UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

| | |

| Ultimus Asset Services, LLC 225 Pictoria Drive, Suite 450 | | Cincinnati, OH 45246 |

| (Address of principal executive offices) | | (Zip code) |

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover, DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law GroupTM

11300 Tomahawk Creek Parkway,

Suite 310

Leawood, KS 66221

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: 5/31

Date of reporting period: 5/31/16

Item 1. Reports to Stockholders.

ANNUAL REPORT

May 31, 2016

BFS Equity Fund

185 Asylum Street ● City Place II ● Hartford, CT 06103 ● (855) 575-2430

Letter to Shareholders

Dear Fellow Shareholders,

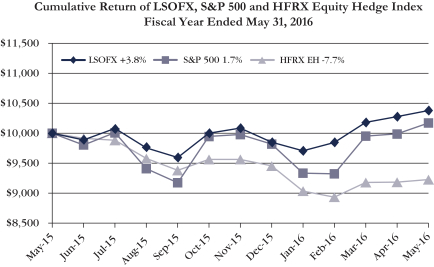

This annual report covers the period June 1, 2015 through May 31, 2016 – the BFS Equity Fund’s second full fiscal year.

The BFS Equity Fund (the “Fund”) was launched on November 8, 2013, with initial funds from investors of $1.1 million. On June 1, 2015, the Fund had net assets of $20.2 million. During the course of the last fiscal year, the net assets of the Fund increased 18% to $23.9 million as of May 31, 2016. This growth was driven totally by inflows from investors into the Fund, the Fund’s investment return having been slightly negative over the past fiscal year. As of May 31, 2016, there were approximately 540 investors in the Fund.

The BFS Equity Fund achieved a total return of -0.91% for the fiscal year commencing June 1, 2015 and ending May 31, 2016. This was less than the 1.72% total return of the S&P 500® Index and the 1.39% total return of the Dow Jones Industrial Average.

This report includes a commentary from the Lead Portfolio Manager, Tim Foster, and Co-Portfolio Managers, Tom Sargent and Keith LaRose. You will also find a listing of the portfolio holdings as of May 31, 2016, as well as financial statements and detailed information about the performance and positioning of the BFS Equity Fund.

Numerous global economic and geo-political challenges continued to face U.S. stock markets during the period under review. A slowdown in the Chinese economy and devaluations in the yuan, steeply declining energy and commodity prices, and a slowdown in the manufacturing and industrial sectors of the U.S. economy have contributed to investor anxiety. Worrisome tensions continue in many parts of the globe. Continued instability in the middle east, the expanding terrorist activities of ISIS, and the re-emergence of Al-Qaeda, and China’s aggressive actions in the South China Sea are additional causes of investor anxiety. Also contributing to market uncertainty is the yet to be determined impact of the U.K. vote to exit the European Union and the results of the upcoming U.S. presidential election, both of which will play out after the period covered by this report. Despite the aforementioned risks, the economy continues its modest growth. The Fed remains accommodative. Inflation and interest rates remain low and there is abundant liquidity we expect to find its way into the U.S. stock market.

1

In closing, it is important to reiterate our belief that our investment strategy of investing in quality growth stocks purchased with a risk-mitigating approach and positioned to provide a margin of safety in the case of economic or market weakness is effective over the longer term. We believe the Fund’s ownership of shares in quality companies with strong brands, good balance sheets, professional management, and robust cash flow should be able to withstand market corrections, even bear markets, and perform well over the longer term.

The Portfolio Managers of the BFS Equity Fund and I are shareholders together with you. We thank you for the trust that you have placed in us to manage your assets.

Sincerely,

Stephen L. Willcox

President and CEO

Bradley, Foster & Sargent, Inc.

2

Portfolio Managers’ Letter

TO OUR SHAREHOLDERS

May 31, 2016 marked the end of the second full fiscal year for the BFS Equity Fund (the “Fund”). During the year, the Fund experienced periods of both positive and negative returns as the market gained as much as +5.0% and on two occasions lost approximately -10.0%. For the twelve month period ended May 31, 2016 the Fund returned -0.91%. During the year, we narrowed down the number of names in the portfolio to 39 to concentrate on our highest confidence ideas. Some of these attractive growth stocks that we like for the long term, like Apple (-21.8%), took a breather over this period and contributed negatively to our total return. Our strategic decision to avoid the highly regulated, slow growth and richly valued Utilities sector backfired as a continued decline in interest rates drove the Utilities sector to new highs that led market sector performance. The S&P 500® Index (“S&P 500”), over the same twelve month period, returned +1.72% while the Dow Jones Industrial Average returned +1.39%. Relative to the two benchmarks, the Fund trailed the S&P 500 by 2.63% and the Dow Jones Industrial Average by 2.30%. These relatively flat market returns reflect the stalling out of corporate earnings over the twelve month period.

MARKET COMMENTARY

The strong U.S. Dollar and weak commodity prices were the primary culprits for the lack of earnings growth over the past year. Earnings drive stock prices and without growth in earnings, stock prices are likely to remain stagnant as well. However, the rising dollar/falling commodity trend reversed sharply in February of this year. The abatement of currency headwinds enabled the market to reverse the January/February 10.0% decline, thereby bringing the market averages back to near all-time highs and ultimately to breakeven for the first five months of 2016 and for the trailing twelve months of the Fund’s fiscal year as well. Where do we go from here? If interest rates remain close to today’s low levels over the next year, we believe there is little fundamental reason for the P/E of the market to vary much from the current multiple of 17 times. This P/E is very close to the 30 year mean multiple as well. With the doubling of oil prices since the February bottom and the reversal of the dollar’s strength, we expect positive earnings comparisons within the Energy sector and improved results from U.S. multinational companies. This could lead to approximately 5.0% earnings growth over the next fiscal year and hopefully stock prices that may mirror that growth as well. Election years can bring many surprises and the 2016 election appears as polarized as any in recent history. Election zeal may bring heightened volatility to the market, but we believe the

3

fundamental case for positive equity returns remains valid, including: positive real GDP growth, an accommodative Federal Reserve, low inflation and low interest rates.

