UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

623 Fifth Avenue, 15th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Bruno del Ama

Global X Management Company LLC

600 Lexington Ave, 20th Floor

New York, NY 10022

(Name and address of agent for service)

With a copy to:

| Daphne Tippens Chisolm, Esq. | Eric S. Purple, Esq. |

| Global X Management Company LLC | Stradley Ronon Stevens & Young, LLP |

| 600 Lexington Ave, 20th Floor | 1250 Connecticut Avenue, N.W. |

| New York, NY 10022 | Suite 500 |

| | Washington, DC 20036 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: October 31, 2016

Date of reporting period: October 31, 2016

| Item 1. | Reports to Stockholders. |

Global X Silver Miners ETF (ticker: SIL)

Global X Gold Explorers ETF (ticker: GOEX)

Global X Copper Miners ETF (ticker: COPX)

Global X Uranium ETF (ticker: URA)

Global X Lithium ETF (ticker: LIT)

Global X Fertilizers/Potash ETF (ticker: SOIL)

Annual Report

October 31, 2016

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Shares may only be redeemed directly from a fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

| Management Discussion of Fund Performance (unaudited) |

| Global X Silver Miners ETF |

Global X Silver Miners ETF

The Global X Silver Miners ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Silver Miners Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure broad-based equity market performance of global companies involved in the silver mining industry, as defined by the index provider.

For the 12-month period ended October 31, 2016 (the “reporting period”), the Fund increased 95.69%, while the Underlying Index increased 97.09%. The Fund had a net asset value of $20.83 per share on October 31, 2015 and ended the reporting period with a net asset value of $40.61 on October 31, 2016.

During the reporting period, the highest returns came from Coeur d’Alene Mines and Bear Creek Mining which returned 314.07% and 271.23%, respectively. The worst performers were Primero Mining and Great Panther Silver which returned

-41.3% and -15.08%, respectively.

After falling to a near six year low at the end of 2015, silver prices rebounded sharply in the first half of 2016. The uptrend in prices was driven by dovish central bank policies around the world, which continued the trend of keeping interest rates low. With low rates, the opportunity cost for holding non-yield bearing asset classes, like precious metals remained low. In addition, heighted geopolitical risks around the world drove additional investor assets towards precious metals as a store of value. The profitability and therefore the performance of silver mining companies tends to be leveraged to changes in spot silver prices. Therefore, as the underlying commodity benefited from the macro environment, silver mining stocks benefited disproportionately.

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2016 | |

| | | One Year Return | | | Three Year Return | | | Five Year Return | | | Annualized Inception to Date* | |

| | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | |

| Global X Silver Miners ETF | | | 95.69 | % | | | 96.00 | % | | | 2.05 | % | | | 2.01 | % | | | -10.18 | % | | | -10.35 | % | | | -0.58 | % | | | -0.58 | % |

| Solactive Global Silver Miners Total Return Index | | | 97.09 | % | | | 97.09 | % | | | 2.56 | % | | | 2.56 | % | | | -9.64 | % | | | -9.64 | % | | | 0.01 | % | | | 0.01 | % |

| S&P 500 Index | | | 4.51 | % | | | 4.51 | % | | | 8.84 | % | | | 8.84 | % | | | 13.57 | % | | | 13.57 | % | | | 11.51 | % | | | 11.51 | % |

