Table of Contents

Letter to Shareholders

Dear Shareholder,

Over the past year, the ETF business has grown and Emerging Global Advisors has grown with it. In the last quarter of 2010, global ETF assets passed the $1 trillion mark. The majority of the most recent flows found their way into emerging markets strategies. We continue to believe that as developed markets investors learn more about the emerging markets (EMs) investment story, the more interesting the opportunity becomes. We also believe that the natural and sensible progression for institutional and other professional investors in emerging markets is trending towards the application of tools that provide more specific exposures. ETFs have proven to be an effective way to express investor opinions in these difficult to trade countries. We have focused on, and will continue to provide, what we feel are the most appropriate tools given the economic drivers in these regions.

As is the case in most equity investing, gaining exposure to emerging market economies comes with some risks. Some of these risks are broad equity-based and others are specific to EMs. We believe that certain risk factors such as political risk actually exist to a large degree in developed markets and not just in emerging markets. As I have stated in our previous reports, we believe this continues to favor emerging market investments and the weapon of choice continues to be the exchange traded fund.

From an investor’s point of view, we see the global investment opportunity for growth investing in its simplest terms. We see the United States, the United Kingdom, Japan, Western Europe, Korea and Taiwan as slower growers (in terms of GDP and locally domiciled company earnings growth) and Southeast Asia, Latin America, The Middle East/North Africa region and Eastern Europe as faster growing regions. As such, we believe investors now need to look globally for their exposure to what many investors refer to as “Growth” investment opportunities. There are a handful of notable fast growing companies that are domiciled in the slower growth regions around the world, but it is uncertain if any sectors or industries, as a group, are likely to grow with any significance over the longer term. Although the past is not always indicative of the future, strong growth rates require what we refer to as a population dividend, or demand driven economy. The US and Japan were once such economies, but a slower growing and aging population, an unsustainable ratio of government debt to GDP and a large amount of consumer debt have put a drag on developed market economic growth. Although there can be no assurances of future growth rates, Emerging Global Advisors has positioned itself squarely in front of the faster growing global economic trends.

To that end, we believe our funds represent asset categories that could provide great potential for active managers to provide accretive exposures to their EM portfolios. For example, it is not enough that we provide investors with a Brazilian ETF. Our Brazil Infrastructure ETF is positioned to potentially benefit from the Brazilian government’s commitment over the next five to ten years. Other EGA ETFs specifically target the domestic EM consumer, another primary driver of these economies.

Ongoing research related to the specific purpose of further product development efforts has been and always will be a focus of our firm. Innovation in our product lineup and a deep appreciation and understanding of the EM opportunity provides us with an edge to make products attractive to investors. We will continue to introduce products in areas we believe will provide a competitive advantage to our firm.

In the first quarter of 2011, I made a very important decision to help better assure our rate of growth will continue to outpace our peers in the asset management industry. On February 7th, I hired Marten Hoekstra who joined the firm as Chief Executive Officer. Mr. Hoekstra was most recently CEO of UBS Wealth Management Americas and a member of parent company UBS’ Group Executive Board. Mr. Hoekstra spent 26 years at UBS, which includes his executive positions with a predecessor firm, PaineWebber. After 2001, he held various management roles in Zurich and the United States on the executive committee of the firm's Global Wealth Management & Business Banking unit, including Deputy CEO. He was also Head of Market Strategy and Development for UBS’ wealth management businesses outside of North America. He became a member of UBS' Group Managing Board in July 2002. He assumes the CEO position from me. I will continue as president and concentrate on investment product development, a discipline that has been a primary focus throughout my career. We strive to be the leading brand for emerging market investing and Mr. Hoekstra has the global vision and experience to help us reach that goal. We are significantly advantaged having him lead our team.

Thank you for your support of Emerging Global Advisors ETFs.

Sincerely,

Robert C. Holderith

President & Founder

Emerging Global Advisors, LLC

EGA Emerging Global Shares Trust 1

Comments from CIO/Director of Research

Dear Shareholder:

The bull market which commenced in March of 2009 continued for most of the 12-month period ending March 31, 2011. Interestingly, various capital markets behaved quite differently in the second half of this 12-month period. Investors went from a risk taking to risk aversion stance and exited from positions many of which had performed well during the bull rally. Emerging market investments of various asset categories (equities, fixed income, currency) underperformed those of developed markets. Whether it be because of a positive outlook for the future affects of Quantitative Easing 21 or other rationales, the US market was relatively strong in the calendar year 2010. This was especially true in the latter half of 2010. With the large cap S&P 5002 underperforming US small caps, investors were not only bullish on the US economy but on the potential for US consumers. This despite lingering concerns of high unemployment, unsustainable debt levels and partisan government muddling through towards the next presidential election.

European concerns regarding sovereign risk remain. The concern is well beyond Greece with every single member of Portugal, Ireland, Italy, Greece and Spain (PIIGS) getting significant press time. Austerity plans and implementation seem unimpressive and various participants talk of default. The Japanese earthquake and resulting tsunami has yet again introduced the X-factor or “black swan” to investors and their portfolios. Although the damage in terms of life and property will have lingering affects, the long-term consideration revolves around energy policy. Do nuclear power plants on the Pacific Rim’s “ring of fire” make sense especially when considering population density?

This is just the developed markets. Add uncertainty from the emerging markets and investors are bombarded with added risks to consider.

The primary concern seems not to be social unrest and armed conflict (Libya) in the Mideast/North Africa (MENA) region. The spread of peaceful uprising is certainly what the region needs so as to compete globally with other emerging markets. Eastern Europe had its “solidarity movement” to spark a chain of events leading to the fall of the Berlin Wall, the end of Soviet sponsored communism and the spread of capitalism over socialism. Concerns on the MENA region’s ability to convert when such conversion has tinges of internal theological turmoil is an interesting debate. Given the success of Indonesia and Malaysia in the east, and progress in certain Gulf Cooperation Council (GCC) states (Qatar, UAE), there must be a path to transition.

With plenty of stand-offs (Iran-Saudi Arabia, Israel-Gaza/West Bank/Lebanon), investors have an eye on oil prices. However, we observe that during the social unrest originating in Tunis of all places there was little movement in traditional gauges of negative crowd psychology: oil prices did not spike nor did gold or VIX.3 Only in the latter half of March and into April 2011 did oil prices hit a distinctly parabolic trajectory. Fueled by a falling dollar over the latter half of the 2011 calendar year and uncertainty of the US government to keep budget deficits reasonable, it appears to be less about turmoil in the Mideast.

