UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22235

AQR Funds

(Exact name of registrant as specified in charter)

Two Greenwich Plaza, 3rd Floor

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Bradley D. Asness, Esq.

Principal and Chief Legal Officer

Two Greenwich Plaza

3rd Floor

Greenwich, CT 06830

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: 203-742-3600

Date of fiscal year end: December 31

Date of reporting period: January 1, 2010 to December 31, 2010

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1.)

AQR FUNDS

Annual Report

December 31, 2010

Table of Contents

Shareholder Letter (Unaudited)

Cliff Asness

Managing & Founding Principal

Ronen Israel

Principal

Oktay Kurbanov

Principal

John Liew

Founding Principal

Lars Nielsen

Principal

Dear Shareholder:

Global equity markets had uneven performance in 2010. During the first half of the year, the MSCI World Index (the “Benchmark”) posted a negative return of -9.84%, followed by a rally of +23.96% in the second half of the year. For the year, the Benchmark finished up +11.76%. The year consisted of two major macro-economic themes: continuation of European debt concerns and quantitative easing policies in the US. These themes had opposite effects on the market, leading to its bumpy performance during the year. During this turbulent period, the AQR Global Equity Fund Class N shares (the “Fund”) fared well, outperforming the Benchmark by +2.07%, with a positive return of +13.83% for the year.

The Fund is actively managed, and it seeks to outperform its benchmark in three ways: by selecting stocks within each country and by using futures and forwards contracts to over and under-weight the portfolio’s exposures to each country and to each currency. In the first half of the year, the stock and currency selection strategies contributed to positive performance while the country selection strategy detracted, with the net result of modest underperformance. In the second half of the year all three strategies were positive contributors. Each of these decisions is made independently. Details on each of the strategies are provided below.

Our stock selection strategies performed well in 2010 led by strong performance in the continental European portfolio. Performance in the US and the UK was also positive, while stock selection in Japan detracted slightly for the year. 2010 was a good year for stock selection in Europe as we observed positive performance across nearly all investment themes, especially momentum. Positive performance in momentum also helped offset negative performance in valuation in the US and UK. The Japan strategy struggled early in the year hurt by poor performance of momentum factors, but contributed positively in Q4 with strong performance of the valuation signals.

Approaching the end of 2010, the portfolio was positioned overweight the industrial sector driven by attractive momentum and underweight the information technology sector due to its high valuation level.

Our stock selection strategy remains broadly diversified across over seven hundred names, with any individual position representing a small active weight against the Benchmark. The portfolio as a whole is overweight cheaper stocks with better momentum and earnings quality.

The country selection strategy detracted from performance in 2010, stemming from underperformance of the value-driven positions. Fears of European defaults made this a difficult year for value. We were overweight in the European region vs. underweight in the Asia/Pacific region. The biggest detractors for the year were our value-driven overweights in Italy and Spain, as these countries sold off during the Greek sovereign debt crisis. An underweight in Canada also detracted from performance. Supported by the rally in commodities, the Canadian equity market showed better than average performance. Momentum themes worked well in 2010, helping to offset losses from

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 2 |

| | | | | | | |

Shareholder Letter (Unaudited)

value signals. Positive contributors supported by momentum were our overweight in Germany in the second half of the year, an overweight in the Netherlands and an underweight of Australia.

Our country views continue to favor European markets versus markets in the Asia/Pacific and North American regions. This reflects the value-oriented allocation in the country selection model as European markets are generally fair to cheaply valued versus other regions based on our measures. As European markets showed dispersion of returns and fundamental signals, the model adjusted accordingly. We reduced our position in Spain to a relatively small underweight. On the other hand, the model moved from a flat to an overweight position in Germany and increased its overweight in France. Price momentum drove these changes as Spain was among the worst performers in 2010, trailed only by Greece and Ireland. Germany outpaced other markets by more than 10%, while France’s performance was in line with an average global market. Strong relative momentum combined with improving macro indicators propelled these two countries to our top overweight positions by the end of the year. Additionally, the Netherlands remained one of our top three countries displaying an opportune combination of positive valuation and momentum signals. We increased our underweight in Switzerland over the past year as Swiss banks did not cheapen as much as other financials in Europe, making Switzerland more expensive on a relative basis.

The portfolio maintained underweight positions in the Asia/Pacific region. Australia’s underweight is driven by all major factor themes. This underweight benefited the model throughout the year as Australia’s equity market has showed weak relative performance. The model has maintained its value-driven underweight of Hong Kong, while Japan’s underweight has been reduced due to improvement in its price momentum signals.

In the North American region, the model has maintained a moderate underweight of Canada due to poor valuation indicators.

The currency selection strategy was a positive contributor in 2010. Notably, in a year fraught with sovereign credit concerns, carry and interest rate related themes worked well and were the top contributors to outperformance. This is partially explained by additional measures of the quantitative easing policy in the US originally announced in Q3. The accommodating policy of the Federal Reserve (“Fed”) encouraged risk taking, which provided support for carry related themes. As the model favored the high yielding Australian Dollar, the currency strategy benefited from this increase in risk appetite. The currency strategy also benefited from our significant underweight in the Euro, the worst performing currency in 2010. On a thematic level, momentum added to the outperformance, as the Australian Dollar and the Euro continued their appreciation / depreciation trends respectively. Value signals detracted from the performance for these currencies.

In the European region, we continue to dislike the Euro, which has remained our top underweight position throughout the period. The Euro position combines negative views stemming from carry, price and fundamental momentum. While the deterioration in the Euro’s price momentum was offset by improved valuations, its fundamentals worsened when Eurozone earnings were revised downwards. Interest rate predictors provided additional negative signals, as the continuing sovereign debt crisis made it less likely that Eurozone interest rates would increase in the near term. In Q1, the model moved from flat to an overweight position in the Swedish Krona, driven by a combination of fundamental momentum and value. As the year progressed, the Krona became strong on all factor themes, moving to the largest overweight position in the currency model. The Norwegian Krone overweight has remained relatively stable throughout the year, driven by a combination of fundamental momentum and interest rate related indicators. However, the weak price momentum of the Krone continues to moderate our positive view.

In the Asia/Pacific region, we remain overweight the Australian Dollar and underweight the Japanese Yen. The Aussie/Yen yield differential, as well as fundamental and valuation signals, motivates this positioning.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 3 |

| | | | | | | |

Shareholder Letter (Unaudited)

Over the second half of the year, we have assumed a meaningful underweight in the New Zealand Dollar as weak macro-economic conditions in New Zealand reduced the likelihood of future interest rate increases, making the New Zealand Dollar less attractive relative to other currencies.

In the North American region, we significantly reduced our underweight of the Canadian Dollar to a quarter of its size earlier in the year driven by significant improvement from interest rate predictors.

| | | | |

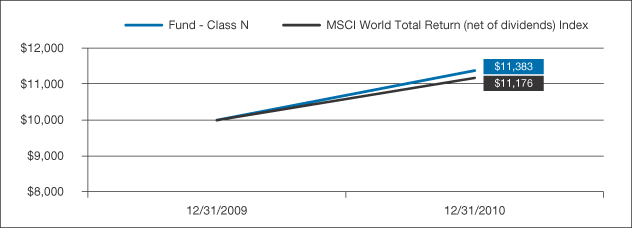

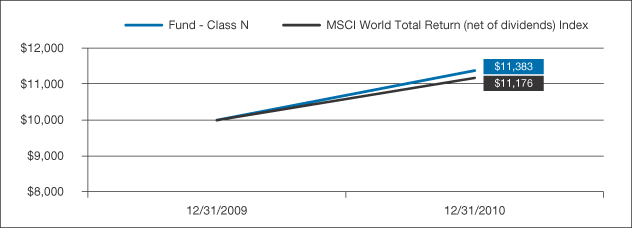

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR GLOBAL EQUITY FUND PERFORMANCE SINCE COMMENCEMENT OF OPERATIONS AS A MUTUAL FUND | |

| | | Since

Inception

(12/31/09) | |

| Fund - Class N: AQGNX | | | 13.83% | |

| Fund - Class I: AQGIX | | | 14.12% | |

| Fund - Class Y: AQGYX | | | 14.54% | |

| MSCI World Total Return (net of dividends) Index | | | 11.76% | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class N and Class I shares of the Fund are subject to a 2% redemption fee for redemptions within 60 days of purchase. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class N/I/Y shares are 1.34%, 1.04% and 0.89%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

