UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| | |

| Ultimus Asset Services, LLC 225 Pictoria Drive, Suite 450 | | Cincinnati, OH 45246 |

| (Address of principal executive offices) | | (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway,

Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: 10/31

Date of reporting period: 10/31/16

Item 1. Reports to Stockholders.

Annual Report

October 31, 2016

Fund Adviser:

Granite Investment Advisors, Inc.

6 Eagle Square, 3rd Floor

Concord, New Hampshire 03301

Toll Free (888) 442-9893

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE – (Unaudited)

Our fiscal year ended October 31, 2016 has been a satisfactory one in terms of performance. So far it has been a tale of two years. During the last months of 2015, we saw continued weakness, but the fund dramatically improved in 2016. While it is still early in the recovery, it seems that the value investment discipline is making a comeback. Since 2010, value has struggled and trailed its growth counterpart for much of that time period. As of the end of October, the Granite Value Fund was up 1.30% versus the S&P 500, which was up 4.51%.

As we discussed in last year’s letter, much of the market’s positive performance in 2015 could be attributed to only a few stocks, whereas the rest of the market was flat to negative. Beginning in 2016, this began to change. Some of yesterday’s darlings are now lagging, while many of the companies that were left behind have begun a broad based rally. Why? The first reason is valuation. We believe that markets always reflect valuation over the long-term. From time to time, stock valuations may be influenced by popular sentiment, which can lead to distortions. While the market can get caught up in short-term euphoria, in the long-term stocks will almost always represent their intrinsic value. Looking back again at 2015, only 20 stocks in the S&P 500 exhibited gains and became rather expensive, whereas the remaining 480 companies were negative on average. I’m happy to report that so far in 2016, the market has started to focus again on traditional valuation metrics, which has benefited many of the attractively valued companies in the Granite Value Fund.

Below please find part of our quarterly letter that we sent to clients at the end of September. In this letter we discussed equity valuations, ongoing global issues, economic “well-being” indicators, and the potential implications of the presidential election on the stock market. While this was written before the election, much of the information is still pertinent to our views on the markets moving forward.

Climbing the Wall of Worry

There is an old saying in the investment industry that “Markets Climb a Wall of Worry”, meaning in some cases markets continue to rise even though headline news seems to be filled with uncertainty. Most would agree that this has been the case since we emerged from the Financial Crisis. We’ve been having many discussions amongst ourselves and other investors that this seems to be the most “unhappy” bull market that any of us can remember. Instead of focusing upon the positives investors and the media seem to be waiting for the next shoe to drop. Our assessment is more positive than consensus and our belief is much of the pessimism has to do with recency bias given the 2008 Financial Crisis.

To quote the late Sir John Templeton who was credited with bringing global investing to the main stream, “Bull markets are born on pessimism; grow on skepticism, mature on optimism and die of euphoria”. His last point on dying on euphoria rings especially true to us. In the past whether it was 2008 or the end of the Tech Bubble in 1999 usually mass euphoria or people believing its different this time usually precedes any type of severe market reaction. As we have written about in the past prior to the Tech Bubble bursting in 1999, there was wide spread euphoria that traditional businesses such as retailers, manufacturing and even value investing as a discipline were outdated and destined to fail as new technology leaders would displace them. Similarly, just before the Financial Crisis, US residential real estate was considered an infallible asset class. Investors and others were clearly euphoric during both of these periods. With this as a backdrop where are we now?

In our opinion stock markets are still growing on “skepticism”. Why? It’s pretty clear that we are nowhere near a euphoric stage and let alone not even close to optimism. The worries are the usual suspects, Chinese implosion, Europe slipping back into recession, and weakness in the United States economy. Add to this list uncertainty about the US future policies given leadership changes that will occur in 2017, the Zika virus and Brexit.

In looking at valuation of the US equity markets it’s pretty hard to see any euphoria. The overall market as judged by the S&P 500 is roughly in range of historical norms trading as 16.5 times next year’s earnings. While not cheap it’s not expensive either. One can argue that with earnings projected to increase 13% in 2017 this number maybe too optimistic. However, given the Energy sector which is a reasonably large component is emerging from one of its worst cyclical downturns gives us some confidence that 2017’s expected earnings growth is reasonable. Another important driver is something we wrote about last year, namely for the first time

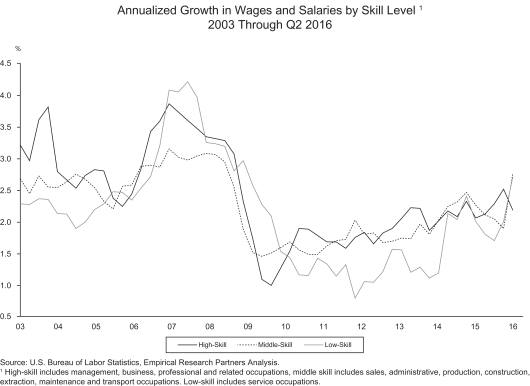

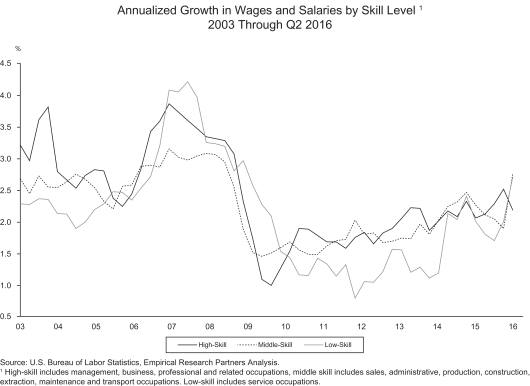

1

since the depths of the financial crisis wages for middle and lower income people in the United States is finally growing after years of stagnation. See exhibit 1 below. Historically these two cohorts spend much of what they earn so this should provide a tail wind to US economic growth. With a reasonably valued market along with a tailwind for the US economy we remain constructive on equities.

Running the risk of touching the political “third rail” we find the current election process one of the strangest in recent memory. As it seems to be affecting investor sentiment we’d like to share our thoughts. The whole thing seems to have decayed from who are the best and brightest to run our great country into my candidate is not as bad as yours, therefore you should vote for them. In the past, voters seemed to have some real excitement and enthusiasm for their candidate of choice, not so it seems in this cycle. Regardless of whether you are a Democrat or Republican, rarely have we heard any side articulating how their candidate is the best possible choice to be the commander and chief of the United States. Instead most of the arguments center around if the opposition gets elected it will be a major negative for our country. It begs the question if our current election process is truly pushing qualified candidates away for whatever reason? Is the current dual party process broken to the point that qualified candidates simply have no interest in participating? What does seem clear to most is that neither party had been able to put forward a candidate that their party can overwhelmingly embrace. Instead of focusing on issues that truly impact our country and economy the process and/or debates seem to focus on political mud-slinging and character assassinations. As a reference point entitlement spending has grown at a roughly nine percent rate per year since the 1960’s.

