united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22208 | |

| Valued Advisers Trust |

| (Exact name of registrant as specified in charter) |

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

Ultimus Fund Solutions, LLC

Attn: Gregory Knoth

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | 5/31 | |

| | | |

| Date of reporting period: | 5/31/2019 | |

Item 1. Reports to Stockholders.

BFS Equity Fund

ANNUAL REPORT

May 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (855) 575-2430 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (855) 575-2430. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

185 Asylum Street ● City Place II ● Hartford, CT 06103 ● (855) 575-2430

BFS Equity Fund

Letter to Shareholders

Dear Fellow Shareholders,

This annual report covers the period June 1, 2018 through May 31, 2019 – the BFS Equity Fund’s fifth full fiscal year.

The BFS Equity Fund (the “Fund”) was launched on November 8, 2013, with initial funds from investors of $1.1 million. On June 1, 2018, at the start of the Fund’s fiscal year, the Fund had net assets of $31.7 million. During the fiscal year, the net assets of the Fund increased 13.3% to $36.0 million, as of May 31, 2019. This growth was driven by inflows from investors into the Fund, as well as by the positive investment return achieved by the Fund over the past fiscal year. As of May 31, 2019, there were approximately 635 investors in the Fund.

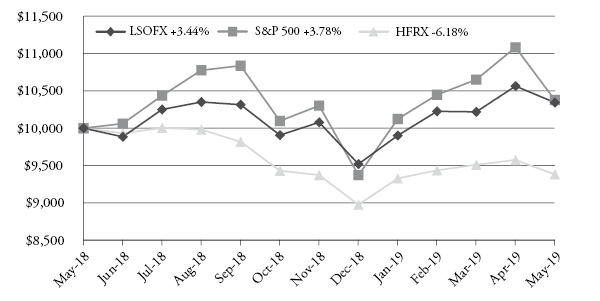

The BFS Equity Fund achieved a total return of 6.84% for the fiscal year commencing June 1, 2018 and ending May 31, 2019, outperforming the S&P 500® Index (“S&P 500”) total return of 3.78% and the Dow Jones Industrial Average (“Dow Jones”) total return of 4.05% for the same period. For the three-year period commencing June 1, 2016 and ending May 31, 2019, the Fund achieved an annualized total return of 11.72%, equaling the S&P 500 total return of 11.72%.

This report includes a commentary from the Lead Portfolio Manager, Tim Foster, and Co-Portfolio Managers, Tom Sargent and Keith LaRose. You will also find a listing of the portfolio holdings as of May 31, 2019, as well as financial statements and detailed information about the performance and positioning of the BFS Equity Fund.

The current economic expansion is now the longest on record. There are indications that the U.S. economy may well continue to expand for some years. The S&P 500 just hit its all-time high, inflation is less than 2%, interest rates are declining, unemployment continues at a low level, and the government continues to spend at a high level. Also, it appears highly likely that the Federal Reserve (the “Fed”) will begin to cut rates – possibly as many as two more times in the next six months – as it continues to shift to a more accommodative monetary policy. These are all signs that the economy will continue to expand in 2019.

1

Nonetheless, we believe that an element of caution is appropriate, at this time. Corporate earnings growth has slowed, some sectors of the stock market have outsized valuations, there is the potential for a more pronounced inverted yield curve, and there is a growing certainty that the daunting strategic issues on trade between China and the U.S. will remain unresolved for an extended period. Geo-political hotspots in the Persian Gulf and North Korea and negative market yields on as much as $13 trillion in sovereign debt worldwide, including Germany, Japan, Sweden, and Switzerland, add to the clouds of worry on the horizon.

In closing, it is important to reiterate our belief that, now more than ever, our investment strategy of investing in quality growth stocks purchased with a risk-mitigating approach and positioned to provide a margin of safety in the case of economic or market weakness is effective over the longer term. We believe the Fund’s ownership of shares in quality companies with sound business models, strong brands, good balance sheets, professional management, and robust cash flow should be able to withstand market corrections, even bear markets, and perform well over the longer term.

The Portfolio Managers of the BFS Equity Fund and I are shareholders together with you. We thank you for the trust that you have placed in us to manage your assets.

Sincerely,

Stephen L. Willcox

President and CEO

Bradley, Foster & Sargent, Inc.

2

BFS Equity Fund

Portfolio Managers Letter

The BFS Equity Fund celebrated its fifth anniversary last fall. Since its inception, Fund assets have grown to approximately $36 million and the price per share of the BFS Equity Fund has grown from $10 to $15.40 at the close of the Fund’s fiscal year on May 31, 2019. Our shareholder base has broadened, but is still primarily client families and friends of Bradley, Foster & Sargent, as well as the principals of the firm. The Fund had a good year performance wise. Total return for the trailing twelve month period was +6.84% for the Fund, while the S&P 500 total return was +3.78%. For the six month period ending May 31, 2019, the Fund returned +3.31% versus +0.74% for the S&P 500. The stock market hit a peak valuation last September, then experienced a 20% swoon into Christmas Eve. By the end of April, however, the market had regained its former high. May was a challenging month, dropping 6%, but for the twelve month period, equity returns were positive and only modestly below the very long term averages.

Political rancor has been especially divisive as both parties have migrated further left and right leaving very little common ground in the middle. It has been both the best of times as well as the worst of times, depending on your perspective. Clearly, the good news has been that the economy continues to grow. During two quarters over the past year, real GDP growth exceeded the 3% mark for the first time in about five years. Labor markets have been robust. Unemployment is near an all-time low at 3.6%. Wages are growing 3.1% as measured by average hourly earnings. Both business and consumer confidence are high. Inflation has remained subdued. Depending on the inflation measure you choose, inflation lies somewhere between 1.5% and 2.5% - very close to the Federal Reserve Board’s stated target of 2%. Full employment and stable prices are the Fed’s primary (but generally conflicting) goals. It is evident the Fed has navigated its mission well, but not without controversy and not without a rather dramatic shift in the Fed’s stated course of policy.

Late last year, the Fed forecast a policy of continuing 25 basis point hikes to the Fed Funds rate with as many as four hikes expected for 2019. As the economy slowed into the fourth quarter last year and investors feared the potential for the economy to slip back into recession, a selling wave commenced culminating in the 20% correction into the end of the year. Between the declines in economic data, including the Leading Economic

3

Indicators as well as the Purchasing Manager surveys, and the stock rout, the Fed shifted to a wait and see, or “data dependent”, policy. By the end of May, Fed Funds futures shifted from a less than 20% chance of a rate cut to more than 80%.

