UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

623 Fifth Avenue, 15th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Bruno del Ama

Global X Management Company LLC

623 Fifth Avenue, 15th Floor

New York, NY 10022

(Name and address of agent for service)

With a copy to:

| Daphne Tippens Chisolm, Esq. | Eric S. Purple, Esq. |

| Global X Management Company LLC | K&L Gates LLP |

| 623 Fifth Ave, 15th floor | 1601 K Street, NW |

| New York, NY 10022 | Washington, DC 20006 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: November 30, 2014

Date of reporting period: November 30, 2014

| Item 1. | Reports to Stockholders. |

Global X MLP ETF (ticker: MLPA)

Global X Junior MLP ETF (ticker: MLPJ)

Annual Report

November 30, 2014

|

| |

| Table of Contents |

| |

The Funds file their complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

|

| |

| Management Discussion of Fund Performance (unaudited) |

| |

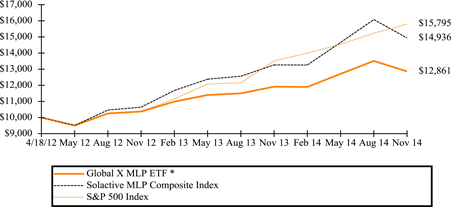

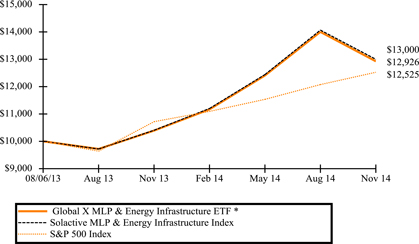

Global X MLP ETF

The Global X MLP ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive MLP Composite Index (the “Index”). The Fund generally seeks to replicate the Index, but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Index is intended to give investors a means of tracking the overall performance of the master limited partnership (“MLP”) asset class in the United States.

For the 12-month period ended November 30, 2014 (the “reporting period”), the Fund’s total return based on the NAV was 7.95% vs. 12.60% for the Index. The Fund had a net asset value of $16.11 on November 30, 2013 and ended the reporting period with a net asset value of $16.45 on November 30, 2014.

During the reporting period, the highest returns came from TC PipeLines and Sunoco Logistics Partners, which returned 56.30% and 40.48%, respectively. The worst performers were Crestwood Equity Partners and Boardwalk Pipeline Partners, which returned -38.72% and -35.77%, respectively.

Growth of a $10,000 Investment

(at Net Asset Value)

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED NOVEMBER 30, 2014 | |

| | | One Year Return | | | Annualized Inception to Date* | |

| | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | |

| Global X MLP ETF | | | 7.95 | % | | | 8.02 | % | | | 10.09 | % | | | 10.11 | % |

| Solactive MLP Composite Index | | | 12.60 | % | | | 12.60 | % | | | 16.55 | % | | | 16.55 | % |

| S&P 500 Index | | | 16.86 | % | | | 16.86 | % | | | 19.07 | % | | | 19.07 | % |

*The Fund commenced investment operations on April 18, 2012.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices above.

|

| |

| Management Discussion of Fund Performance (unaudited) |

| |

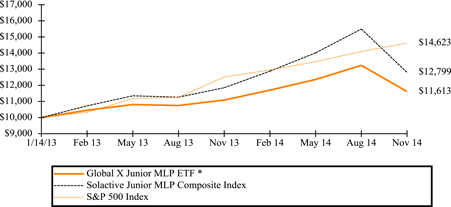

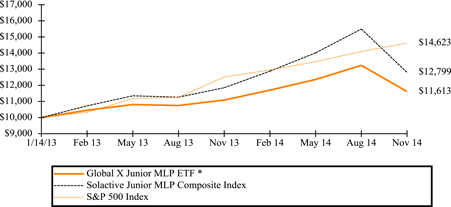

Global X Junior MLP ETF

The Global X Junior MLP ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Junior MLP Composite Index (the “Index”). The Fund generally seeks to replicate the Index, but may at times invest in a representative sample of securities that collectively has an investment profile similar to the Index and as a result may or may not hold all the securities that are included in the Index.

The Index is intended to give investors a means of tracking the overall performance of the small-capitalization segment of the master limited partnership (“MLP”) asset class in the United States.

For the 12-month period ended November 30, 2014 (the “reporting period”), the Fund’s total return based on the NAV was 4.75% vs. 8.00% for the Index. The Fund had a net asset value of $15.64 on November 30, 2013 and ended the reporting period with a net asset value of $15.42 on November 30, 2014.

During the reporting period, the highest returns came from MPLX and EQT Midstream Partners, which returned 78.73% and 64.01%, respectively. The worst performers were Eagle Rock Energy Partners and QEP Midstream Partners, which returned -41.12% and -28.43%, respectively.

Growth of a $10,000 Investment

(at Net Asset Value)

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED NOVEMBER 30, 2014 | |

| | | One Year Return | | | Annualized Inception to Date* | |

| | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | |

| Global X Junior MLP ETF | | | 4.75 | % | | | 4.89 | % | | | 8.28 | % | | | 8.31 | % |

| Solactive Junior MLP Composite Index | | | 8.00 | % | | | 8.00 | % | | | 14.05 | % | | | 14.05 | % |

| S&P 500 Index | | | 16.86 | % | | | 16.86 | % | | | 22.44 | % | | | 22.44 | % |

*The Fund commenced investment operations on January 14, 2013.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices above.

|

| | |

| Schedule of Investments | November 30, 2014 |

| | |

| Global X MLP ETF |

Sector Weightings (unaudited)†:

† Sector Weightings percentages are based on the total market value of investments.

