UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

First Trust Exchange-Traded Fund III

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareolders.

(a) Following is a copy of the annual reports transmitted to shareholders pursuant to Rule 30e-1 under the Act.

First Trust Municipal High Income ETF

FMHI | NASDAQ, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Municipal High Income ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FMHI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Municipal High Income ETF | $73 | 0.70% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 7.77% for the 12 months ended July 31, 2024. The Fund outperformed its blended benchmark, which consists of the following two indexes: 50% of the Bloomberg High Yield 10-Year Municipal Index (8-12 years), and 50% of the Bloomberg Revenue 10-Year Municipal Index (8-12 years). The blended benchmark returned 4.72% for the same Period.

The following key Fund factors impacted Fund performance relative to the blended benchmark during the Period:

Credit Rating: The Fund’s selection and allocation of non-rated, B, BB, BBB and AA rated bonds were the primary contributors to Fund outperformance relative to the blended benchmark. Conversely, the Fund’s underweight allocations to CCC and C rated bonds were the primary detractors to Fund performance.

Yield Curve Positioning/Duration: Relative to the blended benchmark, the Fund’s allocation to bonds with a stated maturity of 18+ years, 12-18 years and 8-10 years were the dominant factors contributing to Fund outperformance relative to the blended benchmark. Conversely, the Fund’s selection of bonds in the 0-2 years maturity range was the primary detractor to Fund performance relative to the blended benchmark. Examining effective duration, the Fund’s selection of bonds with an effective duration of 7-10 years and 3-5 years were the leading contributors to Fund performance while the Fund’s selection of bonds with an effective duration of 0-1 years was a modest detractor to Fund performance.

Interest Rate Hedge: During the year ended July 31, 2024, the use of Treasury futures to hedge interest rate risk was a modest detractor to Fund performance.

Sector/Industry: The Fund’s selection and allocation of bonds in the special tax, health care and education sectors were the leading contributors to Fund outperformance. Contrarywise, the Fund’s allocation and selection of general obligation and cash holdings were modest detractors to Fund performance relative to the blended benchmark.

U.S. Treasury Rate Trends: 10-Year and 30-Year U.S. Treasury yields increased by approximately 7 basis points (“bps”) and 29 bps, respectively, to 4.02% and 4.30%.

Industry Fund Flows: According to data collected by the Investment Company Institute, fund outflows totaled approximately $11.8 billion; however, for the seven-month period ended July 31, 2024, fund flows turned positive at $13.0 billion.

New Issue Supply: Primary market supply increased 25.7% to $445.5 billion compared with $354.3 billion a year ago (SIFMA, Bloomberg, Barclays Research).

Municipal Credit Yields: According to Municipal Market Data, AAA yield curve data, 10-Year and 30-Year municipal yields increased 25 bps and 17 bps, respectively, to 2.82% and 3.68%.

Municipal Credit Spreads: Credit spreads for high yield, BBB, and A rated bonds all compressed.

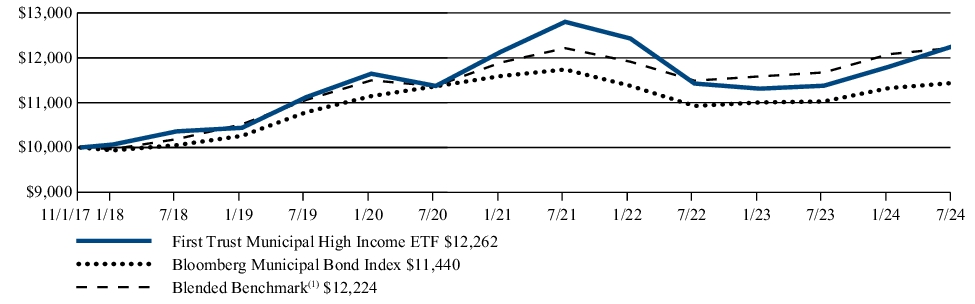

FUND PERFORMANCE (November 1, 2017 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | 5 Year | Since

Inception

(11/1/17) |

| First Trust Municipal High Income ETF | 7.77% | 1.97% | 3.07% |

| Bloomberg Municipal Bond Index | 3.74% | 1.18% | 2.01% |

| Blended Benchmark(1) | 4.72% | 2.02% | 3.02% |

| (1) | The Blended Benchmark consists of the following two indexes: 50% of the Bloomberg High Yield 10-Year Municipal Index (8-12 years) which is comprised of bonds with a final maturity between 8 and 12 years that are part of the Bloomberg Municipal Bond High Yield Index; and 50% of the Bloomberg Revenue 10-Year Municipal Index (8-12 years), which is comprised of revenue bonds that have a final maturity between 8 and 12 years that are part of the Bloomberg Municipal Bond Index. |

Visit www.ftportfolios.com/etf/FMHI for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $645,209,367% |

| Total number of portfolio holdings | $521% |

| Total advisory fee paid | $3,715,659% |

| Portfolio turnover rate | $22% |

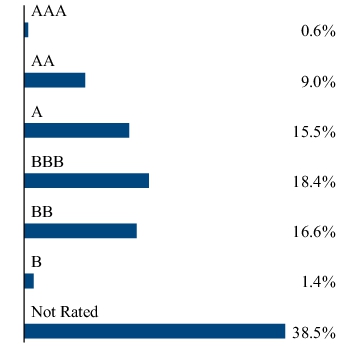

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Special Assessment | 17.5% |

| Industrial Development Bond | 13.2% |

| Continuing Care Retirement Communities | 11.8% |

| Education | 9.4% |

| Hospital | 6.3% |

| Government Obligation Bond - Unlimited Tax | 5.0% |

| Gas | 4.7% |

| Utility | 4.7% |

| Dedicated Tax | 4.2% |

| All Other | 23.2% |

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FMHI to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Horizon

Managed Volatility Domestic ETF

HUSV | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Horizon Managed Volatility Domestic ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/HUSV. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Horizon Managed Volatility Domestic ETF | $74 | 0.70% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 12.74% for the 12 months ended July 31, 2024. The Fund underperformed its benchmark, the S&P 500® Index, which returned 22.15% for the same Period.

The Fund’s portfolio allocation process is to overweight or underweight stocks within each sector based on future expected volatility of each sector’s component stocks. An overweight allocation indicates that we expect that sector to be relatively low risk, while an underweight allocation indicates that we expect that sector to be relatively high risk. This underperformance was primarily driven by the defensive objective of the strategy capturing less of the return of the benchmark in a period of large gains for the benchmark.

Additionally, during the Period, a concentrated subset of the largest stocks within the benchmark primarily drove returns. The Fund’s systematic strategy avoided holding these companies due to their higher volatility and the inherent risks associated with them. This resulted in underweights to some of the sectors experiencing the most gains such as the Information Technology and Communication Services sectors, and overweights to less volatile sectors such as the Consumer Staples and Industrials sectors.

