UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Jasmin M. Ali, Esquire

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

Jasmin M. Ali, Esquire Global X Management Company LLC 605 Third Avenue, 43rd floor New York, NY 10158 | Eric S. Purple, Esquire Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, DC 20006-1871 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2024

Date of reporting period: October 31, 2024

| Item 1. | Reports to Stockholders. |

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

Global X S&P 500® Covered Call ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X S&P 500® Covered Call ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/xyld/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X S&P 500® Covered Call ETF | $65 | 0.60% |

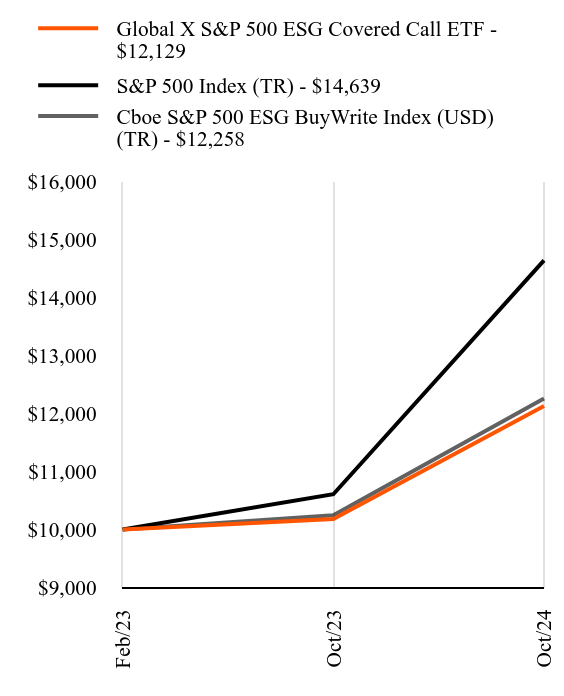

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe S&P 500 BuyWrite Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index is comprised of two parts: (1) all the equity securities in the S&P 500 Index (the "Reference Index") in substantially similar weight as the Reference Index; and (2) short (written) call options on up to 100% of the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 17.72%, while the Secondary Index increased by 18.52%. The Fund had a net asset value of $38.18 per share on October 31, 2023, and ended the reporting period with a net asset value of $40.88 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Royal Caribbean Group, which returned 225.65% and 144.10%, respectively. The worst performers were Super Micro Computer, Inc and Walgreens Boots Alliance, Inc., which returned -72.76% and -51.75%, respectively.

During the reporting period, the equity markets experienced fluctuations influenced by many macroeconomic factors such as interest rate changes and inflationary pressures. In light of these macroeconomic fluctuations, the Fund’s at-the-money covered call strategy produced income, ultimately delivering positive returns. However, the covered call strategy capped potential upside participation during strong rallies by underlying constituents, particularly in the Technology sector, mitigating the Fund’s positive returns.

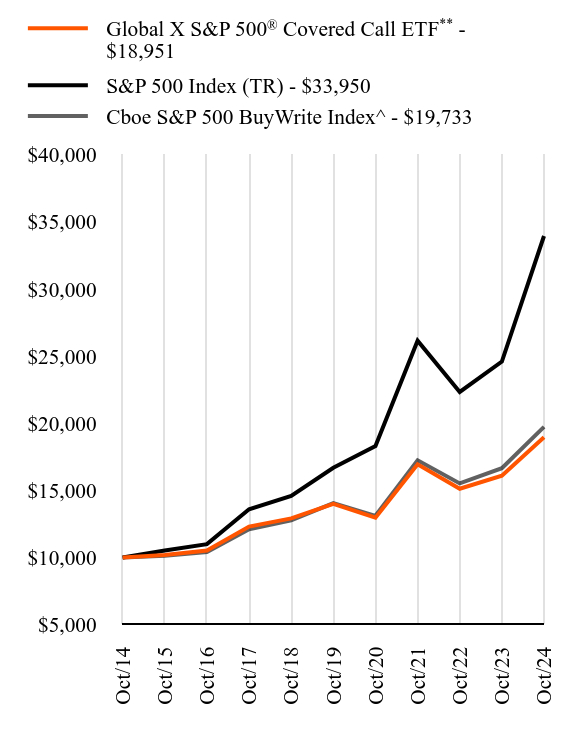

How did the Fund perform during the last 10 years?

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Global X S&P 500® Covered Call ETFFootnote Reference** | 17.72% | 6.24% | 6.60% |

| S&P 500 Index (TR) | 38.02% | 15.27% | 13.00% |

| Cboe S&P 500 BuyWrite Index^ | 18.52% | 7.03% | 7.03% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/xyld/ for current month-end performance.

^ In 2016, the Fund began a two-step process to change from its predecessor Secondary Index to the Secondary Index in an effort to diversify and improve the liquidity of the Fund. Performance reflects the performance of the S&P 500 Stock Covered Call Index through September 14, 2017, the Cboe S&P500 2% OTM BuyWrite Index through August 20, 2020 and the Cboe S&P 500 BuyWrite Index thereafter.

** The Fund operated as the Horizons S&P 500® Covered Call ETF (the “Predecessor Fund”), a series of Horizons ETF Trust I, prior to the Fund’s acquisition of the assets and assumption of the liabilities of the Predecessor Fund on December 24, 2018.

Total Return Based on $10,000 Investment

| Global X S&P 500® Covered Call ETFFootnote Reference** | S&P 500 Index (TR) | Cboe S&P 500 BuyWrite Index^ |

|---|

| Oct/14 | $10,000 | $10,000 | $10,000 |

| Oct/15 | $10,182 | $10,520 | $10,126 |

| Oct/16 | $10,522 | $10,994 | $10,407 |

| Oct/17 | $12,305 | $13,593 | $12,100 |

| Oct/18 | $12,917 | $14,591 | $12,768 |

| Oct/19 | $14,001 | $16,681 | $14,051 |

| Oct/20 | $12,962 | $18,301 | $13,105 |

| Oct/21 | $16,938 | $26,155 | $17,239 |

| Oct/22 | $15,122 | $22,334 | $15,521 |

| Oct/23 | $16,098 | $24,599 | $16,649 |

| Oct/24 | $18,951 | $33,950 | $19,733 |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $2,778,298,455 | 504 | $17,024,620 | 3.83% |

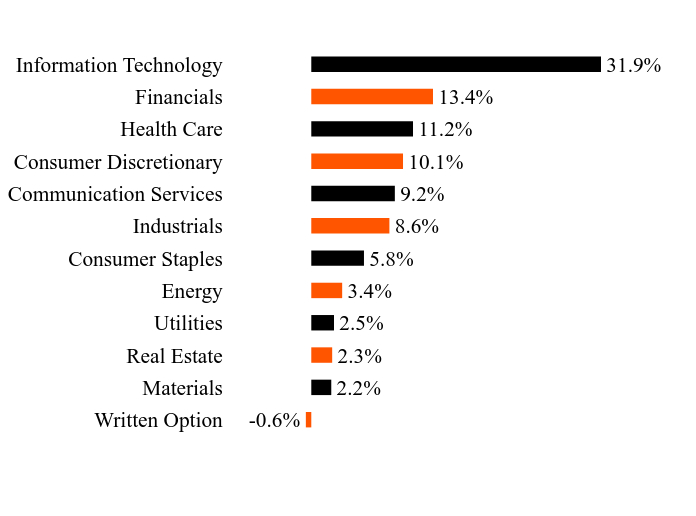

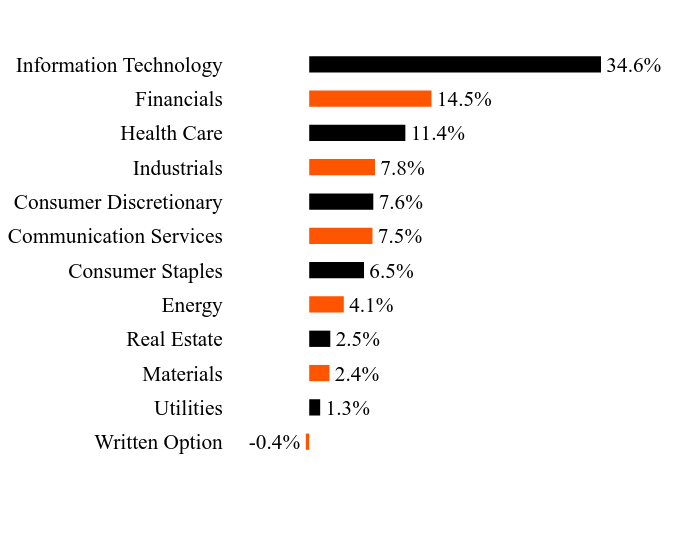

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -0.6% |

| Materials | 2.2% |

| Real Estate | 2.3% |

| Utilities | 2.5% |

| Energy | 3.4% |

| Consumer Staples | 5.8% |

| Industrials | 8.6% |

| Communication Services | 9.2% |

| Consumer Discretionary | 10.1% |

| Health Care | 11.2% |

| Financials | 13.4% |

| Information Technology | 31.9% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 7.2% |

| NVIDIA | | | 6.8% |

| Microsoft | | | 6.3% |

| Amazon.com | | | 3.6% |

| Meta Platforms, Cl A | | | 2.6% |

| Alphabet, Cl A | | | 2.1% |

| Alphabet, Cl C | | | 1.7% |

| Berkshire Hathaway, Cl B | | | 1.7% |

| Broadcom | | | 1.6% |

| Tesla | | | 1.4% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X S&P 500® Covered Call ETF: XYLD

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-7

Global X NASDAQ 100® Covered Call ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X NASDAQ 100® Covered Call ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/qyld/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X NASDAQ 100® Covered Call ETF | $67 | 0.60% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe NASDAQ-100 BuyWrite V2 Index (“Secondary Index”).

The Cboe NASDAQ-100 BuyWrite V2 Index (“BXN Index”) is a benchmark index that measures the performance of a theoretical portfolio that holds a portfolio of the stocks included in the NASDAQ-100® Index (“Reference Index”), and “writes” (or sells) a succession of one-month at-the-money covered call options on the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 21.73%, while the Secondary Index increased 22.52%. The Fund had a net asset value of $16.60 per share on October 31, 2023 and ended the reporting period with a net asset value of $17.96 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Constellation Energy Corporation, which returned 225.65% and 134.68% respectively. The worst performers were Super Micro Computer, Inc. and Walgreens Boots Alliance, Inc., which returned -63.47% and -45.16%, respectively.

