UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22264

The Motley Fool Funds Trust

(Exact name of registrant as specified in charter)

Motley Fool Asset Management, LLC

2000 Duke Street, Suite 175

Alexandria, VA 22314

(Address of principal executive offices) (Zip code)

Peter E. Jacobstein

Motley Fool Asset Management, LLC

2000 Duke Street, Suite 175

Alexandria, VA 22314

(Name and address of agent for service)

Registrant’s telephone number, including area code: (703) 302-1100

Date of fiscal year end: October 31

Date of reporting period: April 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

…Now with LOWER, SIMPLER fees!

Motley Fool Funds is committed to being the most shareholder-friendly fund company in the world. That’s why we recently asked shareholders to approve lower and simpler fees for all of our investors- You overwhelmed us with your response.

So on June 17 we’re lowering our fund management fee1, eliminating our fulcrum fee, and capping your total expenses at 1.15%2. When it comes to investing, lower fees mean better returns — and we work hard to get you the best returns we can. Have questions? See the Q&A on this page or email AskBill@FoolFunds.com.

Q: What just happened?

A: We’re eliminating the Fulcrum Fee that rose and fell with fund performance, lowering our management fee1 and capping total expenses paid by shareholders from 1.35% to 1.15%2.

Q: What does that mean for me?

A: Fund fees are paid by all shareholders to operate the fund, and they’re subtracted directly from the fund’s holdings. So lower fund fees mean higher fund returns for you going forward.

Q: Why are you doing this?

A: Thanks to you Motley Fool Funds has grown quickly over the past five years, allowing us to be more efficient in managing your money. Call us old-fashioned, but we want to pass our savings on to shareholders. It’s part of our goal to become the most shareholder-friendly mutual fund company in the business.

Q: What’s the catch?

A: There is no catch. The fee reduction will happen automatically on June 17 for all shareholders.

1 Management fee will be reduced from 0.95% to 0.85%.

2 The Fund’s net expense ratios reflect fee waivers and expense reimbursements by the investment adviser. The Adviser has contractually agreed to pay, waive or absorb a portion of the Funds’ expenses through the end of February 2016, or such later date as may be determined by the Funds and the Adviser.

Letter to Shareholders

| | |

Portfolio Manager Bill Mann | | “A man who carries a cat by the tail learns something he can learn no other way.” – Mark Twain Dear Fellow Fool Funds Shareholder: You have just witnessed one of the weirdest periods of time you will ever see in the stock markets. I cannot say when it will end, but it will assuredly do so at some point. Ben Graham once famously noted that over the short term the market is a voting machine, while over the long term it is a weighing machine. This is one of the most hopeful quotes I know, and it should be at the center of every investor’s philosophy, whether one considers oneself an adherent of Graham-style value investing or not. |

It was Graham’s own way of saying that the market is inefficient and does illogical things, but it eventually comes to the correct conclusion.

My colleague Bill Barker has taken to calling the rapid rise in U.S. stock prices “the most hated bull market in history.” I think he’s exaggerating a bit. After all, every bull market got its start in the face of economic conditions that made short work of crushing investors’ hopes. Still, there is no question that lots of people have sat on the sidelines, awaiting the second leg of a crisis that has yet to come. Instead we have the Dow Jones Industrial Average and the S&P 500 at all-time highs, and the Nasdaq at its highest point since the bubble of 1999-2000.

Perhaps that goes to explaining the incredible boom of the second half of 2013 and beginning of 2014 – fear of loss finally being upended by a fear of being left behind. There is a meme that the market is driven by what everyone knows that everyone knows. But what if it’s deeper than that – that the market is driven by what everyone knows that everyone feels?

That’s what was so extraordinary about the previous six months, really, longer than that, going back to 2011. Under normal conditions, stock markets move, more or less, in tandem with one another; they are positively correlated. But in 2013, developed and developing market indexes became wildly divergent from one another, with markets such as Japan, the United States, and Germany turning in staggeringly high performances, while the likes of Brazil, Peru, and India declined. In 2013, the correlation between the U.S. markets and a basket of emerging-market indexes dropped to as low as -0.70. This type of divergence simply doesn’t happen. Yet – scoreboard.

We have seen similar periods of negative correlation in other asset classes. The tide of the 1999 dot-com bubble didn’t raise all boats; it was largely limited to tech companies. Old- line companies had fairly pedestrian years, and those that

| | |

| The Motley Fool Funds Trust | | 3 |

were believed to be most vulnerable to online innovation got hammered. (Incidentally, well over 70% of all U.S.-listed IPOs in 2013 were for companies that were unprofitable – the highest percentage since... 1999).

The divergence between domestic and foreign markets through last year was massive, and it happened in part because the market believes that an impending rise in interest rates in the U.S. will be bad for currencies and capital formation in those markets.

So the most fascinating question, then, is “when?” I get asked this all the time. – “When will people recognize X, Y, or Z?” You can fill in your questions. “When will people realize that the Federal Reserve has mortgaged our future?” “When will people realize that our currency has been debased?”“When will people recognize that Apple is cheap?”“When will people realize that wearing dueling plaids looks ridiculous?”

What’s implicit in these questions is that the trend in question cannot go on for that much longer, that it is somehow irrational, and that those on the other side of it will receive great retribution. I’m not so sure (though I do believe this decade may top the 1970’s for cringe-worthy photos in the future).

Our portfolio positions should suggest how we view the relative opportunities in the stock market. As value-driven investors, we are not likely to go chasinge after the next hot thing. As of the end of the measured period, the Epic Voyage Fund had a greater concentration in emerging- market countries than many mutual funds categorized as such. We’re not there because we think a turnaround is imminent. In fact, our track record should suggest strongly that we are terrible at timing. At this point, everyone knows that everyone knows (or feels) that the U.S. and other developed markets aren’t going to go down until that time that their Central Banks will no longer support them.

Two years ago, famed investor David Einhorn used a jelly doughnut metaphor to describe the impact of the liquidity that’s being injected into the markets. It is a great pick-me-up to eat a jelly doughnut, – but it will make you feel sick to eat many of them. And what neither Einhorn nor anyone else can accurately predict is at what point the market will change its mind about all that liquidity. People have been anticipating this for years now. We as humans simply don’t change our minds about things (market conditions, flat Earth, Justin Bieber’s ability to sing, etc.) as soon as conditions are altered. Rather, we can maintain our beliefs long after they have been rendered obsolete – simply because everyone else still believes them.

That’s one of the main challenges in running a mutual fund. Sometimes the market simply operates in a way that is extremely difficult for you to understand. Our job is to make sure that we are reacting to things that are real, big, and permanent, and to ignore the things that happen because of market whim. We witness companies – ones that we really like – making large, dramatic moves on what seem like small pieces of news, while other times massive potentially dislocating events cause nary a budge.

| | |

| 4 | | The Motley Fool Funds Trust |

The game as it is being played at the moment is exhausting, though I also do believe that it is in the process of changing. Since February, emerging markets have outperformed developed ones, and dramatically so. We continue to find opportunity in unloved markets and sectors, but we also find ourselves with the happy problem that of companies that we have owned for a long time and admire are seeing theirhave had their share prices increase quite a bit. As always, our discipline is to seek out companies that offer what we consider to be excellent prospects for market-beating returns over the long term.

A discussion on results

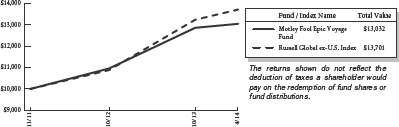

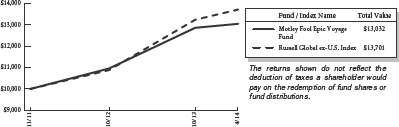

For the period of November 1 2013 through April 30, 2014 the Motley Fool Independence Fund returned 2.12% versus a 6.6% return for the MSCI World Index. The Motley Fool Great America Fund returned 2.17% versus a 7.76% return for the Russell Midcap Index. The Motley Fool Epic Voyage Fund returned 1.34% versus a 3.64% return for the Russell Global ex-US Index.

In our last annual report in October, 2013, I expressed some bewilderment at just how confident investors seemed to have become in the US markets as well as those of several other developed countries, as evidenced by what we believed were some extremely high prices. The US and European markets by and large continued to rise at a torrid pace, while only late in the reported period did emerging markets begin to outperform.

