UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

________

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Luis Berruga

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

Global X Management Company LLC 605 Third Avenue, 43rd floor New York, NY 10158 | Eric S. Purple, Esq. Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, DC 20006-1871 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2022

Date of reporting period: October 31, 2022

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

Global X Blockchain & Bitcoin Strategy ETF (ticker: BITS)

Annual Report

October 31, 2022

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s (defined below) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Fund’s website (www. globalxetfs.com/explore), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Table of Contents

| Management Discussion of Fund Performance | 1 |

| Consolidated Schedule of Investments | |

| Global X Blockchain & Bitcoin Strategy ETF | 4 |

| Consolidated Statement of Assests and Liabilities | 6 |

| Consolidated Statement of Operations | 7 |

| Consolidated Statement of Changes in Net Assets | 8 |

| Consolidated Financial Highlights | 9 |

| Consolidated Notes to Financial Statements | 11 |

| Report of Independent Registered Public Accounting Firm | 27 |

| Disclosure of Fund Expenses | 29 |

| Liquidity Risk Management Program | 31 |

| Supplemental Information | 32 |

| Trustees and Officers of the Trust | 33 |

| Notice to Shareholders | 36 |

Shares are bought and sold at market price (not net asset value (“NAV”)) and are not individually redeemed from the Fund. Shares may only be redeemed directly from the Fund by Authorized Participants, in very large creation/ redemption units. Brokerage commissions will reduce returns.

The Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “SEC” or “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Forms N-PORT are available on the Commission’s website at https://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Fund voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-493-8631; and (ii) on the Commission’s website at https://www.sec.gov.

|

| Management Discussion of Fund Performance (unaudited) |

| Global X Blockchain & Bitcoin Strategy ETF |

Global X Blockchain & Bitcoin Strategy ETF

The Global X Blockchain & Bitcoin Strategy ETF (the “Fund”) is an actively managed exchange traded fund (“ETF”) that seeks to achieve its investment objective by investing directly or indirectly in equity securities of U.S. and non-U.S. “Blockchain Companies”, as defined below, and in long positions in U.S. listed bitcoin futures (“Bitcoin Futures”) contracts. The Fund intends to gain exposure to Blockchain Companies by investing indirectly in underlying ETFs holding Blockchain Companies, including the passively-managed affiliated Global X Blockchain ETF.

Under normal circumstances, the Fund will invest at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in Blockchain Companies and in long positions on U.S. listed Bitcoin Futures contracts. Under normal circumstances, the Fund will invest at least 25% of its assets in Blockchain Companies and will have notional exposure to Bitcoin Futures equal to at least 20% of the total assets of the Fund.

Blockchain Companies include companies that derive or are expected to derive at least 50% of their revenues, operating income, or assets from the following business activities:

1. Digital Asset Mining: Companies involved in verifying and adding digital asset transactions to a blockchain ledger (e.g. digital asset mining), or that produce technology used in digital asset mining.

2. Blockchain & Digital Asset Transactions: Companies that operate trading platforms/exchanges, custodians, wallets, and/or payment gateways for digital assets.

3. Blockchain Applications: Companies involved in the development and distribution of applications and software services related to blockchain and digital asset technology, including smart contracts.

4. Blockchain & Digital Asset Hardware: Companies that manufacture and distribute infrastructure and/or hardware used in blockchain and digital asset activities.

5. Blockchain & Digital Asset Integration: Companies that provide engineering and consulting services specifically tied to the adoption and utilization of blockchain and digital asset technology.

Blockchain Companies also include U.S.-listed operating companies that directly own a material amount of digital assets.

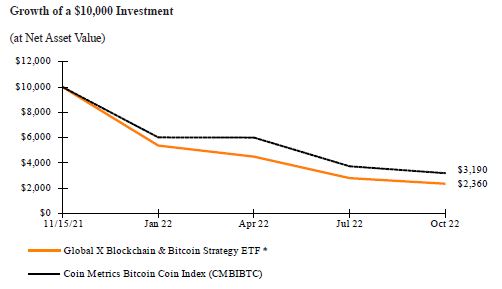

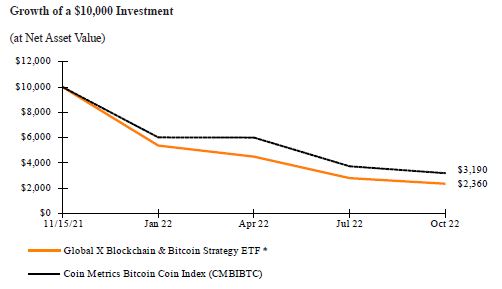

From the inception of the Fund to the period ended October 31, 2022 (the “reporting period”), the Fund decreased 76.40%. The Fund had a net asset value of $119.00 per share on November 15, 2021 and ended the reporting period with a net asset value of $27.56 per share on October 31, 2022.

The Fund’s allocations to blockchain equities and bitcoin futures both detracted. The Global X Blockchain ETF, which is approximately half of the Fund’s holdings, returned -82.8% in the reporting period. Bitcoin futures, the other half of the Fund, also saw negative returns; the CME Bitcoin Reference Rate, an index for bitcoin prices, fell by -66.5%. The Fund saw small positive returns from short-term Treasury securities that generated positive yield.

The Fund generated negative returns during the reporting period as a result of macroeconomic factors and industry-specific events. Macroeconomic factors such as rising inflation and tightening monetary

|

| Management Discussion of Fund Performance (unaudited) |

| Global X Blockchain & Bitcoin Strategy ETF |

policy by central banks put extreme pressure on cryptocurrencies as increased fears of an economic downturn caused investors to shift capital allocations to safer assets. These forces also destabilized a number entities involved in digital asset investing, including large hedge funds, lenders, and exchanges. The failures of these and related institutions have added to the pressure on digital assets by catalyzing forced selling of cryptocurrencies amid investor concerns. Declining cryptocurrency prices coupled with rising energy costs and increased difficulty in digital asset mining have reduced miner profits. In addition, a reduction in trading volume in digital assets negatively affected cryptocurrency exchanges, negatively impacting the Fund’s performance. However, President Biden signed an Executive Order focusing on key areas such as consumer protection, financial stability, illicit activity, U.S. competitiveness, financial inclusion, and responsible innovation to regulate and stabilize the cryptocurrency markets, which may be viewed as an acknowledgment by the U.S. government of the long-term potential of digital assets and its legitimacy as an asset class. Governments and corporations continue to increase their involvement and investments in digital assets, a sign of continued growth.

