UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22235

AQR Funds

(Exact name of registrant as specified in charter)

Two Greenwich Plaza, 3rd Floor

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Bradley D. Asness, Esq.

Principal and Chief Legal Officer

Two Greenwich Plaza

3rd Floor

Greenwich, CT 06830

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: 203-742-3600

Date of fiscal year end: December 31

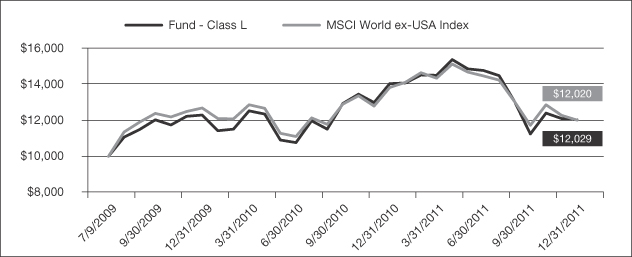

Date of reporting period: January 1, 2011 to December 31, 2011

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1.)

AQR FUNDS Annual Report December 31, 2011

Table of Contents

Shareholder Letter (Unaudited)

Cliff Asness

Managing & Founding Principal

Ronen Israel

Principal

Oktay Kurbanov

Principal

John Liew

Founding Principal

Lars Nielsen

Principal

Dear Shareholder:

Global equity markets experienced significant headwinds in 2011, particularly during the second half of the year. During the first half of the year, the MSCI World Index (the “Index”) posted a positive return of +5.29%, but this was followed by a sharp decline of -10.29% in the second half of the year. For the full year, the index finished down -5.54%. In particular the third quarter was challenging for markets as we faced not only the resurgence of the European sovereign debt crisis, a crisis surrounding the United States debt ceiling, and the downgrade of the country’s long term credit by Standard and Poor’s, but also a rapidly deteriorating world economic outlook. Not surprisingly, these events were followed by a spike in risk-aversion and a significant deterioration in market sentiment. Towards the end of the year, however, equity markets rebounded after a series of surprisingly strong economic data releases in the US, changing governments in a number of European countries, and a coordinated effort by central banks, particularly the European Central Bank (“ECB”), to support the viability of the financial system. During this period, the AQR Global Equity Fund Class I shares (the “Fund”) returned -6.68% for the year, underperforming its benchmark index by -1.14%.

The Fund is actively managed, and it seeks to outperform its benchmark in three ways: by selecting stocks within each country and by using futures and forwards contracts to over-and under-weight countries and currencies relative to the benchmark. Details on each of the strategies are provided below.

The stock selection strategies had a good year driven by positive performance in the US, continental Europe and Japan. The UK strategy detracted while the Canada strategy was flat for the period. The US strategy performed well in 2011 driven by the momentum, valuation and industry valuation signals, outweighing detraction from industry momentum factors. In continental Europe outperformance came from the positive performance in momentum oriented investment themes, both within and across industries, outweighing negative performance in valuation signals. The positive performance in Japan was mainly driven by valuation and industry valuation signals. The negative performance in the UK was due to valuation and earnings quality signals, outweighing positive performance of momentum factors.

Tactically, we now are underweight value in continental Europe and Japan, while being overweight value in the UK and the US.

The country selection strategy contributed positively to fund performance in 2011. Both value and fundamental momentum added, while price momentum detracted. The high volatility in equity markets was challenging for price momentum, but moves in exchange rates and trade based indicators performed well during 2011. Overall, value performed well in the first half of the year, while momentum based signals contributed in the second half. The third quarter was the only down quarter in the year.

The portfolio’s gains were concentrated in our overweights of the UK and US equity markets. The UK overweight, which was motivated by strong price momentum and

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 1 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

attractive valuation, outperformed as the UK equity market proved relatively immune to the eurozone financial and sovereign debt problems. Gains to the US overweight occurred mainly during the third quarter, when US markets held up relatively well in a de-risking environment marked by a global economic slowdown and an escalating crisis in Europe. Germany and France were also positive contributors, primarily because of outperformance during the first half of the year. By contrast, an overweight in Italy detracted from performance as its equity market was hit by a worsening economic outlook and concerns about the country’s ability to finance its national debt. Our positioning in Japan, where we were underweight during the first half of the year, and overweight during the second half, also contributed negatively. Japanese equities rallied early in the year due to positive earnings announcements, but declined during the second half as exporting firms were hurt by an appreciating Japanese Yen.

The UK remains the top overweight position in the portfolio as strong price momentum more than offsets the decline in economic fundamentals and worsening valuation we have seen in recent months. France is now the second-largest overweight based on a combination of attractive value and an improving sentiment view. Improving sentiment is driven by companies in the CAC 40 index experiencing lower deterioration in earnings expectations than companies in other European indices. Meanwhile, Australia continues to be our largest underweight due to expensive valuations and deteriorating fundamentals. The US and Japan are additional underweights. The US positioning is motivated by expensive valuations, while Japanese positioning is driven principally by negative price momentum and a strengthening currency.

We continue to favor European equity markets. Over the recent quarter, our overweight in eurozone countries has moderately increased as we continue to see attractive value opportunities in the region. Valuation spreads across developed equity markets widened over the course of the year, particularly during the third quarter. This widening was caused by a flight to quality associated with de-risking moves, which favored expensive equity markets and hurt cheap ones, especially those in Europe.

The currency selection strategy detracted significantly from fund performance in 2011, as interest rate and price momentum related factors underperformed. Fluctuations in sentiment created risk-on and risk-off moves that prevented clear trends from emerging in currency markets, making momentum trading very challenging. Heightened volatility associated with these moves also created an unfavorable environment for carry trades. In addition, the sharp changes in monetary policy over the year proved a challenging environment for our attempts to predict the direction of interest rates. An example of this is the interest rate increases by the ECB mid-year that were later reversed. Valuation themes had relatively flat performance over the course of the year as we saw mixed performance from our different indicators. Losses were concentrated in the second and third quarters, while we saw some positive contributions at the start and at the end of the year.

Our least successful positions were our underweights in the over-valued Japanese yen and Swiss franc. Both of these low yielding currencies appreciated significantly during the first three quarters of 2011, as investors sought a safe haven from the ongoing European sovereign credit crisis. In response to this move, the Swiss National Bank intervened meaningfully in the currency markets in early September to devalue the currency and effectively cap its exchange rate versus the euro. This caused a reversal in the franc appreciation trend, and resulted in some gains to our short position during the fourth quarter. Similar attempts to intervene by the Bank of Japan proved less successful however, and the yen continued to outperform into the end of the year. One currency that contributed positively throughout the year was the U.S. dollar, which benefited on both an underweight position during the first half, and an overweight during the second half.

Going forward, we see attractive opportunities in the British pound and U.S. dollar, where cheap valuation is coupled with improving fundamentals. We also favor the Scandinavian currencies, which offer high and

| | | | | | | | | | | | | | | | |

| 2 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

improving levels of carry. Conversely, we continue to hold a large underweight in the euro, where the ongoing sovereign credit crisis has driven weakening economic fundamentals, poor price momentum and forced the ECB to lower interest rates. Additionally, we continue to view the Japanese yen and Swiss franc as expensive at current levels, and maintain our underweights in these two currencies.

| | | | | | | | |

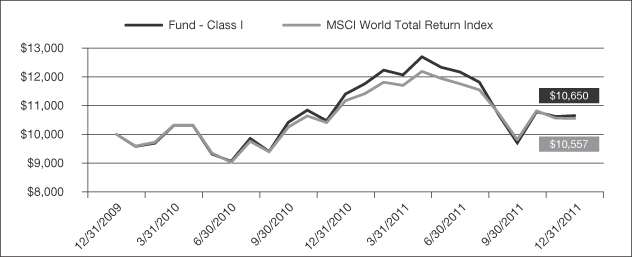

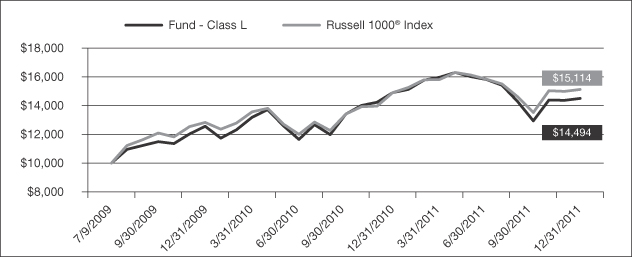

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR GLOBAL EQUITY FUND PERFORMANCE SINCE COMMENCEMENT OF OPERATIONS AS A MUTUAL FUND | |

| | | 1 Year | | | Since

Inception

(12/31/2009) | |

| Fund - Class I: AQGIX | | | -6.68% | | | | 3.20% | |

| Fund - Class N: AQGNX | | | -7.03% | | | | 2.87% | |

| Fund - Class Y: AQGYX | | | -6.22% | | | | 3.64% | |

| | |

MSCI World Total Return (net of dividends) Index | | | -5.54% | | | | 2.75% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/Y shares are 0.79%, 1.10% and 0.71%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

