UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

________

623 Fifth Avenue, 15th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

SEI Investments Global Fund Services

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 493-8631

Date of fiscal year end: June 30, 2012

Date of reporting period: June 30, 2012

| Item 1. | Reports to Stockholders. |

Global X Permanent ETF (ticker: PERM)

Global X Top Guru Holdings Index ETF (ticker: GURU)

Annual Report

June 30, 2012

Table Of Contents

| Management Discussion of Fund Performance (unaudited) | 1 |

| Schedules of Investments | |

| Global X Permanent ETF | 4 |

| Global X Top Guru Holdings Index ETF | 9 |

| Statements of Assets and Liabilities | 12 |

| Statements of Operations | 13 |

| Statements of Changes in Net Assets | 14 |

| Financial Highlights | 15 |

| Notes to Financial Statements | 16 |

| Report of Independent Registered Public Accounting Firm | 25 |

| Disclosure of Fund Expenses (unaudited) | 26 |

| Approval of Investment Advisory Agreement (unaudited) | 28 |

| Supplemental Information (unaudited) | 32 |

| Trustees and Officers of the Trust (unaudited) | 33 |

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, will be available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

| Management Discussion Of Fund Performance (unaudited) |

| Global X Permanent Etf |

Global X Permanent ETF (ticker: PERM)

The Global X Permanent ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Permanent Index (the “Underlying Index”). The Fund generally seeks to replicate the Underlying Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Underlying Index and as a result may or may not hold all the securities that are included in the Underlying Index.

The Underlying Index tracks the performance of four asset class categories that are designed to perform differently across different economic environments, as defined by Structured Solutions AG (the “Index Provider”). On each rebalance, the Underlying Index allocates 25% each to four asset class categories, as follows:

| Asset Class | | Allocation | |

| Stocks: | | | | |

| · U.S. Large Cap Stocks | | | 9% | |

| · U.S. Small Cap Stocks | | | 3% | |

| · International Stocks | | | 3% | |

| · U.S. Real Estate Stocks | | | 5% | |

| · U.S. and Foreign Natural Resource Stocks | | | 5% | |

| U.S. Treasury Bonds (Long-Term) | | | 25% | |

| (remaining maturity greater than 20 years) | | | | |

| U.S. Treasury Bills and Bonds (Short-Term) | | | 25% | |

| (remaining maturity of less than three years) | | | | |

| Gold & Silver | | | | |

| · Gold ETFs and ETCs | | | 20% | |

| · Silver ETFs and ETCs | | | 5% | |

| Total | | | 100% | |

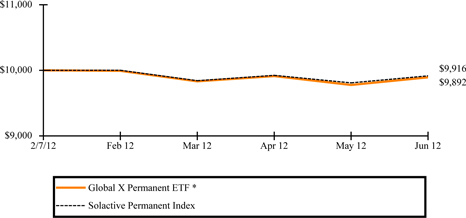

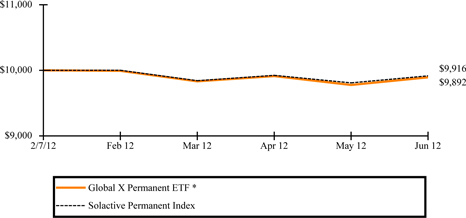

For the period from the Fund’s commencement date on February 7, 2012 through June 30, 2012 (the “reporting period”), the Fund decreased 1.08%, while the Underlying Index decreased 0.84%. The Fund commenced operations with a net asset value of $25.04 per share on February 7, 2012 and ended the period with a net asset value of $24.77 on June 30, 2012.

Of the Fund’s 87 holdings as of June 30, 2012, 53 increased in value for the reporting period, led by U.S. Treasury Bond 3.875%, 08/15/2040 and U.S. Treasury Bond 4.375%, 05/15/2040, which returned 0.56% and 0.55%, respectively. The worst performers were ETFS Physical Gold and ETFS Physical Silver, which returned -1.31% and -0.83%, respectively.

| Management Discussion Of Fund Performance (unaudited) |

| Global X Permanent Etf |

Growth of a $10,000 Investment

| | | TOTAL RETURN FOR THE PERIOD ENDED | |

| | | JUNE 30, 2012* | |

| | | Cumulative Inception to Date | |

| | | Net Asset Value | | | Market Price | |

| Global X Permanent ETF | | | (1.08%) | | | | (0.96%) | |

| Solactive Permanent Index | | | (0.84%) | | | | (0.84%) | |

*Fund commenced operations on February 7, 2012. Total return is for the period indicated and has not been annualized.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Underlying Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the Underlying Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index on previous page.

| Management Discussion Of Fund Performance (unaudited) |

| Global X Top Guru Holdings Index Etf |

Global X Top Guru Holdings Index ETF (ticker: GURU)

The Global X Top Guru Holdings Index ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Top Guru Holdings Index (the “Underlying Index”). The Fund generally seeks to replicate the Underlying Index but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Underlying Index and as a result may or may not hold all the securities that are included in the Underlying Index.

The Underlying Index is comprised of the top U.S. listed equity positions reported on Form 13F by a select group of entities that Structured Solutions AG (the “Index Provider”) characterizes as hedge funds. Hedge funds are selected from a pool of thousands of privately offered pooled investment vehicles based on the size of their reported equity holdings and the efficacy of replicating their publicly disclosed positions. Hedge funds must have minimum reported holdings of $500 million in their form 13F to be considered for the index. Additional filters are applied to eliminate hedge funds that have high turnover rates for equity holdings.

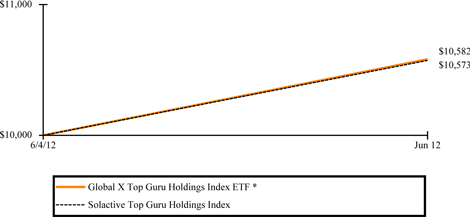

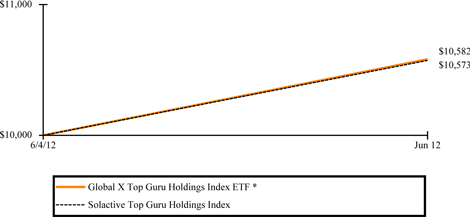

For the period from the Fund’s commencement date on June 4, 2012 through June 30, 2012 (the “reporting period”), the Fund increased 5.82%, while the Underlying Index increased 5.73%. The Fund commenced operations with a net asset value of $14.96 per share on June 4, 2012 and ended the period with a net asset value of $15.83 on June 30, 2012.

Of the Fund’s 50 holdings as of June 30, 2012, 42 increased in value for the reporting period, led by Marathon Petroleum Corp. and NXP Semiconductors N.V., which returned 0.61% and 0.42%, respectively. The worst performers were Tempur-Pedic International Inc. and Senasta Technologies Holding N.V., which returned -0.84% and -0.19%, respectively.