During the reporting period, the Fund had an average approximate stock exposure of 57.71% in the United States, 11.33% in Canada, 6.28% in China, and 3.75% in Germany. By sector, it had the highest exposure to Information Technology, at 48.59%, followed by Financials (17.34%), and Consumer Discretionary (1.92%). The remaining 31.91% of the Fund’s portfolio was held in the Global X Bitcoin Strategy Subsidiary I, a subsidiary organized in the Cayman Islands.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2022

|

| | Cumulative Inception to Date*

|

| | Net Asset Value | Market Price |

Global X Blockchain & Bitcoin Strategy ETF

| -76.40% | -76.47% |

Coin Metrics Bitcoin Coin Index (CMBIBTC)

| -68.10% | -68.10% |

|

| Management Discussion of Fund Performance (unaudited) |

| Global X Blockchain & Bitcoin Strategy ETF |

*Fund commenced operations on November 15, 2021.

The Coin Metrics Bitcoin Coin Index is designed to measure the performance an investor would expect from purchasing and holding Bitcoin.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index. Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

|

|

| Consolidated Schedule of Investments | October 31, 2022 |

| Global X Blockchain & Bitcoin Strategy ETF |

| | | Shares | | | Value | |

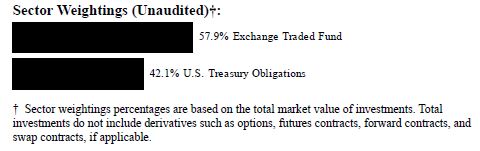

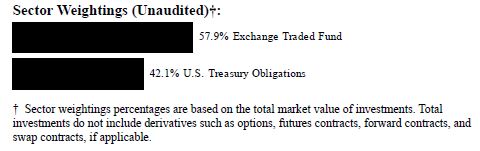

| EXCHANGE TRADED FUND — 49.2% | | | | | | |

| Global X Blockchain ETF(A) | | | | | | |

| | | 679,059 | | | $ | 3,965,705 | |

| | | Face Amount | | | | | |

| U.S. TREASURY OBLIGATIONS — 35.8% | | | | | | | | |

| U.S. Treasury Bills | | | | | | | | |

3.633%, 01/12/23^(B)

| | $ | 500,000 | | | | 496,055 | |

3.614%, 01/31/23^(B)

| | | 500,000 | | | | 494,919 | |

| 2.905%, 12/01/22(B)(C) | | | 900,000 | | | | 897,436 | |

2.772%, 11/08/22(B)

| | | 500,000 | | | | 499,732 | |

2.547%, 11/10/22(B)

| | | 500,000 | | | | 499,679 | |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | | | |

| (Cost $2,889,137) | | | | | | | 2,887,821 | |

| TOTAL INVESTMENTS — 85.0% | | | | | | | | |

| (Cost $15,186,380) | | | | | | $ | 6,853,526 | |

Percentages are based on Net Assets of $8,060,876.

A list of the futures contracts held by the Fund at October 31, 2022, is as follows:

| | | | | | | | | | | | | Unrealized | |

| | | Number of | | Expiration | | Notional | | | | | | Appreciation/ | |

| Type of Contract | | Contracts | | Date | | Amount | | | Value | | | (Depreciation) | |

| Long Contracts | | | | | | | | | | | | | |

| CME BITCOIN FUTURE^ | | | 39 | | Nov-2022 | | $ | 3,747,855 | | | $ | 3,974,100 | | | $ | 226,245 | |

| CME BITCOIN FUTURE^ | | | 1 | | Dec-2022 | | | 101,916 | | | | 101,825 | | | | (91 | ) |

| | | | | | | | $ | 3,849,771 | | | $ | 4,075,925 $ | | | $ | 226,154 | |

^ Security is held by the Global X Bitcoin Strategy Subsidiary I, as of October 31, 2022.

(A) Affiliated investment.

(B) Interest rate represents the security's effective yield at the time of purchase.

(C) Security, or a portion thereof, has been pledged as collateral on futures contracts.

ETF — Exchange Traded Fund

The accompanying notes are an integral part of the financial statements.

|

|

| Consolidated Schedule of Investments | October 31, 2022 |

| Global X Blockchain & Bitcoin Strategy ETF |

USD — U.S. Dollar

The following is a summary of the level of inputs used as of October 31, 2022, in valuing the Fund's investments and other financial instruments carried at value:

| Investments in Securities | Level 1 | | Level 2 | | Level 3 | | Total | |

| Exchange Traded Fund | | $ | 3,965,705 | | | $ | – | | | $ | – | | | $ | 3,965,705 | |

| U.S. Treasury Obligations | | | – | | | | 2,887,821 | | | | – | | | | 2,887,821 | |

| Total Investments in Securities | | $ | 3,965,705 | | | $ | 2,887,821 | | | $ | – | | | $ | 6,853,526 | |

| Other Financial Instruments | Level 1 | | Level 2 | | Level 3 | | Total | |

| Futures Contracts* | | | | | | | | | | | | | | | | |

| Unrealized Appreciation | | $ | 226,245 | | | $ | – | | | $ | – | | | $ | 226,245 | |

| Unrealized Depreciation | | | (91 | ) | | | – | | | | – | | | | (91

| )

|

| Total Other Financial Instruments | | $ | 226,154 | | | $ | – | | | $ | – | | | $ | 226,154 | |

* Futures contracts are valued at the unrealized appreciation/(depreciation) on the instrument.

The following is a summary of the transactions with affiliates for the period ended October 31, 2022:

| | | | Changes in | | | |

| | | | Unrealized | | | |

| | Purchases at | Proceeds from | Appreciation | Realized Gain | Value at | |

| Value at 11/15/21 | Cost | Sales | (Depreciation) | (Loss) | 10/31/22 | Income |

| Global X Blockchain ETF | | | | | |

| $ - | $12,297,243 | $ - | ($8,331,538) | $ - | $3,965,705 | $183,460 |

| Amounts designated as “—“ are $0 or have been rounded to $0. |

The accompanying notes are an integral part of the financial statements.

