UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22245

First Trust Exchange-Traded Fund III

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant’s telephone number, including area code: (630) 765-8000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

(a) The Report to Shareholders is attached herewith.

First Trust Exchange-Traded Fund III

First Trust Preferred Securities and Income ETF (FPE)

First Trust Institutional Preferred Securities and Income

ETF (FPEI)

Annual Report

For the Year Ended

October 31, 2022

First Trust Exchange-Traded Fund III

Annual Report

October 31, 2022

Caution Regarding Forward-Looking Statements

This report contains certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and/or Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”) and their respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of future events or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of any series of First Trust Exchange-Traded Fund III (the “Trust”) described in this report (each such series is referred to as a “Fund” and collectively, the “Funds”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and/or Sub-Advisor and their respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk Disclosure

There is no assurance that any Fund described in this report will achieve its investment objective. Each Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in a Fund. See “Risk Considerations” in the Additional Information section of this report for a discussion of certain other risks of investing in the Funds.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

The Advisor may also periodically provide additional information on Fund performance on each Fund’s web page at www.ftportfolios.com.

How to Read This Report

This report contains information that may help you evaluate your investment. It includes details about each Fund and presents data and analysis that provide insight into each Fund’s performance and investment approach.

By reading the portfolio commentary by the portfolio management team of each Fund, you may obtain an understanding of how the market environment affected each Fund’s performance. The statistical information that follows may help you understand each Fund’s performance compared to that of relevant market benchmarks.

It is important to keep in mind that the opinions expressed by personnel of the Advisor and/or Sub-Advisor are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the date on the cover of this report. The material risks of investing in each Fund are spelled out in the prospectus, the statement of additional information, and other Fund regulatory filings.

First Trust Exchange-Traded Fund III

Annual Letter from the Chairman and CEO

October 31, 2022

Dear Shareholders,

First Trust is pleased to provide you with the annual report for certain series of First Trust Exchange-Traded Fund III (the “Funds”), which contains detailed information about the Funds for the twelve months ended October 31, 2022.

As I’m writing this letter in mid-November, it strikes me that things appear to be a little more chaotic in the current climate than normal. One of the things that may have contributed to the chaotic nature of the news flow of late was the November mid-term election. For the most part, except for a few seats in Congress, the election is behind us. We learned there would be no “red wave” (Republicans gaining a strong majority in Congress) but likely gridlock ahead. Gridlock has been good for stock market investors in the past few decades, particularly when there’s been a Democratic president and the Republicans have control of at least one house of Congress, according to Brian Wesbury, Chief Economist at First Trust.

The Federal Reserve (the “Fed”) has kept its promise to aggressively hike interest rates to combat robust inflation. As of November 13, 2022, the Fed has increased the Federal Funds target rate (upper bound) six times, from 0.25% to 4.00%. The Fed’s actions have some investors and pundits looking for evidence linking the interest rate hikes to a downturn in the economy. In short, the hope is that a pullback in economic activity might deter the Fed from executing further interest rate hikes. Fed Chairman Jerome Powell, however, recently said that the terminal rate (the ultimate rate the Fed is targeting) will likely need to be higher than previously estimated in order to curb stubbornly high inflation. The Consumer Price Index (“CPI”) is a commonly used measure of inflation. The CPI stood at 7.7% on a trailing 12-month basis as of October 31, 2022, according to the U.S. Bureau of Labor Statistics. That is down from its recent high of 9.1% in June 2022. Prior to this year, the last time the CPI was higher than 7.0% was over 40 years ago. While monetary policy is an ongoing process subject to change, the Fed does appear to be steadfast in its mission to bring the rate of inflation back to its preferred level of 2.0%, and that will take some time, in my opinion. Stay tuned!

Equity and fixed income markets have contended with numerous headwinds this year, such as the war between Russia and Ukraine. Since setting its all-time high of 4,796.56 on January 3, 2022, the S&P 500® Index has been in a bear market (a price decline of 20% or more from the most recent high) for the better part of 310 days. Suffice it to say, we are all looking forward to the end of this bear market. With respect to corrections and bear markets, the silver lining is that the S&P 500® Index has never failed to fully recover the losses sustained in any previous downturn. Where might we see demand for stocks moving forward? One such source could be stock buybacks. As of the last week of October 2022, U.S. companies had announced stock buybacks totaling $1 trillion so far this year, according to Birinyi Associates. The fixed income market has not been immune to selling pressure either. Year-to-date through November 10, 2022, yields on the 10-Year Treasury Note increased by 258 basis points. As you may be aware, bond yields and bond prices are inversely related, particularly with respect to investment-grade bonds. As yields rise, prices fall and vice versa. As noted above, the Fed has more work to do, so bond investors should not be surprised to see interest rates and bond yields trend at least a bit higher in the months ahead.

Thank you for giving First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Funds again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust Advisors L.P.

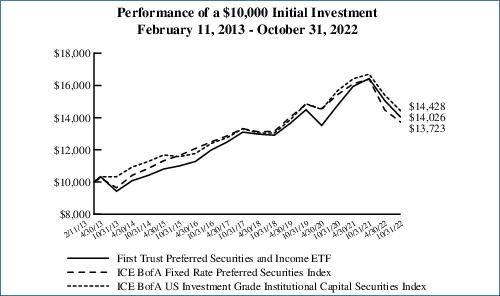

Fund Performance Overview (Unaudited)

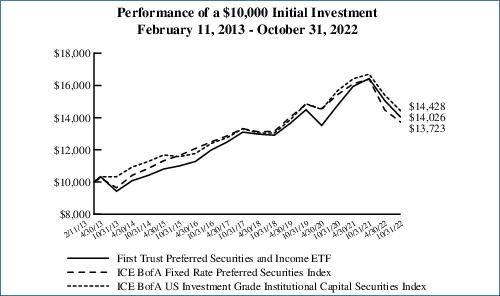

First Trust Preferred Securities and Income ETF (FPE)

The First Trust Preferred Securities and Income ETF’s (the “Fund”) investment objective is to seek total return and to provide current income. Under normal market conditions, the Fund invests at least 80% of its net assets (including investment borrowings) in preferred securities (“Preferred Securities”) and income-producing debt securities (“Income Securities”). The Fund invests in securities that are traded over-the-counter or listed on an exchange. For purposes of the 80% test set forth above, securities of open-end funds, closed-end funds or other exchange-traded funds (“ETFs”) registered under the Investment Company Act of 1940, as amended, that invest primarily in Preferred Securities or Income Securities are deemed to be Preferred Securities or Income Securities.

Preferred Securities held by the Fund generally pay fixed or adjustable-rate distributions to investors and have preference over common stock in the payment of distributions and the liquidation of a company’s assets, but are generally junior to all forms of the company’s debt, including both senior and subordinated debt. Certain of the Preferred Securities may be issued by trusts or other special purpose entities created by companies specifically for the purpose of issuing such securities. Income Securities that may be held by the Fund include corporate bonds, high yield securities (commonly referred to as “junk” bonds) and convertible securities. The broad category of corporate debt securities includes debt issued by U.S. and non-U.S. companies of all kinds, including those with small, mid and large capitalizations. Corporate debt may carry fixed or floating rates of interest.

| Performance | | | | | | |

| | | Average Annual Total Returns | | Cumulative Total Returns |

| | 1 Year

Ended

10/31/22 | 5 Years

Ended

10/31/22 | Inception

(2/11/13)

to 10/31/22 | | 5 Years

Ended

10/31/22 | Inception

(2/11/13)

to 10/31/22 |

| Fund Performance | | | | | | |

| NAV | -14.65% | 1.37% | 3.54% | | 7.06% | 40.26% |

| Market Price | -15.24% | 1.26% | 3.48% | | 6.47% | 39.47% |

| Index Performance | | | | | | |

| ICE BofA US Investment Grade Institutional Capital Securities Index | -13.64% | 1.61% | 3.84% | | 8.33% | 44.28% |

| Blended Index(1)(2)(3) | -16.71% | 1.06% | N/A | | 5.43% | N/A |

| ICE BofA Fixed Rate Preferred Securities Index | -16.32% | 0.60% | 3.31% | | 3.05% | 37.23% |

| Prior Blended Index(4) | -15.84% | 0.99% | 3.48% | | 5.05% | 39.37% |

(See Notes to Fund Performance Overview Page 9.)

| (1) | On July 6, 2021, the Fund’s benchmark changed from the Prior Blended Index to the Blended Index because the Advisor believes that the Blended Index better reflects the investment strategies of the Fund. |

| (2) | The Blended Index consists of a 30/30/30/10 blend of the ICE BofA Core Plus Fixed Rate Preferred Securities Index, the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. The Blended Index is intended to reflect the proportional market cap of each segment of the preferred and hybrid securities market. The indices do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Indices are unmanaged and an investor cannot invest directly in an index. The Blended Index returns are calculated by using the monthly returns of the four indices during each period shown above. At the beginning of each month the four indices are rebalanced to a 30/30/30/10 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Index for each period shown above. |

| (3) | Since the ICE USD Contingent Capital Index had an inception date of December 31, 2013, the performance of the Blended Index is not available for all of the periods disclosed. |

| (4) | The Prior Blended Index consists of a 50/50 blend of the ICE BofA Fixed Rate Preferred Securities Index and the ICE BofA U.S. Capital Securities Index. The indices do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Indices are unmanaged and an investor cannot invest directly in an index. The Prior Blended Index returns are calculated by using the monthly returns of the two indices during each period shown above. At the beginning of each month the two indices are rebalanced to a 50/50 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Index for each period shown above. |