Our view on the entire process regarding the implications for investors is twofold. Markets over time have been a somewhat efficient mechanism of discounting people’s views and expectations. As such, given current polls seem to be quite close and going back and forth depending upon the day and/or comments made, one should expect the markets are discounting roughly the same odds of either getting elected. Regardless of the outcome while there may be some short term volatility it’s hard to argue that markets would be totally surprised by either outcome. In addition, given the checks and balances in Washington it’s not as if either candidate can have a major effect on the direction of the country in the short term.

2

We continue to be constructive on equites going forward as valuations seem reasonable, but not cheap, the global economy seems to be on the upswing and interest rates remain favorable. Additionally, with the risk of touching the proverbial third rail (politics) our belief is so far the market has concluded that the new administration in Washington will be more pro-business than the one its replacing which in turn should increase the overall growth rate of the economy. All of this should be a positive for equites as any pick-up in economic activity should act as a tail wind.

Best Performers

Our best performer in this past fiscal year was Mattel, which was up over 35% (including dividends). Over the years, Mattel and Hasbro have gone back and forth dominating the toy industry. They both have strong brands with widespread appeal. Mattel had recently stumbled with its Barbie franchise and was under pressure. However, management announced plans to restructure the company. Their strategies seemed logical and likely to get the company back on track. Additionally, management pledged to preserve the dividend, which was yielding over 7% at the time. Overall, we liked the company, its business restructuring plans, and the dividend yield. We felt the risk reward tradeoff was quite favorable and chose to invest.

Johnson and Johnson (JNJ) was our second best contributor in this past fiscal year. Similar to Mattel, we view JNJ as a very valuable company with great brands. They have had some issues with their pediatric over-the-counter products, which cast a negative cloud over the company. Additionally, their pharmaceutical division’s growth rate being questioned by analysts on Wall Street. Both of these factors provided an investment opportunity. When we invested in JNJ it had a dividend yield above 3%.

A third great performer in the Granite Value Fund has been Wal-Mart, which underperformed in the previous year. Bearish investors were concerned that the company had lost its way and could not compete with the likes of Amazon. We believe that Walmart has been and continues to be one of the best managed retailers in the world. It is true that ecommerce and Amazon have been a headwind. However, given Wal-Mart’s significant investments in ecommerce and infrastructure, as well as the company’s vast distribution capabilities, we believe that they can compete with Amazon.

Worst Performers

Our worst performing stocks in the past fiscal year were McKesson and Gilead Sciences. Both companies have been short-term victims of the presidential election. Drug price inflation and fears of future price controls by the Clinton administration put heavy pressure on both McKesson and Gilead Sciences. Both parties mentioned the need to do something about drug price inflation that has been occurring. McKesson as the largest drug distributor would clearly be negatively impacted if any type of governmental price controls were instituted. However we believe the possibility of price controls are minimal in the United States. We remain positive on the group due to demographics. It has been shown that there exists a direct correlation between age and drug usage. Given Baby Boomers are just entering retirement age we expect this to be a tailwind for drug consumption. Gilead Sciences was singled out by Hilary Clinton in August for the six-figure pricing of their Hepatitis C drug. While this might seem quite egregious, the campaign did not mention that this is a list price. Very few patients pay this high cost because their insurance carriers are able to negotiate more favorable discounts. Despite high pricing, Gilead Science’s Hepatitis C drug is the only known cure for the disease. While expensive in the short-term, the drug actually saves patients and insurance companies a lot of money in the long-term. Rather than keep patients with Hepatitis C on intermittent doses of interferon – a drug used to combat the disease – patients are now able to be cured completely.

3

As always, we thank you for the trust you place in the Granite Value Fund and will do our best to earn it every day. If you have any questions or comments, please do not hesitate to call.

Sincerely,

Scott B. Schermerhorn

Managing Principal and Chief Investment Officer

4

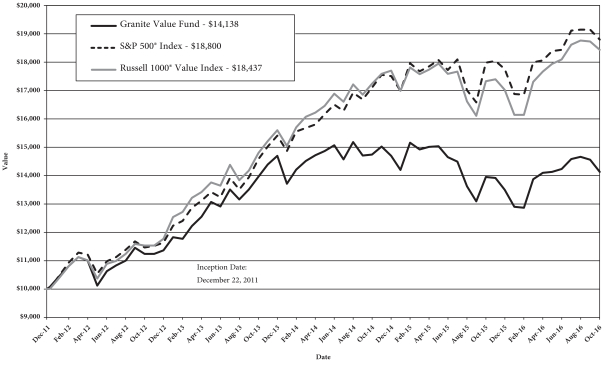

INVESTMENT RESULTS – (Unaudited)

| | | | | | | | |

Average Annual Total Returns* (For the periods ended October 31, 2016) | |

| | | One Year | | | Since Inception

(December 22, 2011) | |

Granite Value Fund | | | 1.30 | % | | | 7.39 | % |

S&P 500® Index** | | | 4.51 | % | | | 13.87 | % |

Russell 1000® Value Index** | | | 6.37 | % | | | 13.41 | % |

Total annual operating expenses, as disclosed in the Fund’s prospectus dated February 29, 2016, were 2.53% of average daily net assets (1.36% after fee waivers/expense reimbursements by Granite Investment Advisors, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and to assume other expenses of the Fund until February 28, 2017, so that the Total Annual Fund Operating Expenses does not exceed 1.35%. This operating expense limitation does not apply to brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, 12b-1 fees; extraordinary expenses and indirect expenses (such as “acquired fund fees and expenses”). Additional information pertaining to the Fund’s expense ratios as of October 31, 2016 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-888-442-9893.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| ** | The S&P 500® Index and the Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

5

INVESTMENT RESULTS – (Unaudited)