Growth of a $10,000 Investment

| | | TOTAL RETURN FOR THE PERIOD ENDED | |

| | | JUNE 30, 2012* | |

| | | Cumulative Inception to Date | |

| | | Net Asset Value | | | Market Price | |

| Global X Top Guru Holdings Index ETF | | | 5.82% | | | | 7.09% | |

| Solactive Top Guru Holdings Index | | | 5.73% | | | | 5.73% | |

*Fund commenced operations on June 4, 2012. Total return is for the period indicated and has not been annualized.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Underlying Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the Underlying Index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative index above.

| Schedule of Investments | June 30, 2012 |

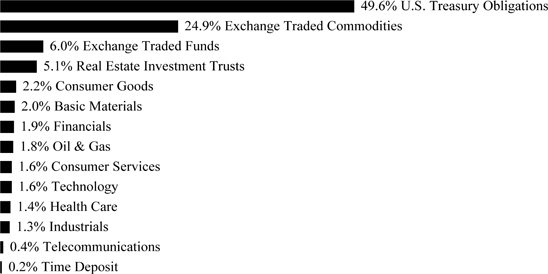

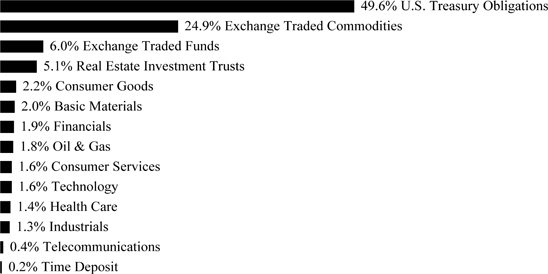

Sector Weightings (Unaudited) †:

† Percentages based on total investments.

| | | Face Amount/ | | | | |

| | | Shares | | | Value | |

| U.S. TREASURY OBLIGATIONS — 49.4% | | | | | | | | |

| U.S. Treasury Bonds | | | | | | | | |

| 4.625%, 02/15/40 | | $ | 658,000 | | | $ | 910,199 | |

| 4.375%, 05/15/40 | | | 688,000 | | | | 916,867 | |

| 4.375%, 11/15/39 | | | 689,000 | | | | 917,769 | |

| 3.875%, 08/15/40 | | | 739,000 | | | | 909,779 | |

| U.S. Treasury Notes | | | | | | | | |

| 2.625%, 12/31/14 | | | 878,000 | | | | 927,182 | |

| 2.500%, 03/31/15 | | | 868,000 | | | | 917,910 | |

| 2.375%, 02/28/15 | | | 871,000 | | | | 916,524 | |

| 2.125%, 11/30/14 | | | 890,000 | | | | 927,477 | |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | | | | |

| (Cost $7,151,005) | | | | | | | 7,343,707 | |

| | | | | | | | | |

| EXCHANGE TRADED COMMODITIES — 24.8% | | | | | | | | |

| ETFS Physical Gold | | | 18,875 | | | | 2,957,146 | |

| ETFS Physical Silver | | | 27,054 | | | | 726,408 | |

| TOTAL EXCHANGE TRADED COMMODITIES | | | | | | | | |

| (Cost $3,929,845) | | | | | | | 3,683,554 | |

| | | | | | | | | |

| COMMON STOCK — 19.2% | | | | | | | | |

| | | | | | | | | |

| BRAZIL— 0.6% | | | | | | | | |

| Basic Materials — 0.3% | | | | | | | | |

| Vale, Cl B | | | 2,234 | | | | 44,345 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | | | |

| Oil & Gas — 0.3% | | | | | | | | |

| Petroleo Brasileiro | | | 2,371 | | | $ | 44,504 | |

| TOTAL BRAZIL | | | | | | | 88,849 | |

| | | | | | | | | |

| CHINA— 0.3% | | | | | | | | |

| Oil & Gas — 0.3% | | | | | | | | |

| PetroChina ADR | | | 348 | | | | 44,941 | |

| SINGAPORE— 0.3% | | | | | | | | |

| Consumer Goods — 0.3% | | | | | | | | |

| Wilmar International | | | 15,513 | | | | 44,209 | |

| SWITZERLAND— 0.2% | | | | | | | | |

| Basic Materials — 0.2% | | | | | | | | |

| Xstrata | | | 2,940 | | | | 36,771 | |

| UNITED STATES— 17.8% | | | | | | | | |

| Basic Materials — 1.5% | | | | | | | | |

| Anglo American | | | 1,209 | | | | 39,545 | |

| BHP Billiton | | | 681 | | | | 44,469 | |

| Mosaic | | | 888 | | | | 48,627 | |

| Potash Corp of Saskatchewan | | | 1,056 | | | | 46,136 | |

| Rio Tinto | | | 930 | | | | 44,464 | |

| | | | | | | | 223,241 | |

| Consumer Goods — 1.9% | | | | | | | | |

| Altria Group | | | 951 | | | | 32,857 | |

| Archer-Daniels-Midland | | | 1,680 | | | | 49,594 | |

| Coca-Cola | | | 396 | | | | 30,963 | |

| Kraft Foods, Cl A | | | 708 | | | | 27,343 | |

| Monsanto | | | 603 | | | | 49,916 | |

| PepsiCo | | | 411 | | | | 29,041 | |

| Philip Morris International | | | 360 | | | | 31,414 | |

| Procter & Gamble | | | 423 | | | | 25,909 | |

| | | | | | | | 277,037 | |

| Consumer Services — 1.6% | | | | | | | | |

| Amazon.com * | | | 144 | | | | 32,882 | |

| Comcast, Cl A | | | 1,020 | | | | 32,610 | |

| CVS Caremark | | | 648 | | | | 30,281 | |

| eBay * | | | 514 | | | | 21,593 | |

| Home Depot | | | 600 | | | | 31,794 | |

| McDonald's | | | 276 | | | | 24,434 | |

| Wal-Mart Stores | | | 444 | | | | 30,956 | |

| Walt Disney | | | 696 | | | | 33,756 | |

| | | | | | | | 238,306 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | | | |

| Financials — 1.9% | | | | | | | | |

| American Express | | | 552 | | | $ | 32,132 | |

| American International Group * | | | 672 | | | | 21,564 | |

| Bank of America | | | 3,807 | | | | 31,141 | |

| Berkshire Hathaway, Cl B * | | | 339 | | | | 28,249 | |

| Citigroup | | | 888 | | | | 24,340 | |

| JPMorgan Chase | | | 732 | | | | 26,155 | |

| Mastercard | | | 50 | | | | 21,506 | |

| US Bancorp | | | 960 | | | | 30,874 | |

| Visa, Cl A | | | 264 | | | | 32,638 | |

| Wells Fargo | | | 924 | | | | 30,898 | |

| | | | | | | | 279,497 | |

| Health Care — 1.4% | | | | | | | | |

| Abbott Laboratories | | | 492 | | | | 31,719 | |

| Amgen | | | 396 | | | | 28,924 | |

| Bristol-Myers Squibb | | | 840 | | | | 30,198 | |

| Johnson & Johnson | | | 408 | | | | 27,565 | |

| Merck | | | 696 | | | | 29,058 | |

| Pfizer | | | 1,260 | | | | 28,980 | |

| UnitedHealth Group | | | 528 | | | | 30,888 | |

| | | | | | | | 207,332 | |

| Industrials — 1.3% | | | | | | | | |

| 3M | | | 312 | | | | 27,955 | |

| Boeing | | | 360 | | | | 26,748 | |

| Caterpillar | | | 240 | | | | 20,378 | |

| General Electric | | | 1,428 | | | | 29,760 | |

| Union Pacific | | | 240 | | | | 28,634 | |

| United Parcel Service, Cl B | | | 351 | | | | 27,645 | |

| United Technologies | | | 348 | | | | 26,285 | |

| | | | | | | | 187,405 | |

| Oil & Gas — 1.2% | | | | | | | | |

| Chevron | | | 480 | | | | 50,640 | |

| Exxon Mobil | | | 588 | | | | 50,315 | |

| Royal Dutch Shell, Cl A | | | 719 | | | | 48,482 | |

| Schlumberger | | | 351 | | | | 22,783 | |

| | | | | | | | 172,220 | |

| Real Estate Investment Trusts — 5.1% | | | | | | | | |

| American Tower | | | 990 | | | | 69,211 | |

| Annaly Capital Management | | | 4,479 | | | | 75,158 | |

| Boston Properties | | | 732 | | | | 79,327 | |

| Equity Residential | | | 1,263 | | | | 78,761 | |

| General Growth Properties | | | 3,839 | | | | 69,447 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