Fund Performance Overview (Unaudited) (Continued)

First Trust Preferred Securities and Income ETF (FPE) (Continued)

| Sector Allocation | % of Total

Investments |

| Financials | 72.7% |

| Energy | 8.9 |

| Utilities | 8.6 |

| Industrials | 3.5 |

| Consumer Staples | 2.9 |

| Real Estate | 2.0 |

| Communication Services | 1.1 |

| Consumer Discretionary | 0.3 |

| Total | 100.0% |

| Credit Rating(5) | % of Total

Fixed-Income

Investments |

| A | 0.4% |

| BBB+ | 10.7 |

| BBB | 21.8 |

| BBB- | 30.3 |

| BB+ | 17.0 |

| BB | 9.7 |

| BB- | 5.0 |

| B+ | 0.8 |

| B | 0.6 |

| Not Rated | 3.7 |

| Total | 100.0% |

| Top Ten Holdings | % of Total

Investments |

| AerCap Holdings N.V. | 2.2% |

| Barclays PLC | 2.1 |

| Wells Fargo & Co., Series L | 1.7 |

| Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. | 1.5 |

| Credit Suisse Group AG | 1.1 |

| Wells Fargo & Co., Series BB | 1.1 |

| Global Atlantic Fin Co. | 1.1 |

| Societe Generale S.A. | 1.0 |

| Deutsche Bank AG, Series 2020 | 1.0 |

| Bank of America Corp., Series L | 1.0 |

| Total | 13.8% |

| Country Allocation | % of Total

Investments |

| United States | 56.6% |

| United Kingdom | 8.4 |

| Canada | 7.1 |

| Switzerland | 5.0 |

| France | 4.8 |

| Bermuda | 4.7 |

| Netherlands | 3.0 |

| Australia | 2.1 |

| Italy | 1.7 |

| Spain | 1.6 |

| Multinational | 1.5 |

| Germany | 1.4 |

| Denmark | 0.9 |

| Mexico | 0.8 |

| Sweden | 0.2 |

| Japan | 0.2 |

| Total | 100.0% |

| (5) | The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

Fund Performance Overview (Unaudited) (Continued)

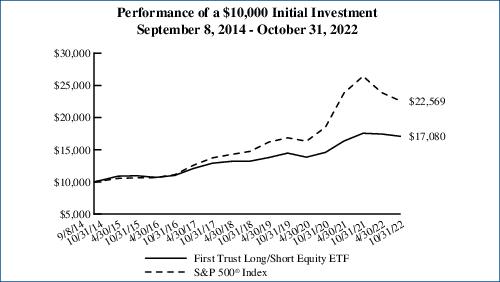

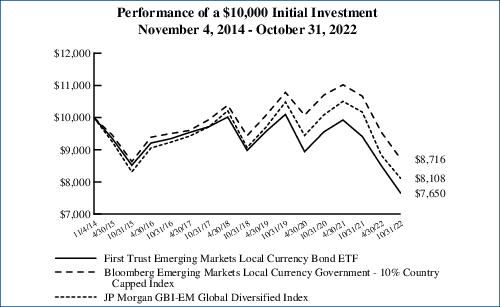

Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, the indices do not actually hold a portfolio of securities and therefore do not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance.

Frequency Distribution of Discounts and Premiums

Information showing the number of days the market price of the Fund’s shares was greater (at a premium) and less (at a discount) than the Fund’s net asset value for the most recently completed year, and the most recently completed calendar quarters since that year (or life of the Fund, if shorter), is available at https://www.ftportfolios.com/Retail/etf/home.aspx.

Fund Performance Overview (Unaudited) (Continued)

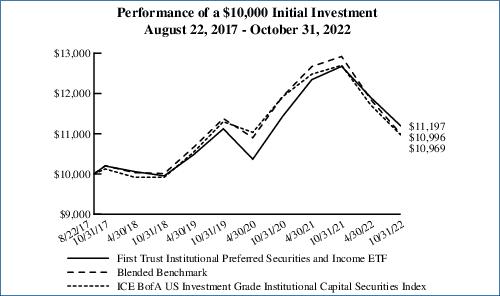

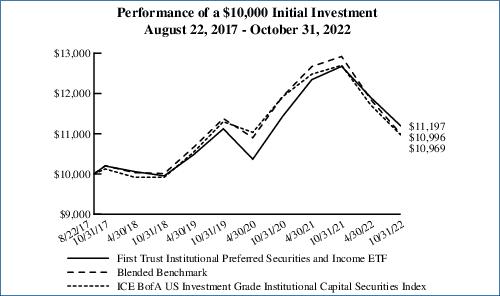

First Trust Institutional Preferred Securities and Income ETF (FPEI)

The First Trust Institutional Preferred Securities and Income ETF’s (the “Fund”) investment objective is to seek total return and to provide current income. Under normal market conditions, the Fund invests at least 80% of its net assets (including investment borrowings) in institutional preferred securities (“Preferred Securities”) and income-producing debt securities (“Income Securities”). Preferred Securities are a type of equity security that have preference over common stock in the payment of distributions and the liquidation of a company’s assets, but are generally junior to all forms of the company’s debt, including both senior and subordinated debt. The Fund’s investments in Preferred Securities will primarily be in institutional preferred securities. Institutional preferred securities are targeted to institutional, rather than retail, investors, are generally traded over-the-counter and may also be known as “$1,000 par preferred securities.” They are typically issued in large, institutional lot sized by U.S. and non-U.S. financial services companies and other companies. While all income-producing debt securities will be categorized as “Income Securities” for purposes of the 80% test above, the Income Securities in which the Fund intends to invest as part of its principal investment strategy include hybrid capital securities, contingent capital securities, U.S. and non-U.S. corporate bonds and convertible securities.

| Performance | | | | | | |

| | | Average Annual Total Returns | | Cumulative Total Returns |

| | 1 Year

Ended

10/31/22 | 5 Years

Ended

10/31/22 | Inception

(8/22/17)

to 10/31/22 | | 5 Years

Ended

10/31/22 | Inception

(8/22/17)

to 10/31/22 |

| Fund Performance | | | | | | |

| NAV | -11.68% | 1.88% | 2.20% | | 9.77% | 11.97% |

| Market Price | -11.70% | 1.91% | 2.24% | | 9.91% | 12.17% |

| Index Performance | | | | | | |

| Blended Benchmark(1)(2) | -14.90% | 1.50% | 1.85% | | 7.75% | 9.96% |

| ICE BofA US Investment Grade Institutional Capital Securities Index | -13.64% | 1.61% | 1.80% | | 8.33% | 9.69% |

(See Notes to Fund Performance Overview Page 9.)

| (1) | On July 6, 2021, the Fund’s benchmark changed from the ICE BofA US Investment Grade Institutional Capital Securities Index to the Blended Benchmark because the Advisor believes that the Blended Benchmark better reflects the investment strategies of the Fund. |

| (2) | The Blended Benchmark consists of a 45/40/15 blend of the ICE BofA US Investment Grade Institutional Capital Securities Index, the ICE USD Contingent Capital Index and the ICE BofA US High Yield Institutional Capital Securities Index. The Blended Benchmark is intended to reflect the proportional market cap of each segment within the institutional market. The Blended Benchmark returns are calculated by using the monthly returns of the three indices during each period shown above. At the beginning of each month the three indices are rebalanced to a 45/40/15 ratio to account for divergence from that ratio that occurred during the course of each month. The monthly returns are then compounded for each period shown above, giving the performance for the Blended Benchmark for each period shown above. |

Fund Performance Overview (Unaudited) (Continued)

First Trust Institutional Preferred Securities and Income ETF (FPEI) (Continued)

| Sector Allocation | % of Total

Investments |

| Financials | 77.8% |

| Energy | 9.6 |

| Utilities | 8.4 |

| Industrials | 2.4 |

| Consumer Staples | 1.8 |

| Total | 100.0% |

| Credit Quality(3) | % of Total

Investments |

| A | 0.5% |

| BBB+ | 13.2 |

| BBB | 27.2 |

| BBB- | 31.7 |

| BB+ | 11.7 |

| BB | 8.7 |

| BB- | 5.3 |

| B+ | 1.0 |

| Not Rated | 0.7 |

| Total | 100.0% |

| Top Ten Holdings | % of Total

Investments |

| Charles Schwab (The) Corp., Series I | 2.6% |

| Wells Fargo & Co., Series BB | 1.9 |

| Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. | 1.8 |

| Barclays PLC | 1.8 |

| Enstar Finance LLC | 1.6 |

| Corebridge Financial, Inc. | 1.6 |

| Prudential Financial, Inc. | 1.6 |

| AerCap Holdings N.V. | 1.5 |

| PNC Financial Services Group (The), Inc., Series V | 1.3 |

| Deutsche Bank AG, Series 2020 | 1.3 |

| Total | 17.0% |

| Country Allocation | % of Total

Investments |

| United States | 56.3% |

| United Kingdom | 8.0 |

| Canada | 7.5 |

| France | 6.6 |

| Switzerland | 6.3 |

| Australia | 2.8 |

| Netherlands | 2.1 |

| Multinational | 1.8 |

| Germany | 1.8 |

| Spain | 1.7 |

| Italy | 1.7 |

| Bermuda | 1.2 |

| Denmark | 0.8 |

| Mexico | 0.5 |

| Finland | 0.4 |

| Japan | 0.3 |

| Sweden | 0.2 |

| Total | 100.0% |

| (3) | The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change. |

Fund Performance Overview (Unaudited) (Continued)

First Trust Institutional Preferred Securities and Income ETF (FPEI) (Continued)

Performance figures assume reinvestment of all distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. An index is a statistical composite that tracks a specified financial market or sector. Unlike the Fund, the indices do not actually hold a portfolio of securities and therefore do not incur the expenses incurred by the Fund. These expenses negatively impact the performance of the Fund. The Fund’s past performance does not predict future performance.