AQR GLOBAL EQUITY FUND VS. MSCI WORLD TOTAL RETURN VALUE OF $10,000 INVESTED ON 12/31/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 4 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | | | | | | | | | | | | | |

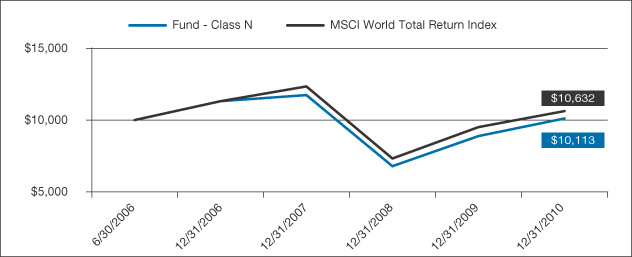

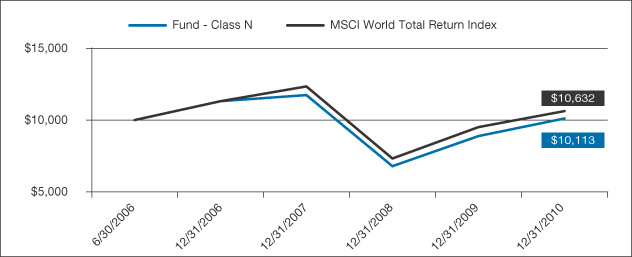

AVERAGE ANNUAL TOTAL RETURN AS OF 12/31/2010 AQR GLOBAL EQUITY FUND PERFORMANCE SINCE INCEPTION OF PREDECESSOR LIMITED PARTNERSHIP | |

| | | | | | Annualized Total Return | |

| | | YTD | | | 1 Year | | | 3 Year | | | Since

Inception

(06/30/2006) | |

| Fund - Class N: AQGNX | | | 13.83% | | | | 13.83% | | | | -4.86% | | | | 0.25% | |

| Fund - Class I: AQGIX | | | 14.12% | | | | 14.12% | | | | -4.55% | | | | 0.58% | |

| Fund - Class Y: AQGYX | | | 14.54% | | | | 14.54% | | | | -4.21% | | | | 0.94% | |

| MSCI WORLD (net of dividends) Index | | | 11.76% | | | | 11.76% | | | | -4.85% | | | | 1.37% | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class N and Class I shares of the Fund are subject to a 2% redemption fee for redemptions within 60 days of purchase. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class N/I/Y shares are 1.34%, 1.04% and 0.89%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

AQR GLOBAL EQUITY FUND VS. MSCI WORLD TOTAL RETURN INDEX VALUE OF $10,000 INVESTED ON 6/30/2006 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 5 |

| | | | | | | |

Shareholder Letter (Unaudited)

A privately offered fund managed by the Adviser was reorganized into Class Y shares of the Fund on December 31, 2009, the date the Fund commenced operations. This privately offered fund was organized in March 2006 and commenced operations in June 2006 and had an investment objective, investment policies and restrictions that were, in all material respects, the same as those of the Fund. However, the privately offered fund was not registered as an investment company under the 1940 Act. In addition, this privately offered fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code which, if applicable, might have adversely affected its performance. The Fund’s performance for periods prior to the commencement of operations on or about December 31, 2009 is that of the privately offered fund. The total annual fund operating expenses of the privately offered fund were lower than the Fund’s estimated total annual fund operating expense for Class N, Class I and Class Y shares during the periods presented. The Fund has restated the performance of the privately offered fund to reflect the Fund’s expenses of the Class N, I and Y shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 6 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

| AQR INTERNATIONAL EQUITY FUND | | | | |

Cliff Asness

Managing & Founding Principal

Ronen Israel

Principal

Oktay Kurbanov

Principal

John Liew

Founding Principal

Lars Nielsen

Principal

Dear Shareholder:

International equity markets had uneven performance in 2010. During the first half of the year, the MSCI EAFE Index (the “Index”) posted a negative return of -13.23%, followed by a rally of +24.18% in the second half of the year. For the year, the index finished up 7.75%. The year was highlighted by two major macro-economic themes: European sovereign debt concerns and quantitative easing in the US. These themes had opposite effects on the market, leading to its bumpy performance during the year. During this period, the AQR International Equity Fund Class N shares (the “Fund”) faired well, outperforming its benchmark index by 2.65%, with a positive return of 10.40% for the year.

The Fund is actively managed, and it seeks to outperform its benchmark in three ways: by selecting stocks within each country and by using futures and forwards contracts to over-and under-weight the portfolio’s exposures to countries and currencies. In the first half of the year, the stock and currency selection strategies contributed to the performance while the country selection strategy detracted, with the net result of modest underperformance. In the second half of the year all three strategies were positive contributors. Details on each of the strategies are provided below.

Our stock selection strategies performed well in 2010 on a benchmark relative basis. The main contributor to the positive performance was the continental European portfolio. Performance in the UK portfolio was also positive, while the Japan strategy was down slightly for the year. This was a good year in Europe as we observed positive performance across nearly all investment themes, especially momentum. In the UK, positive performance in momentum (both within and across industries) offset negative performance in value. The Japan strategy struggled early in the year hurt by poor performance of momentum factors, but contributed positively in Q4 with strong performance of valuation signals.

Approaching the end of 2010, the portfolio was positioned to overweight industrials from attractive momentum, while underweight financials from unfavorable momentum.

Our stock selection strategy remains broadly diversified across over four hundred names, with any individual position representing a small active weight against the benchmark. The portfolio as a whole is overweight cheaper stocks with better momentum and earnings quality.

The country selection strategy was a negative contributor to the performance, stemming from underperformance of value-driven positions. Fears of European defaults made this a difficult year for value, which was overweight the European region vs. underweight the Asia/Pacific region. The biggest detractors for the year were our overweights in Italy and Spain, as these countries sold off during the Greek sovereign debt crisis and amid growing concerns about contagion. An underweight in Sweden was also a detractor as the country significantly outperformed as its macro-economic conditions improved. Momentum themes worked well in 2010, helping offset losses

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 7 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

| AQR INTERNATIONAL EQUITY FUND | | | | |

from value signals. Positive contributors supported by momentum were our overweight in Germany in the second half of the year, an overweight in the Netherlands, and an underweight of Australia.

Our country selection portfolio entered 2010 with an increased weighting towards European markets versus markets in the Asia/Pacific region. This reflects the value-oriented bias in the country selection model as European markets generally were priced fair to cheaply valued relative to markets in the Asia/Pacific region. We maintained this view throughout the year but the positioning within Europe changed materially as the sovereign debt crisis impacted markets differently. Dispersion in performance is reflected in the momentum components of our process. Going into the year we were substantially overweight Spain and Italy based on valuation. Both these positions were reduced over the year on the back of the relative poor performance of these markets. On the other hand, the relative outperformance and better macro economic indicators of Germany and France led us to initiate overweight positions in those countries. The Netherlands remained one of our top positions over the year based on cheap valuation combined with positive momentum signals. Offsetting the overweight positions in Europe is an underweight of Switzerland, which looks unattractive on multiple indicators, as well as a value-driven underweight of Sweden.