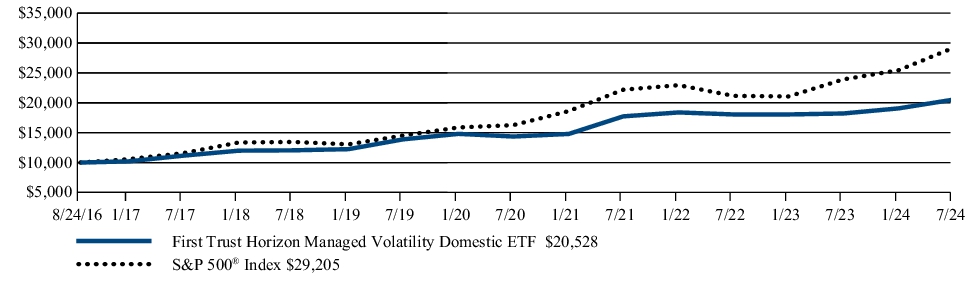

FUND PERFORMANCE (August 24, 2016 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | 5 Year | Since

Inception

(8/24/16) |

| First Trust Horizon Managed Volatility Domestic ETF | 12.74% | 8.14% | 9.49% |

| S&P 500® Index | 22.15% | 15.00% | 14.46% |

Visit www.ftportfolios.com/etf/HUSV for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $87,643,635% |

| Total number of portfolio holdings | $76% |

| Total advisory fee paid | $602,266% |

| Portfolio turnover rate | $100% |

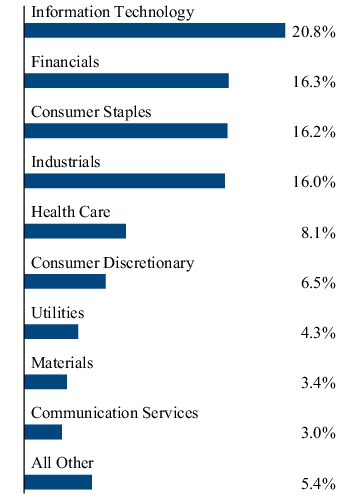

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Cognizant Technology Solutions Corp., Class A | 2.7% |

| Berkshire Hathaway, Inc., Class B | 2.6% |

| Cisco Systems, Inc. | 2.6% |

| Coca-Cola (The) Co. | 2.5% |

| Colgate-Palmolive Co. | 2.5% |

| Republic Services, Inc. | 2.5% |

| TE Connectivity Ltd. | 2.4% |

| PTC, Inc. | 2.4% |

| Roper Technologies, Inc. | 2.3% |

| Amphenol Corp., Class A | 2.2% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/HUSV or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/HUSV to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Horizon Managed

Volatility Developed International ETF

HDMV | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Horizon Managed Volatility Developed International ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/HDMV. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Horizon Managed Volatility Developed International ETF | $83 | 0.80% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 6.33% for the 12 months ended July 31, 2024. The Fund underperformed its benchmark, the MSCI EAFE Index, which returned 11.21% for the same Period.

The Fund’s portfolio allocation process is to overweight or underweight stocks in each region based on future expected volatility of each region’s component stocks. An overweight allocation indicates that we expect that region to be relatively low risk, while an underweight allocation indicates that we expect that region to be relatively high risk. This underperformance was primarily driven by the defensive objective of the strategy capturing less of the return of the benchmark in a period of large gains for the benchmark. The Fund’s underweight to Western Europe due to volatility in those stocks detracted from performance. Denmark stocks were particularly volatile but had a strong quarter. An underweight allocation to this country resulted in a negative attribution effect.

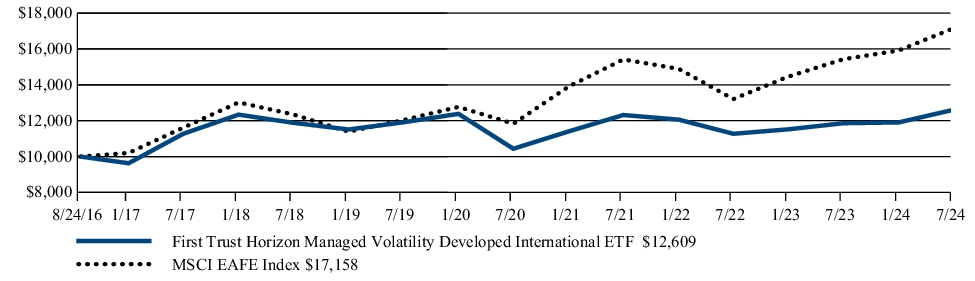

FUND PERFORMANCE (August 24, 2016 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | 5 Year | Since

Inception

(8/24/16) |

| First Trust Horizon Managed Volatility Developed International ETF | 6.33% | 1.15% | 2.97% |

| MSCI EAFE Index | 11.21% | 7.36% | 7.04% |

Visit www.ftportfolios.com/etf/HDMV for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $32,897,380% |

| Total number of portfolio holdings | $151% |

| Total advisory fee paid | $284,244% |

| Portfolio turnover rate | $79% |

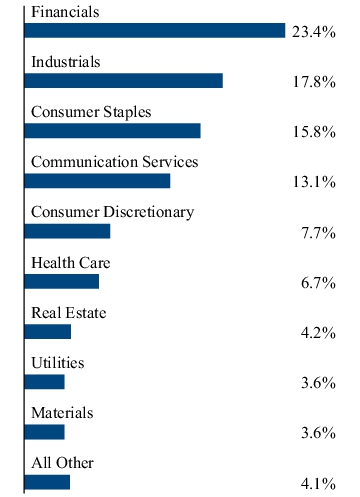

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| United Overseas Bank Ltd. | 2.0% |

| Oversea-Chinese Banking Corp., Ltd. | 2.0% |

| Singapore Exchange Ltd. | 2.0% |

| Koninklijke KPN N.V. | 2.0% |

| Danone S.A. | 1.8% |

| Swisscom AG | 1.7% |

| Zurich Insurance Group AG | 1.6% |

| Swiss Prime Site AG | 1.5% |

| Unilever PLC | 1.5% |

| Deutsche Telekom AG | 1.5% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/HDMV or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/HDMV to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Horizon

Managed Volatility Small/Mid ETF

HSMV | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Horizon Managed Volatility Small/Mid ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/HSMV. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Horizon Managed Volatility Small/Mid ETF | $86 | 0.80% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 14.48% for the 12 months ended July 31, 2024. The Fund underperformed its benchmark, the S&P 1000® Index, which returned 15.08% for the same Period.

The Fund’s portfolio allocation process is to overweight or underweight stocks within each sector based on future expected volatility of each sector’s component stocks. An overweight allocation indicates that we expect that sector to be relatively low risk, while an underweight allocation indicates that we expect that sector to be relatively high risk.

