Exhibit 99.6

BELLATRIX EXPLORATION LTD.

FIRST QUARTER 2012 REPORT

CORPORATE PROFILE

GLOSSARY

AECO | | a storage and pricing hub for Canadian natural gas markets |

/d | | per day |

boe | | barrels of oil equivalent (6 mcf of natural gas = 1 barrel of oil equivalent) |

bbl or bbls | | barrels |

GORR | | gross overriding royalty |

mboe | | thousand boe |

mcf | | thousand cubic feet |

mmboe | | million barrels of oil equivalent |

mmbtu | | million British thermal units |

mmcf | | million cubic feet |

NGL | | natural gas liquids (ethane, propane, butane and condensate) |

OK | | Oklahoma |

WTI | | West Texas Intermediate, a benchmark crude oil used for pricing comparison |

NI 51-101 | | National Instrument 51-101 |

TABLE OF CONTENTS

2 | | Highlights |

5 | | Report to Shareholders |

8 | | Management’s Discussion and Analysis |

30 | | Condensed Consolidated Financial Statements |

30 | | Condensed Consolidated Balance Sheets |

31 | | Condensed Consolidated Statements of Comprehensive Income |

32 | | Condensed Consolidated Statements of Shareholders’ Equity |

33 | | Condensed Consolidated Statements of Cash Flows |

34 | | Notes to the Condensed Consolidated Financial Statements |

42 | | Corporate Information |

1

BELLATRIX EXPLORATION LTD.

FIRST QUARTER 2012 REPORT

HIGHLIGHTS

Forward-Looking Statements

This financial report, including the report to shareholders, contains forward-looking statements. Please refer to our cautionary language on forward-looking statements and the other matters set forth at the beginning of the management’s discussion and analysis (the “MD&A”) attached to this financial report.

| | Three months ended March 31, | |

| | 2012 | | 2011 | |

FINANCIAL

(CDN$000s except share and per share amounts) | | | | | |

Revenue (before royalties and risk management (1)) | | 58,191 | | 40,535 | |

Funds flow from operations (2) | | 29,194 | | 17,027 | |

Per basic share (6) | | $ | 0.27 | | $ | 0.17 | |

Per diluted share (6) | | $ | 0.25 | | $ | 0.16 | |

Cash flow from operating activities | | 24,056 | | 15,718 | |

Per basic share (6) | | $ | 0.22 | | $ | 0.16 | |

Per diluted share (6) | | $ | 0.21 | | $ | 0.15 | |

Net profit before unrealized gain (loss) on commodity contracts (5) | | 5,521 | | 1,434 | |

Per basic share (6) | | $ | 0.05 | | $ | 0.01 | |

Per diluted share (6) | | $ | 0.05 | | $ | 0.01 | |

Net profit (loss) | | 9,172 | | (5,487 | ) |

Per basic share (6) | | $ | 0.09 | | $ | (0.06 | ) |

Per diluted share (6) | | $ | 0.08 | | $ | (0.06 | ) |

Exploration and development | | 74,061 | | 55,486 | |

Corporate and property acquisitions | | 70 | | 3,631 | |

Capital expenditures - cash | | 74,131 | | 59,117 | |

Property dispositions - cash | | (300 | ) | 130 | |

Non-cash items | | (154 | ) | 513 | |

Total capital expenditures - net | | 73,677 | | 59,760 | |

Long-term debt | | 96,760 | | 70,298 | |

Convertible debentures (3) | | 49,464 | | 47,951 | |

Adjusted working capital deficiency | | 18,276 | | 11,921 | |

Total net debt (3) | | 164,500 | | 130,170 | |

Total assets | | 645,648 | | 525,579 | |

Shareholders’ equity | | 358,910 | | 292,976 | |

OPERATING | | | | | |

Average daily sales volumes | | | | | |

Crude oil, condensate and NGLs (bbls/d) | | 6,123 | | 3,860 | |

Natural gas (mcf/d) | | 58,659 | | 37,346 | |

Total oil equivalent (boe/d) | | 15,900 | | 10,084 | |

Average prices | | | | | |

Light crude oil and condensate ($/bbl) | | 90.03 | | 83.75 | |

NGLs ($/bbl) | | 53.97 | | 51.27 | |

Heavy oil ($/bbl) | | 75.93 | | 59.55 | |

Crude oil, condensate and NGLs ($/bbl) | | 81.24 | | 77.36 | |

Crude oil, condensate and NGLs (including risk management(1)) ($/bbl) | | 75.96 | | 74.61 | |

