UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSRS

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

________

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Luis Berruga

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

Global X Management Company LLC 605 Third Avenue, 43rd floor New York, NY 10158 | Eric S. Purple, Esq. Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, DC 20006-1871 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2023

Date of reporting period: April 30, 2023

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

(b) Not applicable.

Global X Silver Miners ETF (ticker: SIL)

Global X Copper Miners ETF (ticker: COPX)

Global X Gold Explorers ETF (ticker: GOEX)

Global X Uranium ETF (ticker: URA)

Semi-Annual Report

April 30, 2023

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’(defined below) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Funds’website (www. globalxetfs.com/explore), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

|

|

| Schedules of Investments | |

| Global X Silver Miners ETF | 1 |

| Global X Copper Miners ETF | 4 |

| Global X Gold Explorers ETF | 8 |

| Global X Uranium ETF | 12 |

| Glossary | 17 |

| Statements of Assets and Liabilities | 18 |

| Statements of Operations | 20 |

| Statements of Changes in Net Assets | 22 |

| Financial Highlights | 25 |

| Notes to Financial Statements | 29 |

| Disclosure of Fund Expenses | 43 |

| Approval of Investment Advisory Agreement | 45 |

| Supplemental Information | 49 |

Shares are bought and sold at market price (not net asset value (“NAV”)) and are not individually redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/ redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “SEC” or “Commission”) for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’Forms N-PORT are available on the Commission’s website at https://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-493-8631; and (ii) on the Commission’s website at https://www.sec.gov.

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Silver Miners ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — 99.9% | | | | | | |

| AUSTRALIA — 0.9% | | | | | | |

| Materials — 0.9% | | | | | | |

| Kingsgate Consolidated * (A) | | | 4,929,298 | | | $ | 4,593,121 | |

| Silver Mines * (A) | | | 32,662,870 | | | | 4,748,765 | |

| TOTAL AUSTRALIA | | | | | | | 9,341,886 | |

| BOSNIA AND HERZEGOVINA — 1.7% | | | | | | | | |

| Materials — 1.7% | | | | | | | | |

| Adriatic Metals, Cl CDI * (A) | | | 6,959,836 | | | | 16,741,874 | |

| BRAZIL — 23.5% | | | | | | | | |

| Materials — 23.5% | | | | | | | | |

| Wheaton Precious Metals (A) | | | 4,785,196 | | | | 236,292,978 | |

| CANADA — 44.2% | | | | | | | | |

| Materials — 44.2% | | | | | | | | |

| AbraSilver Resource * | | | 10,497,161 | | | | 2,631,449 | |

| Americas Gold & Silver * (A) | | | 5,041,061 | | | | 2,527,407 | |

| Aya Gold & Silver * (A) | | | 2,260,890 | | | | 17,969,767 | |

| Blackrock Silver * (A) | | | 4,188,330 | | | | 1,003,618 | |

| Discovery Silver * (A) | | | 6,350,495 | | | | 4,963,153 | |

| Dolly Varden Silver * | | | 2,765,528 | | | | 2,202,146 | |

| Endeavour Silver * (A) | | | 4,778,973 | | | | 18,637,995 | |

| First Majestic Silver (A) | | | 6,587,219 | | | | 46,479,161 | |

| Fortuna Silver Mines * (A) | | | 7,280,778 | | | | 27,270,038 | |

| GoGold Resources * (A) | | | 6,884,595 | | | | 8,984,541 | |

| Guanajuato Silver * | | | 5,753,004 | | | | 2,417,763 | |

| MAG Silver * | | | 2,496,114 | | | | 32,427,581 | |

| McEwen Mining * (A) | | | 990,355 | | | | 8,120,911 | |

| New Pacific Metals * (A) | | | 2,117,489 | | | | 5,152,041 | |

| Pan American Silver | | | 7,983,717 | | | | 142,190,000 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Silver Miners ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| Materials — continued | | | | | | |

| Prime Mining * (A) | | | 2,242,064 | | | $ | 3,669,824 | |

| Santacruz Silver Mining * (A) | | | 7,871,806 | | | | 2,089,398 | |

| Silvercorp Metals (A) | | | 4,290,942 | | | | 15,692,009 | |

| SilverCrest Metals * (A) | | | 3,588,038 | | | | 23,465,234 | |

| SSR Mining (A) | | | 3,253,497 | | | | 46,590,077 | |

Triple Flag Precious Metals

| | | 1,564,850 | | | | 25,278,967 | |

| Vizsla Silver * (A) | | | 3,939,539 | | | | 5,664,013 | |

| TOTAL CANADA | | | | | | | 445,427,093 | |

| MEXICO — 9.1% | | | | | | | | |

| Materials — 9.1% | | | | | | | | |

Fresnillo

| | | 4,527,040 | | | | 40,478,831 | |

| Industrias Penoles * | | | 3,326,042 | | | | 50,942,521 | |

| TOTAL MEXICO | | | | | | | 91,421,352 | |

| PERU — 5.0% | | | | | | | | |

| Materials — 5.0% | | | | | | | | |

| Cia de Minas Buenaventura SAA ADR (A) | | | 6,181,891 | | | | 43,705,969 | |

| Hochschild Mining | | | 7,995,640 | | | | 7,220,708 | |

| TOTAL PERU | | | | | | | 50,926,677 | |

| SOUTH KOREA — 4.6% | | | | | | | | |

| Materials — 4.6% | | | | | | | | |

| Korea Zinc . | | | 121,995 | | | | 46,759,889 | |

| UNITED STATES — 10.9% | | | | | | | | |

| Materials — 10.9% | | | | | | | | |

| Coeur Mining * | | | 7,380,439 | | | | 25,093,492 | |

| Gatos Silver * (A) | | | 1,181,203 | | | | 7,051,782 | |

| Gold Resource | | | 2,182,667 | | | | 2,012,201 | |

| Golden Minerals * | | | 3,472,614 | | | | 798,701 | |

| Hecla Mining | | | 12,385,573 | | | | 74,932,717 | |

| TOTAL UNITED STATES | | | | | | | 109,888,893 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $1,115,302,716) | | | | | | | 1,006,800,642 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Silver Miners ETF |

| | | | |

| |

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENT(B)(C) — 0.3% | | | | | | |

| Fidelity Investments Money Market | | | | | | |

| Government Portfolio, Cl Institutional, | | | | | | |

4.770%

| | | | | | |

| (Cost $2,680,535) | | | 2,680,535 | | | $ | 2,680,535 | |

| | | Face Amount | | | | | |

| REPURCHASE AGREEMENT(B) — 3.0% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 4.700%, dated 04/28/2023, to be | | | | | | | | |

| repurchased on 05/01/2023, repurchase price | | | | | | | | |

| $29,963,224 (collateralized by U.S. Treasury | | | | | | | | |

| Obligations, ranging in par value $1,609,077 | | | | | | | | |

| - $2,418,329, 1.125% - 2.250%, 01/15/2025 | | | | | | | | |

| - 08/15/2027, with a total market value of | | | | | | | | |

$30,489,939)

| | | | | | | | |

(Cost $29,951,494)

| | $ | 29,951,494 | | | | 29,951,494 | |

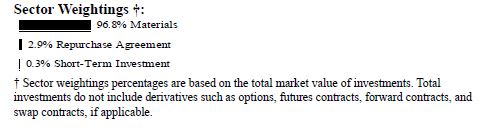

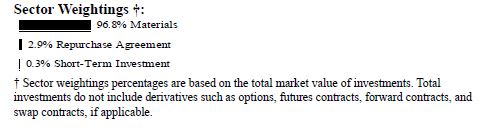

| TOTAL INVESTMENTS — 103.2% | | | | | | | | |

| (Cost $1,147,934,745) | | | | | | $ | 1,039,432,671 | |

Percentages are based on Net Assets of $1,007,271,833.

* | Non-income producing security. |

(A) | This security or a partial position of this security is on loan at April 30, 2023. |

(B) | Security was purchased with cash collateral held from securities on loan. |

(C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2023. |

The following is a summary of the level of inputs used as of April 30, 2023, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 1,006,800,642 | | | $ | — | | | $ | — | | | $ | 1,006,800,642 | |

| Short-Term Investment | | | 2,680,535 | | | | — | | | | — | | | | 2,680,535 | |

| Repurchase Agreement | | | — | | | | 29,951,494 | | | | — | | | | 29,951,494 | |

| Total Investments in Securities | | $ | 1,009,481,177 | | | $ | 29,951,494 | | | $ | — | | | $ | 1,039,432,671 | |

Amounts designated as “—“ are $0 or have been rounded to $0.

See "Glossary" for abbreviations.