| | | Shares | | | Value | |

| MASTER LIMITED PARTNERSHIPS — 104.7% |

| |

| Oil & Gas — 104.7% | | | | | | | | |

| Access Midstream Partners | | | 93,134 | | | $ | 5,837,639 | |

| Alliance Resource Partners | | | 38,459 | | | | 1,771,422 | |

| AmeriGas Partners | | | 81,824 | | | | 3,779,451 | |

| Atlas Energy | | | 43,091 | | | | 1,528,869 | |

| Atlas Pipeline Partners | | | 66,878 | | | | 2,196,274 | |

| Boardwalk Pipeline Partners | | | 106,889 | | | | 1,763,668 | |

| Buckeye Partners | | | 109,953 | | | | 8,452,087 | |

| Cheniere Energy Partners | | | 38,182 | | | | 1,110,333 | |

| Crestwood Equity Partners | | | 100,286 | | | | 902,574 | |

| Crestwood Midstream Partners | | | 138,387 | | | | 2,778,811 | |

| DCP Midstream Partners | | | 79,262 | | | | 3,797,442 | |

| Enable Midstream Partners | | | 22,961 | | | | 461,975 | |

| Enbridge Energy Partners | | | 191,759 | | | | 7,190,963 | |

| Energy Transfer Partners | | | 144,025 | | | | 9,386,109 | |

| EnLink Midstream Partners | | | 84,355 | | | | 2,352,661 | |

| Enterprise Products Partners | | | 216,901 | | | | 8,099,083 | |

| Equities Midstream Partners | | | 35,907 | | | | 3,003,261 | |

| EV Energy Partners | | | 40,845 | | | | 1,157,139 | |

| Genesis Energy | | | 65,080 | | | | 2,865,472 | |

| Magellan Midstream Partners | | | 102,779 | | | | 8,519,351 | |

| MarkWest Energy Partners | | | 112,786 | | | | 8,014,573 | |

| NGL Energy Partners | | | 58,443 | | | | 2,039,661 | |

| Northern Tier Energy | | | 53,123 | | | | 1,268,577 | |

| NuStar Energy | | | 69,473 | | | | 3,890,488 | |

| ONEOK Partners | | | 144,046 | | | | 6,349,548 | |

| Phillips 66 Partners | | | 17,054 | | | | 1,061,612 | |

| Plains All American Pipeline | | | 149,627 | | | | 7,698,309 | |

| Regency Energy Partners | | | 273,552 | | | | 7,793,496 | |

| Spectra Energy Partners | | | 46,168 | | | | 2,491,687 | |

| Suburban Propane Partners | | | 53,947 | | | | 2,427,615 | |

| Sunoco Logistics Partners | | | 140,255 | | | | 6,751,876 | |

| Targa Resources Partners | | | 93,208 | | | | 5,110,595 | |

| TC PipeLines | | | 41,621 | | | | 2,996,296 | |

| Tesoro Logistics | | | 34,431 | | | | 1,971,863 | |

| Viper Energy Partners | | | 8,095 | | | | 145,467 | |

| Western Gas Partners | | | 62,350 | | | | 4,422,486 | |

| Williams Partners | | | 147,137 | | | | 7,612,868 | |

The accompanying notes are an integral part of the financial statements.

|

| | |

| Schedule of Investments | November 30, 2014 |

| | |

| Global X MLP ETF |

| | | Face Amount | | | Value | |

| MASTER LIMITED PARTNERSHIPS — continued |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $130,854,183) | | | | | | $ | 149,001,601 | |

| | | | | | | | | |

|

| TIME DEPOSIT — 0.0% |

| Bank of Tokyo-Mitsubishi, 0.030%, 12/01/14 | | | | | | | | |

| (Cost $29,173) | | $ | 29,173 | | | | 29,173 | |

| TOTAL INVESTMENTS — 104.7% | | | | | | | | |

| (Cost $130,883,356) | | | | | | $ | 149,030,774 | |

| | | | | | | | | |

| Percentages are based on Net Assets of $142,278,568. |

The following is a summary of the inputs used as of November 30, 2014, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Master Limited Partnerships | | $ | 149,001,601 | | | $ | — | | | $ | — | | | $ | 149,001,601 | |

| Time Deposit | | | — | | | | 29,173 | | | | — | | | | 29,173 | |

| Total Investments in Securities | | $ | 149,001,601 | | | $ | 29,173 | | | $ | — | | | $ | 149,030,774 | |

|

For the year ended November 30, 2014, there have been no transfers between Level 1, Level 2 or Level 3 investments.

As of November 30, 2014, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

|

| | |

| Schedule of Investments | November 30, 2014 |

| | |

| Global X Junior MLP ETF |

Sector Weightings (unaudited)†:

† Sector Weightings percentages are based on the total market value of investments.

| | | Shares/Face

Amount | | | Value | |

| MASTER LIMITED PARTNERSHIPS — 101.9% |

| |

| Oil & Gas — 101.9% | | | | | | | | |

| Alon USA Partners | | | 7,002 | | | $ | 119,384 | |

| Atlas Energy | | | 29,848 | | | | 1,059,007 | |

| Atlas Resource Partners | | | 37,126 | | | | 564,687 | |

| Cheniere Energy Partners | | | 26,527 | | | | 771,405 | |

| Crestwood Equity Partners | | | 69,658 | | | | 626,922 | |

| Dorchester Minerals | | | 16,341 | | | | 422,088 | |

| EV Energy Partners | | | 28,304 | | | | 801,852 | |

| Exterran Partners | | | 23,046 | | | | 569,697 | |

| Ferrellgas Partners | | | 34,550 | | | | 959,108 | |

| Foresight Energy | | | 10,959 | | | | 192,878 | |

| Global Partners | | | 10,431 | | | | 436,016 | |

| Holly Energy Partners | | | 22,761 | | | | 765,908 | |

| Legacy Reserves | | | 30,403 | | | | 542,086 | |

| Martin Midstream Partners | | | 14,707 | | | | 515,186 | |

| Memorial Production Partners | | | 51,882 | | | | 713,896 | |

| MPLX | | | 12,406 | | | | 823,882 | |

| Natural Resource Partners | | | 43,698 | | | | 521,754 | |

| Northern Tier Energy | | | 36,902 | | | | 881,220 | |

| NuStar GP Holdings | | | 21,816 | | | | 749,598 | |

| Oiltanking Partners | | | 17,702 | | | | 854,476 | |

| QEP Midstream Partners | | | 14,313 | | | | 229,724 | |

| Rose Rock Midstream | | | 8,662 | | | | 464,976 | |

| Summit Midstream Partners | | | 17,698 | | | | 803,489 | |

| Tallgrass Energy Partners | | | 14,197 | | | | 606,638 | |

| Transmontaigne Partners | | | 6,351 | | | | 234,415 | |

| Valero Energy Partners | | | 10,704 | | | | 446,571 | |

| Vanguard Natural Resources | | | 52,205 | | | | 1,212,200 | |

| Viper Energy Partners | | | 5,642 | | | | 101,387 | |

| Western Refining Logistics | | | 9,489 | | | | 295,108 | |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $17,730,103) | | | | | | | 17,285,558 | |

| | | | | | | | | |

| TIME DEPOSIT — 0.4% |

| Australia and New Zealand Banking Group, 0.030%, 12/01/14 | | | | | | | | |

| (Cost $59,849) | | $ | 59,849 | | | | 59,849 | |

| TOTAL INVESTMENTS — 102.3% | | | | | | | | |

| (Cost $17,789,952) | | | | | | $ | 17,345,407 | |

| | | | | | | | | |

| Percentages are based on Net Assets of $16,964,279. |

The accompanying notes are an integral part of the financial statements.

|

| | |

| Schedule of Investments | November 30, 2014 |

| | |

| Global X Junior MLP ETF |

The following is a summary of the inputs used as of November 30, 2014, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Master Limited Partnerships | | $ | 17,285,558 | | | $ | — | | | $ | — | | | $ | 17,285,558 | |

| Time Deposit | | | — | | | | 59,849 | | | | — | | | | 59,849 | |

| Total Investments in Securities | | $ | 17,285,558 | | | $ | 59,849 | | | $ | — | | | $ | 17,345,407 | |

|

For the year ended November 30, 2014, there have been no transfers between Level 1, Level 2 or Level 3 investments.