Natural gas ($/mcf) | | 2.32 | | 3.94 | |

Natural gas (including risk management (1)) ($/mcf) | | 2.32 | | 3.94 | |

Total oil equivalent ($/boe) | | 39.86 | | 44.20 | |

Total oil equivalent (including risk management (1)) ($/boe) | | 37.83 | | 43.14 | |

2

| | Three months ended March 31, | |

| | 2012 | | 2011 | |

Statistics | | | | | |

Operating netback (4) ($/boe) | | 24.95 | | 23.33 | |

Operating netback (4) (including risk management(1)) ($/boe) | | 22.92 | | 22.28 | |

Transportation ($/boe) | | 1.14 | | 1.29 | |

Production expenses ($/boe) | | 9.20 | | 12.45 | |

General and administrative ($/boe) | | 1.91 | | 2.50 | |

Royalties as a % of sales after transportation | | 12% | | 17% | |

COMMON SHARES | | | | | |

Common shares outstanding | | 107,463,313 | | 97,463,302 | |

Share options outstanding | | 7,929,247 | | 5,903,601 | |

Shares issuable on conversion of convertible debentures (7) | | 9,821,429 | | 9,821,429 | |

Diluted common shares outstanding | | 125,213,989 | | 113,188,332 | |

Diluted weighted average shares - net profit (loss) (6) | | 119,267,434 | | 97,448,078 | |

Diluted weighted average shares - funds flow from operations and cash flow from operating activities (2) (6) | | 119,267,434 | | 109,491,099 | |

SHARE TRADING STATISTICS

(CDN$, except volumes) based on intra-day trading | | | | | |

High | | 5.67 | | 6.19 | |

Low | | 4.36 | | 4.61 | |

Close | | 5.26 | | 5.64 | |

Average daily volume | | 654,591 | | 546,747 | |

(1) The Company has entered into various commodity price risk management contracts which are considered to be economic hedges. Per unit metrics after risk management include only the realized portion of gains or losses on commodity contracts.

The Company does not apply hedge accounting to these contracts. As such, these contracts are revalued to fair value at the end of each reporting date. This results in recognition of unrealized gains or losses over the term of these contracts which is reflected each reporting period until these contracts are settled, at which time realized gains or losses are recorded. These unrealized gains or losses on commodity contracts are not included for purposes of per unit metrics calculations disclosed.

(2) The highlights section contains the term “funds flow from operations” which should not be considered an alternative to, or more meaningful than cash flow from operating activities as determined in accordance with generally accepted accounting principles (“GAAP”) as an indicator of the Company’s performance. Therefore reference to diluted funds flow from operations or funds flow from operations per share may not be comparable with the calculation of similar measures for other entities. Management uses funds flow from operations to analyze operating performance and leverage and considers funds flow from operations to be a key measure as it demonstrates the Company’s ability to generate the cash necessary to fund future capital investments and to repay debt. The reconciliation between cash flow from operating activities and funds flow from operations can be found in the MD&A. Funds flow from operations per share is calculated using the weighted average number of common shares for the period.

(3) Net debt and total net debt are considered non-GAAP terms. The Company’s calculation of total net debt includes the liability component of convertible debentures and excludes deferred liabilities, long-term commodity contract liabilities, decommissioning liabilities, long-term finance lease obligations and the deferred tax liability. Net debt and total net debt include the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligations. Net debt also excludes the liability component of convertible debentures. A reconciliation between total liabilities under GAAP and total net debt and net debt as calculated by the Company is found in the MD&A.

(4) Operating netbacks is considered a non-GAAP term. Operating netbacks are calculated by subtracting royalties, transportation, and operating costs from revenues before other income.

(5) Net profit before the unrealized gain (loss) on commodity contracts is considered a non-GAAP term. Net profit before the unrealized gain (loss) on commodity contracts is calculated as net profit (loss) per the Consolidated Statement of Comprehensive Income, excluding the unrealized gain (loss) on commodity contracts net of the deferred tax impact on the adjustment. The Company’s reconciliation between the net loss and net profit (loss) before unrealized gain (loss) on commodity contracts is found in the MD&A.

3

(6) Basic weighted average shares for the three months ended March 31, 2012 were 107,426,094 (2011: 97,448,078).

In computing weighted average diluted earnings per share for the three months ended March 31, 2012, a total of 2,019,911 share options and a total of 9,821,429 common shares issuable on the conversion of convertible debentures were included in the calculation as they were dilutive, resulting in diluted weighted average common shares of 119,267,434. As a consequence, a total of $1.0 million for interest accretion expense (net of income tax effect) was added to the numerator.