Consolidated Statement of Assets and Liabilities

October 31, 2022

| | | Global X Blockchain & Bitcoin Strategy ETF‡ | |

| Assets: | | | |

| Cost of Investments | | $ | 2,889,137 | |

| Cost of Affiliated Investments | | | 12,297,243 | |

| Investments, at Value | | $ | 2,887,821 | |

| Affiliated Investments, at Value | | | 3,965,705 | |

| Cash | | | 1,179,559 | |

| Receivable for Capital Shares Sold | | | 206,691 | |

| Dividend, Interest, and Securities Lending Income Receivable | | | 14,943 | |

| Total Assets | | | 8,254,719 | |

| Liabilities: | | | | |

| Payable for Investment Securities Purchased | | | 132,670 | |

| Payable for Variation Margin on Futures Contracts | | | 58,591 | |

| Payable due to Investment Adviser | | | 2,582 | |

| Total Liabilities | | | 193,843 | |

| Net Assets | | $ | 8,060,876 | |

| Net Assets Consist of: | | | | |

| Paid-in Capital | | $ | 16,155,145 | |

| Total Distributable Loss | | | (8,094,269 | ) |

| Net Assets | | $ | 8,060,876 | |

| Outstanding Shares of Beneficial Interest | | | | |

| (unlimited authorization — no par value) | | | 292,500 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 27.56 | |

| ‡ | The Outstanding Shares of Beneficial Interest and Net Asset Value, Offering and Redemption Price Per Share were updated to reflect the effect of a 1 for 4 reverse share split on December 19, 2022 (See Note 9 in the Consolidated Notes to Financial Statements). |

| The accompanying notes are an integral part of the financial statements. |

Consolidated Statement of Operations

For the period ended October 31, 2022

| | | Global X Blockchain & Bitcoin Strategy ETF‡ | |

| Investment Income: | | | |

| Dividend Income, from Affiliated Investments | | $ | 183,460 | |

| Interest Income | | | 31,064 | |

| Total Investment Income | | | 214,524 | |

Supervision and Administration Fees(1) | | | 53,351 | |

Custodian Fees(2) | | | 1 | |

| Total Expenses | | | 53,352 | |

| Net Investment Income | | | 161,172 | |

| Net Realized Gain (Loss) on: | | | | |

Investments(3) | | | (771 | ) |

| Futures Contracts | | | (5,993,259 | ) |

Contribution from Adviser(4) | | | 19,618 | |

| Net Realized Gain (Loss) | | | (5,974,412 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | |

| Investments | | | (1,316 | ) |

| Affiliated Investments | | | (8,331,538 | ) |

| Futures Contracts | | | 226,154 | |

| Net Change in Unrealized Appreciation (Depreciation) | | | (8,106,700 | ) |

| Net Realized and Unrealized Gain (Loss) | | | (14,081,112 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (13,919,940 | ) |

| ‡ | Commenced operations on November 15, 2021. |

| (1) | The Supervision and Administration fees reflect the supervisory and administrative fee, which includes fees paid by the Fund for the investment advisory services provided by the Adviser. (See Note 3 in the Consolidated Notes to Financial Statements.) |

| (2) | See Note 2 in the Consolidated Notes to Financial Statements. |

| (3) | See Note 5 in the Consolidated Notes to Financial Statements. |

| (4) | See Note 3 in the Consolidated Notes to Financial Statements. |

| The accompanying notes are an integral part of the financial statements. |

Consolidated Statement of Changes in Net Assets

| | | Global X Blockchain & Bitcoin Strategy ETF‡ | |

| | | Period Ended October 31, 2022(1) | |

| Operations: | | | |

| Net Investment Income | | $ | 161,172 | |

| Net Realized Gain (Loss) | | | (5,974,412 | ) |

| Net Change in Unrealized Appreciation (Depreciation) | | | (8,106,700 | ) |

| Net Decrease in Net Assets Resulting from Operations | | | (13,919,940 | ) |

| Distributions | | | (167,792 | ) |

| Capital Share Transactions: | | | | |

| Issued | | | 22,148,608 | |

| Increase in Net Assets from Capital Share Transactions | | | 22,148,608 | |

| Total Increase in Net Assets | | | 8,060,876 | |

| Net Assets: | | | | |

| Beginning of Period | | | — | |

| End of Period | | $ | 8,060,876 | |

| Share Transactions: | | | | |

| Issued | | | 292,500 | |

| Net Increase in Shares Outstanding from Share Transactions | | | 292,500 | |

| (1) | The Fund commenced operations on November 15, 2021. |

| ‡ | The Outstanding Shares of Beneficial Interest and Net Asset Value, Offering and Redemption Price Per Share were updated to reflect the effect of a 1 for 4 reverse share split on December 19, 2022 (See Note 9 in the Consolidated Notes to Financial Statements). |

Amount designated as “—” is $0.

| The accompanying notes are an integral part of the financial statements. |

| |

Consolidated Financial Highlights

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | | Net Asset Value, Beginning of Period ($) | | | Net Investment Income ($)* | | | Net Realized and Unrealized Loss on Investments ($) | | | Total from Operations ($) | | | Distribution from Net Investment Income ($) | | | Distribution from Capital Gains ($) | | | Return of Capital ($) | |

| Global X Blockchain & Bitcoin Strategy ETF | | | | | | | | | | | | | | | | | | | | | |

2022(1)(2) | | | 119.00 | | | | 0.80 | | | | (90.72 | ) | | | (89.92 | ) | | | (1.52 | ) | | | — | | | | — | |

| * | Per share data calculated using average shares method. |

| ** | Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| † | Annualized. |

| # | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds (See Note 3 in the Consolidated Notes to Financial Statements). |

| †† | Portfolio turnover rate is for the period indicated and periods of less than one year have not been annualized. Excludes effect of in-kind transfers. |

| (1) | The Fund commenced operations on November 15, 2021. |

| (2) | Per share amounts have been adjusted for a 1 for 4 reverse share split on December 19, 2022 (See Note 9 in the Consolidated Notes to Financial Statements). |

Amounts designated as “—” are either $0 or have been rounded to $0.

| The accompanying notes are an integral part of the financial statements. |

Consolidated Financial Highlights

| Total from Distributions ($) | | | Net Asset Value, End of Period ($) | | | Total Return (%)** | | | Net Assets End of Period ($)(000) | | | Ratio of Expenses to Average Net Assets (%) | | | Ratio of Net Investment Income to Average Net Assets (%) | | | Portfolio Turnover (%)†† | |

| | (1.52 | ) | | | 27.56 | | | | (76.40 | ) | | | 8,061 | | | | 0.65 | †# | | | 1.96 | † | | | 0.00 | |

| The accompanying notes are an integral part of the financial statements. |

|

| Consolidated Notes to Financial Statements |

| October 31, 2022 |

1. ORGANIZATION

The Global X Funds (the “Trust”) is a Delaware statutory trust formed on March 6, 2008. The Trust is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company. As of October 31, 2022, the Trust had one hundred and seven portfolios, ninety-seven of which were operational. The financial statements herein and the related notes pertain to the Global X Blockchain & Bitcoin Strategy ETF (the “Fund”). The Fund has elected non-diversified status under the 1940 Act.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Fund.

USE OF ESTIMATES – The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could materially differ from those estimates.

SECURITY VALUATION — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market ("NASDAQ")), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent mean between the quoted bid and asked prices, which approximates fair value (absent both bid and asked prices on such exchange, the bid price may be used).