MENA trades little with anyone other than those within MENA. That is the cost of being behind the curve. The benefit for global investors is that MENA is quite insulated. They sneeze and we don’t catch a cold. Not true with other emerging market regions or the major economies like China.

One of the most interesting market developments in Q4 2010 and Q1 2011 was the incredible outperformance of developed markets over emerging markets. True, EMs outperformed since the bull market began in March 2009. Many reasons were cited to the strong pullback from EMs while the US market and certain other developed markets continued on a slightly positive trend.

The number one concern from emerging markets was and still is inflation. Certainly commodity inflation whether it be in oil prices, metal prices or food prices are concerns. These are input costs that affect governments, companies and households in emerging markets much more than in the developed world. Mindful of history, central banks have been prudent in applying measures to curb inflation. Monetary policy has been stringent. Controlling the money supply with interest rate movements and discussions on controls relating to currency volatility (some say, manipulation) seem to be signaling to the market that their concerns are real and their resolve is equally strong. Furthermore, money supply control domestically through limitations on the banking system’s “multiplier effect4” is clearly an effort being watched in China. With the potential for divergence between the “haves” and “have not”, but without the ability to vote someone else in, a 1-party system has no choice but to put the controls on hard. China is good at putting the controls on hard. We observe India’s continued interest rate hikes and Brazil’s ongoing public relations effort to dissuade excessive fund flows from fueling inflation within its borders as good signs that they know what’s at stake.

There were other reasons for investors to pull back from emerging markets. With India, a series of corruption scandals was enough to finally break a strong bull market there. Continued rate hikes by India’s central bank given heightened inflation fears especially related to food was not able to do what the scandals did. However, at the time of this writing such news is simply history. As with other emerging markets, corruption fears last a very short time. It’s important that the existence of corruption is not one to be dismissed. But as important is to note a simple reality. Three former emerging markets that have been very strong over the past decades leading to their re-classification now as developed markets have colorful modern histories full of corruption scandals. Even today, South Korea, Taiwan and Israel continue to be troubled with ongoing front-page scandals both in the

2 EGA Emerging Global Shares Trust

Comments from CIO/Director of Research (concluded)

realms of government and industry… but of course often in combination. These realities, although disturbing, did not prevent their rise as economic powers. One would be naïve to think that such behavior did not exist during the rise of western economies such as the US, continental Europe or Japan. Surely, it still exists today regardless of location.

In my opinion, corruption scandals are not what investors are concerned with nor should they be. The bigger picture is what needs to be considered: We had a global financial crisis but the global financial system wasn’t fixed. Huge concerns revolve around the fact that the global economy stands on a foundation built on the US, Europe and Japan. Each has its own political puzzle, debt burdens, decreasing growth outlook and decreasing geo-political influence. The timing of the rise of emerging markets is not only welcome… it is of critical necessity. We need to look for slack somewhere when the aging developed markets are incentivized to spend less and save more. The demographic scale of this situation only make the numbers more dramatic and the resulting trends self-evident. Many institutional investors such as state pension plans in the US, simply do not have enough contributors while many beneficiaries are taking too much out. While aging demographics are a burden here, such entitlement programs do not generally exist in emerging markets while at the same time they have some back stops such as government sponsored Sovereign Wealth Funds.5 A recent meeting of the BRICS (Brazil, Russia, India, China, which now includes South Africa for “S”) provides a glimpse of the future. It is not enough that they have created their own meeting to take the spotlight off the G86 annual meeting that yields little but a big expense bill for the host city. Could it be a coincidence that their talk of movement away from the US dollar and towards a basket of world currencies/commodities to represent a new global reserve standard happened a week before a credit rating agency warned of the sovereign risk associated with the USA? Re-alignment could be on the horizon. Textbooks may have to be greatly revised to re-define what a “risk free return” instrument is. Likewise, investors may have to re-calibrate their portfolios for a world where the developed markets mean just a little bit less and the emerging markets mean just a bit more. How this transition happens and its rate of acceleration is something we monitor with great interest.

Danny Quah of the London School of Economics has given a new point of view of this transition geographically. On a world map, he describes the global economy’s center of gravity. On a single point on the map he aims to find the average location of economic activity by taking into account the origination of all GDP on our planet. In 1980, this point was in the mid-Atlantic. Today it is closer to Egypt and by 2050 should be at a point near where China and India meet. Further evidence that the global shift of economic might is moving eastward.

We care less about the raw numbers and more about the trends. Significant growth is likely to be found there in the emerging economies and not here in the developed economies. We are incentivized to save; they spend more. Our aging population is a burden to our system. Their youth is hungry for a better lifestyle and embracing capitalism. We are trying to save blue collar jobs. They compete well for those same jobs (with currency and wages on their side) but are raising the bar on education and thus innovation. As Fareed Zakaria has said, it’s not about the fall of the West but the rise of the others.

Our funds are tools that seek to allow investors to participate in these important trends.

Richard C. Kang

Chief Investment Officer & Director of Research

April 27, 2011

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. To obtain a prospectus containing this and other important information, please call (888) 800-4347 or visit www.emergingglobaladvisors.com to view or download a prospectus online. Read the prospectus carefully before you invest.

Emerging market investments involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, from economic or political instability in other nations or increased volatility and lower trading volume. This fund will concentrate its investments in issuers of one or more particular industries to the same extent that its Underlying Index is so concentrated and to the extent permitted by applicable regulatory guidance. Concentration risk results from maintaining exposure to issuers conducting business in a specific industry.

