UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212)576-7000

Date of fiscal year end: April 30

(MainStay MacKay Intermediate Tax Free Bond Fund and MainStay MacKay Short Term Municipal Fund)

Date of reporting period: October 31, 2019

FORMN-CSR

The information presented in this FormN-CSR relates solely to the

MainStay MacKay Intermediate Tax Free Bond Fund and MainStay MacKay Short Term Municipal Fund,

series of the Registrant.

Item 1. Reports to Stockholders.

MainStay MacKay Short Term Municipal Fund

Message from the President and Semiannual Report

Unaudited I October 31, 2019

Beginning on January 1, 2021, paper copies of each MainStay Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from MainStay Funds or from your financial intermediary. Instead, the reports will be made available on the MainStay Funds’ website. You will be notified by mail and provided with a website address to access the report each time a new report is posted to the website.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from MainStay Funds electronically by calling toll-free 800-624-6782, by sending an e-mail to MainStayShareholderServices@nylim.com, or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper form free of charge. If you hold shares of a MainStay Fund directly, you can inform MainStay Funds that you wish to receive paper copies of reports by calling toll-free 800-624-6782 or by sending an e-mail to MainStayShareholderServices@nylim.com. If you hold shares of a MainStay Fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper form will apply to all MainStay Funds in which you are invested and may apply to all funds held with your financial intermediary.

| | | | | | | | |

| | | | | |

| Not FDIC/NCUA Insured | | Not a Deposit | | May Lose Value | | No Bank Guarantee | | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

U.S. equity and fixed-income securities, including municipal bonds, generally gained ground during thesix-month reporting period ended October 31, 2019, despite concerns about slowing U.S. and global economic growth and international trade conflicts.

Shifting investor sentiment regarding economic growth and trade issues set the backdrop for volatile market performance during thesix-month reporting period. Gross domestic product (“GDP”) growth remained positive in the United States, backed by indications of strong employment, consumer sentiment and corporate earnings. However, domestic manufacturing and business investment showed signs of slowing. Many international economies, including those of leading European and Asian countries, appeared even more fragile, with some experiencing precipitously declining rates of growth and others hovering on the edge of recession. Markets were further undermined by intermittent setbacks in negotiations over the deepening trade dispute between the United States and China, leading to episodes of risk aversion, most notably in May and August 2019.

Central banks provided a much-needed stabilizing force in this environment, injecting liquidity and other forms of stimulus into struggling economies. In the United States, the Federal Reserve Board (“Fed”) cut interest rates three times in the four months between July and October 2019, reversing most of the rate hikes it had implemented during 2018.

Global uncertainties and aggressive Fed easing drove a historic surge in prices for long-term Treasury bonds, which outperformed most other investment sectors, equity and fixed income alike. However, short-term municipal bonds performed

on a par with short-term Treasury securities. Broadly speaking, municipal investors tended to reward quality over yield, long-term over short-term durations and taxable overtax-exempt bonds. State and territorial economic conditions played an important role in performance as well. Progress in the restructuring of Puerto Rico-issued debt led to particularly strong performance from the various debt profiles of issuers from Puerto Rico. Among states, Illinois and Colorado outperformed the overall municipal market, while North Carolina and Wisconsin underperformed.

In an increasingly uncertain political and economic climate, investors are left to ponder how best to position their portfolios. Municipal bonds, which are backed by local tax revenues, provide investors with a degree of insulation from international challenges and corporate disappointments while providingtax-advantaged income to eligible investors. As a MainStay investor, you can rely on us to continually analyze the impact of varying supply/demand dynamics, maturity dates, issuing locales, sectors and credit ratings on the level of risk and reward offered by the municipal bonds within our investable universe. We manage our Funds with unflagging energy and dedication so that you can remain focused on your long-term objectives in the face of uncertainty and change.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to the Fund’s Summary Prospectus and/or Prospectus and consider the Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about the Fund. You may obtain copies of the Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, NJ 07302 or by sending ane-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at nylinvestments.com/funds. Please read the Summary Prospectus and/or Prospectus carefully before investing.

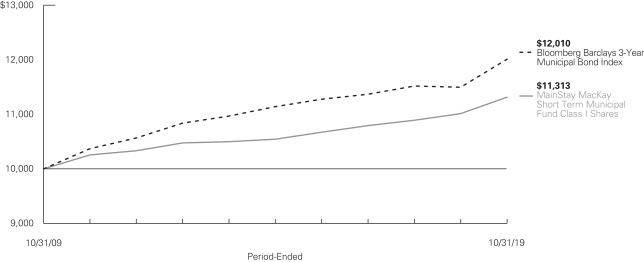

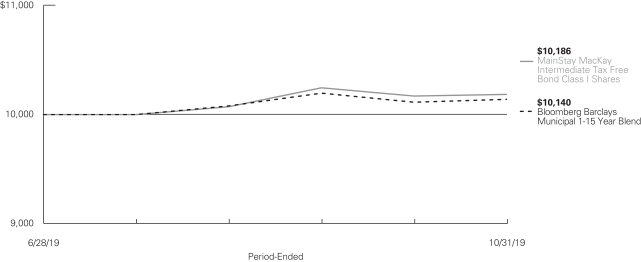

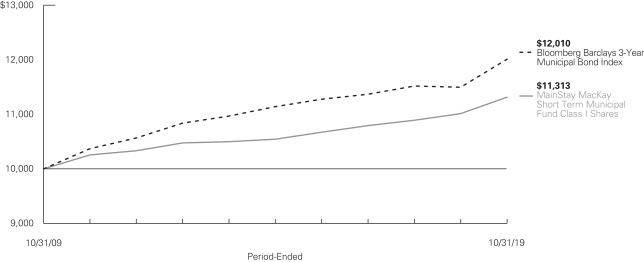

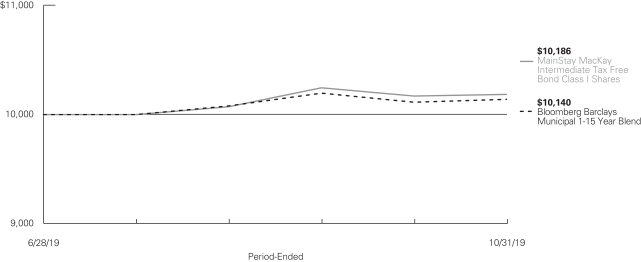

Investment and Performance Comparison1(Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit nylinvestments.com/funds.

Average Annual Total Returns for the Period-Ended October 31, 20192

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Inception

Date | | | Six

Months | | | One Year | | | Five Years | | | Ten Years | | | Gross

Expense

Ratio3 | |

| | | | | | | | |

| Class A Shares | | Maximum 1% Initial Sales Charge4 | | With sales charges Excluding sales charges | |

| 1/2/2004

|

| |

| 0.25

1.27 | %

| |

| 1.49

2.51 | %

| |

| 0.54

1.16 | %

| |

| 0.67

0.97 | %

| |

| 0.70

0.70 | %

|

| Investor Class Shares | | Maximum 1% Initial Sales Charge4 | | With sales charges Excluding sales charges | |

| 2/28/2008

|

| |

| –0.09

0.92 |

| |

| 0.90

1.92 |

| |

| 0.09

0.70 |

| |

| 0.26

0.57 |

| |

| 1.30

1.30 |

|

| Class I Shares | | No Sales Charge | | | | | 1/2/1991 | | | | 1.31 | | | | 2.70 | | | | 1.42 | | | | 1.24 | | | | 0.45 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements. |

| 2. | Effective June 1, 2015, the Fund changed, among other things, its investment objective and principal investment strategies. Effective May 22, 2018, the Fund made further changes to, among other things, its principal investment strategies. Effective February 28, 2019, the Fund further changed its investment objective. The performance information shown in this report reflects the Fund’s prior investment objectives and principal investment strategies, as applicable. |

| 3. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus, as supplemented, and may differ from other expense ratios disclosed in this report. |

| 4. | The maximum initial sales charge prior to June 1, 2015 was 3.00%. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | | | | | | | | | | | | | |

| Benchmark Performance | | Six

Months | | | One Year | | | Five Years | | | Ten Years | |

| | | | |

Bloomberg Barclays 3-Year Municipal Bond Index5 | | | 1.87 | % | | | 4.44 | % | | | 1.51 | % | | | 1.85 | % |

Morningstar Muni National Short Category Average6 | | | 1.49 | | | | 3.68 | | | | 1.23 | | | | 1.58 | |

| 5. | The Bloomberg Barclays 3-Year Municipal Bond Index is the Fund’s primary broad-based securities-market index for comparison purposes. The Bloomberg Barclays 3-Year Municipal Bond Index is considered representative of the broad-based market for investment grade, tax-exempt bonds with a maturity range of 2-4 years. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly into an index. |

| 6. | The Morningstar Muni National Short Category Average is representative of funds that invest in bonds issued by state and local governments to fund |

| | public projects. The income from these bonds is generally free from federal taxes and/or from state taxes in the issuing state. To lower risk, some of these portfolios spread their assets across many states and sectors. Other portfolios buy bonds from only one state in order to get the state-tax benefit. These portfolios have durations of less than 4.5 years. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 6 | | MainStay MacKay Short Term Municipal Fund |

Cost in Dollars of a $1,000 Investment in Mainstay MacKay Short Term Municipal Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from May 1, 2019, to October 31, 2019, and the impact of those costs on your investment.

