united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22208 | |

| Valued Advisers Trust |

| (Exact name of registrant as specified in charter) |

| Ultimus Asset Services, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Bryan Ashmus

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/18 | |

Item 1. Reports to Stockholders.

DANA LARGE CAP EQUITY FUND

DANA SMALL CAP EQUITY FUND

Annual Report

October 31, 2018

Dana Investment Advisors, Inc.

20700 Swenson Drive, Suite 400

Waukesha, WI 53186

(855) 280-9648

www.danafunds.com

Dear Fellow Shareholders,

We are once again pleased to offer you this annual report for the Dana Large Cap Equity Fund (“Large Cap Fund”) and the Dana Small Cap Equity Fund (“Small Cap Fund”) for the 12-month period ended October 31, 2018. During this period, the Large Cap Fund returned a +3.27% (Institutional Class Shares) and the Small Cap Fund returned a -2.95% (Institutional Class Shares). Had the period ended one month earlier, these numbers would have looked very different. October was the worst month for the S&P 500 Index since September 2011 with a return of -6.84% and small capitalization stocks fared worse with the Russell 2000 Index down -10.86%. Investors were spooked in October by trade concerns, slowing growth, and expectations for higher interest rates. The 12-month period was mixed in terms of asset and shareholders growth. The Small Cap Fund saw a slight decline in assets, 5%, and shareholders, 2%, and the Large Cap Fund saw good growth in both areas with assets growing by over 17% and shareholder growth of 19%. In early November, the Small Cap Fund will mark its third year anniversary, opening potential opportunities where a 3-year track record is required.

As we look forward to the next 12 months, we know there will be pressures on the markets from potential raising rates or a slowdown in earnings growth. However, we don’t believe it is in the best interest of our shareholders to focus our efforts on trying to predict market directions. Our value to shareholders is maintaining a discipline to our investment process, focusing on finding companies with attractive valuations, strong balance sheets, cash flow growth and good relative earnings. We believe that companies exhibiting these characteristics will be in demand and rewarded over the long term. We know you have many investment options to choose from, and we thank you for your continued trust and support of Dana Funds.

Economic and Market Recap

The last two months of 2017 finished with a flourish for the U.S. equity market. The S&P 500 Index added +4.2% to an already stellar year, and small cap stocks were also up, as measured by the Russell 2000 Index, but less so than the larger cap index. Much of this move was driven by the Tax Cuts and Jobs Act, signed by President Trump on December 22, 2017. Investors reacted positively to the prospect of greater corporate earnings growth in 2018. The upswing was widespread, and all sectors within the S&P 500 Index (with the exception of Utilities) moved up. Small Cap sector performance was mixed, but mostly positive, with considerable strength in Energy and Consumer Discretionary stocks.

The economy showed steady improvement as the new year unfolded. First quarter 2018 GDP came in at a moderate 2.2%, yet quickly ramped up to a robust 4.2% in Q2, and the advanced GDP figure for Q3 is 3.5%. Corporate earnings in Q2 soared as expected, driven by tax cuts and the strong economic backdrop. Accelerating earnings growth offset deteriorating trade commentary out of Washington. After a pause in the first quarter, the equity market resumed its upward climb in Q2 and Q3. Growth stocks, particularly mega cap and high-valuation technology and communication companies led the market higher. In 2017, the Russell 1000 Growth Index (“Growth”) outperformed the Russell 1000 Value Index (“Value”) by 1700 basis points, and this trend continued in 2018. By the end of September, Growth outperformed Value by another 1300 basis points year-to-date. The same can be said for smaller cap stocks where there is clear outperformance of Growth versus Value styles, as measured by the Russell 2000 Growth and Value Indexes.

As mentioned earlier, October lived up to its reputation as a historically difficult month for the stock market. Escalating trade concerns and fear that the best was over in terms of earnings growth plus the cumulative effect of eight Fed rate hikes brought about a market correction. Cyclical stocks fell on peak earning concerns, and high flying technology stocks experienced price-to-earnings contractions. Investors rotated to more defensive sectors, such as Utilities and Consumer Staples. The looming unknown of midterm elections weighed heavily on investors’ minds as well, resulting in risk-off trades.

1

Large Cap Fund Performance

During the full year, the Large Cap Fund returned +3.27% (Institutional Class Shares) versus the S&P 500 Index return of +7.35%. The market’s strong preference for mega cap growth stocks challenged Dana’s disciplined investment process that focuses on buying stocks with good growth at attractive valuations relative to peers. Despite not being happy with the overall performance, we were pleased to see the Large Cap Fund demonstrate downside protection during the period (i.e., outperformance during negative return markets) since its inception. The Large Cap Fund was able to overcome this trend in calendar year 2017 (outperforming the S&P 500 Index by 5.5%), but the significant extension of already expensive securities into 2018 proved to be a strong headwind for our investment process.

For the full fiscal year, the performance of the Energy and Industrial sectors contributed to returns, while performance lagged in Consumer Discretionary and Information Technology sectors. Within Industrials, Boeing Company (BA) was a stand out for the year. Defense spending is expected to be robust, and Boeing’s backlog in commercial aircraft is quite strong. Oil & Gas services company Halliburton contributed to returns (and was sold on strength) during the period, and refiner Valero Energy Corporation (VLO) was the highest contributor within the Large Cap Fund’s energy holdings. Not owning Amazon in the Consumer Discretionary sector due to its lofty valuation has continued to detract from performance. The Large Cap Fund held several winners in Information Technology, including Broadridge Financial Solutions, Inc. (BR), CDW Corporation (CDW), Cisco Systems, Inc. (CSCO) and Mastercard, Inc. (MA), yet they did not offset weakness in semiconductor companies, Lam Research Corporation (LRCX) and Microchip Technology, Inc. (MCHP), or in Visa, Inc. (V) and NetApp, Inc. (NTAP).

Beyond these sectors, significant performers include Dr. Pepper Snapple, a company that was bought early in the year at a premium by Keurig Green Mountain, Inc. In Health Care, Pfizer, Inc. (PFE) was up over 27% and UnitedHealth Group performed well, up 26%. Owens Corning, Inc. (OC) suffered a significant earnings miss due to cost pressures in oil and transport. This stock was sold from the Large Cap Fund. Bristol-Myers Squibb Company (BMY) declined recently as investors question the potential of cancer drug Optivo.

Our analysis shows that the Large Cap Fund is trading at attractive relative valuations versus its benchmark and is performing well in terms of actual earnings and cash flow generation. We remain committed to our relative value focus and risk-controlled portfolio construction as investors sort out growth expectations for the coming year.

Small Cap Fund Performance

The Small Cap Fund lagged the Russell 2000 Index this past fiscal year, returning -2.95% (Institutional Class Shares) versus +1.85% during this time period. As with the larger market capitalization stocks, growth and factors such as price momentum were rewarded amongst smaller capitalization stocks. Value and quality factors have also largely been ignored by these market participants.

Interestingly, the Small Cap Fund performance lag was largely concentrated in the first half of the fiscal year. The performance in more recent months saw a reversal, and the Small Cap Fund closed the gap in July, August and September. During this period, price momentum factors waned and value and growth factors were more balanced. Our focus remains on company fundamentals, and these are tracking well for our portfolio as a whole. We believe patient investors will reap the benefits of this focus over time.

In terms of sector performance, stock selection within Industrials, Health Care and Consumer Staples excelled, whereas weakness was seen in Consumer Discretionary, Materials and Information Technology. TriNet Group, Inc. (TNET) is a Professional Employer Organization (PEO) providing

2

human resource outsourcing services and insurance solutions. The company is benefiting from a strong macro environment, with full employment, driving employers to seek out tools to attract and retain employees, along with improving insurance margins. BioTelemetry, Inc. (BEAT) was the Small Cap Fund’s top individual contributor for the period. BEAT is a Health Care company offering mobile cardiac monitoring. The industry’s technology is improving, and products are shifting to longer duration monitoring that is helping to bolster exciting growth. The Chef’s Warehouse, Inc. (CHEF) is one of the largest specialty food distributors in the U.S., serving many upscale independent restaurants, hotels and clubs. CHEF management has articulated, and executed on, a clear long-term outlook that includes doubling EBITDA and improving margins by 2022. The company also views technology, selective acquisitions and category expansion as important drivers of market share gains.