The portfolio was underweight equity markets in the Asia-Pacific region throughout the year. Australia’s underweight is driven by all major investment themes in our process. This underweight benefited the model throughout the year as Australia’s equity market has showed weak relative performance. The model has maintained its value-driven underweight of Hong Kong, while Japan’s underweight has been reduced due to improvement in its price momentum signals.

The currency selection strategy was a positive contributor in 2010. Remarkably, in a year fraught with sovereign credit concerns, carry and interest rate related themes performed well and were the top contributors to outperformance. This is partially explained by the additional measures of the quantitative easing policy in the US, which was originally announced in Q3. The accommodating policy of the Fed encouraged risk taking, which provided support for higher yielding currencies. As the model favored the high yielding Australian Dollar, the currency strategy benefited from this increase in risk appetite. The currency strategy also benefited from its significant underweight in the Euro, the worst performing currency in 2010. On a thematic level, momentum added to the outperformance, as the Australian Dollar and the Euro continued their appreciation / depreciation trends respectively. Value detracted from the performance. The Swiss franc was a value-driven underweight that did not perform well, as the franc showed strong performance during the year helped by its safe haven status.

In the European region, our currency views continue to dislike the euro which has remained our top underweight position throughout the period. The strong negative view on the Euro is due to a combination of relatively poor carry, price momentum and fundamental momentum. An additional important consideration is that the continuing sovereign debt crisis makes it less likely that Eurozone interest rates would increase in the near term. The year witnessed meaningful changes in the positioning of the Swiss Franc and the Swedish Krona. The flight to quality caused by the volatile European debt situation led to strong appreciation of the Franc and in the second half of the year, the currency model assumed a significant underweight in the Swiss franc based on valuation. In the first quarter of the year, the model moved from flat to an overweight position in the Swedish Krona, driven by a combination of fundamental momentum and value. As the year progressed, the Krona improved on all factor themes, moving to the largest overweight position in the currency model. The Norwegian Krone overweight has remained relatively stable throughout the year, driven by a combination of fundamental momentum and interest rate related indicators. However, the weak price momentum of the Krone is moderating the positive view.

In the Asia/Pacific region, the model continues to maintain its overweight of the Australian Dollar versus an underweight of the Japanese Yen. The Aussie/Yen yield differential, as well as fundamental and valuation signals, motivates this positioning.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 8 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

| AQR INTERNATIONAL EQUITY FUND | | | | |

Our optimistic view is driven primarily by the opportunity for the country and currency selection strategies, while the opportunity in the stock selection strategy is about average. In country selection we see relatively extended spreads in valuation between cheap and expensive countries. For currency selection we see an unusually strong level of agreement between the valuation and carry indicators in the model – essentially indicating that we can get exposure to relatively high yielding currencies at unusually reasonable valuations. As always, we seek to maintain a highly diversified portfolio both in terms of individual positions but also in terms of the risk allocation to the three strategies.

| | | | | | | | | | | | |

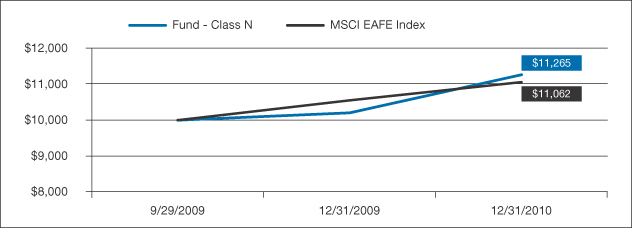

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR INTERNATIONAL EQUITY FUND PERFORMANCE SINCE COMMENCEMENT OF OPERATIONS AS A

MUTUAL FUND | | | | | | | | | |

| | | 1 Year | | | Since

9/29/2009 | | | Since Inception (8/28/2009) | |

| Fund - Class N: AQINX | | | 10.40% | | | | 9.96% | | | | na | |

| Fund - Class I: AQIIX | | | 10.40% | | | | 10.10% | | | | na | |

| Fund - Class Y: AQIYX | | | 10.84% | | | | 10.52% | | | | 12.82% | |

| MSCI EAFE Index | | | 7.75% | | | | 8.38% | | | | 10.03% | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class N and Class I shares of the Fund are subject to a 2% redemption fee for redemptions within 60 days of purchase. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class N/I/Y shares are 1.43%, 1.13% and 0.98%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| * | Class Y shares commenced operations on 8/28/2009 |

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 9 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR INTERNATIONAL EQUITY FUND |

|

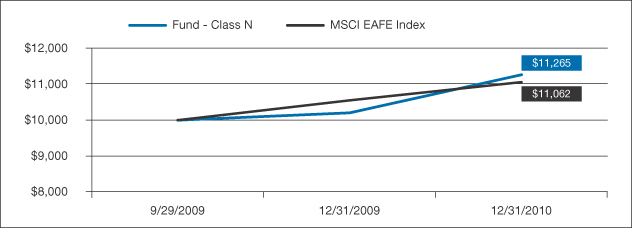

AQR INTERNATIONAL EQUITY FUND VS. MSCI EAFE INDEX VALUE OF $10,000 INVESTED ON 9/29/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

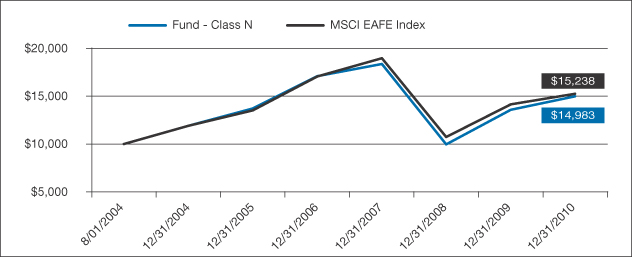

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR INTERNATIONAL EQUITY FUND PERFORMANCE SINCE INCEPTION OF PREDECESSOR LIMITED PARTNERSHIP | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception

(8/1/2004) | |

| Fund - Class N: AQINX | | | 10.40% | | | | -6.56% | | | | 1.79% | | | | 6.50% | |

| Fund - Class I: AQIIX | | | 10.40% | | | | -6.32% | | | | 2.09% | | | | 6.82% | |

| Fund - Class Y: AQIYX | | | 10.84% | | | | -6.00% | | | | 2.44% | | | | 7.19% | |

| MSCI EAFE Index | | | 7.75% | | | | -7.02% | | | | 2.46% | | | | 6.78% | |

Past performance does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class N and Class I shares of the Fund are subject to a 2% redemption fee for redemptions within 60 days of purchase. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class N/I/Y shares are 1.43%, 1.13% and 0.98%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 10 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR INTERNATIONAL EQUITY FUND |

|

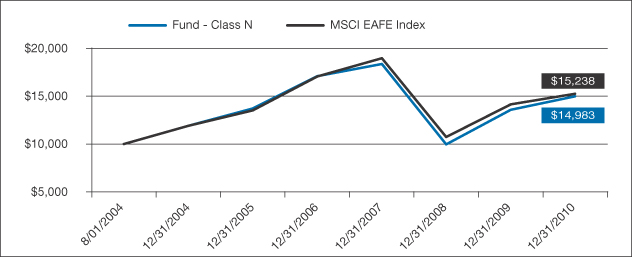

AQR INTERNATIONAL EQUITY FUND VS. MSCI EAFE INDEX VALUE OF $10,000 INVESTED ON 8/1/2004 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

A privately offered fund managed by the Adviser was reorganized into the Class Y shares of the Fund on August 28, 2009, the date the Fund commenced operations. The Class N and Class I shares of the Fund commenced operations on September 30, 2009. This privately offered fund was organized in June 2004 and commenced operations in August 2004 and had an investment objective, investment policies and restrictions that were, in all material respects, the same as those of the Fund. However, the privately offered fund was not registered as an investment company under the 1940 Act. In addition, this privately offered fund was not subject to certain investment limitations, diversification requirements, liquidity requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code which, if applicable, might have adversely affected its performance. The performance of Class N and Class I shares for the period from August 28, 2009 to September 30, 2009 is based on the performance of the Class Y shares of the Fund, and, for all share classes, for periods prior to August 28, 2009 is based on that of the privately offered fund. The total annual fund operating expenses of the privately offered fund were lower than the Fund’s estimated total annual fund operating expenses for Class N, I and Y shares during the periods presented. Also, the Fund’s total annual fund operating expenses for Class Y shares were lower than the Fund’s estimated total annual fund operating expenses for Class N and Class I shares during the periods presented. The Fund has restated the performance of the privately offered fund and of the Class Y shares to reflect the Fund’s expenses of Class N, I and Y shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 11 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

| AQR DIVERSIFIED ARBITRAGE FUND | | | | |

Ronen Israel

Principal

Mark Mitchell, Ph.D.