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Copper Miners ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — 99.9% | | | | | | |

| AUSTRALIA — 13.3% | | | | | | |

| Materials — 13.3% | | | | | | |

29Metals

| | | 5,932,094 | | | $ | 4,645,474 | |

| BHP Group | | | 2,998,030 | | | | 87,967,573 | |

| Glencore | | | 15,286,571 | | | | 90,112,012 | |

| Sandfire Resources * | | | 9,972,030 | | | | 42,901,081 | |

| SolGold * | | | 36,859,512 | | | | 8,802,438 | |

| TOTAL AUSTRALIA | | | | | | | 234,428,578 | |

| BRAZIL — 2.4% | | | | | | | | |

| Materials — 2.4% | | | | | | | | |

| ERO Copper * | | | 1,882,395 | | | | 37,028,901 | |

| Nexa Resources (A) | | | 1,026,597 | | | | 6,159,582 | |

| TOTAL BRAZIL | | | | | | | 43,188,483 | |

| CANADA — 19.7% | | | | | | | | |

| Materials — 19.7% | | | | | | | | |

Altius Minerals

| | | 911,849 | | | | 14,286,508 | |

| Capstone Mining * | | | 9,234,796 | | | | 43,372,152 | |

| Copper Mountain Mining * | | | 4,711,369 | | | | 8,857,916 | |

| Filo Mining * (A) | | | 1,886,558 | | | | 31,352,221 | |

| Foran Mining * | | | 3,703,457 | | | | 10,157,679 | |

| HudBay Minerals | | | 5,789,672 | | | | 28,984,644 | |

| Ivanhoe Mines, Cl A * | | | 10,080,939 | | | | 87,333,948 | |

| NGEx Minerals * | | | 2,396,379 | | | | 10,813,124 | |

| Solaris Resources * (A) | | | 1,091,072 | | | | 5,606,998 | |

| Taseko Mines * | | | 6,533,441 | | | | 10,780,178 | |

| Teck Resources, Cl B | | | 2,068,610 | | | | 96,254,499 | |

| TOTAL CANADA | | | | | | | 347,799,867 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Copper Miners ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| CHILE — 10.0% | | | | | | |

| Materials — 10.0% | | | | | | |

Antofagasta

| | | 4,629,628 | | | $ | 84,986,007 | |

| Lundin Mining (A) | | | 11,962,208 | | | | 91,284,268 | |

| TOTAL CHILE | | | | | | | 176,270,275 | |

| CHINA — 11.5% | | | | | | | | |

| Materials — 11.5% | | | | | | | | |

| China Gold International Resources (A) | | | 5,618,100 | | | | 28,627,626 | |

| China Nonferrous Mining | | | 26,881,400 | | | | 13,697,703 | |

| Jiangxi Copper, Cl H | | | 25,522,501 | | | | 45,258,311 | |

| Jinchuan Group International Resources | | | 98,688,900 | | | | 7,040,317 | |

| MMG * | | | 65,897,500 | | | | 24,008,822 | |

| Zijin Mining Group, Cl H | | | 50,494,760 | | | | 85,038,118 | |

| TOTAL CHINA | | | | | | | 203,670,897 | |

| CYPRUS — 0.6% | | | | | | | | |

| Materials — 0.6% | | | | | | | | |

| Atalaya Mining | | | 2,449,353 | | | | 10,190,116 | |

| GERMANY — 3.7% | | | | | | | | |

| Materials — 3.7% | | | | | | | | |

Aurubis

| | | 703,822 | | | | 65,891,042 | |

| JAPAN — 7.9% | | | | | | | | |

| Materials — 7.9% | | | | | | | | |

| Mitsubishi Materials | | | 2,838,672 | | | | 46,280,996 | |

| Nittetsu Mining | | | 219,336 | | | | 5,903,620 | |

| Sumitomo Metal Mining | | | 2,375,015 | | | | 87,367,900 | |

| TOTAL JAPAN | | | | | | | 139,552,516 | |

| MEXICO — 10.2% | | | | | | | | |

| Materials — 10.2% | | | | | | | | |

| Grupo Mexico, Cl B | | | 18,497,481 | | | | 90,657,037 | |

Southern Copper

| | | 1,161,315 | | | | 89,223,832 | |

| TOTAL MEXICO | | | | | | | 179,880,869 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Copper Miners ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| POLAND — 5.1% | | | | | | |

| Materials — 5.1% | | | | | | |

| KGHM Polska Miedz | | | 3,129,252 | | | $ | 90,042,822 | |

| SWEDEN — 4.8% | | | | | | | | |

| Materials — 4.8% | | | | | | | | |

| Boliden (A) | | | 2,366,591 | | | | 84,491,031 | |

| TURKEY — 0.5% | | | | | | | | |

| Industrials — 0.5% | | | | | | | | |

Sarkuysan Elektrolitik Bakir Sanayi ve Ticaret

| | | 6,541,691 | | | | 9,774,737 | |

| UNITED KINGDOM — 0.6% | | | | | | | | |

| Materials — 0.6% | | | | | | | | |

| Central Asia Metals | | | 4,069,572 | | | | 10,511,394 | |

| UNITED STATES — 4.6% | | | | | | | | |

| Materials — 4.6% | | | | | | | | |

| Freeport-McMoRan | | | 2,167,023 | | | | 82,151,842 | |

| ZAMBIA — 5.0% | | | | | | | | |

| Materials — 5.0% | | | | | | | | |

| First Quantum Minerals | | | 3,629,565 | | | | 88,096,498 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $1,744,911,962) | | | | | | | 1,765,940,967 | |

| SHORT-TERM INVESTMENT(B)(C) — 0.3% | | | | | | | | |

| Fidelity Investments Money Market | | | | | | | | |

| Government Portfolio, Cl Institutional, | | | | | | | | |

| 4.770% | | | | | | | | |

| (Cost $5,573,994) | | | 5,573,994 | | | | 5,573,994 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Copper Miners ETF |

| | | | |

| |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENT(B) — 3.5% | | | | |

| BNP Paribas | | | | | | |

| 4.700%, dated 04/28/2023, to be | | | | | | |

| repurchased on 05/01/2023, repurchase price | | | | |

| $62,306,529 (collateralized by U.S. Treasury | | | | |

| Obligations, ranging in par value $3,345,969 | | | | |

| - $5,028,755, 1.125% - 2.250%, 01/15/2025 | | | | |

| - 08/15/2027, with a total market value of | | | | |

$63,401,796)

| | | | | | |

| (Cost $62,282,136) . | | $ | 62,282,136 | | | $ | 62,282,136 | |

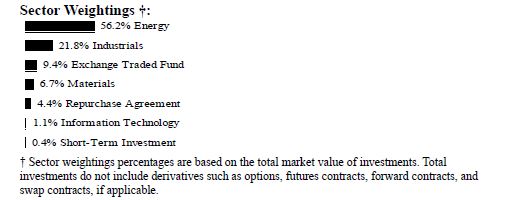

| TOTAL INVESTMENTS — 103.7% | | | | | | | | |

| (Cost $1,812,768,092) | | | | | | $ | 1,833,797,097 | |

Percentages are based on Net Assets of $1,768,383,377.

* | Non-income producing security. |

(A) | This security or a partial position of this security is on loan at April 30, 2023. |

(B) | Security was purchased with cash collateral held from securities on loan. |

(C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of April 30, 2023. |

The following is a summary of the level of inputs used as of April 30, 2023, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 1,765,940,967 | | | $ | — | | | $ | — | | | $ | 1,765,940,967 | |

| Short-Term Investment | | | 5,573,994 | | | | — | | | | — | | | | 5,573,994 | |

| Repurchase Agreement | | | — | | | | 62,282,136 | | | | — | | | | 62,282,136 | |

| Total Investments in Securities | | $ | 1,771,514,961 | | | $ | 62,282,136 | | | $ | — | | | $ | 1,833,797,097 | |