Example

As a shareholder of the Fund you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from May 1, 2019, to October 31, 2019.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended October 31, 2019. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for thesix-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account

Value

5/1/19 | | | Ending Account

Value (Based

on Actual

Returns and

Expenses)

10/31/19 | | | Expenses

Paid

During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses)

10/31/19 | | | Expenses

Paid

During

Period1 | | | Net Expense

Ratio

During

Period2 |

| | | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 1,012.70 | | | $ | 3.49 | | | $ | 1,021.67 | | | $ | 3.51 | | | 0.69% |

| | | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 1,009.20 | | | $ | 5.91 | | | $ | 1,019.25 | | | $ | 5.94 | | | 1.17% |

| | | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 1,013.10 | | | $ | 2.02 | | | $ | 1,023.13 | | | $ | 2.03 | | | 0.40% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 366 and multiplied by 184 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the six-month period. |

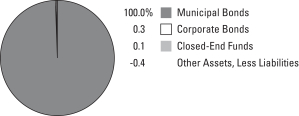

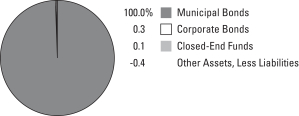

Portfolio Composition as of October 31, 2019(Unaudited)

See Portfolio of Investments beginning on page 10 for specific holdings within these categories. The Fund’s holdings are subject to change.

Top Ten Issuers Held as of October 31, 2019(excludingshort-term investment) (Unaudited)

| 1. | State of Illinois, Unlimited General Obligation, 5.00%–6.00%, due 11/1/19–11/1/26 |

| 2. | Territory of Guam, Revenue Bonds, 5.00%, due 11/15/19–12/1/21 |

| 3. | Metropolitan Transportation Authority, Revenue Bonds, 1.24%–5.50%, due 11/15/19–11/15/41 |

| 4. | City of New York NY, Unlimited General Obligation, 1.35%, due 4/1/42 |

| 5. | Geisinger Authority Health System, Revenue Bonds, 1.16%, due 10/1/43 |

| 6. | New Jersey Turnpike Authority, Revenue Bonds, 1.902%–2.122%, due 1/1/22–1/1/24 |

| 7. | New Jersey Economic Development Authority, School Facilities Construction, Revenue Bonds, 5.00%–5.50%, due 12/15/19–9/1/23 |

| 8. | Philadelphia Parking Authority, Revenue Bonds, 5.00%, due 9/1/21 |

| 9. | Main Street Natural Gas, Inc., Revenue Bonds, 2.111%–5.00%, due 5/15/20–4/1/48 |

| 10. | New Jersey Transportation Trust Fund Authority, Transportation System, Revenue Bonds, 5.25%–5.75%, due 12/15/19–12/15/23 |

| | |

| 8 | | MainStay MacKay Short Term Municipal Fund |

Portfolio Management Discussion and Analysis(Unaudited)

Questions answered by portfolio managers John Loffredo, CFA, Robert DiMella, CFA, Michael Petty, David Dowden, Scott Sprauer, Frances Lewis and John Lawlor of MacKay Shields LLC, the Fund’s Subadvisor.

How did MainStay MacKay Short Term Municipal Fund perform relative to its benchmark and peer group during the six months ended October 31, 2019?

For the six months ended October 31, 2019, Class I shares of MainStay MacKay Short Term Municipal Fund returned 1.31%, underperforming the 1.87% return of the Fund’s primary benchmark, the Bloomberg Barclays3-Year Municipal Bond Index. Over the same period, Class I shares also underperformed the 1.49% return of the Morningstar Muni National Short Category Average.1

Were there any changes to the Fund during the reporting period?

Effective February 28, 2019, the Fund’s investment objective was modified to seek current income exempt from regular federal income tax. Also, on February 28, 2019, John Lawlor was added as a portfolio manager of the Fund. John Loffredo, Robert DiMella, Michael Petty, David Dowden, Scott Sprauer and Frances Lewis continue to manage the Fund. For more information about these changes refer to the supplements dated December 14, 2018, and February 28, 2019.

What factors affected the Fund’s relative performance during the reporting period?

During the reporting period, the Fund’s underweight exposure to the prerefunded and state general obligation sectors detracted from performance relative to the Bloomberg Barclays3-Year Municipal Bond Index, as did underweight holdings of New York and Texas state general obligation bonds. Security selection among bonds rated AAA andAA- further detracted from relative performance.2 These comparatively weak areas of performance were significantly offset by positive contributions from security selection in the leasing and industrial revenue sectors. (Contributions take weightings and total returns into account.)

What was the Fund’s duration3 strategy during the reporting period?

During the reporting period, the Fund targeted a shorter duration posture than the Bloomberg Barclays3-Year Municipal Bond Index. As of October 31, 2019, the Fund’s modified duration to worst4 was 1.57 years while the benchmark’s modified duration to worst was 2.49 years.

During the reporting period, which sectors were the strongest positive contributors to the Fund’s relative performance and which sectors were particularly weak?

The strongest contributors to the Fund’s relative performance were holdings in the hospital, industrial revenue and leasing sectors, while holdings in the prerefunded/escrowed to maturity (ETM), state general obligation and local general obligation sectors detracted from results. Across states and territories, positive contributors included bonds from Illinois, New Jersey and Guam, while securities from New York and Texas detracted. From a credit rating perspective, bonds rated AA and A5 enhanced returns compared to the benchmark, whileAAA- andAA-rated bonds weighed on relative performance.

What were some of the Fund’s largest purchases and sales during the reporting period?

The Fund remained focused on diversification and liquidity, so no individual transaction was considered significant.

How did the Fund’s sector weightings change during the reporting period?

During the reporting period, the Fund increased its exposure to the local general obligation, hospital and transportation sectors, while decreasing its exposure to the leasing and special tax sectors. On a state level, the Fund increased its exposure to California and Illinois bonds during the same period while decreasing its exposure to securities from New Jersey and Indiana. Lastly, the Fund increased its exposure toAA-rated bonds while decreasing its exposure toAAA-rated bonds.

How was the Fund positioned at the end of the reporting period?

As of October 31, 2019, the Fund held overweight positions relative to the Bloomberg Barclays3-Year Municipal Bond Index in the hospital and general obligation sectors, and to bonds from Illinois and New Jersey. At the same point in time, the Fund held underweight exposure to the prerefunded/ETM and state general obligation sectors, and to bonds from New York and Texas.

| 1. | See page 5 for other share class returns, which may be higher or lower than Class I share returns. See page 6 for more information on benchmark and peer group returns. |

| 2. | An obligation rated ‘AAA’ has the highest rating assigned by Standard & Poor’s (“S&P”), and in the opinion of S&P, the obligor’s capacity to meet its financial commitment on the obligation is extremely strong. An obligation rated ‘AA’ by S&P is deemed by S&P to differ from the highest-rated obligations only to a small degree. In the opinion of S&P, the obligor’s capacity to meet its financial commitment on the obligation is very strong. When applied to Fund holdings, ratings are based solely on the creditworthiness of the bonds in the portfolio and are not meant to represent the security or safety of the Fund. |

| 3. | Duration is a measure of the price sensitivity of a fixed-income investment to changes in interest rates. Duration is expressed as a number of years and is considered a more accurate sensitivity gauge than average maturity. |

| 4. | Modified duration is inversely related to the approximate percentage change in price for a given change in yield. Duration to worst is the duration of a bond computed using the bond’s nearest call date or maturity, whichever comes first. This measure ignores future cash flow fluctuations due to embedded optionality. |

| 5. | An obligation rated ‘A’ by S&P is deemed by S&P to be somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. In the opinion of S&P, however, the obligor’s capacity to meet its financial commitment on the obligation is still strong. When applied to Fund holdings, ratings are based solely on the creditworthiness of the bonds in the portfolio and are not meant to represent the security or safety of the Fund. |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Portfolio of InvestmentsOctober 31, 2019 (Unaudited)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Long-Term Bonds 100.3%† Corporate Bonds 0.3% | |

Convertible Securities 0.3% | |

Rogers Memorial Hospital, Inc. | | | | | | | | |

2.067%, due 7/1/20 | | $ | 470,000 | | | $ | 470,355 | |

2.211%, due 7/1/22 | | | 500,000 | | | | 499,168 | |

2.383%, due 7/1/24 | | | 500,000 | | | | 497,950 | |

| | | | | | | | |

Total Corporate Bonds

(Cost $1,470,000) | | | | | | | 1,467,473 | |

| | | | | | | | |

|

| Municipal Bonds 100.0% | |

Long-Term Municipal Bonds 89.9% | |

Alabama 0.3% | |

City of Hamilton AL, Unlimited General Obligation | | | | | | | | |

Insured: BAM

3.00%, due 8/1/21 | | | 370,000 | | | | 380,534 | |

Insured: BAM

5.00%, due 8/1/23 | | | 235,000 | | | | 264,591 | |

City of Thomasville AL, Unlimited General Obligation

Insured: BAM

5.00%, due 2/15/24 | | | 820,000 | | | | 928,101 | |

| | | | | | | | |

| | | | | | | 1,573,226 | |

| | | | | | | | |

Alaska 0.2% | |

Alaska Industrial Development & Export Authority, Tanana Chiefs Conference Project, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 10/1/22 | | | 550,000 | | | | 602,921 | |

Series A

5.00%, due 10/1/23 | | | 585,000 | | | | 658,944 | |

| | | | | | | | |

| | | | | | | 1,261,865 | |

| | | | | | | | |

Arizona 0.3% | |

Industrial Development Authority of the City of Phoenix, Downtown Phoenix Student LLC, Revenue Bonds