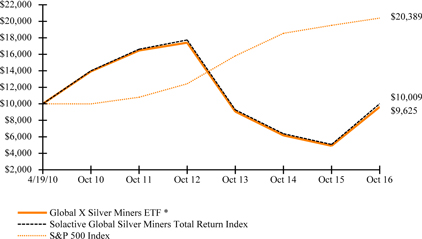

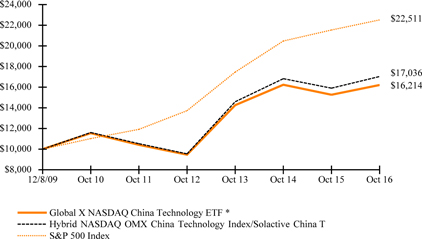

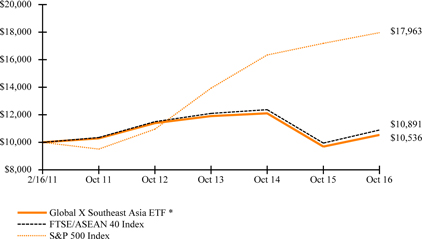

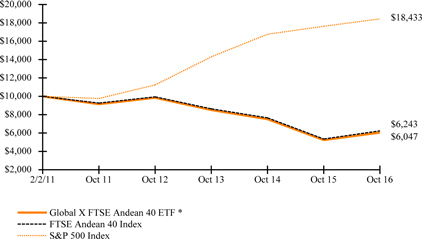

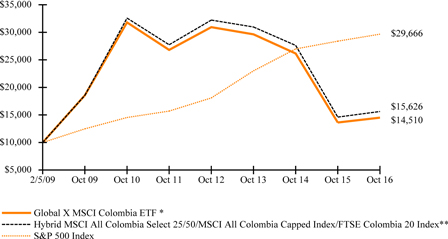

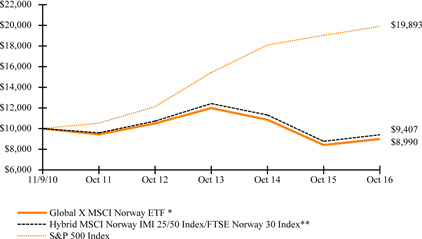

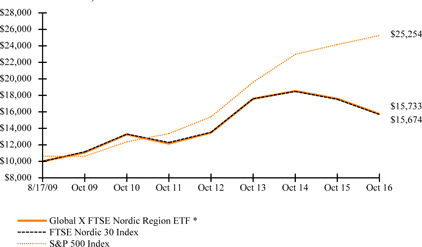

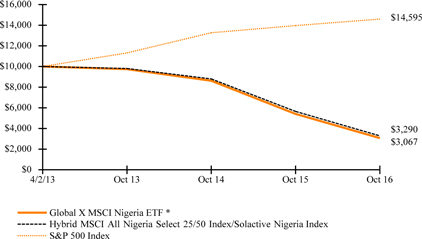

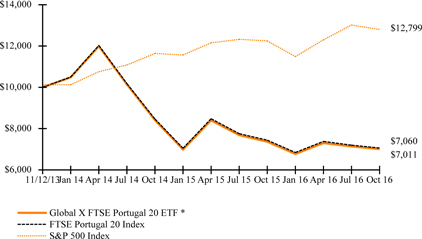

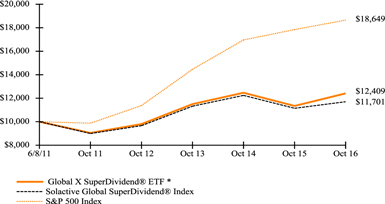

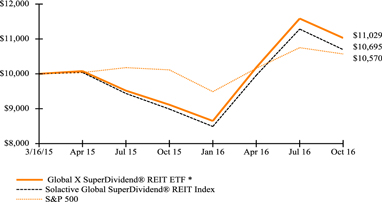

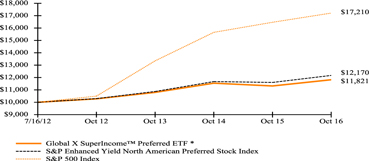

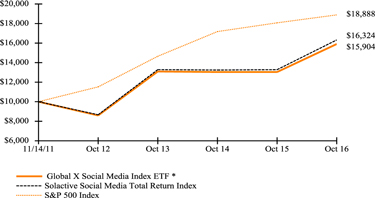

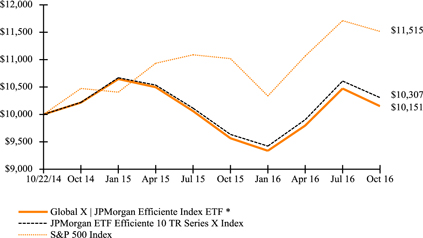

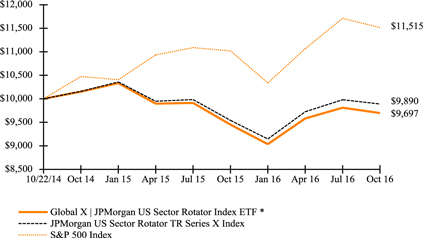

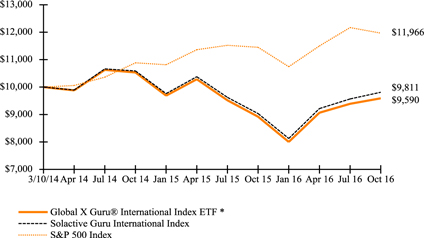

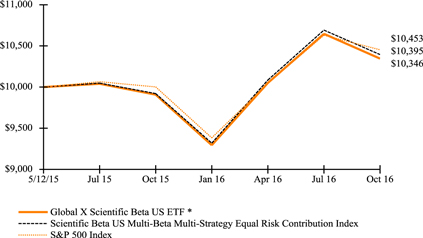

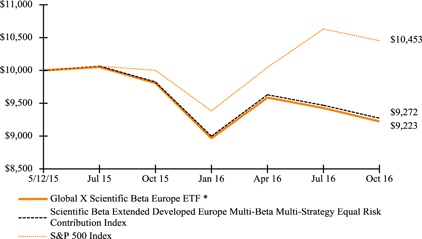

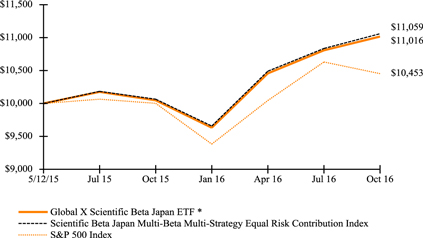

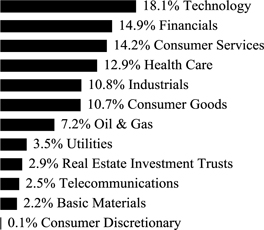

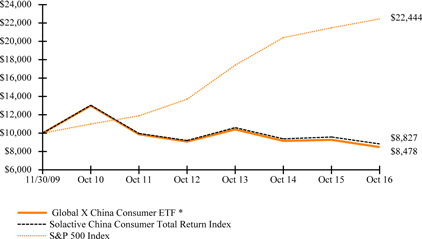

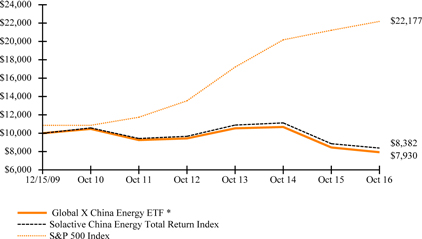

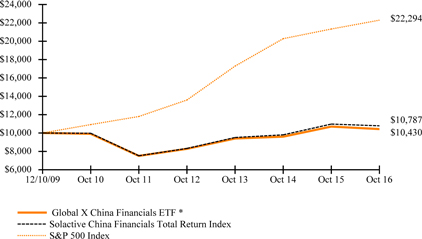

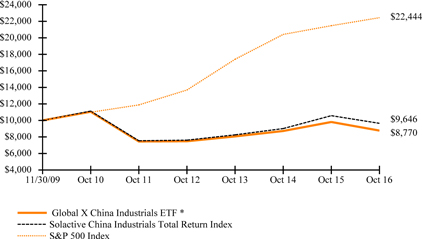

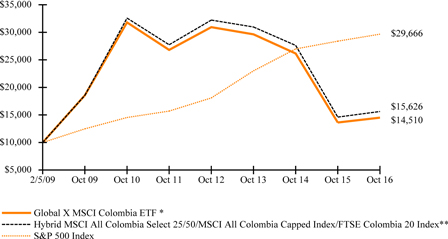

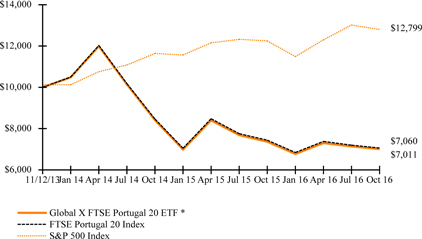

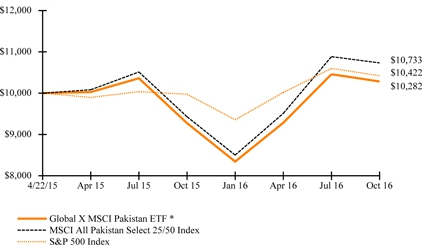

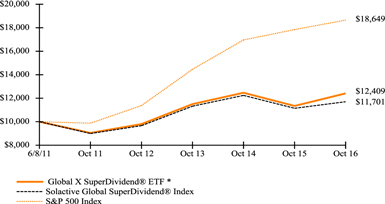

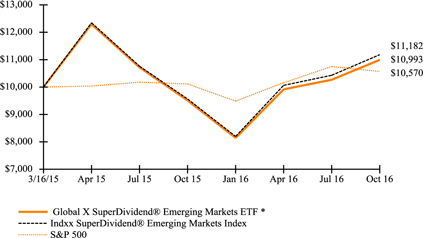

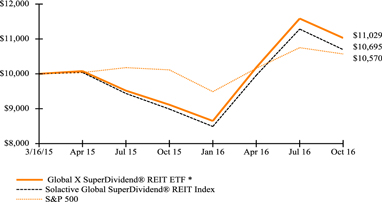

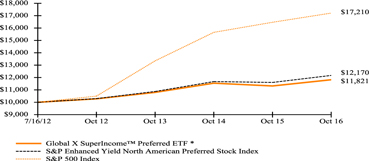

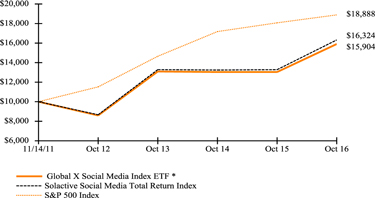

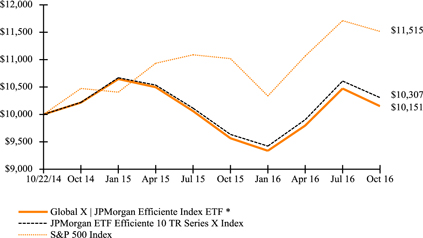

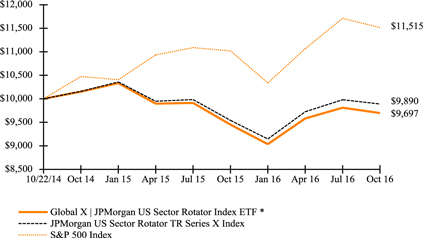

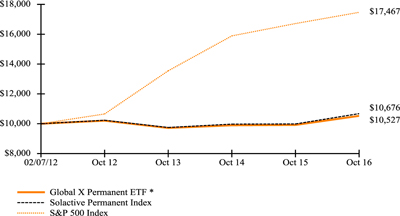

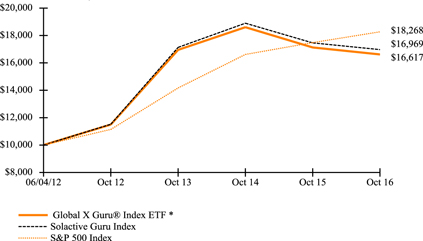

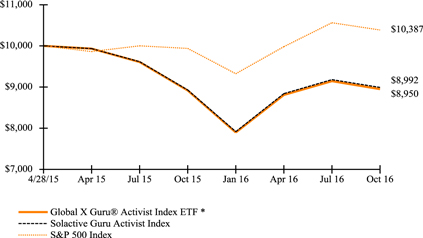

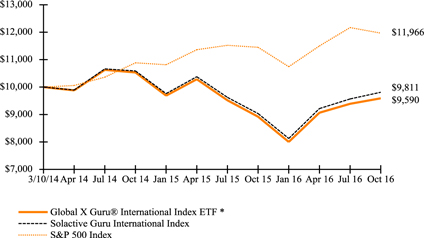

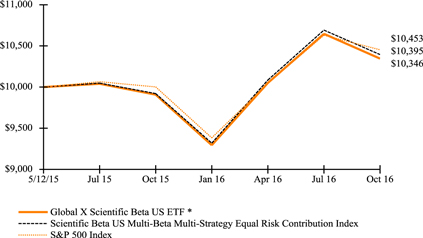

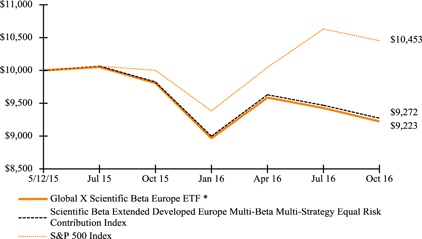

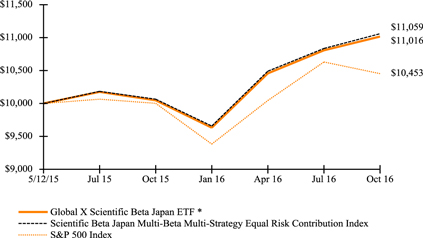

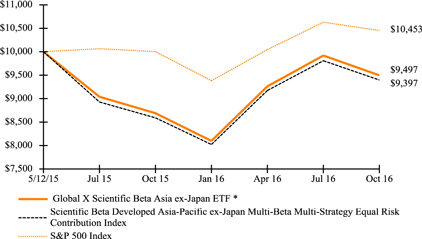

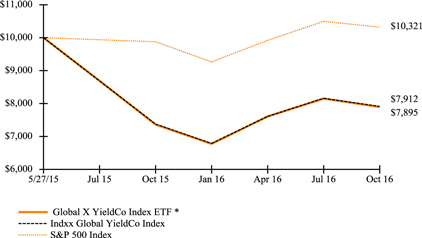

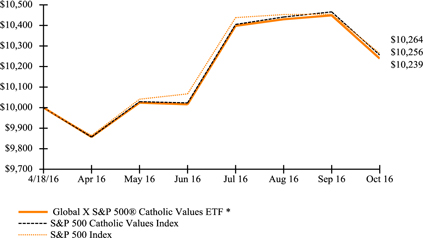

Growth of a $10,000 Investment

(at Net Asset Value)

*Fund commenced operations on April 19, 2010.

The S&P 500 Index is a market capitalization-weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

| Management Discussion of Fund Performance (unaudited) |

| Global X Silver Miners ETF |

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

| Management Discussion of Fund Performance (unaudited) |

| Global X Gold Explorers ETF |

Global X Gold Explorers ETF

The Global X Gold Explorers ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Gold Explorers Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is a free float-adjusted, liquidity-tested and market capitalization-weighted index that is designed to measure broad-based equity market performance of global companies involved in gold exploration, as defined by the index provider.

For the 12-month period ended October 31, 2016 (the “reporting period”), the Fund increased 95.95%, while the Underlying Index increased 97.26%. The Fund had a net asset value of $19.89 per share on October 31, 2015 and ended the reporting period with a net asset value of $34.95 on October 31, 2016.

During the reporting period, the highest returns came from International Tower Hill Mines and Gryphon Minerals which returned 360.35% and 301.79%, respectively. The worst performers were the two Rubicon Minerals stocks, which returned -98.58% and -90.6%.

By the end of 2015, gold prices had reached nearly a 6-year low, which put significant pressure on the gold exploration industry, which tends to benefit from higher gold prices. In early 2016, however, gold prices began to rebound sharply as geopolitical and economic uncertainties came to the forefront, such as the Brexit vote, central bank stimulus packages, and the U.S. presidential elections. Furthermore, increasing demand for physical gold and a weaker U.S. Dollar also supported gold prices during the reporting period. Gold exploration companies are highly sensitive to gold prices, and the increasing value of the yellow metal during the reporting period was a strong contributor of the positive performance of the Fund.

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2016 | |

| | | One Year Return | | | Three Year Return | | | Five Year Return | | | Annualized Inception to

Date* | |

| | | Net Asset

Value | | | Market Price | | | Net Asset

Value | | | Market Price | | | Net Asset

Value | | | Market Price | | | Net Asset

Value | | | Market Price | |

| Global X Gold Explorers ETF | | | 95.95 | % | | | 90.60 | % | | | 13.12 | % | | | 12.06 | % | | | -17.01 | % | | | -17.22 | % | | | -16.50 | % | | | -16.63 | % |

| Solactive Global Gold Explorers Total Return Index | | | 97.26 | % | | | 97.26 | % | | | 13.86 | % | | | 13.86 | % | | | -16.03 | % | | | -16.03 | % | | | -15.81 | % | | | -15.81 | % |

| S&P 500 Index | | | 4.51 | % | | | 4.51 | % | | | 8.84 | % | | | 8.84 | % | | | 13.57 | % | | | 13.57 | % | | | 12.40 | % | | | 12.40 | % |

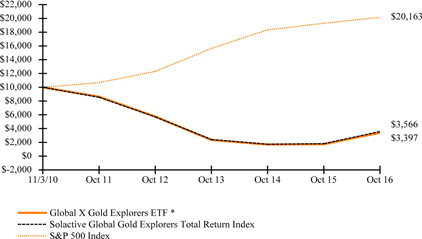

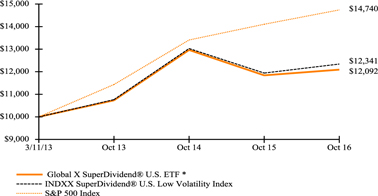

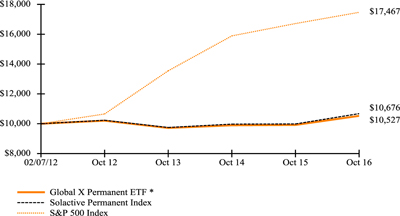

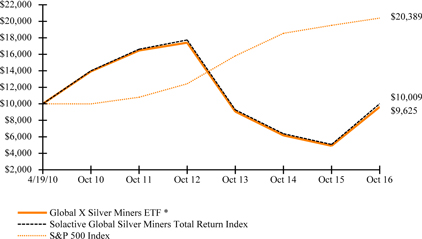

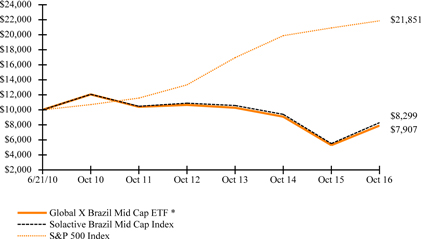

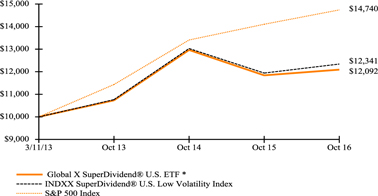

Growth of a $10,000 Investment

(at Net Asset Value)

*Fund commenced operations on November 3, 2010.

The S&P 500 Index is a market capitalization-weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

| Management Discussion of Fund Performance (unaudited) |

| Global X Gold Explorers ETF |

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

| Management Discussion of Fund Performance (unaudited) |

| Global X Copper Miners ETF |

Global X Copper Miners ETF

The Global X Copper Miners ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Copper Miners Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure broad-based equity market performance of global companies involved in the copper mining industry, as defined by the index provider.

For the 12-month period ended October 31, 2016 (the “reporting period”), the Fund increased 18.88%, while the Underlying Index increased 20.21%. The Fund had a net asset value of $14.98 per share on October 31, 2015 and ended the reporting period with a net asset value of $17.60 on October 31, 2016.

During the reporting period, the highest returns came from Teck Resources and KAZ Minerals, which returned 273.91% and 94.74%, respectively. The worst performers were Imperial Metals and KGHM Polska Miedz, which returned -36.52% and -21.01%, respectively.

The performance of copper mining companies tends to be highly correlated to changes in copper prices. In Q1 2016, spot copper prices reached multi-years lows given concerns around global growth, particularly in China, which is a major consumer of raw copper. Copper is used extensively in wiring for vehicles, heavy machinery, and telecommunication networks. Later in the reporting period, broad commodity prices recovered as fears over a hard landing in Chinese economic growth abated, which provided support for a recovery in copper prices. Subsequently, copper mining companies rallied on expectations of higher future profitability.