As of November 30, 2014, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

|

| |

| Statements of Assets and Liabilities |

| November 30, 2014 |

| | | Global X MLP

ETF | | | Global X Junior

MLP ETF | |

| Assets: | | | | | | | | |

| Cost of Investments | | $ | 130,883,356 | | | $ | 17,789,952 | |

| Investments at Value | | $ | 149,030,774 | | | $ | 17,345,407 | |

| Receivable for Investment Securities Sold | | | 13,257,519 | | | | — | |

| Receivable for Capital Shares Sold | | | 2,531,313 | | | | — | |

| Deferred Tax Asset | | | — | | | | 197,810 | |

| Dividend and Interest Receivable | | | — | | | | 10,963 | |

| Total Assets | | | 164,819,606 | | | | 17,554,180 | |

| Liabilities: | | | | | | | | |

| Payable for Investment Securities Purchased | | | 15,489,228 | | | | — | |

| Payable due to Investment Adviser | | | 60,880 | | | | 10,819 | |

| Deferred Tax Liability | | | 6,427,045 | | | | — | |

| Current Income Tax Payable | | | 542,969 | | | | 574,582 | |

| Franchise Tax Payable | | | 20,916 | | | | 4,500 | |

| Total Liabilities | | | 22,541,038 | | | | 589,901 | |

| Net Assets | | $ | 142,278,568 | | | $ | 16,964,279 | |

| Net Assets Consist of: | | | | | | | | |

| Paid-in Capital | | $ | 134,287,764 | | | $ | 17,188,491 | |

| Distributions in Excess of Net Investment Income, Net of Taxes | | | (5,217,626 | ) | | | (1,580,395 | ) |

| Accumulated Net Realized Gain on Investments, Net of Taxes | | | 1,757,234 | | | | 1,639,926 | |

| Net Unrealized Appreciation (Depreciation) on Investments, Net of Taxes | | | 11,451,196 | | | | (283,743 | ) |

| Net Assets | | $ | 142,278,568 | | | $ | 16,964,279 | |

| Outstanding Shares of Beneficial Interest | | | | | | | | |

| (unlimited authorization — no par value) | | | 8,650,000 | | | | 1,100,000 | |

| | | | | | | | | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 16.45 | | | $ | 15.42 | |

The accompanying notes are an integral part of the financial statements.

|

| |

| Statements of Operations |

| For the year ended November 30, 2014 |

| | | Global X

MLP ETF | | | Global X

Junior MLP

ETF | |

| Investment Income: | | | | | | | | |

| Distributions from Master Limited Partnerships | | $ | 6,110,755 | | | $ | 1,178,876 | |

| Less: Return of Capital Distributions | | | (6,110,755 | ) | | | (1,158,433 | ) |

| Interest Income | | | 44 | | | | 15 | |

| Total Investment Income | | | 44 | | | | 20,458 | |

| Supervision and Administration Fees(1) | | | 456,818 | | | | 124,554 | |

| Franchise Tax Expense | | | 19,985 | | | | 372 | |

| Total Expenses | | | 476,803 | | | | 124,926 | |

| Net Investment Loss, Before Taxes | | | (476,759 | ) | | | (104,468 | ) |

| Tax Benefit/(Expense) | | | 174,764 | | | | 37,664 | |

| Net Investment Loss, Net of Taxes | | | (301,995 | ) | | | (66,804 | ) |

| Net Realized Gain (Loss) on: | | | | | | | | |

| Investments | | | 2,840,759 | | | | 2,153,443 | |

| Tax Benefit/(Expense) | | | (1,048,458 | ) | | | (778,206 | ) |

| Net Realized Gain on Investments, Net of Taxes | | | 1,792,301 | | | | 1,375,237 | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | |

| Investments | | | 7,433,031 | | | | (1,113,911 | ) |

| Tax Benefit/(Expense) | | | (2,696,223 | ) | | | 404,119 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments, Net of Taxes | | | 4,736,808 | | | | (709,792 | ) |

| Net Realized and Unrealized Gain on Investments, Net of Taxes | | | 6,529,109 | | | | 665,445 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 6,227,114 | | | $ | 598,641 | |

| (1) | The Supervision and Administration fees reflect the supervisory and administrative fee, which includes fees paid by the Funds for the investment advisory services provided by the Adviser. (See Note 3 in Notes to Financial Statements.) |

The accompanying notes are an integral part of the financial statements.

|

| |

| Statements of Changes in Net Assets |

| |

| | | Global X MLP ETF | | | Global X Junior MLP ETF | |

| | | Year Ended

November 30,

2014 | | | Year Ended

November 30,

2013 | | | Year Ended

November 30,

2014 | | | Period Ended

November 30,

2013(1) | |

| Operations: | | | | | | | | | | | | | | | | |

| Net Investment Loss, Net of Taxes | | $ | (301,995 | ) | | $ | (151,663 | ) | | $ | (66,804 | ) | | $ | (44,273 | ) |

| Net Realized Gain (Loss) on Investments, Net of Taxes | | | 1,792,301 | | | | (50,058 | ) | | | 1,375,237 | | | | 264,689 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments, Net of Taxes | | | 4,736,808 | | | | 6,435,225 | | | | (709,792 | ) | | | 426,049 | |

| Net Increase in Net Assets Resulting from Operations | | | 6,227,114 | | | | 6,233,504 | | | | 598,641 | | | | 646,465 | |

| Dividends and Distributions: | | | | | | | | | | | | | | | | |

| Distributions in Excess of Net Investment Income | | | (3,832,426 | ) | | | (897,053 | ) | | | (1,012,500 | ) | | | (456,818 | ) |

| Tax Return of Capital | | | (2,146,324 | ) | | | (2,221,447 | ) | | | — | | | | (191,282 | ) |

| Total Dividends and Distributions | | | (5,978,750 | ) | | | (3,118,500 | ) | | | (1,012,500 | ) | | | (648,100 | ) |

| Capital Share Transactions: | | | | | | | | | | | | | | | | |

| Issued | | | 75,177,738 | | | | 51,405,000 | | | | 4,971,032 | | | | 14,868,500 | |

| Redeemed | | | — | | | | (3,998,000 | ) | | | (1,665,759 | ) | | | (794,000 | ) |

| Increase in Net Assets from Capital Share Transactions | | | 75,177,738 | | | | 47,407,000 | | | | 3,305,273 | | | | 14,074,500 | |

| Total Increase in Net Assets | | | 75,426,102 | | | | 50,522,004 | | | | 2,891,414 | | | | 14,072,865 | |

| Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of Year/Period | | | 66,852,466 | | | | 16,330,462 | | | | 14,072,865 | | | | — | |

| End of Year/Period | | $ | 142,278,568 | | | $ | 66,852,466 | | | $ | 16,964,279 | | | $ | 14,072,865 | |

| Distributions in Excess of Net Investment Income, Net of Taxes | | $ | (5,217,626 | ) | | $ | (1,083,205 | ) | | $ | (1,580,395 | ) | | $ | (501,091 | ) |

| | | | | | | | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | | | | | | | |

| Issued | | | 4,500,000 | | | | 3,300,000 | | | | 300,000 | | | | 950,000 | |

| Redeemed | | | — | | | | (250,000 | ) | | | (100,000 | ) | | | (50,000 | ) |

| Net Increase in Shares Outstanding from Share Transactions | | | 4,500,000 | | | | 3,050,000 | | | | 200,000 | | | | 900,000 | |

| (1) | Commenced operations on January 14, 2013. |

The accompanying notes are an integral part of the financial statements.