The Fund recorded positive returns during the reporting period, driven by the option premiums attained operating its covered call strategy. The Reference Index experienced positive performance due to strong returns of constituents in the semiconductor industry, particularly from those exposed to artificial intelligence and data center growth. Additionally, robust consumer demand for electronics and gaming devices boosted sales for companies in the Reference Index. Increased enterprise spending on cloud computing infrastructure lifted revenues and the continued global shift towards 5G wireless technology created tailwinds for firms supplying critical components. Constituents in the Reference Index also benefited from healthy IT budgets, which supported demand for software and services. Despite an overall positive performance recorded by the Reference Index, various market factors led to increased volatility. Geopolitical tensions created uncertainties around trade policies, market access, and global prosperity. Inflationary pressures and changing interest rates also resulted in volatility. This heightened volatility in the Reference Index during the reporting period helped drive option premiums attained by the Fund, which contributed to the Fund’s positive performance. During the reporting period, by sector, the Fund had the highest exposure to Information Technology at 50.23% and Communication Services at 15.57%.

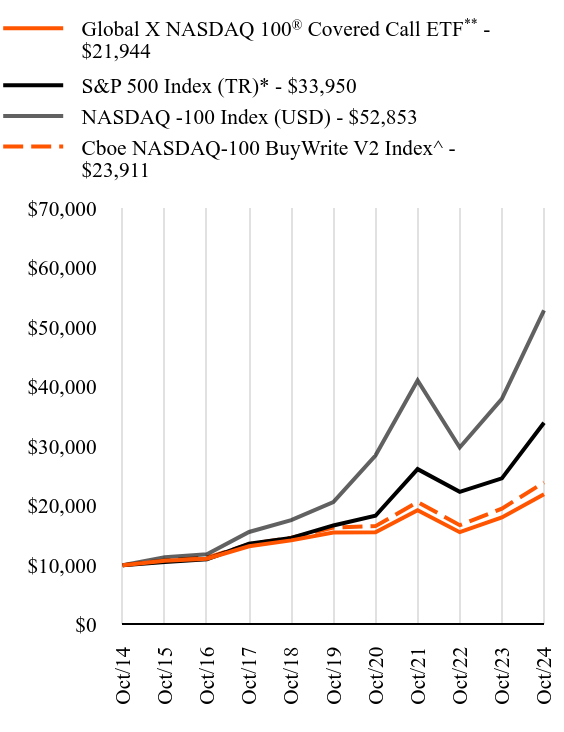

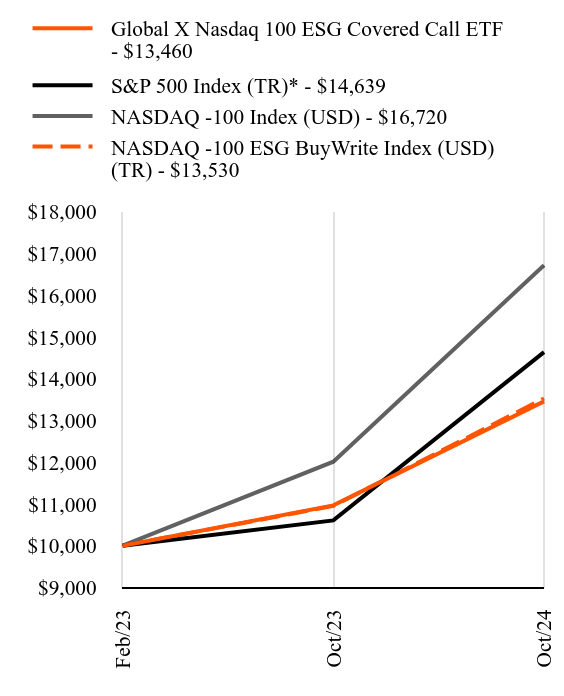

How did the Fund perform during the last 10 years?

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Global X NASDAQ 100® Covered Call ETFFootnote Reference** | 21.73% | 7.20% | 8.18% |

| S&P 500 Index (TR)* | 38.02% | 15.27% | 13.00% |

| NASDAQ -100 Index (USD) | 39.19% | 20.73% | 18.12% |

| Cboe NASDAQ-100 BuyWrite V2 Index^ | 22.52% | 7.95% | 9.11% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/qyld/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from NASDAQ 100® Total Return Index to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

^ In 2015, the Fund changed its Secondary Index in an effort to diversify and improve the liquidity of the Fund. Performance reflects the performance of the Cboe NASDAQ-100 BuyWrite Index through October 14, 2015 and Cboe NASDAQ-100 BuyWrite V2 Index thereafter.

** The Fund operated as the Horizons NASDAQ 100® Covered Call ETF (the “Predecessor Fund”), a series of Horizons ETF Trust I, prior to the Fund’s acquisition of the assets and assumption of the liabilities of the Predecessor Fund on December 24, 2018.

Total Return Based on $10,000 Investment

| Global X NASDAQ 100® Covered Call ETFFootnote Reference** | S&P 500 Index (TR)* | NASDAQ -100 Index (USD) | Cboe NASDAQ-100 BuyWrite V2 Index^ |

|---|

| Oct/14 | $10,000 | $10,000 | $10,000 | $10,000 |

| Oct/15 | $10,752 | $10,520 | $11,314 | $10,786 |

| Oct/16 | $11,079 | $10,994 | $11,836 | $11,247 |

| Oct/17 | $13,188 | $13,593 | $15,586 | $13,516 |

| Oct/18 | $14,169 | $14,591 | $17,561 | $14,623 |

| Oct/19 | $15,500 | $16,681 | $20,606 | $16,312 |

| Oct/20 | $15,533 | $18,301 | $28,440 | $16,565 |

| Oct/21 | $19,244 | $26,155 | $41,075 | $20,616 |

| Oct/22 | $15,552 | $22,334 | $29,794 | $16,727 |

| Oct/23 | $18,027 | $24,599 | $37,972 | $19,516 |

| Oct/24 | $21,944 | $33,950 | $52,853 | $23,911 |

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $8,110,940,920 | 102 | $48,113,519 | 21.54% |

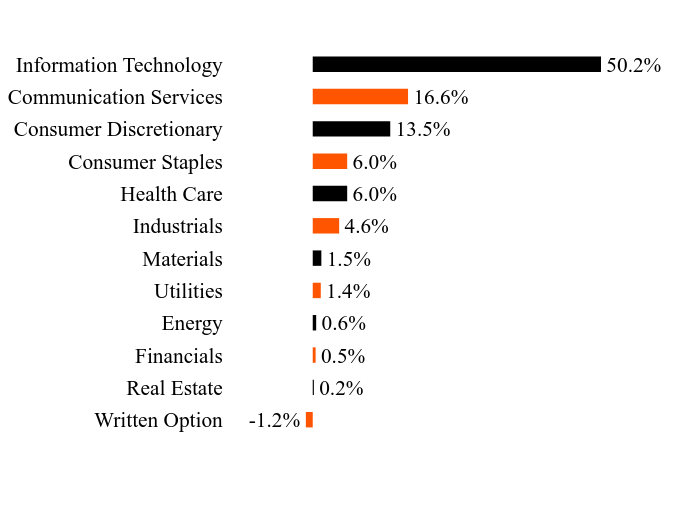

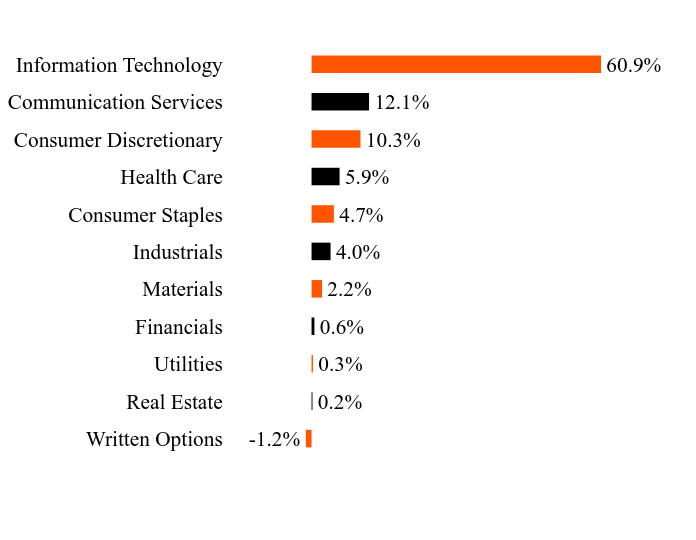

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -1.2% |

| Real Estate | 0.2% |

| Financials | 0.5% |

| Energy | 0.6% |

| Utilities | 1.4% |

| Materials | 1.5% |

| Industrials | 4.6% |

| Health Care | 6.0% |

| Consumer Staples | 6.0% |

| Consumer Discretionary | 13.5% |

| Communication Services | 16.6% |

| Information Technology | 50.2% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 8.9% |

| NVIDIA | | | 8.5% |

| Microsoft | | | 7.9% |

| Broadcom | | | 5.3% |

| Meta Platforms, Cl A | | | 5.1% |

| Amazon.com | | | 5.1% |

| Tesla | | | 3.1% |

| Alphabet, Cl A | | | 2.6% |

| Costco Wholesale | | | 2.6% |

| Alphabet, Cl C | | | 2.5% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X NASDAQ 100® Covered Call ETF: QYLD

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-8

Global X Russell 2000 Covered Call ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Russell 2000 Covered Call ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/ryld/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Russell 2000 Covered Call ETF | $59 | 0.56% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe Russell 2000 BuyWrite Index (the “Secondary Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index measures the performance of a theoretical portfolio that holds a portfolio of stocks included in the Russell 2000 Index (the “Reference Index”), and “writes” (or sells) a succession of one-month at-the-money (“ATM”) covered call options on the Reference Index. The written covered call options on the Reference Index are held until expiration. The Reference Index is an equity benchmark which measures the performance of the small-capitalization sector of the U.S. equity market, as defined by FTSE Russell, the provider of the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 12.30%, while the Secondary Index increased 13.26%. The Fund had a net asset value of $16.10 per share on October 31, 2023 and ended the reporting period with a net asset value of $16.03 on October 31, 2024.

During the reporting period, the highest returns came from Avidity Biosciences Inc and Alpine Immune Sciences, Inc., which returned 644.27% and 534.47% respectively. The worst performers were Fisker Inc Class A and Tingo Group, Inc., which returned -98.81% and -97.44%, respectively.

During the reporting period, the Fund recorded positive performance driven by the option premiums collected from the ATM covered call strategy. An increasingly dovish stance on interest rates by the Federal Reserve toward the tail end of the reporting period proved to be beneficial for many small-capitalization companies, particularly those that have high levels of debt and capital expenditures. These factors, combined with the Fund’s covered call strategy, contributed to the overall positive performance during the reporting period. However, the Fund’s covered call strategy capped its upside participation in the Secondary Index.