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2016 | |

| | | One Year Return | | | Three Year Return | | | Five Year Return | | | Annualized Inception to Date* | |

| | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | |

| Global X Copper Miners ETF | | | 18.88 | % | | | 16.77 | % | | | -14.54 | % | | | -14.37 | % | | | -14.60 | % | | | -14.47 | % | | | -10.84 | % | | | -10.84 | % |

| Solactive Global Copper Miners Total Return Index | | | 20.21 | % | | | 20.21 | % | | | -14.10 | % | | | -14.10 | % | | | -14.41 | % | | | -14.41 | % | | | -10.56 | % | | | -10.56 | % |

| S&P 500 Index | | | 4.51 | % | | | 4.51 | % | | | 8.84 | % | | | 8.84 | % | | | 13.57 | % | | | 13.57 | % | | | 11.51 | % | | | 11.51 | % |

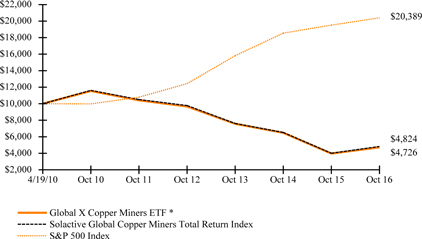

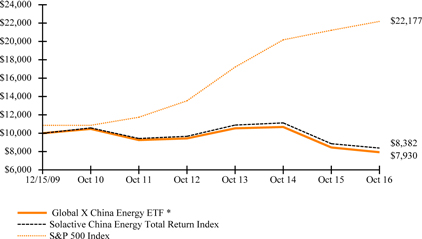

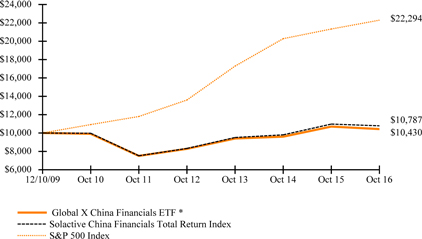

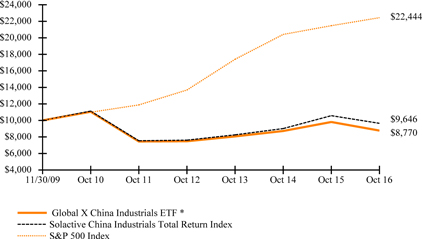

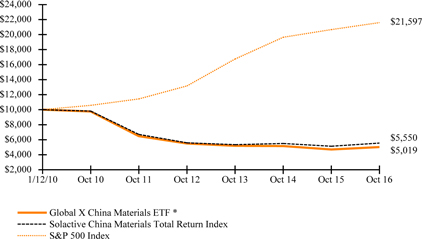

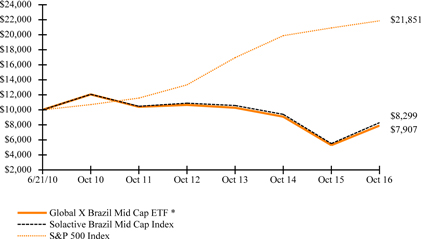

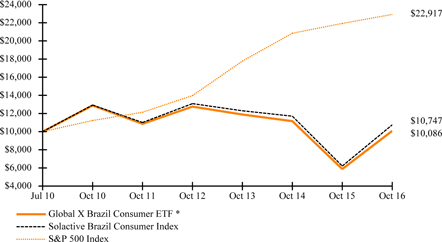

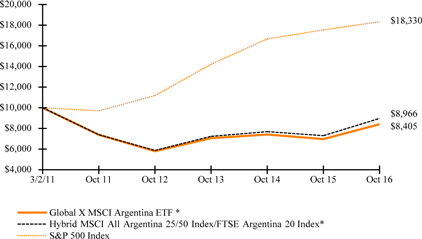

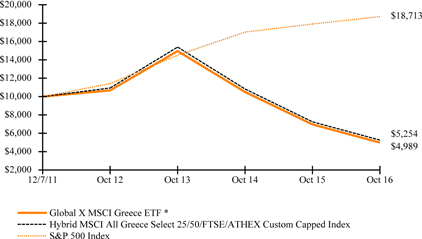

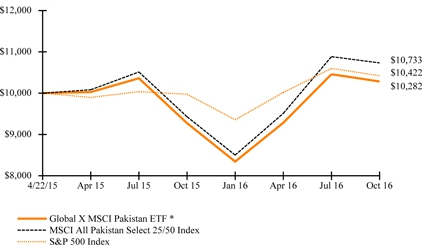

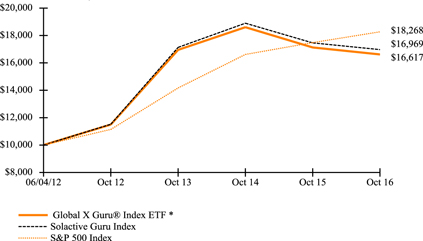

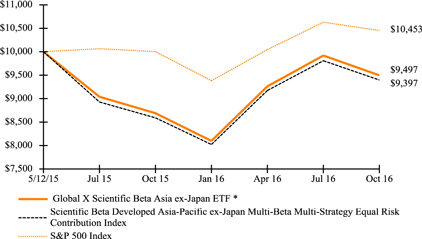

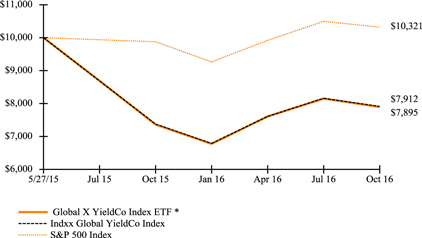

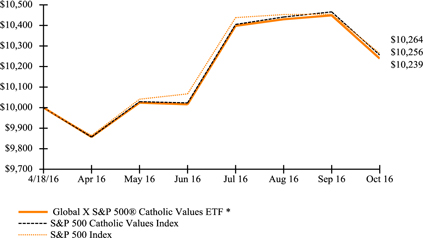

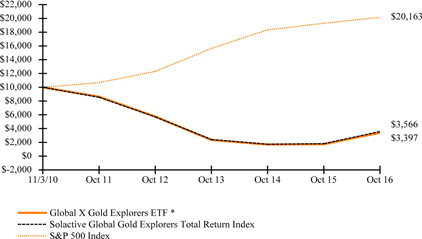

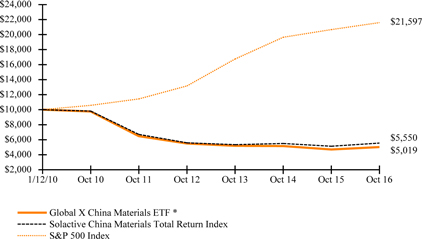

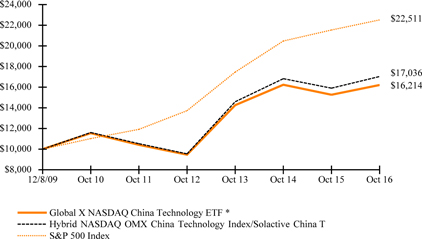

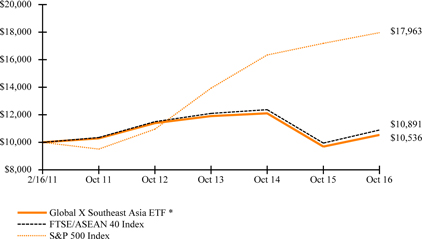

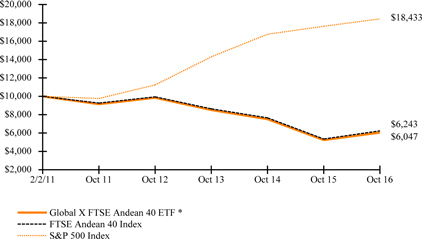

Growth of a $10,000 Investment

(at Net Asset Value)

*Fund commenced operations on April 19, 2010.

The S&P 500 Index is a market capitalization-weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

| Management Discussion of Fund Performance (unaudited) |

| Global X Copper Miners ETF |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

| Management Discussion of Fund Performance (unaudited) |

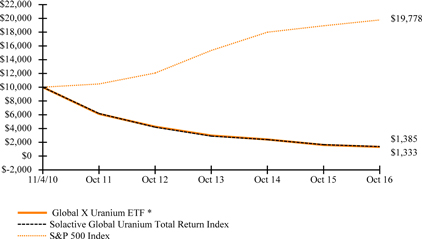

| Global X Uranium ETF |

Global X Uranium ETF

The Global X Uranium ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure broad-based equity market performance of global companies involved in the uranium industry, as defined by the index provider.

For the 12-month period ended October 31, 2016 (the “reporting period”), the Fund decreased 17.53%, while the Underlying Index decreased 16.42%. The Fund had a net asset value of $14.94 per share on October 31, 2015 and ended the reporting period with a net asset value of $12.08 on October 31, 2016.

During the reporting period, the highest returns came from Greenland Minerals and Energy and NexGen Energy, which returned 219.97% and 115.3%, respectively. The worst performers were Uranium Resources and Peninsula Energy, which returned -83.96% and -48.84%, respectively.

Uranium prices came under pressure during the reporting period, given high levels of supply of the commodity in the market. Some of this is due to high stocks of uranium from decommissions weapons, but demand has also suffered as Japan’s uranium consumption remains stifled after the Fukushima disaster, and other countries like Germany are phasing out nuclear power generation. The longer term outlook for the uranium market appears stronger given Japan’s return to nuclear power generation and greater focus on nuclear power from emerging markets like China and India, which have massive power demands but are concerned about air quality.

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2016 | |

| | | One Year Return | | | Three Year Return | | | Five Year Return | | | Annualized Inception to

Date* | |

| | | Net Asset

Value | | | Market Price | | | Net Asset

Value | | | Market Price | | | Net Asset

Value | | | Market Price | | | Net Asset

Value | | | Market Price | |

| Global X Uranium ETF | | | -17.53 | % | | | -16.64 | % | | | -23.57 | % | | | -23.78 | % | | | -26.29 | % | | | -26.22 | % | | | -28.57 | % | | | -28.52 | % |

| Solactive Global Uranium Total Return Index | | | -16.42 | % | | | -16.42 | % | | | -21.77 | % | | | -21.77 | % | | | -25.88 | % | | | -25.88 | % | | | -28.12 | % | | | -28.12 | % |

| S&P 500 Index | | | 4.51 | % | | | 4.51 | % | | | 8.84 | % | | | 8.84 | % | | | 13.57 | % | | | 13.57 | % | | | 12.05 | % | | | 12.05 | % |

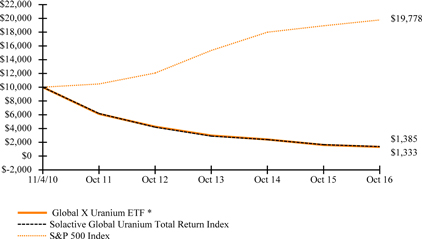

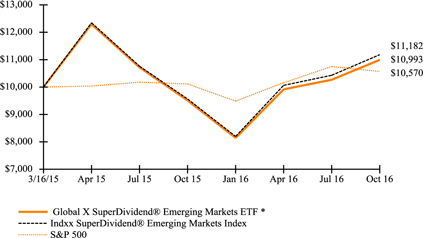

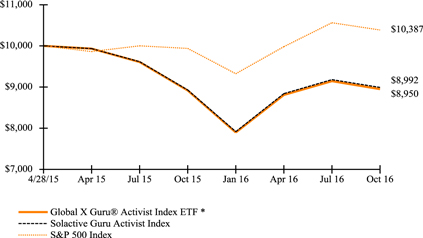

Growth of a $10,000 Investment

(at Net Asset Value)

*Fund commenced operations on November 4, 2010.

The S&P 500 Index is a market capitalization-weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

| Management Discussion of Fund Performance (unaudited) |

| Global X Uranium ETF |

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

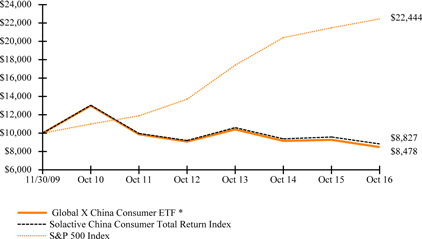

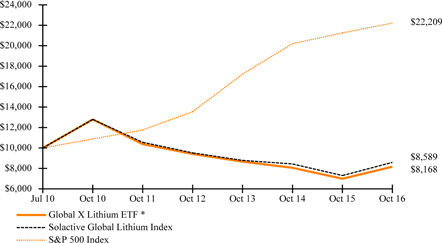

| Management Discussion of Fund Performance (unaudited) |

| Global X Lithium ETF |

Global X Lithium ETF

The Global X Lithium ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Lithium Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure broad-based equity market performance of global companies involved in the lithium industry, as defined by the index provider.

For the 12-month period ended October 31, 2016 (the “reporting period”), the Fund increased 16.76%, while the Underlying Index increased 17.57%. The Fund had a net asset value of $20.62 per share on October 31, 2015 and ended the reporting period with a net asset value of $24.02 on October 31, 2016.

During the reporting period, the highest returns came from Galaxy Resources and Orocobre, which returned 384.81% and 127.58%, respectively. The worst performers were Blue Solutions and China BAK Battery, which returned -46.32% and -42.81%, respectively.

Demand for lithium has continued to grow as its use in state of the art batteries for electric vehicles, mobile electronics and renewable energy have made it an increasingly important commodity for transportation, telecommunications, and energy storage. While lithium broadly benefited from the general rebound in commodity prices during the reporting period, there has been additional optimism around the adoption of electric vehicles by mainstream consumers. Demand for electric vehicles has grown rapidly, not just among affluent consumers in the US, but among emerging markets like China and India, where simplicity, efficiency, and low emissions are increasingly becoming important features.

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2016 | |

| | | One Year Return | | | Three Year Return | | | Five Year Return | | | Annualized Inception to Date* | |

| | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | |

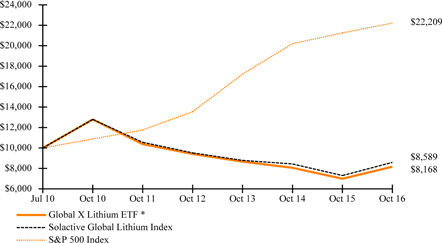

| Global X Lithium ETF | | | 16.76 | % | | | 16.47 | % | | | -1.93 | % | | | -1.97 | % | | | -4.67 | % | | | -4.41 | % | | | -3.17 | % | | | -3.12 | % |

| Solactive Global Lithium Index | | | 17.57 | % | | | 17.57 | % | | | -0.74 | % | | | -0.74 | % | | | -4.04 | % | | | -4.04 | % | | | -2.39 | % | | | -2.39 | % |

| S&P 500 Index | | | 4.51 | % | | | 4.51 | % | | | 8.84 | % | | | 8.84 | % | | | 13.57 | % | | | 13.57 | % | | | 13.54 | % | | | 13.54 | % |

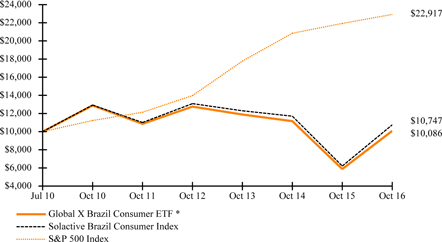

Growth of a $10,000 Investment

(at Net Asset Value)

*Fund commenced operations on July 22, 2010.