Amounts designated as “—“ are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Gold Explorers ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — 100.2% | | | | | | |

| AUSTRALIA — 28.6% | | | | | | |

| Materials — 28.6% | | | | | | |

| Bellevue Gold * | | | 902,567 | | | $ | 843,994 | |

| Capricorn Metals * | | | 235,776 | | | | 690,251 | |

| De Grey Mining * | | | 1,007,379 | | | | 1,075,150 | |

| Emerald Resources NL * | | | 379,576 | | | | 484,128 | |

| Firefinch *(A) | | | 825,148 | | | | 55,239 | |

| Gold Road Resources | | | 863,492 | | | | 1,069,950 | |

| Mincor Resources NL * (B) | | | 203,658 | | | | 188,423 | |

| OceanaGold | | | 584,856 | | | | 1,336,764 | |

Perseus Mining

| | | 1,091,563 | | | | 1,608,634 | |

| Ramelius Resources | | | 661,565 | | | | 574,913 | |

| Red 5 * | | | 2,289,701 | | | | 257,236 | |

| Regis Resources * | | | 621,195 | | | | 874,402 | |

| Resolute Mining * | | | 1,716,103 | | | | 544,363 | |

| Silver Lake Resources * | | | 758,632 | | | | 636,705 | |

| SolGold * | | | 1,299,554 | | | | 310,347 | |

| St Barbara * | | | 640,735 | | | | 256,175 | |

| Tietto Minerals * (B) | | | 505,555 | | | | 200,458 | |

| West African Resources * | | | 759,497 | | | | 489,367 | |

| Westgold Resources * | | | 369,501 | | | | 372,382 | |

| TOTAL AUSTRALIA | | | | | | | 11,868,881 | |

| CANADA — 40.2% | | | | | | | | |

| Materials — 40.2% | | | | | | | | |

| Alamos Gold, Cl A | | | 136,076 | | | | 1,756,758 | |

Centerra Gold

| | | 182,959 | | | | 1,235,644 | |

Dundee Precious Metals

| | | 157,763 | | | | 1,156,207 | |

| Endeavour Silver * (B) | | | 156,442 | | | | 609,020 | |

| Equinox Gold * | | | 237,294 | | | | 1,177,460 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Gold Explorers ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| Materials — continued | | | | | | |

| K92 Mining * (B) | | | 184,185 | | | $ | 874,549 | |

| Karora Resources * | | | 141,644 | | | | 506,505 | |

Lundin Gold

| | | 77,888 | | | | 986,593 | |

| McEwen Mining * (B) | | | 32,427 | | | | 265,901 | |

| New Gold * | | | 565,960 | | | | 726,071 | |

| Novagold Resources * | | | 190,243 | | | | 1,034,922 | |

| Orla Mining * (B) | | | 168,778 | | | | 761,573 | |

| Osisko Mining * | | | 239,256 | | | | 680,917 | |

| Seabridge Gold * | | | 55,971 | | | | 785,833 | |

| Skeena Resources * (B) | | | 55,084 | | | | 370,395 | |

| SSR Mining | | | 115,683 | | | | 1,654,686 | |

| Torex Gold Resources * | | | 71,300 | | | | 1,168,620 | |

| Victoria Gold * | | | 29,853 | | | | 214,824 | |

| Wesdome Gold Mines * | | | 117,991 | | | | 736,846 | |

| TOTAL CANADA | | | | | | | 16,703,324 | |

| EGYPT — 3.0% | | | | | | | | |

| Materials — 3.0% | | | | | | | | |

| Centamin | | | 962,321 | | | | 1,249,453 | |

| INDONESIA — 10.6% | | | | | | | | |

| Materials — 10.6% | | | | | | | | |

Aneka Tambang

| | | 6,996,734 | | | | 1,001,577 | |

| Bumi Resources Minerals * | | | 44,410,800 | | | | 490,426 | |

| Merdeka Copper Gold * | | | 10,874,453 | | | | 2,920,610 | |

| TOTAL INDONESIA | | | | | | | 4,412,613 | |

| PERU — 0.6% | | | | | | | | |

| Materials — 0.6% | | | | | | | | |

| Hochschild Mining | | | 261,816 | | | | 236,441 | |

| TURKEY — 5.9% | | | | | | | | |

| Materials — 5.9% | | | | | | | | |

| Eldorado Gold * | | | 152,793 | | | | 1,686,434 | |

Koza Altin Isletmeleri

| | | 799,462 | | | | 776,103 | |

| TOTAL TURKEY | | | | | | | 2,462,537 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Gold Explorers ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| UNITED KINGDOM — 1.7% | | | | | | |

| Materials — 1.7% | | | | | | |

| Greatland Gold * | | | 3,714,893 | | | $ | 375,407 | |

| Pan African Resources | | | 1,564,374 | | | | 348,027 | |

| TOTAL UNITED KINGDOM | | | | | | | 723,434 | |

| UNITED STATES — 9.6% | | | | | | | | |

| Materials — 9.6% | | | | | | | | |

| Argonaut Gold * | | | 688,838 | | | | 314,886 | |

| Coeur Mining * | | | 241,592 | | | | 821,413 | |

| Hecla Mining | | | 470,344 | | | | 2,845,581 | |

| TOTAL UNITED STATES | | | | | | | 3,981,880 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $44,329,513) | | | | | | | 41,638,563 | |

| | | Number of Rights | | | | | |

| | |

| | | | | |

| RIGHTS — 0.0% | | | | | | | | |

| Canada — 0.0% | | | | | | | | |

| Great Bear Resources# *(A) | | | | | | | | |

| | | 46,614 | | | | — | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENT(C)(D) — 0.4% | | | | | | | | |

| Fidelity Investments Money Market | | | | | | | | |

| Government Portfolio, Cl Institutional, | | | | | | | | |

| | | | | | | | |

| (Cost $155,300) | | | 155,300 | | | | 155,300 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Gold Explorers ETF |

| | | | |

| |

| | | Face Amount | | | Value | |

| REPURCHASE AGREEMENT(C) — 4.2% | | | | | | |

| BNP Paribas | | | | | | |

| 4.700%, dated 04/28/2023, to be repurchased | | | | | | |

| on 05/01/2023, repurchase price $1,735,953 | | | | | | |

| (collateralized by U.S. Treasury Obligations, | | | | | | |

| ranging in par value $93,224 - $140,109, | | | | | | |

| 1.125% - 2.250%, 01/15/2025 - 08/15/2027, | | | | | | |

| with a total market value of $1,766,467) | | | | | | |

| (Cost $1,735,272) | | $ | 1,735,272 | | | $ | 1,735,272 | |

| TOTAL INVESTMENTS — 104.8% | | | | | | | | |

| (Cost $46,220,085) | | | | | | $ | 43,529,135 | |

Percentages are based on Net Assets of $41,547,821.

* | Non-income producing security. |

# | Expiration date not available. |

(A) | Level 3 security in accordance with fair value hierarchy. |

(B) | This security or a partial position of this security is on loan at April 30, 2023. |

(C) | Security was purchased with cash collateral held from securities on loan. |

(D) | The rate reported on the Schedule of Investments is the 7-day effective yield as ofApril 30, 2023. |

The following is a summary of the level of inputs used as of April 30, 2023, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3(1) | | | Total | |

| Common Stock | | $ | 41,583,324 | | | $ | — | | | $ | 55,239 | | | $ | 41,638,563 | |

| Rights | | | — | | | | — | | | —

| ^

| | | — | |

| Short-Term Investment | | | 155,300 | | | | — | | | | — | | | | 155,300 | |

| Repurchase Agreement | | | — | | | | 1,735,272 | | | | — | | | | 1,735,272 | |

| Total Investments in Securities | | $ | 41,738,624 | | | $ | 1,735,272 | | | $ | 55,239 | | | $ | 43,529,135 | |

| (1) | Areconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the end of the period in relation to Net Assets. Management has concluded that Level 3 investments are not material in relation to Net Assets. |

| ^ | Security is fair valued at zero. |

Amounts designated as “—“ are $0 or have been rounded to $0.

See "Glossary" for abbreviations.

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Uranium ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — 90.0% | | | | | | |

| AUSTRALIA — 12.2% | | | | | | |

| Energy — 8.4% | | | | | | |

| Alligator Energy * (A) | | | 135,899,334 | | | $ | 2,963,705 | |

| Aura Energy * (A) | | | 15,603,817 | | | | 2,371,714 | |

| Bannerman Energy * (A) | | | 6,656,129 | | | | 6,378,131 | |

| Berkeley Energia * (A) | | | 18,227,967 | | | | 4,749,172 | |

| Boss Energy * | | | 14,683,837 | | | | 25,521,075 | |

| Deep Yellow * (A) | | | 30,437,894 | | | | 10,761,481 | |

| Elevate Uranium * (A) | | | 9,748,408 | | | | 2,190,364 | |

| Paladin Energy * | | | 123,501,387 | | | | 53,458,504 | |

| Peninsula Energy * (A) | | | 56,834,177 | | | | 5,821,635 | |

| | | | | | | | 114,215,781 | |

| Information Technology — 1.1% | | | | | | | | |

| Silex Systems * | | | 6,761,152 | | | | 14,968,186 | |

| Materials — 2.7% | | | | | | | | |

| Anson Resources * (A) | | | 43,206,517 | | | | 5,425,085 | |

| BHP Group | | | 902,040 | | | | 26,467,470 | |

| Lotus Resources * (A) | | | 36,237,545 | | | | 4,669,787 | |

| | | | | | | | 36,562,342 | |

| TOTAL AUSTRALIA | | | | | | | 165,746,309 | |

| CANADA — 39.8% | | | | | | | | |

| Energy — 35.2% | | | | | | | | |

Cameco

| | | 11,432,001 | | | | 313,973,337 | |

| Denison Mines * (A) | | | 38,696,279 | | | | 42,510,843 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Uranium ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| Energy — continued | | | | | | |