Small and mid-sized stocks in the U.S. generally lagged larger cap stocks over the Period as these companies have exhibited characteristics more sensitive to the higher interest rate regime. Therefore, in spite of the Fund’s more defensive profile, the lower risk nature of the selected stocks captured a majority of the return of the benchmark during a period of large gains for the benchmark. Weights in companies in the Industrials and Financials sectors had particularly high contributions to Fund returns due to their rate sensitivity. Small and mid-sized Energy stocks were strong during the Period but were not held in size due to their volatility as a result of ongoing geopolitical tensions.

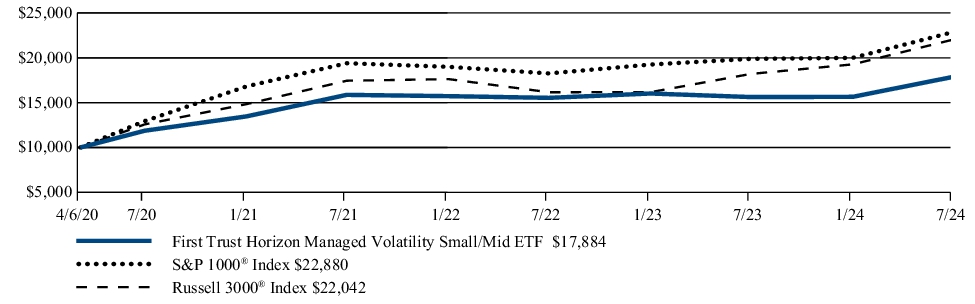

FUND PERFORMANCE (April 6, 2020 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | Since

Inception

(4/6/20) |

| First Trust Horizon Managed Volatility Small/Mid ETF | 14.48% | 14.41% |

| S&P 1000® Index | 15.08% | 21.13% |

| Russell 3000® Index | 21.07% | 20.09% |

Visit www.ftportfolios.com/etf/HSMV for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $19,767,104% |

| Total number of portfolio holdings | $201% |

| Total advisory fee paid | $144,853% |

| Portfolio turnover rate | $53% |

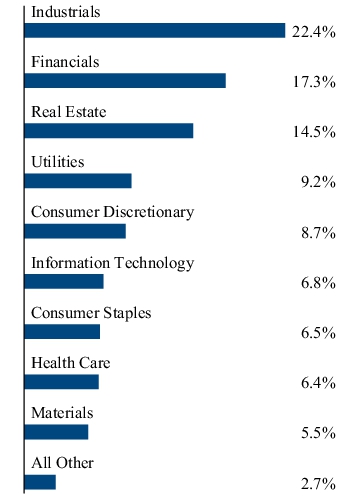

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| LXP Industrial Trust | 0.7% |

| CommVault Systems, Inc. | 0.7% |

| Evercore, Inc., Class A | 0.7% |

| CubeSmart | 0.7% |

| Plexus Corp. | 0.7% |

| Globus Medical, Inc., Class A | 0.7% |

| InterDigital, Inc. | 0.6% |

| Chesapeake Utilities Corp. | 0.6% |

| Jefferies Financial Group, Inc. | 0.6% |

| Sprouts Farmers Market, Inc. | 0.6% |

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/HSMV or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/HSMV to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Merger Arbitrage ETF

MARB | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Merger Arbitrage ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/MARB. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment(1) | Costs paid as a percentage

of a $10,000 investment(1) |

| First Trust Merger Arbitrage ETF | $172 | 1.70% |

(1) | Includes margin interest expense and dividend expense on investments sold short. |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 2.26% for the 12 months ended July 31, 2024. The Fund underperformed its benchmark, the S&P Merger Arbitrage Total Return Index, which returned 9.14% for the same Period.

This underperformance was driven by three negative events in the portfolio. Under normal market conditions, the Fund seeks to achieve its investment objective by establishing long and short positions in the equity securities of companies that are involved in a publicly-announced significant corporate event, such as a merger or acquisition. The primary event was the termination of the proposed merger between iRobot and Amazon in January 2024. We had seen antitrust deal risk as substantively low and manageable, but that was ultimately wrong. For the Fund, it was a disappointing outcome but one that is the risk of a merger arbitrage strategy – a deal termination. The second challenging event during the Period related to our investment in the Albertsons/Kroger merger. The Federal Trade Commission (“FTC”) filed suit to block the deal on February 26, 2024. Our thesis remains that the companies have a strong shot at defeating the FTC case, and therefore, we continue to hold the position within the Fund. Finally, April 2024 also brought an unexpected turn with the FTC suing to block Tapestry, Inc.’s acquisition of Capri Holdings. The companies intend to defend the merger through litigation, and we continue to hold the position within the Fund.

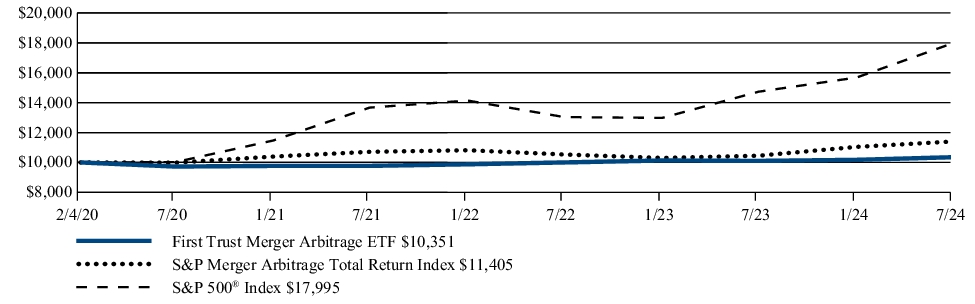

FUND PERFORMANCE (February 4, 2020 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | Since

Inception

(2/4/20) |

| First Trust Merger Arbitrage ETF | 2.26% | 0.77% |

| S&P Merger Arbitrage Total Return Index(1) | 9.14% | 2.97% |

| S&P 500® Index | 22.15% | 14.00% |

(1) Effective as of August 1, 2024, the S&P Merger Arbitrage Total Return Index replaced the Credit Suisse Merger Arbitrage Liquid Index, which is no longer available for use by the Fund.

Visit www.ftportfolios.com/etf/MARB for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $30,981,937% |

| Total number of portfolio holdings | $42% |

| Total advisory fee paid | $669,122% |

| Portfolio turnover rate | $301% |

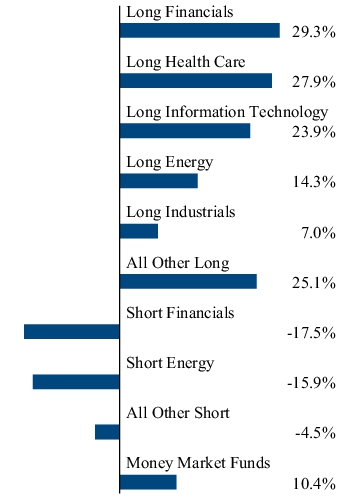

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of net assets and total investments of the Fund, respectively.

| Common Stocks | 89.8%) |

| Rights | 0.0%) |

| Money Market Funds | 7.4%) |

| Common Stocks Sold Short | (26.7%) |

| Net Other Assets and Liabilities | 29.5%) |

| Total | 100.0%) |

Any amount shown as 0.0% represents less than 0.1%.