In short, if you are a value-driven investor, these types of environments are very frustrating. It is wholly unsatisfying during such an occasion to say “I told you so,” but there you go.

Two of our three funds are beating their benchmarks from inception, and given our allocation toward emerging markets in Independence Fund (to a lesser degree) and in Epic Voyage (to a much greater degree) the near-historic levels of divergence between these markets and developed ones have certainly hurt our returns.

Of the three funds, in 2013 Great America is the one that we noted we were struggling the most to find investible ideas. Performance for the last six months was impacted negatively by the poor performance of a few companies which we hold in very high regard, most notably oil services company Geospace, which saw its shares get hammered following an earnings report that disappointed investors. To put it mildly. Also, following a period of time in which American stocks moved essentially in lockstep, in the last 6 months, smaller capitalization companies (our bread and butter) have lagged.

| | |

| The Motley Fool Funds Trust | | 5 |

We constantly monitor our companies, and attempt to “kill” our investing theses. I will say that as I write this I am far more confident at the quality of the companies in our portfolio and the prices available at this point than I’ve been in more than a year. As you can see from the holdings report, we find ourselves close to fully invested in all three funds.

Famed investor Joel Greenblatt once noted about his investing strategy that “it works because it doesn’t always work.” We have never sought to come up with a methodology that consistently beat the market – that’s an almost sure recipe for failure. We are business-centric investors, who believe in trying to buy companies at a low price, and not trading very much. We won’t deviate from these commonsense principles simply because the whims of the investing world don’t seem to favor them at the moment. Whims change. Principles should not.

As always my team and I thank you for your trust in us. We never forget whose money it is we are managing.

Foolish Best,

William H. Mann, III

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by the annual report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. The opinions of the Adviser with respect to those securities may change at any time.

| | |

| 6 | | The Motley Fool Funds Trust |

| | |

New to investing? Reading your first mutual fund semi-annual report? New to investing? Reading your first mutual fund semi-annual report?

Welcome! Here are some important things you need to know. Mutual fund investing offers many potential benefits. But there also are risks. Financial gain is not guaranteed when it comes to investing in equity securities. It’s possible to lose money, including your principal — especially during the short term. We focus on stocks we have good reason to believe are undervalued by the market. We expect the price of these stocks eventually to rise as the market recognizes the true worth of the companies issuing them. But keep in mind that value stocks can remain undervalued by the market for a long time. And it’s possible that the intrinsic worth of any particular company may not match our valuation. Our funds may invest in foreign companies and in companies with small market capitalization. There are certain risks associated with these types of investments. The risks are described on pages 9, 25, and 40 of this report. Additional risk information is provided in section 3 of the Notes to Financial Statements, pp. 60-64. | | |

| | |

| The Motley Fool Funds Trust | | 7 |

Motley Fool Independence Fund Portfolio Characteristics (Unaudited)

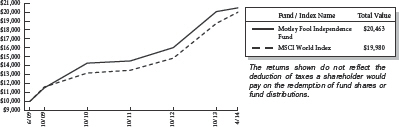

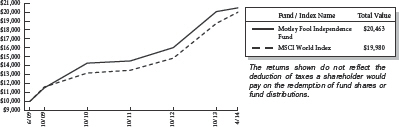

At April 30, 2014, the Motley Fool Independence Fund (the “Fund”) had an unaudited net asset value of $19.42 per share attributed to 19,276,891 shares outstanding. This compares with an unaudited net asset value as of June 16, 2009 of $10.00 per share attributed to 100,000 shares outstanding. From the Fund’s launch on June 16, 2009 to April 30, 2014, the Fund had an average annual total return of 15.83% versus a return of 15.27% over the same period for its benchmark, MSCI World Index. The graph below shows the performance of $10,000 invested in the Fund at inception. The results shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | |

|

| Average Annual Total Returns as of 04/30/2014 |

| | | Fund* | | Benchmark** |

| |

| | |

One Year | | 13.77% | | 17.24% |

Since Inception | | 15.83% | | 15.27% |

Inception Date | | 06/16/2009 | | |

Total Annual Fund Operating Expenses Before Expense Limitation (February 28, 2014 Prospectus) | | 1.36% | | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.FoolFunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

*These returns reflect expense waivers by the Fund’s investment adviser. Without these waivers, returns would have been lower.

**The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The MSCI World Index is not available for direct investment. The Fund may invest in countries that are not included within the MSCI World Index (such as emerging market countries) and its investment portfolio is not weighted in terms of countries or issuers the same as the MSCI World Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the MSCI World Index. Since Inception returns for the Benchmark reflect the performance based on the Inception Date of the Fund.

| | |

| 8 | | Motley Fool Independence Fund |

The investment objective of the Independence Fund is to achieve long-term capital appreciation. The Fund pursues this objective by investing primarily in common stocks of companies located anywhere in the world. The Fund invests in areas of the market that, in the view of Motley Fool Asset Management, LLC (the “Adviser”), offer the greatest potential for long-term capital appreciation. The Fund may invest in other types of securities and in other asset classes when, in the judgment of the Adviser, such investments offer attractive potential returns. As such, the Fund’s performance will deviate significantly from its benchmark from time to time. It is the view of the Adviser that this deviation is less meaningful over shorter time frames and is more relevant over multi-year periods.

Because the Independence Fund is free to invest in companies of any size around the world, at times, the Fund may be heavily invested in small-cap stocks and foreign securities, each of which presents extra risk. Small-cap stocks tend to be more volatile and less liquid than their large-cap counterparts. Fluctuations in currency exchange rates can cause losses when investing in foreign securities, with emerging markets presenting additional risks of illiquidity, political instability, and lax regulation. You are strongly encouraged to read more about the Fund’s strategies and risks in the prospectus.

The Independence Fund invests in securities of companies the Adviser believes are undervalued. Unlike mutual funds that are constrained by a style-box, the Fund may invest in any company, country, market, industry or sector where the Adviser’s analysis suggests that there is opportunity for gains that outweigh risks. In identifying investments for the Fund, the Adviser looks for companies it believes the market has irrationally undervalued and looks for companies that have high-quality businesses with strong market positions, manageable leverage, and robust streams of free cash flow. The following tables show the top 11 holdings, sector allocation and top 11countries in which the Fund was invested as of April 30, 2014. Portfolio holdings are subject to change without notice.

| | |

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box. Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

| | |

| | | | | | | | | | |

| | |

Top Eleven Holdings* | | % of Net Assets | | |

| | | | | |

| | |

Berkshire Hathaway, Inc. | | | | 3.25 | % | | |

Banco Latinoamericano de Comercio Exterior SA | | | | 2.83 | | | |

HDFC Bank Ltd. | | | | 2.73 | | | |

Markel Corp. | | | | 2.71 | | | |

Tod’s S.p.A. | | | | 2.69 | | | |

WellPoint, Inc. | | | | 2.52 | | | |

Under Armour, Inc. | | | | 2.13 | | | |

Baidu, Inc. | | | | 2.12 | | | |

Loews Corp. | | | | 2.07 | | | |

Credicorp Ltd. | | | | 2.07 | | | |

Gentera SAB de CV | | | | 2.03 | | | |

| | | | | | | | |

| | | | 27.15 | % | | |

| | | | | | | | |

| | | | | | | | |

| * | As of the date of the report, the fund had a holding of 3.67% in the BNY Mellon Cash Reserve. |

| | |

| Motley Fool Independence Fund | | 9 |

The Motley Fool Independence Fund uses the Global Industry Classification StandardSM (“GICSSM”) as the basis for the classification of securities on the Schedule of Investments (“SOI”). We believe that this makes the SOI classifications more standard with the rest of the industry.