|

| |

| Financial Highlights |

| |

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Ratio of

Expenses to Average Net Assets | | | Ratio of Investment Income/(Loss) to

Average Net Assets | | | | |

| | | Net Asset

Value,

Beginning of

Period ($) | | | Net

Investment

Income

(Loss) ($)* | | | Net Realized

and

Unrealized

Gain (Loss)

on

Investments

($) | | | Total from

Operations

($) | | | Distributions

in Excess of

Net

Investment

Income ($) | | | Return of

Capital ($) | | | Total from

Distributions ($) | | | Net Asset

Value, End

of Period ($) | | | Total

Return

(%)** | | | Net Assets

End of

Period

($)(000) | | | Before Net

Deferred Tax

Expense (%) | | | Net Deferred

Tax Expense

(%) | | | Total

Expenses

(%) | | | Before Net

Deferred Tax

Benefit (%) | | | Net Deferred

Tax

Benefit (%) | | | Net

Investment

Income

(Loss) (%) | | | Portfolio

Turnover

(%) | |

| Global X MLP ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2014 | | | 16.11 | | | | (0.05 | ) | | | 1.32 | | | | 1.27 | | | | (0.60 | ) | | | (0. 33) | | | | (0.93 | ) | | | 16.45 | | | | 7.95 | | | | 142,279 | | | | 0.47 | | | | 3. 52 | | | | 3.99 | | | | (0.47 | ) | | | 0.17 | | | | (0.30 | ) | | | 30.65 | †† |

| 2013 | | | 14.85 | | | | (0.05 | ) | | | 2.22 | | | | 2.17 | | | | (0.26 | ) | | | (0. 65) | | | | (0.91 | ) | | | 16.11 | | | | 14.85 | | | | 66,852 | | | | 0.47 | | | | 7. 20 | | | | 7.67 | | | | (0.47 | ) | | | 0.18 | | | | (0.29 | ) | | | 14.15 | †† |

| 2012(1) | | | 14.96 | | | | (0.04 | ) | | | 0.58 | | | | 0.54 | | | | (0.02 | ) | | | (0. 63) | | | | (0.65 | ) | | | 14.85 | | | | 3.74 | | | | 16,330 | | | | 0.45 | | | | 3. 07 | | | | 3.52 | † | | | (0.45 | ) | | | 0.17 | | | | (0.28 | )† | | | 6.43 | †† |

| Global X Junior MLP ETF | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2014 | | | 15.64 | | | | (0.07 | ) | | | 0.85 | | | | 0.78 | | | | (1.00 | ) | | | — | | | | (1.00 | ) | | | 15.42 | | | | 4.75 | | | | 16,964 | | | | 0.75 | | | | 2.03 | | | | 2.78 | | | | (0.63 | ) | | | 0.23 | | | | (0.40 | ) | | | 70.42 | †† |

| 2013(2) | | | 15.09 | | | | (0.07 | ) | | | 1.68 | | | | 1.61 | | | | (0.75 | ) | | | (0.31 | ) | | | (1.06 | ) | | | 15.64 | | | | 10.86 | | | | 14,073 | | | | 0.81 | | | | 4.30 | | | | 5.11 | † | | | (0.81 | ) | | | 0.29 | | | | (0.52 | )† | | | 68.54 | †† |

| (1) | The Fund commenced operations on April 18, 2012. |

| (2) | The Fund commenced operations on January 14, 2013. |

| * | Per share data calculated using average shares method. |

| ** | Total Return is based on the change in net asset value of a share during the year/period and assumes reinvestment of dividends and distributions at net asset value. Total Return is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| †† | Portfolio turnover rate is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

Amounts designated as “—” are either $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

|

| |

| Notes to Financial Statements |

| November 30, 2014 |

1. ORGANIZATION

The Global X Funds (the "Trust") is a Delaware statutory trust formed on March 6, 2008. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. As of November 30, 2014, the Trust had eighty-nine portfolios, forty-one of which were operational. The financial statements herein and the related notes pertain to the Global X MLP ETF and Global X Junior MLP ETF (each a “Fund”, and collectively, the “Funds”). The Funds are non-diversified.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Funds.

USE OF ESTIMATES – The Funds are investment companies that apply the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The preparation of financial statements in conformity with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates, and could have a material impact on the Funds.

RETURN OF CAPITAL ESTIMATES – Distributions received by the Funds from underlying master limited partnership (“MLP”) investments generally are comprised of income and return of capital. The Funds record investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from the MLPs and other industry sources. These estimates may subsequently be revised based on information received from the MLPs after their tax reporting periods are concluded.

MLPs – The Funds invest in MLPs in addition to other exchange-traded securities. MLPs are publicly-traded partnerships engaged in the transportation, storage and processing of minerals and natural resources. By confining their operations to these specific activities, their interests, or units, are able to trade on public securities exchanges exactly like the shares of a corporation, without entity-level taxation. Approximately two-thirds of the MLPs eligible for inclusion in the Indices trade on the New York Stock Exchange (“NYSE”) and the remainder trade on the NASDAQ. To qualify as an MLP, and to not be taxed as a corporation, a partnership must receive at least 90% of its income from qualifying sources as set forth in Section 7704(d) of the Internal Revenue Code of 1986, as amended (the “Code”). These qualifying sources include natural resource-based activities such as the processing, transportation and storage of mineral or natural resources. MLPs generally have two classes of owners, the general partner and limited partners. The general partner of an MLP is typically owned by a major energy company, an investment fund, the direct management of the MLP, or is an entity owned by one or more of such parties. The general partner may be structured as a private or publicly-traded corporation or other entity. The general partner typically controls the operations and management of the MLP through an up to 2% equity interest in the MLP plus, in many cases, ownership of common units and subordinated units.

Limited partners typically own the remainder of the partnership, through ownership of common units, and have a limited role in the partnership’s operations and management. MLPs are typically structured such that common units and general partner interests have first priority to receive quarterly cash distributions up to an established minimum amount (“minimum quarterly distributions” or “MQD”). Common and general partner interests also accrue arrearages in distributions to the extent the MQD is not paid. Once common and general partner interests have been paid, subordinated units receive distributions of up to the MQD; however, subordinated units do not accrue arrearages. Distributable cash in excess of the MQD is paid to both common and subordinated units and is distributed to both common and subordinated units generally on a pro rata basis. The general partner is also eligible to receive incentive distributions if the general partner operates the business in a manner which results in distributions paid per common unit surpassing specified target levels. As the

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

general partner increases cash distributions to the limited partners, the general partner receives an increasingly higher percentage of the incremental cash distributions.

SECURITY VALUATION – Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent mean between the quoted bid and asked prices (absent both bid and asked prices on such exchange, the bid price may be used).

For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities are priced based upon valuations provided by independent, third-party pricing agents. Such values generally reflect the last reported sales price if the security is actively traded. The third-party pricing agents may also value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, which approximates market value. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents. If a security’s price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain a bid price from at least one independent broker.

Securities for which market prices are not "readily available" are valued in accordance with Fair Value Procedures established by the Board of Trustees (the “Board”). The Funds’ Fair Value Procedures are implemented through a Fair Value Committee (the “Committee”) designated by the Board. Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security's trading has been halted or suspended; the security has been de-listed from its primary trading exchange; the security's primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security's primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government-imposed restrictions. In addition, the Funds may fair value their securities if an event that may materially affect the value of the Funds’ securities that traded outside of the United States (a “Significant Event”) has occurred between the time of the security's last close and the time that the Funds calculate their net asset value. A Significant Event may relate to a single issuer or to an entire market sector. Events that may be Significant Events include: government actions, natural disasters, armed conflict, acts of terrorism and significant market fluctuations. If Global X Management Company LLC (the “Adviser”) becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Funds calculate net asset value, it may request that a Committee meeting be called. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration all relevant information reasonably available to the Committee. As of November 30, 2014, there were no securities priced using the Fair Value Procedures.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Funds disclose the fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

SECURITY VALUATION (continued)

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date

Level 2 – Other significant observable inputs (including quoted prices in non-active markets, quoted prices for similar investments, fair value of investments for which the Funds have the ability to fully redeem tranches at net asset value as of the measurement date or within the near term, and short-term investments valued at amortized cost)

Level 3 – Significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments and fair value of investments for which the Funds do not have the ability to fully redeem tranches at net asset value as of the measurement date or within the near term)

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

For the year ended November 30, 2014, there have been no significant changes to the Funds’ fair valuation methodologies.