For securities traded on NASDAQ, the NASDAQ official closing price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less will be valued at their market value. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates as of reporting date. The exchange rates used by the Trust for valuation are captured as of the New York or London close each day. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent,

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

third-party pricing agent, the Fund seeks to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures (the "Fair Value Procedures") established by Global X Management Company LLC, the Funds' investment adviser (the "Adviser"), and approved by the Fund's Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the "valuation designee" to determine the fair value of securities and other instruments for which no readily available market quotations are available. The Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”). Some of the more common reasons that may necessitate that a security be valued using the Fair Value Procedures include: the security's trading has been halted or suspended; the security has been de-listed from its primary trading exchange; the security's primary trading market is temporarily closed at a time when, under normal conditions, it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government imposed restrictions. In addition, the Fund may fair value a security if an event that may materially affect the value of the Fund’s security that traded outside of the United States (a “Significant Event”) has occurred between the Fund’s security, the time of the security's last close and the time that the Fund calculates its net asset value ("NAV"). A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If the Adviser becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates its NAV, it may request that a Committee meeting be called. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration all relevant information reasonably available to the Committee.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

Level 2 – Other significant observable inputs (including quoted prices in nonactive markets, quoted prices for similar investments, fair value of investments for which the Fund has the ability to fully redeem tranches at net asset value as of the measurement date or within the near term, and short-term investments valued at amortized cost); and

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments and fair value of investments for which the Fund does not have the ability to fully redeem tranches at NAV as of the measurement date or within the near term).

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement. For details of the investment classification, reference the Schedule of Investments.

The unobservable inputs used to determine fair value of Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

DUE TO/FROM BROKERS — Due to/from brokers includes cash and collateral balances with the Fund’s clearing brokers or counterparties at October 31, 2022. The Fund continuously monitors the credit standing of each broker or counterparty with whom it conducts business. In the event a broker or counterparty is unable to fulfill its obligations, the Fund would be subject to counterparty credit risk.

FEDERAL INCOME TAXES — It is the Fund’s intention to qualify, or continue to qualify, as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986 (the “Code”). Accordingly, no provisions for Federal income taxes have been made in the financial statements except as described below.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is "more-likely-than-not" (i.e., greater than 50 percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax positions in the current period; however, management’s conclusions regarding tax positions may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last three tax year ends, as applicable), and on-going analysis of and changes to tax laws and regulations, and interpretations thereof. If the Fund has foreign tax filings that have not been made, the tax years that remain subject to examination may date back to the inception of the Fund.

As of and during the reporting period ended October 31, 2022, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Consolidated Statement of Operations. During the reporting period, the Fund did not incur any interest or penalties.

SECURITY TRANSACTIONS AND INVESTMENT INCOME – Security transactions are accounted for on the trade date for financial reporting purposes. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from the settlement date. Amortization of premiums and accretion of discounts is included in interest income.

FOREIGN CURRENCY TRANSACTIONS AND TRANSLATION – The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Fund does not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Consolidated Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions and translations represent net foreign exchange gains or losses from foreign currency spot contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid.

FUTURES CONTRACTS – To the extent consistent with its investment objective and strategies, the Fund may use futures contracts for tactical hedging purposes as well as to enhance the Fund’s returns. Initial margin deposits of cash or securities are made upon entering into futures contracts. The contracts are marked to market daily and the resulting

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

changes in value are accounted for as unrealized gains and losses. Variation margin payments are paid or received, depending upon whether unrealized gains or losses are incurred. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the proceeds from (or cost of) the closing transaction and the amount invested in the contract.

Risks of entering into futures contracts include the possibility that there will be an imperfect price correlation between the futures and the underlying securities. Second, it is possible that a lack of liquidity for futures contracts could exist in the secondary market, resulting in an inability to close a position prior to its maturity date. Third, the futures contract involves the risk that the Fund could lose more than the original margin deposit required to initiate a futures transaction.

Futures contracts shall be valued at the settlement price established each day by the board of exchange on which they are traded. The daily settlement prices for financial futures are provided by an independent source.

Finally, the risk exists that losses could exceed amounts disclosed on the Consolidated Statement of Assets and Liabilities. Refer to the Fund’s Consolidated Schedule of Investments for details regarding open futures contracts as of October 31, 2022, if applicable.

The following tables show the derivatives categorized by underlying risk exposure.

The fair value of derivative instruments as of October 31, 2022 was as follows:

| | Asset Derivatives | | | | | | Liability Derivatives | | | | |

| | Consolidated | | | | | | Consolidated | | | | |

| | Statement of Assets and | | | | | | Statement of Assets and | | | | |

| | Liabilities Location | | Fair Value | | | | Liabilities Location | | | Fair Value | |

Derivatives not accounted for as hedging instruments

| | | | | | | | | | | |

| | | | | | | | | | | | |

Global X Blockchain & Bitcoin Strategy ETF

| | | | | | | | | | | |

Commodity

| Unrealized appreciation

| $

| 226,245

| † | | Commodity

| Unrealized depreciation

| | $

| 91

| † |

contracts

| on Future Contracts

| $ | 226,245 | | | contracts

| on Future Contracts

| | $ | 91 | |

† Includes cumulative appreciation/depreciation of futures contracts as reported in the Consolidated Schedule of Investments. Only current day’s variation margin is reported within the Consolidated Statement of Assets & Liabilities.

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The effect of derivative instruments on the Consolidated Statement of Operations for the period ended October 31, 2022:

Amount of realized gain or (loss) on derivatives recognized in income:

| | | Futures | | | | |

| | | Contracts | | | Total | |

| Global X Blockchain & Bitcoin Strategy ETF | | | | | | |

| Commodity contracts | | $ | (5,993,259 | ) | | $ | (5,993,259 | ) |

Change in unrealized appreciation or (depreciation) on derivatives recognized in income:

| | | Futures | | | | |

| | | Contracts | | | Total | |

| Global X Blockchain & Bitcoin Strategy ETF | | | | | | |

| Commodity contracts | | $ | 226,154 $ | | | $ | 226,154 | |

For the period ended October 31, 2022, the monthly average cost of the futures contracts held by the Fund were as follows:

| | | Short Average | | | Long Average | |

| Global X Blockchain & Bitcoin Strategy ETF | | $ | – | | | $ | 4,503,133 | |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS – The Fund distributes its net investment income on a pro rata basis. Any net investment income and net realized capital gains are distributed at least annually. All distributions are recorded on ex-dividend date.

CREATION UNITS – The Fund issues and redeems its shares (“Shares���) on a continuous basis at NAV and only in large blocks of 10,000 Shares, referred to as “Creation Units”. Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an Authorized Participant on the same day.

An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard redemption fee per transaction to Brown Brothers Harriman & Co. ("BBH"), on the date of such redemption, regardless of the number of Creation Units redeemed that day.

