UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| | |

| Ultimus Asset Services, LLC 225 Pictoria Drive, Suite 450 | | Cincinnati, OH 45246 |

| (Address of principal executive offices) | | (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway,

Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: 10/31

Date of reporting period: 10/31/17

| Item 1. | Reports to Stockholders. |

Annual Report

October 31, 2017

Fund Adviser:

Granite Investment Advisors, LLC

6 Eagle Square, 3rd Floor

Concord, New Hampshire 03301

Toll Free (603) 226-6600

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited)

The Fund’s performance for the year ended October 31, 2017 was 16.50% versus the S&P 500 Total Return 23.63%.

The top performing stocks for the last year were:

|

Boeing Co. |

Citigroup |

Apple Inc. |

Berkshire Hathaway Cl. B |

General Motors |

The worst performing stocks for the last year were:

|

Schlumberger |

General Electric |

Mattel, Inc. |

Viacom Inc. – Cl. B |

Southwestern Energy Co. |

On December 15, 2017 the fund will close. We would like to take this opportunity to thank all of the shareholders for their trust and confidence placed in us.

Sincerely,

Scott B. Schermerhorn and Timothy S. Lesko

1

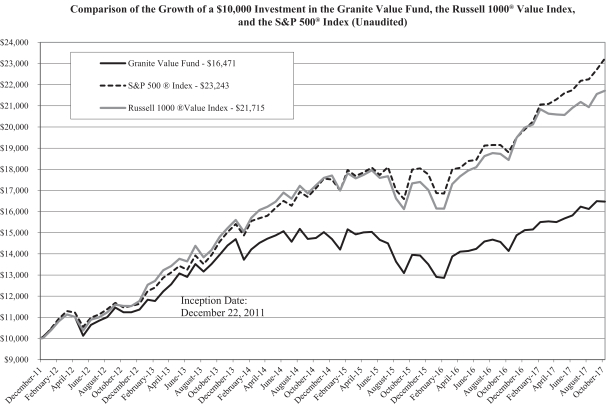

INVESTMENT RESULTS – (Unaudited)

| | | | | | | | | | | | |

Average Annual Total Returns*

(For the periods ended October 31, 2017) | |

| | | One Year | | | Five Year | | | Since Inception

(December 22, 2011) | |

Granite Value Fund | | | 16.50 | % | | | 7.94 | % | | | 8.89 | % |

S&P 500® Index** | | | 23.63 | % | | | 15.18 | % | | | 15.48 | % |

Russell 1000® Value Index** | | | 17.78 | % | | | 13.48 | % | | | 14.15 | % |

Total annual operating expenses, as disclosed in the Granite Value Fund (the “Fund”) prospectus dated February 28, 2017, were 2.88% of average daily net assets (1.36% after fee waivers/expense reimbursements by Granite Investment Advisors, LLC (the “Adviser”). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2018, so that the Total Annual Fund Operating Expenses does not exceed 1.35%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees and extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of October 31, 2017 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-603-226-6600.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would have been lower. |

| ** | The S&P 500® Index and the Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

2

INVESTMENT RESULTS – (Unaudited)

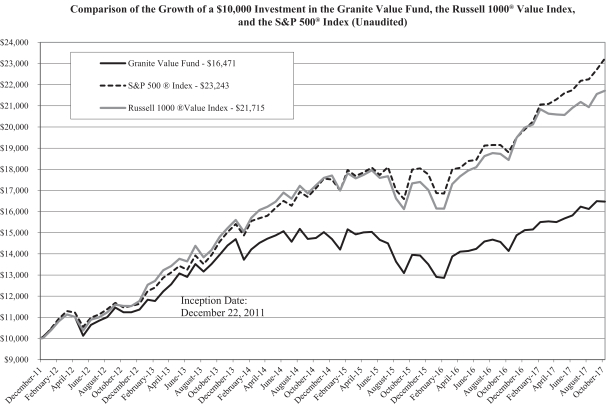

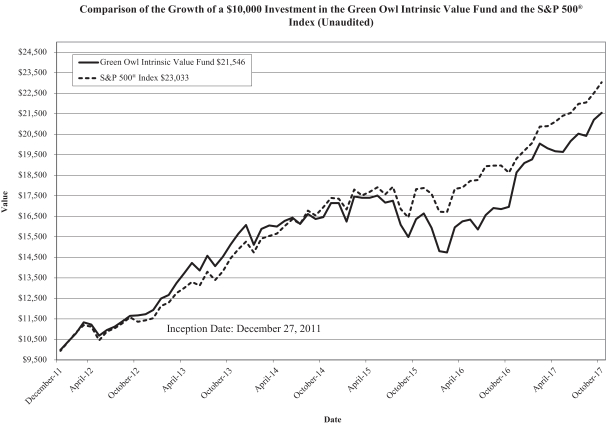

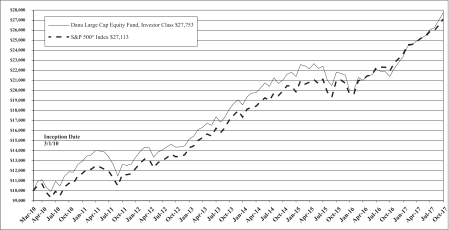

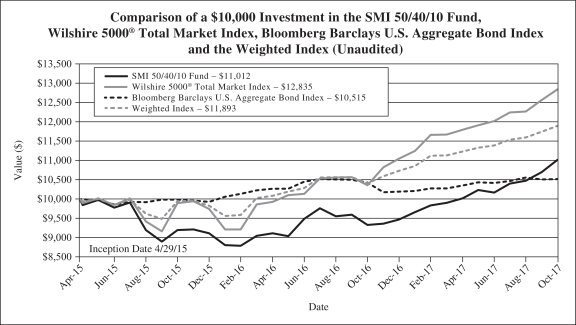

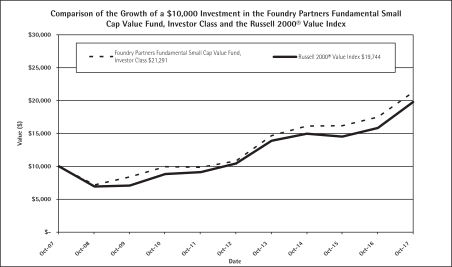

The chart above assumes an initial investment of $10,000 made on December 22, 2011 (commencement of Fund operations) and held through October 31, 2017. The S&P 500® Index and Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-603-226-6600. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