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/MARB or upon request at 1-800-621-1675 or info@ftportfolios.com.

The Fund may have significant investments in various jurisdictions or investment sectors from time to time, making the Fund subject to the risks of such jurisdictions or investment sectors.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/MARB to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust California Municipal

High Income ETF

FCAL | NASDAQ, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust California Municipal High Income ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FCAL. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust California Municipal High Income ETF | $67 | 0.65% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 4.62%, based on net asset value, for the 12 months ended July 31, 2024. The Fund outperformed its benchmark, the Bloomberg 10 Year California Exempt Index, which returned 1.92% for the same Period.

The following key Fund factors impacted Fund performance relative to its benchmark during the Period:

Credit Rating: The Fund’s selection of non-rated, BB, BBB, A, and AA were the primary contributors to the Fund’s outperformance relative to its benchmark. No credit rating category was a material negative contributor to Fund performance relative to its benchmark.

Yield Curve Positioning/Duration: Relative to its benchmark, the Fund’s allocation to bonds with a stated maturity of 18+ years, 16-18 years and 12-16 years were the dominant factors contributing to the Fund’s outperformance relative to its benchmark. Conversely, the Fund’s selection of bonds in the 0-2 years maturity range was the primary detractor to Fund performance relative to its benchmark. Examining effective duration, bonds with an effective duration of 10+ years, 7-10 years, 5-7 years, and 3-5 years were all positive contributors to Fund performance. Bonds with an effective duration of 0-1 years were detractors to Fund performance relative to its benchmark.

Interest Rate Hedge: The use of Treasury futures to hedge interest rate risk was a modest detractor to Fund performance.

Sector/Industry: The Fund’s allocation and selection of bonds in the special tax, education, transportation, and utilities sectors were the leading contributors to Fund performance relative to its benchmark. Conversely, the Fund’s selection of industrial development bonds was a modest negative contributor to Fund performance relative to its benchmark.

U.S. Treasury Rate Trends: 10-Year and 30-Year U.S. Treasury yields increased by approximately 7 basis points (“bps”) and 29 bps, respectively, to 4.02% and 4.30%.

Industry Fund Flows: According to data collected by the Investment Company Institute, fund outflows totaled approximately $11.8 billion; however, for the seven months ended July 31, 2024, fund flows turned positive at $13.0 billion.

New Issue Supply: Primary market supply increased approximately 25.7% to $445.5 billion compared with $354.3 billion a year ago (SIFMA, Bloomberg, Barclays Research).

Municipal Credit Yields: According to Municipal Market Data, AAA yield curve data, 10-Year and 30-Year municipal yields increased 25 bps and 17 bps, respectively, to 2.82% and 3.68%.

Municipal Credit Spreads: Credit spreads for high yield, BBB, and A rated bonds all compressed.

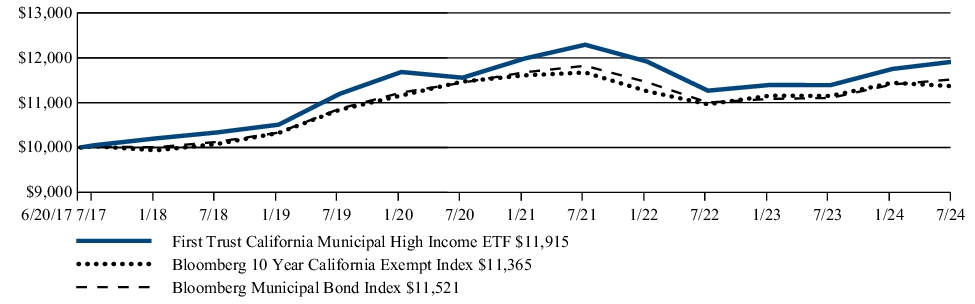

FUND PERFORMANCE (June 20, 2017 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | 5 Year | Since

Inception

(6/20/17) |

| First Trust California Municipal High Income ETF | 4.62% | 1.26% | 2.49% |

| Bloomberg 10 Year California Exempt Index | 1.92% | 0.95% | 1.81% |

| Bloomberg Municipal Bond Index | 3.74% | 1.18% | 2.01% |

Visit www.ftportfolios.com/etf/FCAL for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $253,518,578% |

| Total number of portfolio holdings | $306% |

| Total advisory fee paid | $1,252,427% |

| Portfolio turnover rate | $41% |

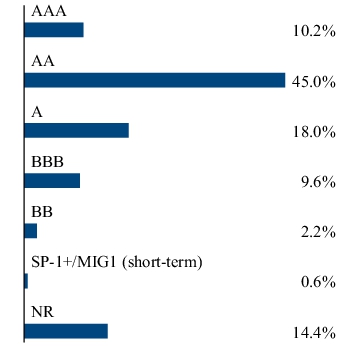

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Insured | 17.4% |

| Special Assessment | 9.3% |

| Airport | 8.1% |

| Hospital | 7.5% |

| Water & Sewer | 7.5% |

| Government Obligation Bond - Unlimited Tax | 7.4% |

| Certificates of Participation | 7.0% |

| Industrial Development Bond | 6.2% |

| Education | 4.6% |

| All Other | 25.0% |

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FCAL to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust New York Municipal

High Income ETF

FMNY | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust New York Municipal High Income ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FMNY. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the Period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust New York Municipal High Income ETF | $55 | 0.54% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 4.86% for the 12 months ended July 31, 2024. The Fund outperformed its benchmark, the Bloomberg Municipal New York 12-17 Year Index, which returned 4.34% for the same Period.

The following key Fund factors impacted Fund performance relative to its benchmark during the Period:

Credit Rating: The Fund’s selection and allocation of AAA and non-rated bonds were the primary contributors to Fund outperformance relative to its benchmark. The Fund’s allocation to AA rated bonds and cash were the primary detractors to Fund performance relative to its benchmark.

Yield Curve Positioning/Duration: Relative to its benchmark, the Fund’s allocation to bonds with a stated maturity of 18+ years and the selection of bonds 16-18 years were the primary factors contributing to Fund outperformance. Conversely, the Fund’s overweight of bonds in the 10-12 years and 4-6 years maturity range and cash were the primary detractors. Examining effective durations, the Fund’s selection of bonds with an effective duration of 7-10 years was the primary contributor to Fund outperformance while the Fund’s selection of bonds with an effective duration of 3-5 years was the primary detractor.

Interest Rate Hedge: The use of Treasury futures to hedge interest rate risk was a modest positive contributor to Fund performance.

Sector/Industry: The Fund’s selection and allocation of bonds in the utilities, special tax and industrial development sectors were the leading contributors to Fund outperformance. The Fund’s allocation and selection of local general obligation bonds were the primary detractors to Fund performance.

