UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Ryan O’Connor

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

Global X Management Company LLC 605 Third Avenue, 43rd floor New York, NY 10158 | Eric S. Purple, Esq. Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, DC 20006-1871 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2024

Date of reporting period: April 30, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

Global X Lithium & Battery Tech ETF (ticker: LIT)

Global X SuperDividend® ETF (ticker: SDIV)

Global X Social Media ETF (ticker: SOCL)

Global X Guru® Index ETF (ticker: GURU)

Global X SuperIncome™ Preferred ETF (ticker: SPFF)

Global X SuperDividend® U.S. ETF (ticker: DIV)

Global X MSCI SuperDividend® Emerging Markets ETF (ticker: SDEM)

Global X SuperDividend® REIT ETF (ticker: SRET)

Global X Renewable Energy Producers ETF (ticker: RNRG)

Global X S&P 500® Catholic Values ETF (ticker: CATH)

Global X MSCI SuperDividend® EAFE ETF (ticker: EFAS)

Global X E-commerce ETF (ticker: EBIZ)

Global X S&P Catholic Values Developed ex-U.S. ETF (ticker: CEFA)

Global X NASDAQ 100® Tail Risk ETF (ticker: QTR)

Global X NASDAQ 100® Collar 95-110 ETF (ticker: QCLR)

Global X S&P 500® Tail Risk ETF (ticker: XTR)

Global X S&P 500® Collar 95-110 ETF (ticker: XCLR)

Global X Disruptive Materials ETF (ticker: DMAT)

Semi-Annual Report

April 30, 2024

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ (defined below) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Funds’ website (www.globalxetfs.com/explore), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Table of Contents

Shares are bought and sold at market price (not net asset value (“NAV”)) and are not individually redeemed from the Fund. Shares may only be redeemed directly from the Fund by Authorized Participants, in very large creation/ redemption units. Brokerage commissions will reduce returns.

The Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “SEC” or “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT is available on the Commission’s website at https://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Fund voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-493-8631; and (ii) on the Commission’s website at https://www.sec.gov.

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X Lithium & Battery Tech ETF |

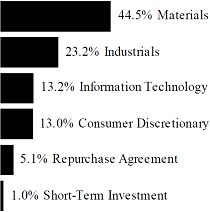

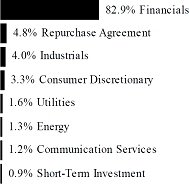

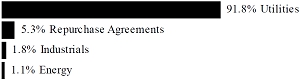

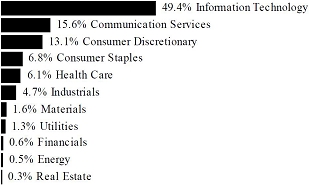

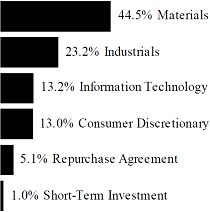

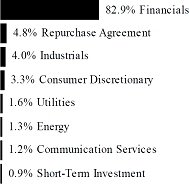

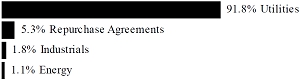

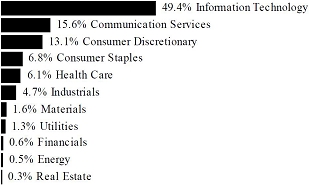

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| COMMON STOCK — 99.9% | | | | | | | | |

| AUSTRALIA — 13.9% | | | | | | | | |

| Materials — 13.9% | | | | | | | | |

| Core Lithium * (A) | | | 20,291,316 | | | $ | 1,910,546 | |

| IGO | | | 6,560,361 | | | | 33,696,400 | |

| Latin Resources * | | | 25,562,184 | | | | 3,734,735 | |

| Liontown Resources * (A) | | | 15,113,169 | | | | 12,218,114 | |

| Mineral Resources | | | 1,856,834 | | | | 87,042,108 | |

| Pilbara Minerals | | | 28,877,207 | | | | 76,130,818 | |

| Sayona Mining * (A) | | | 100,866,916 | | | | 2,226,932 | |

| | | | | | | | | |

| TOTAL AUSTRALIA | | | | | | | 216,959,653 | |

| BRAZIL — 0.5% | | | | | | | | |

| Materials — 0.5% | | | | | | | | |

| Sigma Lithium * (A) | | | 500,699 | | | | 7,195,045 | |

| | | | | | | | | |

| CANADA — 1.4% | | | | | | | | |

| Materials — 1.4% | | | | | | | | |

| Lithium Americas * | | | 1,444,124 | | | | 6,412,022 | |

| Lithium Americas Argentina * (A) | | | 1,343,386 | | | | 6,903,450 | |

| Patriot Battery Metals * (A) | | | 1,330,179 | | | | 6,457,979 | |

The accompanying notes are an integral part of the financial statements.

1

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X Lithium & Battery Tech ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Materials — continued | | | | | | | | |

| Standard Lithium * (A) | | | 1,789,952 | | | $ | 2,266,999 | |

| | | | | | | | | |

| TOTAL CANADA | | | | | | | 22,040,450 | |

| CHILE — 4.7% | | | | | | | | |

| Industrials — 4.7% | | | | | | | | |

| Sociedad Quimica y Minera de Chile ADR (A) | | | 1,584,016 | | | | 72,373,691 | |

| | | | | | | | | |

| CHINA — 34.9% | | | | | | | | |

| Consumer Discretionary — 4.1% | | | | | | | | |

| BYD, Cl H | | | 2,296,674 | | | | 63,310,351 | |

| | | | | | | | | |

| Industrials — 13.3% | | | | | | | | |

| Contemporary Amperex Technology, Cl A | | | 2,218,909 | | | | 61,981,809 | |

| Eve Energy, Cl A | | | 12,256,988 | | | | 62,476,764 | |

| Jiangxi Special Electric Motor, Cl A * | | | 14,897,677 | | | | 19,965,038 | |

| Sunwoda Electronic, Cl A | | | 14,584,091 | | | | 30,583,972 | |

| Wuxi Lead Intelligent Equipment, Cl A | | | 10,663,046 | | | | 32,784,719 | |

| | | | | | | | 207,792,302 | |

| Information Technology — 4.0% | | | | | | | | |

| NAURA Technology Group, Cl A | | | 1,415,241 | | | | 62,245,276 | |

| | | | | | | | | |

| Materials — 13.5% | | | | | | | | |

| Ganfeng Lithium Group, Cl A | | | 7,464,040 | | | | 36,286,208 | |

| Guangzhou Tinci Materials Technology, Cl A | | | 12,395,914 | | | | 35,890,802 | |

| Shanghai Putailai New Energy Technology, Cl A | | | 9,341,553 | | | | 23,840,251 | |

| Sinomine Resource Group, Cl A | | | 5,537,926 | | | | 27,182,066 | |

| Tianqi Lithium, Cl A | | | 11,070,988 | | | | 60,308,528 | |

| Yunnan Energy New Material, Cl A | | | 4,879,859 | | | | 27,995,634 | |

| | | | | | | | 211,503,489 | |

| TOTAL CHINA | | | | | | | 544,851,418 | |

| FRANCE — 0.6% | | | | | | | | |

| Materials — 0.6% | | | | | | | | |

| Eramet | | | 98,937 | | | | 9,663,821 | |

The accompanying notes are an integral part of the financial statements.

2

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X Lithium & Battery Tech ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| JAPAN — 7.4% | | | | | | | | |

| Consumer Discretionary — 3.8% | | | | | | | | |

| Panasonic Holdings | | | 6,659,792 | | | $ | 58,487,164 | |

| | | | | | | | | |

| Information Technology — 3.6% | | | | | | | | |

| TDK | | | 1,257,323 | | | | 56,600,109 | |

| | | | | | | | | |

| TOTAL JAPAN | | | | | | | 115,087,273 | |

| JERSEY — 6.6% | | | | | | | | |

| Materials — 6.6% | | | | | | | | |

| Arcadium Lithium * | | | 11,945,133 | | | | 52,558,585 | |

| Arcadium Lithium CDI * | | | 11,455,563 | | | | 49,987,911 | |

| | | | | | | | | |

| TOTAL JERSEY | | | | | | | 102,546,496 | |

| NETHERLANDS — 0.5% | | | | | | | | |

| Materials — 0.5% | | | | | | | | |

| AMG Critical Materials | | | 336,592 | | | | 7,961,052 | |

| | | | | | | | | |

| SOUTH KOREA — 10.6% | | | | | | | | |

| Industrials — 4.1% | | | | | | | | |

| LG Energy Solution * | | | 229,370 | | | | 64,557,507 | |

| | | | | | | | | |

| Information Technology — 6.5% | | | | | | | | |

| L&F * | | | 278,755 | | | | 33,056,902 | |

| Samsung SDI | | | 217,200 | | | | 68,204,037 | |

| | | | | | | | 101,260,939 | |

| TOTAL SOUTH KOREA | | | | | | | 165,818,446 | |

| UNITED STATES — 18.8% | | | | | | | | |

| Consumer Discretionary — 6.0% | | | | | | | | |

| Lucid Group * (A) | | | 9,496,485 | | | | 24,216,037 | |

| Tesla * | | | 383,182 | | | | 70,229,597 | |

| | | | | | | | 94,445,634 | |

| Industrials — 2.6% | | | | | | | | |

| EnerSys | | | 442,296 | | | | 40,005,673 | |

The accompanying notes are an integral part of the financial statements.

3

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X Lithium & Battery Tech ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Materials — 10.2% | | | | | | | | |

| Albemarle | | | 1,305,218 | | | $ | 157,030,778 | |

| Piedmont Lithium * (A) | | | 183,945 | | | | 2,253,326 | |

| | | | | | | | 159,284,104 | |

| TOTAL UNITED STATES | | | | | | | 293,735,411 | |

TOTAL COMMON STOCK

(Cost $1,916,495,080) | | | | | | | 1,558,232,756 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT(B)(C) — 1.0% | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 5.240%

(Cost $15,813,189) | | | 15,813,189 | | | | 15,813,189 | |

| | | | | | | | |

| | | Face Amount | | | | | |

| REPURCHASE AGREEMENT(C) — 5.4% | | | | | | | | |

BNP Paribas

5.270%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $83,912,933 (collateralized by U.S. Treasury Obligations, ranging in par value $5,737,704 - $13,754,205, 2.875%, 05/15/2032, with a total market value of $85,612,981)

(Cost $83,900,651) | | $ | 83,900,651 | | | | 83,900,651 | |

TOTAL INVESTMENTS — 106.3%

(Cost $2,016,208,920) | | | | | | $ | 1,657,946,596 | |

Percentages are based on Net Assets of $1,560,358,070.