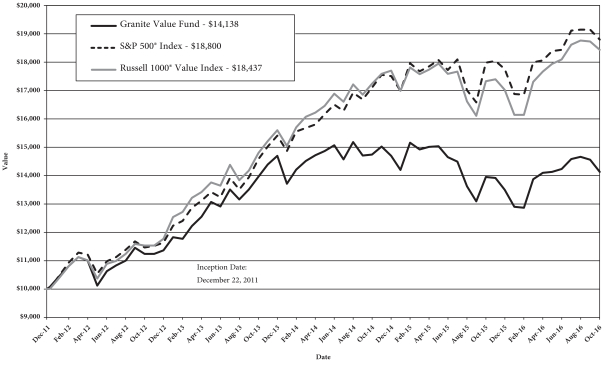

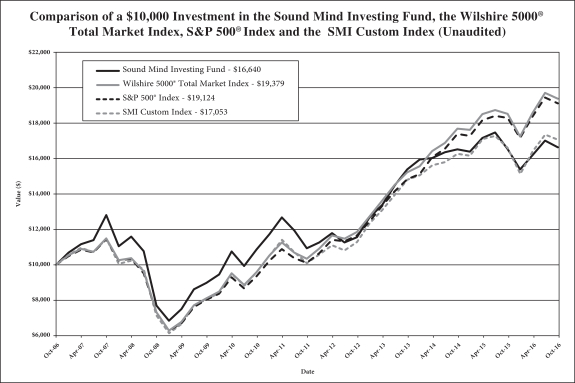

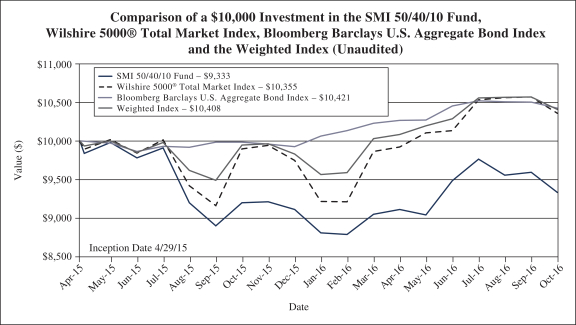

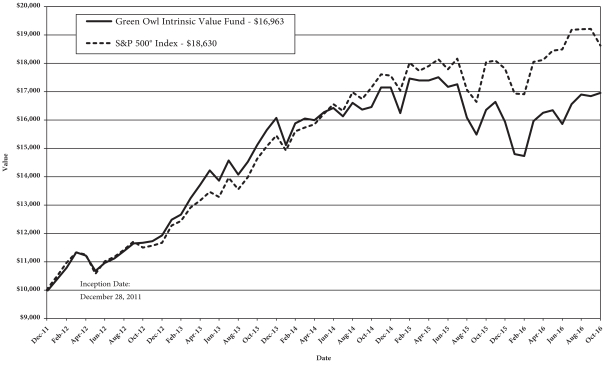

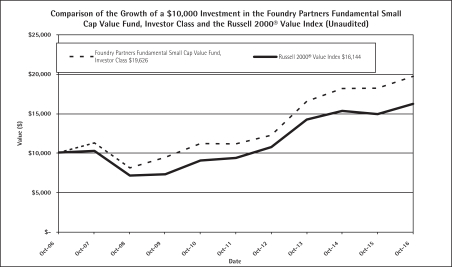

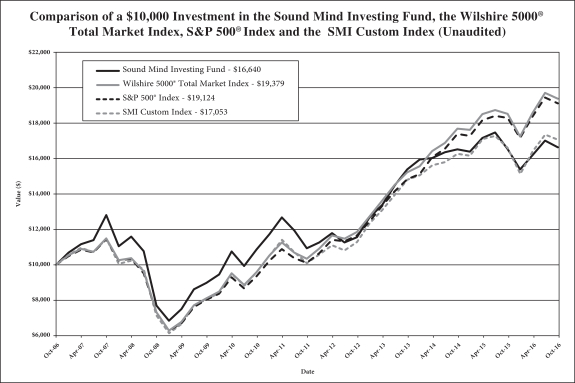

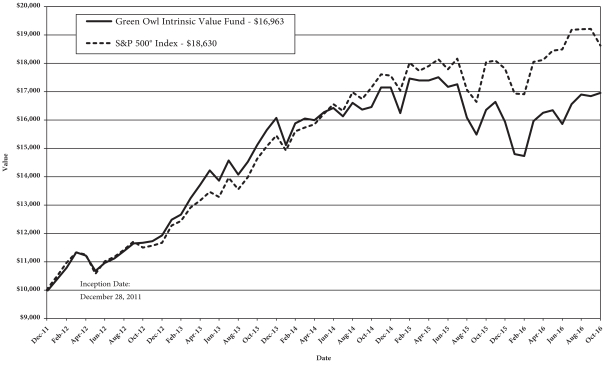

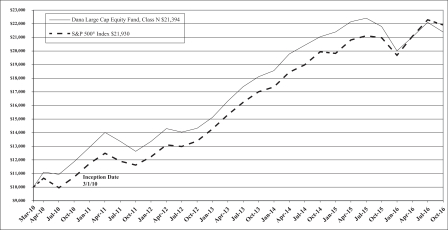

Comparison of the Growth of a $10,000 Investment in the Granite Value Fund, the S&P 500® Index, and the Russell 1000® Value Index (Unaudited)

The chart above assumes an initial investment of $10,000 made on December 22, 2011 (commencement of Fund operations) and held through October 31, 2016. The S&P 500® Index and Russell 1000® Value Index are widely recognized unmanaged indices of equity securities and are representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-888-442-9893. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

6

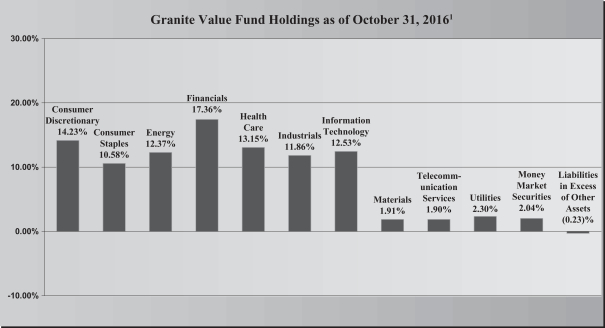

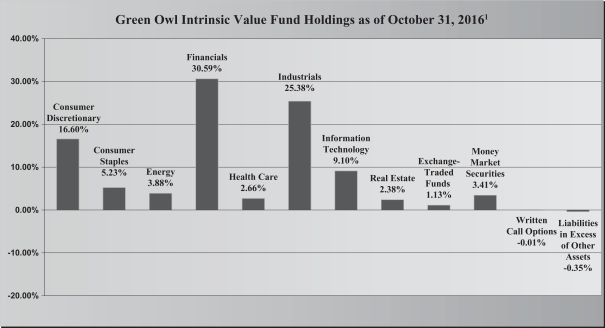

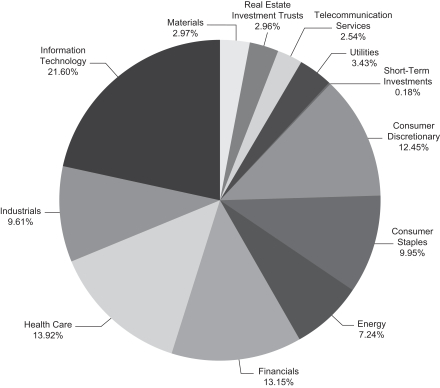

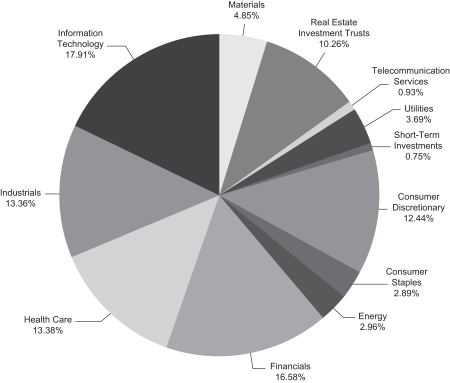

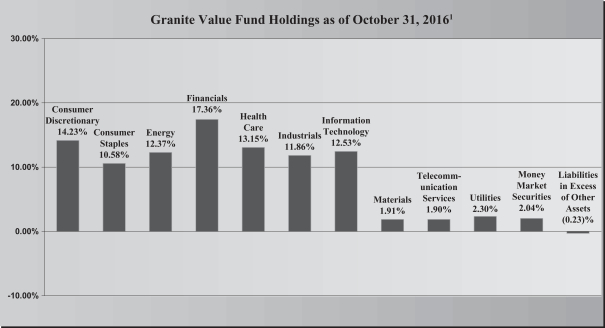

FUND HOLDINGS – (Unaudited)

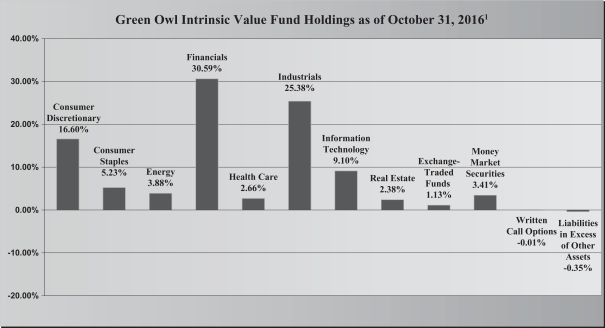

| 1 | As a percentage of net assets. |

The investment objective of the Granite Value Fund is to seek long-term capital appreciation.