The above commentary is for informational purposes only. Nothing in this commentary should be construed as an offer or recommendation to buy or sell a particular security. The opinions and estimates noted herein are accurate as of April 27, 2011 and are subject to change.

| 1 | The second round of the Federal Reserve’s monetary policy used to stimulate the U.S. economy following the recession that began in 2007/08. QE2 was initiated in the fourth quarter of 2010 in order to jump-start the sluggish economic recovery. |

| |

| 2 | An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. |

| |

| 3 | The ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. |

| |

| 4 | The expansion of a country’s money supply that results from banks being able to lend. The size of the multiplier effect depends on the percentage of deposits that banks are required to hold as reserves. |

| |

| 5 | Pools of money derived from a country’s reserves, which are set aside for investment purposes that will benefit the country’s economy and citizens. |

| |

| 6 | The members of the Group of Eight, or G8, are Canada, France, Germany, Italy, Japan, Russia, the United Kingdom and the United States. |

EGA Emerging Global Shares Trust 3

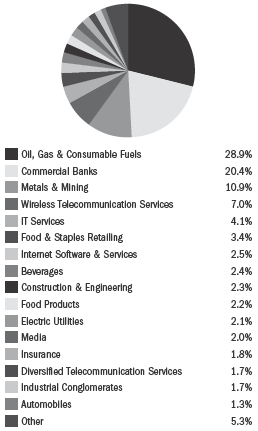

Portfolio Summary (Unaudited)

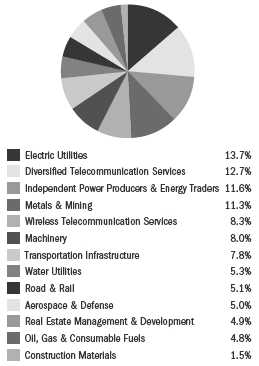

Emerging Global Shares Dow Jones Emerging Markets

Titans Composite Index Fund

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Gazprom OAO | 6.9 | % |

| Itau Unibanco Holding SA | 5.7 | % |

| Petroleo Brasileiro SA | 4.6 | % |

| Reliance Industries, Ltd. | 4.3 | % |

| Vale SA | 4.0 | % |

| Infosys Technologies, Ltd. | 3.8 | % |

| America Movil SAB de CV | 3.8 | % |

| Industrial and Commercial Bank of China, Ltd. | 3.8 | % |

| China Construction Bank Corp. | 3.4 | % |

| Surgutneftegas | 3.0 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

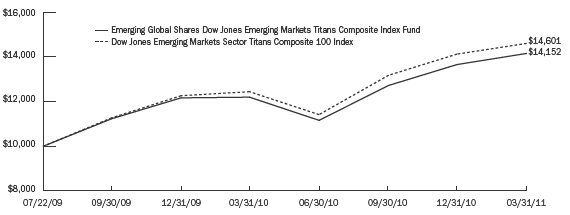

Emerging Global Shares Dow Jones Emerging Markets Titans Composite Index Fund (ticker: EEG)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Sector Titans Composite 100 Index. The Dow Jones Emerging Markets Sector Titans Composite 100 Index is a stock market index comprised of a representative sample of 100 emerging markets companies that Dow Jones Indexes deems to be the 10 leading companies in each of the 10 industrial sectors, as defined by the Industry Classification Benchmark (ICB), across the developing world. Under normal circumstances, the Fund will invest at least 80% of its net assets in companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares Dow Jones Emerging Markets Titans Composite Index Fund covers the broad emerging markets, in our opinion, better than any other broad exposure fund. The underlying index does not include South Korea, Taiwan and Israel which other emerging market indices often include. For many investors new to gaining exposure to markets in the developing world, they are more familiar with the concept of BRIC economies (Brazil, Russia, India, China) which this Fund has its most exposure to. In fact, the weights are ranked in this Fund as Brazil, then China, Russia ad India with South Africa in fifth place. These top five country exposures make up 83% of the Fund as of March 31. Coincidentally, the recent BRICS meeting in China included South Africa as the last “S” in the moniker. The remainder of the Fund mainly covers Mexico, Chile, Malaysia and Indonesia.

The Emerging Global Shares Dow Jones Emerging Markets Titans Composite Index Fund had a total return of 3.64% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 22.77% annualized return since its inception date of July 22, 2009. The Fund NAV had a 16.04% return for the full year ending March 31, 2011.

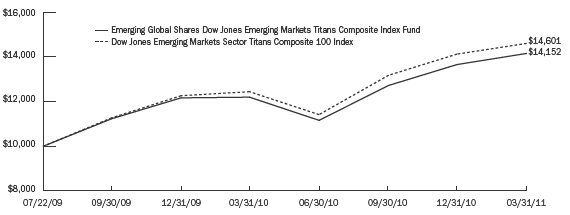

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

4 EGA Emerging Global Shares Trust

Emerging Global Shares Dow Jones Emerging Markets

Titans Composite Index Fund

| | | |

| Performance as of 3/31/2011 | | | |

|

| |

| | Average Annual Total Return |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Sector Titans

Composite 100 Index |

|

| 1 Year | 16.04% | 15.09% | 17.35% |

| Since Inception1 | 22.77% | 22.46% | 25.09% |

|

| 1 July 22, 2009. | | | |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.75%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 5

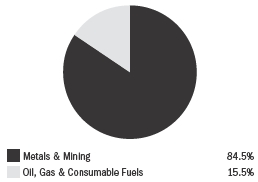

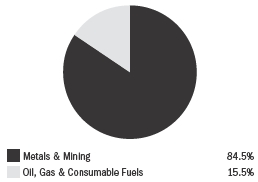

Portfolio Summary (Unaudited)

Emerging Global Shares Dow Jones Emerging Markets

Metals & Mining Titans Index Fund

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Mining and Metallurgical Company Norilsk Nickel JSC | 10.1 | % |