When it comes to economic recoveries, sometimes slower is better. The past decade of below average growth sidestepped much of the historical inflationary pressures enabling the Fed to maintain an accommodative policy. With Fed Funds currently targeted at 2.25-2.5% and inflation running close to 2%, real interest rates are very close to zero – historically a still accommodative level. The dilemma that arises, however, is that low inflation expectations have kept longer maturity bonds at virtually the same level, thus flattening or slightly inverting the yield curve. An inverted yield curve has historically been a red flag to potential recession. But without higher real rates, higher inflation and more robust economic growth straining resources, modest economic growth can likely be further sustained and recession averted for the near future.

INVESTMENT STRATEGY

A year ago, with corporate earnings growth roaring along at a double-digit clip, it seemed likely a more traditional boom – bust economic cycle would play out. We forecast rising inflation as well as rising interest rates. We were wrong on both counts. The good news is that currently with modest economic growth, modest corporate earnings growth, modest inflation, stable interest rates AND a market P/E that does not appear too excessive, the market can continue in an upward trajectory.

In terms of risk, one of our primary concerns is the changing nature of the market itself. There has always been a rational case for passive investing – put your money in a broad equity index, leave it there and you will inevitably participate financially with the long term growth of the economy. Over the duration of this bull market cycle, the passive approach has gained the lion’s share of investable funds from both individual and institutional investors alike. This approach works wonderfully in a bull market, such as the last decade, but not so well when markets turn ugly. The key phrase above of “leaving it there” tends to get thrown under the bus when markets turn south. It is not rational to sell when stock prices go down. It is emotional, and emotions are a big driver to the cyclicality of markets. Adding fuel to that fire is the roughly one trillion dollars of assets that are invested in funds and ETFs with market momentum as a key algorithmic driver. Buy high, sell low. It makes no sense to the fundamental investor, but there is enough money chasing that strategy to inflame volatility. While there is not much the long-only investor can do about these sharp downdrafts when they occur from a level of reasonable

4

valuation, the fundamental investor can eschew the buying frenzies when valuations are driven to excessive levels. The past two 20% corrections we have endured during the past couple of years appear to be good examples of volatility driven funds adding fuel to the correction fire. Buying frenzies have occurred more on a sector rotational basis. Before this cycle reaches its final inning, we may see a tsunami of bond fund selling and stock fund buying to set the top for the cycle. Stay tuned!

Some signs of market “toppiness” are currently evident, primarily the IPO market with wild valuations chasing yet-to-be or may-never-to-be profitable cult stocks like Uber. On the other hand, best in class and globally preeminent companies like Caterpillar and Deere sell at below market P/E multiples with above average dividend yields. President Trump’s tariff tirades have been particularly challenging to the industrial sector, but we believe that has led to some very attractive values within the sector. A flat yield curve challenges net interest margins for the banks, but that challenge has led to very attractive valuations for money center banks like J.P. Morgan and Citicorp. The cry from Vermont for “Medicare For All” dealt a setback to the entire healthcare sector and in particular to managed care companies like United Health Group (UNH), but whether “Medicare As Is” or “Medicare For All” prevails, the economies of scale for UNH should ensure continued growth under either scenario.

One investment theme we like to think about is “companies the world can’t do without”. Often these companies carry lofty valuations due to their entrenched and durable competitive positioning. Some we own. Some we don’t. But it is worth spending some time trying to identify great candidates so when negative events do occur (that we view as temporary – not systemic), we will be in a position to establish new positions or add to our existing positions. Sometimes that negative event may just be a total market setback, as occurred in the fourth quarter of last year. Sometimes it is more specific, like regulatory initiatives or tariff threats. We mentioned Caterpillar and Deere. It is not that there aren’t other manufacturers of construction and agricultural equipment, but these two companies represent the leading technologies and highest quality of equipment. Further, their global dealership networks for sales and service present formidable moats around their share of market. Ecolab is another premier “can’t do without” fortress. Their products and services are not highly visible to consumers, but the cleaning, filtering, sterilizing products and services they provide are what keep many hotels, restaurants, energy and industrial companies humming. How about Disney? Is there a child on planet earth that has not

5

in some way come to love a Disney character or franchise? Thirty years ago, we all did without Google and Amazon, but not so today. These are companies that literally changed the world so we can no longer do without them!

INVESTMENT COMMENTARY

In both magnitude and duration, this recovery cycle has been the longest on record. Being such an outlier may in itself give one pause, but cycles are driven by excess. Excess valuation may be the top contender, but we are a long way from the 20+ market P/E multiples that set up the post Y2K 50% bear market. As well, the more recent bear market crash of 2008 was teed off by vastly over extended financial institution balance sheets and poor lending standards. It has taken many years and significant restructuring, but those excesses appear to be history now as well. The Nifty Fifty had its comeuppance back in the 1970’s. More recently, must own FAANG stocks appeared to have only one trajectory – until they didn’t anymore. Those companies are all doing fine, but there is now somewhat more rationality to their valuations of late. Bitcoin? Zero to $20,000 and back again. Billions vaporized by hacking. Hardly the store of value most folks would choose to store their wealth in. Cannabis stocks may be the latest poster children for excess valuation, but no doubt the better part of the currently listed cannabis stocks will end going up in smoke (sorry about that!).

Avoid hype. Seek value. Maintain investment disciplines. Consider the sustainability of the businesses you are buying. These are tenets that have served investors well over many, many market cycles, particularly if one believes we may be in the latter innings of the cycle, as we do.

Some sector highlights of the past twelve months follow:

Healthcare

Healthcare was the Fund’s largest sector weighting at 21.9% and also the Fund’s largest sector overweight versus the S&P 500 Healthcare sector at 14.2%. The overweight served the Fund well with performance of +22.1% versus the S&P 500 sector return of +7.7%. We maintained our strategy within the Healthcare sector to focus on life science equipment providers versus traditional pharmaceutical companies. Danaher was our top performer with a return of +33.8%, followed by Mettler Toledo at +31.3%. Our recent purchase of United Health Group (UNH) was the only negative performer in the sector with a return of -12.3%. Unfortunately, our purchase of UNH came just before the concept of “Medicare For All” surfaced, but we believe the company can do well even in the event politics swing in that direction.