| Encore Energy * (A) | | | 4,856,691 | | | $ | 10,563,473 | |

| F3 Uranium * (A) | | | 12,891,507 | | | | 3,326,718 | |

| Fission Uranium * (A) | | | 27,736,563 | | | | 12,883,606 | |

| Forsys Metals * (A) | | | 5,409,278 | | | | 1,695,011 | |

| GoviEx Uranium, Cl A * (A) | | | 22,314,021 | | | | 2,714,601 | |

| IsoEnergy * (A) | | | 2,416,790 | | | | 4,882,404 | |

| Laramide Resources * (A) | | | 8,305,569 | | | | 2,388,241 | |

| Mega Uranium * | | | 14,388,498 | | | | 1,909,555 | |

| NexGen Energy * (A) | | | 19,080,822 | | | | 74,139,889 | |

| Skyharbour Resources * | | | 6,755,155 | | | | 2,141,648 | |

| Uranium Royalty * (A) | | | 3,763,871 | | | | 7,603,780 | |

| | | | | | | | 480,733,106 | |

| Industrials — 1.9% | | | | | | | | |

| Aecon Group (A) | | | 2,835,099 | | | | 26,484,336 | |

| Materials — 2.7% | | | | | | | | |

| American Lithium * (A) | | | 9,575,188 | | | | 20,473,380 | |

| Global Atomic * (A) | | | 7,395,364 | | | | 15,648,967 | |

| | | | | | | | 36,122,347 | |

| TOTAL CANADA | | | | | | | 543,339,789 | |

| CHINA — 0.8% | | | | | | | | |

| Energy — 0.8% | | | | | | | | |

| CGN Mining * (A) | | | 100,030,000 | | | | 10,831,412 | |

| JAPAN — 4.6% | | | | | | | | |

| Industrials — 4.6% | | | | | | | | |

| ITOCHU . | | | 977,018 | | | | 32,231,226 | |

Mitsubishi Heavy Industries

| | | 813,019 | | | | 30,612,480 | |

| TOTAL JAPAN | | | | | | | 62,843,706 | |

| KAZAKHSTAN — 6.4% | | | | | | | | |

| Energy — 6.4% | | | | | | | | |

| NAC Kazatomprom JSC GDR | | | 3,071,552 | | | | 87,232,077 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Uranium ETF |

| | | | |

| |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | |

| SOUTH AFRICA — 1.7% | | | | | | |

| Materials — 1.7% | | | | | | |

Sibanye Stillwater

| | | 10,663,765 | | | $ | 23,545,290 | |

| SOUTH KOREA — 12.1% | | | | | | | | |

| Industrials — 12.1% | | | | | | | | |

| Daewoo Engineering & Construction * | | | 8,373,211 | | | | 26,369,609 | |

| Doosan Enerbility * | | | 2,355,281 | | | | 29,370,622 | |

| GS Engineering & Construction | | | 1,669,179 | | | | 26,938,334 | |

| Hyundai Engineering & Construction | | | 1,046,085 | | | | 32,045,341 | |

KEPCO Engineering & Construction

| | | 460,802 | | | | 24,203,811 | |

Samsung C&T

| | | 322,609 | | | | 26,418,071 | |

| TOTAL SOUTH KOREA | | | | | | | 165,345,788 | |

| UNITED KINGDOM — 3.0% | | | | | | | | |

| Industrials — 3.0% | | | | | | | | |

| Yellow Cake * | | | 8,665,907 | | | | 40,954,500 | |

| UNITED STATES — 9.4% | | | | | | | | |

| Energy — 8.2% | | | | | | | | |

| Centrus Energy, Cl A * | | | 547,982 | | | | 16,055,873 | |

| Energy Fuels * (A) | | | 7,311,475 | | | | 41,508,779 | |

| Uranium Energy * | | | 17,221,230 | | | | 44,947,410 | |

| Ur-Energy * | | | 10,191,810 | | | | 9,509,978 | |

| | | | | | | | 112,022,040 | |

| Industrials — 1.2% | | | | | | | | |

| NuScale Power * (A) | | | 1,817,392 | | | | 16,120,267 | |

| TOTAL UNITED STATES | | | | | | | 128,142,307 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $1,399,988,396) | | | | | | | 1,227,981,178 | |

| EXCHANGE TRADED FUND — 9.9% | | | | | | | | |

| Sprott Physical Uranium Trust* (A)(B) | | | | | | | | |

| (Cost $137,327,692) | | | 11,244,476 | | | | 134,970,191 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Uranium ETF |

| | | | |

| |

| | | Shares | | | Value | |

| SHORT-TERM INVESTMENT(C)(D) — 0.4% | | | | | | |

| Fidelity Investments Money Market | | | | | | |

| Government Portfolio, Cl Institutional, | | | | | | |

4.770%

| | | | | | |

| (Cost $5,697,844) | | | 5,697,844 | | | $ | 5,697,844 | |

| | | Face Amount | | | | | |

| REPURCHASE AGREEMENT(C) — 4.7% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 4.700%, dated 04/28/2023, to be | | | | | | | | |

| repurchased on 05/01/2023, repurchase price | | | | | | | | |

| $63,690,933 (collateralized by U.S. Treasury | | | | | | | | |

| Obligations, ranging in par value $3,420,314 | | | | | | | | |

| - $5,140,490, 1.125% - 2.250%, 01/15/2025 | | | | | | | | |

| - 08/15/2027, with a total market value of | | | | | | | | |

$64,810,530)

| | | | | | | | |

| (Cost $63,665,997) . | | $ | 63,665,997 | | | | 63,665,997 | |

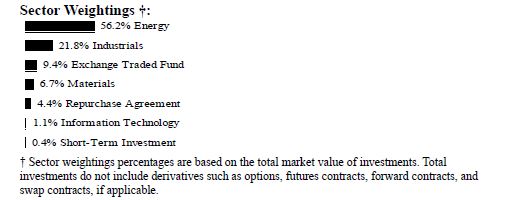

| TOTAL INVESTMENTS — 105.0% | | | | | | | | |

| (Cost $1,606,679,929) | | | | | | $ | 1,432,315,210 | |

Percentages are based on Net Assets of $1,364,365,261.

* | Non-income producing security. |

(A) | This security or a partial position of this security is on loan at April 30, 2023. |

(B) | Affiliated investment. |

(C) | Security was purchased with cash collateral held from securities on loan. |

(D) | The rate reported on the Schedule of Investments is the 7-day effective yield as ofApril 30, 2023. |

The following is a summary of the level of inputs used as of April 30, 2023, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 1,227,981,178 | | | $ | — | | | $ | — | | | $ | 1,227,981,178 | |

| Exchange Traded Fund | | | 134,970,191 | | | | — | | | | — | | | | 134,970,191 | |

| Short-Term Investment | | | 5,697,844 | | | | — | | | | — | | | | 5,697,844 | |

| Repurchase Agreement | | | — | | | | 63,665,997 | | | | — | | | | 63,665,997 | |

| Total Investments in Securities | | $ | 1,368,649,213 | | | $ | 63,665,997 | | | $ | — | | | $ | 1,432,315,210 | |

|

|

|

| Schedule of Investments | | April 30, 2023 (Unaudited) |

| Global X Uranium ETF |

The following is a summary of the transactions with affiliates for the period ended April 30, 2023:

| Value at 10/31/22 | | | Purchases at Cost | | | Proceeds from Sales | | | Realized Gain (Loss) | | | Changes in Unrealized Appreciation (Depreciation) | | | Value at 4/30/23 | | | Income | |

| Sprott Physical Uranium Trust | |

| $ | 155,501,708 | | | $ | 18,932,037 | | | $ | (27,649,821 | ) | | $ | 1,656,179

| | | $ | (13,469,912 | ) | | $ | 134,970,191 | | | $ | - | |

Amounts designated as “—“ are $0 or have been rounded to $0.