Frequency Distribution of Discounts and Premiums

Information showing the number of days the market price of the Fund’s shares was greater (at a premium) and less (at a discount) than the Fund’s net asset value for the most recently completed year, and the most recently completed calendar quarters since that year (or life of the Fund, if shorter), is available at https://www.ftportfolios.com/Retail/etf/home.aspx.

Notes to Fund Performance Overview (Unaudited)

Total returns for the periods since inception are calculated from the inception date of each Fund. “Average Annual Total Returns” represent the average annual change in value of an investment over the periods indicated. “Cumulative Total Returns” represent the total change in value of an investment over the periods indicated.

Each Fund’s per share net asset value (“NAV”) is the value of one share of the Fund and is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of outstanding shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint of the national best bid and offer price (“NBBO”) as of the time that the Fund’s NAV is calculated. Under SEC rules, the NBBO consists of the highest displayed buy and lowest sell prices among the various exchanges trading the Fund at the time the Fund’s NAV is calculated. Prior to January 1, 2019, the price used was the midpoint between the highest bid and the lowest offer on the stock exchange on which shares of the Fund were listed for trading as of the time that the Fund’s NAV was calculated. Since shares of each Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary market trading in shares of the Fund, the NAV of each Fund is used as a proxy for the secondary market trading price to calculate market returns. NAV and market returns assume that all distributions have been reinvested in each Fund at NAV and Market Price, respectively.

An index is a statistical composite that tracks a specified financial market or sector. Unlike each Fund, the indices do not actually hold a portfolio of securities and therefore do not incur the expenses incurred by each Fund. These expenses negatively impact the performance of each Fund. Also, market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. The total returns presented reflect the reinvestment of dividends on securities in the indices. The returns presented do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares. The investment return and principal value of shares of each Fund will vary with changes in market conditions. Shares of each Fund may be worth more or less than their original cost when they are redeemed or sold in the market. Each Fund’s past performance is no guarantee of future performance.

Portfolio Commentary

First Trust Exchange-Traded Fund III

Annual Report

October 31, 2022 (Unaudited)

Advisor

First Trust Advisors L.P. (“First Trust”) serves as the investment advisor to the First Trust Preferred Securities and Income ETF and the First Trust Institutional Preferred Securities and Income ETF (each a “Fund” and collectively the “Funds”). First Trust is responsible for the ongoing monitoring of each Fund’s investment portfolio, managing each Fund’s business affairs and providing certain administrative services necessary for the management of each Fund.

Sub-Advisor

Stonebridge Advisors LLC

Stonebridge Advisors LLC (“Stonebridge” or the “Sub-Advisor”) is the sub-advisor to the Funds and is a registered investment advisor based in Wilton, Connecticut. Stonebridge specializes in the management of preferred and hybrid securities.

Stonebridge Advisors LLC Portfolio Management Team

Scott T. Fleming - Chief Executive Officer and President

Robert Wolf - Chief Investment Officer, Executive Vice President and Senior Portfolio Manager

Eric Weaver - Executive Vice President, Chief Strategist and Portfolio Manager

Angelo Graci, CFA - Executive Vice President, Head of Credit Research and Portfolio Manager

Commentary

Market Recap

The 12-month period ended October 31, 2022 was negative for all segments of the preferred and hybrid securities market as interest rates moved sharply higher across the Treasury curve. In the face of stubbornly high inflation throughout 2021, the Federal Reserve (the “Fed”) pivoted to a hawkish monetary policy stance in early 2022. The Fed proceeded to increase the Federal Funds target rate to 3.00-3.25% by the end of the period, including an unprecedented series of three separate 75 basis points (“bps”) hikes with the market expecting a fourth in early November 2022. In response to the Fed’s pivot, 2-Year Treasury yields moved higher by around 400 bps and 10-Year Treasury yields moved higher by about 250 bps during the period. Meanwhile, the Treasury 2-Year/10-Year yield curve inverted by nearly 50 bps, reflecting the market’s expectation for a potential economic slowdown in response to tighter monetary policy. Long duration and fixed rate securities suffered the deepest losses during the period, while variable rate and floating rate securities outperformed. During the 12-month period ended October 31, 2022, investment grade (“IG”) $1000 par institutional securities were the top performing segment of the preferred and hybrid securities market, returning -13.64% (the ICE BofA US Investment Grade Institutional Capital Securities Index (“CIPS”)), non-IG $1000 par institutional securities returned -16.00% (the ICE BofA US High Yield Institutional Capital Securities Index (“HIPS”)), while non-U.S. bank contingent convertible capital securities (“CoCos”) returned -15.94% (the ICE USD Contingent Capital Index (“CDLR”)). Finally, the exchange-traded $25 par exchange traded market was by far the worst performer due to its longer duration profile and heavy outflows from passive exchange-traded funds (“ETFs”) that focus on the $25 par exchange traded market. The $25 par exchange traded securities returned -20.94% (the ICE BofA Core Plus Fixed Rate Preferred Securities Index (“P0P4”)) during the period.

Performance Analysis

First Trust Preferred Securities and Income ETF (FPE)

For the 12-month period ended October 31, 2022 the net asset value and market price total return for the Fund were -14.65% and -15.24%, respectively. This compares to a total return of -16.71% for the Fund’s benchmark (the “Benchmark”), which is a 30/30/30/10 blend of P0P4, CIPS, CDLR and HIPS, respectively. The largest contributors to the Fund’s outperformance relative to the Benchmark during the period were the Fund’s defensive positioning in regard to rising interest rates, security selection within CoCos, and security selection within IG securities. The Fund also benefited from its security selection within pipelines and $25 par exchange traded holdings.

The Fund began repositioning for potentially higher interest rates as early as the fourth quarter of 2020, which paid off on a relative basis during the fiscal year 2022. Short duration (<3 years) securities significantly outperformed during the period while long duration securities (5+ years) significantly underperformed. The Fund benefited from its significant underweight to longer duration securities and overweight to short duration securities, including floaters, which are not held in the Benchmark. The Fund outperformed versus the Benchmark across every duration segment of the curve.

Portfolio Commentary (Continued)

First Trust Exchange-Traded Fund III

Annual Report

October 31, 2022 (Unaudited)

Another area of outperformance for the Fund was its security selection within non-US bank CoCos, including its security selection within European banks. The Fund also benefited from its underweight allocation to emerging market (EM) banks, which the Fund is comfortable maintaining going forward. Russian bank CoCos, which were not held by the Fund, suffered complete losses during the period.

Within non-IG securities, the Fund benefited from its security selection, particularly within the pipeline sector. The Fund’s pipeline holdings outperformed the Benchmark’s by over 8% for the period. The Fund continues to maintain an overweight allocation to this sector given its favorable outlook.

Turning to the $25 par exchange traded market, the Fund’s relative performance benefited from both its underweight to fixed rate securities and overweight to variable rate structures. The Fund’s superior security selection within variable rate holdings was also a positive contributor. This was partially offset by the relative underperformance of the Fund’s holdings in Equity Real Investment Trusts and Utilities holdings.

Finally, the Fund added to its relative performance through the new issuance markets. Given the volatility and exchange-traded fund outflows during the period, the Fund was very selective within this market segment.

First Trust Institutional Preferred Securities and Income ETF (FPEI)

For the 12-month period ended October 31, 2022, the NAV and market price total return for the Fund were -11.68%, -11.70%, and -14.90%, respectively. This compares to a total return of -14.90% for the Fund’s benchmark (the “Benchmark”), which is a 45%/40%/15% blend of CIPS, CDLR and HIPS, respectively. The largest contributors to the Fund’s outperformance relative to the Benchmark during the period were the Fund’s defensive positioning in regard to rising interest rates, security selection within CoCos, and security selection within IG securities.

The Fund began repositioning for potentially higher interest rates as early as the fourth quarter of 2020, which paid off on a relative basis during the fiscal year 2022. Short duration (<3 years) securities significantly outperformed during the period while long duration securities (5+ years) significantly underperformed. The Fund benefited from its significant underweight to longer duration securities and overweight to short duration securities, including floaters, which are not held in the Benchmark. The Fund outperformed versus the Benchmark across every duration segment of the curve.

Another area of outperformance for the Fund was its security selection within non-US bank CoCos, including its security selection within European banks. The Fund also benefited from its underweight allocation to EM banks, which the Fund is comfortable maintaining going forward. Russian bank CoCos, which were not held by the Fund, suffered complete losses during the period.

Within non-IG securities, the Fund benefited from its security selection, particularly within the pipeline sector. The Fund’s pipeline holdings outperformed the Benchmark’s by over 9% for the period. The Fund continues to maintain an overweight allocation to this sector given its favorable outlook.

Finally, the Fund added to its relative performance through the new issuance markets. Given the volatility and ETF outflows during the period, the Fund was very selective within this market segment.

Market and Funds Outlook

As we look ahead, we believe the risk reward balance has improved in regard to interest rate risk, creating opportunities in the preferred and hybrid securities market. Our base case for the next 12 months is for the market to perform positively with some capital appreciation in addition to income. We believe risks from inflationary pressures, rising rates, and geopolitical conflicts are elevated, but are largely priced into the market. In our view, valuation metrics for preferred securities are at attractive levels with high yields relative to other fixed income asset classes coupled with market prices trading at historically deep discounts to par. We especially favor select longer duration variable rate securities and securities trading at deep discounts. We believe in a “pull to par” effect for many of the deeply discounted securities that have a high likelihood of trading closer to par as they approach their first call dates. The primary driver of this “pull to par” effect are variable rate securities with high resets that project much higher coupons after their first call dates.