AQR GLOBAL EQUITY FUND VS. MSCI WORLD TOTAL RETURN INDEX VALUE OF $10,000 INVESTED ON 12/31/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 3 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | | | | | | | | | | | | | | | |

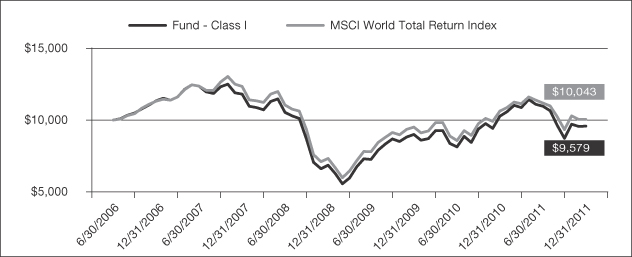

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR GLOBAL EQUITY FUND PERFORMANCE SINCE INCEPTION OF PREDECESSOR LIMITED PARTNERSHIP | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception

(6/30/2006) | |

| Fund - Class I: AQGIX | | | -6.68% | | | | 11.77% | | | | -3.33% | | | | -0.78% | |

| Fund - Class N: AQGNX | | | -7.03% | | | | 11.41% | | | | -3.65% | | | | -1.11% | |

| Fund - Class Y: AQGYX | | | -6.22% | | | | 12.22% | | | | -2.96% | | | | -0.40% | |

| | | | |

MSCI World Total Return (net of dividends) Index | | | -5.54% | | | | 11.13% | | | | -2.37% | | | | 0.08% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/Y shares are 0.79%, 1.10% and 0.71%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

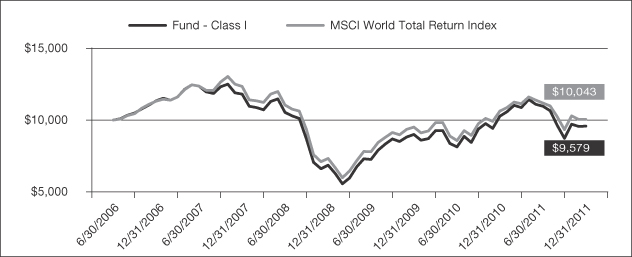

AQR GLOBAL EQUITY FUND VS. MSCI WORLD TOTAL RETURN INDEX VALUE OF $10,000 INVESTED ON 6/30/06 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| 4 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

Cliff Asness

Managing & Founding Principal

Ronen Israel

Principal

Oktay Kurbanov

Principal

John Liew

Founding Principal

Lars Nielsen

Principal

Dear Shareholder:

International equity markets experienced significant headwinds in 2011, particularly during the second half of the year. During the first half of the year, the MSCI EAFE Index (the “Index”) posted a positive return of +4.98%, but this was followed by a sharp decline of -16.31% in the second half of the year. For the full year, the index finished down -12.14%. In particular the third quarter was challenging for markets as we faced not only the resurgence of the European sovereign debt crisis, a crisis surrounding the United States debt ceiling, and the downgrade of the country’s long term credit by Standard and Poor’s, but also a rapidly deteriorating world economic outlook. Not surprisingly, these events were followed by a spike in risk-aversion and a significant deterioration in market sentiment. Towards the end of the year, however, equity markets rebounded after a series of surprisingly strong economic data releases in the US, changing governments in a number of European countries, and a coordinated effort by central banks, particularly the ECB, to support the viability of the financial system. During this period, the AQR International Equity Fund Class I shares (the “Fund”) returned -15.00% for the year, underperforming its benchmark index by -2.86%.

The Fund is actively managed, and it seeks to outperform its benchmark in three ways: by selecting stocks within each country and by using futures and forwards contracts to over-and under-weight countries and currencies relative to the benchmark. Details on each of the strategies are provided below.

The stock selection strategies had a good year driven by positive performance in continental Europe and Japan, while the UK strategy detracted. In continental Europe, outperformance came from positive performance in momentum oriented investment themes, both within and across industries, outweighing negative performance in valuation signals. The positive performance in Japan was driven mainly by valuation and industry valuation factors, outweighing negative performance in our management signaling theme. The negative performance in the UK was due to valuation signals, both within and across industries, while momentum worked well also both within and across industries.

Tactically, we now are underweight value in continental Europe and Japan, and overweight value in the UK.

The country selection strategy contributed positively to fund performance in 2011 driven by strong performance of valuation signals during the first half of the year in particular. Momentum had a negative contribution as volatile equity markets resulted in losses to our price based signals, though we saw some gains to our fundamental momentum signals based on exchange rates and trade. The third quarter was the only down quarter in the year.

The portfolio’s gains were concentrated in our overweight of the UK equity market, which was motivated by strong price momentum and attractive valuation. The UK was one of the top performing equity markets in the developed world, as it continued to be

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 5 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

relatively immune to the eurozone financial and sovereign debt problems. Germany and France were also positive contributors, primarily because of outperformance during the first half of the year. By contrast, an overweight in Italy detracted from performance as its equity market was hit by a worsening economic outlook and concerns about the country’s ability to finance its national debt. Our positioning in Japan, where we were underweight during the first half of the year, and overweight during the second half, also contributed negatively. Japanese equities rallied early in the year due to positive earnings announcements, but declined during the second half as exporting firms were hurt by an appreciating Japanese Yen.

The UK remains the top overweight position in the portfolio as strong price momentum more than offsets the decline in economic fundamentals and worsening valuation we have seen in recent months. France is now the second-largest overweight based on a combination of attractive value and an improving sentiment view. Improving sentiment is driven by companies in the CAC 40 index experiencing lower deterioration in earnings expectations than companies in other European indices. Meanwhile, Australia continues to be our largest underweight due to expensive valuations and deteriorating fundamentals. Japan is a modest underweight driven principally by negative price momentum and the strengthening of the Japanese Yen.

We continue to favor European equity markets. Over the recent quarter, our overweight in eurozone countries has moderately increased as we continue to see attractive value opportunities in the region. Valuation spreads across developed equity markets widened over the course of 2011, particularly during the third quarter. This widening was caused by a flight to quality associated with de-risking moves, which favored expensive equity markets and hurt cheap ones, especially those in Europe.

The currency selection strategy detracted significantly from fund performance in 2011, as interest rate and price momentum related factors underperformed. Fluctuations in sentiment created risk-on and risk-off moves that prevented clear trends from emerging in currency markets, making momentum trading very challenging. Heightened volatility associated with these moves also created an unfavorable environment for carry trades. In addition, the sharp changes in monetary policy over the year proved a challenging environment for our attempts to predict the direction of interest rates. An example of this is the interest rate increases by the ECB mid-year that were later reversed. Valuation themes had relatively flat performance over the course of the year as we saw mixed performance from our different signals. Losses were concentrated in the second and third quarters, while we saw some positive contributions at the start and at the end of the year.

Our least successful positions were our underweights in the over-valued Japanese yen and Swiss franc. Both of these low yielding currencies appreciated significantly during the first three quarters of 2011, as investors sought a safe haven from the ongoing European sovereign credit crisis. In response to this move, the Swiss National Bank intervened meaningfully in the currency markets in early September to devalue the currency and effectively cap its exchange rate versus the euro. This caused a reversal in the franc appreciation trend, and resulted in some gains to our short position during the fourth quarter. Similar attempts to intervene by the Bank of Japan proved less successful however, and the yen continued to outperform into the end of the year. The biggest positive contributor was the U.S. dollar, which benefited on an overweight position during the second half.