Consumer Discretionary was the Small Cap Fund’s weakest relative sector over the past fiscal year. Marriott Vacations Worldwide Corporation (VAC) develops, markets, and sells vacation ownership properties. The stock has been negatively impacted by a recent acquisition of a large competitor that was followed by mixed fundamental results and guidance. VAC shares have also been damaged by fears of slowing demand as interest rates rise. Rising rates and the potential for slowing demand also weighed on automotive retailer Lithia Motors, Inc. (LAD) along with RV components manufacturer LCI Industries (LCII). Specialty Chemicals holdings PolyOne Corporation (POL) and Ferro Corporation (FOE) fell over the last year on concerns surrounding slowing global macroeconomic growth and rising input costs. Higher input costs were a common theme that emerged from materials companies recently, and their ability to pass along higher pricing is becoming exceptionally important. Within Information Technology, investors have soured on the semiconductor equipment industry. The companies involved in this space tend to be very cyclically exposed, often have ties to China, and are facing high supply and pricing issues in the near term. Consequently, the Small Cap Fund’s holdings in the semiconductor equipment space performed poorly. Happily, the Information Technology sector also included some of the Small Cap Fund’s top performers over the past year. Bottomline Technologies, Inc. (EPAY) develops automation and process software for large, complex commercial payments along with document management. The company’s end markets include global corporations and large financial institutions. EPAY returned +83% over the past year on strong organic growth after management transitioned to a model that emphasized recurring revenue. The small cap software space is exciting and includes many niche players offering interesting efficiency solutions to large global players.

The Small Cap Fund continues to seek opportunities to add value through disciplined, fundamentally driven stock selection and believes this strategy will reward investors over the long term.

Respectfully submitted,

Mark R. Mirsberger, CPA

Chief Executive Officer – Dana Investment Advisors, Inc.

Duane Roberts, CFA

Portfolio Manager and Director of Equities – Dana Investment Advisors, Inc.

3

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2018

| One

Year | Three

Year | Five

Year | Since

Inception

(3/1/10) | Since

Inception

(10/29/13) |

Dana Large Cap Equity Fund | | | | | |

Institutional Class | 3.27% | 9.74% | 9.87% | N/A | 9.92% |

Investor Class | 3.01% | 9.44% | 9.56% | 12.88% | N/A |

S&P 500® Index(b) | 7.35% | 11.52% | 11.34% | 13.12% | 11.14% |

| | Expense Ratios(c) | | | |

| Institutional

Class | Investor

Class | | | |

Gross | 0.87% | 1.12% | | | |

With Applicable Waivers | 0.74% | 0.99% | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Large Cap Equity Fund (the “Large Cap Fund”) distributions or the redemption of Large Cap Fund shares. Current performance of the Large Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Large Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. |

(b) | The S&P 500® Index (“S&P Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Large Cap Fund’s portfolio. Individuals cannot invest directly in the S&P Index; however, an individual can invest in exchange-traded funds (“ETFs”) or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Large Cap Fund’s prospectus dated February 28, 2018, as supplemented on June 29, 2018. Dana Investment Advisors, Inc. (the “Adviser”) has contractually agreed to reimburse or limit its fees and to assume other expenses of the Large Cap Fund until February 28, 2019, so that total annual fund operating expenses does not exceed 0.73% of the Large Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Large Cap Fund within three years following the date in which the fee waiver or expense reimbursement occurred, provided that the Large Cap Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Large Cap Fund’s expense ratios as of October 31, 2018 can be found on the financial highlights. |

The Large Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Large Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Large Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

4

Investment Results (Unaudited) | |

Average Annual Total Returns(a) as of October 31, 2018

| One

Year | Since

Inception

(11/3/15) |

Dana Small Cap Equity Fund | | |

Institutional Class | -2.95% | 3.62% |

Investor Class | -3.16% | 3.35% |

Russell 2000® Index(b) | 1.85% | 9.77% |

| | Expense Ratios(c) |

| Institutional

Class | Investor

Class |

Gross | 1.97% | 2.22% |

With Applicable Waivers | 0.95% | 1.20% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Dana Small Cap Equity Fund (the “Small Cap Fund”) distributions or the redemption of Small Cap Fund shares. Current performance of the Small Cap Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-855-280-9648.

(a) | Average annual returns reflect any change in price per share and assume the reinvestment of all distributions. The Small Cap Fund’s returns reflect any fee reductions during the applicable period. If such reductions had not occurred, the quoted performance would have been lower. |

(b) | The Russell 2000® Index (“Russell Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than are found in the Small Cap Fund’s portfolio. Individuals can not invest directly in the Russell Index; however, an individual can invest in ETFs or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratios are from the Small Cap Fund’s prospectus dated February 28, 2018, as supplemented on June 29, 2018. The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Small Cap Fund until February 28, 2019, so that total annual fund operating expenses does not exceed 0.95% of the Small Cap Fund’s average daily net assets. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “Acquired Funds Fees and Expenses”). Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the Small Cap Fund within three years following the date in which the fee waiver or expense reimbursement occurred, provided that the Small Cap Fund is able to make the repayment without exceeding the expense limitation in place at the time of the fee waiver or expense reimbursement. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees. Additional information pertaining to the Small Cap Fund’s expense ratios as of October 31, 2018 can be found in the financial highlights. |

The Small Cap Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small Cap Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Small Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

5

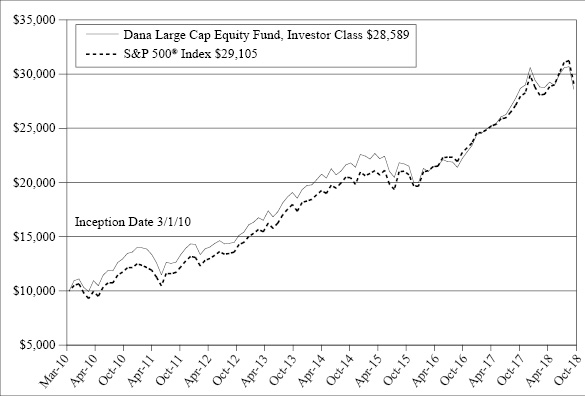

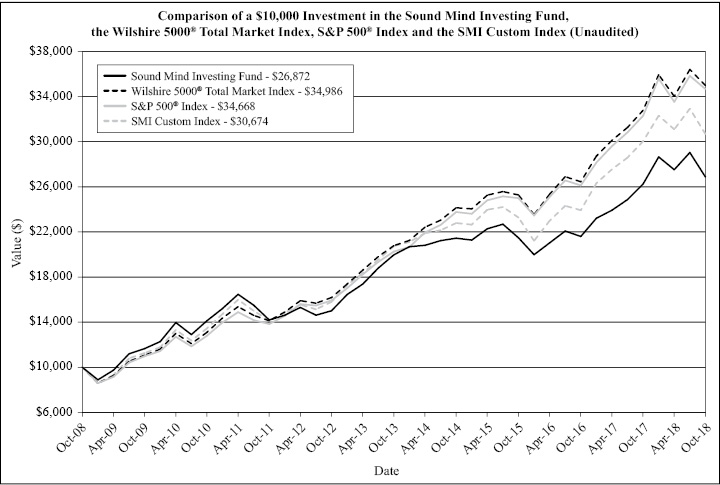

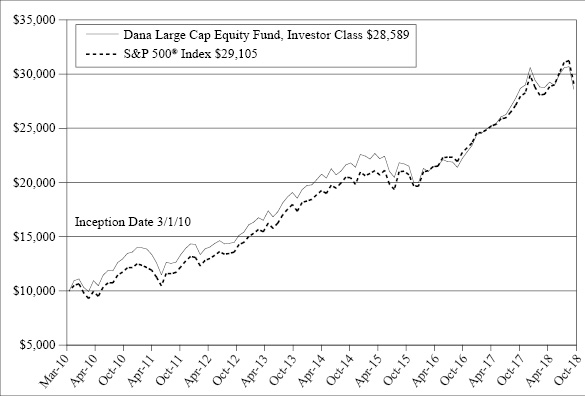

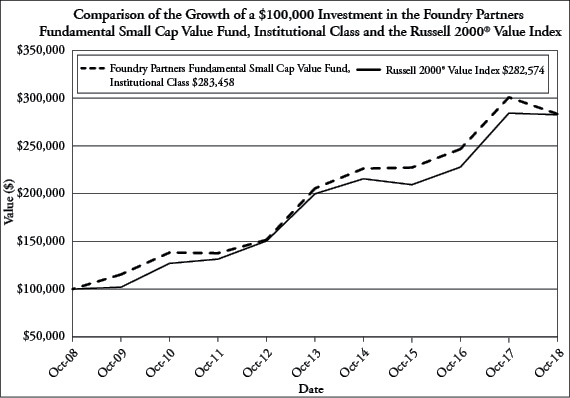

Comparison of Growth of $10,000 Investment in the

Dana Large Cap Equity Fund, Investor Class and

the S&P 500® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on March 1, 2010 (commencement of Investor Class operations) held through October 31, 2018. THE LARGE CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Large Cap Fund distributions or the redemption of Large Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Large Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Large Cap Fund before investing. The Large Cap Fund’s prospectus contains this and other information about the Large Cap Fund, and should be read carefully before investing.