| | | | | | | | | | |

| | |

Sector Allocation | | % of Net Assets | | |

| | | | | |

| | |

Financials | | | | 29.90 | % | | |

Consumer Discretionary | | | | 16.45 | | | |

Information Technology | | | | 14.50 | | | |

Health Care | | | | 9.17 | | | |

Consumer Staples | | | | 8.19 | | | |

Industrials | | | | 7.14 | | | |

Energy | | | | 4.59 | | | |

Telecommunication Services | | | | 2.79 | | | |

Materials | | | | 2.65 | | | |

Utilities | | | | 0.96 | | | |

| | | | | | | | |

| | | | 96.34 | % | | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

Top Eleven Countries | | % of Net Assets | | |

| | | | | |

| | |

United States* | | | | 45.28 | % | | |

Switzerland | | | | 4.47 | | | |

South Korea | | | | 4.33 | | | |

India | | | | 4.06 | | | |

China | | | | 3.26 | | | |

Saudi Arabia | | | | 3.22 | | | |

Bermuda | | | | 3.03 | | | |

Panama | | | | 2.83 | | | |

Japan | | | | 2.74 | | | |

Italy | | | | 2.70 | | | |

Thailand | | | | 2.62 | | | |

| | | | | | | | |

| | | | 78.54 | % | | |

| | | | | | | | |

| | | | | | | | |

| * | As of the date of the report, the fund had a holding of 3.67% in the BNY Mellon Cash Reserve. |

| | |

| 10 | | Motley Fool Independence Fund |

About Your Expenses

As a shareholder of the Independence Fund, you incur ongoing costs, including advisory fees and other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2013 to April 30, 2014.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Independence Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund as compared to the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

| | | |  Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average. Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

| | | | |

| | | | | | | | |

| | | Beginning Account Value 11/01/13 | | Ending Account Value 4/30/14 | | Annualized Expense Ratio(1) | | Expenses Paid During Period(2) |

|

|

Actual | | $1,000 | | $1,021.20 | | 1.33% | | $6.67 |

|

Hypothetical | | $1,000 | | $1,018.20 | | 1.33% | | $6.66 |

|

| (1) | These ratios reflect expenses waived by the Fund’s investment adviser. Without these Waivers, the Fund’s expenses would have been higher and the ending account values would have been lower. | |

| (2) | Expenses are equal to the Fund’s annualized expense ratio for the period November 1,2013 to April 30,2014,multiplied by the average account value over the period,multiplied by the number of days (181) in the most recent fiscal half-year, then divided by 365. | |

| | |

| Motley Fool Independence Fund (Unaudited) | | 11 |

The Motley Fool Funds Trust

Motley Fool Independence Fund

Schedule of Investments

at April 30, 2014

(Unaudited)

| | | | | | | | |

| | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | |

Equity Securities — 93.12% | | | | | | | | |

Banks — 10.77% | | | | | | | | |

Banco Latinoamericano de Comercio Exterior SA (Panama) | | | 412,235 | | | $ | 10,602,684 | |

Bangkok Bank PCL (Thailand)(a) | | | 650,000 | | | | 3,790,929 | |

Credicorp Ltd. (Bermuda) | | | 52,000 | | | | 7,761,000 | |

HDFC Bank Ltd. (India)(b) | | | 255,000 | | | | 10,212,750 | |

Monarch Financial Holdings, Inc. (United States) | | | 170,000 | | | | 1,932,900 | |

Siam Commercial Bank PCL (Thailand)(a) | | | 1,175,000 | | | | 6,024,348 | |

| | | | | | | | |

| | |

| | | | | | | 40,324,611 | |

| | | | | | | | |

| | |

Beverages — 1.41% | | | | | | | | |

Coca-Cola HBC AG (Switzerland) | | | 159,606 | | | | 4,044,796 | |

Coca-Cola Icecek AS (Turkey) | | | 52,000 | | | | 1,221,278 | |

| | | | | | | | |

| | |

| | | | | | | 5,266,074 | |

| | | | | | | | |

| | |

Building Products — 1.38% | | | | | | | | |

American Woodmark Corp. (United States)* | | | 172,771 | | | | 5,184,858 | |

| | | | | | | | |

| | |

Capital Markets — 0.73% | | | | | | | | |

INTL FCStone, Inc. (United States)* | | | 85,513 | | | | 1,617,906 | |

TD Ameritrade Holding Corp. (United States) | | | 35,000 | | | | 1,116,500 | |

| | | | | | | | |

| | |

| | | | | | | 2,734,406 | |

| | | | | | | | |

| | |

Chemicals — 2.37% | | | | | | | | |

China BlueChemical Ltd. (China) | | | 8,000,000 | | | | 4,294,543 | |

Innophos Holdings, Inc. (United States) | | | 81,164 | | | | 4,580,896 | |

| | | | | | | | |

| | |

| | | | | | | 8,875,439 | |

| | | | | | | | |

| | |

Commercial Services & Supplies — 4.29% | | | | | | | | |

Covanta Holding Corp. (United States) | | | 250,000 | | | | 4,612,500 | |

De La Rue PLC (United Kingdom) | | | 286,900 | | | | 3,975,602 | |

Depa Ltd. (United Arab Emirates)* | | | 5,815,390 | | | | 3,969,004 | |

KAR Auction Services, Inc. (United States) | | | 117,708 | | | | 3,505,344 | |

| | | | | | | | |

| | |

| | | | | | | 16,062,450 | |

| | | | | | | | |

| | |

Communications Equipment — 2.43% | | | | | | | | |

Ciena Corp. (United States)* | | | 161,000 | | | | 3,182,970 | |

See Notes to Financial Statements.

| | |

| 12 | | Motley Fool Independence Fund |

| | | | | | | | |

| | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | |

Equity Securities (continued) | | | | | | | | |

Communications Equipment (continued) | | | | | | | | |

Infinera Corp. (United States)#* | | | 661,100 | | | $ | 5,923,456 | |

| | | | | | | | |

| | |

| | | | | | | 9,106,426 | |

| | | | | | | | |

| | |

Consumer Finance — 2.03% | | | | | | | | |

Gentera SAB de CV (Mexico) | | | 4,350,000 | | | | 7,587,625 | |

| | | | | | | | |

| | |

Diversified Financial Services — 3.25% | | | | | | | | |

Berkshire Hathaway, Inc. (United States)* | | | 63 | | | | 12,176,325 | |

| | | | | | | | |

| | |

Diversified Telecommunication Services — 1.35% | | | | | | | | |

Level 3 Communications, Inc. (United States)* | | | 117,500 | | | | 5,056,025 | |

| | | | | | | | |

| | |

Electric Utilities — 0.96% | | | | | | | | |

Brookfield Infrastructure Partners LP (Bermuda) | | | 92,127 | | | | 3,592,032 | |

| | | | | | | | |

| | |

Electronic Equipment, Instruments & Components — 0.92% | | | | | | | | |

Samsung SDI Co., Ltd. (South Korea) | | | 23,500 | | | | 3,450,892 | |

| | | | | | | | |

| | |

Energy Equipment & Services — 1.77% | | | | | | | | |

CGG (France)#*(b) | | | 136,200 | | | | 2,342,640 | |

Geospace Technologies Corp. (United States)* | | | 73,601 | | | | 4,278,426 | |

| | | | | | | | |

| | |

| | | | | | | 6,621,066 | |

| | | | | | | | |

| | |

Food & Staples Retailing — 1.68% | | | | | | | | |

Costco Wholesale Corp. (United States) | | | 54,558 | | | | 6,311,269 | |

| | | | | | | | |

| | |

Food Products — 3.21% | | | | | | | | |

BRF - Brasil Foods SA (Brazil)(b) | | | 108,704 | | | | 2,456,710 | |

Nestle SA (Switzerland) | | | 68,694 | | | | 5,308,967 | |

PT Nippon Indosari Corpindo Tbk (Indonesia) | | | 44,934,800 | | | | 4,247,413 | |

| | | | | | | | |

| | |

| | | | | | | 12,013,090 | |

| | | | | | | | |

| | |

Health Care Equipment & Supplies — 5.33% | | | | | | | | |

Covidien PLC (Ireland) | | | 62,000 | | | | 4,417,500 | |

Natus Medical, Inc. (United States)* | | | 268,900 | | | | 6,676,787 | |

Nihon Kohden Corp. (Japan) | | | 133,481 | | | | 5,466,509 | |

Zimmer Holdings, Inc. (United States) | | | 35,000 | | | | 3,388,000 | |

| | | | | | | | |

| | |

| | | | | | | 19,948,796 | |

| | | | | | | | |

| | |

Health Care Providers & Services — 2.52% | | | | | | | | |

WellPoint, Inc. (United States) | | | 93,697 | | | | 9,433,414 | |

| | | | | | | | |

| | |

Hotels, Restaurants & Leisure — 2.60% | | | | | | | | |

Chipotle Mexican Grill, Inc. (United States)* | | | 10,400 | | | | 5,184,400 | |

See Notes to Financial Statements.

