UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Jasmin M. Ali, Esquire

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

Jasmin M. Ali, Esquire Global X Management Company LLC 605 Third Avenue, 43rd floor New York, NY 10158 | Eric S. Purple, Esquire Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, DC 20006-1871 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

| Item 1. | Reports to Stockholders. |

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

Global X Lithium & Battery Tech ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Lithium & Battery Tech ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/lit/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Lithium & Battery Tech ETF | $72 | 0.75% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index is designed to measure broad-based equity market performance of global companies involved in the lithium industry, as defined by Solactive AG, the provider of the Secondary Index.

For the 12-month period ended October 31, 2024 (the "reporting period"), the Fund decreased 7.04%, while the Secondary Index decreased 6.74%. The Fund had a net asset value of $47.33 per share on October 31, 2023, and ended the reporting period with a net asset value of $43.42 per share on October 31, 2024.

During the reporting period, the highest returns came from TDK Corporation and SUNWODA Electronic Co., Ltd. Class A, which returned 67.27% and 45.67% respectively. The worst performers were Core Lithium Ltd and Sayona Mining Ltd., which returned -68.39% and -53.10%, respectively.

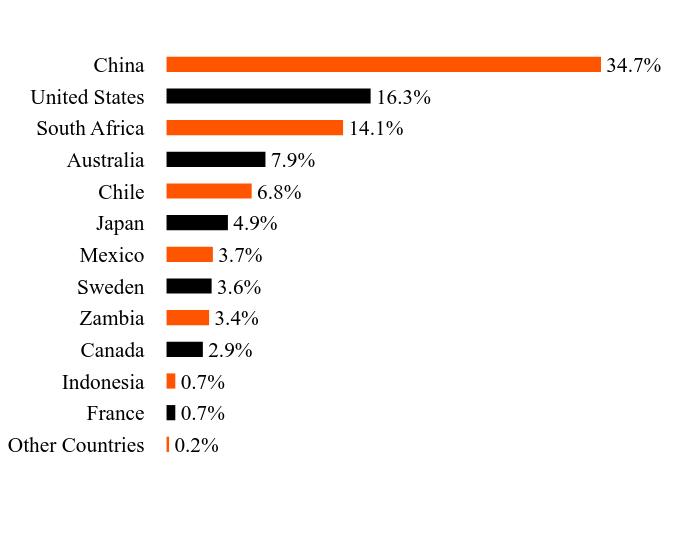

During the reporting period, the Fund recorded negative performance driven by low lithium prices, a symptom of market oversupply. This pronounced oversupply was caused by dampened demand from slower-than-anticipated electric vehicle growth in major auto markets like the U.S. and Europe, along with a ramp-up in lithium production. The low lithium prices put considerable pressure on the margins of lithium producers. The pricing environment also made it challenging for new projects to be economically viable, which negatively impacted the overall market. To manage costs effectively, several major producers paused or scaled back their expansion plans. The industry also started to shift towards more long-term contracts and potential hedging strategies to manage pricing risks, which curtailed performance during the reporting period. During the reporting period, by sector, the Fund had the highest exposure to Materials at 47.70% and Industrials at 22.75%. By country, the Fund had the highest exposure to China at 36.85% and the United States at 19.36%.

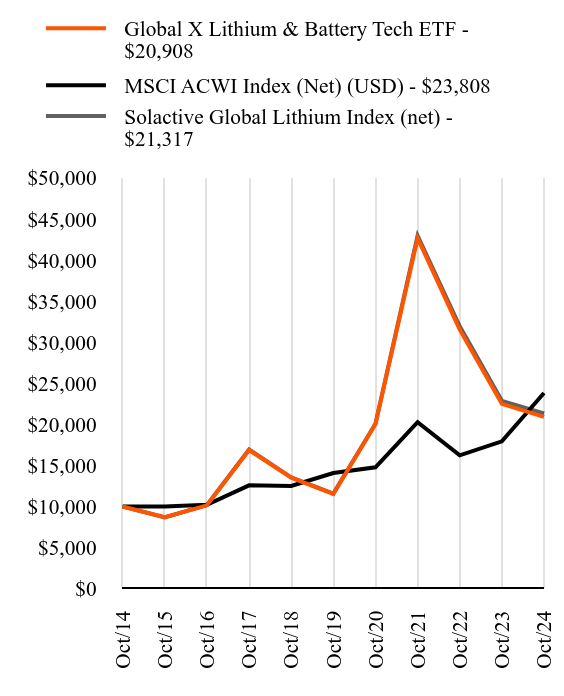

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Global X Lithium & Battery Tech ETF - $20908 | MSCI ACWI Index (Net) (USD) - $23808 | Solactive Global Lithium Index (net) - $21317 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $8682 | $9997 | $8662 |

| Oct/16 | $10137 | $10201 | $10184 |

| Oct/17 | $16875 | $12568 | $16931 |

| Oct/18 | $13498 | $12503 | $13551 |

| Oct/19 | $11526 | $14078 | $11563 |

| Oct/20 | $20034 | $14766 | $20056 |

| Oct/21 | $42652 | $20270 | $42954 |

| Oct/22 | $31521 | $16225 | $31935 |

| Oct/23 | $22492 | $17929 | $22858 |

| Oct/24 | $20908 | $23808 | $21317 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Global X Lithium & Battery Tech ETF | -7.04% | 12.65% | 7.65% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 9.06% |

| Solactive Global Lithium Index (net) | -6.74% | 13.01% | 7.86% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/lit/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $1,275,152,157 | 45 | $11,769,196 | 22.87% |

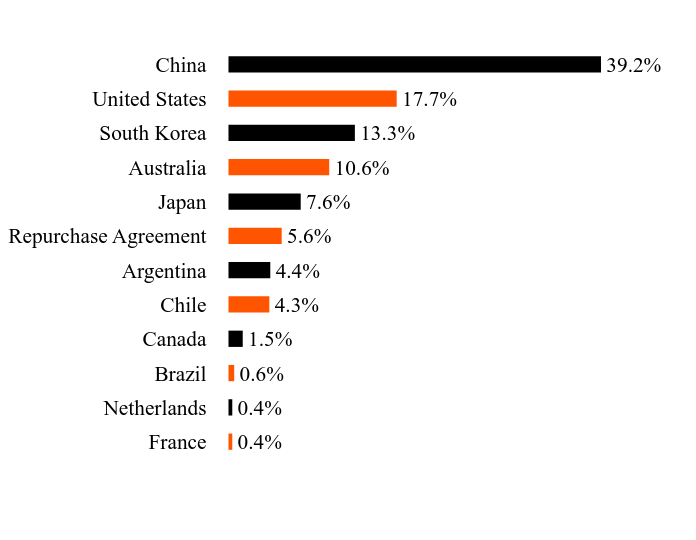

What did the Fund invest in?

Asset/Country WeightingsFootnote Reference*

| Value | Value |

|---|

| France | 0.4% |

| Netherlands | 0.4% |

| Brazil | 0.6% |

| Canada | 1.5% |

| Chile | 4.3% |

| Argentina | 4.4% |

| Repurchase Agreement | 5.6% |

| Japan | 7.6% |

| Australia | 10.6% |

| South Korea | 13.3% |

| United States | 17.7% |

| China | 39.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Albemarle | | | 8.8% |

| Eve Energy, Cl A | | | 4.5% |

| Arcadium Lithium, CDI | | | 4.4% |

| Tesla | | | 4.4% |

| Sociedad Quimica y Minera de Chile ADR | | | 4.3% |

| NAURA Technology Group, Cl A | | | 4.2% |

| Contemporary Amperex Technology, Cl A | | | 4.1% |

| BYD, Cl H | | | 4.0% |

| Ganfeng Lithium Group, Cl A | | | 4.0% |

| Tianqi Lithium, Cl A | | | 4.0% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Lithium & Battery Tech ETF: LIT

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-33

Global X SuperDividend® ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X SuperDividend® ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/sdiv/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X SuperDividend® ETF | $64 | 0.58% |

How did the Fund perform in the last year?

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global SuperDividend® Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index tracks the performance of 100 equally weighted companies that rank among the highest dividend yielding equity securities in the world, including emerging market countries, as defined by Solactive AG, the provider of the Secondary Index ("Index Provider"). The Index Provider applies certain dividend stability filters.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 20.42%, while the Secondary Index increased 21.35%. The Fund had a net asset value of $20.36 per share on October 31, 2023 and ended the reporting period with a net asset value of $21.99 per share on October 31, 2024.

During the reporting period, the highest returns came from Yue Yuen Industrial (Holdings) Limited and SL Green Realty Corp., which returned 117.03% and 76.86% respectively. The worst performers were B. Riley Financial, Inc. and Service Properties Trust, which returned -46.18% and -37.46%, respectively.

During the reporting period, the Fund reported positive performance. The Fund's focus on companies with high dividend payments proved advantageous in a period of strong economic conditions. The U.S. Federal Reserve’s decision to cut interest rates in September 2024 also positively impacted the Fund as high-yield dividend stocks became more attractive relative to some fixed-income investments. This monetary easing, which extended globally, has supported rate-sensitive sectors in which the Fund is invested, such as the Energy, Financials, and Real Estate Investment Trusts (REITs) sectors. These factors combined to contribute to the Fund’s positive performance during the reporting period. During the reporting period, by sector, the Fund had the highest exposure to Financials at 28.00% and Energy at 22.56%. By country, the Fund had the highest exposure to United States at 34.77% and China at 9.42%.