U.S. Treasury Rate Trends: 10-Year and 30-Year U.S. Treasury yields increased by approximately 7 basis points ("bps") and 29 bps, respectively, to 4.02% and 4.30%.

Industry Fund Flows: According to data collected by the Investment Company Institute, fund outflows totaled approximately $11.8 billion; however, for the seven-month period ended July 31, 2024, fund flows turned positive at $13.0 billion.

New Issue Supply: Primary market supply increased 25.7% to $445.5 billion compared with $354.3 billion a year ago (SIFMA, Bloomberg, Barclays Research).

Municipal Credit Yields: According to Municipal Market Data, AAA yield curve data, 10-Year and 30-Year municipal yields increased 25 bps and 17 bps, respectively, to 2.82% and 3.68%.

Municipal Credit Spreads: Credit spreads for high yield, BBB, and A rated bonds all compressed.

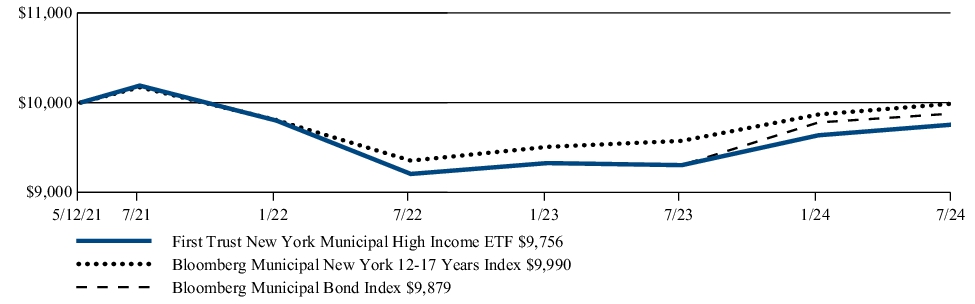

FUND PERFORMANCE (May 12, 2021 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | Since

Inception

(5/12/21) |

| First Trust New York Municipal High Income ETF | 4.86% | -0.77% |

| Bloomberg Municipal New York 12-17 Years Index | 4.34% | -0.03% |

| Bloomberg Municipal Bond Index | 3.74% | -0.38% |

Visit www.ftportfolios.com/etf/FMNY for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $18,827,311% |

| Total number of portfolio holdings | $64% |

| Total advisory fee paid | $87,152% |

| Portfolio turnover rate | $36% |

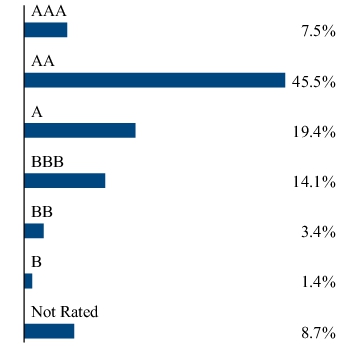

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Higher Education | 15.7% |

| Insured | 10.5% |

| Dedicated Tax | 9.7% |

| Government Obligation Bond - Unlimited Tax | 7.9% |

| Industrial Development Bond | 7.6% |

| Utility | 6.7% |

| Toll Road | 6.0% |

| Hospital | 5.0% |

| Water & Sewer | 4.7% |

| All Other | 26.2% |

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/FMNY or upon request at 1-800-621-1675 or info@ftportfolios.com.

Effective May 12, 2024, a management fee waiver agreement terminated, which resulted in the Fund’s total annual operating expenses increasing from 0.50% to 0.54% of average daily net assets during the fiscal year ended July 31, 2024.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FMNY to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Short Duration

Managed Municipal ETF

FSMB | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Short Duration Managed Municipal ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FSMB. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Short Duration Managed Municipal ETF | $56 | 0.55% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 3.46% for the 12 months ended July 31, 2024. The Fund outperformed its benchmark, the Bloomberg Municipal Short (1-5) Year Index, which returned 3.34% for the same Period.

The following key Fund factors impacted Fund performance relative to its benchmark during the Period:

Yield Curve Positioning/Duration: In terms of bonds’ final maturity dates, the Fund’s under exposure to bonds in the 4-6 years maturity range was a positive contributor to the Fund’s performance relative to the benchmark. The Fund’s relative overweight exposure to bonds in the 6-8 years maturity range was a primary detractor to the Fund’s performance. As to duration, the Fund’s under exposure to bonds with effective durations of 1-3 years and 3-5 years was a primary contributor to the Fund’s outperformance relative to the benchmark. Conversely, the Fund’s over exposure to bonds with durations of 0-1 year was the primary detractor to performance as compared to its benchmark.

Credit Rating: The Fund’s over exposure, relative to its benchmark, to BB-rated and non-rated bonds was the primary source of outperformance. The Fund’s overweight to A-rated bonds was the Fund’s primary source of underperformance as compared to its benchmark.

Sector/Industry: In terms of sector exposure, key positive contributors were select special tax bonds and the Fund’s overweight allocations to industrial development and healthcare bonds. Sources of relative underperformance resulted from cash holdings and a slight overweight allocation to housing bonds.

U.S. Treasury Rate Trends: During the Period, 10-Year and 30-Year U.S. Treasury yields increased by approximately 7 basis points (“bps”) and 29 bps, respectively, to 4.02% and 4.30%.

Industry Fund Flows: For the Period, according to data collected by the Investment Company Institute, fund outflows totaled approximately $11.8 billion; however, for the seven month period ended July 31, 2024, fund flows turned positive at $13.0 billion.

New Issue Supply: During the Period, primary market supply increased approximately 25.7% to $445.5 billion compared with $354.3 billion a year ago (SIFMA, Bloomberg, Barclays Research).

Municipal Credit Yields: For the Period, according to Municipal Market Data, AAA yield curve data, 10-Year and 30-Year municipal yields increased 25 bps and 17 bps, respectively, to 2.82% and 3.68%.

Municipal Credit Spreads: During the Period, credit spreads for high yield, BBB, and A rated bonds all compressed.