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at April 30, 2024. The total market value of securities on loan at April 30, 2024 was $96,214,633. |

| (B) | The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2024. |

| (C) | These securities were purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2024 was $99,713,840. The total value of non-cash collateral held from securities on loan as of April 30, 2024 was $–. |

The accompanying notes are an integral part of the financial statements.

4

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X Lithium & Battery Tech ETF |

The following is a summary of the level of inputs used as of April 30, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 1,558,232,756 | | | $ | — | | | $ | — | | | $ | 1,558,232,756 | |

| Short-Term Investment | | | 15,813,189 | | | | — | | | | — | | | | 15,813,189 | |

| Repurchase Agreement | | | — | | | | 83,900,651 | | | | — | | | | 83,900,651 | |

| Total Investments in Securities | | $ | 1,574,045,945 | | | $ | 83,900,651 | | | $ | — | | | $ | 1,657,946,596 | |

Amounts designated as “—” are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

5

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

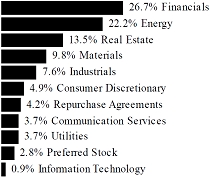

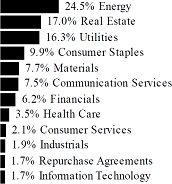

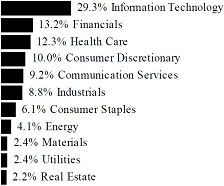

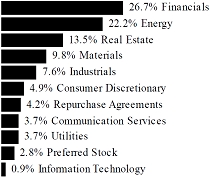

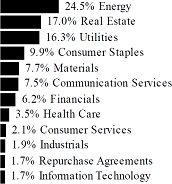

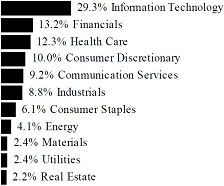

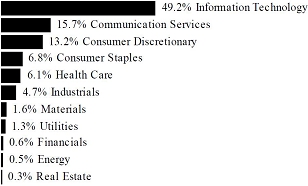

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| COMMON STOCK — 96.2% | | | | | | | | |

| AUSTRALIA — 5.2% | | | | | | | | |

| Energy — 2.7% | | | | | | | | |

| New Hope | | | 2,383,954 | | | $ | 7,043,501 | |

| Woodside Energy Group | | | 379,782 | | | | 6,961,848 | |

| Yancoal Australia (A) | | | 1,846,353 | | | | 6,654,064 | |

| | | | | | | | 20,659,413 | |

| Financials — 0.9% | | | | | | | | |

| Magellan Financial Group | | | 1,197,717 | | | | 6,945,203 | |

| Industrials — 1.6% | | | | | | | | |

| APM Human Services International ltd | | | 6,803,055 | | | | 5,367,345 | |

| McMillan Shakespeare | | | 550,108 | | | | 6,615,585 | |

| | | | | | | | 11,982,930 | |

| TOTAL AUSTRALIA | | | | | | | 39,587,546 | |

| BELGIUM — 2.1% | | | | | | | | |

| Communication Services — 0.9% | | | | | | | | |

| Proximus | | | 902,203 | | | | 6,670,801 | |

The accompanying notes are an integral part of the financial statements.

6

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Materials — 1.2% | | | | | | | | |

| Solvay | | | 290,829 | | | $ | 9,456,615 | |

| | | | | | | | | |

| TOTAL BELGIUM | | | | | | | 16,127,416 | |

| BERMUDA — 1.3% | | | | | | | | |

| Energy — 1.3% | | | | | | | | |

| Avance Gas Holding | | | 671,073 | | | | 9,792,661 | |

| | | | | | | | | |

| BRAZIL — 3.1% | | | | | | | | |

| Consumer Discretionary — 1.5% | | | | | | | | |

| Mahle-Metal Leve | | | 1,009,000 | | | | 5,964,724 | |

| Vulcabras | | | 1,862,800 | | | | 5,689,283 | |

| | | | | | | | 11,654,007 | |

| Materials — 1.6% | | | | | | | | |

| Cia Siderurgica Nacional | | | 2,323,400 | | | | 6,239,843 | |

| CSN Mineracao | | | 6,206,200 | | | | 5,915,114 | |

| | | | | | | | 12,154,957 | |

| TOTAL BRAZIL | | | | | | | 23,808,964 | |

| CHILE — 1.0% | | | | | | | | |

| Industrials — 1.0% | | | | | | | | |

| Quinenco | | | 2,219,344 | | | | 7,764,338 | |

| | | | | | | | | |

| CHINA — 11.0% | | | | | | | | |

| Energy — 0.9% | | | | | | | | |

| Yankuang Energy Group, Cl H | | | 2,990,000 | | | | 6,514,294 | |

| | | | | | | | | |

| Financials — 2.7% | | | | | | | | |

| Chongqing Rural Commercial Bank, Cl H | | | 18,078,100 | | | | 7,766,381 | |

| Lufax Holding ADR | | | 2,923,526 | | | | 12,834,279 | |

| | | | | | | | 20,600,660 | |

| Industrials — 1.4% | | | | | | | | |

| SITC International Holdings (A) | | | 4,813,000 | | | | 10,486,053 | |

| | | | | | | | | |

| Materials — 3.1% | | | | | | | | |

| China National Building Material, Cl H | | | 20,561,800 | | | | 8,018,398 | |

| Fufeng Group (A) | | | 11,654,100 | | | | 8,538,075 | |

The accompanying notes are an integral part of the financial statements.

7

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Materials — continued | | | | | | | | |

| Shougang Fushan Resources Group | | | 17,580,800 | | | $ | 6,721,039 | |

| | | | | | | | 23,277,512 | |

| Real Estate — 2.1% | | | | | | | | |

| China Overseas Grand Oceans Group | | | 31,445,000 | | | | 6,794,616 | |

| Longfor Group Holdings (A) | | | 6,332,500 | | | | 9,553,969 | |

| | | | | | | | 16,348,585 | |

| Utilities — 0.8% | | | | | | | | |

| Guangdong Investment | | | 12,400,000 | | | | 6,500,281 | |

| | | | | | | | | |

| TOTAL CHINA | | | | | | | 83,727,385 | |

| CZECH REPUBLIC — 1.0% | | | | | | | | |

| Utilities — 1.0% | | | | | | | | |

| CEZ | | | 204,975 | | | | 7,573,917 | |

| | | | | | | | | |

| DENMARK — 1.0% | | | | | | | | |

| Industrials — 1.0% | | | | | | | | |

| D/S Norden | | | 171,069 | | | | 7,244,623 | |

| | | | | | | | | |

| FRANCE — 2.9% | | | | | | | | |

| Financials — 1.0% | | | | | | | | |

| Coface | | | 492,171 | | | | 7,604,409 | |

| | | | | | | | | |

| Real Estate — 1.9% | | | | | | | | |

| ICADE ‡ | | | 265,715 | | | | 7,102,932 | |

| Nexity (A) | | | 687,426 | | | | 7,747,260 | |

| | | | | | | | 14,850,192 | |

| TOTAL FRANCE | | | | | | | 22,454,601 | |

| GERMANY — 0.9% | | | | | | | | |

| Financials — 0.9% | | | | | | | | |

| Deutsche Pfandbriefbank (A) | | | 1,498,053 | | | | 7,131,221 | |

The accompanying notes are an integral part of the financial statements.

8

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| GREECE — 1.9% | | | | | | | | |

| Consumer Discretionary — 0.9% | | | | | | | | |

| OPAP | | | 401,006 | | | $ | 6,693,224 | |

| | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| Okeanis Eco Tankers | | | 247,578 | | | | 7,712,954 | |

| | | | | | | | | |

| TOTAL GREECE | | | | | | | 14,406,178 | |

| HONG KONG — 5.4% | | | | | | | | |

| Communication Services — 1.8% | | | | | | | | |

| HKBN | | | 20,101,710 | | | | 6,065,570 | |

| PCCW | | | 14,669,500 | | | | 7,352,381 | |

| | | | | | | | 13,417,951 | |

| Consumer Discretionary — 1.7% | | | | | | | | |

| Yue Yuen Industrial Holdings | | | 7,348,000 | | | | 13,096,599 | |

| | | | | | | | | |

| Industrials — 0.9% | | | | | | | | |

| Orient Overseas International | | | 492,800 | | | | 7,201,841 | |

| | | | | | | | | |

| Information Technology — 1.0% | | | | | | | | |

| VTech Holdings | | | 1,292,600 | | | | 7,494,938 | |

| | | | | | | | | |

| TOTAL HONG KONG | | | | | | | 41,211,329 | |

| INDONESIA — 2.8% | | | | | | | | |

| Energy — 2.8% | | | | | | | | |

| Adaro Energy | | | 43,556,500 | | | | 7,259,417 | |

| Bukit Asam | | | 41,355,400 | | | | 7,706,449 | |

| Indo Tambangraya Megah | | | 4,218,100 | | | | 6,543,762 | |

| | | | | | | | | |

| TOTAL INDONESIA | | | | | | | 21,509,628 | |

| ISRAEL — 0.7% | | | | | | | | |

| Energy — 0.7% | | | | | | | | |

| Oil Refineries | | | 18,700,363 | | | | 5,456,120 | |

The accompanying notes are an integral part of the financial statements.