Going forward, we see attractive opportunities in the British pound and U.S. dollar, where cheap valuation is coupled with improving fundamentals. We also favor the Scandinavian currencies, which offer high and improving levels of carry. Conversely, we continue to hold a large underweight in the euro, where the ongoing sovereign credit crisis has driven weakening economic fundamentals, poor price momentum and forced the ECB to lower interest rates. Additionally, we continue to view the Japanese yen and Swiss franc as expensive at current levels, and maintain our underweights in these two currencies.

| | | | | | | | | | | | | | | | |

| 6 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

| | | | | | | | | | | | |

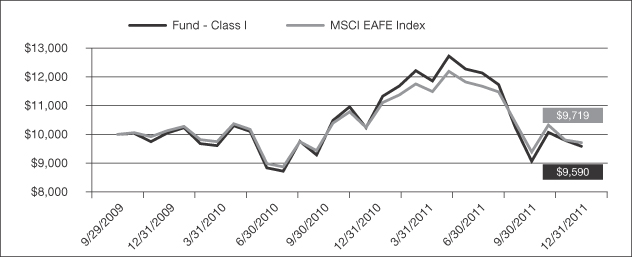

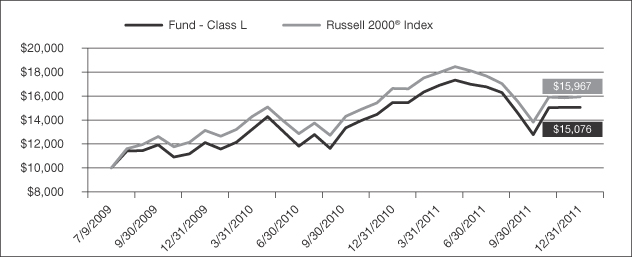

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR INTERNATIONAL EQUITY FUND PERFORMANCE SINCE COMMENCEMENT OF OPERATIONS AS A MUTUAL FUND | |

| | | 1 Year | | | Since

9/29/2009 | | | Since

Inception

(8/28/2009) | |

| Fund - Class I: AQIIX | | | -15.00% | | | | -1.84% | | | | na | |

| Fund - Class N: AQINX | | | -15.27% | | | | -2.04% | | | | na | |

| Fund - Class Y: AQIYX | | | -14.66% | | | | -1.45% | | | | 0.15% | |

| | | |

MSCI EAFE Index | | | -12.14% | | | | -1.26% | | | | -0.05% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/Y shares are 1.03%, 3.50% and 0.77%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

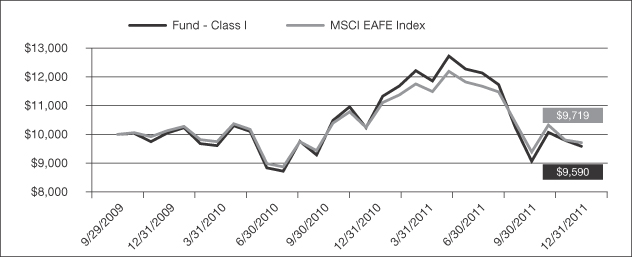

AQR INTERNATIONAL EQUITY FUND VS. MSCI EAFE INDEX VALUE OF $10,000 INVESTED ON 9/29/09 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 7 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR INTERNATIONAL EQUITY FUND | | |

| | | | | | | | | | | | | | | | |

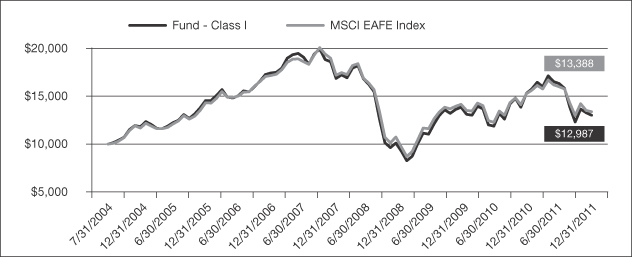

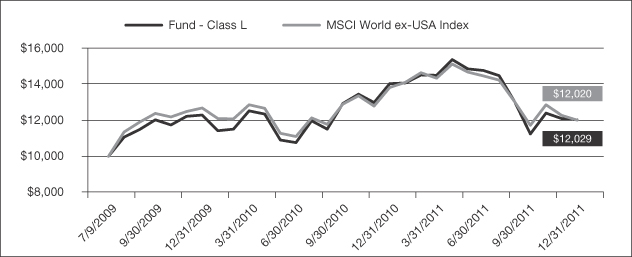

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR INTERNATIONAL EQUITY FUND PERFORMANCE SINCE INCEPTION OF PREDECESSOR LIMITED PARTNERSHIP | |

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception

(7/31/2004) | |

| Fund - Class I: AQIIX | | | -15.00% | | | | 8.72% | | | | -5.51% | | | | 3.58% | |

| Fund - Class N: AQINX | | | -15.27% | | | | 8.46% | | | | -5.78% | | | | 3.27% | |

| Fund - Class Y: AQIYX | | | -14.66% | | | | 9.10% | | | | -5.17% | | | | 3.95% | |

| | | | |

MSCI EAFE Index | | | -12.14% | | | | 7.65% | | | | -4.72% | | | | 4.01% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Class Y shares are subject to a 0.10% redemption fee. If reflected, the redemption fee would reduce the performance quoted. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N/Y shares are 1.03%, 3.50% and 0.77%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

|

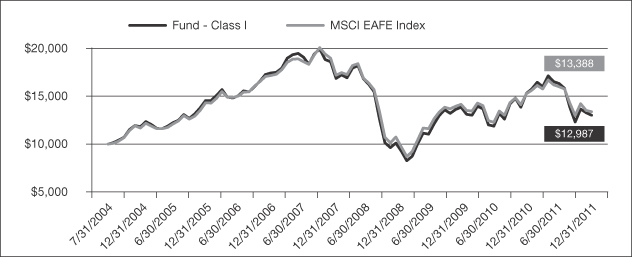

AQR INTERNATIONAL EQUITY FUND VS. MSCI EAFE INDEX VALUE OF $10,000 INVESTED ON 7/31/2004 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| 8 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR DIVERSIFIED ARBITRAGE FUND | | |

Ronen Israel

Principal

Mark Mitchell, Ph.D.

Founding Principal, CNH Partners

Lars Nielsen

Principal

Todd Pulvino, Ph.D.

Founding Principal, CNH Partners

Dear Shareholder:

The Diversified Arbitrage Fund Class I returned 0.99% during the 2011 calendar year. During the corresponding period, the BofA Merrill Lynch 3 Month Treasury Bill Index (the Fund’s benchmark) returned 0.10% and the S&P 500 returned 2.11%. Based on monthly return data, the Fund’s equity market beta (relative to the S&P 500) since inception (January 15, 2009) through December 31, 2011 is 0.06 and its annualized volatility is 2.8%.

Arbitrage strategies involving corporate securities were stable through the first half of 2011. However, beginning in early August, increased uncertainty involving European sovereign debt caused an increase in risk aversion and a commensurate widening of arbitrage spreads. Spread widening first affected the merger market and was likely exacerbated by redemption-related selling by one or more large merger arbitrage hedge funds. This resulted in a doubling of annualized merger spreads, from roughly 5% to more than 10%. Cheapening in the convertible bond market followed approximately one month later as long-only convertible funds and Wall Street trading desks reduced their convertible exposures. By the end of 2011, the discount of convertible bonds relative to their theoretical values was in the 90th percentile.

