | | $ | 33,000 | |

| Boeing Co/The | | | | | 33,000 | | | 5.930 | | 5/1/2060 | | | 33,000 | |

| Howmet Aerospace, Inc. | | | | | 50,000 | | | 6.875 | | 5/1/2025 | | | 51,041 | |

| Signature Aviation US Holdings, Inc. - 144A | | | | | 105,000 | | | 4.000 | | 3/1/2028 | | | 89,738 | |

| TransDigm, Inc. - 144A | | | | | 90,000 | | | 5.500 | | 11/15/2027 | | | 76,469 | |

| | | | | | | | | | | | | | 283,248 | |

| AGRICULTURE - 0.5% | | | | | | | | | | | | | | |

| BAT Capital Corp. | | | | | 110,000 | | | 4.906 | | 4/2/2030 | | | 124,070 | |

| Bunge Ltd. Finance Corp. | | | | | 110,000 | | | 4.350 | | 3/15/2024 | | | 114,838 | |

| | | | | | | | | | | | | | 238,908 | |

| APPAREL - 0.4% | | | | | | | | | | | | | | |

| Hanesbrands, Inc. - 144A | | | | | 45,000 | | | 5.375 | | 5/15/2025 | | | 45,450 | |

| Under Armour, Inc. | | | | | 75,000 | | | 3.250 | | 6/15/2026 | | | 67,705 | |

| VF Corp. | | | | | 74,000 | | | 2.400 | | 4/23/2025 | | | 75,311 | |

| | | | | | | | | | | | | | 188,466 | |

| AUTO MANUFACTURERS - 0.2% | | | | | | | | | | | | | | |

| Ford Motor Co. | | | | | 103,000 | | | 9.000 | | 4/22/2025 | | | 100,811 | |

| | | | | | | | | | | | | | | |

| AUTO PARTS & EQUIPMENT - 0.6% | | | | | | | | | | | | | | |

| American Axle & Manufacturing, Inc. | | | | | 80,000 | | | 6.500 | | 4/1/2027 | | | 60,704 | |

| Dana, Inc. | | | | | 105,000 | | | 5.375 | | 11/15/2027 | | | 93,319 | |

| Lear Corp. ^ | | | | | 165,000 | | | 3.800 | | 9/15/2027 | | | 153,500 | |

| | | | | | | | | | | | | | 307,523 | |

| AUTOMOBILE ABS - 5.3% | | | | | | | | | | | | | | |

| American Credit Acceptance Receivables Trust 2018-3 - 144A | | | | | 165,000 | | | 3.750 | | 10/15/2024 | | | 164,248 | |

| American Credit Acceptance Receivables Trust 2019-2 - 144A | | | | | 125,000 | | | 3.170 | | 6/12/2025 | | | 121,776 | |

| Americredit Automobile Receivables Trust 2018-1 | | | | | 135,000 | | | 3.820 | | 3/18/2024 | | | 132,891 | |

| Avid Automobile Receivables Trust 2018-1 - 144A | | | | | 32,552 | | | 2.840 | | 8/15/2023 | | | 32,508 | |

| Avis Budget Rental Car Funding AESOP LLC - 144A | | | | | 155,000 | | | 2.360 | | 3/20/2026 | | | 138,290 | |

| Avis Budget Rental Car Funding AESOP LLC - 144A | | | | | 150,000 | | | 3.070 | | 9/20/2023 | | | 140,721 | |

| Capital Auto Receivables Asset Trust 2017-1 - 144A | | | | | 160,000 | | | 2.700 | | 9/20/2022 | | | 157,236 | |

| Carmax Auto Owner Trust 2019-1 | | | | | 140,000 | | | 3.740 | | 1/15/2025 | | | 138,810 | |

| Carvana Auto Receivables Trust 2019-1 - 144A | | | | | 145,000 | | | 3.880 | | 10/15/2024 | | | 143,802 | |

| Carvana Auto Receivables Trust 2019-3 - 144A | | | | | 185,000 | | | 2.710 | | 10/15/2024 | | | 175,648 | |

| Centre Point Funding LLC - 144A | | | | | 5,788 | | | 2.610 | | 8/20/2020 | | | 5,770 | |

| Drive Auto Receivables Trust 2019-4 | | | | | 135,000 | | | 2.510 | | 11/17/2025 | | | 134,637 | |

| DT Auto Owner Trust 2019-1 - 144A | | | | | 120,000 | | | 3.610 | | 11/15/2024 | | | 119,964 | |

| First Investors Auto Owner Trust 2017-2 - 144A | | | | | 135,000 | | | 2.650 | | 11/15/2022 | | | 135,086 | |

| First Investors Auto Owner Trust 2019-1 - 144A | | | | | 150,000 | | | 3.260 | | 3/17/2025 | | | 146,954 | |

| GLS Auto Receivables Issuer Trust 2020-1 - 144A | | | | | 190,000 | | | 2.430 | | 11/15/2024 | | | 183,438 | |

| Hertz Vehicle Financing II LP - 144A | | | | | 135,000 | | | 2.670 | | 9/25/2021 | | | 129,111 | |

| OneMain Direct Auto Receivables Trust 2018-1 - 144A | | | | | 125,000 | | | 3.850 | | 10/14/2025 | | | 122,745 | |

| Santander Drive Auto Receivables Trust 2017-1 | | | | | 15,968 | | | 2.580 | | 5/16/2022 | | | 15,976 | |

| Veros Automobile Receivables Trust 2020-1 - 144A | | | | | 155,000 | | | 2.190 | | 6/16/2025 | | | 151,450 | |

| Westlake Automobile Receivables Trust 2018-3 - 144A | | | | | 150,000 | | | 3.610 | | 10/16/2023 | | | 150,881 | |

| | | | | | | | | | | | | | 2,641,942 | |

| BANKS - 5.9% | | | | | | | | | | | | | | |

| Bank of America Corp. | | | | | 211,000 | | | 4.200 | | 8/26/2024 | | | 228,663 | |

| Bank of Montreal | | 5 Year Swap Rate US + 1.432% | | | 234,000 | | | 3.803 | + | 12/15/2032 | | | 241,679 | |

| BBVA Bancomer SA/Texas - 144A | | 5 Year Treasury Note + 2.650% | | | 200,000 | | | 5.125 | + | 1/18/2033 | | | 173,760 | |

| Citigroup, Inc. | | | | | 300,000 | | | 4.050 | | 7/30/2022 | | | 315,124 | |

| Fifth Third Bancorp | | | | | 18,000 | | | 2.550 | | 5/5/2027 | | | 17,965 | |

| Goldman Sachs Group, Inc. | | | | | 230,000 | | | 4.250 | | 10/21/2025 | | | 247,261 | |

| JPMorgan Chase & Co. | | SOFRRATE 3.125% | | | 47,000 | | | 4.600 | + | Perpetual | | | 42,218 | |

| M&T Bank Corp. | | 3 Month LIBOR + 3.520% | | | 109,000 | | | 5.125 | + | Perpetual | | | 109,999 | |

| Morgan Stanley | | | | | 175,000 | | | 6.375 | | 7/24/2042 | | | 270,831 | |

| PNC Financial Services Group, Inc. | | 3 Month LIBOR + 3.300% | | | 170,000 | | | 5.000 | + | Perpetual | | | 173,046 | |

| Santander Holdings USA, Inc. | | | | | 105,000 | | | 3.500 | | 6/7/2024 | | | 106,376 | |

| Santander Holdings USA, Inc. | | | | | 133,000 | | | 3.700 | | 3/28/2022 | | | 134,779 | |

| Santander Holdings USA, Inc. | | | | | 65,000 | | | 4.400 | | 7/13/2027 | | | 66,328 | |

| Synovus Financial Corp. | | 5 Year Swap Rate US + 3.379% | | | 70,000 | | | 5.900 | + | 2/7/2029 | | | 66,941 | |

| Toronto-Dominion Bank ^ | | 5 Year Swap Rate US + 2.205% | | | 195,000 | | | 3.625 | + | 9/15/2031 | | | 208,009 | |

| UBS AG/Stamford CT | | | | | 250,000 | | | 7.625 | | 8/17/2022 | | | 270,123 | |

| Wells Fargo & Co. | | | | | 165,000 | | | 3.550 | | 9/29/2025 | | | 178,470 | |

| Wells Fargo & Co. | | 3 Month LIBOR + 3.110% | | | 115,000 | | | 5.900 | + | Perpetual | | | 116,805 | |

| | | | | | | | | | | | | | 2,968,377 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| CORPORATE BONDS & NOTES - 64.5% (Continued) | | | | | | | | | | | | | | |

| BEVERAGES - 0.6% | | | | | | | | | | | | | | |

| Anheuser-Busch InBev Worldwide, Inc. | | | | $ | 105,000 | | | 4.000 | | 4/13/2028 | | $ | 116,737 | |

| Anheuser-Busch InBev Worldwide, Inc. | | | | | 40,000 | | | 4.750 | | 1/23/2029 | | | 46,357 | |

| Bacardi Ltd. - 144A | | | | | 100,000 | | | 4.700 | | 5/15/2028 | | | 109,399 | |

| | | | | | | | | | | | | | 272,493 | |

| CHEMICALS - 0.8% | | | | | | | | | | | | | | |

| Olin Corp. | | | | | 120,000 | | | 5.625 | | 8/1/2029 | | | 109,008 | |

| PolyOne Corp. - 144A | | | | | 78,000 | | | 5.750 | | 5/15/2025 | | | 79,170 | |