The S&P 500 Index is a market capitalization-weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

| Management Discussion of Fund Performance (unaudited) |

| Global X Lithium ETF |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

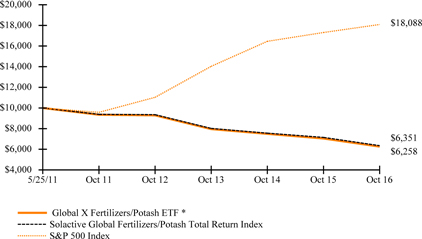

| Management Discussion of Fund Performance (unaudited) |

| Global X Fertilizers/Potash ETF |

Global X Fertilizers/Potash ETF

The Global X Fertilizers/Potash ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Fertilizers/Potash Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to track the performance of the largest listed companies globally that are active in some aspect of the fertilizer/potash industry, as defined by the index provider.

For the 12-month period ended October 31, 2016 (the “reporting period”), the Fund decreased 11.15%, while the Underlying Index decreased 11.13%. The Fund had a net asset value of $9.98 per share on October 31, 2015 and ended the reporting period with a net asset value of $8.56 on October 31, 2016.

During the reporting period, the highest returns came from Sirius Minerals and Sociedad Quimica Y Minera De Chile, which returned 66.54% and 57.13%, respectively. The worst performers were Intrepid Potash and OCI, which returned -67.1% and -51.2%, respectively.

The fertilizers and potash market experienced significant price declines during the period, due in part to delays by China in signing key supply contracts and a flooding of the market with too much supply. North America and Europe are the two major regions for potash and fertilizer production, while China, India and Brazil are the key importers. This dynamic can make the industry sensitive to fluctuations in exchange rates, trade policies, and emerging market growth rates. The expansion of fertilizer production projects, the delay in buyer purchases and falling incomes from farms all contributed to the pressure on fertilizer prices during the period.

| | | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2016 | |

| | | One Year Return | | | Three Year Return | | | Five Year Return | | | Annualized Inception to Date* | |

| | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | | | Net Asset Value | | | Market Price | |

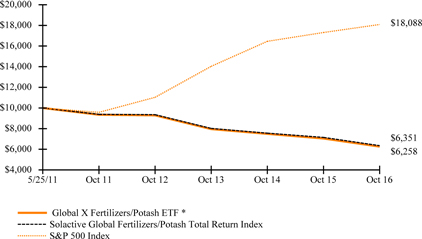

| Global X Fertilizers/Potash ETF | | | -11.15 | % | | | -10.18 | % | | | -7.69 | % | | | -7.45 | % | | | -7.70 | % | | | -7.56 | % | | | -8.27 | % | | | -8.17 | % |

| Solactive Global Fertilizers/Potash Total Return Index | | | -11.13 | % | | | -11.13 | % | | | -7.48 | % | | | -7.48 | % | | | -7.51 | % | | | -7.51 | % | | | -8.02 | % | | | -8.02 | % |

| S&P 500 Index | | | 4.51 | % | | | 4.51 | % | | | 8.84 | % | | | 8.84 | % | | | 13.57 | % | | | 13.57 | % | | | 11.51 | % | | | 11.51 | % |

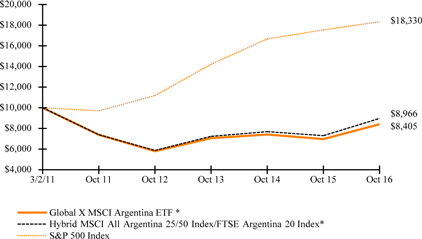

Growth of a $10,000 Investment

(at Net Asset Value)

*Fund commenced operations on May 25, 2011.

The S&P 500 Index is a market capitalization-weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

| Management Discussion of Fund Performance (unaudited) |

| Global X Fertilizers/Potash ETF |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

| Schedule of Investments | October 31, 2016 |

| Global X Silver Miners ETF |

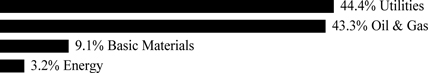

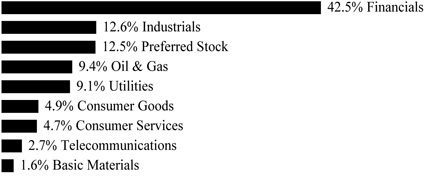

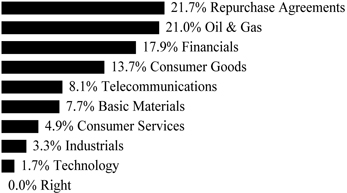

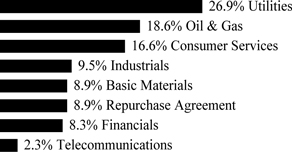

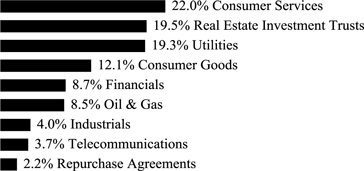

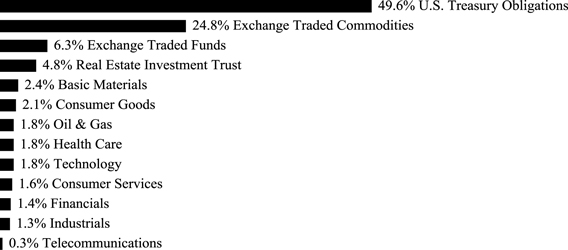

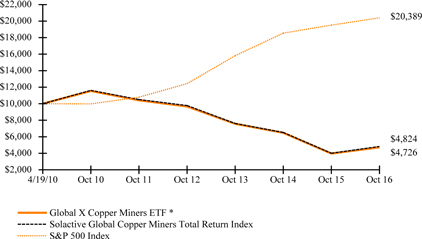

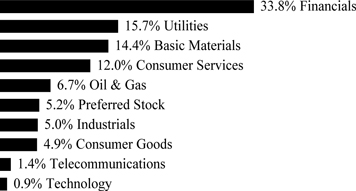

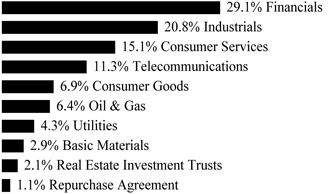

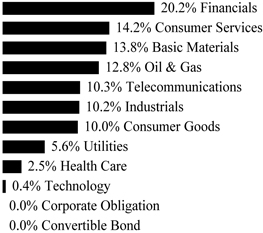

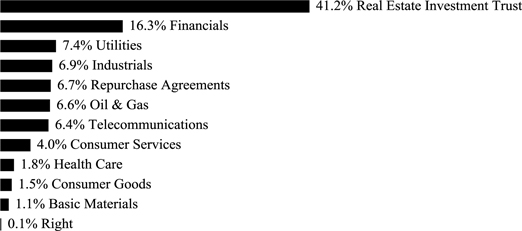

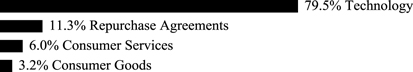

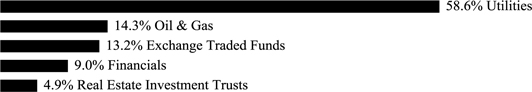

Sector Weightings (unaudited)†:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | Shares | | | Value | |

| COMMON STOCK — 99.7% |

| CANADA— 24.4% | | | | | | | | |

| Basic Materials — 24.4% | | | | | | | | |

| Alexco Resource * | | | 238,300 | | | $ | 414,280 | |

| AuRico Metals * | | | 1,169,231 | | | | 1,073,049 | |

| AuRico Metals^ * (A) | | | 533,199 | | | | 495,875 | |

| Bear Creek Mining * (A) | | | 1,112,438 | | | | 2,241,062 | |

| Excellon Resources * | | | 94,300 | | | | 119,612 | |

| First Majestic Silver * (A) | | | 1,878,556 | | | | 15,095,727 | |

| Fortuna Silver Mines * | | | 1,759,550 | | | | 12,038,854 | |

| Great Panther Silver * | | | 1,892,560 | | | | 2,584,133 | |

| Klondex Mines, Cl Common Subscription Receipt * | | | 741,800 | | | | 4,090,209 | |

| Primero Mining * (A) | | | 2,226,588 | | | | 3,006,994 | |

| Silvercorp Metals * (A) | | | 2,376,139 | | | | 6,177,961 | |

| Tahoe Resources | | | 3,761,260 | | | | 45,126,701 | |

| TOTAL CANADA | | | | | | | 92,464,457 | |

| MEXICO— 8.1% | | | | | | | | |

| Basic Materials — 8.1% | | | | | | | | |

| Industrias Penoles | | | 1,266,913 | | | | 30,801,327 | |

| UNITED KINGDOM— 19.3% | | | | | | | | |

| Basic Materials — 19.3% | | | | | | | | |

| Fresnillo | | | 2,295,758 | | | | 45,967,294 | |

| Hochschild Mining | | | 2,802,871 | | | | 9,119,674 | |

| Polymetal International | | | 1,677,921 | | | | 18,252,745 | |

| TOTAL UNITED KINGDOM | | | | | | | 73,339,713 | |

| UNITED STATES— 47.9% | | | | | | | | |

| Basic Materials — 47.9% | | | | | | | | |

| Alamos Gold, Cl A | | | 2,263,432 | | | | 17,767,941 | |

| Coeur d'Alene Mines * | | | 1,907,479 | | | | 21,325,615 | |

| Endeavour Silver * (A) | | | 1,611,453 | | | | 7,090,393 | |

| Hecla Mining | | | 3,864,158 | | | | 23,146,306 | |

| MAG Silver * | | | 1,073,245 | | | | 15,701,574 | |

| McEwen Mining (A) | | | 2,914,750 | | | | 9,472,938 | |

| Pan American Silver | | | 1,537,726 | | | | 24,649,748 | |

| Silver Standard Resources * | | | 1,415,409 | | | | 15,512,883 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Silver Miners ETF |

| | | Shares/Face

Amount | | | Value | |

| COMMON STOCK — continued |

| Basic Materials — continued | | | | | | | | |

| Silver Wheaton | | | 1,961,432 | | | $ | 47,290,126 | |

| TOTAL UNITED STATES | | | | | | | 181,957,524 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $334,080,408) | | | | | | | 378,563,021 | |

| | | | | | | | | |

| REPURCHASE AGREEMENTS — 3.0% |

| Barclays Bank | | | | | | | | |

| 0.320%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $10,000,089 (collateralized by U.S Treasury Obligations, ranging in par value $1-$3,479,661, 0.000%-4.750%, 11/15/16-05/15/46, with a total market value of $10,200,000)(B) | | $ | 10,000,000 | | | | 10,000,000 | |

| Deutsche Bank | | | | | | | | |

| 0.350%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $1,205,567 (collateralized by U.S. Treasury Obligations, par value $1,121,100, 3.000%, 05/15/45 with a total market value of $1,234,992)(B) | | | 1,205,555 | | | | 1,205,555 | |

| TOTAL REPURCHASE AGREEMENTS | | | | | | | | |

| (Cost $11,205,555) | | | | | | | 11,205,555 | |

| TOTAL INVESTMENTS — 102.7% | | | | | | | | |

| (Cost $345,285,963) | | | | | | $ | 389,768,576 | |

Percentages are based on Net Assets of $379,617,292.

| * | Non-income producing security. |

| ^ | Traded on U.S. stock exchange |

| (A) | This security or a partial position of this security is on loan as of October 31, 2016. The total value of securities on loan as of October 31, 2016 was $10,710,032. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2016 was $11,205,555. |

Cl — Class

The following is a summary of the inputs used as of October 31, 2016, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 378,563,021 | | | $ | — | | | $ | — | | | $ | 378,563,021 | |

| Repurchase Agreements | | | — | | | | 11,205,555 | | | | — | | | | 11,205,555 | |

| Total Investments in Securities | | $ | 378,563,021 | | | $ | 11,205,555 | | | $ | — | | | $ | 389,768,576 | |

For the year ended October 31, 2016, there have been no transfers between Level 1, Level 2 and Level 3 investments.