The Fund invests in multiple arbitrage and alternative investment strategies, and tactically allocates to strategies based on relative attractiveness. The long-run strategic allocations to merger arbitrage, convertible arbitrage, and event arbitrage are 33% each. However, as displayed in the table below, strategy weights have varied significantly since the Fund’s inception. For example, the allocation to merger arbitrage decreased to 23% at the end of 2010 and subsequently rebounded to 35% by year-end 2011. Other notable changes in strategy weights during the year include a reduction in credit-related trades reflecting fewer corporate bond issuances and a reduction in secondary market trading, a reduction in dual-class arbitrage trades caused by tightening dual-class spreads, a reduction in price-pressure trades caused by abnormally low corporate security issuance, and an increase in SPAC (Special Purpose Acquisition Corporations) holdings resulting from increased activity in the SPAC IPO market. While the convertible arbitrage strategy displays only minor year-end variations, as discussed below, intra-year variations have been significant.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 9 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR DIVERSIFIED ARBITRAGE FUND | | |

| | | | | | | | | | | | |

ARBITRAGE STRATEGY WEIGHTS

AS PERCENTAGE OF TOTAL LONG MARKET VALUE | |

| Strategy | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | |

| Convertible Arbitrage | | | 44% | | | | 38% | | | | 36% | |

| Merger Arbitrage | | | 34% | | | | 23% | | | | 35% | |

| Credit | | | 1% | | | | 15% | | | | 10% | |

| Dual-Class Arbitrage | | | 12% | | | | 8% | | | | 5% | |

| Price Pressure | | | 4% | | | | 6% | | | | 1% | |

| SPACs | | | 1% | | | | 3% | | | | 6% | |

| Private Investment in Public Equity (“PIPEs”) | | | 0% | | | | 3% | | | | 2% | |

| Closed-End Fund Arbitrage | | | 2% | | | | 0% | | | | 2% | |

| Other Arbitrage and Alternative Investment Strategies | | | 2% | | | | 4% | | | | 3% | |

As measured by the percentage of long market value, convertible arbitrage continues to have the largest strategy weight. Convertible arbitrage involves the purchase of a convertible security at a price below its fundamental or intrinsic value, and the contemporaneous hedging of the convertible’s risk via shorting the underlying stock. In addition to hedging equity risk, convertible arbitrage investments often require hedging of credit and interest rate risk. With a fully hedged position, the arbitrageur profits when the difference between the convertible security’s fundamental value and its traded value converges. As discussed in prior letters, the convertible bond market unraveled during the 2008 financial crisis causing convertible bonds to trade at significant discounts to fundamental values. As financial markets stabilized in 2009, convertibles richened and as of mid-2011, the median discount of convertible prices relative to their theoretical values was roughly at the long-term historical average. In response to systematic richening in the convertible market, we took two actions. First, we reduced the Fund’s allocation to convertible arbitrage. Second, we repositioned the convertible portfolio to hold equity-sensitive convertibles where the equity short provides a direct hedge to the long convertible position. Both of these actions helped to insulate the Fund from losses during the second half of 2011 when convertible securities cheapened considerably as the European sovereign risk crisis unfolded. Although bond cheapening causes losses even if positions are perfectly hedged (this is essentially the definition of “cheapening”), cheapening episodes are often accompanied by unexpectedly high volatility in the underlying stocks. Because of the convexity inherent in a convertible security’s structure, this volatility allows the arbitrageur to create trading profits as the convertible’s hedge ratio changes with stock price changes. That is, as the stock price underlying the convertible security falls, the arbitrageur reduces the short position by buying stock (buy low) and as the stock price rises, the arbitrageur increases the short position by selling stock (sell high). These trading profits are more likely to be obtained with equity-sensitive convertible bonds where the equity option embedded in the convertible security comprises more of the bond’s value. Whereas, convertible arbitrage funds, as reported by various hedge-fund indices, suffered portfolio losses in 2011, the Fund actually profited. Convertible arbitrage contributed -0.01% to the Fund’s return in the second half of 2011 and contributed +0.32% to the Fund’s return for the year. Importantly, in light of the substantial cheapening that occurred due to selling by long-only holders and by Wall Street market makers, the Fund’s year-end portfolio of hedged convertible securities are attractively cheap relative to historical measures.1

Merger arbitrage involves the assumption of deal failure risk following publicly announced mergers and acquisitions. The most common merger arbitrage trade involves the purchase of the target company’s

| 1 | It is important to note that the Fund’s investment in a convertible bond is based on the cheapness of the bond relative to its fundamental value rather than on a view about the underlying stock price. Specifically, we hedge our long position and attempt to capture the cheapness of the convertible by shorting the stock of the underlying issuer, and by hedging systematic credit and interest rate risk. |

| | | | | | | | | | | | | | | | |

| 10 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR DIVERSIFIED ARBITRAGE FUND | | |

equity. Depending on the structure of the transaction, additional trades are used to hedge market and industry risk. For example, in a merger where the consideration is the acquirer’s stock, the Fund seeks to hedge market and industry exposure by shorting the stock of the acquiring company in an amount based on the exchange ratio specified in the merger agreement. Conditions for investing in merger arbitrage are especially attractive when deal spreads (the percentage difference between the consideration offered by the acquiring firm and the stock price of the target firm) are wide and when merger activity is robust. The Fund began 2011 with a low weight in merger arbitrage, a result of the large number of merger closings in December 2010.2 Because of strong deal flow at the beginning of 2011, the Fund quickly increased its allocation to merger arbitrage back to long-term target levels. During the third quarter of 2011, annualized merger spreads, which began the year around 5%, more than doubled to over 10%. This was caused by significant selling in the merger market in part caused by greater fundamental risk related to increased macroeconomic uncertainty but also caused by redemption-induced selling by some large funds. In our view, since spread widening was in excess of that due solely to declining fundamentals, the Fund increased its exposure to merger arbitrage to 40% during the fourth quarter. By year-end, merger deal spreads had contracted to their beginning-of-year levels. Overall, the Fund realized +0.95% from the merger arbitrage strategy for the year, a result of a substantial number of investable mergers, frequent increased offers, few adverse merger failures, and the tactical allocation towards merger arbitrage when spreads widened during the third quarter. Looking forward to 2012, we expect merger activity and spreads to be similar to those observed in 2011.

As shown in the table above, within the credit event driven/alternative investments category, credit has the largest sub-strategy weight at 10% of total long market value. The credit sub-strategy consists primarily of short-term (average duration of 12-15 months) corporate debentures. Historically, as we have documented using our proprietary corporate debenture database, short-dated corporate debentures, particularly in the high-yield arena, produce excess returns after accounting for systematic credit and interest rate risk. We postulate that the reason for the excess returns is that fixed-income investors often choose to exchange short-term debentures for longer-term debentures in order to generate higher-expected returns associated with bearing greater systematic credit risk. We focus on short-dated debentures issued by companies that have stable near-term cash flow and sufficient assets to retire the debenture at maturity. We view this trade as similar to a long-dated cash merger trade, but one in which the downside is contractually protected by the underlying indenture. This is not to say that the trade is absent risk. Rather, the systematic component of risk is minimal, a direct result of the short-dated nature of the investments. Our analysis using our proprietary database shows that the modest systematic credit and interest rate risk that remains can be hedged at the portfolio level using credit default swaps and Treasury futures. The Fund’s exposure to Credit declined in 2011 from 15% as of year-end 2010 because of a reduction in the issuance of new debentures which resulted in a contraction in portfolio rebalancing by investors that choose to exchange short-term debentures for newly issued longer-term debentures.

The second largest sub-strategy within the event-driven/alternative investment category is SPACs. SPACs are corporations that raise cash through an initial public offering, and place the cash in a trust to be used to acquire an operating company. The number of SPAC initial public offerings has increased during the past year allowing the Fund to increase its exposure from 3% a year ago to its current 6%. Because SPAC assets are held in trust accounts invested in Treasury securities while the SPAC sponsors search for assets to acquire, these investments have very little risk. On the low side, SPACs will generate Treasury bill returns. However, if the SPAC sponsor finds a good acquisition at a great price, the embedded call option on the acquisition target provides significant upside to SPAC investors.

| 2 | It is not uncommon for a disproportionate number of pending mergers to close in December as merging companies often prefer to avoid having multiple legal entities in the ensuing year. |

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 11 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR DIVERSIFIED ARBITRAGE FUND | | |

Dual-class arbitrage represents the third largest sub-strategy within the event-driven/alternative investment category. Dual-class arbitrage involves trading two classes of stocks issued by the same firm where each class has identical rights to the underlying cash flows of the firm. When the prices of the two classes of stock diverge, buying the low-price share class and shorting the high-price share class generates excess returns on average. In addition, because the dual-class arbitrage strategy has a negative beta, it helps to reduce the systematic equity market risk in the portfolio. As dual-class spreads tightened during the year, the Fund reduced its exposure to dual-class arbitrage from 8% to 5%.

Other sub-strategies (price pressure, PIPEs, closed-end-funds, and other arbitrage and alternative investments) collectively account for 8% of the Fund’s portfolio. The price pressure sub-strategy saw a reduction in exposure from 6% to 1%, a direct result of the decrease in corporate security issuances, particularly in the convertible market. The event-driven/alternative investments category contributed -0.19% to the Fund’s return in 2011, with positive contributions from credit, SPACs, and closed-end-fund arbitrage, offset by negative contributions from dual-class arbitrage, price pressure and other arbitrage and alternative investments.

