UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22321

MAINSTAY FUNDS TRUST

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

30 Hudson Street

Jersey City, New Jersey 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: November 30

(MainStay Cushing MLP Premier Fund)

Date of reporting period: May 31, 2020

FORM N-CSR

The information presented in this Form N-CSR relates solely to MainStay Cushing MLP Premier Fund

series of the Registrant.

| Item 1. | Reports to Stockholders. |

MainStay Cushing® MLP Premier Fund

Message from the President and Semiannual Report

Unaudited | May 31, 2020

Beginning on January 1, 2021, paper copies of MainStay Fund annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from MainStay Funds or from your financial intermediary. Instead, the reports will be made available on the MainStay Funds’ website. You will be notified by mail and provided with a website address to access the report each time a new report is posted to the website.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from MainStay Funds electronically by calling toll-free 800-624-6782, by sending an e-mail to MainStayShareholderServices@nylim.com, or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper form free of charge. If you hold shares of a MainStay Fund directly, you can inform MainStay Funds that you wish to receive paper copies of reports by calling toll-free 800-624-6782 or by sending an e-mail to MainStayShareholderServices@nylim.com. If you hold shares of a MainStay Fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper form will apply to all MainStay Funds in which you are invested and may apply to all funds held with your financial intermediary.

| | | | | | | | |

| | | | | |

| Not FDIC/NCUA Insured | | Not a Deposit | | May Lose Value | | No Bank Guarantee | | Not Insured by Any Government Agency |

This page intentionally left blank

Message from the President

Financial markets experienced high levels of volatility in response to the spread of the novel coronavirus and a sharpening decline in global economic activity during the six months ended May 31, 2020.

After gaining ground in late 2019, energy stocks began to dip in January 2020 as the novel coronavirus spread in China, raising concerns that the outbreak could weaken demand from the world’s largest energy consumer. Most broad stock and bond indices followed suit in late February as growing numbers of COVID-19 cases were seen in hotspots around the world. On March 11, 2020, the World Health Organization acknowledged that the disease had reached pandemic proportions, with over 80,000 identified cases in China, thousands in Italy, South Korea and the United States, and more cases in dozens of additional countries. Governments and central banks pledged trillions of dollars to address the mounting economic and public health crises; however, “stay-at-home” orders and other restrictions on non-essential activities caused global economic activity to slow.

Most stocks and bonds lost significant ground in this challenging environment. The energy sector suffered the steepest declines due to weakening demand and an escalating petroleum price war between Saudi Arabia and Russia, the world’s second and third largest producers after the United States. The price war, along with the pandemic-related economic slowdown, resulted in a decline in global energy demand coupled with an increase in global supply, driving petroleum prices sharply lower in March 2020, while stocks of energy-related companies fell as well.

With the number of reported COVID-19 cases in the United States continuing to rise, the Federal Reserve twice cut interest rates and announced unlimited quantitative easing. In late

March, the Federal government declared a national emergency; and Congress passed and the President signed a $2 trillion stimulus package, with the promise of further aid for consumers and businesses to come. Investors generally responded positively to the government’s fiscal and monetary measures, as well as to prospects for a gradual lessening of restrictions on non-essential businesses. Accordingly, despite mounting signs of recession and rapidly rising unemployment levels; in April, markets regained some of the ground that they had lost the previous month and commodity prices began to recover in response to easing coronavirus fears and a Russia/Saudi Arabia agreement to cut production. May 2020 saw gradual but steady increases in commodity prices as pandemic-related restrictions began to relax. Stock prices within the energy sector continued to recover as well, though they remained well below pre-COVID-19 levels.

Today, as we at New York Life Investments continue to track the curve of the ongoing health crisis and its financial ramifications, we are particularly mindful of the people at the heart of our enterprise—our colleagues and valued clients. By taking appropriate steps to minimize community spread of COVID-19 within our organization, we strive to safeguard the health of our investment professionals so that they can continue to provide you, as a MainStay investor, with world class investment solutions in this rapidly evolving environment.

Sincerely,

Kirk C. Lehneis

President

The opinions expressed are as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. Past performance is no guarantee of future results.

Not part of the Semiannual Report

Table of Contents

Investors should refer to each Fund’s Summary Prospectus and/or Prospectus and consider each Fund’s investment objectives, strategies, risks, charges and expenses carefully before investing. The Summary Prospectus and/or Prospectus contain this and other information about each Fund. You may obtain copies of each Fund’s Summary Prospectus, Prospectus and Statement of Additional Information free of charge, upon request, by calling toll-free 800-624-6782, by writing to NYLIFE Distributors LLC, Attn: MainStay Marketing Department, 30 Hudson Street, Jersey City, New Jersey 07302 or by sending an e-mail to MainStayShareholderServices@nylim.com. These documents are also available via the MainStay Funds’ website at nylinvestments.com/funds. Please read each Summary Prospectus and/or Prospectus carefully before investing.

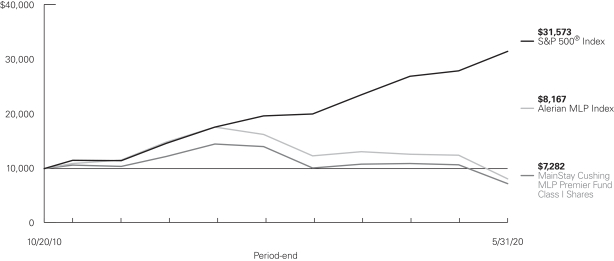

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility and other factors, current performance may be lower or higher than the figures shown. Investment return and principal value will fluctuate, and as a result, when shares are redeemed, they may be worth more or less than their original cost. The graph below depicts the historical performance of Class I shares of the Fund. Performance will vary from class to class based on differences in class-specific expenses and sales charges. For performance information current to the most recent month-end, please call 800-624-6782 or visit nylinvestments.com/funds.

Average Annual Total Returns for the Period Ended May 31, 2020

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class | | Sales Charge | | | | Inception

Date | | | Six Months | | | One

Year | | | Five Years | | | Since

Inception | | | Gross

Expense

Ratio2 | |

| | | | | | | | |

| Class A Shares3 | | Maximum 5.5% Initial Sales Charge | | With sales charge Excluding sales charge | |

| 10/20/2010

|

| |

| –29.43

–25.33 | %

| |

| –35.92

–32.19 | %

| |

| –13.53

–12.54 | %

| |

| –4.05

–3.49 | %

| |

| 1.54

1.54 | %

|

| Investor Class Shares | | Maximum 5.5% Initial Sales Charge | | With sales charge Excluding sales charge | |

| 7/11/2014

|

| |

| –29.41

–25.30 |

| |

| –35.89

–32.16 |

| |

| –13.50

–12.52 |

| |

| –12.76

–11.92 |

| |

| 1.54

1.54 |

|

| Class C Shares3 | | Maximum 1% CDSC if Redeemed Within One Year of Purchase | | With sales charge Excluding sales charge | |

| 10/20/2010

|

| |

| –26.41

–25.72 |

| |

| –33.40

–32.80 |

| |

| –13.22

–13.22 |

| |

| –4.23

–4.23 |

| |

| 2.29

2.29 |

|

| Class I Shares3 | | No Sales Charge | | | | | 10/20/2010 | | | | –25.21 | | | | –32.00 | | | | –12.31 | | | | –3.24 | | | | 1.29 | |

| 1. | The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on distributions or Fund share redemptions. Total returns reflect maximum applicable sales charges as indicated in the table above, if any, changes in share price, and reinvestment of dividend and capital gain distributions. The graph assumes the initial investment amount shown above and reflects the deduction of all sales charges that would have applied for the period of investment. Performance figures may reflect certain fee waivers and/or expense limitations, without which total returns may have been lower. For more information on share classes and current fee waivers and/or expense limitations (if any), please refer to the Notes to Financial Statements. |

| 2. | The gross expense ratios presented reflect the Fund’s “Total Annual Fund Operating Expenses” from the most recent Prospectus and may differ from other expense ratios disclosed in this report. |

| 3. | Performance figures for Class A shares, Class C shares and Class I shares reflect the historical performance of the then–existing Class A shares, Class C shares and Class I shares, respectively, of the Cushing® MLP Premier Fund (the predecessor to the Fund, which was subject to a different fee structure) for periods prior to July 12, 2014. The Cushing® MLP Premier Fund commenced operations on October 20, 2010. |