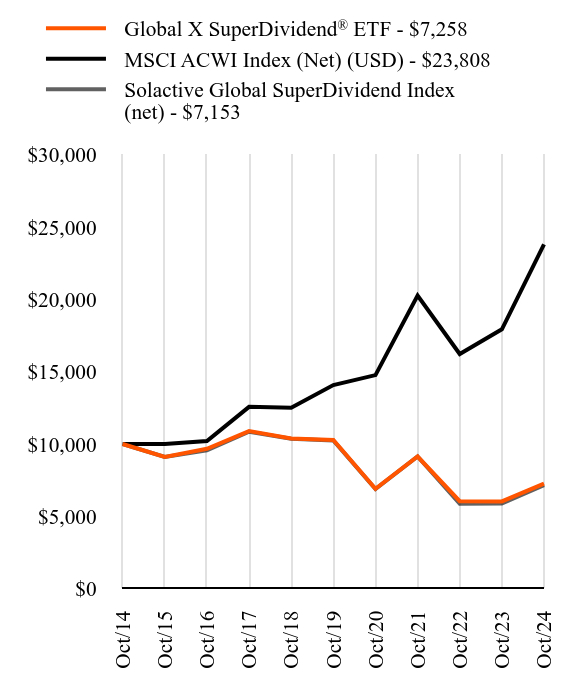

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Global X SuperDividend® ETF - $7258 | MSCI ACWI Index (Net) (USD) - $23808 | Solactive Global SuperDividend Index (net) - $7153 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $9099 | $9997 | $9104 |

| Oct/16 | $9666 | $10201 | $9559 |

| Oct/17 | $10893 | $12568 | $10851 |

| Oct/18 | $10387 | $12503 | $10357 |

| Oct/19 | $10281 | $14078 | $10243 |

| Oct/20 | $6908 | $14766 | $6890 |

| Oct/21 | $9134 | $20270 | $9138 |

| Oct/22 | $6046 | $16225 | $5866 |

| Oct/23 | $6027 | $17929 | $5894 |

| Oct/24 | $7258 | $23808 | $7153 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Global X SuperDividend® ETF | 20.42% | -6.73% | -3.15% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 9.06% |

| Solactive Global SuperDividend Index (net) | 21.35% | -6.93% | -3.30% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/sdiv/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $789,022,363 | 111 | $4,455,563 | 92.54% |

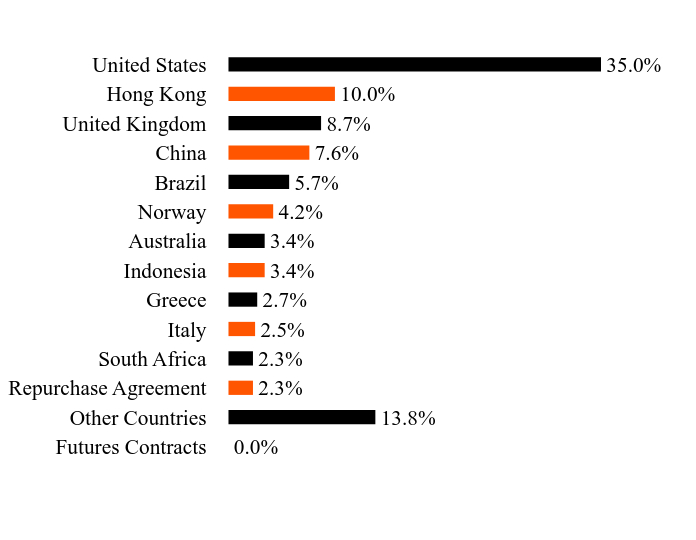

What did the Fund invest in?

Asset/Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Futures Contracts | 0.0% |

| Other Countries | 13.8% |

| Repurchase Agreement | 2.3% |

| South Africa | 2.3% |

| Italy | 2.5% |

| Greece | 2.7% |

| Indonesia | 3.4% |

| Australia | 3.4% |

| Norway | 4.2% |

| Brazil | 5.7% |

| China | 7.6% |

| United Kingdom | 8.7% |

| Hong Kong | 10.0% |

| United States | 35.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Yue Yuen Industrial Holdings | | | 1.8% |

| Adaro Energy | | | 1.3% |

| Van Lanschot Kempen | | | 1.3% |

| Hysan Development | | | 1.3% |

| Kerry Properties | | | 1.3% |

| C&D International Investment Group | | | 1.3% |

| Kinetik Holdings, Cl A | | | 1.3% |

| MFE-MediaForEurope, Cl A | | | 1.3% |

| Sabra Health Care REIT | | | 1.3% |

| Hang Lung Group | | | 1.2% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X SuperDividend® ETF: SDIV

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-34

Global X Social Media ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Social Media ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/socl/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Social Media ETF | $72 | 0.65% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Social Media Total Return Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index is designed to reflect the performance of companies involved in the social media industry, as determined by Solactive AG, the provider of the Secondary Index. Such companies include those that provide social networking, file sharing, and other web-based media applications.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 21.15%, while the Secondary Index increased 21.64%. The Fund had a net asset value of $34.75 per share on October 31, 2023 and ended the reporting period with a net asset value of $41.94 per share on October 31, 2024.

During the reporting period, the highest returns came from Life360, Inc. Shs Chess Depository Interests Repr 3 Sh and Trustpilot Group Plc, which returned 193.27% and 162.76% respectively. The worst performers were Bumble, Inc. Class A and Sprinklr, Inc. Class A, which returned -47.32% and -45.33%, respectively.

The Fund recorded positive returns during the reporting period as increasing adoption of e-commerce features on social media platforms significantly boosted revenues for some companies in the industry. Many social media firms successfully monetized their large user bases by integrating seamless shopping experiences, leading to higher advertising revenues and transaction fees. The continued growth in digital advertising spending also benefited social media companies, as businesses allocated more of their marketing budgets to these platforms due to their targeted advertising capabilities and extensive reach. Lastly, the expansion of social media usage in emerging markets contributed to user growth and increased engagement. Despite the Fund’s positive performance during the reporting period, regulatory pressures on data privacy and content moderation led to increased compliance costs and potential revenue headwinds, mitigating the Fund’s returns during the reporting period. During the reporting period, by country, the Fund had the highest exposure to the United States at 47.19% and China at 32.82%.

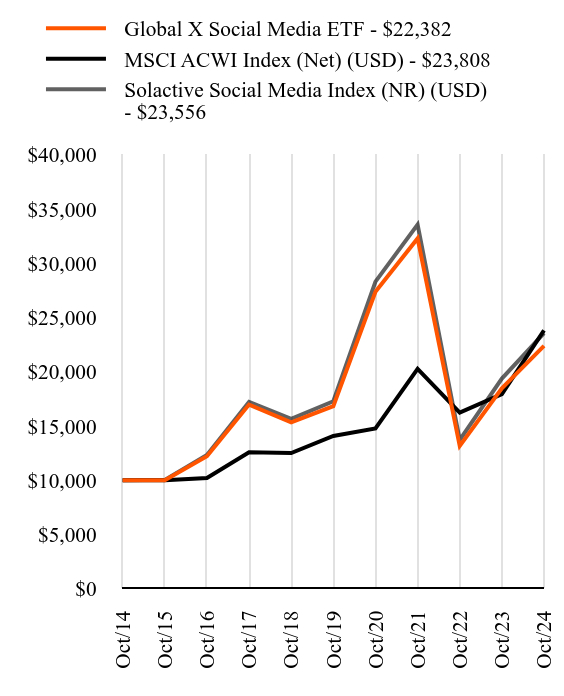

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Global X Social Media ETF - $22382 | MSCI ACWI Index (Net) (USD) - $23808 | Solactive Social Media Index (NR) (USD) - $23556 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $10000 | $9997 | $10028 |

| Oct/16 | $12199 | $10201 | $12327 |

| Oct/17 | $16967 | $12568 | $17222 |

| Oct/18 | $15336 | $12503 | $15662 |

| Oct/19 | $16822 | $14078 | $17278 |

| Oct/20 | $27378 | $14766 | $28304 |

| Oct/21 | $32285 | $20270 | $33563 |

| Oct/22 | $13159 | $16225 | $13709 |

| Oct/23 | $18475 | $17929 | $19366 |

| Oct/24 | $22382 | $23808 | $23556 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Global X Social Media ETF | 21.15% | 5.88% | 8.39% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 9.06% |

| Solactive Social Media Index (NR) (USD) | 21.64% | 6.39% | 8.95% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/socl/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $119,099,636 | 53 | $937,335 | 16.85% |

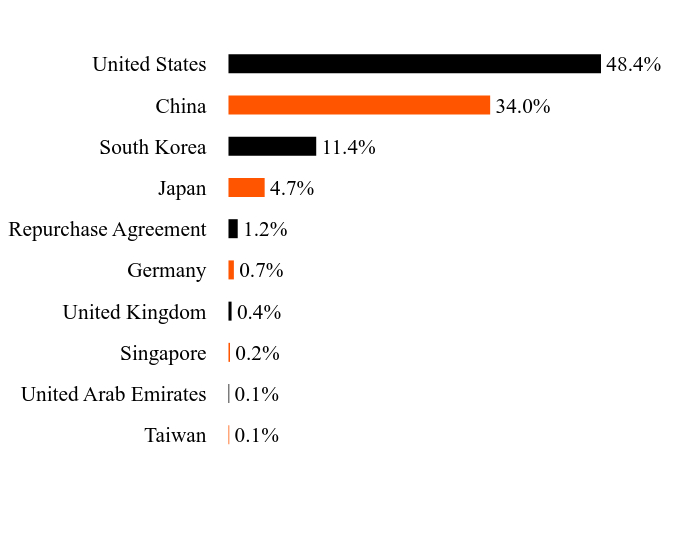

What did the Fund invest in?

Asset/Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Taiwan | 0.1% |

| United Arab Emirates | 0.1% |

| Singapore | 0.2% |

| United Kingdom | 0.4% |

| Germany | 0.7% |

| Repurchase Agreement | 1.2% |

| Japan | 4.7% |

| South Korea | 11.4% |

| China | 34.0% |

| United States | 48.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Meta Platforms, Cl A | | | 9.7% |

| Tencent Holdings | | | 9.6% |

| Pinterest, Cl A | | | 8.2% |

| NAVER | | | 7.6% |

| Kuaishou Technology, Cl B | | | 6.8% |

| Snap, Cl A | | | 5.6% |

| Alphabet, Cl A | | | 4.9% |

| Spotify Technology | | | 4.9% |

| NetEase ADR | | | 4.7% |

| Baidu ADR | | | 4.6% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Social Media ETF: SOCL

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-35

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Guru® Index ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/guru/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X Guru® Index ETF | $91 | 0.75% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Guru Index (“Secondary Index”).

The Secondary Index is comprised of the top U.S. listed equity positions reported on Form 13F by a select group of entities that Solactive AG characterizes as hedge funds.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 41.98%, while the Secondary Index increased 42.81%. The Fund had a net asset value of $34.23 per share on October 31, 2023, and ended the reporting period with a net asset value of $48.38 per share on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Tenet Healthcare Corporation, which returned 225.65% and 188.68% respectively. The worst performers were Hertz Global Holdings Inc and Avis Budget Group, Inc., which returned -67.02% and -46.37%, respectively.

Over the reporting period, the Fund experienced positive performance, influenced by several key factors. The Technology sector, a significant component of the Fund, saw substantial growth driven by advancements in artificial intelligence and cloud computing solutions. Additionally, the Consumer Discretionary sector benefited from strong consumer spending and e-commerce growth, boosting the Fund's retail and online marketplace companies. Lastly, the Healthcare sector contributed to the Fund's positive performance, with biotechnology and pharmaceutical companies making significant advancements in drug development and receiving regulatory approvals. Overall, the Fund's strategy of selecting high-conviction ideas from top hedge funds contributed to the overall positive performance during the reporting period, particularly in emerging and innovative technologies. During the reporting period, by sector, the Fund had the highest exposure to Health Care at 17.83% and Consumer Discretionary at 17.20%.