INVESTMENT STRATEGY

In structuring the composition of the Fund, we strive to be proactive, building our exposure to those sectors and companies we view as potential beneficiaries of change. It can be the halo effect of new product innovation, the enhancement of an economic moat or improved pricing power. On the flip side, the absence of malice can be equally beneficial, whether it be the release from regulatory constraints, diminished competition, diminishing currency headwinds or a shifting of the yield curve. These investment themes often take time to play out; thus, when evaluating the attractiveness of a particular holding, we often have a three to five-year time horizon. Our stock selection process is to choose among the many high-quality businesses we have identified through our bottom-up research process and to use a longer investment time horizon as a competitive advantage in our favor. Two opportunities emerge from the time-is-in-our-favor camp. The first opportunity presents itself as we attempt to identify changes the market has not yet priced in. The second opportunity presents itself when investors overreact to a short term negative event. Top down macro-economic views do play a role with respect to both our sector and security selection, but our purchase and sale decisions are driven to a greater extent by our analysis of the absolute and relative attractiveness of each company. For instance, best-of-breed or industry leaders are highly sought after candidates for inclusion in the Fund, ideally if valuations provide a margin of safety in terms of a discount to intrinsic value or, at a minimum, a discount relative to comparable companies. Investment risks and opportunities are analyzed company-by-company and, for each holding, we seek to judge whether all the key factors are incorporated into the company’s stock price. As such, we endeavor to deliver attractive risk-adjusted results over a full market cycle by utilizing a disciplined approach targeting results which should compare favorably to benchmarks, as well as peer managers. We eschew the high risk purchases reaching for that elusive top decile performance that can invite bottom decile rankings as well.

INVESTMENT COMMENTARY

For the past seven years, the trend has been your friend in the equity markets, but over the past several quarters the duration and the magnitude of the stock market recovery extended into a loftier zone and seemed to run out of oxygen. While the net decline in the benchmark indices has been modest, in the interim the market experienced two nearly 10.0% corrections. Among the many market concerns, the slowdown in global

4

growth was first and foremost. In the U.S., Real GDP growth declined from 3.9% in the second quarter of 2015 to 1.4% in the fourth quarter of 2015 and a lethargic 0.8% in the first quarter of 2016. In China, growth slowed to about 6.0% as of the first quarter of 2016 (down from almost twice that a few years ago), prompting China’s policy makers to devalue the Yuan versus the dollar. Through mid-February, the dollar strengthened versus almost every global currency with the biggest impact stemming from the Yuan, the Euro and the Yen. For commodities priced in dollars, like oil, this meant a sharp drop in price and the slashing of capital spending budgets. For U.S. manufacturers of everything from jet engines to tractors and bulldozers, the dollar’s strength means a competitive disadvantage for global pricing. For U.S. companies doing business across the globe, translating foreign profits back to stronger U.S. dollars means fewer dollars – hence lower profits. Estimates for corporate profits, which at the start of 2015 were optimistic at high single digit or low double digit comparisons, collapsed to -3.5% for the fourth quarter of 2015 and remained in negative territory through the first quarter of 2016. A peak in merger and acquisition activity was an important component of individual stock returns.

Technology

The Technology sector was our heaviest weighted sector at 21.2% and slightly higher than the S&P 500 Technology sector at 20.4%. Our Tech selections returned +5.1% over the past year, better than the S&P 500 Technology sector return of +3.1%. Our top performing stocks were Alphabet (Google) (+37.3%), Adobe (+25.8%), and Microsoft (+16.3%). Our biggest disappointment was Apple (-21.8%). Apple’s heady growth stalled out between generations of iPhones, but we believe the breadth of Apple’s ecosystem will continue to power attractive returns going forward.

Healthcare

At a 17.0% weighting, Healthcare was our second largest sector exposure. Uncertainties about the future of pharmaceutical pricing pressured the sector to negative returns for the year. The Fund returned -2.5% versus the S&P 500 Healthcare sector return of -3.3%. Novartis was our worst performer (-19.7%). Biotech was particularly hard hit with losses for Celgene of -14.8% and Gilead Sciences of -13.0%. With less drug exposure, Thermo Fisher Scientific (+17.6%) and Johnson & Johnson (+15.9%) were our best performers.

Industrials

Compared to the S&P 500 Industrial sector weighting of 10.0%, the Industrial sector was our largest relative sector bet at 14.6%. Our return lagged the S&P 500 Industrial sector at +0.4% versus +3.3%. Nielsen Holdings was our best performing industrial

5

(+22.4%), but the data collection and mining company could hardly be considered a traditional manufacturer. Danaher (+14.7%) and GE (+14.5%) also performed well. United Technologies was a disappointment (-11.8%), but will remain a long-term holding with a major new growth platform – the geared turbofan aircraft engine. Union Pacific and Transdigm both lost ground and were sold.

Consumer Discretionary

The Consumer Discretionary sector was another sizeable overweight in the Fund with a position of 16.0% versus the S&P 500 Consumer Discretionary sector at 12.6%. We believe the overweighting is appropriate due to superior growth prospects for many companies in the sector, as well as improving consumer balance sheets. The Fund’s return of +3.3% lagged the S&P 500 Consumer Discretionary sector return of +5.7%. Unfortunately, a company and management team we like, Polaris Industries, suffered a perfect storm of currency headwinds, the warmest December on record and some manufacturing growing pains in their new line of Indian motorcycles – and the stock took a real beating (-36.9%). It was our worst performing stock in the portfolio. Similarly, another company whose management team we like, Under Armour, also pulled back -12.4%. After a fairly sharp correction in early 2016, we initiated a new position in Amazon which jumped +23.1%. The continued strength in the housing sector pushed Home Depot’s return up +21.6%. Jarden returned +11.1%, helped by its merger with Newell Rubbermaid to form Newell Brands.

Financials

The Fund’s holdings in the Financials sector totaled 11.2% of the portfolio; well under the S&P 500 Financials sector weight of 16.3%. The underweight was to our advantage as our Financials sector return was -5.9% versus -1.3% for the S&P 500 Financials sector. The flattening yield curve left little optimism for improvement in net interest margins and we chose to reduce our bank exposure. Our timing to reduce our bank weighting was ill timed, having been executed during the mid-February market sell-off. We initiated a position in Chubb, the former ACE Insurance, which purchased Chubb and changed its corporate moniker. Chubb has made steady progress since our purchase and returned +10.1%. We repurchased American Express after the shares fell in response to the loss of the Costco branded card partnership and the stock regained +8.1%. Our strategy to reduce bank exposure in the midst of the market correction in February led to losses of -29.4% in East West Bancorp and -11.9% in M&T Bank.

6

Consumer Staples

At 9.4% the Fund’s Consumer Staples sector weighting was very close to the S&P 500 Consumer Staples sector weighting at 10.1%. The Fund’s Consumer Staples sector return was +12.3%, better than the S&P 500 Consumer Staples sector return at +10.8%. We like the dividend yields and defensive characteristics of this sector; however, with current P/E multiples at a significant premium to the S&P multiple, we believe the defensive characteristics will be limited. We are hanging on to our Constellation Brands (+31.2%), but consider the stock richly priced. We sold Church & Dwight (+17.3%), whose modest but consistent growth is now just too richly priced. Mondelez (+11.8%) and Costco (+12.6%) were also positive contributors. CVS Health (-4.4%) was our weakest link among the Consumer Staples sector stocks, but we believe the pharmacy benefit management aspect brings this leading pharmacy retailer significant competitive advantages to others.