6

Information Technology

The Information Technology sector was the Fund’s second largest weighting at 19.4%, a slight underweight to the S&P 500 Tech sector weighting of 21.2%. The Fund’s stock selection in the sector led to better returns relative to the S&P 500 Tech sector benchmark, returning +10.8% versus +4.4% for the S&P 500 Tech sector. First Data, Microsoft, ADP and Cisco were the Fund’s top contributors with returns of +28.6%, +27.2%, +25.7% and +25.4%, respectively. Coherent and Apple were the only losing positions returning -26.6% and -4.88%, respectively. Coherent was sold.

Industrials

The Fund’s Industrials sector holdings were the third largest sector weighting at 15.7% and a large overweight to the S&P 500 weighting of 9.3%. We generally believe the Industrials sector offers more attractive valuations than most other S&P 500 sectors. Industrials faced major headwinds during the past year, however, due to tariffs imposed by the president. We believe ultimately these tariffs will be negotiated with a favorable outcome for these companies, but the timing of resolution is still very uncertain. The Fund’s Industrials sector’s performance was a disappointing -7.1% versus -1.0% for the S&P 500 Industrials sector. Although we like, and continue to hold Caterpillar, Raytheon and 3M, all three hurt our absolute and relative sector performance with returns of -19.1%, -15.1% and -12.0%, respectively. The best performing industrial sector holding was Fortive at +5.1%.

Consumer Discretionary

The Fund was slightly underweight the Consumer Discretionary sector at 8.4% versus the S&P 500 at 10.2%. Relative performance in the sector was very good with the Fund returning +13.9% versus +5.9% for the S&P 500 Consumer Discretionary sector. The Fund’s standout performer was Starbucks with a +37.2% return. We had one negative return in the sector from NVR Corp at -8.1%. The position was subsequently sold.

Consumer Staples

As we mentioned in last year’s report, the world has changed in terms of consumer packaged goods. Consumer tastes have shifted from processed foods to fresh foods and the Consumer Staples sector has suffered. The Fund is underweight the sector at 6.8% versus the S&P 500 weighting of 7.4%. The Fund outperformed the S&P 500 in this sector with a return of +20.7% versus +15.6%, respectively. Mondelez reversed its negative

7

performance from the year before, returning +32.5%. Costco continues to be a big winner for the Fund and returned +22.1%. Kraft Heinz had a disastrous year, but the Fund’s loss was limited to -8.6% when the position was sold.

Communication Services

This sector, new to the S&P 500 last year, has a 10.4% weighting for the S&P 500. The Fund was underweight relative to the S&P 500 at 6.3%. Performance lagged the S&P 500 Communication Services sector, returning +7.2% versus +11.6% for the S&P 500. Former highfliers, Alphabet and Facebook, both had disappointing returns of +0.6% and -21.8%, respectively. The Fund’s big winner was Disney, which gained +34.9%. Facebook was sold due to a profound decline in support from users and advertisers alike, as well as adverse regulatory concerns. We see Alphabet and Disney as core long term holdings.

Financials

With the flat to slightly inverted yield curve serving as a headwind for the sector, the Fund is underweight the Financials sector at 10.4% versus 13.2% for the S&P 500 Financials sector. The underweighting, as well as stock selection, were both helpful in generating a +6.5% return versus -2.3% for the S&P 500. American Express lead the gainers with a +18.4% return, followed by Chubb with a +14.3% return. Banks were particularly depressed by the flat yield curve, with J.P. Morgan gaining only +1.8%, while Citigroup lost -4.3%.

Energy

Energy stocks have been a challenge with falling oil prices most of the past year. The Fund is underweighted at 3.7% versus 4.9% for the S&P 500 Energy sector. Returns were negative for both the Fund and the S&P 500. The Fund had a negative return of -25.4%, while the S&P 500 had a loss of -20.1%. Every one of the Fund’s holdings declined with Schlumberger faring the worst at -41.0%. Schlumberger and Apache were sold and EOG Resources, the premier player in the prolific Permian shale basin, was purchased.

Materials

The Fund was close to benchmark weighted in the Materials sector at 2.8% versus 2.6% for the S&P 500 Materials sector. The Fund’s returns far outpaced the benchmark with the Fund gaining +38.7% while the S&P 500 lost -7.3%. We sold the Fund’s Mosaic

8

position in a very timely manner creating a +19.8% return, but our biggest winner, by far, was Ecolab at +30.5%. We really consider Ecolab as more of an essential service company than a commodity material company, but it sure helped to outpace the benchmark!

Utilities and Real Estate

The Fund had no exposure to the Utilities and Real Estate sectors, which make up only 3.4% and 3.2%, respectively, of the S&P 500 Index. Returns for the S&P 500 Utilities and Real Estate sectors were attractive, however, returning +18.4% and +19.9%, respectively. With very slow growth, above market P/E multiples and historically low dividend yields, virtually the entire Utilities sector looks overpriced to us.

CLOSING COMMENTS

With corporate profits up double digits over the past twelve months, it is somewhat surprising that stock returns have only amounted to low single digits. The timing of the 20% market correction last fall is largely to blame. So far in 2019, the inverse is true. Profits are expected to rise mid-single digits, while the market has already gained a mid-teen percentage return. We expect continued volatility, driven in part by the growing impact of momentum players. Another 10% move to the downside, or the upside, would be no surprise. The primary market underpinnings remain positive. The economy continues to grow. Valuations are not unreasonably high. Inflation is low. The Fed remains accommodative. Corporate profits are growing. Each of these factors seems to be a little less compelling than earlier in the cycle, however, so our return expectations are modest as well. We are comfortable staying the course with our focus on buying good companies at fair prices and worrying less about the vagaries of the market as a whole.

We, the portfolio managers at Bradley, Foster & Sargent, Inc., are also shareholders of the BFS Equity Fund. We look forward to serving you through our management of the Fund. Thank you for placing your capital under our care.