FEDERAL INCOME TAXES – The Funds are taxed as regular C-corporations for federal income tax purposes. Currently, the maximum marginal regular federal income tax rate for a corporation is 35 percent. The Funds may be subject to a 20 percent federal alternative minimum tax on their federal alternative taxable income to the extent that their alternative minimum tax liability exceeds their regular federal income tax liability. This differs from most investment companies, which elect to be treated as “regulated investment companies” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”) in order to avoid paying entity-level income taxes. Under current law, the Funds are not eligible to elect treatment as regulated investment companies due to their investments primarily in MLPs invested in energy assets. As a result, the Funds will be obligated to pay applicable federal and state corporate income taxes on their taxable income as opposed to most other investment companies, which are not so obligated. The Funds expect that a portion of the distributions that are received from MLPs may be treated as a tax-deferred return of capital, thus reducing the Funds’ current tax liability. However, the amount of taxes currently paid by the Funds will vary depending on the amount of income and gains derived from investments and/or sales of MLP interests and such taxes have the potential to reduce your return from an investment in the Funds.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Cash distributions from MLPs to the Funds that exceed such Funds’ allocable share of such MLP’s net taxable income are considered tax-deferred return of capital that will reduce the Funds’ adjusted tax basis in the equity securities of the MLP. These reductions in the Funds’ adjusted tax basis in MLP equity securities will increase the amount of gain (or decrease the amount of loss) recognized by the Funds on a subsequent sale of the securities. The Funds will accrue deferred income taxes for any future tax liability associated with (i) that portion of MLP distributions considered to be a tax-deferred return of capital as well as (ii) capital appreciation of their investments. Upon the sale of an MLP security, the Funds may be liable for previously deferred taxes. The Funds will rely to some extent on information provided by the MLPs, which may not necessarily be timely, to estimate deferred tax liability for purposes of financial statement reporting and determining the Funds’ NAV. From time to time, the Adviser will modify the estimates or assumptions related to the Funds’ deferred tax liabilities as new information becomes available. The Funds will generally compute deferred income taxes based on the marginal regular federal income tax rate applicable to corporations and an assumed rate attributable to state taxes.

The Funds recognize interest and penalties, if any, related to unrecognized tax benefits within the income tax expense line in the accompanying Statement of Operations. Accrued interest and penalties, if any, are included within the related tax liability line in the Statement of Assets and Liabilities. During the year ended November 30, 2014, the Funds did not incur any interest or penalties.

Since the Funds will be subject to taxation on their taxable income, the NAV of Fund shares will also be reduced by the accrual of any current and deferred tax liabilities. The Indices, however, are calculated without any adjustments for taxes. As a result, the Funds’ after-tax performance could differ significantly from the Indices even if the pretax performance of the Funds and the performance of the Indices are closely correlated.

The Funds’ income tax expense/(benefit) consists of the following:

| For the year ended November 30, 2014 | | Current | | | Deferred | | | Total | |

| | | MLP | | | Junior MLP | | | MLP | | | Junior MLP | | | MLP | | | Junior MLP | |

| Federal | | $ | 595,379 | | | $ | 591,632 | | | $ | 2,794,815 | | | $ | (272,213 | ) | | $ | 3,390,194 | | | $ | 319,419 | |

| State | | | 35,748 | | | | 35,873 | | | | 143,975 | | | | (18,869 | ) | | | 179,723 | | | | 17,004 | |

| Total tax expense | | $ | 631,127 | | | $ | 627,505 | | | $ | 2,938,790 | | | $ | (291,082 | ) | | $ | 3,569,917 | | | $ | 336,423 | |

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Components of the Funds’ deferred tax assets and liabilities are as follows:

| For the year ended November 30, 2014 | | | | | | |

| | | MLP | | | Junior MLP | |

| Deferred tax assets: | | | | | | | | |

| Net unrealized loss on investment securities | | $ | - | | | $ | 320,946 | |

| Other | | | 6,373 | | | | 1,903 | |

| | | | | | | | | |

| Less deferred tax liabilities: | | | | | | | | |

| Net unrealized gain on investment securities | | | (6,072,375 | ) | | | - | |

| Income from MLP investments | | | (361,043 | ) | | | (125,039 | ) |

| Net deferred tax asset (liability) | | $ | (6,427,045 | ) | | $ | 197,810 | |

The Funds review the recoverability of their deferred tax assets based upon the weight of available evidence. When assessing the recoverability of their deferred tax assets, significant weight is given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized. Currently, any capital losses that may be generated by the Funds in the future are eligible to be carried back up to three years and can be carried forward for five years to offset capital gains recognized by the Funds in those years. Net operating losses that may be generated by the Funds in the future are eligible to be carried back up to two years and can be carried forward for 20 years to offset income generated by the Funds in those years.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

Based upon the Funds’ assessment, they have determined that it is more likely than not that their deferred tax assets will be realized through future taxable income of the appropriate character. Accordingly, no valuation allowance has been established for the Funds’ deferred tax assets. The Funds will continue to assess the need for a valuation allowance in the future. Significant declines in the fair value of their portfolio of investments may change the Funds’ assessment of the recoverability of these assets and may result in the recording of a valuation allowance against all or a portion of the Funds’ gross deferred tax assets.

Total income tax benefit (current and deferred) differs from the amount computed by applying the federal statutory income tax rate of 35% for Global X MLP ETF and 34% for Global X Junior MLP ETF to net investment and realized and unrealized gain/(losses) on investment before taxes as follows:

| For the year ended November 30, 2014 | | | |

| | | MLP | | | Junior MLP | |

| Income tax expense at statutory rate | | $ | 3,428,961 | | | | 35 | % | | $ | 317,922 | | | | 34 | % |

| State income taxes (net of federal benefit) | | | 208,643 | | | | 2.130 | % | | | 22,346 | | | | 2.390 | % |

| Change in estimated federal rate | | | (25,277 | ) | | | (0.258 | )% | | | 947 | | | | 0.101 | % |

| Change in estimated state rate | | | (28,920 | ) | | | (0.295 | )% | | | (5,346 | ) | | | (0.572 | )% |

| Permanent differences, net | | | (13,490 | ) | | | (0.138 | )% | | | 554 | | | | 0.059 | % |

| | | $ | 3,569,917 | | | | 36.439 | % | | $ | 336,423 | | | | 35.978 | % |

The difference in federal statutory rates between the two Funds relates to the progressive nature of the federal corporate income tax brackets and management’s expectation of what rates the Funds will be subject.

For the year ended November 30, 2014, the Funds had no unrecognized tax benefits.

The Funds recognize interest accrued related to unrecognized tax benefits and penalties as income tax expense. For the year ended November 30, 2014, the Funds had no accrued penalties or interest.

The Funds recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Funds’ tax positions, and have concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on U.S. tax returns and state tax returns filed since inception of the Funds. No U.S. federal or state income tax returns are currently under examination. The tax years ended November 30, 2014, 2013 and 2012 remain subject to examination by tax authorities in the U.S.. Due to the nature of the Funds’ investments, the Funds may be required to file income tax returns in several states. The Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (continued)

The Funds have accrued a state franchise tax liability for the year ended November 30, 2014. State franchise taxes are separate and distinct from state income taxes. State franchise taxes are imposed on a corporation for the right to conduct business in the state and typically are based off the net worth or capital apportioned to a state. Due to the nature of the Funds’ investments, the Funds may be required to file franchise state returns in several states.