| SABIC Capital II BV - 144A | | | | | 200,000 | | | 4.500 | | 10/10/2028 | | | 214,009 | |

| | | | | | | | | | | | | | 402,187 | |

| COAL - 0.1% | | | | | | | | | | | | | | |

| Alliance Resource Operating Partners LP - 144A | | | | | 70,000 | | | 7.500 | | 5/1/2025 | | | 45,850 | |

| | | | | | | | | | | | | | | |

| COMMERCIAL MBS - 5.1% | | | | | | | | | | | | | | |

| Aventura Mall Trust 2013-AVM - 144A | | | | | 155,000 | | | 3.867 | ++ | 12/5/2032 | | | 157,051 | |

| Aventura Mall Trust 2013-AVM - 144A | | | | | 100,000 | | | 3.867 | ++ | 12/5/2032 | | | 101,323 | |

| BAMLL Commercial Mortgage Securities Trust 2015-200P - 144A | | | | | 105,000 | | | 3.218 | | 4/14/2033 | | | 110,098 | |

| BX Trust 2019-OC11 - 144A | | | | | 130,000 | | | 4.075 | ++ | 12/9/2041 | | | 114,681 | |

| BXMT 2020-FL2 Ltd. - 144A | | 1 Month LIBOR + 0.900% | | | 135,000 | | | 1.651 | + | 2/16/2037 | | | 127,385 | |

| CHC Commercial Mortgage Trust 2019 - CHC - 144A | | 1 Month LIBOR + 1.120% | | | 233,990 | | | 1.934 | + | 6/15/2034 | | | 213,489 | |

| Citigroup Commercial Mortgage Trust 2015-GC27 | | | | | 130,000 | | | 2.878 | | 2/10/2048 | | | 134,939 | |

| Citigroup Commercial Mortgage Trust 2019-SST2 - 144A | | 1 Month LIBOR + 0.920% | | | 145,000 | | | 1.734 | + | 12/15/2036 | | | 140,629 | |

| Credit Suisse Mortgage Capital Certificates 2019-ICE4 - 144A | | 1 Month LIBOR + 0.980% | | | 205,000 | | | 1.794 | + | 5/15/2036 | | | 199,740 | |

| Exantas Capital Corp. - 144A | | 1 Month LIBOR + 1.150% | | | 160,000 | | | 1.901 | + | 3/15/2035 | | | 149,283 | |

| GS Mortgage Securities Corp. Trust 2012-ALOHA - 144A | | | | | 252,000 | | | 3.551 | | 4/10/2022 | | | 255,566 | |

| GS Mortgage Securities Trust 2020-GC45 | | | | | 135,000 | | | 3.173 | | 2/13/2053 | | | 143,747 | |

| Hilton USA Trust 2016-SFP - 144A | | | | | 185,000 | | | 3.323 | | 11/5/2035 | | | 174,782 | |

| JP Morgan Chase Commercial Mortgage Securities Trust 2011-C4 - 144A | | | | | 28,649 | | | 4.388 | | 5/15/2021 | | | 29,224 | |

| JPMBB Commercial Mortgage Securities Trust 2015-C28 | | | | | 155,000 | | | 3.986 | | 10/15/2048 | | | 153,491 | |

| JPMBB Commercial Mortgage Securities Trust 2015-C31 | | | | | 125,000 | | | 4.106 | | 8/15/2048 | | | 132,498 | |

| One Market Plaza Trust 2017-1MKT - 144A | | | | | 105,000 | | | 3.614 | | 2/10/2024 | | | 109,626 | |

| WFRBS Commercial Mortgage Trust 2014-C24 | | | | | 125,000 | | | 3.931 | | 11/15/2047 | | | 126,230 | |

| | | | | | | | | | | | | | 2,573,782 | |

| COMMERCIAL SERVICES - 0.4% | | | | | | | | | | | | | | |

| ASGN, Inc. - 144A | | | | | 55,000 | | | 4.625 | | 5/15/2028 | | | 50,977 | |

| DP World PLC - 144A | | | | | 100,000 | | | 6.850 | | 7/2/2037 | | | 109,563 | |

| Garda World Security Corp. - 144A | | | | | 55,000 | | | 4.625 | | 2/15/2027 | | | 53,281 | |

| | | | | | | | | | | | | | 213,821 | |

| COMPUTERS - 0.6% | | | | | | | | | | | | | | |

| Dell International LLC / EMC Corp. - 144A | | | | | 155,000 | | | 6.020 | | 6/15/2026 | | | 168,617 | |

| Hewlett Packard Enterprise Co. ^ | | | | | 100,000 | | | 4.900 | | 10/15/2025 | | | 108,565 | |

| Science Applications International Corp. - 144A | | | | | 5,000 | | | 4.875 | | 4/1/2028 | | | 4,920 | |

| | | | | | | | | | | | | | 282,102 | |

| CREDIT CARD ABS - 0.6% | | | | | | | | | | | | | | |

| Fair Square Issuance Trust - 144A | | | | | 305,000 | | | 2.900 | | 9/20/2024 | | | 289,477 | |

| | | | | | | | | | | | | | | |

| DIVERSIFIED FINANCIAL SERVICES - 2.8% | | | | | | | | | | | | | | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust | | | | | 150,000 | | | 3.650 | | 7/21/2027 | | | 126,495 | |

| Avolon Holdings Funding Ltd. - 144A | | | | | 125,000 | | | 4.375 | | 5/1/2026 | | | 107,473 | |

| Brightsphere Investment Group, Inc. | | | | | 165,000 | | | 4.800 | | 7/27/2026 | | | 150,681 | |

| Brookfield Finance LLC | | | | | 174,000 | | | 4.000 | | 4/1/2024 | | | 183,808 | |

| Capital One Financial Corp. | | | | | 165,000 | | | 3.750 | | 7/28/2026 | | | 163,650 | |

| Capital One Financial Corp. | | | | | 120,000 | | | 4.200 | | 10/29/2025 | | | 123,228 | |

| Charles Schwab Corp. | | 5 Year Treasury Note + 4.971% | | | 112,000 | | | 5.375 | + | Perpetual | | | 114,940 | |

| Citadel LP - 144A | | | | | 105,000 | | | 4.875 | | 1/15/2027 | | | 104,399 | |

| Navient Corp. | | | | | 25,000 | | | 5.000 | | 3/15/2027 | | | 21,206 | |

| Navient Corp. | | | | | 70,000 | | | 6.750 | | 6/25/2025 | | | 65,188 | |

| Springleaf Finance Corp. | | | | | 10,000 | | | 5.375 | | 11/15/2029 | | | 8,348 | |

| Springleaf Finance Corp. | | | | | 70,000 | | | 6.875 | | 3/15/2025 | | | 66,637 | |

| Springleaf Finance Corp. | | | | | 25,000 | | | 7.125 | | 3/15/2026 | | | 23,680 | |

| Synchrony Financial | | | | | 135,000 | | | 3.950 | | 12/1/2027 | | | 124,624 | |

| | | | | | | | | | | | | | 1,384,357 | |

| ELECTRIC - 2.1% | | | | | | | | | | | | | | |

| American Electric Power Co, Inc. | | | | | 120,000 | | | 2.300 | | 3/1/2030 | | | 119,085 | |

| DPL, Inc. | | | | | 155,000 | | | 4.350 | | 4/15/2029 | | | 151,368 | |

| Edison International | | | | | 130,000 | | | 4.950 | | 4/15/2025 | | | 142,158 | |

| Exelon Corp. | | | | | 175,000 | | | 3.497 | | 6/1/2022 | | | 180,418 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| CORPORATE BONDS & NOTES - 64.5% (Continued) | | | | | | | | | | | | | | |

| ELECTRIC - 2.1% (Continued) | | | | | | | | | | | | | | |

| Pennsylvania Electric Co. - 144A | | | | $ | 140,000 | | | 3.600 | | 6/1/2029 | | $ | 153,591 | |

| PSEG Power LLC | | | | | 110,000 | | | 3.850 | | 6/1/2023 | | | 117,087 | |

| Talen Energy Supply LLC - 144A | | | | | 60,000 | | | 6.625 | | 1/15/2028 | | | 56,874 | |

| Vistra Operations Co. LLC - 144A | | | | | 130,000 | | | 4.300 | | 7/15/2029 | | | 129,630 | |

| | | | | | | | | | | | | | 1,050,211 | |

| ENERGY - ALTERNATE SOURCES - 0.2% | | | | | | | | | | | | | | |

| TerraForm Power Operating LLC - 144A | | | | | 90,000 | | | 5.000 | | 1/31/2028 | | | 94,019 | |

| | | | | | | | | | | | | | | |

| ENTERTAINMENT - 0.2% | | | | | | | | | | | | | | |

| Eldorado Resorts, Inc. | | | | | 35,000 | | | 6.000 | | 9/15/2026 | | | 35,329 | |

| Gateway Casinos & Entertainment Ltd. - 144A | | | | | 45,000 | | | 8.250 | | 3/1/2024 | | | 38,129 | |

| Scientific Games International, Inc. - 144A | | | | | 50,000 | | | 8.250 | | 3/15/2026 | | | 37,985 | |

| Scientific Games International, Inc. - 144A | | | | | 20,000 | | | 7.000 | | 5/15/2028 | | | 14,493 | |

| | | | | | | | | | | | | | 125,936 | |

| ENVIRONMENTAL CONTROL - 0.3% | | | | | | | | | | | | | | |

| Waste Connections, Inc. | | | | | 125,000 | | | 2.600 | | 2/1/2030 | | | 127,802 | |