As of October 31, 2016, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Gold Explorers ETF |

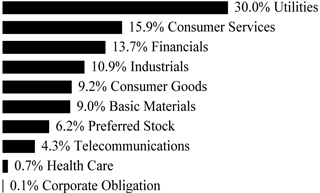

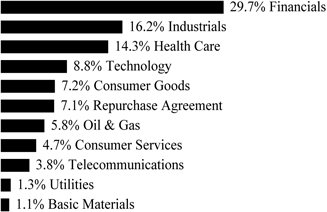

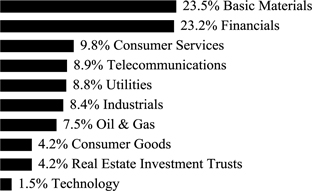

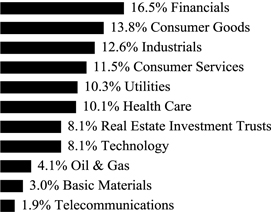

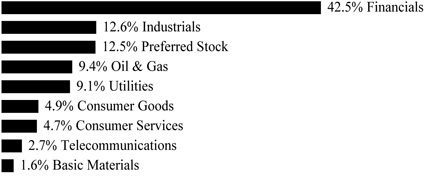

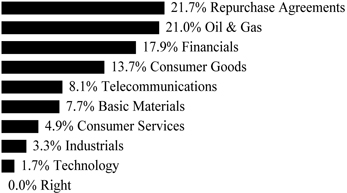

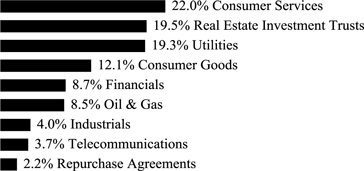

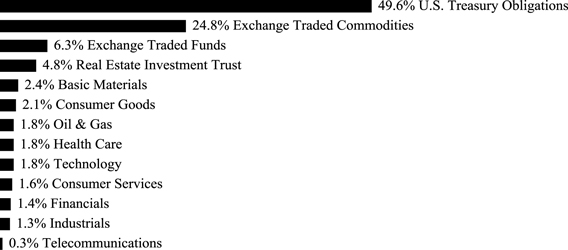

Sector Weightings (unaudited)†:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | Shares/Face

Amount | | | Value | |

| COMMON STOCK — 99.9% |

| AUSTRALIA— 10.3% | | | | | | | | |

| Basic Materials — 10.3% | | | | | | | | |

| Gold Road Resources * | | | 5,542,806 | | | $ | 2,383,050 | |

| Teranga Gold * | | | 6,056,776 | | | | 5,023,693 | |

| TOTAL AUSTRALIA | | | | | | | 7,406,743 | |

| CANADA— 80.5% | | | | | | | | |

| Basic Materials — 80.5% | | | | | | | | |

| Asanko Gold * | | | 979,624 | | | | 3,618,085 | |

| Atac Resources * | | | 5,010,501 | | | | 2,056,165 | |

| Chesapeake Gold * | | | 1,027,032 | | | | 3,448,345 | |

| Continental Gold * | | | 711,209 | | | | 1,958,113 | |

| Exeter Resource * (A) | | | 3,971,463 | | | | 4,592,999 | |

| First Mining Finance * (A) | | | 16,146,208 | | | | 9,878,672 | |

| Guyana Goldfields * | | | 577,532 | | | | 3,399,909 | |

| International Tower Hill Mines * (A) (B) | | | 6,042,874 | | | | 4,553,854 | |

| Lydian International, Cl Common Subscription Receipt * | | | 4,087,460 | | | | 1,219,910 | |

| OceanaGold | | | 1,414,244 | | | | 4,326,357 | |

| Premier Gold Mines * | | | 1,084,033 | | | | 2,280,898 | |

| Pretium Resources * | | | 325,478 | | | | 3,183,747 | |

| Roxgold * | | | 4,563,960 | | | | 5,107,957 | |

| Rubicon Minerals * (A) (C) (D) | | | 1,759,902 | | | | 11,083 | |

| Sabina Gold & Silver * (A) | | | 4,241,595 | | | | 4,367,395 | |

| Torex Gold Resources * | | | 217,745 | | | | 4,053,526 | |

| TOTAL CANADA | | | | | | | 58,057,015 | |

| UNITED STATES— 9.1% | | | | | | | | |

| Basic Materials — 9.1% | | | | | | | | |

| Novagold Resources * (A) | | | 600,852 | | | | 3,004,260 | |

| Seabridge Gold * (A) | | | 322,984 | | | | 3,536,675 | |

| TOTAL UNITED STATES | | | | | | | 6,540,935 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $59,874,635) | | | | | | | 72,004,693 | |

| | | | | | | | | |

| U.S. TREASURY OBLIGATION — 9.7% |

| United States Treasury Bill | | | | | | | | |

| 0.130%, 11/10/16(E) | | | | | | | | |

| (Cost $6,999,773) | | $ | 7,000,000 | | | | 6,999,783 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Gold Explorers ETF |

| | | Face Amount | | | Value | |

| |

| REPURCHASE AGREEMENT — 8.1% |

| Deutsche Bank | | | | | | | | |

| 0.350%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $5,814,568 (collateralized by U.S. Treasury Obligations, par value $5,407,175, 3.000%, 05/15/45 with a total market value of $5,956,489)(F) (Cost $5,814,511) | | $ | 5,814,511 | | | $ | 5,814,511 | |

| TOTAL INVESTMENTS — 117.7% | | | | | | | | |

| (Cost $72,688,919) | | | | | | $ | 84,818,987 | |

Percentages are based on Net Assets of $72,074,094.

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan as of October 31, 2016. The total value of securities on loan as of October 31, 2016 was $5,595,578. |

| (B) | Affiliated investment (See Note 3 in Notes to Financial Statements). |

| (C) | Security considered illiquid. The total value of such securities as of October 31, 2016 was $11,083 and represented 0.0% of Net Assets. |

| (D) | Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such securities as of October 31, 2016, was $11,083 and represents 0.0% of Net Assets. |

| (E) | The rate reported on the Schedule of Investments is the effective yield at time of purchase. |

| (F) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2016 was $5,814,511. |

Cl — Class

The following is a summary of the level of inputs used as of October 31, 2016, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3(1) | | | Total | |

| Common Stock | | $ | 71,993,610 | | | $ | — | | | $ | 11,083 | | | $ | 72,004,693 | |

| U.S. Treasury Obligation | | | — | | | | 6,999,783 | | | | — | | | | 6,999,783 | |

| Repurchase Agreement | | | — | | | | 5,814,511 | | | | — | | | | 5,814,511 | |

| Total Investments in Securities | | $ | 71,993,610 | | | $ | 12,814,294 | | | $ | 11,083 | | | $ | 84,818,987 | |

(1) A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the period in relation to Net Assets. Management has concluded that Level 3 investments are not material in relation to Net Assets.

For the year ended October 31, 2016, the transfers into Level 3 were due to changes in the availability of observable inputs to determine fair value. Transfers between levels are recognized at period end.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Copper Miners ETF |

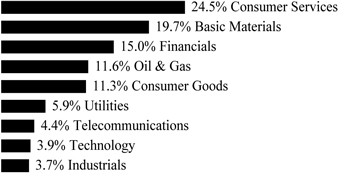

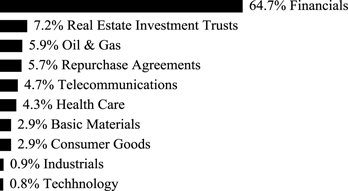

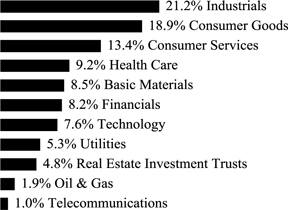

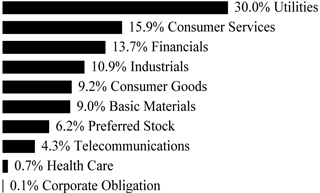

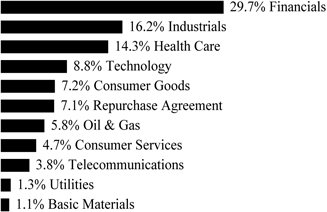

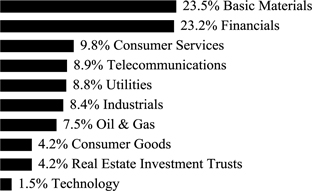

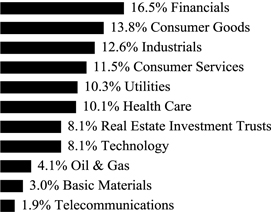

Sector Weightings (unaudited)†:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | Shares | | | Value | |

| COMMON STOCK — 99.9% |

| AUSTRALIA— 10.5% | | | | | | | | |

| Basic Materials — 10.5% | | | | | | | | |

| Cudeco * (A) (B) (C) | | | 670,647 | | | $ | 199,385 | |

| OZ Minerals | | | 254,449 | | | | 1,297,271 | |

| Sandfire Resources | | | 296,786 | | | | 1,174,361 | |

| TOTAL AUSTRALIA | | | | | | | 2,671,017 | |

| CANADA— 37.9% | | | | | | | | |

| Basic Materials — 37.9% | | | | | | | | |

| Altius Minerals | | | 125,845 | | | | 1,044,131 | |

| Capstone Mining * | | | 1,702,252 | | | | 1,028,781 | |

| First Quantum Minerals | | | 159,233 | | | | 1,513,620 | |

| HudBay Minerals, Cl B | | | 301,156 | | | | 1,269,563 | |

| Imperial Metals * (C) | | | 169,600 | | | | 651,699 | |

| Lundin Mining, Cl Common Subscription Receipt * | | | 297,315 | | | | 1,164,636 | |

| Nevsun Resources | | | 386,592 | | | | 1,122,062 | |

| Teck Resources, Cl B | | | 86,002 | | | | 1,858,323 | |

| TOTAL CANADA | | | | | | | 9,652,815 | |

| HONG KONG— 6.1% | | | | | | | | |

| Basic Materials — 6.1% | | | | | | | | |

| Jiangxi Copper, Cl H | | | 991,829 | | | | 1,171,545 | |

| NetMind Financial Holdings * | | | 42,368,000 | | | | 382,439 | |

| TOTAL HONG KONG | | | | | | | 1,553,984 | |

| JAPAN— 1.2% | | | | | | | | |

| Basic Materials — 1.2% | | | | | | | | |

| Nittetsu Mining | | | 7,500 | | | | 313,318 | |

| MEXICO— 4.3% | | | | | | | | |

| Basic Materials — 4.3% | | | | | | | | |

| Grupo Mexico, Cl B | | | 447,114 | | | | 1,103,075 | |

| PERU— 4.7% | | | | | | | | |

| Basic Materials — 4.7% | | | | | | | | |

| Southern Copper (C) | | | 42,609 | | | | 1,209,669 | |

| POLAND— 4.6% | | | | | | | | |

| Basic Materials — 4.6% | | | | | | | | |

| KGHM Polska Miedz | | | 65,219 | | | | 1,177,831 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Copper Miners ETF |

| | | Shares/Face

Amount | | | Value | |

| COMMON STOCK — continued |

| UNITED KINGDOM— 19.3% | | | | | | | | |

| Basic Materials — 19.3% | | | | | | | | |

| Antofagasta (C) | | | 179,243 | | | $ | 1,188,286 | |

| Glencore | | | 403,070 | | | | 1,230,267 | |

| KAZ Minerals * | | | 353,687 | | | | 1,234,992 | |

| Vedanta Resources (C) | | | 145,477 | | | | 1,267,265 | |

| TOTAL UNITED KINGDOM | | | | | | | 4,920,810 | |

| UNITED STATES— 11.3% | | | | | | | | |

| Basic Materials — 11.3% | | | | | | | | |

| Freeport-McMoRan Copper & Gold | | | 118,313 | | | | 1,322,739 | |

| Turquoise Hill Resources * | | | 379,176 | | | | 1,175,446 | |

| Vedanta ADR | | | 32,064 | | | | 386,692 | |

| TOTAL UNITED STATES | | | | | | | 2,884,877 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $30,139,432) | | | | | | | 25,487,396 | |

| | | | | | | | | |

| REPURCHASE AGREEMENT — 8.7% |

| Deutsche Bank | | | | | | | | |

| 0.350%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $2,210,717 (collateralized by U.S. Treasury Obligations, par value $2,055,826, 3.000%, 05/15/45 with a total market value of $2,264,676)(D) (Cost $2,210,696) | | $ | 2,210,696 | | | | 2,210,696 | |

| TOTAL INVESTMENTS — 108.6% | | | | | | | | |

| (Cost $32,350,128) | | | | | | $ | 27,698,092 | |

Percentages are based on Net Assets of $25,503,853.