See “Glossary” for abbreviations.

|

| April 30, 2023 (Unaudited) |

| Glossary: (abbreviations which may be used in the preceding Schedules of Investments) |

Fund Abbreviations

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

JSC — Joint-Stock Company

|

| Statements of Assets and Liabiities |

| April 30, 2023 (Unaudited) |

| | | Global X Silver Miners ETF

| | | Global X Copper Miners ETF

| | | Global X Gold Explorers ETF

| |

| | | | | | | | | | |

| Assets: | | | | | | | | | |

| Cost of Investments | | $ | 1,117,983,251 | | | $ | 1,750,485,956 | | | $ | 44,484,813 | |

| Cost of Repurchase Agreement | | | 29,951,494 | | | | 62,282,136 | | | | 1,735,272 | |

| Cost of Foreign Currency | | | 2,879 | | | | 25,199 | | | | 4,115 | |

| Investments, at Value | | $ | 1,009,481,177 | * | | $ | 1,771,514,961 | * | | $ | 41,793,863 | * |

| Repurchase Agreement, at Value | | | 29,951,494 | | | | 62,282,136 | | | | 1,735,272 | |

| Cash | | | 1,764,544 | | | | — | | | | 73,170 | |

| Foreign Currency, at Value | | | 2,943 | | | | 25,739 | | | | 4,115 | |

| Receivable for Investment Securities Sold | | | 117,985,826 | | | | 89,682,378 | | | | 4,564,481 | |

| Dividend, Interest, and Securities Lending Income Receivable | | | 1,487,028 | | | | 9,721,707 | | | | 1,325 | |

| Reclaim Receivable | | | 213,192 | | | | 1,088,434 | | | | 2,624 | |

| Unrealized Appreciation on Spot Contracts | | | 9,564 | | | | — | | | | 1,363 | |

| Total Assets | | | 1,160,895,768 | | | | 1,934,315,355 | | | | 48,176,213 | |

| Liabilities: | |

| Obligation to Return Securities Lending Collateral | | | 32,632,029 | | | | 67,856,130 | | | | 1,890,572 | |

| Payable for Investment Securities Purchased | | | 120,436,496 | | | | 91,137,622 | | | | 4,714,802 | |

| Payable due to Investment Adviser | | | 551,720 | | | | 1,010,055 | | | | 22,942 | |

| Payable for Capital Shares Redeemed | | | — | | | | 5,120,743 | | | | — | |

| Unrealized Depreciation on Spot Contracts | | | — | | | | 29,004 | | | | — | |

| Cash Overdraft | | | — | | | | 772,223 | | | | — | |

| Custodian Fees Payable | | | 3,690 | | | | 6,201 | | | | 76 | |

| Total Liabilities | | | 153,623,935 | | | | 165,931,978 | | | | 6,628,392 | |

| Net Assets | | $ | 1,007,271,833 | | | $ | 1,768,383,377 | | | $ | 41,547,821 | |

| Net Assets Consist of: | |

| Paid-in Capital | | $ | 1,692,003,880 | | | $ | 1,756,338,490 | | | $ | 112,411,360 | |

| Total Distributable Earnings/(Loss) | | | (684,732,047 | ) | | | 12,044,887 | | | | (70,863,539 | ) |

| Net Assets | | $ | 1,007,271,833 | | | $ | 1,768,383,377 | | | $ | 41,547,821 | |

| Outstanding Shares of Beneficial Interest | |

| (unlimited authorization — no par value) | | | 33,787,318 | | | | 44,899,374 | | | | 1,502,054 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 29.81 | | | $ | 39.39 | | | $ | 27.66 | |

| * Includes Market Value of Securities on Loan | | $ | 31,219,674 | | | $ | 64,451,304 | | | $ | 1,793,464 | |

|

| Statements of Assets and Liabilities |

| April 30, 2023 (Unaudited) |

| |

| | | Global X Uranium ETF

| |

| Assets: | | | |

| Cost of Investments | | $ | 1,405,686,240 | |

| Cost of Repurchase Agreement | | | 63,665,997 | |

| Cost of Affiliated Investments | | | 137,327,692 | |

| Cost of Foreign Currency | | | 6,900 | |

| Investments, at Value | | $ | 1,233,679,022 | * |

| Repurchase Agreement, at Value | | | 63,665,997 | |

| Affiliated Investments, at Value | | | 134,970,191 | |

| Cash | | | 1,109,910 | |

| Foreign Currency, at Value | | | 7,019 | |

| Receivable for Investment Securities Sold | | | 46,291,973 | |

| Dividend, Interest, and Securities Lending Income Receivable | | | 998,757 | |

| Unrealized Appreciation on Spot Contracts | | | 16,342 | |

| Total Assets | | | 1,480,739,211 | |

| Liabilities: | |

| Obligation to Return Securities Lending Collateral | | | 69,363,841 | |

| Payable for Investment Securities Purchased | | | 46,228,446 | |

| Payable due to Investment Adviser | | | 770,210 | |

| Custodian Fees Payable | | | 11,453 | |

| Total Liabilities | | | 116,373,950 | |

| Net Assets | | $ | 1,364,365,261 | |

| Net Assets Consist of: | |

| Paid-in Capital | | $ | 2,144,893,228 | |

| Total Distributable Loss | | | (780,527,967 | ) |

| Net Assets | | $ | 1,364,365,261 | |

| Outstanding Shares of Beneficial Interest | |

| (unlimited authorization — no par value) | | | 68,191,666 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 20.01 | |

| *Includes Market Value of Securities on Loan | | $ | 67,244,345 | |

|

| Statements of Operations |

| For the period ended April 30, 2023 (Unaudited) |

| | | | | | | | | | |

| | | Global X Silver Miners ETF | | | Global X Copper Miners ETF | | | Global X Gold Explorers ETF | |

Investment Income:

| | | | | | | | | |

| Dividend Income | | $ | 8,032,371 | | | $ | 23,025,755 | | | $ | 144,465 | |

| Interest Income | | | 13,498 | | | | 24,711 | | | | 622 | |

| Security Lending Income | | | 579,879 | | | | 358,159 | | | | 10,951 | |

| Less: Foreign Taxes Withheld | | | (1,206,086 | ) | | | (2,065,813 | ) | | | (15,270 | ) |

| Total Investment Income | | | 7,419,662 | | | | 21,342,812 | | | | 140,768 | |

Supervision and Administration Fees(1) | | | 3,130,782 | | | | 5,754,845 | | | | 119,948 | |

| Custodian Fees(2) | | | 5,476 | | | | 4,349 | | | | 74 | |

| Total Expenses | | | 3,136,258 | | | | 5,759,194 | | | | 120,022 | |

| Net Investment Income | | | 4,283,404 | | | | 15,583,618 | | | | 20,746 | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Investments(3) | | | (16,884,235 | ) | | | 87,799,977 | | | | 265,771 | |

| Foreign Currency Transactions | | | (27,722 | ) | | | 10,324 | | | | 1,857 | |

| Net Realized Gain (Loss) | | | (16,911,957 | ) | | | 87,810,301 | | | | 267,628 | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | 176,194,619 | | | | 417,862,493 | | | | 10,553,790 | |

| Foreign Currency Translations | | | 21,594 | | | | 155,477 | | | | 333 | |

| Net Change in Unrealized Appreciation (Depreciation) | | | 176,216,213 | | | | 418,017,970 | | | | 10,554,123 | |

| Net Realized and Unrealized Gain (Loss) | | | 159,304,256 | | | | 505,828,271 | | | | 10,821,751 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 163,587,660 | | | $ | 521,411,889 | | | $ | 10,842,497 | |

| (1) | The Supervision andAdministration fees reflect the supervisory and administrative fee, which includes fees paid by the Funds for the investment advisory services provided by the Adviser. (See Note 3 in Notes to Financial Statements.) |

| (2) | See Note 2 in the Notes to Financial Statements. |

| (3) | Includes realized gains (losses) as a result of in-kind redemptions. (See Note 4 in Notes to Financial Statements.) |

|

| Statements of Operations |

| For the period ended April 30, 2023 (Unaudited) |

| |

| |

| | | Global X Uranium ETF

| |

| | | | |

| Investment Income: | | | |

| Dividend Income | | $ | 7,590,259 | |

| Interest Income | | | 29,807 | |

| Security Lending Income | | | 1,431,152 | |

| Less: Foreign Taxes Withheld | | | (1,016,181 | ) |

| Total Investment Income | | | 8,035,037 | |

| Supervision and Administration Fees(1) | | | 5,227,702 | |

| Custodian Fees(2) | | | 11,079 | |

| Total Expenses | | | 5,238,781 | |

| Net Investment Income | | | 2,796,256 | |

| Net Realized Gain (Loss) on: | | | | |

| Investments(3) | | | 20,133,239 | |

| Affiliated Investments | | | 1,656,179 | |

| Foreign Currency Transactions | | | (248,383 | ) |

| Net Realized Gain (Loss) | | | 21,541,035 | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | |

| Investments | | | (30,875,239 | ) |

| Affiliated Investments | | | (13,469,912 | ) |

| Foreign Currency Translations | | | 30,888 | |

| Net Change in Unrealized Appreciation (Depreciation) | | | (44,314,263 | ) |

| Net Realized and Unrealized Gain (Loss) | | | (22,773,228 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (19,976,972 | ) |

| (1) | The Supervision andAdministration fees reflect the supervisory and administrative fee, which includes fees paid by the Funds for the investment advisory services provided by the Adviser. (See Note 3 in Notes to Financial Statements.) |

| (2) | See Note 2 in the Notes to Financial Statements. |

| (3) | Includes realized gains (losses) as a result of in-kind redemptions. (See Note 4 in Notes to Financial Statements.) |

|

| Statements of Changes in Net Assets |

| |

| | | Global X Silver Miners ETF | | | Global X Copper Miners ETF | |

| | | Period Ended April 30, 2023 (Unaudited) | | | Year Ended October 31, 2022 | | | Period Ended April 30, 2023 (Unaudited)

| | | Year Ended October 31, 2022

| |

| Operations: | | | | | | | | | | | | |

| Net Investment Income | | $ | 4,283,404 | | | $ | 6,091,528 | | | $ | 15,583,618 | | | $ | 50,898,257 | |