Timothy Foster

Lead Portfolio Manager | Keith LaRose

Co-Portfolio Manager | Thomas Sargent

Co-Portfolio Manager |

9

BFS Equity Fund

ANNUAL PERFORMANCE REVIEW

(Unaudited)

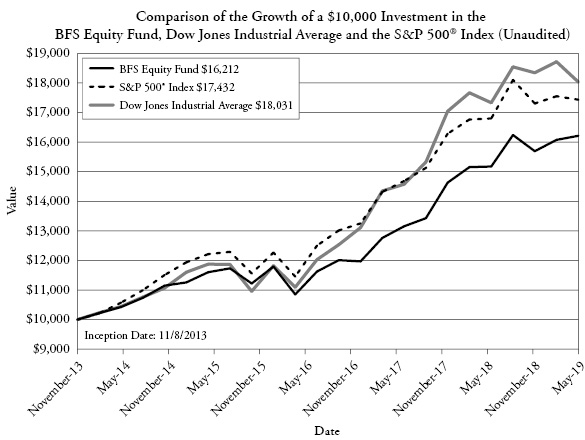

The Fund returned +6.84% for the twelve month period commencing June 1, 2018 and ending May 31, 2019, outperforming the S&P 500, which returned +3.78%, and the Dow Jones, which gained +4.05% over the same period.

Key Detractors from Relative Results

| | ● | With falling oil prices over the period, the Energy sector was the worst performing sector for both the Fund (-25.4%) as well as for the S&P 500 (-20.1%). Schlumberger returned -41.0% and was sold. |

| | ● | The Fund had no exposure to both the Utilities and Real Estate sectors of the S&P 500 which returned 18.4% and 19.9%, respectively, for the S&P 500. |

| | ● | The Fund overweighted the Industrials sector at 15.7% versus 9.3% for the S&P 500. The Fund’s performance lagged the S&P 500 with the Fund’s return -7.1% versus -1.0% for the S&P 500. Trade tariffs significantly impaired performance for this sector. |

Key Contributors to Relative Results

| | ● | The Healthcare sector was the Fund’s largest weighting at 21.9% as well as one of the best performing sectors, returning +22.1%, relative to the S&P 500 return of +7.7%. Danaher was the second largest position for the Fund and the stock returned +33.8%. |

| | ● | The single best performing sector for the Fund relative to the S&P 500 benchmark was the Materials sector. The Fund’s return was +38.7% versus -7.3% for the S&P 500. |

| | ● | Information Technology was the second largest weighting in the Fund at 19.4% versus 21.2% for the S&P 500. Stock selection generated a superior return of +10.8% versus +4.4% for the S&P 500 Tech sector. |

FUND INFORMATION(a)

May 31, 2019 (Unaudited)

ASSET ALLOCATION

TEN LARGEST HOLDINGS (%) | FUND |

Alphabet Inc. | 3.4 |

Danaher | 3.3 |

Chubb | 3.0 |

Walt Disney | 2.9 |

Raytheon | 2.9 |

Ecolab | 2.8 |

Oracle | 2.8 |

Microsoft | 2.8 |

United Health Group | 2.7 |

Costco | 2.7 |

SECTOR

DIVERSIFICATION (%) | FUND | S&P 500 |

Healthcare | 21.9 | 14.2 |

Information Technology | 19.4 | 21.2 |

Industrials | 15.7 | 9.3 |

Financials | 10.4 | 13.2 |

Consumer Discretionary | 8.4 | 10.2 |

Consumer Staples | 6.8 | 7.4 |

Communication Services | 6.3 | 10.4 |

Energy | 3.7 | 4.9 |

Materials | 2.8 | 2.6 |

Utilities | 0.0 | 3.4 |

Real Estate | 0.0 | 3.2 |

Cash Equivalents | 4.6 | 0.0 |

(a) | Fund percentages based on net assets as of May 31, 2019. |

10

BFS Equity Fund

Investment Results (Unaudited)

Average Annual Total Returns(a) (For the periods ended May 31, 2019)

| | One Year | Three Year | Five Year | Since Inception

(November 8, 2013) |

BFS Equity Fund | 6.84% | 11.72% | 8.59% | 9.08% |

S&P 500® Index(b) | 3.78% | 11.72% | 9.66% | 10.51% |

Dow Jones Industrial Average®(c) | 4.05% | 14.45% | 10.88% | 11.19% |

Total annual fund operating expenses, as disclosed in the BFS Equity Fund’s (the “Fund”) prospectus dated September 28, 2018, were 1.65% of average daily net assets (1.25% after fee waivers/expense reimbursements by Bradley, Foster & Sargent, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until September 30, 2019, so that Total Annual Fund Operating Expenses does not exceed 1.00%. This contractual arrangement may only be terminated by mutual consent of the Adviser and the Board of Trustees of the Trust, and it will automatically terminate upon the termination of the investment advisory agreement between the Fund and the Adviser. This operating expense limitation does not apply to: (i) interest, (ii) taxes, (iii) brokerage commissions, (iv) other expenditures which are capitalized in accordance with generally accepted accounting principles, (v) other extraordinary expenses not incurred in the ordinary course of the Fund’s business, (vi) dividend expense on short sales, (vii) expenses incurred under a plan of distribution under Rule 12b-1, and (viii) expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, in any fiscal year. The operating expense limitation also excludes any “Acquired Fund Fees and Expenses,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including exchange-traded funds, that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 575-2430.

(a) | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

(b) | The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The Dow Jones Industrial Average® is a widely recognized unmanaged index of equity prices and is representative of a narrower market and range of securities than is found in the Fund’s portfolio. The index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

11

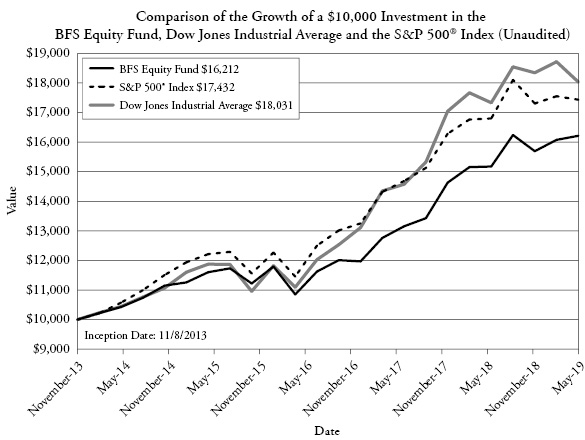

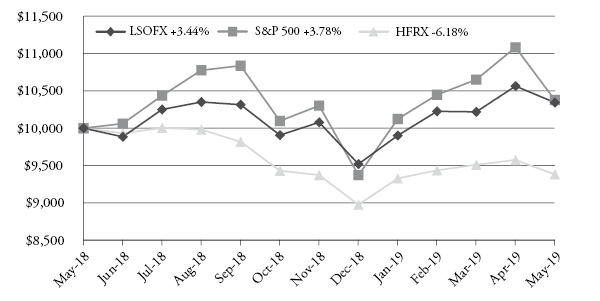

The chart above assumes an initial investment of $10,000 made on November 8, 2013 (commencement of operations) held through May 31, 2019.THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS.The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (855) 575-2430. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of investments with the Securities and Exchange Commission (“SEC”) as of the end of the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov.