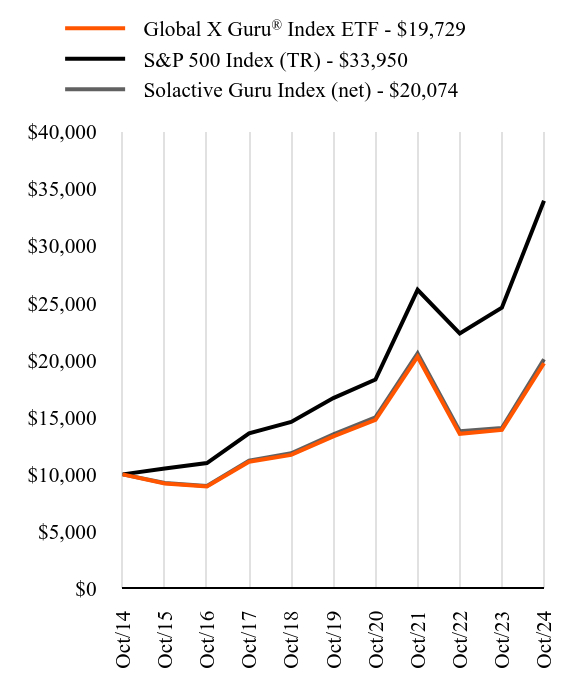

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Global X Guru® Index ETF - $19729 | S&P 500 Index (TR) - $33950 | Solactive Guru Index (net) - $20074 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $9206 | $10520 | $9240 |

| Oct/16 | $8932 | $10994 | $8981 |

| Oct/17 | $11103 | $13593 | $11191 |

| Oct/18 | $11703 | $14591 | $11847 |

| Oct/19 | $13330 | $16681 | $13513 |

| Oct/20 | $14774 | $18301 | $14992 |

| Oct/21 | $20304 | $26155 | $20592 |

| Oct/22 | $13547 | $22334 | $13786 |

| Oct/23 | $13896 | $24599 | $14057 |

| Oct/24 | $19729 | $33950 | $20074 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Global X Guru® Index ETF | 41.98% | 8.16% | 7.03% |

| S&P 500 Index (TR) | 38.02% | 15.27% | 13.00% |

| Solactive Guru Index (net) | 42.81% | 8.24% | 7.22% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/guru/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $44,994,898 | 66 | $332,193 | 100.83% |

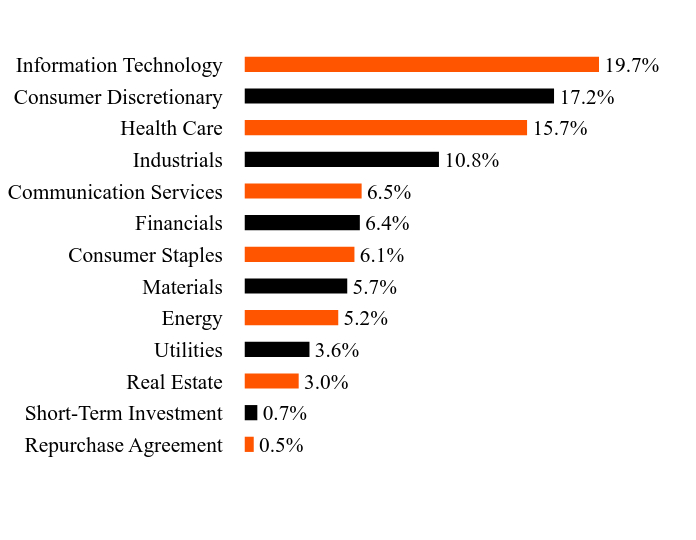

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Repurchase Agreement | 0.5% |

| Short-Term Investment | 0.7% |

| Real Estate | 3.0% |

| Utilities | 3.6% |

| Energy | 5.2% |

| Materials | 5.7% |

| Consumer Staples | 6.1% |

| Financials | 6.4% |

| Communication Services | 6.5% |

| Industrials | 10.8% |

| Health Care | 15.7% |

| Consumer Discretionary | 17.2% |

| Information Technology | 19.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Delta Air Lines | | | 2.1% |

| Texas Pacific Land | | | 2.0% |

| Constellation Energy | | | 2.0% |

| Maplebear | | | 2.0% |

| ROBLOX, Cl A | | | 1.9% |

| Guidewire Software | | | 1.8% |

| Nuvalent, Cl A | | | 1.8% |

| Alibaba Group Holding ADR | | | 1.8% |

| Oracle | | | 1.8% |

| PTC Therapeutics | | | 1.8% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Guru® Index ETF: GURU

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-36

Global X SuperIncome™ Preferred ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X SuperIncome™ Preferred ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/spff/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X SuperIncome™ Preferred ETF | $54 | 0.48% |

How did the Fund perform in the last year?

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Global X U.S. High Yield Preferred Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index tracks the performance of the highest-yielding preferred securities listed in the United States, as determined by Solactive AG, the administrator of the Secondary Index (“Index Administrator”). The Secondary Index is comprised of preferred stocks that meet certain criteria relating to size, liquidity, issuer concentration and rating, maturity and other requirements, as determined by the Index Administrator. The Secondary Index does not seek to directly reflect the performance of the companies issuing the preferred stock. The Secondary Index is owned and was developed by Global X Management Company LLC, an affiliate of the Fund and the Fund’s investment adviser.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 24.16%, while the Secondary Index increased 24.70%. The Fund had a net asset value of $8.21 per share on October 31, 2023 and ended the reporting period with a net asset value of $9.59 per share on October 31, 2024.

During the reporting period, the highest returns came from Apollo Global Management Inc Mandatory Conv Pfd Registered Shs Series A and KeyCorp Depositary Shs Repr 1/40th Non-Cum Red Perp Pfd Rg Shs Series H, which returned 67.19% and 59.93% respectively. The worst performers were Qurate Retail, Inc. 8 % Cum Red Pfd Registered Shs Series A and Clarivate PLC Conv Pref Registered Shs 2021-01.06.24, which returned -16.62% and -10.76%, respectively.

During the reporting period, the Fund reported positive performance. The U.S. Federal Reserve's rate cuts in September 2024 positively influenced the Fund because the value of preferred shares often shares an inverse relationship with interest rates. Despite interest rate volatility throughout stretches of the reporting period, preferred stocks continued to offer attractive distributions. During the reporting period, by sector, the Fund had the highest exposure to Financials at 84.49%. Financial preferred stocks delivered strong performance, which positively impacted the Fund's holdings. A resilient economic environment, which supported credit assets, also contributed positively to performance.

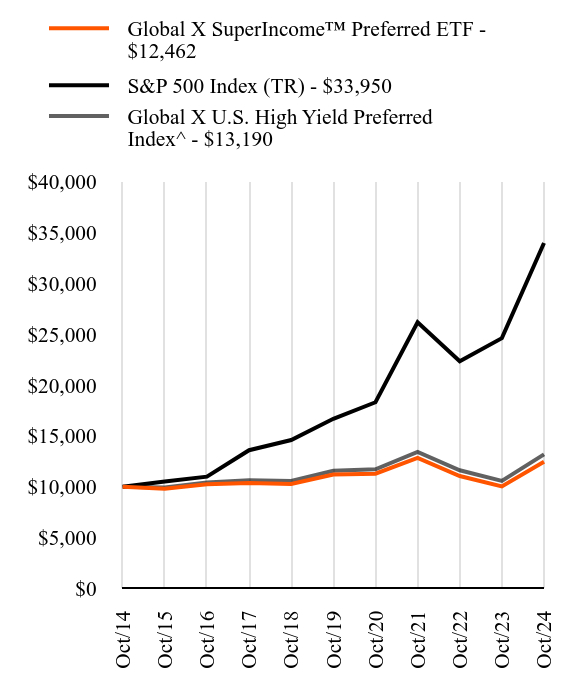

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Global X SuperIncome™ Preferred ETF - $12462 | S&P 500 Index (TR) - $33950 | Global X U.S. High Yield Preferred Index^ - $13190 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $9805 | $10520 | $9940 |

| Oct/16 | $10241 | $10994 | $10426 |

| Oct/17 | $10375 | $13593 | $10633 |

| Oct/18 | $10285 | $14591 | $10578 |

| Oct/19 | $11197 | $16681 | $11572 |

| Oct/20 | $11287 | $18301 | $11722 |

| Oct/21 | $12835 | $26155 | $13428 |

| Oct/22 | $11062 | $22334 | $11625 |

| Oct/23 | $10037 | $24599 | $10577 |

| Oct/24 | $12462 | $33950 | $13190 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| Global X SuperIncome™ Preferred ETF | 24.16% | 2.16% | 2.23% |

| S&P 500 Index (TR) | 38.02% | 15.27% | 13.00% |

| Global X U.S. High Yield Preferred Index^ | 24.70% | 2.65% | 2.81% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/spff/ for current month-end performance.

^ Secondary Index performance reflects the performance of the S&P Enhanced Yield North American Preferred Stock Index through April 2, 2023, and the Global X U.S. High Yield Preferred Index thereafter. The performance above reflects results achieved pursuant to different principal investment strategies than the strategies currently employed by the Fund. If the Fund's current strategies had been in place prior to April 2, 2023, results shown would have been different.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $150,709,426 | 52 | $761,481 | 63.31% |

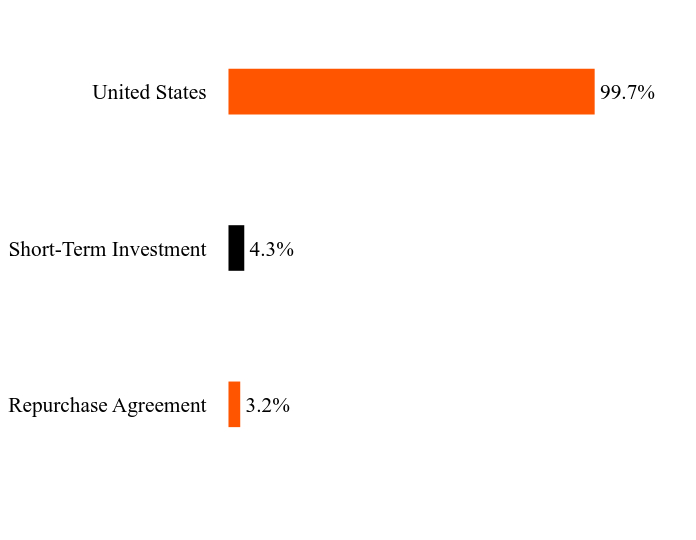

What did the Fund invest in?

Asset/Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Repurchase Agreement | 3.2% |

| Short-Term Investment | 4.3% |

| United States | 99.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| Apollo Global Management, 6.75% | | | 6.1% |

| Albemarle, 7.25% | | | 5.7% |

| Wells Fargo, 7.50% | | | 5.1% |

| Bank of America, 7.25% | | | 3.8% |

| JPMorgan Chase, 4.63% | | | 3.4% |

| JPMorgan Chase, 4.20% | | | 3.4% |

| RBC Capital Markets | | | 3.2% |

| M&T Bank, 7.50% | | | 2.9% |

| Morgan Stanley, 6.50% | | | 2.9% |

| Morgan Stanley, 4.25% | | | 2.8% |

| Footnote | Description |

Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X SuperIncome™ Preferred ETF: SPFF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-37

Global X SuperDividend® U.S. ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X SuperDividend® U.S. ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/div/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X SuperDividend® U.S. ETF | $51 | 0.45% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx SuperDividend® U.S. Low Volatility Index (“Secondary Index"). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index is maintained by Indxx, LCC (the "Index Provider"). The Secondary Index tracks the performance of 50 equally weighted common stocks, Master Limited Partnerships and real estate investment trusts (“REITs”) that rank among the highest dividend yielding equity securities in the United States, as defined by the Index Provider. The components of the Secondary Index will have also paid dividends consistently over the last two years. The Secondary Index is comprised of securities that the Index Provider determines to have lower volatility relative to the market.