Founding Principal, CNH Partners

Lars Nielsen

Principal

Todd Pulvino, Ph.D.

Founding Principal, CNH Partners

Dear Shareholder:

The Diversified Arbitrage Fund returned 4.43% for the Fund’s Class N Shares during the 2010 calendar year. During the corresponding period, the Merrill Lynch 3-Month Treasury-Bill Index (the Fund’s benchmark) returned 0.13% and the S&P 500 returned 15.06%. Based on monthly return data, the Fund’s equity market beta (relative to the S&P 500) since inception (January 15, 2009) through December 31, 2010 is 0.06 and its annualized volatility is 3.3%.

Arbitrage markets were largely stable throughout the year, aside from disruptions in May when economic uncertainty increased commensurate with an increase in European sovereign risk and a worsening outlook for the global economy. Indeed, May was the only month during 2010 in which the Fund had a negative return (-1.37%) as arbitrage spreads temporarily widened.

The Fund invests in multiple arbitrage and alternative-investment strategies, and tactically allocates to various strategies based on relative attractiveness. As displayed in the Table below, strategy weights have varied throughout the past 12 months, though considerably less so than in 2009. The Fund reduced its exposure to convertible arbitrage during the year, bringing the weight in convertible arbitrage close to what we expect to be the long-term average. The Table indicates a substantial drop-off in the allocation to merger arbitrage at year-end, but this decline is largely an artifact of the consummation of mergers prior to year-end. This seasonal effect is not uncommon and is driven by firms’ desires to avoid the administrative burden (e.g. tax filings) of carrying two entities into a new fiscal year. The Fund’s allocation to merger arbitrage is expected to rebound in early 2011 as new mergers are announced. The weight in credit-related trades increased from 1% at the end of 2009 to 15% at the end of the 2010 due to numerous opportunities in short-term corporate credit. Both dual-class arbitrage and closed-end-fund arbitrage saw reductions in strategy weights, a result of declining spreads and discounts. The Table also indicates the addition of PIPEs (Private Investments in Public Entities) in the second half of 2010. PIPEs have many structures, but typically are comprised of an equity-linked security (convertible debenture, convertible preferred, or common stock) and long-lived warrants (up to five years). These deals are usually priced such that the unit (for example, common stock plus warrant) is priced at a discount to the market price of the common stock. A common trade is to purchase the unit, and over time sell the common stock. We generally continue to hold the warrant as it tends to have a substantially higher value than what can be obtained by selling in the open market.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 12 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR DIVERSIFIED ARBITRAGE FUND |

Table of Arbitrage Strategy Weights

| | | | | | | | | | | | |

Long Positions By Strategy as % of Investment in Securities | | | | | | | | | |

| | | 12/31/09 | | | 6/30/10 | | | 12/31/10 | |

| Convertible Arbitrage | | | 44% | | | | 35% | | | | 38% | |

| Merger Arbitrage | | | 34% | | | | 34% | | | | 23% | |

| Credit | | | 1% | | | | 13% | | | | 15% | |

| Dual-Class Arbitrage | | | 12% | | | | 8% | | | | 8% | |

| Price Pressure | | | 4% | | | | 5% | | | | 6% | |

| SPACs (Special Purpose Acquisition Company) | | | 1% | | | | 1% | | | | 3% | |

| PIPEs | | | 0% | | | | 0% | | | | 3% | |

| Closed-End Fund Arbitrage | | | 5% | | | | 2% | | | | 0% | |

| Other Arbitrage and Alternative Investment Strategies | | | 2% | | | | 2% | | | | 4% | |

Notwithstanding the reduction in the allocation to the convertible arbitrage strategy, it continues to have the largest strategy weight. As discussed in detail in the 2009 year-end letter, the convertible bond market unraveled during the 2008 financial crisis causing convertible bonds to trade at significant discounts to fundamental values. As financial markets stabilized in 2009, convertible cheapness began to revert to historical levels. By the end of 2010, convertible cheapness was close to its long-term historical average. Because of the convergence of convertible bonds toward fundamental value in 2010, the convertible arbitrage strategy contributed significantly to the Fund’s positive return for the year, accounting for 34% of the total return. In the meantime, we have positioned the convertible portfolio defensively with 95% of the convertible portfolio invested in equity-sensitive convertibles, where the equity short provides a direct hedge to the long convertible bond position. Although we are still exposed to convertible bonds cheapening relative to fundamental values, these losses are generally temporary, and would be at least partially offset by an increase in realized volatility (realized volatility that is higher than expected results in increased profits) that tends to accompany cheapening episodes.1

Merger arbitrage, a well-known arbitrage strategy like convertible arbitrage, involves the purchase of shares of firms that are targets in announced mergers or reorganizations. For a merger where the consideration is the acquirer’s stock, the Fund seeks to hedge market exposure by shorting the stock of the acquiring company in an amount based on the exchange ratio specified in the merger agreement. Conditions for investing in merger arbitrage are especially attractive when deal spreads (the percentage difference between the consideration offered by the acquiring firm and the stock price of the target firm) are wide and when merger activity is robust. As deal flow began to increase during the latter part of 2009, the Fund increased its allocation to merger arbitrage to 34%. The Fund maintained a higher allocation to merger arbitrage in 2010 than in 2009, although as previously discussed, the allocation fell at year-end as a result of numerous deal closings. Merger arbitrage generated 28% of the Fund’s return during 2010 as the strategy benefited from a combination of deal spread tightening, reasonably strong deal flow, a low frequency of deal failures, and frequent increased offers. We anticipate robust deal flow in 2011 in light of increased business confidence and thus expect to maintain substantial exposure to the merger arbitrage strategy.

| 1 | It is important to note that the Fund’s investment in a convertible bond is based on the cheapness of the bond relative to its fundamental value rather than on a view about the underlying stock price. Specifically, we hedge our long position and attempt to capture the cheapness of the convertible by shorting the stock of the underlying issuer, and by hedging systematic credit and interest rate risk. |

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 13 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR DIVERSIFIED ARBITRAGE FUND |

As mentioned above, the Fund increased its exposure to specific short-term (average duration of 12-15 months) corporate debentures during the first half of the year, particularly in May amid heightened economic uncertainty and European sovereign risk. Historically, as we have documented using our proprietary credit database, short-dated corporate debentures, particularly in the high-yield arena, produce excess returns after accounting for systematic credit and interest rate risk. We postulate that the reason for the excess returns is that fixed-income investors often choose to exchange short-term debentures for longer-term debentures in order to generate higher-expected returns associated with bearing greater systematic credit risk. We focus on short-dated debentures issued by companies that have stable near-term cash flow and sufficient assets to retire the debenture at maturity. We view this trade as similar to a long-dated cash merger trade, but one in which the downside is contractually protected by the underlying indenture. This is not to say that the trade is absent risk. However, the systematic component of risk can be minimized due to the short-dated nature of the security. Our analysis using our proprietary database shows that the modest systematic credit and interest rate risk may be hedged at the portfolio level using credit default swaps and Treasury futures. The Fund took advantage of attractive risk-adjusted yields by selectively purchasing several short-dated corporate debentures and contemporaneously hedging credit risk and interest rate risk at the portfolio level. This strategy contributed 14% to the Fund’s return for the year.