9

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| ITALY — 1.3% | | | | | | | | |

| Communication Services — 1.3% | | | | | | | | |

| MFE-MediaForEurope, Cl A (A) | | | 3,254,003 | | | $ | 9,596,078 | |

| | | | | | | | | |

| KUWAIT — 0.9% | | | | | | | | |

| Consumer Discretionary — 0.9% | | | | | | | | |

| Humansoft Holding KSC | | | 716,512 | | | | 6,744,049 | |

| | | | | | | | | |

| MEXICO — 1.0% | | | | | | | | |

| Materials — 1.0% | | | | | | | | |

| Alpek, Cl A (A) | | | 10,536,422 | | | | 7,878,277 | |

| | | | | | | | | |

| NETHERLANDS — 1.0% | | | | | | | | |

| Financials — 1.0% | | | | | | | | |

| Van Lanschot Kempen | | | 214,833 | | | | 7,660,875 | |

| | | | | | | | | |

| NORWAY — 2.0% | | | | | | | | |

| Energy — 2.0% | | | | | | | | |

| FLEX LNG (A) | | | 294,042 | | | | 7,648,032 | |

| Var Energi | | | 2,265,684 | | | | 7,443,062 | |

| | | | | | | | | |

| TOTAL NORWAY | | | | | | | 15,091,094 | |

| RUSSIA — 0.0% | | | | | | | | |

| Materials — 0.0% | | | | | | | | |

| Magnitogorsk Iron & Steel Works PJSC *(B) | | | 6,332,020 | | | | — | |

| PhosAgro PJSC GDR *(B) | | | 119 | | | | — | |

| Severstal PJSC *(B) | | | 312,897 | | | | — | |

| | | | | | | | — | |

| Utilities — 0.0% | | | | | | | | |

| Unipro PJSC *(B) | | | 209,143,887 | | | | — | |

| | | | | | | | | |

| TOTAL RUSSIA | | | | | | | — | |

| SINGAPORE — 3.4% | | | | | | | | |

| Energy — 2.3% | | | | | | | | |

| BW LPG | | | 674,985 | | | | 9,819,271 | |

The accompanying notes are an integral part of the financial statements.

10

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Energy — continued | | | | | | | | |

| Hafnia | | | 1,019,092 | | | $ | 7,748,455 | |

| | | | | | | | 17,567,726 | |

| Real Estate — 1.1% | | | | | | | | |

| Cromwell European Real Estate Investment Trust ‡ | | | 5,096,500 | | | | 8,119,698 | |

| | | | | | | | | |

| TOTAL SINGAPORE | | | | | | | 25,687,424 | |

| SOUTH AFRICA — 3.9% | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| Exxaro Resources (A) | | | 763,114 | | | | 7,333,501 | |

| | | | | | | | | |

| Materials — 1.0% | | | | | | | | |

| African Rainbow Minerals (A) | | | 762,374 | | | | 7,942,825 | |

| | | | | | | | | |

| Real Estate — 1.9% | | | | | | | | |

| Equites Property Fund ‡ | | | 11,185,220 | | | | 7,363,522 | |

| Redefine Properties ‡ | | | 34,815,927 | | | | 7,319,688 | |

| | | | | | | | 14,683,210 | |

| | | | | | | | | |

| TOTAL SOUTH AFRICA | | | | | | | 29,959,536 | |

| SPAIN — 2.1% | | | | | | | | |

| Materials — 1.1% | | | | | | | | |

| Ence Energia y Celulosa | | | 2,413,933 | | | | 8,641,562 | |

| | | | | | | | | |

| Utilities — 1.0% | | | | | | | | |

| Enagas | | | 509,542 | | | | 7,496,870 | |

| | | | | | | | | |

| TOTAL SPAIN | | | | | | | 16,138,432 | |

| TAIWAN — 1.1% | | | | | | | | |

| Industrials — 1.1% | | | | | | | | |

| Wisdom Marine Lines | | | 3,993,400 | | | | 8,351,776 | |

| | | | | | | | | |

| THAILAND — 1.9% | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| Banpu NVDR | | | 48,747,800 | | | | 7,300,332 | |

The accompanying notes are an integral part of the financial statements.

11

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Industrials — 0.9% | | | | | | | | |

| Regional Container Lines NVDR | | | 12,701,876 | | | $ | 7,060,406 | |

| | | | | | | | | |

| TOTAL THAILAND | | | | | | | 14,360,738 | |

| UNITED ARAB EMIRATES — 1.1% | | | | | | | | |

| Materials — 1.1% | | | | | | | | |

| Fertiglobe | | | 10,548,983 | | | | 8,013,195 | |

| | | | | | | | | |

| UNITED KINGDOM — 3.0% | | | | | | | | |

| Energy — 2.2% | | | | | | | | |

| Diversified Energy (A) | | | 626,858 | | | | 8,838,161 | |

| Serica Energy | | | 3,195,456 | | | | 7,442,180 | |

| | | | | | | | 16,280,341 | |

| Financials — 0.8% | | | | | | | | |

| M&G PLC | | | 2,519,122 | | | | 6,343,306 | |

| | | | | | | | | |

| TOTAL UNITED KINGDOM | | | | | | | 22,623,647 | |

| UNITED STATES — 33.2% | | | | | | | | |

| Energy — 5.2% | | | | | | | | |

| Berry | | | 1,053,452 | | | | 8,943,808 | |

| Civitas Resources | | | 108,792 | | | | 7,828,672 | |

| Kimbell Royalty Partners | | | 481,602 | | | | 7,628,576 | |

| Kinetik Holdings, Cl A | | | 213,244 | | | | 8,175,775 | |

| Sitio Royalties, Cl A | | | 314,235 | | | | 7,302,821 | |

| | | | | | | | 39,879,652 | |

| Financials — 20.2% | | | | | | | | |

| AGNC Investment ‡ | | | 775,137 | | | | 7,092,504 | |

| Annaly Capital Management ‡ | | | 380,425 | | | | 7,129,164 | |

| Apollo Commercial Real Estate Finance ‡ | | | 679,866 | | | | 6,547,110 | |

| Arbor Realty Trust ‡ | | | 578,182 | | | | 7,418,075 | |

| B Riley Financial (A) | | | 335,317 | | | | 11,534,905 | |

| Blackstone Mortgage Trust, Cl A ‡ | | | 374,523 | | | | 6,606,586 | |

| BrightSpire Capital, Cl A ‡ | | | 1,111,863 | | | | 6,993,618 | |

| Chimera Investment ‡ | | | 1,689,249 | | | | 6,959,706 | |

| Claros Mortgage Trust ‡ | | | 767,322 | | | | 6,675,701 | |

| Dynex Capital ‡ | | | 600,021 | | | | 7,002,245 | |

| Ellington Financial ‡ | | | 656,573 | | | | 7,511,195 | |

The accompanying notes are an integral part of the financial statements.

12

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| Franklin BSP Realty Trust ‡ | | | 582,723 | | | $ | 7,278,210 | |

| KKR Real Estate Finance Trust ‡ | | | 754,927 | | | | 7,103,863 | |

| MFA Financial ‡ | | | 666,473 | | | | 7,057,949 | |

| New York Mortgage Trust ‡ | | | 1,041,105 | | | | 7,131,569 | |

| PennyMac Mortgage Investment Trust ‡ | | | 524,133 | | | | 7,259,242 | |

| Ready Capital ‡ | | | 864,557 | | | | 7,366,026 | |

| Redwood Trust ‡ | | | 1,237,830 | | | | 6,845,200 | |

| Rithm Capital ‡ | | | 679,865 | | | | 7,560,099 | |

| Starwood Property Trust ‡ | | | 366,977 | | | | 6,961,554 | |

| Two Harbors Investment ‡ | | | 582,672 | | | | 7,359,147 | |

| | | | | | | | 153,393,668 | |

| Real Estate — 6.8% | | | | | | | | |

| Brandywine Realty Trust ‡ | | | 1,708,313 | | | | 7,755,741 | |

| Gladstone Commercial ‡ | | | 580,775 | | | | 7,764,962 | |

| Global Net Lease ‡ | | | 1,001,782 | | | | 6,962,385 | |

| Medical Properties Trust ‡ | | | 1,681,800 | | | | 7,736,280 | |

| Omega Healthcare Investors ‡ | | | 244,053 | | | | 7,421,651 | |

| Sabra Health Care REIT ‡ | | | 545,748 | | | | 7,596,812 | |

| Uniti Group ‡ | | | 1,139,172 | | | | 6,550,239 | |

| | | | | | | | 51,788,070 | |

| Utilities — 1.0% | | | | | | | | |

| NextEra Energy Partners (A) | | | 258,722 | | | | 7,337,356 | |

| | | | | | | | | |

| TOTAL UNITED STATES | | | | | | | 252,398,746 | |

TOTAL COMMON STOCK

(Cost $787,632,857) | | | | | | | 732,299,794 | |

| | | | | | | | | |

| PREFERRED STOCK — 2.9% | | | | | | | | |

| BRAZIL—2.9% | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| Petroleo Brasileiro (C) | | | 911,900 | | | | 7,392,880 | |

| Materials — 1.9% | | | | | | | | |

| Bradespar (C) | | | 1,778,800 | | | | 6,839,823 | |

| Metalurgica Gerdau, Cl A (C) | | | 3,760,100 | | | | 7,675,302 | |

| | | | | | | | 14,515,125 | |

| TOTAL BRAZIL | | | | | | | 21,908,005 | |

TOTAL PREFERRED STOCK

(Cost $23,643,747) | | | | | | | 21,908,005 | |

The accompanying notes are an integral part of the financial statements.

13

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENTS(D) — 4.3% | | | | | | | | |

Bank of America Securities

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $7,681,692 (collateralized by various U.S. Government Obligations, ranging in par value $4,904 - $6,222,489, 2.000% - 7.500%, 10/17/2025 - 08/20/2063, with a total market value of $7,834,168) | | $ | 7,680,557 | | | $ | 7,680,557 | |

Citigroup Global Markets Inc.