Availability of Portfolio Schedule – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

7

GRANITE VALUE FUND

SCHEDULE OF INVESTMENTS

October 31, 2016

| | | | | | | | |

| Common Stocks – 98.19% | | Shares | | | Fair Value | |

Consumer Discretionary – 14.23% | | | | | | | | |

Carnival Corp. | | | 4,145 | | | $ | 203,519 | |

Comcast Corp., Class A | | | 3,675 | | | | 227,188 | |

General Motors Co. | | | 11,315 | | | | 357,554 | |

Mattel, Inc. | | | 6,615 | | | | 208,571 | |

TJX Cos., Inc./The | | | 3,260 | | | | 240,425 | |

Whirlpool Corp. | | | 930 | | | | 139,333 | |

| | | | | | | | |

| | | | | | | 1,376,590 | |

| | | | | | | | |

Consumer Staples – 10.58% | | | | | | | | |

Coca-Cola Co./The | | | 7,000 | | | | 296,800 | |

Danone SA ADR | | | 14,435 | | | | 200,791 | |

Unilever PLC ADR | | | 6,840 | | | | 285,023 | |

Wal-Mart Stores, Inc. | | | 3,440 | | | | 240,869 | |

| | | | | | | | |

| | | | | | | 1,023,483 | |

| | | | | | | | |

Energy – 12.37% | | | | | | | | |

Cimarex Energy Co. | | | 1,550 | | | | 200,151 | |

Royal Dutch Shell PLC ADR | | | 6,740 | | | | 352,569 | |

Schlumberger Ltd. | | | 2,755 | | | | 215,524 | |

Southwestern Energy Co. * | | | 20,735 | | | | 215,437 | |

Tenaris SA ADR | | | 7,545 | | | | 212,769 | |

| | | | | | | | |

| | | | | | | 1,196,450 | |

| | | | | | | | |

Financials – 17.36% | | | | | | | | |

Alleghany Corp. * | | | 605 | | | | 312,307 | |

American International Group, Inc. | | | 6,125 | | | | 377,912 | |

Berkshire Hathaway, Inc., Class B * | | | 3,320 | | | | 479,076 | |

Citigroup, Inc. | | | 6,855 | | | | 336,923 | |

MetLife, Inc. | | | 3,680 | | | | 172,813 | |

| | | | | | | | |

| | | | | | | 1,679,031 | |

| | | | | | | | |

Health Care – 13.15% | | | | | | | | |

C.R. Bard, Inc. | | | 860 | | | | 186,345 | |

Gilead Sciences, Inc. | | | 3,210 | | | | 236,352 | |

Johnson & Johnson | | | 1,580 | | | | 183,264 | |

McKesson Corp. | | | 1,810 | | | | 230,178 | |

Merck & Co., Inc. | | | 3,680 | | | | 216,090 | |

UnitedHealth Group, Inc. | | | 1,555 | | | | 219,768 | |

| | | | | | | | |

| | | | | | | 1,271,997 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

8

GRANITE VALUE FUND

SCHEDULE OF INVESTMENTS – (continued)

October 31, 2016

| | | | | | | | |

| Common Stocks – 98.19% – continued | | Shares | | | Fair Value | |

Industrials – 11.86% | | | | | | | | |

Boeing Co./The | | | 1,485 | | | $ | 211,509 | |

Caterpillar, Inc. | | | 2,755 | | | | 229,932 | |

General Electric Co. | | | 7,240 | | | | 210,684 | |

Honeywell International, Inc. | | | 2,095 | | | | 229,780 | |

United Technologies Corp. | | | 2,600 | | | | 265,720 | |

| | | | | | | | |

| | | | | | | 1,147,625 | |

| | | | | | | | |

Information Technology – 12.53% | | | | | | | | |

Apple, Inc. | | | 2,575 | | | | 292,365 | |

Corning, Inc. | | | 9,770 | | | | 221,877 | |

Microsoft Corp. | | | 4,185 | | | | 250,765 | |

Oracle Corp. | | | 6,380 | | | | 245,120 | |

Western Union Co./The | | | 10,040 | | | | 201,503 | |

| | | | | | | | |

| | | | | | | 1,211,630 | |

| | | | | | | | |

Materials – 1.91% | | | | | | | | |

AdvanSix, Inc. * | | | 83 | | | | 1,325 | |

Agrium, Inc. | | | 2,000 | | | | 183,640 | |

| | | | | | | | |

| | | | | | | 184,965 | |

| | | | | | | | |

Telecommunication Services – 1.90% | | | | | | | | |

AT&T, Inc. | | | 4,985 | | | | 183,398 | |

| | | | | | | | |

Utilities – 2.30% | | | | | | | | |

Calpine Corp. * | | | 18,675 | | | | 222,232 | |

| | | | | | | | |

| | |

Total Common Stocks (Cost $8,644,216) | | | | | | | 9,497,401 | |

| | | | | | | | |

Money Market Securities – 2.04% | | | | | | | | |

Fidelity Money Market Government Portfolio, Institutional Class, 0.32% (a) | | | 197,042 | | | | 197,042 | |

| | | | | | | | |

Total Money Market Securities (Cost $197,042) | | | | | | | 197,042 | |

| | | | | | | | |

Total Investments – 100.23% (Cost $8,841,258) | | | | | | | 9,694,443 | |

| | | | | | | | |

Liabilities in Excess of Other Assets – (0.23)% | | | | | | | (22,125) | |

| | | | | | | | |

NET ASSETS – 100.00% | | | | | | $ | 9,672,318 | |

| | | | | | | | |

| | (a) | Rate disclosed is the seven day effective yield as of October 31, 2016. |

| | * | Non-income producing security. |

ADR – American Depositary Receipt

The sectors shown on the schedule of investments are based on Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

9

GRANITE VALUE FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2016

| | | | |

Assets | | | | |

Investments in securities at fair value (cost $8,841,258) | | $ | 9,694,443 | |

Receivable for investments sold | | | 204,672 | |

Dividends receivable | | | 7,175 | |

Receivable from Adviser | | | 2,738 | |

Prepaid expenses | | | 5,577 | |

| | | | |

Total Assets | | | 9,914,605 | |

| | | | |

Liabilities | | | | |

Payable for investments purchased | | | 202,304 | |

Payable to administrator, fund accountant, and transfer agent | | | 13,759 | |

Payable to trustees | | | 31 | |

Other accrued expenses | | | 26,193 | |

| | | | |

Total Liabilities | | | 242,287 | |

| | | | |

| |

Net Assets | | $ | 9,672,318 | |

| | | | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 8,491,124 | |

Accumulated undistributed net investment income | | | 74,852 | |

Accumulated undistributed net realized gain from investments | | | 253,157 | |

Net unrealized appreciation on investments | | | 853,185 | |

| | | | |

| |

Net Assets | | $ | 9,672,318 | |

| | | | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 744,095 | |

| | | | |

Net asset value (“NAV”) and offering price per share | | $ | 13.00 | |

| | | | |

Redemption price per share (NAV * 98%) (a) | | $ | 12.74 | |

| | | | |

| (a) | The Fund charges a 2.00% redemption fee on shares redeemed in 60 days or less of purchase. Shares are redeemed at the NAV if held longer than 60 calendar days. |

See accompanying notes which are an integral part of these financial statements.