The adjusted cost basis of investment and gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

| Global X Funds | | Federal Tax

Cost | | | Aggregated

Gross

Unrealized

Appreciation | | | Aggregated

Gross

Unrealized

Depreciation | | | Net

Unrealized

Appreciation

(Depreciation) | |

| Global X MLP ETF | | $ | 132,685,217 | | | $ | 20,556,858 | | | $ | (4,211,301 | ) | | $ | 16,345,557 | |

| Global X Junior MLP ETF | | | 18,228,097 | | | | 1,033,310 | | | | (1,916,000 | ) | | | (882,690 | ) |

The difference between cost amounts for financial statement purposes and tax purposes is due primarily to the recognition of return of capital and wash sales adjustments from the Funds’ investments in MLPs.

SECURITY TRANSACTIONS AND INVESTMENT INCOME – Security transactions are accounted for on the trade date for financial reporting purposes. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis from the settlement date.

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS – The Funds intend to declare and make quarterly distributions; however, the Board of Trustees may determine to make distributions at its own discretion. Distributions from net investment income are determined in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Funds, timing differences and differing characterization of distributions made by the Funds.

Distributions received from the Funds’ investments in MLPs generally are comprised of income and return of capital. The Funds record investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

2. SIGNIFICANT ACCOUNTING POLICIES (concluded)

The Funds also expect that a portion of the distributions they receive from MLPs may be treated as a tax deferred return of capital, thus reducing the Funds’ current tax liability. Return of capital distributions are not taxable income to the shareholder, but reduce the shareholder’s tax basis in the shareholder’s Fund shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of Fund shares. Shareholders who periodically receive the payment of dividends or other distributions consisting of a return of capital may be under the impression that they are receiving net profits from the Funds when, in fact, they are not. Shareholders should not assume that the source of the distributions is from the net profits of the Funds.

For the year ended November 30, 2014, the Funds made the following distributions from MLP distributions received.

| | | MLP | | | Junior MLP | |

| Net investment income | | $ | 3,832,426 | | | $ | 1,012,500 | |

| Return of capital | | | 2,146,324 | | | | - | |

| Total | | $ | 5,978,750 | | | $ | 1,012,500 | |

CREATION UNITS – The Funds issue and redeem shares (“Shares”) at Net Asset Value (“NAV”) and only in large blocks of Shares (each block of Shares for a Fund is called a “Creation Unit” or multiples thereof). Purchasers of Creation Units (“Authorized Participants”) at NAV must pay a standard creation fee per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an investor on the same day. An Authorized Participant who holds Creation Units and wishes to redeem at NAV would also pay a standard redemption fee per transaction to the custodian on the date of such redemption, regardless of the number of Creation Units redeemed that day.

If a Creation Unit is purchased or redeemed for cash, a higher transaction fee will be charged. The following table discloses the Creation Unit breakdown:

| | | Creation

Unit Shares | | | Creation Fee | | | Value | | | Redemption

Fee | |

| Global X MLP ETF | | | 50,000 | | | $ | 500 | | | $ | 822,500 | | | $ | 500 | |

| Global X Junior MLP ETF | | | 50,000 | | | | 500 | | | | 771,000 | | | | 500 | |

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

3. RELATED PARTY TRANSACTIONS

The Adviser serves as the investment adviser and the administrator for the Funds. Subject to the supervision of the Board of Trustees, the Adviser is responsible for managing the investment activities of the Funds and the Funds’ business affairs and other administrative matters and provides or causes to be furnished all supervisory, administrative and other services reasonably necessary for the operation of the Funds, including certain distribution services, if any, (provided pursuant to a separate Distribution Agreement), certain shareholder and distribution-related services (provided pursuant to a separate Rule 12b-1 Plan and related agreements) and investment advisory services (provided pursuant to a separate Investment Advisory Agreement), under what is essentially an "all-in" fee structure. For its service to the Funds, under the Supervision and Administration Agreement, each Fund pays a monthly fee to the Adviser at the annual rate (stated as a percentage of the average daily net assets of the Fund). In addition, the Funds bear other expenses that are not covered by the Supervision and Administration Agreement, which may vary and affect the total expense ratios of the Funds, such as taxes, brokerage fees, commissions, acquired fund fees, and other transaction expenses, interest expenses and extraordinary expenses (such as litigation and indemnification expenses).

| | | Supervision and | |

| | | Administration Fee | |

| Global X MLP ETF | | | 0.45 | % |

| Global X Junior MLP ETF | | | 0.75 | % |

SEI Investments Global Funds Services (“SEIGFS”) serves as Sub-Administrator to the Funds. As Sub-Administrator, SEIGFS provides the Funds with the required general administrative services, including, without limitation: office space, equipment, and personnel; clerical and general back office services; bookkeeping, internal accounting and secretarial services; the calculation of NAV; and assistance with the preparation and filing of reports, registration statements, proxy statements and other materials required to be filed or furnished by the Funds under federal and state securities laws. As compensation for these services, the Sub-Administrator receives certain out-of-pocket costs, transaction fees and asset-based fees which are accrued daily and paid monthly by the Adviser.

Cohen Fund Audit Services, Ltd. (“Cohen”) prepares Federal form 1120 and state tax returns for the Funds. In addition, among other things, Cohen assists the Funds in the calculation of the current and deferred tax provisions for financial statement purposes for the Funds’ fiscal year ended November 30, 2014.

SEI Investments Distribution Co. (“SIDCO”) serves as the Funds’ underwriter and distributor of Shares pursuant to a Distribution Agreement. Under the Distribution Agreement, SIDCO, as agent, receives orders to create and redeem Shares in Creation Unit Aggregations and transmits such orders to the Trust’s custodian and transfer agent. The distributor has no obligation to sell any specific quantity of Fund Shares. SIDCO bears the following costs and expenses relating to the distribution of Shares: (i) the costs of processing and maintaining records of creations of Creation Units; (ii) all costs of maintaining the records required of a registered broker/dealer; (iii) the expenses of maintaining its registration or qualification as a dealer or broker under Federal or state laws; (iv) filing fees; and (v) all other expenses incurred in connection with the distribution services as contemplated in the Distribution Agreement. SIDCO receives no fee for its distribution services under the Distribution Agreement.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

3. RELATED PARTY TRANSACTIONS (concluded)

Brown Brothers Harriman & Co. (“BBH”), located at 40 Water Street, Boston, MA 02109, serves as Custodian of the Funds’ assets. As Custodian, BBH has agreed to (1) make receipts and disbursements of money on behalf of the Funds, (2) collect and receive all income and other payments and distributions on account of the Funds’ portfolio investments, (3) respond to correspondence from shareholders, security brokers and others relating to its duties; and (4) make periodic reports to the Funds concerning the Funds’ operations. BBH does not exercise any supervisory function over the purchase and sale of securities. As compensation for these services, the Custodian receives certain out-of-pocket costs, transaction fees and asset-based fees, which are accrued daily and paid monthly by the Adviser from its fees.