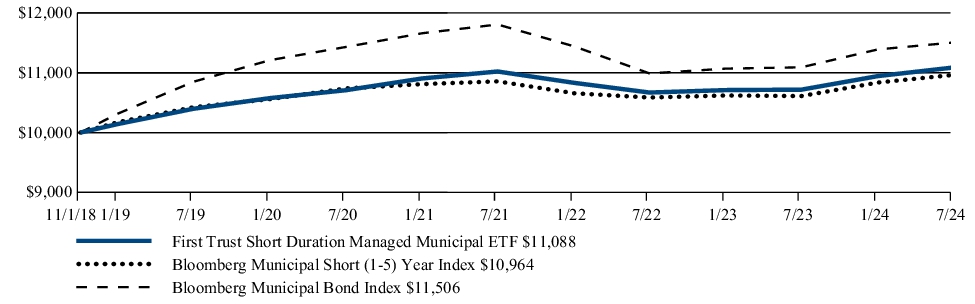

FUND PERFORMANCE (November 1, 2018 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | 5 Year | Since

Inception

(11/1/18) |

| First Trust Short Duration Managed Municipal ETF | 3.46% | 1.29% | 1.81% |

| Bloomberg Municipal Short (1-5) Year Index | 3.34% | 1.02% | 1.62% |

| Bloomberg Municipal Bond Index | 3.74% | 1.18% | 2.47% |

Visit www.ftportfolios.com/etf/FSMB for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $419,165,010% |

| Total number of portfolio holdings | $484% |

| Total advisory fee paid | $2,268,433% |

| Portfolio turnover rate | $51% |

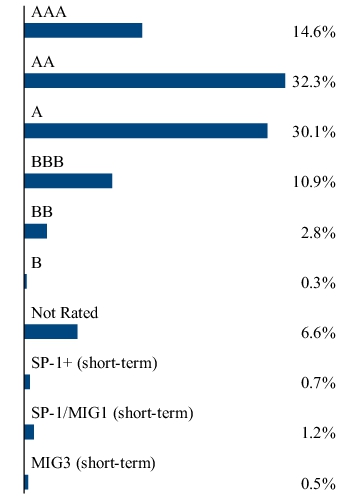

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Utility | 13.1% |

| Gas | 10.5% |

| Hospital | 10.3% |

| Airport | 7.5% |

| Government Obligation Bond - Unlimited Tax | 7.2% |

| Insured | 6.6% |

| Industrial Development Bond | 6.5% |

| Certificates of Participation | 5.5% |

| Local Housing | 5.1% |

| All Other | 27.7% |

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/FSMB or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended July 31, 2024, the Fund’s total annual operating expenses increased from 0.49% to 0.55% of average daily net assets due to the termination of a management fee waiver agreement on November 30, 2022.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FSMB to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

First Trust Ultra Short Duration

Municipal ETF

FUMB | NYSE ARCA, INC.

ANNUAL SHAREHOLDER REPORT | July 31, 2024

This annual shareholder report contains important information about the First Trust Ultra Short Duration Municipal ETF (the “Fund”) for the year of August 1, 2023 to July 31, 2024 (the “Period”). You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FUMB. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| First Trust Ultra Short Duration Municipal ETF | $46 | 0.45% |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 3.37% for the 12 months ended July 31, 2024. The Fund underperformed its benchmark, the Bloomberg Municipal Short-Term Index, which returned 3.61% for the same Period.

The following key Fund factors impacted the Fund’s performance relative to its benchmark during the Period:

Credit Rating: The Fund’s selection and allocation of bonds in the A and BBB rated category were the primary negative contributors to performance versus the Fund’s benchmark during the Period.

Years to Maturity: In terms of the Fund’s selection and allocation in years to a bond’s final maturity date, the Fund’s underweight allocation of bonds in the 0-2 years range was the primary detractor to the Fund’s performance relative to its benchmark during the Period.

Effective Duration: Focusing on the Fund’s bonds’ effective duration, the Fund’s underweight allocation and selection of bonds with effective duration of 0-1 years were the primary detractors to the Fund’s performance relative to its benchmark during the Period.

Sector/Industry: In terms of the Fund’s selection and allocation to municipal bond sectors, the Fund’s investment in the Industrial Development sector was the main detractor from the Fund’s performance relative to its benchmark during the Period.

U.S. Treasury Rate Trends: During the Period, 10-Year and 30-Year U.S. Treasury yields increased by approximately 7 basis points (“bps”) and 29 bps, respectively, to 4.02% and 4.30%.

Industry Fund Flows: For the Period, according to data collected by the Investment Company Institute, fund outflows totaled approximately $11.8 billion; however, for the seven-month period ended July 31, 2024, fund flows turned positive at $13.0 billion.

New Issue Supply: During the Period, primary market supply increased 25.7% to $445.5 billion compared with $354.3 billion a year ago (SIFMA, Bloomberg, Barclays Research).

Municipal Credit Yields: For the Period, according to Municipal Market Data, AAA yield curve data, 10-Year and 30-Year municipal yields increased 25 bps and 17 bps, respectively, to 2.82% and 3.68%.

Municipal Credit Spreads: During the Period, credit spreads for high yield, BBB, and A rated bonds all compressed.

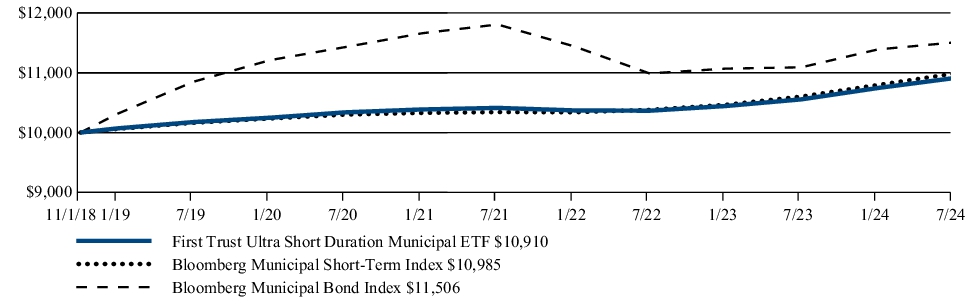

FUND PERFORMANCE (November 1, 2018 to July 31, 2024)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

| Average Annual Total Returns (as of July 31, 2024) | 1 Year | 5 Year | Since

Inception

(11/1/18) |

| First Trust Ultra Short Duration Municipal ETF | 3.37% | 1.41% | 1.53% |

| Bloomberg Municipal Short-Term Index | 3.61% | 1.57% | 1.65% |

| Bloomberg Municipal Bond Index | 3.74% | 1.18% | 2.47% |

Visit www.ftportfolios.com/etf/FUMB for more recent performance information.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Performance in municipal bond investment strategies can be impacted from the benefits of purchasing odd lot positions. The impact of these investments can be particularly meaningful when funds have limited assets under management and may not be a sustainable source of performance as a fund grows in size.

KEY FUND STATISTICS (As of July 31, 2024)

| Fund net assets | $199,215,632% |

| Total number of portfolio holdings | $183% |

| Total advisory fee paid | $1,023,599% |

| Portfolio turnover rate | $112% |

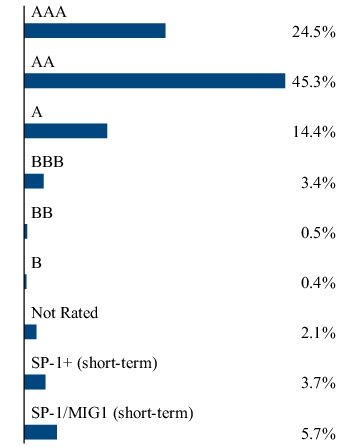

WHAT DID THE FUND INVEST IN? (As of July 31, 2024)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

| Government Obligation Bond - Unlimited Tax | 14.3% |

| Water & Sewer | 11.4% |

| Insured | 11.1% |

| Pre-refunded/Escrowed-to-maturity | 10.1% |

| Dedicated Tax | 7.1% |

| Industrial Development Bond | 6.2% |

| Airport | 6.0% |

| Hospital | 5.8% |

| Certificates of Participation | 5.4% |

| All Other | 22.6% |

(1) The credit quality and ratings information presented above reflect the ratings assigned by one or more nationally recognized statistical rating organizations (NRSROs), including S&P Global Ratings, Moody’s Investors Service, Inc., Fitch Ratings or a comparably rated NRSRO. For situations in which a security is rated by more than one NRSRO and the ratings are not equivalent, the highest rating is used. Sub-investment grade ratings are those rated BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or higher. The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

HOW HAS THE FUND MATERIALLY CHANGED?

