UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22255

EGA Emerging Global Shares Trust

(Exact name of registrant as specified in charter)

171 East Ridgewood Avenue

Ridgewood, NJ 07450

(Address of principal executive offices) (Zip code)

Robert C. Holderith

171 East Ridgewood Avenue

Ridgewood, NJ 07450

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-201-389-6872

Date of fiscal year end: March 31

Date of reporting period: March 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

EGA Emerging Global Shares Trust

Annual Report

March 31, 2012

EGShares GEMS Composite ETF

EGShares Basic Materials GEMS ETF

EGShares Consumer Goods GEMS ETF

EGShares Consumer Services GEMS ETF

EGShares Energy GEMS ETF

EGShares Financials GEMS ETF

EGShares Health Care GEMS ETF

EGShares Industrials GEMS ETF

EGShares Technology GEMS ETF

EGShares Telecom GEMS ETF

EGShares Utilities GEMS ETF

EGShares Emerging Markets Metals & Mining ETF

EGShares Emerging Markets Consumer ETF

EGShares India Infrastructure ETF

EGShares China Infrastructure ETF

EGShares Brazil Infrastructure ETF

EGShares India Small Cap ETF

EGShares India Consumer ETF

EGShares Low Volatility Emerging Markets Dividend ETF

Table of Contents

(This page intentionally left blank.)

Letter to Shareholders

Dear Shareholder,

As we enter our fourth year as an ETF provider, much has changed in our industry. Although there are less than fifty US-based ETF firms, some areas of this space are getting crowded. There has been a proliferation of fixed income and equity income products as well as numerous fourth and fifth to market US equity ETFs that are having a difficult time finding a place in investor’s portfolios.

At Emerging Global Advisors (EGA), we continue to remain focused solely on emerging markets. We believe the natural and sensible progression for institutional and other professional investors in emerging markets is trending towards more sector and theme focused exposure tools. We also feel, given our expertise in this area, EGA can offer updated and theme centric broad emerging markets exposure tools. Many of the larger emerging market ETF indexes are less focused on potential future economic drivers. We have focused on, and will continue to provide, what we feel are the most appropriate tools given the economic drivers in these regions. To that end, we believe our funds represent asset categories that could provide great potential for active managers to provide accretive exposures to their EM portfolios.

Ongoing research related to the specific purpose of further product development efforts has been and always will be a focus of our firm. Innovation in our product lineup and a deep appreciation and understanding of the EM opportunity provides us with an edge to make products attractive to investors.

In June of 2011, EGA launched eight additional emerging market sector ETFs, completing the suite of ten. We followed up with an India Consumer ETF (INCO) and Low Volatility Emerging Markets Dividend ETF (HILO) in August. These launches brought our total of funds to 19.

We continue to believe that as developed markets investors learn more about the emerging markets (EMs) investment story, the more interesting the opportunity becomes. We look to continue to introduce products in areas we believe will provide a competitive advantage to emerging market investors and our firm.

Thank you for your support of Emerging Global Advisors ETFs.

Sincerely,

Robert C. Holderith

Chairman of the Board, EGA Emerging Global Shares Trust

President & Founder, Emerging Global Advisors, LLC

This material must be accompanied or preceded by the prospectus

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This fund will concentrate its investments in issuers of one or more particular industries to the same extent that its Underlying Index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from maintaining exposure to issuers conducting business in a specific industry.

Robert Holderith is a registered representative of ALPS Distributors Inc.

Emerging Global Shares are distributed by ALPS Distributors Inc.

| EGA Emerging Global Shares Trust 1 |

Comments from the Chief Investment Officer & Director of Research

Dear Shareholder:

Twelve months ago, I offered my comments in a similar letter. My remarks included:

| • | | “The “risk on” trade was quickly reversed with investors exiting from positions which had outperformed.” |

| • | | “Emerging market investments of various asset categories (equities, fixed income, currency) underperformed those of developed markets.” |

| • | | “… the US market was relatively strong in the calendar year 2010. This was especially true in the latter half of 2010 … This despite lingering concerns of high unemployment, unsustainable debt levels and partisan government muddling through towards the next presidential election.” |

| • | | “European concerns regarding sovereign risk remain.” |

| • | | “The primary concern seems not to be social unrest and armed conflict (Libya) in the Mideast/North Africa (MENA) region … we observe that during the social unrest … there was little movement in traditional gauges of negative crowd psychology: oil prices did not spike nor did gold or VIX.” |

It is amazing but the clichéd phrase rings true: The more things change, the more they stay the same. Despite some improved economic indicators from the US, we remain in a risk-off psychological environment globally. It may not be enough to blame the Eurozone sovereign crisis. Similar to Europe structurally, the US and Japan remain slow to pull out firmly from the past recession’s grip. Unlike continental Europe which barely dodged a formal recession due to stronger numbers out of Germany, the UK reported a recession for the first quarter of 2012. Thus, one year later we still have a collection of developed economies that are still struggling from the effects of the global financial crisis. In this broad regard, very little has changed.

In fact, with all points listed above, the story remains the same. Short term treasuries remain close to historically low yields as investors accept zero versus the uncertainty of Europe. Emerging market investments continue to relatively underperform as investors gravitate towards the US dollar/treasuries impacting foreign returns both based on capital appreciation and dividend income. Even in the Mideast, concerns remain in Egypt although far greater suffering exists now in Syria. The threat of full scale conventional warfare between Israel and Iran is high.

One distinct difference this year is national politics and in particular, elections. True, the BRICs1 have held national elections with little change. Putin’s return is all about change yet remaining the same. What is more interesting now is recent election results in France and Greece. It may not be a resurgence of the left as it is an ongoing bias towards leftist agendas. Obama’s similar strength is harder to gauge. A simple observation: His entry to the executive office seems to have timed well with the market low of the S&P 500 in March 2009. We make no argument for causality but note how his re-election has greater potential of success as growing hints of sustained economic recovery prevail.