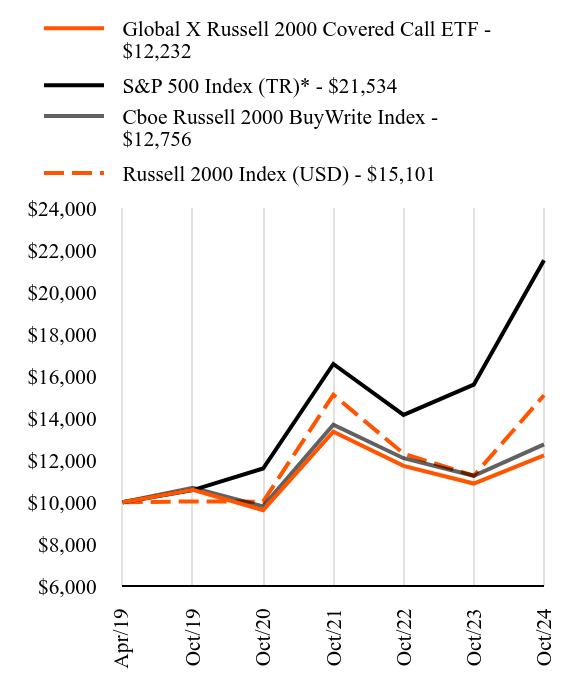

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Russell 2000 Covered Call ETF - $12232 | S&P 500 Index (TR)* - $21534 | Cboe Russell 2000 BuyWrite Index - $12756 | Russell 2000 Index (USD) - $15101 |

|---|

| Apr/19 | $10000 | $10000 | $10000 | $10000 |

| Oct/19 | $10599 | $10581 | $10690 | $10041 |

| Oct/20 | $9626 | $11608 | $9807 | $10028 |

| Oct/21 | $13363 | $16590 | $13692 | $15122 |

| Oct/22 | $11735 | $14166 | $12100 | $12318 |

| Oct/23 | $10892 | $15603 | $11263 | $11263 |

| Oct/24 | $12232 | $21534 | $12756 | $15101 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | 5 Years | Annualized Since Inception |

|---|

| Global X Russell 2000 Covered Call ETF | 12.30% | 2.91% | 3.70% |

| S&P 500 Index (TR)* | 38.02% | 15.27% | 14.84% |

| Cboe Russell 2000 BuyWrite Index | 13.26% | 3.60% | 4.49% |

| Russell 2000 Index (USD) | 34.07% | 8.50% | 7.72% |

Since its inception on April 17, 2019. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/ryld/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from Russell 2000 Index to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $1,409,648,364 | 8 | $7,810,225 | 105.44% |

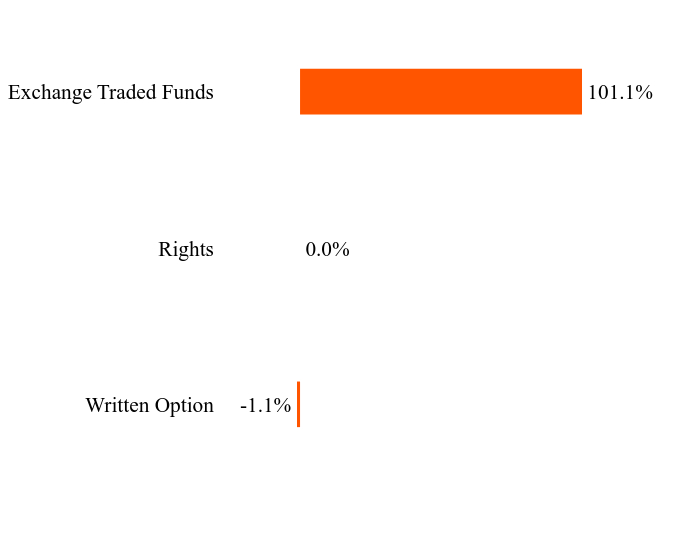

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -1.1% |

| Rights | 0.0% |

| Exchange Traded Funds | 101.1% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

Global X Russell 2000 ETFFootnote Reference** | | | 101.1% |

| CinCor Pharma CVR | | | 0.0% |

| Inhibrx CVR | | | 0.0% |

| Novartis CVR | | | 0.0% |

| Cartesian Therapeutics CVR | | | 0.0% |

| OmniAb CVR | | | 0.0% |

| OmniAb CVR | | | 0.0% |

| Written Option - Russell 2000 Index, $2,280, 11/15/24 | | | -1.1% |

| Footnote | Description |

Footnote** | Affiliated Investment |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Russell 2000 Covered Call ETF: RYLD

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-9

Global X Nasdaq 100® Covered Call & Growth ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Nasdaq 100® Covered Call & Growth ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/qylg/. You can also request this information by contacting us at 1-888-493-8631. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X Nasdaq 100® Covered Call & Growth ETF | $53 | 0.46% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe NASDAQ 100 Half BuyWrite V2 Index (USD) (“Secondary Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index is a benchmark index that measures the performance of a theoretical portfolio that owns the portfolio of stocks included in the NASDAQ-100® Index ("Reference Index"), and “writes” (or sells) corresponding call options on approximately 50% of the value of the portfolio of stocks in the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 30.15%, while the Secondary Index increased 30.84%. The Fund had a net asset value of $26.07 per share on October 31, 2023, and ended the reporting period with a net asset value of $31.89 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Constellation Energy Corporation, which returned 225.65% and 134.68% respectively. The worst performers were Super Micro Computer, Inc. and Walgreens Boots Alliance, Inc., which returned -63.47% and -45.16%, respectively.

The Fund recorded positive returns during the reporting period, driven by several key factors. The Technology sector, a significant component of the Reference Index, experienced robust growth. Notably, artificial intelligence advancements led to increased demand for semiconductor chips and cloud computing services. The Consumer Discretionary sector also contributed positively, with e-commerce giants seeing strong sales growth. Additionally, the Fund's covered call strategy generated income through option premiums, providing a buffer against market volatility. Also, the Federal Reserve's dovish stance on interest rates toward the tail end of the reporting period boosted investor confidence, leading to increased market participation towards the end of the reporting period. These factors combined to contribute to the Fund’s positive performance during the reporting period. During the reporting period, by sector allocation, the Fund had the highest exposure to Information Technology at 50.30% and Communication Services at 15.60%.

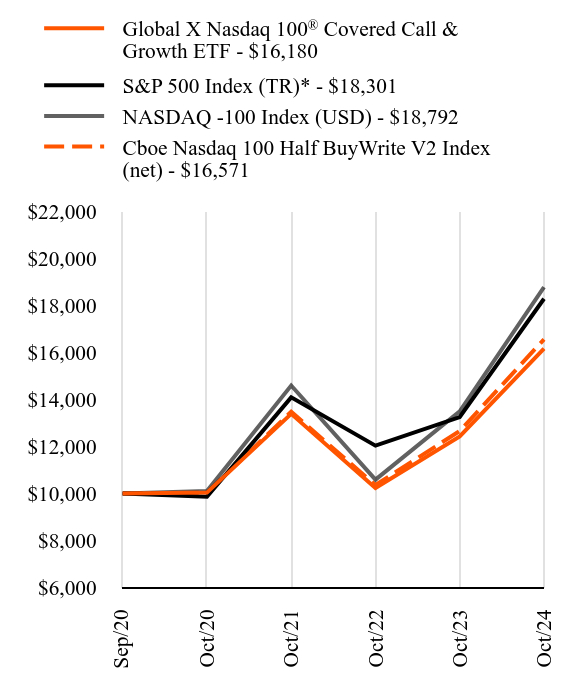

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Nasdaq 100® Covered Call & Growth ETF - $16180 | S&P 500 Index (TR)* - $18301 | NASDAQ -100 Index (USD) - $18792 | Cboe Nasdaq 100 Half BuyWrite V2 Index (net) - $16571 |

|---|

| Sep/20 | $10000 | $10000 | $10000 | $10000 |

| Oct/20 | $10040 | $9865 | $10112 | $10036 |

| Oct/21 | $13395 | $14099 | $14604 | $13485 |

| Oct/22 | $10238 | $12039 | $10593 | $10362 |

| Oct/23 | $12431 | $13260 | $13501 | $12665 |

| Oct/24 | $16180 | $18301 | $18792 | $16571 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

Global X Nasdaq 100® Covered Call & Growth ETF | 30.15% | 12.39% |

| S&P 500 Index (TR)* | 38.02% | 15.80% |

| NASDAQ -100 Index (USD) | 39.19% | 16.54% |

| Cboe Nasdaq 100 Half BuyWrite V2 Index (net) | 30.84% | 13.04% |

Since its inception on September 18, 2020. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/qylg/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from NASDAQ-100 Index (USD) to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $104,271,160 | 102 | $502,988 | 14.82% |

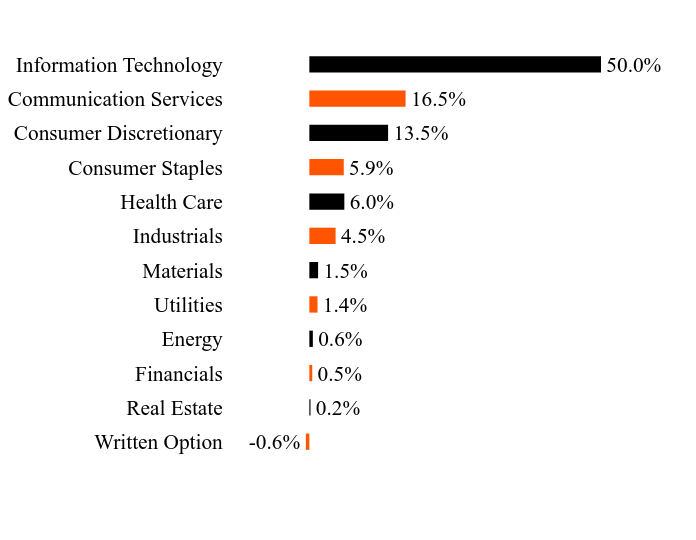

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -0.6% |

| Real Estate | 0.2% |

| Financials | 0.5% |

| Energy | 0.6% |

| Utilities | 1.4% |

| Materials | 1.5% |

| Industrials | 4.5% |

| Health Care | 6.0% |

| Consumer Staples | 5.9% |

| Consumer Discretionary | 13.5% |

| Communication Services | 16.5% |

| Information Technology | 50.0% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 8.9% |

| NVIDIA | | | 8.4% |

| Microsoft | | | 7.8% |

| Broadcom | | | 5.3% |

| Meta Platforms, Cl A | | | 5.1% |

| Amazon.com | | | 5.1% |

| Tesla | | | 3.1% |

| Alphabet, Cl A | | | 2.6% |

| Costco Wholesale | | | 2.6% |

| Alphabet, Cl C | | | 2.5% |

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at https://www.globalxetfs.com/funds/qylg or upon request at 1-888-493-8631.

Effective April 11, 2024, the Annual Fund Operating Expenses for the Fund were changed to reflect a reduction to the Management Fee from 0.60% to 0.35%.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Nasdaq 100® Covered Call & Growth ETF: QYLG

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-10

Global X S&P 500® Covered Call & Growth ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X S&P 500® Covered Call & Growth ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/xylg/. You can also request this information by contacting us at 1-888-493-8631. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X S&P 500® Covered Call & Growth ETF | $52 | 0.46% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe S&P 500 Half BuyWrite Index (“Secondary Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index is a benchmark index that measures the performance of a theoretical portfolio that owns the portfolio of stocks included in the S&P 500 Index ("Reference Index"), and “writes” (or sells) corresponding call options on approximately 50% of the value of the portfolio of stocks in the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 27.47%, while the Secondary Index increased 28.08%. The Fund had a net asset value of $26.07 per share on October 31, 2023 and ended the reporting period with a net asset value of $31.71 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Royal Caribbean Group, which returned 225.65% and 144.10% respectively. The worst performers were Super Micro Computer, Inc. and Walgreens Boots Alliance, Inc., which returned -72.76% and -51.75%, respectively.