Overall, the Fund realized a modest +0.99% return in 2011. As of year-end, arbitrage markets in corporate securities are largely stable, especially in the context of current worldwide economic and financial uncertainty. An exception is convertible arbitrage. As noted above, convertible securities are trading well below fundamental values relative to historical levels as a result of widespread selling by long-only holders and by Wall Street market makers seeking to reduce their inventories of convertibles in response to changing regulations and increased macro-economic uncertainty. As of year-end, strategy weights are near long-run expected levels. We anticipate increasing the exposure to convertible arbitrage, however, our ability to do so is constrained by the weak new-issue market and thin secondary market trading. In addition, our leverage is constrained as a 40-Act fund which forces us to focus on less equity-sensitive convertibles that are slightly cheaper but less efficiently hedged. We are exploring various ways to loosen this leverage constraint to allow us to increase the Fund’s exposure in well-hedged equity sensitive convertibles. With respect to the merger market, predicting the deal pipeline with any degree of reliability is difficult due to shocks from the macro-economic environment. If anything, we expect a continuation of the current environment, that is, a steady but less than robust flow of high-quality mergers and somewhat tight spreads and roughly average expected returns. Opportunities in event-driven/alternative investments will depend on the level of corporate activity related to new capital issues and restructuring events. Importantly, irrespective of where the Fund deploys capital in 2012, we will continue to hedge systematic equity, credit, and interest rate risk, with the intention of delivering uncorrelated positive returns.3

| 3 | Note that the Fund utilizes various derivatives instruments (e.g., futures, options, forwards, and swaps), primarily to hedge against systematic risks including credit risk and interest rate risk. While the purpose of employing derivatives instruments is to decrease the Fund’s overall risk, hedging instruments are imperfect tools and their success depends on the degree of price correlation between the derivative instruments and the assets being hedged. Imperfect correlation may be caused by several factors, including temporary price disparities between derivative markets and markets for the underlying assets. |

| | | | | | | | | | | | | | | | |

| 12 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR DIVERSIFIED ARBITRAGE FUND | | |

| | | | | | | | |

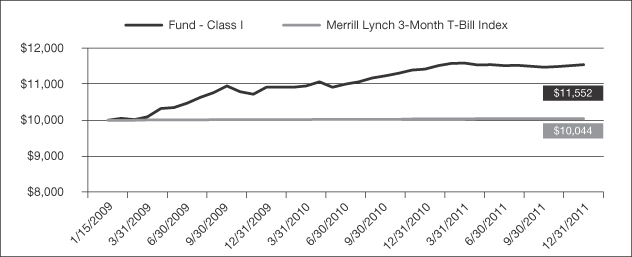

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR DIVERSIFIED ARBITRAGE FUND | |

| | | 1 Year | | | Since

Inception

(1/15/2009) | |

| Fund - Class I: ADAIX | | | 0.99% | | | | 5.03% | |

| Fund - Class N: ADANX | | | 0.68% | | | | 4.71% | |

| | |

Merrill Lynch 3-Month T-Bill Index | | | 0.10% | | | | 0.15% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N shares are 2.63% and 2.93%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | |

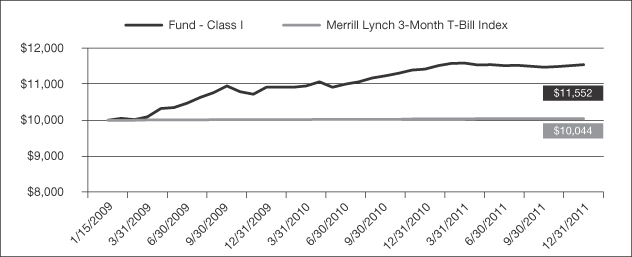

AQR DIVERSIFIED ARBITRAGE FUND VS MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 1/15/2009 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 13 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MANAGED FUTURES STRATEGY FUND | | |

Cliff Asness

Managing & Founding Principal

John Liew

Founding Principal

Brian Hurst

Principal

Yao Hua Ooi

Principal

Dear Shareholder:

In 2011, the Fund’s Class I shares returned -6.37% and realized an annualized volatility of 9.0%. During this same period, the BofA Merrill Lynch 3 Month Treasury Bill Index (the Fund’s benchmark) returned 0.10%. The Barclay BTOP50 index, which contains 28 of the largest Managed Futures hedge funds by AUM, was down -4.11% over this same period. The Fund’s assets grew to $1.6 B by the end of December, reflecting strong investor demand for an actively run managed futures fund in the mutual fund space.

The Fund invests both long and short across a portfolio of futures contracts and futures-related instruments, utilizing more than 100 contracts across four major asset classes: commodities, currencies, fixed income, and equity markets. The Fund pursues a trend-following strategy, and as such, it tends to perform well when there are persistent trends in markets and suffers when there is a lack of trends or when trends reverse sharply. In 2011, the Fund realized gains in fixed income markets, benefiting from a consistent decline in global interest rates throughout the year. Those gains were offset by losses in equity, currency, and commodity markets, where choppy markets and sharp reversals resulted in losses for trend following strategies. For example, global equity and commodity markets declined sharply in mid-March following the Japanese earthquake, only to rebound back strongly by the end of the month, leading to losses for short-term trend-following strategies. In the third quarter of 2011, there was a reversal in long-standing bullish trends in equities, commodities and carry-sensitive currencies due to the European sovereign debt crisis, which led to losses for long-term trend following strategies. Additionally, both short-term and long-term trend following strategies suffered losses in October, as risky markets rebounded very sharply following bearish trends that had been building up throughout Q3.

By design, the Fund tactically changes the amount of risk it takes in pursuing trends across the four major asset classes depending on the relative attractiveness of the trend-following opportunities within each asset class. The Fund will invest more in an asset class when there are perceived strong trends across many assets within that particular asset class. The Fund began the year with a reduced allocation to fixed income, and ended the year with its largest risk allocation in fixed income and commodities.

| | | | | | | | | | | | | | | | |

| 14 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MANAGED FUTURES STRATEGY FUND | | |

In addition, the Fund also tactically changes the level of risk it targets depending on the strength and correlation of trends across the four asset classes. The Fund started 2011 targeting 13% annualized volatility (the maximum ex-ante risk the Fund will target), as there were strong and correlated trends in equity, risk currency, and commodity markets following the strong performance of those markets in late 2010. The Fund reduced its risk target over May and June as the performance of different markets diverged, and did not take risk back up until September. The Fund ended the year at a reduced target of 7% annualized volatility. Below is a summary of the asset class risk exposures throughout 2011:

| | | | | | | | | | | | | | | | | | | | |

Asset Class Exposure

(% of Risk Allocation) | |

| | | 12/31/2010 | | | 3/31/2011 | | | 6/30/2011 | | | 9/30/2011 | | | 12/31/2011 | |

| Fixed Income | | | 7% | | | | 15% | | | | 30% | | | | 28% | | | | 30% | |

| Commodities | | | 32% | | | | 16% | | | | 13% | | | | 19% | | | | 32% | |

| Currencies | | | 29% | | | | 39% | | | | 38% | | | | 22% | | | | 17% | |

| Equities | | | 32% | | | | 30% | | | | 19% | | | | 31% | | | | 21% | |

Within each of the asset classes, the fund pursues short-term trend strategies, long-term trend strategies and over-extended trend strategies. Overall, short-term trend strategies were slightly positive in 2011. Within short term trend strategies, the shorter horizon signals (a month or less) performed very poorly, while longer horizon signals (around three months) performed very well. Long-term trend strategies performed poorly, detracting in every asset class outside of fixed income. Long-term trend following strategies were particularly hurt in Q3, when long-standing bullish trends in a number of markets reversed sharply. The over-extended trend strategies helped dampen volatility and even added to performance over this period, especially in commodities, where the Fund’s long exposures were reduced on long-term overextended trend indicators.

The Fund gained 7.0% in the fixed income markets in 2011. The Fund started the year with small long positions in most fixed income instruments. The first quarter saw fixed income losses, as optimism about economic recovery led to increases in global bond yields. However, sovereign debt fears resurfaced and macro fears led to worldwide yield declines over the course of the rest of the year, especially in the third quarter. By the end of the year, central banks such as the European Central Bank (“ECB”) and Reserve Bank of Australia (“RBA”) were cutting interest rates and turning increasingly dovish. The Fund benefitted from these yield declines as it increased its fixed income longs throughout the year.