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $7,681,692 (collateralized by various U.S. Government Obligations, ranging in par value $153,705 - $3,856,019, 2.000% - 6.500%, 12/01/2033 - 05/01/2054, with a total market value of $7,834,170) | | | 7,680,557 | | | | 7,680,557 | |

Deutsche Bank

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $1,961,285 (collateralized by various U.S. Government Obligations, ranging in par value $1,194 - $410,467, 2.000% - 7.000%, 02/01/2037 - 02/01/2054, with a total market value of $2,000,216) | | | 1,960,996 | | | | 1,960,996 | |

Nomura Securities International

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $7,681,690 (collateralized by various U.S. Government Obligations, ranging in par value $3,279 - $1,543,912, 2.000% - 7.500%, 10/01/2029 - 03/15/2058, with a total market value of $7,837,061) | | | 7,680,557 | | | | 7,680,557 | |

The accompanying notes are an integral part of the financial statements.

14

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENTS — continued | | | | | | | | |

RBC Dominion Securities

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $7,681,692 (collateralized by various U.S. Government Obligations and U.S. Treasury Obligations, ranging in par value $7,304 - $16,350,522, 0.000% - 5.500%, 05/09/2024 - 02/15/2054, with a total market value of $7,834,168) | | $ | 7,680,557 | | | $ | 7,680,557 | |

TOTAL REPURCHASE AGREEMENTS

(Cost $32,683,224) | | | | | | | 32,683,224 | |

TOTAL INVESTMENTS — 103.4%

(Cost $843,959,828) | | | | | | $ | 786,891,023 | |

Percentages are based on Net Assets of $761,226,179.

A list of the open futures contracts held by the Fund at April 30, 2024, is as follows:

| Type of Contract | | | Number of

Contracts | | | Expiration

Date | | Notional Amount | | | Value | | | Unrealized

Depreciation | |

| Long Contracts | | | | | | | | | | | | | | | | | | |

| MSCI EAFE Index | | | 32 | | | Jun-2024 | | $ | 3,708,338 | | | $ | 3,628,000 | | | $ | (80,338 | ) |

| S&P Mid Cap 400 Index E-MINI | | | 12 | | | Jun-2024 | | | 3,531,880 | | | | 3,452,640 | | | | (79,240 | ) |

| | | | | | | | | $ | 7,240,218 | | | $ | 7,080,640 | | | $ | (159,578 | ) |

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

| (A) | This security or a partial position of this security is on loan at April 30, 2024. The total market value of securities on loan at April 30, 2024 was $35,558,121. |

| (B) | Level 3 security in accordance with fair value hierarchy. |

| (C) | There is currently no stated interest rate. |

| (D) | These securities were purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2024 was $32,683,224. The total value of non-cash collateral held from securities on loan as of April 30, 2024 was $5,616,243. |

The accompanying notes are an integral part of the financial statements.

15

| Schedule of Investments | April 30, 2024 (Unaudited) |

| Global X SuperDividend® ETF |

The following is a summary of the level of inputs used as of April 30, 2024, in valuing the Fund’s investments and other financial instruments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3(1) | | | Total | |

| Common Stock | | $ | 732,299,794 | | | $ | — | | | $ | — | ^ | | $ | 732,299,794 | |

| Preferred Stock | | | 21,908,005 | | | | — | | | | — | | | | 21,908,005 | |

| Repurchase Agreements | | | — | | | | 32,683,224 | | | | — | | | | 32,683,224 | |

| Total Investments in Securities | | $ | 754,207,799 | | | $ | 32,683,224 | | | $ | — | | | $ | 786,891,023 | |

| | | | | | | | | | | | | | | | | |

| Other Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Futures Contracts* | | | | | | | | | | | | | | | | |

| Unrealized Depreciation | | $ | (159,578) | | | $ | — | | | $ | — | | | $ | (159,578) | |

| Total Other Financial Instruments | | $ | (159,578) | | | $ | — | | | $ | — | | | $ | (159,578) | |

| * | Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

| ^ | Includes Securities in which the fair value is $0 or has been rounded to $0. |

| (1) | A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the end of the period in relation to Net Assets. Management has concluded that Level 3 investments are not material in relation to Net Assets. |

Amounts designated as “—” are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

16

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Social Media ETF | |

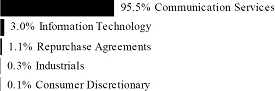

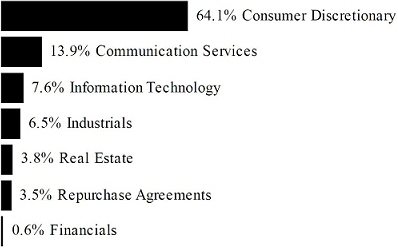

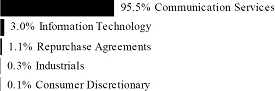

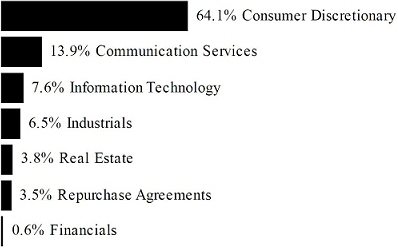

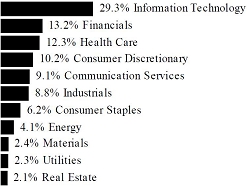

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| COMMON STOCK — 99.9% | | | | | | | | |

| CHINA — 35.3% | | | | | | | | |

| Communication Services — 35.3% | | | | | | | | |

| Baidu ADR * | | | 64,415 | | | $ | 6,660,511 | |

| Bilibili ADR * | | | 173,283 | | | | 2,190,297 | |

| Hello Group ADR | | | 100,440 | | | | 585,565 | |

| HUYA ADR * | | | 60,612 | | | | 272,148 | |

| JOYY ADR | | | 19,613 | | | | 639,776 | |

| Kuaishou Technology, Cl B * | | | 1,443,988 | | | | 10,329,761 | |

| Meitu (A) | | | 1,932,100 | | | | 805,330 | |

| NetEase ADR | | | 68,635 | | | | 6,415,314 | |

| Tencent Holdings | | | 338,527 | | | | 15,027,946 | |

| Tencent Music Entertainment Group ADR * | | | 443,759 | | | | 5,569,175 | |

| Weibo ADR | | | 56,614 | | | | 488,013 | |

| | | | | | | | | |

| TOTAL CHINA | | | | | | | 48,983,836 | |

| GERMANY — 1.0% | | | | | | | | |

| Communication Services — 1.0% | | | | | | | | |

| United Internet | | | 55,341 | | | | 1,339,692 | |

| | | | | | | | | |

| HONG KONG — 0.2% | | | | | | | | |

| Information Technology — 0.2% | | | | | | | | |

| Newborn Town * | | | 500,000 | | | | 217,997 | |

| | | | | | | | | |

| JAPAN — 4.7% | | | | | | | | |

| Communication Services — 4.7% | | | | | | | | |

| DeNA * (A) | | | 51,223 | | | | 519,505 | |

| giftee * (A) | | | 11,845 | | | | 89,647 | |

The accompanying notes are an integral part of the financial statements.

17

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Social Media ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Communication Services — continued | | | | | | | | |

| Gree | | | 33,400 | | | $ | 99,119 | |

| Kakaku.com | | | 85,465 | | | | 990,344 | |

| MIXI | | | 24,035 | | | | 368,089 | |

| Nexon | | | 284,642 | | | | 4,470,452 | |

| | | | | | | | | |

| TOTAL JAPAN | | | | | | | 6,537,156 | |

| SINGAPORE — 0.1% | | | | | | | | |

| Communication Services — 0.1% | | | | | | | | |

| Grindr * | | | 7,926 | | | | 77,596 | |

| | | | | | | | | |

| SOUTH KOREA — 13.0% | | | | | | | | |

| Communication Services — 13.0% | | | | | | | | |

| AfreecaTV | | | 5,575 | | | | 455,003 | |

| Com2uSCorp | | | 4,927 | | | | 142,595 | |

| Kakao | | | 184,828 | | | | 6,499,270 | |

| NAVER | | | 81,734 | | | | 10,904,963 | |

| | | | | | | | | |

| TOTAL SOUTH KOREA | | | | | | | 18,001,831 | |

| TAIWAN — 0.0% | | | | | | | | |

| Consumer Discretionary — 0.0% | | | | | | | | |

| PChome Online * | | | 77,626 | | | | 74,975 | |

| | | | | | | | | |

| UNITED ARAB EMIRATES — 0.2% | | | | | | | | |

| Communication Services — 0.2% | | | | | | | | |

| Yalla Group ADR * | | | 67,002 | | | | 314,910 | |

| | | | | | | | | |

| UNITED KINGDOM — 0.4% | | | | | | | | |

| Communication Services — 0.4% | | | | | | | | |

| Trustpilot Group * | | | 235,009 | | | | 559,692 | |

| | | | | | | | | |

| UNITED STATES — 45.0% | | | | | | | | |

| Communication Services — 41.7% | | | | | | | | |

| Alphabet, Cl A * | | | 40,001 | | | | 6,511,363 | |

| Angi, Cl A * | | | 47,898 | | | | 101,065 | |

| Bumble, Cl A * | | | 64,692 | | | | 653,389 | |

| IAC * | | | 52,762 | | | | 2,509,361 | |

| Match Group * | | | 187,434 | | | | 5,776,716 | |

The accompanying notes are an integral part of the financial statements.