The Fund recorded positive returns during the reporting period, largely due to broader market growth in the United States. The robust performance of large-capitalization technology stocks within the Reference Index significantly contributed to the Fund's gains. These companies, which form a substantial portion of the Reference Index, benefited from increased demand for digital services and cloud computing solutions. Although the Fund's covered call strategy generated income through option premiums, providing a buffer against market volatility, the strategy minimized a portion of the upside participation in market rallies. During the reporting period, by sector, the Fund had the highest exposure to Information Technology at 30.35% and Financials at 12.90%.

How did the Fund perform since inception?

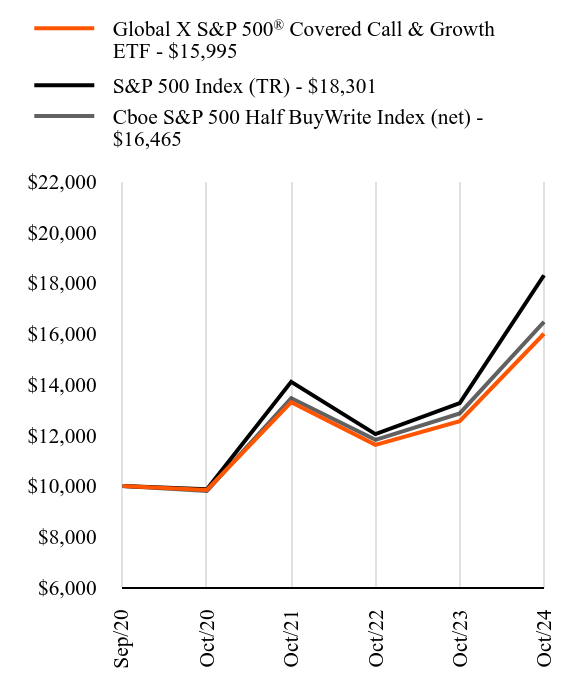

Total Return Based on $10,000 Investment

| Global X S&P 500® Covered Call & Growth ETF - $15995 | S&P 500 Index (TR) - $18301 | Cboe S&P 500 Half BuyWrite Index (net) - $16465 |

|---|

| Sep/20 | $10000 | $10000 | $10000 |

| Oct/20 | $9840 | $9865 | $9805 |

| Oct/21 | $13297 | $14099 | $13458 |

| Oct/22 | $11618 | $12039 | $11816 |

| Oct/23 | $12549 | $13260 | $12855 |

| Oct/24 | $15995 | $18301 | $16465 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

Global X S&P 500® Covered Call & Growth ETF | 27.47% | 12.07% |

| S&P 500 Index (TR) | 38.02% | 15.80% |

| Cboe S&P 500 Half BuyWrite Index (net) | 28.08% | 12.86% |

Since its inception on September 18, 2020. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/xylg/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $59,295,043 | 504 | $295,848 | 3.25% |

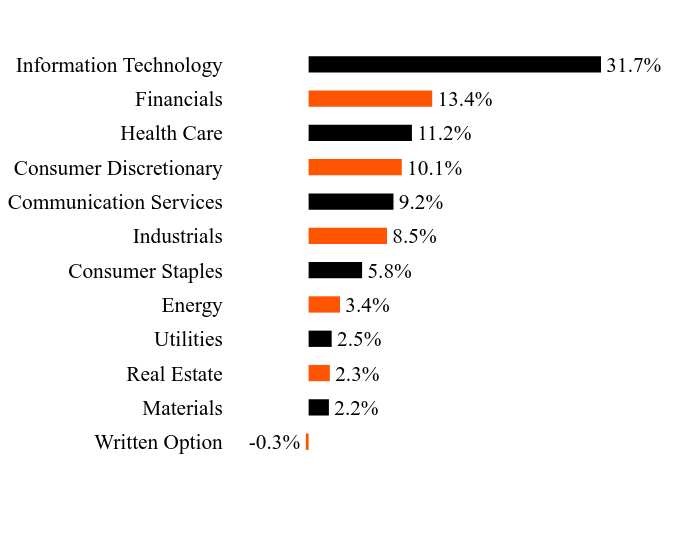

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -0.3% |

| Materials | 2.2% |

| Real Estate | 2.3% |

| Utilities | 2.5% |

| Energy | 3.4% |

| Consumer Staples | 5.8% |

| Industrials | 8.5% |

| Communication Services | 9.2% |

| Consumer Discretionary | 10.1% |

| Health Care | 11.2% |

| Financials | 13.4% |

| Information Technology | 31.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 7.1% |

| NVIDIA | | | 6.8% |

| Microsoft | | | 6.3% |

| Amazon.com | | | 3.6% |

| Meta Platforms, Cl A | | | 2.6% |

| Alphabet, Cl A | | | 2.1% |

| Alphabet, Cl C | | | 1.7% |

| Berkshire Hathaway, Cl B | | | 1.7% |

| Broadcom | | | 1.6% |

| Tesla | | | 1.4% |

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at https://www.globalxetfs.com/funds/xylg or upon request at 1-888-493-8631.

Effective April 11, 2024, the Annual Fund Operating Expenses for the Fund were changed to reflect a reduction to the Management Fee from 0.60% to 0.35%.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X S&P 500® Covered Call & Growth ETF: XYLG

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-11

Global X NASDAQ 100® Risk Managed Income ETF

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X NASDAQ 100® Risk Managed Income ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/qrmi/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X NASDAQ 100® Risk Managed Income ETF | $64 | 0.60% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the NASDAQ-100 Monthly Net Credit Collar 95-100 Index (“Secondary Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index measures the performance of a risk managed income strategy that holds the underlying stocks of the NASDAQ 100® Index ("Reference Index") and applies an options collar strategy consisting of a mix of short (sold) call options and long (purchased) put options on the Reference Index. The Secondary Index specifically reflects the performance of the component securities of the Reference Index, combined with a long position in the 5% out-of-the-money (“OTM”) put options and a short position in at-the-money (“ATM”) call options, each corresponding to the value of the portfolio of stocks in the Reference Index. The options collar seeks to generate a net-credit, meaning that the premium received from the sale of the call options will be greater than the premium paid when buying the put options.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 14.48%, while the Secondary Index increased 15.66%. The Fund had a net asset value of $16.64 per share on October 31, 2023 and ended the reporting period with a net asset value of $16.89 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Constellation Energy Corporation, which returned 225.65% and 134.68% respectively. The worst performers were Super Micro Computer, Inc. and Walgreens Boots Alliance, Inc., which returned -63.47% and -45.16%, respectively.

During the reporting period, the Fund recorded positive performance. Growth in artificial intelligence, cloud computing, and semiconductors were some of many major factors resulting in broader market growth during the reporting period, particularly in the Technology sector, which is well represented in the Reference Index. While the Fund’s option writing strategy does not allow it to directly participate in the upward performance of the underlying constituents, its net-credit collar strategy still resulted in an overall positive performance. During the reporting period, by sector, the Fund had the highest exposure to Information Technology at 50.25% and Communication Services at 15.49%.

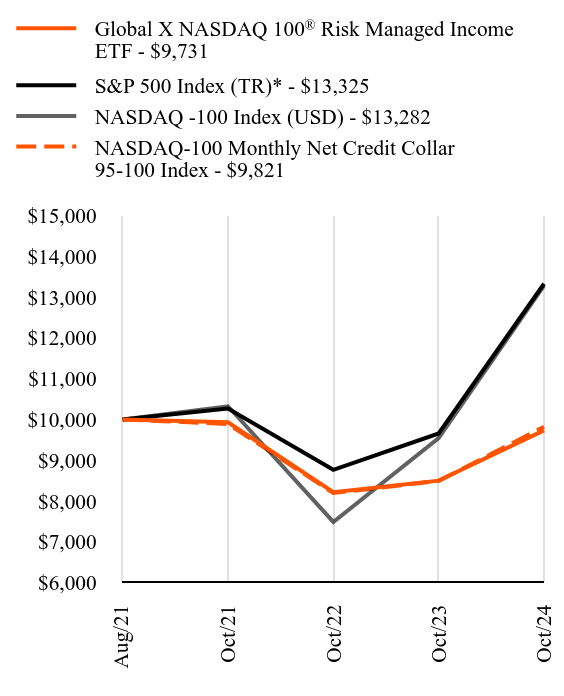

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X NASDAQ 100® Risk Managed Income ETF - $9731 | S&P 500 Index (TR)* - $13325 | NASDAQ -100 Index (USD) - $13282 | NASDAQ-100 Monthly Net Credit Collar 95-100 Index - $9821 |

|---|

| Aug/21 | $10000 | $10000 | $10000 | $10000 |

| Oct/21 | $9931 | $10266 | $10323 | $9889 |

| Oct/22 | $8219 | $8766 | $7488 | $8196 |

| Oct/23 | $8500 | $9655 | $9543 | $8491 |

| Oct/24 | $9731 | $13325 | $13282 | $9821 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

Global X NASDAQ 100® Risk Managed Income ETF | 14.48% | -0.85% |

| S&P 500 Index (TR)* | 38.02% | 9.43% |

| NASDAQ -100 Index (USD) | 39.19% | 9.32% |

| NASDAQ-100 Monthly Net Credit Collar 95-100 Index | 15.66% | -0.57% |

Since its inception on August 25, 2021. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/qrmi/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from NASDAQ-100 Index (USD) to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $17,392,123 | 105 | $82,776 | 8.02% |

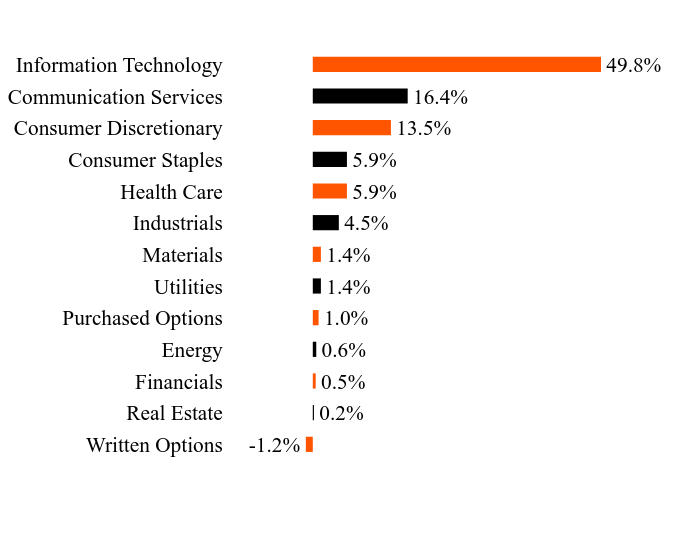

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Options | -1.2% |

| Real Estate | 0.2% |

| Financials | 0.5% |

| Energy | 0.6% |

| Purchased Options | 1.0% |

| Utilities | 1.4% |

| Materials | 1.4% |

| Industrials | 4.5% |

| Health Care | 5.9% |

| Consumer Staples | 5.9% |

| Consumer Discretionary | 13.5% |

| Communication Services | 16.4% |

| Information Technology | 49.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 8.8% |

| NVIDIA | | | 8.4% |

| Microsoft | | | 7.8% |

| Broadcom | | | 5.2% |

| Meta Platforms, Cl A | | | 5.1% |

| Amazon.com | | | 5.0% |

| Tesla | | | 3.1% |

| Alphabet, Cl A | | | 2.6% |

| Costco Wholesale | | | 2.6% |

| Alphabet, Cl C | | | 2.5% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X NASDAQ 100® Risk Managed Income ETF: QRMI

Principal Listing Exchange: Nasdaq

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-12

Global X S&P 500® Risk Managed Income ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X S&P 500® Risk Managed Income ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/xrmi/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X S&P 500® Risk Managed Income ETF | $64 | 0.60% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe S&P 500 Risk Managed Income Index (“Secondary Index”).