3

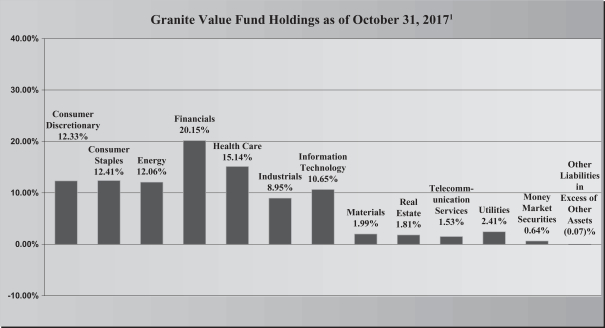

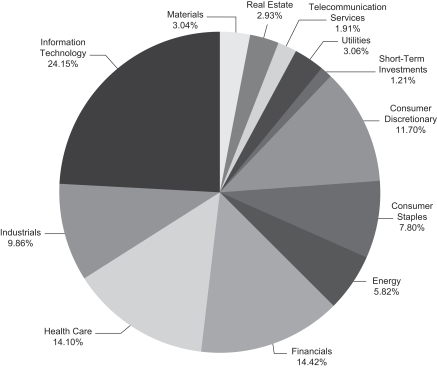

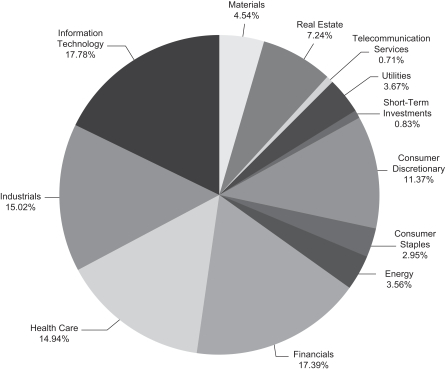

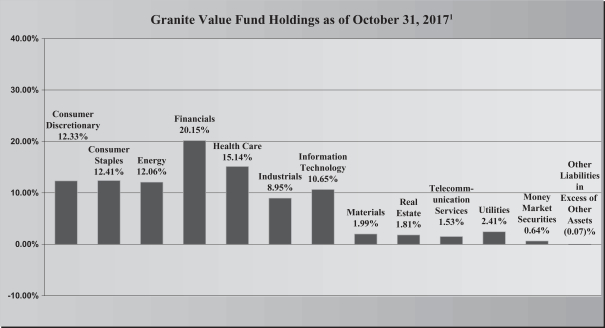

FUND HOLDINGS – (Unaudited)

| 1 | As a percentage of net assets. |

The investment objective of the Fund is to seek long-term capital appreciation.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