If a Creation Unit is purchased or redeemed for cash, an additional variable fee may be charged. The following table discloses Creation Unit breakdown:

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

| | | | | | Value at | | |

| | Creation Unit | | Creation | | October | | Redemption |

| | Shares | | Fee | | 31, 2022 | | Fee |

Global X Blockchain & Bitcoin Strategy ETF

| 10,000

| | $ | 50 | | $

| 275,600 | | $ | 50 |

CASH OVERDRAFT CHARGES – Per the terms of an agreement with BBH, if the Fund has a cash overdraft on a given day, it will be assessed an overdraft charge of LIBOR plus 2.00%. Cash overdraft charges are included in custodian fees on the Consolidated Statement of Operations.

3. RELATED PARTIES AND SERVICE PROVIDER TRANSACTIONS

On July 2, 2018, the Adviser consummated a transaction pursuant to which it became an indirect, wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae”). In this manner, the Adviser is ultimately controlled by Mirae, which is a leading financial services company in Korea and is the headquarters for the Mirae Asset Global Investments Group.

The Adviser serves as the investment adviser and the administrator for the Fund. Subject to the supervision of the Board, the Adviser is responsible for managing the investment activities of the Fund and the Fund’s business affairs and other administrative matters and provides or causes to be furnished all supervisory, administrative and other services reasonably necessary for the operation of the Fund, including certain distribution services (provided pursuant to a separate distribution agreement), certain shareholder and distribution-related services (provided pursuant to a separate Rule 12b-1 Plan and related agreements) and investment advisory services (provided pursuant to a separate investment advisory agreement), under what is essentially an "all-in" fee structure. For the Adviser’s services to the Fund, under a supervision and administration agreement (the "Supervision and Administration Agreement"), the Fund pays a monthly fee to the Adviser at the annual rate (stated as a percentage of the average daily net assets of the Fund) (“Supervision and Administration Fee”). In addition, the Fund bears other expenses that are not covered by the Supervision and Administration Agreement, which may vary and affect the total expense ratios of the Fund, such as taxes, brokerage fees, commissions, acquired fund fees, other transaction expenses, interest expenses and extraordinary expenses (such as litigation and indemnification expenses).

The Supervision and Administration Agreement for the Fund provides that the Adviser also bears the costs for acquired fund fees and expenses generated by investments by the Global X Blockchain & Bitcoin Strategy ETF in affiliated investment companies. For the period ended October 31, 2022, the Adviser paid acquired fund fees and expenses of $19,618, and made such reimbursement payments to the Global X Blockchain & Bitcoin Strategy

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

3. RELATED PARTIES AND SERVICE PROVIDER TRANSACTIONS (continued)

ETF on a monthly basis. These amounts are included in Contribution from Adviser on the Consolidated Statement of Operations.

The following table discloses supervision and administration fees payable pursuant to the Supervision and Administration Agreement:

| | | Supervision and |

| | | Administration Fee |

| Global X Blockchain & Bitcoin Strategy ETF | | 0.65% |

SEI Investments Global Funds Services (“SEIGFS”) serves as sub-administrator to the Fund.As sub-administrator, SEIGFS provides the Fund with required general administrative services, including, without limitation: office space, equipment, and personnel; clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and assistance with the preparation and filing of reports, registration statements, proxy statements, and other materials required to be filed or furnished by the Fund under federal and state securities laws. As compensation for these services, SEIGFS receives certain out-of-pocket costs, transaction fees, and asset-based fees which are accrued daily and paid monthly by the Adviser.

SEI Investments Distribution Co. (“SIDCO”) serves as the Fund’s underwriter and distributor of Creation Units pursuant to a distribution agreement. SIDCO has no obligation to sell any specific quantity of Fund Shares.

SIDCO bears the following costs and expenses relating to the distribution of Shares: (1) the costs of processing and maintaining records of creations of Creation Units; (2) all costs of maintaining the records required of a registered broker/dealer; (3) the expenses of maintaining its registration or qualification as a dealer or broker under federal or state laws; (4) filing fees; and (5) all other expenses incurred in connection with the distribution services as contemplated in the distribution agreement. SIDCO receives no fee from the Fund for its distribution services under the distribution agreement, rather, the Adviser compensates SIDCO for certain expenses, out-of-pocket costs, and transaction fees.

BBH serves as custodian and transfer agent of the Fund’s assets. As custodian, BBH has agreed to (1) make receipts and disbursements of money on behalf of the Fund; (2) collect and receive all income and other payments and distributions on account of the Fund’s portfolio investments; (3) respond to correspondence from shareholders, security brokers and others relating to its duties; and (4) make periodic reports to the Fund concerning the Fund’s operations. BBH does not exercise any supervisory function over the purchase and sale of securities. As transfer agent, BBH has agreed to (1) issue and redeem Shares of the Fund; (2) make dividend and other distributions to shareholders of the Fund; (3) respond to correspondence by shareholders and others relating to its duties; (4) maintain shareholder accounts; and (5) make periodic reports to the Fund. As compensation for these services,

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

3. RELATED PARTIES AND SERVICE PROVIDER TRANSACTIONS (continued)

BBH receives certain out-of-pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser from its fees.

4. BASIS FOR CONSOLIDATION FOR THE GLOBAL X BITCOIN STRATEGY SUBSIDIARY I

The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statement of Changes in Net Assets, and the Consolidated Financial Highlights of the Global X Blockchain & Bitcoin Strategy ETF include the accounts of the Fund’s wholly-owned Subsidiary. All intercompany accounts and transactions have been eliminated in consolidation for the Fund. The Global X Bitcoin Strategy Subsidiary I (the "Subsidiary") has a fiscal year end and conforming tax year end of October 31 for financial statement consolidation purposes.

The Subsidiary is classified as controlled foreign corporation under the Code. The Subsidiary’s taxable income is included in the calculation of the relevant Fund’s taxable income. Net losses of the Subsidiary are not deductible by the Fund either in the current period or carried forward to future periods.

The Fund may invest up to 25% of its total assets in the Subsidiary.

A summary of the Fund’s investments in the Subsidiary are as follows:

| | | | Subsidiary Net | | % of Total Net |

| | Inception Date of | | Assets at | | Assets at |

| | Subsidiary | | October 31, 2022 | | October 31, 2022 |

GLOBAL X BITCOIN STRATEGY SUBSIDIARY I

| November 15, 2021 | | $1,631,316 | | 20.2% |

Gains and losses attributed to the Fund’s investments in the Subsidiary are as follows:

| | | Global X

| |

| | | Bitcoin Strategy | |

| | | Subsidiary I | |

| Investment Income: | | | |

| Interest Income | | $ | 12,335 | |

| Net Investment Income | | | 12,335 | |

| Net Realized Loss on: | | | | |

| Investments | | | (204 | ) |

| Futures Contracts | | | (5,993,259 | ) |

| Net Realized Loss | | | (5,993,463 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | |

| Investments | | | (911 | ) |

| Futures Contracts | | | 226,154 | |

| Net Change in Unrealized Appreciation (Depreciation) | | | 225,243 | |

| Net Realized and Unrealized Gain Loss | | | (5,768,220 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (5,755,885 | ) |

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

5. INVESTMENT TRANSACTIONS

For the period ended October 31, 2022, the purchases and sales of investments in securities excluding in-kind transactions, long-term U.S. Government, and short-term securities, were:

| | | | |

|

| | | | | | Sales and |

| | | Purchases | | | Maturities |

| Global X Blockchain & Bitcoin Strategy ETF | | $ | 6,894,419 | | $

| – |

During the period ended October 31, 2022, there were no purchases or sales of long-term U.S. Government securities for the Fund.