18

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Social Media ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Communication Services — continued | | | | | | | | |

| Meta Platforms, Cl A | | | 26,100 | | | $ | 11,227,437 | |

| Nextdoor Holdings * (A) | | | 101,741 | | | | 207,552 | |

| Pinterest, Cl A * | | | 337,988 | | | | 11,305,698 | |

| Reddit, Cl A * | | | 19,039 | | | | 846,093 | |

| Rumble * (A) | | | 42,761 | | | | 301,893 | |

| Snap, Cl A * | | | 601,382 | | | | 9,050,799 | |

| Spotify Technology * | | | 20,645 | | | | 5,789,684 | |

| Trump Media & Technology Group * | | | 26,913 | | | | 1,343,766 | |

| Vimeo * | | | 96,306 | | | | 345,738 | |

| Yelp, Cl A * | | | 45,986 | | | | 1,850,477 | |

| | | | | | | | 57,821,031 | |

| Consumer Discretionary — 0.1% | | | | | | | | |

| Groupon, Cl A * (A) | | | 14,465 | | | | 167,215 | |

| | | | | | | | | |

| Industrials — 0.4% | | | | | | | | |

| Fiverr International * | | | 23,399 | | | | 479,913 | |

| | | | | | | | | |

| Information Technology — 2.8% | | | | | | | | |

| Life360, CDI,* (A) | | | 136,825 | | | | 1,223,429 | |

| Sprinklr, Cl A * | | | 83,679 | | | | 978,207 | |

| Sprout Social, Cl A * | | | 33,617 | | | | 1,695,978 | |

| | | | | | | | 3,897,614 | |

| TOTAL UNITED STATES | | | | | | | 62,365,773 | |

TOTAL COMMON STOCK

(Cost $189,486,946) | | | | | | | 138,473,458 | |

| | | | | | | | |

| | | Face Amount | | | | | |

| REPURCHASE AGREEMENTS(B) — 1.1% | | | | | | | | |

Bank of America Securities

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $357,548 (collateralized by various U.S. Government Obligations, ranging in par value $228 - $289,629, 2.000% - 7.500%, 10/17/2025 - 08/20/2063, with a total market value of $364,645) | | $ | 357,495 | | | | 357,495 | |

The accompanying notes are an integral part of the financial statements.

19

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Social Media ETF | |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENTS — continued | | | | | | | | |

Citigroup Global Markets Inc.

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $357,548 (collateralized by various U.S. Government Obligations, ranging in par value $7,154 - $179,480, 2.000% - 6.500%, 12/01/2033 - 05/01/2054, with a total market value of $364,645) | | $ | 357,495 | | | $ | 357,495 | |

Deutsche Bank

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $98,441 (collateralized by various U.S. Government Obligations, ranging in par value $60 - $20,602, 2.000% - 7.000%, 02/01/2037 - 02/01/2054, with a total market value of $100,395) | | | 98,426 | | | | 98,426 | |

HSBC Securities

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $350,397 (collateralized by various U.S. Government Obligations, ranging in par value $21,897 - $529,154, 2.500% - 3.000%, 04/20/2043 - 10/20/2051, with a total market value of $357,352) | | | 350,345 | | | | 350,345 | |

Nomura Securities International

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $357,548 (collateralized by various U.S. Government Obligations, ranging in par value $153 - $71,862, 2.000% - 7.500%, 10/01/2029 - 03/15/2058, with a total market value of $364,780) | | | 357,495 | | | | 357,495 | |

TOTAL REPURCHASE AGREEMENTS

(Cost $1,521,256) | | | | | | | 1,521,256 | |

TOTAL INVESTMENTS — 101.0%

(Cost $191,008,202) | | | | | | $ | 139,994,714 | |

Percentages are based on Net Assets of $138,642,875.

The accompanying notes are an integral part of the financial statements.

20

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Social Media ETF | |

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at April 30, 2024. The total market value of securities on loan at April 30, 2024 was $1,427,310. |

| (B) | These securities were purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2024 was $1,521,256. The total value of non-cash collateral held from securities on loan as of April 30, 2024 was $–. |

The following is a summary of the level of inputs used as of April 30, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 138,473,458 | | | $ | — | | | $ | — | | | $ | 138,473,458 | |

| Repurchase Agreements | | | — | | | | 1,521,256 | | | | — | | | | 1,521,256 | |

| Total Investments in Securities | | $ | 138,473,458 | | | $ | 1,521,256 | | | $ | — | | | $ | 139,994,714 | |

Amounts designated as “—” are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

21

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Guru® Index ETF | |

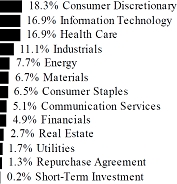

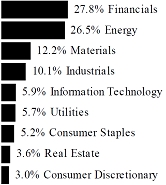

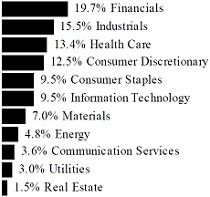

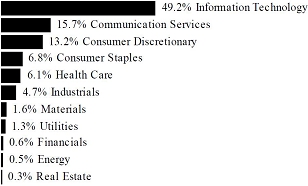

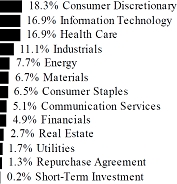

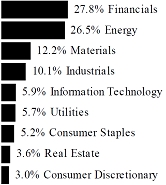

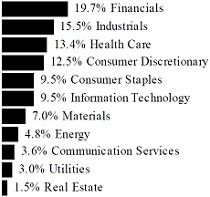

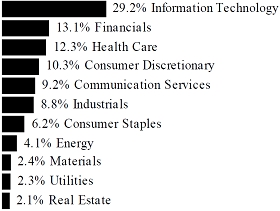

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| COMMON STOCK — 100.0% | | | | | | |

| SOUTH KOREA — 2.4% | | | | | | |

| Consumer Discretionary — 2.4% | | | | | | |

| Coupang, Cl A * | | | 42,576 | | | $ | 957,960 | |

| | | | | | | | | |

| UNITED KINGDOM — 1.4% | | | | | | | | |

| Health Care — 1.4% | | | | | | | | |

| Immunocore Holdings ADR * | | | 9,520 | | | | 562,442 | |

| | | | | | | | | |

| UNITED STATES — 96.2% | | | | | | | | |

| Communication Services — 5.2% | | | | | | | | |

| Alphabet, Cl A * | | | 4,699 | | | | 764,903 | |

| Endeavor Group Holdings, Cl A | | | 27,358 | | | | 722,525 | |

| Meta Platforms, Cl A | | | 1,389 | | | | 597,506 | |

| | | | | | | | 2,084,934 | |

| Consumer Discretionary — 16.2% | | | | | | | | |

| Amazon.com * | | | 3,971 | | | | 694,925 | |

| Asbury Automotive Group * | | | 3,041 | | | | 639,340 | |

| Chipotle Mexican Grill, Cl A * | | | 256 | | | | 808,858 | |

| Expedia Group * | | | 4,868 | | | | 655,379 | |

| Green Brick Partners * | | | 12,148 | | | | 657,571 | |

The accompanying notes are an integral part of the financial statements.

22

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Guru® Index ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Consumer Discretionary — continued | | | | | | | | |

| Home Depot | | | 1,859 | | | $ | 621,315 | |

| Lithia Motors, Cl A | | | 2,206 | | | | 561,162 | |

| Planet Fitness, Cl A * | | | 9,925 | | | | 593,912 | |

| RH * | | | 2,434 | | | | 601,320 | |

| United Parks & Resorts * | | | 14,092 | | | | 716,155 | |

| | | | | | | | 6,549,937 | |

| Consumer Staples — 6.6% | | | | | | | | |

| Albertsons, Cl A | | | 31,603 | | | | 644,701 | |

| Kellanova | | | 12,109 | | | | 700,627 | |

| Kenvue | | | 35,216 | | | | 662,765 | |

| Post Holdings * | | | 6,356 | | | | 674,689 | |

| | | | | | | | 2,682,782 | |

| Energy — 7.8% | | | | | | | | |

| Chesapeake Energy (A) | | | 8,618 | | | | 774,586 | |

| Pioneer Natural Resources | | | 2,899 | | | | 780,759 | |

| Targa Resources | | | 7,202 | | | | 821,460 | |

| Texas Pacific Land | | | 1,353 | | | | 779,734 | |

| | | | | | | | 3,156,539 | |

| Financials — 4.9% | | | | | | | | |

| Fiserv * | | | 4,541 | | | | 693,274 | |

| S&P Global | | | 1,583 | | | | 658,259 | |

| Visa, Cl A | | | 2,395 | | | | 643,321 | |

| | | | | | | | 1,994,854 | |

| Health Care — 15.7% | | | | | | | | |

| Amicus Therapeutics * | | | 47,945 | | | | 478,971 | |

| IDEXX Laboratories * | | | 1,180 | | | | 581,457 | |

| Incyte * | | | 11,382 | | | | 592,433 | |

| IQVIA Holdings * | | | 2,785 | | | | 645,479 | |

| MoonLake Immunotherapeutics, Cl A * | | | 11,177 | | | | 457,251 | |

| Nuvalent, Cl A * | | | 7,942 | | | | 547,045 | |

| PTC Therapeutics * | | | 26,117 | | | | 839,662 | |

| Roivant Sciences * | | | 58,593 | | | | 638,664 | |

| Tenet Healthcare * | | | 7,467 | | | | 838,469 | |

| United Therapeutics * | | | 3,127 | | | | 732,750 | |

| | | | | | | | 6,352,181 | |

The accompanying notes are an integral part of the financial statements.

23

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Guru® Index ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Industrials — 11.3% | | | | | | | | |

| Array Technologies * | | | 44,129 | | | $ | 544,552 | |

| Avis Budget Group | | | 5,552 | | | | 529,938 | |

| Carrier Global | | | 12,015 | | | | 738,802 | |

| Delta Air Lines | | | 16,423 | | | | 822,300 | |

| Ferguson | | | 3,384 | | | | 710,301 | |

| Hertz Global Holdings * | | | 85,356 | | | | 388,370 | |

| Quanta Services | | | 3,135 | | | | 810,586 | |

| | | | | | | | 4,544,849 | |

| Information Technology — 17.2% | | | | | | | | |

| Apple | | | 3,666 | | | | 624,430 | |

| CyberArk Software * | | | 2,538 | | | | 607,216 | |

| Elastic * | | | 5,058 | | | | 517,029 | |

| GoDaddy, Cl A * | | | 6,022 | | | | 736,972 | |

| Guidewire Software * | | | 5,557 | | | | 613,493 | |

| Microsoft | | | 1,651 | | | | 642,784 | |

| NVIDIA | | | 931 | | | | 804,403 | |

| Oracle | | | 5,945 | | | | 676,244 | |

| Salesforce | | | 2,306 | | | | 620,176 | |

| Seagate Technology Holdings | | | 7,617 | | | | 654,376 | |

| Snowflake, Cl A * | | | 2,895 | | | | 449,304 | |

| | | | | | | | 6,946,427 | |

| Materials — 6.8% | | | | | | | | |

| Ashland Global Holdings | | | 7,259 | | | | 692,001 | |

| Linde PLC | | | 1,565 | | | | 690,102 | |

| Sherwin-Williams | | | 2,146 | | | | 642,963 | |

| Vulcan Materials | | | 2,772 | | | | 714,150 | |

| | | | | | | | 2,739,216 | |

| Real Estate — 2.8% | | | | | | | | |

| American Tower ‡ | | | 3,556 | | | | 610,067 | |

| ProLogis ‡ | | | 5,049 | | | | 515,251 | |

| | | | | | | | 1,125,318 | |

The accompanying notes are an integral part of the financial statements.