I do not, nor does our firm, make calls on economies or markets. We observe, and provide exposures so investors can make certain calls. However, we do surmise that a strong US economy is in the greater interest of all investors. The emerging markets are growing yet without support rather than drag from the US, Europe and Japan, especially with such globalized and highly correlated markets, investors will continue to be burned by a low return, low yielding environment.

The tug of war among investor psyche remains. Many investors are realizing that they need the growth and income that may come from emerging markets more so than developed markets yet the front page news, regardless of where the focus is, has acted somewhat as a deterrent. Some observers see this as equilibrium of classic greed versus fear.

Market Performance Review

This tug of war may be the only logical explanation for overall sideways or falling markets especially since the summer of 2011. The first quarter of 2012 was a short respite from what has overall been a bearish environment in equity markets with the months of January and February especially stable to the upside. For the quarter ending March 31, 2012, price returns for various capital market benchmarks2 were as follows (source: Bloomberg):

| • | | S&P 500 up 12.00%. MSCI EM index up 13.65%. MSCI World up 10.94%. |

| • | | Gold up 6.38%. Oil (brent crude) up 7.26%. US aggregate bond index up 0.30%. |

| 2 EGA Emerging Global Shares Trust |

Comments from the Chief Investment Officer & Director of Research

(continued)

Due to market weakness in mid 2011, returns were relatively muted over the 12 months ending March 31, 2012:

| • | | S&P 500 up 6.23%. MSCI EM index down 11.05%. MSCI World down 1.72%. |

| • | | Gold up 15.25%. Oil (brent crude) up 14.89%. US aggregate bond index up 7.71%. |

Overall for the 12 months ending March 31, 2012, markets found difficulty establishing a longer term trend. For the months of April to July of 2011, global equities were flat overall. The months of August and September saw a clear uptrend but not necessarily for riskier assets including emerging market equities. The last quarter of 2011 was volatile overall with large swings both ways. Only a broad bull market in the first calendar quarter of 2012 brought some calm to markets.

As of March 31st, total firm assets were US 711.7 million. Our largest funds by assets and their NAV total returns were:

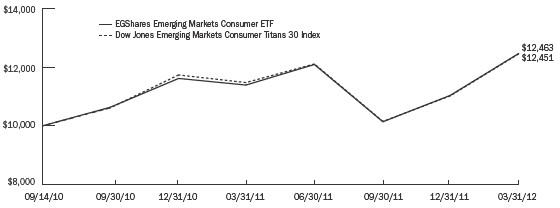

| • | | ECON (EGShares Emerging Markets Consumer ETF): 9.44% for the past 12 months. |

| • | | BRXX (EGShares Brazil Infrastructure ETF): -0.04% for the past 12 months. |

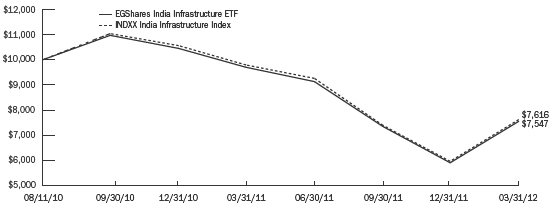

| • | | INXX (EGShares India Infrastructure ETF): -22.19% for the past 12 months. |

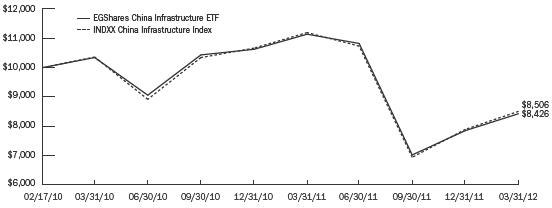

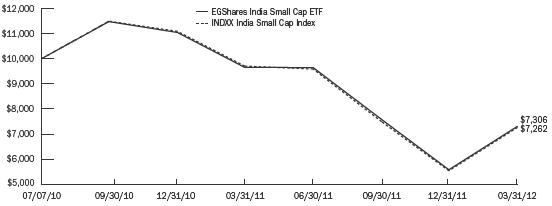

For the nine EGShares ETFs whose inception date was prior to March 31, 2011, 12-month returns (based on NAV) ranged from 9.44% for ECON down to -27.66% for EMT (EGShares Emerging Markets Metals & Mining ETF). Along with EMT, three other funds (CHXX, INXX, SCIN) had returns below -20% for the 12-month period.

It is an interesting observation that of the nine EGShares ETFs with at least a 12-month track record, the two top performers were also the largest funds by assets: ECON and BRXX.

Although, for such a short measurement period, it may seem that these returns may seem large but historically may be deemed quite common for emerging markets. Furthermore, although trading volumes may be low in historical terms, price volatility is high and we see this by the wide swings in both quarterly and annual performance along with ranges among various of our funds.

From the data, we see that this inherent volatility is in the nature of the markets overall and not necessarily isolated to the emerging markets.

Global concerns over Europe remain even at the time of this report’s writing if not at heights unseen previously. The VIX index3 was calm (sub 20 in value) prior to Eurozone concerns of the summer of 2011. The VIX spiked to high 40’s and stayed above 30 for most of August to November having not sustained that length of elevated position since the midst of the financial crisis in late 2008. No surprise that oil dropped during that period. Oil did climb from a low below 80 in early October to a high above USD 110 in late February, a rise of over 40%. It has steadily declined since then however at the time of writing, demand for oil has dissipated as crude prices approach USD 90. Gold did provide its classic hedge during the market declines of 2011 especially its climb towards USD 1900 in August 2011. Since then, it has been range-bound (albeit a wide range) between USD 1600-1800. Interestingly, at the time of writing, with rising levels of fear (VIX) related to the Eurozone, gold has fallen to USD 1540.

To repeat again what I stated in last year’s CIO letter to fund shareholders:

“We care less about the raw numbers and more about the trends. Real growth is found there and not here. We are incentivized to save; they spend more. Our aging population is a burden to our system. Their youth is hungry for a better lifestyle and embracing capitalism. We are trying to save blue collar jobs. They compete well for those same jobs (with currency and wages on their side) but are raising the bar on education and thus innovation.”