The Large Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

6

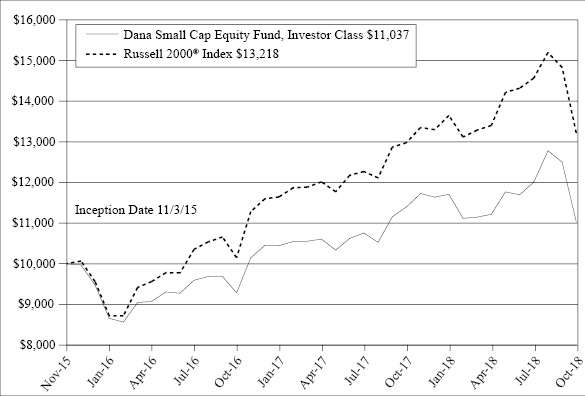

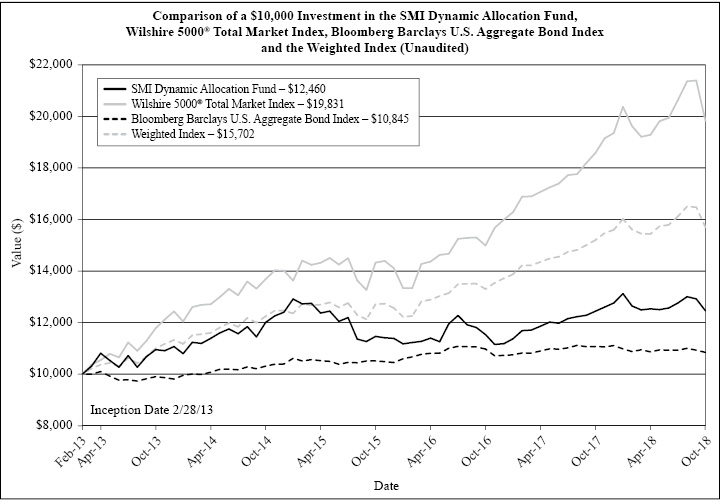

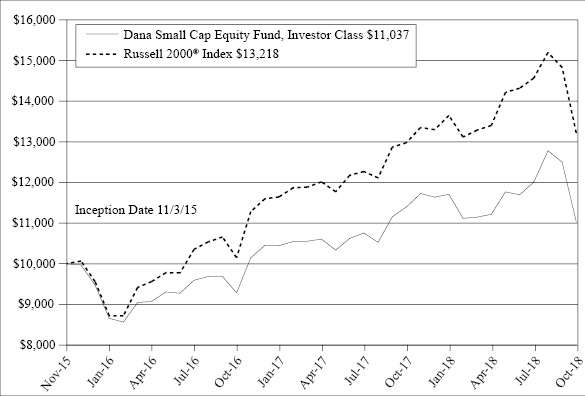

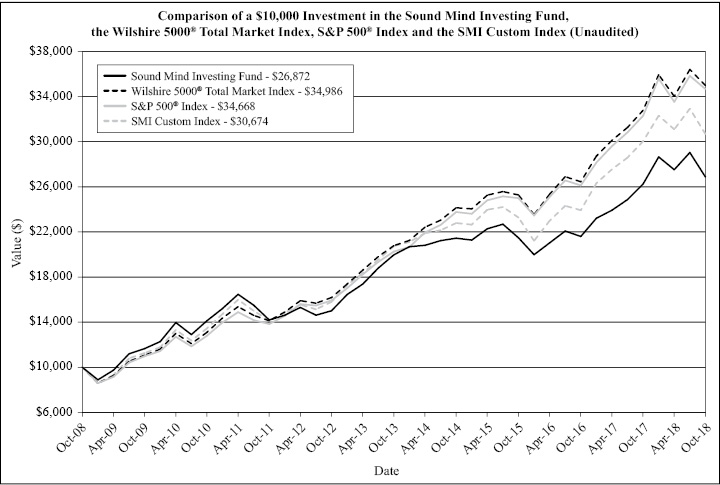

Comparison of Growth of $10,000 Investment in the

Dana Small Cap Equity Fund, Investor Class and

the Russell 2000® Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on November 3, 2015 (commencement of Investor Class operations) held through October 31, 2018. THE SMALL CAP FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Small Cap Fund distributions or the redemption of Small Cap Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small Cap Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-855-280-9648. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small Cap Fund before investing. The Small Cap Fund’s prospectus contains this and other information about the Small Cap Fund, and should be read carefully before investing.

The Small Cap Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

7

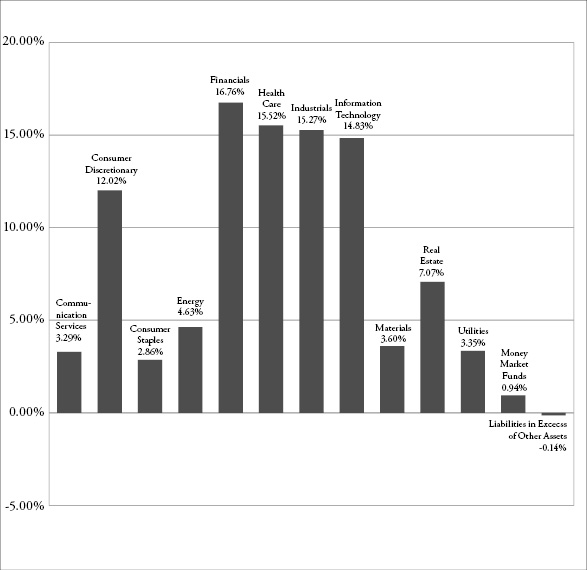

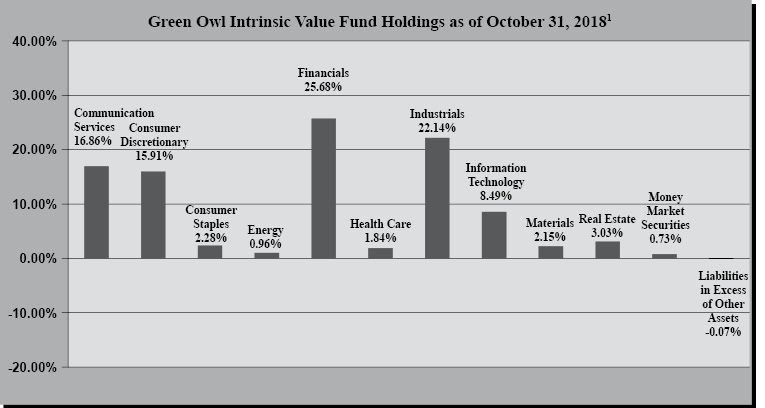

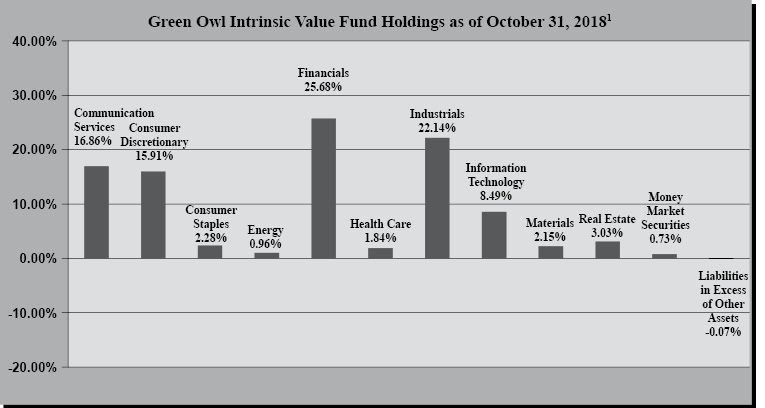

Portfolio Illustration (Unaudited)

October 31, 2018

The following chart gives a visual breakdown of the Large Cap Fund by sector weighting as a percentage of net assets as of October 31, 2018.