This is a summary of certain changes to the Fund since August 1, 2023. For more complete information, you may review the Fund’s current prospectus and any applicable supplements at www.ftportfolios.com/fund-documents/etf/FUMB or upon request at 1-800-621-1675 or info@ftportfolios.com.

During the fiscal year ended July 31, 2024, the Fund’s total annual operating expenses increased from 0.39% to 0.45% of average daily net assets due to the termination of a management fee waiver agreement on November 30, 2022.

WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND?

Visit www.ftportfolios.com/fund-documents/etf/FUMB to view additional information about the Fund such as the prospectus, financial information, Fund holdings and proxy voting information. You may also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

| (b) | Not applicable to the Registrant. |

Item 2. Code of Ethics.

| (a) | The First Trust Exchange-Traded Fund III (“Registrant”), as of the end of the period covered by this report, has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party. |

| (c) | There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, and that relates to any element of the code of ethics description. |

| (d) | The Registrant, during the period covered by this report, has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. |

| (f) | A copy of the code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller is filed as an exhibit pursuant to Item 13(a)(1). |

Item 3. Audit Committee Financial Expert.

As of the end of the period covered by the report, the Registrant’s Board of Trustees has determined that Thomas R. Kadlec and Robert F. Keith are qualified to serve as audit committee financial experts serving on its audit committee and that each of them is “independent,” as defined by Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

| (a) | Audit Fees (Registrant) -- The aggregate fees billed for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $296,000 for the fiscal year ended 2023 and $323,000 for the fiscal year ended 2024. |

| (b) | Audit-Related Fees (Registrant) -- The aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024. |

Audit-Related Fees (Investment Advisor) -- The aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024.

Audit-Related Fees (Distributor) -- The aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024.

| (c) | Tax Fees (Registrant) -- The aggregate fees billed for professional services rendered by the principal accountant for tax return review and debt instrument tax analysis and reporting were $92,114 for the fiscal year ended 2023 and $160,802 for the fiscal year ended 2024. These fees were for tax consultation and/or tax return preparation and professional services rendered for PFIC (Passive Foreign Investment Company) Identification Services. |

Tax Fees (Investment Advisor) -- The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning to the Registrant’s advisor and distributor $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024.

Tax Fees (Distributor) -- The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning to the Registrant’s distributor were $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024.

| (d) | All Other Fees (Registrant) -- The aggregate fees billed for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024. |

All Other Fees (Investment Advisor) -- The aggregate fees billed for products and services provided by the principal accountant to the Registrant’s investment advisor, other than the services reported in paragraphs (a) through (c) of this Item were $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024.

All Other Fees (Distributor) -- The aggregate fees billed for products and services provided by the principal accountant to the Registrant’s distributor, other than the services reported in paragraphs (a) through (c) of this Item were $0 for the fiscal year ended 2023 and $0 for the fiscal year ended 2024.

(e)(1) Disclose the audit committee’s pre-approval policies and procedures described in paragraph (c) (7) of Rule 2-01 of Regulation S-X.

Pursuant to its charter and its Audit and Non-Audit Services Pre-Approval Policy, the Audit Committee (the “Committee”) is responsible for the pre-approval of all audit services and permitted non-audit services (including the fees and terms thereof) to be performed for the Registrant by its independent auditors. The Chairman of the Committee is authorized to give such pre-approvals on behalf of the Committee up to $25,000 and report any such pre-approval to the full Committee.

The Committee is also responsible for the pre-approval of the independent auditor’s engagements for non-audit services with the Registrant’s advisor (not including a sub-advisor whose role is primarily portfolio management and is sub-contracted or overseen by another investment advisor) and any entity controlling, controlled by or under common control with the investment advisor that provides ongoing services to the Registrant, if the engagement relates directly to the operations and financial reporting of the Registrant, subject to the de minimis exceptions for non-audit services described in Rule 2-01 of Regulation S-X. If the independent auditor has provided non-audit services to the Registrant’s advisor (other than any sub-advisor whose role is primarily portfolio management and is sub-contracted with or overseen by another investment advisor) and any entity controlling, controlled by or under common control with the investment advisor that provides ongoing services to the Registrant that were not pre-approved pursuant to its policies, the Committee will consider whether the provision of such non-audit services is compatible with the auditor’s independence.

(e)(2) The percentage of services described in each of paragraphs (b) through (d) for the Registrant and the Registrant’s investment advisor and distributor of this Item that were approved by the audit committee pursuant to the pre-approval exceptions included in paragraph (c)(7)(i)(C) or paragraph(C)(7)(ii) of Rule 2-01 of Regulation S-X are as follows:

| Registrant: | | Advisor and Distributor: |

| (b) 0% | | (b) 0% |

| (c) 0% | | (c) 0% |

| (d) 0% | | (d) 0% |

| (f) | The percentage of hours expended on the principal accountant’s engagement to audit the Registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees was less than fifty percent. |

| (g) | The aggregate non-audit fees billed by the Registrant’s accountant for services rendered to the Registrant, and rendered to the Registrant’s investment advisor (not including any sub-advisor whose role is primarily portfolio management and is subcontracted with or overseen by another investment advisor), and any entity controlling, controlled by, or under common control with the advisor that provides ongoing services to the Registrant for the fiscal year ended 2023 were $92,114 for the Registrant, $31,000 for the Registrant’s investment advisor and $45,500 for the Registrant’s distributor; and for the fiscal year ended 2024 were $160,802 for the Registrant, $28,600 for the Registrant’s investment advisor and $33,000 for the Registrant’s distributor. |

| (h) | The Registrant’s audit committee of its Board of Trustees has determined that the provision of non-audit services that were rendered to the Registrant’s investment advisor (not including any sub-advisor whose role is primarily portfolio management and is subcontracted with or overseen by another investment advisor), and any entity controlling, controlled by, or under common control with the investment advisor that provides ongoing services to the Registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

(i) Not applicable to the Registrant.

(j) Not applicable to the Registrant.