The Secondary Index measures the performance of a risk managed income strategy that holds the underlying stocks of the S&P 500 Index ("Reference Index") and applies an options collar strategy which is a mix of short (sold) call options and long (purchased) put options on the Reference Index. The Secondrary Index specifically reflects the performance of the component securities of the Reference Index, combined with a long position in the 5% out-of-the-money (“OTM”) put options and a short position in at-the-money (“ATM”) call options, each corresponding to the value of the portfolio of stocks in the Reference Index. The options collar seeks to generate a net-credit, meaning that the premium received from the sale of the call options will be greater than the premium paid when buying the put options.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 14.10%, while the Secondary Index increased 14.94%. The Fund had a net asset value of $18.56 per share on October 31, 2023, and ended the reporting period with a net asset value of $18.78 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Royal Caribbean Group, which returned 225.65% and 144.10% respectively. The worst performers were Super Micro Computer, Inc. and Walgreens Boots Alliance, Inc., which returned –72.76% and –51.75%, respectively.

During the reporting period, the Fund recorded positive performance. The positive performance can be attributed to the Fund’s net-credit collar strategy which involved an ATM covered call component and a long 5% OTM put option component. Ultimately, the positive performance was driven by the premiums generated from the ATM covered calls in excess of the premiums spent on the put options. While the Reference Index experienced overall positive performance during the reporting period, the put options component of the Fund’s strategy effectively mitigated downside volatility. Positive performance displayed by the Reference Index also effectively buoyed the Fund during the reporting period. During the reporting period, by sector, the Fund had the highest exposure to Information Technology at 30.28% and Financials at 12.88%.

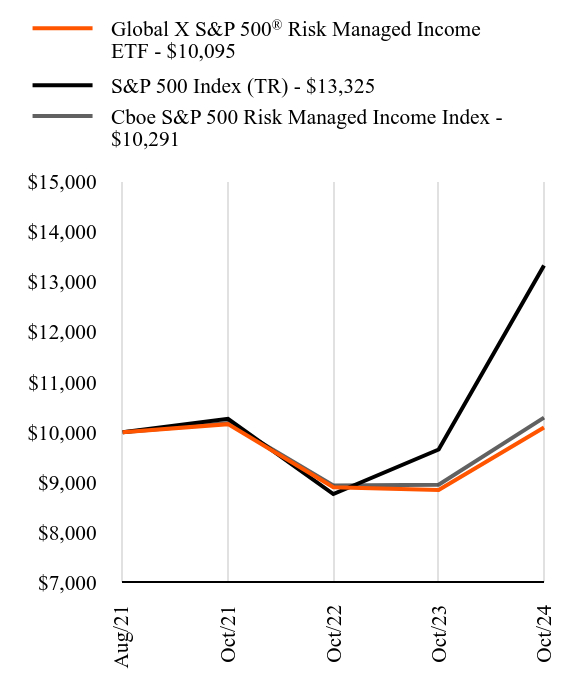

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X S&P 500® Risk Managed Income ETF - $10095 | S&P 500 Index (TR) - $13325 | Cboe S&P 500 Risk Managed Income Index - $10291 |

|---|

| Aug/21 | $10000 | $10000 | $10000 |

| Oct/21 | $10160 | $10266 | $10182 |

| Oct/22 | $8901 | $8766 | $8939 |

| Oct/23 | $8847 | $9655 | $8954 |

| Oct/24 | $10095 | $13325 | $10291 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

Global X S&P 500® Risk Managed Income ETF | 14.10% | 0.30% |

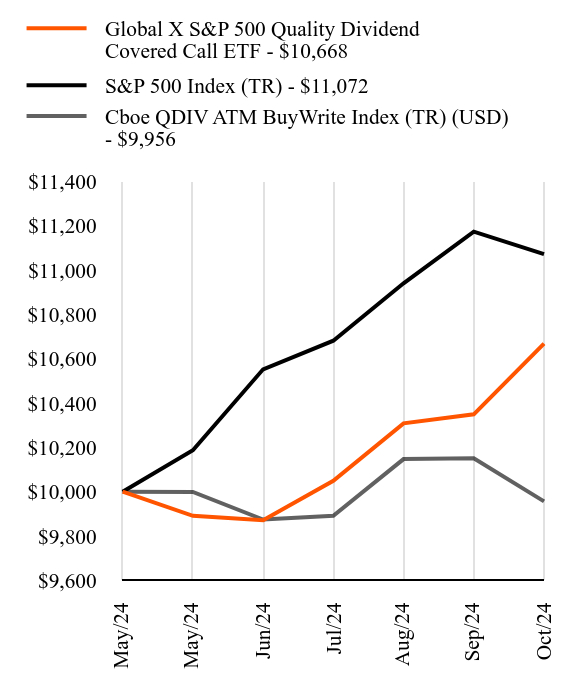

| S&P 500 Index (TR) | 38.02% | 9.43% |

| Cboe S&P 500 Risk Managed Income Index | 14.94% | 0.91% |

Since its inception on August 25, 2021. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/xrmi/ for current month-end performance.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $39,446,051 | 507 | $199,961 | 3.08% |

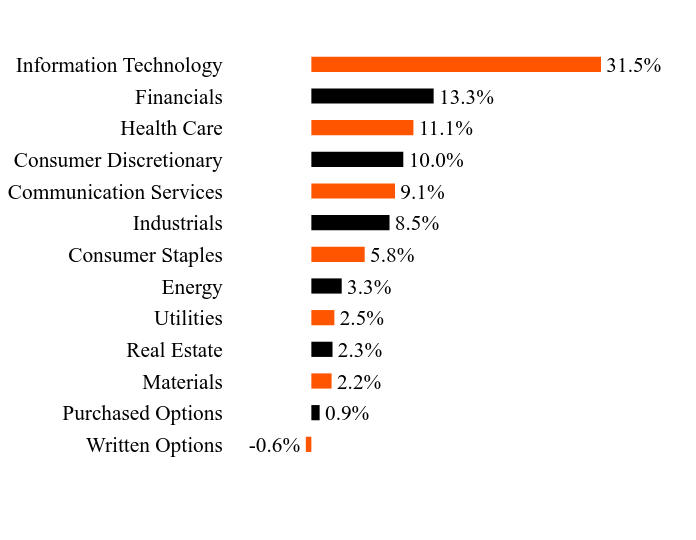

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Options | -0.6% |

| Purchased Options | 0.9% |

| Materials | 2.2% |

| Real Estate | 2.3% |

| Utilities | 2.5% |

| Energy | 3.3% |

| Consumer Staples | 5.8% |

| Industrials | 8.5% |

| Communication Services | 9.1% |

| Consumer Discretionary | 10.0% |

| Health Care | 11.1% |

| Financials | 13.3% |

| Information Technology | 31.5% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Apple | | | 7.1% |

| NVIDIA | | | 6.8% |

| Microsoft | | | 6.2% |

| Amazon.com | | | 3.6% |

| Meta Platforms, Cl A | | | 2.6% |

| Alphabet, Cl A | | | 2.1% |

| Alphabet, Cl C | | | 1.7% |

| Berkshire Hathaway, Cl B | | | 1.7% |

| Broadcom | | | 1.6% |

| Tesla | | | 1.4% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X S&P 500® Risk Managed Income ETF: XRMI

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-13

Global X Dow 30® Covered Call ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Dow 30® Covered Call ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/djia/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global X Dow 30® Covered Call ETF | $64 | 0.60% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the DJIA Cboe BuyWrite v2 Index ("Secondary Index").

The Secondary Index measures the performance of a covered call strategy that holds a theoretical portfolio of the underlying stocks of the Dow Jones Industrial Average Index (USD) (the “Reference Index”) and “writes” (or sells) a succession of one-month at-the-money (“ATM”) covered call options on the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 13.86%, while the Secondary Index increased 14.79%. The Fund had a net asset value of $20.89 per share on October 31, 2023 and ended the reporting period with a net asset value of $22.23 on October 31, 2024.

During the reporting period, the highest returns came from American Express Company and Goldman Sachs Group, Inc., which returned 87.16% and 75.21% respectively. The worst performers were Intel Corporation and NIKE, Inc., which returned -40.04% and -23.79%, respectively.

During the reporting period, the Fund recorded positive performance driven by the option premiums attained by the Fund’s covered call strategy. Low unemployment rates boosted consumer confidence, resulting in increased spending, which in turn supported the financials of companies in the Reference Index. Easing inflation, and other positive economic indicators resulted in the U.S. Federal Reserve's rate cut in September 2024, which helped the broader market and improved investor sentiment. Additionally, underlying healthcare-related constituents in the Reference Index saw gains due to continued demand for medical services and pharmaceutical innovations. Technological advancements and increased digital transformation efforts directly benefited the Technology sector, which is well represented in the Reference Index. Similarly, the Industrials sector experienced growth due to increased infrastructure spending and manufacturing activity. These factors, combined with income from options premiums contributed to the Fund’s overall positive returns during the reporting period, though the Fund's covered call strategy limited potential upside participation. During the reporting period, by sector, the Fund had the highest exposure to Financials at 22.29% and Information Technology at 19.26%.