The Fund lost -6.8% in equities in 2011. The Fund suffered losses in long term trend following signals, particularly in the third quarter when equity markets dropped sharply following a choppy but generally up-trending period over the prior 12 months. Short term trend signals did not help to mitigate the losses, as uncertainty over the year led to very choppy markets. The largest losses were in European countries, where worries over the sovereign debt crisis alternating with proposed solutions to the crisis led to extreme choppiness in those markets.

The Fund lost -4.0% in currencies over the course of the year. Most of the losses came in the third quarter, when risk aversion led to a strong carry unwind, as growing economies which had started to raise interest rates saw their currencies depreciate relative to low yielding (or safe-haven) currencies like the U.S. Dollar, Japanese Yen, and Swiss Franc. The Fund lost money over the quarter due to long positions in high carry, high growth currencies as well as from U.S. Dollar strengthening. Over the course of the year, the Swiss

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 15 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MANAGED FUTURES STRATEGY FUND | | |

Franc and British Pound were large positive contributors, while the Fund suffered losses in the Swedish Krona, Japanese Yen, Norwegian Krone, and the Euro.

In commodities, the Fund lost -2.6% in 2011. The Fund profited from a bearish trend in natural gas and bullish trends in gold, and brent crude oil, but lost money in the agricultural commodities, industrial metals, and the other energies. Commodities markets generally suffered from choppiness, for example exhibiting sharp sell-offs in the first week of May and in September. Long term overextended trend signals helped to mitigate some of those losses

The Fund’s performance in 2011 was disappointing. While we are always disappointed by negative performance, the Fund did behave as expected in this environment. Trend following strategies tend to do poorly in sharp reversals and choppy markets, which characterized the markets this year. However, losses were mitigated by the Fund’s construction which emphasizes diversification across assets, asset classes, and signals. In particular, strong trends in fixed income markets helped to offset the losses from trend following in other markets. Short-term trend-following and overextended strategies were positive throughout the year, helping offset losses from long-term trend following. We continue to pursue a risk-balanced approach in investing across the major asset classes, and trust that doing so will benefit the Fund in the long-run.

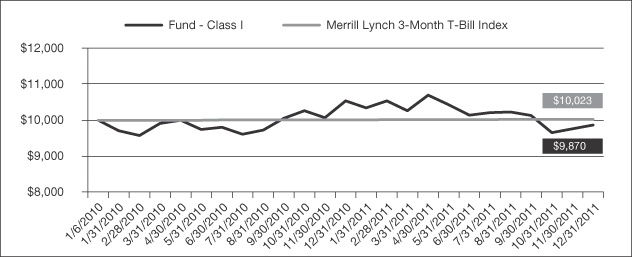

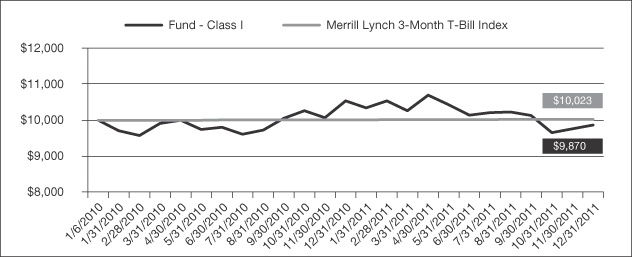

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR MANAGED FUTURES STRATEGY FUND | |

| | | 1 Year | | | Since

Inception

(1/6/2010) | |

| Fund - Class I: AQMIX | | | -6.37% | | | | -0.66% | |

| Fund - Class N: AQMNX | | | -6.59% | | | | -0.91% | |

| | |

Merrill Lynch 3-Month T-Bill Index | | | 0.10% | | | | 0.12% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N shares are 1.28% and 1.56%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | | | | | | | |

| 16 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MANAGED FUTURES STRATEGY FUND | | |

| | | | | | | | |

AQR MANAGED FUTURES STRATEGY FUND VS. MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 1/6/10 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 17 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

John Liew

Founding Principal

Brian Hurst

Principal

Michael

Mendelson

Principal

Yao Hua Ooi

Principal

Dear Shareholder:

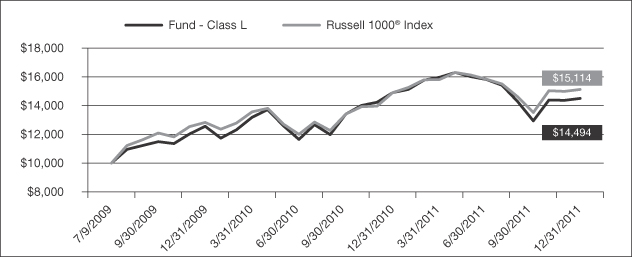

On December 31, 2011, the AQR Risk Parity Fund completed its first full fiscal year. From December 31, 2010 through December 31, 2011, the Fund’s Class I shares returned +5.45% and realized an annualized volatility of 8.24%. During this same period, the Fund’s benchmark the BofA Merrill Lynch 3 Month Treasury returned 0.10% and a 60/40 benchmark consisting of 60% S&P 500 Index/40% Barclays U.S. Aggregate Bond Index returned 5.19% at an average realized volatility of 13.21%. The Fund’s net assets across all share classes grew to $389 million by the end of 2011.

Through the use of derivatives such as futures and swaps, the Fund invests across a wide variety of global markets, including: developed and emerging market equities, fixed income and currencies, global credit (corporate, government, and mortgage), and commodities in an attempt to build a truly diversified portfolio where all asset classes matter, but no one asset class matters too much. Risk Parity investing involves allocating investments by risk which means that instruments which have lower risk will generally be allocated larger capital than instruments which are deemed more risky. As markets move through different risk regimes, the portfolio is dynamically adjusted to help keep the overall portfolio risk and balance of risks across asset classes fairly steady through time. We believe this leads to more consistent results, reduces tail risk associated with investments in the capital markets, and enables the investor to remain invested through more difficult market environments.

In addition to varying position sizes to control for increasing or decreasing risk expectations, we also overlay modest portfolio tilts based on AQR’s proprietary expected return models, which include signals based on carry, momentum, valuation, and other important economic variables. These views determine over- and underweights across a broad array of global markets. The ultimate goal is to build a portfolio that in the long run will deliver higher returns at a risk level similar to that of traditional portfolios by combining a better asset allocation with return-boosting tactical tilts. The Fund will remain long all of the markets in which we invest while averaging a moderate (under 0.5 on average) beta to the stock market over a full market cycle.

The targeted annualized volatility for the Fund is 10%, on average, which varies modestly over time based on our perceptions of tactical opportunities within the different asset classes we trade. Over the first half of the year, our tactical signals indicated an attractive environment for all four major risk premia in the Fund. In addition, our estimates of market risk were moderate, leading to Fund exposure levels that were higher than normal.

The resurgence of European sovereign concerns in the third quarter led to a big increase in volatility of all risky assets, and our tactical models picked up on the negative trends in equities and commodities, leading to a more bearish stance on those markets. As a result, we reduced exposures in all asset classes during the third

| | | | | | | | | | | | | | | | |

| 18 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

quarter, with the largest reductions in equities and credit. Overall, Fund exposures were reduced by about one-third over the third quarter. Due to persisting higher volatility in equities, credit, and commodities, exposure levels remained low toward the end of the year. In order to maintain portfolio risk at a steady target, the Fund moved from a 0.45 beta versus the S&P 500 Index in the second quarter to a 0.20 beta in the third and fourth quarters. However, given the recovery in markets in the fourth quarter, the Fund ended the year with bullish tilts toward fixed-income, credit, and equities and a bearish tilt toward commodities.

The Fund experienced gains in only two of the four major asset class buckets for the full year. To a net return of 5.4% for 2011, fixed income contributed 10.1%, inflation-linked assets contributed 1.7%, equities detracted -3.5%, and credit assets detracted -3.1%. Returns to cash in the portfolio added another 0.1%. The tactical tilts we made in the Fund added to returns in fixed income and credit, but detracted in equities and inflation, on net adding 0.1% to the Fund’s return. Like risk, returns for the year were shaped heavily by the declining global economic outlook and fiscal problems in the European periphery. These dual trends took hold in the third quarter, generating poor returns for nearly all risky assets, especially for markets outside the U.S.