Series A

5.00%, due 7/1/23 | | | 50,000 | | | | 55,540 | |

City of Tucson AZ, Certificates of Participation Insured: AGM

4.00%, due 7/1/20 | | | 350,000 | | | | 356,310 | |

Glendale Union School District No. 205, School Improvement Project, Unlimited General Obligation

Series B, Insured: AGM

5.00%, due 7/1/20 | | | 540,000 | | | | 553,370 | |

Maricopa County Industrial Development Authority, Paradise Schools Project, Revenue Bonds

4.00%, due 7/1/22 | | | 150,000 | | | | 159,759 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Arizona (continued) | |

Sedona Wastewater Municipal Property Corp., Revenue Bonds

Insured: NATL-RE

(zero coupon), due 7/1/24 | | $ | 500,000 | | | $ | 457,265 | |

| | | | | | | | |

| | | | | | | 1,582,244 | |

| | | | | | | | |

California 11.2% | |

Alta Loma School District, Capital Appreciation, Unlimited General Obligation

Series A, Insured: NATL-RE

(zero coupon), due 8/1/21 | | | 1,750,000 | | | | 1,710,957 | |

Anaheim Public Financing Authority, Public Improvements Project, Revenue Bonds

Series C, Insured: AGM

(zero coupon), due 9/1/21 | | | 300,000 | | | | 292,518 | |

Cabrillo Unified School District, Capital Appreciation, Unlimited General Obligation

Series A, Insured: AMBAC

(zero coupon), due 8/1/20 | | | 400,000 | | | | 396,348 | |

California Educational Facilities Authority, Loyola Marymount University, Revenue Bonds

Series A, Insured: NATL-RE

(zero coupon), due 10/1/22 | | | 3,000,000 | | | | 2,879,850 | |

California Health Facilities Financing Authority, Los Angeles Biomedical Research Institute, Revenue Bonds | | | | | | | | |

3.00%, due 9/1/20 | | | 215,000 | | | | 217,862 | |

4.00%, due 9/1/21 | | | 275,000 | | | | 287,741 | |

4.00%, due 9/1/22 | | | 300,000 | | | | 320,766 | |

4.00%, due 9/1/23 | | | 310,000 | | | | 338,269 | |

California Municipal Finance Authority, California Lutheran University, Revenue Bonds | | | | | | | | |

5.00%, due 10/1/20 | | | 325,000 | | | | 335,761 | |

5.00%, due 10/1/21 | | | 250,000 | | | | 267,033 | |

California Municipal Finance Authority, LAX Integrated Express Solutions Project, Revenue Bonds

Series A

5.00%, due 12/31/23 (a) | | | 1,300,000 | | | | 1,476,371 | |

California Municipal Finance Authority, Paradise Valley Estates Project, Revenue Bonds

Series B-2, Insured: California Mortgage Insurance

2.00%, due 7/1/24 | | | 500,000 | | | | 504,025 | |

California Municipal Finance Authority, West Village Student Housing Project, Revenue Bonds

5.00%, due 5/15/23 | | | 1,520,000 | | | | 1,711,155 | |

| | | | |

| 10 | | MainStay MacKay Short Term Municipal Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

California (continued) | |

California School Finance Authority, Classical Academies Project, Revenue Bonds

Series A-1

7.375%, due 10/1/43 | | $ | 5,050,000 | | | $ | 5,898,703 | |

California State Educational Facilities Authority, Art Center College of Design, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 12/1/19 | | | 125,000 | | | | 125,360 | |

Series A

5.00%, due 12/1/21 | | | 290,000 | | | | 311,646 | |

Series A

5.00%, due 12/1/22 | | | 200,000 | | | | 221,762 | |

Series A

5.00%, due 12/1/23 | | | 215,000 | | | | 245,362 | |

California Statewide Communities Development Authority, Methodist Hospital of Southern California Project, Revenue Bonds | | | | | | | | |

5.00%, due 1/1/20 | | | 365,000 | | | | 367,044 | |

5.00%, due 1/1/21 | | | 300,000 | | | | 312,156 | |

5.00%, due 1/1/22 | | | 500,000 | | | | 537,235 | |

California Statewide Communities Development Authority, Southern California Edison Co., Revenue Bonds

2.625%, due 11/1/33 (b) | | | 1,265,000 | | | | 1,314,234 | |

Chula Vista Elementary School District, Unlimited General Obligation

(zero coupon), due 8/1/23 | | | 1,500,000 | | | | 1,436,775 | |

City of Oakland CA, Pension Obligation, Revenue Bonds

4.00%, due 12/15/22 | | | 1,000,000 | | | | 1,049,520 | |

City of Oakland CA, Revenue Bonds Insured: AGM

(zero coupon), due 12/15/19 | | | 1,000,000 | | | | 997,760 | |

County of Fresno CA, Pension Obligation, Capital Appreciation, Revenue Bonds

Series A, Insured: NATL-RE

(zero coupon), due 8/15/20 | | | 500,000 | | | | 492,755 | |

Dinuba Unified School District, Unlimited General Obligation | | | | | | | | |

Insured: AGM

(zero coupon), due 8/1/20 | | | 155,000 | | | | 153,472 | |

Insured: AGM

(zero coupon), due 8/1/21 | | | 160,000 | | | | 156,187 | |

Federal Home Loan Mortgage Corp., Revenue Bonds

Series M-057

2.40%, due 10/15/29 | | | 4,500,000 | | | | 4,669,515 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

California (continued) | |

Imperial Community College District, Capital Appreciation, Unlimited General Obligation Insured: AGC

(zero coupon), due 8/1/21 | | $ | 305,000 | | | $ | 297,887 | |

Inglewood Unified School District, Unlimited General Obligation

Series B, Insured: BAM

4.00%, due 8/1/20 | | | 1,000,000 | | | | 1,019,700 | |

Los Angeles Department of Airports, Revenue Bonds

Series A

5.00%, due 5/15/21 (a) | | | 1,065,000 | | | | 1,126,195 | |

Oakland Unified School District, Alameda County, Unlimited General Obligation

Series B

2.146%, due 8/1/21 | | | 835,000 | | | | 839,576 | |

Oxnard County Water Revenue, Revenue Bonds | | | | | | | | |

Insured: BAM

5.00%, due 6/1/20 | | | 925,000 | | | | 944,990 | |

Insured: BAM

5.00%, due 6/1/21 | | | 280,000 | | | | 297,094 | |

Palm Springs Airport Passenger Facilities, Palm Springs International Airport, Revenue Bonds (a) | | | | | | | | |

5.00%, due 6/1/20 | | | 565,000 | | | | 577,492 | |

5.00%, due 6/1/22 | | | 400,000 | | | | 437,020 | |

Insured: BAM

5.00%, due 6/1/25 | | | 925,000 | | | | 1,101,175 | |

Petaluma City Elementary School District, Unlimited General Obligation

3.00%, due 8/1/20 | | | 435,000 | | | | 440,033 | |

Sacramento City Financing Authority, Capital Appreciation, Tax Allocation

Series A, Insured: NATL-RE

(zero coupon), due 12/1/21 | | | 4,170,000 | | | | 4,038,645 | |

Sacramento County Sanitation District Financing Authority, Revenue Bonds

Series B

2.239%, due 12/1/19 | | | 2,000,000 | | | | 2,001,000 | |

Sacramento Municipal Utility District, Revenue Bonds

Series A

5.00%, due 8/15/49 (b) | | | 6,000,000 | | | | 6,781,620 | |

San Ysidro School District, Unlimited General Obligation

Insured: AGM

5.00%, due 8/1/22 | | | 1,320,000 | | | | 1,445,255 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of InvestmentsOctober 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

California (continued) | |

Santa Fe Springs Community Development Commission, Consolidated Redevelopment Project, Tax Allocation

Series A, Insured: NATL-RE

(zero coupon), due 9/1/20 | | $ | 325,000 | | | $ | 321,123 | |

South Bay Union School District / San Diego County, Unlimited General Obligation

(zero coupon), due 8/1/22 | | | 1,000,000 | | | | 960,220 | |

Southern California Public Power Authority, Apex Power Project No. 1, Revenue Bonds

Series A

5.25%, due 11/1/21 | | | 1,300,000 | | | | 1,396,200 | |

State of California, Build America Bonds, Unlimited General Obligation

5.70%, due 11/1/21 | | | 1,385,000 | | | | 1,491,506 | |

Stockton Public Financing Authority, Water Revenue, Revenue Bonds

Series A, Insured: BAM

5.00%, due 10/1/20 | | | 400,000 | | | | 413,984 | |

Susanville, Natural Gas Enterprise Refunding Project, Revenue Bonds

Insured: AGM

2.00%, due 6/1/20 | | | 350,000 | | | | 351,459 | |

Ukiah Unified School District, Capital Appreciation, Unlimited General Obligation Insured: NATL-RE

(zero coupon), due 8/1/21 | | | 875,000 | | | | 854,744 | |

Vallejo City Unified School District, Unlimited General Obligation

Series A, Insured: NATL-RE

5.90%, due 2/1/20 | | | 2,500,000 | | | | 2,526,475 | |

| | | | | | | | |

| | | | | | | 58,691,535 | |

| | | | | | | | |

Colorado 0.6% | |

Colorado Educational & Cultural Facilities Authority, Johnson & Wales University, Revenue Bonds | | | | | | | | |