| | | Shares/Face | | | | |

| | | Amount | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | | | |

| Real Estate Investment Trusts — continued | | | | | | | | |

| HCP | | | 1,812 | | | $ | 80,000 | |

| Public Storage | | | 543 | | | | 78,415 | |

| Simon Property Group | | | 446 | | | | 69,424 | |

| Ventas | | | 1,287 | | | | 81,235 | |

| Vornado Realty Trust | | | 936 | | | | 78,605 | |

| | | | | | | | 759,583 | |

| Technology — 1.5% | | | | | | | | |

| Apple | | | 37 | | | | 21,608 | |

| Cisco Systems | | | 1,380 | | | | 23,695 | |

| EMC * | | | 851 | | | | 21,811 | |

| Google, Cl A * | | | 48 | | | | 27,843 | |

| Intel | | | 1,008 | | | | 26,863 | |

| International Business Machines | | | 144 | | | | 28,164 | |

| Microsoft | | | 912 | | | | 27,898 | |

| Oracle | | | 939 | | | | 27,888 | |

| QUALCOMM | | | 456 | | | | 25,390 | |

| | | | | | | | 231,160 | |

| Telecommunications — 0.4% | | | | | | | | |

| AT&T | | | 915 | | | | 32,629 | |

| Verizon Communications | | | 720 | | | | 31,997 | |

| | | | | | | | 64,626 | |

| TOTAL UNITED STATES | | | | | | | 2,640,407 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $2,834,782) | | | | | | | 2,855,177 | |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS — 5.9% | | | | | | | | |

| Vanguard FTSE All-World ex-US ETF | | | 10,768 | | | | 441,272 | |

| Vanguard Small-Cap ETF | | | 5,801 | | | | 441,108 | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Cost $898,298) | | | | | | | 882,380 | |

| | | | | | | | | |

| TIME DEPOSIT — 0.2% | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 07/02/12 | | | | | | | | |

| (Cost $24,629) | | $ | 24,629 | | | | 24,629 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 99.5% | | | | | | | | |

| (Cost $14,838,559) | | | | | | $ | 14,789,447 | |

| | | | | | | | | |

| Percentages are based on Net Assets of $14,859,067 | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

* Non-income producing security.

ADR — American Depositary Receipt

Cl — Class

ETF — Exchange Traded Fund

FTSE — Financial Times and London Stock Exchange

The following is a summary of the inputs used as of June 30, 2012, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Treasury Obligations | | $ | — | | | $ | 7,343,707 | | | $ | — | | | $ | 7,343,707 | |

| Exchange Traded Commodities | | | 3,683,554 | | | | — | | | | — | | | | 3,683,554 | |

| Common Stock | | | 2,855,177 | | | | — | | | | — | | | | 2,855,177 | |

| Exchange Traded Funds | | | 882,380 | | | | — | | | | — | | | | 882,380 | |

| Time Deposit | | | — | | | | 24,629 | | | | — | | | | 24,629 | |

| Total Investments in Securities | | $ | 7,421,111 | | | $ | 7,368,336 | | | $ | — | | | $ | 14,789,447 | |

For the period ended June 30, 2012, there have been no transfers between Level 1 and Level 2 investments. The Fund generally recognizes transfers between the levels at the beginning of the period.

For the period ended June 30, 2012, there were no Level 3 investments at the beginning or end of the period.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

| Global X Top Guru Holdings Index ETF |

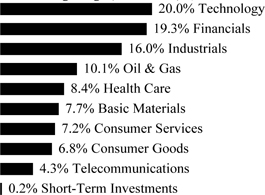

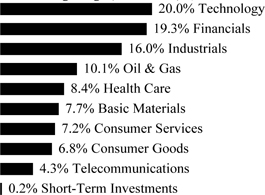

Sector Weightings (Unaudited) †:

† Percentages based on total investments.

| | | Shares | | | Value | |

| COMMON STOCK — 99.7% | | | | | | | | |

| BRAZIL— 4.2% | | | | | | | | |

| Consumer Goods — 2.1% | | | | | | | | |

| Cosan, Cl A | | | 9,246 | | | $ | 117,332 | |

| Financials — 2.1% | | | | | | | | |

| Banco Bradesco | | | 7,672 | | | | 114,083 | |

| TOTAL BRAZIL | | | | | | | 231,415 | |

| | | | | | | | | |

| MEXICO— 2.2% | | | | | | | | |

| Telecommunications — 2.2% | | | | | | | | |

| America Movil, Ser L | | | 4,615 | | | | 120,267 | |

| NETHERLANDS— 1.9% | | | | | | | | |

| Technology — 1.9% | | | | | | | | |

| Yandex, Cl A * | | | 5,381 | | | | 102,508 | |

| UNITED STATES— 91.4% | | | | | | | | |

| Basic Materials — 7.7% | | | | | | | | |

| BHP Billiton | | | 1,780 | | | | 116,234 | |

| Celanese, Cl A | | | 2,698 | | | | 93,405 | |

| Chemtura * | | | 7,542 | | | | 109,359 | |

| Cytec Industries | | | 1,816 | | | | 106,490 | |

| | | | | | | | 425,488 | |

| Consumer Goods — 4.8% | | | | | | | | |

| Delphi Automotive * | | | 3,868 | | | | 98,634 | |

| Kraft Foods, Cl A | | | 2,853 | | | | 110,183 | |

| Tempur-Pedic International * | | | 2,247 | | | | 52,557 | |

| | | | | | | | 261,374 | |

| Consumer Services — 7.2% | | | | | | | | |

| Dollar Thrifty Automotive Group * | | | 1,369 | | | | 110,834 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

| Global X Top Guru Holdings Index ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | | | |

| Consumer Services — continued | | | | | | | | |

| Education Management * | | | 12,180 | | | $ | 84,651 | |

| GameStop, Cl A | | | 5,637 | | | | 103,495 | |

| Pandora Media * | | | 9,333 | | | | 101,450 | |

| | | | | | | | 400,430 | |

| Financials — 17.1% | | | | | | | | |

| American Capital Agency | | | 3,415 | | | | 114,778 | |

| American International Group * | | | 3,796 | | | | 121,814 | |

| CBRE Group, Cl A * | | | 6,718 | | | | 109,906 | |

| CIT Group * | | | 3,163 | | | | 112,729 | |

| Hartford Financial Services Group | | | 6,374 | | | | 112,373 | |

| JPMorgan Chase | | | 3,285 | | | | 117,373 | |

| Nationstar Mortgage Holdings * | | | 6,224 | | | | 133,941 | |

| SLM | | | 8,160 | | | | 128,194 | |

| | | | | | | | 951,108 | |

| Health Care — 8.4% | | | | | | | | |

| Cigna | | | 2,473 | | | | 108,812 | |

| Life Technologies * | | | 2,630 | | | | 118,324 | |

| St. Jude Medical | | | 2,791 | | | | 111,389 | |

| Vivus * | | | 4,475 | | | | 127,716 | |

| | | | | | | | 466,241 | |

| Industrials — 15.9% | | | | | | | | |

| Canadian Pacific Railway | | | 1,468 | | | | 107,546 | |

| Goodrich | | | 877 | | | | 111,291 | |

| Lockheed Martin | | | 1,342 | | | | 116,862 | |

| Monster Worldwide * | | | 12,735 | | | | 108,247 | |

| Owens-Illinois * | | | 5,611 | | | | 107,563 | |

| Quad | | | 8,775 | | | | 126,184 | |

| Sensata Technologies Holding * | | | 3,465 | | | | 92,793 | |

| Spirit Aerosystems Holdings, Cl A * | | | 4,700 | | | | 112,001 | |

| | | | | | | | 882,487 | |

| Oil & Gas — 10.1% | | | | | | | | |

| Energy Transfer Equity | | | 2,921 | �� | | | 119,819 | |

| Hess | | | 2,357 | | | | 102,412 | |

| Marathon Petroleum | | | 2,984 | | | | 134,041 | |

| Pioneer Natural Resources | | | 1,109 | | | | 97,825 | |

| Targa Resources | | | 2,493 | | | | 106,451 | |

| | | | | | | | 560,548 | |

| Technology — 18.1% | | | | | | | | |

| Apple * | | | 196 | | | | 114,464 | |

| Cisco Systems | | | 6,738 | | | | 115,692 | |

| Google, Cl A * | | | 186 | | | | 107,893 | |

| Magnachip Semiconductor * | | | 11,546 | | | | 110,033 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | June 30, 2012 |

| Global X Top Guru Holdings Index ETF |

| | | Shares/Face | | | | |

| | | Amount | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| | | | | | | | | |

| Technology — continued | | | | | | | | |

| Microsoft | | | 3,786 | | | $ | 115,814 | |

| Motorola Solutions | | | 2,291 | | | | 110,220 | |

| NXP Semiconductor * | | | 5,038 | | | | 117,134 | |

| ViaSat * | | | 2,607 | | | | 98,466 | |

| Yahoo! * | | | 7,164 | | | | 113,406 | |

| | | | | | | | 1,003,122 | |

| Telecommunications — 2.1% | | | | | | | | |

| Crown Castle International * | | | 2,031 | | | | 119,138 | |

| TOTAL UNITED STATES | | | | | | | 5,069,936 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $5,231,769) | | | | | | | 5,524,126 | |

| | | | | | | | | |

| TIME DEPOSIT — 0.2% | | | | | | | | |

| Brown Brothers Harriman, 0.030%, 07/02/12 | | | | | | | | |

| (Cost $10,574) | | $ | 10,574 | | | | 10,574 | |

| TOTAL INVESTMENTS — 99.9% | | | | | | | | |

| (Cost $5,242,343) | | | | | | $ | 5,534,700 | |

| | | | | | | | | |

| Percentages are based on Net Assets of $5,539,284 | | | | | | | | |

* Non-income producing security.

Cl — Class

Ser — Series

The following is a summary of the inputs used as of June 30, 2012, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 5,524,126 | | | $ | — | | | $ | — | | | $ | 5,524,126 | |

| Time Deposit | | | — | | | | 10,574 | | | | — | | | | 10,574 | |

| Total Investments in Securities | | $ | 5,524,126 | | | $ | 10,574 | | | $ | — | | | $ | 5,534,700 | |

For the period ended June 30, 2012, there have been no transfers between Level 1 and Level 2 investments. The Fund generally recognizes transfers between the levels at the beginning of the period.

For the period ended June 30, 2012, there were no Level 3 investments at the beginning or end of the period.

The accompanying notes are an integral part of the financial statements.

Statements Of Assets And Liabilities

| | | | | | Global X Top Guru | |

| | | Global X | | | Holdings Index | |

| | | Permanent ETF | | | ETF | |

| Assets: | | | | | | | | |

| Cost of Investments | | $ | 14,838,559 | | | $ | 5,242,343 | |

| Cost of Foreign Currency | | | 212 | | | | — | |

| Investments at Value | | $ | 14,789,447 | | | $ | 5,534,700 | |

| Foreign Currency at Value | | | 214 | | | | — | |

| Receivable for Investment Securities Sold | | | 2,357,930 | | | | — | |

| Dividend and Interest Receivable | | | 59,684 | | | | 7,346 | |

| Total Assets | | | 17,207,275 | | | | 5,542,046 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Payable for Investment Securities Purchased | | | 2,342,636 | | | | — | |

| Payable due to Investment Adviser | | | 5,572 | | | | 2,762 | |

| | | | | | | | | |

| Total Liabilities | | | 2,348,208 | | | | 2,762 | |

| | | | | | | | | |

| Net Assets | | $ | 14,859,067 | | | $ | 5,539,284 | |

| | | | | | | | | |

| Net Assets Consist of: | | | | | | | | |

| Paid-in Capital | | $ | 14,882,500 | | | $ | 5,236,000 | |

| Undistributed Net Investment Income | | | 40,850 | | | | 7,013 | |

| Accumulated Net Realized Gain (Loss) on Investments and Foreign Currency Translations | | | (15,171 | ) | | | 3,914 | |

| Net Unrealized Appreciation (Depreciation) on Investments | | | (49,112 | ) | | | 292,357 | |

| | | | | | | | | |

| Net Assets | | $ | 14,859,067 | | | $ | 5,539,284 | |

| Outstanding Shares of Beneficial Interest (unlimited authorization — no par value) | | | 600,000 | | | | 350,000 | |

| | | | | | | | | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 24.77 | | | $ | 15.83 | |

The accompanying notes are an integral part of the financial statements.

Statements Of Operations

| For the period ended June 30, 2012 |

| |

| | | | | | Global X Top | |

| | | Global X | | | Guru | |

| | | Permanent | | | Holdings | |

| | | ETF (1) | | | Index ETF(2) | |

| Investment Income: | | | | | | | | |

| Dividend Income | | $ | 23,682 | | | $ | 9,970 | |

| Interest Income | | | 32,355 | | | | — | |

| Less: Foreign Taxes Withheld | | | (379 | ) | | | (195 | ) |

| | | | | | | | | |

| Total Investment Income | | | 55,658 | | | | 9,775 | |

| Supervision and Administration Fees(3) | | | 19,122 | | | | 2,762 | |

| | | | | | | | | |

| Total Expenses | | | 19,122 | | | | 2,762 | |

| Net Expenses | | | 19,122 | | | | 2,762 | |

| Net Investment Income | | | 36,536 | | | | 7,013 | |

| | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | |

| Investments | | | (13,859 | ) | | | 3,914 | |

| Foreign Currency Transactions | | | 3,002 | | | | — | |

| | | | | | | | | |

| Net Realized Gain (Loss) | | | (10,857 | ) | | | 3,914 | |

| | | | | | | | | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | |

| Investments | | | (49,112 | ) | | | 292,357 | |

| | | | | | | | | |

| Net Change in Unrealized Appreciation (Depreciation) | | | (49,112 | ) | | | 292,357 | |

| | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) | | | (59,969 | ) | | | 296,271 | |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | (23,433 | ) | | $ | 303,284 | |

| (1) | The Fund commenced operations on February 7, 2012. |

| (2) | The Fund commenced operations on June 4, 2012. |

| (3) | The Supervision and Administration fees reflect the supervisory and administrative fee, which includes fees paid by the Funds for the investment advisory services provided by the Adviser. See Note 3 in Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