| * | Non-income producing security. |

| (A) | Security considered illiquid. The total value of such securities as of October 31, 2016 was $199,385 and represented 0.8% of Net Assets. |

| (B) | Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such securities as of October 31, 2016, was $199,385 and represents 0.8% of Net Assets. |

| (C) | This security or a partial position of this security is on loan as of October 31, 2016. The total value of securities on loan as of October 31, 2016 was $2,130,405. |

| (D) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2016 was $2,210,696. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of October 31, 2016, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 25,288,011 | | | $ | — | | | $ | 199,385 | | | $ | 25,487,396 | |

| Repurchase Agreement | | | — | | | | 2,210,696 | | | | — | | | | 2,210,696 | |

| Total Investments in Securities | | $ | 25,288,011 | | | $ | 2,210,696 | | | $ | 199,385 | | | $ | 27,698,092 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Copper Miners ETF |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | Common Stock | |

| | | | |

| Beginning Balance as of October 31, 2015 | | $ | 377,503 | |

| Realized gain/(loss) | | | (30,277 | ) |

| Net purchases | | | 67,216 | |

| Net sales | | | (72,311 | ) |

| Change in unrealized appreciation/(depreciation) | | | (142,746 | ) |

| Ending Balance as of October 31, 2016 | | $ | 199,385 | |

For the year ended October 31, 2016, there have been no transfers between Level 1, Level 2 and Level 3 investments.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

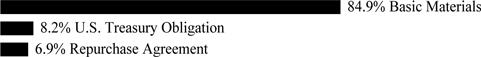

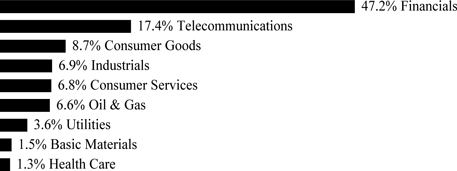

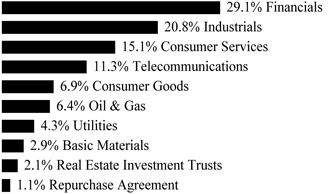

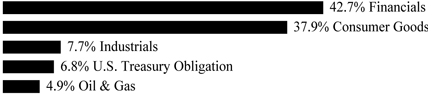

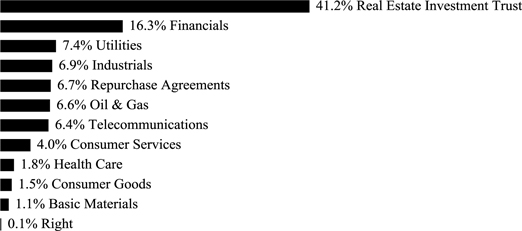

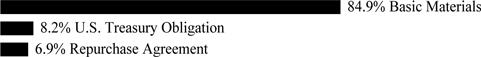

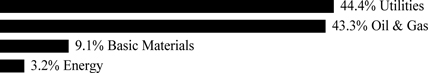

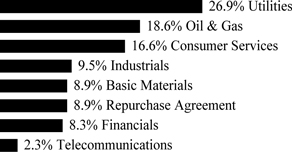

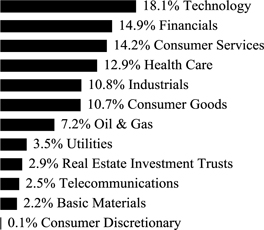

Sector Weightings (unaudited)†:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | Shares | | | Value | |

| COMMON STOCK — 100.0% |

| AUSTRALIA— 18.1% | | | | | | | | |

| Basic Materials — 16.6% | | | | | | | | |

| Berkeley Energia * | | | 7,477,441 | | | $ | 4,210,559 | |

| Energy Resources of Australia * (A) | | | 8,851,984 | | | | 2,290,206 | |

| Greenland Minerals & Energy * | | | 42,900,270 | | | | 2,742,170 | |

| Paladin Energy * (A) | | | 36,853,017 | | | | 3,926,053 | |

| Peninsula Energy * | | | 8,371,868 | | | | 3,758,629 | |

| | | | | | | | 16,927,617 | |

| Industrials — 1.5% | | | | | | | | |

| Silex Systems * | | | 6,054,724 | | | | 1,566,493 | |

| TOTAL AUSTRALIA | | | | | | | 18,494,110 | |

| CANADA— 52.0% | | | | | | | | |

| Basic Materials — 52.0% | | | | | | | | |

| Cameco | | | 2,590,107 | | | | 19,963,295 | |

| Denison Mines * (A) | | | 11,937,419 | | | | 4,809,704 | |

| Energy Fuels * (A) | | | 2,369,019 | | | | 3,429,134 | |

| Fission 3.0 * | | | 7,037,000 | | | | 367,536 | |

| Fission Uranium * | | | 9,498,795 | | | | 3,898,032 | |

| Laramide Resources * | | | 4,397,821 | | | | 754,709 | |

| Mega Uranium * (A) (B) | | | 14,714,670 | | | | 1,427,276 | |

| NexGen Energy * (A) | | | 7,175,401 | | | | 8,619,583 | |

| Uex * (A) | | | 11,899,156 | | | | 1,775,662 | |

| Uranium Participation * | | | 2,960,444 | | | | 8,217,013 | |

| TOTAL CANADA | | | | | | | 53,261,944 | |

| CHINA— 5.3% | | | | | | | | |

| Utilities — 5.3% | | | | | | | | |

| CGN Power, Cl H (C) | | | 18,630,600 | | | | 5,453,550 | |

| FRANCE— 5.5% | | | | | | | | |

| Utilities — 5.5% | | | | | | | | |

| Areva * | | | 1,066,072 | | | | 5,589,562 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| | | Shares/Face

Amount | | | Value | |

| COMMON STOCK — continued |

| HONG KONG— 9.2% | | | | | | | | |

| Industrials — 9.2% | | | | | | | | |

| CGN Mining * | | | 76,124,300 | | | $ | 6,576,953 | |

| CNNC International * | | | 8,994,600 | | | | 2,864,873 | |

| TOTAL HONG KONG | | | | | | | 9,441,826 | |

| UNITED STATES— 9.9% | | | | | | | | |

| Basic Materials — 9.9% | | | | | | | | |

| Centrus Energy, Cl A * (A) | | | 305,590 | | | | 1,194,857 | |

| Uranium Energy * (A) | | | 5,716,947 | | | | 5,133,246 | |

| Ur-Energy * (A) (B) | | | 7,603,407 | | | | 3,809,307 | |

| TOTAL UNITED STATES | | | | | | | 10,137,410 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $215,988,904) | | | | | | | 102,378,402 | |

| | | | | | | | | |

| REPURCHASE AGREEMENTS — 7.5% |

| Barclays Bank | | | | | | | | |

| 0.320%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $5,000,044 (collateralized by U.S Treasury Obligations, ranging in par value $1-$1,456,630, 0.000%-4.750%, 11/15/16-05/15/46, with a total market value of $5,100,000)(D) | | $ | 5,000,000 | | | | 5,000,000 | |

| Deutsche Bank | | | | | | | | |

| 0.350%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $2,694,229 (collateralized by U.S. Treasury Obligations, par value $2,505,461, 3.000%, 05/15/45 with a total market value of $2,759,990)(D) | | | 2,694,203 | | | | 2,694,203 | |

| TOTAL REPURCHASE AGREEMENT | | | | | | | | |

| (Cost $7,694,203) | | | | | | | 7,694,203 | |

| TOTAL INVESTMENTS — 107.5% | | | | | | | | |

| (Cost $223,683,107) | | | | | | $ | 110,072,605 | |

Percentages are based on Net Assets of $102,436,689.

| * | Non-income producing security. |

| (A) | This security or a partial position of this security is on loan at October 31, 2016. The total value of securities on loan as of October 31, 2016 was $6,448,642. |

| (B) | Affiliated investment (See Note 3 in Notes to Financial Statements). |

| (C) | Security sold within terms of a private placement memorandum, exempt from registration under Section 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other "accredited investors." The total value of such securities as of October 31, 2016 was $5,453,550 and represents 5.3% of Net Assets. |

| (D) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2016 was $7,694,203. |

Cl — Class

The following is a summary of the level of inputs used as of October 31, 2016, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 102,378,402 | | | $ | — | | | $ | — | | | $ | 102,378,402 | |

| Repurchase Agreements | | | — | | | | 7,694,203 | | | | — | | | | 7,694,203 | |

| Total Investments in Securities | | $ | 102,378,402 | | | $ | 7,694,203 | | | $ | — | | | $ | 110,072,605 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

For the year ended October 31, 2016, there have been no transfers between Level 1, Level 2 or Level 3 investments.

As of October 31, 2016, there were no Level 3 investments.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

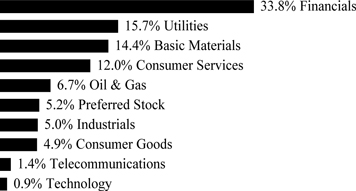

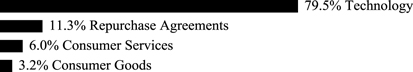

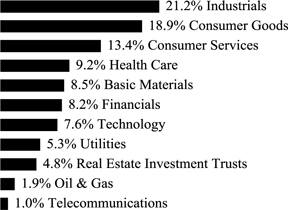

Sector Weightings (unaudited)†:

† Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information.

| | | Shares | | | Value | |

| COMMON STOCK — 99.8% |

| AUSTRALIA— 8.4% | | | | | | | | |

| Basic Materials — 8.4% | | | | | | | | |

| Galaxy Resources * (A) | | | 12,225,589 | | | $ | 3,256,064 | |

| Orocobre * | | | 1,418,299 | | | | 4,133,535 | |

| Pilbara Minerals * | | | 5,162,072 | | | | 2,042,596 | |

| TOTAL AUSTRALIA | | | | | | | 9,432,195 | |

| CANADA— 2.3% | | | | | | | | |

| Basic Materials — 2.3% | | | | | | | | |

| Lithium Americas * | | | 3,563,296 | | | | 2,020,597 | |

| Nemaska Lithium * | | | 591,677 | | | | 618,054 | |

| TOTAL CANADA | | | | | | | 2,638,651 | |

| CHINA— 4.7% | | | | | | | | |

| Consumer Goods — 4.7% | | | | | | | | |

| BYD, Cl H * | | | 802,638 | | | | 5,278,572 | |

| FRANCE— 0.6% | | | | | | | | |

| Industrials — 0.6% | | | | | | | | |

| Blue Solutions * | | | 56,255 | | | | 728,903 | |

| HONG KONG— 5.5% | | | | | | | | |

| Consumer Goods — 4.3% | | | | | | | | |

| FDG Electric Vehicles * | | | 93,020,900 | | | | 4,858,052 | |

| Industrials — 1.2% | | | | | | | | |

| Coslight Technology International Group * | | | 1,773,373 | | | | 1,310,332 | |

| TOTAL HONG KONG | | | | | | | 6,168,384 | |

| JAPAN— 9.4% | | | | | | | | |

| Consumer Goods — 4.6% | | | | | | | | |

| Panasonic | | | 500,920 | | | | 5,229,188 | |

| Industrials — 4.8% | | | | | | | | |

| GS Yuasa | | | 1,243,094 | | | | 5,370,554 | |

| TOTAL JAPAN | | | | | | | 10,599,742 | |

| SOUTH KOREA— 11.7% | | | | | | | | |

| Basic Materials — 4.7% | | | | | | | | |

| LG Chemical | | | 24,444 | | | | 5,265,847 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| | | Shares/Face

Amount | | | Value | |

| COMMON STOCK — continued |

| Industrials — 7.0% | | | | | | | | |

| L&F | | | 65,405 | | | $ | 940,277 | |

| Samsung SDI | | | 63,603 | | | | 5,241,655 | |

| Vitzrocell | | | 176,616 | | | | 1,674,707 | |

| | | | | | | | 7,856,639 | |

| TOTAL SOUTH KOREA | | | | | | | 13,122,486 | |

| TAIWAN— 9.1% | | | | | | | | |

| Industrials — 9.1% | | | | | | | | |

| Advanced Lithium Electrochemistry Cayman * | | | 1,286,229 | | | | 1,294,075 | |

| Changs Ascending Enterprise * | | | 423,551 | | | | 574,443 | |

| Dynapack International Technology | | | 2,631,300 | | | | 3,443,641 | |

| Simplo Technology | | | 1,572,200 | | | | 4,857,466 | |

| TOTAL TAIWAN | | | | | | | 10,169,625 | |

| UNITED KINGDOM— 0.7% | | | | | | | | |

| Basic Materials — 0.7% | | | | | | | | |

| Bacanora Minerals * | | | 788,557 | | | | 765,384 | |

| UNITED STATES— 47.4% | | | | | | | | |

| Basic Materials — 38.8% | | | | | | | | |

| Albemarle | | | 63,526 | | | | 5,307,597 | |

| FMC | | | 468,748 | | | | 21,979,594 | |

| Sociedad Quimica y Minera de Chile ADR | | | 556,731 | | | | 16,289,949 | |

| | | | | | | | 43,577,140 | |

| Consumer Goods — 4.5% | | | | | | | | |

| Tesla Motors * | | | 25,806 | | | | 5,102,621 | |

| Industrials — 4.1% | | | | | | | | |

| China BAK Battery * (A) | | | 148,887 | | | | 260,552 | |

| EnerSys | | | 54,669 | | | | 3,560,592 | |

| Ultralife * | | | 183,190 | | | | 751,079 | |

| | | | | | | | 4,572,223 | |

| TOTAL UNITED STATES | | | | | | | 53,251,984 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $112,826,196) | | | | | | | 112,155,926 | |

| | | | | | | | | |

| REPURCHASE AGREEMENT — 1.6% |

| Deutsche Bank | | | | | | | | |

| 0.350%, dated 10/31/16, to be repurchased on 11/01/16 repurchase price $1,768,469 (collateralized by U.S. Treasury Obligations, par value $1,644,563, 3.000%, 05/15/45 with a total market value of $1,811,634)(B) (Cost $1,768,452) | | $ | 1,768,452 | | | | 1,768,452 | |

| TOTAL INVESTMENTS — 101.4% | | | | | | | | |

| (Cost $114,594,648) | | | | | | $ | 113,924,378 | |

Percentages are based on Net Assets of $112,304,244.

| * | Non-income producing security. |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| (A) | This security or a partial position of this security is on loan as of October 31, 2016. The total value of securities on loan as of October 31, 2016 was $1,707,966. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of October 31, 2016 was $1,768,452. |

ADR — American Depositary Receipt

Cl — Class

The following is a summary of the level of inputs used as of October 31, 2016, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 112,155,926 | | | $ | — | | | $ | — | | | $ | 112,155,926 | |

| Repurchase Agreement | | | — | | | | 1,768,452 | | | | — | | | | 1,768,452 | |

| Total Investments in Securities | | $ | 112,155,926 | | | $ | 1,768,452 | | | $ | — | | | $ | 113,924,378 | |

For the year ended October 31, 2016, there have been no transfers between Level 1, Level 2 or Level 3 investments.