4. INVESTMENT TRANSACTIONS

For the year ended November 30, 2014, the purchases and sales of investments in securities excluding in-kind transactions, long-term U.S. Government and short-term securities were:

| | | Purchases | | | Sales | |

| Global X MLP ETF | | $ | 33,327,366 | | | $ | 39,453,705 | |

| Global X Junior MLP ETF | | | 12,284,393 | | | | 15,162,668 | |

For the year or period ended November 30, 2013 and November 30, 2014, in-kind transactions associated with creations and redemptions were, respectively:

| | | | | | | | | Realized | |

| 2013 | | Purchases | | | Sales | | | Gain/(Loss) | |

| Global X MLP ETF | | $ | 51,338,953 | | | $ | - | | | $ | - | |

| Global X Junior MLP ETF | | | 14,877,535 | | | | - | | | | - | |

| | | | | | | | | Realized | |

| 2014 | | Purchases | | | Sales | | | Gain/(Loss) | |

| Global X MLP ETF | | $ | 75,359,886 | | | $ | - | | | $ | - | |

| Global X Junior MLP ETF | | | 4,955,907 | | | | - | | | | - | |

For the year ended November 30, 2014, there were no purchases or sales of long term U.S. Government securities for the Funds.

5. CONCENTRATION OF RISKS

The Funds use a replication strategy. A replication strategy is an indexing strategy that involves investing in the securities of an underlying Index in approximately the same proportions as in the underlying Index. The Funds may utilize a representative sampling strategy with respect to their underlying Indices when a replication strategy might be detrimental to its shareholders, such as when there are practical difficulties or substantial costs involved in compiling a portfolio of equity securities to follow their underlying Indices, or, in certain instances, when securities in their underlying Indices become temporarily illiquid, unavailable or less liquid, or due to legal restrictions (such as diversification requirements that apply to the Funds but not their underlying Indices).

Under normal circumstances, the Global X MLP ETF and Global X Junior MLP ETF intend to invest at least 80% of their total assets in securities of MLPs, which are subject to certain risks, such as supply and demand risk, depletion and exploration risk, and the risk associated with the hazards inherent in midstream energy industry activities. A substantial portion of the cash flow received by the Funds is derived from investment in equity securities of MLPs. The amount of cash that an MLP has available for distributions and the tax character of such distributions are dependent upon the amount of cash generated by the MLP’s operations.

|

| |

| Notes to Financial Statements (continued) |

| November 30, 2014 |

5. CONCENTRATION OF RISKS (continued)

MLPs operating in the energy sector are subject to risks that are specific to the industry they serve.

Midstream - Midstream MLPs that provide crude oil, refined product and natural gas services are subject to supply and demand fluctuations in the markets they serve which may be impacted by a wide range of factors including fluctuating commodity prices, weather, increased conservation or use of alternative fuel sources, increased governmental or environmental regulation, depletion, rising interest rates, declines in domestic or foreign production, accidents or catastrophic events, increasing operating expenses and economic conditions, among others.

Exploration and production - Exploration and production MLPs produce energy resources, including natural gas and crude oil. Exploration and production MLPs that own oil and gas reserves are particularly vulnerable to declines in the demand for and prices of crude oil and natural gas. Substantial downward adjustments in reserve estimates could have a material adverse effect on the value of such reserves and the financial condition of an MLP. Exploration and production MLPs seek to reduce cash flow volatility associated with commodity prices by executing multi-year hedging strategies that fix the price of gas and oil produced. There can be no assurance that the hedging strategies currently employed by these MLPs are currently effective or will remain effective.

Marine shipping - Marine shipping MLPs are primarily marine transporters of natural gas, crude oil or refined petroleum products. Marine shipping companies are exposed to many of the same risks as other energy companies. The highly cyclical nature of the marine transportation industry may lead to volatile changes in charter rates and vessel values, which may adversely affect the revenues, profitability and cash flows of MLPs with marine transportation assets.

Propane - Propane MLPs are distributors of propane to homeowners for space and water heating. MLPs with propane assets are subject to earnings variability based upon weather conditions in the markets they serve, fluctuating commodity prices, customer conservation and increased use of alternative fuels, increased governmental or environmental regulation, and accidents or catastrophic events, among others.

Natural Resource - MLPs with coal, timber, fertilizer and other mineral assets are subject to supply and demand fluctuations in the markets they serve, which will be impacted by a wide range of domestic and foreign factors including fluctuating commodity prices, the level of their customers’ coal stockpiles, weather, increased conservation or use of alternative fuel sources, increased governmental or environmental regulation, depletion, declines in production, mining accidents or catastrophic events, health claims and economic conditions, among others.

|

| |

| Notes to Financial Statements (concluded) |

| November 30, 2014 |

6. LOANS OF PORTFOLIO SECURITIES

The Funds may lend portfolio securities having a market value up to one-third of the Funds’ total assets. Security loans made pursuant to a securities lending agreement are required at all times to be secured by collateral equal to at least 102% for U.S.-based securities and 105% for foreign based securities. Such collateral received in connection with these loans will be cash and can be invested in repurchase agreements or U.S. Treasury obligations and is recognized in the Schedule of Investments and Statement of Assets and Liabilities. The obligation to return securities lending collateral is also recognized as a liability in the Statement of Assets and Liabilities. It is the Funds’ policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day, following the valuation date of the securities loaned. Therefore, the value of the collateral held may be temporarily less than the value of the securities on loan. Lending securities entails a risk of loss to the Funds if and to the extent that the market value of the securities loans were to increase and the borrower did not increase the collateral accordingly, and the borrower fails to return the securities. The Funds could also experience delays and costs in gaining access to the collateral. The Funds bear the risk of any deficiency in the amount of the collateral available for return to the borrower due to any loss on the collateral invested. As of November 30, 2014, and for the year ended November 30, 2014, the Funds had no securities on loan.

7. CONTRACTUAL OBLIGATIONS

The Funds enter into contracts in the normal course of business that contain a variety of indemnifications. The Funds’ maximum exposure under these arrangements is unknown. However, the Funds have not had prior gains or losses pursuant to these contracts. Management has reviewed the Funds’ existing contracts and expects the risk of loss to be remote.

Pursuant to the Trust’s organizational documents, the Trustees of the Trust and the Trust’s officers are indemnified against certain liabilities that may arise out of the performance of their duties.

8. SUBSEQUENT EVENTS

The Funds have evaluated the need for additional disclosures and/or adjustments resulting from subsequent events. Based on this evaluation, no additional disclosures or adjustments were required to the financial statements as of the date the financial statements were issued.

|

| |

| Report of Independent Registered Public Accounting Firm |

The Board of Trustees and Shareholders of Global X Funds

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Global X MLP ETF and Global X Junior MLP ETF (two of the portfolios constituting the Global X Funds) (the “Funds”) as of November 30, 2014, and the related statements of operations for the year then ended, the statements of changes in net assets for the years or periods then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of November 30, 2014, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds listed above at November 30, 2014, and the results of their operations for the year then ended, the changes in their net assets for each of the years or periods then ended, and their financial highlights for each of the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania January 29, 2015 |  |

|

| |

| Disclosure of Fund Expenses (unaudited) |

| |

All Exchange Traded Funds (“ETFs”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF management, administrative services, commissions, and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns. In addition, a shareholder is responsible for brokerage fees as a result of his or her investment in the Fund.

Operating expenses such as these are deducted from an ETF’s gross income and directly reduce its final investment return. These expenses are expressed as a percentage of the ETF’s average net assets; this percentage is known as the ETF’s expense ratio.