8

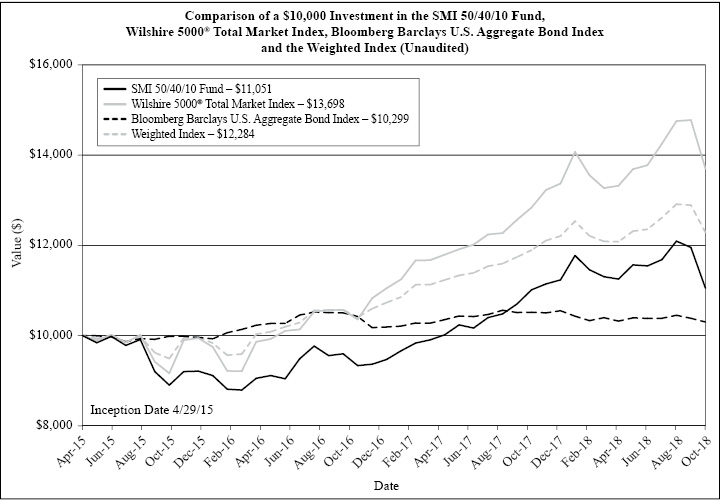

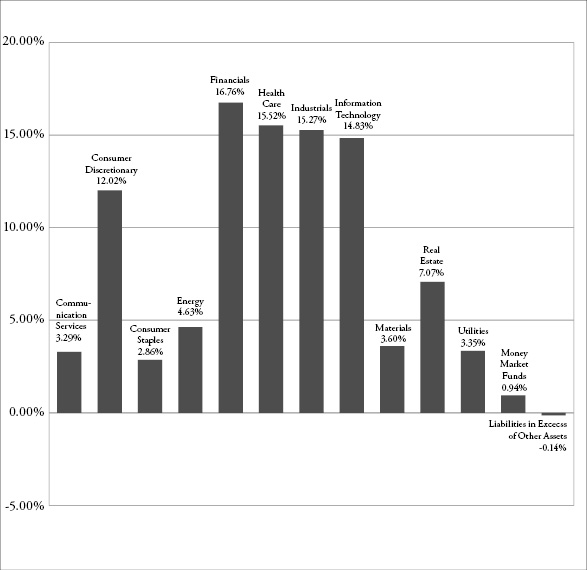

Portfolio Illustration (Unaudited)

October 31, 2018

The following chart gives a visual breakdown of the Small Cap Fund by sector weighting as a percentage of net assets as of October 31, 2018.

Availability of Portfolio Schedules (Unaudited)

The Large Cap Fund and the Small Cap Fund (each a “Fund” and collectively the “Funds”) file their complete schedule of investments with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is available at the SEC’s website at www.sec.gov.

9

Dana Large Cap Equity Fund

Schedule of Investments

October 31, 2018

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.17% | | | | | | | | |

Communication Services — 10.22% | | | | | | | | |

Alphabet, Inc., Class A(a) | | | 4,100 | | | $ | 4,471,378 | |

AT&T, Inc. | | | 128,000 | | | | 3,927,040 | |

Comcast Corporation, Class A | | | 120,000 | | | | 4,576,800 | |

Facebook, Inc., Class A(a) | | | 26,000 | | | | 3,946,540 | |

T-Mobile US, Inc.(a) | | | 60,000 | | | | 4,113,000 | |

| | | | | | | | 21,034,758 | |

Consumer Discretionary — 9.62% | | | | | | | | |

Amazon.com, Inc.(a) | | | 300 | | | | 479,403 | |

Best Buy Company, Inc. | | | 51,000 | | | | 3,578,160 | |

D.R. Horton, Inc. | | | 90,000 | | | | 3,236,400 | |

Home Depot, Inc. (The) | | | 17,400 | | | | 3,060,312 | |

PVH Corporation | | | 24,800 | | | | 2,995,592 | |

Royal Caribbean Cruises Ltd. | | | 28,000 | | | | 2,932,440 | |

Target Corporation | | | 42,000 | | | | 3,512,460 | |

| | | | | | | | 19,794,767 | |

Consumer Staples — 7.14% | | | | | | | | |

Ingredion, Inc. | | | 300 | | | | 30,354 | |

Keurig Dr Pepper, Inc. | | | 1,000 | | | | 26,000 | |

Kimberly-Clark Corporation | | | 33,000 | | | | 3,441,900 | |

Sysco Corporation | | | 52,000 | | | | 3,709,160 | |

Tyson Foods, Inc., Class A | | | 58,000 | | | | 3,475,360 | |

Walmart, Inc. | | | 40,000 | | | | 4,011,200 | |

| | | | | | | | 14,693,974 | |

Energy — 5.73% | | | | | | | | |

Chevron Corporation | | | 29,400 | | | | 3,282,510 | |

Exxon Mobil Corporation | | | 40,000 | | | | 3,187,200 | |

ONEOK, Inc. | | | 38,000 | | | | 2,492,800 | |

Valero Energy Corporation | | | 31,000 | | | | 2,823,790 | |

| | | | | | | | 11,786,300 | |

Financials — 13.51% | | | | | | | | |

American Express Company | | | 33,000 | | | | 3,390,090 | |

Bank of America Corporation | | | 121,500 | | | | 3,341,250 | |

Citizens Financial Group, Inc. | | | 97,000 | | | | 3,622,950 | |

JPMorgan Chase & Company | | | 31,400 | | | | 3,423,228 | |

KeyCorp | | | 186,000 | | | | 3,377,760 | |

Morgan Stanley | | | 78,400 | | | | 3,579,744 | |

Prudential Financial, Inc. | | | 36,000 | | | | 3,376,080 | |

Starwood Property Trust, Inc. | | | 170,000 | | | | 3,692,400 | |

| | | | | | | | 27,803,502 | |

10 | See accompanying notes which are an integral part of these financial statements. | |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

October 31, 2018

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.17% — (continued) |

Health Care — 14.69% | | | | | | | | |

AbbVie, Inc. | | | 400 | | | $ | 31,140 | |

Amgen, Inc. | | | 23,200 | | | | 4,472,728 | |

Bristol-Myers Squibb Company | | | 76,600 | | | | 3,871,364 | |

Johnson & Johnson | | | 32,000 | | | | 4,479,680 | |

Pfizer, Inc. | | | 105,000 | | | | 4,521,300 | |

Stryker Corporation | | | 26,000 | | | | 4,217,720 | |

UnitedHealth Group, Inc. | | | 17,200 | | | | 4,495,220 | |

WellCare Health Plans, Inc.(a) | | | 15,000 | | | | 4,139,850 | |

| | | | | | | | 30,229,002 | |

Industrials — 9.26% | | | | | | | | |

Boeing Company (The) | | | 10,600 | | | | 3,761,516 | |

Caterpillar, Inc. | | | 28,200 | | | | 3,421,224 | |

Delta Air Lines, Inc. | | | 72,000 | | | | 3,940,560 | |

Norfolk Southern Corporation | | | 23,800 | | | | 3,994,354 | |

Waste Management, Inc. | | | 44,000 | | | | 3,936,680 | |

| | | | | | | | 19,054,334 | |

Information Technology — 20.80% | | | | | | | | |

Apple, Inc. | | | 24,000 | | | | 5,252,640 | |

Broadridge Financial Solutions, Inc. | | | 33,000 | | | | 3,859,020 | |

CDW Corporation | | | 48,000 | | | | 4,320,480 | |

Cisco Systems, Inc. | | | 85,000 | | | | 3,888,750 | |

DXC Technology Company | | | 40,000 | | | | 2,913,200 | |

Intel Corporation | | | 88,000 | | | | 4,125,440 | |

Mastercard, Inc., Class A | | | 19,000 | | | | 3,755,730 | |

Microchip Technology, Inc. | | | 36,000 | | | | 2,368,080 | |

Microsoft Corporation | | | 42,000 | | | | 4,486,020 | |

NetApp, Inc. | | | 51,000 | | | | 4,002,990 | |

Visa, Inc., Class A | | | 28,000 | | | | 3,859,800 | |

| | | | | | | | 42,832,150 | |

Materials — 2.29% | | | | | | | | |

Albemarle Corporation | | | 300 | | | | 29,766 | |

Packaging Corporation of America | | | 25,400 | | | | 2,331,974 | |

Steel Dynamics, Inc. | | | 59,400 | | | | 2,352,240 | |

| | | | | | | | 4,713,980 | |

Real Estate — 2.82% | | | | | | | | |

American Tower Corporation, Class A | | | 18,600 | | | | 2,898,066 | |

Prologis, Inc. | | | 45,000 | | | | 2,901,150 | |

| | | | | | | | 5,799,216 | |

| | See accompanying notes which are an integral part of these financial statements. | 11 |

Dana Large Cap Equity Fund

Schedule of Investments (continued)