4

GRANITE VALUE FUND

SCHEDULE OF INVESTMENTS

October 31, 2017

| | | | | | | | |

| Common Stocks – 99.43% | | Shares | | | Fair Value | |

Consumer Discretionary – 12.33% | | | | | | | | |

Carnival Corp. | | | 4,145 | | | $ | 275,187 | |

Comcast Corp., Class A | | | 7,350 | | | | 264,820 | |

General Motors Co. | | | 6,965 | | | | 299,356 | |

TJX Cos., Inc./The | | | 2,760 | | | | 192,648 | |

Viacom, Inc., Class B | | | 6,915 | | | | 166,167 | |

Whirlpool Corp. | | | 930 | | | | 152,455 | |

| | | | | | | | |

| | | | | | | 1,350,633 | |

| | | | | | | | |

Consumer Staples – 12.41% | | | | | | | | |

Coca-Cola Co./The | | | 2,365 | | | | 108,743 | |

CVS Health Corp. | | | 2,550 | | | | 174,752 | |

Danone SA ADR | | | 23,575 | | | | 387,573 | |

Unilever PLC ADR | | | 6,840 | | | | 387,486 | |

Wal-Mart Stores, Inc. | | | 3,440 | | | | 300,346 | |

| | | | | | | | |

| | | | | | | 1,358,900 | |

| | | | | | | | |

Energy – 12.06% | | | | | | | | |

Cimarex Energy Co. | | | 1,550 | | | | 181,242 | |

Royal Dutch Shell PLC ADR | | | 6,740 | | | | 440,526 | |

Schlumberger Ltd. | | | 2,755 | | | | 176,320 | |

Southwestern Energy Co. * | | | 23,020 | | | | 127,761 | |

Tenaris SA ADR | | | 7,545 | | | | 205,601 | |

Transocean Ltd. * | | | 17,975 | | | | 188,738 | |

| | | | | | | | |

| | | | | | | 1,320,188 | |

| | | | | | | | |

Financials – 20.15% | | | | | | | | |

Alleghany Corp. * | | | 605 | | | | 342,563 | |

American International Group, Inc. | | | 2,785 | | | | 179,939 | |

Bank of New York Mellon Corp./The | | | 4,260 | | | | 219,177 | |

Berkshire Hathaway, Inc., Class B * | | | 3,120 | | | | 583,253 | |

Brighthouse Financial, Inc. * | | | 3,739 | | | | 232,491 | |

Citigroup, Inc. | | | 6,155 | | | | 452,392 | |

MetLife, Inc. | | | 3,680 | | | | 197,174 | |

| | | | | | | | |

| | | | | | | 2,206,989 | |

| | | | | | | | |

Health Care – 15.14% | | | | | | | | |

Abbott Laboratories | | | 6,305 | | | | 341,920 | |

C.R. Bard, Inc. | | | 600 | | | | 196,242 | |

Gilead Sciences, Inc. | | | 3,210 | | | | 240,622 | |

Johnson & Johnson | | | 1,580 | | | | 220,268 | |

McKesson Corp. | | | 1,810 | | | | 249,563 | |

Merck & Co., Inc. | | | 3,680 | | | | 202,731 | |

UnitedHealth Group, Inc. | | | 980 | | | | 206,016 | |

| | | | | | | | |

| | | | | | | 1,657,362 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

5

GRANITE VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

October 31, 2017

| | | | | | | | |

| Common Stocks – 99.43% – continued | | Shares | | | Fair Value | |

Industrials – 8.95% | | | | | | | | |

Boeing Co./The | | | 855 | | | $ | 220,573 | |

General Electric Co. | | | 7,240 | | | | 145,958 | |

Honeywell International, Inc. | | | 2,095 | | | | 302,015 | |

United Technologies Corp. | | | 2,600 | | | | 311,376 | |

| | | | | | | | |

| | | | | | | 979,922 | |

| | | | | | | | |

Information Technology – 10.65% | | | | | | | | |

Apple, Inc. | | | 2,265 | | | | 382,876 | |

Microsoft Corp. | | | 4,185 | | | | 348,108 | |

Oracle Corp. | | | 8,550 | | | | 435,195 | |

| | | | | | | | |

| | | | | | | 1,166,179 | |

| | | | | | | | |

Materials – 1.99% | | | | | | | | |

Agrium, Inc. | | | 2,000 | | | | 217,840 | |

| | | | | | | | |

Real Estate – 1.81% | | | | | | | | |

Tanger Factory Outlet Centers, Inc. | | | 8,700 | | | | 197,925 | |

| | | | | | | | |

Telecommunication Services – 1.53% | | | | | | | | |

AT&T, Inc. | | | 4,985 | | | | 167,745 | |

| | | | | | | | |

Utilities – 2.41% | | | | | | | | |

Calpine Corp. * | | | 17,675 | | | | 264,064 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $9,032,135) | | | | | | | 10,887,747 | |

| | | | | | | | |

Money Market Securities – 0.64% | | | | | | | | |

Fidelity Money Market Government Portfolio, Institutional Class, 0.96% (a) | | | 70,667 | | | | 70,667 | |

| | | | | | | | |

Total Money Market Securities (Cost $70,667) | | | | | | | 70,667 | |

| | | | | | | | |

Total Investments – 100.07% (Cost $9,102,802) | | | | | | | 10,958,414 | |

| | | | | | | | |

Liabilities in Excess of Other Assets – (0.07)% | | | | | | | (7,769) | |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 10,950,645 | |

| | | | | | | | |

| | (a) | Rate disclosed is the seven day effective yield as of October 31, 2017. |

| | * | Non-income producing security. |

ADR – American Depositary Receipt

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator.

See accompanying notes which are an integral part of these financial statements.

6

GRANITE VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2017

| | | | |

Assets | | | | |

Investments in securities at fair value (cost $9,102,802) | | $ | 10,958,414 | |

Dividends receivable | | | 9,471 | |

Receivable from Adviser | | | 2,790 | |

Prepaid expenses | | | 9,812 | |

| | | | |

Total Assets | | | 10,980,487 | |

| | | | |

Liabilities | | | | |

Payable to Administrator | | | 6,875 | |

Payable to custodian | | | 600 | |

Other accrued expenses | | | 22,367 | |

| | | | |

Total Liabilities | | | 29,842 | |

| | | | |

| |

Net Assets | | $ | 10,950,645 | |

| | | | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 8,544,038 | |

Accumulated undistributed net investment income | | | 59,507 | |

Accumulated undistributed net realized gain from investments | | | 491,488 | |

Net unrealized appreciation on investments | | | 1,855,612 | |

| | | | |

| |

Net Assets | | $ | 10,950,645 | |

| | | | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 748,039 | |

| | | | |

Net asset value, offering and redemption price per share (a) | | $ | 14.64 | |

| | | | |

| (a) | The Fund charges a 2.00% redemption fee on shares redeemed in 60 days or less of purchase. Shares are redeemed at the NAV if held longer than 60 calendar days. |

See accompanying notes which are an integral part of these financial statements.

7

GRANITE VALUE FUND

STATEMENT OF OPERATIONS

For the year ended October 31, 2017

| | | | |

Investment Income | | | | |

Dividend income (net of foreign taxes withheld of $4,318) | | $ | 233,908 | |

| | | | |

Total investment income | | | 233,908 | |

| | | | |

| |

Expenses | | | | |

Investment Adviser | | | 104,309 | |

Administration | | | 37,500 | |

Fund accounting | | | 25,000 | |

Transfer agent | | | 20,022 | |

Audit and tax | | | 17,900 | |

Legal | | | 17,165 | |

Registration | | | 15,585 | |

Report printing | | | 10,155 | |

Trustee | | | 6,507 | |

Custodian | | | 3,600 | |

Miscellaneous | | | 28,413 | |

| | | | |

Total expenses | | | 286,156 | |

| | | | |

Fees waived and reimbursed by Adviser | | | (145,209 | ) |

| | | | |

Net operating expenses | | | 140,947 | |

| | | | |

Net investment income | | | 92,961 | |

| | | | |

| |

Net Realized and Unrealized Gain on Investments | | | | |

Net realized gain on investment securities transactions | | | 471,597 | |

Net change in unrealized appreciation of investment securities | | | 1,002,427 | |

| | | | |

Net realized and unrealized gain on investments | | | 1,474,024 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 1,566,985 | |

| | | | |

See accompanying notes which are an integral part of these financial statements.

8

GRANITE VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the

Year Ended

October 31, 2017 | | | For the

Year Ended

October 31, 2016 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 92,961 | | | $ | 101,076 | |

Net realized gain on investment transactions | | | 471,597 | | | | 384,642 | |

Net change in unrealized appreciation (depreciation) of investments | | | 1,002,427 | | | | (398,113 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,566,985 | | | | 87,605 | |

| | | | | | | | |

Distributions | | | | | | | | |

From net investment income | | | (88,414 | ) | | | (53,723 | ) |

From net realized gains | | | (253,158 | ) | | | – | |

| | | | | | | | |

Total distributions | | | (341,572 | ) | | | (53,723 | ) |

| | | | | | | | |

Capital Transactions | | | | | | | | |

Proceeds from shares sold | | | 510,986 | | | | 591,824 | |

Reinvestment of distributions | | | 286,875 | | | | 44,897 | |

Amount paid for shares redeemed | | | (744,947 | ) | | | (1,719,950 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from capital transactions | | | 52,914 | | | | (1,083,229 | ) |

| | | | | | | | |

Total Increase (Decrease) in Net Assets | | | 1,278,327 | | | | (1,049,347 | ) |

| | | | | | | | |

Net Assets | | | | | | | | |

Beginning of year | | | 9,672,318 | | | | 10,721,665 | |

| | | | | | | | |

End of year | | $ | 10,950,645 | | | $ | 9,672,318 | |

| | | | | | | | |

Accumulated undistributed net investment income included in net assets at end of period | | $ | 59,507 | | | $ | 74,852 | |

| | | | | | | | |

Share Transactions | | | | | | | | |

Shares sold | | | 36,644 | | | | 45,877 | |

Shares issued in reinvestment of distributions | | | 21,172 | | | | 3,558 | |

Shares redeemed | | | (53,872 | ) | | | (136,304 | ) |

| | | | | | | | |

Net increase (decrease) in shares outstanding | | | 3,944 | | | | (86,869 | ) |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