Energy

The Energy sector weighting of the Fund and the S&P 500 Energy sector weighting were similar at 7.5% and 7.1%, respectively. With oil prices in free fall for most of the year there were few places to hide. EOG Resources lost -27.9% and Core Laboratories lost -19.4%. Owning the industry leader, Exxon (+10.3%), helped cushion the -10.1% blow the S&P 500 Energy sector experienced. The Fund’s Energy sector return of -3.4% beat the S&P 500 Energy sector return by 6.7 percentage points. Pipeline company, Spectra Energy, was our best performer (+35.8%), primarily because the timing of our purchase just about caught the bottom in the steep energy correction.

Materials, Telecommunication Services and Utilities

On May 31, 2016, the Fund had no exposure to these three sectors which represent a combined 8.8% weighting in the S&P 500. The primary rationale for this is the general lack of good growth prospects in each industry. The lack of exposure to the Utilities and Telecom Services sectors was particularly painful on a relative basis as the S&P 500 Utilities sector led all S&P 500 sector returns with a +14.6% gain and the S&P 500 Telecommunications Services sector returned +11.8%. These are interest rate sensitive sectors. While the modest decline in interest rates over the past year helped these sectors, our view on interest rates is that rates are much closer to a bottom than a top making the bet on these high yield stocks very risky.

CLOSING COMMENTS

When the market sells at a reasonable multiple relative to history and to prevailing interest rates, as the market currently does at about 16 times forward twelve month expected earnings, then further price appreciation is most likely to be driven by

7

earnings. The flattening of earnings expectations seems fairly reflected by the flattening out in the market’s advance. With little pricing power to be had in this near zero inflation environment, revenue growth has been nearly nonexistent. Growth comes at the price of higher multiples, but we believe some higher growth names will be essential for good performance. The Fund recently initiated positions in Facebook, Amazon and Under Armour, all of which are growing revenues at better than a 20.0% clip. We paid a higher P/E multiple than we would like, but we believe we will need this revenue growth to grow faster than the market. For the bulk of the market participants who can’t drive revenue growth much above low single digits, then earnings growth will have to come from margins and/or financial engineering. But pretax margins are already at record highs of about 10.0%—what will drive margins higher from here? The substitution of capital for labor has historically been a primary driver of productivity, but as labor markets tighten (unemployment has declined from 10.0% at the start of this cycle to now 4.7%) the cost of labor will inevitably go up thereby putting downward pressure on margins. Witness the public and private employees who have recently benefited from higher mandated minimum wages. Lean manufacturing practices have come a long way and further improvements can always be found, but the impact of tighter labor will likely pressure margins lower. In addition to high revenue growth opportunities, companies focused on lean manufacturing are an important theme in the Fund’s stock selection. Companies like United Technologies, Danaher and Polaris are prime examples.

We, at Bradley, Foster & Sargent, Inc., look forward to serving you through our management of the BFS Equity Fund. Thank you for placing your capital under our care.

| | | | |

| Timothy Foster | | Keith LaRose | | Thomas Sargent |

| Lead Portfolio Manager | | Co-Portfolio Manager | | Co-Portfolio Manager |

8

ANNUAL PERFORMANCE REVIEW

(UNAUDITED)

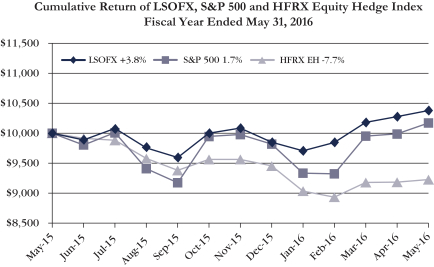

The Fund performed behind the S&P 500 and the Dow Jones Industrial Average for the twelve month period ended May 31, 2016, returning -0.9% versus +1.7% for the S&P 500 and +1.4% for the Dow Jones Industrial Average.

Key Detractors from Relative Results

| | • | | The lack of exposure to the positively performing Utilities (+14.6%) and Telecommunication Services (+11.8%) sectors of the S&P 500 was a missed opportunity and a key detractor for the Fund over the past twelve months. Strategically, however, we view these sectors as likely lagging performers over the long-term. |

| | • | | Financials proved vexing for our stock selections. While we were underweight the S&P 500 Financials sector at 11.2% versus 16.3%, our returns trailed at -5.9% versus -1.3% for the index. Our decision to reduce exposure to banking by selling East West (-29.4%) and M&T (-11.9%) occurred very near the interim bottom for the sector, detracting from our relative performance. |

Key Contributors to Relative Results

| | • | | The Fund made very timely purchases of high growth names, each contributing positively to portfolio returns: Amazon (+23.1%), Alphabet (Google) (+37.3%) and Facebook (+5.9%) as all three firms continue to dominate and monetize their respective Internet-based networks. Spectra Energy (+35.8%) was our single largest contributor. |

| | • | | The Fund’s long term preference for companies with high free cash flow, growing dividends and sustainable brand values, like the Fund’s holdings in the Consumer Staples sector, offered a rewarding contribution to performance over the past twelve months; however, going forward, we are viewing last year’s winners more cautiously due to valuation concerns. |

FUND INFORMATION

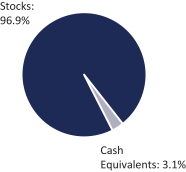

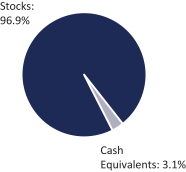

ASSET ALLOCATION

(as a percentage of total investments)