October 31, 2018

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.17% — (continued) |

Utilities — 3.09% | | | | | | | | |

CenterPoint Energy, Inc. | | | 119,000 | | | $ | 3,214,190 | |

Exelon Corporation | | | 72,000 | | | | 3,154,320 | |

| | | | | | | | 6,368,510 | |

Total Common Stocks (Cost $185,461,449) | | | | | | | 204,110,493 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 0.51% | | | | | | | | |

| | | | | | | | | |

Federated Government Obligations Fund, Institutional Class, 2.06%(b) | | | 1,048,163 | | | | 1,048,163 | |

Total Money Market Funds (Cost $1,048,163) | | | | | | | 1,048,163 | |

| | | | | | | | | |

Total Investments — 99.68% (Cost $186,509,612) | | | | | | | 205,158,656 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.32% | | | | | | | 665,016 | |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 205,823,672 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2018. |

12 | See accompanying notes which are an integral part of these financial statements. | |

Dana Small Cap Equity Fund

Schedule of Investments

October 31, 2018

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.20% | | | | | | | | |

Communication Services — 3.29% | | | | | | | | |

Marcus Corporation (The) | | | 7,838 | | | $ | 305,839 | |

Vonage Holdings Corporation(a) | | | 25,680 | | | | 340,517 | |

| | | | | | | | 646,356 | |

Consumer Discretionary — 12.02% | | | | | | | | |

Boot Barn Holdings, Inc.(a) | | | 15,477 | | | | 381,972 | |

Boyd Gaming Corporation | | | 10,408 | | | | 276,436 | |

G-III Apparel Group Ltd.(a) | | | 9,324 | | | | 371,655 | |

Marriott Vacations Worldwide Corporation | | | 3,718 | | | | 329,006 | |

Ruth's Hospitality Group, Inc. | | | 12,059 | | | | 325,955 | |

Urban Outfitters, Inc.(a) | | | 9,058 | | | | 357,429 | |

Weight Watchers International, Inc.(a) | | | 4,862 | | | | 321,378 | |

| | | | | | | | 2,363,831 | |

Consumer Staples — 2.86% | | | | | | | | |

Central Garden & Pet Company(a) | | | 8,041 | | | | 261,172 | |

Chefs' Warehouse, Inc. (The)(a) | | | 8,933 | | | | 300,416 | |

| | | | | | | | 561,588 | |

Energy — 4.63% | | | | | | | | |

Delek US Holdings, Inc. | | | 5,168 | | | | 189,769 | |

Matador Resources Company(a) | | | 8,591 | | | | 247,765 | |

ProPetro Holding Corporation(a) | | | 17,498 | | | | 308,840 | |

SRC Energy, Inc.(a) | | | 23,280 | | | | 164,822 | |

| | | | | | | | 911,196 | |

Financials — 16.76% | | | | | | | | |

Berkshire Hills Bancorp, Inc. | | | 9,378 | | | | 312,944 | |

Cadence Bancorporation | | | 13,652 | | | | 301,163 | |

CenterState Banks Corporation | | | 12,532 | | | | 308,037 | |

First Bancorp | | | 9,401 | | | | 346,802 | |

First Merchants Corporation | | | 7,482 | | | | 311,326 | |

Primerica, Inc. | | | 3,664 | | | | 402,087 | |

Stifel Financial Corporation | | | 7,263 | | | | 332,064 | |

United Community Banks, Inc. | | | 12,570 | | | | 312,616 | |

Universal Insurance Holdings, Inc. | | | 8,725 | | | | 366,276 | |

Western Alliance Bancorporation(a) | | | 6,337 | | | | 305,697 | |

| | | | | | | | 3,299,012 | |

Health Care — 15.52% | | | | | | | | |

AMN Healthcare Services, Inc.(a) | | | 5,063 | | | | 256,289 | |

ANI Pharmaceuticals, Inc.(a) | | | 4,898 | | | | 237,700 | |

BioTelemetry, Inc.(a) | | | 6,458 | | | | 375,210 | |

| | See accompanying notes which are an integral part of these financial statements. | 13 |

Dana Small Cap Equity Fund

Schedule of Investments (continued)

October 31, 2018

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.20% — (continued) |

Health Care — (continued) |

Corcept Therapeutics, Inc.(a) | | | 21,150 | | | $ | 248,512 | |

Emergent BioSolutions, Inc.(a) | | | 5,266 | | | | 322,227 | |

HMS Holdings Corporation(a) | | | 11,344 | | | | 326,934 | |

Horizon Pharma plc(a) | | | 17,874 | | | | 325,485 | |

Ligand Pharmaceuticals, Inc., Class B(a) | | | 1,658 | | | | 273,255 | |

Merit Medical Systems, Inc.(a) | | | 6,475 | | | | 369,852 | |

Tabula Rasa HealthCare, Inc.(a) | | | 4,303 | | | | 317,906 | |

| | | | | | | | 3,053,370 | |

Industrials — 15.27% | | | | | | | | |

ASGN, Inc.(a) | | | 4,209 | | | | 282,340 | |

Comfort Systems USA, Inc. | | | 7,213 | | | | 385,752 | |

Echo Global Logistics, Inc.(a) | | | 9,766 | | | | 251,084 | |

Harsco Corporation(a) | | | 13,009 | | | | 357,358 | |

MasTec, Inc.(a) | | | 6,359 | | | | 276,680 | |

Patrick Industries, Inc.(a) | | | 5,434 | | | | 236,433 | |

SkyWest, Inc. | | | 5,430 | | | | 311,085 | |

Tetra Tech, Inc. | | | 5,435 | | | | 358,927 | |

Timken Company (The) | | | 6,337 | | | | 250,628 | |

TriNet Group, Inc.(a) | | | 6,226 | | | | 292,559 | |

| | | | | | | | 3,002,846 | |

Information Technology — 14.83% | | | | | | | | |

Alarm.com Holdings, Inc.(a) | | | 6,335 | | | | 281,781 | |

Bottomline Technologies (de), Inc.(a) | | | 4,262 | | | | 284,020 | |

Five9, Inc.(a) | | | 7,111 | | | | 279,889 | |

Mellanox Technologies Ltd.(a) | | | 4,240 | | | | 359,086 | |

MKS Instruments, Inc. | | | 3,693 | | | | 272,137 | |

Quantenna Communications, Inc.(a) | | | 16,466 | | | | 295,729 | |

RealPage, Inc.(a) | | | 5,559 | | | | 294,627 | |

Rudolph Technologies, Inc.(a) | | | 12,394 | | | | 257,671 | |

Trade Desk, Inc. (The), Class A(a) | | | 2,447 | | | | 302,326 | |

Upland Software, Inc.(a) | | | 9,194 | | | | 289,979 | |

| | | | | | | | 2,917,245 | |

Materials — 3.60% | | | | | | | | |

AdvanSix, Inc.(a) | | | 8,234 | | | | 228,411 | |

Ferro Corporation(a) | | | 14,140 | | | | 239,532 | |

PolyOne Corporation | | | 7,430 | | | | 240,063 | |

| | | | | | | | 708,006 | |

14 | See accompanying notes which are an integral part of these financial statements. | |

Dana Small Cap Equity Fund

Schedule of Investments (continued)

October 31, 2018

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.20% — (continued) |

Real Estate — 7.07% | | | | | | | | |

CoreSite Realty Corporation | | | 3,413 | | | $ | 320,344 | |

Monmouth Real Estate Investment Corporation, Class A | | | 21,707 | | | | 324,737 | |

Preferred Apartment Communities, Inc., Class A | | | 22,006 | | | | 370,801 | |

STAG Industrial, Inc. | | | 14,163 | | | | 374,753 | |

| | | | | | | | 1,390,635 | |

Utilities — 3.35% | | | | | | | | |

Chesapeake Utilities Corporation | | | 4,058 | | | | 322,408 | |

Southwest Gas Holdings, Inc. | | | 4,354 | | | | 336,434 | |

| | | | | | | | 658,842 | |

Total Common Stocks (Cost $18,319,124) | | | | | | | 19,512,927 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 0.94% | | | | | | | | |

| | | | | | | | | |

Federated Government Obligations Fund, Institutional Class, 2.06%(b) | | | 184,439 | | | | 184,439 | |

Total Money Market Funds (Cost $184,439) | | | | | | | 184,439 | |

| | | | | | | | | |

Total Investments — 100.14% (Cost $18,503,563) | | | | | | | 19,697,366 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.14)% | | | | | | | (28,507 | ) |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 19,668,859 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of October 31, 2018. |

The sectors shown on the schedules of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

| | See accompanying notes which are an integral part of these financial statements. | 15 |

Dana Funds

Statements of Assets and Liabilities

October 31, 2018

| | | Dana Large Cap

Equity Fund | | | Dana Small Cap

Equity Fund | |

Assets | | | | |

Investments in securities at fair value (cost $186,509,612 and $18,503,563) | | $ | 205,158,656 | | | $ | 19,697,366 | |

Receivable for fund shares sold | | | 81,949 | | | | — | |

Receivable for investments sold | | | 751,661 | | | | — | |

Dividends receivable | | | 188,756 | | | | 1,966 | |

Receivable from Adviser | | | — | | | | 2,908 | |

Prepaid expenses | | | 20,494 | | | | 21,315 | |

Total Assets | | | 206,201,516 | | | | 19,723,555 | |

Liabilities | | | | |

Payable for fund shares redeemed | | | 221,442 | | | | 20,612 | |

Payable to Adviser | | | 101,025 | | | | — | |

Payable for Distribution Fees | | | 6,289 | | | | 770 | |

Payable to Administrator | | | 14,698 | | | | 7,583 | |

Payable to trustees | | | 2,455 | | | | 1,512 | |

Other accrued expenses | | | 31,935 | | | | 24,219 | |

Total Liabilities | | | 377,844 | | | | 54,696 | |

Net Assets | | $ | 205,823,672 | | | $ | 19,668,859 | |

Net Assets consist of: | | | | | | | | |

Paid-in capital | | | 170,877,630 | | | | 17,220,259 | |

Accumulated earnings | | | 34,946,042 | | | | 2,448,600 | |

Net Assets | | $ | 205,823,672 | | | $ | 19,668,859 | |

Institutional Class: | | | | | | | | |

Net Assets | | $ | 176,953,590 | | | $ | 16,195,986 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 7,915,989 | | | | 1,460,193 | |

Net asset value, offering and redemption price per share | | $ | 22.35 | | | $ | 11.09 | |

Investor Class: | | | | | | | | |

Net Assets | | $ | 28,870,082 | | | $ | 3,472,873 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,291,550 | | | | 315,238 | |

Net asset value, offering and redemption price per share | | $ | 22.35 | | | $ | 11.02 | |

16 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Operations

For the year ended October 31, 2018

| | | Dana Large Cap

Equity Fund | | | Dana Small Cap

Equity Fund | |

Investment Income | | | | | | | | |

Dividend income | | $ | 4,524,853 | | | $ | 153,729 | |

Total investment income | | | 4,524,853 | | | | 153,729 | |

Expenses | | | | | | | | |

Investment Adviser | | | 1,438,158 | | | | 167,066 | |

Administration | | | 106,033 | | | | 38,000 | |

Distribution (12b-1), Investor Class | | | 82,940 | | | | 11,815 | |

Fund accounting | | | 55,986 | | | | 30,001 | |

Registration | | | 47,231 | | | | 35,988 | |

Custodian | | | 29,290 | | | | 5,774 | |

Transfer agent | | | 22,895 | | | | 23,400 | |

Legal | | | 21,665 | | | | 21,665 | |

Audit and tax preparation | | | 18,200 | | | | 18,200 | |

Insurance | | | 17,600 | | | | 4,305 | |

Printing | | | 16,299 | | | | 3,842 | |

Trustee | | | 12,032 | | | | 7,917 | |

Interest | | | 4,072 | | | | 652 | |

Miscellaneous | | | 20,397 | | | | 17,497 | |

Total expenses | | | 1,892,798 | | | | 386,122 | |

Fees contractually waived by Adviser | | | (267,323 | ) | | | (170,979 | ) |

Net operating expenses | | | 1,625,475 | | | | 215,143 | |

Net investment income (loss) | | | 2,899,378 | | | | (61,414 | ) |

Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

Net realized gain on investment securities transactions | | | 16,014,437 | | | | 1,549,728 | |

Net change in unrealized appreciation (depreciation) on investment securities | | | (13,223,401 | ) | | | (2,109,601 | ) |

Net realized and change in unrealized gain (loss) on investments | | | 2,791,036 | | | | (559,873 | ) |

Net increase (decrease) in net assets resulting from operations | | $ | 5,690,414 | | | $ | (621,287 | ) |

| | See accompanying notes which are an integral part of these financial statements. | 17 |

Dana Funds

Statements of Changes in Net Assets

| | | Dana Large Cap Equity Fund | | | Dana Small Cap Equity Fund | |

| | | For the Year

Ended

October 31, 2018 | | | For the Year

Ended

October 31, 2017(a) | | | For the Year

Ended

October 31, 2018 | | | For the Year

Ended

October 31, 2017(a) | |

Increase (Decrease) in Net Assets due to: | | | | | | | | | | | | |

Operations | | | | | | | | | | | | |

Net investment income (loss) | | $ | 2,899,378 | | | $ | 2,094,303 | | | $ | (61,414 | ) | | $ | (13,430 | ) |

Net realized gain on investment securities transactions | | | 16,014,437 | | | | 13,094,901 | | | | 1,549,728 | | | | 63,928 | |

Net change in unrealized appreciation (depreciation) of investment securities | | | (13,223,401 | ) | | | 25,349,579 | | | | (2,109,601 | ) | | | 2,944,021 | |

Net increase (decrease) in net assets resulting from operations | | | 5,690,414 | | | | 40,538,783 | | | | (621,287 | ) | | | 2,994,519 | |

Distributions to Shareholders from Earnings | | | | | | | | |

Class A (b) | | | — | | | | (18,088 | ) | | | | | | | | |

Institutional Class | | | (7,459,066 | ) | | | (1,652,850 | ) | | | (4,138 | ) | | | (12,219 | ) |

Investor Class (b) | | | (1,701,334 | ) | | | (466,217 | ) | | | — | | | | (3,424 | ) |

Total distributions | | | (9,160,400 | ) | | | (2,137,155 | ) | | | (4,138 | ) | | | (15,643 | ) |

Capital Transactions – Class A(b) | | | | | | | | | | | | |

Proceeds from shares sold | | | — | | | | 88,095 | | | | | | | | | |

Shares redeemed in connection with class consolidation | | | — | | | | (1,435,747 | ) | | | | | | | | |

Reinvestment of distributions | | | — | | | | 16,810 | | | | | | | | | |

Amount paid for shares redeemed | | | — | | | | (331,496 | ) | | | | | | | | |

Total – Class A | | | — | | | | (1,662,338 | ) | | | | | | | | |

18 | See accompanying notes which are an integral part of these financial statements. | |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Large Cap Equity Fund | | | Dana Small Cap Equity Fund | |

| | | For the Year

Ended

October 31, 2018 | | | For the Year

Ended

October 31, 2017(a) | | | For the Year

Ended

October 31, 2018 | | | For the Year

Ended

October 31, 2017(a) | |

Capital Transactions - Institutional Class | | | | | | | | |

Proceeds from shares sold | | $ | 111,001,907 | | | $ | 43,190,437 | | | $ | 5,280,124 | | | $ | 6,663,858 | |

Reinvestment of distributions | | | 5,913,368 | | | | 163,064 | | | | 3,493 | | | | 11,845 | |

Amount paid for shares redeemed | | | (70,457,043 | ) | | | (76,805,815 | ) | | | (2,548,354 | ) | | | (1,194,695 | ) |

Proceeds from redemption fees (c) | | | — | | | | 4,007 | | | | — | | | | — | |

Total – Institutional Class | | | 46,458,232 | | | | (33,448,307 | ) | | | 2,735,263 | | | | 5,481,008 | |

Capital Transactions – Investor Class(b) | | | | | | | | | | | | |

Proceeds from shares sold | | | 1,935,954 | | | | 1,374,972 | | | | 320,769 | | | | 2,501,527 | |

Shares issued in connection with class consolidation | | | — | | | | 1,435,747 | | | | — | | | | — | |

Reinvestment of distributions | | | 1,700,677 | | | | 459,195 | | | | — | | | | 3,424 | |

Amount paid for shares redeemed | | | (16,049,342 | ) | | | (3,707,148 | ) | | | (3,548,803 | ) | | | (356,670 | ) |

Total – Investor Class | | | (12,412,711 | ) | | | (437,234 | ) | | | (3,228,034 | ) | | | 2,148,281 | |

Net increase (decrease) in net assets resulting from capital transactions | | | 34,045,521 | | | | (35,547,879 | ) | | | (492,771 | ) | | | 7,629,289 | |

Total Increase (Decrease) in Net Assets | | | 30,575,535 | | | | 2,853,749 | | | | (1,118,196 | ) | | | 10,608,165 | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of year | | | 175,248,137 | | | | 172,394,388 | | | | 20,787,055 | | | | 10,178,890 | |

End of year | | $ | 205,823,672 | | | $ | 175,248,137 | | | $ | 19,668,859 | | | $ | 20,787,055 | |

| | See accompanying notes which are an integral part of these financial statements. | 19 |