Statements Of Changes In Net Assets

| | | Global X | | | Global X Top | |

| | | Permanent | | | Guru Holdings | |

| | | ETF | | | Index ETF | |

| | | Period Ended | | | Period Ended | |

| | | June 30, 2012(1) | | | June 30, 2012(2) | |

| Operations: | | | | | | | | |

| Net Investment Income | | $ | 36,536 | | | $ | 7,013 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (10,857 | ) | | | 3,914 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments | | | (49,112 | ) | | | 292,357 | |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | (23,433 | ) | | | 303,284 | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Issued | | | 14,882,500 | | | | 5,236,000 | |

| | | | | | | | | |

| Increase in Net Assets from Capital Share Transactions | | | 14,882,500 | | | | 5,236,000 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 14,859,067 | | | | 5,539,284 | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | — | | | | — | |

| | | | | | | | | |

| End of Period | | $ | 14,859,067 | | | $ | 5,539,284 | |

| | | | | | | | | |

| Undistributed Net Investment Income | | $ | 40,850 | | | $ | 7,013 | |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Issued | | | 600,000 | | | | 350,000 | |

| | | | | | | | | |

| Net Increase in Shares Outstanding from Share Transactions | | | 600,000 | | | | 350,000 | |

| (1) | The Fund commenced operations on February 7, 2012. |

| (2) | The Fund commenced operations on June 4, 2012. |

The accompanying notes are an integral part of the financial statements.

Financial Highlights

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period Ended June 30, 2012

| | | | | | | | | Net Realized | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of | | | |

| | | | | | | | | and | | | | | | | | | | | | | | | | | | | | | | | Ratio of | | | Net | | | |

| | | | | | | | | Unrealized | | | | | | | | | | | | | | | | | | | | Net | | | Expenses | | | Investment | | | |

| | | Net Asset | | | Net | | | Gain (Loss) | | | | | Distribution | | | Distribution | | | | | | Net Asset | | | | | | Assets, | | | to | | | Income to | | | |

| | | Value, | | | Investment | | | on | | Total from | | | from Net | | | from | | | Total from | | | Value, End | | | Total | | | End of | | | Average | | | Average | | Portfolio | |

| | | Beginning | | | Income | | | Investments | | Operations | | | Investment | | | Capital | | | Distributions | | | of Period | | | Return | | | Period | | | Net Assets | | | Net Assets | | Turnover | |

| | | of Period ($) | | | ($)* | | | ($) | | ($) | | | Income ($) | | | Gains ($) | | | ($) | | | ($) | | | (%)** | | | ($)(000) | | | (%)† | | | (%)† | | (%)†† | |

| Global X Permanent ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2012 (1) | | | 25 .04 | | | | 0 .09 | | | (0 .36 | ) | | (0 .27 | ) | | | — | | | | — | | | | — | | | | 24 .77 | | | | (1.08 | ) | | | 14,859 | | | | 0 .48 | | | 0 .92 | | | 14 .89 | |

| Global X Top Guru Holdings Index ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | �� | | | | | | | | | | |

| 2012 (2) | | | 14 .96 | | | | 0 .02 | | | 0 .85 | | | 0 .87 | | | | — | | | | — | | | | — | | | | 15 .83 | | | | 5.82 | | | | 5,539 | | | | 0 .75 | | | 1 .90 | | | 1 .90 | |

| (1) | The Fund commenced operations on February 7, 2012. |

| (2) | The Fund commenced operations on June 4, 2012. |

| * | Per share data calculated using average shares method. |

| ** | Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| †† | Portfolio turnover rate is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

Notes to Financial Statements

1. ORGANIZATION

The Global X Funds (the "Trust") is a Delaware Statutory Trust formed on March 6, 2008. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company with eighty-seven portfolios as of June 30, 2012. The financial statements herein and the related notes pertain to the Global X Permanent ETF and Global X Top Guru Holdings Index ETF (each a “Fund”, collectively, the “Funds”). Each Fund is non-diversified.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the Significant Accounting Policies followed by the Funds.

USE OF ESTIMATES — The preparation of financial statements in conformity with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates, and could have a material impact to the Funds.

SECURITY VALUATION — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent mean between the quoted bid and asked prices (absent both bid and asked prices on such exchange, the bid price may be used).

For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain a bid price from at least one independent broker.

Notes to Financial Statements (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

SECURITY VALUATION (continued)

Securities for which market prices are not readily available are valued in accordance with Fair Value Procedures established by the Board of Trustees (the “Board”). The Funds’ Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security's trading has been halted or suspended; the security has been de-listed from a national exchange; the security's primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee. As of June 30, 2012, there were no securities priced using the Fair Value Procedures.

For securities that principally trade on a foreign market or exchange, a significant gap in time can exist between the time of a particular security's last trade and the time at which the Funds calculated their net asset value. The closing prices of such securities may no longer reflect their market value at the time the Funds calculated net asset value if an event that could materially affect the value of those securities (a “Significant Event”) has occurred between the time of the security's last close and the time that the Funds calculate net asset value. A Significant Event may relate to a single issuer or to an entire market sector. If Global X Management Company LLC (the “Adviser”) becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Funds calculate net asset value, it may request that a Committee meeting be called. In addition, the Funds’ Sub-administrator, SEI Investments Global Funds Services (“SEIGFS”), monitors price movements among certain selected indices, securities and/or baskets of securities that may be an indicator that the closing prices received earlier from foreign exchanges or markets may not reflect market value at the time the Funds calculate net asset value. If price movements in a monitored index or security exceed levels established by SEIGFS, SEIGFS notifies the Adviser that such limits have been exceeded. In such event, the Adviser makes the determination whether a Committee meeting should be called based on the information provided.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Funds disclose the fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date

Notes to Financial Statements (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

SECURITY VALUATION (concluded)

Level 2 – Other significant observable inputs (including quoted prices for similar investments, fair value of investments for which the Funds have the ability to fully redeem tranches at net asset value as of the measurement date or within the near-term, and short-term investments valued at amortized cost)

Level 3 – Significant unobservable inputs (including the Funds own assumptions in determining the fair value of investments, fair value of investments for which the Funds do not have the ability to fully redeem tranches at net asset value as of the measurement date or within the near-term)

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

For the period ended June 30, 2012, there have been no significant changes to the Funds’ fair valuation methodologies.

In May 2011, the Financial Accounting Standards Board issued Accounting Standards Updates (“ASU”) No. 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards” (“IFRS”) (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU 2011-04 requires reporting entities to disclose the following information for fair value measurements categorized within Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity, and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 requires reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. Adoption of ASU 2011-04 did not materially affect the Funds’ financial condition or results of operations.

FEDERAL INCOME TAXES — It is each Fund’s intention to qualify or continue to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, no provisions for Federal income taxes have been made in the financial statements.