Without meaning to sound over-dramatic, these comments are more prescient now and the concept of “competing well” needs to be emphasized. The decisions being made in emerging markets are meant to provide a few key results:

| 1. | | Generate a competitive environment within their borders and likely abroad to not only compete with us in the west but against their emerging market brethren. |

| 2. | | As a result of this, they hope to duplicate the economic miracles of recent growth stories such as South Korea, Taiwan and Israel so as to have some form of social harmony and higher standards of living. |

| EGA Emerging Global Shares Trust 3 |

Comments from the Chief Investment Officer & Director of Research

(concluded)

It is not over-dramatic to suggest something is different in the developed world. Europe is a mess and it is amazing that the likelihood of Greece’s exit from the union is a catalyst for unknown potential scenarios for global citizens and investors alike. If Europe is in a mess of unknown proportions, then they are not thinking about competing in this modern, globalized and hyper-competitive world. They are just trying to survive. Some would question if the Japanese are in a similar situation.

It is not for Emerging Global Advisors to determine if the US is also in a similar situation. We are in the business of considering foreign investments, and in particular towards the growth oriented markets. The logic here suggests that of the areas where investors generally have gravitated towards for international diversification, therein lies the greater risks. Europe and Japan are not likely to be growth engines of the future. Certain economies in Europe may in fact be submerging similar to Argentina’s fall of the last 100 years. Of course, there is a fine line here between our observation and the reality of the situation. We only stress the concern that for US investors looking for international diversification, a fair risk assessment may require a more open mind to the so called risky asset class that is emerging markets.

Our firm and the indices our products track remain focused on allowing investors the access to relevant themes, sectors and various niche exposures as well as broader coverage of these important new growth markets.

Richard C. Kang

Chief Investment Officer & Director of Research

May 23, 2012

This material must be accompanied or preceded by the prospectus.

Past performance does not guarantee future results.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This fund will concentrate its investments in issuers of one or more particular industries to the same extent that its Underlying Index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from maintaining exposure to issuers conducting business in a specific industry. Small cap and mid cap companies generally will have greater volatility in price than the stocks of large companies due to limited product lines or resources or a dependency upon a particular market niche.

The above commentary is for informational purposes only. Nothing in this commentary should be construed as an offer or recommendation to buy or sell a particular security. The opinions and estimates noted herein are accurate as of May 23, 2012 and are subject to change.

The funds are distributed by ALPS Distributors, Inc.

Richard C. Kang and Robert C. Holderith are registered representative of ALPS Distributors, Inc.

| 1 | | BRICs = Brazil, Russia, India, China |

| 2 | | S&P 500 = Standard and Poor’s 500 Price Return Index, MSCI EM = MSCI Emerging Market Index, MSCI World = MSCI World Index, Gold = Comex Gold 100 oz Futures Contract, Oil (brent crude) = Brent Crude Futures Contract , US Aggregate Bond Index = Barclays US Aggregate Total Return Value Index (unhedged USD) |

| 3 | | VIX Index = The Chicago Board Options Exchange Volatility Index. A reflection of future market volatility based on the weighted average of implied volatilities (time value) found among active S&P 500 index options. Higher values mean greater perceived risk and a higher overall cost as a result to purchase portfolio insurance in the form of index options. Lower values mean less risk aversion. |

| 4 EGA Emerging Global Shares Trust |

(This page intentionally left blank.)

Portfolio Summary (Unaudited)

EGShares GEMS Composite ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Gazprom OAO | 5.5% |

| China Mobile, Ltd. | 4.1% |

| Industrial and Commercial Bank of China, Ltd. | 3.5% |

| America Movil SAB de CV | 3.5% |

| Petroleo Brasileiro SA | 3.2% |

| Itau Unibanco Holding SA | 3.2% |

| China Construction Bank Corp. | 3.1% |

| Companhia de Bebidas das Americas | 2.7% |

| Surgutneftegas | 2.6% |

| PetroChina Co., Ltd. | 2.5% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

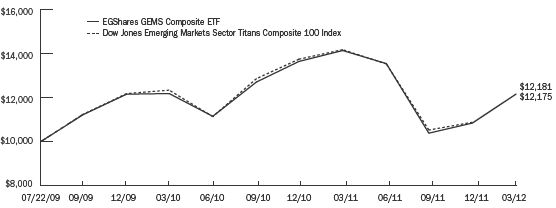

EGShares GEMS Composite ETF (ticker: AGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Sector Titans Composite 100 IndexSM (“Sector Underlying Index”). The Sector Underlying Index is comprised of a representative sample of 100 Emerging Markets companies deemed to be the 10 leading companies in each of the 10 “Industries,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy. The annual expense ratio of the Fund is 0.75%.

The EGShares GEMS Composite ETF covers the broad emerging markets, in our opinion, better than any other broad exposure global emerging market indexed exchange traded fund. The underlying index does not include South Korea, Taiwan and Israel which many other emerging market indices often include. For investors new to gaining exposure to markets in the developing world, they may be more familiar with the concept of BRIC economies (Brazil, Russia, India, China) which this fund has significant exposure to. In fact, the weights are ranked in this fund as Brazil, then China, Russia and India with South Africa in fifth place. These top five country exposures make up 82% of the fund as of March 31, 2012. The remainder of the Fund predominately gives exposure to Mexico, Chile, Indonesia and Malaysia with several other countries each with less than 1% weight within the fund. Overall, emerging markets underperformed developed markets over the 12 month period ending March 31, 2012 as investors fled for the safety of domestic markets and especially US treasuries.