| | | | | | | | | | | | | | | |

| FOOD - 0.3% | | | | | | | | | | | | | | |

| Albertsons Cos Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC - 144A | | | | | 105,000 | | | 4.625 | | 1/15/2027 | | | 106,538 | |

| Albertsons Cos Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC - 144A | | | | | 65,000 | | | 4.875 | | 2/15/2030 | | | 66,300 | |

| | | | | | | | | | | | | | 172,838 | |

| FOOD SERVICE - 0.1% | | | | | | | | | | | | | | |

| Aramark Services, Inc. - 144A | | | | | 50,000 | | | 6.375 | | 5/1/2025 | | | 52,125 | |

| | | | | | | | | | | | | | | |

| HAND/MACHINE TOOLS - 0.3% | | | | | | | | | | | | | | |

| Stanley Black & Decker, Inc. | | 5 Year Treasury Note + 2.657% | | | 140,000 | | | 4.000 | + | 3/15/2060 | | | 137,362 | |

| | | | | | | | | | | | | | | |

| HEALTHCARE - SERVICES - 0.8% | | | | | | | | | | | | | | |

| Catalent Pharma Solutions, Inc. - 144A | | | | | 15,000 | | | 5.000 | | 7/15/2027 | | | 15,370 | |

| Centene Corp. - 144A | | | | | 45,000 | | | 4.625 | | 12/15/2029 | | | 49,484 | |

| Charles River Laboratories International, Inc. - 144A | | | | | 25,000 | | | 4.250 | | 5/1/2028 | | | 25,335 | |

| HCA, Inc. | | | | | 135,000 | | | 4.125 | | 6/15/2029 | | | 146,479 | |

| HCA, Inc. | | | | | 65,000 | | | 5.375 | | 2/1/2025 | | | 70,222 | |

| LifePoint Health, Inc. - 144A | | | | | 35,000 | | | 4.375 | | 2/15/2027 | | | 33,119 | |

| Tenet Healthcare Corp. - 144A | | | | | 15,000 | | | 7.500 | | 4/1/2025 | | | 16,208 | |

| Tenet Healthcare Corp. - 144A | | | | | 50,000 | | | 5.125 | | 11/1/2027 | | | 49,533 | |

| | | | | | | | | | | | | | 405,750 | |

| HOME BUILDERS - 0.7% | | | | | | | | | | | | | | |

| M/I Homes, Inc. - 144A | | | | | 105,000 | | | 4.950 | | 2/1/2028 | | | 92,531 | |

| NVR, Inc. | | | | | 36,000 | | | 3.000 | | 5/15/2030 | | | 35,932 | |

| PulteGroup, Inc. | | | | | 125,000 | | | 6.375 | | 5/15/2033 | | | 133,525 | |

| TRI Pointe Group, Inc. | | | | | 85,000 | | | 5.875 | | 6/15/2024 | | | 83,079 | |

| | | | | | | | | | | | | | 345,067 | |

| HOME EQUITY ABS - 0.1% | | | | | | | | | | | | | | |

| GSAA Trust 2005-1 AF4 (a) | | | | | 8,010 | | | 5.619 | | 11/25/2034 | | | 8,024 | |

| NovaStar Mortgage Funding Trust Series 2004-4 | | 1 Month LIBOR + 1.725% | | | 52,642 | | | 3.386 | + | 3/25/2035 | | | 52,490 | |

| | | | | | | | | | | | | | 60,514 | |

| INSURANCE - 1.8% | | | | | | | | | | | | | | |

| Allstate Corp. | | 3 Month LIBOR + 2.938% | | | 150,000 | | | 5.750 | + | 8/15/2053 | | | 153,193 | |

| Athene Holding Ltd. | | | | | 135,000 | | | 4.125 | | 1/12/2028 | | | 128,041 | |

| MetLife, Inc. | | 3 Month LIBOR + 2.959% | | | 76,000 | | | 5.875 | + | 9/15/2166 | | | 78,342 | |

| Prudential Financial, Inc. | | 3 Month LIBOR + 3.920% | | | 230,000 | | | 5.625 | + | 6/15/2043 | | | 237,751 | |

| Teachers Insurance & Annuity Association of America - 144A | | 3 Month LIBOR + 2.661% | | | 110,000 | | | 4.375 | + | 9/15/2054 | | | 121,079 | |

| Trinity Acquisition PLC | | | | | 60,000 | | | 4.400 | | 3/15/2026 | | | 66,662 | |

| Voya Financial, Inc. | | 3 Month LIBOR + 3.580% | | | 105,000 | | | 5.650 | + | 5/15/2053 | | | 103,083 | |

| | | | | | | | | | | | | | 888,151 | |

| INTERNET - 0.5% | | | | | | | | | | | | | | |

| Tencent Holdings Ltd. - 144A | | | | | 200,000 | | | 3.975 | | 4/11/2029 | | | 226,121 | |

| | | | | | | | | | | | | | | |

| INVESTMENT COMPANIES - 0.3% | | | | | | | | | | | | | | |

| Icahn Enterprises LP / Icahn Enterprises Finance Corp. | | | | | 130,000 | | | 6.250 | | 5/15/2026 | | | 128,352 | |

| | | | | | | | | | | | | | | |

| IRON/STEEL - 0.1% | | | | | | | | | | | | | | |

| Cleveland-Cliffs, Inc. - 144A | | | | | 75,000 | | | 6.750 | | 3/15/2026 | | | 65,790 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| CORPORATE BONDS & NOTES - 64.5% (Continued) | | | | | | | | | | | | | | |

| MACHINERY- CONSTRUCTION & MINING - 0.2% | | | | | | | | | | | | | | |

| Oshkosh Corp. | | | | $ | 113,000 | | | 4.600 | | 5/15/2028 | | $ | 119,109 | |

| | | | | | | | | | | | | | | |

| MANUFACTURED HOUSING ABS - 0.3% | | | | | | | | | | | | | | |

| Towd Point Mortgage Trust 2019-MH1 - 144A | | | | | 133,831 | | | 3.000 | ++ | 11/25/2058 | | | 140,948 | |

| | | | | | | | | | | | | | | |

| MEDIA - 0.5% | | | | | | | | | | | | | | |

| CCO Holdings LLC / CCO Holdings Capital Corp. - 144A | | | | | 45,000 | | | 4.500 | | 8/15/2030 | | | 45,788 | |

| Diamond Sports Group LLC / Diamond Sports Finance Co. - 144A | | | | | 55,000 | | | 5.375 | | 8/15/2026 | | | 42,059 | |

| Diamond Sports Group LLC / Diamond Sports Finance Co. - 144A | | | | | 30,000 | | | 6.625 | | 8/15/2027 | | | 16,565 | |

| DISH DBS Corp. | | | | | 25,000 | | | 5.000 | | 3/15/2023 | | | 23,906 | |

| Meredith Corp. | | | | | 85,000 | | | 6.875 | | 2/1/2026 | | | 73,338 | |

| Sirius XM Radio, Inc. - 144A | | | | | 35,000 | | | 5.500 | | 7/1/2029 | | | 37,086 | |

| | | | | | | | | | | | | | 238,742 | |

| MINING - 0.9% | | | | | | | | | | | | | | |

| BHP Billiton Finance USA Ltd. - 144A | | 5 Year Swap Rate USD + 5.093% | | | 200,000 | | | 6.750 | + | 10/19/2075 | | | 221,349 | |

| Glencore Funding LLC - 144A ^ | | | | | 165,000 | | | 4.000 | | 3/27/2027 | | | 167,481 | |

| Novelis Corp. - 144A | | | | | 55,000 | | | 4.750 | | 1/30/2030 | | | 48,554 | |

| | | | | | | | | | | | | | 437,384 | |

| MISCELLANEOUS MANUFACTURING - 0.8% | | | | | | | | | | | | | | |

| Carlisle Cos, Inc. | | | | | 59,000 | | | 2.750 | | 3/1/2030 | | | 54,507 | |

| General Electric Co. | | 3 Month LIBOR + 3.330% | | | 136,000 | | | 5.000 | + | 12/29/2049 | | | 111,690 | |

| Hillenbrand, Inc. | | | | | 65,000 | | | 4.500 | | 9/15/2026 | | | 59,652 | |

| Pentair Finance Sarl | | | | | 180,000 | | | 4.500 | | 7/1/2029 | | | 194,489 | |

| | | | | | | | | | | | | | 420,338 | |

| OIL & GAS - 2.3% | | | | | | | | | | | | | | |

| CrownRock LP / CrownRock Finance, Inc. - 144A | | | | | 75,000 | | | 5.625 | | 10/15/2025 | | | 61,227 | |

| Holly Frontier Corp. | | | | | 165,000 | | | 5.875 | | 4/1/2026 | | | 169,030 | |

| Nabors Industries, Inc. | | | | | 60,000 | | | 5.750 | | 2/1/2025 | | | 14,088 | |

| Parsley Energy LLC / Parsley Finance Corp. - 144A | | | | | 100,000 | | | 4.125 | | 2/15/2028 | | | 82,625 | |

| Patterson-UTI Energy, Inc. | | | | | 80,000 | | | 5.150 | | 11/15/2029 | | | 53,108 | |

| Pertamina Persero PT - 144A | | | | | 200,000 | | | 6.450 | | 5/30/2044 | | | 222,921 | |

| Petroleos Mexicanos - 144A | | | | | 100,000 | | | 7.690 | | 1/23/2050 | | | 74,000 | |