9

GRANITE VALUE FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding during each year)

| | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

October 31,

2017 | | | For the

Year Ended

October 31,

2016 | | | For the

Year Ended

October 31,

2015 | | | For the

Year Ended

October 31,

2014 | | | For the

Year Ended

October 31,

2013 | |

Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 13.00 | | | $ | 12.90 | | | $ | 14.22 | | | $ | 13.84 | | | $ | 11.24 | |

| | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.13 | | | | 0.14 | | | | 0.05 | | | | 0.02 | | | | 0.02 | |

Net realized and unrealized gain (loss) on investments | | | 1.98 | | | | 0.03 | (a) | | | (0.80 | ) | | | 0.74 | | | | 2.68 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.11 | | | | 0.17 | | | | (0.75 | ) | | | 0.76 | | | | 2.70 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.12 | ) | | | (0.07 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.10 | ) |

Net realized gains | | | (0.35 | ) | | | – | | | | (0.54 | ) | | | (0.36 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.47 | ) | | | (0.07 | ) | | | (0.57 | ) | | | (0.38 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees | | | – | | | | – | | | | – | | | | – | (b) | | | – | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 14.64 | | | $ | 13.00 | | | $ | 12.90 | | | $ | 14.22 | | | $ | 13.84 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return (c) | | | 16.50 | % | | | 1.30 | % | | | -5.37 | % | | | 5.65 | % | | | 24.21 | % |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 10,951 | | | $ | 9,672 | | | $ | 10,722 | | | $ | 13,212 | | | $ | 10,577 | |

Ratio of net expenses to average net assets | | | 1.35 | % | | | 1.35 | % | | | 1.36 | %(d) | | | 1.35 | % | | | 1.35 | % |

Ratio of expenses to average net assets before waiver and reimbursement | | | 2.74 | % | | | 2.87 | % | | | 2.53 | % | | | 2.39 | % | | | 3.32 | % |

Ratio of net investment income to average net assets | | | 0.89 | % | | | 1.02 | % | | | 0.40 | % | | | 0.17 | % | | | 0.27 | % |

Portfolio turnover rate | | | 17 | % | | | 31 | % | | | 32 | % | | | 30 | % | | | 33 | % |

| (a) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

| (b) | Resulted in less than $0.005 per share. |

| (c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (d) | Includes 0.01% overdraft fees. |

See accompanying notes which are an integral part of these financial statements.

10

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS

October 31, 2017

NOTE 1. ORGANIZATION

The Granite Value Fund (the “Fund”) is an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund commenced operations December 22, 2011. The Fund’s investment adviser is Granite Investment Advisors, LLC. (the “Adviser”). The investment objective of the Fund is to seek long-term capital appreciation. The Fund liquidated effective December 15, 2017.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended October 31, 2017, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations, when incurred. During the fiscal year ended October 31, 2017, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. For financial statement and income tax purposes, the specific identification method is used for determining gains or losses. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method, if applicable. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

11

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2017

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Redemption Fees – The Fund charges a 2.00% redemption fee for shares redeemed within 60 days. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily net asset value (“NAV”) calculation.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For fiscal year ended October 31, 2017, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | |

Accumulated Undistributed

Net Investment Income (loss) | | Accumulated Net Realized

Gain (Loss) from Investments |

$(19,892) | | $19,892 |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| | • | | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

12

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2017

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing agent at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount which the Fund might reasonably expect to receive upon the current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of October 31, 2017:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks* | | $ | 10,887,747 | | | $ | – | | | $ | – | | | $ | 10,887,747 | |

Money Market Securities | | | 70,667 | | | | – | | | | – | | | | 70,667 | |

Total | | $ | 10,958,414 | | | $ | – | | | $ | – | | | $ | 10,958,414 | |

| * | Refer to the Schedule of Investments for sector classifications. |

The Fund did not hold any investments at the end of the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period. There were no transfers between any levels as of October 31, 2017 based on input levels assigned at October 31, 2016.

13

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2017

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the management agreement, on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.00% of the average daily net assets of the Fund. For the fiscal year ended October 31, 2017, the Adviser earned a fee of $104,309 from the Fund before the reimbursement described below.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses through February 28, 2018, so that total annual fund operating expenses, excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year, do not exceed 1.35% of the Fund’s average daily net assets. The operating expense limitation also excludes any fees and expenses of acquired funds.

Each fee waiver and expense reimbursement is subject to repayment by the Fund in the three fiscal years following the date the particular expense payment occurred, provided such reimbursement can be achieved without exceeding the expense limitation that was in effect at the time of the expense payment or the reimbursement. As of October 31, 2017, the Adviser may seek repayment of investment advisory fees waived and expense reimbursements in the amount of $444,003 from the Fund no later than October 31, 2020.

The Trust retains Ultimus Asset Services, LLC (the “Administrator”) to provide the Fund with administration and compliance, fund accounting, and transfer agent services, including all regulatory reporting. For the fiscal year ended October 31, 2017, the Administrator earned fees of $37,500 for administration services, $25,000 for fund accounting services and $20,022 for transfer agent services. At October 31, 2017, the Fund owed the Administrator $6,875 for such services.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares.

The Fund has adopted a 12b-1 Plan that permits the Fund to pay 0.25% of its average daily net assets to financial institutions that provide distribution and/or shareholder servicing. The 12b-1 Plan has not been activated as of October 31, 2017.

NOTE 5. PURCHASES AND SALES

For the fiscal year ended October 31, 2017, purchases and sales of investment securities, other than short-term investments and U.S. government obligations, were as follows:

| | | | |

Purchases | | $ | 1,808,517 | |

Sales | | $ | 1,892,194 | |

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended October 31, 2017.