The Funds evaluate tax positions taken or expected to be taken in the course of preparing the Funds’ tax returns to determine whether it is "more-likely-than-not" (i.e., greater than 50 percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Funds did not record any tax provisions in the current period. However, management’s conclusions regarding tax positions may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last three tax year ends, as applicable), on-going analysis of and changes to

Notes to Financial Statements (continued)

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

tax laws, regulations and interpretations thereof. Interest and penalties, if incurred, will be included in expenses on the Statement of Operations.

SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on the trade date for financial reporting purposes. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from the settlement date.

FOREIGN CURRENCY TRANSLATION — The books and records of the Funds are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent amounts actually received or paid.

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — The Funds distribute their net investment income on a pro rata basis. Any net realized capital gains are distributed annually. All distributions are recorded on the ex-dividend date.

CREATION UNITS — The Funds issue and redeem shares (“Shares”) at Net Asset Value (“NAV”), and only in large blocks of Shares (each block of Shares for a Fund is called a “Creation Unit” or multiples thereof). Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation transaction fee per transaction (“Transaction Fee”). The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an investor on the same day. An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard Redemption Fee per transaction on the date of such redemption, regardless of the number of Creation Units redeemed that day.

If a Creation Unit is purchased or redeemed for cash, a higher Transaction Fee will be charged. The following table discloses Creation Unit breakdown:

| | | Creation | | | | | | | | | | |

| | | Unit | | | Transaction | | | | | | Redemption | |

| | | Shares | | | Fee | | | Value | | | Fee | |

| Global X Permanent ETF | | | 50,000 | | | $ | 1,000 | | | $ | 1,238,500 | | | $ | 1,000 | |

| Global X Top Guru Holdings Index ETF | | | 50,000 | | | | 750 | | | | 791,500 | | | | 750 | |

Notes to Financial Statements (continued)

3. RELATED PARTY TRANSACTIONS

The Adviser serves as the investment adviser and the administrator for the Funds. Subject to the supervision of the Board of Trustees, the Adviser is responsible for managing the investment activities of the Funds and the Funds’ business affairs and other administrative matters and provides or causes to be furnished all supervisory, administrative and other services reasonably necessary for the operation of the Funds, including certain distribution services (provided pursuant to a separate Distribution Agreement), certain shareholder and distribution-related services (provided pursuant to a separate Rule 12b-1 Plan and related agreements) and investment advisory services (provided pursuant to a separate Investment Advisory Agreement), under what is essentially an "all-in" fee structure. For its service to the Funds, under the Supervision and Administration Agreement, each Fund pays a monthly fee to the Adviser at the annual rate (stated as a percentage of the average daily net assets of the Fund). In addition, the Funds bear other expenses that are not covered by the Supervision and Administration Agreement, which may vary and affect the total expense ratios of the Funds, such as taxes, brokerage fees, commissions, acquired fund fees, and other transaction expenses, interest expenses and extraordinary expenses (such as litigation and indemnification expenses).

| | | Supervision and | |

| | | Administration Fee | |

| Global X Permanent ETF | | | 0.48 | % |

| Global X Top Guru Holdings Index ETF | | | 0.75 | % |

SEIGFS serves as Sub-Administrator to the Funds. As Sub-Administrator, SEIGFS provides the Funds with the required general administrative services, including, without limitation: office space, equipment, and personnel; clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and assistance with the preparation and filing of reports, registration statements, proxy statements and other materials required to be filed or furnished by the Funds under federal and state securities laws. As compensation for these services, the Sub-Administrator receives certain out-of-pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser.

SEI Investments Distribution Co. (“SIDCO”) serves as each Fund’s underwriter and distributor of Shares pursuant to a Distribution Agreement. Under the Distribution Agreement, SIDCO, as agent, receives orders to create and redeem Shares in Creation Unit Aggregations and transmits such orders to the Trust’s custodian and transfer agent. The Distributor has no obligation to sell any specific quantity of Fund Shares. SIDCO bears the following costs and expenses relating to the distribution of Shares: (i) the costs of processing and maintaining records of creations of Creation Units; (ii) all costs of maintaining the records required of a registered broker/dealer; (iii) the expenses of maintaining its registration or qualification as a dealer or broker under Federal or state laws; (iv) filing fees; and (v) all other expenses incurred in connection with the distribution services as contemplated in the Distribution Agreement. SIDCO receives no fee for its distribution services under the Distribution Agreement.

Notes to Financial Statements (continued)

4. INVESTMENT TRANSACTIONS

For the period ended June 30, 2012, the purchases and sales of investments in securities excluding in-kind transactions, long-term U.S. Government and short-term securities were:

| | | | | | Sales and | |

| | | Purchases | | | Maturities | |

| Global X Permanent ETF | | $ | 8,488,526 | | | $ | 1,503,077 | |

| Global X Top Guru Holdings Index ETF | | | 186,771 | | | | 105,131 | |

For the period ended June 30, 2012, in-kind transactions associated with creations were:

| | | Purchases | |

| Global X Permanent ETF | | $ | 7,862,056 | |

| Global X Top Guru Holdings Index ETF | | | 5,146,215 | |

5. TAX INFORMATION

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with Federal income tax regulations, which may differ from U.S. GAAP. As a result investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed net investment income (loss), accumulated net realized gain (loss) or paid-in capital, as appropriate, in the period that the differences arise.

The following differences, primarily attributable to foreign currency, have been reclassified to/from the following accounts during the fiscal period ended June 30, 2012.

| | | Undistributed | | | | |

| | | Net | | | Accumulated | |

| | | Investment | | | Net Realized | |

| Global X Funds | | Income | | | Loss | |

| Global X Permanent ETF | | $ | 4,314 | | | $ | (4,314 | ) |

| Global X Top Guru Holdings Index ETF | | | – | | | | – | |

These reclassifications have no impact on net assets or net asset value per share.

There were no distributions from either Fund during the period ended June 30, 2012.

As of June 30, 2012, the components of tax basis distributable earnings (accumulated losses) were as follows:

Notes to Financial Statements (continued)

5. TAX INFORMATION (continued)

| | | Global X Funds | |

| | | | | | Global X Top | |

| | | Global X | | | Guru Holdings | |

| | | Permanent ETF | | | Index ETF | |

| Undistributed Ordinary Income | | $ | 50,594 | | | $ | 10,927 | |

| Post October losses | | | (9,941 | ) | | | — | |

| Unrealized Appreciation (Depreciation) on Investments and Foreign Currency | | | (64,086 | ) | | | 292,357 | |

| Total Distributable Earnings (Accumulated Losses) | | $ | (23,433 | ) | | $ | 303,284 | |

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Funds will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law. As of June 30, 2012, the Funds had no capital loss carryforwards.

The Federal tax cost and aggregate gross unrealized appreciation and depreciation on investments held by the Funds at June 30, 2012, were as follows:

| | | | | | Aggregated | | | Aggregated | | | Net | |

| | | | | | Gross | | | Gross | | | Unrealized | |

| | | Federal Tax | | | Unrealized | | | Unrealized | | | Appreciation | |

| Global X Funds | | Cost | | | Appreciation | | | Depreciation | | | (Depreciation) | |

| Global X Permanent ETF | | $ | 14,853,533 | | | $ | 315,021 | | | $ | (379,107 | ) | | $ | (64,086 | ) |

| Global X Top Guru Holdings Index ETF | | | 5,242,343 | | | | 376,418 | | | | (84,061 | ) | | | 292,357 | |

The preceding differences between book and tax cost are primarily due to mark to market treatment of passive foreign investment companies and wash sales.