| Net Realized Gain (Loss) | | | (16,911,957 | ) | | | (162,152,951 | ) | | | 87,810,301 | | | | (5,605,150 | ) |

| Net Change in Unrealized Appreciation (Depreciation) | | | 176,216,213 | | | | (256,020,595 | ) | | | 418,017,970 | | | | (361,943,382 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 163,587,660 | | | | (412,082,018 | ) | | | 521,411,889 | | | | (316,650,275 | ) |

| Distributions | | | (2,143,417 | ) | | | (10,656,479 | ) | | | (18,611,794 | ) | | | (48,850,684 | ) |

| Return of Capital | | | — | | | | (3,107,323 | ) | | | — | | | | — | |

| Capital Share Transactions: | |

| Issued | | | 62,152,213 | | | | 240,640,155 | | | | 209,391,952 | | | | 1,192,691,215 | |

| Redeemed | | | (58,232,798 | ) | | | (73,077,499 | ) | | | (259,296,585 | ) | | | (505,711,107 | ) |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | 3,919,415 | | | | 167,562,656 | | | | (49,904,633 | ) | | | 686,980,108 | |

| Total Increase (Decrease) in Net Assets | | | 165,363,658 | | | | (258,283,164 | ) | | | 452,895,462 | | | | 321,479,149 | |

| Net Assets: | |

| Beginning of Year/Period | | | 841,908,175 | | | | 1,100,191,339 | | | | 1,315,487,915 | | | | 994,008,766 | |

| End of Year/Period | | $ | 1,007,271,833 | | | $ | 841,908,175 | | | $ | 1,768,383,377 | | | $ | 1,315,487,915 | |

| Share Transactions: | |

| Issued | | | 2,090,000 | | | | 7,690,000 | | | | 5,560,000 | | | | 33,190,000 | |

| Redeemed | | | (2,070,000 | ) | | | (2,290,000 | ) | | | (6,440,000 | ) | | | (14,050,000 | ) |

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | 20,000 | | | | 5,400,000 | | | | (880,000 | ) | | | 19,140,000 | |

|

| Statements of Changes in Net Assets |

| |

| | | Global X Gold Explorers ETF | | | Global X Uranium ETF | |

| | | Period Ended April 30, 2023 (Unaudited) | | | Year Ended October 31, 2022 | | | Period Ended April 30, 2023 (Unaudited) | | | Year Ended October 31, 2022 | |

Operations:

| | | | | | | | | | | | |

| Net Investment Income | | $ | 20,746 | | | $ | 261,995 | | | $ | 2,796,256 | | | $ | 19,072,965 | |

| Net Realized Gain (Loss) | | | 267,628 | | | | 1,143,660 | | | | 21,541,035 | | | | (46,867,233 | ) |

| Net Change in Unrealized Appreciation (Depreciation) | | | 10,554,123 | | | | (14,150,744 | ) | | | (44,314,263 | ) | | | (402,350,552 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 10,842,497 | | | | (12,745,089 | ) | | | (19,976,972 | ) | | | (430,144,820 | ) |

| Distributions | | | (292,264 | ) | | | (967,622 | ) | | | (3,660,937 | ) | | | (74,869,077 | ) |

| Capital Share Transactions: | |

| Issued | | | 2,252,803 | | | | — | | | | 100,907,439 | | | | 1,082,750,695 | |

| Redeemed | | | — | | | | (7,264,855 | ) | | | (301,433,707 | ) | | | (304,816,155 | ) |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | 2,252,803 | | | | (7,264,855 | ) | | | (200,526,268 | ) | | | 777,934,540 | |

| Total Increase (Decrease) in Net Assets | | | 12,803,036 | | | | (20,977,566 | ) | | | (224,164,177 | ) | | | 272,920,643 | |

| Net Assets: | |

| Beginning of Year/Period | | | 28,744,785 | | | | 49,722,351 | | | | 1,588,529,438 | | | | 1,315,608,795 | |

| End of Year/Period | | $ | 41,547,821 | | | $ | 28,744,785 | | | $ | 1,364,365,261 | | | $ | 1,588,529,438 | |

| Share Transactions: | |

| Issued | | | 90,000 | | | | — | | | | 4,560,000 | | | | 44,260,000 | |

| Redeemed | | | — | | | | (240,000 | ) | | | (14,620,000 | ) | | | (14,670,000 | ) |

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | 90,000 | | | | (240,000 | ) | | | (10,060,000 | ) | | | 29,590,000 | |

Page intentionally left blank.

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | Net Asset Value, Beginning

of Period ($)

| | | Net Investment Income ($)* | | | Net Realized and Unrealized Gain (Loss) on Investments ($) | | | Total from Operations

($) | | | Distribution

from Net

Investment Income ($) | | | Distribution from Capital Gains ($) | | | Return of Capital ($) | |

| Global X Silver Miners ETF | | | | | | | | | | | | | | | | | | | |

| 2023 (Unaudited) | | | 24.93 | | | | 0.13 | | | | 4.81 | | | | 4.94 | | | | (0.06 | ) | | | — | | | | — | |

| 2022 | | | 38.78 | | | | 0.20 | | | | (13.57 | ) | | | (13.37 | ) | | | (0.37 | ) | | | — | | | | (0.11 | ) |

| 2021 | | | 42.28 | | | | 0.41 | | | | (3.00 | ) | | | (2.59 | ) | | | (0.91 | ) | | | — | | | | — | |

| 2020 | | | 30.39 | | | | 0.33 | | | | 12.11 | | | | 12.44 | | | | (0.55 | ) | | | — | | | | — | |

| 2019 | | | 23.20 | | | | 0.21 | | | | 7.38 | | | | 7.59 | | | | (0.40 | ) | | | — | | | | — | |

| 2018 | | | 31.96 | | | | 0.32 | | | | (9.07 | ) | | | (8.75 | ) | | | (0.01 | ) | | | — | | | | — | |

| Global X Copper Miners ETF | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 (Unaudited) | | | 28.74 | | | | 0.33 | | | | 10.72 | | | | 11.05 | | | | (0.40 | ) | | | — | | | | — | |

| 2022 | | | 37.31 | | | | 1.19 | | | | (8.66 | ) | | | (7.47 | ) | | | (1.10 | ) | | | — | | | | — | |

| 2021 | | | 21.42 | | | | 0.63 | | | | 15.74 | | | | 16.37 | | | | (0.48 | ) | | | — | | | | — | |

| 2020 | | | 17.47 | | | | 0.23 | | | | 3.85 | | | | 4.08 | | | | (0.13 | ) | | | — | | | | — | |

| 2019 | | | 19.38 | | | | 0.37 | | | | (1.58 | ) | | | (1.21 | ) | | | (0.70 | ) | | | — | | | | — | |

| 2018 | | | 25.61 | | | | 0.43 | | | | (6.23 | ) | | | (5.80 | ) | | | (0.43 | ) | | | — | | | | — | |

*

| Per share data calculated using average shares method.

|

| ** | Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

†

| Annualized.

|

††

| Portfolio turnover rate is for the period indicated and periods of less than one year have not been annualized. Excludes effect of in-kind transfers. |

Amounts designated as “—” are either $0 or have been rounded to $0.

Total from Distributions ($) | | | Net Asset Value,

End of Period ($) | | | Total

Return (%)** | | | Net Assets End of Period ($)(000) | | | Ratio of Expenses to Average Net Assets (%) | | | Ratio of Net

Investment Income

to Average Net Assets (%) | | | Portfolio Turnover (%)†† | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (0.06 | ) | | | 29.81 | | | | 19.84 | | | | 1,007,272 | | | | 0.65 | † | | | 0.89 | † | | | 13.39 | |

| (0.48 | ) | | | 24.93 | | | | (34.83 | ) | | | 841,908 | | | | 0.65 | | | | 0.64 | | | | 17.72 | |

| (0.91 | ) | | | 38.78 | | | | (6.43 | ) | | | 1,100,191 | | | | 0.65 | | | | 0.96 | | | | 15.61 | |

| (0.55 | ) | | | 42.28 | | | | 41.40 | | | | 984,993 | | | | 0.65 | | | | 0.90 | | | | 19.95 | |

| (0.40 | ) | | | 30.39 | | | | 33.08 | | | | 525,591 | | | | 0.66 | | | | 0.80 | | | | 42.16 | |

| (0.01 | ) | | | 23.20 | | | | (27.40 | ) | | | 301,515 | | | | 0.65 | | | | 1.10 | | | | 25.71 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (0.40 | ) | | | 39.39 | | | | 38.57 | | | | 1,768,383 | | | | 0.65 | † | | | 1.76 | † | | | 13.38 | |

| (1.10 | ) | | | 28.74 | | | | (20.38 | ) | | | 1,315,488 | | | | 0.65 | | | | 3.31 | | | | 30.46 | |

| (0.48 | ) | | | 37.31 | | | | 76.80 | | | | 994,009 | | | | 0.65 | | | | 1.71 | | | | 20.13 | |

| (0.13 | ) | | | 21.42 | | | | 23.45 | | | | 103,888 | | | | 0.65 | | | | 1.26 | | | | 16.85 | |

| (0.70 | ) | | | 17.47 | | | | (6.51 | ) | | | 48,021 | | | | 0.65 | | | | 1.89 | | | | 18.77 | |

| (0.43 | ) | | | 19.38 | | | | (23.12 | ) | | | 68,798 | | | | 0.65 | | | | 1.74 | | | | 17.00 | |