14

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2017

NOTE 6. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At October 31, 2017, Charles Schwab & Co., Inc. for the benefit of its customers, owned 49.23%.

NOTE 7. FEDERAL TAX INFORMATION

At October 31, 2017, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | | |

Gross appreciation | | $ | 2,353,209 | |

Gross depreciation | | | (497,603 | ) |

| | | | |

Net appreciation on investments | | $ | 1,855,606 | |

| | | | |

At October 31, 2017, the aggregate cost of securities for federal income tax purposes was $9,102,808. At October 31, 2017, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of gains on wash sales.

On November 29, 2017 the Fund paid an income distribution of $0.09006 per share, short-term capital gain of $0.005277 per share, and a long-term capital gain of $3.154998 per share to shareholders of record on November 28, 2017.

The tax characterization of distributions for the fiscal year ended October 31, 2017 and 2016, was as follows:

| | | | | | | | |

| | | 2017 | | | 2016 | |

Distributions paid from: | | | | | | | | |

Ordinary Income* | | $ | 88,341 | | | $ | 53,723 | |

Long-Term Capital Gains | | $ | 253,231 | | | $ | – | |

| | | | | | | | |

Total Distributions | | $ | 341,572 | | | $ | 53,723 | |

| | | | | | | | |

| * | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At October 31, 2017, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 65,634 | |

Undistributed long-term capital gain | | | 487,653 | |

Accumulated capital and other losses | | | (2,286 | ) |

Net unrealized appreciation | | | 1,855,606 | |

| | | | |

| | $ | 2,406,607 | |

| | | | |

15

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2017

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

The Board has determined to liquidate the Fund and to cease operations of the Fund due to the Adviser’s business decision that it no longer is economically feasible to continue managing the Fund because of the Fund’s small size and the difficulty encountered in attracting and maintaining assets. The Fund is no longer accepting purchase orders for its shares and it will close effective as of December 15, 2017.

16

REPORT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Granite Value Fund and

Board of Trustees of Valued Advisers Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Granite Value Fund (the “Fund”), a series of Valued Advisers Trust, as of October 31, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2017, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Granite Value Fund as of October 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Subsequent to October 31, 2017, the Board of Trustees of Valued Advisers Trust approved the liquidation of Granite Value Fund, as disclosed in Note 9 to the financial statements.

COHEN & COMPANY, LTD.

Cleveland, Ohio

December 27, 2017

17

SUMMARY OF FUND EXPENSES – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2017 through October 31, 2017.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| | | | | | | | | | | | |

| Granite Value Fund | | Beginning

Account Value May 1, 2017 | | | Ending Account Value October 31, 2017 | | | Expenses Paid

During Period* May 1, 2017 – October 31, 2017 | |

Actual | | $ | 1,000.00 | | | $ | 1,024.65 | | | $ | 6.89 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.40 | | | $ | 6.87 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.35%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | Assumes a 5% return before expenses. |

18

TRUSTEES AND OFFICERS (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each of the independent trustees.

| | | | |

Name, Address*, Age, Position with Trust**, Term

of Position with Trust | | Principal Occupation During Past 5 Years

and Other Directorships | | Other Directorships |

Andrea N. Mullins, 50 Independent Trustee Since December 2013 Chairperson since March 2017 | | Current: Private investor; Independent Contractor, SWM Wealth Management, LLC (since April 2014). | | None. |

Ira Cohen, 58 Independent Trustee Since June 2010 | | Current: Independent financial services consultant (since February 2005); Executive Vice President of Asset Management Services, Recognos Financial (since August 2015). | | Trustee, Griffin Institutional Access Credit Fund (since January 2017); Trustee and Audit Committee Chairman, Griffin Institutional Real Estate Access Fund (since May 2014); Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Strategic Credit Fund (since December 2017). |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 13 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below should serve as a Trustee.

| | | | |

Name, Address*, Age, Position with Trust**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

Mark J. Seger, 55 Trustee Since March 2017 | | Current: President, Managing Director, and Co-Founder, Ultimus Fund Solutions, LLC (since 1999); Treasurer and Managing Director, Ultimus Fund Distributors, LLC (since 1999); President and Managing Director, Ultimus Asset Services, LLC (since 2016). | | None. |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 13 series. |

19

The following table provides information regarding the officers of the Trust:

| | | | |

Name, Address*, Age, Position with Trust,**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

Bo J. Howell, 36 Principal Executive Officer and President Since March 2017 | | Current: Vice President, Director of Fund Administration, Ultimus Fund Solutions, LLC (since 2014). Previous: Counsel, Securities and Mutual Funds, Western & Southern Financial Group (2012 – 2014). | | None. |

Brandon R. Kipp, 34 Chief Compliance Officer Since October 2017 | | Current: Senior Fund Compliance Officer, Ultimus Fund Solutions, LLC (since July 2017). Previous: Assistant Vice President and Compliance Manager, UMB Fund Services, Inc. (March 2014 to July 2017); Officer and Lead Fund Administrator, UMB Fund Services, Inc. (May 2012 to March 2014). | | None. |

Carol J. Highsmith, 53 Vice President Since August 2008 Secretary Since March 2014 | | Current: Assistant Vice President, Ultimus Fund Solutions, LLC (since December 2015). Previous: Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (November 1994 to December 2015), most recently Vice President of Legal Administration (2005 to December 2015). | | None. |

Matthew J. Miller, 41 Vice President Since December 2011 | | Current: Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (since December 2015). Previous: Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (July 1998 to December 2015), most recently Vice President of Relationship Management (2005 to December 2015). | | None. |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 13 series. |

20

| | | | |

Name, Address*, Age, Position with Trust,**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

| Bryan W. Ashmus, 44 Principal Financial Officer and Treasurer Since December 2013 | | Current: Vice President and Director of Financial Administration, Ultimus Fund Solutions, LLC (since December 2015). Previous: Vice President and Manager of Financial Administration, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (September 2013 to December 2015); Vice President, Fund Administration, Citi Fund Services Ohio, Inc. (from May 2005 to September 2013). | | None. |

| Stephen L. Preston, 50 AML Officer since June 2017 | | Current: Chief Compliance Officer, Ultimus Fund Solutions, LLC (since June 2011); Chief Compliance Officer, Ultimus Fund Distributors, LLC (since June 2011). | | None. |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 13 series. |

OTHER INFORMATION (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (603) 226-6600 to request a copy of the SAI or to make shareholder inquiries.