The EGShares GEMS Composite ETF had a total return of 12.18% at net asset value (“NAV”) for the quarter ended March 31, 2012 and 7.58% annualized return since its inception date of July 22, 2009. The Fund NAV had a -13.97% return for the full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

Performance Charts

The following performance chart is provided for comparative purposes and represents the periods noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 6 EGA Emerging Global Shares Trust |

EGShares GEMS Composite ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Sector Titans

Composite 10 Index |

| 1 Year | (13.97)% | (13.62)% | (14.16)% |

| Since Inception1 | 7.58% | 7.58% | 7.60% |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.75%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

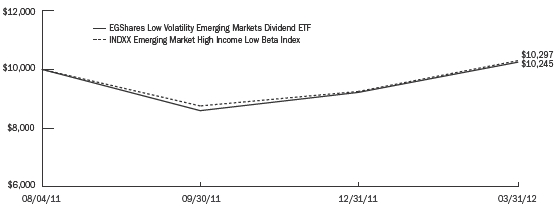

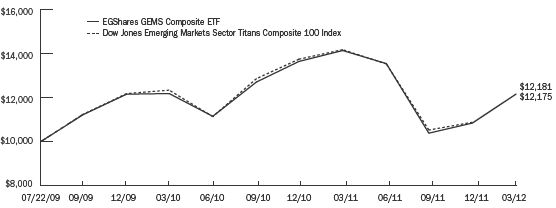

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 7 |

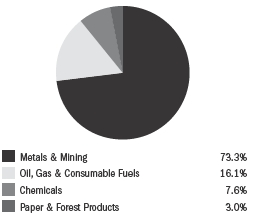

Portfolio Summary (Unaudited)

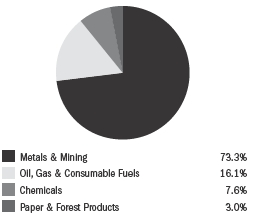

EGShares Basic Materials GEMS ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Vale SA | 10.6% |

| MMC Norilsk Nickel OJSC | 7.2% |

| China Shenhua Energy Co., Ltd. | 5.7% |

| AngloGold Ashanti, Ltd. | 5.7% |

| Grupo Mexico SAB de CV | 5.0% |

| Impala Platinum Holdings, Ltd. | 4.9% |

| Uralkali OJSC | 4.7% |

| Gold Fields, Ltd. | 4.3% |

| Gerdau SA | 4.1% |

| Companhia Siderurgica Nacional SA | 3.9% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

EGShares Basic Materials GEMS ETF (ticker: LGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Basic Materials Titans 30 IndexSM (“Basic Materials Underlying Index”). The Basic Materials Underlying Index is comprised of publicly traded firms in the “Basic Materials Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in securities of Emerging Markets basic materials companies that are included in the Fund’s Basic Materials Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in those securities. The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Basic Materials Underlying Index through investments in equity securities, including common shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). ADRs and GDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world. The Basic Materials Underlying Index includes companies whose businesses generally involve: chemicals; forestry and paper; industrial metals and mining; and mining. The annual expense ratio of the Fund is 0.85%.

The EGShares Basic Materials GEMS ETF provides a means for investors to have exposure to a particular slice of the commodity complex excluding energy and agriculture. With heightened fears related to Eurozone sovereign risk, investors moved assets away from commodity related investments as concerns lingered of reduced demand. Although January 2012 saw price increases, the months thereafter up to this report’s writing have seen continued price deterioration. Even gold, a classic hedge to market uncertainty, has not been consistent in its ability to retain value during periods of fear. Broader commodity demand, especially from emerging markets, may lead to broader market stability and should provide a stable floor for this Fund going forward. The five largest country exposures (in descending order) were South Africa, Brazil, China, Russia and India.

The EGShares Basic Materials GEMS ETF had a total return of 10.65% at net asset value (“NAV”) for the quarter ended March 31, 2012 and -18.87% return since its inception date of June 23, 2011. Based on this inception date, the Fund did not have enough historical pricing to cover a full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 8 EGA Emerging Global Shares Trust |

EGShares Basic Materials GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return1 |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Basic Materials

Titans 30 Index |

| Since Inception2 | (18.87)% | (18.85)% | (21.23)% |

| 1 | | Returns of less than one year are not annualized. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This Fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 9 |

Portfolio Summary (Unaudited)

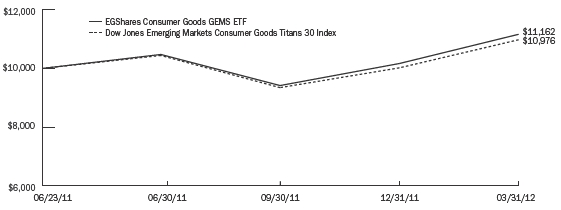

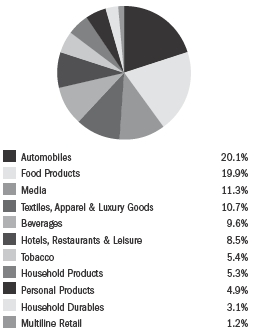

EGShares Consumer Goods GEMS ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Companhia de Bebidas das Americas | 10.3% |

| Astra International Tbk PT | 7.2% |

| Fomento Economico Mexicano SAB de CV | 6.4% |

| ITC, Ltd. | 6.2% |

| BRF - Brasil Foods SA | 6.0% |

| Hindustan Unilever, Ltd. | 4.6% |

| Grupo Bimbo SAB de CV | 3.9% |

| Dongfeng Motor Group Co., Ltd. | 3.8% |

| Tiger Brands, Ltd. | 3.8% |

| Bajaj Auto, Ltd. | 3.6% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

EGShares Consumer Goods GEMS ETF (ticker: GGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Consumer Goods Titans 30 IndexSM (“Consumer Goods Underlying Index”). The Consumer Goods Underlying Index is comprised of publicly traded firms in the “Consumer Goods Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in securities of Emerging Markets Consumer Goods companies that are included in the Fund’s Consumer Goods Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in those securities. The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Consumer Goods Underlying Index through investments in equity securities, including common shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). ADRs and GDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world. The Consumer Goods Underlying Index includes companies whose businesses generally involve: automobiles and parts; beverages; food production; household goods; leisure goods; personal goods; and tobacco. The annual expense ratio of the Fund is 0.85%.