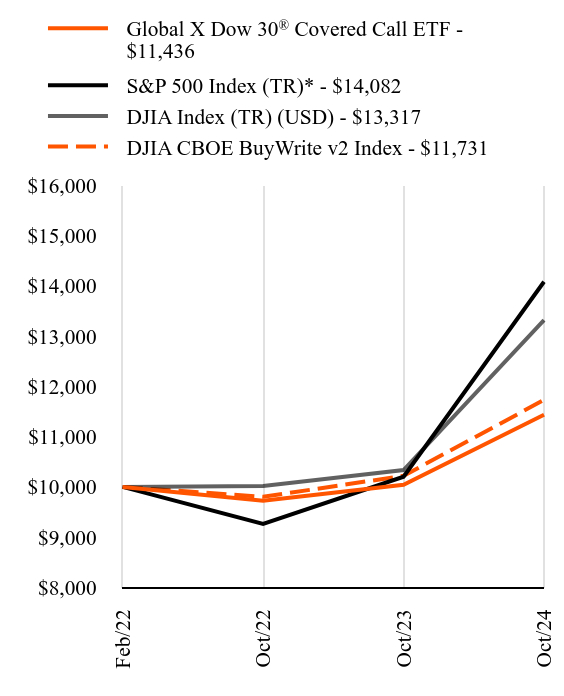

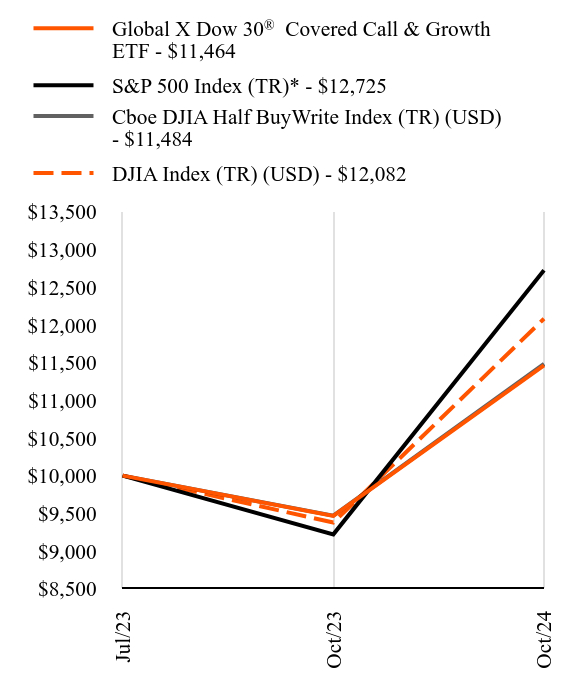

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Dow 30® Covered Call ETF - $11436 | S&P 500 Index (TR)* - $14082 | DJIA Index (TR) (USD) - $13317 | DJIA CBOE BuyWrite v2 Index - $11731 |

|---|

| Feb/22 | $10000 | $10000 | $10000 | $10000 |

| Oct/22 | $9723 | $9264 | $10018 | $9802 |

| Oct/23 | $10044 | $10203 | $10335 | $10220 |

| Oct/24 | $11436 | $14082 | $13317 | $11731 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

Global X Dow 30® Covered Call ETF | 13.86% | 5.12% |

| S&P 500 Index (TR)* | 38.02% | 13.58% |

| DJIA Index (TR) (USD) | 28.85% | 11.25% |

| DJIA CBOE BuyWrite v2 Index | 14.79% | 6.12% |

Since its inception on February 23, 2022. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/djia/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from DJIA Index (TR) (USD) to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $90,715,220 | 31 | $512,003 | 6.14% |

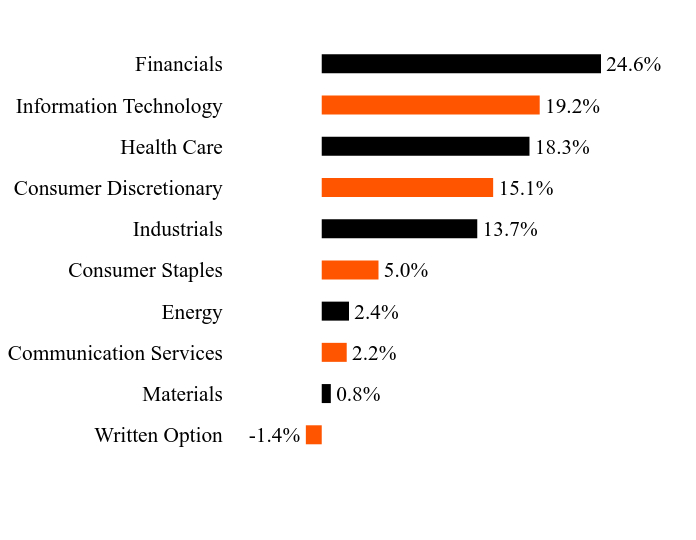

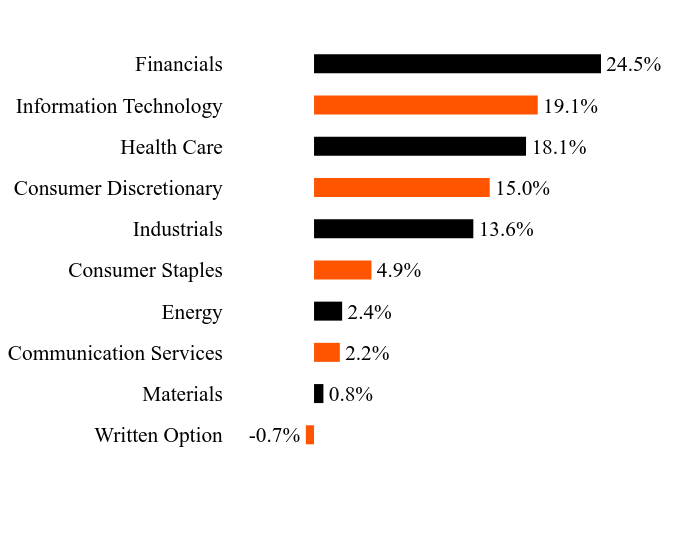

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -1.4% |

| Materials | 0.8% |

| Communication Services | 2.2% |

| Energy | 2.4% |

| Consumer Staples | 5.0% |

| Industrials | 13.7% |

| Consumer Discretionary | 15.1% |

| Health Care | 18.3% |

| Information Technology | 19.2% |

| Financials | 24.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| UnitedHealth Group | | | 9.0% |

| Goldman Sachs Group | | | 8.3% |

| Microsoft | | | 6.5% |

| Home Depot | | | 6.3% |

| Caterpillar | | | 6.0% |

| Amgen | | | 5.1% |

| McDonald's | | | 4.7% |

| Salesforce | | | 4.6% |

| Visa, Cl A | | | 4.6% |

| American Express | | | 4.3% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Dow 30® Covered Call ETF: DJIA

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-14

Global X Russell 2000 Covered Call & Growth ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Russell 2000 Covered Call & Growth ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/rylg/. You can also request this information by contacting us at 1-888-493-8631. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Russell 2000 Covered Call & Growth ETF | $42 | 0.38% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe Russell 2000 Half BuyWrite Index (“Secondary Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index measures the performance of a covered call strategy that holds a theoretical portfolio of the underlying stocks of the Russell 2000 Index (“Reference Index”) and “writes” (or sells) a succession of one-month at-the-money covered call options on the Reference Index. The written covered call options on the Reference Index correspond to approximately 50% of the value of the portfolio of stocks in the Reference Index.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 23.12%, while the Secondary Index increased 23.67%. The Fund had a net asset value of $22.38 per share on October 31, 2023 and ended the reporting period with a net asset value of $25.65 on October 31, 2024.

During the reporting period, the highest returns came from Vanguard Russell 2000 ETF and Global X Russell 2000 ETF, which returned 23.45% and 9.27% respectively.

During the reporting period, the Fund recorded positive performance, driven by several key factors within the small-capitalization equity market. Increased infrastructure spending and a resurgence in manufacturing activity resulted in the robust performance of industrial companies within the Reference Index. Similarly, the Technology sector, particularly software and semiconductor companies, benefited from advancements in artificial intelligence and cloud computing. Lastly, the healthcare sector, specifically biotechnology and medical device companies, saw positive momentum due to breakthrough innovations and increased healthcare spending. Additionally, the Fund's covered call strategy moderated volatility while generating income through option premiums, which contributed to the Fund’s overall positive return.

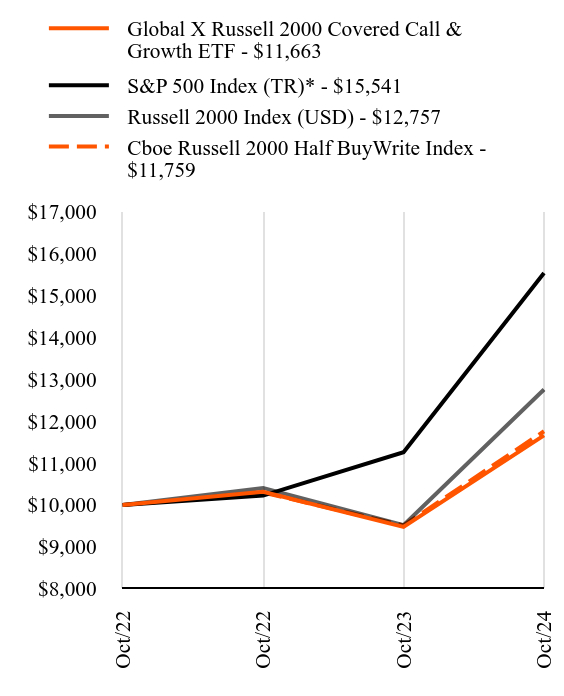

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Russell 2000 Covered Call & Growth ETF - $11663 | S&P 500 Index (TR)* - $15541 | Russell 2000 Index (USD) - $12757 | Cboe Russell 2000 Half BuyWrite Index - $11759 |

|---|

| Oct/22 | $10000 | $10000 | $10000 | $10000 |

| Oct/22 | $10314 | $10223 | $10406 | $10298 |

| Oct/23 | $9473 | $11260 | $9515 | $9509 |

| Oct/24 | $11663 | $15541 | $12757 | $11759 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

| Global X Russell 2000 Covered Call & Growth ETF | 23.12% | 7.69% |

| S&P 500 Index (TR)* | 38.02% | 23.65% |

| Russell 2000 Index (USD) | 34.07% | 12.44% |

| Cboe Russell 2000 Half BuyWrite Index | 23.67% | 8.12% |

Since its inception on October 4, 2022. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/rylg/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from Russell 2000 Index to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $6,413,345 | 3 | $31,390 | 96.85% |