The three strategies described above accounted for roughly 76% of the capital allocated to the Fund (based on 2010 year-end allocations), and likewise 76% of the Fund’s return in 2010. Allocations to the other strategies (dual-class arbitrage, price pressure, PIPEs, SPACs, closed-end-fund arbitrage, etc.) were relatively small on an individual basis as they offered fewer investment opportunities. These strategies contributed positively to the Fund’s return, with only one exception as dual-class arbitrage realized a reasonably small loss to the Fund.

Overall, the Fund had a successful second year. It realized a return in line with our long-term expectations, investing opportunities were good, though not great, and given our multi-strategy approach, we were able to reposition the portfolio as opportunities arose. Looking forward to 2011, we anticipate there will be several opportunities to successfully deploy capital. In particular, merger deal flow is strengthening, in light of the increased business confidence, and we are seeing good opportunities to invest in target firms with attractive deal spreads. Likewise, with the economy growing, we anticipate a pick-up in new capital issues which will lead to an increase in opportunities involving price pressure, PIPEs and SPACs. Importantly, irrespective of where the Fund deploys capital in 2011, we will continue to attempt to hedge out systematic equity, credit and interest rate risk, with the intention of out-performing the Treasury Bill benchmark return.

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR DIVERSIFIED ARBITRAGE FUND | |

| | | 1 Year | | | Since

Inception

(1/15/2009) | |

| Fund - Class N: ADANX | | | 4.43% | | | | 6.78% | |

| Fund - Class I: ADAIX | | | 4.71% | | | | 7.11% | |

| Merrill Lynch 3-Month T-Bill Index | | | 0.13% | | | | 0.17% | |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. If reflected, the redemption fee would reduce the performance quoted.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 14 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR DIVERSIFIED ARBITRAGE FUND |

Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the Class N/I shares are expected to be 2.69% and 2.46%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

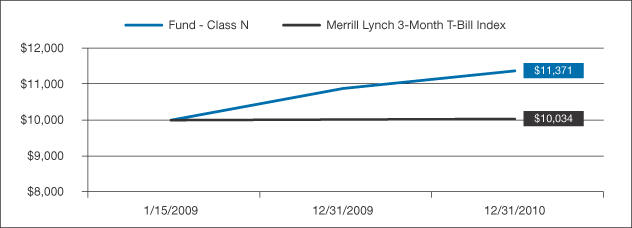

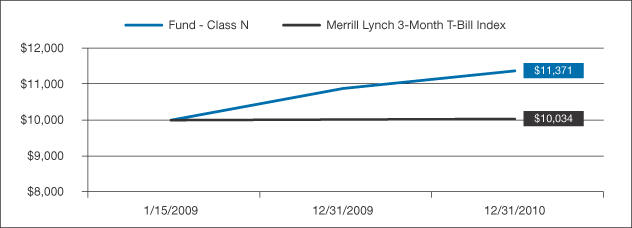

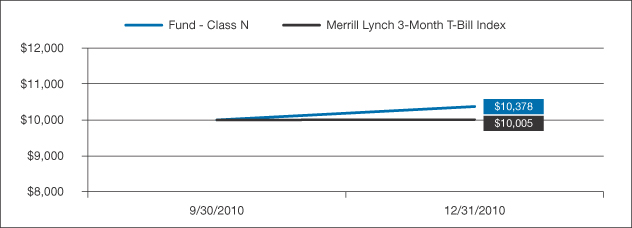

AQR DIVERSIFIED ARBITRAGE FUND VS. MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 1/15/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 15 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

| AQR MANAGED FUTURES STRATEGY FUND | | | | |

Cliff Asness

Managing & Founding Principal

John Liew

Founding Principal

Brian Hurst

Principal

Lasse Pedersen

Principal

Yao Hua Ooi

Vice President

Dear Shareholder:

On January 6, 2011, the Managed Futures Strategy Fund celebrated its one year anniversary. From its inception date of January 6, 2010 through December 31, 2010, the Fund’s Class N shares returned +5.12% and realized an annualized volatility of 8.6%. During this same period, the Merrill Lynch 3-Month Treasury-Bill Index (the Fund’s benchmark) returned 0.13%. The S&P 500 returned 12.89% over this same period. The Fund’s assets grew to $928 MM by the end of December, reflecting strong investor demand for an actively run managed futures fund in the mutual fund space.

The Fund invests both long and short across a portfolio of futures contracts and futures-related instruments, utilizing more than 100 contracts across four major asset classes: commodities, currencies, fixed income, and equity markets. The Fund pursues a trend-following strategy, and as such, it tends to perform well when there are persistent trends in markets and suffers when there is a lack of trends or when trends reverse sharply. In 2010, the Fund realized gains in currency and fixed income markets, benefiting from a number of persistent trends, such as the weakening of the Euro and declines in government bond yields globally. Those gains were partially offset by losses in equity and commodity markets, where a number of positive trends that formed throughout the latter half of 2009 reversed during the first half of 2010.

By design, the Fund tactically changes the amount of risk it takes in pursing trends across the four major asset classes depending on the relative attractiveness of the trend-following opportunities within each asset class. The Fund will invest more in an asset class when there are perceived strong trends across many assets within that particular asset class. The Fund began the year having its largest risk allocation in equities and currencies, and ended the year with its largest risk allocation in equities and commodities.

In addition, the Fund also tactically changes the level of risk it targets depending on the strength and correlation of trends across the four asset classes. The Adviser started 2010 targeting close to 13% annualized volatility (the maximum ex-ante risk the Fund will target), as there were strong and correlated trends in equity and commodity markets following the strong performance of those markets in 2009, but reduced its overall risk target gradually over the first half of 2010 as those trends weakened. As trends picked up again in the second half of 2010 the risk target was increased, ending the year back at its maximum target. Below is a summary of the asset class risk exposures throughout 2010:

| | | | | | | | | | | | | | | | | | | | |

| Asset Class Exposure (% of Risk Allocation) | | | | | | | |

| | | 1/31/2010 | | | 3/31/2010 | | | 6/30/2010 | | | 9/30/2010 | | | 12/31/2010 | |

| Fixed Income | | | 19.8% | | | | 12.5% | | | | 33.9% | | | | 21.2% | | | | 7.3% | |

| Commodities | | | 15.1% | | | | 17.1% | | | | 27.5% | | | | 19.0% | | | | 32.0% | |

| Currencies | | | 22.6% | | | | 22.6% | | | | 22.0% | | | | 26.8% | | | | 28.7% | |

| Equities | | | 42.5% | | | | 47.8% | | | | 16.6% | | | | 33.0% | | | | 32.0% | |

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 16 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

| AQR MANAGED FUTURES STRATEGY FUND | | | | |

Within each of the asset classes, the fund pursues short-term trend strategies, long-term trend strategies and over-extended trend strategies. Overall, short-term trend strategies performed well in 2010, particularly in fixed income and currency markets, where short-term trends continued in the first part of the year. Long-term trend strategies performed even better than short-term trend strategies, contributing positively in every asset class. The over-extended trend strategies detracted from performance over this period, especially in commodities, where the Fund’s long exposures were reduced on long-term overextended trend indicators. This detracted from performance in the second half of the year, as commodities experienced an extended rally.

The Fund gained 4.9% in the fixed income markets in 2010. The majority of the gains were driven by the Fund’s long positions in European and US government bonds and short-term interest rate futures for most of the year, based on both positive short-term trends and long-term trends. Yields on government bonds of most maturities declined over this period as investors turned to safe-haven assets following fears of a European sovereign debt crisis, benefiting the Fund. While this trend reversed toward the end of the year as growth expectations rose, losses were mitigated by overextended trend signals and short term trend signals which quickly reduced positions, leaving the Fund with reduced fixed income exposure at the end of the year.