Series A

4.00%, due 4/1/23 | | | 315,000 | | | | 336,845 | |

Series B

5.00%, due 4/1/22 | | | 770,000 | | | | 826,726 | |

Series B

5.00%, due 4/1/24 | | | 500,000 | | | | 551,100 | |

Denver City & County Airport Revenue (a) | | | | | | | | |

Series A

5.00%, due 12/1/20 | | | 550,000 | | | | 571,170 | |

Series A

5.00%, due 11/15/22 | | | 720,000 | | | | 795,218 | |

| | | | | | | | |

| | | | | | | 3,081,059 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Connecticut 1.4% | |

City of Bridgeport CT, Unlimited General Obligation

Series D, Insured: AGM

5.00%, due 8/15/20 | | $ | 1,000,000 | | | $ | 1,027,430 | |

City of Hartford CT, Unlimited General Obligation | | | | | | | | |

Series C, Insured: AGM

5.00%, due 7/15/21 | | | 200,000 | | | | 212,518 | |

Series A, Insured: AGM

5.00%, due 4/1/22 | | | 1,000,000 | | | | 1,087,750 | |

City of Milford CT, Unlimited General Obligation

4.00%, due 11/1/19 | | | 235,000 | | | | 235,000 | |

City of Torrington CT, Unlimited General Obligation

4.00%, due 12/1/19 | | | 110,000 | | | | 110,241 | |

Hartford County Metropolitan District, Unlimited General Obligation

Series C, Insured: AGM

5.00%, due 11/1/19 | | | 495,000 | | | | 495,000 | |

State of Connecticut, Unlimited General Obligation | | | | | | | | |

Series C

4.00%, due 6/15/22 | | | 2,210,000 | | | | 2,359,727 | |

Series C

5.00%, due 6/15/23 | | | 1,500,000 | | | | 1,689,495 | |

| | | | | | | | |

| | | | | | | 7,217,161 | |

| | | | | | | | |

District of Columbia 0.2% | |

District of Columbia Income Tax Secured, Revenue Bonds | | | | | | | | |

Series A

4.00%, due 12/1/19 | | | 320,000 | | | | 320,685 | |

Series A

5.25%, due 12/1/26 | | | 500,000 | | | | 501,535 | |

District of Columbia, KIPP DC Project, Revenue Bonds | | | | | | | | |

3.00%, due 7/1/20 | | | 230,000 | | | | 232,233 | |

5.00%, due 7/1/22 | | | 200,000 | | | | 217,550 | |

| | | | | | | | |

| | | | | | | 1,272,003 | |

| | | | | | | | |

Florida 2.8% | |

Atlantic Beach Health Care Facilities, Fleet Landing Project, Revenue Bonds

Series A

5.00%, due 11/15/19 | | | 1,135,000 | | | | 1,136,180 | |

City of Jacksonville FL, Revenue Bonds

Series A

5.00%, due 10/1/21 | | | 1,165,000 | | | | 1,248,717 | |

County of Broward Port Facilities, Revenue Bonds

Series B

5.00%, due 9/1/20 | | | 3,420,000 | | | | 3,520,560 | |

| | | | |

| 12 | | MainStay MacKay Short Term Municipal Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Florida (continued) | |

County of Miami-Dade FL Aviation, Revenue Bonds

Series E

1.872%, due 10/1/20 | | $ | 1,200,000 | | | $ | 1,198,776 | |

Florida Department of Environmental Protection, Revenue Bonds

Series A

5.00%, due 7/1/20 | | | 1,000,000 | | | | 1,024,960 | |

Florida Ports Financing Commission, Revenue Bonds

Series B

5.00%, due 6/1/20 (a) | | | 1,065,000 | | | | 1,086,928 | |

Highlands County Health Facilities Authority, Adventist Health Systems/Sunbelt Obligated Group, Revenue Bonds

Series E

5.25%, due 11/15/21 | | | 1,400,000 | | | | 1,401,750 | |

Hillsborough County, Community Investment Tax, Revenue Bonds

5.00%, due 11/1/19 | | | 195,000 | | | | 195,000 | |

Lee County Tourist Development, Revenue Bonds

Series A

3.00%, due 10/1/21 | | | 1,030,000 | | | | 1,065,463 | |

Mid-Bay Bridge Authority, Revenue Bonds

Series A

5.00%, due 10/1/21 | | | 1,000,000 | | | | 1,065,980 | |

Tolomato Community Development District, Special Assessment | | | | | | | | |

Series A-1, Insured: AGM

2.00%, due 5/1/20 | | | 625,000 | | | | 625,944 | |

Series B, Insured: AGM

2.00%, due 5/1/20 | | | 910,000 | | | | 911,593 | |

| | | | | | | | |

| | | | | | | 14,481,851 | |

| | | | | | | | |

Georgia 2.3% | |

Brookhaven Development Authority, Children’s Healthcare of Atlanta, Revenue Bonds

Series A

5.00%, due 7/1/20 | | | 3,240,000 | | | | 3,321,745 | |

Georgia Municipal Electric Authority, Project 1, Revenue Bonds

Series C

5.00%, due 1/1/22 | �� | | 580,000 | | | | 623,836 | |

Gwinnett County Development Authority, Gwinnett County Public Schools Project, Certificates of Participation

Insured: NATL-RE

5.25%, due 1/1/20 | | | 500,000 | | | | 503,265 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Georgia (continued) | |

Main Street Natural Gas, Inc., Revenue Bonds | | | | | | | | |

Series A

5.00%, due 5/15/20 | | $ | 1,000,000 | | | $ | 1,017,990 | |

Series A

5.00%, due 5/15/22 | | | 550,000 | | | | 594,759 | |

Series A

5.00%, due 5/15/23 | | | 1,000,000 | | | | 1,109,310 | |

Municipal Electric Authority of Georgia, Plant Vogtle Units 3 & 4 Project, Revenue Bonds | | | | | | | | |

Series B

5.00%, due 1/1/23 | | | 350,000 | | | | 385,760 | |

Series B

5.00%, due 1/1/24 | | | 445,000 | | | | 503,073 | |

Municipal Electric Authority of Georgia, Revenue Bonds | | | | | | | | |

Series 18A

5.00%, due 1/1/20 | | | 230,000 | | | | 231,341 | |

Series HH

5.00%, due 1/1/20 | | | 1,460,000 | | | | 1,468,512 | |

Series B

5.00%, due 1/1/20 | | | 2,250,000 | | | | 2,262,937 | |

| | | | | | | | |

| | | | | | | 12,022,528 | |

| | | | | | | | |

Guam 2.9% | |

Guam Government Waterworks Authority, Water & Wastewater Systems Revenue, Revenue Bonds

Series A

5.00%, due 7/1/20 | | | 400,000 | | | | 408,568 | |

Port Authority of Guam, Revenue Bonds | | | | | | | | |

Series C

3.587%, due 7/1/20 | | | 500,000 | | | | 503,505 | |

Series C

3.783%, due 7/1/21 | | | 500,000 | | | | 509,690 | |

Series B

5.00%, due 7/1/22 (a) | | | 400,000 | | | | 433,356 | |

Territory of Guam, Business Privilege Tax, Revenue Bonds

Series A

5.00%, due 1/1/20 | | | 660,000 | | | | 663,346 | |

Territory of Guam, Revenue Bonds | | | | | | | | |

Series D

5.00%, due 11/15/19 | | | 1,000,000 | | | | 1,001,020 | |

Series D

5.00%, due 11/15/20 | | | 2,740,000 | | | | 2,830,283 | |

Series A

5.00%, due 12/1/20 | | | 3,230,000 | | | | 3,340,951 | |

Series A

5.00%, due 12/1/21 | | | 5,295,000 | | | | 5,630,862 | |

| | | | | | | | |

| | | | | | | 15,321,581 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Portfolio of InvestmentsOctober 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Illinois 14.4% | |

Chicago Board of Education, Certificate of Participation

Series A, Insured: NATL-RE

6.00%, due 1/1/20 | | $ | 2,715,000 | | | $ | 2,733,679 | |

Chicago Board of Education, Chicago School Board, Unlimited General Obligation

Series A, Insured: NATL-RE

5.25%, due 12/1/19 | | | 400,000 | | | | 401,080 | |

Chicago Board of Education, Unlimited General Obligation | | | | | | | | |

Series A, Insured: NATL-RE

5.00%, due 12/1/19 | | | 1,775,000 | | | | 1,779,455 | |

Series A, Insured: AGM

5.00%, due 12/1/23 | | | 1,600,000 | | | | 1,782,224 | |

Chicago Midway International Airport, Revenue Bonds

Series A

5.00%, due 1/1/20 (a) | | | 1,425,000 | | | | 1,432,980 | |

Chicago O’ Hare International Airport, Revenue Bonds

5.00%, due 1/1/21 | | | 250,000 | | | | 260,742 | |

Chicago O’Hare International Airport, Revenue Bonds

Series F

4.25%, due 1/1/20 | | | 750,000 | | | | 753,532 | |

Chicago Park District, Limited General Obligation | | | | | | | | |

Series C

3.357%, due 1/1/21 | | | 955,000 | | | | 970,079 | |

Series C

3.545%, due 1/1/22 | | | 450,000 | | | | 463,383 | |

Series E

5.00%, due 11/15/20 | | | 750,000 | | | | 776,145 | |

Series E

5.00%, due 11/15/21 | | | 800,000 | | | | 851,312 | |

Series C

5.00%, due 1/1/23 | | | 500,000 | | | | 547,735 | |

Chicago Transit Authority, Revenue Bonds

5.00%, due 12/1/21 | | | 5,000,000 | | | | 5,358,450 | |

City of Chicago IL, Waterworks Second Lien, Revenue Bonds | | | | | | | | |

5.00%, due 11/1/19 | | | 2,150,000 | | | | 2,150,000 | |

5.00%, due 11/1/22 | | | 1,270,000 | | | | 1,396,327 | |

City of Rockford IL, Unlimited General Obligation | | | | | | | | |

Series A, Insured: AGM

4.00%, due 12/15/20 | | | 100,000 | | | | 102,694 | |

Series A, Insured: AGM

4.00%, due 12/15/21 | | | 130,000 | | | | 136,377 | |

Series A, Insured: AGM

4.00%, due 12/15/22 | | | 135,000 | | | | 144,357 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Illinois (continued) | |