As of October 31, 2016, there were no Level 3 investments

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Fertilizers/Potash ETF |

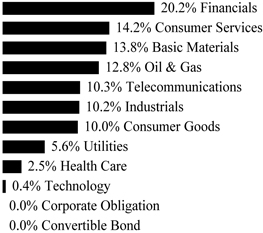

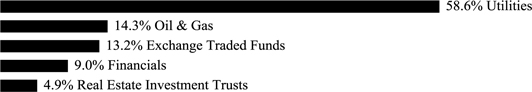

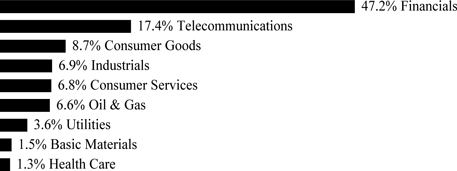

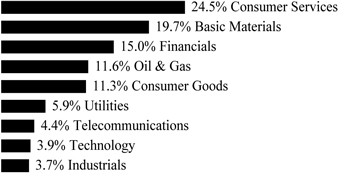

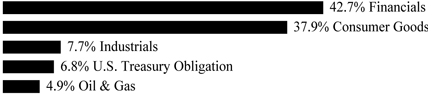

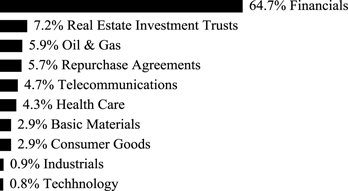

Sector Weightings (unaudited)†:

† Sector weightings percentages are based on the total market value of investments.

| | | Shares | | | Value | |

| COMMON STOCK — 99.8% |

| AUSTRALIA— 10.3% | | | | | | | | |

| Basic Materials — 10.3% | | | | | | | | |

| Incitec Pivot | | | 213,391 | | | $ | 479,019 | |

| Nufarm | | | 99,473 | | | | 670,647 | |

| TOTAL AUSTRALIA | | | | | | | 1,149,666 | |

| BELGIUM— 4.6% | | | | | | | | |

| Basic Materials — 4.6% | | | | | | | | |

| Tessenderlo Chemie | | | 15,293 | | | | 509,297 | |

| CANADA— 9.8% | | | | | | | | |

| Basic Materials — 9.8% | | | | | | | | |

| Agrium | | | 6,018 | | | | 552,879 | |

| Potash Corp of Saskatchewan | | | 32,793 | | | | 533,643 | |

| TOTAL CANADA | | | | | | | 1,086,522 | |

| GERMANY— 4.0% | | | | | | | | |

| Basic Materials — 4.0% | | | | | | | | |

| K+S | | | 22,082 | | | | 446,123 | |

| HONG KONG— 2.8% | | | | | | | | |

| Basic Materials — 2.8% | | | | | | | | |

| China BlueChemical | | | 983,501 | | | | 190,236 | |

| Sinofert Holdings | | | 937,865 | | | | 123,358 | |

| TOTAL HONG KONG | | | | | | | 313,594 | |

| ISRAEL—6.6% | | | | | | | | |

| Basic Materials — 6.6% | | | | | | | | |

| Israel Chemicals | | | 127,309 | | | | 452,793 | |

| The Israel Corp * | | | 1,916 | | | | 285,352 | |

| TOTAL ISRAEL | | | | | | | 738,145 | |

| NETHERLANDS— 4.2% | | | | | | | | |

| Basic Materials — 4.2% | | | | | | | | |

| OCI * | | | 33,789 | | | | 468,551 | |

| NORWAY— 4.8% | | | | | | | | |

| Basic Materials — 4.8% | | | | | | | | |

| Yara International | | | 14,902 | | | | 527,348 | |

| POLAND— 3.5% | | | | | | | | |

| Basic Materials — 3.5% | | | | | | | | |

| Grupa Azoty | | | 24,748 | | | | 392,990 | |

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Fertilizers/Potash ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued |

| SOUTH KOREA— 0.6% | | | | | | | | |

| Basic Materials — 0.6% | | | | | | | | |

| Namhae Chemical | | | 8,649 | | | $ | 61,603 | |

| SWITZERLAND— 4.8% | | | | | | | | |

| Basic Materials — 4.8% | | | | | | | | |

| Syngenta * | | | 1,328 | | | | 531,254 | |

| TAIWAN— 4.7% | | | | | | | | |

| Basic Materials — 4.7% | | | | | | | | |

| Taiwan Fertilizer | | | 389,697 | | | | 522,354 | |

| TURKEY— 1.1% | | | | | | | | |

| Basic Materials — 1.1% | | | | | | | | |

| Bagfas Bandirma Gubre Fabrik | | | 13,565 | | | | 47,311 | |

| Gubre Fabrikalari | | | 43,188 | | | | 71,131 | |

| TOTAL TURKEY | | | | | | | 118,442 | |

| UNITED KINGDOM— 8.5% | | | | | | | | |

| Basic Materials — 8.5% | | | | | | | | |

| PhosAgro PJSC GDR | | | 36,463 | | | | 452,141 | |

| Sirius Minerals * | | | 1,055,900 | | | | 496,321 | |

| TOTAL UNITED KINGDOM | | | | | | | 948,462 | |

| UNITED STATES— 29.5% | | | | | | | | |

| Basic Materials — 29.5% | | | | | | | | |

| CF Industries Holdings | | | 18,510 | | | | 444,425 | |

| Compass Minerals International | | | 6,896 | | | | 495,478 | |

| CVR Partners (A) | | | 35,876 | | | | 163,594 | |

| Mosaic | | | 20,513 | | | | 482,671 | |

| Rentech Escrow Shares * (B) (C) | | | 7,168 | | | | — | |

| Scotts Miracle-Gro, Cl A | | | 7,966 | | | | 701,725 | |

| Sociedad Quimica y Minera de Chile ADR | | | 25,280 | | | | 739,693 | |

| Terra Nitrogen (A) | | | 2,469 | | | | 256,134 | |

| TOTAL UNITED STATES | | | | | | | 3,283,720 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $15,675,144) | | | | | | | 11,098,071 | |

| TOTAL INVESTMENTS — 99.8% | | | | | | | | |

| (Cost $15,675,144) | | | | | | $ | 11,098,071 | |

Percentages are based on Net Assets of $11,124,672.

| * | Non-income producing security. |

| (A) | Security considered Master Limited Partnership. As of October 31, 2016, these securities amounted to $419,728 or 3.8% of net assets. |

| (B) | Security considered illiquid. The total value of such securities as of October 31, 2016 was $– and represented 0.0% of Net Assets. |

| (C) | Security is fair valued using methods determined in good faith by the Fair Value Committee of the Fund. The total value of such securities as of October 31, 2016, was $– and represents 0.0% of Net Assets. |

Amounts designated as “—“ are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

| Schedule of Investments | October 31, 2016 |

| Global X Fertilizers/Potash ETF |

ADR — American Depositary Receipt

Cl — Class

GDR — Global Depositary Receipt

The following is a summary of the level of inputs used as of October 31, 2016, in valuing the Fund's investments carried at value:

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3(1) | | | Total | |

| Common Stock | | $ | 11,098,071 | | | $ | — | | | $ | — | (2) | | $ | 11,098,071 | |

| Total Investments in Securities | | $ | 11,098,071 | | | $ | — | | | $ | — | | | $ | 11,098,071 | |

(1) A reconciliation of Level 3 investments and disclosures of significant unobservable inputs are presented when the Fund has a significant amount of Level 3 investments at the beginning and/or end of the period in relation to Net Assets. Management has concluded that Level 3 investments are not material in relation to Net Assets.

(2) Amounts designated as “—“ are $0 or have been rounded to $0.

For the year ended October 31, 2016, there have been no transfers between Level 1, Level 2 and Level 3 investments.

The accompanying notes are an integral part of the financial statements.

| Statements of Assets and Liabilities |

| October 31, 2016 |

| | | Global X Silver

Miners ETF | | | Global X Gold

Explorers ETF | | | Global X Copper

Miners ETF | |

| Assets: | | | | | | | | | | | | |

| Cost of Investments | | $ | 334,080,408 | | | $ | 63,283,695 | | | $ | 30,139,432 | |

| Cost of Repurchase Agreement | | | 11,205,555 | | | | 5,814,511 | | | | 2,210,696 | |

| Cost of Affiliated Investments | | | — | | | | 3,590,713 | | | | — | |

| Cost of Foreign Currency | | | 122,303 | | | | — | | | | 24 | |

| Investments, at Value | | $ | 378,563,021 | * | | $ | 74,450,622 | * | | $ | 25,487,396 | * |

| Repurchase Agreement, at Value | | | 11,205,555 | | | | 5,814,511 | | | | 2,210,696 | |

| Foreign Currency, at Value | | | 122,303 | | | | — | | | | 23 | |

| Affiliated Investments, at Value | | | — | | | | 4,553,854 | | | | — | |

| Cash | | | — | | | | — | | | | 98,009 | |

| Receivable for Investment Securities Sold | | | 32,526,037 | | | | — | | | | 2,598,677 | |

| Reclaim Receivable | | | 22,735 | | | | — | | | | 9,438 | |

| Dividend and Interest Receivable | | | 16,768 | | | | 19,865 | | | | 13,671 | |

| Unrealized Appreciation on Spot Contracts | | | 10,253 | | | | — | | | | 69 | |

| Total Assets | | | 422,466,672 | | | | 84,838,852 | | | | 30,417,979 | |

| Liabilities: | | | | | | | | | | | | |

| Payable for Investment Securities Purchased | | | 28,416,320 | | | | — | | | | 2,689,959 | |

| Obligation to Return Securities Lending Collateral | | | 11,205,555 | | | | 5,814,511 | | | | 2,210,696 | |

| Cash Overdraft | | | 3,001,632 | | | | 6,910,306 | | | | — | |

| Payable due to Investment Adviser | | | 213,934 | | | | 39,941 | | | | 13,416 | |

| Unrealized Depreciation on Spot Contracts | | | 11,939 | | | | — | | | | 55 | |

| Total Liabilities | | | 42,849,380 | | | | 12,764,758 | | | | 4,914,126 | |

| Net Assets | | $ | 379,617,292 | | | $ | 72,074,094 | | | $ | 25,503,853 | |

| Net Assets Consist of: | | | | | | | | | | | | |

| Paid-in Capital | | $ | 592,164,043 | | | $ | 111,755,578 | | | $ | 53,160,865 | |

| Undistributed (Distributions in Excess of) Net Investment Income | | | 269,857 | | | | (938,905 | ) | | | 76,960 | |

| Accumulated Net Realized Loss on Investments and Foreign Currency Transactions | | | (257,310,689 | ) | | | (50,872,651 | ) | | | (23,081,142 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments | | | 44,482,613 | | | | 12,130,068 | | | | (4,652,036 | ) |

| Net Unrealized Appreciation (Depreciation) on Foreign Currency Translations | | | 11,468 | | | | 4 | | | | (794 | ) |

| Net Assets | | $ | 379,617,292 | | | $ | 72,074,094 | | | $ | 25,503,853 | |

| Outstanding Shares of Beneficial Interest | | | | | | | | | | | | |

| (unlimited authorization — no par value) | | | 9,347,318 | | | | 2,062,054 | | | | 1,449,374 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 40.61 | | | $ | 34.95 | | | $ | 17.60 | |

| *Includes Market Value of Securities on Loan | | $ | 10,710,032 | | | $ | 5,595,578 | | | $ | 2,130,405 | |