The footnotes on the next page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | | | | | | | | | | | | | | | |

| Benchmark Performance | | Six Months | | | One

Year | | | Five

Years | | | Since

Inception | |

| | | | |

Alerian MLP Index4 | | | –24.26 | % | | | –34.74 | % | | | –12.93 | % | | | –2.08 | % |

Alerian U.S. Midstream Energy Index5 | | | –24.58 | | | | –30.46 | | | | –10.98 | | | | N/A | |

S&P 500® Index6 | | | –2.10 | | | | 12.84 | | | | 9.86 | | | | 12.71 | |

Morningstar Energy Limited Partnership Category Average7 | | | –23.26 | | | | –29.80 | | | | –12.42 | | | | –2.15 | |

| 4. | Effective March 29, 2019, the Alerian MLP Index is the Fund’s primary benchmark. The Alerian MLP Index is an unmanaged, capped, float-adjusted, capitalization-weighted index and a leading gauge of energy MLPs. |

| 5. | The Alerian U.S. Midstream Energy Index is the Fund’s secondary benchmark. The Alerian U.S. Midstream Energy Index is a broad-based composite of U.S. energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, is comprised of constituents who earn the majority of their cash flow from midstream activities involving energy commodities. The inception date for the Alerian U.S. Midstream Energy Index is June 25, 2018. Data prior to that date reflects the application of the then-current index methodology to each historical rebalancing date to select and weight index constituents. |

| 6. | Prior to March 29, 2019, the S&P 500® Index was the Fund’s primary benchmark. “S&P 500®” is a trademark of The McGraw-Hill Companies, Inc. The S&P 500® Index is widely regarded as the standard index for measuring large-cap U.S. stock market performance. Results assume reinvestment of all dividends and capital gains. An investment cannot be made directly in an index. |

| 7. | The Morningstar Energy Limited Partnership Category Average is representative of funds that invest primarily a significant amount of their portfolio in energy master limited partnerships. These include but are not limited to limited partnerships specializing in midstream operations in the energy industry. Results are based on average total returns of similar funds with all dividends and capital gain distributions reinvested. |

The footnotes on the preceding page are an integral part of the table and graph and should be carefully read in conjunction with them.

| | |

| 6 | | MainStay Cushing MLP Premier Fund |

Cost in Dollars of a $1,000 Investment in MainStay Cushing MLP Premier Fund (Unaudited)

The example below is intended to describe the fees and expenses borne by shareholders during the six-month period from December 1, 2019, to May 31, 2020, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the six-month period and held for the entire period from December 1, 2019, to May 31, 2020.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the six months ended May 31, 2020. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then

multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Share Class | | Beginning

Account Value

12/1/19 | | | Ending Account Value (Based

on Actual

Returns and

Expenses)

5/31/20 | | | Expenses

Paid During

Period1 | | | Ending Account

Value (Based

on Hypothetical

5% Annualized

Return and

Actual Expenses) 5/31/20 | | | Expenses

Paid During

Period1 | | | Net Expense

Ratio

During

Period2 |

| | | | | | |

| Class A Shares | | $ | 1,000.00 | | | $ | 746.70 | | | $ | 6.90 | | | $ | 1,017.10 | | | $ | 7.97 | | | 1.58% |

| | | | | | |

| Investor Class Shares | | $ | 1,000.00 | | | $ | 747.00 | | | $ | 7.12 | | | $ | 1,016.85 | | | $ | 8.22 | | | 1.63% |

| | | | | | |

| Class C Shares | | $ | 1,000.00 | | | $ | 742.80 | | | $ | 10.33 | | | $ | 1,013.15 | | | $ | 11.93 | | | 2.37% |

| | | | | | |

| Class I Shares | | $ | 1,000.00 | | | $ | 747.90 | | | $ | 5.81 | | | $ | 1,018.35 | | | $ | 6.71 | | | 1.33% |

| 1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 366 and multiplied by 183 (to reflect the six-month period). The table above represents the actual expenses incurred during the six-month period. |

| 2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the six-month period. |

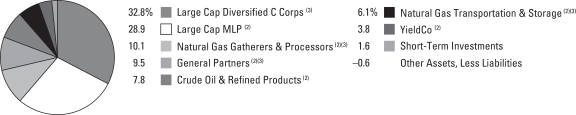

Portfolio Composition as of May 31, 2020(1) (Unaudited)

See Portfolio of Investments beginning on page 11 for specific holdings within these categories.

Top Ten Holdings as of May 31, 2020 (excluding short-term investments) (Unaudited)

| 1. | Plains All American Pipeline, L.P. |

| 4. | Enterprise Products Partners, L.P. |

| 5. | Magellan Midstream Partners, L.P. |

| 6. | Williams Companies, Inc. |

| 8. | Targa Resources Corporation |

| 10. | Pembina Pipeline Corporation |

| (1) | Fund holdings and sector allocations are subject to change, and there is no assurance that the Fund will continue to hold any particular security. |

| (2) | MLPs and Related Companies |

| | |

| 8 | | MainStay Cushing MLP Premier Fund |

Portfolio Management Discussion and Analysis (Unaudited)

Questions answered by portfolio managers Jerry V. Swank, John M. Musgrave and Kevin Gallagher of Cushing Asset Management, LP, the Fund’s Subadvisor.

How did MainStay Cushing MLP Premier Fund perform relative to its benchmarks and peer group during the six months ended May 31, 2020?

For the six months ended May 31, 2020, Class I shares of MainStay Cushing MLP Premier Fund returned –25.21%, underperforming the –24.26% return of the Fund’s primary benchmark, the Alerian MLP Index. Class I shares also underperformed the –24.58% return of the Alerian U.S. Midstream Energy Index, which is the Fund’s secondary benchmark, and the –23.26% return of the Morningstar Energy Limited Partnership Category Average. The Fund’s former primary benchmark, the S&P 500® Index, returned –2.01% during the same period.1

Were there any changes to the Fund during the reporting period?

Effective January 6, 2020, Kevin Gallagher no longer served as a portfolio manager of the Fund and John M. Musgrave was added as a portfolio manager of the Fund. Jerry Swank continues to serve as a portfolio manager of the Fund. For more information about this change refer to the prospectus supplement dated January 6, 2020.

What factors affected the Fund’s relative performance during the reporting period?

While the first half of the reporting period was largely uneventful, the speed and severity of the declines in energy commodity prices and midstream energy equities during March 2020 were unprecedented. As the COVID-19 pandemic spread, virtually all asset classes saw swift, historic drawdowns with many investors selling indiscriminately for the sake of capital preservation. The energy sector, including midstream energy equities, was not immune.

Midstream management teams took steps to preserve financial flexibility and better endure the prevailing environment. In response to volatility, most midstream companies announced remedial updates, including slashing capital expenditure forecasts, deferring projects, cutting operating costs and, in select cases, voluntarily reducing distributions and dividends. These revisions resulted in several billion dollars of capital savings and even higher free cash flow yields, despite reduced earnings projections. As of May 31, 2020, performance of the Alerian MLP Index rallied by approximately 110% from its March 18, 2020, low. While the Fund participated in the benchmark’s rally, relative performance for the overall reporting period suffered due to weak returns from holdings in midstream companies positioned “closer to the wellhead” (typically gathering and processing companies), as well as companies with higher leverage than their peers.