The EGShares Consumer Goods GEMS ETF is one of very few available ETFs to play the emerging market consumer theme. Unlike most other emerging market sectors, since its inception in late June of 2011, GGEM has been a relative outperformer beating both the S&P 500 and MSCI Emerging market indices for the period up to March 31, 2012. Large positions such as Ambev, a major Latin American beverage company not only performed strongly, but also demonstrate the basics of consumer demand. Many of the names in this Fund focus heavily on consumer staples versus consumer discretionary names. As opposed to many consumer funds focused on luxury goods to the emerging markets, this Fund focuses on the goods of greater demand to the billions of new emerging market consumers. As of March 31, 2012, roughly 57% of the Fund’s weight was in the food producers and beverage industries, the two largest components. Geographic diversification was evident with the four largest country exposures all between 18.2% and 13.8% as of March 31, 2012.

The EGShares Consumer Goods GEMS ETF had a total return of 9.80% at net asset value (“NAV”) for the quarter ended March 31, 2012 and 11.62% return since its inception date of June 23, 2011. Based on this inception date, the Fund did not have enough historical pricing to cover a full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

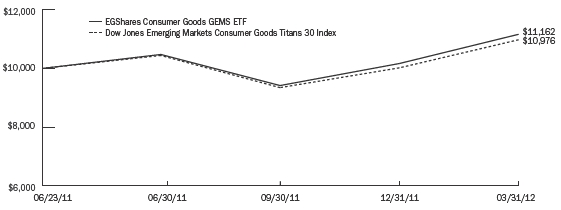

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 10 EGA Emerging Global Shares Trust |

EGShares Consumer Goods GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return1 |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Consumer Goods

Titans 30 Index |

| Since Inception2 | 11.62% | 11.84% | 9.76% |

| 1 | | Returns of less than one year are not annualized. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This Fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 11 |

Portfolio Summary (Unaudited)

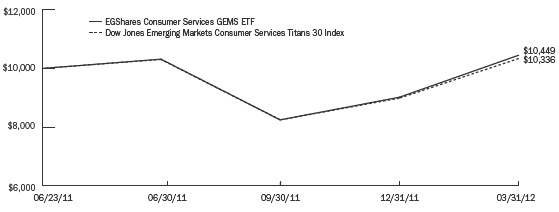

EGShares Consumer Services GEMS ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Naspers, Ltd. | 10.4% |

| Wal-Mart de Mexico SAB de CV | 9.3% |

| Grupo Televisa SAB | 6.9% |

| Cencosud SA | 6.2% |

| S.A.C.I. Falabella | 6.0% |

| Grupo Elektra SA de CV | 4.6% |

| Genting BHD | 4.5% |

| Magnit OJSC | 4.2% |

| Companhia Brasileira de Distribuicao Grupo | |

| Pao de Acucar | 4.0% |

| Shoprite Holdings, Ltd. | 4.0% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

EGShares Consumer Services GEMS ETF (ticker: VGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Consumer Services Titans 30 IndexSM (“Consumer Services Underlying Index”). The Consumer Services Underlying Index is comprised of publicly traded firms in the “Consumer Services Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in securities of Emerging Markets Consumer Services companies that are included in the Fund’s Consumer Services Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in those securities. The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Consumer Services Underlying Index through investments in equity securities, including common shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). ADRs and GDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world. The Consumer Services Underlying Index includes companies whose businesses generally involve: food and drug retail; general retail; media; and travel and leisure. The annual expense ratio of the Fund is 0.85%.

The EGShares Consumer Services GEMS ETF is a fund heavily biased to basic retailers. The heaviest industry components as of March 31, 2012 were general retailers and food/drug retailers which provided roughly 60% of the Fund’s exposure. Media and travel/leisure were the next largest industry weights with just over one third of the Fund’s exposure. As economies grow and consumers come out of poverty, the services they require will be fairly modest. Basic retailers, media and travel are required of any citizen. Thus, similar to our consumer goods ETF, so the exposures within this Fund focus less on high-end services not of great demand to the larger population of new middle class consumers in these growth markets.

The EGShares Consumer Services GEMS ETF had a total return of 15.88% at net asset value (“NAV”) for the quarter ended March 31, 2012 and 4.49% return since its inception date of June 23, 2011. Based on this inception date, the Fund did not have enough historical pricing to cover a full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

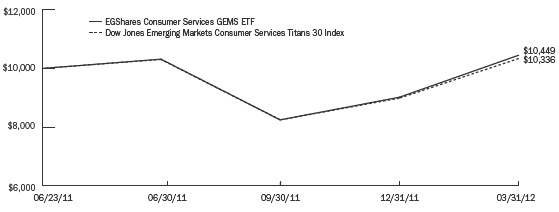

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 12 EGA Emerging Global Shares Trust |

EGShares Consumer Services GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return1 |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Consumer Services

Titans 30 Index |

| Since Inception2 | 4.49% | 4.54% | 3.36% |

| 1 | | Returns of less than one year are not annualized. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This Fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 13 |

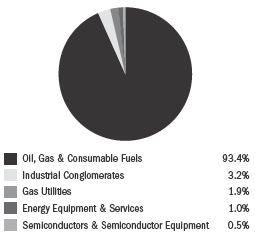

Portfolio Summary (Unaudited)

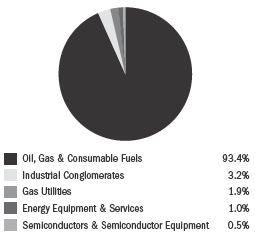

EGShares Energy GEMS ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Gazprom OAO | 10.0% |

| Petroleo Brasileiro SA | 7.1% |

| LUKOIL OAO | 6.6% |

| Surgutneftegas | 6.0% |

| PetroChina Co., Ltd. | 5.9% |

| CNOOC, Ltd. | 5.9% |

| NovaTek OAO | 4.6% |

| China Petroleum & Chemical Corp. | 4.4% |

| Sasol, Ltd. | 4.2% |

| Reliance Industries, Ltd. | 4.2% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

EGShares Energy GEMS ETF (ticker: OGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Oil and Gas Titans 30 IndexSM (“Oil and Gas Underlying Index”). The Oil and Gas Underlying Index is comprised of publicly traded firms in the “Oil and Gas Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in Energy companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Energy companies as companies that are included in the Oil and Gas Underlying Index at the time of purchase and generally includes companies whose businesses involve: oil and gas production; oil equipment, services and distribution; and alternative energy. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy. The annual expense ratio of the Fund is 0.85%.