10

GRANITE VALUE FUND

STATEMENT OF OPERATIONS

For the year ended October 31, 2016

| | | | |

Investment Income | |

Dividend income (net of foreign taxes withheld of $571) | | $ | 234,824 | |

| | | | |

Total investment income | | | 234,824 | |

| | | | |

|

Expenses | |

Investment Adviser | | | 98,873 | |

Administration | | | 37,500 | |

Fund accounting | | | 25,000 | |

Transfer agent | | | 20,056 | |

Registration | | | 17,999 | |

Audit | | | 16,800 | |

Legal | | | 15,176 | |

Report printing | | | 10,501 | |

Trustee | | | 4,807 | |

Custodian | | | 3,894 | |

Miscellaneous | | | 33,808 | |

| | | | |

Total expenses | | | 284,414 | |

| | | | |

Fees waived and expenses reimbursed by Adviser | | | (150,666 | ) |

| | | | |

Net operating expenses | | | 133,748 | |

| | | | |

Net investment income | | | 101,076 | |

| | | | |

|

Net Realized and Unrealized Gain (Loss) on Investments | |

Net realized gain on investment securities transactions | | | 384,642 | |

Net change in unrealized appreciation/depreciation of investment securities | | | (398,113 | ) |

| | | | |

Net realized and unrealized loss on investments | | | (13,471 | ) |

| | | | |

Net increase in net assets resulting from operations | | $ | 87,605 | |

| | | | |

See accompanying notes which are an integral part of these financial statements.

11

GRANITE VALUE FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | For the

Year Ended

October 31, 2016 | | | For the

Year Ended

October 31, 2015 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 101,076 | | | $ | 50,264 | |

Net realized gain (loss) on investment securities transactions | | | 384,642 | | | | (130,519 | ) |

Net change in unrealized appreciation/depreciation of investment securities | | | (398,113 | ) | | | (573,813 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 87,605 | | | | (654,068 | ) |

| | | | | | | | |

Distributions | | | | | | | | |

From net investment income | | | (53,723 | ) | | | (31,319 | ) |

From net realized gains | | | – | | | | (484,050 | ) |

| | | | | | | | |

Total distributions | | | (53,723 | ) | | | (515,369 | ) |

| | | | | | | | |

Capital Transactions | | | | | | | | |

Proceeds from shares sold | | | 591,824 | | | | 1,720,031 | |

Reinvestment of distributions | | | 44,897 | | | | 446,979 | |

Amount paid for shares redeemed | | | (1,719,950 | ) | | | (3,488,076 | ) |

| | | | | | | | |

Net decrease in net assets resulting from capital transactions | | | (1,083,229 | ) | | | (1,321,066 | ) |

| | | | | | | | |

Total Decrease in Net Assets | | | (1,049,347 | ) | | | (2,490,503 | ) |

| | | | | | | | |

Net Assets | | | | | | | | |

Beginning of year | | | 10,721,665 | | | | 13,212,168 | |

| | | | | | | | |

End of year | | $ | 9,672,318 | | | $ | 10,721,665 | |

| | | | | | | | |

Accumulated undistributed net investment income | | $ | 74,852 | | | $ | 31,636 | |

| | | | | | | | |

Share Transactions | | | | | | | | |

Shares sold | | | 45,877 | | | | 125,135 | |

Shares issued in reinvestment of distributions | | | 3,558 | | | | 33,607 | |

Shares redeemed | | | (136,304 | ) | | | (257,087 | ) |

| | | | | | | | |

Net decrease in shares outstanding | | | (86,869 | ) | | | (98,345 | ) |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

12

GRANITE VALUE FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding during each period)

| | | | | | | | | | | | | | | | | | | | |

| | | For the

Year Ended

October 31,

2016 | | | For the

Year Ended

October 31,

2015 | | | For the

Year Ended

October 31,

2014 | | | For the

Year Ended

October 31,

2013 | | | For the

Period Ended

October 31,

2012 (a) | |

Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 12.90 | | | $ | 14.22 | | | $ | 13.84 | | | $ | 11.24 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.14 | | | | 0.05 | | | | 0.02 | | | | 0.02 | | | | 0.05 | (b) |

Net realized and unrealized gain (loss) on investments | | | 0.03 | (c) | | | (0.80 | ) | | | 0.74 | | | | 2.68 | | | | 1.19 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.17 | | | | (0.75 | ) | | | 0.76 | | | | 2.70 | | | | 1.24 | |

| | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.07 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.10 | ) | | | – | |

Net realized gains | | | – | | | | (0.54 | ) | | | (0.36 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.07 | ) | | | (0.57 | ) | | | (0.38 | ) | | | (0.10 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | |

Paid in capital from redemption fees | | | – | | | | – | | | | – | (d) | | | – | | | | – | (d) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 13.00 | | | $ | 12.90 | | | $ | 14.22 | | | $ | 13.84 | | | $ | 11.24 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Total Return (e) | | | 1.30 | % | | | -5.37 | % | | | 5.65 | % | | | 24.21 | % | | | 12.40 | %(f) |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (000) | | $ | 9,672 | | | $ | 10,722 | | | $ | 13,212 | | | $ | 10,577 | | | $ | 4,750 | |

Ratio of net expenses to average net assets | | | 1.35 | % | | | 1.36 | %(h) | | | 1.35 | % | | | 1.35 | % | | | 1.35 | %(g) |

Ratio of expenses to average net assets before waiver and reimbursement | | | 2.87 | % | | | 2.53 | % | | | 2.39 | % | | | 3.32 | % | | | 8.11 | %(g) |

Ratio of net investment income to average net assets | | | 1.02 | % | | | 0.40 | % | | | 0.17 | % | | | 0.27 | % | | | 0.55 | %(g) |

Portfolio turnover rate | | | 31 | % | | | 32 | % | | | 30 | % | | | 33 | % | | | 20 | %(f) |

| (a) | For the period December 22, 2011 (commencement of operations) to October 31, 2012. |

| (b) | Calculated using the average shares method. |

| (c) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

| (d) | Resulted in less than $0.005 per share. |

| (e) | Total return in the above table represents the rate that an investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (h) | Includes 0.01% overdraft fees. |

See accompanying notes which are an integral part of these financial statements.