In the equity bucket, the Fund was tactically overweight equities through the first half due to short- and long-term momentum signals. With the global market declines and rising volatility in August, we trimmed notional positions by over 50%, largely driven by higher estimates of equity volatility, and partially due to increasingly bearish views in our trend-following signals. Despite the rapid reduction in position size through August, third quarter equities losses were still large enough to outweigh gains from the rest of the year. Our tactical tilts in equities detracted for the year, with a -0.6% return to trend-following strategies and -0.3% return to macro timing strategies. Both tactical tilts were hurt by overweights in equities going into the third quarter based on positive momentum in both prices and fundamental economic data up to that point. Capital allocation to equities rose slightly from the lows of August, but still finished the year well below our expected long-term average due to elevated risk expectations.

In the nominal bond bucket, the Fund entered the year with a weak tactical overweight on bonds that grew stronger through the year based mostly on positive price trends. Nominal rates continued to fall in the second half as economic news turned more negative and central banks coordinated to provide greater liquidity to markets. Tactical overweights to bonds from asset-timing and trend-following models contributed 1.3% to performance, mostly in the second and third quarters. Relative value trades in fixed-income were flat for the year. The Fund finished the year bullish on fixed-income, and especially bullish on Japanese bonds due to positive price momentum. U.K. gilts were underweight at year-end due to high relative valuation.

In the inflation bucket, the Fund began the year with an overweight on commodities based on strong macroeconomic growth indicators as well as positive market momentum. This contributed modestly to performance in the first quarter as improving economic forecasts and political turmoil in the Middle East pushed most commodity sectors higher, but detracted heavily during the third quarter as assets sensitive to macro economic growth declined. For the year, commodities detracted 1.7% from Fund performance, of which 0.3% was due to poor trend-following performance. The Fund ended the year with a tactical underweight in commodities driven by deteriorating global economic growth. Inflation-linked bonds performed well throughout the year, contributing 3.5%, as real rates fell in the U.S., UK, and France on expectations of lower growth.

In the credit bucket, the Fund suffered from large losses during the third quarter as credit spreads widened drastically and emerging market currencies fell in value. A strong fundamental environment for credit spreads and positive credit market momentum led us to overweight high yield credit at the start of

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 19 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

the year. Although notional exposure to credit assets fell nearly 60% due to rising risk estimates in the third quarter’s resurgence of European debt worries, we maintained a tactical overweight on high yield debt due to attractive spreads and strong corporate balance sheets through the end of the year. While our tactical overweight to high yield credit hurt us throughout the year, we benefited from tactical underweights to emerging currencies and commercial mortgage backed spreads throughout the year.

This has been a good first full year for the Fund, as it managed to beat the benchmark’s return at a much lower level of volatility. We believe the Fund’s especially strong relative performance in the third quarter’s adverse environment showed the benefits of broad risk-based diversification and volatility targeting. We remain significantly concerned about the health of the European economy and, in particular, its financial system. Further, the potential global spillover effects of a bad resolution of the current crisis adds risk to all markets, something we believe is reflected in our current elevated risk estimates. We remain confident, however, that the diversification of a risk parity approach provides a sound allocation for the unusually wide variety of potential market environments we may face in the coming year.

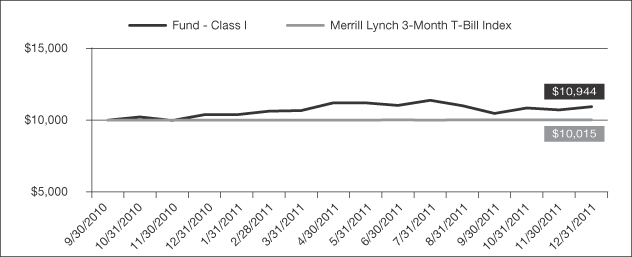

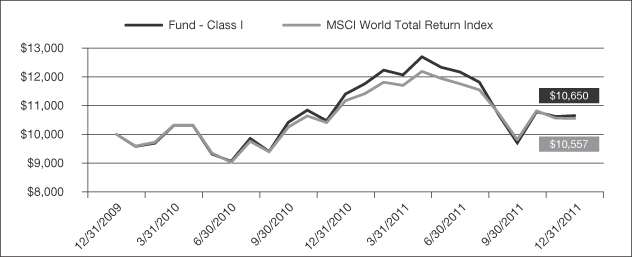

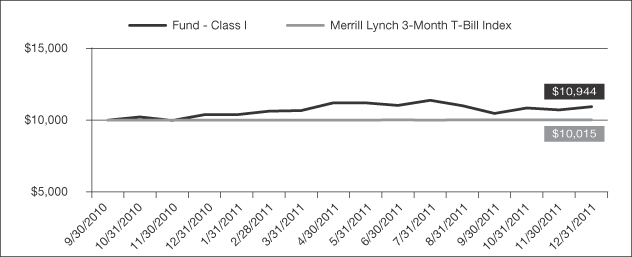

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF 12/31/2011 AQR RISK PARITY FUND |

| | | | | | | | |

| | | 1 Year | | | Since

Inception

(9/29/2010) | |

| Fund - Class I: AQRIX | | | 5.45% | | | | 7.62% | |

| Fund - Class N: AQRNX | | | 5.12% | | | | 7.27% | |

| | |

Merrill Lynch 3-Month T-Bill Index | | | 0.10% | | | | 0.12% | |

Performance data quoted represents past performance and does not guarantee future results. Investment results and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. As of the latest prospectus, the gross expense ratio for the Fund’s Class I/N shares are 3.80% and 3.96%, respectively. Call 1-866-290-2688 or visit www.aqrfunds.com for current month-end performance.

| | | | | | | | | | | | | | | | |

| 20 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

|

AQR RISK PARITY FUND VS. MERRILL LYNCH 3-MONTH T-BILL INDEX VALUE OF $10,000 INVESTED ON 9/30/10 |

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years (or since inception if shorter). Performance data quoted represents past performance and does not guarantee future results. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 21 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MULTI-STRATEGY ALTERNATIVE FUND | | |

John Liew

Founding Principal

Jacques Friedman

Principal

Ronen Israel

Principal

Lars Nielsen

Principal

Mark Mitchell, Ph.D.

Founding Principal, CNH Partners

Todd Pulvino, Ph.D.

Founding Principal, CNH Partners

Dear Shareholder:

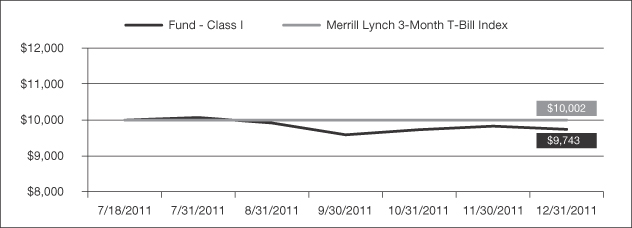

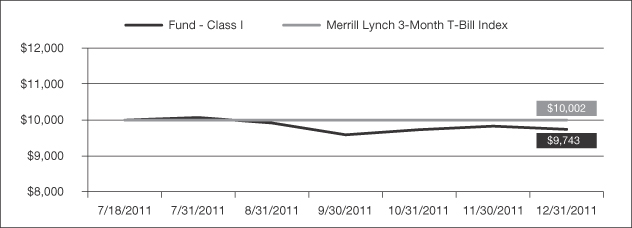

The Multi-Strategy Alternative Fund attempts to provide attractive risk-adjusted returns by providing exposure to a broadly-diversified portfolio of classic, relative-value alternative strategies. We include strategies that are liquid and which can be built to be low-to-uncorrelated with traditional markets, something we believe should be a key feature of alternative strategies that are meant to be a source of diversifying returns. We believe in providing a great deal of transparency, which means providing insight into our investment process and the economic themes we seek to capture in addition to positions.

Our focus on providing a broadly-diversified portfolio starts with including nine major categories in our Fund. They are Long/Short Equity, Equity Market Neutral, Dedicated Short Bias, Emerging Markets, Convertible Arbitrage, Event Driven, Global Macro, Managed Futures and Fixed Income Relative Value. We believe that each of these categories offers good long term risk-adjusted returns, but they each go through good times and bad times. The key is that they usually go through ups and downs at different times, thus allowing us to benefit by diversifying across the nine and generating more consistent long-term performance. Underlying the nine major categories are approximately 60+ strategies that make up the economic themes and classic strategies within the Fund. Each strategy is built from the bottom up by internal, experienced teams at AQR.