| | |

| Motley Fool Independence Fund | | 13 |

| | | | | | | | |

| | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | |

Equity Securities (continued) | | | | | | | | |

Hotels, Restaurants & Leisure (continued) | | | | | | | | |

Penn National Gaming, Inc. (United States)* | | | 52,083 | | | $ | 581,246 | |

Wynn Macau Ltd. (Macau) | | | 1,000,000 | | | | 3,957,572 | |

| | | | | | | | |

| | |

| | | | | | | 9,723,218 | |

| | | | | | | | |

| | |

Insurance — 6.50% | | | | | | | | |

HCC Insurance Holdings, Inc. (United States) | | | 140,200 | | | | 6,440,788 | |

Loews Corp. (United States) | | | 176,690 | | | | 7,769,059 | |

Markel Corp. (United States)* | | | 16,200 | | | | 10,139,904 | |

| | | | | | | | |

| | |

| | | | | | | 24,349,751 | |

| | | | | | | | |

| | |

Internet & Catalog Retail — 1.79% | | | | | | | | |

CJ O Shopping Co., Ltd. (South Korea) | | | 18,949 | | | | 6,698,726 | |

| | | | | | | | |

| | |

Internet Software & Services — 4.67% | | | | | | | | |

Baidu, Inc. (China)*(b) | | | 51,500 | | | | 7,923,275 | |

Google, Inc. Class A (United States)* | | | 9,000 | | | | 4,813,920 | |

Google, Inc. Class C (United States)* | | | 9,000 | | | | 4,739,940 | |

| | | | | | | | |

| | |

| | | | | | | 17,477,135 | |

| | | | | | | | |

| | |

Leisure Products — 1.28% | | | | | | | | |

Shimano, Inc. (Japan) | | | 48,000 | | | | 4,798,166 | |

| | | | | | | | |

| | |

Media — 1.33% | | | | | | | | |

DreamWorks Animation SKG, Inc. (United States)#* | | | 85,000 | | | | 2,042,550 | |

Multiplus SA (Brazil) | | | 228,600 | | | | 2,923,947 | |

| | | | | | | | |

| | |

| | | | | | | 4,966,497 | |

| | | | | | | | |

| | |

Metals & Mining — 0.28% | | | | | | | | |

Antofagasta PLC (United Kingdom) | | | 80,000 | | | | 1,066,171 | |

| | | | | | | | |

| | |

Multiline Retail — 0.73% | | | | | | | | |

PT Mitra Adiperkasa Tbk (Indonesia) | | | 4,952,000 | | | | 2,730,528 | |

| | | | | | | | |

| | |

Oil, Gas & Consumable Fuels — 2.82% | | | | | | | | |

Denbury Resources, Inc. (United States) | | | 262,200 | | | | 4,410,204 | |

Lukoil OAO (Russia)(b) | | | 62,350 | | | | 3,299,562 | |

Total Gabon SA (Gabon) | | | 4,670 | | | | 2,841,068 | |

| | | | | | | | |

| | |

| | | | | | | 10,550,834 | |

| | | | | | | | |

| | |

Pharmaceuticals — 1.33% | | | | | | | | |

Dr. Reddy’s Laboratories Ltd. (India)#(b) | | | 110,177 | | | | 4,965,677 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 14 | | Motley Fool Independence Fund |

| | | | | | | | |

| | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | |

Equity Securities (continued) | | | | | | | | |

Real Estate Investment Trusts — 3.05% | | | | | | | | |

American Tower Corp. (United States) | | | 64,000 | | | $ | 5,345,280 | |

Gaming and Leisure Properties, Inc. (United States) | | | 68,217 | | | | 2,506,975 | |

Lippo Malls Indonesia Retail Trust (Singapore) | | | 11,000,000 | | | | 3,557,640 | |

| | | | | | | | |

| | |

| | | | | | | 11,409,895 | |

| | | | | | | | |

| | |

Real Estate Management & Development — 2.23% | | | | | | | | |

Cheung Kong Holdings Ltd. (Hong Kong) | | | 235,337 | | | | 4,018,936 | |

Henderson Land Development Co., Ltd. (Hong Kong) | | | 726,671 | | | | 4,343,646 | |

| | | | | | | | |

| | |

| | | | | | | 8,362,582 | |

| | | | | | | | |

| | |

Road & Rail — 0.98% | | | | | | | | |

CSX Corp. (United States) | | | 130,000 | | | | 3,668,600 | |

| | | | | | | | |

| | |

Semiconductors & Semiconductor Equipment — 3.12% | | | | | | | | |

Intel Corp. (United States) | | | 219,000 | | | | 5,845,110 | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan)(b) | | | 290,000 | | | | 5,829,000 | |

| | | | | | | | |

| | |

| | | | | | | 11,674,110 | |

| | | | | | | | |

| | |

Software — 1.62% | | | | | | | | |

DuzonBizon Co., Ltd. (South Korea) | | | 513,180 | | | | 6,074,801 | |

| | | | | | | | |

| | |

Specialty Retail — 1.93% | | | | | | | | |

Williams-Sonoma, Inc. (United States) | | | 115,000 | | | | 7,224,300 | |

| | | | | | | | |

| | |

Technology Hardware, Storage & Peripherals — 1.73% | | | | | | | | |

Apple, Inc. (United States) | | | 11,000 | | | | 6,490,990 | |

| | | | | | | | |

| | |

Textiles, Apparel & Luxury Goods — 6.80% | | | | | | | | |

Swatch Group SA (Switzerland) | | | 11,500 | | | | 7,394,959 | |

Tod’s S.p.A. (Italy)# | | | 72,000 | | | | 10,089,505 | |

Under Armour, Inc. (United States)* | | | 162,820 | | | | 7,960,270 | |

| | | | | | | | |

| | |

| | | | | | | 25,444,734 | |

| | | | | | | | |

| | |

Transportation Infrastructure — 0.49% | | | | | | | | |

International Container Terminal Services, Inc. (Philippines) | | | 750,000 | | | | 1,822,368 | |

| | | | | | | | |

| | |

Wireless Telecommunication Services — 1.44% | | | | | | | | |

SBA Communications Corp. (United States)* | | | 60,000 | | | | 5,385,600 | |

| | | | | | | | |

| | |

Total Equity Securities (Cost $ 263,130,394) | | | | | | | 348,629,481 | |

| | | | | | | | |

| | |

Participatory Notes — 3.22% | | | | | | | | |

Banks — 1.33% | | | | | | | | |

Al Rajhi Banking & Investment Co. (Saudi Arabia)(c) | | | 290,332 | | | | 4,979,956 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Motley Fool Independence Fund | | 15 |

| | | | | | | | |

| | |

Issues | | Shares | | | Value

(Note 2) | |

| | |

| | |

Participatory Notes (continued) | | | | | | | | |

Food Products — 1.89% | | | | | | | | |

Almarai Co. (Saudi Arabia)(c) | | | 385,759 | | | $ | 7,061,126 | |

| | | | | | | | |

| | |

Total Participatory Notes (Cost $ 9,675,985) | | | | | | | 12,041,082 | |

| | | | | | | | |

| | |

Other Investments — 3.67% | | | | | | | | |

Temporary Cash Investment — 3.67% | | | | | | | | |

BNY Mellon Cash Reserve | | | 13,740,955 | | | | 13,740,955 | |

| | | | | | | | |

| | |

Total Other Investments (Cost $ 13,740,955) | | | | | | | 13,740,955 | |

| | | | | | | | |

| | |

Total Investments Before Short-Term Investments Held as Collateral for Loaned Securities (Cost $ 286,547,334) — 100.01% | | | | | | $ | 374,411,518 | |

| | | | | | | | |

| | |

| | | Principal | | | Value (Note 2) | |

| | |

| | |

Short-Term Investments Held as Collateral For Loaned Securities — 3.22% | | | | | | | | |