For the 12-month period ended October 31, 2024 (the "reporting period"), the Fund increased 26.21%, while the Secondary Index increased 26.94%. The Fund had a net asset value of $15.62 per share on October 31, 2023 and ended the reporting period with a net asset value of $18.50 per share on October 31, 2024.

During the reporting period, the highest returns came from Virtu Financial, Inc. Class A and International Paper Company, which returned 75.17% and 72.61% respectively. The worst performers were Flagstar Financial, Inc. and Frontline Plc, which returned -48.03% and -27.45%, respectively.

During the reporting period, the Fund reported positive performance. The Fund’s high dividend strategy fared well during the reporting period as interest rate tailwinds kicked in and improved the relative attractiveness of dividend paying equities versus bonds. Dovish expectations on interest rate policy boosted investor sentiment and encouraged market participation which drove positive performance, particularly among rate sensitive sectors such as Real Estate (which includes REITs), Financials, and Utilities. Overall, the Fund's equal-weighting methodology helped ensure a more balanced approach to capturing the broad-based strength of high dividend paying stocks during the reporting period. During the reporting period, by sector, the Fund had the highest exposure to Financials at 28.00% and Energy at 22.56%.

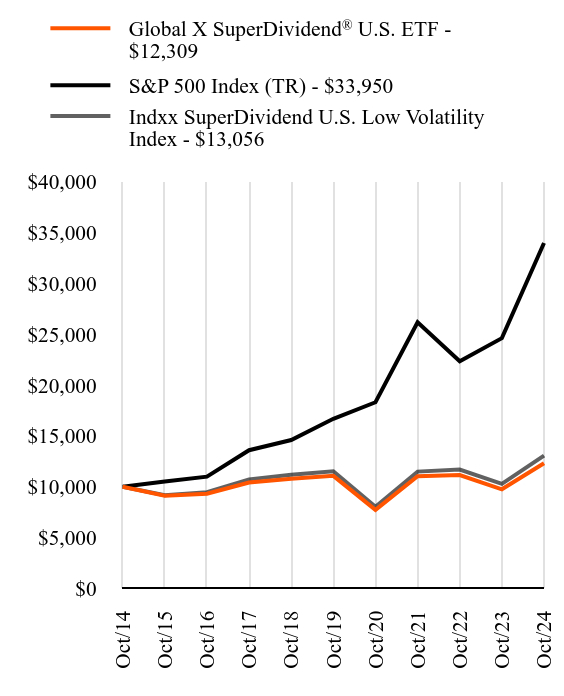

How did the Fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| Global X SuperDividend® U.S. ETF - $12309 | S&P 500 Index (TR) - $33950 | Indxx SuperDividend U.S. Low Volatility Index - $13056 |

|---|

| Oct/14 | $10000 | $10000 | $10000 |

| Oct/15 | $9133 | $10520 | $9166 |

| Oct/16 | $9328 | $10994 | $9473 |

| Oct/17 | $10413 | $13593 | $10732 |

| Oct/18 | $10794 | $14591 | $11185 |

| Oct/19 | $11076 | $16681 | $11531 |

| Oct/20 | $7739 | $18301 | $8048 |

| Oct/21 | $11031 | $26155 | $11492 |

| Oct/22 | $11159 | $22334 | $11699 |

| Oct/23 | $9753 | $24599 | $10285 |

| Oct/24 | $12309 | $33950 | $13056 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Global X SuperDividend® U.S. ETF | 26.21% | 2.13% | 2.10% |

| S&P 500 Index (TR) | 38.02% | 15.27% | 13.00% |

| Indxx SuperDividend U.S. Low Volatility Index | 26.94% | 2.51% | 2.70% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/div/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $644,834,762 | 51 | $2,774,047 | 53.21% |

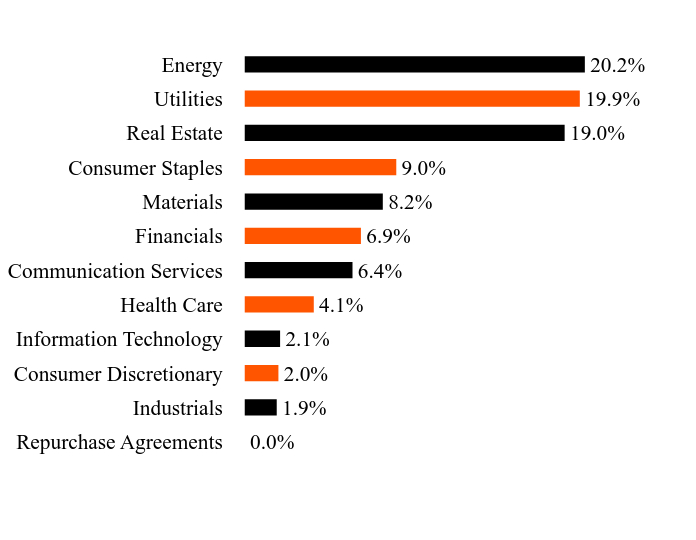

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Repurchase Agreements | 0.0% |

| Industrials | 1.9% |

| Consumer Discretionary | 2.0% |

| Information Technology | 2.1% |

| Health Care | 4.1% |

| Communication Services | 6.4% |

| Financials | 6.9% |

| Materials | 8.2% |

| Consumer Staples | 9.0% |

| Real Estate | 19.0% |

| Utilities | 19.9% |

| Energy | 20.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Virtu Financial, Cl A | | | 3.5% |

| International Paper | | | 2.9% |

| Spire | | | 2.8% |

| Philip Morris International | | | 2.8% |

| National Health Investors | | | 2.7% |

| Kinder Morgan | | | 2.7% |

| Omega Healthcare Investors | | | 2.6% |

| Altria Group | | | 2.5% |

| AT&T | | | 2.5% |

| Dominion Energy | | | 2.4% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X SuperDividend® U.S. ETF: DIV

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-38

Global X MSCI SuperDividend® Emerging Markets ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X MSCI SuperDividend® Emerging Markets ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/sdem/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X MSCI SuperDividend® Emerging Markets ETF | $72 | 0.66% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Emerging Markets Top 50 Dividend Index (“Secondary Index”).

The Secondary Index is based on the MSCI Emerging Markets Index, its parent index ("Parent Index"), which includes large- and mid-capitalization stocks across 23 emerging markets countries. The Secondary Index tracks the performance of 50 equally-weighted companies from the Parent Index that rank among the highest dividend yielding securities in emerging markets.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 17.80%, while the Secondary Index increased 20.15%. The Fund had a net asset value of $22.48 per share on October 31, 2023, and ended the reporting period with a net asset value of $24.66 per share on October 31, 2024.

During the reporting period, the highest returns came from Vedanta Limited and Evergreen Marine Corp. (Taiwan) Ltd., which returned 131.42% and 86.40% respectively. The worst performers were Xinjiang Daqo New Energy Co. Ltd. Class A and Banpu Public Co. Ltd. NVDR, which returned -36.05% and -26.16%, respectively.

The Fund recorded positive returns during the reporting period, driven by several key factors. Robust economic growth in select emerging economies contributed significantly to the Fund's performance, as companies in these markets benefited from increased consumer spending and infrastructure development. Additionally, dovish interest rate policies worldwide contributed to the positive performance of rate-sensitive sectors like Financials and Real Estate Investment Trusts (REITs), which are well represented in the Fund. The Fund's focus on high-dividend-yielding stocks proved advantageous, as some investors sought income-generating assets amidst global economic uncertainties. Rising global commodity prices, particularly for energy and metals, provided a tailwind for the Fund's holdings across various export-oriented sectors and ultimately helped capture gains from different areas of global growth, contributing to the Fund’s positive performance during the reporting period. During the reporting period, by sector, the Fund had the highest exposure to Financials at 28.51% and Energy at 22.54%. By country, the Fund had the highest exposure to China at 31.11% and Brazil at 8.89%.

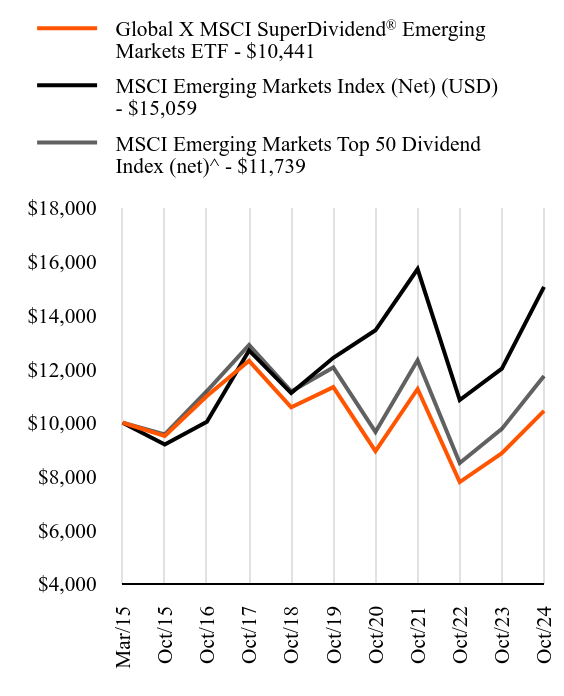

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X MSCI SuperDividend® Emerging Markets ETF - $10441 | MSCI Emerging Markets Index (Net) (USD) - $15059 | MSCI Emerging Markets Top 50 Dividend Index (net)^ - $11739 |

|---|

| Mar/15 | $10000 | $10000 | $10000 |

| Oct/15 | $9511 | $9186 | $9565 |

| Oct/16 | $10993 | $10037 | $11182 |

| Oct/17 | $12307 | $12692 | $12897 |

| Oct/18 | $10571 | $11103 | $11167 |

| Oct/19 | $11326 | $12420 | $12060 |

| Oct/20 | $8946 | $13444 | $9657 |

| Oct/21 | $11257 | $15725 | $12331 |

| Oct/22 | $7791 | $10846 | $8498 |

| Oct/23 | $8864 | $12017 | $9770 |

| Oct/24 | $10441 | $15059 | $11739 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

Global X MSCI SuperDividend® Emerging Markets ETF | 17.80% | -1.61% | 0.45% |

| MSCI Emerging Markets Index (Net) (USD) | 25.32% | 3.93% | 4.34% |

| MSCI Emerging Markets Top 50 Dividend Index (net)^ | 20.15% | -0.54% | 1.68% |

Since its inception on March 16, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/sdem/ for current month-end performance.