Our portfolio construction approach is to be as diversified and balanced as possible, starting with equal risk weighting as a baseline and then making small tactical tilts around the strategic risk allocation when we think strategies are conditionally attractive or unattractive. Because we are trading in these markets daily and because all of the strategies are managed in one portfolio, we can stay disciplined about rebalancing to our strategic weights, stay nimble by taking advantage of tactical opportunities and also provide efficient exposure by netting positions and transactions costs.

We target 10% annual volatility in the Fund and an annual return of 7-8% net of fees in excess of cash.

The Multi-Strategy Alternative Fund’s I shares returned -2.6% in 2011. This was a partial year for the Fund as it launched on July 18, 2011. While during the same period the Fund’s benchmark, the Bank of America Merrill Lynch 3 Month Treasury Index, had a slight positive return of 0.02%, the MSCI World Index lost 8.0% and the S&P 500 Index lost 2.6%. The year was challenging for funds like ours, which employ hedge fund-like investment strategies. The hedge fund industry, as measured by its major indices, posted its second worst annual performance ever. The Dow Jones Credit Suisse (DJCS) Hedge Fund Index lost 2.5% net of fees for the year and 4.1% over the July to December period. The investable DJCS Core Index lost 7.4% net of fees in 2011 and 6.5% since the Fund’s inception. The HFRI Fund Weighted Composite Index lost 5.0% net of fees in 2011 and 5.7% over the July to December period. The investable HFRX Global Hedge Fund Index lost 8.9% net of fees in 2011 and 6.9% since the Fund’s inception.

| | | | | | | | | | | | | | | | |

| 22 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MULTI-STRATEGY ALTERNATIVE FUND | | |

The main themes developing over the year were the sovereign debt crisis in Europe, US budget issues accompanied by a downgrade by S&P, and renewed uncertainty about the global economic recovery. Prices reacted sharply to these themes, which in some cases may have created price dislocations unrelated to fundamentals, such as excessive flow into perceived safe-havens. This was particularly true in the third quarter when global equity and commodity markets fell sharply and a strong flight-to-quality scenario played out across and within asset classes. The fourth quarter started with renewed optimism and risk appetite which saw global stock and commodity markets recover much of their third quarter losses. This rebound proved difficult to sustain, however, as concerns about the sovereign debt crisis in Europe and the threat of contagion for the global economy triggered a new wave of risk aversion for the remainder of the year. These developments affected adversely strategies with a beta to de-risking and flight-to-quality scenarios. Policymakers globally took active steps to accommodate economic growth by reducing or keeping stable key interest rates which helped sustain the rally in fixed income securities.

On a relative basis the Fund’s performance was slightly better than the performance of the major hedge fund indices and global equity markets. The Fund’s realized volatility was below target, realizing 5.5% volatility based on daily returns. The Fund’s realized beta to the MSCI World index was less than 0.1. Of the nine major categories, four had positive returns and five had negative returns. The estimated contributions were as follows:

Long/Short Equity: -1.1%

Equity Market Neutral: -1.1%

Dedicated Short Bias: 1.6%

Emerging Markets: -1.1%

Event Driven: 0.6%

Convertible Arbitrage: 0.5%

Global Macro: -2.1%

Managed Futures: -0.1%

Fixed Income Relative Value: 0.2%

Following is a more detailed review of the performance of the categories with notable contributions.

Dedicated Short Bias: The Fund profited from shorting stocks based on investor sentiment in US, Japanese and European markets. The UK portfolio detracted slightly. The category also benefited from being slightly net short the equity market (recall for the most part we hedge out the market exposure via a long portfolio) as stock markets fell on a net basis during the period since the Fund’s inception. The strategy contributed both in the third quarter and in the fourth quarter with September, October and particularly November contributing, and August and December detracting. Portfolio gains were driven largely by the US region, particularly in the month of November when heavily shorted stocks underperformed with the strong market reversal. The Japanese portfolio had modest contributions in both quarters, while the region of Europe detracted in the third quarter but contributed in the fourth quarter with heavily shorted stocks underperforming during both the rally and the subsequent reversal.

Event Driven: The category provided a strong contribution during the period, particularly in the fourth quarter. Returns were driven by merger deal spreads contracting from a high of above 15% in early August to below 7% at year-end accompanied by a very low incidence of deal failure. The Fund tactically increased its exposure to the category in mid-August to take advantage of merger spreads increasing sharply with the global de-risking early in the month. The Fund ended the year with a tactical underweight in the strategy to reflect normal spread levels but very slow deal flow.

| | | | | | | | | | | | | | | | |

| | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | 23 |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MULTI-STRATEGY ALTERNATIVE FUND | | |

Convertible Arbitrage: Converts cheapened in the third quarter due to increased market volatility around the US debt ceiling vote and later due to continuing macroeconomic uncertainty worldwide. However, the increased volatility benefited the strategy as the option component of equity sensitive names strengthened and gamma trading yielded some gains. New issuance remained very slow during this period. Cheapness continued to increase in the fourth quarter as high as 6.5% and remains above 5.5% levels, making converts attractively priced. We increased our tactical weight to 90% as a result with a view towards increasing it further to 100% once new issuance improves.

Emerging Markets: The category detracted significantly during the period with losses in the currency, equity directional and stock selection components. The currency relative value strategy drove the bulk of the performance with losses due mostly to carry and trend themes. Carry underperformed as high-yielding emerging currencies in Eastern Europe and Latin America sold off due to high beta to the global economic downturn. These losses were mitigated somewhat by our systematic carry drawdown control process. Trend factors took a hit as prior positive trends in Eastern European and Latin American currencies reversed in the third quarter. The equity directional and stock selection components, which were long throughout the period, also detracted with the global sell-off. The equity index relative value component contributed modestly.

Long/Short Equity: The category detracted significantly during the period with losses concentrated in the third quarter and positive performance in the fourth quarter. In the third quarter, losses came from being net long the market (recall again here for the most part we hedge out the market exposure of this strategy) while global equity markets sold off sharply. The UK portfolio also detracted with losses in most themes. In the fourth quarter, positive performance was concentrated in the month of October when global equity markets rallied on optimism about the global economic recovery. October saw positive performance from all geographical regions and from the directional component of the strategy. Renewed risk aversion in November and December resulted in negative performance. Our growth indicators in the stock portfolio contributed in all regions except the US, while our industry selection model contributed in all regions.

Equity Market Neutral: The category underperformed during the period, both in the third quarter and in the fourth quarter. In the third quarter, value themes suffered, particularly in Europe and the UK. The Japanese portfolio’s strong performance helped partially offset losses in the other regions. In the fourth quarter, losses were concentrated mostly in the region of Europe where valuation themes struggled with continuing risk aversion and uncertainty about reliable solutions to the region’s sovereign debt crisis leading investors towards safer, more expensive stocks. Earnings quality themes also detracted in Europe, the UK and the US.

Global Macro: The category was the biggest detractor in the Fund during the period. The primary source of underperformance was the developed currencies relative value strategy where trend and carry themes detracted significantly, while value was flat. Carry was hit especially hard in the third quarter when global de-risking directed funds into low-yielding (or safe-haven) currencies such as the Japanese Yen. Rate predicting factors also took a hit as we saw a complete re-pricing of expected policy moves. Trend losses were entirely driven by price momentum themes with the worsening risk environment causing a reversal in the general trend of outperformance in high-yielding and risk-sensitive currencies. Position-wise, the biggest detractors were our value-driven shorts in Japanese Yen and Swiss Francs as both of them appreciated with the risk-off moves in the third quarter, and our trend and carry driven long in New Zealand Dollars which depreciated with the carry-trade unwind. The developed equity relative value strategy also detracted for the period with the losses concentrated in the third quarter when European debt concerns hurt our value-driven long European positions while our value and trend driven short in Australia lost as Gross Domestic Product growth positively surprised markets and the global slowdown led to speculation

| | | | | | | | | | | | | | | | |

| 24 | | AQR Funds | | | | | | Annual Report | | | | | | December 2011 | | |

| | | | | | | | | | |

Shareholder Letter (Unaudited)

| | |

| AQR MULTI-STRATEGY ALTERNATIVE FUND | | |

of rate cuts by the RBA. The developed equity directional strategy also detracted as its long position in the basket of developed equity markets was hurt during the sell-off in the third quarter. We saw some gains from our long positions in the fixed income directional category which benefited from aggressive monetary policy actions globally.