In addition, the high quality credit fundamentals and sector concentrations in highly regulated industries could help to insulate the asset class in a recessionary environment and against current geopolitical risks. We believe U.S. and European banks are well capitalized and entering the new fiscal year from a position of strength in the face of economic headwinds, while other major sectors like Insurance, Utilities, and Real Estate Investment Trusts offer lower sensitivity to inflation.

Portfolio Commentary (Continued)

First Trust Exchange-Traded Fund III

Annual Report

October 31, 2022 (Unaudited)

We foresee the risk-reward dynamic progressively improving as we approach 2023 and think that the preferred and hybrid securities market is set up to outperform longer term. As active fund managers, we have the advantage of repositioning the portfolio as market conditions change. As a result, we believe the Funds are positioned for outperformance over the next 12 months due to an overweight in discounted securities that we think have the greatest upside potential, defensive credit exposure and capacity to take advantage of market dislocations as they arise.

First Trust Exchange-Traded Fund III

Understanding Your Fund Expenses

October 31, 2022 (Unaudited)

As a shareholder of First Trust Preferred Securities and Income ETF or First Trust Institutional Preferred Securities and Income ETF (each a “Fund” and collectively, the “Funds”), you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, if any, and other Fund expenses. This Example is intended to help you understand your ongoing costs of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held through the six-month period ended October 31, 2022.

Actual Expenses

The first line in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this six-month period.

Hypothetical Example for Comparison Purposes

The second line in the following table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as brokerage commissions. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

May 1, 2022 | Ending

Account Value

October 31, 2022 | Annualized

Expense Ratio

Based on the

Six-Month

Period | Expenses Paid

During the

Six-Month

Period (a) |

| First Trust Preferred Securities and Income ETF (FPE) |

| Actual | $1,000.00 | $1,068.60 | 0.85% | $4.43 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.92 | 0.85% | $4.33 |

| First Trust Institutional Preferred Securities and Income ETF (FPEI) |

| Actual | $1,000.00 | $941.00 | 0.85% | $4.16 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.92 | 0.85% | $4.33 |

| (a) | Expenses are equal to the annualized expense ratios as indicated in the table multiplied by the average account value over the period (May 1, 2022 through October 31, 2022), multiplied by 184/365 (to reflect the six-month period). |

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments

October 31, 2022

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES – 23.8% |

| | | Automobiles – 0.3% | | | | | | |

| 705,603 | | Ford Motor Co.

| | 6.50% | | 08/15/62 | | $16,087,748 |

| | | Banks – 4.4% | | | | | | |

| 10,915 | | Atlantic Union Bankshares Corp., Series A

| | 6.88% | | (a) | | 259,668 |

| 360,423 | | Bank of America Corp., Series KK

| | 5.38% | | (a) | | 7,713,052 |

| 105,331 | | Bank of America Corp., Series LL

| | 5.00% | | (a) | | 2,100,300 |

| 1,371,123 | | Bank of America Corp., Series NN

| | 4.38% | | (a) | | 23,871,251 |

| 88,701 | | Bank of America Corp., Series SS

| | 4.75% | | (a) | | 1,727,895 |

| 320,641 | | Citizens Financial Group, Inc., Series D (b)

| | 6.35% | | (a) | | 7,519,031 |

| 48,593 | | Citizens Financial Group, Inc., Series E

| | 5.00% | | (a) | | 936,873 |

| 100,000 | | Fifth Third Bancorp, Series A

| | 6.00% | | (a) | | 2,184,000 |

| 886,828 | | First Republic Bank, Series M

| | 4.00% | | (a) | | 13,311,288 |

| 356,061 | | Fulton Financial Corp., Series A

| | 5.13% | | (a) | | 7,149,705 |

| 68,150 | | Huntington Bancshares, Inc., Series H

| | 4.50% | | (a) | | 1,187,173 |

| 792 | | JPMorgan Chase & Co., Series DD

| | 5.75% | | (a) | | 18,351 |

| 81,943 | | JPMorgan Chase & Co., Series JJ

| | 4.55% | | (a) | | 1,492,182 |

| 518,075 | | JPMorgan Chase & Co., Series LL

| | 4.63% | | (a) | | 9,605,111 |

| 218,650 | | KeyCorp, Series F

| | 5.65% | | (a) | | 4,622,261 |

| 152,538 | | Old National Bancorp, Series A

| | 7.00% | | (a) | | 3,927,854 |

| 1,222,469 | | PacWest Bancorp, Series A (b)

| | 7.75% | | (a) | | 30,341,681 |

| 835,910 | | Pinnacle Financial Partners, Inc., Series B

| | 6.75% | | (a) | | 20,354,409 |

| 1,705,351 | | Signature Bank, Series A

| | 5.00% | | (a) | | 30,048,285 |

| 116,076 | | Texas Capital Bancshares, Inc., Series B

| | 5.75% | | (a) | | 2,301,787 |

| 135,679 | | Truist Financial Corp., Series R

| | 4.75% | | (a) | | 2,571,117 |

| 107,837 | | Valley National Bancorp, Series B, 3 Mo. LIBOR + 3.58% (c)

| | 7.25% | | (a) | | 2,601,028 |

| 194,398 | | Wells Fargo & Co., Series AA

| | 4.70% | | (a) | | 3,489,444 |

| 83,272 | | Wells Fargo & Co., Series DD

| | 4.25% | | (a) | | 1,336,516 |

| 567,107 | | Wells Fargo & Co., Series Q (b)

| | 5.85% | | (a) | | 12,901,684 |

| 746,818 | | Wells Fargo & Co., Series Y

| | 5.63% | | (a) | | 15,929,628 |

| 391,052 | | Wells Fargo & Co., Series Z

| | 4.75% | | (a) | | 7,038,936 |

| 626,023 | | WesBanco, Inc., Series A (b)

| | 6.75% | | (a) | | 15,688,136 |

| 620,288 | | Western Alliance Bancorp, Series A (b)

| | 4.25% | | (a) | | 12,405,760 |

| 875,783 | | Wintrust Financial Corp., Series E (b)

| | 6.88% | | (a) | | 22,183,583 |

| | | | | 266,817,989 |

| | | Capital Markets – 2.3% | | | | | | |

| 136,104 | | Affiliated Managers Group, Inc.

| | 5.88% | | 03/30/59 | | 2,813,270 |

| 288,442 | | Affiliated Managers Group, Inc.

| | 4.75% | | 09/30/60 | | 4,929,474 |

| 980,305 | | Affiliated Managers Group, Inc.

| | 4.20% | | 09/30/61 | | 14,547,726 |

| 1,436,731 | | Carlyle Finance LLC

| | 4.63% | | 05/15/61 | | 22,829,656 |

| 826,758 | | Goldman Sachs Group (The), Inc., Series J (b)

| | 5.50% | | (a) | | 20,346,514 |

| 1,126,769 | | KKR Group Finance Co., IX LLC

| | 4.63% | | 04/01/61 | | 19,639,584 |

| 920,357 | | Morgan Stanley, Series P

| | 6.50% | | (a) | | 22,824,854 |

| 496,152 | | Oaktree Capital Group LLC, Series A

| | 6.63% | | (a) | | 11,758,802 |

| 813,527 | | Oaktree Capital Group LLC, Series B

| | 6.55% | | (a) | | 18,841,285 |

| | | | | 138,531,165 |

| | | Consumer Finance – 0.1% | | | | | | |

| 349,303 | | Capital One Financial Corp., Series I

| | 5.00% | | (a) | | 6,472,585 |

| 110,166 | | Capital One Financial Corp., Series J

| | 4.80% | | (a) | | 1,916,888 |

| | | | | 8,389,473 |

| | | Diversified Financial Services – 0.6% | | | | | | |

| 529,821 | | Apollo Asset Management, Inc., Series B

| | 6.38% | | (a) | | 11,550,098 |

Page 14

See Notes to Financial Statements

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES (Continued) |

| | | Diversified Financial Services (Continued) | | | | | | |

| 1,284,884 | | Equitable Holdings, Inc., Series A

| | 5.25% | | (a) | | $23,924,540 |

| | | | | 35,474,638 |

| | | Diversified Telecommunication Services – 0.7% | | | | | | |

| 78,274 | | AT&T, Inc.

| | 5.35% | | 11/01/66 | | 1,681,326 |

| 249,322 | | AT&T, Inc., Series C

| | 4.75% | | (a) | | 4,318,257 |

| 969,955 | | Qwest Corp.

| | 6.50% | | 09/01/56 | | 16,634,728 |

| 1,039,347 | | Qwest Corp.

| | 6.75% | | 06/15/57 | | 18,708,246 |

| | | | | 41,342,557 |

| | | Electric Utilities – 1.1% | | | | | | |

| 14,925 | | BIP Bermuda Holdings I Ltd.

| | 5.13% | | (a) | | 260,441 |

| 891,011 | | Brookfield BRP Holdings Canada, Inc.