The Fund lost 0.7% in equities in 2010. The majority of the losses occurred in the second quarter, as strong short and long term trends in both developed and emerging equity markets reversed sharply following fears of a European sovereign debt crisis, as well as a slowdown in global economic growth. However, the longer term trend reasserted itself in the second half of the year as increased growth expectations and the second round of quantitative easing (“QE2”) drove equities higher, offsetting most of the losses from the first half of the year.

The Fund lost 0.6% in commodities over the course of the year. While the Fund benefited from being long copper and agricultural commodities in the 4th quarter when many commodities rose on increased growth prospects, the gains were not sufficient to overcome losses suffered in energies, base metals and agricultural commodities during the 2nd quarter. During the 2nd quarter, positive short and long term trends reversed in the majority of commodity markets following fears of slower global economic growth in both developed and emerging markets.

In currencies, the Fund gained 1.5% in 2010. Much of the gains came as a result of the Fund’s short position in the Euro in the first part of the year, which profited as the Euro fell on Euro-zone worries. The fund also gained from being long the Australian Dollar, which profited as commodity linked currencies strengthened in the 4th quarter.

The Fund’s performance in 2010 highlighted the potential benefits of the Fund’s approach in diversifying across various trend indicators and asset classes. While fixed income and currencies contributed in the first half of the year, commodities and equities contributed in the second half. While overextended trend signals suffered moderate losses, trend signals performed well. We continue to pursue a risk-balanced approach in investing across the major asset classes, and trust that doing so will benefit the Fund in the long-run.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 17 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR MANAGED FUTURES STRATEGY FUND |

| | | | |

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2010 AQR MANAGED FUTURES STRATEGY FUND | |

| | | Since

Inception

(1/6/2010) | |

Fund - Class N: AQMNX | | | 5.12% | |

Fund - Class I: AQMIX | | | 5.41% | |

Merrill Lynch 3-Month T-Bill Index | | | 0.13% | |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the Class N/I shares are expected to be 1.50% and 1.25%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

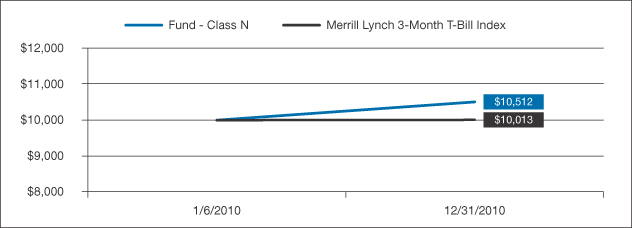

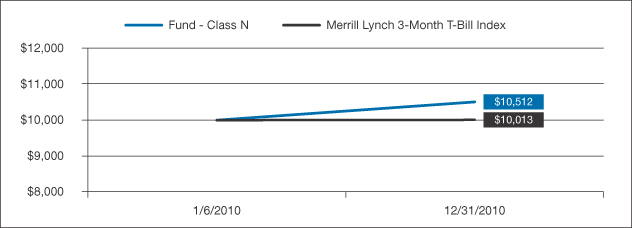

AQR MANAGED FUTURES STRATEGY FUND VS. MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 1/6/10 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 18 |

| | | | | | | |

Shareholder Letter (Unaudited)

John Liew

Founding Principal

Brian Hurst

Principal

Michael Mendelson

Principal

Yao Hua Ooi

Vice President

Dear Shareholder:

On December 31, 2010, the AQR Risk Parity Fund completed its first quarter. From its inception date of September 30, 2010 through December 31, 2010, the Fund’s Class N shares returned +3.78% and realized an annualized volatility of 11.75%. During this same period, a 60/40 reference portfolio consisting of 60% S&P 500 Index/40% Barclays US Aggregate Index returned 5.67%. The Fund’s assets grew to $24 MM by the end of December.

The Fund invests across a wide variety of global markets, including: developed and emerging market equities, fixed income and currencies, global credit (corporate, government, and mortgage), and commodities. The Fund’s strategic allocation across these markets is determined by a risk parity approach to allocating investments – which spreads capital across the various asset classes to roughly equally balance the risk allocated to them. The balancing of risk allocation across different asset classes can create a portfolio that can potentially perform more consistently across a wider array of economic environments than portfolios which may have risk more concentrated into a specific asset class.

Starting from this strategic risk parity allocation, we then use AQR’s proprietary macroeconomic views to determine actual capital allocations across a broad array of global markets. The actual allocations represent over- and under-weights of the strategy vs. the strategic risk parity allocation. This strategy centers around building a truly diversified and risk targeted portfolio whose allocations reflect AQR’s forecasts of changes in market environments, all in an attempt to deliver higher returns at a risk level similar to that of traditional portfolios.

The Fund will remain long all of the markets in which we invest while maintaining a moderate (under 0.5 on average) beta to the stock market. Our risk parity framework centers around a core risk allocation balanced across the various types of asset classes (equity, fixed income, credit, commodities). From this core starting point, we rely on the proprietary models we use in our hedge funds, which include signals based on carry, momentum, valuation, and other important economic variables, to determine views across the various markets and apply controlled allocations away from risk parity in an attempt to take advantage of opportunities in the various markets.

The targeted annualized volatility for the fund is 10%, on average, which varies modestly over time based on our perceptions of tactical opportunities within the different asset classes we trade. Over the fourth quarter, our signals indicated an attractive environment for equities, credit and commodities, and as a result the strategy was targeting a higher level of volatility (took a more aggressive stance) than normal.

The Fund experienced gains in three out of its four major asset class buckets. Equities contributed +2.1%, the inflation-sensitive assets contributed 2.7%, the credit assets contributed 2.8%, while the nominal interest exposures lost 3.8% over the quarter.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 19 |

| | | | | | | |

Shareholder Letter (Unaudited)

In the equity bucket, the fund was tactically overweight equities in the fourth quarter on both short-term and long-term market trend signals and profited from a strong rally across both developed and emerging equity markets.

In the inflation bucket, the Fund was tactically overweight commodities in the fourth quarter based on strong macroeconomic growth indicators as well as positive market momentum, and profited from a strong rally across all commodity sectors on hopes of stronger economic growth. The Fund’s inflation-linked bond positions ended the quarter relatively flat, as losses in European linkers and Treasury Inflation-Protected Securities (“TIPS”) were offset by gains in UK linkers.

In the credit bucket, the Fund was tactically overweight high yield credit because of a strong fundamental environment for credit spreads and positive credit market momentum. In addition, the fund was overweight emerging currencies, which appreciated versus developed currencies over the quarter.

In the nominal interest rate bucket, the Fund entered the quarter being overweight bonds on strong momentum coming into the quarter, but reduced its overweight position over the quarter as yields rose and the positive momentum in the market deteriorated following the Fed’s QE2 announcement. In addition, our risk forecasts for bonds increased substantially over the quarter. Part of our risk parity approach to investing involves targeting risk levels. So, when our forecast for risk of a market increases, we generally will lower capital allocation to that market. The combination of a weaker view on fixed income and an increase in forecasted fixed income market risk led us to cut our holdings in bonds by 25% over the quarter.