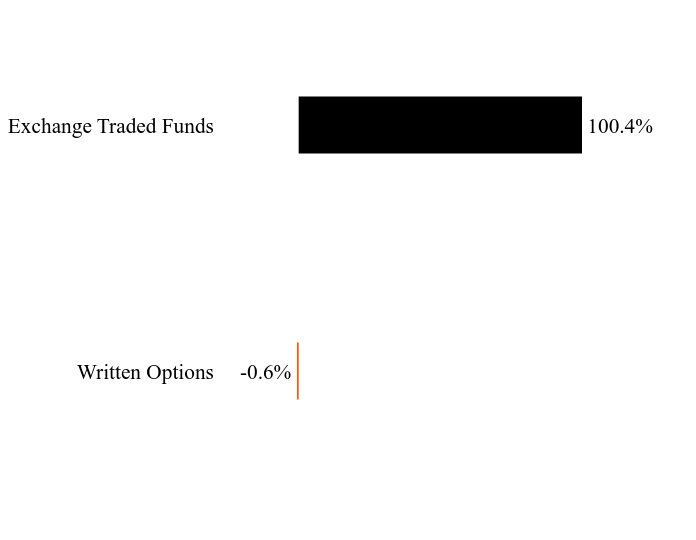

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Options | -0.6% |

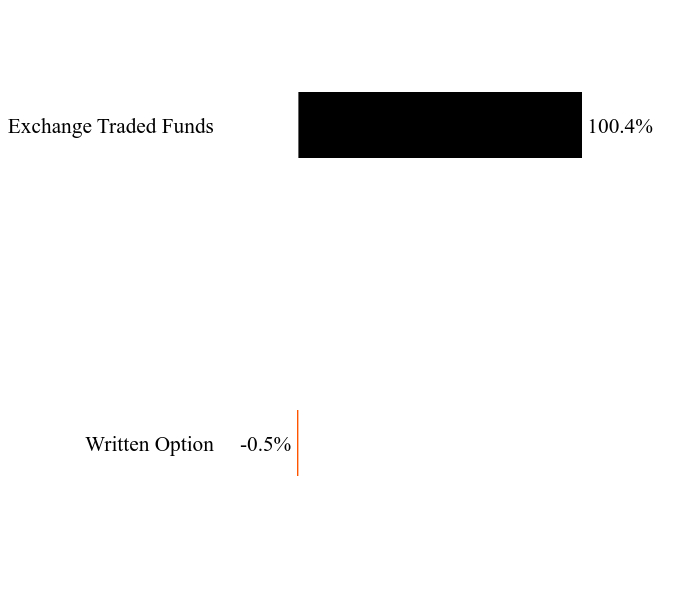

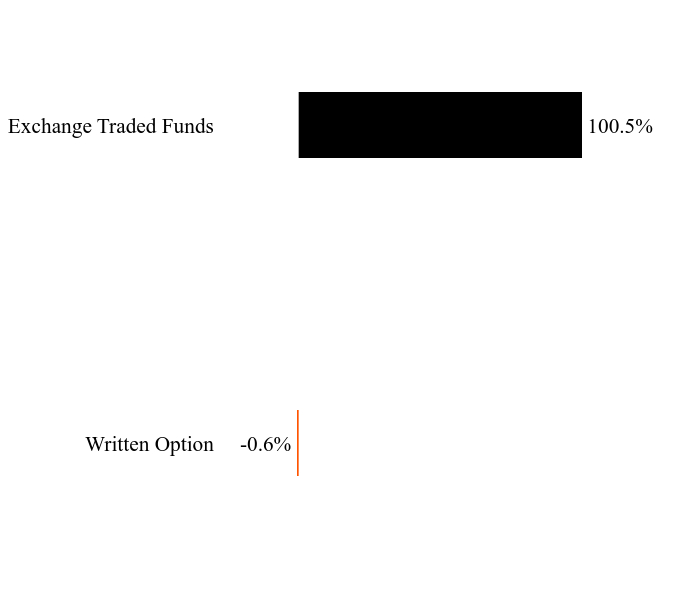

| Exchange Traded Funds | 100.4% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

Global X Russell 2000 ETFFootnote Reference** | | | 100.4% |

| Written Option - Russell 2000 Index, $2,280, 11/15/24 | | | -0.5% |

| Written Option - Cboe Mini-Russell 2000 Index, $228, 11/15/24 | | | -0.1% |

| Footnote | Description |

Footnote** | Affiliated Investment |

This is a summary of certain changes to the Fund since November 1, 2023. For more complete information, you may review the Fund's next prospectus, which we expect to be available by March 1, 2025 at https://www.globalxetfs.com/funds/rylg or upon request at 1-888-493-8631.

Effective April 11, 2024, the Annual Fund Operating Expenses for the Fund were changed to reflect a reduction to the Management Fee from 0.60% to 0.35% and a change in the expense limitation amount from 0.60% to 0.35%.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Russell 2000 Covered Call & Growth ETF: RYLG

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-15

Global X Financials Covered Call & Growth ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Financials Covered Call & Growth ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/fylg/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Financials Covered Call & Growth ETF | $63 | 0.55% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe S&P Financial Select Sector Half BuyWrite Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index measures the performance of a partially covered call strategy that holds a theoretical portfolio of the underlying securities of the Financial Select Sector Index (TR) (USD) (the “Reference Index”). The Reference Index “writes” (or sells) a succession of one-month at-the-money covered call options on the Financial Select Sector SPDR Fund (the “Reference Fund”), or such other fund that seeks to track the performance of the Reference Index, as determined by Cboe. The call options correspond to approximately 50% of the value of the securities in the Reference Index, thereby representing a partially covered call strategy.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 30.17%, while the Secondary Index increased 31.76%. The Fund had a net asset value of $22.30 per share on October 31, 2023, and ended the reporting period with a net asset value of $27.56 on October 31, 2024.

During the reporting period, the highest returns came from Synchrony Financial and Fifth Third Bancorp, which returned 100.06% and 91.29% respectively. The worst performers were Erie Indemnity Company Class A and Globe Life Inc., which returned -13.64% and -8.41%, respectively.

During the reporting period, the Fund recorded positive performance. The robust performance of large banks and financial institutions had a positive impact on the Fund's performance. These institutions benefited from higher interest rates, which expanded their net interest margins and boosted profitability. Strong consumer spending also contributed positively as it led to increased demand for various financial services and products. Lastly, the growth in digital banking and fintech provided a positive tailwind for many companies in the Fund's portfolio, as financial institutions invested heavily in technology to improve their services and operational efficiency. Investors in the Fund also benefited from the covered call strategy which generated income from options premiums.

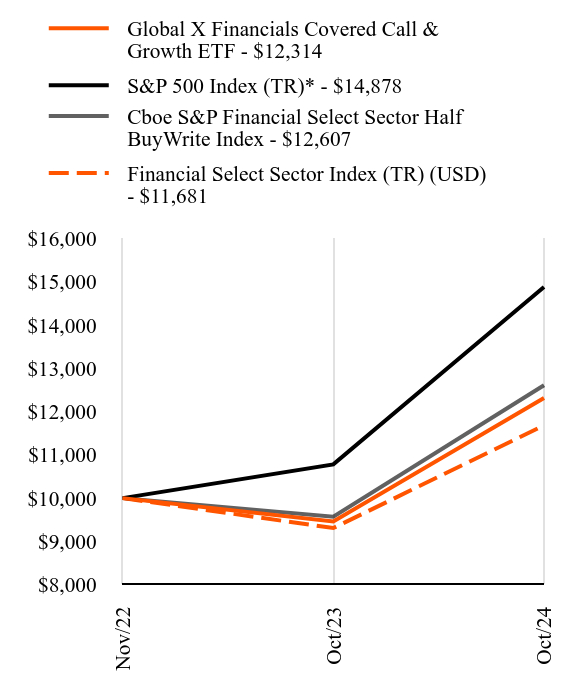

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Financials Covered Call & Growth ETF - $12314 | S&P 500 Index (TR)* - $14878 | Cboe S&P Financial Select Sector Half BuyWrite Index - $12607 | Financial Select Sector Index (TR) (USD) - $11681 |

|---|

| Nov/22 | $10000 | $10000 | $10000 | $10000 |

| Oct/23 | $9460 | $10780 | $9569 | $9309 |

| Oct/24 | $12314 | $14878 | $12607 | $11681 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

| Global X Financials Covered Call & Growth ETF | 30.17% | 11.29% |

| S&P 500 Index (TR)* | 38.02% | 22.66% |

| Cboe S&P Financial Select Sector Half BuyWrite Index | 31.76% | 12.65% |

| Financial Select Sector Index (TR) (USD) | 46.35% | 17.23% |

Since its inception on November 21, 2022. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/fylg/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from Financial Select Sector Index (TR) (USD) to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $3,583,090 | 74 | $14,366 | 3.32% |

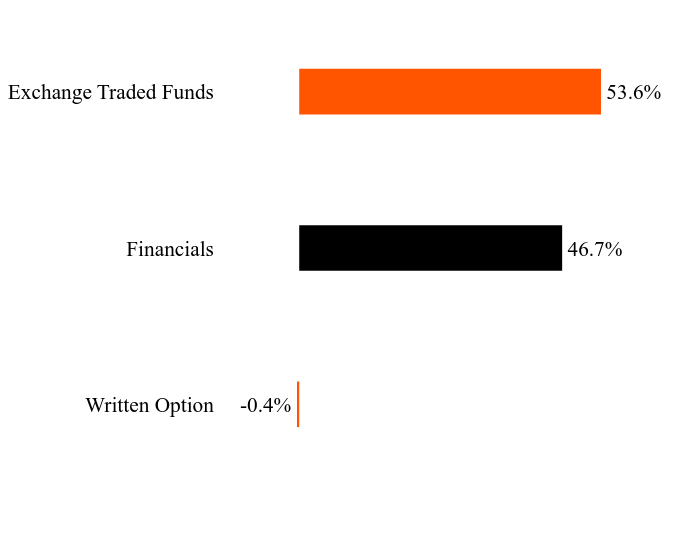

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -0.4% |

| Financials | 46.7% |

| Exchange Traded Funds | 53.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Financial Select Sector SPDR Fund | | | 53.6% |

| Berkshire Hathaway, Cl B | | | 6.0% |

| JPMorgan Chase | | | 4.6% |

| Visa, Cl A | | | 3.5% |

| Mastercard, Cl A | | | 3.0% |

| Bank of America | | | 2.0% |

| Wells Fargo | | | 1.6% |

| Goldman Sachs Group | | | 1.2% |

| S&P Global | | | 1.1% |

| American Express | | | 1.1% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Financials Covered Call & Growth ETF: FYLG

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-16

Global X Health Care Covered Call & Growth ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Health Care Covered Call & Growth ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/hylg/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Health Care Covered Call & Growth ETF | $59 | 0.55% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe S&P Health Care Select Sector Half BuyWrite Index (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

The Secondary Index measures the performance of a partially covered call strategy that holds a theoretical portfolio of the underlying securities of the Health Care Select Sector Index (TR) (USD) (“Reference Index”). The Index “writes” (or sells) a succession of one-month at-the-money covered call options on the Health Care Select Sector SPDR Fund (“Reference Fund”), or such other fund that seeks to track the performance of the Reference Index, as determined by Cboe. The call options correspond to approximately 50% of the value of the securities in the Reference Index, thereby representing a partially covered call strategy.

For the 12-month period ended October 31, 2024 (the "reporting period"), the Fund increased 15.20%, while the Secondary Index increased 16.31%. The Fund had a net asset value of $23.42 per share on October 31, 2023 and ended the reporting period with a net asset value of $25.19 on October 31, 2024.