With Barclays Capital: at 0.01%, dated 04/30/14, to be repurchased on 05/01/14, repurchase price $536,920 (collateralized by U.S. Treasury Notes, par values ranging from $7,572 - $ 539,560, coupon rates ranging from 0.25% - 2.13%, 09/15/15 - 08/31/20; total market value $547,659) | | $ | 536,920 | | | $ | 536,920 | |

With Citibank: at 0.06%, dated 04/30/14, to be repurchased 05/01/14, repurchase price $942,907 (collateralized by Government National Mortgage Association & Federal National Mortgage Association, par values ranging from $54 - $446,865, coupon rates ranging from 1.82% - 7.00%, 08/01/17 - 11/15/48; total market value $961,765) | | | 942,907 | | | | 942,907 | |

With Credit Agricole: at 0.06%, dated 04/30/14, to be repurchased 05/01/14, repurchase price $2,828,721 (collateralized by Federal National Mortgage Association & Federal Mortgage Acceptance Corporation, par values ranging from $49,269 - $ 342,884, coupon rates ranging from 2.50% - 5.00%, 04/01/24 - 09/01/43; total market value $2,885,295) | | | 2,828,721 | | | | 2,828,721 | |

With Daiwa Capital Markets: at 0.07%, dated 04/30/14, to be repurchased 05/01/14, repurchase price $2,828,721 (collateralized by Federal Mortgage Acceptance Corporation & Federal National Mortgage Association, par values ranging from $1 - $ 189,907, coupon rates ranging from 1.32% - 6.50%, 06/01/17 - 10/01/44; total market value $2,885,295) | | | 2,828,721 | | | | 2,828,721 | |

With Merrill Lynch: at 0.04%, dated 04/30/14, to be repurchased 05/01/14, repurchase price $215,431 (collateralized by U.S. Treasury Notes, par values ranging from $10,311 - $ 161,723, coupon rates ranging from 0.00% - 3.63%, 11/30/16 - 04/15/28; total market value $219,739) | | | 215,431 | | | | 215,431 | |

See Notes to Financial Statements.

| | |

| 16 | | Motley Fool Independence Fund |

| | | | | | | | |

| | |

| | | Principal | | | Value (Note 2) | |

| | |

Short-Term Investments Held as Collateral For Loaned Securities (continued) | |

With Nomura Securities: at 0.06%, dated 04/30/14, to be repurchased 05/01/14, repurchase price $2,828,721 (collateralized by Federal Home Loan Bank & Federal National Mortgage Association, par values ranging from $1 - $206,331, coupon rates ranging from 0.00% - 8.88%, 05/01/14 - 07/15/36; total market value $2,885,296) | | $ | 2,828,721 | | | $ | 2,828,721 | |

With RBS Securities: at 0.05%, dated 04/30/14, to be repurchased 05/01/14, repurchase price $1,885,814 (collateralized by Trading Index Notes and Bonds, par values ranging from $278 - $435,454, coupon rates ranging from 0.63% - 3.88%, 07/15/15 - 02/15/44; total market value $1,923,534) | | | 1,885,814 | | | | 1,885,814 | |

| | | | | | | | |

Total Short-Term Investments Held as Collateral for Loaned Securities (Cost $ 12,067,235) | | | | | | | 12,067,235 | |

| | | | | | | | |

Total Investments Portfolio (Cost $ 298,614,569) — 103.23% | | | | | | $ | 386,478,753(d | ) |

| Liabilities in Excess of Other Assets — (3.23)% | | | | | | | (12,088,107 | ) |

| | | | | | | | |

NET ASSETS — 100.00% (Applicable to 19,276,891 shares outstanding) | | | | | | $ | 374,390,646 | |

| | | | | | | | |

| | | | | | | | |

| # | Security partially or fully on loan. |

| * | Non-income producing security. |

| (a) | NVDR — Non-Voting Depository Receipts |

| (b) | ADR — American Depositary Receipts |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. Total market value of Rule 144A securities is $12,041,082 and represents 3.22% of net assets as of April 30, 2014. |

| (d) | At April 30, 2014, the market value of securities on loan for the Motley Fool Independence Fund was $11,519,780. In the event that the collateral received is insufficient to cover the value of the loaned securities and provided such collateral shortfall is not the result of investment losses, the Fund’s securities lending agent, The Bank of New York Mellon, has agreed to pay the amount of the shortfall to the Fund, or at its discretion, replace the loaned securities. |

LP — Limited Partnership

PCL — Public Company Limited

PLC — Public Limited Company

See Notes to Financial Statements.

| | |

| Motley Fool Independence Fund | | 17 |

Statement of Assets and Liabilities

| | | | | | | |

| | | April 30, 2014

(Unaudited) | | |

| |

Assets: | | | | | | | |

| | |

Investments in securities of unaffiliated issuers, at value (at cost, $298,614,569)* | | | $ | 386,478,753 | | | |

Cash | | | | 222 | | | |

| | |

Foreign currency, at value (at cost, $1,045,278) | | | | 1,033,586 | | | |

Receivables: | | | | | | | |

Dividends and tax reclaims | | | | 827,747 | | | |

Interest | | | | 833 | | | |

Securities lending | | | | 3,577 | | | |

Shares of beneficial interest sold | | | | 268,156 | | | |

Prepaid expenses and other assets | | | | 57,951 | | | |

| | | | | | | |

Total Assets | | | | 388,670,825 | | | |

| | | | | | | |

| | |

Liabilities | | | | | | | |

Payables: | | | | | | | |

Obligation to return securities lending collateral | | | | 12,067,235 | | | |

Investment securities purchased | | | | 751,473 | | | |

Shares of beneficial interest redeemed | | | | 439,284 | | | |

Dividend withholding tax | | | | 30,277 | | | |

Accrued expenses: | | | | | | | |

Audit fees | | | | 9,603 | | | |

Accounting and administration fees | | | | 165,053 | | | |

Advisory fees | | | | 594,610 | | | |

Custodian fees | | | | 21,644 | | | |

Transfer agent fees | | | | 75,970 | | | |

Trustee fees | | | | 1,146 | | | |

Other expenses | | | | 123,884 | | | |

| | | | | | | |

Total Liabilities | | | | 14,280,179 | | | |

| | | | | | | |

Net Assets | | | $ | 374,390,646 | | | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| 18 | | Motley Fool Independence Fund |

Statement of Assets and Liabilities

| | | | | | | |

| | | April 30, 2014

(Unaudited) | | |

| |

| | |

Net Assets Consist of: | | | | | | | |

Paid-in-Capital | | | $ | 276,854,832 | | | |

Undistributed Net Investment Income | | | | 541,383 | | | |

Accumulated Net Realized Gain on Investments and Foreign Currency Transactions | | | | 9,139,371 | | | |

Net Unrealized Appreciation/(Depreciation) on Investments, Foreign Currencies, and Assets and Liabilities Denominated in Foreign Currencies | | | | 87,855,060 | | | |

| | | | | | | |

Net Assets | | | $ | 374,390,646 | | | |

| | | | | | | |

| | | | | | | |

Net Asset Value: | | | | | | | |

$0.001 par value, unlimited shares authorized Net assets applicable to capital shares outstanding | | | $ | 374,390,646 | | | |

Shares outstanding | | | | 19,276,891 | | | |

| | | | | | | |

Net asset value, offering, and redemption price per share** | | | $ | 19.42 | | | |

| | | | | | | |

| | | | | | | |

| * | Includes securities loaned of $11,519,780. |

| ** | A charge of 2% is imposed on the redemption proceeds of shares redeemed or exchanged within 90 days of purchase. |

The accompanying notes are an integral part of these financial statements.