The EGShares Energy GEMS ETF is a fund which can act as an inflation hedge although global investors are likely more concerned with deflation as growth remains lackluster. Aside from certain markets such as India, global markets have not demonstrated anxiety over inflation. For the period from the beginning of 2011 to the end of October 2011, the price of OGEM was fairly close in directional movement with the price of oil. However, a strong 40% increase in oil prices from October 2011 to February 2012 occurred while OGEM underperformed likely due to emerging market currency weakness relative to the US dollar among other macro market factors. Of course, westerners have had little time to complain as energy prices fell back in the first quarter of 2012 as Eurozone worries led to reduced demand assumptions. Longer term optimism exists for the emerging market energy sector given that of the fewer new discoveries, most that are significant are generally found in the developing world such as the Petrobras subsalt deepwater project off the Brazilian Atlantic coast. Other large names in OGEM are also major state owned companies with the BRICs with these four country exposures comprising roughly three-quarters of the Fund’s assets as of March 31, 2012.

The EGShares Energy GEMS ETF had a total return of 14.25% at net asset value (“NAV”) for the quarter ended March 31, 2012 and 8.46% annualized return since its inception date of May 21, 2009. The Fund NAV had a -14.78% return for the full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

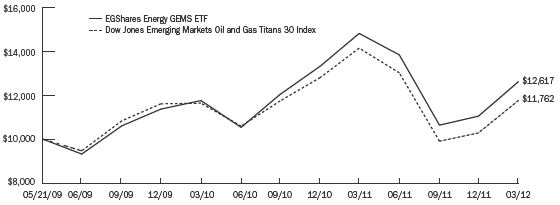

Performance Charts

The following performance chart is provided for comparative purposes and represents the periods noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 14 EGA Emerging Global Shares Trust |

EGShares Energy GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Oil and Gas

Titans 30 Index |

| 1 Year | (14.78)% | (15.12)% | (16.80)% |

| Since Inception1 | 8.46% | 8.44% | 5.83% |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 15 |

Portfolio Summary (Unaudited)

EGShares Financials GEMS ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Industrial and Commercial Bank of China, Ltd. | 9.8% |

| Itau Unibanco Holding SA | 9.1% |

| China Construction Bank Corp. | 8.9% |

| Banco Bradesco SA | 7.3% |

| Sberbank of Russia | 5.9% |

| Bank of China, Ltd. | 4.5% |

| Standard Bank Group, Ltd. | 4.3% |

| Housing Development Finance Corp., Ltd. | 4.3% |

| China Life Insurance Co., Ltd. | 4.3% |

| HDFC Bank, Ltd. | 3.9% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

EGShares Financials GEMS ETF (ticker: FGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Financials Titans 30 IndexSM (“Financials Underlying Index”). The Financials Underlying Index is comprised of publicly traded firms in the “Financials Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in Financials companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Financials companies as companies that are included in the Financials Underlying Index at the time of purchase and generally includes companies whose businesses involve: banking; insurance; real estate; and financial services. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy. The annual expense ratio of the Fund is 0.85%.

The EGShares Financials GEMS ETF provides unique exposure to a sector that has traditionally and even today remains focused on American, European and Japanese banks. Given new regulations (Dodd-Frank, Volker rule, etc.) and increased public scrutiny (Occupy Wall Street), it is quite surprising that investors have not generally accepted diversification of financial sector assets into emerging markets. Not burdened by household or corporate indebtedness, nor with balance sheets littered with real estate related holdings, financial institutions in the emerging markets are tied to individuals and companies that are in their prime growth stage. Furthermore, for early stage economies, the financial sector acts in a function similar to a utility or key infrastructure. For the economy to grow and modernize, financial institutions both public and private are required so as to allow for the efficient allocation of high growth capital. As of March 31, 2012, the emerging market financial sector had one of the lowest valuations, by trailing P/E among all sectors.

The EGShares Financials GEMS ETF had a total return of 12.66% at net asset value (“NAV”) for the quarter ended March 31, 2012 and 2.15% annualized return since its inception date of September 16, 2009. The Fund NAV had a -16.52% return for the full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

Performance Charts

The following performance chart is provided for comparative purposes and represents the periods noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 16 EGA Emerging Global Shares Trust |

EGShares Financials GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Financials

Titans 30 Index |

| 1 Year | (16.52)% | (16.64)% | (17.75)% |

| Since Inception1 | 2.15% | 2.01% | 0.31% |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 17 |

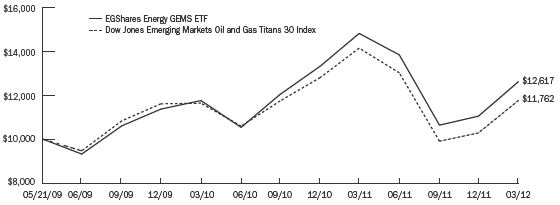

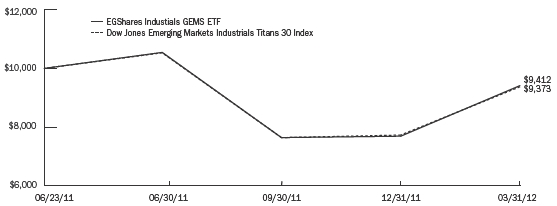

Portfolio Summary (Unaudited)