During the reporting period, were there any market events that materially impacted the Fund’s performance or liquidity?

Investor uncertainty spiked during the reporting period as governments imposed austerity measures to mitigate the advance of the coronavirus pandemic. Further damaging, particularly for energy investors, were the failed talks between OPEC and Russia on a coordinated production cut to support crude oil prices. Saudi Arabia and Russia reacted to the disagreement by showing a willingness to flood the market with crude oil. These two factors combined to create a “perfect storm” across the energy supply chain: a decline in global demand coupled with an increase in global supply. As a result, the Alerian MLP Index declined by –47.2% in March 2020, the worst monthly return by far in the Index’s 24-year history (the Index dropped by –17.17% in its second worst month, September 2008).

We believe price-agnostic, forced selling from midstream-focused, listed closed-end funds further exacerbated midstream equity weakness. These closed-end funds have the ability to operate with up to 50% leverage. During sharp market declines, particularly ones of great magnitude in price, closed-end funds may be forced to quickly reduce leverage, often without regard to price. As a result, many of these funds sustained significant net asset value impairment during the reporting period.

During the reporting period, which subsectors were the strongest positive contributors to the Fund’s relative performance and which subsectors were particularly weak?

The Fund’s strongest contributions to performance relative to Alerian MLP Index were companies that either the Fund did not own or subsectors in which the Fund held underweighted exposure versus the Index, such as crude oil & refined products. (Contributions take weightings and total returns into account.) Conversely, the weakest relative contributions to performance came from companies the Fund owned, but were not included in the Index, such as large-cap diversified C-corporations.

Midstream companies positioned “closer to the wellhead,” (typically gathering and processing companies), performed poorly for the quarter, as did companies with higher leverage than their peers. We also believe select companies were among the top holdings of midstream-focused closed-end funds and were thus part of the previously discussed forced- selling activity that occurred during March 2020.

| 1. | See page 5 for other share class returns, which may be higher or lower than Class I share returns. See page 6 for more information on benchmark and peer group returns. |

During the reporting period, which individual stocks made the strongest positive contributions to the Fund’s absolute performance and which stocks detracted the most?

On an absolute basis, the top contributors to the Fund’s absolute performance included Hess Midstream, Equitrans Midstream and Antero Midstream Corporation. The Fund initiated a position in Hess Midstream during the March lows, reflecting our belief that the company was well positioned amid market uncertainty with over 95% of its revenues secured by minimum volume commitments. The holding benefited from the overall sector recovery that took place through the end of the reporting period. Equitrans Midstream and Antero Midstream, two northeast natural gas-focused stocks, benefited from an anticipated slowdown in crude oil-focused drilling activity, which was also expected to reduce associated natural gas production (natural gas produced as a byproduct of crude oil production). The Fund added to both positions during the reporting period.

The most substantial detractors from the Fund’s absolute performance during the reporting period included ONEOK, Inc., Plains All American Pipeline, L.P. and Enterprise Products Partners, L.P. all large-cap diversified MLPs that were among the Fund’s largest holdings. All three companies were negatively impacted by broad-based selling in midstream energy equities. ONEOK was further negatively impacted by investor concerns regarding production growth in the Bakken Formation, located beneath parts of Montana, North Dakota, Saskatchewan and Manitoba. All three companies remained among the Fund’s largest holdings as of the end of the reporting period. We believe these companies are well positioned to benefit from their integrated value chains across multiple geographies and products, as well as their ability to withstand slowing activity levels among exploration & production customers.

What were some of the Fund’s largest purchases and sales during the reporting period?

The Fund’s largest purchases during the period included Equitrans Midstream and Plains All American Pipeline. As mentioned above, we believe Equitrans Midstream is likely to benefit from a strengthened natural gas market resulting from reduced domestic crude oil-focused drilling activity. Additionally, we believe that Equitrans Midstream stands to benefit from the company’s pending merger with EQM Midstream Partners, L.P. (finalized shortly after the end of the reporting period). Plains All American Pipeline was increased to the largest position in the Fund during the reporting period, reflecting our favorable opinion of the company’s risk/return opportunity given its discounted valuation as the largest Permian-focused crude oil pipeline company and its clear path for leverage reduction after its planned May 2020 distribution cut.

The Fund’s largest sales during the same period included its full positions in Western Midstream Partners, L.P. and Genesis Energy, L.P. Western Midstream shares continued to struggle from investor uncertainty following Occidental Petroleum Corporation’s acquisition of Western Midstream’s general partner, Anadarko Petroleum, as well as significantly reduced drilling activity in Western Midstream’s core basins. Genesis Energy shares were negatively impacted by weak fundamentals in several of its core businesses, including soda ash pricing and Gulf of Mexico crude volumes.

How did the Fund’s subsector weightings change during the reporting period?

The Fund’s subsector weightings remained generally stable during the reporting period. Exposure to the natural gas transportation & storage subsector incrementally increased as a result of purchases of shares in Equitrans Midstream. Exposure to the crude oil & refined products subsector incrementally decreased as a result of negative performance and sales, notably of the Fund’s position in Genesis Energy.

How was the Fund positioned at the end of the reporting period?

As of May 31, 2020, while we remain constructive on the midstream sector, the Fund has adopted a more defensive posture to address ongoing concerns regarding the impact of crude oil price volatility. We have significantly reduced the Fund’s exposure to more commodity-sensitive names and companies positioned “closer to the wellhead.” We have also increased the Fund’s exposure to natural gas midstream companies that we consider overly discounted. We believe such companies may benefit from the decline (or flattening) of crude oil production and the reduction of associated gas supply, particularly those whose outlook has structurally improved.

In addition, in light of the commodity downturn, we have positioned the Fund in companies with cash flows that we consider relatively resilient. We have also favored companies with conservative leverage profiles and the ability to cancel capital expenditures projects to enhance financial flexibility (to further delever or conduct stock buybacks).

As of May 31, 2020, the Fund’s most overweight positions relative to the Alerian MLP Index were in Equitrans Midstream, Targa Resources Corporation and Kinder Morgan, Inc. As of the same date, the Fund’s most significantly underweight positions were in Western Midstream, TC Pipelines and Magellan Midstream Partners, L.P.

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecasts will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

| | |

| 10 | | MainStay Cushing MLP Premier Fund |

Portfolio of Investments May 31, 2020 (Unaudited)