| Vale SA | 9.3 | % |

| Sterlite Industries India, Ltd. | 7.8 | % |

| Impala Platinum Holdings, Ltd. | 6.6 | % |

| AngloGold Ashanti, Ltd. | 5.8 | % |

| Grupo Mexico SAB de CV | 5.4 | % |

| China Shenhua Energy Co., Ltd. | 4.9 | % |

| Companhia Siderurgica Nacional SA | 4.7 | % |

| Gold Fields, Ltd. | 4.4 | % |

| Yanzhou Coal Mining Co., Ltd. | 4.0 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares Dow Jones Emerging Markets Metals & Mining Titans Index Fund (ticker: EMT)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Metals & Mining Titans 30 Index. The Dow Jones Emerging Markets Metals & Mining Titans 30 Index is a stock market index comprised of 30 leading Emerging Markets companies that Dow Jones Indexes deems to be in the Metals & Mining sector of the global economy. The Metals & Mining sector is a sub-sector of the Basic Materials industry, as defined by ICB. Accordingly, some securities in which the Fund invests may also be held by the Emerging Global Shares Dow Jones Emerging Markets Basic Materials Titans Index. Upon normal circumstances, the Fund will invest at least 80% of its net assets in Metals & Mining companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Metals & Mining companies as companies that are included in the Dow Jones Emerging Markets Metals & Mining Titans 30 Index at the time of purchase and generally includes companies involved in the extraction and basic processing of basic resources (other than oil and gas), such as coal, metal ore (including the production of basic aluminum, iron and steel products), precious metals and gemstones. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares Dow Jones Emerging Markets Metals & Mining Titans Index Fund, as of March 31, 2011 was our top performing fund in terms of total return since inception. Of course, along with our energy sector ETF, the metals/mining ETF has the longest track record among our product lineup. With global concerns of rising inflation, the metals/mining sector continues to garner added attention as a hedge. For every newsworthy global event, there is usually a commodity angle whether it be related to food, energy or materials. For example, the Japanese earthquake/tsunami, although a large scale human tragedy, has turned out to be a long-term concern related to energy security. Can nuclear plants exist on the “ring of fire” where dense populations are nearby? This leads to discussions on cheaper albeit dirtier forms of energy production such as coal burning. China Shenhua Energy is a coal related name in the metals/mining fund. More obvious connections such as the rising price of gold and the resulting higher revenues for gold producers may relate to this Fund as well.

The Emerging Global Shares Dow Jones Emerging Markets Metals & Mining Titans Index Fund had a total return of -0.78% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 32.56% annualized return since its inception date of May 21, 2009. The Fund NAV had a 12.95% return for the full year ending March 31, 2011.

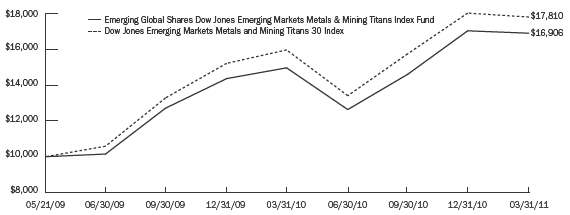

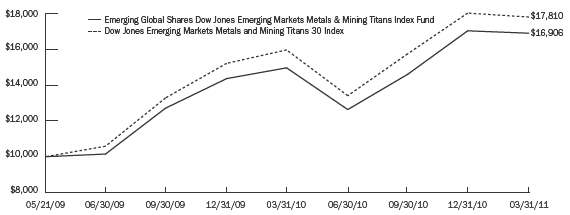

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

6 EGA Emerging Global Shares Trust

Emerging Global Shares Dow Jones Emerging Markets

Metals & Mining Titans Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Metals & Mining

Titans 30 Index |

|

| 1 Year | 12.95% | 12.85% | 11.51% |

| Since Inception1 | 32.56% | 32.74% | 36.38% |

|

| 1 May 21, 2009. | | | |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 7

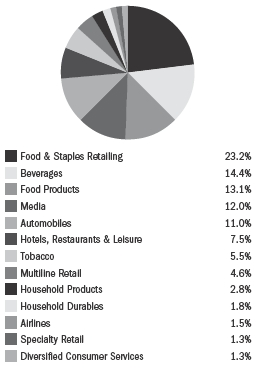

Portfolio Summary (Unaudited)

Emerging Global Shares Dow Jones Emerging Markets

Consumer Titans Index Fund

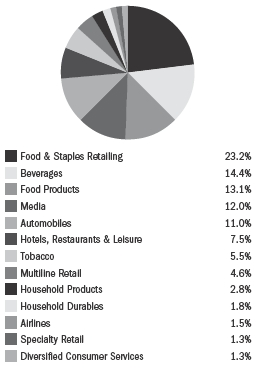

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Comphania de Bebidas DAS Americas | 9.1 | % |

| Wal-Mart de Mexico SAB de CV | 7.4 | % |

| Naspers, Ltd. | 6.0 | % |

| Grupo Televisa SA | 6.0 | % |

| Astra International Tbk PT | 5.5 | % |

| ITC, Ltd. | 5.5 | % |

| BRF - Brasil Foods SA | 5.4 | % |

| Fomento Economico Mexicano SAB de CV | 5.3 | % |

| S.A.C.I. Falabella | 4.6 | % |

| Cencosud SA | 4.5 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares Dow Jones Emerging Markets Consumer Titans Index Fund (ticker: ECON)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Consumer Titans 30 Index. The Dow Jones Emerging Markets Consumer Titans 30 Index is a stock market index comprised of 30 leading Emerging Markets companies that Dow Jones Indexes deems to be part of the Consumer sectors of the global economy. Under normal circumstances, the Fund will invest at least 80% of its net assets in Consumer companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Consumer companies as companies that are included in the Dow Jones Emerging Markets Consumer Goods Titans Index and Dow Jones Emerging Markets Consumer Services Titans Index at the time of purchase and generally includes companies whose business involve: general retailers, beverage providers, food producers, media, auto& parts, travel & leisure and personal goods. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares Dow Jones Emerging Markets Consumer Titans Index Fund is our biggest fund by assets. In terms of broad appeal, the concept of billions of new consumers who are relatively new to capitalism within their borders is easy to understand. While some investors may focus on multi-nationals who strive to increase their exposure to consumers in new growth markets, we believe that sophisticated investors will want to go straight to the source. Local providers have greater affinity with the local consumer. Brand recognition and lower costs go a long way in younger markets. The Fund focuses on the basics with large exposures to beverage makers and low cost retailers. We focus less on the increased sales of Italian cars or Swiss watches for the top 0.01% of a few billion new consumers. We seek to focus more on what a relatively poorer demographic requires as they move forward in raising their standard of living.

The Emerging Global Shares Dow Jones Emerging Markets Consumer Titans Index Fund had a total return of -1.94% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 13.88% annualized return since its inception date of September 14, 2010. The Fund did not have enough history as of March 31, 2011 to provide a one-year return.