| | |

| Motley Fool Independence Fund | | 19 |

Statement of Operations

| | | | | | |

| | | Six-Months Ended

April 30, 2014

(Unaudited) | | | |

| |

| | |

Investment Income | | | | | | |

Dividends | | $ | 3,241,431 | | | |

Securities lending income | | | 6,251 | | | |

Less foreign taxes withheld | | | (90,030 | ) | | |

| | | | | | |

Total Investment Income | | | 3,157,652 | | | |

| | | | | | |

| | |

Expenses | | | | | | |

Accounting and administration fees | | | 148,148 | | | |

Blue sky fees | | | 17,943 | | | |

Shareholder account-related services | | | 139,882 | | | |

Chief Compliance Officer fees | | | 7,642 | | | |

Custodian fees | | | 60,760 | | | |

Investment advisory fees | | | 1,654,990 | | | |

Professional fees | | | 27,147 | | | |

Shareholder reporting fees | | | 11,074 | | | |

Transfer agent fees | | | 201,713 | | | |

Trustee fees | | | 19,100 | | | |

Other expenses | | | 15,192 | | | |

| | | | | | |

Total expenses | | | 2,303,591 | | | |

| | | | | | |

Expenses waived/reimbursed net of amount recaptured | | | 67,062 | | | |

| | | | | | |

Net expenses | | | 2,370,653 | | | |

| | | | | | |

Net Investment Income | | | 786,999 | | | |

| | | | | | |

Realized and Unrealized Gain (Loss) | | | | | | |

Net realized gain (loss) from: | | | | | | |

Investment securities | | | 9,146,389 | | | |

Foreign currency transactions | | | 63,519 | | | |

| | | | | | |

Net realized gain on investments and foreign currency transactions | | | 9,209,908 | | | |

| | | | | | |

| | |

Change in net unrealized appreciation/(depreciation) on: | | | | | | |

Investment securities | | | (2,287,606 | ) | | |

Foreign currency translations | | | (27,869 | ) | | |

| | | | | | |

Change in net unrealized appreciation/ (depreciation) on investments, foreign currencies, and assets and liabilities denominated in foreign currencies | | | (2,315,475 | ) | | |

| | | | | | |

Net realized and unrealized gain | | | 6,894,433 | | | |

| | | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 7,681,432 | | | |

| | | | | | |

| | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| 20 | | Motley Fool Independence Fund |

Statements of Changes in Net Assets

| | | | | | | | | | | | |

| | | Six-Months

Ended

April 30,

2014

(Unaudited) | | | | | Year Ended

October 31,

2013 | | | |

| | | | |

Operations: | | | | | | | | | | | | |

Net Investment Income | | $ | 786,999 | | | | | $ | 1,195,303 | | | |

Net Realized Gain/(Loss) on Investments and Foreign Currency Transactions | | | 9,209,908 | | | | | | 3,261,402 | | | |

Change in Net Unrealized Appreciation/ (Depreciation) on Investments and Foreign Currency Translation | | | (2,315,475 | ) | | | | | 58,000,042 | | | |

| | | | | | | | | | | | |

| | | | |

Net increase in net assets resulting from operations | | | 7,681,432 | | | | | | 62,456,747 | | | |

| | | | | | | | | | | | |

| | | | |

Dividends to Shareholders: | | | | | | | | | | | | |

Dividends from net investment income | | | (835,870 | ) | | | | | (1,588,159 | ) | | |

Distributions from net realized capital gains | | | (3,348,906 | ) | | | | | — | | | |

| | | | | | | | | | | | |

Total dividends and distributions | | | (4,184,776 | ) | | | | | (1,588,159 | ) | | |

| | | | | | | | | | | | |

| | | | |

Capital Share Transactions: | | | | | | | | | | | | |

Proceeds from shares sold (2,507,239 and 6,299,592 shares, respectively) | | | 47,704,621 | | | | | | 109,943,562 | | | |

Reinvestment of dividends (215,247 and 100,131 shares, respectively) | | | 4,104,739 | | | | | | 1,561,039 | | | |

Value of shares redeemed (1,844,483 and 2,718,295 shares, respectively) | | | (35,146,532 | ) | | | | | (46,269,770 | ) | | |

| | | | | | | | | | | | |

Redemption and small-balance account fees | | | 150,342 | | | | | | 96,740 | | | |

| | | | | | | | | | | | |

Net increase from capital share transactions | | | 16,813,170 | | | | | | 65,331,571 | | | |

| | | | | | | | | | | | |

Total increase in net assets | | | 20,309,826 | | | | | | 126,200,159 | | | |

| | | | | | | | | | | | |

| | | | |

Net Assets: | | | | | | | | | | | | |

Beginning of Period | | | 354,080,820 | | | | | | 227,880,661 | | | |

| | | | | | | | | | | | |

End of Period* | | $ | 374,390,646 | | | | | $ | 354,080,820 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Including undistributed net investment income | | $ | 541,383 | | | | | $ | 609,266 | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| Motley Fool Independence Fund | | 21 |

Financial Highlights

(for a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

April 30, 2014 | | Years Ended October 31, | |

| | | (Unaudited)(1) | | 2013 | | | 2012 | | | 2011 | | | 2010(2) | | | 2009(3)(4) | |

Net Asset Value, Beginning of Period | | $ 19.24 | | $ | 15.48 | | | $ | 14.15 | | | $ | 14.14 | | | $ | 11.48 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income(5) | | 0.04 | | | 0.07 | | | | 0.14 | | | | 0.11 | | | | 0.16 | | | | 0.02 | |

Net Gains on Securities (Realized and Unrealized) | | 0.35 | | | 3.79 | | | | 1.29 | | | | 0.15 | | | | 2.59 | | | | 1.46 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total From Investment Operations | | 0.39 | | | 3.86 | | | | 1.43 | | | | 0.26 | | | | 2.75 | | | | 1.48 | |

| | | | | | | | | | | | | | | | | | | | | | |

Less Distributions | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | (0.04) | | | (0.11 | ) | | | (0.10 | ) | | | (0.15 | ) | | | (0.02 | ) | | | — | |

Net Realized Capital Gains | | (0.18) | | | — | | | | — | | | | (0.11 | ) | | | (0.08 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | (0.22) | | | (0.11 | ) | | | (0.10 | ) | | | (0.26 | ) | | | (0.10 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | �� |

Redemption and Small-Balance Account Fees | | 0.01 | | | 0.01 | | | | —* | | | | 0.01 | | | | 0.01 | | | | —* | |

| | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Period | | $ 19.42 | | $ | 19.24 | | | $ | 15.48 | | | $ | 14.15 | | | $ | 14.14 | | | $ | 11.48 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Return(6)(7) | | 2.12% | | | 25.14 | % | | | 10.21 | % | | | 1.91 | % | | | 24.18 | % | | | 14.80 | % |

Net Assets, End of Period (thousands) | | $374,391 | | $ | 354,081 | | | $ | 227,881 | | | $ | 198,232 | | | $ | 128,406 | | | $ | 30,427 | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | |

Ratio of Expenses to Average Net Assets | | 1.33% | | | 1.36 | % | | | 1.47 | % | | | 1.43 | % | | | 1.38 | % | | | 1.35 | % |

The accompanying notes are an integral part of these financial statements.

| | |

| 22 | | Motley Fool Independence Fund |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Six Months Ended

April 30, 2014 | | | | Years Ended October 31, | | |

| | | | | (Unaudited)(1) | | | | 2013 | | 2012 | | 2011 | | 2010(2) | | 2009(3)(4) |

Ratio of Expenses to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | | | | 1.29 | % | | | | | | 1.37 | % | | | | 1.54 | % | | | | 1.58 | % | | | | 2.20 | % | | | | 7.01 | % |

Ratio of Net Investment Income to Average Net Assets | | | | | | 0.44 | % | | | | | | 0.44 | % | | | | 0.93 | % | | | | 0.76 | % | | | | 1.29 | % | | | | 0.41 | % |

Ratio of Net Investment Income to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | | | | 0.48 | % | | | | | | 0.43 | % | | | | 0.86 | % | | | | 0.61 | % | | | | 0.47 | % | | | | (5.25 | )% |