Notes to Financial Statements (continued)

6. CONCENTRATION OF RISKS

The Funds invest in securities of foreign issuers in several countries. These investments may involve certain considerations and risks not typically associated with investments in the U.S. as a result of, among other factors, the possibility of future political and economic developments and the level of governmental supervision and regulation of securities markets in the respective countries.

The securities markets of emerging countries are less liquid and subject to greater price volatility, and have a smaller market capitalization, than the U.S. securities markets. In certain countries, there may be fewer publicly traded securities and the market may be dominated by a few issuers or sectors. Issuers and securities markets in such countries are not subject to as extensive and frequent accounting, financial and other reporting requirements or as comprehensive government regulations as are issuers and securities markets in the U.S. In particular, the assets and profits appearing on the financial statements of emerging country issuers may not reflect their financial position or results of operations in the same manner as financial statements for U.S. issuers. Substantially less information may be publicly available about emerging country issuers than is available about issuers in the U.S.

The Funds may be subject to taxes imposed by countries in which they invest. Such taxes are generally based on either income or gains earned or repatriated. The Funds accrue and apply such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned.

The Funds use a replication strategy. A replication strategy is an indexing strategy that involves investing in the securities of the Underlying Index in approximately the same proportions as in the Underlying Indices. The Funds may utilize a representative sampling strategy with respect to their Underlying Indices when a replication strategy might be detrimental to their shareholders, such as when there are practical difficulties or substantial costs involved in compiling a portfolio of equity securities to follow its Underlying Index, or, in certain instances, when securities in the Underlying Indices become temporarily illiquid, unavailable or less liquid, or due to legal restrictions (such as diversification requirements that apply to the Funds but not the Underlying Indices).

The Global X Permanent ETF may hold Exchange Traded Commodities (“ETC”) to gain exposure to gold and silver. As a result, the Fund is subject to the same risks as the underlying ETCs. While the risks of owning shares of an underlying ETC generally reflect the risks of owning the underlying commodities the ETC is designed to track, lack of liquidity in an underlying ETC can result in its value being more volatile than the underlying portfolio securities. The Fund will pay brokerage commissions in connection with the purchase and sale of shares of ETCs. ETCs that invest in commodities may be, or may become, subject to regulatory trading limits that could hurt the value of their securities and could affect the Fund’s ability to pursue its investment program. Additionally, ETCs are not registered under the Investment Company of 1940 Act and, therefore, are not subject to the regulatory scheme and investor protections of the Investment Company Act of 1940.

Notes to Financial Statements (concluded)

7. OTHER

At June 30, 2012, the total Shares outstanding that were held by Authorized Participants were as follows. The Authorized Participants have entered into an agreement with the Funds’ Distributor.

| | | | | | Percentage of | |

| | | Authorized | | | Shares | |

| | | Participants | | | Outstanding | |

| Global X Permanent ETF | | 4 | | | | 100 | % |

| Global X Top Guru Holdings Index ETF | | 1 | | | | 100 | % |

| | | | | | | | | |

Pursuant to the Trust’s organizational documents, the Trustees of the Trust and the Trust’s officers are indemnified against certain liabilities that may arise out of the performance of their duties.

8. CONTRACTUAL OBLIGATIONS

The Funds enter into contracts in the normal course of business that contain a variety of indemnifications. The Funds maximum exposure under these arrangements is unknown. However the Funds have not had prior gains or losses pursuant to these contracts. Management has reviewed the Funds’ existing contracts and expects the risk of loss to be remote.

9. SUBSEQUENT EVENT

The Funds have evaluated the need for additional disclosures and/or adjustments resulting from subsequent events. Based on this evaluation, no additional disclosures or adjustments were required to the financial statements as of the date the financial statements were issued.

Subsequent to fiscal year end, the following investment portfolio of the Trust had commenced operations:

| Fund Name | | Commenced Operations |

| Global X SuperIncome Preferred ETF | | 07/16/2012 |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of Global X Funds

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Global X Permanent ETF and Global X Top Guru Holdings Index ETF (two of the series constituting the Global X Funds) (the “Funds”) as of June 30, 2012, and the related statements of operations, statements of changes in net assets, and financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of June 30, 2012, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Global X Permanent ETF and Global X Top Guru Holdings Index ETF at June 30, 2012, and the results of their operations, the changes in their net assets, and their financial highlights for each of the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

August 27, 2012

Disclosure of Fund Expenses (unaudited)

All Exchange Traded Funds (“ETF”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF management, administrative services, commissions fees, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns. In addition, a shareholder is responsible for brokerage fees as a result of their investment in the Fund.

Operating expenses such as these are deducted from an ETF’s gross income and directly reduce your final investment return. These expenses are expressed as a percentage of the ETF’s average net assets; this percentage is known as the ETF’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates your Fund’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Funds, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return: This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expense Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

Disclosure of Fund Expenses (unaudited) (concluded)

| | | Beginning | | | Ending | | | | | | Expenses | |

| | | Account | | | Account | | | Annualized | | | Paid | |

| | | Value | | | Value | | | Expense | | | During | |

| | | 2/7/2012 | | | 6/30/2012 | | | Ratios | | | Period | |

| Global X Permanent ETF | | | | | | | | | | | | |

| Actual Fund Return(1) | | $ | 1,000.00 | | | $ | 989.20 | | | | 0.48 | % | | $ | 1.89 | |

| Hypothetical 5% Return(2) | | | 1,000.00 | | | | 1,022.48 | | | | 0.48 | | | | 2.41 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied 145/366 (to reflect the period from inception to date.) |

| (2) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied 182/366 (to reflect the one-half year period.) |

| | | Beginning | | | Ending | | | | | | Expenses | |

| | | Account | | | Account | | | Annualized | | | Paid | |

| | | Value | | | Value | | | Expense | | | During | |

| | | 6/4/2012 | | | 6/30/2012 | | | Ratios | | | Period | |

| Global X Top Guru Holdings Index ETF | | | | | | | | | | | | |

| Actual Fund Return (1) | | $ | 1,000.00 | | | $ | 1,058.20 | | | | 0.75 | % | | $ | 0.57 | |

| Hypothetical 5% Return(2) | | | 1,000.00 | | | | 1,021.13 | | | | 0.75 | | | | 3.77 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied 27/366 (to reflect the period from inception to date.) |

| (2) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied 182/366 (to reflect the one-half year period.) |

Approval of Investment Advisory Agreement (unaudited)

Section 15(c) of the Investment Company Act of 1940, as amended ("1940 Act"), requires that each mutual fund’s board of trustees, including a majority of those trustees who are not "interested persons" ("Independent Trustees") of the mutual fund, as defined in the 1940 Act, consider on an initial basis and periodically thereafter (as required by the 1940 Act), at an in person meeting called for such purpose, the terms of each fund’s investment advisory agreement and approve each agreement with such changes as the Independent Trustees deem appropriate.