City of Rockford IL, Unlimited General Obligation (continued) | | | | | | | | |

Series A, Insured: AGM

4.00%, due 12/15/23 | | $ | 140,000 | | | $ | 152,148 | |

Series A, Insured: AGM

4.00%, due 12/15/24 | | | 290,000 | | | | 319,093 | |

Cook County Community High School District No. 212 Leyden, Revenue Bonds

Series B, Insured: BAM

2.00%, due 12/1/19 | | | 1,140,000 | | | | 1,140,308 | |

Cook County Community Unit School District No. 401 Elmwood Park, Limited General Obligation

Series A, Insured: AGM

5.00%, due 12/1/20 | | | 1,340,000 | | | | 1,392,890 | |

Cook County School District No. 122 Ridgeland, Unlimited General Obligation | | | | | | | | |

Series A

3.00%, due 12/1/22 | | | 700,000 | | | | 731,570 | |

Series A

3.00%, due 12/1/23 | | | 620,000 | | | | 656,103 | |

Cook County School District No. 99 Cicero, Limited Tax, Unlimited General Obligation Insured: BAM

5.00%, due 12/1/21 | | | 1,270,000 | | | | 1,359,700 | |

Cook County School District, No. 81 Schiller Park, Limited General Obligation

Series B

4.00%, due 12/1/19 | | | 570,000 | | | | 571,043 | |

County of Cook IL, Unlimited General Obligation

Series G

5.00%, due 11/15/25 | | | 1,665,000 | | | | 1,723,974 | |

Crawford Hospital District, Unlimited General Obligation | | | | | | | | |

Insured: AGM

4.00%, due 1/1/21 | | | 125,000 | | | | 128,428 | |

Insured: AGM

4.00%, due 1/1/22 | | | 100,000 | | | | 104,894 | |

Illinois Educational Facilities Authority, University of Chicago, Revenue Bonds

Series B

1.875%, due 7/1/25 (b) | | | 2,250,000 | | | | 2,253,937 | |

Illinois Finance Authority, Edward Elmhurst Obligated Group, Revenue Bonds

5.00%, due 1/1/21 | | | 300,000 | | | | 310,914 | |

Illinois Finance Authority, Illinois Wesleyan University, Revenue Bonds

4.00%, due 9/1/21 | | | 265,000 | | | | 275,319 | |

| | | | |

| 14 | | MainStay MacKay Short Term Municipal Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Illinois (continued) | |

Illinois State University, Auxiliary Facilities System, Revenue Bonds | | | | | | | | |

Series A, Insured: AGM

5.00%, due 4/1/21 | | $ | 505,000 | | | $ | 526,427 | |

Series B, Insured: AGM

5.00%, due 4/1/21 | | | 250,000 | | | | 260,608 | |

Series A, Insured: AGM

5.00%, due 4/1/22 | | | 425,000 | | | | 455,375 | |

Series B, Insured: AGM

5.00%, due 4/1/22 | | | 645,000 | | | | 691,098 | |

Kane Cook & DuPage Counties School District No. 46, Unlimited General Obligation

Series B, Insured: AMBAC

(zero coupon), due 1/1/21 | | | 2,000,000 | | | | 1,964,140 | |

Kane County School District No. 131 Aurora East Side, Unlimited General Obligation Insured: BAM

4.00%, due 12/1/22 | | | 580,000 | | | | 621,168 | |

Kankakee County School District No. 111, Limited General Obligation | | | | | | | | |

Insured: BAM

4.00%, due 1/1/22 | | | 255,000 | | | | 267,204 | |

Insured: BAM

4.00%, due 1/1/24 | | | 370,000 | | | | 401,180 | |

La Salle County School District No. 141, Unlimited General Obligation | | | | | | | | |

Insured: MAC

4.00%, due 12/1/20 | | | 560,000 | | | | 575,478 | |

Insured: MAC

4.00%, due 12/1/21 | | | 585,000 | | | | 610,845 | |

Insured: MAC

4.00%, due 12/1/22 | | | 370,000 | | | | 393,169 | |

Madison Macoupin Etc Counties Illinois Community College District No. 536, Lewis & Clark Community College, Unlimited General Obligation | | | | | | | | |

4.50%, due 5/1/20 | | | 305,000 | | | | 309,630 | |

5.00%, due 11/1/22 | | | 420,000 | | | | 452,697 | |

Madison Macoupin Etc Counties Illinois Community College District No. 536, Unlimited General Obligation | | | | | | | | |

Series A

5.00%, due 11/1/20 | | | 150,000 | | | | 154,187 | |

Series A

5.00%, due 11/1/21 | | | 70,000 | | | | 73,931 | |

Peoria County School District No. 68 Oak Grove, Unlimited General Obligation

Series C, Insured: AGM

2.00%, due 12/1/19 | | | 180,000 | | | | 180,088 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Illinois (continued) | |

Public Building Commission of Chicago, Chicago Transit Authority, Revenue Bonds Insured: AMBAC

5.25%, due 3/1/24 | | $ | 1,000,000 | | | $ | 1,128,770 | |

Railsplitter Tobacco Settlement Authority, Revenue Bonds

5.25%, due 6/1/20 | | | 3,765,000 | | | | 3,847,905 | |

Randolph County Community Unit School District No. 140 Sparta, Unlimited General Obligation

Insured: AGM

4.00%, due 12/1/19 | | | 210,000 | | | | 210,410 | |

Regional Transportation Authority, Revenue Bonds | | | | | | | | |

Insured: AGM

5.75%, due 6/1/21 | | | 480,000 | | | | 513,264 | |

Insured: AGM

6.25%, due 7/1/22 | | | 360,000 | | | | 405,562 | |

Round Lake IL, Lakewood Grove Special Service Area No. 3 & 4, Special Tax Insured: BAM

2.65%, due 3/1/21 | | | 499,000 | | | | 502,493 | |

Sales Tax Securitization Corp., Revenue Bonds

Series C

5.00%, due 1/1/22 | | | 1,250,000 | | | | 1,332,350 | |

Sauk Village, Unlimited General Obligation | | | | | | | | |

Series B, Insured: BAM

4.00%, due 12/1/21 | | | 750,000 | | | | 786,112 | |

Series C, Insured: BAM

4.00%, due 12/1/21 | | | 130,000 | | | | 136,046 | |

Series C, Insured: BAM

4.00%, due 12/1/22 | | | 100,000 | | | | 106,447 | |

Series C, Insured: BAM

4.00%, due 12/1/23 | | | 1,030,000 | | | | 1,111,864 | |

St. Clair County High School District No. 201 Belleville, Unlimited General Obligation

Series B, Insured: BAM

4.00%, due 2/1/22 | | | 1,180,000 | | | | 1,239,755 | |

State of Illinois, Revenue Bonds

5.00%, due 6/15/20 | | | 250,000 | | | | 254,828 | |

State of Illinois, Sales Tax, Revenue Bonds | | | | | | | | |

Series B

5.00%, due 6/15/22 | | | 655,000 | | | | 701,525 | |

Series C

5.00%, due 6/15/22 | | | 95,000 | | | | 101,748 | |

State of Illinois, Unlimited General Obligation | | | | | | | | |

Series B

5.00%, due 11/1/19 | | | 5,000,000 | | | | 5,000,000 | |

5.00%, due 6/1/21 | | | 4,000,000 | | | | 4,183,160 | |

Series B

5.25%, due 1/1/20 | | | 840,000 | | | | 844,343 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Portfolio of InvestmentsOctober 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Illinois (continued) | |

State of Illinois, Unlimited General Obligation (continued) | | | | | | | | |

1st Series, Insured: NATL-RE

6.00%, due 11/1/26 | | $ | 4,115,000 | | | $ | 4,821,916 | |

University of Illinois, Auxiliary System Facilities, Revenue Bonds

Series A, Insured: AMBAC

5.50%, due 4/1/22 | | | 175,000 | | | | 192,119 | |

Upper Illinois River Valley Development Authority, Morris Hospital, Revenue Bonds