EGShares Health Care GEMS ETF

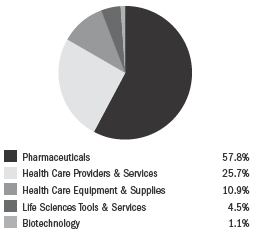

Industry Breakdown*

Top Ten Holdings*

| |

| Aspen Pharmacare Holdings, Ltd. | 10.7% |

| Dr. Reddy’s Laboratories, Ltd. | 8.5% |

| Sun Pharmaceutical Industries, Ltd. | 8.1% |

| Cipla, Ltd. | 6.5% |

| Mindray Medical International, Ltd. | 6.2% |

| Richter Gedeon Nyrt | 4.7% |

| Sinopharm Group Co. | 4.7% |

| Netcare, Ltd. | 4.4% |

| Mediclinic International, Ltd. | 4.2% |

| Kalbe Farma Tbk PT | 3.6% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

EGShares Health Care GEMS ETF (ticker: HGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Health Care Titans 30 IndexSM (“Health Care Underlying Index”). The Health Care Underlying Index is comprised of publicly traded firms in the “Health Care Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in securities of Emerging Markets Health Care companies that are included in the Fund’s Health Care Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in those securities. The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Health Care Underlying Index through investments in equity securities, including common shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). ADRs and GDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world. The Health Care Underlying Index includes companies whose businesses generally involve: health care equipment and services; and pharmaceuticals and biotechnology. The annual expense ratio of the Fund is 0.85%.

The EGShares Health Care GEMS ETF is a unique sector fund that plays the consumption story both in the emerging markets and globally. Roughly 70% of the Fund’s exposure is in pharmaceutical and biotech companies. The remainder of the Fund is in health care equipment and services companies. Along with such industry bias, the Fund’s geographical breakdown is heavily biased towards India (37%), South Africa (25%) and China (19%) as of March 31, 2012. The remaining 20% is divided among seven other economies. Although these companies are headquartered in the emerging markets, their revenue reach is globally oriented. For example, one of the largest positions in the Fund, Dr. Reddy’s Laboratories, had only 17.8% of its FY2011 revenues from its domestic market according to Bloomberg. Although involved in proprietary drug research, a significant component of its business is generic drug distribution to western markets. If developed market consumers have become more cost conscious because of the effects of the global financial crisis as well as high health care and drug costs, emerging market companies seem willing to compete in this sector.

The EGShares Health Care GEMS ETF had a total return of 16.33% at net asset value (“NAV”) for the quarter ended March 31, 2012 and -4.33% return since its inception date of June 23, 2011. Based on this inception date, the Fund did not have enough historical pricing to cover a full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 18 EGA Emerging Global Shares Trust |

EGShares Health Care GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return1 |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Health Care

Titans 30 Index |

| Since Inception2 | (4.33)% | (4.43)% | (4.93)% |

| 1 | | Returns of less than one year are not annualized. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This Fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio after expense waivers and reimbursements is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call 1-888-800-4EGS (4347). Read the prospectus carefully before you invest. There are risks involved with investing including the possible loss of principal. Past performance does not guarantee future results.

Emerging Global Shares are distributed by ALPS Distributors Inc.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

| EGA Emerging Global Shares Trust 19 |

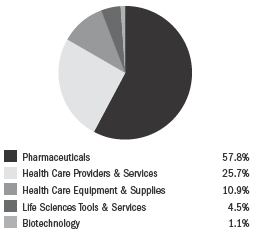

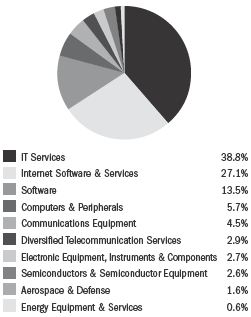

Portfolio Summary (Unaudited)

EGShares Industrials GEMS ETF

Industry Breakdown*

Top Ten Holdings*

| |

| Larsen & Toubro, Ltd. | 9.3% |

| Tata Motors, Ltd. | 6.6% |

| Cemex SAB de CV | 6.1% |

| Sime Darby BHD | 5.4% |

| Bidvest Group, Ltd. | 5.0% |

| United Tractors Tbk PT | 4.8% |

| Mahindra & Mahindra, Ltd. | 4.8% |

| Semen Gresik Persero Tbk PT | 3.9% |

| China Communications Construction Co., Ltd. | 3.9% |

| Embraer SA | 3.6% |

| * | | Expressed as a percentage of total investments in securities as of 3/31/2012. Holdings are subject to change. |

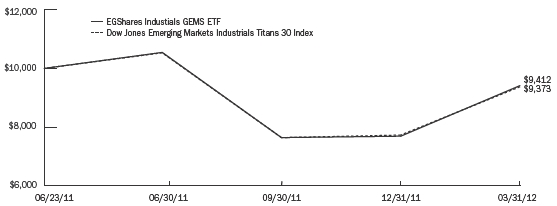

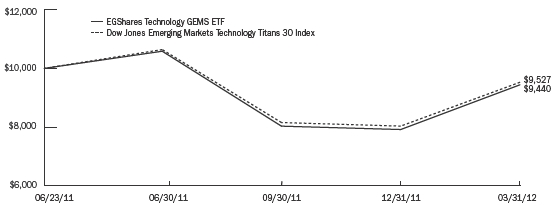

EGShares Industrials GEMS ETF (ticker: IGEM)

The Fund’s investment objective is to seek investment results that correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Industrials Titans 30 IndexSM (“Industrials Underlying Index”). The Industrials Underlying Index is comprised of publicly traded firms in the “Industrials Industry,” as defined by the Industry Classification Benchmark (“ICB”). Under normal circumstances, the Fund will invest at least 80% of its net assets in securities of Emerging Markets Industrials companies that are included in the Fund’s Industrials Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in those securities. The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Industrials Underlying Index through investments in equity securities, including common shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). ADRs and GDRs represent ownership interests in shares of foreign companies that are held in financial institution custodial accounts, and are traded on exchanges in the United States and around the world. The Industrials Underlying Index includes companies whose businesses generally involve: construction and materials; aerospace and defense; general industrials; electronic and electrical equipment; industrial engineering; industrial transportation; and support services. The annual expense ratio of the Fund is 0.85%.