At a quarterly Board meeting held on November 11, 2011, the Board of Trustees (including the Independent Trustees) considered and unanimously approved (i) the initial Investment Advisory Agreement for the Global X Permanent ETF and (ii) the initial Supervision and Administration Agreement between the Trust, on behalf of Global X Permanent ETF, and Global X Management. At the quarterly Board meeting held on May 25, 2012, the Board (including the Independent Trustees) also considered and unanimously approved (i) the initial Investment Advisory Agreement for the Global X Top Guru Holdings Index ETF, and (ii) the initial Supervision and Administration Agreement between the Trust, on behalf of Global X Top Guru Holdings Index ETF, and Global X Management. The Global X Permanent ETF and Global X Top Guru Holdings Index ETF are referred to herein as the “New Funds.” The Investment Advisory Agreements and Supervision and Administration Agreements for each New Fund are referred to herein as the “New Fund Agreements.”

In advance of the Board meeting, the Board (including the Independent Trustees) requested (in writing) detailed information from Global X Management in connection with their consideration of the New Fund Agreements and received and reviewed written responses from Global X Management and supporting materials relating to those requests for information.

In determining to approve the New Fund Agreements for each New Fund, the Board concluded that the New Fund Agreements were fair and reasonable and in the best interests of each New Fund and its respective shareholders. In approving the New Fund Agreements for each New Fund, the Board considered, among other things, the following categories of material factors.

In reaching this decision, the Board did not assign relative weights to the factors discussed below, nor did the Board deem any one factor or group of them to be controlling in and of themselves. Certain factors considered by the Board (including the Independent Trustees) with respect to the approval of the New Fund Agreements are discussed separately below.

Nature, extent and quality of services

With respect to this factor, the Board considered:

| • | the terms of the New Fund Agreements and the range of services to be provided to the New Funds in accordance with the New Fund Agreements; |

| • | Global X Management’s key personnel and the portfolio managers who would provide investment advisory services to the New Funds; |

| • | Global X Management’s responsibilities under the New Fund Agreements to, among other things, (i) manage the investment operations of each New Fund and the composition of each New Fund’s assets, including the purchase, retention and disposition of its holdings, (ii) provide quarterly reports to the Trust’s officers and Board and other reports as the Board deems necessary or appropriate, |

Approval of Investment Advisory Agreement (unaudited)

| | (iii) vote proxies, exercise consents, and exercise all other rights appertaining to securities and assets held by each of the New Funds, (iv) select broker-dealers to execute portfolio transactions for each of the New Funds when necessary, (v) assist in the preparation and filing of reports and proxy statements (if any) to the shareholders of each of the New Funds, the periodic updating of the registration statement, prospectuses, statement of additional information, and other reports and documents for each of the New Funds that are required to be filed by the Trust with the Securities and Exchange Commission ("SEC") and other regulatory or governmental bodies, and (vi) monitor anticipated purchases and redemptions of the Shares (including Creation Units) of each of the New Funds by shareholders and new investors; |

| • | the nature, extent and quality of Global X Management’s services (including advisory, administrative and compliance services) that would be made available to each of the New Funds; and |

| • | the quality of Global X Management’s resources and personnel that would be made available to each of the New Funds, including Global X Management’s experience and the professional qualifications of Global X Management’s key personnel. |

Based on these considerations, the Board concluded that it was satisfied with the nature, extent and quality of the services to be provided to each of the New Funds.

Performance

The Board determined that because each of the New Funds had not commenced operations, meaningful data relating to investment performance of each New Fund was not available and, therefore, could not be a factor in approving the New Fund Agreements.

Cost of Services and Profitability

With respect to this factor, the Board considered:

| • | Global X Management’s expected cost to provide investment management, supervision and administrative and related services to each of the New Funds; |

| • | The unitary fee (including the proposed investment advisory fee) ("Management Fee") that was proposed to be borne by each New Fund under the New Fund Agreements for the investment advisory, supervisory and administrative services that each New Fund requires under a unitary fee structure (including the types of fees and expenses that are not included within the unitary fee and would be borne by each New Fund); and |

| • | the expected profitability to Global X Management, if any, from all services to be provided to each of the New Funds and all aspects of the relationship between Global X Management and each of the New Funds. In connection with these considerations, the Board noted that Global X Management advised the Board that it was uncertain whether it would generate any profits from its services to each of the New Funds during the first 12 months of each New Fund’s operations, but expected to generate profits after that initial period. |

Based on these considerations, the Board concluded that the profits anticipated to be realized by Global X Management from its relationship with each of the New Funds would not be excessive.

Approval of Investment Advisory Agreement (unaudited)

Comparison of Fees and Services

With respect to this factor, the Board considered:

| • | comparative information with respect to the proposed Management Fee to be paid to Global X Management by each of the New Funds. In connection with this consideration, Global X Management provided the Board with detailed comparative expense data for each of the New Funds, including fees and expenses paid by unaffiliated comparable specialized and/or focused exchange-traded funds and other registered funds as well as the fees and expenses paid by other Funds that are series of the Trust under the same unified Management Fee structure; |

| • | the structure of the proposed unified Management Fee structure (which includes as one component the proposed investment advisory fee for each New Fund) and the expected total expense ratios for each of the New Funds. In this regard, the Board took into consideration that the purpose of adopting a unitary Management Fee structure for the New Funds was to create a simple, all-inclusive fee that would provide a level of predictability with respect to the overall expense ratio (i.e., the total fees) of each of the New Funds and that the proposed Management Fee for each New Fund was set at a competitive fee to make each New Fund viable in the marketplace; and |

| • | that Global X Management would be responsible for most ordinary expenses of the New Funds, including the costs of various third-party services required by the New Funds, including investment advisory, administrative, audit, certain custody, portfolio accounting, legal, transfer agency and printing costs, but that each New Fund would bear other expenses not covered under the proposed all-inclusive Management Fee, such as such as taxes, brokerage fees, commissions, and other transaction expenses, interest expenses, and extraordinary expenses. |

Based on these considerations, the Board concluded that the proposed Management Fee and expected total expense ratio of each New Fund should not preclude approval of the New Fund Agreements.

Economies of Scale

With respect to this factor, the Board considered:

| • | the extent to which economies of scale would be realized as each of the New Funds grow and whether the proposed unitary Management Fee for each New Fund reflected these economies of scale; |

| • | the significant investment of time, personnel and other resources that Global X Management intends to made in each of the New Funds in order to seek to assure that the New Funds are attractive to investors; and |

| • | that the proposed unitary Management Fee would provide a high level of certainty as to the total level of expenses for each of the New Funds and its respective shareholders. |

Approval of Investment Advisory Agreement (unaudited)

Based on these considerations, the Board concluded that approval of the proposed Management Fee for each New Fund was reasonable.

Other Benefits

In considering the New Fund Agreement, in addition to the categories discussed above, the Board considered other benefits that may be realized by Global X Management as a result of its relationships with each of the New Funds.

| Supplemental Information (unaudited) |

| |

Net asset value, or “NAV”, is the price per Share at which the Funds issue and redeem Shares. It is calculated in accordance with the standard formula for valuing mutual fund shares. The “Market Price” of the Funds generally is determined using the midpoint between the highest bid and the lowest offer on the stock exchange on which the Shares of the Funds are listed for trading, as of the time that the Funds’ NAV is calculated. The Funds’ Market Price may be at, above or below their NAV. The NAV of the Funds will fluctuate with changes in the market value of their Funds’ holdings. The Market Price of the Funds will fluctuate in accordance with changes in its NAV, as well as market supply and demand.