Portfolio Turnover | | | | | | 11 | % | | | | | | 22 | % | | | | 37 | % | | | | 37 | % | | | | 37 | % | | | | 50 | % |

| * | Amount represents less than $0.005 per share. |

| (1) | For the six months ended April 30, 2014, all ratios for the period have been annualized. Total return and portfolio turnover for the period have not been annualized. |

| (2) | Due to a clerical error, Net Gains on Securities (Realized and Unrealized) and Total From Investment Operations for the year ended October 31, 2010 were reported in the 2010 Annual Report as $2.39 and $2.55, respectively. Such amounts have been revised as shown above. |

| (3) | Because of commencement of operations and related preliminary transaction costs, these ratios are not necessarily indicative of future ratios. |

| (4) | Commenced operations on June 16, 2009. All ratios for the period have been annualized. Total return and portfolio turnover for the period have not been annualized. |

| (5) | Per share data calculated using average shares outstanding method. |

| (6) | During the six months ended April 30, 2014 and the years ended October 31, 2013, October 31, 2011 and October 31, 2010, 0.05% 0.06%, 0.07% and 0.08%, respectively, of the Fund’s total return was attributable to redemption and small-balance account fees received as referenced in Note 4. Excluding this item, the total return would have been 2.07%, 25.08%, 1.84% and 24.10%, respectively. For the year ended October 31, 2012 and the period ended October 31, 2009, redemption and small-balance account fees received had no effect on the Fund’s total return. |

| (7) | Total return reflects the rate an investor would have earned on an investment in the Fund during each period, assuming reinvestment of all distributions. |

The accompanying notes are an integral part of these financial statements.

| | |

| Motley Fool Independence Fund | | 23 |

Motley Fool Great America Fund Portfolio Characteristics (Unaudited)

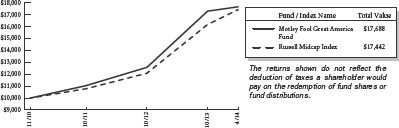

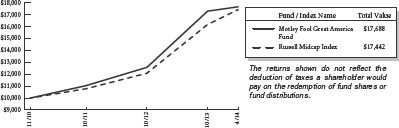

At April 30, 2014, the Motley Fool Great America Fund (the “Fund”) had an unaudited net asset value of $17.37 per share attributed to 11,154,109 shares outstanding. This compares with an unaudited net asset value as of November 1, 2010 of $10.00 per share attributed to 102,000 shares outstanding. From the Fund’s launch on November 1, 2010 to April 30, 2014, the Fund had an average annual total return of 17.74% versus a return of 17.26% over the same period for its benchmark, Russell Midcap Index. The graph below shows the performance of $10,000 invested in the Fund at inception. The results shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | |

Let’s be serious though. A graph of the performance of any investment over less than three years tells you virtually nothing. In about five years, they’ll actually tell you quite a bit about how well we’re managing your money. Let’s be serious though. A graph of the performance of any investment over less than three years tells you virtually nothing. In about five years, they’ll actually tell you quite a bit about how well we’re managing your money.

| | |

| | | | |

|

| Average Annual Total Returns as of 04/30/2014 |

| | | Fund* | | Benchmark** |

| |

| | |

One Year | | 21.71% | | 21.25% |

Since Inception | | 17.74% | | 17.26% |

Inception Date | | 11/01/2010 | | |

Total Annual Fund Operating Expenses Before Expense Limitation (February 28, 2014 Prospectus) | | 1.38% | | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.FoolFunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

*These returns reflect expense waivers by the Fund’s investment adviser. Without these waivers, returns would have been lower.

**The Russell Midcap Index is an unmanaged, free float-adjusted, market capitalization weighted index that is designed to measure the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The Fund may invest in companies that are not included within the Russell Midcap Index and its investment portfolio is not weighted in terms of issuers the same as the Russell Midcap Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the Russell Midcap Index. Since Inception returns for the Benchmark reflect the performance based on the Inception Date of the Fund.

| | |

| 24 | | Motley Fool Great America Fund |

The investment objective of the Great America Fund is to achieve long-term capital appreciation. The Fund pursues this objective by investing primarily in common stocks of companies organized in the United States. The Fund employs a value-based investment strategy and seeks long-term growth of capital by acquiring securities of companies at prices the investment adviser, Motley Fool Asset Management, LLC (the “Adviser”), believes to be significantly below their intrinsic value. The Fund may invest in other types of securities and in other asset classes when, in the judgment of the Adviser, such investments offer attractive potential returns. As such, the Fund’s performance will deviate significantly from its benchmark from time to time. It is the view of the Adviser that this deviation is less meaningful over shorter time frames and is more relevant over multi-year periods.

Although the Great America Fund may invest in companies with any market capitalization, the Adviser expects that investments in the securities of companies having smaller- and mid-market capitalizations will be important components of the Fund’s investment program. Investments in securities of these companies may involve greater risk than do investments in larger, more established companies. Small-and mid-cap stocks tend to be more volatile and less liquid than their large-cap counterparts. You are strongly encouraged to read more about the Fund’s strategies and risks in the prospectus.

The Great America Fund invests in securities of companies the Adviser believes are undervalued. Unlike mutual funds that hew to their benchmark, the Fund may invest in any company, industry or sector where the Adviser’s analysis suggests that there is opportunity for gains that outweigh risks. In identifying investments for the Fund, the Adviser looks for companies it believes the market has irrationally undervalued and looks for companies that have high-quality businesses with strong market positions, manageable leverage, and robust streams of free cash flow. The following tables show the top 11 holdings and sectors in which the Fund was invested as of April 30, 2014. Portfolio holdings are subject to change without notice.

| | |

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box. Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

| | |

| | | | | | | | | | |

| | |

Top Eleven Holdings* | | % of Net

Assets | | |

| | | | | |

| | |

Berkshire Hathaway, Inc. | | | | 2.99 | % | | |

Markel Corp. | | | | 2.74 | | | |

CARBO Ceramics, Inc. | | | | 2.45 | | | |

TriMas Corp. | | | | 2.28 | | | |

Costco Wholesale Corp. | | | | 2.27 | | | |

SBA Communications Corp. | | | | 2.21 | | | |

Tractor Supply Co. | | | | 2.19 | | | |

American Woodmark Corp. | | | | 2.15 | | | |

Natus Medical, Inc. | | | | 2.15 | | | |

Intel Corp. | | | | 2.15 | | | |

WellPoint, Inc. | | | | 2.13 | | | |

| | | | | | | | |

| | | | 25.71 | % | | |

| | | | | | | | |

| | | | | | | | |

| * | As of the date of the report, the fund had a holding of 4.62% in the BNY Mellon Cash Reserve. |

| | |

| Motley Fool Great America Fund | | 25 |

The Motley Fool Great America Fund uses the Global Industry Classification StandardSM (“GICSSM”) as the basis for the classification of securities on the Schedule of Investments (“SOI”). We believe that this makes the SOI classifications more standard with the rest of the industry.

| | | | | | | | | | |

| | |

Sector Allocation | | % of Net

Assets | | |

| | | | | |

| | |

Consumer Discretionary | | | | 24.33 | % | | |

Financials | | | | 22.68 | | | |

Industrials | | | | 13.93 | | | |

Information Technology | | | | 8.23 | | | |

Health Care | | | | 7.71 | | | |

Materials | | | | 6.00 | | | |

Energy | | | | 5.45 | | | |

Consumer Staples | | | | 4.00 | | | |

Telecommunication Services | | | | 3.38 | | | |

| | | | | | | | |

| | | | 95.71 | % | | |

| | | | | | | | |

| | | | | | | | |

| | |

| 26 | | Motley Fool Great America Fund |

About Your Expenses

As a shareholder of the Great America Fund, you incur ongoing costs, including advisory fees and other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2013 to April 30, 2014.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund as compared to the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | |

Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average. Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

| | |

| | | | | | | | |

| | | | |

| | | Beginning Account Value 11/01/13 | | Ending Account Value 04/30/14 | | Annualized Expense Ratio(1) | | Expenses Paid During Period(2) |

| |

| | | | |

Actual | | $1,000 | | $1,021.69 | | 1.36% | | $6.82 |

Hypothetical | | $1,000 | | $1,018.05 | | 1.36% | | $6.80 |

| (1) | These ratios reflect expenses waived by the Fund’s investment adviser. Without these Waivers, the Fund’s expenses would have been higher and the ending account values would have been lower. | |

| (2) | Expenses are equal to the Fund’s annualized expense ratio for the period November 1,2013 to April 30, 2014, multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year, then divided by 365. | |

| | |

| Motley Fool Great America Fund (Unaudited) | | 27 |

The Motley Fool Funds Trust

Motley Fool Great America Fund

Schedule of Investments

at April 30, 2014

(Unaudited)

| | | | | | | | |

| | |

Issues | | Shares | | | Value

(Note 2) | |

| | |

| | |

Equity Securities — 95.71% | | | | | | | | |

Air Freight & Logistics — 3.44% | | | | | | | | |

CH Robinson Worldwide, Inc. (United States) | | | 46,000 | | | $ | 2,709,400 | |

XPO Logistics, Inc. (United States)#* | | | 146,000 | | | | 3,962,440 | |

| | | | | | | | |

| | | | | | | 6,671,840 | |

| | | | | | | | |

| | |

Auto Components — 1.67% | | | | | | | | |

Drew Industries, Inc. (United States) | | | 64,500 | | | | 3,245,640 | |

| | | | | | | | |

| | |

Automobiles — 2.55% | | | | | | | | |

Harley-Davidson, Inc. (United States) | | | 12,500 | | | | 924,250 | |

Thor Industries, Inc. (United States) | | | 66,000 | | | | 4,017,420 | |

| | | | | | | | |

| | | | | | | 4,941,670 | |

| | | | | | | | |

| | |

Banks — 5.87% | | | | | | | | |

Access National Corp. (United States) | | | 65,529 | | | | 966,553 | |

Carter Bank & Trust (United States) | | | 247,075 | | | | 2,742,532 | |

Cascade Bancorp. (United States)#* | | | 225,000 | | | | 1,064,250 | |

Home Federal Bancorp., Inc. (United States) | | | 75,000 | | | | 1,128,750 | |

Monarch Financial Holdings, Inc. (United States) | | | 252,900 | | | | 2,875,473 | |

Suffolk Bancorp. (United States)* | | | 118,646 | | | | 2,601,907 | |

| | | | | | | | |

| | | | | | | 11,379,465 | |

| | | | | | | | |

| | |

Beverages — 1.59% | | | | | | | | |

Crimson Wine Group Ltd. (United States)* | | | 346,047 | | | | 3,076,358 | |

| | | | | | | | |

| | |

Building Products — 2.15% | | | | | | | | |

American Woodmark Corp. (United States)* | | | 138,778 | | | | 4,164,728 | |

| | | | | | | | |

| | |

Capital Markets — 2.55% | | | | | | | | |

Diamond Hill Investment Group, Inc. (United States) | | | 29,023 | | | | 3,445,611 | |

INTL FCStone, Inc. (United States)* | | | 79,300 | | | | 1,500,356 | |

| | | | | | | | |

| | | | | | | 4,945,967 | |

| | | | | | | | |

| | |

Chemicals — 1.16% | | | | | | | | |

Innophos Holdings, Inc. (United States) | | | 40,000 | | | | 2,257,600 | |

| | | | | | | | |

| | |

Commercial Services & Supplies — 2.26% | | | | | | | | |

Covanta Holding Corp. (United States) | | | 100,000 | | | | 1,845,000 | |

KAR Auction Services, Inc. (United States) | | | 85,000 | | | | 2,531,300 | |

| | | | | | | | |

| | | | | | | 4,376,300 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 28 | | Motley Fool Great America Fund |

| | | | | | | | |

| | |

Issues | | Shares | | | Value

(Note 2) | |

| | |

| | |

Equity Securities (continued) | | | | | | | | |

Communications Equipment — 2.28% | | | | | | | | |

Ciena Corp. (United States)* | | | 83,000 | | | $ | 1,640,910 | |

Infinera Corp. (United States)* | | | 309,500 | | | | 2,773,120 | |

| | | | | | | | |

| | | | | | | 4,414,030 | |

| | | | | | | | |

| | |

Diversified Financial Services — 2.99% | | | | | | | | |

Berkshire Hathaway, Inc. (United States)* | | | 30 | | | | 5,798,250 | |

| | | | | | | | |

| | |

Diversified Telecommunication Services — 1.16% | | | | | | | | |

Level 3 Communications, Inc. (United States)* | | | 52,418 | | | | 2,255,546 | |

| | | | | | | | |

| | |

Energy Equipment & Services — 3.91% | | | | | | | | |

CARBO Ceramics, Inc. (United States)# | | | 34,000 | | | | 4,756,940 | |

Geospace Technologies Corp. (United States)* | | | 48,500 | | | | 2,819,305 | |

| | | | | | | | |

| | | | | | | 7,576,245 | |

| | | | | | | | |

| | |

Food & Staples Retailing — 2.27% | | | | | | | | |

Costco Wholesale Corp. (United States) | | | 38,000 | | | | 4,395,840 | |

| | | | | | | | |

| | |

Food Products — 0.15% | | | | | | | | |

Flowers Foods, Inc. (United States) | | | 14,000 | | | | 287,280 | |

| | | | | | | | |

| | |

Health Care Equipment & Supplies — 4.25% | | | | | | | | |

Cooper Companies, Inc. (The) (United States) | | | 7,000 | | | | 923,370 | |

Natus Medical, Inc. (United States)* | | | 167,700 | | | | 4,163,991 | |

Varian Medical Systems, Inc. (United States)* | | | 39,500 | | | | 3,142,225 | |

| | | | | | | | |

| | | | | | | 8,229,586 | |

| | | | | | | | |

| | |

Health Care Providers & Services — 3.46% | | | | | | | | |

Catamaran Corp. (United States)* | | | 33,000 | | | | 1,245,750 | |

Quest Diagnostics, Inc. (United States) | | | 24,000 | | | | 1,342,320 | |

WellPoint, Inc. (United States) | | | 41,000 | | | | 4,127,880 | |

| | | | | | | | |

| | | | | | | 6,715,950 | |

| | | | | | | | |

| | |

Hotels, Restaurants & Leisure — 6.13% | | | | | | | | |

Chipotle Mexican Grill, Inc. (United States)* | | | 4,800 | | | | 2,392,800 | |

Panera Bread Co. (United States)* | | | 2,000 | | | | 305,940 | |

Penn National Gaming, Inc. (United States)* | | | 41,117 | | | | 458,866 | |

Red Robin Gourmet Burgers, Inc. (United States)* | | | 20,000 | | | | 1,359,600 | |

Texas Roadhouse, Inc. (United States) | | | 149,000 | | | | 3,686,260 | |

Wynn Resorts Ltd. (United States) | | | 18,000 | | | | 3,670,020 | |

| | | | | | | | |

| | | | | | | 11,873,486 | |

| | | | | | | | |

| | |

Household Durables — 1.94% | | | | | | | | |

TRI Pointe Homes, Inc. (United States)#* | | | 234,000 | | | | 3,760,380 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Motley Fool Great America Fund | | 29 |

| | | | | | | | |

| | |

Issues | | Shares | | | Value

(Note 2) | |

| | |

| | |

Equity Securities (continued) | | | | | | | | |

Insurance — 5.18% | | | | | | | | |

HCC Insurance Holdings, Inc. (United States) | | | 38,000 | | | $ | 1,745,720 | |

Loews Corp. (United States) | | | 67,500 | | | | 2,967,975 | |

Markel Corp. (United States)* | | | 8,500 | | | | 5,320,320 | |

| | | | | | | | |

| | | | | | | 10,034,015 | |

| | | | | | | | |

| | |

Internet & Catalog Retail — 1.33% | | | | | | | | |

Liberty Interactive Corp. (United States)* | | | 89,000 | | | | 2,586,340 | |

| | | | | | | | |

| | |

Internet Software & Services — 1.70% | | | | | | | | |

Google, Inc. Class A (United States)* | | | 3,100 | | | | 1,658,128 | |

Google, Inc. Class C (United States)* | | | 3,100 | | | | 1,632,646 | |

| | | | | | | | |

| | | | | | | 3,290,774 | |

| | | | | | | | |

| | |

Machinery — 3.71% | | | | | | | | |

Actuant Corp. (United States) | | | 82,000 | | | | 2,776,520 | |

TriMas Corp. (United States)* | | | 123,091 | | | | 4,414,043 | |

| | | | | | | | |

| | | | | | | 7,190,563 | |

| | | | | | | | |

| | |

Media — 1.20% | | | | | | | | |

DreamWorks Animation SKG, Inc. (United States)* | | | 96,600 | | | | 2,321,298 | |

| | | | | | | | |

| | |

Metals & Mining — 1.31% | | | | | | | | |

Horsehead Holding Corp. (United States)* | | | 163,200 | | | | 2,544,288 | |

| | | | | | | | |

| | |