This has been a good first quarter for the Fund, and we hope to continue to add value to your portfolios going forward.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 20 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | |

SINCE INCEPTION TOTAL RETURNS AS OF 12/31/2010 AQR RISK PARITY FUND | |

| | | Since

Inception

(9/30/2010) | |

Fund - Class N: AQRNX | | | 3.78% | |

Fund - Class I: AQRIX | | | 3.88% | |

Merrill Lynch 3-Month T-Bill Index | | | 0.05% | |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the Class N/I shares are expected to be 1.20% and 0.95%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

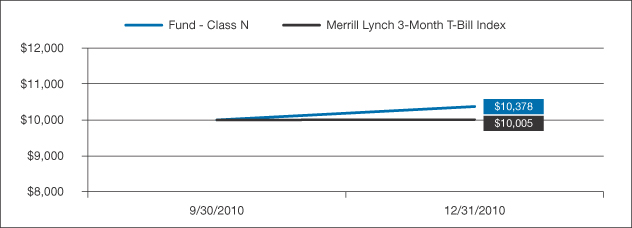

AQR RISK PARITY FUND VS. MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 9/30/2010 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 21 |

| | | | | | | |

Shareholder Letter (Unaudited)

Cliff Asness

Managing & Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Dear Shareholder:

Despite a rocky first half of 2010, the equity markets rallied in the second half, as investors put aside European debt troubles and governments around the world continued to bolster the economy. The AQR Momentum Fund finished its first full year beating the equity markets, gaining 18.60%, while the Russell 1000 Index returned 16.10%. The Fund outperformed the Russell 1000 Growth Index, which returned 16.72%.

Most of the outperformance to the Russell 1000 Index was driven by the implied sector over/underweights that result from individual stock positions in the Fund; in other words, the Fund profited by being overweight the sectors that had previously done well and underweight those that had suffered. The Fund was overweight Consumer Discretionary throughout the year, and in the third quarter the overweight swelled to 13%, with 24% of the Fund in Consumer Discretionary names versus 11% in the Russell 1000 Index. Particularly adding to performance were internet retailers that the Fund held such as Amazon.com and Priceline.com, which both saw tremendous gains in the third quarter. In the fourth quarter, the Fund benefitted from underweights in the Healthcare sector and especially in pharmaceutical companies such as Johnson & Johnson and Abbott Labs.

Relative over/underweights within sectors played a smaller role in outperformance. Good stock selection within certain sectors such as Consumer Discretionary and Information Technology were offset by less successful exposures within Financials, particularly in the first quarter, when the Fund failed to capture the upswing of certain beaten-down financials. The Fund’s biggest single contributor to outperformance was Apple, which we were overweight throughout the year. The stock rose 53% in 2010.

The AQR Momentum Fund invests in stocks of large and mid-cap U.S. companies with positive momentum. A stock is considered to have positive momentum if it has performed well in the prior twelve months (excluding the most recent month) relative to other stocks in the Fund’s investment universe, which is comprised of the 1000 largest U.S. companies by market capitalization. The Fund is not actively managed to outperform a growth, value or core benchmark. Rather, it seeks to provide systematic exposure to stocks that share the common characteristic of positive momentum.

Note that the Fund sometimes uses derivatives, such as S&P500 E-Mini futures, to gain market exposure and equitize daily flows. The Fund’s derivatives positions in 2010 detracted about -0.90% over the year, because a larger portion of the Fund was in these positions in mid-May and late June, when markets were falling.

In summary, the AQR Momentum Fund finished its first full year delivering a strong +18.60% return.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 22 |

| | | | | | | |

Shareholder Letter (Unaudited)

| | | | | | | | |

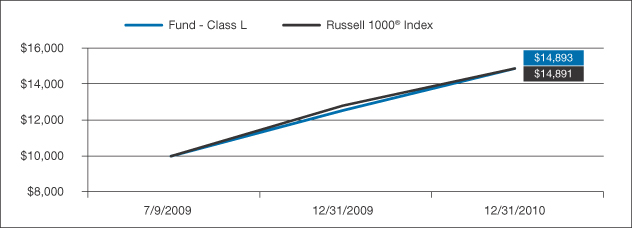

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR MOMENTUM FUND | |

| | | 1 Year | | | Since

Inception

(7/9/2009) | |

| Fund—Class L: AMOMX | | | 18.60% | | | | 30.90% | |

| Russell 1000® Index | | | 16.10% | | | | 30.88% | |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the Class L shares is expected to be 0.49%. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

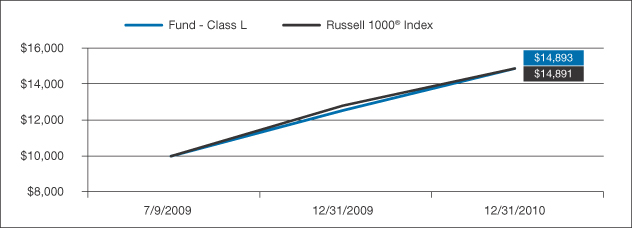

AQR MOMENTUM FUND VS. RUSSELL 1000® INDEX VALUE OF $10,000 INVESTED ON 7/9/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 23 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR SMALL CAP MOMENTUM FUND |

Cliff Asness

Managing & Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Dear Shareholder:

For US small cap stocks, while the first half of 2010 was as rocky as their large and mid-cap peers, the market rally in the second half of the year was even more pronounced. The Russell 2000 Index gained 26.85% for the year, and the AQR Small Cap Momentum Fund (the “Fund”) finished its first full year beating the market, gaining 27.69%. The Fund underperformed the Russell 2000 Growth Index, which returned 29.09%.

Outperformance relative to the Russell 2000 Index was driven both by implied sector over/underweights as well as relative over/underweights within sectors. The Fund’s overweight of Consumer Discretionary stocks during the first quarter and overweight of Energy stocks during the fourth quarter were especially profitable. In the fourth quarter, oil and gas exploration companies like Rosetta Resource and Clayton Williams were both up more than 60%, and the Fund benefitted from being overweight these names.

Relative over/underweights within sectors were also a positive contributor to outperformance. Stock selection within the Industrials sector was noteworthy, as the Fund was overweight big winners like Polypore International and underweight losing stocks like American Semiconductor.

The AQR Small Cap Momentum Fund invests in stocks of small-cap U.S. companies with positive momentum. A stock is considered to have positive momentum if it has performed well in the prior twelve months (excluding the most recent month) relative to other stocks in the investment universe, which is comprised of U.S. companies smaller than the 1000th largest and larger than the 3000th smallest company by market capitalization. The Fund is not actively managed to outperform a growth, value or core benchmark. Rather, it seeks to provide systematic exposure to stocks that share the common characteristic of positive momentum.

Note that the Fund sometimes uses derivatives, such as Russell 2000 E-Mini futures, to gain market exposure and equitize daily flows. The Fund’s derivatives positions in 2010 contributed about +0.88% to performance over the year, because it had larger positions on when the markets were rising in early December.

In summary, the AQR Small Cap Momentum Fund finished its first full year delivering a strong +27.69% return.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 24 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR SMALL CAP MOMENTUM FUND |

| | | | | | | | |

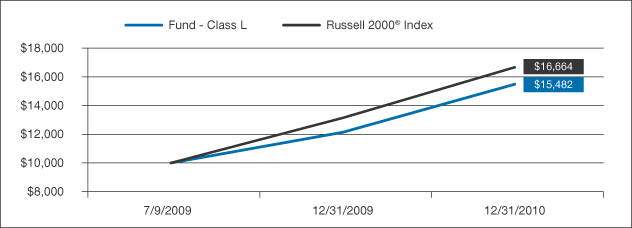

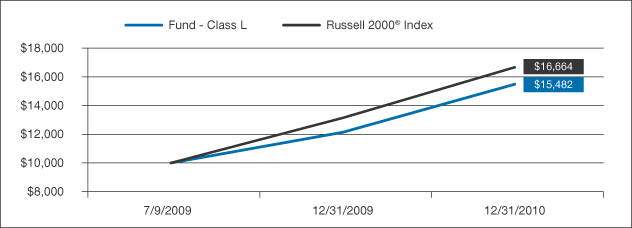

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR SMALL CAP MOMENTUM FUND | |

| | | 1 Year | | | Since

Inception

(7/9/2009) | |

| Fund—Class L: ASMOX | | | 27.69% | | | | 34.37% | |

| Russell 2000® Index | | | 26.85% | | | | 41.22% | |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 1% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest Prospectus, the gross expense ratios for the Class L shares is expected to be 0.65%. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

AQR SMALL CAP MOMENTUM FUND VS. RUSSELL 2000® INDEX VALUE OF $10,000 INVESTED ON 7/9/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 25 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR INTERNATIONAL MOMENTUM FUND |

Cliff Asness

Managing & Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Dear Shareholder:

While global markets were up overall in 2010, performance was less stellar than the US market, having fared worse in the first half of the year. European countries most affected by the debt crisis suffered more than others. The AQR International Momentum Fund (the “Fund”) finished its first full year beating the global equity markets, returning 14.11% while the MSCI World ex-USA Index gained a modest 8.95%. The Fund outperformed the MSCI World ex-USA Growth Index, which returned 13.06%.