24

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Guru® Index ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Utilities — 1.7% | | | | | | | | |

| PG&E | | | 40,584 | | | $ | 694,392 | |

| | | | | | | | | |

| TOTAL UNITED STATES | | | | | | | 38,871,429 | |

TOTAL COMMON STOCK

(Cost $39,902,778) | | | | | | | 40,391,831 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT(B)(C) — 0.2% | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 5.240%

(Cost $97,216) | | | 97,216 | | | | 97,216 | |

| | | | | | | | |

| | | Face Amount | | | | | |

| REPURCHASE AGREEMENT(C) — 1.3% | | | | | | | | |

BNP Paribas

5.270%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $515,876 (collateralized by U.S. Treasury Obligations, ranging in par value $35,274 - $84,557, 2.875%, 05/15/2032, with a total market value of $526,326)

(Cost $515,800) | | $ | 515,800 | | | | 515,800 | |

TOTAL INVESTMENTS — 101.5%

(Cost $40,515,794) | | | | | | $ | 41,004,847 | |

Percentages are based on Net Assets of $40,394,795.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

| (A) | This security or a partial position of this security is on loan at April 30, 2024. The total market value of securities on loan at April 30, 2024 was $580,894. |

| (B) | The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2024. |

| (C) | These securities were purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2024 was $613,016. The total value of non-cash collateral held from securities on loan as of April 30, 2024 was $–. |

The accompanying notes are an integral part of the financial statements.

25

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X Guru® Index ETF | |

The following is a summary of the level of inputs used as of April 30, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 40,391,831 | | | $ | — | | | $ | — | | | $ | 40,391,831 | |

| Short-Term Investment | | | 97,216 | | | | — | | | | — | | | | 97,216 | |

| Repurchase Agreement | | | — | | | | 515,800 | | | | — | | | | 515,800 | |

| Total Investments in Securities | | $ | 40,489,047 | | | $ | 515,800 | | | $ | — | | | $ | 41,004,847 | |

Amounts designated as “—” are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

26

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperIncome™ Preferred ETF | |

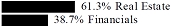

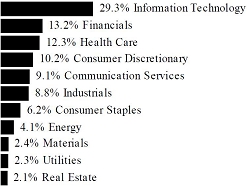

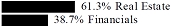

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| PREFERRED STOCK — 99.7% | | | | | | |

| UNITED STATES— 99.7% | | | | | | |

| Communication Services — 1.2% | | | | | | |

| Telephone and Data Systems, 6.000% | | | 123,426 | | | $ | 1,856,327 | |

| Consumer Discretionary — 3.5% | | | | | | | | |

| Ford Motor, 6.500% | | | 107,449 | | | | 2,632,500 | |

| Qurate Retail, 8.000% | | | 56,959 | | | | 2,629,797 | |

| | | | | | | | 5,262,297 | |

| Energy — 1.4% | | | | | | | | |

| Energy Transfer, 9.250% | | | 185,412 | | | | 2,033,970 | |

| Financials — 87.7% | | | | | | | | |

| AGNC Investment, 6.125%, CME Term SOFR + 4.697% ‡ (A) | | | 102,915 | | | | 2,404,094 | |

| Allstate, 7.375% | | | 107,448 | | | | 2,866,713 | |

| Apollo Global Management, 7.625%, H15T5Y + 3.226% (A) | | | 107,970 | | | | 2,852,567 | |

| Apollo Global Management, 6.750% | | | 129,261 | | | | 7,882,336 | |

| Athene Holding, 7.750%, H15T5Y + 3.962% (A) | | | 89,497 | | | | 2,381,515 | |

| Athene Holding, 6.375%, H15T5Y + 5.970% (A) | | | 107,976 | | | | 2,702,639 | |

| Athene Holding, 6.350%, US0003M + 4.253% (A) | | | 154,604 | | | | 3,634,740 | |

The accompanying notes are an integral part of the financial statements.

27

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperIncome™ Preferred ETF | |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| Banc of California, 7.750%, H15T5Y + 4.820% (A) | | | 91,840 | | | $ | 2,087,523 | |

| Bank of America, 7.250% * | | | 9,058 | | | | 10,416,700 | |

| Bank of America, 4.750% | | | 81,069 | | | | 1,640,026 | |

| Bank of America, 4.250% | | | 151,699 | | | | 2,776,092 | |

| Brighthouse Financial, 5.375% | | | 102,858 | | | | 1,893,616 | |

| Capital One Financial, 4.800% | | | 224,064 | | | | 4,113,815 | |

| Capital One Financial, 4.375% | | | 120,776 | | | | 2,042,322 | |

| Charles Schwab, 4.450% (B) | | | 107,446 | | | | 2,134,952 | |

| F&G Annuities & Life, 7.950% | | | 62,401 | | | | 1,622,426 | |

| Huntington Bancshares, 6.875%, H15T5Y + 2.704% (A) (B) | | | 58,797 | | | | 1,460,518 | |

| Jackson Financial, 8.000%, H15T5Y + 3.728% (A) (B) | | | 98,483 | | | | 2,578,285 | |

| JPMorgan Chase, 4.625% | | | 255,286 | | | | 5,302,290 | |

| JPMorgan Chase, 4.550% | | | 206,915 | | | | 4,204,513 | |

| JPMorgan Chase, 4.200% | | | 276,002 | | | | 5,249,558 | |

| KeyCorp, 6.200%, H15T5Y + 3.132% (A) | | | 107,403 | | | | 2,405,827 | |

| KeyCorp, 6.125%, TSFR3M + 4.154% (A) | | | 89,453 | | | | 2,062,786 | |

| Lincoln National, 9.000% | | | 89,501 | | | | 2,412,052 | |

| MetLife, 4.750% | | | 179,221 | | | | 3,659,693 | |

| Morgan Stanley, 6.500% | | | 179,350 | | | | 4,535,762 | |

| Morgan Stanley, 5.850%, + 0.000% (A) (B) | | | 179,318 | | | | 4,296,459 | |

| Morgan Stanley, 4.250% | | | 233,148 | | | | 4,329,558 | |

| New York Community Bancorp, 6.375%, US0003M + 3.821% (A) | | | 93,129 | | | | 1,454,675 | |

| Regions Financial, 5.700%, TSFR3M + 3.410% (A) | | | 89,412 | | | | 1,954,546 | |

| Reinsurance Group of America, 7.125%, H15T5Y + 3.456% (A) | | | 125,944 | | | | 3,298,473 | |

| State Street, 5.350%, TSFR3M + 3.971% (A) (B) | | | 89,535 | | | | 2,129,142 | |

| Synchrony Financial, 8.250%, H15T5Y + 4.044% (A) | | | 89,462 | | | | 2,248,180 | |

| TPG Operating Group II, 6.950% (B) | | | 71,527 | | | | 1,844,681 | |

| Truist Financial, 5.250% | | | 103,011 | | | | 2,293,025 | |

| Truist Financial, 4.750% | | | 165,737 | | | | 3,286,565 | |

| US Bancorp, 4.000% | | | 135,541 | | | | 2,339,438 | |

| Wells Fargo, 7.500% * | | | 6,677 | | | | 7,648,103 | |

| Wells Fargo, 4.750% | | | 135,159 | | | | 2,753,189 | |

The accompanying notes are an integral part of the financial statements.

28

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperIncome™ Preferred ETF | |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| Wells Fargo, 4.700% (B) | | | 79,326 | | | $ | 1,599,212 | |

| Wells Fargo, 4.375% | | | 71,223 | | | | 1,356,798 | |

| Wells Fargo, 4.250% (B) | | | 84,726 | | | | 1,565,737 | |

| | | | | | | | 131,721,141 | |

| Industrials — 4.2% | | | | | | | | |

| Chart Industries, 6.750% | | | 36,001 | | | | 2,068,617 | |

| Clarivate, 5.250% | | | 64,968 | | | | 1,761,283 | |

| WESCO International, 10.625%, H15T5Y + 10.325% (A) | | | 96,402 | | | | 2,544,049 | |

| | | | | | | | 6,373,949 | |

| Utilities — 1.7% | | | | | | | | |

| SCE Trust VII, 7.500% | | | 99,410 | | | | 2,594,601 | |

| TOTAL UNITED STATES | | | | | | | 149,842,285 | |

TOTAL PREFERRED STOCK

(Cost $155,167,934) | | | | | | | 149,842,285 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT(C)(D) — 1.0% | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Cl Institutional, 5.240%

(Cost $1,442,869) | | | 1,442,869 | | | | 1,442,869 | |

| | | | | | | | |

| | | Face Amount | | | | | |

| REPURCHASE AGREEMENT(D) — 5.1% | | | | | | | | |

BNP Paribas

5.270%, dated 04/30/2024 , to be repurchased on 05/01/2024, repurchase price $7,656,607 (collateralized by U.S. Treasury Obligations, ranging in par value $523,535 - $1,254,998, 2.875%, 05/15/2032, with a total market value of $7,811,725)

(Cost $7,655,486) | | $ | 7,655,486 | | | | 7,655,486 | |

TOTAL INVESTMENTS — 105.8%

(Cost $164,266,289) | | | | | | $ | 158,940,640 | |

Percentages are based on Net Assets of $150,256,312.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

The accompanying notes are an integral part of the financial statements.