| | | | |

TEN LARGEST HOLDINGS (%) | | FUND | |

Apple, Inc. | | | 3.3 | |

Chubb Ltd. | | | 3.2 | |

Alphabet, Inc. — Class A | | | 3.1 | |

Danaher Corp. | | | 3.1 | |

American Express Co. | | | 3.0 | |

Amazon.com, Inc. | | | 3.0 | |

Facebook, Inc. | | | 3.0 | |

Exxon Mobil Corp. | | | 3.0 | |

Walt Disney Co./The | | | 2.9 | |

Thermo Fisher Scientific, Inc. | | | 2.9 | |

| | | | | | | | |

SECTOR DIVERSIFICATION (%) | | FUND | | | S&P 500 | |

Information Technology | | | 21.2 | | | | 20.4 | |

Healthcare | | | 17.0 | | | | 14.7 | |

Consumer Discretionary | | | 16.0 | | | | 12.6 | |

Industrial | | | 14.6 | | | | 10.0 | |

Financials | | | 11.2 | | | | 16.3 | |

Consumer Staples | | | 9.4 | | | | 10.1 | |

Energy | | | 7.5 | | | | 7.1 | |

Cash Equivalents | | | 3.1 | | | | 0.0 | |

Materials | | | 0.0 | | | | 2.8 | |

Telecommunication Services | | | 0.0 | | | | 2.7 | |

Utilities | | | 0.0 | | | | 3.3 | |

9

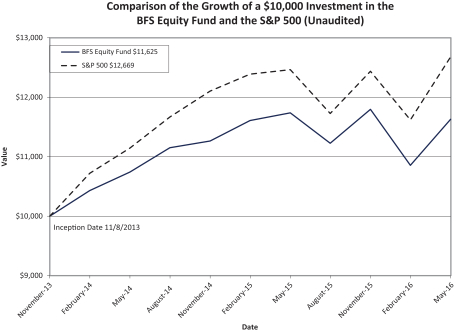

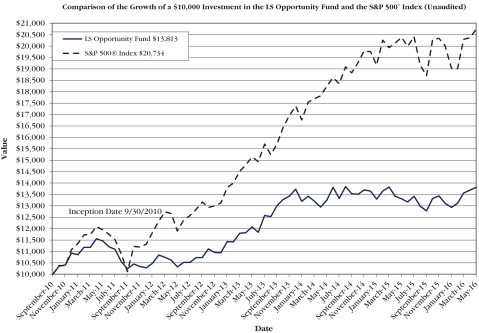

Investment Results (Unaudited)

Average Annual Total Returns(a) (For the periods ended May 31, 2016)

| | | | | | | | |

| | | One Year | | | Since Inception

(November 8, 2013) | |

BFS Equity Fund | | | -0.91% | | | | 6.05% | |

S&P 500® Index(b) | | | 1.72% | | | | 9.68% | |

Dow Jones Industrial Average®(c) | | | 1.39% | | | | 7.92% | |

Total annual operating expenses, as disclosed in the BFS Equity Fund’s (the “Fund”) prospectus dated September 28, 2015, were 2.26% of average daily net assets (1.25% after fee waivers/expense reimbursements by Bradley, Foster & Sargent, Inc. (the “Adviser”)). The Adviser has contractually agreed to waive or limit its fees and assume other expenses of the Fund until September 30, 2016, so that total annual fund operating expenses do not exceed 1.00%. This operating expense limitation does not apply to: interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a plan of distribution under Rule 12b-1, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, in any fiscal year. The operating expense limitation also excludes any “Fees and Expenses of Acquired Funds,” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including ETFs, that have their own expenses. Each waiver or reimbursement of an expense by the Adviser is subject to repayment by the Fund within the three fiscal years following the fiscal year in which the expense was incurred, provided that the Fund is able to make the repayment without exceeding the expense limitation in place at the time of the waiver or reimbursement. This agreement may only be terminated by mutual consent of the Adviser and the Board of Trustees.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance of a Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (855) 575-2430.

| (a) | | Average annual total returns reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | | The S&P 500® Index (“S&P 500”) is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | | The Dow Jones Industrial Average® is a widely recognized unmanaged index of equity prices and is representative of a narrower market and range of securities than is found in the Fund’s portfolio. The Index is an unmanaged benchmark that assumes reinvestment of all distributions and excludes the effect of taxes and fees. Individuals cannot invest directly in this Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

10

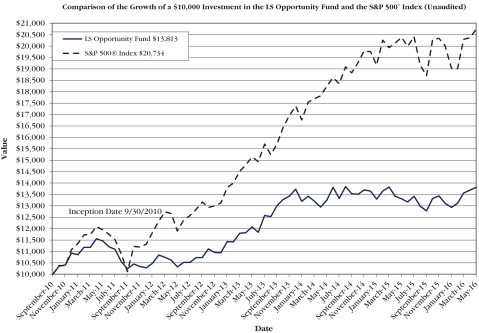

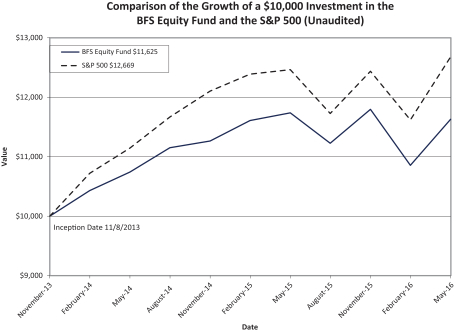

The chart above assumes an initial investment of $10,000 made on November 8, 2013 (commencement of operations) held through May 31, 2016. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call (855) 575-2430. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q will be available at the SEC’s website at www.sec.gov. The Fund’s Form N-Q may be reviewed and copied at the Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

11

Schedule of Investments

May 31, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

| | COMMON STOCKS — 96.84% | |

| | |

| | | | Aerospace & Defense — 4.82% | | | | |

| | 5,000 | | | Raytheon Co. | | $ | 648,350 | |

| | 5,000 | | | United Technologies Corp. | | | 502,900 | |

| | | | | | | | |

| | | | | | | 1,151,250 | |

| | | | | | | | |

| | | | Airlines — 2.18% | | | | |

| | 12,000 | | | Delta Air Lines, Inc. | | | 521,520 | |

| | | | | | | | |

| | | | Beverages — 4.04% | | | | |

| | 3,000 | | | Constellation Brands, Inc.—Class A | | | 459,450 | |

| | 5,000 | | | PepsiCo, Inc. | | | 505,850 | |

| | | | | | | | |

| | | | | | | 965,300 | |

| | | | | | | | |

| | | | Biotechnology — 2.43% | | | | |

| | 2,000 | | | Biogen, Inc. * | | | 579,460 | |

| | | | | | | | |

| | | | Commercial Banks — 2.55% | | | | |

| | 12,000 | | | Wells Fargo & Co. | | | 608,640 | |

| | | | | | | | |

| | | | Computers & Peripherals — 3.34% | | | | |

| | 8,000 | | | Apple, Inc. | | | 798,880 | |

| | | | | | | | |

| | | | Consumer Finance — 3.03% | | | | |

| | 11,000 | | | American Express Co. | | | 723,360 | |

| | | | | | | | |

| | | | Diversified Financial Services — 2.46% | | | | |

| | 9,000 | | | JPMorgan Chase & Co. | | | 587,430 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 2.21% | | | | |

| | 9,000 | | | Amphenol Corp. — Class A | | | 528,480 | |

| | | | | | | | |

| | | | Energy Equipment & Services — 2.08% | | | | |

| | 6,500 | | | Schlumberger Ltd. | | | 495,950 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 2.83% | | | | |

| | 7,000 | | | CVS Health Corp. | | | 675,150 | |

| | | | | | | | |

| | | | Food Products — 2.51% | | | | |

| | 13,500 | | | Mondelez International, Inc. — Class A | | | 600,615 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies — 2.49% | | | | |

| | 15,000 | | | Abbott Laboratories | | | 594,450 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 1.84% | | | | |

| | 8,000 | | | Starbucks Corp. | | | 439,120 | |

| | | | | | | | |

| | | | Industrial Conglomerates — 5.37% | | | | |

| | 7,500 | | | Danaher Corp. | | | 737,700 | |

| | 18,000 | | | General Electric Co. | | | 544,140 | |

| | | | | | | | |

| | | | | | | 1,281,840 | |

| | | | | | | | |

| | | | Insurance — 3.18% | | | | |

| | 6,000 | | | Chubb Ltd. | | | 759,660 | |

| | | | | | | | |

| | | | Internet & Catalog Retail — 3.03% | | | | |

| | 1,000 | | | Amazon.com, Inc. * | | | 722,790 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

12

Schedule of Investments (continued)

May 31, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

| | COMMON STOCKS — (continued) | |

| | |

| | | | Internet Software & Services — 6.12% | | | | |

| | 1,000 | | | Alphabet, Inc. — Class A * | | $ | 748,850 | |

| | 6,000 | | | Facebook, Inc. — Class A * | | | 712,860 | |

| | | | | | | | |

| | | | | | | 1,461,710 | |

| | | | | | | | |

| | | | IT Services — 4.72% | | | | |

| | 9,000 | | | Cognizant Technology Solutions Corp. — Class A * | | | 552,960 | |

| | 6,000 | | | MasterCard, Inc. — Class A | | | 575,400 | |

| | | | | | | | |

| | | | | | | 1,128,360 | |

| | | | | | | | |

| | | | Leisure Equipment & Products — 2.49% | | | | |

| | 7,000 | | | Polaris Industries, Inc. | | | 595,140 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services — 2.86% | | | | |

| | 4,500 | | | Thermo Fisher Scientific, Inc. | | | 682,965 | |

| | | | | | | | |

| | | | Media — 2.91% | | | | |

| | 7,000 | | | Walt Disney Co./The | | | 694,540 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 5.38% | | | | |

| | 8,000 | | | Exxon Mobil Corp. | | | 712,160 | |

| | 18,000 | | | Spectra Energy Corp. | | | 573,480 | |

| | | | | | | | |

| | | | | | | 1,285,640 | |

| | | | | | | | |

| | | | Pharmaceuticals — 9.22% | | | | |

| | 4,000 | | | Johnson & Johnson | | | 450,760 | |

| | 9,000 | | | Merck & Co., Inc. | | | 506,340 | |

| | 8,500 | | | Novartis AG ADR | | | 675,835 | |

| | 12,000 | | | Zoetis, Inc. | | | 569,040 | |

| | | | | | | | |

| | | | | | | 2,201,975 | |

| | | | | | | | |

| | | | Professional Services — 2.24% | | | | |

| | 10,000 | | | Nielsen Holdings PLC | | | 533,900 | |

| | | | | | | | |

| | | | Software — 4.74% | | | | |

| | 5,000 | | | Adobe Systems, Inc. * | | | 497,350 | |

| | 12,000 | | | Microsoft Corp. | | | 636,000 | |

| | | | | | | | |

| | | | | | | 1,133,350 | |

| | | | | | | | |

| | | | Specialty Retail — 1.94% | | | | |

| | 3,500 | | | Home Depot, Inc./The | | | 462,420 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 3.83% | | | | |

| | 7,000 | | | NIKE, Inc. | | | 386,540 | |

| | 14,000 | | | Under Armour, Inc. — Class A * | | | 528,220 | |

| | | | | | | | |

| | | | | | | 914,760 | |

| | | | | | | | |

| | | | Total Common Stocks (Cost $20,456,504) | | | 23,128,655 | |

| | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

13

Schedule of Investments (continued)

May 31, 2016

| | | | | | | | |

| Shares | | | | | Fair Value | |

|

| | MONEY MARKET FUNDS — 3.06% | |

| | 731,734 | | | Fidelity Prime Money Market Portfolio, Institutional Class, 0.44% (a) | | $ | 731,734 | |

| | | | | | | | |

| | | | Total Money Market Funds (Cost $731,734) | | | 731,734 | |

| | | | | | | | |

| | | | | | | | |

| | | | Total Investments (Cost $21,188,238) 99.90% | | | 23,860,389 | |

| | | | | | | | |

| | | | | | | | |

| | | | Other Assets in Excess of Liabilities – 0.10% | | | 23,758 | |

| | | | | | | | |

| | | | | | | | |

| | | | NET ASSETS – 100.00% | | $ | 23,884,147 | |

| | | | | | | | |

| (a) | | Rate disclosed is the seven day effective yield as of May 31, 2016. |

| * | | Non-income producing security. |

| ADR | | – American Depositary Receipt |

The industries shown on the schedule of investments are based on the Global Industry Classification Standard, or GICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Asset Services, LLC.

See accompanying notes which are an integral part of these financial statements.

14

Statement of Assets and Liabilities

May 31, 2016

| | | | |

Assets | | | | |

Investments in securities at fair value (cost $21,188,238) | | $ | 23,860,389 | |

Receivable for fund shares sold | | | 8,000 | |

Dividends receivable | | | 45,321 | |

Prepaid expenses | | | 9,350 | |

Total Assets | | | 23,923,060 | |

Liabilities | | | | |

Payable to Adviser | | | 4,234 | |

Payable to administrator, fund accountant, and transfer agent | | | 6,748 | |

Distribution fees accrued | | | 4,995 | |

Other accrued expenses | | | 22,936 | |

Total Liabilities | | | 38,913 | |

Net Assets | | $ | 23,884,147 | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 21,971,803 | |

Accumulated undistributed net investment income/(loss) | | | 53,020 | |

Accumulated undistributed net realized gain/(loss) from investment transactions | | | (812,827 | ) |

Net unrealized appreciation (depreciation) on investments | | | 2,672,151 | |

Net Assets | | $ | 23,884,147 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,068,093 | |

Net asset value, offering and redemption price per share | | $ | 11.55 | |

15

See accompanying notes which are an integral part of these financial statements.

Statement of Operations

For the year ended May 31, 2016

| | | | |

Investment Income | | | | |

Dividend income (net of foreign taxes withheld of $6,113) | | $ | 372,540 | |

Total investment income | | | 372,540 | |

Expenses | | | | |

Investment Adviser | | | 166,747 | |

Distribution (12b-1) | | | 55,582 | |

Administration | | | 38,000 | |

Fund accounting | | | 25,000 | |

Transfer agent | | | 18,074 | |

Legal | | | 14,505 | |

Registration | | | 24,667 | |

Custodian | | | 4,200 | |

Audit | | | 16,000 | |

Trustee | | | 5,546 | |

Printing | | | 12,175 | |

Miscellaneous | | | 32,738 | |

Total expenses | | | 413,234 | |

Fees waived and reimbursed by Adviser | | | (135,629 | ) |

Net operating expenses | | | 277,605 | |

Net investment income/(loss) | | | 94,935 | |

Net Realized and Unrealized Gain/(Loss) on Investments | |

Net realized gain/(loss) on investment securities transactions | | | (458,394 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 217,958 | |

Net realized and unrealized gain/(loss) on investments | | | (240,436 | ) |

Net increase (decrease) in net assets resulting from operations | | $ | (145,501 | ) |

16

See accompanying notes which are an integral part of these financial statements.

Statements of Changes in Net Assets

| | | | | | | | |

| Increase (Decrease) in Net Assets due to: | | For the Year Ended May 31, 2016 | | | For the Year Ended

May 31, 2015 | |

Operations | | | | | | | | |

Net investment income/(loss) | | $ | 94,935 | | | $ | 49,326 | |

Net realized gain/(loss) on investment securities transactions | | | (458,394 | ) | | | (179,137 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 217,958 | | | | 1,676,273 | |

Net increase (decrease) in net assets resulting from operations | | | (145,501 | ) | | | 1,546,462 | |

Distributions | | | | | | | | |

From net investment income | | | (69,881 | ) | | | (50,367 | ) |

Total distributions | | | (69,881 | ) | | | (50,367 | ) |

Capital Transactions | | | | | | | | |

Proceeds from shares sold | | | 5,178,205 | | | | 6,774,960 | |

Reinvestment of distributions | | | 62,385 | | | | 31,188 | |

Amount paid for shares redeemed | | | (1,308,552 | ) | | | (879,815 | ) |

Net increase (decrease) in net assets resulting from capital transactions | | | 3,932,038 | | | | 5,926,333 | |

Total Increase (Decrease) in Net Assets | | | 3,716,656 | | | | 7,422,428 | |

Net Assets | | | | | | | | |

Beginning of year | | | 20,167,491 | | | | 12,745,063 | |

End of year | | $ | 23,884,147 | | | $ | 20,167,491 | |

Accumulated undistributed net investment income/(loss) included in net assets at end of year | | $ | 53,020 | | | $ | 29,496 | |

Share Transactions | | | | | | | | |

Shares sold | | | 455,719 | | | | 613,346 | |

Shares issued in reinvestment of distributions | | | 5,364 | | | | 2,772 | |

Shares redeemed | | | (118,087 | ) | | | (79,058 | ) |

Net increase (decrease) in shares outstanding | | | 342,996 | | | | 537,060 | |

17

See accompanying notes which are an integral part of these financial statements.

Financial Highlights

(For a share outstanding during each period)

| | | | | | | | | | | | |

| | | For the Year Ended

May 31, 2016 | | | For the Year Ended

May 31, 2015 | | | For the Period Ended

May 31, 2014(a) | |

Selected Per Share Data: | |

Net asset value, beginning of period | | | $11.69 | | | | $10.73 | | | | $10.00 | |

| | | | | | | | | | | | |

| | | |

Income from investment operations: | | | | | | | | | | | | |

| | | |

Net investment income/(loss) | | | 0.04 | | | | 0.02 | | | | 0.04 | |

| | | |

Net realized and unrealized gain/(loss) on investments | | | (0.15 | ) | | | 0.97 | | | | 0.70 | |

| | | | | | | | | | | | |

| | | |

Total from investment operations | | | (0.11 | ) | | | 0.99 | | | | 0.74 | |

| | | | | | | | | | | | |

| | | |

Less distributions to shareholders from: | | | | | | | | | | | | |

| | | |

Net investment income | | | (0.03 | ) | | | (0.03 | ) | | | (0.01 | ) |

| | | | | | | | | | | | |

| | | |

Total distributions | | | (0.03 | ) | | | (0.03 | ) | | | (0.01 | ) |

| | | | | | | | | | | | |

Net asset value, end of period | | | $11.55 | | | | $11.69 | | | | $10.73 | |

| | | | | | | | | | | | |

| | | |

Total Return(b) | | | (0.91 | )% | | | 9.27 | % | | | 7.36 | %(c) |

| | | | | | | | | | | | |

Ratios and Supplemental Data: | |

Net assets, end of period (000) | | | $23,884 | | | | $20,167 | | | | $12,745 | |

Ratio of net expenses to average net assets | | | 1.25 | % | | | 1.25 | % | | | 1.25 | %(d) |

Ratio of expenses to average net assets before waiver and reimbursement | | | 1.86 | % | | | 2.26 | % | | | 3.93 | %(d) |

Ratio of net investment income/(loss) to average net assets | | | 0.43 | % | | | 0.30 | % | | | 0.68 | %(d) |

Ratio of net investment income/(loss) to average net assets before waiver and reimbursement | | | (0.18 | )% | | | (0.71 | )% | | | (2.00 | )%(d) |

| | | |

Portfolio turnover rate | | | 49.38 | % | | | 51.17 | % | | | 46.50 | %(c) |

| (a) | | For the period November 8, 2013 (commencement of operations) to May 31, 2014. |

| (b) | | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends, if any. |

18

See accompanying notes which are an integral part of these financial statements.

Notes to Financial Statements

May 31, 2016

NOTE 1 – ORGANIZATION

The BFS Equity Fund (the “Fund”) was organized as an open-end diversified series of the Valued Advisers Trust (the “Trust”) on July 23, 2013 and commenced operations on November 8, 2013. The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund’s investment adviser is Bradley, Foster & Sargent, Inc. (the “Adviser”). The investment objective of the Fund is long-term appreciation through growth of principal and income.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of, and during the fiscal year ended May 31, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the fiscal year, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for all tax years since inception.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The Fund has chosen specific identification as its tax lot identification method for all securities transactions. Interest income is recorded on an accrual basis and dividend income is recorded on the ex-dividend date except in the case of foreign securities, in which case dividends are generally recorded as soon as

19

Notes to Financial Statements (continued)

May 31, 2016

such information becomes available. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method. The ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. For the fiscal year ended May 31, 2016, the Fund made the following reclassifications of net assets:

| | | | | | | | |

| Paid-in Capital | | Accumulated Undistributed Net Investment Income/(loss) | | | Accumulated Net Realized Gain/(Loss) on Investments | |

$ – | | $ | (1,530 | ) | | $ | 1,530 | |

NOTE 3 – SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | • | | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published |

20

Notes to Financial Statements (continued)

May 31, 2016

| | and is the basis for current transactions for identical assets or liabilities at the valuation date. |

| | • | | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing agent when the Adviser believes such prices more accurately reflect the fair value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing agent at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing agent at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing agent at the NASDAQ Official Closing Price.

When using the market quotations or close prices provided by the pricing agent and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing agent with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Adviser determines that the market quotation or the price provided by the pricing agent does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review by the Board. These securities are generally categorized as Level 3 securities.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending net asset value (“NAV”) provided by the pricing agent of the funds. These securities are categorized as Level 1 securities.