| | 4.63% | | (a) | | 12,905,047 |

| 648,305 | | Brookfield Infrastructure Finance ULC

| | 5.00% | | 05/24/81 | | 10,321,016 |

| 139,433 | | SCE Trust III, Series H (b)

| | 5.75% | | (a) | | 2,696,634 |

| 455,006 | | SCE Trust IV, Series J (b)

| | 5.38% | | (a) | | 8,162,808 |

| 1,000,755 | | SCE Trust V, Series K (b)

| | 5.45% | | (a) | | 19,194,481 |

| 627,885 | | Southern (The) Co., Series 2020A

| | 4.95% | | 01/30/80 | | 12,005,161 |

| 156,295 | | Southern (The) Co., Series C

| | 4.20% | | 10/15/60 | | 2,789,866 |

| | | | | 68,335,454 |

| | | Equity Real Estate Investment Trusts – 0.6% | | | | | | |

| 333 | | Digital Realty Trust, Inc., Series L

| | 5.20% | | (a) | | 6,433 |

| 850,146 | | Global Net Lease, Inc., Series A

| | 7.25% | | (a) | | 18,142,116 |

| 1,080,167 | | Hudson Pacific Properties, Inc., Series C

| | 4.75% | | (a) | | 13,728,923 |

| 957 | | National Storage Affiliates Trust, Series A

| | 6.00% | | (a) | | 20,709 |

| 31,880 | | PS Business Parks, Inc., Series Z

| | 4.88% | | (a) | | 401,688 |

| 318,431 | | Vornado Realty Trust, Series N

| | 5.25% | | (a) | | 4,938,865 |

| | | | | 37,238,734 |

| | | Food Products – 0.8% | | | | | | |

| 601,882 | | CHS, Inc., Series 2 (b)

| | 7.10% | | (a) | | 15,077,144 |

| 1,393,686 | | CHS, Inc., Series 3 (b)

| | 6.75% | | (a) | | 34,047,749 |

| | | | | 49,124,893 |

| | | Gas Utilities – 0.3% | | | | | | |

| 815,676 | | South Jersey Industries, Inc.

| | 5.63% | | 09/16/79 | | 14,282,487 |

| 54,298 | | Spire, Inc., Series A

| | 5.90% | | (a) | | 1,243,424 |

| | | | | 15,525,911 |

| | | Independent Power & Renewable Electricity Producers – 0.2% | | | | | | |

| 679,080 | | Brookfield Renewable Partners L.P., Series 17

| | 5.25% | | (a) | | 11,130,121 |

| | | Insurance – 6.0% | | | | | | |

| 2,183,916 | | Aegon Funding Co., LLC

| | 5.10% | | 12/15/49 | | 42,586,362 |

| 463,083 | | Allstate (The) Corp. (b)

| | 5.10% | | 01/15/53 | | 11,197,347 |

| 18,254 | | Allstate (The) Corp., Series H

| | 5.10% | | (a) | | 358,691 |

| 1,896,300 | | American Equity Investment Life Holding Co., Series A (b)

| | 5.95% | | (a) | | 42,723,639 |

| 941,232 | | American Equity Investment Life Holding Co., Series B (b)

| | 6.63% | | (a) | | 21,798,933 |

| 312,756 | | AmTrust Financial Services, Inc.

| | 7.25% | | 06/15/55 | | 5,352,819 |

| 363,925 | | AmTrust Financial Services, Inc.

| | 7.50% | | 09/15/55 | | 6,368,687 |

| 24,872 | | Arch Capital Group Ltd., Series F

| | 5.45% | | (a) | | 503,907 |

| 598,334 | | Arch Capital Group Ltd., Series G

| | 4.55% | | (a) | | 10,506,745 |

| 279,359 | | Aspen Insurance Holdings Ltd.

| | 5.63% | | (a) | | 5,391,629 |

| 1,711,649 | | Aspen Insurance Holdings Ltd.

| | 5.63% | | (a) | | 32,504,215 |

| 508,376 | | Aspen Insurance Holdings Ltd. (b)

| | 5.95% | | (a) | | 11,596,057 |

See Notes to Financial Statements

Page 15

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES (Continued) |

| | | Insurance (Continued) | | | | | | |

| 612,099 | | Assurant, Inc.

| | 5.25% | | 01/15/61 | | $11,525,824 |

| 826,625 | | Athene Holding Ltd., Series A (b)

| | 6.35% | | (a) | | 19,681,941 |

| 68,990 | | Athene Holding Ltd., Series B

| | 5.63% | | (a) | | 1,417,744 |

| 108,391 | | Athene Holding Ltd., Series D

| | 4.88% | | (a) | | 1,865,409 |

| 438,412 | | Axis Capital Holdings Ltd., Series E

| | 5.50% | | (a) | | 8,663,021 |

| 754,186 | | CNO Financial Group, Inc. (d)

| | 5.13% | | 11/25/60 | | 13,726,185 |

| 1,244,856 | | Delphi Financial Group, Inc., 3 Mo. LIBOR + 3.19% (c)

| | 6.10% | | 05/15/37 | | 27,542,439 |

| 386,476 | | Enstar Group Ltd., Series D (b)

| | 7.00% | | (a) | | 8,494,742 |

| 449,644 | | Globe Life, Inc.

| | 4.25% | | 06/15/61 | | 7,814,813 |

| 215,020 | | Phoenix Cos. (The), Inc.

| | 7.45% | | 01/15/32 | | 3,297,055 |

| 1,568,378 | | Prudential Financial, Inc.

| | 5.95% | | 09/01/62 | | 37,594,021 |

| 2 | | Reinsurance Group of America, Inc. (b)

| | 7.13% | | 10/15/52 | | 51 |

| 106,528 | | RenaissanceRe Holdings Ltd., Series F

| | 5.75% | | (a) | | 2,316,984 |

| 1,186,079 | | RenaissanceRe Holdings Ltd., Series G

| | 4.20% | | (a) | | 19,771,937 |

| 21,531 | | Selective Insurance Group, Inc., Series B

| | 4.60% | | (a) | | 360,321 |

| 314,714 | | W.R. Berkley Corp.

| | 5.10% | | 12/30/59 | | 6,297,427 |

| | | | | 361,258,945 |

| | | Mortgage Real Estate Investment Trusts – 0.9% | | | | | | |

| 536,098 | | AGNC Investment Corp., Series C, 3 Mo. LIBOR + 5.11% (c)

| | 9.19% | | (a) | | 12,651,913 |

| 300,285 | | AGNC Investment Corp., Series D (b)

| | 6.88% | | (a) | | 5,522,241 |

| 138,354 | | AGNC Investment Corp., Series E (b)

| | 6.50% | | (a) | | 2,711,738 |

| 670,845 | | AGNC Investment Corp., Series F (b)

| | 6.13% | | (a) | | 12,477,717 |

| 651,383 | | Annaly Capital Management, Inc., Series F, 3 Mo. LIBOR + 4.99% (c)

| | 8.67% | | (a) | | 15,691,817 |

| 279,676 | | Annaly Capital Management, Inc., Series I (b)

| | 6.75% | | (a) | | 5,822,854 |

| | | | | 54,878,280 |

| | | Multi-Utilities – 1.7% | | | | | | |

| 409,425 | | Algonquin Power & Utilities Corp. (b)

| | 6.88% | | 10/17/78 | | 9,191,591 |

| 538,458 | | Algonquin Power & Utilities Corp., Series 19-A (b)

| | 6.20% | | 07/01/79 | | 12,206,843 |

| 639,721 | | Brookfield Infrastructure Partners L.P., Series 13

| | 5.13% | | (a) | | 10,222,741 |

| 62,311 | | Brookfield Infrastructure Partners L.P., Series 14

| | 5.00% | | (a) | | 962,705 |

| 175,035 | | CMS Energy Corp.

| | 5.88% | | 10/15/78 | | 3,810,512 |

| 115,124 | | CMS Energy Corp.

| | 5.88% | | 03/01/79 | | 2,508,552 |

| 330,504 | | CMS Energy Corp., Series C

| | 4.20% | | (a) | | 5,436,791 |

| 128,700 | | DTE Energy Co.

| | 4.38% | | 12/01/81 | | 2,211,066 |

| 818,320 | | DTE Energy Co., Series E

| | 5.25% | | 12/01/77 | | 17,577,514 |

| 955,325 | | Integrys Holding, Inc. (b) (d)

| | 6.00% | | 08/01/73 | | 22,115,774 |

| 796,257 | | Sempra Energy

| | 5.75% | | 07/01/79 | | 17,294,702 |

| | | | | 103,538,791 |

| | | Oil, Gas & Consumable Fuels – 1.4% | | | | | | |

| 37,093 | | Enbridge, Inc., Series B (b)

| | 6.38% | | 04/15/78 | | 880,959 |

| 92,177 | | Energy Transfer L.P., Series C (b)

| | 7.38% | | (a) | | 2,064,765 |

| 2,064,508 | | Energy Transfer L.P., Series E (b)

| | 7.60% | | (a) | | 47,545,619 |

| 737,441 | | NuStar Energy L.P., Series A, 3 Mo. LIBOR + 6.77% (c)

| | 10.25% | | (a) | | 17,079,133 |

| 599,189 | | NuStar Logistics L.P., 3 Mo. LIBOR + 6.73% (c)

| | 10.81% | | 01/15/43 | | 14,925,798 |

| | | | | 82,496,274 |

| | | Real Estate Management & Development – 1.4% | | | | | | |

| 1,613,702 | | Brookfield Property Partners L.P., Series A

| | 5.75% | | (a) | | 24,415,311 |

| 167,079 | | Brookfield Property Partners L.P., Series A-1

| | 6.50% | | (a) | | 2,781,865 |

| 1,281,802 | | Brookfield Property Partners L.P., Series A2

| | 6.38% | | (a) | | 20,893,373 |

| 1,559,574 | | Brookfield Property Preferred L.P.