12

BFS Equity Fund

Schedule of Investments

May 31, 2019

| | Shares | | | Fair Value | |

COMMON STOCKS — 95.40% | | | | | | | | |

| | | | | | | | | |

Aerospace & Defense — 5.37% | | | | | | | | |

Raytheon Company | | | 6,000 | | | $ | 1,047,000 | |

United Technologies Corporation | | | 7,000 | | | | 884,100 | |

| | | | | | | | 1,931,100 | |

Banks — 5.24% | | | | | | | | |

Citigroup, Inc. | | | 15,000 | | | | 932,250 | |

JPMorgan Chase & Company | | | 9,000 | | | | 953,640 | |

| | | | | | | | 1,885,890 | |

Beverages — 2.45% | | | | | | | | |

Constellation Brands, Inc., Class A | | | 5,000 | | | | 882,250 | |

| | | | | | | | | |

Chemicals — 2.82% | | | | | | | | |

Ecolab, Inc. | | | 5,500 | | | | 1,012,495 | |

| | | | | | | | | |

Communications Equipment — 2.46% | | | | | | | | |

Cisco Systems, Inc. | | | 17,000 | | | | 884,510 | |

| | | | | | | | | |

Consumer Finance — 2.07% | | | | | | | | |

American Express Company | | | 6,500 | | | | 745,615 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 4.52% | | | | | | | | |

Amphenol Corporation, Class A | | | 9,000 | | | | 783,000 | |

TE Connectivity Ltd. | | | 10,000 | | | | 842,300 | |

| | | | | | | | 1,625,300 | |

Entertainment — 2.94% | | | | | | | | |

Walt Disney Company (The) | | | 8,000 | | | | 1,056,320 | |

| | | | | | | | | |

Food & Staples Retailing — 2.66% | | | | | | | | |

Costco Wholesale Corporation | | | 4,000 | | | | 958,320 | |

| | | | | | | | | |

Food Products — 1.70% | | | | | | | | |

Mondelez International, Inc., Class A | | | 12,000 | | | | 610,200 | |

| | | | | | | | | |

Health Care Equipment & Supplies — 7.28% | | | | | | | | |

Abbott Laboratories | | | 8,000 | | | | 609,040 | |

Danaher Corporation | | | 9,000 | | | | 1,188,090 | |

Stryker Corporation | | | 4,500 | | | | 824,580 | |

| | | | | | | | 2,621,710 | |

Health Care Providers & Services — 2.69% | | | | | | | | |

UnitedHealth Group, Inc. | | | 4,000 | | | | 967,200 | |

| | See accompanying notes which are an integral part of these financial statements. | 13 |

BFS Equity Fund

Schedule of Investments (continued)

May 31, 2019

| | Shares | | | Fair Value | |

COMMON STOCKS — 95.40% - continued | | | | | | | | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 2.12% | | | | | | | | |

Starbucks Corporation | | | 10,000 | | | $ | 760,600 | |

| | | | | | | | | |

Industrial Conglomerates — 1.78% | | | | | | | | |

3M Company | | | 4,000 | | | | 639,000 | |

| | | | | | | | | |

Insurance — 3.05% | | | | | | | | |

Chubb Ltd. | | | 7,500 | | | | 1,095,525 | |

| | | | | | | | | |

Interactive Media & Services — 3.38% | | | | | | | | |

Alphabet, Inc., Class A(a) | | | 1,100 | | | | 1,217,150 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 2.46% | | | | | | | | |

Amazon.com, Inc.(a) | | | 500 | | | | 887,535 | |

| | | | | | | | | |

IT Services — 2.23% | | | | | | | | |

Automatic Data Processing, Inc. | | | 5,000 | | | | 800,600 | |

| | | | | | | | | |

Life Sciences Tools & Services — 6.80% | | | | | | | | |

Illumina, Inc.(a) | | | 3,000 | | | | 920,730 | |

Mettler-Toledo International, Inc.(a) | | | 1,000 | | | | 723,090 | |

Thermo Fisher Scientific, Inc. | | | 3,000 | | | | 800,940 | |

| | | | | | | | 2,444,760 | |

Machinery — 8.54% | | | | | | | | |

Caterpillar, Inc. | | | 6,000 | | | | 718,860 | |

Deere & Company | | | 5,000 | | | | 700,850 | |

Fortive Corporation | | | 10,000 | | | | 761,500 | |

Stanley Black & Decker, Inc. | | | 7,000 | | | | 890,540 | |

| | | | | | | | 3,071,750 | |

Oil, Gas & Consumable Fuels — 3.72% | | | | | | | | |

Chevron Corporation | | | 6,000 | | | | 683,100 | |

EOG Resources, Inc. | | | 8,000 | | | | 655,040 | |

| | | | | | | | 1,338,140 | |

Pharmaceuticals — 5.13% | | | | | | | | |

Johnson & Johnson | | | 3,000 | | | | 393,450 | |

Novartis AG - ADR | | | 7,500 | | | | 642,300 | |

Zoetis, Inc. | | | 8,000 | | | | 808,400 | |

| | | | | | | | 1,844,150 | |

14 | See accompanying notes which are an integral part of these financial statements. | |

BFS Equity Fund

Schedule of Investments (continued)