The following examples use the expense ratio and are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other funds. The examples are based on an investment of $1,000 made at the beginning of the six month period ended November 30, 2014 and held for the entire period.

The table below illustrates your Fund’s costs in two ways:

Actual Fund Return. This section helps you to estimate the actual expenses that your Fund incurred over the period. The “Expenses Paid During Period” column shows the actual dollar expense cost incurred by a $1,000 investment in the Fund, and the “Ending Account Value” number is derived from deducting that expense cost from the Fund’s gross investment return.

You can use this information, together with the actual amount you invested in the Fund, to estimate the expenses you paid over that period. Simply divide your actual account value by $1,000 to arrive at a ratio (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply that ratio by the number shown for your Fund under “Expenses Paid During Period.”

Hypothetical 5% Return. This section helps you compare your Fund’s costs with those of other funds. It assumes that the Fund had an annual 5% return before expenses during the year, but that the expense ratio (Column 3) for the period is unchanged. This example is useful in making comparisons because the Securities and Exchange Commission requires all funds to make this 5% calculation. You can assess your Fund’s comparative cost by comparing the hypothetical result for your Fund in the “Expenses Paid During Period” column with those that appear in the same charts in the shareholder reports for other funds.

NOTE: Because the return is set at 5% for comparison purposes — NOT your Fund’s actual return — the account values shown may not apply to your specific investment.

| | | Beginning

Account

Value

6/1/2014 | | | Ending

Account

Value

11/30/2014 | | | Annualized

Expense

Ratios(2) | | | Expenses

Paid

During

Period(1) | |

| Global X MLP ETF |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 1,012.10 | | | | 0.47 | % | | $ | 2.35 | |

| Hypothetical 5% Return | | | 1,000.00 | | | | 1,022.73 | | | | 0.47 | | | | 2.36 | |

| Global X Junior MLP ETF |

| Actual Fund Return | | $ | 1,000.00 | | | $ | 939.30 | | | | 0.75 | % | | $ | 3.66 | |

| Hypothetical 5% Return | | | 1,000.00 | | | | 1,021.30 | | | | 0.75 | | | | 3.81 | |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period.) |

| (2) | Tax benefit/(expense) is not included in the ratio calculation. |

|

| |

| Approval of Investment Advisory Agreement (unaudited) |

| |

Section 15(c) of the Investment Company Act of 1940, as amended ("1940 Act"), requires that the board of trustees of an exchange-traded fund (“ETF”), including a majority of those trustees who are not "interested persons" of the ETF, as defined in the 1940 Act ("Independent Trustees"), consider on an initial basis and periodically thereafter (as required by the 1940 Act), at an in person meeting called for such purpose, the terms of each fund’s investment advisory agreement and whether to approve entering into, or renewing, each agreement.

At a quarterly Board meeting held on November 14, 2014, the Board of Trustees (including the Trust’s Independent Trustees voting separately) considered and unanimously approved the continuation of (i) the Investment Advisory Agreement ("Renewal Investment Advisory Agreement") for each Fund covered by this Annual Report (each a "Renewal Fund") and (ii) the Supervision and Administration Agreement between the Trust ("Renewal Supervision and Administration Agreement"), on behalf of each Renewal Fund, and Global X Management Company LLC ("Global X Management"). The Renewal Investment Advisory Agreement and the Renewal Supervision and Administration Agreement are referred to herein as the "Renewal Agreements."

In advance of the Board meeting, the Board (including the Trust’s Independent Trustees) and the Independent Trustees’ independent legal counsel requested (in writing) detailed information from Global X Management in connection with their consideration of the Renewal Agreements and received and reviewed written responses from Global X Management and supporting materials relating to those requests for information. In the course of their consideration of the Renewal Agreements, the Trust’s Independent Trustees were advised by their counsel and, in addition to meeting with management of Global X Management, they met separately in executive session with their counsel.

In determining to approve the continuation of the Renewal Agreements for each Renewal Fund, the Board considered a variety of factors, including the factors discussed at greater detail below. After full consideration of the factors below, as well as other factors that were instructive in their consideration, the Board, including all of the Trust’s Independent Trustees voting separately, concluded that the Renewal Agreements were fair and reasonable and in the best interest of each Renewal Fund.

In reaching this decision, the Board did not assign relative weights to the factors discussed below nor did the Board deem any one factor or group of them to be controlling in and of themselves.

Nature, extent and quality of services

With respect to this factor, the Board considered:

| • | the terms of the Renewal Agreements and the range of services that would continue to be provided to each Renewal Fund in accordance with the Renewal Agreements; |

| • | Global X Management’s key personnel and the portfolio managers who would continue to provide investment advisory, supervision and administrative services to each Renewal Fund; |

| • | Global X Management’s responsibilities under the Renewal Agreements, among other things, to: (i) manage the investment operations of each Renewal Fund and the composition of each Renewal Fund’s assets, including the purchase, retention and disposition of its holdings, (ii) provide quarterly reports to the Trust’s officers and Board and other reports as the Board deems necessary or appropriate, (iii) vote proxies, exercise consents, and exercise all other rights relating to securities and assets held by each Renewal Fund, (iv) select broker-dealers to execute portfolio transactions for each Renewal Fund when necessary, (v) assist in the preparation and filing of reports and proxy statements (if any) to the shareholders of each Renewal Fund, and the periodic updating of the registration statement, prospectuses, statement of additional information, and other reports and documents for each Renewal Fund that are required to be filed by the Trust with the SEC and other regulatory and |

|

| |

| Approval of Investment Advisory Agreement (unaudited) |

| |

governmental bodies, and (vi) monitor anticipated purchases and redemptions of the shares (including Creation Units) of each Renewal Fund by shareholders and new investors;

| • | the nature, extent and quality of all of the services (including advisory, administrative and compliance services) that have been provided by Global X Management or made available to each Renewal Fund and the adequacy of Global X Management’s personnel resources that would continue to be made available to each Renewal Fund; and |

| • | Global X Management’s experience and the professional qualifications of Global X Management’s key personnel. |

Based on these considerations, the Board concluded that it was satisfied with the nature, extent and quality of the services provided to each Renewal Fund by Global X Management.

Performance

With respect to this factor, the Board considered each Renewal Fund’s total return and investment performance relative to (i) the performance of unaffiliated comparable specialized and/or focused ETFs and other registered funds (“Unaffiliated Comparable Funds”) in the same classification as each of the Renewal Funds, which performance information is publicly available from such registered funds as well as other third party sources; and (ii) the performance of comparable registered funds and pertinent indices.

Based on these considerations and comparisons, the Board concluded that the investment performance of each Renewal Fund did not adversely affect the Board’s approval of the continuance of the Renewal Agreements.

Cost of Services and Profitability

The Board considered Global X Management’s cost to provide investment management and related services to each Renewal Fund. In this regard, the Board considered the management fee (“Management Fee”) that has been borne by each Renewal Fund under the Renewal Agreements for the various investment advisory, supervisory and administrative services that each Renewal Fund requires under a unitary fee structure (including the types of fees and expenses that are not included within the unitary fee and would be borne by each Renewal Fund).

In addition, the Board considered the current and expected profitability to Global X Management from all services provided to the Renewal Funds and all aspects of Global X Management’s relationship with each of the Renewal Funds. In connection with these considerations, Global X Management provided the Board with financial information regarding its operations and the services provided to the Renewal Funds and discussed with the Board its current and expected profitability with respect to each of the Renewal Funds.