21

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

At a meeting held on June 8, 2017, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (the “Granite Agreement”) between Valued Advisers Trust (the “Trust”) and Granite Investment Advisors, LLC (“Granite”) with respect to the Granite Value Fund (the “Granite Fund”). Granite provided written information to the Board to assist the Board in its considerations.

The Board discussed the contractual arrangements between Granite and the Trust for the Granite Fund. They reflected upon the Board’s prior experience with Granite in managing the Granite Fund, as well as their earlier discussions with Granite.

Counsel then directed the Trustees to a memorandum from his firm that summarized, among other things, the fiduciary duties and responsibilities of the Board in reviewing and approving the Granite Agreement. In assessing the factors and reaching its decision, the Board took into consideration information furnished by Granite and the Trust’s other service providers for the Board’s review and consideration throughout the year, as well as information specifically prepared or presented in connection with the renewal process, including: (i) reports regarding the services and support provided to the Granite Fund by Granite; (ii) quarterly assessments of the investment performance of the Granite Fund; (iii) commentary on the reasons for the performance; (iv) presentations by Granite addressing its investment philosophy, investment strategy, personnel, and operations of Granite; (v) compliance and audit reports concerning the Granite Fund and Granite; (vi) disclosure information contained in the registration statement of the Trust for the Granite Fund and Granite’s Form ADV; and (vii) a memorandum from counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Granite Agreement. The Board also requested and received materials including, without limitation: (a) documents containing information about Granite, including its financial information; a description of its personnel and the services it provides to the Granite Fund; information on Granite’s investment advice and performance; summaries of the Granite Fund’s expenses, compliance program, current legal matters, and other general information; (b) comparative expense and performance information for other mutual funds with strategies similar to the Granite Fund; and (c) the benefits to be realized by Granite from its relationship with the Granite Fund. The Board did not identify any particular information that was most relevant to its consideration to approve the Granite Agreement and each Trustee may have afforded different weight to the various factors.

| 1. | The nature, extent, and quality of the services to be provided by Granite. In this regard, the Board considered Granite’s responsibilities under the Granite Agreement. The Trustees considered the services being provided by Granite to the Granite Fund including, without limitation: the quality of its investment advisory services (including research and recommendations with respect to portfolio securities), its process for formulating investment recommendations and assuring compliance with the Granite Fund’s investment objectives and limitations, Granite’s coordination of services for the Granite Fund among the Granite Fund’s service providers, and Granite’s efforts to promote the Granite Fund and grow its assets. The Trustees considered Granite’s continuity of, and commitment to retain, qualified personnel and Granite’s commitment to maintain its resources and systems and options that allow the Granite Fund to maintain its goals, and Granite’s continued cooperation with the Independent Trustees and Counsel for the Granite Fund. The Trustees considered Granite’s methods of operation and its personnel, including their education and experience; and Granite’s compliance program, policies, and procedures. The Trustees considered Granite’s efforts to engage an outside marketing firm. After considering the foregoing information and further information in the Meeting materials provided by Granite, the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by Granite to the Granite Fund were satisfactory and adequate. |

| 2. | Investment Performance of the Granite Fund and Granite. In considering the investment performance of the Granite Fund and Granite, the Trustees compared the performance, including the year-to-date, 1-year, 3-year, 5-year, and since inception annualized returns of the Granite Fund (for the periods ending March 31, 2017) with the performance of funds in the same Morningstar category, and with the performance of the Granite Fund’s benchmark. The Trustees also considered the consistency of Granite’s management of the Granite Fund with its investment objective, strategies, and limitations. The Trustees noted that the Granite Fund’s performance for all periods was below the category average and median, and was below the performance of the benchmark. The Trustees also considered the |

22

| | performance of Granite’s separate accounts that were managed in a manner similar to that of the Granite Fund and they noted that the performance was relatively comparable and that Granite’s explanations for the differences in performance were acceptable. The Trustees took into consideration discussions with a representative of Granite regarding the reasons for the performance of the Granite Fund. After reviewing and discussing the investment performance of the Granite Fund further, Granite’s experience managing the Granite Fund, the Granite Fund’s historical performance, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Granite Fund and Granite was satisfactory. |

| 3. | The costs of the services to be provided and profits to be realized by Granite from the relationship with the Granite Fund. In considering the costs of services to be provided and the profits to be realized by Granite from the relationship with the Granite Fund, the Trustees considered: (1) Granite’s financial condition; (2) the asset levels of the Granite Fund; (3) the overall expenses of the Granite Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by Granite regarding its profits associated with managing the Granite Fund. The Trustees also considered potential benefits for Granite in managing the Granite Fund. The Trustees then compared the fees and expenses of the Granite Fund (including the management fee) to other comparable mutual funds. The Trustees noted that the Granite Fund’s management fee was higher than its peer average and median, as was the net operating expense ratio, although the Trustees noted that other funds in the peer group had higher management fees and net operating expense ratios. The Trustees discussed the difference between the fees charged to the Granite Fund as compared to the fees charged to Granite’s separately managed accounts with investment strategies and objectives similar to the Granite Fund. They acknowledged the increased resources required to manage the Granite Fund, including increased compliance and administrative costs. Based on the foregoing, the Board concluded that the fees to be paid to Granite by the Granite Fund and the profits to be realized by Granite, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Granite. |

| 4. | The extent to which economies of scale would be realized as the Granite Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Granite Fund’s investors. In this regard, the Board considered the Granite Fund’s fee arrangements with Granite. The Board considered that while the management fee remained the same at all asset levels, the Granite Fund’s shareholders had experienced benefits from the Granite Fund’s expense limitation arrangement. The Trustees noted Granite’s representation of its current intent to keep the expense limitation arrangement in place into the near future. The Trustees also noted that once the Granite Fund’s expenses fell below the cap set by the arrangement, the Granite Fund’s shareholders would continue to benefit from the economies of scale under the Granite Fund’s agreements with service providers other than Granite. In light of its ongoing consideration of the Granite Fund’s asset levels, expectations for growth in the Granite Fund, and fee levels, the Board determined that the Granite Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Granite. |

| 5. | Possible conflicts of interest and benefits to Granite. In considering Granite’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Granite Fund; the basis of decisions to buy or sell securities for the Granite Fund and/or Granite’s other accounts; and the substance and administration of Granite’s Code of Ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to Granite’s potential conflicts of interest. The Trustees considered Granite’s policies with respect to the use of soft dollars. The Trustees noted that Granite benefited from the Granite Fund in that it is able to utilize the Granite Fund as a vehicle into which to direct advisory clients with small account balances. The Trustees did not identify any other potential benefits (other than the management fee) that would be realized by Granite. Based on the foregoing, the Board determined that the standards and practices of Granite relating to the identification and mitigation of potential conflicts of interest and the benefits that it derives from managing the Granite Fund are acceptable. |