| | | | | | | | |

| | |

Shares | | | Value | |

| Common Stocks 42.1%† | |

General Partners 1.3% | |

United States 1.3% | |

EnLink Midstream LLC | | | 3,343,845 | | | $ | 7,891,474 | |

| | | | | | | | |

|

Large Cap Diversified C Corps 32.8% | |

Canada 13.6% | |

Enbridge, Inc. | | | 775,060 | | | | 25,150,697 | |

Pembina Pipeline Corporation | | | 1,168,780 | | | | 29,254,563 | |

TC Energy Corporation | | | 652,350 | | | | 29,362,274 | |

United States 19.2% | | | | | | | | |

Cheniere Energy Inc. (a) | | | 520,000 | | | | 23,062,000 | |

Kinder Morgan, Inc. | | | 2,086,250 | | | | 32,962,750 | |

ONEOK, Inc. | | | 791,016 | | | | 29,022,377 | |

Williams Companies, Inc. | | | 1,643,864 | | | | 33,584,141 | |

| | | | | | | | |

| | | | | | | 202,398,802 | |

| | | | | | | | |

Natural Gas Gatherers & Processors 6.3% | |

United States 6.3% | |

Antero Midstream Corporation | | | 1,990,312 | | | | 9,513,691 | |

Targa Resources Corporation | | | 1,660,157 | | | | 29,700,209 | |

| | | | | | | | |

| | | | | | | 39,213,900 | |

| | | | | | | | |

Natural Gas Transportation & Storage 1.7% | |

United States 1.7% | |

Equitrans Midstream Corporation | | | 1,263,440 | | | | 10,221,230 | |

| | | | | | | | |

Total Common Stocks

(Cost $309,989,554) | | | | | | | 259,725,406 | |

| | | | | | | | |

|

| MLP Investments and Related Companies 56.9% | |

Crude Oil & Refined Products 7.8% | |

United States 7.8% | |

NuStar Energy, L.P. | | | 425,000 | | | | 7,382,250 | |

Phillips 66 Partners, L.P. | | | 602,978 | | | | 26,941,057 | |

Shell Midstream Partners, L.P. | | | 1,023,150 | | | | 13,802,293 | |

| | | | | | | | |

| | | | | | | 48,125,600 | |

| | | | | | | | |

Large Cap MLP 36.4% | |

United States 36.4% | |

Energy Transfer, L.P. | | | 6,185,137 | | | | 50,470,718 | |

Enterprise Products Partners, L.P. | | | 2,140,233 | | | | 40,878,450 | |

Magellan Midstream Partners, L.P. | | | 816,440 | | | | 37,017,390 | |

MPLX, L.P. | | | 2,328,126 | | | | 44,211,113 | |

Plains All American Pipeline, L.P. | | | 5,380,255 | | | | 52,188,473 | |

| | | | | | | | |

| | | | | | | 224,766,144 | |

| | | | | | | | |

Natural Gas Gatherers & Processors 4.5% | |

United States 4.5% | |

Crestwood Equity Partners, L.P. | | | 913,868 | | | | 12,986,064 | |

DCP Midstream Partners, L.P. | | | 433,207 | | | | 4,765,277 | |

Enable Midstream Partners, L.P. | | | 1,329,518 | | | | 5,530,795 | |

Hess Midstream, L.P. | | | 219,792 | | | | 4,268,361 | |

| | | | | | | | |

| | | | | | | 27,550,497 | |

| | | | | | | | |

| | | | | | | | |

| | |

Shares | | | Value | |

Natural Gas Transportation & Storage 4.4% | |

United States 4.4% | |

EQM Midstream Partners, L.P. | | | 1,388,540 | | | $ | 27,284,811 | |

| | | | | | | | |

|

YieldCo 3.8% | |

United States 3.8% | |

NextEra Energy Partners, L.P. | | | 460,000 | | | | 23,510,600 | |

| | | | | | | | |

Total MLP Investments and Related Companies (Cost $381,563,021) | | | | | | | 351,237,652 | |

| | | | | | | | |

|

| Short-Term Investments—Investment Companies 1.6% | |

United States 1.6% | |

First American Government Obligations Fund—Class X, 0.09% (b) | | | 4,932,945 | | | | 4,932,945 | |

First American Treasury Obligations Fund—Class X, 0.10% (b) | | | 4,932,945 | | | | 4,932,945 | |

| | | | | | | | |

Total Short-Term Investments—Investment Companies (Cost $9,865,890) | | | | 9,865,890 | |

| | | | | | | | |

Total Investments (Cost $701,418,465) | | | 100.6 | % | | | 620,828,948 | |

Other Assets, Less Liabilities | | | (0.6 | ) | | | (3,861,671 | ) |

Net Assets | | | 100.0 | % | | $ | 616,967,277 | |

| † | Calculated as a percentage of net assets applicable to common shareholders. |

| (a) | Non-income producing security. |

| (b) | Current yield as of May 31, 2020. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 11 | |

Portfolio of Investments May 31, 2020 (Unaudited) (continued)

The following is a summary of the fair valuations according to the inputs used as of May 31, 2020, for valuing the Fund’s assets.

| | | | | | | | | | | | | | | | |

Description | | Quoted

Prices in

Active

Markets for

Identical

Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

| | | | |

Asset Valuation Inputs | | | | | | | | | | | | | | | | |

| Investments in Securities (a) | | | | | | | | | | | | | | | | |

Common Stocks | | $ | 259,725,406 | | | $ | — | | | $ | — | | | $ | 259,725,406 | |

MLP Investments and Related Companies | | | 351,237,652 | | | | — | | | | — | | | | 351,237,652 | |

Short-Term Investments—Investment Companies | | | 9,865,890 | | | | — | | | | — | | | | 9,865,890 | |

| | | | | | | | | | | | | | | | |

| Total Investments in Securities | | $ | 620,828,948 | | | $ | — | | | $ | — | | | $ | 620,828,948 | |

| | | | | | | | | | | | | | | | |

| (a) | For a complete listing of investments and their industries, see the Portfolio of Investments. |

| | | | |

| 12 | | MainStay Cushing MLP Premier Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statement of Assets and Liabilities as of May 31, 2020 (Unaudited)

| | | | |

| Assets | | | | |

Investments, at value

(identified cost $701,418,465) | | $ | 620,828,949 | |

Receivables: | | | | |

Fund shares sold | | | 960,520 | |

Dividends and interest | | | 841,159 | |

Prepaid expenses | | | 118,360 | |

| | | | |

Total assets | | | 622,748,988 | |

| | | | |

| |

| Liabilities | | | | |

Payables: | | | | |

Fund shares redeemed | | | 4,047,184 | |

Manager fees (See Note 3) | | | 548,608 | |

Transfer agent (See Note 3) | | | 390,180 | |

NYLIFE Distributors (See Note 3) | | | 169,682 | |

Distributions payable | | | 128,691 | |

Professional fees | | | 120,778 | |

Dividends payable | | | 93,285 | |

Shareholder communication | | | 63,198 | |

Trustees | | | 8,627 | |

Custodian | | | 1,871 | |

Franchise taxes | | | 182,099 | |

Accrued expenses | | | 27,508 | |

| | | | |

Total liabilities | | | 5,781,711 | |

| | | | |

Net assets | | $ | 616,967,277 | |

| | | | |

| |

| Composition of Net Assets | | | | |

Shares of beneficial interest outstanding (par value of $.001 per share) unlimited number of shares authorized | | $ | 99,003 | |

Additional paid-in capital | | | 1,314,495,629 | |

| | | | |

| | | 1,314,594,632 | |

Total distributable earnings (loss), net of income taxes | | | (697,627,355 | ) |

| | | | |

Net assets | | $ | 616,967,277 | |

| | | | |

| | | | |

Class A | | | | |

Net assets applicable to outstanding shares | | $ | 177,100,827 | |

| | | | |

Shares of beneficial interest outstanding | | | 27,902,430 | |

| | | | |

Net asset value per share outstanding | | $ | 6.35 | |

Maximum sales charge (5.50% of offering price) | | | 0.37 | |

| | | | |

Maximum offering price per share outstanding | | $ | 6.72 | |

| | | | |

Investor Class | | | | |

Net assets applicable to outstanding shares | | $ | 1,950,290 | |

| | | | |

Shares of beneficial interest outstanding | | | 306,702 | |

| | | | |

Net asset value per share outstanding | | $ | 6.36 | |

Maximum sales charge (5.50% of offering price) | | | 0.37 | |

| | | | |

Maximum offering price per share outstanding | | $ | 6.73 | |

| | | | |

Class C | | | | |

Net assets applicable to outstanding shares | | $ | 165,573,679 | |

| | | | |

Shares of beneficial interest outstanding | | | 29,500,166 | |

| | | | |

Net asset value per share outstanding | | $ | 5.61 | |

| | | | |

Class I | | | | |

Net assets applicable to outstanding shares | | $ | 272,342,481 | |

| | | | |

Shares of beneficial interest outstanding | | | 41,293,796 | |

| | | | |

Net asset value per share outstanding | | $ | 6.60 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 13 | |