13

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS

October 31, 2016

NOTE 1. ORGANIZATION

The Granite Value Fund (the “Fund”) is an open-end diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board. The Fund commenced operations December 22, 2011. The Fund’s investment adviser is Granite Investment Advisors, Inc. (the “Adviser”). The investment objective of the Fund is to seek long-term capital appreciation.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the year ended October 31, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. The Fund is subject to examination by U.S. federal tax authorities for the last three tax year ends and the interim tax period since then.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or other appropriate basis (using procedures approved by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

14

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2016

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES – continued

Redemption Fees – The Fund charges a 2.00% redemption fee for shares redeemed within 60 days of purchase. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily NAV calculation.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, net realized long-term capital gains and its net realized short-term capital gains, if any, to its shareholders on at least an annual basis. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For fiscal year ended October 31, 2016, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | | |

Accumulated Undistributed

Net Investment Income (loss) | | Accumulated Net Realized

Gain (Loss) from Investments | |

$(4,137) | | $ | 4,137 | |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in a orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including items such as a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| | • | | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

15

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2016

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities that are traded on any stock exchange are generally valued by the pricing agent at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing agent at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing agent at the NASDAQ Official Closing Price.

When using the market quotations or close prices provided by the pricing agent and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing agent with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Adviser determines that the market quotation or the price provided by the pricing agent does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Adviser, in conformity with policies adopted by and subject to review by the Board. These will generally be categorized as Level 3 securities.

Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Adviser would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations. The following is a summary of the inputs used to value the Fund’s investments as of October 31, 2016:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks* | | $ | 9,497,401 | | | $ | – | | | $ | – | | | $ | 9,497,401 | |

Money Market Securities | | | 197,042 | | | | – | | | | – | | | | 197,042 | |

Total | | $ | 9,694,443 | | | $ | – | | | $ | – | | | $ | 9,694,443 | |

| * | Refer to the Schedule of Investments for industry classifications. |

16

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2016

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

The Fund did not hold any investments during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Trust recognizes transfers between fair value hierarchy levels at the reporting period end. There were no transfers between any levels as of October 31, 2016 and the previous reporting period end.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the management agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.00% of the average daily net assets of the Fund. For the year ended October 31, 2016, the Adviser earned a fee of $98,873 from the Fund before the reimbursement described below.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses through February 28, 2017, so that total annual fund operating expenses, excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year, do not exceed 1.35% of the Fund’s average daily net assets. The operating expense limitation also excludes any fees and expenses of acquired funds.

For the year ended October 31, 2016, fees and expenses totaling $150,666 were waived or reimbursed by the Adviser. Each fee waiver or expense reimbursement by the Adviser with respect to the Fund is subject to repayment by the Fund within the three fiscal years following the fiscal year in which that particular fee waiver or expense reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in effect at the time of the fee waiver or expense reimbursement and any expense limitation in place at the time of repayment.

The amounts subject to repayment by the Fund pursuant to the aforementioned conditions are as follows:

| | | | |

Amount | | Recoverable through

October 31, | |

$ 129,076 | | | 2017 | |

148,128 | | | 2018 | |

150,666 | | | 2019 | |

The Trust retains Ultimus Asset Services, LLC (“Ultimus”), formerly Huntington Asset Services, Inc. (“HASI”) to provide the Fund with administration, fund accounting, transfer agent and compliance services, including all regulatory reporting. For the period ended October 31, 2016, Ultimus earned fees of $37,500, $25,000 and $20,056 for administration, fund accounting and transfer agent services, respectively. At October 31, 2016, the Fund owed Ultimus $13,759 for such services.

The officers and one trustee of the Trust are members of management and/or employees of Ultimus. Unified Financial Securities, LLC (the “Distributor”), acts as the principal distributor of the Fund’s shares. Effective at the close of business on December 31, 2015, Ultimus Fund Solutions, LLC, acquired HASI and the Distributor from Huntington Bancshares, Inc. (“HBI”). Prior to January 1, 2106, HASI and the Distributor were under common control by HBI.

17

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2016

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES – continued

There were no payments made by the Fund to the Distributor during the year ended October 31, 2016. A trustee and certain officers of the Trust are officers of the Distributor and each such person may be deemed to be an affiliate of the Distributor.

The Fund has adopted a 12b-1 Plan that permits the Fund to pay 0.25% of its average daily net assets to financial institutions that provide distribution and/or shareholder servicing. The 12b-1 Plan has not been activated as of October 31, 2016.

NOTE 5. PURCHASES AND SALES

For the year ended October 31, 2016, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| | | | |

Purchases | | | | |

U.S. Government Obligations | | $ | – | |

Other | | | 3,090,410 | |

Sales | | | | |

U.S. Government Obligations | | $ | – | |

Other | | | 4,091,287 | |

NOTE 6. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At October 31, 2016, Charles Schwab & Co., Inc. for the benefit of its customers, owned 50.58%. The Trust does not know whether Charles Schwab & Co., Inc. or any of the underlying beneficial owners controlled more than 25% of the voting securities of the Fund.

NOTE 7. FEDERAL TAX INFORMATION

At October 31, 2016, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | | |

Gross appreciation | | $ | 1,236,789 | |

Gross depreciation | | | (371,664 | ) |

| | | | |

Net appreciation on investments | | $ | 865,125 | |

| | | | |

At October 31, 2016, the aggregate cost of securities, excluding U.S. government obligations, for federal income tax purposes was $8,829,318 for the Fund.

On December 14, 2016 the Fund paid an income distribution of $0.120847 per share and a long term capital gain of $0.346023 per share to shareholders of record on December 13, 2016.

18

GRANITE VALUE FUND

NOTES TO THE FINANCIAL STATEMENTS – (continued)

October 31, 2016

NOTE 7. FEDERAL TAX INFORMATION – continued

The tax characterization of distributions for the fiscal years ended October 31, 2016 and 2015, was as follows:

| | | | | | | | |

| Distributions paid from: | | 2016 | | | 2015 | |

Ordinary Income* | | $ | 53,723 | | | $ | 31,319 | |

Long-Term Capital Gains | | $ | — | | | $ | 484,050 | |

| | | | | | | | |

Total Distributions | | $ | 53,723 | | | $ | 515,369 | |

| | | | | | | | |

| * | Short term capital gain distributions are treated as ordinary income for tax purposes. |

At October 31, 2016, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 65,446 | |

Undistributed long-term capital gain | | | 253,158 | |

Accumulated capital and other losses | | | (2,535 | ) |

Net unrealized appreciation (depreciation) | | | 865,125 | |

| | | | |

| | $ | 1,181,194 | |

| | | | |

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. There were no items requiring adjustment of the financial statements or additional disclosure.

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Granite Value Fund and

Board of Trustees of Valued Advisers Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Granite Value Fund (the “Fund”), a series of Valued Advisers Trust, as of October 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2016, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Granite Value Fund as of October 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN & COMPANY, LTD.