5.00%, due 12/1/20 | | | 575,000 | | | | 594,504 | |

Village of Cary IL, Special Service Area No. 2, Special Tax

Insured: BAM

1.70%, due 3/1/20 | | | 149,000 | | | | 149,042 | |

Village of Crestwood IL, Alternate Revenue Source, Unlimited General Obligation

Series B, Insured: BAM

2.00%, due 12/15/19 | | | 500,000 | | | | 500,270 | |

Village of Stone Park, Unlimited General Obligation | | | | | | | | |

Series B, Insured: BAM

4.00%, due 2/1/20 | | | 135,000 | | | | 135,784 | |

Series B, Insured: BAM

4.00%, due 2/1/21 | | | 120,000 | | | | 123,404 | |

Series B, Insured: BAM

4.00%, due 2/1/24 | | | 135,000 | | | | 146,754 | |

Series B, Insured: BAM

4.00%, due 2/1/25 | | | 150,000 | | | | 164,984 | |

Washington County Community Unit School District No. 10, Unlimited General Obligation | | | | | | | | |

Insured: BAM

4.00%, due 1/15/21 | | | 740,000 | | | | 763,288 | |

Insured: BAM

4.00%, due 1/15/22 | | | 580,000 | | | | 609,905 | |

Western Illinois University, Revenue Bonds Insured: BAM

5.00%, due 4/1/20 | | | 460,000 | | | | 465,819 | |

White Oak Library District, Unlimited General Obligation | | | | | | | | |

5.00%, due 1/1/21 | | | 355,000 | | | | 369,374 | |

5.00%, due 1/1/22 | | | 315,000 | | | | 338,458 | |

5.00%, due 1/1/23 | | | 430,000 | | | | 475,894 | |

Will County Community High School District No. 210 Lincoln-Way, Unlimited General Obligation

Insured: AGM

5.00%, due 1/1/20 | | | 2,000,000 | | | | 2,010,760 | |

| | | | | | | | |

| | | | | | | 75,366,954 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Indiana 2.7% | |

Center Grove Multi-Facility School Building Corp., Revenue Notes

2.50%, due 12/15/20 | | $ | 3,000,000 | | | $ | 3,015,330 | |

Hammond Multi-School Building Corp., Revenue Bonds | | | | | | | | |

4.00%, due 1/15/20 | | | 470,000 | | | | 472,312 | |

4.00%, due 7/15/21 | | | 330,000 | | | | 343,883 | |

5.00%, due 1/15/22 | | | 555,000 | | | | 597,175 | |

5.00%, due 7/15/22 | | | 1,040,000 | | | | 1,136,283 | |

Indiana Finance Authority, Marian University Project, Revenue Bonds | | | | | | | | |

Series B

2.52%, due 9/15/20 | | | 535,000 | | | | 535,631 | |

Series B

2.57%, due 9/15/21 | | | 450,000 | | | | 449,424 | |

Series A

5.00%, due 9/15/20 | | | 55,000 | | | | 56,597 | |

Series A

5.00%, due 9/15/21 | | | 60,000 | | | | 63,673 | |

Series A

5.00%, due 9/15/22 | | | 50,000 | | | | 54,549 | |

Series A

5.00%, due 9/15/23 | | | 75,000 | | | | 83,899 | |

Indiana Health & Educational Facilities Financing Authority, Ascension Senior Health Credit Group, Revenue Bonds (b) | | | | | | | | |

Series A-9

1.375%, due 10/1/27 | | | 4,470,000 | | | | 4,472,727 | |

Series 2006 B-3

1.75%, due 11/15/31 | | | 1,400,000 | | | | 1,412,082 | |

IPS Multi-School Building Corp., Indianapolis Board of School Commissioners, Revenue Bonds

5.00%, due 1/15/22 | | | 1,250,000 | | | | 1,348,938 | |

| | | | | | | | |

| | | | | | | 14,042,503 | |

| | | | | | | | |

Iowa 1.0% | |

City of Coralville IA, Certificates of Participation

Series E

4.00%, due 6/1/20 | | | 500,000 | | | | 502,225 | |

PEFA, Inc., Revenue Bonds

5.00%, due 9/1/49 (b) | | | 2,000,000 | | | | 2,353,040 | |

Sioux Center Community School District, Unlimited General Obligation | | | | | | | | |

Insured: AGM

5.00%, due 5/1/20 | | | 885,000 | | | | 901,390 | |

Insured: AGM

5.00%, due 5/1/21 | | | 755,000 | | | | 797,174 | |

Insured: AGM

5.00%, due 5/1/22 | | | 350,000 | | | | 382,196 | |

| | | | |

| 16 | | MainStay MacKay Short Term Municipal Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Iowa (continued) | |

Xenia Rural Water District, Capital Loan Notes, Revenue Bonds

3.00%, due 12/1/19 | | $ | 375,000 | | | $ | 375,323 | |

| | | | | | | | |

| | | | | | | 5,311,348 | |

| | | | | | | | |

Kansas 0.2% | |

Johnson County Unified School District No. 233 Olathe, Unlimited General Obligation

Series A

5.00%, due 9/1/20 | | | 1,250,000 | | | | 1,289,588 | |

| | | | | | | | |

|

Kentucky 0.9% | |

Kentucky Bond Development Corp., Lexington Center Corp. Project, Revenue Bonds

Series A

5.00%, due 9/1/22 | | | 550,000 | | | | 604,516 | |

Kentucky Bond Development Corp., Revenue Bonds

5.00%, due 9/1/21 | | | 325,000 | | | | 346,063 | |

Louisville & Jefferson County Metropolitan Government, Louisville Gas & Electric Co., Revenue Bonds

Series A

1.85%, due 10/1/33 (b) | | | 3,000,000 | | | | 3,024,630 | |

Louisville / Jefferson County Metropolitan Government, Norton Healthcare, Revenue Bonds

Series A

5.00%, due 10/1/20 | | | 790,000 | | | | 814,988 | |

| | | | | | | | |

| | | | | | | 4,790,197 | |

| | | | | | | | |

Louisiana 0.9% | |

Evangeline Parish Road & Drain Sales Tax District No. 1, Revenue Bonds

Insured: AGM

5.00%, due 12/1/20 | | | 500,000 | | | | 520,010 | |

Louisiana Public Facilities Authority, Willis-Knighton Medical Center, Revenue Bonds

Series 1993, Insured: AMBAC

2.631%, due 9/1/23 (b) | | | 4,400,000 | | | | 4,400,000 | |

| | | | | | | | |

| | | | | | | 4,920,010 | |

| | | | | | | | |

Maine 0.5% | |

Maine Finance Authority, Revenue Bonds (a) | | | | | | | | |

Series 2019A-1, Insured: AGM

5.00%, due 12/1/22 | | | 500,000 | | | | 549,635 | |

Series 2019A-1, Insured: AGM

5.00%, due 12/1/23 | | | 545,000 | | | | 614,580 | |

Series 2019A-1, Insured: AGM

5.00%, due 12/1/24 | | | 520,000 | | | | 599,836 | |

Series 2019A-1, Insured: AGM

5.00%, due 12/1/25 | | | 500,000 | | | | 588,820 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Maine (continued) | |

Maine Municipal Bond Bank, Revenue Bonds

Series D

3.00%, due 11/1/19 | | $ | 250,000 | | | $ | 250,000 | |

| | | | | | | | |

| | | | | | | 2,602,871 | |

| | | | | | | | |

Maryland 0.9% | |

Maryland Economic Development Corp., Seagirt Marine Terminal Project, Revenue Bonds | | | | | | | | |

Series B

3.25%, due 6/1/22 | | | 755,000 | | | | 766,952 | |

Series B

3.70%, due 6/1/25 | | | 1,000,000 | | | | 1,035,940 | |

Maryland Health & Higher Educational Facilities Authority, Broadmead Issue, Revenue Bonds

Series B

2.875%, due 7/1/23 | | | 1,750,000 | | | | 1,830,675 | |

Prince George’s County, Regional Medical Center, Certificates of Participation

5.00%, due 10/1/20 | | | 1,040,000 | | | | 1,076,254 | |

| | | | | | | | |

| | | | | | | 4,709,821 | |

| | | | | | | | |

Massachusetts 0.6% | |

Massachusetts Development Finance Agency, Green Bond, Boston Medical Center Issue, Revenue Bonds

Series F

5.00%, due 7/1/20 | | | 480,000 | | | | 490,858 | |

Massachusetts Housing Finance Agency, Revenue Bonds

Series B

2.60%, due 12/1/39 (b) | | | 2,535,000 | | | | 2,546,230 | |

| | | | | | | | |

| | | | | | | 3,037,088 | |

| | | | | | | | |

Michigan 2.6% | |

City of Detroit MI, Sewage Disposal System, Second Lien, Revenue Bonds

Series B, Insured: NATL-RE

5.50%, due 7/1/22 | | | 1,500,000 | | | | 1,661,415 | |

City of Detroit MI, Sewage Disposal System, Senior Lien, Revenue Bonds

Series A, Insured: AGM

5.25%, due 7/1/20 | | | 400,000 | | | | 410,424 | |

Michigan Finance Authority, Local Government Loan Program, Revenue Bonds

Series D1, Insured: AGM

5.00%, due 7/1/20 | | | 200,000 | | | | 204,926 | |

Michigan Finance Authority, Revenue Bonds (a) | | | | | | | | |

Series 25-A

5.00%, due 11/1/21 | | | 1,700,000 | | | | 1,810,568 | |

Series 25-A

5.00%, due 11/1/22 | | | 1,775,000 | | | | 1,942,826 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Portfolio of InvestmentsOctober 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Michigan (continued) | |

Michigan Finance Authority, Trinity Health Credit Group, Revenue Bonds | | | | | | | | |

Series MI-1

5.00%, due 12/1/21 | | $ | 200,000 | | | $ | 215,184 | |

Series MI-1

5.00%, due 12/1/22 | | | 200,000 | | | | 222,272 | |

Michigan Finance Authority, Wayne County Criminal Justice Center Project, Revenue Bonds