Statement of Operations for the six months ended May 31, 2020 (Unaudited)

| | | | |

| Investment Income (Loss) | | | | |

Income | | | | |

Dividends and distributions

(Net of return of capital of $24,627,721) (a) | | $ | 7,971,099 | |

Interest | | | 78,090 | |

| | | | |

Total income | | | 8,049,189 | |

| | | | |

Expenses | | | | |

Manager (See Note 3) | | | 4,329,264 | |

Distribution/Service—Class A (See Note 3) | | | 253,895 | |

Distribution/Service—Investor Class (See Note 3) | | | 2,541 | |

Distribution/Service—Class C (See Note 3) | | | 1,045,084 | |

Transfer agent (See Note 3) | | | 633,972 | |

Professional fees | | | 117,154 | |

Shareholder communication | | | 104,764 | |

Franchise tax | | | 76,971 | |

Registration | | | 64,160 | |

Trustees | | | 14,345 | |

Custodian | | | 7,317 | |

Insurance | | | 6,810 | |

Miscellaneous | | | 20,601 | |

| | | | |

Net expenses | | | 6,676,878 | |

| | | | |

Net investment income (loss) | | | 1,372,311 | |

| | | | |

|

| Realized and Unrealized Gain (Loss) on Investments | |

Net realized gain (loss) on: | | | | |

Investments, before income taxes | | | (70,664,365 | ) |

Foreign currency transactions | | | (6,504 | ) |

| | | | |

Net realized gain (loss) on investments and foreign currency transactions | | | (70,670,869 | ) |

| | | | |

Net change in unrealized appreciation (depreciation) on investments before income taxes | | | (190,738,642 | ) |

| | | | |

Net realized and unrealized gain (loss) on investments | | | (261,409,511 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (260,037,200 | ) |

| | | | |

| (a) | Dividends and distributions recorded net of foreign withholding taxes in the amount of $398,756. |

| | | | |

| 14 | | MainStay Cushing MLP Premier Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Six months

ended

May 31,

2020

(Unaudited) | | | Year ended

November 30,

2019 | |

| Increase (Decrease) in Net Assets | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 1,372,311 | | | $ | (12,289,653 | ) |

Net realized gain (loss) on investments and foreign currency transactions | | | (70,670,869 | ) | | | (19,728,088 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (190,738,642 | ) | | | (38,134,671 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | (260,037,200 | ) | | | (70,152,412 | ) |

| | | | |

Distributions to shareholders from return of capital: | | | | | | | | |

Class A | | | (12,253,451 | ) | | | (24,758,011 | ) |

Investor Class | | | (124,857 | ) | | | (236,575 | ) |

Class C | | | (13,827,782 | ) | | | (35,368,999 | ) |

Class I | | | (21,039,474 | ) | | | (49,829,343 | ) |

| | | | |

Total distributions to shareholders | | | (47,245,564 | ) | | | (110,192,928 | ) |

| | | | |

Capital share transactions: | | | | | | | | |

Net proceeds from sale of shares | | | 264,604,185 | | | | 388,297,290 | |

Net asset value of shares issued to shareholders in reinvestment of dividends and distributions | | | 46,457,820 | | | | 108,574,026 | |

Cost of shares redeemed | | | (372,256,997 | ) | | | (672,939,921 | ) |

| | | | |

Increase (decrease) in net assets derived from capital share transactions | | | (61,194,992 | ) | | | (176,068,605 | ) |

| | | | |

Net increase (decrease) in net assets | | | (368,477,756 | ) | | | (356,413,945 | ) |

| | |

| Net Assets | | | | | | | | |

Beginning of period | | | 985,445,033 | | | | 1,341,858,978 | |

| | | | |

End of period | | $ | 616,967,277 | | | $ | 985,445,033 | |

| | | | |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 15 | |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Six months

ended

May 31,

2020 | | | Year ended November 30, | |

| | | | | | |

| Class A | | (Unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Net asset value at beginning of period | | $ | 9.09 | | | $ | 10.64 | | | $ | 11.71 | | | $ | 14.09 | | | $ | 14.47 | | | $ | 22.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (a) | | | 0.02 | | | | (0.09 | ) | | | (0.08 | ) | | | (0.17 | ) | | | (0.16 | ) | | | 0.03 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | (2.31 | ) | | | (0.52 | ) | | | 0.35 | | | | (0.87 | ) | | | 1.23 | | | | (6.37 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | (2.29 | ) | | | (0.61 | ) | | | 0.27 | | | | (1.04 | ) | | | 1.07 | | | | (6.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

From return of capital | | | (0.45 | ) | | | (0.94 | ) | | | (1.34 | ) | | | (1.34 | ) | | | (1.45 | ) | | | (1.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value at end of period | | $ | 6.35 | | | $ | 9.09 | | | $ | 10.64 | | | $ | 11.71 | | | $ | 14.09 | | | $ | 14.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total investment return (b) | | | (25.33 | %) | | | (6.40 | %) | | | 1.90 | % | | | (8.19 | %) | | | 8.75 | % | | | (29.92 | %) |

| | | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (including net deferred income tax benefit (expense)) (c) | | | 0.48 | % †† | | | (0.92 | %) | | | (0.67 | %) | | | (1.21 | %) | | | (1.21 | %) | | | 8.32 | % (d) |

| | | | | | |

Net investment income (loss) (excluding net deferred income tax benefit (expense)) (c) | | | 0.50 | % †† | | | (0.90 | %) | | | (0.66 | %) | | | (1.20 | %) | | | (1.22 | %) | | | (0.24 | %)(d) |

| | | | | | |

Net expenses (including net deferred income tax (benefit) expense) (c)(e)(f) | | | 1.60 | % †† | | | 1.54 | % | | | 1.51 | % | | | 1.51 | % | | | 1.52 | % | | | (7.07 | %)(d) |

| | | | | | |

Expenses (before waiver/recoupment, including net deferred income tax (benefit) expense) (c)(e)(f) | | | 1.60 | % †† | | | 1.54 | % | | | 1.51 | % | | | 1.51 | % | | | 1.52 | % | | | (7.07 | %)(d) |

| | | | | | |

Portfolio turnover rate | | | 14 | % | | | 50 | % | | | 50 | % | | | 29 | % | | | 52 | % | | | 32 | % |

| | | | | | |

Net assets at end of period (in 000’s) | | $ | 177,101 | | | $ | 249,399 | | | $ | 278,507 | | | $ | 264,449 | | | $ | 360,473 | | | $ | 317,903 | |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| | For periods of less than one year, total return is not anualized. |

| (c) | Ratios including/excluding net deferred income tax benefit (expense) includes applicable franchise tax expense for the period. |

| | For the period from December 1, 2019 to May 31, 2020, the Fund accrued $76,971 in franchise tax benefit, of which $20,213 is attributable to Class A. |

| | For the year ended November 30, 2019, the Fund accrued $(209,064) in franchise tax expense, of which $(48,618) is attributable to Class A. |

| | For the year ended November 30, 2018, the Fund accrued $(107,814) in franchise tax expense, of which $(22,756) is attributable to Class A. |

| | For the year ended November 30, 2017, the Fund accrued $(131,121) in franchise tax expense, of which $(29,083) is attributable to Class A. |

| | For the year ended November 30, 2016, the Fund accrued $43,881 in franchise tax benefit, of which $14,819 is attributable to Class A. |

| | For the year ended November 30, 2015, the Fund accrued $(517,762) in franchise tax expense, of which $(128,449) is attributable to Class A. |

| (d) | For the year ended November 30, 2015, the Fund accrued $154,807,419 in net deferred income tax benefit, of which $39,834,200 is attributable to Class A. |