Cleveland, Ohio

December 23, 2016

20

SUMMARY OF FUND EXPENSES (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning and held for the six month period, May 1, 2016 to October 31, 2016.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds.

| | | | | | | | | | | | |

| Granite Value Fund | | Beginning

Account Value May 1, 2016 | | | Ending Account Value October 31, 2016 | | | Expenses Paid

During Period* May 1, 2016 – October 31, 2016 | |

Actual | | $ | 1,000.00 | | | $ | 994.36 | | | $ | 6.75 | |

Hypothetical** | | $ | 1,000.00 | | | $ | 1,018.34 | | | $ | 6.86 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.35%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

| ** | Assumes a 5% return before expenses. |

21

TRUSTEES AND OFFICERS (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following tables provide information regarding the Trustees and Officers.

The following table provides information regarding each of the Independent Trustees.

| | | | |

Name, Address*, (Age),

Position with Trust**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

Ira Cohen, 57, Independent Trustee, June 2010 to present. | | Current: Independent financial services consultant since February 2005; Executive Vice President of Asset Management Services, Recognos Financial, since August 2015. | | Trustee and Audit Committee Chairman, Griffin Institutional Real Estate Access Fund, since May 2014. Trustee, Angel Oak Funds Trust, since October 2014. |

Andrea N. Mullins, 49, Independent Trustee, December 2013 to present. | | Current: Private investor; Independent Contractor, Seabridge Wealth Management, LLC, since April 2014. | | None. |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| ** | As of the date of this report, the Trust consists of 14 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below is qualified to serve as a Trustee.

| | | | |

Name, Address*, (Age),

Position with Trust**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

R. Jeffrey Young, 52, Trustee and Chairman, June 2010 to present. | | Current: Vice President and Director of Relationship Management, Ultimus Fund Solutions, LLC (since December 2015); President, Unified Financial Securities, LLC (since July 2015). Previous: President, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (April 2015 to December 2015), Director (May 2014 to December 2015), Senior Vice President (January 2010 to April 2015); Director, Unified Financial Securities, Inc. (n/k/a Unified Financial Securities, LLC) (May 2014 to December 2015); Chief Executive Officer, Huntington Funds (February 2010 to March 2015); Chief Executive Officer, Huntington Strategy Shares (November 2010 to March 2015); President and Chief Executive Officer, Dreman Contrarian Funds (March 2011 to February 2013). | | Trustee and Chairman, Capitol Series Trust, since September 2013. |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| ** | As of the date of this report, the Trust consists of 14 series. |

22

The following table provides information regarding the Officers of the Trust:

| | | | |

Name, Address*, (Age),

Position with Trust,** Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

R. Jeffrey Young, 52, Trustee and Chairman, June 2010 to present; Principal Executive Officer and President, Valued Advisers Trust since February 2010. | | Current: Vice President and Director of Relationship Management, Ultimus Fund Solutions, LLC (since December 2015); President, Unified Financial Securities, LLC (since July 2015). Previous: President, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (April 2015 to December 2015), Director (May 2014 to December 2015), Senior Vice President (January 2010 to April 2015); Director, Unified Financial Securities, Inc. (n/k/a Unified Financial Securities, LLC) (May 2014 to December 2015); Chief Executive Officer, Huntington Funds (February 2010 to March 2015); Chief Executive Officer, Huntington Strategy Shares (November 2010 to March 2015); President and Chief Executive Officer, Dreman Contrarian Funds (March 2011 to February 2013). | | Trustee and Chairman, Capitol Series Trust, since September 2013. |

John C. Swhear, 55, Chief Compliance Officer, AML Officer and Vice President, August 2008 to present. | | Current: Assistant Vice President and Associate Director of Compliance, Ultimus Fund Solutions, LLC (since December 2015); Chief Compliance Officer, Unified Financial Securities, LLC (since May 2007); Chief Compliance Officer and AML Officer, Capitol Series Trust (since September 2013); Vice President Unified Series Trust (since January 2016). Previous: Vice President of Legal Administration and Compliance, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (April 2007 to December 2015), Director (May 2014 to December 2015); Director, Unified Financial Securities, Inc. (n/k/a Unified Financial Securities, LLC) (May 2014 to December 2015); President , Unified Series Trust (March 2012 to January 2016), Senior Vice President (May 2007 to March 2012); Secretary , Huntington Funds (April 2010 to February 2012). | | None. |

Carol J. Highsmith, 52, Vice President, August 2008 to present; Secretary, March 2014 to present | | Current: Assistant Vice President, Ultimus Fund Solutions, LLC (since December 2015). Previous: Secretary, Cross Shore Discovery Fund (May 2014 to February 2016); Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (November 1994 to December 2015), most recently Vice President of Legal Administration (2005 to December 2015). | | None. |

23

| | | | |

Name, Address*, (Age),

Position with Trust,** Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

Matthew J. Miller, 40, Vice President, December 2011 to present. | | Current: Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (since December 2015); President and Chief Executive Officer, Capitol Series Trust (since September 2013). Previous: Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (since July 1998), most recently Vice President of Relationship Management (2005 to December 2015); Vice President, Huntington Funds (February 2010 to April 2015). | | None. |

Bryan W. Ashmus, 43, Principal Financial Officer and Treasurer, December 2013 to present. | | Current: Vice President and Director of Financial Administration, Ultimus Fund Solutions, LLC (since December 2015); Chief Financial Officer and Treasurer, Cross Shore Discovery Fund (since June 2016). Previous: Vice President and Manager of Financial Administration, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (September 2013 to December 2015); Chief Financial Officer and Treasurer, Huntington Strategy Shares and Huntington Funds Trust (November 2013 to April 2016); Vice President, Fund Administration, Citi Fund Services Ohio, Inc. (from May 2005 to September 2013). | | None. |

| * | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| ** | As of the date of this report, the Trust consists of 14 series. |

OTHER INFORMATION (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (888) 442-9893 to request a copy of the SAI or to make shareholder inquiries.

24

APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

At a meeting held on September 7-8, 2016, the Board of Trustees (the “Board”) considered the renewal of the Investment Advisory Agreement (the “Agreement”) between Valued Advisers Trust (the “Trust”) and Granite Investment Advisors, Inc. (“Granite”) with respect to the Granite Value Fund (the “Fund”). Granite provided written information to the Board to assist the Board in its considerations.