^ The Fund changed its Secondary Index from the Indxx SuperDividend® Emerging Markets Index to the MSCI Emerging Markets Top 50 Dividend Index on November 16, 2016 to enhance the Fund's exposure to emerging markets. Performance through November 15, 2016 reflects the performance of the Indxx SuperDividend® Emerging Markets Index. Performance thereafter reflects the performance of the MSCI Emerging Markets Top 50 Dividend Index.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $36,233,524 | 60 | $281,894 | 88.93% |

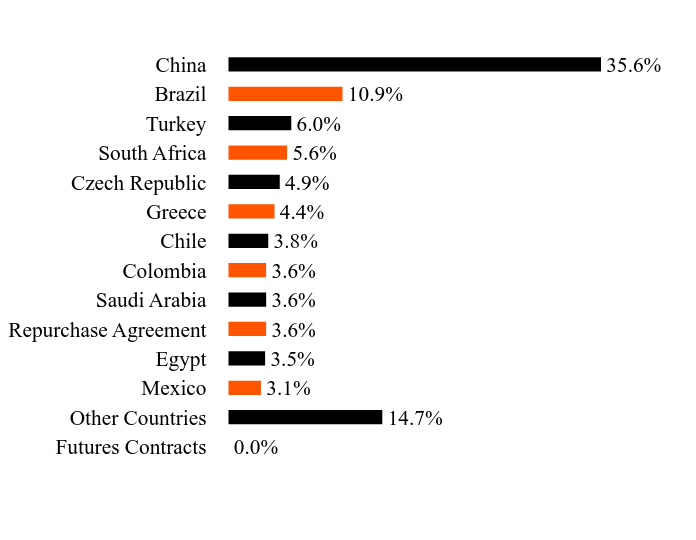

What did the Fund invest in?

Asset/Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Futures Contracts | 0.0% |

| Other Countries | 14.7% |

| Mexico | 3.1% |

| Egypt | 3.5% |

| Repurchase Agreement | 3.6% |

| Saudi Arabia | 3.6% |

| Colombia | 3.6% |

| Chile | 3.8% |

| Greece | 4.4% |

| Czech Republic | 4.9% |

| South Africa | 5.6% |

| Turkey | 6.0% |

| Brazil | 10.9% |

| China | 35.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Eastern SAE | | | 3.5% |

| Moneta Money Bank | | | 2.7% |

| MINISO Group Holding | | | 2.6% |

| SCB X NVDR | | | 2.6% |

| Absa Group | | | 2.5% |

| NEPI Rockcastle | | | 2.5% |

| China Construction Bank, Cl H | | | 2.4% |

| OPAP | | | 2.3% |

| Komercni Banka | | | 2.3% |

| Yutong Bus, Cl A | | | 2.3% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X MSCI SuperDividend® Emerging Markets ETF: SDEM

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-39

Global X SuperDividend® REIT ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X SuperDividend® REIT ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/sret/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X SuperDividend® REIT ETF | $65 | 0.58% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global SuperDividend® REIT Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index tracks the performance of real estate investment trusts (“REITs”) that rank among the highest yielding REITs globally, as determined by Solactive AG, the provider of the Secondary Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 24.41%, while the Secondary Index increased 25.01%. The Fund had a net asset value of $18.67 per share on October 31, 2023, and ended the reporting period with a net asset value of $21.42 per share on October 31, 2024.

During the reporting period, the highest returns came from National Health Investors, Inc. and Growthpoint Properties Limited, which returned 61.71% and 57.01% respectively. The worst performers were Ready Capital Corporation and Office Properties Income Trust, which returned -19.10% and -18.48%, respectively.

The Fund recorded positive returns during the reporting period. Occupancy rates improved and rental income stabilized in commercial real estate which contributed to the Fund’s positive performance. Interest rate cuts and rising price certainty, contributed to the positive performance of diversified REITs. Healthcare REITs saw their valuations continue to recover during the reporting period, while continuing to benefit from aging population tailwinds, as well as moderating inflation pressures. During the reporting period, by country, the Fund had the highest exposure to the United States at 72.66% and Singapore at 9.26%.

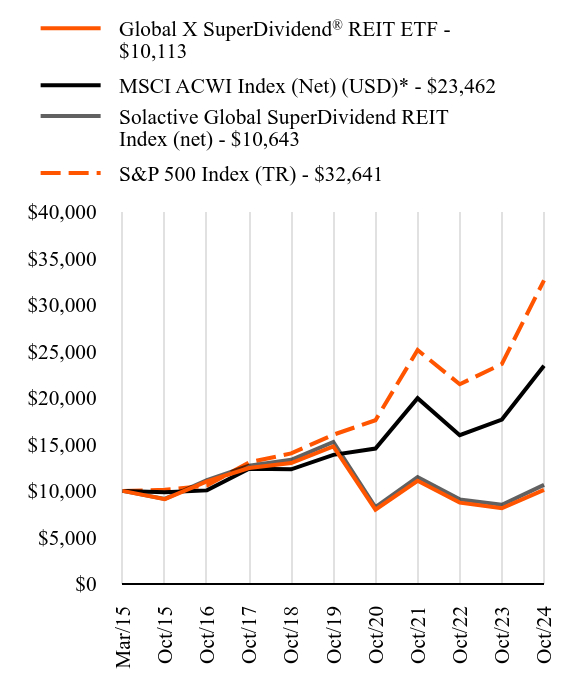

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X SuperDividend® REIT ETF - $10113 | MSCI ACWI Index (Net) (USD)* - $23462 | Solactive Global SuperDividend REIT Index (net) - $10643 | S&P 500 Index (TR) - $32641 |

|---|

| Mar/15 | $10000 | $10000 | $10000 | $10000 |

| Oct/15 | $9114 | $9851 | $9141 | $10114 |

| Oct/16 | $11029 | $10053 | $11148 | $10570 |

| Oct/17 | $12462 | $12386 | $12715 | $13068 |

| Oct/18 | $12998 | $12322 | $13340 | $14028 |

| Oct/19 | $14776 | $13873 | $15260 | $16038 |

| Oct/20 | $7987 | $14551 | $8243 | $17595 |

| Oct/21 | $11090 | $19975 | $11486 | $25146 |

| Oct/22 | $8738 | $15989 | $9088 | $21472 |

| Oct/23 | $8129 | $17668 | $8513 | $23650 |

| Oct/24 | $10113 | $23462 | $10643 | $32641 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

Global X SuperDividend® REIT ETF | 24.41% | -7.30% | 0.12% |

| MSCI ACWI Index (Net) (USD)* | 32.79% | 11.08% | 9.25% |

| Solactive Global SuperDividend REIT Index (net) | 25.01% | -6.95% | 0.65% |

| S&P 500 Index (TR) | 38.02% | 15.27% | 13.06% |

Since its inception on March 16, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/sret/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from S&P 500 Index (TR) to MSCI ACWI (Net) (USD) to reflect that MSCI ACWI (Net) (USD) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $220,575,873 | 31 | $1,298,852 | 84.50% |

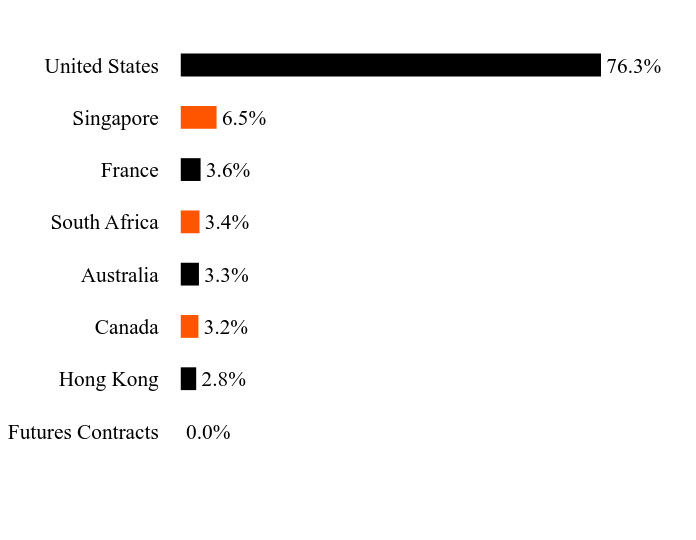

What did the Fund invest in?

Asset/Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Futures Contracts | 0.0% |

| Hong Kong | 2.8% |

| Canada | 3.2% |

| Australia | 3.3% |

| South Africa | 3.4% |

| France | 3.6% |

| Singapore | 6.5% |

| United States | 76.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Omega Healthcare Investors | | | 4.9% |

| National Health Investors | | | 4.6% |

| Sabra Health Care REIT | | | 4.5% |

| LTC Properties | | | 3.9% |

| MFA Financial, | | | 3.8% |

| Getty Realty | | | 3.7% |

| Covivio | | | 3.6% |

| Gaming and Leisure Properties | | | 3.5% |

| Broadstone Net Lease, Cl A | | | 3.5% |

| Growthpoint Properties | | | 3.4% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X SuperDividend® REIT ETF: SRET

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-40

Global X Renewable Energy Producers ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Renewable Energy Producers ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/rnrg. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Renewable Energy Producers ETF | $67 | 0.65% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Renewable Energy Producers Index (“Secondary Index”).

The Secondary Index is designed to provide exposure to publicly traded companies that produce energy from renewable sources including wind, solar, hydroelectric, geothermal, and biofuels (including publicly traded companies that are formed to own operating assets that produce defined cash flows), as defined by Indxx LLC, the provider of the Secondary Index.

For the 12-month period ended October 31, 2024 (“reporting period”), the Fund increased 6.18%, while the Secondary Index increased 6.61%. The Fund had a net asset value of $9.30 per share on October 31, 2023 and ended the reporting period with a net asset value of $9.74 per share on October 31, 2024.

During the reporting period, the highest returns came from Neoen SA and Drax Group plc, which returned 63.69% and 63.37%, respectively. The worst performers were Enviva Inc and Energy Absolute Public Co. Ltd. NVDR, which returned -87.90% and -79.80%, respectively.

During the reporting period the Fund recorded positive performance. Supportive climate and energy policies across the globe remained a key tailwind for renewable energy growth. Additionally, the decreasing cost of renewable energy technologies, as well as technological advancements within the Wind and Solar Power sectors, have resulted in renewables being cost-competitive with fossil fuels in many regions. Another critical driver of the Fund’s performance was rising corporate interest in renewable energy systems. In particular, technology companies have looked to wind and solar power as one of the solutions for meeting the energy demand growth from artificial intelligence and data center operations. Despite experiencing overall positive growth, the constituents in the Secondary Index also continued to face various headwinds. The high-interest rate environment made it more challenging to finance new capital-intensive projects and dampened demand in major residential solar markets like the U.S. and Europe. In addition, lengthy and complex permitting procedures delayed project timelines and escalated costs throughout the U.S. and Europe. Despite these headwinds, the Fund experienced positive performance during the reporting period. During the reporting period, by country, the Fund had the highest exposure to New Zealand at 13.35%. and Brazil at 12.21%.