| Petronas Capital Ltd. - 144A | | | | | 200,000 | | | 3.500 | | 4/21/2030 | | | 209,707 | |

| State Oil Co. of the Azerbaijan Republic | | | | | 200,000 | | | 6.950 | | 3/18/2030 | | | 210,708 | |

| Transocean Guardian Ltd. - 144A | | | | | 33,400 | | | 5.875 | | 1/15/2024 | | | 26,052 | |

| | | | | | | | | | | | | | 1,123,466 | |

| OIL & GAS SERVICES - 0.2% | | | | | | | | | | | | | | |

| USA Compression Partners LP / USA Compression Finance Corp. | | | | | 105,000 | | | 6.875 | | 4/1/2026 | | | 85,019 | |

| | | | | | | | | | | | | | | |

| OTHER ABS - 8.6% | | | | | | | | | | | | | | |

| Ajax Mortgage Loan Trust 2019-D - 144A (a) | | | | | 181,156 | | | 2.956 | | 9/25/2065 | | | 183,952 | |

| American Homes 4 Rent 2014-SFR2 Trust - 144A | | | | | 230,000 | | | 4.705 | | 10/17/2036 | | | 238,504 | |

| American Homes 4 Rent 2015-SFR2 Trust - 144A | | | | | 220,000 | | | 4.691 | | 10/17/2045 | | | 223,370 | |

| AMSR 2020-SFR1 Trust - 144A | | | | | 315,000 | | | 1.819 | | 4/17/2025 | | | 326,355 | |

| Amur Equipment Finance Receivables VI LLC - 144A | | | | | 101,560 | | | 3.890 | | 7/20/2022 | | | 103,332 | |

| Aqua Finance Trust 2019-A - 144A | | | | | 130,926 | | | 3.140 | | 7/16/2040 | | | 131,753 | |

| Aqua Finance Trust 2019-A - 144A | | | | | 180,000 | | | 4.010 | | 7/16/2040 | | | 182,749 | |

| Bayview Opportunity Master Fund IVa Trust 2017-RT1 - 144A | | | | | 58,394 | | | 3.000 | ++ | 3/28/2057 | | | 58,763 | |

| Bayview Opportunity Master Fund IVa Trust 2017-SPL5 - 144A | | | | | 100,000 | | | 4.000 | ++ | 6/28/2057 | | | 98,845 | |

| BRE Grand Islander Timeshare Issuer 2019-A LLC - 144A | | | | | 121,278 | | | 3.280 | | 9/26/2033 | | | 121,816 | |

| CCG Receivables Trust 2019-2 - 144A | | | | | 100,000 | | | 2.550 | | 3/15/2027 | | | 100,025 | |

| CoreVest American Finance 2018-2 Trust - 144A | | | | | 227,763 | | | 4.026 | | 11/15/2052 | | | 235,908 | |

| CoreVest American Finance 2019-3 Trust - 144A | | | | | 100,000 | | | 3.265 | | 10/15/2052 | | | 79,873 | |

| Corevest American Finance 2020-1 Trust - 144A | | | | | 159,734 | | | 1.832 | | 3/15/2050 | | | 158,155 | |

| Diamond Resorts Owner Trust - 144A | | | | | 52,098 | | | 3.270 | | 10/22/2029 | | | 50,951 | |

| Foundation Finance Trust 2019-1 - 144A | | | | | 95,784 | | | 3.860 | | 11/15/2034 | | | 94,590 | |

| Jersey Mike’s Funding - 144A | | | | | 130,000 | | | 4.433 | | 2/15/2050 | | | 119,374 | |

| Marlette Funding Trust 2019-4 - 144A | | | | | 116,466 | | | 2.390 | | 12/17/2029 | | | 114,651 | |

| MVW 2019-2 LLC - 144A | | | | | 141,384 | | | 2.220 | | 10/20/2038 | | | 128,477 | |

| MVW Owner Trust 2016-1 - 144A | | | | | 42,406 | | | 2.250 | | 12/20/2033 | | | 41,445 | |

| Orange Lake Timeshare Trust 2019-A - 144A | | | | | 110,279 | | | 3.360 | | 4/9/2038 | | | 103,628 | |

| Small Business Lending Trust 2019-A - 144A | | | | | 85,257 | | | 2.850 | | 7/15/2026 | | | 82,984 | |

| Sofi Consumer Loan Program 2017-5 LLC - 144A | | | | | 58,231 | | | 2.780 | | 9/25/2026 | | | 56,315 | |

| Sofi Consumer Loan Program 2017-6 LLC - 144A | | | | | 50,672 | | | 2.820 | | 11/25/2026 | | | 50,324 | |

| Towd Point Mortgage Trust 2015-1 - 144A | | | | | 172,000 | | | 3.250 | ++ | 10/25/2053 | | | 173,264 | |

| Towd Point Mortgage Trust 2017-1 - 144A | | | | | 115,000 | | | 3.750 | ++ | 10/25/2056 | | | 116,970 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| CORPORATE BONDS & NOTES - 64.5% (Continued) | | | | | | | | | | | | | | |

| OTHER ABS - 8.6% (Continued) | | | | | | | | | | | | | | |

| Towd Point Mortgage Trust 2017-6 - 144A | | | | $ | 135,000 | | | 3.000 | ++ | 10/25/2057 | | $ | 137,329 | |

| Towd Point Mortgage Trust 2018-4 - 144A | | | | | 191,281 | | | 3.000 | ++ | 6/25/2058 | | | 196,399 | |

| Towd Point Mortgage Trust 2018-6 - 144A | | | | | 185,000 | | | 3.750 | ++ | 3/25/2058 | | | 174,074 | |

| Towd Point Mortgage Trust 2018-SJ1 - 144A | | | | | 122,843 | | | 4.000 | ++ | 10/25/2058 | | | 124,167 | |

| Tricon American Homes 2017-SFR1 Trust - 144A | | | | | 99,292 | | | 2.716 | | 9/17/2022 | | | 100,429 | |

| TRIP Rail Master Funding LLC - 144A | | | | | 78,279 | | | 2.709 | | 8/15/2047 | | | 78,053 | |

| VOLT LXIV LLC - 144A (a) | | | | | 48,333 | | | 3.375 | | 10/25/2047 | | | 45,879 | |

| VSE 2017-A VOI Mortgage LLC - 144A | | | | | 61,230 | | | 2.330 | | 3/20/2035 | | | 58,054 | |

| | | | | | | | | | | | | | 4,290,757 | |

| PACKAGING & CONTAINERS - 0.4% | | | | | | | | | | | | | | |

| Greif, Inc. - 144A | | | | | 70,000 | | | 6.500 | | 3/1/2027 | | | 70,326 | |

| Sonoco Products Co. | | | | | 150,000 | | | 3.125 | | 5/1/2030 | | | 150,411 | |

| | | | | | | | | | | | | | 220,737 | |

| PHARMACEUTICALS - 1.2% | | | | | | | | | | | | | | |

| CVS Health Corp. | | | | | 110,000 | | | 2.875 | | 6/1/2026 | | | 115,762 | |

| Mylan NV | | | | | 145,000 | | | 3.950 | | 6/15/2026 | | | 154,107 | |

| Par Pharmaceutical, Inc. - 144A | | | | | 50,000 | | | 7.500 | | 4/1/2027 | | | 51,127 | |

| Perrigo Finance Unlimited Co. | | | | | 200,000 | | | 4.375 | | 3/15/2026 | | | 214,134 | |

| Teva Pharmaceutical Finance Netherlands III BV | | | | | 85,000 | | | 3.150 | | 10/1/2026 | | | 74,486 | |

| | | | | | | | | | | | | | 609,616 | |

| PIPELINES - 2.2% | | | | | | | | | | | | | | |

| Boardwalk Pipelines LP | | | | | 110,000 | | | 4.950 | | 12/15/2024 | | | 98,609 | |

| Cheniere Energy Partners LP | | | | | 55,000 | | | 5.625 | | 10/1/2026 | | | 52,816 | |

| Cheniere Energy Partners LP - 144A | | | | | 55,000 | | | 4.500 | | 10/1/2029 | | | 50,993 | |

| Energy Transfer Partners LP | | | | | 165,000 | | | 4.200 | | 4/15/2027 | | | 155,705 | |

| Kinder Morgan Inc/DE | | | | | 160,000 | | | 4.300 | | 6/1/2025 | | | 171,318 | |

| Kinder Morgan Inc/DE | | | | | 45,000 | | | 7.750 | | 1/15/2032 | | | 57,875 | |

| MPLX LP | | | | | 55,000 | | | 4.875 | | 12/1/2024 | | | 54,722 | |

| MPLX LP - 144A | | | | | 135,000 | | | 4.250 | | 12/1/2027 | | | 130,053 | |

| Sabine Pass Liquefaction LLC | | | | | 25,000 | | | 4.200 | | 3/15/2028 | | | 24,506 | |

| Sabine Pass Liquefaction LLC | | | | | 100,000 | | | 6.250 | | 3/15/2022 | | | 103,231 | |

| Targa Resources Partners LP | | | | | 100,000 | | | 5.875 | | 4/15/2026 | | | 90,120 | |

| Valero Energy Partners LP | | | | | 120,000 | | | 4.500 | | 3/15/2028 | | | 124,718 | |

| | | | | | | | | | | | | | 1,114,666 | |

| PRIVATE EQUITY - 0.3% | | | | | | | | | | | | | | |

| Apollo Management Holdings LP - 144A | | | | | 135,000 | | | 4.000 | | 5/30/2024 | | | 139,304 | |