5.00%, due 11/1/22 | | | 500,000 | | | | 554,850 | |

Michigan Hospital Finance Authority, Ascension Health Credit Group, Revenue Bonds

Series B

5.00%, due 11/15/21 | | | 250,000 | | | | 250,295 | |

Michigan State Housing Development Authority, Revenue Bonds

Series C

1.65%, due 6/1/20 (a) | | | 1,500,000 | | | | 1,501,620 | |

Michigan Strategic Fund, Detroit Edison Project, Revenue Bonds

Series ET-2

1.45%, due 8/1/29 (b) | | | 2,000,000 | | | | 1,995,320 | |

Muskegon Local Development Finance Authority, Revenue Bonds

Insured: AGM

4.00%, due 11/1/19 | | | 330,000 | | | | 330,000 | |

State of Michigan, School Loan, Revenue Bonds

Series B, Insured: Q-SBLF

4.14%, due 11/1/20 | | | 715,000 | | | | 733,454 | |

Wayne County Airport Authority, Revenue Bonds | | | | | | | | |

Series A, Insured: AGM

4.00%, due 12/1/20 (a) | | | 1,000,000 | | | | 1,028,830 | |

Series C

5.00%, due 12/1/21 | | | 500,000 | | | | 519,845 | |

| | | | | | | | |

| | | | | | | 13,381,829 | |

| | | | | | | | |

Minnesota 0.6% | |

Kanabec County MN, FirstLight Health System, Revenue Bonds

2.75%, due 12/1/19 | | | 2,750,000 | | | | 2,751,237 | |

Minnesota Higher Education Facilities Authority, College of St. Scholastica, Inc., Revenue Bonds

2.00%, due 12/1/19 | | | 150,000 | | | | 150,065 | |

| | | | | | | | |

| | | | | | | 2,901,302 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

Mississippi 1.0% | |

City of Jackson MS Water & Sewer System, Revenue Bonds

Insured: BAM

4.00%, due 9/1/20 | | $ | 625,000 | | | $ | 636,144 | |

Mississippi Development Bank, Jackson Public School District, Revenue Bonds Insured: BAM

5.00%, due 10/1/21 | | | 450,000 | | | | 481,275 | |

Mississippi Development Bank, Jackson Water & Sewer System Project, Revenue Bonds | | | | | | | | |

Series B, Insured: AGM

2.375%, due 9/1/20 | | | 830,000 | | | | 828,357 | |

Insured: AGM

5.00%, due 12/1/20 | | | 1,000,000 | | | | 1,036,300 | |

Mississippi Gaming Tax, Revenue Bonds | | | | | | | | |

Series A

5.00%, due 10/15/20 | | | 750,000 | | | | 776,392 | |

Series A

5.00%, due 10/15/22 | | | 1,000,000 | | | | 1,107,510 | |

State of Mississippi, Unlimited General Obligation

Series D, Insured: NATL-RE

5.00%, due 11/1/19 | | | 240,000 | | | | 240,000 | |

| | | | | | | | |

| | | | | | | 5,105,978 | |

| | | | | | | | |

Missouri 1.6% | |

Kansas City Industrial Development Authority, Downtown Redevelopment District, Revenue Bonds

Series A

5.00%, due 9/1/21 | | | 4,420,000 | | | | 4,722,240 | |

Lincoln University, Auxiliary Systems, Revenue Bonds | | | | | | | | |

Insured: AGM

5.00%, due 6/1/22 | | | 300,000 | | | | 326,409 | |

Insured: AGM

5.00%, due 6/1/23 | | | 320,000 | | | | 358,227 | |

Missouri Health & Educational Facilities Authority, A.T. Still University of Health Sciences, Revenue Bonds | | | | | | | | |

Series B

2.24%, due 10/1/20 | | | 750,000 | | | | 750,495 | |

Series B

2.29%, due 10/1/21 | | | 1,000,000 | | | | 1,001,630 | |

Missouri Public Utilities Commission, Interim Construction Notes, Revenue Bonds

Series 2019

1.50%, due 3/1/21 | | | 1,200,000 | | | | 1,201,860 | |

| | | | | | | | |

| | | | | | | 8,360,861 | |

| | | | | | | | |

| | | | |

| 18 | | MainStay MacKay Short Term Municipal Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Montana 0.2% | |

Montana Facilities Finance Authority, Kalispell Regional Medical Center, Revenue Bonds

Series A

4.378%, due 7/1/22 | | $ | 915,000 | | | $ | 948,809 | |

| | | | | | | | |

|

Nebraska 1.1% | |

Central Plains Energy, Project No. 4, Revenue Bonds

5.00%, due 3/1/50 (b) | | | 5,000,000 | | | | 5,572,000 | |

| | | | | | | | |

|

Nevada 0.6% | |

County of Washoe, Sierra Pacific Power Co. Project, Revenue Bonds

Series D

2.05%, due 3/1/36 (a)(b) | | | 3,000,000 | | | | 3,028,050 | |

| | | | | | | | |

|

New Hampshire 0.7% | |

New Hampshire Business Finance Authority, Pennichuck Water Works, Inc. Project, Revenue Bonds

Series A

5.00%, due 1/1/23 (a) | | | 600,000 | | | | 656,448 | |

New Hampshire Business Finance Authority, United Illuminating Co., Revenue Bonds

Series A

2.80%, due 10/1/33 (b) | | | 3,000,000 | | | | 3,132,300 | |

| | | | | | | | |

| | | | | | | 3,788,748 | |

| | | | | | | | |

New Jersey 9.0% | |

Atlantic County Improvement Authority, Stockton University Atlantic City, Revenue Bonds

Series B, Insured: AGM

5.00%, due 9/1/20 | | | 3,745,000 | | | | 3,863,604 | |

Borough of North Plainfield NJ, Unlimited General Obligation

Insured: MAC

3.00%, due 6/1/20 | | | 330,000 | | | | 333,373 | |

Buena Regional School District, Unlimited General Obligation | | | | | | | | |

Insured: MAC

5.00%, due 8/1/23 | | | 210,000 | | | | 237,344 | |

Insured: MAC

5.00%, due 8/1/24 | | | 220,000 | | | | 255,224 | |

City of Atlantic City NJ, Tax Appeal, Unlimited General Obligation | | | | | | | | |

Series B, Insured: AGM

5.00%, due 3/1/20 | | | 200,000 | | | | 202,190 | |

Series A, Insured: BAM

5.00%, due 3/1/21 | | | 600,000 | | | | 626,544 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

New Jersey (continued) | |

Garden State Preservation Trust, Revenue Bonds | | | | | | | | |

Series C, Insured: AGM

5.125%, due 11/1/19 | | $ | 3,175,000 | | | $ | 3,175,000 | |

Series C, Insured: AGM

5.25%, due 11/1/20 | | | 1,535,000 | | | | 1,593,775 | |

New Jersey Economic Development Authority, North Star Academy Charter School of Newark, Inc., Revenue Bonds

5.00%, due 7/15/21 | | | 200,000 | | | | 210,576 | |

New Jersey Economic Development Authority, Revenue Bonds | | | | | | | | |

Series B

5.00%, due 11/1/19 | | | 5,000,000 | | | | 5,000,000 | |

Series DDD

5.00%, due 6/15/21 | | | 960,000 | | | | 1,013,683 | |

New Jersey Economic Development Authority, School Facilities Construction, Revenue Bonds | | | | | | | | |

Series NN

5.00%, due 3/1/20 | | | 640,000 | | | | 647,258 | |

Series K, Insured: AMBAC

5.25%, due 12/15/20 | | | 970,000 | | | | 1,010,236 | |

Series K; Insured: AMBAC

5.50%, due 12/15/19 | | | 5,000,000 | | | | 5,022,650 | |

Series N-1, Insured: NATL-RE

5.50%, due 9/1/23 | | | 1,500,000 | | | | 1,702,095 | |

New Jersey Housing & Mortgage Finance Agency, Pilgrim Baptist Village I & II Project, Revenue Bonds

Series E

1.50%, due 9/1/22 (b) | | | 2,650,000 | | | | 2,655,777 | |

New Jersey State Economic Development Authority, Revenue Bonds

Series A, Insured: BAM

5.00%, due 7/1/27 | | | 2,525,000 | | | | 3,069,466 | |

New Jersey Transportation Trust Fund Authority, Federal Highway Reimbursement, Revenue Bonds

Series A

5.00%, due 6/15/24 | | | 1,000,000 | | | | 1,147,930 | |

New Jersey Transportation Trust Fund Authority, Transportation System, Revenue Bonds | | | | | | | | |

Series B-4

5.25%, due 12/15/19 | | | 250,000 | | | | 251,063 | |

Series B, Insured: AMBAC

5.25%, due 12/15/23 | | | 275,000 | | | | 313,723 | |

Series B, Insured: AGC

5.50%, due 12/15/20 | | | 1,000,000 | | | | 1,045,140 | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Portfolio of InvestmentsOctober 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

New Jersey (continued) | |

New Jersey Transportation Trust Fund Authority, Transportation System, Revenue Bonds (continued) | | | | | | | | |

Series B, Insured: NATL-RE

5.50%, due 12/15/20 | | $ | 5,000,000 | | | $ | 5,221,150 | |

Series A, Insured: AMBAC

5.75%, due 6/15/20 | | | 190,000 | | | | 194,936 | |

Newark Housing Authority, Newark Marine Terminal Rental, Redevelopment Project, Revenue Bonds