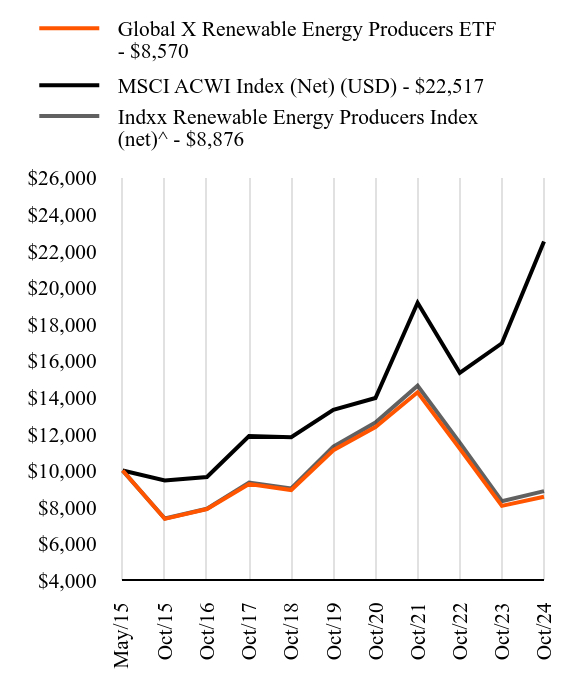

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Renewable Energy Producers ETF - $8570 | MSCI ACWI Index (Net) (USD) - $22517 | Indxx Renewable Energy Producers Index (net)^ - $8876 |

|---|

| May/15 | $10000 | $10000 | $10000 |

| Oct/15 | $7361 | $9455 | $7377 |

| Oct/16 | $7895 | $9648 | $7912 |

| Oct/17 | $9261 | $11887 | $9346 |

| Oct/18 | $8936 | $11826 | $9022 |

| Oct/19 | $11111 | $13315 | $11304 |

| Oct/20 | $12377 | $13965 | $12623 |

| Oct/21 | $14279 | $19171 | $14638 |

| Oct/22 | $11198 | $15345 | $11519 |

| Oct/23 | $8071 | $16957 | $8326 |

| Oct/24 | $8570 | $22517 | $8876 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Global X Renewable Energy Producers ETF | 6.18% | -5.06% | -1.62% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 8.98% |

| Indxx Renewable Energy Producers Index (net)^ | 6.61% | -4.72% | -1.25% |

Since its inception on May 27, 2015. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/rnrg for current month-end performance.

^ The Fund changed its Secondary Index from the Indxx Global YieldCo Index to the Indxx YieldCo & Renewable Energy Income Index on November 19, 2018 to increase the Fund's diversification and liquidity. Performance through November 18, 2018 reflects the performance of the Indxx Global YieldCo Index. Performance thereafter reflects the performance of the Indxx YieldCO & Renewable Energy Income Index. Effective February 1, 2021, the name of the Secondary Index changed from Indxx YieldCo & Renewable Energy Income Index to the Indxx Renewable Energy Producers Index.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $33,981,427 | 45 | $264,343 | 16.51% |

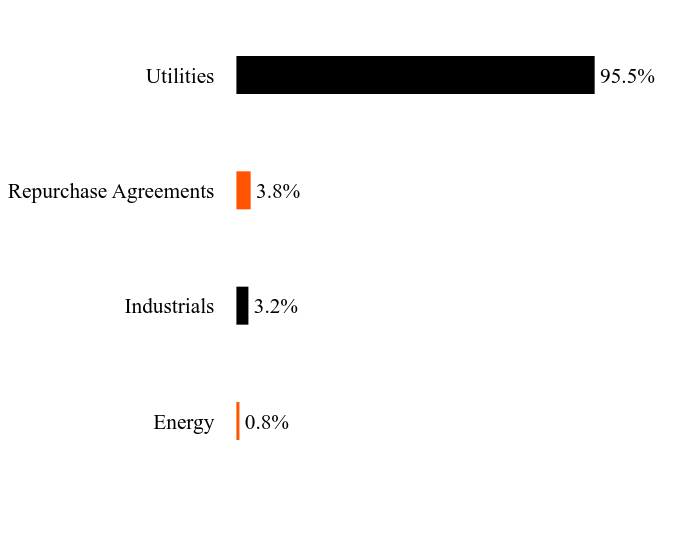

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Energy | 0.8% |

| Industrials | 3.2% |

| Repurchase Agreements | 3.8% |

| Utilities | 95.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Orsted | | | 6.6% |

| Verbund | | | 6.4% |

| Centrais Eletricas Brasileiras | | | 6.3% |

| Meridian Energy | | | 5.9% |

| EDP Renovaveis | | | 5.8% |

| Barito Renewables Energy | | | 5.2% |

| Brookfield Renewable Partners, Cl A | | | 5.0% |

| Neoen | | | 5.0% |

| Mercury NZ | | | 4.5% |

| Engie Brasil Energia | | | 4.2% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Renewable Energy Producers ETF: RNRG

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-41

Global X S&P 500® Catholic Values ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X S&P 500® Catholic Values ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/cath/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X S&P 500® Catholic Values ETF | $34 | 0.29% |

How did the Fund perform in the last year?

The Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P 500® Catholic Values Index (“Secondary Index”). The Fund is passively managed and generally seeks to fully replicate the Secondary Index.

The Secondary Index is designed to provide exposure to U.S. equity securities included in the S&P 500® Index while maintaining alignment with the moral and social teachings of the Catholic Church. From this starting universe, constituents are screened to exclude companies involved in activities which are perceived to be inconsistent with Catholic values as outlined in the Socially Responsible Investment Guidelines of the U.S. Conference of Catholic Bishops. The Secondary Index then reweights the remaining constituents so that the Secondary Index's sector exposures matches the sector exposures of the S&P 500® Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 36.53%, while the Secondary Index increased by 36.92%. The Fund had a net asset value of $50.89 per share on October 31, 2023, and ended the reporting period with a net asset value of $68.72 per share on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Fair Isaac Corporation, which returned 225.65% and 135.63% respectively. The worst performers were Super Micro Computer, Inc. and Walgreens Boots Alliance, Inc., which returned -67.84% and -51.75%, respectively.

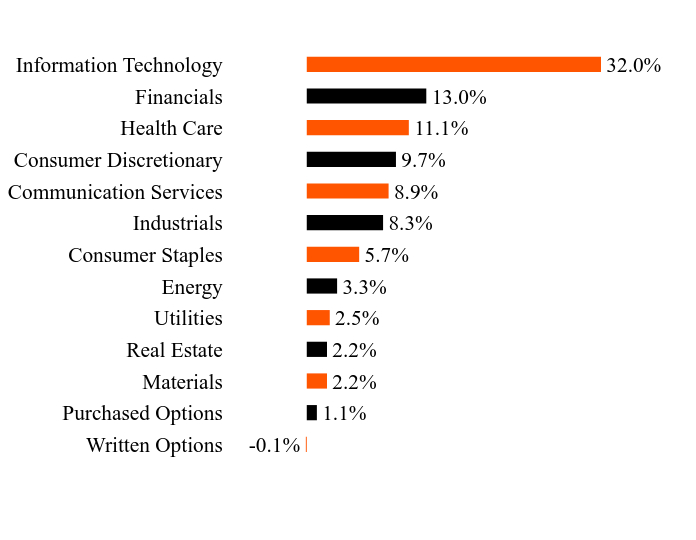

The Fund recorded positive returns during the reporting period, driven by several key factors. The Technology sector, which constitutes the largest portion of the Fund, was the primary driver of performance. This was fueled by increased earnings from several of the sector’s largest companies which have been capitalizing on the artificial intelligence cycle. Additionally, investors have shown increased interest in values-based and ethical investments in the equity markets. Declining inflation levels and interest rates, and a strong economic environment with a low unemployment rate, have contributed to positive performance of securities in broad-based securities indexes, such as the S&P 500® Index. During the reporting period, by sector, the Fund had the highest exposure of 30.49% in Information Technology, 12.96% in Financials, and 12.25% in Health Care.

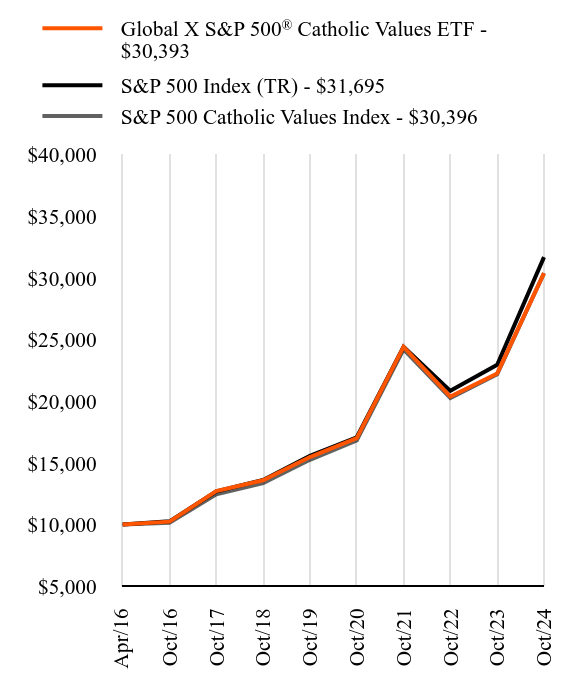

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X S&P 500® Catholic Values ETF - $30393 | S&P 500 Index (TR) - $31695 | S&P 500 Catholic Values Index - $30396 |

|---|

| Apr/16 | $10000 | $10000 | $10000 |

| Oct/16 | $10239 | $10264 | $10148 |

| Oct/17 | $12724 | $12690 | $12461 |

| Oct/18 | $13597 | $13622 | $13356 |

| Oct/19 | $15482 | $15573 | $15257 |

| Oct/20 | $17013 | $17085 | $16827 |

| Oct/21 | $24417 | $24417 | $24221 |

| Oct/22 | $20381 | $20850 | $20264 |

| Oct/23 | $22261 | $22965 | $22201 |

| Oct/24 | $30393 | $31695 | $30396 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

Global X S&P 500® Catholic Values ETF | 36.53% | 14.44% | 13.90% |

| S&P 500 Index (TR) | 38.02% | 15.27% | 14.46% |

| S&P 500 Catholic Values Index | 36.92% | 14.78% | 13.90% |

Since its inception on April 18, 2016. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/cath/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $899,518,711 | 435 | $2,416,278 | 8.42% |

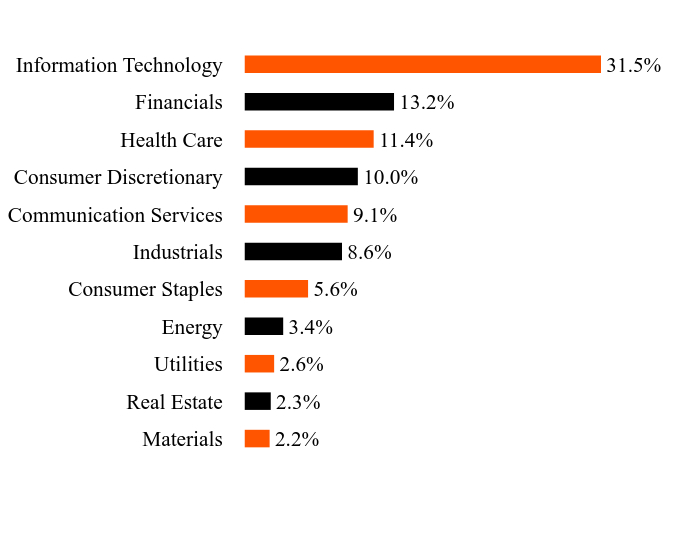

What did the Fund invest in?

Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Materials | 2.2% |

| Real Estate | 2.3% |

| Utilities | 2.6% |

| Energy | 3.4% |

| Consumer Staples | 5.6% |

| Industrials | 8.6% |

| Communication Services | 9.1% |

| Consumer Discretionary | 10.0% |

| Health Care | 11.4% |

| Financials | 13.2% |

| Information Technology | 31.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 7.2% |

| NVIDIA | | | 6.9% |

| Microsoft | | | 6.4% |

| Meta Platforms, Cl A | | | 2.6% |

| Tesla | | | 2.3% |

| Alphabet, Cl A | | | 2.1% |

| Alphabet, Cl C | | | 1.7% |

| Broadcom | | | 1.7% |

| Procter & Gamble | | | 1.6% |

| Costco Wholesale | | | 1.6% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X S&P 500® Catholic Values ETF: CATH

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-42

Global X MSCI SuperDividend® EAFE ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X MSCI SuperDividend® EAFE ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/efas/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X MSCI SuperDividend® EAFE ETF | $62 | 0.55% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI EAFE Top 50 Dividend Index (“Secondary Index”).

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 23.95%, while the Secondary Index increased 24.51%. The Fund had a net asset value of $12.76 per share on October 31, 2023, and ended the reporting period with a net asset value of $14.84 per share on October 31, 2024.

During the reporting period, the highest returns came from SITC International Holdings Co., Ltd. and NN Group N.V., which returned 74.17% and 65.55% respectively. The worst performers were Spark New Zealand Limited and Volkswagen AG Pref, which returned -35.09% and -22.66%, respectively.

During the reporting period, the Fund recorded positive performance driven by several key factors. The Secondary Index's focus on companies that grew or maintained their dividends resulted in a collection of firms that typically have stable balance sheets and cash flows. Companies in the Utilities and Financial sectors, which often display the aforementioned traits, may perform well in volatile and uncertain markets as investors seek refuge in income-generating assets that show some degree of resilience to external forces under these conditions. Additionally, the Fund exhibited positive performance partly due to an economic recovery in both Japan and the United Kingdom. Japan's economy showed promising signs of growth with gross domestic product growth fueled by rising real incomes and increased household consumption. Improvements in Japan’s logistics sector was an integral component to Japan’s overall growth during the reporting period. The United Kingdom's recovery has been part of a broader global economic trend characterized by reduced inflation and lower borrowing costs. Finally, the Fund's equal-weighting methodology provided diversification benefits and reduced concentration risk during the reporting period. During the reporting period, by sector, the Fund had the highest exposure to Financials at 32.36% and Utilities at 14.73%. By country, the Fund had the highest exposure to the United Kingdom at 16.11%, Hong Kong at 10.17%, and France at 9.72%.

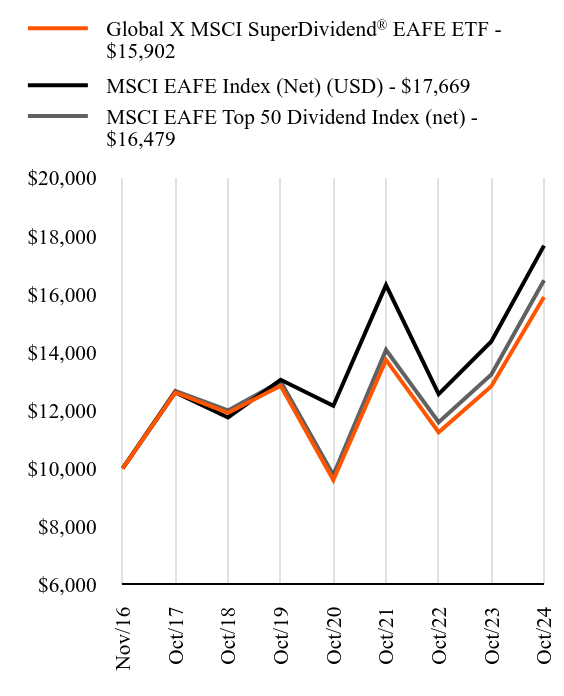

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X MSCI SuperDividend® EAFE ETF - $15902 | MSCI EAFE Index (Net) (USD) - $17669 | MSCI EAFE Top 50 Dividend Index (net) - $16479 |

|---|

| Nov/16 | $10000 | $10000 | $10000 |

| Oct/17 | $12619 | $12619 | $12666 |

| Oct/18 | $11914 | $11754 | $11997 |

| Oct/19 | $12844 | $13052 | $12994 |

| Oct/20 | $9601 | $12156 | $9773 |

| Oct/21 | $13735 | $16311 | $14081 |

| Oct/22 | $11246 | $12560 | $11589 |

| Oct/23 | $12829 | $14369 | $13235 |

| Oct/24 | $15902 | $17669 | $16479 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

Global X MSCI SuperDividend® EAFE ETF | 23.95% | 4.36% | 5.99% |

| MSCI EAFE Index (Net) (USD) | 22.97% | 6.24% | 7.41% |

| MSCI EAFE Top 50 Dividend Index (net) | 24.51% | 4.87% | 6.47% |

Since its inception on November 14, 2016. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/efas/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $10,831,075 | 50 | $58,525 | 64.02% |

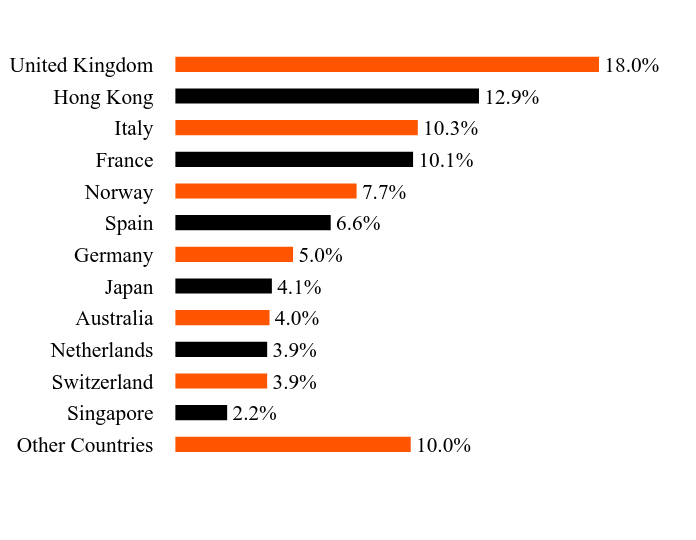

What did the Fund invest in?

Country WeightingsFootnote Reference*

| Value | Value |

|---|

| Other Countries | 10.0% |

| Singapore | 2.2% |

| Switzerland | 3.9% |

| Netherlands | 3.9% |

| Australia | 4.0% |

| Japan | 4.1% |

| Germany | 5.0% |

| Spain | 6.6% |

| Norway | 7.7% |

| France | 10.1% |

| Italy | 10.3% |

| Hong Kong | 12.9% |

| United Kingdom | 18.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Hongkong Land Holdings | | | 2.5% |

| Imperial Brands | | | 2.5% |

| CK Infrastructure Holdings | | | 2.4% |

| ACS Actividades de Construccion y Servicios | | | 2.3% |

| Klepierre | | | 2.3% |

| Zurich Insurance Group | | | 2.3% |

| CaixaBank | | | 2.2% |

| British American Tobacco PLC | | | 2.2% |

| Power Assets Holdings | | | 2.2% |

| DNB Bank | | | 2.2% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X MSCI SuperDividend® EAFE ETF: EFAS

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-43

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X E-commerce ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/ebiz/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X E-commerce ETF | $64 | 0.50% |

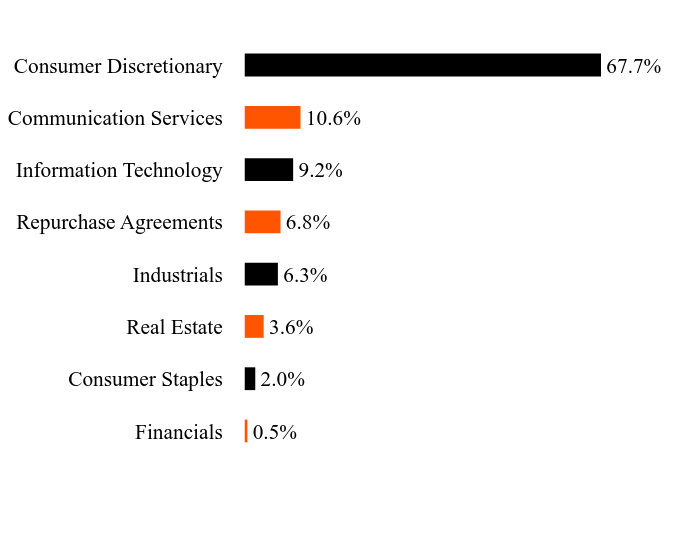

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive E-commerce Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index tracks the price movements in shares of companies which are (or are expected to be in the near future) active in the field of E-commerce, as defined by Solactive AG, the provider of the Secondary Index. The Secondary Index is designed to provide exposure to exchange-listed companies that are positioned to benefit from the increased adoption of e-commerce as a distribution model, including but not limited to companies whose principal business is in operating e-commerce platforms, providing e-commerce software and services, and or/selling goods and services online.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 57.51%, while the Index increased 58.23%. The Fund had a net asset value of $16.96 per share on October 31, 2023 and ended the reporting period with a net asset value of $26.65 per share on October 31, 2024.

During the reporting period, the highest returns came from Carvana Co. Class A and LendingTree, Inc., which returned 474.34% and 331.07% respectively. The worst performers were Beyond, Inc. and LivePerson, Inc., which returned -58.91% and -54.36%, respectively.

The Fund recorded positive returns during the reporting period, as the shift towards online shopping and digital transactions continued. To further accelerate the adoption of e-commerce and boost customer satisfaction and online sales volumes, major e-commerce players invested in their supply chain to expand same-day and next-day delivery capabilities. Additionally, the rise of social commerce, where consumers discover and purchase products through social media platforms, provided a new avenue for growth within the e-commerce ecosystem. Furthermore, digital payment solutions integrated into e-commerce platforms also saw heightened usage, contributing to the Fund's performance. During the reporting period, by sector, the Fund had the highest exposure to Consumer Discretionary at 67.45% and Communication Services at 12.75%. By country, the Fund had the highest exposure to the United States at 50.67% and China at 23.68%.