May 31, 2019

| | Shares | | | Fair Value | |

COMMON STOCKS — 95.40% - continued | | | | | | | | |

| | | | | | | | | |

Software — 8.20% | | | | | | | | |

Adobe, Inc.(a) | | | 3,500 | | | $ | 948,150 | |

Microsoft Corporation | | | 8,000 | | | | 989,440 | |

Oracle Corporation | | | 20,000 | | | | 1,012,000 | |

| | | | | | | | 2,949,590 | |

Specialty Retail — 2.11% | | | | | | | | |

Home Depot, Inc. (The) | | | 4,000 | | | | 759,400 | |

| | | | | | | | | |

Technology Hardware, Storage & Peripherals — 1.95% | | | | | | | | |

Apple, Inc. | | | 4,000 | | | | 700,280 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 1.72% | | | | | | | | |

NIKE, Inc., Class B | | | 8,000 | | | | 617,120 | |

| | | | | | | | | |

Total Common Stocks (Cost $24,684,321) | | | | | | | 34,306,510 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 4.64% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 2.31%(b) | | | 1,668,933 | | | | 1,668,933 | |

Total Money Market Funds (Cost $1,668,933) | | | | | | | 1,668,933 | |

| | | | | | | | | |

Total Investments — 100.04% (Cost $26,353,254) | | | | | | | 35,975,443 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.04)% | | | | | | | (15,162 | ) |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 35,960,281 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of May 31, 2019. |

ADR - American Depositary Receipt

The industries shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

| | See accompanying notes which are an integral part of these financial statements. | 15 |

BFS Equity Fund

Statement of Assets and Liabilities

May 31, 2019

Assets |

Investments in securities at fair value (cost $26,353,254) (Note 3) | | $ | 35,975,443 | |

Receivable for fund shares sold | | | 8,994 | |

Dividends receivable | | | 34,600 | |

Prepaid expenses | | | 12,870 | |

Total Assets | | | 36,031,907 | |

Liabilities |

Payable for fund shares redeemed | | | 4,000 | |

Payable to Adviser (Note 4) | | | 19,528 | |

Payable to Administrator (Note 4) | | | 6,750 | |

Distribution (12b-1) fees accrued (Note 4) | | | 15,675 | |

Other accrued expenses | | | 25,673 | |

Total Liabilities | | | 71,626 | |

Net Assets | | $ | 35,960,281 | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 25,930,320 | |

Accumulated earnings | | | 10,029,961 | |

Net Assets | | $ | 35,960,281 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,335,209 | |

Net asset value, offering and redemption price per share (Note 2) | | $ | 15.40 | |

16 | See accompanying notes which are an integral part of these financial statements. | |

BFS Equity Fund

Statement of Operations

For the year ended May 31, 2019

Investment Income | | | | |

Dividend income | | $ | 532,632 | |

Total investment income | | | 532,632 | |

Expenses | | | | |

Investment Adviser fees (Note 4) | | | 261,074 | |

Distribution (12b-1) fees (Note 4) | | | 87,025 | |

Administration fees (Note 4) | | | 38,250 | |

Registration expenses | | | 26,912 | |

Legal fees | | | 25,032 | |

Fund accounting fees (Note 4) | | | 25,000 | |

Transfer agent fees (Note 4) | | | 18,000 | |

Audit and tax preparation fees | | | 18,000 | |

Printing and postage expenses | | | 7,027 | |

Trustee fees | | | 6,915 | |

Insurance expenses | | | 4,392 | |

Custodian fees | | | 4,208 | |

Miscellaneous | | | 24,205 | |

Total expenses | | | 546,040 | |

Fees contractually waived by Adviser (Note 4) | | | (110,755 | ) |

Net operating expenses | | | 435,285 | |

Net investment income | | | 97,347 | |

Net Realized and Change in Unrealized Gain (Loss) on Investments |

Net realized gain on investment securities transactions | | | 715,995 | |

Net change in unrealized appreciation on investments | | | 1,346,387 | |

Net realized and change in unrealized gain on investments | | | 2,062,382 | |

Net increase in net assets resulting from operations | | $ | 2,159,729 | |

| | See accompanying notes which are an integral part of these financial statements. | 17 |

BFS Equity Fund

Statements of Changes in Net Assets

Increase (Decrease) in Net Assets due to: | | For the

Year Ended

May 31, 2019 | | | For the

Year Ended

May 31, 2018(a) | |

Operations | | | | | | | | |

Net investment income | | $ | 97,347 | | | $ | 76,860 | |

Net realized gain on investment securities transactions | | | 715,995 | | | | 968,655 | |

Net change in unrealized appreciation on investments | | | 1,346,387 | | | | 3,076,603 | |

Net increase in net assets resulting from operations | | | 2,159,729 | | | | 4,122,118 | |

Distributions to Shareholders from Earnings (Note 2) | | | (1,113,363 | ) | | | (97,004 | ) |

Capital Transactions | | | | | | | | |

Proceeds from shares sold | | | 5,524,451 | | | | 3,055,217 | |

Reinvestment of distributions | | | 950,796 | | | | 84,293 | |

Amount paid for shares redeemed | | | (3,311,176 | ) | | | (2,599,930 | ) |

Net increase in net assets resulting from capital transactions | | | 3,164,071 | | | | 539,580 | |

Total Increase in Net Assets | | | 4,210,437 | | | | 4,564,694 | |

Net Assets | | | | | | | | |

Beginning of year | | | 31,749,844 | | | | 27,185,150 | |

End of year | | $ | 35,960,281 | | | $ | 31,749,844 | |

Share Transactions | | | | | | | | |

Shares sold | | | 360,348 | | | | 213,569 | |

Shares issued in reinvestment of distributions | | | 73,138 | | | | 5,801 | |

Shares redeemed | | | (220,822 | ) | | | (185,706 | ) |

Net increase in shares outstanding | | | 212,664 | | | | 33,664 | |

(a) | For the year ended May 31, 2018, the Fund had Distributions to Shareholders from earnings from net investment income and net realized gains of $78,543 and $18,461, respectively. As of May 31, 2018, accumulated net investment income was $25,353. |

18 | See accompanying notes which are an integral part of these financial statements. | |

BFS Equity Fund

Financial Highlights

(For a share outstanding during each year)

| | | For the

Year

Ended

May 31,

2019 | | | For the

Year

Ended

May 31,

2018 | | | For the

Year

Ended

May 31,

2017 | | | For the

Year

Ended

May 31,

2016 | | | For the

Year

Ended

May 31,

2015 | |

Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 14.96 | | | $ | 13.01 | | | $ | 11.55 | | | $ | 11.69 | | | $ | 10.73 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.04 | | | | 0.02 | |