| | 6.25% | | 07/26/81 | | 24,360,546 |

Page 16

See Notes to Financial Statements

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

| Shares | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| $25 PAR PREFERRED SECURITIES (Continued) |

| | | Real Estate Management & Development (Continued) | | | | | | |

| 677 | | DigitalBridge Group, Inc., Class H

| | 7.13% | | (a) | | $12,802 |

| 448,382 | | DigitalBridge Group, Inc., Series I

| | 7.15% | | (a) | | 8,523,742 |

| 41,830 | | DigitalBridge Group, Inc., Series J

| | 7.13% | | (a) | | 778,038 |

| | | | | 81,765,677 |

| | | Thrifts & Mortgage Finance – 0.3% | | | | | | |

| 659,132 | | New York Community Bancorp, Inc., Series A (b)

| | 6.38% | | (a) | | 14,098,833 |

| 73,851 | | Washington Federal, Inc., Series A

| | 4.88% | | (a) | | 1,287,223 |

| | | | | 15,386,056 |

| | | Trading Companies & Distributors – 0.3% | | | | | | |

| 462,382 | | Air Lease Corp., Series A (b)

| | 6.15% | | (a) | | 9,941,213 |

| 267,732 | | WESCO International, Inc., Series A (b)

| | 10.63% | | (a) | | 7,228,764 |

| | | | | 17,169,977 |

| | | Wireless Telecommunication Services – 0.4% | | | | | | |

| 259,030 | | United States Cellular Corp.

| | 6.25% | | 09/01/69 | | 5,040,724 |

| 267,143 | | United States Cellular Corp.

| | 5.50% | | 03/01/70 | | 4,560,131 |

| 955,053 | | United States Cellular Corp.

| �� | 5.50% | | 06/01/70 | | 16,536,743 |

| | | | | 26,137,598 |

| | | Total $25 Par Preferred Securities

| | 1,430,630,281 |

| | | (Cost $1,761,238,457) | | | | | | |

| $100 PAR PREFERRED SECURITIES – 0.3% |

| | | Banks – 0.3% | | | | | | |

| 28,231 | | AgriBank FCB (b)

| | 6.88% | | (a) | | 2,805,456 |

| 49,330 | | CoBank ACB, Series H (b)

| | 6.20% | | (a) | | 4,982,330 |

| 120,015 | | Farm Credit Bank of Texas (b) (e)

| | 6.75% | | (a) | | 11,971,496 |

| | | | | 19,759,282 |

| | | Food Products – 0.0% | | | | | | |

| 700 | | Dairy Farmers of America, Inc. (e)

| | 7.88% | | (a) | | 67,550 |

| | | Total $100 Par Preferred Securities

| | 19,826,832 |

| | | (Cost $20,588,116) | | | | | | |

| $1,000 PAR PREFERRED SECURITIES – 2.8% |

| | | Banks – 2.7% | | | | | | |

| 51,461 | | Bank of America Corp., Series L

| | 7.25% | | (a) | | 59,718,432 |

| 88,218 | | Wells Fargo & Co., Series L

| | 7.50% | | (a) | | 102,820,726 |

| | | | | 162,539,158 |

| | | Diversified Financial Services – 0.1% | | | | | | |

| 7,900 | | Compeer Financial ACA (b) (e)

| | 6.75% | | (a) | | 7,860,500 |

| | | Total $1,000 Par Preferred Securities

| | 170,399,658 |

| | | (Cost $201,128,350) | | | | | | |

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES – 70.0% |

| | | Banks – 29.6% | | | | | | |

| $32,549,000 | | Australia & New Zealand Banking Group Ltd. (b) (e) (f)

| | 6.75% | | (a) | | 31,199,597 |

| 30,500,000 | | Banco Bilbao Vizcaya Argentaria S.A., Series 9 (b) (f)

| | 6.50% | | (a) | | 27,320,683 |

| 11,250,000 | | Banco Mercantil del Norte S.A. (b) (e) (f)

| | 7.50% | | (a) | | 8,792,044 |

| 15,700,000 | | Banco Mercantil del Norte S.A. (b) (e) (f)

| | 7.63% | | (a) | | 12,896,506 |

See Notes to Financial Statements

Page 17

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Banks (Continued) | | | | | | |

| $21,630,000 | | Banco Mercantil del Norte S.A. (b) (e) (f)

| | 8.38% | | (a) | | $18,841,136 |

| 35,600,000 | | Banco Santander S.A. (b) (f)

| | 4.75% | | (a) | | 25,145,288 |

| 43,200,000 | | Banco Santander S.A. (b) (f) (g)

| | 7.50% | | (a) | | 41,013,000 |

| 27,075,000 | | Bank of America Corp., Series RR (b)

| | 4.38% | | (a) | | 21,795,375 |

| 22,000,000 | | Bank of America Corp., Series TT (b)

| | 6.13% | | (a) | | 20,845,000 |

| 11,594,000 | | Bank of America Corp., Series X (b)

| | 6.25% | | (a) | | 11,315,019 |

| 13,800,000 | | Bank of Nova Scotia (The) (b)

| | 4.90% | | (a) | | 12,830,444 |

| 8,000,000 | | Bank of Nova Scotia (The) (b)

| | 8.63% | | 10/27/82 | | 8,046,654 |

| 3,000,000 | | Bank of Nova Scotia (The), Series 2 (b)

| | 3.63% | | 10/27/81 | | 2,118,904 |

| 24,300,000 | | Barclays PLC (b) (f)

| | 4.38% | | (a) | | 16,188,886 |

| 39,909,000 | | Barclays PLC (b) (f)

| | 6.13% | | (a) | | 34,670,944 |

| 5,760,000 | | Barclays PLC (b) (f)

| | 7.75% | | (a) | | 5,436,000 |

| 134,865,000 | | Barclays PLC (b) (f)

| | 8.00% | | (a) | | 127,238,101 |

| 64,400,000 | | Barclays PLC (b) (f)

| | 8.00% | | (a) | | 57,857,502 |

| 11,600,000 | | BBVA Bancomer S.A. (b) (e) (f)

| | 5.88% | | 09/13/34 | | 9,719,060 |

| 57,500,000 | | BNP Paribas S.A. (b) (e) (f)

| | 4.63% | | (a) | | 44,159,795 |

| 7,500,000 | | BNP Paribas S.A. (b) (e) (f)

| | 4.63% | | (a) | | 5,259,375 |

| 29,498,000 | | BNP Paribas S.A. (b) (e) (f)

| | 6.63% | | (a) | | 27,717,561 |

| 16,665,000 | | BNP Paribas S.A. (b) (e) (f)

| | 7.38% | | (a) | | 16,161,128 |

| 34,580,000 | | BNP Paribas S.A. (b) (e) (f)

| | 7.75% | | (a) | | 32,689,690 |

| 46,133,000 | | Citigroup, Inc. (b)

| | 3.88% | | (a) | | 37,990,526 |

| 13,272,000 | | Citigroup, Inc. (b)

| | 5.95% | | (a) | | 13,172,460 |

| 15,113,000 | | Citigroup, Inc., Series D (b)

| | 5.35% | | (a) | | 14,584,045 |

| 12,000,000 | | Citigroup, Inc., Series M (b)

| | 6.30% | | (a) | | 11,235,000 |

| 16,200,000 | | Citigroup, Inc., Series P (b)

| | 5.95% | | (a) | | 14,684,048 |

| 23,355,000 | | Citigroup, Inc., Series T (b)

| | 6.25% | | (a) | | 22,598,298 |

| 34,393,000 | | Citigroup, Inc., Series W (b)

| | 4.00% | | (a) | | 29,096,478 |

| 29,875,000 | | Citigroup, Inc., Series Y (b)

| | 4.15% | | (a) | | 23,384,573 |

| 6,560,000 | | Citizens Financial Group, Inc., Series B (b)

| | 6.00% | | (a) | | 6,036,124 |

| 21,030,000 | | Citizens Financial Group, Inc., Series G (b)

| | 4.00% | | (a) | | 16,713,784 |

| 18,474,000 | | CoBank ACB, Series I (b)

| | 6.25% | | (a) | | 17,688,855 |

| 35,655,000 | | CoBank ACB, Series K (b)

| | 6.45% | | (a) | | 34,674,738 |

| 11,200,000 | | Commerzbank AG (b) (f) (g)

| | 7.00% | | (a) | | 9,630,779 |

| 18,810,000 | | Credit Agricole S.A. (b) (e) (f)

| | 6.88% | | (a) | | 17,596,376 |

| 43,500,000 | | Credit Agricole S.A. (b) (e) (f)

| | 8.13% | | (a) | | 43,425,963 |

| 26,200,000 | | Danske Bank A.S. (b) (f) (g)

| | 4.38% | | (a) | | 20,992,750 |

| 21,313,000 | | Danske Bank A.S. (b) (f) (g)

| | 6.13% | | (a) | | 19,833,217 |

| 15,960,000 | | Danske Bank A.S. (b) (f) (g)

| | 7.00% | | (a) | | 14,784,785 |

| 7,650,000 | | Farm Credit Bank of Texas, Series 3 (b) (e)

| | 6.20% | | (a) | | 6,782,612 |

| 20,300,000 | | Farm Credit Bank of Texas, Series 4 (b) (e)

| | 5.70% | | (a) | | 18,349,089 |

| 8,527,000 | | Fifth Third Bancorp, Series H (b)

| | 5.10% | | (a) | | 7,787,709 |

| 1,400,000 | | Fifth Third Bancorp, Series L (b)