| | | | | | | | | | | | | | | |

| REC VEHICLE LOAN ABS - 0.2% | | | | | | | | | | | | | | |

| Octane Receivables Trust 2019-1 - 144A | | | | | 104,657 | | | 3.160 | | 9/20/2023 | | | 104,768 | |

| | | | | | | | | | | | | | | |

| REITS - 3.2% | | | | | | | | | | | | | | |

| Corporate Office Properties LP | | | | | 196,000 | | | 3.600 | | 5/15/2023 | | | 198,436 | |

| EPR Properties | | | | | 220,000 | | | 4.750 | | 12/15/2026 | | | 186,709 | |

| ESH Hospitality, Inc. - 144A | | | | | 80,000 | | | 4.625 | | 10/1/2027 | | | 72,600 | |

| GLP Capital LP / GLP Financing II, Inc. | | | | | 155,000 | | | 5.750 | | 6/1/2028 | | | 153,574 | |

| Healthcare Realty Trust, Inc. | | | | | 90,000 | | | 3.875 | | 5/1/2025 | | | 91,217 | |

| Healthcare Trust of America Holdings LP | | | | | 15,000 | | | 3.100 | | 2/15/2030 | | | 13,917 | |

| Healthcare Trust of America Holdings LP | | | | | 150,000 | | | 3.750 | | 7/1/2027 | | | 149,116 | |

| Iron Mountain, Inc. - 144A | | | | | 110,000 | | | 4.875 | | 9/15/2029 | | | 105,963 | |

| iStar, Inc. | | | | | 105,000 | | | 4.250 | | 8/1/2025 | | | 83,606 | |

| Ladder Capital Finance Holdings LLLP - 144A | | | | | 80,000 | | | 4.250 | | 2/1/2027 | | | 56,100 | |

| MPT Operating Partnership LP / MPT Finance Corp. | | | | | 25,000 | | | 4.625 | | 8/1/2029 | | | 24,977 | |

| MPT Operating Partnership LP / MPT Finance Corp. | | | | | 85,000 | | | 5.000 | | 10/15/2027 | | | 87,235 | |

| Office Properties Income Trust | | | | | 170,000 | | | 4.500 | | 2/1/2025 | | | 161,523 | |

| Retail Opportunity Investments Partnership LP | | | | | 105,000 | | | 4.000 | | 12/15/2024 | | | 96,517 | |

| Service Properties Trust | | | | | 165,000 | | | 4.950 | | 2/15/2027 | | | 127,934 | |

| | | | | | | | | | | | | | 1,609,424 | |

| RETAIL - 0.6% | | | | | | | | | | | | | | |

| Lithia Motors, Inc. - 144A | | | | | 40,000 | | | 4.625 | | 12/15/2027 | | | 38,050 | |

| QVC, Inc. | | | | | 75,000 | | | 4.375 | | 3/15/2023 | | | 71,993 | |

| QVC, Inc. | | | | | 85,000 | | | 4.750 | | 2/15/2027 | | | 76,916 | |

| Ross Stores Inc | | | | | 100,000 | | | 4.800 | | 4/15/2030 | | | 109,490 | |

| | | | | | | | | | | | | | 296,449 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| CORPORATE BONDS & NOTES - 64.5% (Continued) | | | | | | | | | | | | | | |

| SOFTWARE - 0.7% | | | | | | | | | | | | | | |

| Citrix Systems, Inc. | | | | $ | 190,000 | | | 3.300 | | 3/1/2030 | | $ | 193,050 | |

| MSCI, Inc. - 144A | | | | | 81,000 | | | 4.000 | | 11/15/2029 | | | 85,069 | |

| MSCI, Inc. - 144A | | | | | 5,000 | | | 3.625 | | 9/1/2030 | | | 5,086 | |

| Vmware, Inc. | | | | | 55,000 | | | 4.700 | | 5/15/2030 | | | 59,029 | |

| | | | | | | | | | | | | | 342,234 | |

| TELECOMMUNICATIONS - 1.4% | | | | | | | | | | | | | | |

| Frontier Communications Corp. - 144A | | | | | 70,000 | | | 8.500 | | 4/1/2026 | | | 65,076 | |

| Juniper Networks, Inc. | | | | | 120,000 | | | 3.750 | | 8/15/2029 | | | 127,037 | |

| Motorola Solutions, Inc. | | | | | 96,429 | | | 4.600 | | 2/23/2028 | | | 107,155 | |

| Motorola Solutions, Inc. | | | | | 50,000 | | | 4.600 | | 5/23/2029 | | | 56,888 | |

| Sprint Spectrum Co. LLC - 144A | | | | | 150,000 | | | 3.360 | | 9/20/2021 | | | 150,847 | |

| Telesat Canada - 144A | | | | | 45,000 | | | 4.875 | | 6/1/2027 | | | 44,606 | |

| T-Mobile USA, Inc. - 144A | | | | | 145,000 | | | 3.875 | | 4/15/2030 | | | 159,852 | |

| | | | | | | | | | | | | | 711,461 | |

| TRUCKING & LEASING - 0.6% | | | | | | | | | | | | | | |

| Aviation Capital Group LLC - 144A | | | | | 205,000 | | | 3.500 | | 11/1/2027 | | | 149,518 | |

| Penske Truck Leasing Co. LP - 144A | | | | | 140,000 | | | 4.125 | | 8/1/2023 | | | 145,505 | |

| | | | | | | | | | | | | | 295,023 | |

| WHOLE LOAN COLLATERAL CMO - 7.6% | | | | | | | | | | | | | | |

| Arroyo Mortgage Trust 2019-1 - 144A | | | | | 147,524 | | | 3.920 | ++ | 1/25/2049 | | | 149,678 | |

| Arroyo Mortgage Trust 2019-2 - 144A | | | | | 78,342 | | | 3.347 | ++ | 4/25/2049 | | | 78,142 | |

| Banc of America Funding 2005-1 Trust | | | | | 37,710 | | | 5.500 | | 2/25/2035 | | | 37,365 | |

| Chase Home Lending Mortgage Trust 2019-ATR1 - 144A | | | | | 46,792 | | | 4.000 | ++ | 4/25/2049 | | | 47,239 | |

| Chase Mortgage Finance Corp. - 144A | | | | | 105,339 | | | 3.750 | ++ | 4/25/2045 | | | 108,198 | |

| Chase Mortgage Finance Corp. - 144A | | | | | 71,676 | | | 3.750 | ++ | 2/25/2044 | | | 71,537 | |

| Citigroup Mortgage Loan Trust 2019-IMC1 - 144A | | | | | 100,250 | | | 2.720 | ++ | 7/25/2049 | | | 99,426 | |

| Citigroup Mortgage Loan Trust, Inc. | | | | | 40,221 | | | 6.750 | | 8/25/2034 | | | 42,653 | |

| Deephaven Residential Mortgage Trust 2017-2 - 144A | | | | | 35,367 | | | 2.453 | ++ | 6/25/2047 | | | 34,676 | |

| Ellington Financial Mortgage Trust 2019-2 - 144A | | | | | 89,172 | | | 3.046 | ++ | 11/25/2059 | | | 88,422 | |

| Galton Funding Mortgage Trust 2017-1 - 144A | | | | | 71,369 | | | 3.500 | ++ | 11/25/2057 | | | 72,686 | |

| Galton Funding Mortgage Trust 2018-2 - 144A | | | | | 48,847 | | | 4.500 | ++ | 10/25/2058 | | | 49,904 | |

| Galton Funding Mortgage Trust 2019-H1 - 144A | | | | | 123,414 | | | 2.657 | ++ | 10/25/2059 | | | 125,231 | |

| Homeward Opportunities Fund I Trust 2018-2 - 144A | | | | | 160,184 | | | 3.985 | ++ | 11/25/2058 | | | 161,050 | |

| JP Morgan Mortgage Trust 2005-A5 | | | | | 59,274 | | | 4.106 | ++ | 8/25/2035 | | | 55,359 | |

| JP Morgan Mortgage Trust 2017-5 - 144A | | | | | 209,498 | | | 3.149 | ++ | 12/15/2047 | | | 212,253 | |

| LHOME Mortgage Trust 2019-RTL1 - 144A (a) | | | | | 145,000 | | | 4.580 | | 10/25/2023 | | | 136,421 | |

| MASTR Alternative Loan Trust 2004-4 | | | | | 42,254 | | | 5.500 | | 4/25/2034 | | | 44,141 | |

| Metlife Securitization Trust - 144A | | | | | 100,000 | | | 3.691 | ++ | 4/25/2055 | | | 94,277 | |

| Metlife Securitization Trust 2019-1 - 144A | | | | | 122,830 | | | 3.750 | ++ | 4/25/2058 | | | 131,341 | |

| New Residential Mortgage Loan Trust 2016-4 - 144A | | | | | 84,164 | | | 3.750 | ++ | 11/25/2056 | | | 86,272 | |

| New Residential Mortgage Loan Trust 2018-1 - 144A | | | | | 170,566 | | | 4.000 | ++ | 12/25/2057 | | | 179,401 | |

| New Residential Mortgage Loan Trust 2020-1 - 144A | | | | | 125,170 | | | 3.500 | ++ | 10/25/2059 | | | 134,625 | |

| OBX 2018-EXP2 Trust - 144A | | | | | 89,889 | | | 4.000 | ++ | 11/25/2048 | | | 91,149 | |

| OBX 2019-INV1 Trust - 144A | | | | | 106,555 | | | 4.500 | ++ | 11/25/2048 | | | 110,619 | |

| RCKT Mortgage Trust 2020-1 - 144A | | | | | 265,877 | | | 3.000 | ++ | 2/25/2050 | | | 272,142 | |

| RCO V Mortgage LLC 2019-1 - 144A (a) | | | | | 172,101 | | | 3.721 | | 5/24/2024 | | | 160,795 | |

| Residential Mortgage Loan Trust 2019-2 - 144A | | | | | 140,763 | | | 5.500 | ++ | 5/25/2059 | | | 139,715 | |

| Residential Mortgage Loan Trust 2020-1 - 144A | | | | | 108,075 | | | 2.913 | ++ | 2/25/2024 | | | 106,508 | |

| Thornburg Mortgage Securities Trust 2004-2 | | 1 Month LIBOR + 0.620% | | | 79,507 | | | 2.281 | + | 6/25/2044 | | | 72,989 | |

| Towd Point HE Trust 2019-HE1 - 144A | | 1 Month LIBOR + 0.900% | | | 139,057 | | | 2.561 | + | 4/25/2048 | | | 136,339 | |

| Verus Securitization Trust 2018-2 - 144A | | | | | 105,000 | | | 2.929 | ++ | 6/1/2058 | | | 96,081 | |

| Verus Securitization Trust 2018-3 - 144A | | | | | 81,564 | | | 4.426 | ++ | 10/25/2058 | | | 82,679 | |

| Verus Securitization Trust 2019-INV2 - 144A | | | | | 301,202 | | | 4.108 | ++ | 7/25/2059 | | | 300,639 | |

| | | | | | | | | | | | | | 3,809,952 | |

| | | | | | | | | | | | | | | |

| TOTAL CORPORATE BONDS & NOTES (Cost - $32,714,512) | | | | | | | | | | | | | 32,182,779 | |

| | | | | | | | | | | | | | | |

| FOREIGN GOVERNMENT BONDS - 0.2% | | | | | | | | | | | | | | |

| Turkey Government International Bond (Cost - $85,419) | | | | | 85,000 | | | 7.375 | | 2/5/2025 | | | 86,610 | |

| | | | | | | | | | | | | | | |

| MUNICIPAL BONDS - 6.7% | | | | | | | | | | | | | | |

| City of Bristol VA | | | | | 340,000 | | | 4.210 | | 1/1/2042 | | | 354,141 | |

| Clackamas & Washington Counties School District No 3 | | | | | 120,000 | | | 5.000 | | 6/15/2032 | | | 155,422 | |

| Idaho Health Facilities Authority | | | | | 135,000 | | | 5.020 | | 3/1/2048 | | | 166,901 | |

| Klein Independent School District | | | | | 95,000 | | | 5.000 | | 8/1/2032 | | | 122,533 | |

| Massachusetts Bay Transportation Authority | | | | | 120,000 | | | 5.250 | | 7/1/2032 | | | 164,099 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| MUNICIPAL BONDS - 6.7% (Continued) | | | | | | | | | | | | | | |

| Rockdale County Water & Sewerage Authority | | | | $ | 305,000 | | | 3.060 | | 7/1/2024 | | $ | 318,838 | |

| Sales Tax Securitization Corp. | | | | | 20,000 | | | 3.411 | | 1/1/2043 | | | 18,848 | |

| San Diego County Regional Airport Authority | | | | | 325,000 | | | 5.594 | | 7/1/2043 | | | 358,274 | |

| State of California | | | | | 385,000 | | | 7.600 | | 11/1/2040 | | | 665,249 | |

| State of Texas | | | | | 245,000 | | | 3.011 | | 10/1/2026 | | | 262,574 | |

| State of Texas | | | | | 600,000 | | | 3.211 | | 4/1/2044 | | | 640,536 | |

| University of California | | | | | 115,000 | | | 4.428 | | 5/15/2048 | | | 126,929 | |

| TOTAL MUNICIPAL - (Cost - $3,114,291) | | | | | | | | | | | | | 3,354,344 | |

| | | | | | | | | | | | | | | |

| U.S. GOVERNMENT & AGENCY - 18.3% | | | | | | | | | | | | | | |

| U.S. GOVERNMENT AGENCY - 6.4% | | | | | | | | | | | | | | |

| Fannie Mae Pool | | | | | 15,902 | | | 6.000 | | 11/1/2034 | | | 18,387 | |

| Fannie Mae Pool | | | | | 13,925 | | | 6.000 | | 3/1/2036 | | | 16,071 | |

| Fannie Mae Pool | | | | | 130,121 | | | 5.500 | | 9/1/2036 | | | 148,730 | |

| Fannie Mae Pool | | | | | 54,259 | | | 6.500 | | 5/1/2037 | | | 66,043 | |

| Fannie Mae Pool | | | | | 25,158 | | | 5.500 | | 4/1/2038 | | | 28,812 | |

| Fannie Mae Pool | | | | | 20,531 | | | 5.000 | | 4/1/2038 | | | 23,457 | |

| Fannie Mae Pool | | | | | 62,461 | | | 6.000 | | 8/1/2038 | | | 71,877 | |

| Fannie Mae Pool | | | | | 130,161 | | | 5.000 | | 6/1/2039 | | | 148,891 | |

| Fannie Mae Pool | | | | | 167,584 | | | 4.000 | | 9/1/2044 | | | 183,201 | |

| Fannie Mae Pool | | | | | 152,997 | | | 3.500 | | 1/1/2046 | | | 164,600 | |

| Fannie Mae Pool | | | | | 237,364 | | | 4.000 | | 4/1/2046 | | | 256,473 | |

| Fannie Mae Pool | | | | | 377,153 | | | 4.000 | | 4/1/2048 | | | 403,101 | |

| Fannie Mae Pool | | | | | 171,587 | | | 3.000 | | 9/1/2049 | | | 181,460 | |

| Fannie Mae Pool | | | | | 469,238 | | | 3.500 | | 10/1/2049 | | | 495,994 | |

| Fannie Mae Pool | | | | | 229,782 | | | 3.000 | | 1/1/2050 | | | 243,003 | |

| Fannie Mae Pool | | | | | 544,712 | | | 3.000 | | 1/1/2050 | | | 576,054 | |

| Freddie Mac Gold Pool | | | | | 146,165 | | | 5.000 | | 12/1/2035 | | | 167,393 | |

| Freddie Mac Gold Pool | | | | | 22,511 | | | 5.500 | | 10/1/2039 | | | 25,751 | |

| | | | | | | | | | | | | | 3,219,298 | |

| U.S. TREASURY OBLIGATIONS - 11.9% | | | | | | | | | | | | | | |

| United States Treasury Bond ^ | | | | | 590,000 | | | 3.000 | | 8/15/2048 | | | 832,292 | |

| United States Treasury Bond ^ | | | | | 1,100,000 | | | 2.875 | | 5/15/2049 | | | 1,527,969 | |

| United States Treasury Bond ^ | | | | | 1,260,000 | | | 2.000 | | 2/15/2050 | | | 1,486,849 | |

| United States Treasury Note | | | | | 480,000 | | | 2.875 | | 8/15/2028 | | | 569,663 | |

| United States Treasury Note ^ | | | | | 160,000 | | | 2.625 | | 2/15/2029 | | | 187,931 | |

| United States Treasury Note | | | | | 660,000 | | | 2.250 | | 3/31/2021 | | | 672,800 | |

| United States Treasury Note ^ | | | | | 605,000 | | | 2.000 | | 2/15/2025 | | | 652,360 | |

| | | | | | | | | | | | | | 5,929,864 | |

| | | | | | | | | | | | | | | |

| TOTAL U.S. GOVERNMENT & AGENCY (Cost - $8,410,949) | | | | | | | | | | | | | 9,149,162 | |

| | | | | | | | | | | | | | | |

| BANK LOANS - 5.4% | | | | | | | | | | | | | | |

| AEROSPACE - 0.3% | | | | | | | | | | | | | | |

| AI Convoy Luxembourg Sarl Facility B | | 1 Month LIBOR + 3.500% | | | 95,000 | | | 4.251 | + | 1/20/2027 | | | 90,329 | |

| TransDigm, Inc. New Tranche E Term Loan | | 1 Month LIBOR + 2.500% | | | 49,248 | | | 2.688 | + | 5/30/2025 | | | 43,434 | |

| | | | | | | | | | | | | | 133,763 | |

| AIRLINES - 0.2% | | | | | | | | | | | | | | |

| American Airlines, Inc. 2018 Replacement Term Loan | | 3 Month LIBOR + 1.750% | | | 105,000 | | | 2.320 | + | 6/27/2025 | | | 75,075 | |

| | | | | | | | | | | | | | | |

| AUTO MANUFACTURERS - 0.2% | | | | | | | | | | | | | | |

| Navistar, Inc. Tranche B Term Loan | | 3 Month LIBOR + 3.500% | | | 88,425 | | | 4.531 | + | 10/31/2026 | | | 80,757 | |

| | | | | | | | | | | | | | | |

| AUTO PARTS & EQUIPMENT - 0.2% | | | | | | | | | | | | | | |

| Clarios Global LP Initial Dollar Term Loan (First Lien) | | 3 Month LIBOR + 3.500% | | | 64,675 | | | 3.938 | + | 3/18/2026 | | | 58,822 | |