Net realized and unrealized gain/(loss) on investments | | | 0.90 | | | | 1.96 | | | | 1.47 | | | | (0.15 | ) | | | 0.97 | |

Total from investment operations | | | 0.94 | | | | 2.00 | | | | 1.51 | | | | (0.11 | ) | | | 0.99 | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.04 | ) | | | (0.04 | ) | | | (0.05 | ) | | | (0.03 | ) | | | (0.03 | ) |

Net realized gains | | | (0.46 | ) | | | (0.01 | ) | | | — | | | | — | | | | — | |

Total distributions | | | (0.50 | ) | | | (0.05 | ) | | | (0.05 | ) | | | (0.03 | ) | | | (0.03 | ) |

Net asset value, end of year | | $ | 15.40 | | | $ | 14.96 | | | $ | 13.01 | | | $ | 11.55 | | | $ | 11.69 | |

Total Return(a) | | | 6.84 | % | | | 15.36 | % | | | 13.15 | % | | | (0.91 | )% | | | 9.27 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000 omitted) | | $ | 35,960 | | | $ | 31,750 | | | $ | 27,185 | | | $ | 23,884 | | | $ | 20,167 | |

Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Ratio of expenses to average net assets before waiver and reimbursement | | | 1.57 | % | | | 1.65 | % | | | 1.75 | % | | | 1.86 | % | | | 2.26 | % |

Ratio of net investment income to average net assets | | | 0.28 | % | | | 0.26 | % | | | 0.35 | % | | | 0.43 | % | | | 0.30 | % |

Portfolio turnover rate | | | 38.71 | % | | | 38.17 | % | | | 47.82 | % | | | 49.38 | % | | | 51.17 | % |

| | | | | | | | | | | | | | | | | | | | | |

(a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| | See accompanying notes which are an integral part of these financial statements. | 19 |

BFS Equity Fund

Notes to the Financial Statements

May 31, 2019

NOTE 1. ORGANIZATION

The BFS Equity Fund (the “Fund”) was organized as an open-end diversified series of Valued Advisers Trust (the “Trust”) on July 23, 2013 and commenced operations on November 8, 2013. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund’s investment adviser is Bradley, Foster & Sargent, Inc. (the “Adviser”). The investment objective of the Fund is long-term appreciation through growth of principal and income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended May 31, 2019, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the statement of operations when incurred. During the fiscal year ended May 31, 2019, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last three tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

20

BFS Equity Fund

Notes to the Financial Statements (continued)

May 31, 2019

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method, if applicable. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions– The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share (“NAV”) of the Fund. For the fiscal year ended May 31, 2019, the Fund did not make any reclassifications.

Share Valuation – The NAV is calculated each day the New York Stock Exchange is open by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding for the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

All investments in securities are recorded at their estimated fair value. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect

21

BFS Equity Fund

Notes to the Financial Statements (continued)

May 31, 2019

the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| | ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt

22

BFS Equity Fund

Notes to the Financial Statements (continued)

May 31, 2019

issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2019:

| | | Valuation Inputs | | | | | |

Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks(a) | | $ | 34,306,510 | | | $ | — | | | $ | — | | | $ | 34,306,510 | |

Money Market Funds | | | 1,668,933 | | | | — | | | | — | | | | 1,668,933 | |

Total | | $ | 35,975,443 | | | $ | — | | | $ | — | | | $ | 35,975,443 | |

(a) | Refer to Schedule of Investments for industry classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement on behalf of the Fund, the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund pays the Adviser a fee, computed and accrued daily and paid monthly, at an annual rate of 0.75% of the average daily net assets of the Fund. For the fiscal year ended May 31, 2019, the Adviser earned a fee of $261,074 from the Fund before the waivers described below. At May 31, 2019, the Fund owed the Adviser $19,528.

The Adviser has contractually agreed to waive its management fee and/or reimburse certain operating expenses until September 30, 2019, but only to the extent necessary so that the Fund’s net expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses, fees and expenses paid under a distribution plan adopted pursuant to Rule 12b-1, fees and expenses paid under a shareholder services plan, and indirect expenses (such as “acquired funds fees and expenses”) does not exceed 1.00%.

Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three years following such waiver or reimbursement, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement and the expense limitation in place at the time of the repayment. The contractual agreement is in effect through September 30, 2019. The expense cap may not be terminated prior to this date except by mutual consent of the Adviser and the Board. For the fiscal year ended May 31, 2019, the Adviser waived fees of

23

BFS Equity Fund

Notes to the Financial Statements (continued)

May 31, 2019

$110,755. As of May 31, 2019, the Adviser may seek repayment of investment advisory fees waived and expense reimbursements in the amount of $124,587, $117,155, and $110,755, pursuant to the aforementioned conditions, from the Fund no later than May 31, 2020, 2021, and 2022, respectively.

The Trust retains Ultimus Fund Solutions, LLC (“Ultimus” or “Administrator”) to provide the Fund with administration and compliance, fund accounting, and transfer agent services, including all regulatory reporting. For the fiscal year ended May 31, 2019, the Administrator earned fees of $38,250 for administration and compliance services, $25,000 for fund accounting services and $18,000 for transfer agent services. At May 31, 2019, the Fund owed the Administrator $6,750 for such services.

The officers and one trustee of the Trust are members of management and/or employees of the Administrator. Unified Financial Securities, LLC (the “Distributor” or “Unified”) acts as the principal distributor of the Fund’s shares.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “1940 Act”). The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. For the fiscal year ended May 31, 2019, 12b-1 fees incurred by the Fund were $87,025. The Fund owed $15,675 for 12b-1 fees as of May 31, 2019.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended May 31, 2019, purchases and sales of investment securities, other than short-term investments, were $14,317,033 and $13,105,325, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended May 31, 2019.

NOTE 6. FEDERAL TAX INFORMATION

At May 31, 2019, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

Gross unrealized appreciation | | $ | 10,166,618 | |

Gross unrealized depreciation | | | (596,717 | ) |

Net unrealized appreciation on investments | | $ | 9,569,901 | |

Tax cost of investments | | $ | 26,405,542 | |

24

BFS Equity Fund

Notes to the Financial Statements (continued)

May 31, 2019

At May 31, 2019, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the tax deferral of losses on wash sales.