Dana Funds

Statements of Changes in Net Assets (continued)

| | | Dana Large Cap Equity Fund | | | Dana Small Cap Equity Fund | |

| | | For the Year

Ended

October 31, 2018 | | | For the Year

Ended

October 31, 2017(a) | | | For the Year

Ended

October 31, 2018 | | | For the Year

Ended

October 31, 2017(a) | |

Share Transactions – Class A(b) | | | | | | | | | | | | |

Shares sold | | | — | | | | 4,307 | | | | | | | | | |

Shares redeemed in connection with class consolidation | | | — | | | | (64,455 | ) | | | | | | | | |

Shares issued in reinvestment of distributions | | | — | | | | 835 | | | | | | | | | |

Shares redeemed | | | — | | | | (16,663 | ) | | | | | | | | |

Total – Class A | | | — | | | | (75,976 | ) | | | | | | | | |

Share Transactions - Institutional Class | | | | | | | | | | | | |

Shares sold | | | 4,762,130 | | | | 2,049,462 | | | | 451,665 | | | | 628,613 | |

Shares issued in reinvestment of distributions | | | 256,328 | | | | 8,132 | | | | 298 | | | | 1,113 | |

Shares redeemed | | | (3,032,827 | ) | | | (3,965,578 | ) | | | (217,413 | ) | | | (110,673 | ) |

Total – Institutional Class | | | 1,985,631 | | | | (1,907,984 | ) | | | 234,550 | | | | 519,053 | |

Share Transactions - Investor Class(b) | | | | | | | | | | | | |

Shares sold | | | 83,654 | | | | 66,528 | | | | 27,535 | | | | 240,680 | |

Shares issued in connection with class consolidation | | | — | | | | 64,333 | | | | — | | | | — | |

Shares issued in reinvestment of distributions | | | 73,934 | | | | 22,704 | | | | — | | | | 323 | |

Shares redeemed | | | (674,880 | ) | | | (184,163 | ) | | | (307,754 | ) | | | (33,941 | ) |

Total – Investor Class | | | (517,292 | ) | | | (30,598 | ) | | | (280,219 | ) | | | 207,062 | |

(a) | For the year ended October 31, 2017, all distributions to shareholders from earnings were from net investment income. As of October 31, 2017, accumulated net investment income (loss) for the Dana Large Cap Equity Fund and the Dana Small Cap Equity Fund were $186,203 and $(25,143), respectively. |

(b) | Effective October 13, 2017, the outstanding Class A shares of the Dana Large Cap Equity Fund were exchanged for Class N shares of the Dana Large Cap Equity Fund and immediately following the class exchange Class N shares were re-designated as Investor Class shares. |

(c) | Prior to February 28, 2017, the Funds charged a 2.00% redemption fee on shares redeemed within 60 days of purchase. |

20 | See accompanying notes which are an integral part of these financial statements. | |

This page is intentionally left blank.

Dana Large Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 22.64 | | | $ | 17.67 | | | $ | 18.22 | | | $ | 18.52 | | | $ | 17.19 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.32 | | | | 0.32 | | | | 0.26 | (a) | | | 0.19 | | | | 0.26 | |

Net realized and unrealized gain (loss) on investments | | | 0.45 | | | | 4.96 | | | | (0.56 | ) | | | 0.52 | (b) | | | 2.44 | |

Total from investment operations | | | 0.77 | | | | 5.28 | | | | (0.30 | ) | | | 0.71 | | | | 2.70 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.32 | ) | | | (0.31 | ) | | | (0.25 | ) | | | (0.19 | ) | | | (0.25 | ) |

Net realized gains | | | (0.74 | ) | | | — | | | | — | | | | (0.83 | ) | | | (1.12 | ) |

Total distributions | | | (1.06 | ) | | | (0.31 | ) | | | (0.25 | ) | | | (1.02 | ) | | | (1.37 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | (c) | | | — | (c) | | | 0.01 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.67 | | | $ | 18.22 | | | $ | 18.52 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (d) | | | 3.27 | % | | | 30.11 | % | | | (1.66 | )% | | | 3.89 | % | | | 16.60 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 176,954 | | | $ | 134,291 | | | $ | 138,540 | | | $ | 117,663 | | | $ | 6,919 | |

Before waiver: | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.86 | % | | | 0.92 | % | | | 0.91 | % | | | 1.00 | % | | | 1.68 | % |

After waiver: | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.73 | % | | | 0.74 | %(e) | | | 0.73 | % | | | 0.73 | % | | | 0.73 | % |

Ratio of net investment income to average net assets | | | 1.41 | % | | | 1.48 | % | | | 1.45 | % | | | 1.25 | % | | | 1.34 | % |

Portfolio turnover rate (f) | | | 58 | % | | | 50 | % | | | 69 | % | | | 45 | % | | | 57 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Per share net investment income has been determined on the basis of average shares outstanding during the year. |

(b) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

(c) | Rounds to less than $0.005 per share. |

(d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(e) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.73% for the fiscal year ended October 31, 2017. |

(f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

22 | See accompanying notes which are an integral part of these financial statements. | |

Dana Large Cap Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each year)

| | | Years Ended October 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 22.64 | | | $ | 17.68 | | | $ | 18.23 | | | $ | 18.54 | | | $ | 17.19 | |

| | | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.28 | | | | 0.24 | | | | 0.22 | (a) | | | 0.18 | | | | 0.19 | |

Net realized and unrealized gain (loss) on investments | | | 0.43 | | | | 4.98 | | | | (0.57 | ) | | | 0.49 | (b) | | | 2.46 | |

Total from investment operations | | | 0.71 | | | | 5.22 | | | | (0.35 | ) | | | 0.67 | | | | 2.65 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.26 | ) | | | (0.26 | ) | | | (0.20 | ) | | | (0.15 | ) | | | (0.18 | ) |

Net realized gains | | | (0.74 | ) | | | — | | | | — | | | | (0.83 | ) | | | (1.12 | ) |

Total distributions | | | (1.00 | ) | | | (0.26 | ) | | | (0.20 | ) | | | (0.98 | ) | | | (1.30 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | (c) | | | — | (c) | | | — | (c) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 22.35 | | | $ | 22.64 | | | $ | 17.68 | | | $ | 18.23 | | | $ | 18.54 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (d) | | | 3.01 | % | | | 29.72 | % | | | (1.91 | )% | | | 3.61 | % | | | 16.23 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 28,870 | | | $ | 40,957 | | | $ | 32,514 | | | $ | 36,909 | | | $ | 29,197 | |

Before waiver: | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 1.11 | % | | | 1.17 | % | | | 1.16 | % | | | 1.25 | % | | | 1.93 | % |

After waiver: | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.98 | % | | | 0.99 | %(e) | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % |

Ratio of net investment income to average net assets | | | 1.17 | % | | | 1.20 | % | | | 1.22 | % | | | 1.00 | % | | | 1.09 | % |

Portfolio turnover rate (f) | | | 58 | % | | | 50 | % | | | 69 | % | | | 45 | % | | | 57 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Per share net investment income has been determined on the basis of average shares outstanding during the year. |

(b) | The amount shown for a share outstanding throughout the year does not accord with the change in aggregate gains and losses in the portfolio of securities during the year because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the year. |

(c) | Rounds to less than $0.005 per share. |

(d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(e) | This ratio includes the impact of overdraft fees. If this cost had been excluded, the ratio of expenses to average net assets would have been 0.98% for the fiscal year ended October 31, 2017. |

(f) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | See accompanying notes which are an integral part of these financial statements. | 23 |

Dana Small Cap Equity Fund – Institutional Class

Financial Highlights

(For a share outstanding during each period)

| | | Years Ended

October 31, | | | For the

Period

Ended

October 31, | |

| | | 2018 | | | 2017 | | | 2016(a) | |

Selected Per Share Data: | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.43 | | | $ | 9.30 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | |

Net investment income (loss) | | | (0.03 | ) | | | — | (b) | | | 0.01 | |

Net realized and unrealized gain (loss) on investments | | | (0.31 | ) | | | 2.14 | | | | (0.70 | )(c) |

Total from investment operations | | | (0.34 | ) | | | 2.14 | | | | (0.69 | ) |

| | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | |

Net investment income | | | — | (b) | | | (0.01 | ) | | | (0.01 | ) |

Total distributions | | | — | (b) | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | (b) |

| | | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.09 | | | $ | 11.43 | | | $ | 9.30 | |

| | | | | | | | | | | | | |

Total Return (d) | | | (2.95 | )% | | | 23.08 | % | | | (6.87 | )%(e) |

| | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 16,196 | | | $ | 14,011 | | | $ | 6,575 | |