29

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperIncome™ Preferred ETF | |

| (A) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (B) | This security or a partial position of this security is on loan at April 30, 2024. The total market value of securities on loan at April 30, 2024 was $8,785,171. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2024. |

| (D) | These securities were purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2024 was $9,098,355. The total value of non-cash collateral held from securities on loan as of April 30, 2024 was $–. |

The following is a summary of the level of inputs used as of April 30, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Preferred Stock | | $ | 44,852,506 | | | $ | 104,989,779 | | | $ | — | | | $ | 149,842,285 | |

| Short-Term Investment | | | 1,442,869 | | | | — | | | | — | | | | 1,442,869 | |

| Repurchase Agreement | | | — | | | | 7,655,486 | | | | — | | | | 7,655,486 | |

| Total Investments in Securities | | $ | 46,295,375 | | | $ | 112,645,265 | | | $ | — | | | $ | 158,940,640 | |

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

30

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperDividend® U.S. ETF | |

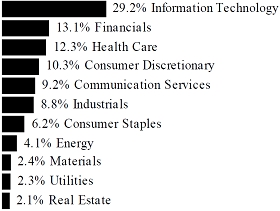

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| COMMON STOCK — 83.9% | | | | | | |

| NORWAY — 2.0% | | | | | | |

| Energy — 2.0% | | | | | | |

| SFL | | | 923,686 | | | $ | 12,312,734 | |

| | | | | | | | | |

| UNITED STATES — 81.9% | | | | | | | | |

| Communication Services — 7.6% | | | | | | | | |

| AT&T | | | 700,092 | | | | 11,824,554 | |

| Cogent Communications Holdings | | | 155,131 | | | | 9,956,307 | |

| Telephone and Data Systems | | | 845,985 | | | | 13,239,665 | |

| Verizon Communications | | | 291,181 | | | | 11,498,738 | |

| | | | | | | | 46,519,264 | |

| Consumer Services — 2.1% | | | | | | | | |

| Wendy’s | | | 639,707 | | | | 12,787,743 | |

| | | | | | | | | |

| Consumer Staples — 10.1% | | | | | | | | |

| Altria Group | | | 295,678 | | | | 12,953,653 | |

| Kraft Heinz | | | 338,679 | | | | 13,076,396 | |

| Philip Morris International | | | 132,773 | | | | 12,605,469 | |

| Universal | | | 239,358 | | | | 12,310,182 | |

The accompanying notes are an integral part of the financial statements.

31

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperDividend® U.S. ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| Consumer Staples — continued | | | | | | |

| Vector Group | | | 1,040,590 | | | $ | 10,770,107 | |

| | | | | | | | 61,715,807 | |

| Energy — 10.9% | | | | | | | | |

| Berry | | | 1,739,125 | | | | 14,765,171 | |

| Chesapeake Energy (A) | | | 150,871 | | | | 13,560,285 | |

| Chord Energy | | | 72,706 | | | | 12,867,508 | |

| Coterra Energy | | | 481,291 | | | | 13,168,122 | |

| Kinder Morgan | | | 694,307 | | | | 12,691,932 | |

| | | | | | | | 67,053,018 | |

| Financials — 6.3% | | | | | | | | |

| TFS Financial | | | 881,153 | | | | 10,582,648 | |

| Virtu Financial, Cl A | | | 707,853 | | | | 15,360,410 | |

| Western Union | | | 928,746 | | | | 12,482,346 | |

| | | | | | | | 38,425,404 | |

| Health Care — 3.6% | | | | | | | | |

| AbbVie | | | 66,946 | | | | 10,888,097 | |

| Pfizer | | | 426,853 | | | | 10,935,974 | |

| | | | | | | | 21,824,071 | |

| Industrials — 1.9% | | | | | | | | |

| Ennis | | | 581,083 | | | | 11,563,552 | |

| | | | | | | | | |

| Information Technology — 1.7% | | | | | | | | |

| International Business Machines | | | 62,844 | | | | 10,444,673 | |

| | | | | | | | | |

| Materials — 5.8% | | | | | | | | |

| Dow | | | 214,550 | | | | 12,207,895 | |

| International Paper | | | 329,336 | | | | 11,507,000 | |

| LyondellBasell Industries, Cl A | | | 121,834 | | | | 12,179,745 | |

| | | | | | | | 35,894,640 | |

| Real Estate — 17.3% | | | | | | | | |

| Alexander’s ‡ | | | 52,985 | | | | 11,209,507 | |

| CBL & Associates Properties ‡ | | | 508,385 | | | | 11,057,374 | |

| Community Healthcare Trust ‡ | | | 436,933 | | | | 11,591,832 | |

| Easterly Government Properties, Cl A ‡ | | | 1,009,400 | | | | 11,799,886 | |

The accompanying notes are an integral part of the financial statements.

32

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperDividend® U.S. ETF | |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Real Estate — continued | | | | | | | | |

| Gaming and Leisure Properties ‡ | | | 260,879 | | | $ | 11,147,360 | |

| LTC Properties ‡ | | | 377,755 | | | | 12,503,690 | |

| National Health Investors ‡ | | | 222,999 | | | | 14,062,317 | |

| Omega Healthcare Investors ‡ | | | 380,924 | | | | 11,583,899 | |

| Universal Health Realty Income Trust ‡ | | | 296,914 | | | | 10,697,811 | |

| | | | | | | | 105,653,676 | |

| Utilities — 14.6% | | | | | | | | |

| Avangrid | | | 375,628 | | | | 13,721,691 | |

| Avista | | | 353,912 | | | | 12,733,754 | |

| Dominion Energy | | | 259,551 | | | | 13,231,910 | |

| Duke Energy | | | 129,550 | | | | 12,729,583 | |

| Northwest Natural Holding | | | 323,100 | | | | 12,326,265 | |

| Northwestern Energy Group | | | 241,448 | | | | 12,178,637 | |

| OGE Energy | | | 360,705 | | | | 12,498,428 | |

| | | | | | | | 89,420,268 | |

| TOTAL UNITED STATES | | | | | | | 501,302,116 | |

TOTAL COMMON STOCK

(Cost $516,163,930) | | | | | | | 513,614,850 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS — 15.7% | | | | | | | | |

| UNITED STATES— 15.7% | | | | | | | | |

| Energy — 11.9% | | | | | | | | |

| Black Stone Minerals | | | 781,080 | | | | 12,458,226 | |

| CrossAmerica Partners | | | 541,011 | | | | 12,443,253 | |

| Global Partners | | | 249,042 | | | | 11,677,579 | |

| MPLX | | | 304,974 | | | | 12,747,913 | |

| NuStar Energy | | | 505,557 | | | | 11,410,422 | |

| USA Compression Partners | | | 492,308 | | | | 11,928,623 | |

| | | | | | | | 72,666,016 | |

| Materials — 1.9% | | | | | | | | |

| Westlake Chemical Partners | | | 528,465 | | | | 11,552,245 | |

| Utilities — 1.9% | | | | | | | | |

| Suburban Propane Partners | | | 602,342 | | | | 11,763,739 | |

| TOTAL UNITED STATES | | | | | | | 95,982,000 | |

TOTAL MASTER LIMITED PARTNERSHIPS

(Cost $58,720,628) | | | | | | | 95,982,000 | |

The accompanying notes are an integral part of the financial statements.

33

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperDividend® U.S. ETF | |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENTS(B) — 1.8% | | | | | | | | |

Bank of America Securities

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $2,532,438 (collateralized by various U.S. Government Obligations, ranging in par value $1,617 - $2,051,380, 2.000% - 7.500%, 10/17/2025 - 08/20/2063, with a total market value of $2,582,705) | | $ | 2,532,064 | | | $ | 2,532,064 | |

Citigroup Global Markets Inc.

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $2,532,438 (collateralized by various U.S. Government Obligations, ranging in par value $50,672 - $1,271,221, 2.000% - 6.500%, 12/01/2033 - 05/01/2054, with a total market value of $2,582,706) | | | 2,532,064 | | | | 2,532,064 | |

Deutsche Bank

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $646,583 (collateralized by various U.S. Government Obligations, ranging in par value $394 - $135,320, 2.000% - 7.000%, 02/01/2037 - 02/01/2054, with a total market value of $659,418) | | | 646,488 | | | | 646,488 | |

Nomura Securities International

5.310%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $2,532,437 (collateralized by various U.S. Government Obligations, ranging in par value $1,081 - $508,984, 2.000% - 7.500%, 10/01/2029 - 03/15/2058, with a total market value of $2,583,659) | | | 2,532,064 | | | | 2,532,064 | |

The accompanying notes are an integral part of the financial statements.

34

| Schedule of Investments | | April 30, 2024 (Unaudited) |

| | Global X SuperDividend® U.S. ETF | |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENTS — continued | | | | | | |

RBC Dominion Securities

5.320%, dated 04/30/2024, to be repurchased on 05/01/2024, repurchase price $2,532,438 (collateralized by various U.S. Government Obligations and U.S. Treasury Obligations, ranging in par value $2,408 - $5,390,308, 0.000% - 5.500%, 05/09/2024 - 02/15/2054, with a total market value of $2,582,705) | | $ | 2,532,064 | | | $ | 2,532,064 | |

TOTAL REPURCHASE AGREEMENTS

(Cost $10,774,744) | | | | | | | 10,774,744 | |

TOTAL INVESTMENTS — 101.4%

(Cost $585,659,302) | | | | | | $ | 620,371,594 | |

Percentages are based on Net Assets of $611,778,481.

| ‡ | Real Estate Investment Trust |

| (A) | This security or a partial position of this security is on loan at April 30, 2024. The total market value of securities on loan at April 30, 2024 was $10,170,192. |

| (B) | These securities were purchased with cash collateral held from securities on loan. The total value of such securities as of April 30, 2024 was $10,774,744. The total value of non-cash collateral held from securities on loan as of April 30, 2024 was $–. |

The following is a summary of the level of inputs used as of April 30, 2024, in valuing the Fund’s investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 513,614,850 | | | $ | — | | | $ | — | | | $ | 513,614,850 | |

| Master Limited Partnerships | | | 95,982,000 | | | | — | | | | — | | | | 95,982,000 | |

| Repurchase Agreements | | | — | | | | 10,774,744 | | | | — | | | | 10,774,744 | |

| Total Investments in Securities | | $ | 609,596,850 | | | $ | 10,774,744 | | | $ | — | | | $ | 620,371,594 | |

Amounts designated as “—” are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

The accompanying notes are an integral part of the financial statements.