At May 31, 2019, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

Undistributed ordinary income | | $ | 39,481 | |

Undistributed long-term capital gains | | | 420,579 | |

Unrealized appreciation (depreciation) | | | 9,569,901 | |

Total | | $ | 10,029,961 | |

The tax character of distributions for the fiscal years ended May 31, 2019 and May 31, 2018 were as follows:

| | 2019 | | | 2018 | |

Distributions paid from:(a) | | | | | | | | |

Ordinary income | | $ | 83,219 | | | $ | 78,543 | |

Long-term capital gains | | | 1,030,144 | | | | 18,461 | |

Total distributions paid | | $ | 1,113,363 | | | $ | 97,004 | |

(a) | For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

NOTE 7. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 8. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

25

Report of Independent Registered Public Accounting Firm

To the Shareholders of BFS Equity Fund and

Board of Trustees of Valued Advisers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BFS Equity Fund (“The Fund”), a series of Valued Advisers Trust, as of May 31, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2019, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2013.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 29, 2019

26

BFS Equity Fund

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from December 1, 2018 through May 31, 2019.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | Beginning

Account Value

December 1, 2018 | Ending

Account Value

May 31, 2019 | Expenses Paid

During Period(a) | Annualized

Expense Ratio |

Actual | $1,000.00 | $1,033.10 | $ 6.34 | 1.25% |

Hypothetical(b) | $1,000.00 | $1,018.70 | $ 6.29 | 1.25% |

(a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

(b) | Hypothetical assumes 5% annual return before expenses. |

27

Additional Federal Income Tax Information

(Unaudited)

The Form 1099-DIV you receive in January 2020 will show the tax status of all distributions paid to your account in calendar year 2019. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 100% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2019 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

For the fiscal year ended May 31, 2019, the Fund designated $1,030,144 as 20% long-term capital gain distributions.

Trustees and Officers (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each of the Independent Trustees.

Name, Address*, Age,

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other Directorships | Other Directorships |

Andrea N. Mullins, 52

Independent Trustee

Since December 2013 Chairperson since

March 2017 | Current:Private investor; Independent Contractor, SWM Advisors (since April 2014). | Trustee, Angel Oak Funds Trust (since February 2019) (4 portfolios); Trustee, Angel Oak Strategic Credit Fund (since February 2019) Angel Oak Financial Strategies Income Term Trust (since April 2019). |

28

Trustees and Officers (Unaudited) (continued)

Name, Address*, Age,

Position with Trust**,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other Directorships | Other Directorships |

Ira P. Cohen,60

Independent Trustee

Since June 2010 | Current:Independent financial services consultant (since February 2005); Executive Vice President of Asset Management Services, Recognos Financial (since August 2015). | Trustee and Audit Committee Chairman, Griffin Institutional Access Credit Fund (since January 2017); Trustee and Audit Committee Chairman, Griffin Institutional Real Estate Access Fund (since May 2014); Trustee, Angel Oak Financial Strategies Income Term Trust (since April 2019) Angel Oak Funds Trust (since October 2014) (4 portfolios) Trustee, Chairman, and Nominating and Governance Committee Chairman, Angel Oak Strategic Credit Fund (since December 2017). |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below should serve as a Trustee.

Name, Address*, Age,

Position with Trust**,

Term of Position with Trust | Principal Occupation During Past 5 Years | Other Directorships |

Mark J. Seger, 57

Trustee

Since March 2017 | Current:Vice Chairman of Ultimus Fund Solutions, LLC (since 1999). Previous: Managing Director and Co-Chief Executive Officer of Ultimus Fund Solutions, LLC (since 1999). | None. |

* | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

** | As of the date of this report, the Trust consists of 12 series. |

29

Trustees and Officers (Unaudited) (continued)

The following table provides information regarding the Officers of the Trust:

Name, Address*, Age,

Position with Trust**,

Term of Position with Trust | Principal Occupation During Past 5 Years | Other Directorships |

Adam T. Kornegay,34

Principal Executive Officer and President

Since April 2018 | Current:Assistant Vice President, Business Development Director, Ultimus Fund Solutions, LLC (since March 2015). Previous:Vice President, Citigroup, Inc. (July 2009 to February 2015). | None. |

Gregory Knoth, 49

Principal Financial Officer and Treasurer

Since April 2019 | Current:Vice President, Mutual Fund Controller, Ultimus Fund Solutions, LLC (since December 2015). Previous:Vice President and Manager of Fund Accounting, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (June 2013 to December 2015). | None. |

Martin R. Dean, 55

Interim Chief

Compliance Officer

Since May 2019 | Current:Vice President, Director of Fund Compliance of Ultimus Fund Solutions, LLC (since January 2016) Previous:Senior Vice President and Compliance Group Manager, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (July 2013 to December 2015). | None. |

Carol J. Highsmith, 54

Vice President

Since August 2008 Secretary

Since March 2014 | Current:Assistant Vice President, Ultimus Fund Solutions, LLC (since December 2015). Previous: Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (November 1994 to December 2015), most recently Vice President of Legal Administration (2005 to December 2015). | None. |

* | The address for each officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

** | As of the date of this report, the Trust consists of 12 series. |

Other Information (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (855) 575-2430 to request a copy of the SAI or to make shareholder inquiries.

30

FACTS | WHAT DOES VALUED ADVISERS TRUST DO WITH YOUR PERSONAL INFORMATION? |

| | |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ account balances and account transactions ■ transaction or loss history and purchase history ■ checking account information and wire transfer instructions When you areno longer our customer, we continue to share your information as described in this notice. |

| | |

How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Valued Advisers Trust chooses to share; and whether you can limit this sharing. |

| | |

Reasons we can share your personal information | Does Valued Advisers Trust share? |

For our everyday business purposes —

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes —

to offer our products and services to you | Yes |

For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No |

For nonaffiliates to market to you | No |

| | |

Questions? | Call 1-855-575-2430 |

31

Who we are |

Who is providing this notice? | Valued Advisers Trust |

What we do |

How does Valued Advisers Trust protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |