UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-22235

AQR Funds

(Exact name of registrant as specified in charter)

Two Greenwich Plaza, 3rd Floor

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Bradley D. Asness, Esq.

Principal & General Counsel

Two Greenwich Plaza

3rd Floor

Greenwich, CT 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: 203-742-3600

Date of fiscal year end: December 31

Date of reporting period: January 15, 2009 – December 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Table of Contents

Shareholder Letter

|

| AQR INTERNATIONAL EQUITY FUND |

Cliff Asness

Managing & Founding Principal

Ronen Israel

Principal

Oktay Kurbanov

Principal

John Liew

Founding Principal

Lars Nielsen

Principal

Dear Shareholder:

International equity markets had a tumultuous year in 2009. After declining by more than 25% during the first quarter in the aftermath of the financial crisis of 2008, the MSCI EAFE Index (the “Index”) rallied strongly in the remainder of the year, posting a return of 31.78% for the full year.

The AQR International Equity Fund Class N shares (the “Fund”) outperformed its benchmark index by a substantial margin, posting a return of 36.38%.1

The Fund is actively managed, and it seeks to outperform its benchmark in three ways: by selecting stocks within each country, and by using futures and forwards contracts to over and under-weight the portfolio’s exposures to each country and to each currency. Each of these decisions is made independently. For the year, all three active strategies contributed to outperformance in a balanced fashion. Stock selection was the strongest contributor driven by positive results in the first eight months of the year. Currency and country selection both had strong years, but their positive results dominated the second half. We believe the year serves as an illustration of the diversification benefits of our multi-strategy approach to international equity management: while stock selection strategies had flat excess returns over the second half of the year, asset allocation strategies produced strong results. More detail on each strategy is provided below.

Stock selection was strongly positive led by outperformance in Europe and Japan, while the U.K. was slightly down. In Japan, value factors – both industry relative and across industries – drove results, particularly earlier in the year. In Europe, value and earnings quality factors, along with relatively less negative momentum contribution led to strong excess performance in 2009. In the UK, weak performance by earnings quality factors depressed the strategy’s performance for the year.

Our stock selection strategy remains broadly diversified across over four hundred names, with any individual position representing a small active weight against the benchmark. The portfolio as a whole is overweight cheaper stocks2 with better momentum and earnings quality.

The country selection strategy was another positive contributor to outperformance. Our underweight position in Japan was the top contributor for 2009. Japan was our least favorite market throughout the year, as it severely lagged other developed markets – with only Greece’s post-downgrade results in contention for worst performer in the second half. In addition, our underweight of Germany and overweights of the Netherlands and Spain were top contributors. Positions that detracted the most value were our overweights of Italy, UK and France, as these markets suffered relative underperformance earlier in the year along with an underweight position in Hong Kong in Q2.

Our country views remained relatively stable over the course of the year. We continued to primarily favor European markets, with our top five countries remaining consistent

| 1 | Full year performance of the Fund includes the performance of a predecessor fund. See p. 6 for further discussion. |

| 2 | Stocks with lower valuation ratios such as Price to Book |

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 2 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL EQUITY FUND |

through most of the year, although their relative weightings shifted. For instance during the fourth quarter, Italy and the Netherlands became our favorite markets, and while we remain positive on Spain, France and the UK, our overweights of these countries decreased. In addition, we remain bearish on Japan, Australia, and Germany, which were our largest underweights throughout the year.

Our positive view on Italy, the Netherlands and France is primarily motivated by valuation themes, as these are the three cheapest markets in our universe. This view on valuations has been consistent throughout 2009. Spain and the UK are our other favorite markets, driven by momentum and catalyst based themes. Spain continues to benefit from strong price momentum along with neutral valuation scores, which have improved slightly through the year. Our UK position is motivated by positive fundamental momentum scores such as the depreciation of the Pound, and improvements in analyst sentiment, which overcame more expensive valuations that grew relatively richer during the year.

Our negative view on Japan is driven by weak momentum scores and richer than average valuation measures. While fundamental momentum indicators improved through the year – particularly the health of export partners – this improvement was overcome by worsening momentum themes and more expensive relative valuations. Australia remains the most expensive market on our valuation measures and also features negative fundamental momentum scores such as an appreciating currency and rising interest rates. Both sets of indicators have grown more negative through the year. Our underweight position in Germany is motivated by a collection of small negatives in both price and fundamental momentum measures combined with neutral valuations.

Overall for 2009 the country selection strategy ran at above average attractiveness – meaning the portfolio targeted more tracking error from the strategy than average. This was motivated by above average valuation spreads across the universe of equity markets that we cover. These valuation spreads peaked in early March, retracted throughout 2009 but remained wide at year’s end. Combined with attractive value spreads, we are seeing positive agreement across our factors – especially among our suite of valuation measures, which also increases the strategy’s attractiveness.

The currency selection strategy was a strong positive contributor in 2009. Looking back on the year, the pattern we saw in stocks and country selection also appeared for currencies: i.e., a tale of two periods. During the first half of the year, value themes dominated, while both carry and momentum struggled. During the second half, carry themes drove performance – particularly in Q3 – while value and momentum signals were flat. For the year, value was the strongest theme, followed by carry. 2009 was a negative year for momentum.

We made several significant changes in our currency positioning as the effects of the dramatic currency movements from last Fall’s carry unwind and flight to safety faded. While signals focusing on nominal interest rate differentials started to recover earlier in the year, other interest rate signals, such as those focused on real rate differences, showed positive results later in the summer. While Aussie and Euro positions remain our strongest views, our positioning on the Yen turned bearish from being one our favorite currencies for most of the year.

In the fourth quarter, the Norwegian Krone became our second largest overweight. We believe the Krone, like the Aussie, is particularly attractive on carry indicators and also features positive fundamental and price momentum signals, which overcome slightly rich valuations. Improvements in carry and momentum signals during Q4 also drove our improving opinion. These two positive views reflect Norway and Australia having higher nominal interest rates than the G4 markets, which employed extremely lax monetary policies in 2009 as a response to the financial crisis. In addition, Australia and Norway’s were the first central banks to hike short-term interest rates and market indicators point to further tightening action in the first half of 2010. At

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 3 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL EQUITY FUND |

the same time, little tightening is currently expected in G4 markets. Both Australia and Norway’s economies appear to be in better shape than other developed markets and have been able to start contracting monetary policy to prevent a potential rise in inflation, while other central banks remain focused on stimulating economic activity.

At year end, the portfolio’s top underweights continued to be in Euro followed by Yen. The Euro scored particularly poorly on valuation and momentum – both price and fundamental – measures. In addition, the Euro has unattractive carry and interest rate signals. The Yen has expensive valuations and poor momentum which deteriorated over the quarter as the positive impact of last year’s carry unwind faded and relative analyst sentiment has decayed.

| | | | | | | | |

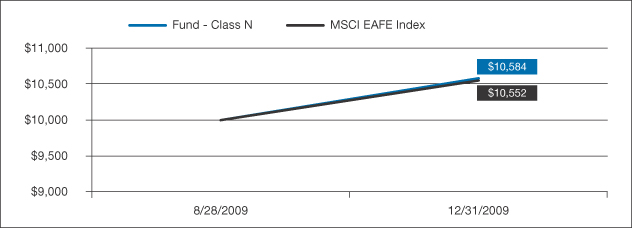

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2009 AQR INTERNATIONAL EQUITY FUND PERFORMANCE SINCE COMMENCEMENT OF OPERATIONS AS A MUTUAL FUND |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(8/28/2009) |

| Fund - Class N: AQINX | | – | | – | | – | | 5.84% |

| Fund - Class I: AQIIX | | – | | – | | – | | 5.95% |

| Fund - Class Y: AQIYX | | – | | – | | – | | 6.08% |

| MSCI EAFE Index | | – | | – | | – | | 5.52% |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class N and Class I shares of the Fund are subject to a 2% redemption fee for redemptions within 60 days of purchase. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the for the Fund’s Class N/I/YI shares are 1.36%/0.97%/0.91% respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 4 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL EQUITY FUND |

|

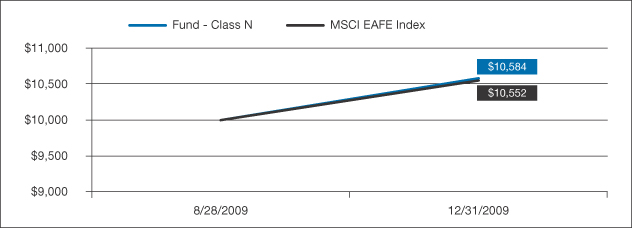

AQR INTERNATIONAL EQUITY FUND VS. MSCI EAFE INDEX VALUE OF $10,000 INVESTED ON 8/28/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | |

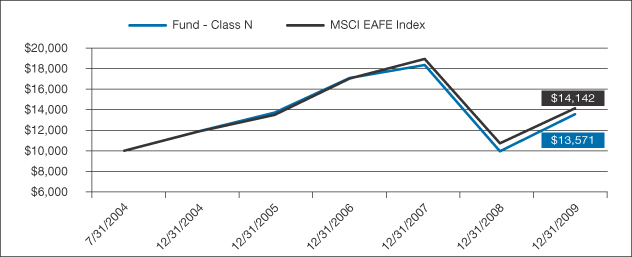

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2009 AQR INTERNATIONAL EQUITY FUND PERFORMANCE SINCE INCEPTION OF PREDECESSOR LIMITED PARTNERSHIP |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(8/1/2004) |

| Fund - Class N: AQINX | | 36.38% | | -7.41% | | 2.64% | | 5.79% |

| Fund - Class I: AQIIX | | 36.94% | | -7.06% | | 3.01% | | 6.18% |

| Fund - Class Y: AQIYX | | 37.30% | | -6.76% | | 3.36% | | 6.53% |

| MSCI EAFE Index | | 31.78% | | -6.04% | | 3.54% | | 6.60% |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class N and Class I shares of the Fund are subject to a 2% redemption fee for redemptions within 60 days of purchase. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the for the Fund’s Class N/I/YI shares are 1.36%/0.97%/0.91% respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 5 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL EQUITY FUND |

|

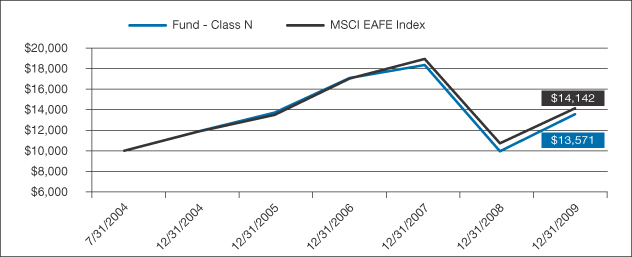

AQR INTERNATIONAL EQUITY FUND VS. MSCI EAFE INDEX VALUE OF $10,000 INVESTED ON 7/31/04 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

A privately offered fund managed by the Adviser was reorganized into the Class Y shares of the Fund on August 28, 2009, the date the Fund commenced operations. The Class N and Class I shares of the Fund commenced operations on September 30, 2009. The performance of Class N and Class I shares for the period from August 28, 2009 to September 30, 2009 is based on the performance of the Class Y shares of the Fund, and, for all share classes, for periods prior to August 28, 2009 is based on that of the privately offered fund. The total annual fund operating expenses of the privately offered fund were lower than the Fund’s estimated total annual fund operating expenses for Class N, I and Y shares. Also, the Fund’s total annual fund operating expenses for Class Y shares were lower than the Fund’s estimated total annual fund operating expenses for Class N and Class I shares. The Fund has restated the performance of the privately offered fund and of the Class Y shares to reflect the Fund’s expenses of Class N, I and Y shares.

The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Principal Risks: The Fund uses derivatives to manage its country and currency exposures. The use of derivatives exposes the Fund to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. Foreign investing involves special risks such as currency fluctuations and political uncertainty. The Fund is not suitable for all investors.

An investment in any of the AQR Funds involves risk, including loss of principal. Diversification does not eliminate this risk. The value of the Funds’ portfolio holdings may fluctuate in response to events specific to

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 6 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL EQUITY FUND |

the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad. Please refer to the prospectus for complete information regarding all risks associated with the Funds.

An investor considering the Funds should be able to tolerate potentially wide price fluctuations. The funds are subject to high portfolio turnover risk as a result of frequent trading, and thus will incur a higher level of brokerage fees and commissions and cause a higher level of tax liability to shareholders in the funds. The Funds may attempt to increase their income or total return through the use of securities lending, and they may be subject to the possibility of additional loss as a result of this investment technique.

Cliff Asness is a registered representative of ALPS Distributors, Inc.

DEFINITIONS:

The Morgan Stanley Capital International EAFE Index is a market capitalization weighted index composed of companies representative of the market structure of 21 developed market countries in Europe, Australasia and the Far East. You can not invest directly in an index.

Carry: The return obtained from holding an asset (if positive), or the cost of holding it (if negative).

Futures and Forwards contracts: A financial contract obligating the buyer to purchase an asset (or the seller to sell an asset) at a pre-determined future date and price.

G4 Markets: The currencies of the U.S., U.K., Japan, and the Euro.

Momentum: An investment style wherein an asset is deemed to have positive momentum if it has performed well in the past relative to other assets in the same universe.

Price to Book: A valuation ratio of a company’s current share price compared to its book value.

Tracking Error: A measure of how closely a portfolio follows the index to which it is benchmarked. It measures the standard deviation of the difference between the portfolio and index returns.

Valuation: A process of determining the current worth of an asset or company.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 7 |

| | | | | | | |

Ronen Israel

Principal

Mark Mitchell, Ph.D.

Founding Principal, CNH Partners

Lars Nielsen

Principal

Todd Pulvino, Ph.D.

Founding Principal, CNH Partners

Shareholder Letter

| | |

| AQR DIVERSIFIED ARBITRAGE FUND | | |

Dear Shareholder:

The Diversified Arbitrage Fund completed a positive first year, returning 8.88% (inception date of January 15, 2009 through December 31, 2009) for the Fund’s Class N Shares. During this same time period, the Merrill Lynch 3-Month Treasury Bill Index (the Fund’s benchmark) returned 0.21%. Based on weekly data, the Fund’s equity market beta relative to the S&P 500 during this period was 0.04.

Financial markets were in disarray at the time of the Fund’s launch in January 2009. Arbitrage strategies were impacted causing securities to trade at significant discounts to fundamental values, and causing substantially similar assets to trade at significantly different prices. Thus, at the beginning of the year, low-risk arbitrage strategies offered expected returns in excess of what is typical, a consequence of the high level of risk aversion following the financial crisis of 2008. Arbitrage markets stabilized steadily throughout 2009, commensurate with stabilization of the entire financial markets. As the arbitrage markets stabilized, spreads and cheapness levels reverted to more normal levels, generating a realized return which was greater than would be achieved in a more normal environment.

By design, the Fund invests in multiple arbitrage strategies, and tactically allocates to various strategies based on relative attractiveness. As displayed in the table below, the Fund substantially altered its weights among arbitrage strategies throughout the year.

| | | | | | |

LONG POSITIONS BY STRATEGY (AS % OF INVESTMENT IN SECURITIES) | | | | | | |

| | | 1/31/09 | | 6/30/09 | | 12/31/09 |

| Convertible Arbitrage | | 28% | | 49% | | 44% |

| Merger Arbitrage | | 10% | | 19% | | 34% |

| Dual-Class Arbitrage | | 14% | | 10% | | 12% |

| Price Pressure | | 0% | | 5% | | 4% |

| SPACs | | 37% | | 10% | | 1% |

| Closed-End Fund Arbitrage | | 11% | | 5% | | 2% |

| Other Arbitrage and Alternative Investment Strategies | | 0% | | 2% | | 3% |

Convertible arbitrage has accounted for the largest average strategy weight during the year at 40%, ranging from 28% to 49%. The convertible bond market unraveled during the fall of 2008 when prime brokers reduced the amount of leverage they were willing to provide to convertible arbitrage hedge funds. The prime brokers’ unwillingness to lend was driven by their inability to post convertible bonds as collateral to raise outside capital, a problem that became particularly acute following Lehman’s bankruptcy. As a result, prime brokers increased margin requirements which effectively forced many convertible funds to reduce leverage by selling bonds. This forced selling resulted in a cheapening of bonds relative to fundamental values on a scale that had not been observed historically.1 Given their high level of attractiveness, the Fund immediately allocated a substantial portion of the investment portfolio to convertible bonds. The Fund’s peak allocation to convertibles reached nearly 50% of the total investment portfolio. This tactical allocation paid off. Throughout 2009, prime brokerage financing

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 8 |

| | | | | | | |

Shareholder Letter

|

| AQR DIVERSIFIED ARBITRAGE FUND |

stabilized, allowing convertible funds to become active purchasers. In addition, corporate issuers recognized the opportunity to retire debt at less than par by buying bonds in the secondary market. As a result, convertible prices rebounded–convertible arbitrage was the Fund’s strongest contributor accounting for roughly 65% of the Fund’s 2009 return. It is important to note that the Fund’s investment in a convertible bond is based on the cheapness of the bond relative to its fundamental value rather than on a view about the underlying stock price. To capture the bond’s cheapness, equity risk can be hedged by shorting the stock of the underlying issuer. In addition, portfolio hedges are used to reduce systematic credit and interest rate risks.

Merger arbitrage, a well-known arbitrage strategy like convertible arbitrage, involves the purchase of shares of firms that are targets in announced mergers or reorganizations. For a merger where the consideration is the acquirer’s stock, the Fund seeks to hedge market exposure by shorting the stock of the acquiring company in an amount based on the merger agreement between the two firms. Merger arbitrage is especially attractive when deal spreads (the percentage difference between the consideration offered by the acquiring firm and the stock price of the target firm) are wide and when merger activity is high. While deal spreads were relatively wide at the beginning of 2009 due to the tremendous uncertainty in the economy, deal flow was anemic as potential acquirers were hesitant to pursue acquisitions in an unstable market. Consequently the Fund allocated a small amount of capital to merger arbitrage at the beginning of the year. As deal flow increased through 2009, the Fund increased its allocation and by year-end, 34% of the investment portfolio was allocated to merger arbitrage. Roughly 25% of the Fund’s return came from its investment in merger arbitrage benefiting from the fact that mergers closed on time during the year, failures did not cause large losses, and some target holdings received higher bids.

Special Purpose Acquisition Companies (SPACs) also contributed positively to the Fund, accounting for nearly 13% of the 2009 return. SPACs are corporations that raise cash through an initial public offering and place the cash in a trust, typically invested in Treasury bills that can be used to acquire an operating company. If the SPAC fails to complete an acquisition by a pre-determined date, proceeds from the IPO that are held in trust are returned to stock holders. Moreover, even if a sufficient number of stock holders approve the proposed acquisition, opposing stock holders can elect to exchange their shares for a pro-rata portion of the trust. Thus, downside risk is extremely low for the investor who holds the SPAC to maturity. Despite their low risk, SPACs, similar to convertible bonds, were hit hard by hedge fund delevering during the financial crisis of 2008. By simply buying SPAC shares in the secondary market and redeeming those shares for a pro-rata portion of the trust account, investors could earn returns that, in some cases, reached double digits. Given the high risk-adjusted yields, the SPAC strategy received the largest allocation of capital at the beginning of 2009. As financial markets stabilized in 2009 and SPAC yields declined to more normal levels, the Fund steadily reduced its exposure to this asset class. By year end, the allocated weight dropped to only 1% due to low yields and a dormant new-issue market.

The three strategies described above accounted for roughly 80% of the capital allocated in the Fund and all of the return to the Fund in 2009. None of the other strategies such as dual-class arbitrage or closed-end-fund arbitrage contributed materially, either positive or negative, to the Fund’s annual return. However, one strategy that did not perform well in the fourth quarter was Price Pressure. The Price Pressure strategy is designed to profit by providing liquidity to groups of investors that simultaneously initiate trades in a particular direction (i.e. either buy or sell) and where there are no natural investors willing to take the other side. These situations often result from corporate actions that induce trading on pre-specified days resulting in temporary price movements. Through the end of September, the Price Pressure strategy had contributed +0.9% to the Fund’s return. However, in October, Price Pressure contributed -1.4%. This was followed by a -0.5% contribution in November, generating the worst two-month return that we have experienced in the strategy (although well-within the distribution of expected returns based on large-sample historical analysis). The Price Pressure strategy rebounded in December and ended the year with an annual contribution of -0.6% to the Fund, a reasonably small loss given the magnitude of the October and November returns.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 9 |

| | | | | | | |

Shareholder Letter

|

| AQR DIVERSIFIED ARBITRAGE FUND |

Looking forward for 2010, we are optimistic on several fronts. While convertible bonds richened substantially during 2009, they remain systematically cheap. Furthermore, there currently exists a high level of dispersion in cheapness which will allow the Fund to profit from bond selection. Note, however, that we expect to reduce the weight in convertible arbitrage during the year as convertibles continue richening to fair value. With respect to merger arbitrage, the conventional wisdom is that deal flow will improve considerably in 2010 as a result of higher business confidence amidst a rebounding economy. We expect that most new deals will be strategic in nature as firms and industries are forced to restructure in response to the recent upheaval in the economy. An appealing attribute of strategic mergers is that, unlike financing-contingent deals, strategic mergers are less susceptible to termination caused by broad market downturns. We also expect to see several short-term credit investment opportunities as well as opportunities to invest in securities issued by firms raising capital in the convertible and equity markets.

Overall, we believe the Fund had a strong first year. Arbitrage opportunities were plentiful and the Fund successfully allocated capital from one strategy to the next throughout the year. The Fund tries to generate returns that are typically uncorrelated with traditional asset classes, thereby enhancing the typical investor’s portfolio. Investor confidence in our approach was high as the Fund ended its first year with net assets of $239 million. For 2010, there are several arbitrage and alternative investment opportunities for the Fund to deploy capital with the intention of generating a 2010 return substantially greater than the Treasury Bill Index benchmark return.

| | | | | | | | |

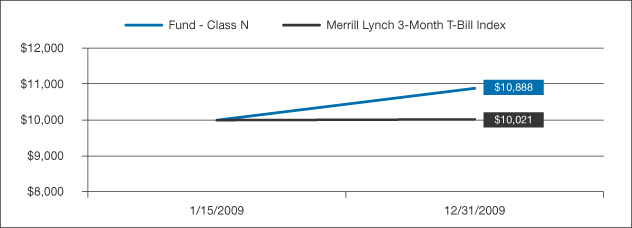

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2009 AQR DIVERSIFIED ARBITRAGE FUND |

| | | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(1/15/2009) |

| Fund - Class N: ADANX | | – | | – | | – | | 8.88% |

| Fund - Class I: ADAIX | | – | | – | | – | | 9.24% |

| Merrill Lynch 3-Month T-Bill Index | | – | | – | | – | | 0.21% |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the Class N/I shares are expected to be 2.23%/1.93%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 10 |

| | | | | | | |

Shareholder Letter

|

| AQR DIVERSIFIED ARBITRAGE FUND |

|

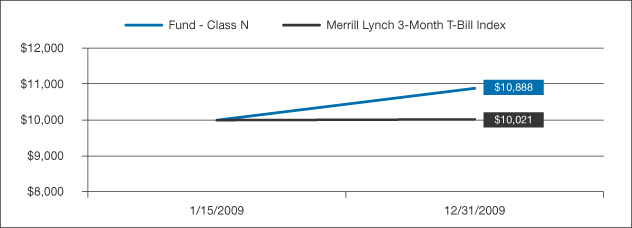

AQR DIVERSIFIED ARBITRAGE FUND VS. MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 1/15/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Principal Risks: This Fund has the risk that the anticipated arbitrage opportunities do not play out as planned, resulting in potentially reduced returns or losses to the Fund as it unwinds its trades. This Fund enters into a short sale by selling a security it has borrowed. If the market price of a security increases after the Fund borrows the security, the Fund will suffer a potentially unlimited loss when it replaces the borrowed security at the higher price. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses. This Fund is not suitable for all Investors.

An investment in any of the AQR Funds involves risk, including loss of principal. The value of the Funds’ portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad. The use of derivatives exposes the Funds to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. Please refer to the prospectus for complete information regarding all risks associated with the Funds.

DEFINITIONS:

Arbitrage: The simultaneous purchase and sale of an asset or two related assets in order to profit from a difference in price.

Beta is a measure of the volatility of a security or portfolio in comparison to an index or the market as a whole, where a security with a beta of 1.0 has equivalent volatility to the index or market it is compared to.

Cheapness: A measure of the discount of a security’s price relative to the fundamental value of the security.

Convertible Bonds: Fixed-income securities that are convertible into common stock.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 11 |

| | | | | | | |

Shareholder Letter

|

| AQR DIVERSIFIED ARBITRAGE FUND |

De-Levering: A process by which a portfolio decreases its notional exposure to the market due to a decrease in available debt capital.

Dual-Class Arbitrage: An investment strategy wherein one simultaneously purchases and sells different share classes of the same company, seeking to profit from a price convergence.

Richness: A measure of the premium of a security’s price relative to the fundamental value of the security.

Spread: The percentage difference in price between two related securities.

S&P 500 Index: An Index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors.

The Merrill Lynch 3 Month Treasury Bill Index is designed to measure the performance of high-quality short-term cash-equivalent investments. Indexes are unmanaged and one cannot invest directly in an index.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 12 |

| | | | | | | |

Shareholder Letter

Cliff Asness

Managing & Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Dear Shareholder:

The AQR Momentum Fund invests in stocks of large and mid-cap U.S. companies with positive momentum. A stock is considered to have positive momentum if it has performed well in the prior twelve months (excluding the most recent month) relative to other stocks in the Fund’s investment universe, which is comprised of the 1000 largest U.S. companies by market capitalization. The Fund is not actively managed to outperform a growth, value or core benchmark. Rather, it seeks to provide systematic exposure to stocks that share the common characteristic of positive momentum.

From the Fund’s inception on July 9, 2009 to December 31, 2009, the Fund returned 25.58%. The major driver of the Fund’s performance was the overall performance of large and mid-cap US equity markets, as measured by the Russell 1000® Index of large and mid-cap stocks, which rose by 28.26%. Compared to this broad universe, the Fund under-performed by 2.69%. Most of the underperformance was driven by stock momentum, meaning that within a given sector, stocks with poor momentum outperformed those with strong momentum. Sector momentum (i.e. the sector over and under-weights implied by the momentum style) also detracted from performance, but to a lesser extent.

While the momentum style underperformed during the period in question, the benefits of investing in the momentum style need to be judged over the course of one or more business cycles, based both on the Fund’s return and its ability to provide diversification relative to the more traditional value and growth investment styles.

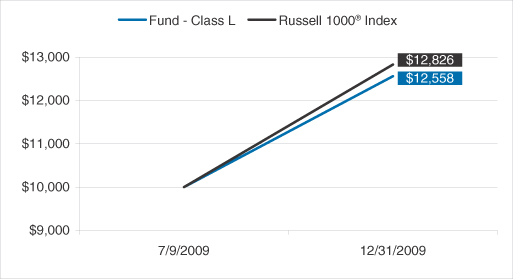

| | | | | | | | |

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2009 AQR MOMENTUM FUND | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(7/9/2009) |

| Fund - Class L: AMOMX | | – | | – | | – | | 25.58% |

| Russell 1000® Index | | – | | – | | – | | 28.26% |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the is expected to be 0.73%. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 13 |

| | | | | | | |

Shareholder Letter

|

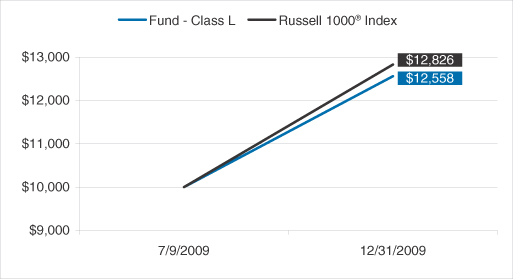

AQR MOMENTUM FUND VS. RUSSELL 1000® INDEX VALUE OF $10,000 INVESTED ON 7/9/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Principal Risks: Securities with positive momentum generally will be more volatile than a broad cross-section of securities. In addition, there may be periods when the momentum style is out of favor, and during which the investment performance of a Fund using a momentum strategy generally will suffer. This Fund is not suitable for all investors.

An investment in any of the AQR Funds involves risk, including loss of principal. The value of the Funds’ portfolio holdings may fluctuate in response to events specific to the companies in which the Funds invest, as well as economic, political or social events in the United States or abroad. An investor considering the Funds should be able to tolerate potentially wide price fluctuations. The Funds are subject to high portfolio turnover risk as a result of frequent trading, and thus, will incur a higher level of brokerage fees and commissions, and cause a higher level of tax liability to shareholders in the Funds. The Funds may attempt to increase their income or total return through the use of securities lending, and they may be subject to the possibility of additional loss as a result of this investment technique. Please refer to the prospectus for complete information regarding all risks associated with the Funds.

Cliff Asness is a registered representative of ALPS Distributors, Inc.

Definitions: The Russell 1000® Index measures the performance of the large and mid-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 90% of the U.S. market. Indexes are unmanaged and one cannot invest directly in an index.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 14 |

| | | | | | | |

Shareholder Letter

|

| AQR SMALL CAP MOMENTUM FUND |

Cliff Asness

Managing & Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Dear Shareholder:

The AQR Small Cap Momentum Fund invests in stocks of small-cap U.S. companies with positive momentum. A stock is considered to have positive momentum if it has performed well in the prior twelve months (excluding the most recent month) relative to other stocks in the investment universe, which is comprised of U.S. companies smaller than the 1000th largest and larger than the 3000th smallest company by market capitalization. The Fund is not actively managed to outperform a growth, value or core benchmark. Rather, it seeks to provide systematic exposure to stocks that share the common characteristic of positive momentum.

From the Fund’s inception on July 9, 2009 to December 31, 2009, the Fund returned 21.24%. The major driver of the Fund’s performance was the overall performance of small-cap U.S equity markets, as measured by the Russell 2000® Index of small-cap stocks, which rose by 31.37%. Compared to this broad universe, the Fund under-performed by 10.12%. Most of the underperformance was driven by stock momentum, meaning that within a given sector, stocks with poor momentum outperformed those with strong momentum. Sector momentum (i.e. the sector over and under-weights implied by the momentum style) also detracted from performance, but to a lesser extent.

While the momentum style underperformed during the period in question, the benefits of investing in the momentum style need to be judged over the course of one or more business cycles, based both on the Fund’s return and its ability to provide diversification relative to the more traditional value and growth investment styles.

| | | | | | | | |

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2009 AQR SMALL CAP MOMENTUM FUND |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(7/9/2009) |

| Fund—Class L: ASMOX | | – | | – | | – | | 21.24% |

| Russell 2000® Index | | – | | – | | – | | 31.37% |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the is expected to be 0.85%. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 15 |

| | | | | | | |

Shareholder Letter

|

| AQR SMALL CAP MOMENTUM FUND |

|

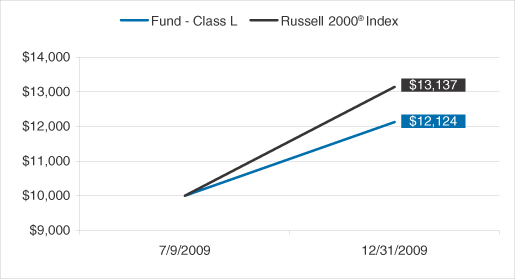

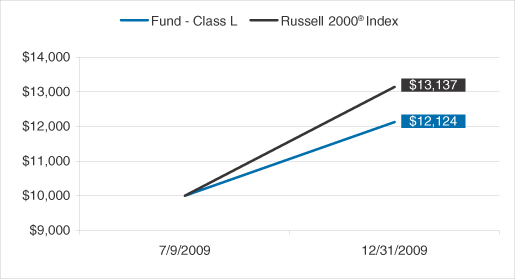

AQR SMALL CAP MOMENTUM FUND VS. RUSSELL 2000® INDEX VALUE OF $10,000 INVESTED ON 7/9/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Principal Risks: Securities with positive momentum generally will be more volatile than a broad cross-section of securities. In addition, there may be periods when the momentum style is out of favor, and during which the investment performance of a Fund using a momentum strategy generally will suffer. Funds that emphasize investments in smaller companies generally will experience greater price volatility. This Fund is not suitable for all investors.

An investment in any of the AQR Funds involves risk, including loss of principal. The value of the Funds’ portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad. An investor considering the Funds should be able to tolerate potentially wide price fluctuations. The Funds are subject to high portfolio turnover risk as a result of frequent trading, and thus, will incur a higher level of brokerage fees and commissions, and cause a higher level of tax liability to shareholders in the Funds. The Funds may attempt to increase their income or total return through the use of securities lending, and they may be subject to the possibility of additional loss as a result of this investment technique. Please refer to the prospectus for complete information regarding all risks associated with the Funds.

Cliff Asness is a registered representative of ALPS Distributors, Inc.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 16 |

| | | | | | | |

Shareholder Letter

|

| AQR SMALL CAP MOMENTUM FUND |

Definitions: The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 8% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. Indexes are unmanaged and one cannot invest directly in an index.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 17 |

| | | | | | | |

Cliff Asness

Managing & Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Shareholder Letter

|

| AQR INTERNATIONAL MOMENTUM FUND |

Dear Shareholder:

The AQR International Momentum Fund invests in stocks of large and mid-cap non-U.S. companies with positive momentum. A stock is considered to have positive momentum if it has performed well in the prior twelve months (excluding the most recent month) relative to other stocks in the investment universe, which is comprised of the top 85% of stocks by market capitalization of each of the 19 major developed markets outside the U.S. The Fund is not actively managed to outperform a growth, value or core benchmark. Rather, it seeks to provide systematic exposure to stocks that share the common characteristic of positive momentum.

From the Fund’s inception on July 9, 2009 to December 31, 2009, the Fund returned 23.08%. The major driver of the Fund’s performance was the overall performance of international developed country equity markets, as measured by the MSCI World ex-USA Index, which rose by 26.97%. Compared to this broad universe, the Fund under-performed by 3.89%. Most of the underperformance was driven by stock momentum, meaning that within a given sector, stocks with poor momentum outperformed those with strong momentum. Sector and country momentum (i.e. the sector and country over and under-weights implied by the momentum style) also detracted from performance, but to a lesser extent.

While the momentum style underperformed during the period in question, the benefits of investing in the momentum style need to be judged over the course of one or more business cycles, based both on the Fund’s return and its ability to provide diversification relative to the more traditional value and growth investment styles.

| | | | | | | | |

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2009 AQR INTERNATIONAL MOMENTUM FUND | | | | | | |

| | | 1 Year | | 3 Year | | 5 Year | | Since

Inception

(7/9/2009) |

| Fund - Class L: AIMOX | | – | | – | | – | | 23.08% |

| MSCI World ex-USA Index | | – | | – | | – | | 26.97% |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 2% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratios for the is expected to be 0.92%. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 18 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL MOMENTUM FUND |

|

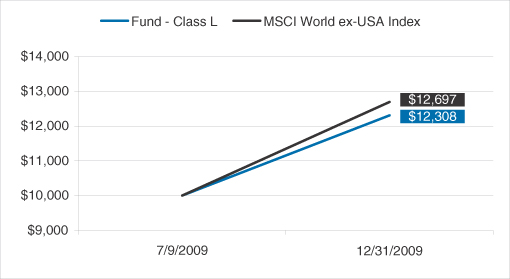

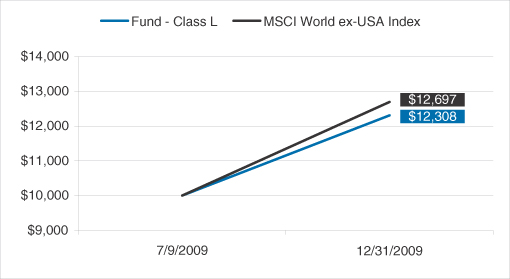

AQR INTERNATIONAL MOMENTUM FUND VS. MSCI WORLD EX-USA INDEX VALUE OF $10,000 INVESTED ON 7/9/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Principal Risks: Securities with positive momentum generally will be more volatile than a broad cross-section of securities. In addition, there may be periods when the momentum style is out of favor, and during which the investment performance of a Fund using a momentum strategy generally will suffer. Foreign investing involves special risks such as currency fluctuations and political uncertainty. This Fund is not suitable for all investors.

An investment in any of the AQR Funds involves risk, including loss of principal. The value of the Funds’ portfolio holdings may fluctuate in response to events specific to the companies in which the Fund invests, as well as economic, political or social events in the United States or abroad. An investor considering the Funds should be able to tolerate potentially wide price fluctuations. The Funds are subject to high portfolio turnover risk as a result of frequent trading, and thus, will incur a higher level of brokerage fees and commissions, and cause a higher level of tax liability to shareholders in the Funds. The Funds may attempt to increase their income or total return through the use of securities lending, and they may be subject to the possibility of additional loss as a result of this investment technique. Please refer to the prospectus for complete information regarding all risks associated with the Funds.

Cliff Asness is a registered representative of ALPS Distributors, Inc.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 19 |

| | | | | | | |

Shareholder Letter

|

| AQR INTERNATIONAL MOMENTUM FUND |

Definitions: The MSCI World ex-USA Index is a market capitalization weighted index composed of companies representative of the market structure of 22 developed market countries in North America, Europe and the Asia/Pacific Region, excluding the U.S.A. Indexes are unmanaged and one cannot invest directly in an index.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 20 |

| | | | | | | |

| | |

| Schedule of Investments | | December 31, 2009 |

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

| | | | | |

| COMMON STOCKS - 79.1% | | SHARES | | VALUE

(Note 2) |

| Australia - 6.7% | | | | | |

| AGL Energy Ltd. | | 2,943 | | $ | 36,991 |

| Amcor Ltd. | | 135,964 | | | 756,957 |

| AMP Ltd. | | 107,632 | | | 650,132 |

| Ansell Ltd. | | 20,714 | | | 202,176 |

| Asciano Group † | | 233,226 | | | 377,573 |

| ASX Ltd. | | 3,473 | | | 108,276 |

| Australia & New Zealand Banking Group Ltd. | | 58,165 | | | 1,185,310 |

| AWB Ltd. | | 183,073 | | | 184,688 |

| BHP Billiton Ltd. | | 115,822 | | | 4,432,116 |

| Billabong International Ltd. | | 10,448 | | | 102,225 |

| Bluescope Steel Ltd. | | 229,219 | | | 631,583 |

| Boral Ltd. | | 53,520 | | | 284,075 |

| Caltex Australia Ltd. † | | 36,251 | | | 301,551 |

| CFS Retail Property Trust REIT | | 69,740 | | | 118,751 |

| Challenger Financial Services Group Ltd. | | 52,749 | | | 198,544 |

| Commonwealth Bank of Australia | | 63,327 | | | 3,091,737 |

| Computershare Ltd. | | 7,774 | | | 79,540 |

| David Jones Ltd. | | 41,608 | | | 200,188 |

| Dexus Property Group REIT | | 136,404 | | | 103,486 |

| Downer EDI Ltd. | | 6,619 | | | 55,123 |

| Energy Resources of Australia Ltd. | | 5,935 | | | 126,656 |

| Felix Resources Ltd. †*(a)(e) | | 592 | | | 43 |

| Flight Centre Ltd. | | 10,987 | | | 180,684 |

| Goodman Group REIT | | 193,631 | | | 109,546 |

| GPT Group REIT † | | 143,427 | | | 77,072 |

| MAp Group | | 174,269 | | | 471,686 |

| Macquarie Group Ltd. | | 6,383 | | | 273,487 |

| Macquarie Infrastructure Group | | 25,619 | | | 30,513 |

| Metcash Ltd. | | 63,748 | | | 255,614 |

| Mirvac Group REIT | | 88,938 | | | 124,091 |

| National Australia Bank Ltd. | | 99,256 | | | 2,422,246 |

| Newcrest Mining Ltd. | | 16,024 | | | 507,555 |

| Orica Ltd. | | 6,777 | | | 157,565 |

| Origin Energy Ltd. | | 33,140 | | | 498,600 |

| Ramsay Health Care Ltd. | | 4,025 | | | 39,198 |

| Rio Tinto Ltd. | | 10,793 | | | 720,483 |

| Santos Ltd. | | 36,866 | | | 464,310 |

| Sigma Pharmaceuticals Ltd. | | 173,386 | | | 153,759 |

| Sims Metal Management Ltd. | | 1,860 | | | 36,444 |

| SP Ausnet | | 81,737 | | | 67,078 |

| Stockland REIT | | 58,884 | | | 207,460 |

| Suncorp-Metway Ltd. | | 54,810 | | | 424,335 |

| TABCORP Holdings Ltd. | | 55,304 | | | 343,124 |

| Tatts Group Ltd. | | 267,448 | | | 583,459 |

| Telstra Corp Ltd. | | 325,979 | | | 1,002,180 |

| Toll Holdings Ltd. | | 27,252 | | | 212,810 |

| Transurban Group | | 37,755 | | | 186,852 |

| Wesfarmers Ltd. | | 38,906 | | | 1,087,609 |

| Wesfarmers Ltd. Price Protected Shares | | 1,765 | | | 49,282 |

| West Australian Newspapers Holdings Ltd. | | 9,379 | | | 67,776 |

| Westfield Group REIT | | 68,093 | | | 762,087 |

| Westpac Banking Corp. | | 76,995 | | | 1,739,217 |

| Woodside Petroleum Ltd. | | 2,736 | | | 115,383 |

| Woolworths Ltd. | | 14,209 | | | 356,373 |

| | | | | |

| | | | | 26,955,599 |

| | | | | |

| Belgium - 0.6% | | | | | |

| Anheuser-Busch InBev NV | | 24,874 | | | 1,287,655 |

| Bekaert NV | | 1,129 | | | 174,240 |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Belgium - 0.6% (continued) | | | | | |

| Delhaize Group | | 4,715 | | $ | 360,694 |

| Groupe Bruxelles Lambert SA | | 2,641 | | | 249,378 |

| Solvay SA Class A | | 3,613 | | | 389,103 |

| | | | | |

| | | | | 2,461,070 |

| | | | | |

| China - 0.0% (b) | | | | | |

| Foxconn International Holdings Ltd. † | | 69,406 | | | 79,901 |

| | | | | |

| | |

| Denmark - 1.1% | | | | | |

| Carlsberg A/S Class B | | 16,514 | | | 1,215,672 |

| Danisco A/S | | 2,919 | | | 194,754 |

| Danske Bank A/S † | | 58,094 | | | 1,304,176 |

| H. Lundbeck A/S | | 17,986 | | | 324,956 |

| Novo Nordisk A/S Class B | | 20,876 | | | 1,332,760 |

| | | | | |

| | | | | 4,372,318 |

| | | | | |

| Finland - 0.8% | | | | | |

| Elisa Oyj Class A | | 9,069 | | | 206,994 |

| Fortum Oyj | | 2,410 | | | 65,382 |

| Metso Oyj | | 29,568 | | | 1,040,065 |

| Sampo Oyj - A Shares | | 24,205 | | | 589,633 |

| Stora Enso Oyj - R Shares † | | 44,418 | | | 311,539 |

| Tieto Oyj | | 14,130 | | | 293,589 |

| UPM-Kymmene Oyj | | 74,955 | | | 891,125 |

| | | | | |

| | | | | 3,398,327 |

| | | | | |

| France - 7.8% | | | | | |

| Atos Origin SA † | | 5,536 | | | 253,624 |

| BNP Paribas | | 12,976 | | | 1,029,230 |

| Bourbon SA | | 5,276 | | | 198,156 |

| Bouygues SA | | 29,915 | | | 1,549,544 |

| Christian Dior SA | | 8,324 | | | 853,041 |

| CNP Assurances | | 9,393 | | | 909,574 |

| Compagnie de Saint-Gobain | | 15,104 | | | 819,336 |

| Compagnie Generale des Etablissements Michelin Class B | | 20,766 | | | 1,590,442 |

| Credit Agricole SA | | 36,854 | | | 646,782 |

| France Telecom SA | | 11,393 | | | 284,691 |

| GDF Suez | | 11,715 | | | 507,505 |

| Klepierre | | 3,675 | | | 148,893 |

| Lagardere SCA | | 10,910 | | | 441,697 |

| Legrand SA | | 6,433 | | | 179,041 |

| LVMH Moet Hennessy Louis Vuitton SA | | 9,659 | | | 1,083,041 |

| M6 Metropole Television | | 11,236 | | | 287,577 |

| PSA Peugot Citroen † | | 16,176 | | | 543,796 |

| PPR | | 10,988 | | | 1,318,944 |

| Publicis Groupe | | 24,422 | | | 993,001 |

| Sanofi-Aventis | | 45,637 | | | 3,589,020 |

| Schneider Electric SA | | 16,492 | | | 1,917,566 |

| SCOR SE | | 36,520 | | | 917,456 |

| Societe BIC SA | | 6,242 | | | 431,229 |

| Societe Generale | | 24,185 | | | 1,680,371 |

| Technip SA | | 3,909 | | | 275,024 |

| Teleperformance | | 3,651 | | | 118,463 |

| Total SA | | 60,684 | | | 3,897,726 |

| Unibail-Rodamco SE | | 3,619 | | | 795,021 |

| Valeo SA † | | 4,783 | | | 167,405 |

| Vallourec SA | | 6,797 | | | 1,229,703 |

| Vinci SA | | 11,314 | | | 636,650 |

| Vivendi | | 73,040 | | | 2,167,806 |

| | | | | |

| | | | | 31,461,355 |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 21 |

| | | | | | | |

| | |

| Schedule of Investments | | December 31, 2009 |

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Germany - 7.4% | | | | | |

| Allianz SE | | 21,131 | | $ | 2,619,397 |

| BASF SE | | 38,133 | | | 2,360,076 |

| Bayer AG | | 21,664 | | | 1,733,629 |

| Daimler AG | | 30,620 | | | 1,630,931 |

| Deutsche Bank AG | | 20,985 | | | 1,483,848 |

| Deutsche Boerse AG | | 5,256 | | | 435,247 |

| Deutsche Lufthansa AG | | 57,556 | | | 971,874 |

| Deutsche Post AG | | 100,719 | | | 1,946,574 |

| Deutsche Telekom AG | | 33,425 | | | 490,338 |

| E.ON AG | | 40,607 | | | 1,704,439 |

| Hannover Rueckversicherung AG † | | 42,846 | | | 2,001,779 |

| Hochtief AG | | 8,039 | | | 613,109 |

| Infineon Technologies AG † | | 123,802 | | | 688,757 |

| MTU Aero Engines Holding AG | | 22,559 | | | 1,227,762 |

| Muenchener Rueckversicherungs-Gesellschaft AG | | 12,005 | | | 1,869,894 |

| RWE AG | | 19,773 | | | 1,918,817 |

| Salzgitter AG | | 8,551 | | | 837,900 |

| Siemens AG | | 27,612 | | | 2,533,976 |

| Software AG | | 3,266 | | | 355,922 |

| Suedzucker AG | | 13,831 | | | 288,175 |

| ThyssenKrupp AG | | 31,492 | | | 1,183,855 |

| Tognum AG | | 423 | | | 7,002 |

| Volkswagen AG | | 2,843 | | | 268,172 |

| Volkswagen AG Preferred Shares | | 2,126 | | | 235,556 |

| Wincor Nixdorf AG | | 4,291 | | | 293,886 |

| | | | | |

| | | | | 29,700,915 |

| | | | | |

| Hong Kong - 1.8% | | | | | |

| ASM Pacific Technology Ltd. | | 6,404 | | | 60,548 |

| BOC Hong Kong Holdings Ltd. | | 216,553 | | | 486,524 |

| Cheung Kong Holdings Ltd. | | 54,278 | | | 697,482 |

| Cheung Kong Infrastructure Holdings Ltd. | | 14,827 | | | 56,382 |

| Chinese Estates Holdings Ltd. | | 63,869 | | | 108,822 |

| CLP Holdings Ltd. | | 76,509 | | | 517,780 |

| Esprit Holdings Ltd. | | 1,528 | | | 10,138 |

| Hang Lung Group Ltd. | | 21,276 | | | 105,221 |

| Hang Seng Bank Ltd. | | 21,988 | | | 323,487 |

| Henderson Land Development Co., Ltd. | | 40,333 | | | 301,398 |

| Hong Kong and China Gas Co., Ltd. | | 168,813 | | | 423,409 |

| Hong Kong Exchanges & Clearing Ltd. | | 28,854 | | | 513,382 |

| Hopewell Holdings Ltd. | | 73,762 | | | 237,825 |

| Hutchison Whampoa Ltd. | | 45,832 | | | 313,576 |

| Hysan Development Co., Ltd. | | 25,616 | | | 72,495 |

| Industrial and Commercial Bank of China Ltd. | | 55,918 | | | 121,118 |

| Li & Fung Ltd. | | 55,668 | | | 230,156 |

| Link REIT | | 60,382 | | | 154,078 |

| Mongolia Energy Co., Ltd. † | | 95,406 | | | 48,545 |

| Neo-China Land Group Holdings Ltd. †(a)(e) | | 6,136 | | | 633 |

| New World Development Co., Ltd. | | 68,896 | | | 140,369 |

| Orient Overseas International Ltd. | | 16,752 | | | 77,682 |

| Sun Hung Kai Properties Ltd. | | 38,046 | | | 565,710 |

| Swire Pacific Ltd. Class A | | 20,530 | | | 248,277 |

| Television Broadcasts Ltd. | | 54,403 | | | 261,374 |

| Wharf Holdings Ltd. | | 128,243 | | | 735,988 |

| Wheelock and Co., Ltd. | | 77,621 | | | 236,766 |

| Yue Yuen Industrial Holdings Ltd. | | 117,109 | | | 339,059 |

| | | | | |

| | | | | 7,388,224 |

| | | | | |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Italy - 3.2% | | | | | |

| Banca Popolare di Milano Scarl | | 7,766 | | $ | 55,176 |

| Enel SpA | | 278,641 | | | 1,613,160 |

| Eni SpA | | 154,863 | | | 3,943,706 |

| Intesa Sanpaolo † | | 162,062 | | | 729,282 |

| Mediaset SpA | | 140,579 | | | 1,155,831 |

| Prysmian SpA | | 61,779 | | | 1,078,365 |

| Telecom Italia SpA | | 1,312,735 | | | 2,047,795 |

| UniCredit SpA † | | 647,258 | | | 2,164,272 |

| | | | | |

| | | | | 12,787,587 |

| | | | | |

| Japan - 15.3% | | | | | |

| Alfresa Holdings Corp. | | 4,267 | | | 169,654 |

| ALPS Electric Co., Ltd. † | | 21,859 | | | 128,245 |

| AMADA Co., Ltd. | | 40,314 | | | 252,511 |

| Asahi Glass Co., Ltd. | | 104,413 | | | 993,185 |

| Asics Corp. | | 40,319 | | | 361,858 |

| Astellas Pharma, Inc. | | 24,897 | | | 928,879 |

| Bank of Yokohama Ltd. | | 39,142 | | | 178,467 |

| Canon, Inc. | | 49,715 | | | 2,114,800 |

| Canon Marketing Japan, Inc. | | 26,406 | | | 389,124 |

| Central Glass Co., Ltd. | | 63,690 | | | 243,769 |

| Central Japan Railway Co. | | 36 | | | 240,958 |

| Chubu Electric Power Co., Inc. | | 15,197 | | | 362,533 |

| Circle K Sunkus Co., Ltd. | | 19,641 | | | 242,286 |

| COMSYS Holdings Corp. | | 68,886 | | | 724,657 |

| Cosmo Oil Co., Ltd. | | 26,030 | | | 54,695 |

| Credit Saison Co., Ltd. | | 36,512 | | | 408,910 |

| Dai Nippon Printing Co., Ltd. | | 53,861 | | | 686,735 |

| Daiei, Inc. † | | 14,331 | | | 49,336 |

| Daifuku Co., Ltd. | | 24,255 | | | 155,072 |

| Daito Trust Construction Co., Ltd. | | 4,687 | | | 221,922 |

| Daiwa House Industry Co., Ltd. | | 295 | | | 3,172 |

| Daiwa Securities Group, Inc. | | 117,723 | | | 592,458 |

| Doutor Nichires Holdings Co., Ltd. | | 12,483 | | | 160,787 |

| Dowa Holdings Co., Ltd. | | 86,818 | | | 480,370 |

| East Japan Railway Co. | | 5,413 | | | 342,539 |

| Ebara Corp. † | | 67,983 | | | 293,597 |

| FamilyMart Co., Ltd. | | 7,557 | | | 223,095 |

| Fuji Heavy Industries Ltd. † | | 24,721 | | | 120,795 |

| Fuji Oil Co., Ltd. | | 7,454 | | | 109,209 |

| Fujifilm Holdings Corp. | | 18,543 | | | 560,011 |

| Fujikura Ltd. | | 114,188 | | | 594,765 |

| Fujitsu Ltd. | | 39,635 | | | 257,168 |

| Fukuoka Financial Group, Inc. | | 75,046 | | | 261,535 |

| Funai Electric Co., Ltd. | | 14,167 | | | 711,493 |

| Glory Ltd. | | 13,003 | | | 289,186 |

| Hanwa Co., Ltd. | | 26,030 | | | 94,629 |

| Hitachi Capital Corp. | | 36,810 | | | 447,547 |

| Hitachi Chemical Co., Ltd. | | 10,589 | | | 215,810 |

| Hitachi High-Technologies Corp. | | 10,806 | | | 214,395 |

| Hokuhoku Financial Group, Inc. | | 76,812 | | | 157,052 |

| Honda Motor Co., Ltd. | | 32,097 | | | 1,089,009 |

| HOYA Corp. | | 21,563 | | | 575,355 |

| IBIDEN Co., Ltd. | | 7,575 | | | 271,673 |

| ITOCHU Corp. | | 121,444 | | | 897,079 |

| JFE Holdings, Inc. | | 7,247 | | | 286,466 |

| JGC Corp. | | 32,936 | | | 606,933 |

| JTEKT Corp. | | 15,270 | | | 196,399 |

| Kaken Pharmaceutical Co., Ltd. | | 47,918 | | | 407,134 |

The accompanying notes are an integral part of these financial statements.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 22 |

| | | | | | | |

| | |

| Schedule of Investments | | December 31, 2009 |

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Japan - 15.3% (continued) | | | | | |

| Kandenko Co., Ltd. | | 55,894 | | $ | 353,072 |

| Kaneka Corp. | | 82,625 | | | 526,437 |

| Kansai Electric Power Co., Inc. | | 9,932 | | | 224,131 |

| Kansai Paint Co., Ltd. | | 91,291 | | | 765,058 |

| Kao Corp. | | 15,185 | | | 355,887 |

| Kawasaki Kisen Kaisha Ltd. † | | 60,933 | | | 174,104 |

| KDDI Corp. | | 160 | | | 847,475 |

| Kinden Corp. | | 10,564 | | | 89,516 |

| Kissei Pharmaceutical Co., Ltd. | | 2,663 | | | 52,462 |

| Kobayashi Pharmaceutical Co., Ltd. | | 4,149 | | | 166,248 |

| Komatsu Ltd. | | 6,685 | | | 139,945 |

| KOSE Corp. | | 11,714 | | | 236,842 |

| K’s Holdings Corp. | | 13,432 | | | 403,220 |

| Kyowa Exeo Corp. | | 20,469 | | | 174,165 |

| Lintec Corp. | | 16,021 | | | 322,361 |

| Makita Corp. | | 7,000 | | | 240,436 |

| Marubeni Corp. | | 52,974 | | | 292,627 |

| Matsumotokiyoshi Holdings Co., Ltd. | | 6,270 | | | 138,028 |

| Megmilk Snow Brand Co., Ltd. (f)† | | 3,433 | | | 50,499 |

| Miraca Holdings, Inc. | | 29,206 | | | 803,781 |

| Mitsubishi Corp. | | 24,402 | | | 607,819 |

| Mitsubishi Estate Co., Ltd. | | 41,020 | | | 654,921 |

| Mitsubishi Gas Chemical Co., Inc. | | 38,324 | | | 193,122 |

| Mitsubishi UFJ Financial Group, Inc. | | 223,991 | | | 1,103,331 |

| Mitsui & Co., Ltd. | | 119,143 | | | 1,690,177 |

| Mitsui Chemicals, Inc. | | 56,211 | | | 145,547 |

| Mitsui Engineering & Shipbuilding Co., Ltd. | | 61,509 | | | 148,141 |

| Mitsui Fudosan Co., Ltd. | | 28,205 | | | 476,896 |

| Mitsui O.S.K. Lines Ltd. | | 42,634 | | | 225,221 |

| Mitsumi Electric Co., Ltd. | | 28,889 | | | 510,258 |

| Mizuho Financial Group, Inc. | | 131,957 | | | 237,299 |

| Mizuho Securities Co., Ltd. | | 43,185 | | | 130,676 |

| Mochida Pharmaceutical Co., Ltd. | | 10,649 | | | 95,254 |

| Murata Manufacturing Co., Ltd. | | 2,946 | | | 147,027 |

| Musashino Bank Ltd. | | 4,258 | | | 100,991 |

| NEC Electronics Corp. † | | 29,585 | | | 245,733 |

| NHK Spring Co., Ltd. | | 53,196 | | | 495,299 |

| Nichirei Corp. | | 33,467 | | | 116,187 |

| Nidec Corp. | | 1,804 | | | 166,731 |

| Nintendo Co., Ltd. | | 1,530 | | | 365,421 |

| Nippon Electric Glass Co., Ltd. | | 77,614 | | | 1,068,270 |

| Nippon Mining Holdings, Inc. | | 116,895 | | | 501,690 |

| Nippon Oil Corp. | | 38,353 | | | 177,809 |

| Nippon Telegraph and Telephone Corp. | | 19,019 | | | 751,309 |

| Nipro Corp. | | 7,505 | | | 155,242 |

| Nishi-Nippon City Bank Ltd. | | 49,737 | | | 121,790 |

| Nissan Motor Co., Ltd. † | | 135,755 | | | 1,193,004 |

| Nissan Shatai Co., Ltd. | | 57,403 | | | 512,949 |

| Nisshin Seifun Group, Inc. | | 12,584 | | | 170,060 |

| Nitto Denko Corp. | | 5,383 | | | 193,378 |

| Nomura Holdings, Inc. | | 57,313 | | | 426,218 |

| NTT DoCoMo, Inc. | | 474 | | | 661,461 |

| Okinawa Electric Power Co., Inc. | | 6,253 | | | 333,938 |

| OKUMA Corp. | | 44,072 | | | 230,705 |

| OMRON Corp. | | 14,937 | | | 268,639 |

| ORIX Corp. | | 3,669 | | | 249,801 |

| Osaka Gas Co., Ltd. | | 99,802 | | | 336,361 |

| Point, Inc. | | 9,541 | | | 533,103 |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Japan - 15.3% (continued) | | | | | |