35

| Schedule of Investments | April 30, 2024 (Unaudited) |

Global X MSCI SuperDividend® Emerging Markets ETF

Sector Weightings †:

† Sector weightings percentages are based on the total market value of investments. Total investments do not include derivatives such as options, futures contracts, forward contracts, and swap contracts, if applicable.

| | | Shares | | | Value | |

| COMMON STOCK — 92.4% | | | | | | | | |

| BRAZIL — 5.3% | | | | | | | | |

| Financials — 3.5% | | | | | | | | |

| Banco do Brasil | | | 184,600 | | | $ | 976,584 | |

| BB Seguridade Participacoes | | | 99,700 | | | | 619,386 | |

| | | | | | | | 1,595,970 | |

| Materials — 1.8% | | | | | | | | |

| Cia Siderurgica Nacional | | | 303,351 | | | | 814,695 | |

| | | | | | | | | |

| TOTAL BRAZIL | | | | | | | 2,410,665 | |

| CHILE — 6.7% | | | | | | | | |

| Financials — 1.8% | | | | | | | | |

| Banco de Chile | | | 7,538,391 | | | | 839,702 | |

| | | | | | | | | |

| Industrials — 1.4% | | | | | | | | |

| Cia Sud Americana de Vapores | | | 8,229,205 | | | | 644,668 | |

| | | | | | | | | |

| Materials — 2.0% | | | | | | | | |

| Empresas CMPC | | | 451,360 | | | | 895,072 | |

The accompanying notes are an integral part of the financial statements.

36

| Schedule of Investments | April 30, 2024 (Unaudited) |

Global X MSCI SuperDividend® Emerging Markets ETF

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Utilities — 1.5% | | | | | | | | |

| Enel Chile | | | 11,236,594 | | | $ | 669,894 | |

| | | | | | | | | |

| TOTAL CHILE | | | | | | | 3,049,336 | |

| CHINA — 34.0% | | | | | | | | |

| Consumer Staples — 1.3% | | | | | | | | |

| Tingyi Cayman Islands Holding | | | 522,000 | | | | 578,650 | |

| | | | | | | | | |

| Energy — 14.2% | | | | | | | | |

| China Shenhua Energy, Cl H | | | 230,864 | | | | 965,230 | |

| Guanghui Energy, Cl A | | | 824,600 | | | | 840,181 | |

| Jizhong Energy Resources, Cl A | | | 731,000 | | | | 754,891 | |

| Shaanxi Coal Industry, Cl A | | | 339,900 | | | | 1,149,566 | |

| Shanxi Coking Coal Energy Group, Cl A | | | 664,500 | | | | 961,988 | |

| Shanxi Lu’an Environmental Energy Development, Cl A | | | 351,900 | | | | 1,025,675 | |

| Yankuang Energy Group, Cl H | | | 357,350 | | | | 778,556 | |

| | | | | | | | 6,476,087 | |

| Financials — 7.7% | | | | | | | | |

| Bank of China, Cl H | | | 1,959,900 | | | | 884,576 | |

| Bank of Communications, Cl H | | | 1,211,180 | | | | 876,500 | |

| China CITIC Bank, Cl H | | | 1,440,300 | | | | 847,105 | |

| China Construction Bank, Cl H | | | 1,443,400 | | | | 941,204 | |

| | | | | | | | 3,549,385 | |

| Industrials — 3.3% | | | | | | | | |

| COSCO SHIPPING Holdings, Cl A | | | 514,200 | | | | 834,438 | |

| Shanxi Coal International Energy Group, Cl A | | | 354,800 | | | | 700,017 | |

| | | | | | | | 1,534,455 | |

| Information Technology — 1.7% | | | | | | | | |

| Xinjiang Daqo New Energy, Cl A | | | 228,492 | | | | 769,941 | |

| | | | | | | | | |

| Materials — 4.8% | | | | | | | | |

| Western Mining, Cl A | | | 458,200 | | | | 1,269,803 | |

| Zangge Mining, Cl A | | | 231,600 | | | | 920,914 | |

| | | | | | | | 2,190,717 | |

The accompanying notes are an integral part of the financial statements.

37

| Schedule of Investments | April 30, 2024 (Unaudited) |

Global X MSCI SuperDividend® Emerging Markets ETF

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Utilities — 1.0% | | | | | | | | |

| Guangdong Investment | | | 890,400 | | | $ | 466,762 | |

| | | | | | | | | |

| TOTAL CHINA | | | | | | | 15,565,997 | |

| CZECH REPUBLIC — 3.4% | | | | | | | | |

| Financials — 2.0% | | | | | | | | |

| Moneta Money Bank | | | 228,668 | | | | 923,605 | |

| | | | | | | | | |

| Utilities — 1.4% | | | | | | | | |

| CEZ | | | 17,210 | | | | 635,917 | |

| | | | | | | | | |

| TOTAL CZECH REPUBLIC | | | | | | | 1,559,522 | |

| EGYPT — 1.5% | | | | | | | | |

| Consumer Staples — 1.5% | | | | | | | | |

| Eastern SAE | | | 1,511,961 | | | | 695,154 | |

| | | | | | | | | |

| GREECE — 3.0% | | | | | | | | |

| Consumer Discretionary — 3.0% | | | | | | | | |

| JUMBO | | | 22,705 | | | | 708,416 | |

| OPAP | | | 40,818 | | | | 681,297 | |

| | | | | | | | | |

| TOTAL GREECE | | | | | | | 1,389,713 | |

| INDIA — 5.8% | | | | | | | | |

| Energy — 3.3% | | | | | | | | |

| Coal India | | | 280,618 | | | | 1,527,930 | |

| | | | | | | | | |

| Materials — 2.5% | | | | | | | | |

| Vedanta | | | 236,383 | | | | 1,127,148 | |

| | | | | | | | | |

| TOTAL INDIA | | | | | | | 2,655,078 | |

| INDONESIA — 3.1% | | | | | | | | |

| Energy — 1.9% | | | | | | | | |

| Adaro Energy | | | 5,046,100 | | | | 841,017 | |

| | | | | | | | | |

| Industrials — 1.2% | | | | | | | | |

| Astra International | | | 1,751,800 | | | | 554,844 | |

| | | | | | | | | |

| TOTAL INDONESIA | | | | | | | 1,395,861 | |

The accompanying notes are an integral part of the financial statements.

38

| Schedule of Investments | April 30, 2024 (Unaudited) |

Global X MSCI SuperDividend® Emerging Markets ETF

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| MEXICO — 3.6% | | | | | | | | |

| Financials — 2.0% | | | | | | | | |

| Banco del Bajio | | | 245,540 | | | $ | 910,192 | |

| | | | | | | | | |

| Real Estate — 1.6% | | | | | | | | |

| Fibra Uno Administracion ‡ | | | 497,000 | | | | 717,271 | |

| | | | | | | | | |

| TOTAL MEXICO | | | | | | | 1,627,463 | |

| POLAND — 1.9% | | | | | | | | |

| Energy — 1.9% | | | | | | | | |

| Polski Koncern Naftowy Orlen S.A. | | | 53,174 | | | | 873,114 | |

| | | | | | | | | |

| QATAR — 2.0% | | | | | | | | |

| Industrials — 2.0% | | | | | | | | |

| Industries Qatar QSC | | | 269,419 | | | | 906,450 | |

| | | | | | | | | |

| ROMANIA — 2.0% | | | | | | | | |

| Real Estate — 2.0% | | | | | | | | |

| NEPI Rockcastle | | | 136,175 | | | | 918,165 | |

| | | | | | | | | |

| RUSSIA — 0.0% | | | | | | | | |

| Materials — 0.0% | | | | | | | | |

| Alrosa PJSC (A) | | | 1,194,381 | | | | — | |

| PhosAgro PJSC GDR *(A) | | | 42 | | | | — | |

| Severstal PJSC *(A) | | | 71,665 | | | | — | |

| | | | | | | | | |

| TOTAL RUSSIA | | | | | | | — | |

| SOUTH AFRICA — 1.8% | | | | | | | | |

| Information Technology — 1.8% | | | | | | | | |

| Sasol | | | 115,032 | | | | 813,838 | |

| | | | | | | | | |

| TAIWAN — 4.5% | | | | | | | | |

| Industrials — 2.1% | | | | | | | | |

| Evergreen Marine Taiwan | | | 165,920 | | | | 965,599 | |

The accompanying notes are an integral part of the financial statements.

39

| Schedule of Investments | April 30, 2024 (Unaudited) |

Global X MSCI SuperDividend® Emerging Markets ETF

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Information Technology — 2.4% | | | | | | | | |

| MediaTek | | | 35,800 | | | $ | 1,090,646 | |

| | | | | | | | | |

| TOTAL TAIWAN | | | | | | | 2,056,245 | |

| TURKEY — 11.4% | | | | | | | | |

| Energy — 3.2% | | | | | | | | |

| Turkiye Petrol Rafinerileri | | | 246,135 | | | | 1,488,525 | |

| | | | | | | | | |

| Financials — 8.2% | | | | | | | | |

| Akbank | | | 1,077,047 | | | | 1,977,683 | |

| Yapi ve Kredi Bankasi | | | 1,773,978 | | | | 1,768,690 | |

| | | | | | | | 3,746,373 | |

| TOTAL TURKEY | | | | | | | 5,234,898 | |

| UNITED STATES — 2.4% | | | | | | | | |

| Consumer Staples — 2.4% | | | | | | | | |

| JBS | | | 239,148 | | | | 1,081,521 | |

| | | | | | | | | |

TOTAL COMMON STOCK

(Cost $39,603,463) | | | | | | | 42,233,020 | |

| | | | | | | | | |

| PREFERRED STOCK — 7.2% | | | | | | | | |

| BRAZIL—3.6% | | | | | | | | |

| Energy — 1.8% | | | | | | | | |

| Petroleo Brasileiro (B) | | | 103,500 | | | | 839,087 | |

| Utilities — 1.8% | | | | | | | | |

| Cia Energetica de Minas Gerais (B) | | | 436,085 | | | | 822,008 | |