| | 4.50% | | (a) | | 1,288,001 |

| 12,800,000 | | HSBC Holdings PLC (b) (f)

| | 4.60% | | (a) | | 8,476,160 |

| 4,397,000 | | Huntington Bancshares, Inc., Series G (b)

| | 4.45% | | (a) | | 3,874,896 |

| 35,836,000 | | ING Groep N.V. (b) (f)

| | 5.75% | | (a) | | 30,643,507 |

| 21,579,000 | | ING Groep N.V. (b) (f)

| | 6.50% | | (a) | | 19,686,544 |

| 40,125,000 | | Intesa Sanpaolo S.p.A. (b) (e) (f)

| | 7.70% | | (a) | | 34,834,736 |

| 15,896,000 | | JPMorgan Chase & Co., Series Q (b)

| | 5.15% | | (a) | | 15,538,340 |

| 5,861,000 | | JPMorgan Chase & Co., Series R (b)

| | 6.00% | | (a) | | 5,787,738 |

| 32,100,000 | | Lloyds Banking Group PLC (b) (f)

| | 6.75% | | (a) | | 29,259,466 |

| 44,931,668 | | Lloyds Banking Group PLC (b) (f)

| | 7.50% | | (a) | | 42,944,060 |

| 42,017,000 | | Lloyds Banking Group PLC (b) (f)

| | 7.50% | | (a) | | 39,075,810 |

| 14,924,602 | | M&T Bank Corp. (b)

| | 3.50% | | (a) | | 11,104,593 |

| 7,932,000 | | M&T Bank Corp., Series G (b)

| | 5.00% | | (a) | | 7,307,355 |

| 8,500,000 | | NatWest Group PLC (b) (f)

| | 6.00% | | (a) | | 7,585,400 |

Page 18

See Notes to Financial Statements

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Banks (Continued) | | | | | | |

| $21,325,000 | | NatWest Group PLC (b) (f)

| | 8.00% | | (a) | | $20,149,459 |

| 44,615,000 | | PNC Financial Services Group (The), Inc., Series V (b)

| | 6.20% | | (a) | | 42,370,865 |

| 85,600,000 | | Societe Generale S.A. (b) (e) (f)

| | 5.38% | | (a) | | 62,218,494 |

| 8,589,000 | | Societe Generale S.A. (b) (e) (f)

| | 7.88% | | (a) | | 8,383,822 |

| 11,500,000 | | Societe Generale S.A. (b) (e) (f)

| | 8.00% | | (a) | | 11,332,061 |

| 68,460,000 | | Standard Chartered PLC (b) (e) (f)

| | 4.30% | | (a) | | 45,178,635 |

| 25,600,000 | | Standard Chartered PLC (b) (e) (f)

| | 6.00% | | (a) | | 23,384,753 |

| 46,190,000 | | Standard Chartered PLC (b) (e) (f)

| | 7.75% | | (a) | | 42,321,587 |

| 48,046,398 | | SVB Financial Group, Series C (b)

| | 4.00% | | (a) | | 33,668,277 |

| 50,341,000 | | SVB Financial Group, Series D (b)

| | 4.25% | | (a) | | 33,717,337 |

| 13,000,000 | | Swedbank AB, Series NC5 (b) (f) (g)

| | 5.63% | | (a) | | 12,262,250 |

| 5,695,000 | | Texas Capital Bancshares, Inc. (b)

| | 4.00% | | 05/06/31 | | 4,934,970 |

| 24,600,000 | | Toronto-Dominion Bank (The) (b)

| | 8.13% | | 10/31/82 | | 24,955,470 |

| 5,000,000 | | Truist Financial Corp., Series N (b)

| | 4.80% | | (a) | | 4,501,250 |

| 56,950,000 | | UniCredit S.p.A. (b) (f) (g)

| | 8.00% | | (a) | | 53,426,219 |

| 4,400,000 | | UniCredit S.p.A. (b) (e)

| | 7.30% | | 04/02/34 | | 3,734,445 |

| 13,500,000 | | UniCredit S.p.A. (b) (e)

| | 5.46% | | 06/30/35 | | 10,055,827 |

| 79,980,378 | | Wells Fargo & Co., Series BB (b)

| | 3.90% | | (a) | | 67,953,329 |

| | | | | 1,782,255,557 |

| | | Capital Markets – 9.0% | | | | | | |

| 40,096,000 | | Apollo Management Holdings L.P. (b) (e)

| | 4.95% | | 01/14/50 | | 33,696,354 |

| 1,500,000 | | Bank of New York Mellon (The) Corp., Series H (b)

| | 3.70% | | (a) | | 1,316,882 |

| 24,740,000 | | Bank of New York Mellon (The) Corp., Series I (b)

| | 3.75% | | (a) | | 19,112,887 |

| 15,800,000 | | Charles Schwab (The) Corp. (b)

| | 5.00% | | (a) | | 14,062,000 |

| 2,000,000 | | Charles Schwab (The) Corp., Series H (b)

| | 4.00% | | (a) | | 1,488,000 |

| 63,997,000 | | Charles Schwab (The) Corp., Series I (b)

| | 4.00% | | (a) | | 52,695,130 |

| 81,425,000 | | Credit Suisse Group AG (b) (e) (f)

| | 5.25% | | (a) | | 57,882,624 |

| 1,200,000 | | Credit Suisse Group AG (b) (e) (f)

| | 6.25% | | (a) | | 1,013,110 |

| 51,775,000 | | Credit Suisse Group AG (b) (e) (f)

| | 6.38% | | (a) | | 38,752,503 |

| 76,900,000 | | Credit Suisse Group AG (b) (e) (f)

| | 7.50% | | (a) | | 68,344,875 |

| 23,400,000 | | Credit Suisse Group AG (b) (e) (f)

| | 9.75% | | (a) | | 22,279,070 |

| 77,200,000 | | Deutsche Bank AG, Series 2020 (b) (f)

| | 6.00% | | (a) | | 60,785,328 |

| 28,725,000 | | EFG International AG (b) (f) (g)

| | 5.50% | | (a) | | 22,871,563 |

| 24,875,000 | | Goldman Sachs Group (The), Inc., Series R (b)

| | 4.95% | | (a) | | 22,488,990 |

| 13,870,000 | | Goldman Sachs Group (The), Inc., Series T (b)

| | 3.80% | | (a) | | 10,681,295 |

| 40,611,000 | | Goldman Sachs Group (The), Inc., Series U (b)

| | 3.65% | | (a) | | 30,957,154 |

| 38,000,000 | | UBS Group AG (b) (e) (f)

| | 4.88% | | (a) | | 30,419,056 |

| 2,400,000 | | UBS Group AG (b) (f) (g)

| | 5.13% | | (a) | | 2,088,000 |

| 26,389,000 | | UBS Group AG (b) (f) (g)

| | 6.88% | | (a) | | 25,105,808 |

| 28,500,000 | | UBS Group AG (b) (e) (f)

| | 7.00% | | (a) | | 27,636,823 |

| | | | | 543,677,452 |

| | | Consumer Finance – 1.6% | | | | | | |

| 35,292,000 | | Ally Financial, Inc., Series B (b)

| | 4.70% | | (a) | | 25,696,988 |

| 5,830,000 | | Ally Financial, Inc., Series C (b)

| | 4.70% | | (a) | | 3,935,250 |

| 47,679,000 | | American Express Co. (b)

| | 3.55% | | (a) | | 36,891,626 |

| 35,077,000 | | Capital One Financial Corp., Series M (b)

| | 3.95% | | (a) | | 26,271,970 |

| | | | | 92,795,834 |

| | | Diversified Financial Services – 3.1% | | | | | | |

| 64,250,000 | | American AgCredit Corp. (b) (e)

| | 5.25% | | (a) | | 59,029,687 |

| 40,400,000 | | Ares Finance Co. III LLC (b) (e)

| | 4.13% | | 06/30/51 | | 30,765,133 |

| 28,250,000 | | Capital Farm Credit ACA, Series 1 (b) (e)

| | 5.00% | | (a) | | 24,083,126 |

| 13,950,000 | | Compeer Financial ACA (b) (e)

| | 4.88% | | (a) | | 12,363,197 |

See Notes to Financial Statements

Page 19

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Diversified Financial Services (Continued) | | | | | | |

| $50,110,000 | | Corebridge Financial, Inc. (b) (e)

| | 6.88% | | 12/15/52 | | $44,959,182 |

| 16,548,000 | | Voya Financial, Inc., Series A (b)

| | 6.13% | | (a) | | 16,175,670 |

| | | | | 187,375,995 |

| | | Electric Utilities – 1.9% | | | | | | |

| 21,918,000 | | Duke Energy Corp. (b)

| | 4.88% | | (a) | | 19,561,815 |

| 17,965,000 | | Edison International, Series B (b)

| | 5.00% | | (a) | | 14,416,912 |

| 36,567,000 | | Emera, Inc., Series 16-A (b)

| | 6.75% | | 06/15/76 | | 34,222,033 |

| 5,000,000 | | NextEra Energy Capital Holdings, Inc. (b)

| | 5.65% | | 05/01/79 | | 4,224,554 |

| 12,865,000 | | Southern (The) Co., Series 21-A (b)

| | 3.75% | | 09/15/51 | | 10,188,265 |

| 2,000,000 | | Southern (The) Co., Series B (b)

| | 4.00% | | 01/15/51 | | 1,742,900 |

| 32,516,000 | | Southern California Edison Co., Series E, 3 Mo. LIBOR + 4.20% (c)