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | | | Net Asset Value, Beginning

of Period ($)

| | | | Net Investment Income ($)* | | | | Net Realized and Unrealized Gain (Loss) on Investments ($) | | | | Total from Operations

($) | | | | Distribution

from Net

Investment Income ($) | | | | Distribution from Capital Gains ($) | | | | Return of Capital ($) | |

Global X Gold Explorers ETF

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 (Unaudited) | | | 20.36 | | | | 0.01 | | | | 7.50 | | | | 7.51 | | | | (0.21 | ) | | | — | | | | — | |

| 2022 | | | 30.10 | | | | 0.17 | | | | (9.32 | ) | | | (9.15 | ) | | | (0.59 | ) | | | — | | | | — | |

| 2021 | | | 33.48 | | | | 0.20 | | | | (2.54 | ) | | | (2.34 | ) | | | (1.04 | ) | | | — | | | | — | |

| 2020 | | | 25.39 | | | | 0.06 | | | | 8.47 | | | | 8.53 | | | | (0.44 | ) | | | — | | | | — | |

| 2019 | | | 18.49 | | | | 0.04 | | | | 6.87 | | | | 6.91 | | | | (0.01 | ) | | | — | | | | — | |

| 2018 | | | 21.46 | | | | 0.06 | | | | (3.03 | ) | | | (2.97 | ) | | | — | | | | — | | | | — | |

| Global X Uranium ETF | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 (Unaudited) | | | 20.30 | | | | 0.04 | | | | (0.28 | ) | | | (0.24 | ) | | | (0.05 | ) | | | — | | | | — | |

| 2022 | | | 27.04 | | | | 0.28 | | | | (5.61 | ) | | | (5.33 | ) | | | (1.41 | ) | | | — | | | | — | |

| 2021 | | | 10.87 | | | | 0.39 | | | | 15.91 | | | | 16.30 | | | | (0.13 | ) | | | — | | | | — | |

| 2020 | | | 10.92 | | | | 0.22 | | | | (0.03 | ) | | | 0.19 | | | | (0.24 | ) | | | — | | | | — | |

| 2019 | | | 12.08 | | | | 0.17 | | | | (1.17 | ) | | | (1.00 | ) | | | (0.16 | ) | | | — | | | | — | |

| 2018 | | | 11.88 | | | | 0.03 | | | | 0.48 | | | | 0.51 | | | | (0.31 | ) | | | — | | | | — | |

*

| Per share data calculated using average shares method.

|

| ** | Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

†

| Annualized.

|

††

| Portfolio turnover rate is for the period indicated and periods of less than one year have not been annualized. Excludes effect of in-kind transfers. |

Amounts designated as “—” are either $0 or have been rounded to $0.

Total from Distributions ($) | | | | Net Asset Value,

End of Period ($) | | | | Total

Return (%)** | | | | Net Assets End of Period ($)(000) | | | | Ratio of Expenses to Average Net Assets (%) | | | | Ratio of Net

Investment Income

to Average Net Assets (%) | | | | Portfolio Turnover (%)†† | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (0.21 | ) | | | 27.66 | | | | 36.99 | | | | 41,548 | | | | 0.65 | † | | | 0.11 | † | | | 14.10 | |

| (0.59 | ) | | | 20.36 | | | | (30.94 | ) | | | 28,745 | | | | 0.65 | | | | 0.63 | | | | 30.04 | |

| (1.04 | ) | | | 30.10 | | | | (7.36 | ) | | | 49,722 | | | | 0.65 | | | | 0.61 | | | | 18.30 | |

| (0.44 | ) | | | 33.48 | | | | 34.03 | | | | 60,670 | | | | 0.65 | | | | 0.20 | | | | 18.81 | |

| (0.01 | ) | | | 25.39 | | | | 37.40 | | | | 43,470 | | | | 0.65 | | | | 0.19 | | | | 16.35 | |

| — | | | | 18.49 | | | | (13.84 | ) | | | 32,582 | | | | 0.65 | | | | 0.26 | | | | 20.31 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (0.05 | ) | | | 20.01 | | | | (1.18 | ) | | | 1,364,365 | | | | 0.69 | † | | | 0.37 | † | | | 15.34 | |

| (1.41 | ) | | | 20.30 | | | | (20.11 | ) | | | 1,588,529 | | | | 0.69 | | | | 1.25 | | | | 26.47 | |

| (0.13 | ) | | | 27.04 | | | | 150.73 | | | | 1,315,609 | | | | 0.69 | | | | 1.91 | | | | 30.01 | |

| (0.24 | ) | | | 10.87 | | | | 1.72 | | | | 141,609 | | | | 0.69 | | | | 2.03 | | | | 59.21 | |

| (0.16 | ) | | | 10.92 | | | | (8.42 | ) | | | 187,616 | | | | 0.71 | | | | 1.46 | | | | 23.93 | |

| (0.31 | ) | | | 12.08 | | | | 3.79 | | | | 308,953 | | | | 0.72 | | | | 0.20 | | | | 54.06 | |

|

| Notes to Financial Statements (Unaudited) |

| April 30, 2023 |

1. ORGANIZATION

The Global X Funds (the “Trust”) is a Delaware statutory trust formed on March 6, 2008. The Trust is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company.As ofApril 30, 2023, the Trust had one hundred and fourteen portfolios, one hundred and three of which were operational. The financial statements herein and the related notes pertain to the Global X Silver Miners ETF, Global X Copper Miners ETF, Global X Gold Explorers ETF and Global X Uranium ETF (the “Funds”). Each Fund has elected non-diversified status under the 1940 Act.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Funds:

USE OF ESTIMATES — The Funds are investment companies that apply the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could materially differ from those estimates.

RETURN OF CAPITAL ESTIMATES — Distributions received by the Funds from underlying master limited partnership (“MLP”) and real estate investment trust (“REIT”) investments generally are comprised of income and return of capital. The Funds record investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from the MLPs, REITs and other industry sources. These estimates may subsequently be revised based on information received from the MLPs and REITs after their tax reporting periods are concluded.

SECURITY VALUATION — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market (“NASDAQ”)), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent mean between the quoted bid and asked prices, which approximates fair value (absent both bid and asked prices on such exchange, the bid price may be used). For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates as of the reporting date. The exchange rates used by the Trust for valuation are captured as of the New York or London close each day.

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Securities for which market prices are not “readily available” are valued in accordance with fair value procedures (the “Fair Value Procedures”) established by Global X Management Company LLC, the Funds’ investment adviser (the “Adviser”), and approved by the Funds’ Board of Trustees (the “Board”). Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the "valuation designee" to determine the fair value of securities and other instruments for which no readily available market quotations are available. The Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) of the Adviser. Some of the more common reasons that may necessitate that a security be valued using the Fair Value Procedures include: the security's trading has been halted or suspended; the security has been de-listed from its primary trading exchange; the security's primary trading market is temporarily closed at a time when, under normal conditions, it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Funds may fair value a security if an event that may materially affect the value of the Funds’security that traded outside of the United States (a “Significant Event”) has occurred between the time of the security's last close and the time that each Fund calculates its net asset value (“NAV”). A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If theAdviser becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Funds calculate their NAV, it may request that a Committee meeting be called. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration all relevant information reasonably available to the Committee.

If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less will be valued at their market value. Prices for most securities held by the Funds are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain a bid price from at least one independent broker.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Funds disclose the fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date

Level 2 – Other significant observable inputs (including quoted prices in non-active markets, quoted prices for similar investments, fair value of investments for which the Funds have the ability to fully redeem tranches at NAV as of the measurement date or within the near term, and short-term investments valued at amortized cost)

Level 3 – Significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments and fair value of investments for which the Funds do not have the ability to fully redeem tranches at NAV as of the measurement date or within the near term)

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement. For details of the investment classification, reference the Schedules of Investments.

The unobservable inputs used to determine fair value of Level 3 assets may have similar or diverging impacts on valuation. Significant increases and decreases in these inputs in isolation and interrelationships between those inputs could result in significantly higher or lower fair value measurement.

DUE TO/FROM BROKERS — Due to/from brokers includes cash and collateral balances with the Funds’ clearing brokers or counterparties as of April 30, 2023. The Funds continuously monitor the credit standing of each broker or counterparty with whom they conduct business. In the event a broker or counterparty is unable to fulfill its obligations, the Funds would be subject to counterparty credit risk.