| (e) | The ratio of expenses excluding net deferred income tax expense to average net assets before waiver and recoupment was 1.58%, 1.53%, 1.50%, 1.50%, 1.53% and 1.49% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. The ratio of expenses excluding net deferred income tax expense to average net assets after waiver and recoupment was 1.58%, 1.53%, 1.50%, 1.50%, 1.53% and 1.49% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. |

| (f) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | | | |

| 16 | | MainStay Cushing MLP Premier Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Six months

ended

May 31,

2020 | | | Year ended November 30, | |

| | | | | | |

| Investor Class | | (Unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Net asset value at beginning of period | | $ | 9.10 | | | $ | 10.65 | | | $ | 11.71 | | | $ | 14.09 | | | $ | 14.47 | | | $ | 22.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (a) | | | 0.02 | | | | (0.09 | ) | | | (0.08 | ) | | | (0.17 | ) | | | (0.15 | ) | | | (0.00 | )‡ |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | (2.31 | ) | | | (0.52 | ) | | | 0.36 | | | | (0.87 | ) | | | 1.22 | | | | (6.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | (2.29 | ) | | | (0.61 | ) | | | 0.28 | | | | (1.04 | ) | | | 1.07 | | | | (6.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

From return of capital | | | (0.45 | ) | | | (0.94 | ) | | | (1.34 | ) | | | (1.34 | ) | | | (1.45 | ) | | | (1.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value at end of period | | $ | 6.36 | | | $ | 9.10 | | | $ | 10.65 | | | $ | 11.71 | | | $ | 14.09 | | | $ | 14.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total investment return (b) | | | (25.30 | %) | | | (6.04 | %) | | | 1.99 | % | | | (8.19 | %) | | | 8.75 | % | | | (29.91 | %)(c) |

| | | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (including net deferred income tax benefit (expense)) (d) | | | 0.43 | % †† | | | (0.92 | %) | | | (0.71 | %) | | | (1.22 | %) | | | (1.16 | %) | | | 8.17 | % (e) |

| | | | | | |

Net investment income (loss) (excluding net deferred income tax benefit (expense)) (d) | | | 0.45 | % †† | | | (0.91 | %) | | | (0.70 | %) | | | (1.21 | %) | | | (1.16 | %) | | | (0.38 | %)(e) |

| | | | | | |

Net expenses (including net deferred income tax (benefit) expense) (d)(f)(g) | | | 1.65 | % †† | | | 1.54 | % | | | 1.53 | % | | | 1.53 | % | | | 1.55 | % | | | (7.05 | %)(e) |

| | | | | | |

Expenses (before waiver, including net deferred income tax (benefit) expense) (d)(f)(g) | | | 1.65 | % †† | | | 1.54 | % | | | 1.53 | % | | | 1.53 | % | | | 1.55 | % | | | (7.05 | %)(e) |

| | | | | | |

Portfolio turnover rate | | | 14 | % | | | 50 | % | | | 50 | % | | | 29 | % | | | 52 | % | | | 32 | % |

| | | | | | |

Net assets at end of period (in 000’s) | | $ | 1,950 | | | $ | 2,446 | | | $ | 2,575 | | | $ | 2,616 | | | $ | 3,157 | | | $ | 2,631 | |

| ‡ | Less than one cent per share. |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| | For periods of less than one year, total return is not annualized. |

| (c) | Total investment return may reflect adjustments to conform to generally accepted accounting principles. |

| (d) | Ratios including/excluding net deferred income tax benefit (expense) includes applicable franchise tax expense for the period. |

| | For the period from December 1, 2019 to May 31, 2020, The Fund accrued $76,971 in franchise tax benefit, of which $203 is attributable to Investor Class. |

| | For the year ended November 30, 2019, the Fund accrued $(209,064) in franchise tax expense, of which $(466) is attributable to Investor Class. |

| | For the year ended November 30, 2018, the Fund accrued $(107,814) in franchise tax expense, of which $(218) is attributable to Investor Class. |

| | For the year ended November 30, 2017, the Fund accrued $(131,121) in franchise tax expense, of which $(333) is attributable to Investor Class. |

| | For the year ended November 30, 2016, the Fund accrued $43,881 in franchise tax benefit, of which $50 is attributable to Investor Class. |

| | For the year ended November 30, 2015, the Fund accrued $(517,762) in franchise tax expense, of which $(830) is attributable to Investor Class. |

| (e) | For the year ended November 30, 2015, the Fund accrued $154,807,419 in net deferred income tax benefit, of which $202,049 is attributable to Investor Class. |

| (f) | The ratio of expenses excluding net deferred income tax expense to average net assets before waiver was 1.63%, 1.53%, 1.52%, 1.52%, 1.55% and 1.50% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. The ratio of expenses excluding net deferred income tax expense to average net assets after waiver was 1.63%, 1.53%, 1.52%, 1.52%, 1.55% and 1.50% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. |

| (g) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 17 | |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Six months

ended

May 31,

2020 | | | Year ended November 30, | |

| | | | | | |

| Class C | | (Unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Net asset value at beginning of period | | $ | 8.14 | | | $ | 9.69 | | | $ | 10.86 | | | $ | 13.26 | | | $ | 13.81 | | | $ | 21.36 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (a) | | | (0.01 | ) | | | (0.15 | ) | | | (0.16 | ) | | | (0.25 | ) | | | (0.24 | ) | | | (0.12 | ) |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | (2.07 | ) | | | (0.46 | ) | | | 0.33 | | | | (0.81 | ) | | | 1.14 | | | | (6.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | (2.08 | ) | | | (0.61 | ) | | | 0.17 | | | | (1.06 | ) | | | 0.90 | | | | (6.21 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

From return of capital | | | (0.45 | ) | | | (0.94 | ) | | | (1.34 | ) | | | (1.34 | ) | | | (1.45 | ) | | | (1.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value at end of period | | $ | 5.61 | | | $ | 8.14 | | | $ | 9.69 | | | $ | 10.86 | | | $ | 13.26 | | | $ | 13.81 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total investment return (b) | | | (25.72 | %) | | | (7.06 | %) | | | 1.09 | % | | | (8.88 | %) | | | 7.89 | % | | | (30.43 | %) |

| | | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (including net deferred income tax benefit (expense)) (c) | | | (0.35 | %)†† | | | (1.65 | %) | | | (1.45 | %) | | | (1.99 | %) | | | (1.95 | %) | | | 7.56 | % (d) |

| | | | | | |

Net investment income (loss) (excluding net deferred income tax benefit (expense)) (c) | | | (0.33 | %)†† | | | (1.65 | %) | | | (1.44 | %) | | | (1.98 | %) | | | (1.95 | %) | | | (1.00 | %)(d) |

| | | | | | |

Net expenses (including net deferred income tax (benefit) expense) (c)(e)(f) | | | 2.39 | % †† | | | 2.29 | % | | | 2.28 | % | | | 2.28 | % | | | 2.30 | % | | | (6.32 | %)(d) |

| | | | | | |

Expenses (before waiver/recoupment, including net deferred income tax (benefit) expense) (c)(e)(f) | | | 2.39 | % †† | | | 2.29 | % | | | 2.28 | % | | | 2.28 | % | | | 2.30 | % | | | (6.32 | %)(d) |

| | | | | | |

Portfolio turnover rate | | | 14 | % | | | 50 | % | | | 50 | % | | | 29 | % | | | 52 | % | | | 32 | % |

| | | | | | |

Net assets at end of period (in 000’s) | | $ | 165,574 | | | $ | 272,423 | | | $ | 397,557 | | | $ | 445,524 | | | $ | 538,336 | | | $ | 553,892 | |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. |

| | For periods of less than one year, total return is not annualized. |

| (c) | Ratios including/excluding net deferred income tax benefit (expense) includes applicable franchise tax expense for the period. |