| Cooper-Standard Automotive, Inc. Additional Term B-1 Loan | | 3 Month LIBOR + 2.000% | | | 69,322 | | | 2.750 | + | 11/2/2023 | | | 51,992 | |

| | | | | | | | | | | | | | 110,814 | |

| BUILDING MATERIALS - 0.3% | | | | | | | | | | | | | | |

| AZEK Co LLC/The New Term Loan | | 3 Month LIBOR + 3.750% | | | 69,033 | | | 5.125 | + | 5/4/2024 | | | 63,148 | |

| Ingersoll-Rand Services Co. 2020 Spinco Tranche B-1 Dollar Term Loan | | 1 Month LIBOR + 1.750% | | | 10,000 | | | 2.732 | + | 2/28/2027 | | | 9,546 | |

| Summit Materials LLC New Term Loan | | 3 Month LIBOR + 2.000% | | | 98,489 | | | 2.438 | + | 11/10/2024 | | | 93,638 | |

| | | | | | | | | | | | | | 166,332 | |

| CHEMICALS - 0.1% | | | | | | | | | | | | | | |

| HB Fuller Co. Commitment | | 3 Month LIBOR + 2.000% | | | 50,000 | | | 2.751 | + | 10/20/2024 | | | 48,238 | |

| | | | | | | | | | | | | | | |

| COMMERCIAL SERVICES - 0.2% | | | | | | | | | | | | | | |

| CHG Healthcare Services, Inc. New Term Loan (2017) (First Lien) | | 3 Month LIBOR + 3.000% | | | 77,215 | | | 4.375 | + | 6/7/2023 | | | 73,527 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| BANK LOANS - 5.4% (Continued) | | | | | | | | | | | | | | |

| DISTRIBUTION/WHOLESALE- 0.2% | | | | | | | | | | | | | | |

| American Builders & Contractors Supply Co., Inc. Restatement Effective Date Term Loan | | 1 Month LIBOR + 2.000% | | $ | 104,475 | | | 2.438 | + | 1/15/2027 | | $ | 98,413 | |

| | | | | | | | | | | | | | | |

| ELECTRIC - 0.3% | | | | | | | | | | | | | | |

| APLP Holdings LP Term Loan (2020) | | 1 Month LIBOR + 2.500% | | | 56,842 | | | 3.500 | + | 4/19/2025 | | | 54,808 | |

| Calpine Corp. Term Loan (2019) | | 1 Month LIBOR + 2.250% | | | 99,250 | | | 2.688 | + | 4/1/2026 | | | 95,962 | |

| | | | | | | | | | | | | | 150,770 | |

| ENGINEERING & CONSTRUCTION - 0.0% | | | | | | | | | | | | | | |

| Atlantic Aviation FBO, Inc. Term Loan | | 3 Month LIBOR + 3.750% | | | 14,813 | | | 4.188 | + | 11/30/2025 | | | 13,418 | |

| | | | | | | | | | | | | | | |

| FOOD SERVICE - 0.2% | | | | | | | | | | | | | | |

| Aramark Services, Inc. U.S. Term B-4 Loan | | 1 Month LIBOR + 1.750% | | | 25,000 | | | 2.614 | + | 12/10/2026 | | | 23,563 | |

| TKC Holdings, Inc. Initial Term Loan (First Lien) | | 3 Month LIBOR + 3.750% | | | 81,855 | | | 4.750 | + | 2/1/2023 | | | 75,275 | |

| | | | | | | | | | | | | | 98,838 | |

| HEALTHCARE - SERVICES - 0.5% | | | | | | | | | | | | | | |

| Catalent Pharma Solutions, Inc. Dollar Term B-2 Loan | | 3 Month LIBOR + 2.250% | | | 50,000 | | | 3.942 | + | 5/10/2026 | | | 49,229 | |

| Iqvia, Inc. Term B-3 Dollar Loan | | 3 Month LIBOR + 1.750% | | | 108,075 | | | 3.125 | + | 6/8/2025 | | | 104,157 | |

| LifePoint Health, Inc. Term B Loan (First Lien) | | 1 Month LIBOR + 3.750% | | | 102,732 | | | 4.188 | + | 11/16/2025 | | | 95,655 | |

| Select Medical Corp. Tranche B Term Loan | | 3 Month LIBOR + 2.500% | | | 14,981 | | | 3.125 | + | 3/6/2025 | | | 14,337 | |

| | | | | | | | | | | | | | 263,378 | |

| HOUSEHOLD PRODUCTS - 0.2% | | | | | | | | | | | | | | |

| KIK Custom Products, Inc. Initial Loan | | 3 Month LIBOR + 4.000% | | | 108,120 | | | 5.000 | + | 5/15/2023 | | | 97,518 | |

| Reynolds Consumer Products LLC Initial Term Loan | | 1 Month LIBOR + 1.750% | | | 15,000 | | | 2.237 | + | 1/30/2027 | | | 14,517 | |

| | | | | | | | | | | | | | 112,035 | |

| INSURANCE - 0.2% | | | | | | | | | | | | | | |

| Sedgwick Claims Management Services, Inc. Initial Term Loan | | 3 Month LIBOR + 3.250% | | | 103,935 | | | 3.688 | + | 11/5/2025 | | | 96,270 | |

| | | | | | | | | | | | | | | |

| INTERNET- 0.1% | | | | | | | | | | | | | | |

| Pug LLC USD Term B Loan | | 1 Month LIBOR + 3.500% | | | 65,000 | | | 3.987 | + | 12/31/2049 | | | 53,733 | |

| | | | | | | | | | | | | | | |

| LODGING - 0.1% | | | | | | | | | | | | | | |

| Station Casinos LLC Term B-1 Facility Loan | | 1 Month LIBOR + 2.250% | | | 39,739 | | | 2.737 | + | 1/31/2027 | | | 35,288 | |

| | | | | | | | | | | | | | | |

| MACHINERY CONSTRUCTION & MINING - 0.2% | | | | | | | | | | | | | | |

| Brookfield WEC Holdings, Inc. Initial Term Loan (2020) | | 1 Month LIBOR + 3.000% | | | 118,699 | | | 3.750 | + | 8/1/2025 | | | 113,001 | |

| | | | | | | | | | | | | | | |

| MACHINERY DIVERSIFIED - 0.1% | | | | | | | | | | | | | | |

| Star US Bidco LLC Initial Term Loan | | 1 Month LIBOR + 4.250% | | | 75,000 | | | 5.250 | + | 3/3/2027 | | | 60,188 | |

| | | | | | | | | | | | | | | |

| MEDIA / TELECOMMUNICATIONS - 0.2% | | | | | | | | | | | | | | |

| Nexstar Broadcasting, Inc. Term B-4 Loan | | 1 Month LIBOR + 2.750% | | | 81,653 | | | 3.739 | + | 9/18/2026 | | | 77,175 | |

| Ziggo BV Term Loan I Facility | | 3 Month LIBOR + 2.500% | | | 20,000 | | | 3.314 | + | 4/30/2028 | | | 18,825 | |

| | | | | | | | | | | | | | 96,000 | |

| OIL & GAS - 0.1% | | | | | | | | | | | | | | |

| CITGO Petroleum Corp. 2019 Incremental Term B Loan | | 3 Month LIBOR + 5.000% | | | 64,350 | | | 6.000 | + | 3/27/2024 | | | 57,915 | |

| | | | | | | | | | | | | | | |

| PACKAGING & CONTAINERS - 0.1% | | | | | | | | | | | | | | |

| Berry Global, Inc. Term Y Loan | | 1 Month LIBOR + 2.000% | | | 54,588 | | | 2.829 | + | 5/17/2026 | | | 52,323 | |

| | | | | | | | | | | | | | | |

| PHARMACEUTICALS - 0.1% | | | | | | | | | | | | | | |

| Bausch Health Americas, Inc. Initial Term Loan | | 3 Month LIBOR + 3.000% | | | 8,250 | | | 3.751 | + | 6/1/2025 | | | 8,002 | |

| Bausch Health Americas, Inc. First Incremental Term Loan | | 3 Month LIBOR + 2.750% | | | 25,500 | | | 3.501 | + | 6/1/2025 | | | 24,600 | |

| | | | | | | | | | | | | | 32,602 | |

| PIPELINES - 0.0% | | | | | | | | | | | | | | |

| Buckeye Partners LP Initial Term Loan | | 1 Month LIBOR + 3.000% | | | 25,000 | | | 3.743 | + | 10/16/2026 | | | 23,578 | |

| | | | | | | | | | | | | | | |

| REGIONAL - 0.2% | | | | | | | | | | | | | | |

| Seminole Tribe of Florida, Inc. 2018 Replacement Term B Loan | | 3 Month LIBOR + 1.750% | | | 93,184 | | | 2.188 | + | 7/6/2024 | | | 88,758 | |

| | | | | | | | | | | | | | | |

| SOFTWARE - 0.4% | | | | | | | | | | | | | | |

| Boxer Parent Co, Inc. Initial Dollar Term Loan | | 3 Month LIBOR + 4.250% | | | 43,952 | | | 4.688 | + | 6/28/2025 | | | 38,184 | |

| Dun & Bradstreet Corp/The Initial Dollar Term Loan | | 1 Month LIBOR + 4.000% | | | 95,000 | | | 4.570 | + | 2/1/2026 | | | 89,347 | |

| Kronos Inc/MA Incremental Term Loan (First Lien) | | 3 Month LIBOR + 3.000% | | | 78,400 | | | 4.763 | + | 11/1/2023 | | | 76,052 | |