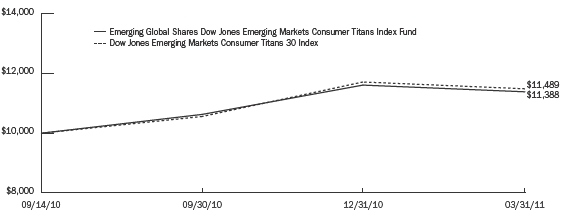

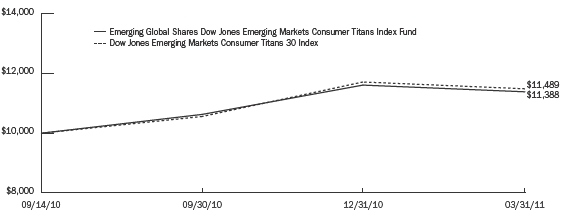

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

8 EGA Emerging Global Shares Trust

Emerging Global Shares Dow Jones Emerging Markets

Consumer Titans Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return1 |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Consumer

Titans 30 Index |

|

| Since Inception2 | 13.88% | 14.08% | 14.84% |

|

| 1 | Returns of less than one year are not annualized. |

| 2 | September 14, 2010. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 9

Portfolio Summary (Unaudited)

Emerging Global Shares Dow Jones Emerging Markets

Energy Titans Index Fund

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Gazprom OAO | 8.2 | % |

| CNOOC, Ltd. | 8.0 | % |

| Reliance Industries, Ltd. | 7.5 | % |

| Petroleo Brasileiro SA | 7.5 | % |

| Surgutneftegas | 6.3 | % |

| Sasol, Ltd. | 5.0 | % |

| PetroChina Co., Ltd. | 4.9 | % |

| NovaTek OAO | 4.8 | % |

| China Petroleum & Chemical Corp. | 4.6 | % |

| Tatneft | 4.5 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares Dow Jones Emerging Markets Energy Titans Index Fund (ticker: EEO)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Oil and Gas Titans 30 Index. Dow Jones Emerging Markets Oil and Gas Titans 30 Index is a stock market index comprised of 30 leading emerging markets companies that Dow Jones Indexes deems to be part of the Oil and Gas sector of the global economy, which also includes alternative energy sources other than oil and gas. Under normal circumstances, the Fund will invest at least 80% of its net assets in Energy companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Energy companies as companies that are included in the Dow Jones Emerging Markets Oil and Gas Titans 30 Index at the time of purchase and generally includes companies whose businesses involve: oil and gas production; oil equipment, services and distribution; and alternative energy. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares Dow Jones Emerging Markets Energy Titans Index Fund is another fund where we focus on its ability to provide an inflation hedge. Westerners complain of rising fuel prices. As a percentage of basic spending, it cannot compare with the burdens such basic inflation causes in the developing world. But as a result of a lower US dollar, producers have no choice but to elevate prices to compensate on any commodity priced in dollars, especially oil. Traditional energy sources are harder to find and when they are found they are usually in the developing world. Petrobras’ deep water discovery off the coast of Brazil is a good example. As with the supply side, the demand side of energy may grow in significance in the emerging markets especially as the West attempts to diversify supply dependency away from Mideast oil.

The Emerging Global Shares Dow Jones Emerging Markets Energy Titans Index Fund had a total return of 11.18% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 23.44% annualized return since its inception date of May 21, 2009. The Fund NAV had a 25.96% return for the full year ending March 31, 2011.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

10 EGA Emerging Global Shares Trust

Emerging Global Shares Dow Jones Emerging Markets

Energy Titans Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Oil and Gas

Titans 30 Index |

|

| 1 Year | 25.96% | 25.76% | 24.18% |

| Since Inception1 | 23.44% | 23.67% | 24.53% |

|

| 1 May 21, 2009. | | | |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 11

Portfolio Summary (Unaudited)

Emerging Global Shares Dow Jones Emerging Markets

Financials Titans Index Fund

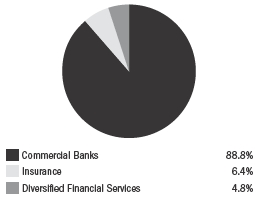

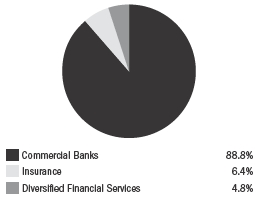

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Industrial and Commercial Bank of China, Ltd. | 7.9 | % |

| Itau Unibanco Holding SA | 7.4 | % |

| Banco Bradesco SA | 7.4 | % |

| China Construction Bank Corp. | 7.1 | % |

| Bank of China, Ltd. | 5.8 | % |

| ICICI Bank, Ltd. | 5.6 | % |

| China Life Insurance Co., Ltd. | 4.8 | % |

| Banco do Brasil SA | 4.4 | % |

| Ping An Insurance Group Co. of China, Ltd. | 4.2 | % |

| State Bank of India, Ltd. | 4.0 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares Dow Jones Emerging Markets Financials Titans Index Fund (ticker: EFN)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the Dow Jones Emerging Markets Financials Titans 30 Index. The Dow Jones Emerging Markets Financials Titans 30 Index is a stock market index comprised of 30 leading emerging markets companies that Dow Jones Indexes deems to be part of the Financials sector of the global economy. Under normal circumstances, the Fund will invest at least 80% of its net assets in Financials companies included in the Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Financials companies as companies that are included in the Dow Jones Emerging Markets Financials Titans 30 Index at the time of purchase and generally includes companies whose businesses involve: banking; insurance; real estate; and financial services. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

Not burdened by household or corporate indebtedness, nor with balance sheets littered with real estate related holdings, financial institutions in the emerging markets are tied to individuals and companies that are in their prime growth stage. Concerns exist in high inflation environments such as China and India on the banking system; however authorities have taken measures so as not to repeat the levered speculative behavior seen previous to the global financial crisis. This includes limiting the multiplier effect in China via the reserve ratio requirement.

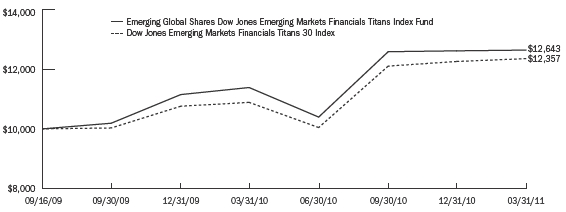

The Emerging Global Shares Dow Jones Emerging Markets Financials Titans Index Fund had a total return of 0.20% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 16.45% annualized return since its inception date of September 16, 2009. The Fund NAV had a 11.03% return for the full year ending March 31, 2011.