| | For the period from December 1, 2019 to May 31, 2020, the Fund accrued $76,971 in franchise tax benefit, of which $20,441 is attributable to Class C. |

| | For the year ended November 30, 2019, the Fund accrued $(209,064) in franchise tax expense, of which $(60,864) is attributable to Class C. |

| | For the year ended November 30, 2018, the Fund accrued $(107,814) in franchise tax expense, of which $(34,832) is attributable to Class C. |

| | For the year ended November 30, 2017, the Fund accrued $(131,121) in franchise tax expense, of which $(50,302) is attributable to Class C. |

| | For the year ended November 30, 2016, the Fund accrued $43,881 in franchise tax benefit, of which $14,231 is attributable to Class C. |

| | For the year ended November 30, 2015, the Fund accrued $(517,762) in franchise tax expense, of which $(220,745) is attributable to Class C. |

| (d) | For the year ended November 30, 2015, the Fund accrued $154,807,419 in net deferred income tax benefit, of which $66,219,265 is attributable to Class C. |

| (e) | The ratio of expenses excluding net deferred income tax expense to average net assets before waiver and recoupment was 2.37%, 2.28%, 2.27%, 2.27%, 2.30% and 2.24% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. The ratio of expenses excluding net deferred income tax expense to average net assets after waiver and recoupment was 2.37%, 2.28%, 2.27%, 2.27%, 2.30% and 2.24% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. |

| (f) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | | | |

| 18 | | MainStay Cushing MLP Premier Fund | | The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. |

Financial Highlights selected per share data and ratios

| | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | | Six months

ended

May 31,

2020 | | | Year ended November 30, | |

| | | | | | |

| Class I | | (Unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Net asset value at beginning of period | | $ | 9.41 | | | $ | 10.95 | | | $ | 11.99 | | | $ | 14.36 | | | $ | 14.69 | | | $ | 22.40 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (a) | | | 0.03 | | | | (0.07 | ) | | | (0.05 | ) | | | (0.14 | ) | | | (0.12 | ) | | | 0.07 | |

| | | | | | |

Net realized and unrealized gain (loss) on investments | | | (2.39 | ) | | | (0.53 | ) | | | 0.35 | | | | (0.89 | ) | | | 1.24 | | | | (6.44 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | (2.36 | ) | | | (0.60 | ) | | | 0.30 | | | | (1.03 | ) | | | 1.12 | | | | (6.37 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

From return of capital | | | (0.45 | ) | | | (0.94 | ) | | | (1.34 | ) | | | (1.34 | ) | | | (1.45 | ) | | | (1.34 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value at end of period | | $ | 6.60 | | | $ | 9.41 | | | $ | 10.95 | | | $ | 11.99 | | | $ | 14.36 | | | $ | 14.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total investment return (b) | | | (25.21 | %) | | | (6.12 | %) | | | 2.12 | % | | | (7.95 | %) | | | 8.97 | % | | | (29.71 | %) |

| | | | | | |

| Ratios (to average net assets)/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income (loss) (including net deferred income tax benefit (expense)) (c) | | | 0.67 | % †† | | | (0.65 | %) | �� | | (0.41 | %) | | | (1.01 | %) | | | (0.93 | %) | | | 8.53 | % (d) |

| | | | | | |

Net investment income (loss) (excluding net deferred income tax benefit (expense)) (c) | | | 0.69 | % †† | | | (0.63 | %) | | | (0.40 | %) | | | (1.00 | %) | | | (0.93 | %) | | | (0.02 | %)(d) |

| | | | | | |

Net expenses (including net deferred income tax (benefit) expense) (c)(e)(f) | | | 1.35 | % †† | | | 1.29 | % | | | 1.26 | % | | | 1.26 | % | | | 1.28 | % | | | (7.31 | %)(d) |

| | | | | | |

Expenses (before waiver/recoupment, including net deferred income tax (benefit) expense) (c)(e)(f) | | | 1.35 | % †† | | | 1.29 | % | | | 1.26 | % | | | 1.26 | % | | | 1.28 | % | | | (7.31 | %)(d) |

| | | | | | |

Portfolio turnover rate | | | 14 | % | | | 50 | % | | | 50 | % | | | 29 | % | | | 52 | % | | | 32 | % |

| | | | | | |

Net assets at end of period (in 000’s) | | $ | 272,342 | | | $ | 461,177 | | | $ | 663,220 | | | $ | 536,749 | | | $ | 481,819 | | | $ | 449,755 | |

| (a) | Per share data based on average shares outstanding during the period. |

| (b) | Total investment return is calculated exclusive of sales charges and assumes the reinvestment of dividends and distributions. Class I shares are not subject to sales charges. |

| | For periods of less than one year, total return is not annualized. |

| (c) | Ratios including/excluding net deferred income tax benefit (expense) includes applicable franchise tax expense for the period. |

| | For the period from December 1, 2019 to May 31, 2020, the Fund accrued $76,971 in franchise tax benefit, of which $36,114 is attributable to Class I. |

| | For the year ended November 30, 2019, the Fund accrued $(209,064) in franchise tax expense, of which $(99,116) is attributable to Class I. |

| | For the year ended November 30, 2018, the Fund accrued $(107,814) in franchise tax expenses, of which $(50,008) is attributable to Class I. |

| | For the year ended November 30, 2017, the Fund accrued $(131,121) in franchise tax expense, of which $(51,403) is attributable to Class I. |

| | For the year ended November 30, 2016, the Fund accrued $43,881 in franchise tax benefit, of which $14,781 is attributable to Class I. |

| | For the year ended November 30, 2015, the Fund accrued $(517,762) in franchise tax expense, of which $(167,738) is attributable to Class I. |

| (d) | For the year ended November 30, 2015, the Fund accrued $154,807,419 in net deferred income tax benefit, of which $48,551,905 is attributable to Class I. |

| (e) | The ratio of expenses excluding net deferred income tax expense to average net assets before waiver and recoupment was 1.33%, 1.27%, 1.25%, 1.25%, 1.28% and 1.24% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. The ratio of expenses excluding net deferred income tax expense to average net assets after waiver and recoupment was 1.33%, 1.27%, 1.25%, 1.25%, 1.28% and 1.24% for the period from December 1, 2019 to May 31, 2020 and fiscal years ended November 30, 2019, 2018, 2017, 2016 and 2015, respectively. |

| (f) | In addition to the fees and expenses which the Fund bears directly, it also indirectly bears a pro-rata share of the fees and expenses of the underlying funds in which it invests. Such indirect expenses are not included in the above expense ratios. |

| | | | | | |

The notes to the financial statements are an integral part of,

and should be read in conjunction with, the financial statements. | | | | | 19 | |

Notes to Financial Statements (Unaudited)

Note 1–Organization and Business

MainStay Funds Trust (the “Trust”) was organized as a Delaware statutory trust on April 28, 2009 and is governed by a Declaration of Trust. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and is comprised of twenty-nine funds (collectively referred to as the “Funds”). These financial statements and notes relate to the MainStay Cushing MLP Premier Fund (the “Fund”), a “non-diversified” fund, as that term is defined in the 1940 Act, as interpreted or modified by regulatory authorities having jurisdiction, from time to time. The Fund is the successor to the Cushing® MLP Premier Fund (the “Predecessor Fund”), for which Cushing® Asset Management, LP, a Texas limited partnership and the Fund’s Subadvisor (as defined in Note 3(A)), served as investment adviser. The financial statements of the Fund reflect the historical results of the Predecessor Fund prior to its reorganization on July 11, 2014. Upon the completion of the reorganization, Class A, Class C and Class I shares of the Fund assumed the performance, financial and other information of the Predecessor Fund.