In accordance with the Trust’s good faith pricing guidelines, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith

21

Notes to Financial Statements (continued)

May 31, 2016

pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2016:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks* | | $ | 23,128,655 | | | $ | – | | | $ | – | | | $ | 23,128,655 | |

Money Market Funds | | | 731,734 | | | | – | | | | – | | | | 731,734 | |

Total | | $ | 23,860,389 | | | $ | – | | | $ | – | | | $ | 23,860,389 | |

| * | | Refer to Schedule of Investments for industry classifications. |

The Fund did not hold any investments during the reporting period in which other significant observable inputs (Level 2) were used in determining fair value. The Fund did not hold any assets during the reporting period in which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

The Trust recognizes transfers between fair value hierarchy levels at the end of the reporting period. There were no transfers between any levels during the fiscal year ended May 31, 2016.

NOTE 4 – FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement, on behalf of the Fund (the “Agreement”), the Adviser manages the Fund’s investments subject to oversight of the Board. As compensation for its services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.75% of the average daily net assets of the Fund. For the fiscal year ended May 31, 2016, the Adviser earned a fee of $166,747 from the Fund before the waivers described below. At May 31, 2016, the Fund owed the Adviser $4,234.

The Adviser has contractually agreed to waive or limit its fee and assume other expenses of the Fund, until September 30, 2016, so that the ratio of total annual operating expenses do not exceed 1.00%. This operating expense limitation does not apply to interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund’s business, dividend expense on short sales, expenses incurred under a plan of distribution under Rule 12b-1, and expenses that the Fund has incurred but did not actually pay because of an expense offset arrangement, if applicable, incurred by the Fund in any fiscal year. The operating expense limitation also excludes any “Fees and Expenses of Acquired Funds” which are the expenses indirectly incurred by the Fund as a result of investing in money market funds or other investment companies, including ETFs, that have their own expenses. The Adviser may be entitled to recoup the sum of all fees previously waived or expenses reimbursed during any of the previous three years, less any reimbursement previously paid, provided total expenses do not exceed the limitation set forth above. For the fiscal year ended

22

Notes to Financial Statements (continued)

May 31, 2016

May 31, 2016, expenses totaling $135,629 were waived or reimbursed by the Adviser. The amounts subject to repayment by the Fund, pursuant to the aforementioned conditions are as follows:

| | | | |

| Amount | | Recoverable through

May 31, | |

| $146,030 | | | 2017 | |

| 163,520 | | | 2018 | |

| 135,629 | | | 2019 | |

The Trust retains Ultimus Asset Services, LLC (“Ultimus”), formerly Huntington Asset Services, Inc. (“HASI”), to manage the Fund’s business affairs and provide the Fund with administrative and compliance services, including all regulatory reporting. For the fiscal year ended May 31, 2016, Ultimus earned fees of $38,000 for administrative and compliance services provided to the Fund. At May 31, 2016, Ultimus was owed $3,167 from the Fund for administrative and compliance services. The officers and one Trustee of the Trust are members of management and/or employees of Ultimus. Unified Financial Securities, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. Huntington National Bank is the custodian of the Fund’s investments (the “Custodian”). Effective at the close of business on December 31, 2015, Ultimus Fund Solutions, LLC acquired HASI and the Distributor from Huntington Bancshares, Inc. (HBI”). Prior to January 1, 2016, the Custodian, HASI and the Distributor were under common control by HBI.

The Trust also retains Ultimus to act as the Fund’s transfer agent and to provide fund accounting services. For the fiscal year ended May 31, 2016, Ultimus earned fees of $18,074 for providing transfer agent services to the Fund. At May 31, 2016, the Fund owed Ultimus $1,498 for transfer agent services. For the fiscal year ended May 31, 2016, Ultimus earned fees of $25,000 from the Fund for fund accounting services. At May 31, 2016, Ultimus was owed $2,083 from the Fund for fund accounting services.

The Fund has adopted a Distribution Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 (the “Plan”). The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. For the fiscal year ended May 31, 2016, 12b-1 expenses incurred by the Fund were $55,582. The Fund owed $4,995 for 12b-1 expenses as of May 31, 2016.

A trustee and certain officers of the Trust are officers of the Distributor and each such person may be deemed to be an affiliate of the Distributor.

23

Notes to Financial Statements (continued)

May 31, 2016

NOTE 5 – PURCHASES AND SALES OF SECURITIES

For the fiscal year ended May 31, 2016, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| | | | | | |

Purchases | | | Sales | |

| $ | 14,464,600 | | | $ | 10,725,836 | |

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended May 31, 2016.

NOTE 6 – ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

NOTE 7 – BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At May 31, 2016, Charles Schwab & Co. (“Schwab”) owned, as record shareholder, 57% of the outstanding shares of the Fund. It is not known whether Schwab or any of the underlying beneficial owners owned or controlled 25% or more of the voting securities of the Fund.

NOTE 8 – FEDERAL TAX INFORMATION

At May 31, 2016, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| | | | |

Gross Unrealized Appreciation | | $ | 3,141,824 | |

Gross Unrealized (Depreciation) | | | (488,204 | ) |

Net Unrealized Appreciation on Investments | | $ | 2,653,620 | |

At May 31, 2016, the aggregate cost of securities for federal income tax purposes was $21,206,769 for the Fund.

At May 31, 2016, the Fund’s most recent fiscal year end, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 53,020 | |

Accumulated capital and other losses | | | (794,296 | ) |

Unrealized appreciation | | | 2,653,620 | |

Total | | $ | 1,912,344 | |

The difference between book and tax basis appreciation was attributable primarily to the tax deferral of losses on wash sale.

24

Notes to Financial Statements (continued)

May 31, 2016

The tax character of distributions paid for the fiscal year ended May 31, 2016 was as follows:

| | | | | | | | |

| | | 2016 | | | 2015 | |

Distributions paid from: | | | | | | | | |

Ordinary Income | | $ | 69,881 | | | $ | 50,367 | |

As of May 31, 2016, the Fund has available for federal tax purposes an unused capital loss carryforward of $31,655 and $400,253 of long-term and short-term capital losses, respectively, with no expiration, which is available to offset against future taxable net capital gains. To the extent that these carryforwards are used to offset future gains, it is probable that the amount offset will not be distributed to shareholders.

Certain capital losses incurred after October 31, and within the current taxable year, are deemed to arise on the first business day of the Fund’s following taxable year. For the tax year ended May 31, 2016, the Fund deferred post October capital losses in the amount of $362,388.