The EGShares Industrials GEMS ETF is a fund with a heavy bias to constructions & materials with a roughly 46% weight as of March 31, 2012. Infrastructure is key part of the thematic play within this sector fund although the manufacturing of cars and airplanes are also components. India and China are the largest country weights covering nearly half the portfolio by assets. Performing very similarly since its inception March 31, 2012 versus the common broad global emerging market indices, emerging market industrials was the top performer among sectors in Q1 2012.

The EGShares Industrials GEMS ETF had a total return of 22.42% at net asset value (“NAV”) for the quarter ended March 31, 2012 and -5.88% return since its inception date of June 23, 2011. Based on this inception date, the Fund did not have enough historical pricing to cover a full year ending March 31, 2012.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This Fund will concentrate its investments in issuers of one or more particular industries to the same extent that its underlying index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from investing more than 25% of the Fund’s assets in issuers conducting business in the same industry.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these fees and expenses. Fund returns do not reflect brokerage commissions, or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

| 20 EGA Emerging Global Shares Trust |

EGShares Industrials GEMS ETF

Performance as of 3/31/2012

| | | |

| | Average Annual Total Return1 |

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Industrials

Titans 30 Index |

| Since Inception2 | (5.88)% | (7.63)% | (6.27)% |

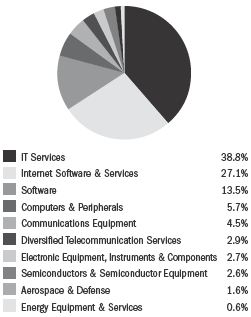

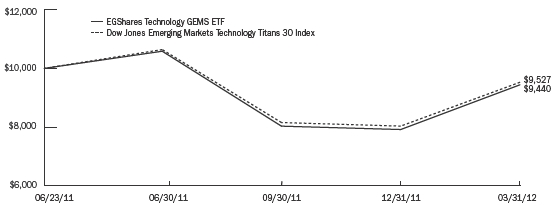

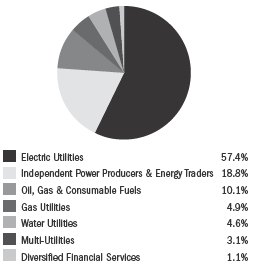

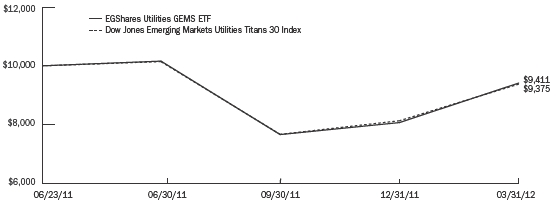

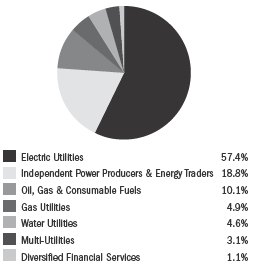

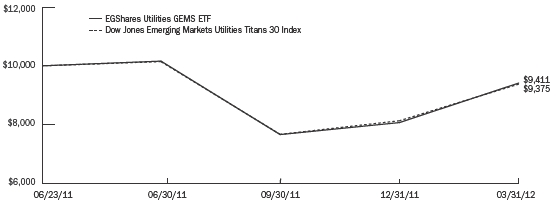

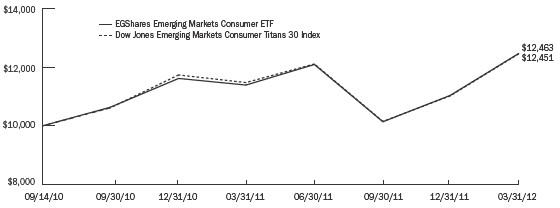

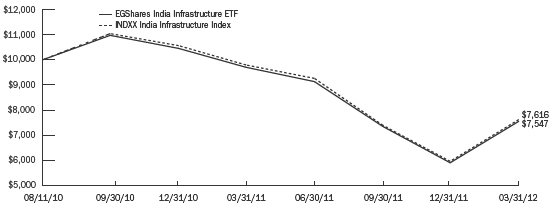

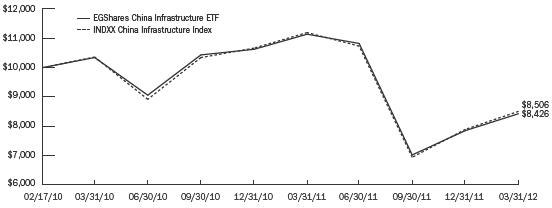

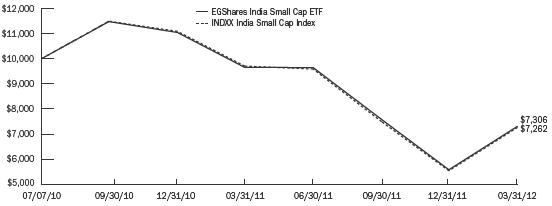

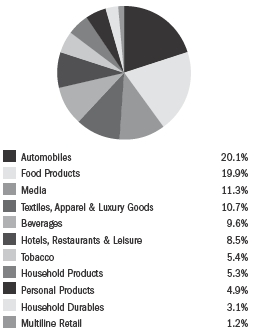

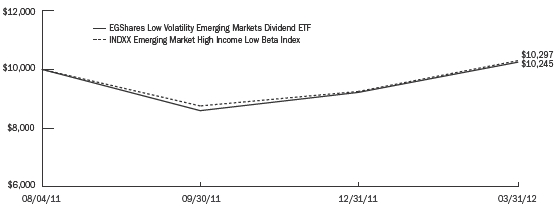

| 1 | | Returns of less than one year are not annualized. |