The Fund currently has five classes of shares registered for sale. Class A, Class C and Class I shares commenced operations on October 20, 2010. Investor Class shares commenced operations on July 11, 2014. Class R6 shares were registered for sale effective as of March 31, 2017. As of May 31, 2020, Class R6 shares were not yet offered for sale.

Class A and Investor Class shares are offered at net asset value (“NAV”) per share plus an initial sales charge. No initial sales charge applies to investments of $1 million or more (and certain other qualified purchases) in Class A and Investor Class shares. However, a contingent deferred sales charge (“CDSC”) of 1.00% may be imposed on certain redemptions made within 18 months of the date of purchase on shares that were purchased without an initial sales charge. Class C shares are offered at NAV without an initial sales charge, although a 1.00% CDSC may be imposed on certain redemptions of such shares made within one year of the date of purchase of Class C shares. Class I shares are offered at NAV without a sales charge. Class R6 shares are currently expected to be offered at NAV without a sales charge. As disclosed in the Fund’s prospectus, Class A shares may convert automatically to Investor Class shares and Investor Class shares may convert automatically to Class A shares. In addition, depending upon eligibility, Class C shares convert to either Class A or Investor Class shares at the end of the calendar quarter ten years after the date they were purchased. Under certain circumstances and as may be permitted by the Trust’s multiple class plan pursuant to Rule 18f-3 under the 1940 Act, specified share classes of the Fund may be converted to one or more other share classes of the Fund as disclosed in the capital share transactions within these Notes. The classes of shares have the same voting (except for issues that relate solely to one class), dividend, liquidation and other rights, and the same terms and conditions, except that under distribution plans pursuant to Rule 12b-1 under the 1940 Act, Class C shares are subject to higher distribution and/or service fees than Class A and Investor Class shares. Class I and Class R6 shares are not subject to a distribution and/or service fee.

The Fund’s investment objective is to seek current income and capital appreciation. In seeking current income, the Fund intends to pay current

cash distributions to shareholders, regardless of the character of such distributions for tax or accounting purposes.

Note 2–Significant Accounting Policies

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The Fund prepares its financial statements in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and follows the significant accounting policies described below.

(A) Securities Valuation. Investments are usually valued as of the close of regular trading on the New York Stock Exchange (the “Exchange”) (usually 4:00 p.m. Eastern time) on each day the Fund is open for business (“valuation date”).

The Board of Trustees of the Trust (the “Board”) adopted procedures establishing methodologies for the valuation of the Fund’s securities and other assets and delegated the responsibility for valuation determinations under those procedures to the Valuation Committee of the Trust (the “Valuation Committee”). The procedures state that, subject to the oversight of the Board and unless otherwise noted, the responsibility for the day-to-day valuation of portfolio assets (including fair value measurements for the Fund’s assets and liabilities) rests with New York Life Investment Management LLC (“New York Life Investments” or the “Manager”), aided to whatever extent necessary by the Subadvisor (as defined in Note 3(A)). To assess the appropriateness of security valuations, the Manager, the Subadvisor or the Fund’s third-party service provider, who is subject to oversight by the Manager, regularly compares prior day prices, prices on comparable securities and the sale prices to the prior and current day prices and challenges prices with changes exceeding certain tolerance levels with third-party pricing services or broker sources.

The Board authorized the Valuation Committee to appoint a Valuation Subcommittee (the “Subcommittee”) to establish the prices of securities for which market quotations are not readily available or the prices of which are not otherwise readily determinable under the procedures. The Subcommittee meets (in person, via electronic mail or via teleconference) on an as-needed basis. The Valuation Committee meets to ensure that actions taken by the Subcommittee were appropriate. For those securities valued through either a standardized fair valuation methodology or a fair valuation measurement, the Subcommittee deals with such valuation and the Valuation Committee reviews and affirms, if appropriate, the reasonableness of the valuation based on such methodologies and measurements on a regular basis after considering information that is reasonably available and deemed relevant by the Valuation Committee. Any action taken by the Subcommittee with respect to the valuation of a portfolio security or other asset is submitted for review and ratification (if appropriate) to the Valuation Committee and the Board at the next regularly scheduled meeting.

“Fair value” is defined as the price the Fund would reasonably expect to receive upon selling an asset or liability in an orderly transaction to an independent buyer in the principal or most advantageous market for the asset or liability. Fair value measurements are determined within a framework that establishes a three-tier hierarchy that maximizes the use

| | |

| 20 | | MainStay Cushing MLP Premier Fund |

of observable market data and minimizes the use of unobservable inputs to establish a classification of fair value measurements for disclosure purposes. “Inputs” refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, such as the risk inherent in a particular valuation technique used to measure fair value using a pricing model and/or the risk inherent in the inputs for the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions market participants would use in pricing the asset or liability based on the information available. The inputs or methodology used for valuing assets or liabilities may not be an indication of the risks associated with investing in those assets or liabilities. The three-tier hierarchy of inputs is summarized below.

| • | | Level 1—quoted prices in active markets for an identical asset or liability |

| • | | Level 2—other significant observable inputs (including quoted prices for a similar asset or liability in active markets, interest rates and yield curves, prepayment speeds, credit risk, etc.) |

| • | | Level 3—significant unobservable inputs (including the Fund’s own assumptions about the assumptions that market participants would use in measuring fair value of an asset or liability) |

The level of an asset or liability within the fair value hierarchy is based on the lowest level of an input, both individually and in the aggregate, that is significant to the fair value measurement. The aggregate value by input level of the Fund’s assets and liabilities as of May 31, 2020, is included at the end of the Portfolio of Investments.

The Fund may use third-party vendor evaluations, whose prices may be derived from one or more of the following standard inputs, among others:

| | |

• Benchmark yields | | • Reported trades |

• Broker/dealer quotes | | • Issuer spreads |

• Two-sided markets | | • Benchmark securities |

• Bids/offers | | • Reference data (corporate actions or material event notices) |

• Industry and economic events | | • Monthly payment information |

• Comparable bonds | | |

An asset or liability for which market values cannot be measured using the methodologies described above is valued by methods deemed reasonable in good faith by the Valuation Committee, following the procedures established by the Board, to represent fair value. Under these procedures, the Fund generally uses a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the asset or liability are discounted to calculate fair value. Discounts may also be applied due to the nature and/or duration of any restrictions on the disposition of the asset or liability. Fair value represents a good faith approximation of the value of a security. Fair value determinations involve the consideration of a

number of subjective factors, an analysis of applicable facts and circumstances and the exercise of judgment. As a result, it is possible that the fair value for a security determined in good faith in accordance with the Fund’s valuation procedures may differ from valuations for the same security determined by other funds using their own valuation procedures. Although the Fund’s valuation procedures are designed to value a security at the price the Fund may reasonably expect to receive upon the security’s sale in an orderly transaction, there can be no assurance that any fair value determination thereunder would, in fact, approximate the amount that the Fund would actually realize upon the sale of the security or the price at which the security would trade if a reliable market price were readily available. During the six-month period ended May 31, 2020, there were no material changes to the fair value methodologies.

Securities which may be valued in this manner include, but are not limited to: (i) a security for which trading has been halted or suspended; (ii) a debt security that has recently gone into default and for which there is not a current market quotation; (iii) a security of an issuer that has entered into a restructuring; (iv) a security that has been delisted from a national exchange; (v) a security for which the market price is not readily available from a third-party pricing source or, if so provided, does not, in the opinion of the Manager or the Subadvisor, reflect the security’s market value; (vi) a security subject to trading collars for which no or limited trading takes place; and (vii) a security whose principal market has been temporarily closed at a time when, under normal conditions, it would be open. Securities for which market quotations or observable inputs are not readily available are generally categorized as Level 3 in the hierarchy. As of May 31, 2020, no securities held by the Fund were fair valued in such a manner.