NOTE 9 – COMMITMENTS AND CONTINGENCIES

The Fund indemnifies its officers and trustees for certain liabilities that may arise from performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

NOTE 10 – SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosure and/or adjustments resulting from subsequent events through the date these financials were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

25

Report of Independent Registered Public Accounting Firm

To the Shareholders of BFS Equity Fund and

Board of Trustees of Valued Advisers Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of BFS Equity Fund (the “Fund”), a series of Valued Advisers Trust, as of May 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the three periods in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2016, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of BFS Equity Fund as of May 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the three periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

August 1, 2016

26

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, and held for the six month period, December 1, 2015 to May 31, 2016.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | |

| | | Beginning

Account Value

December 1, 2015 | | | Ending

Account Value

May 31, 2016 | | | Expenses Paid During

the Period(a) | |

Actual expenses | | $ | 1,000.00 | | | $ | 985.90 | | | $ | 6.20 | |

Hypothetical expenses(b) | | $ | 1,000.00 | | | $ | 1,018.76 | | | $ | 6.30 | |

| (a) | | Expenses are equal to the Fund’s annualized expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 183/366. |

| (b) | | Assumes a 5% return before expenses. |

27

Additional Federal Income Tax Information (Unaudited):

The Form 1099-DIV you receive in January 2017 will show the tax status of all distributions paid to your account in calendar year 2016. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income: The Fund designates approximately 100%, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction: Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal year 2016 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

28

Trustees and Officers (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each of the Independent Trustees.

| | | | |

Name, Address*, (Age),

Position with Trust**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

| | |

| Ira P. Cohen, 57, Independent Trustee, June 2010 to present. | | Current: Independent financial services consultant since February 2005; Executive Vice President of Asset Management Services, Recognos Financial, since August 2015. | | Trustee and Audit Committee Chairman, Griffin Institutional Real Estate Access Fund, since May 2014. Trustee, Angel Oak Funds Trust, since October 2014. |

| | |

| Andrea N. Mullins, 49, Independent Trustee, December 2013 to present. | | Current: Private investor; Independent Contractor, Seabridge Wealth Management, LLC, since April 2014. | | None. |

| * | | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| ** | | As of the date of this report, the Trust consists of 15 series. |

The following table provides information regarding the Trustee who is considered an “interested person” of the Trust, as that term is defined under the 1940 Act. Based on the experience of the Trustee, the Trust concluded that the individual described below is qualified to serve as a Trustee.

| | | | |

Name, Address*, (Age),

Position with Trust**, Term

of Position with Trust | | Principal Occupation During Past 5 Years | | Other Directorships |

| | |

| R. Jeffrey Young, 51, Trustee and Chairman, June 2010 to present; Principal Executive Officer and President since February 2010 to present. | | Current: Vice President and Director of Relationship Management, Ultimus Fund Solutions, LLC (since December 2015); President, Unified Financial Securities, LLC (since July 2015). Previous: President, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (April 2015 to December 2015), Director (May 2014 to December 2015), Senior Vice President (January 2010 to April 2015); Director, Unified Financial Securities, Inc. (n/k/a Unified Financial Securities, LLC) (May 2014 to December 2015); Chief Executive Officer, Huntington Funds (February 2010 to March 2015); Chief Executive Officer, Huntington Strategy Shares (November 2010 to March 2015); President and Chief Executive Officer, Dreman Contrarian Funds (March 2011 to February 2013). | | Trustee and Chairman, Capitol Series Trust, since September 2013. |

| * | | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

| ** | | As of the date of this report, the Trust consists of 15 series. |

29

The following table provides information regarding the Officers of the Trust:

| | |

Name, Address*, (Age),

Position with Trust, Term

of Position with Trust | | Principal Occupation During Past 5 Years |

| |

| John C. Swhear, 55, Chief Compliance Officer, AML Officer and Vice President, August 2008 to present. | | Current: Assistant Vice President and Associate Director of Compliance, Ultimus Fund Solutions, LLC (since December 2015); Chief Compliance Officer, Unified Financial Securities, LLC (since May 2007); Chief Compliance Officer and AML Officer, Capitol Series Trust (since September 2013). Previous: Vice President of Legal Administration and Compliance, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (April 2007 to December 2015), Director (May 2014 to December 2015); Director, Unified Financial Securities, Inc. (n/k/a Unified Financial Securities, LLC) (May 2014 to December 2015); President, Unified Series Trust (March 2012 to January 2016), Senior Vice President (May 2007 to March 2012); Secretary, Huntington Funds (April 2010 to February 2012). |

| |

| Carol J. Highsmith, 51, Vice President, August 2008 to present; Secretary, March 2014 to present | | Current: Assistant Vice President, Ultimus Fund Solutions, LLC (since December 2015). Previous: Secretary, Cross Shore Discovery Fund (May 2014 to February 2016); Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (November 1994 to December 2015), most recently Vice President of Legal Administration (2005 to December 2015). |

| |

| Matthew J. Miller, 40, Vice President, December 2011 to present. | | Current: Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (since December 2015); President and Chief Executive Officer, Capitol Series Trust (since September 2013). Previous: Employed in various positions with Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (since July 1998), most recently Vice President of Relationship Management (2005 to December 2015); Vice President, Huntington Funds (February 2010 to April 2015). |

| |

| Bryan W. Ashmus, 43, Principal Financial Officer and Treasurer, December 2013 to present. | | Current: Vice President and Director of Financial Administration, Ultimus Fund Solutions, LLC (since December 2015); Chief Financial Officer and Treasurer, Cross Shore Discovery Fund (since June 2016). Previous: Vice President and Manager of Financial Administration, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (September 2013 to December 2015); Chief Financial Officer and Treasurer, Huntington Strategy Shares and Huntington Funds Trust (November 2013 to April 2016); Vice President, Fund Administration, Citi Fund Services Ohio, Inc. (from May 2005 to September 2013). |

| * | | The address for each trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. |

OTHER INFORMATION

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and officers of the Trust and is available without charge, upon request. You may call toll-free at (855) 575-2430 to request a copy of the SAI or to make shareholder inquiries.

30

VALUED ADVISERS TRUST

PRIVACY POLICY

The following is a description of the policies of the Valued Advisers Trust (the “Trust”) regarding disclosure of nonpublic personal information that shareholders provide to a series of the Trust (each, a “Fund”) or that the Fund collects from other sources. In the event that a shareholder holds shares of a Fund through a broker-dealer or other financial intermediary, the privacy policy of the financial intermediary would govern how shareholder nonpublic personal information would be shared with nonaffiliated third parties.

Categories of Information a Fund May Collect. A Fund may collect the following nonpublic personal information about its shareholders:

| | • | | Information the Fund receives from a shareholder on applications or other forms, correspondence, or conversations (such as the shareholder’s name, address, phone number, social security number, and date of birth); and |

| | • | | Information about the shareholder’s transactions with the Fund, its affiliates, or others (such as the shareholder’s account number and balance, payment history, cost basis information, and other financial information). |

Categories of Information a Fund May Disclose. A Fund may not disclose any nonpublic personal information about its current or former shareholders to unaffiliated third parties, except as required or permitted by law. A Fund is permitted by law to disclose all of the information it collects, as described above, to its service providers (such as the Fund’s custodian, administrator, transfer agent, accountant and legal counsel) to process shareholder transactions and otherwise provide services to the shareholder.