For the period ended October 31, 2022, in-kind transactions associated with creations and redemptions were:

| | | | | | | |

| |

| | | | | | Sales and | | | Realized | |

| 2022 | | Purchases | | | Maturities | | | Gain/(Loss) | |

| Global X Blockchain & Bitcoin Strategy ETF | | $ | 5,402,824 | | | $ | – | | | $ | – | |

6. TAX INFORMATION

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income (loss), accumulated net realized gain (loss) or paid-in capital, as appropriate, in the period that the differences arise.

The following difference, primarily attributable to CFC’s capital loss, has been reclassified to/from the following accounts during the fiscal year ended October 31, 2022:

| | | | |

| |

| | | | | | Distributable | |

| | | Paid-in | | | Earnings | |

| Global X Fund | | Capital | | | (Loss) | |

| Global X Blockchain & Bitcoin Strategy ETF | | $ | (5,993,463 | ) | | $ | 5,993,463 | |

These reclassifications have no impact on net assets or NAV per share.

The tax character of dividends and distributions declared during the period ended October 31, 2022 was as follows:

| Global X Fund | | Ordinary Income | | | Long-Term Capital Gain | | | Return of Capital | | | Totals | |

Global X Blockchain & Bitcoin Strategy ETF

| | | | | | | | | | | | |

2022

| | $ | 167,792 | | | $ | – | | | $ | – | | | $ | 167,792 | |

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

6. TAX INFORMATION (continued)

As of October 31, 2022, the components of tax basis accumulated losses were as follows:

| | | | |

| | | Global X Fund

| |

| | | Global X

| |

| | | Blockchain &

| |

| | | Bitcoin Strategy

| |

| | | ETF | |

| Undistributed Ordinary Income | | $ | 10,429 | |

| Capital Loss Carryforwards | | | (567 | ) |

| Unrealized Depreciation on Investments | | | (8,104,132 | ) |

| Other Temporary Differences | | | 1 | |

| Total Accumulated Losses | | $ | (8,094,269 | ) |

For taxable years beginning after December 22, 2010, a Registered Investment Company within the meaning of the 1940 Act is permitted to carry forward net capital losses to offset capital gains realized in later years, and the losses carried forward retain their original character as either long-term or short-term losses. Losses carried forward under these provisions are as follows:

| | | Short-Term | | | Long-Term | | | |

| | | Loss | | | Loss | | | Total |

| Global X Blockchain & Bitcoin Strategy ETF | | $ | 567 | | | $ | – | | | $ | 567 |

The Federal tax cost and aggregate gross unrealized appreciation and depreciation on investments held by the Fund at October 31, 2022 were as follows:

| | | | Aggregated | | Aggregated | | |

| | | | Gross | | Gross | | Net |

| | Federal Tax | | Unrealized | | Unrealized | | Unrealized |

| Global X Fund | Cost | | Appreciation | | Depreciation | | Depreciation |

| Global X Blockchain & Bitcoin Strategy ETF | $ | 14,957,658 | | $ | – | | $ | (8,104,132) | | $ | (8,104,132) |

The preceding differences between book and tax cost are primarily due to investment a controlled foreign subsidiary.

7. CONCENTRATION OF RISKS

Bitcoin is a relatively new asset with a limited history. It is subject to unique and substantial risks, and historically has been a highly speculative asset and has experienced significant price volatility. While the Fund will not invest directly in bitcoin, the value of the Fund’s investments in Bitcoin Futures and bitcoin funds is subject to fluctuations in the value of bitcoin, which may be highly volatile. The value of bitcoin is determined by supply

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

7. CONCENTRATION OF RISKS (continued)

and demand in the global market, which consists primarily of transactions of bitcoin on electronic exchanges (“Bitcoin Exchanges”). Pricing on Bitcoin Exchanges and/or other venues could drop precipitously for a variety of reasons, including, but not limited to, regulatory changes, a crisis of confidence, a flaw or operational issue in the bitcoin network (a network on which users may exchange bitcoin directly with one another (the "Bitcoin Network")), or users preferring competing digital assets and cryptocurrencies. The further development of bitcoin as an asset and the growing acceptance and use of bitcoin in the marketplace are subject to a variety of factors that are difficult to evaluate. Currently, there is relatively limited use of bitcoin in the retail and commercial marketplace, which contributes to price volatility. A lack of expansion, or a contraction in the use of bitcoin, may result in increased volatility in its value. Legal or regulatory changes may negatively impact the operation of the Bitcoin Network or its protocols or restrict the ability to use bitcoin. Additionally, bitcoin transactions are irrevocable, and therefore stolen or incorrectly transferred bitcoin may be irretrievable. The realization of any of these risks could result in a decline in the acceptance of bitcoin and consequently a reduction in the value of bitcoin, Bitcoin Futures, and the Fund. Bitcoin is also subject to the risk of fraud, theft and manipulation, as well as security failures and operational or other problems that impact bitcoin trading venues. Unlike the exchanges utilized by traditional assets, such as equity and bond securities, Bitcoin Exchanges are largely unregulated. As a result, individuals or groups may engage in fraud and investors in bitcoin may be more exposed to the risk of theft and market manipulation than when investing in more traditional asset classes. Investors in bitcoin may have little or no recourse should such theft, fraud or manipulation occur and could suffer significant losses, which could ultimately impact bitcoin utilization, the price of bitcoin and the value of Fund investments with indirect exposure to bitcoin. Additionally, if one or a coordinated group of miners were to gain control of 51% or more of the Bitcoin Network, they would have the ability to manipulate transactions, halt payments and fraudulently obtain bitcoin. A significant portion of bitcoin is held by a small number of holders, who may have the ability to manipulate the price of bitcoin. In addition, Bitcoin Exchanges are subject to the risk of cybersecurity threats and breach, which has occurred in the past and resulted in the theft and/or loss of digital assets, including bitcoin. A risk also exists with respect to malicious actors or previously unknown vulnerabilities in the Bitcoin Network or its protocols, which may adversely affect the value of bitcoin. Shares of some bitcoin funds in which the Fund invests may trade at a premium or discount to the net asset value of the bitcoin fund itself.