The accompanying notes are an integral part of the financial statements.

| Statements of Assets and Liabilities |

| October 31, 2016 |

| | | Global X Uranium

ETF | | | Global X Lithium

ETF | | | Global X

Fertilizers/Potash

ETF | |

| Assets: | | | | | | | | | | | | |

| Cost of Investments | | $ | 205,411,773 | | | $ | 112,826,196 | | | $ | 15,675,144 | |

| Cost of Repurchase Agreement | | | 7,694,203 | | | | 1,768,452 | | | | — | |

| Cost of Affiliated Investments | | | 10,577,131 | | | | — | | | | — | |

| Cost of Foreign Currency | | | 2,389 | | | | 894,823 | | | | 22,028 | |

| Investments, at Value | | $ | 97,141,819 | * | | $ | 112,155,926 | * | | $ | 11,098,071 | |

| Repurchase Agreement, at Value | | | 7,694,203 | | | | 1,768,452 | | | | — | |

| Affiliated Investments, at Value | | | 5,236,583 | | | | — | | | | — | |

| Cash | | | 62,491 | | | | — | | | | — | |

| Foreign Currency, at Value | | | 2,388 | | | | 894,805 | | | | 22,028 | |

| Dividend and Interest Receivable | | | 62,198 | | | | 82,267 | | | | 10,941 | |

| Receivable for Investment Securities Sold | | | 1,360 | | | | 11,378,586 | | | | — | |

| Unrealized Appreciation on Spot Contracts | | | — | | | | 28 | | | | — | |

| Reclaim Receivable | | | — | | | | — | | | | 22,544 | |

| Due from Broker | | | — | | | | — | | | | 44,266 | |

| Total Assets | | | 110,201,042 | | | | 126,280,064 | | | | 11,197,850 | |

| Liabilities: | | | | | | | | | | | | |

| Obligation to Return Securities Lending Collateral | | | 7,694,203 | | | | 1,768,452 | | | | — | |

| Payable due to Investment Adviser | | | 62,260 | | | | 68,933 | | | | 5,841 | |

| Payable for Investment Securities Purchased | | | 7,886 | | | | 12,062,214 | | | | 44,319 | |

| Unrealized Depreciation on Spot Contracts | | | 4 | | | | — | | | | — | |

| Cash Overdraft | | | — | | | | 73,629 | | | | 23,018 | |

| Due to Broker | | | — | | | | 2,592 | | | | — | |

| Total Liabilities | | | 7,764,353 | | | | 13,975,820 | | | | 73,178 | |

| Net Assets | | $ | 102,436,689 | | | $ | 112,304,244 | | | $ | 11,124,672 | |

| Net Assets Consist of: | | | | | | | | | | | | |

| Paid-in Capital | | $ | 512,931,803 | | | $ | 168,653,266 | | | $ | 21,804,205 | |

| Undistributed Net Investment Income | | | 2,129,397 | | | | 710,566 | | | | 195,160 | |

| Accumulated Net Realized Loss on Investments and Foreign Currency Transactions | | | (299,014,008 | ) | | | (56,389,305 | ) | | | (6,296,154 | ) |

| Net Unrealized Appreciation (Depreciation) on Investments | | | (113,610,502 | ) | | | (670,270 | ) | | | (4,577,073 | ) |

| Net Unrealized Appreciation (Depreciation) on Foreign Currency Translations | | | (1 | ) | | | (13 | ) | | | (1,466 | ) |

| Net Assets | | $ | 102,436,689 | | | $ | 112,304,244 | | | $ | 11,124,672 | |

| Outstanding Shares of Beneficial Interest | | | | | | | | | | | | |

| (unlimited authorization — no par value) | | | 8,481,666 | | | | 4,674,628 | | | | 1,300,000 | |

| Net Asset Value, Offering and Redemption Price Per Share | | $ | 12.08 | | | $ | 24.02 | | | $ | 8.56 | |

| *Includes Market Value of Securities on Loan | | $ | 6,448,642 | | | $ | 1,707,966 | | | $ | — | |

The accompanying notes are an integral part of the financial statements.

| Statements of Operations |

| For the year ended October 31, 2016 |

| | | Global X Silver

Miners ETF | | | Global X Gold

Explorers ETF | | | Global X Copper

Miners ETF | |

| Investment Income: | | | | | | | | | | | | |

| Dividend Income | | $ | 2,151,656 | | | $ | 44,469 | | | $ | 232,202 | |

| Interest Income | | | 1,604 | | | | 210 | | | | 25 | |

| Security Lending Income | | | 291,173 | | | | 195,584 | | | | 31,582 | |

| Less: Foreign Taxes Withheld | | | (153,700 | ) | | | (6,670 | ) | | | (10,817 | ) |

| Total Investment Income | | | 2,290,733 | | | | 233,593 | | | | 252,992 | |

| Supervision and Administration Fees(1) | | | 1,809,280 | | | | 349,438 | | | | 135,171 | |

| Custodian Fees | | | 10,354 | | | | 3,119 | | | | 261 | |

| Total Expenses | | | 1,819,634 | | | | 352,557 | | | | 135,432 | |

| Net Investment Income(Loss) | | | 471,099 | | | | (118,964 | ) | | | 117,560 | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Investments (2) | | | (32,546,896 | ) | | | 1,650,072 | | | | (5,345,402 | ) |

| Affiliated Investments | | | — | | | | (442,176 | ) | | | — | |

| Foreign Currency Transactions | | | (64,340 | ) | | | (3,554 | ) | | | 13,266 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (32,611,236 | ) | | | 1,204,342 | | | | (5,332,136 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | 168,050,967 | | | | 22,006,653 | | | | 10,571,708 | |

| Affiliated Investments | | | — | | | | 2,555,281 | | | | — | |

| Foreign Currency Translations | | | 14,459 | | | | 4 | | | | (11,451 | ) |

| Net Change in Unrealized Appreciation on Investments, Affiliated Investments and Foreign Currency Translations | | | 168,065,426 | | | | 24,561,938 | | | | 10,560,257 | |

| Net Realized and Unrealized Gain on Investments, Affiliated Investments and Foreign Currency Transactions and Translations | | | 135,454,190 | | | | 25,766,280 | | | | 5,228,121 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 135,925,289 | | | $ | 25,647,316 | | | $ | 5,345,681 | |

| (1) | The Supervision and Administration fees includes fees paid by the Funds for the investment advisory services provided by the Adviser. (See Note 3 in Notes to Financial Statements.) |

| (2) | Includes realized gains (losses) as a result of in-kind transactions. (See Note 4 in Notes to Financial Statements.) |

The accompanying notes are an integral part of the financial statements.

| Statements of Operations |

| For the year ended October 31, 2016 |

| | | Global X Uranium

ETF | | | Global X Lithium

ETF | | | Global X

Fertilizers/Potash

ETF | |

| Investment Income: | | | | | | | | | | | | |

| Dividend Income | | $ | 823,303 | | | $ | 1,352,434 | | | $ | 293,736 | |

| Interest Income | | | 779 | | | | 146 | | | | 35 | |

| Security Lending Income | | | 960,622 | | | | 205,451 | | | | — | |

| Less: Foreign Taxes Withheld | | | (119,542 | ) | | | (180,136 | ) | | | (38,506 | ) |

| Total Investment Income | | | 1,665,162 | | | | 1,377,895 | | | | 255,265 | |

| Supervision and Administration Fees(1) | | | 818,754 | | | | 524,846 | | | | 65,512 | |

| Custodian Fees | | | 5,635 | | | | 7,653 | | | | 31 | |

| Total Expenses | | | 824,389 | | | | 532,499 | | | | 65,543 | |

| Net Investment Income | | | 840,773 | | | | 845,396 | | | | 189,722 | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Investments (2) | | | (36,121,419 | ) | | | (2,487,651 | ) | | | (2,763,715 | ) |

| Affiliated Investments | | | (2,975,892 | ) | | | — | | | | — | |

| Foreign Currency Transactions | | | (1,934 | ) | | | (23,305 | ) | | | (1,608 | ) |

| Net Realized Loss on Investments and Foreign Currency Transactions | | | (39,099,245 | ) | | | (2,510,956 | ) | | | (2,765,323 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | 11,667,862 | | | | 8,278,991 | | | | 1,327,167 | |

| Affiliated Investments | | | 3,175,874 | | | | — | | | | — | |

| Foreign Currency Translations | | | (272 | ) | | | 1,386 | | | | 1,701 | |

| Net Change in Unrealized Appreciation on Investments, Affiliated Investments and Foreign Currency Translations | | | 14,843,464 | | | | 8,280,377 | | | | 1,328,868 | |

| Net Realized and Unrealized Gain (Loss) on Investments, Affiliated Investments and Foreign Currency Transactions and Translations | | | (24,255,781 | ) | | | 5,769,421 | | | | (1,436,455 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | (23,415,008 | ) | | $ | 6,614,817 | | | $ | (1,246,733 | ) |

| (1) | The Supervision and Administration fees includes fees paid by the Funds for the investment advisory services provided by the Adviser. (See Note 3 in Notes to Financial Statements.) |

| (2) | Includes realized gains (losses) as a result of in-kind transactions. (See Note 4 in Notes to Financial Statements.) |

The accompanying notes are an integral part of the financial statements.

| Statements of Changes in Net Assets |

| | | Global X Silver Miners ETF | | | Global X Gold Explorers ETF | |

| | | Year Ended

October 31, 2016 | | | Year Ended

October 31, 2015 | | | Year Ended

October 31, 2016 | | | Year Ended

October 31, 2015 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net Investment Income (Loss) | | $ | 471,099 | | | $ | 373,126 | | | $ | (118,964 | ) | | $ | 208,471 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | (32,611,236 | )(1) | | | (66,954,054 | )(1) | | | 1,204,342 | (1) | | | (18,400,329 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency Translations | | | 168,065,426 | | | | 30,513,172 | | | | 24,561,938 | | | | 19,099,199 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 135,925,289 | | | | (36,067,756 | ) | | | 25,647,316 | | | | 907,341 | |

| Dividends and Distributions from: | | | | | | | | | | | | | | | | |

| Net Investment Income | | | (492,527 | ) | | | (129,601 | ) | | | (2,809,410 | ) | | | (40,294 | ) |

| Total Dividends and Distributions | | | (492,527 | ) | | | (129,601 | ) | | | (2,809,410 | ) | | | (40,294 | ) |

| Capital Share Transactions: | | | | | | | | | | | | | | | | |

| Issued | | | 145,373,948 | | | | 29,928,286 | | | | 23,235,210 | | | | 512,019 | |

| Redeemed | | | (44,945,232 | ) | | | (20,940,116 | ) | | | (3,092,103 | ) | | | — | |

| Increase in Net Assets from Capital Share Transactions | | | 100,428,716 | | | | 8,988,170 | | | | 20,143,107 | | | | 512,019 | |

| Total Increase (Decrease) in Net Assets | | | 235,861,478 | | | | (27,209,187 | ) | | | 42,981,013 | | | | 1,379,066 | |

| Net Assets: | | | | | | | | | | | | | | | | |

| Beginning of Year | | | 143,755,814 | | | | 170,965,001 | | | | 29,093,081 | | | | 27,714,015 | |

| End of Year | | $ | 379,617,292 | | | $ | 143,755,814 | | | $ | 72,074,094 | | | $ | 29,093,081 | |

| Undistributed Net Investment Income | | $ | 269,857 | | | $ | 225,582 | | | $ | (938,905 | ) | | $ | 162,412 | |

| Share Transactions: | | | | | | | | | | | | | | | | |

| Issued | | | 3,550,000 | | | | 1,183,334 | (2) | | | 700,000 | | | | 25,000 | (3) |

| Redeemed | | | (1,102,682 | ) | | | (816,667 | )(2) | | | (100,325 | ) | | | — | |

| Net Increase in Shares Outstanding from Share Transactions | | | 2,447,318 | | | | 366,667 | | | | 599,675 | | | | 25,000 | |

| (1) | Includes realized gain (loss) as a result of in-kind transactions. (See Note 4 in Notes to Financial Statements.) |

| (2) | Adjusted to reflect the effect of a 1 for 3 reverse share split on November 18, 2015. (See Note 10 in the Notes to Financial Statements.) |

| (3) | Adjusted to reflect the effect of a 1 for2 reverse share split on November 18, 2015. (See Note 10 in the Notes to Financial Statements.) |

The accompanying notes are an integral part of the financial statements.

| Statements of Changes in Net Assets |

| | | Global X Copper Miners ETF | | | Global X Uranium ETF | |

| | | Year Ended

October 31, 2016 | | | Year Ended

October 31, 2015 | | | Year Ended

October 31, 2016 | | | Year Ended

October 31, 2015 | |

| Operations: | | | | | | | | | | | | | | | | |

| Net Investment Income | | $ | 117,560 | | | $ | 237,118 | | | $ | 840,773 | | | $ | 1,437,849 | |