| | | | | | | | | | | | | | 203,583 | |

| TELECOMMUNICATIONS - 0.7% | | | | | | | | | | | | | | |

| CenturyLink, Inc. Term B Loan | | 1 Month LIBOR + 2.500% | | | 44,888 | | | 2.737 | + | 3/15/2027 | | | 42,646 | |

| CommScope, Inc. Initial Term Loan | | 3 Month LIBOR + 3.250% | | | 39,800 | | | 3.688 | + | 2/7/2026 | | | 37,746 | |

| Consolidated Communications, Inc. Initial Term Loan | | 3 Month LIBOR + 3.000% | | | 44,884 | | | 4.000 | + | 10/5/2023 | | | 40,097 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS (Unaudited) |

| Dunham Corporate/Government Bond Fund (Continued) |

| April 30, 2020 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate % | | Date | | Value | |

| BANK LOANS - 5.4% (Continued) | | | | | | | | | | | | | | |

| TELECOMMUNICATIONS - 0.7% | | | | | | | | | | | | | | |

| Telenet Financing USD LLC Term Loan AR Facility | | 6 Month LIBOR + 2.000% | | $ | 110,000 | | | 2.814 | + | 4/30/2028 | | $ | 105,188 | |

| T-Mobile USA, Inc. Term Loan | | 1 Month LIBOR + 3.000% | | | 70,000 | | | 3.370 | + | 4/1/2027 | | | 69,639 | |

| Zayo Group Holdings, Inc. Initial Dollar Term Loan | | 1 Month LIBOR + 3.000% | | | 85,000 | | | 3.921 | + | 2/21/2027 | | | 80,104 | |

| | | | | | | | | | | | | | 375,420 | |

| | | | | | | | | | | | | | | |

| TOTAL BANK LOANS - (Cost - $2,917,650) | | | | | | | | | | | | | 2,714,017 | |

| | | | | | | | | | | | | | | |

| | | | | Shares | | | | | | | | | |

| EXCHANGE TRADED FUNDS - 0.5% | | | | | | | | | | | | | | |

| iShares iBoxx High Yield Corporate Bond ETF | | | | | 635 | | | | | | | | 51,073 | |

| SPDR Bloomberg Barclays High Yield Bond ETF | | | | | 2,094 | | | | | | | | 207,369 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost - $260,623) | | | | | | | | | | | | | 258,442 | |

| | | | | | | | | | | | | | | |

| SHORT- TERM INVESTMENT - 0.9% | | | | | | | | | | | | | | |

| MONEY MARKET - 0.9% | | | | | | | | | | | | | | |

| Fidelity Investments Money Market Fund - Class I | | | | | 456,163 | | | 0.160 | + | | | | 456,163 | |

| TOTAL SHORT-TERM INVESTMENT (Cost - $456,163) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| COLLATERAL FOR SECURITIES LOANED - 10.9% | | | | | | | | | | | | | | |

| Mount Vernon Prime Portfolio # | | | | | 5,450,279 | | | 0.480 | + | | | | 5,450,279 | |

| TOTAL COLLATERAL FOR SECURITIES LOANED (Cost - $5,450,279) | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 107.4% (Cost - $53,409,886) | | | | | | | | | | | | $ | 53,651,796 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (7.4)% | | | | | | | | | | | | | (3,712,676 | ) |

| NET ASSETS - 100.0% | | | | | | | | | | | | $ | 49,939,120 | |

LLC - Limited Liability Corporation

ABS - Asset Backed Security

MBS - Mortgage Backed Security

CMO - Collateralized Mortgage Obligation

LP - Limited Partnership

REITS - Real Estate Investment Trust

Perpetual - Perpetual bonds are fixed income instruments without defined maturity dates

| ^ | All or a portion of these securities are on loan. Total loaned securities had a value of $5,315,151 at April 30, 2020. |

| + | Variable rate security. Interest rate is as of April 30, 2020. |

| ++ | Variable or floating rate security, the interest rate of which adjusts periodically based on changes in current interest rates and prepayments on the underlying pool of assets. |

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. The 144A securities amounted to $18,138,718 or 36.32% of net assets.

| # | The Trust’s securities lending policies and procedures require that the borrower. (i) deliver cash or U.S. Government securities as collateral with respect to each new loan of U.S. securities, at least 102% of the value of the portfolio securities loaned, and (ii) at all times thereafter mark-to-market the collateral on a daily basis so that the market value of such collateral is at least 100% of the value of securities loaned. From time to time the collateral may not be 102% due to end of day market movement. The next business day additional collateral is obtained/received from the borrower to replenish/reestablish 102%. |

| (a) | Step-Up Bond; the interest rate shown is the rate in effect as of April 30, 2020. |

| Portfolio Composition * - (Unaudited) | |

| Corporate Bonds & Notes | | | 60.0 | % | | Exchange Traded Funds | | | 0.5 | % |

| U.S. Government & Agencies | | | 17.0 | % | | Foreign Government Bonds | | | 0.1 | % |

| Municipal | | | 6.3 | % | | Others ** | | | 11.0 | % |

| Bank Loans | | | 5.1 | % | | Total | | | 100.0 | % |

| * | Based on total value of investments as of April 30, 2020. |

| ** | Includes collateral for securities loaned as of April 30, 2020. |

Percentage may differ from Schedule of Investments which is based on Fund net assets.

See accompanying notes to financial statements.

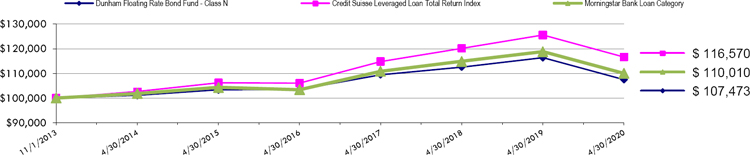

| Dunham Floating Rate Bond Fund (Unaudited) |

| Message from the Sub-Adviser (Newfleet Asset Management, LLC) |

Asset Class Recap

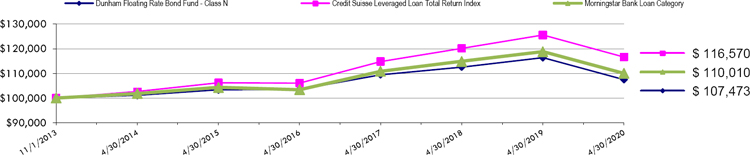

Since the start of the fiscal year, the 10-year U.S. Treasury yield has been in a general decline. After declining 17 basis points during the first fiscal quarter, the Fed’s actions in the second fiscal quarter to help maintain liquidity and support the economy amidst the virus-caused shutdowns saw the yield plummet another 90 basis points. Therefore, the already weakened demand for instruments such as bank loans did not receive any new tailwinds. Traditional high- yield bonds, as measured by the BofA Merrill Lynch High- Yield Bond Index, decreased 7.6 percent during the six-month period, and bank loans, as measured by the Credit Suisse Leveraged Loan Index, decreased 7.5 percent. As high- yield bonds saw yields surge 201 basis points, 3-month LIBOR dropped 134 basis points, impacting the overall yield offered in bank loans. Therefore, the semi-annual period ended with bank loans yielding 55 basis points less than traditional high- yield bonds, slightly wider than at the beginning of the fiscal year despite having a nearly identical return.

Portfolio Review

The Sub- Adviser has consistently maintained a slightly more defensive stance relative to the benchmark index, which generally benefitted the Fund on a relative basis heading into the most dire days and weeks of the crisis. This same positioning generally detracted during April’s rally, as the lowest credit quality loans generally outpaced higher-rated loans. The Fund had an overweight position in the auto industry, as well as gaming and leisure, which were initial drags on the Fund in the heat of the crisis. These industry-level overweights relative to the benchmark index were partially offset by underweights to the energy and retail industries. Despite the strong rally in the energy industry as well as lower-rated bank loans, the Sub-Adviser is cautious about what it believes will be an aggressive downgrade schedule. Specifically, it believes that the primary credit rating agencies will seek to make downgrades more quickly, so as to avoid some of the criticism they received during the Global Financial Crisis when downgrades appeared to be slow despite crumbling fundamentals. The average duration of the bank loans in the Fund ended April at 0.44 years, which is slightly higher than the 0.35 years at the beginning of the fiscal year. The Fund did not have any exposure to derivatives during the six-month period that meaningfully affected performance.

Holdings Insights

During the semi-annual period, very few holdings in the Fund that were held since the start of the fiscal year experienced positive returns. Those positive performing holdings included the One Call Corp. bond maturing in 2024 (682322AE2) (holding weight*: 0.32 percent), a health care services provider, and the Bausch Health Companies Inc. bond maturing in 2025 (91911KAN2) (holding weight*: 0.28 percent), a drug developer primarily focused on central nervous system disorders and gastrointestinal diseases. During the six-month period, the One Call Corp. bond and the Bausch Health bond, returned 1.1 percent and 2.1 percent, respectively. Although it was not positive across the entire six-month period, the bank loan of TKC Holdings Inc. (BL2726547) (holding weight*: 0.38 percent), a food and personal care products provider, declined only 2.6 percent. TKC Holdings was also one of the few positive bank loan performers in the second fiscal quarter, as its increased 0.1 percent during the three- month period. While not unscathed during the tumultuous months of February and March, these holdings appreciated primarily due to their respective industry exposures and corresponding lack of impact directly from the virus and related global shutdown. For example, One Call Corp. and Bausch Health were in the less affected segments of the healthcare and pharmaceutical industries, while TKC Holdings’ food distribution was in high demand throughout the shutdown.