After additional consideration of the factors delineated in the memorandum provided by counsel and further discussion among the Board members, the Board determined to approve the continuation of the Granite Agreement between the Trust and Granite.

23

ADDITIONAL FEDERAL INCOME TAX INFORMATION – (Unaudited)

The Form 1099-DIV you receive in January 2018 will show the tax status of all distributions paid to your account in calendar year 2017. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 100% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2017 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

For the year ended October 31, 2017, the Fund designated $253,231 as long-term capital gain distributions.

24

| | | | |

| |

FACTS | | WHAT DOES VALUED ADVISERS TRUST DO

WITH YOUR PERSONAL INFORMATION? |

| | | | |

| | |

Why? | | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | | | |

| | |

What? | | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ◾ Social Security number ◾ account balances and account transactions ◾ account transactions, transaction or loss history and purchase history ◾ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| | | | |

| | |

How? | | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Valued Advisers Trust chooses to share; and whether you can limit this sharing. |

| | |

Reasons we can share your personal information | | Does Valued Advisers Trust share? |

For our everyday business purposes –

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | | Yes |

For our marketing purposes –

to offer our products and services to you | | Yes |

For joint marketing with other financial companies | | No |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | | No |

For our affiliates’ everyday business purposes –

information about your creditworthiness | | No |

For nonaffiliates to market to you | | No |

| | | | |

Questions? | | Call 1-603-226-6600. |

25

| | |

Who we are |

| Who is providing this notice? | | Valued Advisers Trust |

What we do |

| How does Valued Advisers Trust protect my personal information? | | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

| How does Valued Advisers Trust collect my personal information? | | We collect your personal information, for example, when you ◾ open an account or deposit money ◾ buy securities from us or sell securities to us ◾ make deposits or withdrawals from your account or provide account information ◾ give us your account information ◾ make a wire transfer ◾ tell us who receives the money ◾ tell us where to send the money ◾ show your government-issued ID ◾ show your driver’s license |

| Why can’t I limit all sharing? | | Federal law gives you the right to limit only ◾ sharing for affiliates’ everyday business purposes – information about your creditworthiness ◾ affiliates from using your information to market to you ◾ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions | | |

| Affiliates | | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

| Nonaffiliates | | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ◾ Valued Advisers Trust does not share your personal information with nonaffiliates so they can market to you. |

| Joint marketing | | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ◾ Valued Advisers Trust doesn’t jointly market financial products or services to you. |

26

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies is available without charge upon request by (1) calling the Fund at (603) 226-6600 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Andrea N. Mullins, Chairperson

Ira P. Cohen

Mark J. Seger

OFFICERS

Bo J. Howell, Principal Executive Officer and President

Bryan W. Ashmus, Principal Financial Officer and Treasurer

Brandon R. Kipp, Chief Compliance Officer

Carol J. Highsmith, Vice President and Secretary

Matthew J. Miller, Vice President

Stephen L. Preston, Anti-Money Laundering Officer

INVESTMENT ADVISER

Granite Investment Advisors, LLC

6 Eagle Square, 3rd Floor

Concord, NH 03301

DISTRIBUTOR

Unified Financial Securities, LLC

9465 Counselors Row, Suite 200

Indianapolis, IN 46240

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway, Ste. 310

Leawood, KS 66211

CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215

ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Ultimus Asset Services, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, LLC

Member FINRA/SIPC

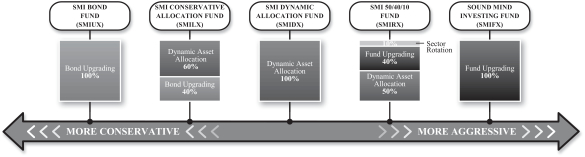

SOUND MIND INVESTING FUND (SMIFX)

SMI CONSERVATIVE

ALLOCATION FUND (SMILX)

SMI DYNAMIC

ALLOCATION FUND (SMIDX)

SMI BOND FUND (SMIUX)

SMI 50/40/10 FUND (SMIRX)

|

| |

| ANNUAL REPORT |

| |

| OCTOBER 31, 2017 |

Fund Adviser:

SMI Advisory Services, LLC

411 6th Street

Columbus, IN 47201

(877) 764-3863

(877) SMI-FUND

www.smifund.com

“Steady plodding brings prosperity; hasty speculation brings poverty.” Proverbs 21:5

Dear Fellow Shareholder,

The stock market continued its uninterrupted march higher throughout the fiscal year ending October 31, 2017 with most stocks adding healthy gains. Both foreign and domestic markets were strong performers, and domestic stocks were strong across all of SMI’s risk categories.

The S&P 500 total-return index has now had 12 consecutive winning months (Nov-Oct). That’s quite rare, happening for only the second time in the past four decades. This is also just the sixth time since 1950 that more than a year has passed without at least a 5% pull-back for the S&P 500 index. This lack of volatility has been highly unusual by historical standards.

Sustained trends like this are great for SMI’s trend-following strategies, so it’s no surprise they have posted particularly strong performance of late and sport compelling year-to-date numbers as well. While market storm clouds may be rumbling in the distance, the third quarter was a reminder that cashing out of a richly-valued market while it is still rallying can mean leaving considerable gains on the table. These are heady times for stock investors. For the fiscal year ended October 31, 2017, the gain for the S&P 500 was 23.63%. Even more remarkable, SMI’s Sector Rotation strategy was up a stunning 74% in that time! While the significance of this impacts the 10% allocated to it in SMI 50/40/10 Fund, it’s clear there are strong pockets of strength even within a richly-valued market.