Item 5. Audit Committee of Listed Registrants.

| (a) | The Registrant has a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 consisting of all the independent directors of the Registrant. The audit committee of the Registrant is comprised of: Richard E. Erickson, Thomas R. Kadlec, Denise M. Keefe, Robert F. Keith, Niel B. Nielson and Bronwyn Wright. |

| (b) | Not applicable to the Registrant. |

Item 6. Investments.

| (a) | The Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included in the Financial Statements and Other Information filed under Item 7(a) of this Form N-CSR. |

| (b) | Not applicable to the Registrant. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a) Following is a copy of the annual financial statements required, and for the periods specified, by Regulation S-X.

Annual Financial

Statements and

Other Information |

For the Year Ended

July 31, 2024 |

First Trust Exchange-Traded Fund III

First Trust Horizon Managed Volatility Domestic ETF (HUSV) |

First Trust Horizon Managed Volatility Developed International ETF (HDMV) |

First Trust Horizon Managed Volatility Small/Mid ETF (HSMV) |

First Trust Exchange-Traded Fund III

Annual Financial Statements and Other Information

July 31, 2024

Performance and Risk Disclosure

There is no assurance that any series of First Trust Exchange-Traded Fund III (the “Trust”) described in this report (each such series is referred to as a “Fund” and collectively, as the “Funds”) will achieve its investment objective. Each Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in a Fund.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and share price will fluctuate and Fund shares, when sold, may be worth more or less than their original cost.

First Trust Advisors L.P., the Funds’ advisor, may also periodically provide additional information on Fund performance on each Fund’s webpage at www.ftportfolios.com.

This report contains information that may help you evaluate your investment. It includes details about each Fund and presents data that provides insight into each Fund’s performance and investment approach.

The material risks of investing in each Fund are spelled out in its prospectus, statement of additional information, and other Fund regulatory filings.

First Trust Horizon Managed Volatility Domestic ETF (HUSV)Portfolio of InvestmentsJuly 31, 2024

| | |

|

| Aerospace & Defense — 3.0% | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Regeneron Pharmaceuticals, Inc. (a) | |

| | |

| Ameriprise Financial, Inc. | |

| Intercontinental Exchange, Inc. | |

| | |

| | |

| | |

| | |

| | |

| LyondellBasell Industries N.V., Class A | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Consumer Staples Distribution | |

| | |

| | |

| | |

| | |

| | |

| Electric Utilities — 2.2% | |

| | |

| | |

| | |

| Electrical Equipment — 1.1% | |

| | |

| | |

|

| Electronic Equipment, Instruments & Components | |

| | |

| | |

| | |

| | |

| | |

| Financial Services — 7.6% | |

| Berkshire Hathaway, Inc., Class B (a) | |

| | |

| Mastercard, Inc., Class A | |

| | |

| | |

| | |

| Mondelez International, Inc., Class A | |

| | |

| | |

| | |

| | |

| | |

| | |

| Boston Scientific Corp. (a) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Hotels, Restaurants & Leisure | |

| | |

| Hilton Worldwide Holdings, Inc. | |

| | |

| | |

| | |

| Household Products — 6.8% | |

| Church & Dwight Co., Inc. | |

| | |

| | |

| Procter & Gamble (The) Co. | |

| | |

See Notes to Financial Statements

First Trust Horizon Managed Volatility Domestic ETF (HUSV)Portfolio of Investments (Continued)July 31, 2024 | | |

COMMON STOCKS (Continued) |

| Industrial Conglomerates — | |

| Honeywell International, Inc. | |

| | |

| Arthur J. Gallagher & Co. | |

| Hartford Financial Services Group (The), Inc. | |

| | |

| Marsh & McLennan Cos., Inc. | |

| | |

| | |

| Cognizant Technology Solutions Corp., Class A | |

| | |

| | |

| | |

| Illinois Tool Works, Inc. | |

| | |

| | |

| | |

| Consolidated Edison, Inc. | |

| Oil, Gas & Consumable Fuels | |

| | |

| | |

| Williams (The) Cos., Inc. | |

| | |

| | |

| | |

| | |

| | |

| Professional Services — 2.1% | |

| Automatic Data Processing, Inc. | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| O’Reilly Automotive, Inc. (a) | |

| | |

|

| Specialty Retail (Continued) | |

| | |

| | |

| | |

| | |

| | |

| Philip Morris International, Inc. | |

| | |

| Wireless Telecommunication | |

| | |

| | |

| | |

MONEY MARKET FUNDS — 0.2% |

| Dreyfus Government Cash Management Fund, Institutional Shares - 5.21% (b) | |

| | |

|

|

| Total Investments — 100.0% | |

| | |

| Net Other Assets and Liabilities — 0.0% | |

| | |

| Non-income producing security. |

| Rate shown reflects yield as of July 31, 2024. |

Abbreviations throughout the Portfolio of Investments: |

| – Real Estate Investment Trusts |

Valuation InputsA summary of the inputs used to value the Fund’s investments as of July 31, 2024 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

| | | Level 2

Significant

Observable

Inputs | Level 3

Significant

Unobservable

Inputs |

| | | | |

| | | | |

| | | | |

| See Portfolio of Investments for industry breakout. |

See Notes to Financial Statements

First Trust Horizon Managed Volatility Developed International ETF (HDMV)Portfolio of InvestmentsJuly 31, 2024

| | |

COMMON STOCKS (a) (b) — 99.6% |

| | |

| ANZ Group Holdings Ltd. (AUD) (c) | |

| Aurizon Holdings Ltd. (AUD) (c) | |

| | |

| | |

| Coles Group Ltd. (AUD) (c) | |

| Commonwealth Bank of Australia (AUD) (c) | |

| Computershare Ltd. (AUD) (c) | |

| | |

| Lottery (The) Corp., Ltd. (AUD) (c) | |

| National Australia Bank Ltd. (AUD) (c) | |

| | |

| Origin Energy Ltd. (AUD) (c) | |

| | |

| Suncorp Group Ltd. (AUD) (c) | |

| Telstra Group Ltd. (AUD) (c) | |

| Washington H Soul Pattinson & Co., Ltd. (AUD) (c) | |

| Wesfarmers Ltd. (AUD) (c) | |

| Woolworths Group Ltd. (AUD) (c) | |

| | |

| | |

| Ageas S.A./N.V. (EUR) (c) | |

| Groupe Bruxelles Lambert N.V. (EUR) (c) | |

| | |

| | |

| Carlsberg A/S, Class B (DKK) (c) | |

| | |

| | |

| | |

| | |

| Air Liquide S.A. (EUR) (c) | |

| | |

| Bureau Veritas S.A. (EUR) (c) | |

| Cie Generale des Etablissements Michelin S.C.A. (EUR) (c) | |

| Credit Agricole S.A. (EUR) (c) | |

| | |

| | |

| EssilorLuxottica S.A. (EUR) (c) | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Deutsche Boerse AG (EUR) (c) | |

| Deutsche Post AG (EUR) (c) | |

| Deutsche Telekom AG (EUR) (c) | |

| | |

| Evonik Industries AG (EUR) (c) | |

| | |

| Henkel AG & Co. KGaA (EUR) (c) | |