Insured: NATL-RE

5.25%, due 1/1/20 | | | 1,000,000 | | | | 1,005,980 | |

Passaic Valley Sewerage Commissioners, Sewer System, Revenue Bonds | | | | | | | | |

Series H, Insured: AGM

5.00%, due 12/1/20 | | | 300,000 | | | | 311,742 | |

Series H, Insured: AGM

5.00%, due 12/1/23 | | | 2,190,000 | | | | 2,505,820 | |

Tobacco Settlement Financing Corp., Revenue Bonds | | | | | | | | |

Series A

5.00%, due 6/1/20 | | | 2,500,000 | | | | 2,550,025 | |

Series A

5.00%, due 6/1/21 | | | 500,000 | | | | 526,945 | |

Series A

5.00%, due 6/1/22 | | | 1,250,000 | | | | 1,357,437 | |

Series A

5.00%, due 6/1/23 | | | 250,000 | | | | 278,967 | |

| | | | | | | | |

| | | | | | | 47,329,653 | |

| | | | | | | | |

New Mexico 0.2% | |

Rio Rancho Water & Wastewater Systems, Revenue Bonds

5.00%, due 5/15/20 | | | 800,000 | | | | 816,200 | |

| | | | | | | | |

|

New York 7.7% | |

Brookfield Central School District, Unlimited General Obligation

Insured: AGM

3.00%, due 6/15/22 | | | 310,000 | | | | 313,472 | |

City of Long Beach, Limited General Obligation

Insured: BAM

5.00%, due 1/15/21 | �� | | 600,000 | | | | 626,424 | |

City of Newburgh NY, G.O. Unlimited Notes

Series A

2.75%, due 8/1/20 | | | 2,155,000 | | | | 2,174,029 | |

City of Plattsburgh NY, Limited General Obligation

Series B, Insured: AGM

5.00%, due 9/15/20 | | | 440,000 | | | | 454,243 | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

New York (continued) | |

Dutchess County Local Development Corp., Nuvance Health Issue, Revenue Bonds

Series B

5.00%, due 7/1/21 | | $ | 1,725,000 | | | $ | 1,833,761 | |

Dutchess County Resource Recovery Agency, Revenue Bonds (a) | | | | | | | | |

5.00%, due 1/1/20 | | | 1,055,000 | | | | 1,060,802 | |

5.00%, due 1/1/22 | | | 1,165,000 | | | | 1,250,721 | |

Hempstead Town Local Development Corp., Molloy College Project, Revenue Bonds | | | | | | | | |

5.00%, due 7/1/20 | | | 1,235,000 | | | | 1,264,838 | |

5.00%, due 7/1/21 | | | 435,000 | | | | 460,722 | |

Metropolitan Transportation Authority, Revenue Bonds | | | | | | | | |

Series D2

4.00%, due 7/1/20 | | | 1,500,000 | | | | 1,525,845 | |

Series B-1A

5.00%, due 5/15/20 | | | 3,500,000 | | | | 3,567,095 | |

Series A, Insured: NATL-RE

5.50%, due 11/15/19 | | | 500,000 | | | | 500,640 | |

New York City Housing Development Corp., Revenue Bonds

Series C-2

1.70%, due 7/1/21 | | | 200,000 | | | | 200,050 | |

New York City Industrial Development Agency, Revenue Bonds

Series A

5.00%, due 7/1/20 (a) | | | 500,000 | | | | 511,580 | |

New York State Dormitory Authority, Interagency Council Pooled Loan Program, Revenue Bonds | | | | | | | | |

SubseriesA-1

4.00%, due 7/1/20 | | | 275,000 | | | | 279,884 | |

SubseriesA-1

4.00%, due 7/1/21 | | | 255,000 | | | | 266,299 | |

SubseriesA-1

4.00%, due 7/1/22 | | | 400,000 | | | | 426,240 | |

SubseriesA-1

4.00%, due 7/1/23 | | | 430,000 | | | | 467,272 | |

New York State Housing Finance Agency, Affordable Housing, Revenue Bonds

Series D, Insured: SONYMA

2.35%, due 11/1/21 | | | 1,500,000 | | | | 1,516,560 | |

New York Transportation Development Corp., LaGuardia Airport Terminals C&D Redevelopment Project, Revenue Bonds

5.00%, due 1/1/22 (a) | | | 5,000,000 | | | | 5,361,300 | |

Niagara Frontier Transportation Authority, Buffalo Niagara International Airport, Revenue Bonds (a) | | | | | | | | |

Series A

5.00%, due 4/1/20 | | | 1,600,000 | | | | 1,623,216 | |

| | | | |

| 20 | | MainStay MacKay Short Term Municipal Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

New York (continued) | |

Niagara Frontier Transportation Authority, Buffalo Niagara International Airport, Revenue Bonds (continued) | | | | | | | | |

Series A

5.00%, due 4/1/21 | | $ | 1,850,000 | | | $ | 1,940,132 | |

Series A

5.00%, due 4/1/23 | | | 825,000 | | | | 915,090 | |

Oneida Co. NY, Local Development Corp., Mohawk Valley Health System, Revenue Bonds | | | | | | | | |

Insured: AGM

2.252%, due 12/1/20 | | | 895,000 | | | | 895,000 | |

Insured: AGM

2.272%, due 12/1/21 | | | 900,000 | | | | 900,000 | |

Onondaga County Resource Recovery Agency, Revenue Bonds

Series A, Insured: AGM

5.00%, due 5/1/21 (a) | | | 155,000 | | | | 163,635 | |

Port Authority of New York & New Jersey, Revenue Bonds

5.00%, due 10/15/21 (a) | | | 375,000 | | | | 401,666 | |

Suffolk County NY, Limited General Obligation

Series I

2.00%, due 9/25/20 | | | 5,000,000 | | | | 5,028,950 | |

Suffolk County NY, Public Improvement, Limited General Obligation

Series B, Insured: AGM

5.00%, due 10/15/20 | | | 2,000,000 | | | | 2,069,040 | |

Oyster Bay NY, Oys | | | | | | | | |

Insured: BAM

4.00%, due 2/15/22 | | | 110,000 | | | | 116,488 | |

Insured: BAM

4.00%, due 2/15/24 | | | 115,000 | | | | 127,093 | |

Town of Oyster Bay NY, Public Improvement Project, Limited General Obligation

Series B, Insured: AGM

4.00%, due 11/1/20 | | | 775,000 | | | | 796,716 | |

Wellsville Central School District, Unlimited General Obligation

Insured: AGM

2.50%, due 6/15/22 | | | 370,000 | | | | 372,993 | |

Westchester County Local Development Corp., Westchester Medical Center, Revenue Bonds

5.00%, due 11/1/19 | | | 1,145,000 | | | | 1,145,000 | |

| | | | | | | | |

| | | | | | | 40,556,796 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

North Carolina 0.6% | |

Charlotte Airport Revenue, Charlotte Douglas International Airport, Revenue Bonds

Series B

4.00%, due 7/1/21 (a) | | $ | 550,000 | | | $ | 574,371 | |

Guilford County, Unlimited General Obligation

5.00%, due 3/1/20 | | | 1,830,000 | | | | 1,853,058 | |

New Hanover County NC, New Hanover Regional Medical Center, Revenue Bonds

5.00%, due 10/1/24 | | | 690,000 | | | | 729,661 | |

| | | | | | | | |

| | | | | | | 3,157,090 | |

| | | | | | | | |

North Dakota 0.1% | |

County of Ward ND, Unlimited General Obligation

4.00%, due 4/1/20 | | | 750,000 | | | | 757,313 | |

| | | | | | | | |

|

Ohio 2.1% | |

Cincinnati City School District, Limited General Obligation

Insured: AGM

5.00%, due 12/1/19 | | | 300,000 | | | | 300,864 | |

City of Cleveland OH, Airport System, Revenue Bonds

Series A

5.00%, due 1/1/21 (a) | | | 500,000 | | | | 520,485 | |

City of Toledo OH, Limited General Obligation Insured: AGM

4.00%, due 12/1/19 | | | 1,540,000 | | | | 1,543,157 | |

Cleveland Department of Public Utilities Division of Public Power, Revenue Bonds

Series A, Insured: AGM

5.00%, due 11/15/20 | | | 4,810,000 | | | | 4,991,577 | |

Dayton International Airport, Revenue Bonds

Series A: Insured: AGM

5.00%, due 12/1/20 (a) | | | 995,000 | | | | 1,029,706 | |

Lucas County Ohio Hospital Revenue, ProMedica Healthcare Obligated Group, Revenue Bonds

Series A

5.00%, due 11/15/19 | | | 500,000 | | | | 500,495 | |

Ohio Higher Educational Facility Commission, Ohio Wesleyan University 2019 Project, Revenue Bonds | | | | | | | | |

5.00%, due 10/1/20 | | | 765,000 | | | | 789,970 | |

5.00%, due 10/1/22 | | | 385,000 | | | | 424,008 | |

Ohio Higher Educational Facility Commission, Otterbein University Project, Revenue Bonds

Series A

4.00%, due 12/1/19 | | | 915,000 | | | | 916,638 | |

| | | | | | | | |

| | | | | | | 11,016,900 | |

| | | | | | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 21 | |

Portfolio of InvestmentsOctober 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| Municipal Bonds (continued) | |

Oklahoma 0.6% | |