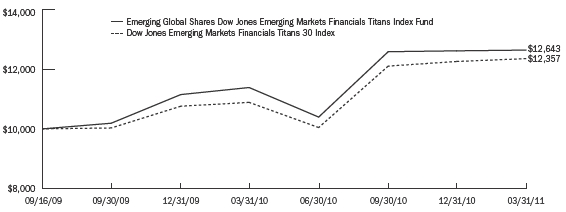

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

12 EGA Emerging Global Shares Trust

Emerging Global Shares Dow Jones Emerging Markets

Financials Titans Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | Dow Jones

Emerging Markets

Financials

Titans 30 Index |

|

| 1 Year | 11.03% | 10.05% | 13.48% |

| Since Inception1 | 16.45% | 16.29% | 14.76% |

|

| 1 September 16, 2009. | | | |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 13

Portfolio Summary (Unaudited)

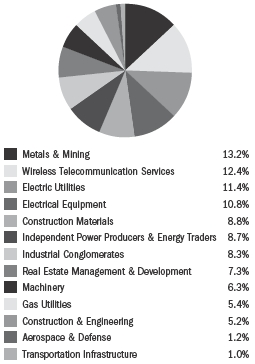

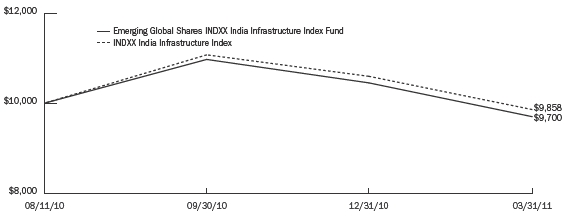

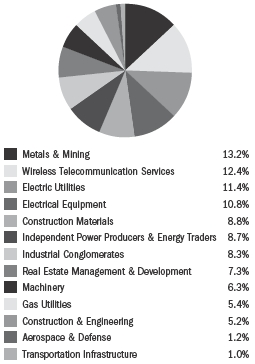

Emerging Global Shares INDXX India Infrastructure Index Fund

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Tata Motors, Ltd. | 6.3 | % |

| Sterlite Industries India, Ltd. | 5.6 | % |

| Tata Power Co., Ltd. | 5.6 | % |

| Bharti Airtel, Ltd. | 5.6 | % |

| Gail India, Ltd. | 5.4 | % |

| NTPC, Ltd. | 5.3 | % |

| Bharat Heavy Electricals, Ltd. | 4.6 | % |

| Larsen & Toubro, Ltd. | 4.5 | % |

| Siemens India, Ltd. | 4.5 | % |

| DLF, Ltd. | 4.2 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares INDXX India Infrastructure Index Fund (ticker: INXX)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the INDXX India Infrastructure Index (the “Underlying Index”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Underlying Index through investments in equity securities, including shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). The Underlying Index is a free-float capitalization weighted stock market index comprised of 30 leading companies that INDXX, LLC determines to be representative of India’s infrastructure sectors. The Fund invests in Indian mid cap infrastructure companies that are included in the Underlying Index, which are generally defined as companies that are domiciled in India and that have a market capitalization of at least $200 million at the time of purchase. Under normal circumstances, the Fund will invest at least 80% of its net assets in Indian Infrastructure companies included in the Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its nets assets invested in these securities. The Fund defines Indian Infrastructure companies as companies that are included in the Underlying Index at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares INDXX India Infrastructure Index Fund is our most compelling story related to infrastructure. From my visits to various emerging markets over the past 4 decades, I never saw such a dire need for infrastructure as I saw on my trip to Mumbai in the summer of 2010. Even the Philippines of the 1970’s looked very similar, if not better, than what I saw in Mumbai. The need for basic infrastructure (water utilities, large scale hospitals, subway systems, ports) is critical for India to compete globally with other high growth economies. Of course, to get the large and young population to consume, they will need the necessities to get to work, communicate and be educated first. Despite having a tough first quarter in 2011, India has rebounded nicely in the latter part of March. Concerns of inflation linger in India however we believe the need for infrastructure is self-evident.

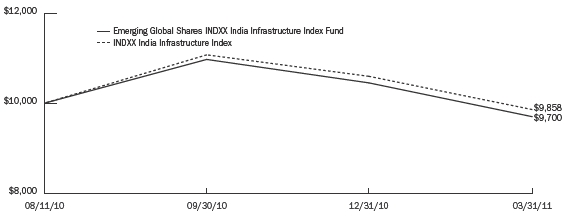

The Emerging Global Shares INDXX India Infrastructure Index Fund had a total return of -7.18% at net asset value (“NAV”) for the quarter ended March 31, 2011. There was not enough track record to provide one year returns. The Fund had a -3.00% annualized return since its inception date of August 11, 2010.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

14 EGA Emerging Global Shares Trust

Emerging Global Shares INDXX India Infrastructure Index Fund

| | | |

| Performance as of 3/31/2011 | | | |

|

| |

| | Average Annual Total Return1 |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | INDXX India

Infrastructure

Index |

|

| Since Inception2 | (3.00)% | (2.55)% | (1.42)% |

|

| 1 | Returns of less than one year are not annualized. |

| |

| 2 | August 11, 2010. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 15

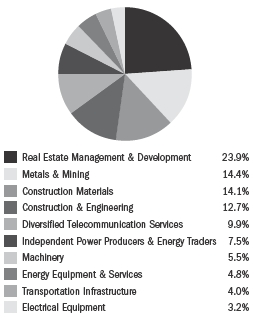

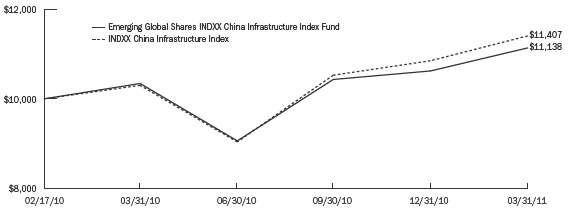

Portfolio Summary (Unaudited)