Trust counsel reminded the Trustees of their fiduciary duties and responsibilities as summarized in the memorandum from his firm, including the factors to be considered, and the application of those factors to the Agreement. In assessing the factors, the Board took into consideration information furnished by Granite and Trust management for the Board’s review and consideration throughout the year, as well as information specifically prepared or presented in connection with the annual renewal process, including: (i) reports regarding the services and support provided to the Fund and its shareholders by Granite; (ii) quarterly assessments of the investment performance of the Fund by personnel of Granite; (iii) commentary on the reasons for the Fund’s performance; (iv) presentations by Granite addressing Granite’s investment philosophy, investment strategy, personnel, and operations; (v) compliance and audit reports concerning the Fund and Granite; (vi) disclosure information contained in the registration statement for the Fund and the Form ADV of Granite; and (vii) a memorandum from counsel, that summarized the fiduciary duties and responsibilities of the Board in reviewing and approving the Agreement. The Board also requested and received various informational materials including, without limitation: (i) documents containing information about Granite, including its financial information, a description of personnel and the services it provides to the Fund; information on Granite’s investment advice and performance; summaries of the Fund’s expenses, compliance program, current legal matters, and other general information; (ii) comparative expense and performance information for other mutual funds with strategies similar to the Fund; and (iii) the benefits to be realized by Granite from its relationship with the Fund. The Board did not identify any particular information that was most relevant to its consideration of the Agreement and each Trustee may have afforded different weight to the various factors.

| 1. | The nature, extent, and quality of the services to be provided by Granite. In this regard, the Board considered Granite’s responsibilities under the Agreement. The Trustees considered the services being provided by Granite to the Fund including, without limitation: the quality of its investment advisory services (including research and recommendations with respect to portfolio securities), its process for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations, Granite’s coordination of services for the Fund among the fund’s service providers, and Granite’s efforts to promote the Fund and grow its assets. The Trustees considered Granite’s continuity of, and commitment to retain, qualified personnel and Granite’s commitment to maintain its resources and systems and options that allow the Fund to maintain its goals, and Granite’s continued cooperation with the Independent Trustees and counsel for the Fund. The Trustees considered Granite’s methods of operation and its personnel, including their education and experience; and Granite’s compliance program, policies, and procedures. The Trustees considered Granite’s intent to add to its business development resources. After considering the foregoing information and further information in the meeting materials provided by Granite (including Granite’s Form ADV), the Board concluded that, in light of all the facts and circumstances, the nature, extent, and quality of the services provided by Granite to the Fund were satisfactory and adequate. |

| 2. | Investment Performance of the Fund and Granite. In considering the investment performance of the Fund and Granite, the Trustees compared the performance, including the year-to-date, 1-year, 3-year and since inception annualized returns of the Fund (for the periods ending June 30, 2016) with the performance of funds in the Morningstar Large Cap Value category. The Trustees also considered the consistency of Granite’s management of the Fund with its investment objective, strategies, and limitations. The Trustees noted that the Fund’s performance for the year-to-date and since inception periods was above the category average, and the performance over the 1-year and 3-year periods was below the average of its Morningstar category. The Trustees also considered the performance of Granite’s separate accounts that were managed in a manner similar to that of the Fund and they noted that the performance was relatively comparable and that |

25

| | Granite’s explanations for the differences in performance were acceptable. After reviewing and discussing the investment performance of the Fund further, Granite’s experience managing the Fund, the Fund’s historical performance, and other relevant factors, the Board concluded, in light of all the facts and circumstances, that the investment performance of the Fund and Granite was satisfactory. |

| 3. | The costs of the services to be provided and profits to be realized by Granite from the relationship with the Fund. In considering the costs of services to be provided and the profits to be realized by Granite from the relationship with the Fund, the Trustees considered: (1) Granite’s financial condition; (2) the asset levels of the Fund; (3) the overall expenses of the Fund; and (4) the nature and frequency of advisory fee payments. The Trustees reviewed information provided by Granite regarding its profits associated with managing the Fund. The Trustees also considered potential benefits for Granite in managing the Fund. The Trustees then compared the fees and expenses of the Fund (including the management fee) to other comparable mutual funds. The Trustees noted that the Fund’s management fee was higher than its peer average and median, as was the net operating expense ratio, although the Trustees noted that other funds in the peer group had higher management fees and net operating expense ratios. The Trustees discussed the difference between the fees charged to the Fund as compared to the fees charged to Granite’s separately managed accounts with investment strategies and objectives similar to the Fund. They acknowledged the increased resources required to manage the Fund, including increased compliance and administrative costs. Based on the foregoing, the Board concluded that the fees to be paid to Granite by the Fund and the profits to be realized by Granite, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Granite. |

| 4. | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with Granite. The Board considered that while the management fee remained the same at all asset levels, the Fund’s shareholders had experienced benefits from the Fund’s expense limitation arrangement. The Trustees noted Granite’s representation of its current intent to keep the expense limitation arrangement in place into the foreseeable future. The Trustees also noted that once the Fund’s expenses fell below the cap set by the arrangement, the Fund’s shareholders would continue to benefit from the economies of scale under the Fund’s agreements with service providers other than Granite. In light of its ongoing consideration of the Fund’s asset levels, expectations for growth in the Fund, and fee levels, the Board determined that the Fund’s fee arrangements, in light of all the facts and circumstances, were fair and reasonable in relation to the nature and quality of the services provided by Granite. |

| 5. | Possible conflicts of interest and benefits to Granite. In considering Granite’s practices regarding conflicts of interest, the Trustees evaluated the potential for conflicts of interest and considered such matters as the experience and ability of the advisory personnel assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and/or Granite’s other accounts; and the substance and administration of Granite’s Code of Ethics. The Trustees also considered disclosure in the registration statement of the Trust relating to Granite’s potential conflicts of interest. The Trustees considered Granite’s policies with respect to the use of soft dollars. The Trustees noted that Granite benefited from the Fund in that it is able to utilize the Fund as a vehicle into which to direct advisory clients with small account balances. The Trustees did not identify any other potential benefits (other than the management fee) that would be realized by Granite. Based on the foregoing, the Board determined that the standards and practices of Granite relating to the identification and mitigation of potential conflicts of interest and the benefits that it derives from managing the Fund are acceptable. |

After additional consideration of the factors delineated in the memorandum provided by counsel and further discussion among the Board members, the Board determined to approve the continuation of the Agreement between the Trust and Granite.

26

OTHER FEDERAL INCOME TAX INFORMATION (Unaudited)

The Form 1099-DIV you receive in January 2017 will show the tax status of all distributions paid to your account in calendar year 2016. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 100% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2016 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

For the year ended October 31, 2016, the Fund did not designate any long-term capital gain distributions.

27

VALUED ADVISERS TRUST

PRIVACY POLICY

The following is a description of the policies of the Valued Advisers Trust (the “Trust”) regarding disclosure of nonpublic personal information that shareholders provide to a series of the Trust (each, a “Fund”) or that the Fund collects from other sources. In the event that a shareholder holds shares of a Fund through a broker-dealer or other financial intermediary, the privacy policy of the financial intermediary would govern how shareholder nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information A Fund May Collect. A Fund may collect the following nonpublic personal information about its shareholders:

| • | | Information the Fund receives from a shareholder on applications or other forms, correspondence, or conversations (such as the shareholder’s name, address, phone number, social security number, and date of birth); and |

| • | | Information about the shareholder’s transactions with the Fund, its affiliates, or others (such as the shareholder’s account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information A Fund May Disclose. A Fund may not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. A Fund is permitted by law to disclose all of the information it collects, as described above, to its service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process shareholder transactions and otherwise provide services to the shareholder.

Confidentiality and Security. Each Fund shall restrict access to shareholder nonpublic personal information to those persons who require such information to provide products or services to the shareholder. Each Fund shall maintain physical, electronic, and procedural safeguards that comply with federal standards to guard shareholder nonpublic personal information.