When investors are enjoying these types of gains, it’s tough for them to listen to the voice of reason. But the unfortunate reality of investing is that big gains don’t reduce future risk...they increase it. If stocks were risky a year ago (and they were), they are that much more so after another year of growing toward the sky.

SMI readers have heard our many cautions regarding market risk in the current environment, so I’ll keep this brief by limiting myself to just two thoughts.

First, the U.S. has experienced at least one economic recession in every decade since 1850. Some decades had more than one, but every decade has had at least one. So far, the 2010-2019 decade is the lone exception. If we make it through the next two years without a recession, it will be unique in the past 170 years.

Keep in mind that the U.S. stock market typically peaks roughly one year before economic recessions begin. By definition, then, if we see a recession within the next two years, that would imply a stock market peak sometime in the next year.

That said, there are no particularly worrisome signs of recession on the horizon. Markets love political gridlock and expanding earnings, both of which are present right now – at least partially explaining the

1

big gains of the past year. These gains could well continue. For that matter, there’s nothing magical about the “recession every decade” idea other than the fact that it demonstrates that downturns happen with a certain regularity which we’ve been able to push off lately. The current economic expansion is the third longest on record; if it lasts through the end of 2019 it will become the longest. It could happen. But it might not be smart to expect it to.

Second, we’ve emphasized that the change in central bank policy from accommodation to tightening, which took an important step forward in October when the U.S. Federal Reserve (the “Fed”) started intentionally shrinking its balance sheet, is a big deal. Not so much in its immediate impact, which is starting off quite modest (and is more than offset by the continuing stimulus from the European Central Bank and Bank of Japan). But as with QE on the expansion side, the Fed’s recent move has signaled the other central banks to start discussing their own exit strategies from this decade of propping up the economy and financial markets with central bank largesse. If all goes as these central banks have currently outlined, roughly a year from now (Fall 2018) the world will be facing a net tightening of central bank capital for the first time since the financial crisis.

It’s unfortunate that the numbers are so big that they’re barely relatable, but the net impact of this shift is that the financial markets will go from half a trillion dollars’ worth of stimulus in 2016 to a trillion dollars of tightening in 2018. That’s a $1.5 trillion-dollar swing, roughly equivalent to 2% of world GDP. Or put differently, that $1.5 trillion is roughly the size of Canada’s GDP, which is the 10th largest economy in the world. Just as that money materialized out of nothing to buy bonds through QE, it’s scheduled to evaporate, pulling that capital out of the world’s system. It would be noticed if Canada just didn’t show up economically all of a sudden. We certainly expect this significant central bank policy shift will be noticed as well.

Along that same line, courtesy of Baird Advisors’ Mary Ellen Stanek: “Collectively, the Fed, European Central Bank and Bank of Japan own one-third of the global bond market.” Astonishing.

Think ahead

Now that I’ve gone all Debby-Downer on you, what’s the point of all this? Am I telling you to sell and run for the hills? Of course not.

However, an important fact of investing is that when prospective returns are high, that’s when you want to be maximally aggressive. And when prospective returns are low, that’s the time to get more conservative. We know when these times are (roughly) based on valuations, which have a fantastic track record of projecting long-term future returns. Valuation is a lousy short-term timing signal. But it’s great at telling us what type of returns to expect over the next 7-12 years. And with current valuations ranging somewhere between “worst ever” and “only worse before the 1929 and 2000 market peaks,” we know total returns over the next decade aren’t likely to be very good. Usually that means enduring a significant bear market that knocks those valuations down to a more reasonable level. The message here isn’t to sell and run away. It’s that prospective returns are low and risk is high, so keep risk front-of-mind as these fantastic returns continue to roll in. That’s hard to do when Sector Rotation skyrockets +16.1% in a month, as it did in October. But it’s a necessary discipline if you’re going to be a successful long-term investor.

At a minimum, applying this information means sticking to your long-term plan. Just this simple step will keep you ahead of most investors, who unthinkingly get more aggressive as risk increases late in a bull market. Recent high returns entice them to allocate more and more to riskier stocks/strategies – right up

2

until the moment the market trap door swings open beneath them. At a minimum, keep yourself from following that path. Stick to your long-term plan and reallocate back to your baseline allocations at year-end. To be blunt, this is not the time to be increasing your long-term allocation to Sector Rotation!

If you want to be more proactive��than that, one approach I’ve long advocated is to gradually shift money away from more aggressive strategies (such as Sector Rotation) as bull markets get over-extended, and re-allocate it to conservative strategies (like Dynamic Asset Allocation “DAA”) that will hold up better in the next downturn. Full disclosure: this process stinks as you’re doing it, because you’re never going to get the timing perfect, which means kicking yourself month by month as the high returns continue – until the market rolls over. Then it’s sweet relief. Naturally, there will come a point in the next bear market when the losses have deepened and accelerated to the point that you want to throw up – that’s your cue to reverse the process and start gradually re-allocating more aggressively again. [Just to be clear, the process outlined in this paragraph is optional – sticking with an appropriate mix of strategy allocations and not making these types of adjustments is perfectly fine. You don’t have to do this to be successful.]

Always be aware of your surroundings

In closing, it’s worth noting that we’re working every day at SMI to figure out ways to protect your capital between now and the next market opportunity. DAA was a huge step in that direction. We continue to look for more breakthroughs along those lines. As we do, be mindful of where we are in this bull/bear market cycle. And make sure your current portfolio is such that if a major market downturn were to occur that you could handle it without it being devastating to your long-term financial progress.

Thankfully, SMI’s success isn’t based on correctly predicting the market’s future. Rather, our approach begins within the context of following God’s protective principles. A strong financial foundation, established by working to become debt-free and creating a savings reserve, provides the strength to weather unexpected setbacks. Allocating your stock/bond mix (that is, setting your risk level) in a way that balances your need for growth and your emotional fear of loss is another key step. We build portfolios based on the principle of diversification, both between and within various asset classes, knowing that performance excellence rotates. Finally, we suggest taking no more risk than is absolutely necessary in order to reach your financial destination. After all, investing isn’t about building the biggest pile of money possible – it’s about meeting your specific financial goals.