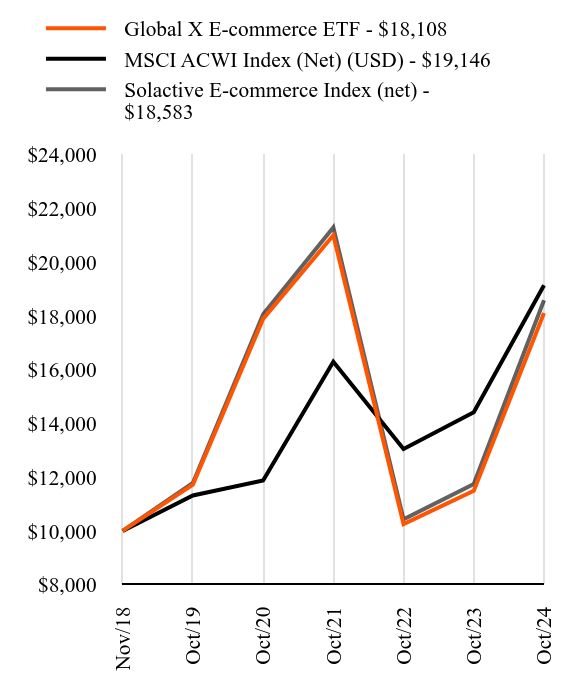

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X E-commerce ETF - $18108 | MSCI ACWI Index (Net) (USD) - $19146 | Solactive E-commerce Index (net) - $18583 |

|---|

| Nov/18 | $10000 | $10000 | $10000 |

| Oct/19 | $11720 | $11321 | $11788 |

| Oct/20 | $17893 | $11875 | $18066 |

| Oct/21 | $21005 | $16301 | $21295 |

| Oct/22 | $10253 | $13048 | $10430 |

| Oct/23 | $11497 | $14418 | $11745 |

| Oct/24 | $18108 | $19146 | $18583 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Global X E-commerce ETF | 57.51% | 9.09% | 10.53% |

| MSCI ACWI Index (Net) (USD) | 32.79% | 11.08% | 11.57% |

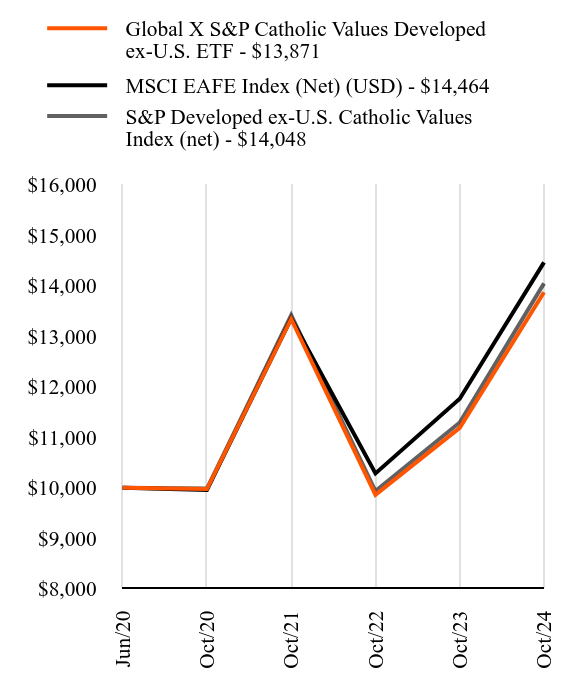

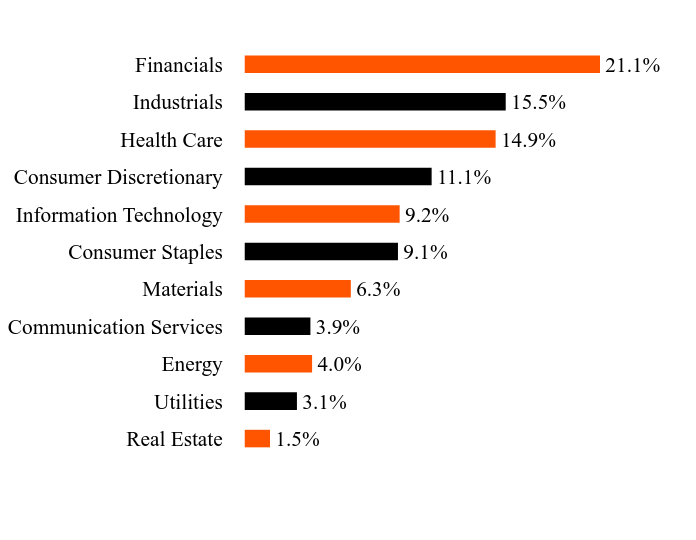

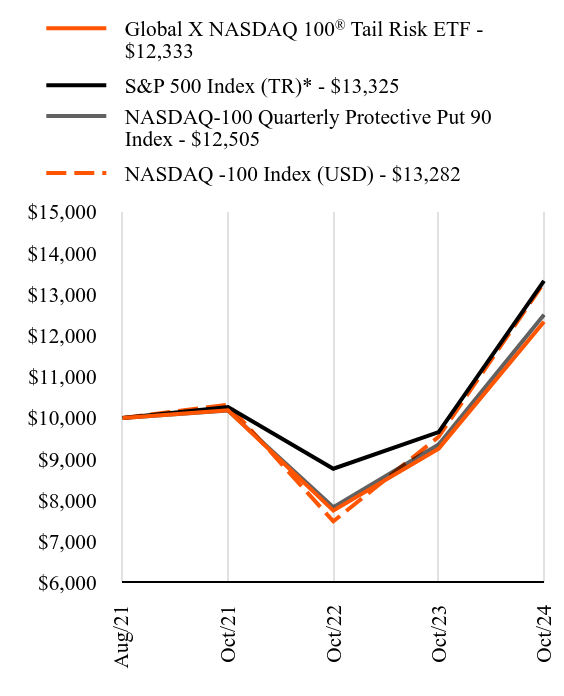

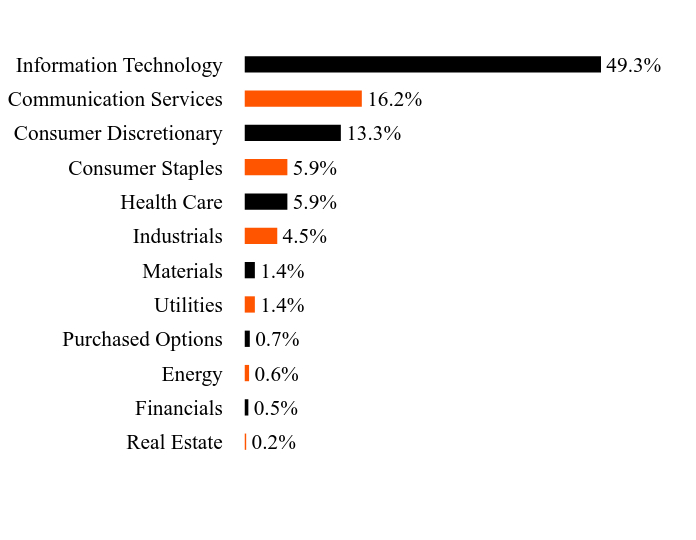

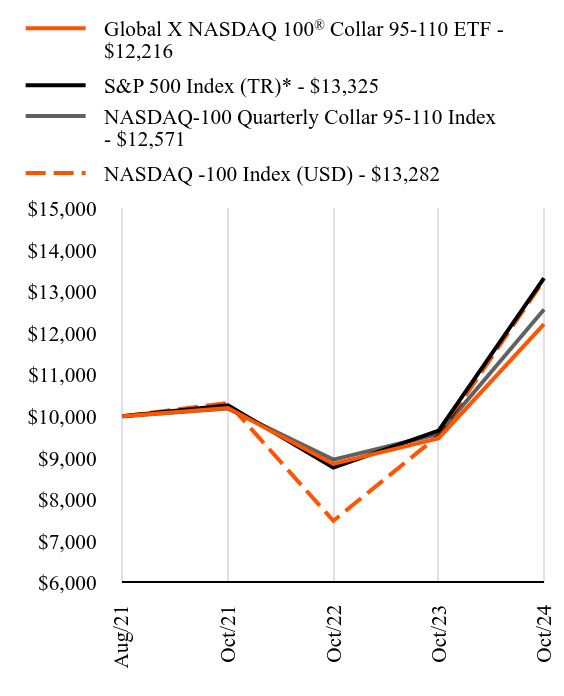

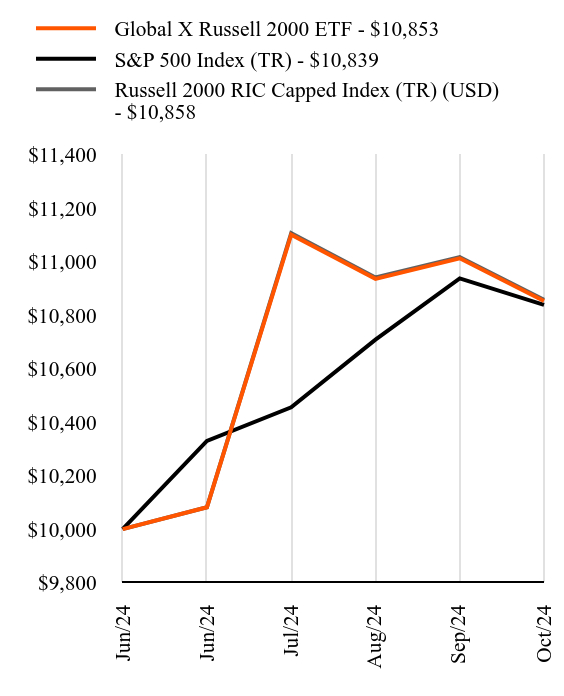

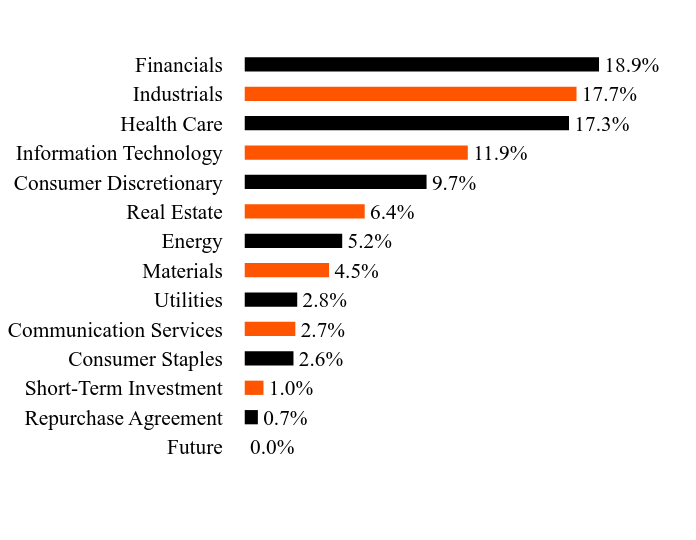

| Solactive E-commerce Index (net) | 58.23% | 9.53% | 11.01% |