The Fund outperformed the broader MSCI World ex-USA Index, driven in large part by stock selection in the Energy Sector, meaning that within this sector, stocks with good momentum tended to outperform their peers. The largest contributors to outperformance were Royal Dutch Shell, in which the Fund had roughly a 2% overweight during the second half of the year, and BP, in which the Fund had about a -1.3% underweight throughout the year. BP finished down almost -23% on the year in the wake of its oil spill, while Royal Dutch was up 24%, mostly after surprisingly good earnings announcements in the fourth quarter.

To a lesser extent, the Fund also benefitted from good sector and country selection. A sector overweight in Materials contributed positively as the fund was heavily invested in global mining companies such as Rio Tinto and Xstrata, both having outperformed the rest of the market in 2010. The Fund was actually quite well-positioned for the European debt problems during the year, maintaining an overweight in safer countries such as Sweden while underweighting Spain and Greece. Its country over/underweights within Europe contributed positively to outperformance versus the MSCI World ex-USA Index in 2010.

The AQR International Momentum Fund invests in stocks of large and mid-cap non-U.S. companies with positive momentum. A stock is considered to have positive momentum if it has performed well in the prior twelve months (excluding the most recent month) relative to other stocks in the investment universe, which is comprised of approximately the top 85% of stocks by market capitalization of each of the 20 major developed markets outside the U.S. The Fund is not actively managed to outperform a growth, value or core benchmark. Rather, it seeks to provide systematic exposure to stocks that share the common characteristic of positive momentum.

Note that the Fund sometimes uses derivatives to implement its strategy. In particular, the Fund will sometimes trade swaps in UK securities to minimize certain trading costs. Its derivatives positions in 2010 contributed about +2.00% to performance over the year, consistent with UK equity markets in general being up for the year.

In summary, the AQR International Momentum Fund finished its first full year delivering a strong +14.11% return.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 26 |

| | | | | | | |

Shareholder Letter (Unaudited)

|

| AQR INTERNATIONAL MOMENTUM FUND |

| | | | | | | | |

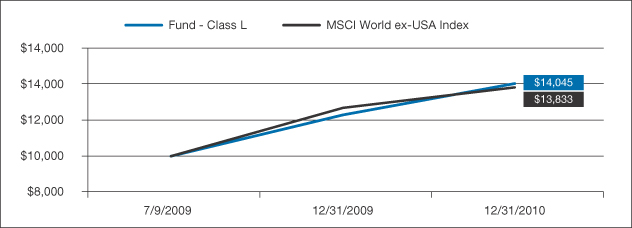

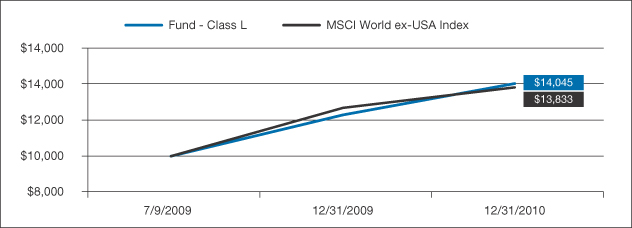

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2010 AQR INTERNATIONAL MOMENTUM FUND | | | | |

| | | 1 Year | | | Since

Inception

(7/9/2009) | |

| Fund—Class L: AIMOX | | | 14.11% | | | | 25.81% | |

| MSCI World ex-USA Index | | | 8.95% | | | | 24.52% | |

Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund generally charges 2% of redemption proceeds on shares held for 60 days or less. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratios for the Class L shares is expected to be 0.65%. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

AQR INTERNATIONAL MOMENTUM FUND VS. MSCI WORLD EX-USA INDEX VALUE OF $10,000 INVESTED ON 7/9/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance calculations are as of the end of December each year. Past performance does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

The recent growth rate in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 27 |

| | | | | | | |

Shareholder Letter (Unaudited)

PRINCIPAL RISKS:

AQR Global Equity Fund and AQR International Equity Fund: The AQR Global Equity Fund and the AQR International Equity Fund use derivatives to manage their country and currency exposures. The use of derivatives exposes the Fund to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. Foreign investing involves special risks such as currency fluctuations and political uncertainty. The Funds are not suitable for all investors.

AQR Diversified Arbitrage Fund: As the AQR Diversified Arbitrage Fund (the “Fund”) employs arbitrage and alternative strategies, the Fund has the risk that the anticipated opportunities do not play out as planned, resulting in potentially reduced returns or losses to the Fund as it unwinds its trades. This Fund enters into a short sale by selling a security it has borrowed. If the market price of a security increases after the Fund borrows the security, the Fund will suffer a potentially unlimited loss when it replaces the borrowed security at the higher price. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses. The Fund uses derivatives to hedge certain economic exposures. The use of derivatives exposes the Fund to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. This Fund is not suitable for all investors.

AQR Managed Futures Strategy Fund: The use of derivatives, forward and futures contracts, and commodities exposes the Fund to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. Concentration generally will lead to greater price volatility. The Fund enters into a short sale by selling a security it has borrowed. If the market price of a security increases after the Fund borrows the security, the Fund will suffer a potentially unlimited loss when it replaces the borrowed security at the higher price. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses. This Fund is not suitable for all investors.

AQR Risk Parity Fund: Foreign investing involves special risks such as currency fluctuations and political uncertainty. The use of derivatives, forward and futures contracts, and commodities exposes the Fund to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. This Fund enters into a short sale by selling a security it has borrowed. If the market price of a security increases after the Fund borrows the security, the Fund will suffer a potentially unlimited loss when it replaces the borrowed security at the higher price. Short sales also involve transaction and other costs that will reduce potential Fund gains and increase potential Fund losses. When investing in bonds, yield and share price will vary with changes in interest rates and market conditions. Investors should note that if interest rates rise significantly from current levels, bond total returns will decline and may even turn negative in the short term. There is also a chance that some of the Fund’s holdings may have their credit rating downgraded or may default. Actual or realized volatility can and will differ from the forecasted or target volatility. This Fund is not suitable for all investors.

AQR Momentum Fund: Securities with positive momentum generally will be more volatile than a broad crosssection of securities. In addition, there may be periods when the momentum style is out of favor, and during which the investment performance of a Fund, which uses a momentum strategy, generally will suffer. This Fund is not suitable for all investors.

AQR Small Cap Momentum Fund: Securities with positive momentum generally will be more volatile than a broad crosssection of securities. In addition, there may be periods when the momentum style is out of favor, and during which the investment performance of a Fund, which uses a momentum strategy, generally will suffer. Derivatives are generally more sensitive to changes in economic or market conditions than other types of investments, which could result in losses that significantly exceed the Fund’s original investment. The use of derivatives exposes the Fund to additional risks including increased volatility, lack of liquidity, and possible losses greater than the Fund’s initial investment as well as increased transaction costs. Funds that emphasize investments in smaller companies generally will experience greater price volatility. This Fund is not suitable for all investors.

| | | | | | | | | | |

| AQR Funds | | | | Annual Report | | | | December 2010 | | 28 |

| | | | | | | |

Shareholder Letter (Unaudited)