| Promise Co., Ltd. | | 16,933 | | $ | 129,965 |

| Rengo Co., Ltd. | | 84,299 | | | 501,049 |

| Resona Holdings, Inc. | | 8,770 | | | 89,101 |

| Sankyo Co., Ltd. | | 3,024 | | | 151,422 |

| SBI Holdings, Inc. | | 600 | | | 107,420 |

| Secom Co., Ltd. | | 2,273 | | | 107,962 |

| Seino Holdings Co., Ltd. | | 81,837 | | | 519,459 |

| Seven & I Holdings Co., Ltd. | | 11,539 | | | 235,608 |

| Shimachu Co., Ltd. | | 3,933 | | | 77,513 |

| Shin-Etsu Chemical Co., Ltd. | | 16,652 | | | 940,144 |

| Shinko Electric Industries Co., Ltd. | | 43,688 | | | 635,951 |

| SKY Perfect JSAT Holdings, Inc. | | 263 | | | 104,744 |

| Softbank Corp. | | 24,284 | | | 569,283 |

| Sojitz Corp. | | 89,062 | | | 168,514 |

| Sompo Japan Insurance, Inc. | | 80,933 | | | 521,812 |

| Sony Corp. | | 27,971 | | | 813,167 |

| Stanley Electric Co., Ltd. | | 40,694 | | | 825,411 |

| Sumco Corp. | | 7,113 | | | 125,690 |

| Sumitomo Bakelite Co., Ltd. | | 110,263 | | | 544,568 |

| Sumitomo Electric Industries Ltd. | | 24,454 | | | 304,596 |

| Sumitomo Forestry Co., Ltd. | | 10,837 | | | 81,761 |

| Sumitomo Metal Mining Co., Ltd. | | 32,758 | | | 483,428 |

| Sumitomo Mitsui Financial Group, Inc. | | 22,036 | | | 632,331 |

| Sumitomo Realty & Development Co., Ltd. | | 17,261 | | | 325,844 |

| Sumitomo Trust and Banking Co., Ltd. | | 27,075 | | | 132,939 |

| Taiyo Yuden Co., Ltd. | | 44,651 | | | 578,062 |

| Takara Holdings, Inc. | | 26,475 | | | 152,369 |

| Takeda Pharmaceutical Co., Ltd. | | 12,281 | | | 505,993 |

| TDK Corp. | | 3,904 | | | 238,583 |

| THK Co., Ltd. | | 13,205 | | | 234,823 |

| Toho Gas Co., Ltd. | | 31,627 | | | 168,047 |

| Tokai Rika Co., Ltd. | | 28,299 | | | 641,862 |

| Tokai Rubber Industries, Inc. | | 5,608 | | | 58,086 |

| Tokuyama Corp. | | 60,920 | | | 340,634 |

| Tokyo Electron Ltd. | | 9,495 | | | 609,465 |

| Tokyo Gas Co., Ltd. | | 54,071 | | | 215,832 |

| Tokyo Steel Manufacturing Co., Ltd. | | 44,345 | | | 499,221 |

| Tokyu Land Corp. | | 26,483 | | | 98,375 |

| Toppan Forms Co., Ltd. | | 7,253 | | | 75,640 |

| Toshiba Corp. † | | 60,341 | | | 334,826 |

| Toshiba Tec Corp. † | | 5,479 | | | 20,767 |

| Toyo Seikan Kaisha Ltd. | | 19,761 | | | 301,041 |

| Toyo Suisan Kaisha Ltd. | | 28,370 | | | 654,230 |

| Toyota Auto Body Co., Ltd. | | 1,857 | | | 35,142 |

| Toyota Motor Corp. | | 77,953 | | | 3,286,575 |

| Toyota Tsusho Corp. | | 17,510 | | | 259,105 |

| USS Co., Ltd. | | 8,644 | | | 527,683 |

| West Japan Railway Co., | | 82 | | | 274,917 |

| Yamaguchi Financial Group, Inc. | | 7,652 | | | 71,031 |

| Yamatake Corp. | | 4,437 | | | 98,628 |

| Yamato Holdings Co., Ltd. | | 43,160 | | | 600,789 |

| Yamato Kogyo Co., Ltd. | | 5,137 | | | 167,956 |

| Yokogawa Electric Corp. | | 33,711 | | | 297,721 |

| Yokohama Rubber Co., Ltd. | | 12,719 | | | 56,228 |

| | | | | |

| | | | | 61,998,642 |

| | | | | |

| Luxembourg - 0.3% | | | | | |

| ArcelorMittal | | 28,352 | | | 1,295,863 |

| | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2009 | | 23 |

| | | | | | | |

| | |

| Schedule of Investments | | December 31, 2009 |

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Netherlands - 3.1% | | | | | |

| Akzo Nobel NV | | 6,944 | | $ | 460,491 |

| Corio NV | | 2,174 | | | 148,114 |

| CSM | | 10,279 | | | 269,995 |

| ING Groep NV † | | 67,777 | | | 652,718 |

| James Hardie Industries NV | | 8,198 | | | 62,356 |

| Koninklijke Ahold NV | | 60,088 | | | 796,086 |

| Koninklijke DSM NV | | 9,593 | | | 471,337 |

| Koninklijke (Royal) Philips Electronics NV | | 25,505 | | | 753,910 |

| Randstad Holding NV † | | 9,403 | | | 467,868 |

| Royal Dutch Shell PLC Class A | | 117,869 | | | 3,566,737 |

| Royal Dutch Shell PLC Class B | | 98,748 | | | 2,875,854 |

| Unilever NV | | 59,667 | | | 1,941,968 |

| | | | | |

| | | | | 12,467,434 |

| | | | | |

| New Zealand - 0.0% (b) | | | | | |

| Telecom Corp. of New Zealand Ltd. | | 78,357 | | | 141,316 |

| | | | | |

| | |

| Singapore - 1.1% | | | | | |

| Ascendas REIT | | 49,637 | | | 77,920 |

| CapitaMall Trust REIT | | 71,994 | | | 91,891 |

| ComfortDelGro Corp., Ltd. | | 129,356 | | | 150,466 |

| Creative Technology Ltd. | | 6 | | | 28 |

| DBS Group Holdings Ltd. | | 56,128 | | | 610,166 |

| Haw Par Corp., Ltd. | | 7,960 | | | 32,790 |

| Jardine Cycle & Carriage Ltd. | | 20,066 | | | 383,118 |

| Keppel Corp., Ltd. | | 77,571 | | | 451,862 |

| Oversea-Chinese Banking Corp., Ltd. | | 90,479 | | | 582,607 |

| Pacific Century Regional Developments Ltd. | | 45,410 | | | 5,820 |

| SembCorp Industries Ltd. | | 32,017 | | | 83,661 |

| SembCorp Marine Ltd. | | 51,142 | | | 133,438 |

| Singapore Exchange Ltd. | | 21,472 | | | 126,431 |

| Singapore Technologies Engineering Ltd. | | 44,265 | | | 101,879 |

| Singapore Telecommunications Ltd. | | 231,524 | | | 509,959 |

| StarHub Ltd. | | 1,988 | | | 3,036 |

| United Overseas Bank Ltd. | | 48,097 | | | 669,499 |

| Yangzijiang Shipbuilding Holdings Ltd. | | 525,319 | | | 448,687 |

| | | | | |

| | | | | 4,463,258 |

| | | | | |

| Spain - 4.7% | | | | | |

| Almirall SA | | 11,258 | | | 147,366 |

| Banco Bilbao Vizcaya Argentaria SA | | 173,991 | | | 3,170,987 |

| Banco Espanol de Credito SA | | 32,402 | | | 396,928 |

| Banco Santander SA | | 6,735 | | | 111,039 |

| Banco Santander SA | | 380,220 | | | 6,283,004 |

| Endesa SA | | 74,446 | | | 2,567,355 |

| Repsol YPF SA | | 34,941 | | | 937,627 |

| Tecnicas Reunidas SA | | 20,264 | | | 1,165,382 |

| Telefonica SA | | 152,986 | | | 4,281,928 |

| | | | | |

| | | | | 19,061,616 |

| | | | | |

| Sweden - 3.2% | | | | | |

| Atlas Copco AB A Shares | | 25,813 | | | 379,448 |

| Boliden AB | | 3,468 | | | 44,440 |

| Electrolux AB Class B † | | 104,600 | | | 2,458,013 |

| Hennes & Mauritz AB B Shares | | 12,776 | | | 708,260 |

| Investor AB B Shares | | 19,364 | | | 358,666 |

| Nordea Bank AB | | 221,074 | | | 2,239,923 |

| Skanska AB B Shares | | 59,389 | | | 1,007,716 |

| Svenska Cellulosa AB B Shares | | 93,410 | | | 1,245,409 |

| Svenska Handelsbanken AB A Shares | | 40,770 | | | 1,161,530 |

| | | | | |

| | | SHARES | | VALUE

(Note 2) |

| Sweden - 3.2% (continued) | | | | | |

| Tele2 AB B Shares | | 65,958 | | $ | 1,013,200 |

| Telefonaktiebolaget LM Ericsson B Shares | | 240,296 | | | 2,212,177 |

| | | | | |

| | | | | 12,828,782 |

| | | | | |

| Switzerland - 6.6% | | | | | |

| ABB Ltd. † | | 105,764 | | | 2,038,001 |

| Adecco SA | | 9,399 | | | 518,496 |

| Baloise Holding AG | | 4,507 | | | 374,203 |

| Compagnie Financiere Richemont SA Class A | | 29,763 | | | 1,000,836 |

| Credit Suisse Group AG | | 42,274 | | | 2,094,312 |

| Helvetia Holding AG | | 113 | | | 34,996 |

| Nestle SA | | 133,451 | | | 6,476,862 |

| Novartis AG | | 111,208 | | | 6,072,986 |

| Roche Holding AG - Genusschein | | 28,267 | | | 4,834,021 |

| Schindler Holding AG | | 11,162 | | | 854,676 |

| Sulzer AG | | 5,717 | | | 448,498 |

| Swiss Life Holding AG † | | 5,123 | | | 651,832 |

| Swisscom AG | | 1,003 | | | 383,058 |

| UBS AG † | | 30,705 | | | 478,145 |

| Zurich Financial Services AG | | 2,191 | | | 479,005 |

| | | | | |

| | | | | 26,739,927 |

| | | | | |

| United Kingdom - 15.4% | | | | | |

| AMEC PLC | | 53,664 | | | 683,704 |

| Anglo American PLC † | | 13,549 | | | 586,773 |

| AstraZeneca PLC | | 56,368 | | | 2,649,135 |

| Aviva PLC | | 299,570 | | | 1,905,606 |

| BAE Systems PLC | | 174,702 | | | 1,011,117 |

| Barclays PLC | | 487,635 | | | 2,148,740 |

| BBA Aviation PLC | | 108,596 | | | 286,392 |

| BG Group PLC | | 34,020 | | | 614,274 |

| BHP Billiton PLC | | 61,575 | | | 1,963,007 |

| BP PLC | | 723,905 | | | 6,990,141 |

| Brit Insurance Holdings NV | | 245,744 | | | 776,100 |

| British American Tobacco PLC | | 45,784 | | | 1,486,298 |

| British Land Co. PLC REIT | | 25,597 | | | 197,106 |

| Cadbury PLC | | 27,670 | | | 355,769 |

| Charter International PLC | | 26,871 | | | 311,282 |

| Daily Mail and General Trust PLC | | 90,114 | | | 605,662 |

| Electrocomponents PLC | | 131,896 | | | 343,167 |

| Eurasian Natural Resources Corp. | | 74,018 | | | 1,084,179 |

| GlaxoSmithKline PLC | | 134,876 | | | 2,860,160 |

| Hays PLC | | 236,406 | | | 395,323 |

| Hiscox Ltd. | | 97,912 | | | 498,941 |

| HMV Group PLC | | 17,621 | | | 26,371 |

| Home Retail Group PLC | | 182,171 | | | 826,230 |

| HSBC Holdings PLC | | 481,886 | | | 5,497,510 |