| | 6.98% | | (a) | | 31,791,657 |

| | | | | 116,148,136 |

| | | Energy Equipment & Services – 0.9% | | | | | | |

| 3,524,000 | | Transcanada Trust (b)

| | 5.63% | | 05/20/75 | | 3,223,403 |

| 25,600,000 | | Transcanada Trust (b)

| | 5.50% | | 09/15/79 | | 21,536,000 |

| 34,700,000 | | Transcanada Trust (b)

| | 5.60% | | 03/07/82 | | 29,728,878 |

| | | | | 54,488,281 |

| | | Food Products – 2.0% | | | | | | |

| 10,700,000 | | Dairy Farmers of America, Inc. (h)

| | 7.13% | | (a) | | 9,964,383 |

| 25,362,000 | | Land O’Lakes Capital Trust I (h)

| | 7.45% | | 03/15/28 | | 25,268,287 |

| 44,888,000 | | Land O’Lakes, Inc. (e)

| | 7.00% | | (a) | | 41,627,785 |

| 14,010,000 | | Land O’Lakes, Inc. (e)

| | 7.25% | | (a) | | 13,100,121 |

| 31,520,000 | | Land O’Lakes, Inc. (e)

| | 8.00% | | (a) | | 31,290,377 |

| | | | | 121,250,953 |

| | | Insurance – 8.7% | | | | | | |

| 16,400,000 | | Allianz SE (b) (e)

| | 3.50% | | (a) | | 12,990,398 |

| 9,502,000 | | Asahi Mutual Life Insurance Co. (b) (g)

| | 6.50% | | (a) | | 9,273,002 |

| 32,200,000 | | Assurant, Inc. (b)

| | 7.00% | | 03/27/48 | | 30,698,514 |

| 12,999,000 | | Assured Guaranty Municipal Holdings, Inc. (b) (e)

| | 6.40% | | 12/15/66 | | 11,829,090 |

| 38,875,000 | | AXIS Specialty Finance LLC (b)

| | 4.90% | | 01/15/40 | | 31,583,216 |

| 11,400,000 | | CNP Assurances (b) (g)

| | 4.88% | | (a) | | 7,621,060 |

| 23,688,000 | | Enstar Finance LLC (b)

| | 5.75% | | 09/01/40 | | 21,100,252 |

| 55,217,000 | | Enstar Finance LLC (b)

| | 5.50% | | 01/15/42 | | 43,472,344 |

| 13,700,000 | | Fortegra Financial Corp. (b) (h)

| | 8.50% | | 10/15/57 | | 13,929,920 |

| 87,495,000 | | Global Atlantic Fin Co. (b) (e)

| | 4.70% | | 10/15/51 | | 64,695,137 |

| 18,871,000 | | Hartford Financial Services Group (The), Inc., 3 Mo. LIBOR + 2.13% (c) (e)

| | 5.03% | | 02/12/47 | | 15,662,733 |

| 26,429,000 | | Kuvare US Holdings, Inc. (b) (e)

| | 7.00% | | 02/17/51 | | 26,627,217 |

| 9,310,000 | | La Mondiale SAM (b) (g)

| | 5.88% | | 01/26/47 | | 8,342,318 |

| 40,630,000 | | Lancashire Holdings Ltd. (b) (g)

| | 5.63% | | 09/18/41 | | 30,309,980 |

| 35,910,000 | | Liberty Mutual Group, Inc. (b) (e)

| | 4.13% | | 12/15/51 | | 27,243,301 |

| 27,059,000 | | Principal Financial Group, Inc., 3 Mo. LIBOR + 3.04% (c)

| | 5.95% | | 05/15/55 | | 26,145,759 |

| 12,670,000 | | Progressive (The) Corp., Series B (b)

| | 5.38% | | (a) | | 11,787,281 |

| 49,840,000 | | Prudential Financial, Inc. (b)

| | 6.00% | | 09/01/52 | | 45,494,222 |

| 38,900,000 | | QBE Insurance Group Ltd. (b) (e)

| | 5.88% | | (a) | | 35,517,882 |

| 24,999,000 | | QBE Insurance Group Ltd. (b) (g)

| | 6.75% | | 12/02/44 | | 24,105,161 |

| 16,000,000 | | QBE Insurance Group Ltd. (b) (g)

| | 5.88% | | 06/17/46 | | 14,481,134 |

| 13,110,000 | | Reinsurance Group of America, Inc., 3 Mo. LIBOR + 2.67% (c)

| | 5.96% | | 12/15/65 | | 11,077,950 |

| | | | | 523,987,871 |

Page 20

See Notes to Financial Statements

First Trust Preferred Securities and Income ETF (FPE)

Portfolio of Investments (Continued)

October 31, 2022

Par

Amount | | Description | | Stated

Rate | | Stated

Maturity | | Value |

| CAPITAL PREFERRED SECURITIES (Continued) |

| | | Mortgage Real Estate Investment Trusts – 0.3% | | | | | | |

| $23,600,000 | | Scentre Group Trust 2 (b) (e)

| | 5.13% | | 09/24/80 | | $18,064,616 |

| | | Multi-Utilities – 3.2% | | | | | | |

| 64,818,000 | | Algonquin Power & Utilities Corp. (b)

| | 4.75% | | 01/18/82 | | 51,874,818 |

| 51,658,000 | | CenterPoint Energy, Inc., Series A (b)

| | 6.13% | | (a) | | 48,544,456 |

| 17,052,000 | | CMS Energy Corp. (b)

| | 3.75% | | 12/01/50 | | 12,362,700 |

| 2,400,000 | | Dominion Energy, Inc., Series B (b)

| | 4.65% | | (a) | | 2,088,845 |

| 28,520,000 | | NiSource, Inc. (b)

| | 5.65% | | (a) | | 26,381,000 |

| 9,031,000 | | Sempra Energy (b)

| | 4.88% | | (a) | | 8,218,888 |

| 59,610,000 | | Sempra Energy (b)

| | 4.13% | | 04/01/52 | | 44,967,617 |

| | | | | 194,438,324 |

| | | Oil, Gas & Consumable Fuels – 6.5% | | | | | | |

| 19,778,000 | | Buckeye Partners L.P. (b)

| | 6.38% | | 01/22/78 | | 15,945,716 |

| 50,510,000 | | DCP Midstream Operating L.P. (b) (e)

| | 5.85% | | 05/21/43 | | 48,940,757 |

| 57,082,000 | | Enbridge, Inc. (b)

| | 6.25% | | 03/01/78 | | 50,498,243 |

| 45,400,000 | | Enbridge, Inc. (b)

| | 7.63% | | 01/15/83 | | 43,474,416 |

| 65,166,000 | | Enbridge, Inc., Series 16-A (b)

| | 6.00% | | 01/15/77 | | 58,707,993 |

| 40,850,000 | | Enbridge, Inc., Series 20-A (b)

| | 5.75% | | 07/15/80 | | 36,197,593 |

| 31,252,000 | | Energy Transfer L.P., 3 Mo. LIBOR + 3.02% (c)

| | 5.80% | | 11/01/66 | | 23,326,493 |

| 9,660,000 | | Energy Transfer L.P., Series A (b)

| | 6.25% | | (a) | | 8,054,352 |

| 24,986,000 | | Energy Transfer L.P., Series F (b)

| | 6.75% | | (a) | | 21,454,963 |

| 24,500,000 | | Energy Transfer L.P., Series G (b)

| | 7.13% | | (a) | | 20,380,815 |

| 9,000,000 | | Energy Transfer L.P., Series H (b)

| | 6.50% | | (a) | | 7,762,500 |

| 55,280,000 | | Enterprise Products Operating LLC, 3 Mo. LIBOR + 2.78% (c)

| | 5.86% | | 06/01/67 | | 46,266,928 |

| 14,318,000 | | Enterprise Products Operating LLC, Series D, 3 Mo. LIBOR + 2.99% (c)

| | 5.91% | | 08/16/77 | | 12,623,894 |

| | | | | 393,634,663 |

| | | Trading Companies & Distributors – 2.9% | | | | | | |

| 142,083,000 | | AerCap Holdings N.V. (b)

| | 5.88% | | 10/10/79 | | 128,039,516 |

| 15,700,000 | | Air Lease Corp., Series B (b)

| | 4.65% | | (a) | | 13,123,649 |

| 42,300,000 | | Aircastle Ltd. (b) (e)

| | 5.25% | | (a) | | 31,845,500 |

| | | | | 173,008,665 |

| | | Transportation Infrastructure – 0.3% | | | | | | |

| 9,666,000 | | AerCap Global Aviation Trust (b) (e)

| | 6.50% | | 06/15/45 | | 8,841,973 |

| 11,000,000 | | BNSF Funding Trust I (b)

| | 6.61% | | 12/15/55 | | 10,269,679 |

| | | | | 19,111,652 |

| | | Total Capital Preferred Securities

| | 4,220,237,999 |

| | | (Cost $4,891,088,269) | | | | | | |

Principal

Value | | Description | | Stated

Coupon | | Stated

Maturity | | Value |

| FOREIGN CORPORATE BONDS AND NOTES – 1.5% |

| | | Insurance – 1.5% | | | | | | |

| 94,408,028 | | Highlands Holdings Bond Issuer Ltd./Highlands Holdings Bond Co-Issuer, Inc. (e) (i)

| | 7.63% | | 10/15/25 | | 89,089,890 |

| | | (Cost $98,915,699) | | | | | | |

| CORPORATE BONDS AND NOTES – 0.2% |

| | | Insurance – 0.2% | | | | | | |

| 12,296,000 | | AmTrust Financial Services, Inc.

| | 6.13% | | 08/15/23 | | 11,987,897 |