Blockchain companies may be adversely impacted by government regulations or economic conditions. Blockchain technology is new and its uses are in many cases untested or unclear. These companies may also have significant exposure to fluctuations in the spot prices of digital assets, particularly to the extent that demand for a company’s hardware or services may increase as the spot price of digital assets increase. Blockchain companies typically face intense competition and potentially rapid product obsolescence. In addition, many Blockchain companies store sensitive consumer information and could be the target

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

7. CONCENTRATION OF RISKS (continued)

of cybersecurity attacks and other types of theft, which could have a negative impact on these companies. Access to a given blockchain may require a specific cryptographic key (in effect a string of characters granting unique access to initiate transactions related to specific digital assets) or set of keys, the theft, loss, or destruction of which, either by accident or as a result of the efforts of a third party, could irrevocably impair a claim to the digital assets stored on that blockchain.

Many Blockchain companies currently operate under less regulatory scrutiny than traditional financial services companies and banks, but there is significant risk that regulatory oversight could increase in the future. For example, companies that operate trading platforms and/or exchanges may face heightened regulatory risks associated with their operations. The U.S. Securities and Exchange Commission (the "SEC") has made several public statements indicating that some cryptocurrency exchanges may be operating as unregistered securities exchanges in violation of applicable regulations. In August 2021, the SEC settled charges with Poloniex for selling digital asset securities between 2017 and 2019 without registering as a national securities exchange. Higher levels of regulation could increase costs and adversely impact the current business models of some Blockchain companies and could even result in the outright prohibition of certain business activities. For example, on September 24, 2021, multiple Chinese regulators issued prohibitions on all cryptocurrency transactions and mining. Any further restrictions imposed by governments (including China or the U.S.) on crypto-currency related activities may adversely impact Blockchain Companies, and in turn the Fund. Blockchain companies could be negatively impacted by disruptions in service caused by hardware or software failure, or by interruptions or delays in service by third-party data center hosting facilities and maintenance providers. Blockchain companies involved in digital assets may face slow adoption rates and be subject to higher levels of regulatory scrutiny in the future, which could severely impact their viability. Blockchain companies, especially smaller companies, tend to be more volatile than companies that do not rely heavily on technology. The customers and/or suppliers of Blockchain companies may be concentrated in a particular country, region or industry. Any adverse event affecting one of these countries, regions or industries could have a negative impact on Blockchain companies.

Cryptocurrency (notably, bitcoin), often referred to as “virtual currency” or “digital currency,” operates as a decentralized, peer-to-peer financial exchange and value storage that is used like money. The Fund will have exposure to bitcoin, indirectly through investment in Bitcoin Futures, and individual Blockchain Companies held by the Fund may have exposure to cryptocurrencies, including cryptocurrencies other than bitcoin. Cryptocurrencies operate without central authority or banks and are not backed by any government. Cryptocurrencies may experience very high volatility, and related investment vehicles that invest in cryptocurrencies may be affected by such volatility. Cryptocurrency is not legal tender. Federal, state or foreign governments may restrict the use and exchange of cryptocurrency, and regulation in the U.S. is still developing.

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

7. CONCENTRATION OF RISKS (continued)

Some cryptocurrency have stopped operating and have permanently shut down due to fraud, technical glitches, hackers or malware. Cryptocurrency exchanges are new, largely unregulated, and may be more exposed to fraud.

A futures contract may generally be described as an agreement for the future sale by one party and the purchase by another of a specified security or instrument at a specified price and time. The risks of futures contracts include but are not limited to: (1) the Adviser’s ability to predict movements in the prices of individual currencies or securities, fluctuations in markets and movements in interest rates; (2) an imperfect or no correlation between the changes in market value of the currencies or securities and the prices of futures contracts; and (3) no guarantee that an active market will exist for the contracts at any particular time. Trading in the cash bitcoin market remains difficult as compared to more traditional cash markets, and in particular, short selling bitcoin remains challenging and costly. As a result of these features of the bitcoin cash market, market makers and arbitrageurs may not be as willing to participate in the Bitcoin Futures market as they are in other futures markets. Each of these factors may increase the likelihood that the price of Bitcoin Futures will be volatile and/or will deviate from the price of bitcoin. Bitcoin Futures may experience significant price volatility. Exchange-specified collateral for Bitcoin Futures is substantially higher than for most other futures contracts, and collateral may be set as a percentage of the value of the contract, which means that collateral requirements for long positions can increase if the price of the contract rises. In addition, futures commission merchants (“FCMs”) may require collateral beyond the exchange’s minimum requirement. FCMs may also restrict trading activity in Bitcoin Futures by imposing position limits, prohibiting short selling of Bitcoin Futures or prohibiting trades where the executing broker places a trade on behalf of another broker (so-called “give-up transactions”). Although the Fund will only take long positions in Bitcoin Futures, restrictions on the ability of certain market participants to take short Bitcoin Futures positions may ultimately constrain the Fund’s ability to take long positions in Bitcoin Futures or may impact the price at which the Fund is able to take such positions. Bitcoin Futures are subject to daily limits that may impede a market participant’s ability to exit a position during a period of high volatility.

The Fund may invest in securities of foreign issuers in various countries. These investments may involve certain considerations and risks not typically associated with investments in the United States as a result of, among other factors, the possibility of future political and economic developments, the level of governmental supervision and regulation of securities markets in the respective countries.

The securities markets of emerging countries are less liquid, subject to greater price volatility, and have a smaller market capitalization than those of U.S. securities markets. In certain countries, there may be fewer publicly traded securities and the market may be dominated by a few issuers or sectors. Issuers and securities markets in such countries are not subject to as extensive and frequent accounting, financial and other reporting

|

| Consolidated Notes to Financial Statements (Continued) |

| October 31, 2022 |

7. CONCENTRATION OF RISKS (continued)

requirements or as comprehensive government regulations as are issuers and securities markets in the United States. In particular, the assets and profits appearing on the financial statements of emerging country issuers may not reflect their financial position or results of operations in the same manner as financial statements for U.S. issuers. Substantially less information may be publicly available about emerging country issuers than is available about issuers in the United States.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned.