Emerging Global Shares INDXX China Infrastructure Index Fund

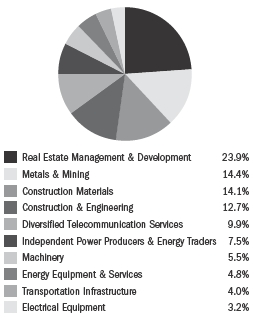

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Jiangxi Copper Co., Ltd. | 6.3 | % |

| China National Building Material Co., Ltd. | 5.8 | % |

| Anhui Conch Cement Co., Ltd. | 5.8 | % |

| China Telecom Corp., Ltd. | 5.2 | % |

| China Oilfield Services, Ltd. | 4.8 | % |

| China Unicom Hong Kong, Ltd. | 4.8 | % |

| Aluminum Corp. of China, Ltd. | 4.8 | % |

| China Communications Construction Co., Ltd. | 4.5 | % |

| Renhe Commercial Holdings | 4.4 | % |

| Evergrande Real Estate Group Ltd. | 3.9 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares INDXX China Infrastructure Index Fund (ticker: CHXX)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the INDXX China Infrastructure Index (the “Underlying Index”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Underlying Index through investments in equity securities, including shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). The Underlying Index is a freefloat market capitalization weighted stock market index comprised of 30 leading companies that INDXX, LLC determines to be representative of China’s Infrastructure sectors. The Fund invests in Chinese mid cap infrastructure companies that are included in the Underlying Index, which are generally defined as companies that are domiciled in China and that have a market capitalization of at least $200 million at the time of purchase. Under normal circumstances, the Fund will invest at least 80% of its net assets in Chinese Infrastructure companies included in the Underlying Index and generally expects to be substantially invested at such times with at least 95% of its net assets invested in these securities. The Fund defines Chinese Infrastructure companies as companies that are included in the Underlying Index at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares INDXX China Infrastructure Index Fund aims to provide investors with the means to participate in one of the greatest shifts within China in our lifetime. According to Stephen Roach of Morgan Stanley, China’s 12th Five-Year Plan (2011-2015) will shift the focus from export and investment driven growth to one dependent more on its 1.3 billion consumers within. Roach contends that the 5th Five-Year Plan of the late 70’s was about Deng Xiaoping’s willingness for economic reform and opening to a market driven economy. The 9th Five-Year Plan of the mid 90’s was about ownership transition – essentially state-owned enterprise reforms. The reality now is that the vast majority of Chinese are poor. They don’t have the basic necessities to live the way we do in the West, nor to consume. You don’t just need money to consume. You need infrastructure. The vast majority of Chinese live in the interior that is what we would call a developing world. Consumerism is not about the coastline. It’s done and they have their infrastructure. But for the roughly 750 million people in the interior (twice the population of the US), we believe they need the infrastructure first and then they can consume.

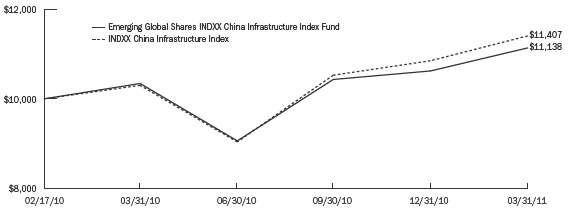

The Emerging Global Shares INDXX China Infrastructure Index Fund had a total return of 4.86% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 10.13% annualized return since its inception date of February 17, 2010. The Fund NAV had a 7.69% return for the full year ending March 31, 2011.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

16 EGA Emerging Global Shares Trust

Emerging Global Shares INDXX China Infrastructure Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | INDXX China

Infrastructure

Index |

|

| 1 Year | 7.69% | 7.48% | 10.73% |

| Since Inception1 | 10.13% | 10.88% | 12.53% |

|

| 1 February 17, 2010. | | | |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 17

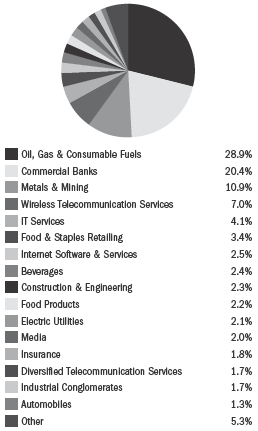

Portfolio Summary (Unaudited)

Emerging Global Shares INDXX Brazil Infrastructure Index Fund

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Telemar Norte Leste SA | 6.8 | % |

| Vivo Participacoes SA | 6.1 | % |

| Centrais Eletricas Brasileiras SA | 5.9 | % |

| CESP - Companhia Energetica de Sao Paulo | 5.4 | % |

| CPFL Energia SA | 5.2 | % |

| Companhia de Concessoes Rodoviarias SA | 5.2 | % |

| Embraer SA | 5.0 | % |

| Ultrapar Participacoes SA | 4.8 | % |

| Weg SA | 4.8 | % |

| Tele Norte Leste Participacoes SA | 4.3 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares INDXX Brazil Infrastructure Index Fund (ticker: BRXX)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the INDXX Brazil Infrastructure Index (the “Underlying Index”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Underlying Index through investments in equity securities, including shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). The Underlying Index is a freefloat capitalization weighted stock market index comprised of 30 leading companies that INDXX, LLC determines to be representative of Brazil’s Infrastructure sectors. The Fund invests in Brazilian mid cap infrastructure companies that are included in the Underlying Index, which are generally defined as companies that are domiciled in Brazil and that have a market capitalization of at least $200 million at the time of purchase. Under normal circumstances, the Fund will invest at least 80% of its net assets in Brazilian Infrastructure companies included in the Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Brazilian Infrastructure companies as companies that are included in the Underlying Index at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares INDXX Brazil Infrastructure Index Fund is in many ways like our other infrastructure funds. It is a play on a country that is truly in need of emerging on a grander scale. For Brazil, it’s just as much the movement of natural resources and voice/data as it is people and this Fund covers such exposures. One of our top performing funds in terms of total returns, this Fund has also been a great outperformer versus the large cap Brazil ETF (roughly 1500 bps for the 1-year period ending March 31, 2011). For Brazil, infrastructure as an equity group has proven to be an excellent defensive performer existing within a sideways channel in Q4 2010 and Q1 2011 while other Brazilian equity index exposures were falling. Brazil remains a strong story broadly because of its BRIC affiliation and its close ties to those that depend on its resources like China. Dilma Rouseff has proven to be a popular figure internationally and has made measured steps to communicate her wish to control inflationary pressures that affect Brazil as well as other emerging markets. As commodity prices increase, Brazil benefits from this tailwind and the infrastructure build-out continues as planned within.

The Emerging Global Shares INDXX Brazil Infrastructure Index Fund had a total return of 6.95% at net asset value (“NAV”) for the quarter ended March 31, 2011 and 25.73% annualized return since its inception date of February 24, 2010. The Fund NAV had a 25.16% return for the full year ending March 31, 2011.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

18 EGA Emerging Global Shares Trust

Emerging Global Shares INDXX Brazil Infrastructure Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | INDXX Brazil

Infrastructure

Index |

|

| 1 Year | 25.16% | 23.03% | 27.52% |

| Since Inception1 | 25.73% | 27.50% | 31.99% |

|

| 1 February 24, 2010. | | | |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 19

Portfolio Summary (Unaudited)

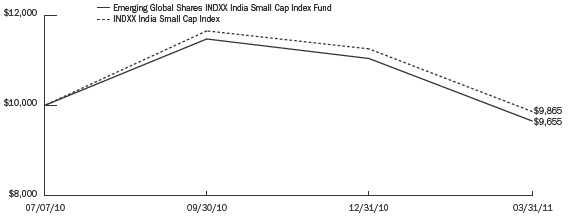

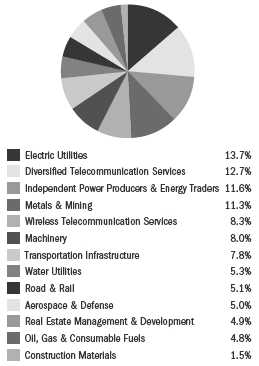

Emerging Global Shares INDXX India Small Cap Index Fund

Industry Breakdown*

| | |

| Top Ten Holdings* | | |

|

| Patni Computer Systems, Ltd. | 3.5 | % |

| UCO Bank | 3.1 | % |

| Dish TV India, Ltd. | 2.9 | % |

| Indian Bank | 2.8 | % |

| Orchid Chemicals & Pharmaceuticals, Ltd. | 2.8 | % |

| Vijaya Bank, Ltd | 2.6 | % |

| Hexaware Technologies, Ltd. | 2.5 | % |

| Amtek Auto, Ltd. | 2.4 | % |

| Godrej Industries, Ltd. | 2.3 | % |

| Havells India, Ltd. | 2.3 | % |

| * | Expressed as a percentage of total investments in securities as of 3/31/2011. |

Emerging Global Shares INDXX India Small Cap Index Fund (ticker: SCIN)

The Fund seeks investment results that generally correspond (before fees and expenses) to the price and yield performance of the INDXX India Small Cap Index (the “Underlying Index”). The Fund seeks to achieve its investment objective by attempting to replicate the portfolio of the Underlying Index through investments in equity securities, including shares traded on local exchanges, American Depositary Receipts (“ADRs”) and Global Depositary Receipts (“GDRs”). The Underlying Index is a freefloat capitalization weighted stock market index comprised of 75 leading companies that INDXX, LLC determines to be representative of India’s small capitalization equity market. The Fund invests in Indian Small Cap companies that are included in the Underlying Index, which are generally defined as companies that are domiciled in India and are at the bottom end of the group that have a market capitalization of at least $100 million but below $2 billion at the time of purchase. Under normal circumstances, the Fund will invest at least 80% of its net assets in Indian small cap companies included in the Underlying Index and generally expects to be substantially invested at such times, with at least 95% of its net assets invested in these securities. The Fund defines Indian Small Cap companies as companies that are included in the Underlying Index at the time of purchase. The Fund will provide shareholders with at least 60 days’ notice prior to any change in this policy.

The Emerging Global Shares INDXX India Small Cap Index Fund is our attempt to play on the booming domestic consumption story out of India. As many large cap companies earn significant proportions of their top line revenues from global operations, small cap companies (regardless of where they are domiciled) normally focus more on domestic customers. Although the Indian market had a tough period from November 2010 to March 2011, it was an even harder fall for small cap names. A set of corruption scandals led to further rumor-mongering. What central bankers couldn’t do which was slow down a hot economy was finally accomplished with the crowd psychology of fear. We believe long term prospects for India and its growing consumer class remain positive as the underlying factors of demographics and low debts provide a strong foundation.

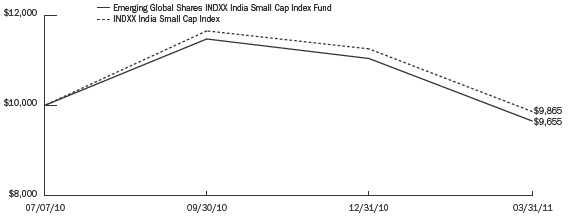

The Emerging Global Shares INDXX India Small Cap Index Fund had a total return of -12.56% at net asset value (“NAV”) for the quarter ended March 31, 2011 and -3.45% annualized return since its inception date of July 7, 2010. The Fund did not have enough history as of March 31, 2011 to provide a one-year return.

Performance Charts

The following performance chart is provided for comparative purposes and represents the period noted. The Fund’s per share NAV is the value of one share of the Fund and is calculated by dividing the value of total assets less total liabilities by the number of shares outstanding. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market price returns is the mid-point of the highest bid and lowest offer for Fund shares as of the close of trading on the exchange where Fund shares are listed. NAV and market returns assume that dividends and capital gain distributions have been reinvested in the Fund at NAV and market price, respectively. As with other ETFs, NAV returns and market price returns may differ because of factors such as the supply and demand for Fund shares and investors’ assessments of the underlying value of a Fund’s portfolio securities. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions or taxes on transactions in Fund shares or that a shareholder would pay on Fund distributions.

20 EGA Emerging Global Shares Trust

Emerging Global Shares INDXX India Small Cap Index Fund

Performance as of 3/31/2011

| | | |

| | Average Annual Total Return1 |

| |

|

| | Fund

Net Asset Value | Fund

Market Price | INDXX India

Small Cap Index |

|

| Since Inception2 | (3.45)% | (2.99)% | (1.35)% |

|

| 1 | Returns of less than one year are not annualized. |

| 2 | July 7, 2010. |

Performance data quoted represents past performance. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please visit www.egshares.com or call (888) 800-4347. This fund is new and has limited operating history. As stated in the current prospectus, the Fund’s total annual operating expense ratio is 0.85%. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange (“NYSE”) Arca, ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming the reinvestment of distributions. Past performance does not guarantee future results. The hypothetical example does not represent the returns of any particular investment.

EGA Emerging Global Shares Trust 21

Shareholder Expense Examples (Unaudited)

As a shareholder of an EGA Emerging Global Shares Trust ETF, you incur advisory fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (October 1, 2010 to March 31, 2011).

Actual expenses

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid Through 3/31/2011” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line under each Fund in the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.