REPURCHASE AGREEMENTS — Securities pledged as collateral for repurchase agreements by BNP Paribas are held by Brown Brothers Harriman & Co. (“BBH”), the Funds’ custodian ("Custodian"), and are designated as being held on each Fund’s behalf by the Custodian under a book-entry system. Each Fund monitors the adequacy of the collateral on a daily basis and can require the seller to provide additional collateral in the event the market value of the securities pledged falls below the carrying value of the repurchase agreement, including accrued interest.

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

It is the Funds’ policy to only enter into repurchase agreements with banks and other financial institutions which are deemed by the Adviser to be creditworthy. The Funds bear the risk of loss in the event that the counterparty to a repurchase agreement defaults on its obligations, and the Funds are prevented from exercising their rights to dispose of the underlying securities received as collateral. For financial statement purposes, the Funds record the securities lending collateral (included in repurchase agreements, at value or restricted cash) as an asset and the obligation to return securities lending collateral as a liability on the Statements of Assets and Liabilities.

Repurchase agreements are entered into by the Funds under Master Repurchase Agreements (“MRA”) which permit the Funds, under certain circumstances, including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under an MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Funds.

As of April 30, 2023, the open repurchase agreements by counterparty which are subject to an MRA on a net payment basis are as follows:

| | | | | | | | | |

| |

| | | | | | Fair Value | | | | | | |

| | | | | | of Non-Cash | | | Cash | | | |

| | | Repurchase | | | Collateral | | | Collateral | | | |

| | | Agreements* | | | Received(1) | | | Received | | Net Amount(2) | |

| Global X Silver Miners ETF | | | | | | | | | | | |

| BNP Paribas | | $ | 29,951,494 | | | $ | 29,951,494 | | $ | – | | $ | – | |

| Global X Copper Miners ETF | | | | | | | | | |

| | |

| |

| BNP Paribas | | | 62,282,136 | | | | 62,282,136 | | | – | | | – | |

| Global X Gold Explorers ETF | | | | | | | | | |

| | |

| |

| BNP Paribas | | | 1,735,272 | | | | 1,735,272 | | | – | | | – | |

| Global X Uranium ETF | | | | | | | | | |

| | |

| |

| BNP Paribas | | | 63,665,997 | | | | 63,665,997 | | | – | | | – | |

* Repurchase agreements with an overnight and continuous maturity.

(1) Excess collateral received is not presented in the table above. Please refer to the Schedules of Investments for the market value of the collateral received for each Fund.

(2) Net Amount represents the net amount receivable due from the counterparty in the event of default.

FEDERAL INCOME TAXES — It is each Fund’s intention to qualify or continue to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, no provisions for Federal income taxes have been made in the financial statements.

The Funds evaluate tax positions taken or expected to be taken in the course of preparing the Funds’ tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50 percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Funds did not record any tax positions in the current period. Management’s conclusions regarding tax positions may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last three tax year ends, as applicable) and on-going analysis of and changes to tax laws and regulations, and interpretations thereof.

If a Fund has foreign tax filings that have not been made, the tax years that remain subject to examination may date back to the inception of the Fund.

As of and during the period ended April 30, 2023, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. During the year, the Funds did not incur any interest or penalties.

SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on the trade date for financial reporting purposes. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from the settlement date. Amortization of premiums and accretion of discounts is included in interest income.

FOREIGN CURRENCY TRANSACTIONS AND TRANSLATION — The books and records of the Funds are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Statements of Operations. Net realized and unrealized gains and losses on foreign currency transactions and translations represent net foreign exchange gains or losses from foreign currency spot contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent amounts actually received or paid.

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — The Funds distribute their net investment income on a pro rata basis. Any net investment income and net realized capital gains are distributed at least annually. All distributions are recorded on the ex-dividend date.

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

CREATION UNITS —The Funds issue and redeem their shares (“Shares”) on a continuous basis at NAV and only in large blocks of 10,000 Shares, referred to as “Creation Units”. Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an Authorized Participant on the same day. An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard redemption fee per transaction to BBH, on the date of such redemption, regardless of the number of Creation Units redeemed that day. If a Creation Unit is purchased or redeemed for cash, an additional variable fee may be charged. The following table discloses Creation Unit breakdown:

| | |

| | |

| | |

| |

| | | | Creation Unit Shares

| | | | Creation Fee

| | | | Value at April 30, 2023

| | | | Redemption Fee

| |

| Global X Silver Miners ETF | | | 10,000 | | | $ | 500 | | | $ | 298,100 | | | $ | 500 | |

| Global X Copper Miners ETF | | | 10,000 | | | | 600 | | | | 393,900 | | | | 600 | |

| Global X Gold Explorers ETF | | | 10,000 | | | | 1,000 | | | | 276,600 | | | | 1,000 | |

| Global X Uranium ETF | | | 10,000 | | | | 500 | | | | 200,100 | | | | 500 | |

CASH OVERDRAFT CHARGES — Per the terms of an agreement with BBH, if a Fund has a cash overdraft on a given day, it will be assessed an overdraft charge equal to the applicable BBH Base Rate plus 2.00%. Cash overdraft charges are included in custodian fees on the Statements of Operations.

3. RELATED PARTIES AND SERVICE PROVIDER TRANSACTIONS

On July 2, 2018, the Adviser consummated a transaction pursuant to which it became an indirect, wholly-owned subsidiary of Mirae Asset Global Investments Co., Ltd. (“Mirae”). In this manner, the Adviser is ultimately controlled by Mirae, which is a leading financial services company in Korea and is the headquarters for the Mirae Asset Global Investments Group. The Adviser serves as the investment adviser and the administrator for the Funds. Subject to the supervision of the Board, the Adviser is responsible for managing the investment activities of the Funds and the Funds’business affairs and other administrative matters and provides or causes to be furnished all supervisory, administrative and other services reasonably necessary for the operation of the Funds, including certain distribution services (provided pursuant to a separate distribution services agreement), certain shareholder and distribution-related services (provided pursuant to a separate Rule 12b-1 Plan and related agreements) and investment advisory services (provided pursuant to a separate Investment Advisory Agreement), under what is essentially an "all-in" fee structure. For the Adviser’s services to the Funds, under a supervision and administration agreement (the “Supervision and Administration Agreement”), each Fund pays a monthly fee to the Adviser at the annual rate (stated as a percentage of the average daily net

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |

3. RELATED PARTIES AND SERVICE PROVIDER TRANSACTIONS (continued)

assets of the Fund) (the “Supervision and Administration Fee”). In addition, the Funds bear other expenses, directly and indirectly, that are not covered by the Supervision and AdministrationAgreement, which may vary and affect the total expense ratios of the Funds, such as taxes, brokerage fees, commissions, custodian fees, acquired fund fees and other transaction expenses, interest expenses, and extraordinary expenses (such as litigation and indemnification expenses).

The following table discloses supervision and administration fees payable pursuant to the Supervision and Administration Agreement:

| |

| |

| | | Supervision and | |

| | | Administration Fee | |

| Global X Silver Miners ETF | | | 0.65 | % |

| Global X Copper Miners ETF | | | 0.65 | % |

| Global X Gold Explorers ETF | | | 0.65 | % |

| Global X Uranium ETF | | | 0.69 | % |

SEI Investments Global Funds Services (“SEIGFS”) serves as sub-administrator to the Funds. As sub-administrator, SEIGFS provides the Funds with the required general administrative services, including, without limitation: office space, equipment, and personnel; clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and assistance with the preparation and filing of reports, registration statements, proxy statements and other materials required to be filed or furnished by the Funds under federal and state securities laws. As compensation for these services, SEIGFS receives certain out-of-pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser.

SEI Investments Distribution Co. (“SIDCO”) serves as each Fund’s underwriter and distributor of Creation Units pursuant to a distribution agreement (the “Distribution Agreement”). SIDCO has no obligation to sell any specific quantity of Fund Shares. SIDCO bears the following costs and expenses relating to the distribution of Shares: (1) the costs of processing and maintaining records of creations of Creation Units; (2) all costs of maintaining the records required of a registered broker/dealer; (3) the expenses of maintaining its registration or qualification as a dealer or broker under federal or state laws; (4) filing fees; and (5) all other expenses incurred in connection with the distribution services as contemplated in the Distribution Agreement. SIDCO receives no fee from the Funds for its distribution services under the Distribution Agreement; rather, the Adviser compensates SIDCO for certain expenses, out-of-pocket costs, and transaction fees.

BBH serves as transfer agent and custodian (“Custodian”) of the Funds’ assets.As Custodian, BBH has agreed to (1) make receipts and disbursements of money on behalf of the Funds; (2) collect and receive all income and other payments and distributions on account of the

|

| Notes to Financial Statements (Unaudited) (Continued) |

| April 30, 2023 |