The elimination of the London Inter-Bank Offered Rate (“LIBOR”) may adversely affect the interest rates on, and value of, certain Fund investments for which the value is tied to LIBOR. The U.K. Financial Conduct Authority has announced that it intends to stop compelling or inducing banks to submit LIBOR rates after 2021. On March 5, 2021, the administrator of LIBOR clarified that the publication of LIBOR on a representative basis will cease for the one-week and two-month U.S. dollar LIBOR settings immediately after December 31, 2021, and for the remaining U.S. dollar LIBOR settings immediately after June 30, 2023. Alternatives to LIBOR are established or in development in most major currencies, including the Secured Overnight Financing Rate (“SOFR”), which is intended to replace U.S. dollar LIBOR. Markets are slowly developing in response to these new rates. Questions regarding the impact of this transition remain a concern for the Fund. Accordingly, it is difficult to predict the full impact of the transition away from LIBOR on the Fund until new reference rates and fallbacks for both legacy and new products, instruments and contracts are commercially accepted.

Please refer to the Fund's prospectus and statement of additional information for a more complete description of risks.

8. CONTRACTUAL OBLIGATION

The Fund enters into contracts in the normal course of business that contain a variety of indemnifications. The Fund’s maximum exposure under these contracts is unknown; however, the Fund has not had prior gains or losses pursuant to these contracts. Management has reviewed the Fund’s existing contracts and expects the risk of loss to be remote.

Pursuant to the Trust’s organizational documents, the Trustees of the Trust (the “Trustees”) and the Trust’s officers are indemnified against certain liabilities that may arise out of the performance of their duties.

|

| Consolidated Notes to Financial Statements (Concluded) |

| October 31, 2022 |

9. SUBSEQUENT EVENTS

The Board approved a reverse share split of one to four (1:4) of the issued and outstanding shares of the Fund, (the "Reverse Share Split"). The Reverse Share Split was completed after the close of business on December 19, 2022. The effect of this transaction for the Fund was to divide the number of outstanding shares of the Fund by four, resulting in a corresponding increase in the NAV per Share. The capital share activity presented on the Consolidated Statement of Changes in Net Assets for the period ended, and the per share data in the Consolidated Financial Highlights for the period then ended, have been given retroactive effect to reflect this reverse share split. There were no changes in net assets, results of operations or total return as a result of this transaction.

The Fund has been evaluated by management regarding the need for additional disclosures (other than what is disclosed in the preceding paragraph) and/or adjustments resulting from subsequent events. Based on this evaluation, no additional adjustments were required to the financial statements.

|

| Report of Independent Registered Public Accounting Firm |

To the Board of Trustees of Global X Funds and Shareholders of Global X Blockchain & Bitcoin Strategy ETF

Opinions on the Financial Statements

We have audited the accompanying consolidated statement of assets and liabilities, including the consolidated schedule of investments, of Global X Blockchain & Bitcoin Strategy ETF and its subsidiary (one of the funds constituting Global X Funds, referred to hereafter as the "Fund") as of October 31, 2022, the related consolidated statements of operations and of changes in net assets, including the related notes, and the consolidated financial highlights for the period November 15, 2021 (commencement of operations) through October 31, 2022 (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2022, and the results of its operations, changes in its net assets, and the financial highlights for the period November 15, 2021 (commencement of operations) through October 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinions

These consolidated financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. Our procedures included confirmation of securities owned as of

|

| Report of Independent Registered Public Accounting Firm |

October 31, 2022 by correspondence with the custodian, transfer agent and brokers. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 29, 2022

We have served as the auditor of one or more investment companies in Global X Funds since 2016.

|

| Disclosure of Fund Expenses (Unaudited) |

ETFs (such as the Fund) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF management, administrative services, brokerage fees, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns. In addition, a shareholder is responsible for brokerage fees as a result of the shareholder’s investment in the Fund.

Operating expenses such as these are deducted from the Fund’s gross income and directly reduce your final investment return. These expenses are expressed as a percentage of the Fund’s average net assets; this percentage is known as the Fund’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period from May 1, 2022 through October 31, 2022.

The table on the next page illustrates your Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 =8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

|

| Disclosure of Fund Expenses (Unaudited) (Concluded) |

| | | | | | | | | | |

| |

| | | | | | Ending | | | | | | | |

| | | Beginning | | | Account | | | Annualized | | | Expenses | |

| | | Account Value | | | Value | | | Expense | | | Paid During | |

| | | 5/1/2022 | | | 10/31/2022 | | | Ratios | | | Period(1) | |

| Global X Blockchain & Bitcoin Strategy ETF | | | | | | | | | | |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 525.10 | | | | 0.65 | % | | $ | 2.50 | |

| Hypothetical 5% Return | | | 1,000.00 | | | | 1,021.93 | | | | 0.65 | | | | 3.31 | |

(1) Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

| Liquidity Risk Management Program (UNAUDITED) |

Pursuant to Rule 22e-4 under the 1940 Act, the Fund’s investment adviser has adopted, and the Board has approved, a liquidity risk management program (the “Program”) to govern each fund of the Trust's (each, a "Fund" and collectively, the "Funds") approach to managing liquidity risk. The Program is overseen by the Funds’ Liquidity Risk Management Committee (the “Committee”), and the Program’s principal objectives include assessing, managing and periodically reviewing each Fund’s liquidity risk, based on factors specific to the circumstances of the Funds.

At a meeting of the Board held on May 20, 2022, the Trustees received a report from the Committee addressing the operations of the Program and assessing its adequacy and effectiveness of implementation for the period from January 1, 2021 through December 31, 2021. The Committee’s report noted that the Committee had determined that the Program is reasonably designed to assess and manage each Fund’s Liquidity Risk and operated adequately and effectively to manage each Fund’s Liquidity Risk for the period covered by the report. The Committee’s report noted that during the period covered by the report, there were no liquidity events that impacted the Funds or their ability to timely meet redemptions without dilution to existing shareholders. The Committee’s report noted that one Fund, the Global X Nigeria Fund, was classified as an In-Kind Fund for purposes of Liquidity Reporting. The Committee’s report noted that no other material changes have been made to the Program since its implementation.

There can be no assurance that the Program will achieve its objectives in the future. Please refer to the prospectus for more information regarding a Fund’s exposure to liquidity risk and other principal risks to which an investment in the Funds may be subject.

|

| Supplemental Information (UNAUDITED) |

NAV is the price per Share at which the Fund issues and redeems Shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Fund generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. The Fund’s Market Price may be at, above or below its NAV. The NAV of Fund will fluctuate with changes in the market value of the Fund’s holdings. The Market Price of the Fund will fluctuate in accordance with changes in its NAV, as well as market supply and demand.

Premiums or discounts are the differences (expressed as a percentage) between the NAV and Market Price of the Fund on a given day, generally at the time NAV is calculated. A premium is the amount that the Fund is trading above the reported NAV, expressed as a percentage of the NAV. A discount is the amount that the Fund is trading below the reported NAV, expressed as a percentage of the NAV.

Further information regarding premiums and discounts is available on the Fund’s website at www.globalxetfs.com.

|

| Trustees and Officers of the Trust (UNAUDITED) |