During the reporting period, the highest returns came from Intuitive Surgical, Inc. and DaVita Inc., which returned 92.14% and 81.03% respectively. The worst performers were Humana Inc. and Moderna, Inc., which returned -50.29% and -28.44%, respectively.

During the reporting period, the Fund recorded positive performance. Growth in telemedicine and digital health solutions continued as healthcare providers increasingly adopted remote care technologies. Medical device manufacturers also experienced an increased demand for their products as elective procedures increased and hospitals upgraded their equipment. These factors, combined with the Fund's covered call strategy which generated additional income through option premiums, contributed to the overall positive performance during the reporting period. However, the Fund's covered call strategy capped some potential upside participation.

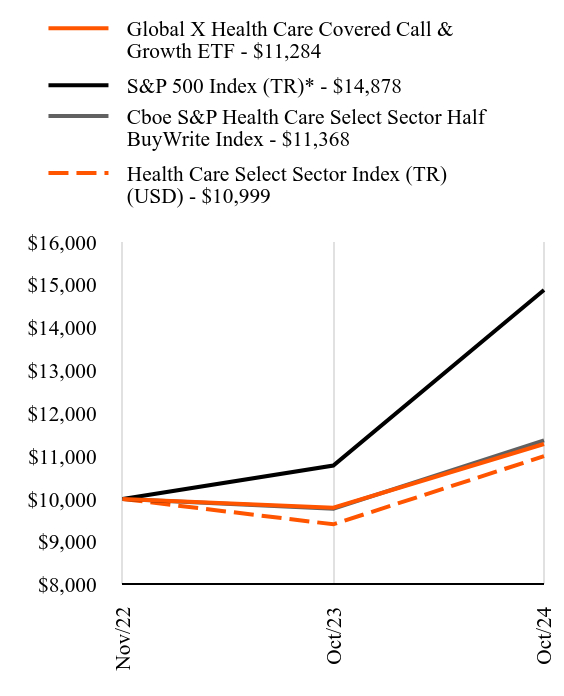

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Health Care Covered Call & Growth ETF - $11284 | S&P 500 Index (TR)* - $14878 | Cboe S&P Health Care Select Sector Half BuyWrite Index - $11368 | Health Care Select Sector Index (TR) (USD) - $10999 |

|---|

| Nov/22 | $10000 | $10000 | $10000 | $10000 |

| Oct/23 | $9795 | $10780 | $9774 | $9409 |

| Oct/24 | $11284 | $14878 | $11368 | $10999 |

Average Annual Total Returns as of October 31, 2024

| Fund/Index Name | 1 Year | Annualized Since Inception |

|---|

| Global X Health Care Covered Call & Growth ETF | 15.20% | 6.41% |

| S&P 500 Index (TR)* | 38.02% | 22.66% |

| Cboe S&P Health Care Select Sector Half BuyWrite Index | 16.31% | 6.81% |

| Health Care Select Sector Index (TR) (USD) | 19.91% | 6.40% |

Since its inception on November 21, 2022. The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is not indicative of future performance.Call 1-888-493-8631 or visit https://www.globalxetfs.com/funds/hylg/ for current month-end performance.

* As of October 2024, pursuant to new regulatory requirements, the Fund changed its broad-based securities market benchmark from Health Care Select Sector Index (TR) (USD) to S&P 500 Index (TR) to reflect that S&P 500 Index (TR) is more broadly representative of the overall applicable securities market.

Key Fund Statistics as of October 31, 2024

| Total Net Assets | Number of Portfolio Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $2,771,327 | 64 | $15,357 | 2.34% |

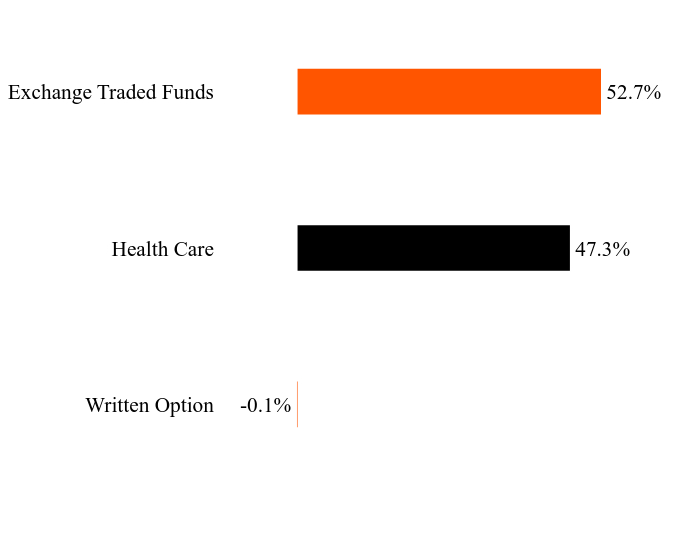

What did the Fund invest in?

Asset/Sector WeightingsFootnote Reference*

| Value | Value |

|---|

| Written Option | -0.1% |

| Health Care | 47.3% |

| Exchange Traded Funds | 52.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Health Care Select Sector SPDR Fund | | | 52.7% |

| Eli Lilly | | | 5.7% |

| UnitedHealth Group | | | 4.6% |

| Johnson & Johnson | | | 3.4% |

| AbbVie | | | 3.2% |

| Merck | | | 2.3% |

| Thermo Fisher Scientific | | | 1.8% |

| Abbott Laboratories | | | 1.7% |

| Intuitive Surgical | | | 1.6% |

| Amgen | | | 1.5% |

There were no material changes during the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request.

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, call or visit:

Global X Health Care Covered Call & Growth ETF: HYLG

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

GX-AR-TSR-10.2024-17

Global X Information Technology Covered Call & Growth ETF

Principal Listing Exchange: NYSE Arca, Inc.

Annual Shareholder Report: October 31, 2024

This annual shareholder report contains important information about the Global X Information Technology Covered Call & Growth ETF (the "Fund") for the period from November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://www.globalxetfs.com/funds/tylg/. You can also request this information by contacting us at 1-888-493-8631.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global X Information Technology Covered Call & Growth ETF | $63 | 0.55% |

How did the Fund perform in the last year?

The Fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe S&P Technology Select Sector Half BuyWrite Index. (“Secondary Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Secondary Index.

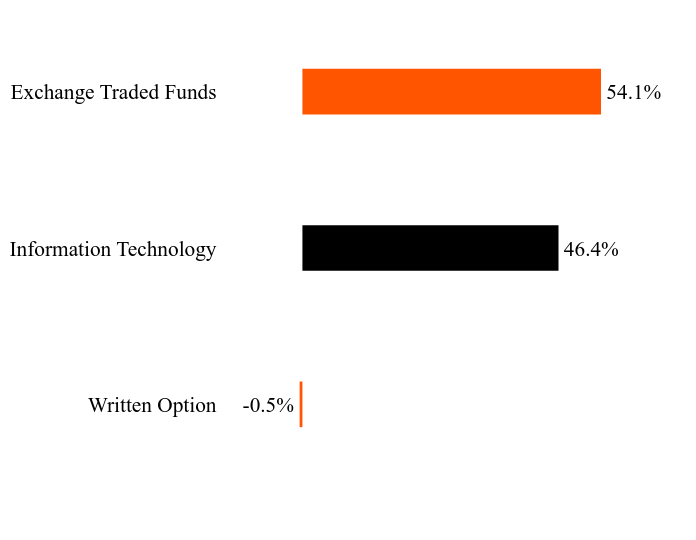

The Secondary Index measures the performance of a partially covered call strategy that holds a theoretical portfolio of the underlying securities of the Information Technology Select Sector Index (TR) (USD) (“Reference Index”). The Secondary Index “writes” (or sells) a succession of one-month at-the- money covered call options on the Information Technology Select Sector SPDR® Fund, or such other fund that seeks to track the performance of the Reference Index, as determined by Cboe. The call options correspond to approximately 50% of the value of the securities in the Reference Index, creating a partially covered call strategy.

For the 12-month period ended October 31, 2024 (the “reporting period”), the Fund increased 27.98%, while the Secondary Index increased 29.38%. The Fund had a net asset value of $28.86 per share on October 31, 2023 and ended the reporting period with a net asset value of $32.36 on October 31, 2024.

During the reporting period, the highest returns came from NVIDIA Corporation and Fair Isaac Corporation, which returned 225.65% and 135.63% respectively. The worst performers were Super Micro Computer, Inc. and Intel Corporation, which returned -72.76% and -40.04%, respectively.

During the reporting period, the Fund recorded positive performance. The continued growth in cloud computing services boosted companies specializing in this area, generally improving their profit margins. Additionally, the increasing adoption of artificial intelligence and machine learning technologies across various industries led to higher demand for specialized hardware and software, benefiting companies in the Fund's Reference Index. Lastly, ongoing digital transformation efforts by businesses resulted in increased spending on IT infrastructure and services, positively impacting the Fund's holdings in enterprise software and IT consulting firms. These drivers collectively enabled the Fund to capitalize on industry trends that drive innovation and growth and contributed to the Fund’s positive performance during the reporting period. However, the Fund’s covered call strategy capped some potential upside participation.

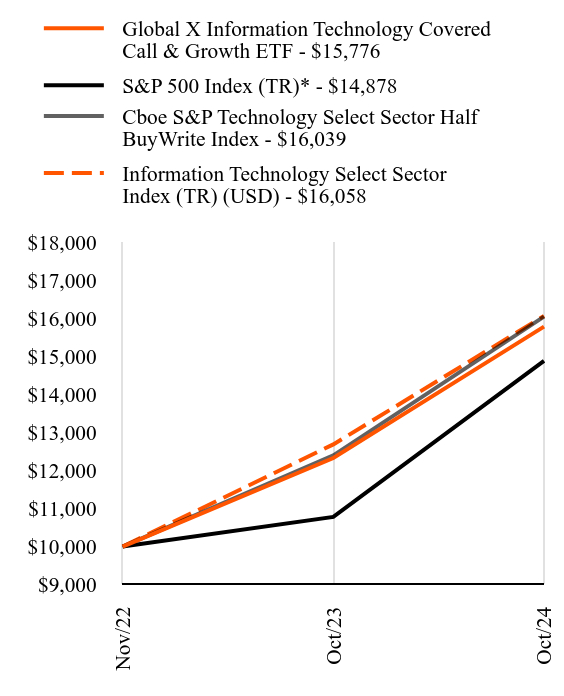

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Global X Information Technology Covered Call & Growth ETF - $15776 | S&P 500 Index (TR)* - $14878 | Cboe S&P Technology Select Sector Half BuyWrite Index - $16039 | Information Technology Select Sector Index (TR) (USD) - $16058 |

|---|

| Nov/22 | $10000 | $10000 | $10000 | $10000 |

| Oct/23 | $12327 | $10780 | $12397 | $12684 |

| Oct/24 | $15776 | $14878 | $16039 | $16058 |