Before waiver: | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 1.75 | % | | | 2.02 | % | | | 4.11 | %(f) |

After waiver: | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 0.95 | % | | | 0.95 | % | | | 0.95 | %(f) |

Ratio of net investment income (loss) to average net assets | | | (0.24 | )% | | | — | % | | | 0.12 | %(f) |

Portfolio turnover rate (g) | | | 78 | % | | | 58 | % | | | 54 | %(e) |

| | | | | | | | | | | | | |

(a) | For the period November 3, 2015(commencement of operations) to October 31, 2016. |

(b) | Rounds to less than $0.005 per share. |

(c) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

(d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(g) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

24 | See accompanying notes which are an integral part of these financial statements. | |

Dana Small Cap Equity Fund – Investor Class

Financial Highlights

(For a share outstanding during each period)

| | | Years Ended

October 31, | | | For the

Period

Ended

October 31, | |

| | | 2018 | | | 2017 | | | 2016(a) | |

Selected Per Share Data: | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 11.38 | | | $ | 9.28 | | | $ | 10.00 | |

| | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | |

Net investment income (loss) | | | (0.08 | ) | | | (0.02 | ) | | | — | (b) |

Net realized and unrealized gain (loss) on investments | | | (0.28 | ) | | | 2.13 | | | | (0.71 | )(c) |

Total from investment operations | | | (0.36 | ) | | | 2.11 | | | | (0.71 | ) |

| | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.01 | ) | | | (0.01 | ) |

Total distributions | | | — | | | | (0.01 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | |

Redemption fees | | | — | | | | — | | | | — | (b) |

| | | | | | | | | | | | | |

Net asset value, end of period | | $ | 11.02 | | | $ | 11.38 | | | $ | 9.28 | |

| | | | | | | | | | | | | |

Total Return (d) | | | (3.16 | )% | | | 22.73 | % | | | (7.13 | )%(e) |

| | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 3,473 | | | $ | 6,776 | | | $ | 3,604 | |

Before waiver: | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 2.00 | % | | | 2.27 | % | | | 4.53 | %(f) |

After waiver: | | | | | | | | | | | | |

Ratio of expenses to average net assets | | | 1.20 | % | | | 1.20 | % | | | 1.20 | %(f) |

Ratio of net investment loss to average net assets | | | (0.46 | )% | | | (0.25 | )% | | | (0.10 | )%(f) |

Portfolio turnover rate (g) | | | 78 | % | | | 58 | % | | | 54 | %(e) |

| | | | | | | | | | | | | |

(a) | For the period November 3, 2015(commencement of operations) to October 31, 2016. |

(b) | Rounds to less than $0.005 per share. |

(c) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

(d) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

(g) | Portfolio turnover is calculated on the basis on the Fund as a whole without distinguishing among the classes of shares. |

| | See accompanying notes which are an integral part of these financial statements. | 25 |

Dana Funds

Notes to the Financial Statements

October 31, 2018

NOTE 1. ORGANIZATION

The Dana Large Cap Equity Fund (the “Large Cap Fund”) and the Dana Small Cap Equity Fund (the “Small Cap Fund”) (each a “Fund” and collectively, the “Funds”) are each an open-end diversified series of Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (“Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. Each Fund is one of a series of funds currently authorized by the Board. The investment adviser to the Funds is Dana Investment Advisors, Inc. (the “Adviser”). Each Fund seeks long-term growth of capital.

The Large Cap Fund and Small Cap Fund currently offer Investor Class shares and Institutional Class shares. Effective on the close of business on October 13, 2017, Class A shares were consolidated into Class N shares of the Large Cap Fund which was subsequently re-designated Investor Class shares. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as declared by the Board. Prior to February 28, 2017, all share classes imposed a 2.00% redemption fee on shares redeemed within 60 days of purchase.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. These policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Funds make no provision for federal income or excise tax. Each Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. Each Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended October 31, 2018, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the statements of operations when incurred. During the fiscal year ended October 31, 2018, the Funds did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major

26

Dana Funds

Notes to the Financial Statements (continued)

October 31, 2018

tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (as determined by the Board). Expenses attributable to any class are borne by that class. Income, realized gains and losses, unrealized appreciation and depreciation, and expenses are allocated to each class based on the net assets in relation to the relative net assets of the Fund.

Security Transactions and Related Income – The Funds follow industry practice and record security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method, if applicable. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds intend to distribute substantially all of their net investment income quarterly. The Funds intend to distribute their net realized long-term and short-term capital gains, if any, annually. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Funds.

For the fiscal year ended October 31, 2018, the Funds made the following reclassifications to increase (decrease) the components of net assets:

| | Paid-In

Capital | | | Accumulated

Earnings | |

Large Cap Fund | | $ | (1 | ) | | $ | 1 | |

Small Cap Fund | | | (9,283 | ) | | | 9,283 | |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

All investments in securities are recorded at their estimated fair value. Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

27

Dana Funds

Notes to the Financial Statements (continued)

October 31, 2018

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely

28

Dana Funds

Notes to the Financial Statements (continued)

October 31, 2018

traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Funds’ investments as of October 31, 2018:

Large Cap Fund | | Valuation Inputs | | | | | |

Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks(a) | | $ | 204,110,493 | | | $ | — | | | $ | — | | | $ | 204,110,493 | |

Money Market Funds | | | 1,048,163 | | | | — | | | | — | | | | 1,048,163 | |

Total | | $ | 205,158,656 | | | $ | — | | | $ | — | | | $ | 205,158,656 | |

Small Cap Fund | | Valuation Inputs | | | | | |

Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks(a) | | $ | 19,512,927 | | | $ | — | | | $ | — | | | $ | 19,512,927 | |

Money Market Funds | | | 184,439 | | | | — | | | | — | | | | 184,439 | |

Total | | $ | 19,697,366 | | | $ | — | | | $ | — | | | $ | 19,697,366 | |

(a) | Refer to Schedule of Investments for sector classifications. |

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Adviser, under the terms of the management agreement for each Fund, manages the Funds’ investments subject to oversight of the Board. As compensation for its management services, the Funds are obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.65% and 0.75% of the average daily net assets of the Large Cap Fund and the Small Cap Fund, respectively. Prior to July 1, 2018, the Funds were obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.70% and 0.80% of the average daily net assets of the Large Cap Fund and the Small Cap Fund, respectively. For the fiscal year ended October 31, 2018, the Adviser earned fees of $1,438,158 from the Large Cap Fund and $167,066 from the Small Cap Fund before the waivers described below. At October 31, 2018, the Large Cap Fund owed the Adviser $101,025 and the Adviser owed the Small Cap Fund $2,908.

The Adviser has contractually agreed to waive its management fee and/or reimburse certain operating expenses through February 28, 2019, but only to the extent necessary so that the Funds’ net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and

29

Dana Funds

Notes to the Financial Statements (continued)

October 31, 2018

indirect expenses (such as “acquired funds fees and expenses”) do not exceed 0.73% for Institutional Class and Investor Class for the Large Cap Fund and do not exceed 0.95% for the Institutional Class and Investor Class for the Small Cap Fund.

Each fee waiver or expense reimbursement by the Adviser is subject to repayment by the applicable Fund within three years following the date in which the fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation that is in effect at the time of the repayment or at the time of the fee waiver or expense reimbursement, whichever is lower. The contractual agreement is in effect through February 28, 2019. The expense cap may not be terminated prior to this date except by the Board. For the fiscal year ended October 31, 2018, the Adviser waived fees of $267,323 from the Large Cap Fund and $170,979 from the Small Cap Fund. As of October 31, 2018, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements of $857,905 and $494,903 from the Large Cap Fund and Small Cap Fund, respectively, pursuant to the aforementioned conditions, no later than October 31, 2021.

The Trust retains Ultimus Asset Services, LLC (“Ultimus” or “Administrator”), to provide the Funds with administration, compliance (including a chief compliance officer), fund accounting, and transfer agent services, including all regulatory reporting. Prior to April 12, 2018, Ultimus Asset Services, LLC, an affiliate of the Administrator, provided these services. Expenses incurred by the Funds for these services are allocated to the individual Funds based on each Fund’s relative net assets.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares.

| | Large Cap

Fund | | | Small Cap

Fund | |

Administration | | $ | 106,033 | | | $ | 38,000 | |

Fund accounting | | | 55,986 | | | | 30,001 | |

Transfer agent | | | 22,895 | | | | 23,400 | |

Payable to Administrator | | | 14,698 | | | | 7,583 | |