In computing weighted average diluted earnings per share for the three months ended March 31, 2011, a total of 5,903,601 share options and a total of 9,821,429 common shares issuable on conversion of convertible debentures were excluded from the calculation as they were not dilutive.

In computing weighted average diluted net profit before the unrealized gain (loss) on commodity contracts per share for the three months ended March 31, 2012, a total of 2,019,911 (2011: 2,221,591) common shares were added to the denominator as a consequence of applying the treasury stock method to the Company’s outstanding share options as they were dilutive, and a total of 9,821,429 (2011: 9,821,429) common shares issuable on conversion of convertible debentures were excluded from the denominator as they were not dilutive, resulting in diluted weighted average shares of 109,446,005 (2011: 99,669,670).

In computing weighted average diluted cash flow from operating activities and funds flow from operations for the three months ended March 31, 2012, a total of 2,019,911 (2011: 2,221,592) common shares were added to the denominator as a consequence of applying the treasury stock method to the Company’s outstanding share options and a total of 9,821,429 (2011: 9,821,429) common shares issuable on conversion of convertible debentures were also added to the denominator as they were dilutive, resulting in diluted weighted average common shares of 119,267,434 (2011: 109,491,099). As a consequence, a total of $1.0 million (2011: $0.7 million) for interest accretion expense (net of income tax effect) was added to the numerator.

(7) Shares issuable on conversion of convertible debentures are calculated by dividing the $55.0 million principal amount of the convertible debentures by the conversion price of $5.60 per share.

4

BELLATRIX EXPLORATION LTD.

FIRST QUARTER 2012 REPORT

REPORT TO SHAREHOLDERS

Bellatrix, under the auspices of our highly technical staff, continues to provide the Company’s stakeholders with accelerated drill bit driven growth, facilitated by the recognition of reservoir variability within the Company’s two key resource development plays and the application of technology to achieve top decile results with panache. In the first quarter of 2012, the Company posted robust earnings, increased funds flow from operations, drove down operating costs, established another 100% drilling success quarter and ramped up production resulting in an increase to the 2012 exit production rate estimate.

Operational highlights for the quarter ended March 31, 2012 include:

· During the first quarter of 2012, Bellatrix successfully drilled and/or participated in 13 gross (10.72 net) wells resulting in 10 gross (8.22 net) Cardium light oil horizontal wells and 3 gross (2.5 net) natural gas horizontal wells. The 3 gross (2.5 net) natural gas wells include: 1 gross (1 net) Duvernay well; 1 gross (0.5 net) Notikewin well with 35 bbls liquids per mmcf and 1 gross (1 net) Cardium well producing 70 bbls liquids per mmcf.

· In West Central Alberta, Bellatrix operated nine of ten light oil wells drilled in the Cardium consisting of 2 wells at Brazeau, 4 wells at Pembina, 2 wells at Ferrier and 1 well at Buck Creek. The following average initial production (“IP”) rates for the first 7 days (“IP 7”), for the first 15 days (“IP 15”) and the first 30 days (“IP 30”) were achieved:

Time | | # of wells | | boe/d |

IP 7 | | 9 | | 668 |

IP 15 | | 9 | | 558 |

IP 30 | | 8 | | 581 |

· Q1 2012 sales volumes averaged 15,900 boe/d (weighted 39% to oil, condensate and NGLs and 61% to natural gas), despite infrastructure restrictions in early 2012 which were resolved at the end of February. This represents a 58% increase from the first quarter 2011 average sales volumes of 10,084 boe/d and a 12% increase from fourth quarter 2011 average sales volumes of 14,209 boe/d.

· Sales volumes in March averaged 18,283 boe/d (weighted 40% to oil, condensate and NGLs and 60% to natural gas). This represents a significant 13% increase over the December 2011 production rate of 16,141 boe/d.

· To remove infrastructure constraints on growth, Bellatrix completed an 18 km pipeline project including crossing the North Saskatchewan River with two 8 inch lines, one 10 inch line and one 4 inch line designed to deliver up to a maximum of 150 mmcf/d to existing underutilized facilities.

· The Company hedged 62% of Q1 gas production volumes through to the conclusion of the 2012 storage fill cycle (November 1) at CDN $3.87 / mcf.

· At the end of Q1 the Company raised the 2012 exit rate guidance by 1,000 boe/d to an exit rate of 19,000 to 19,500 boe/d.

· The Company successfully drilled its first 100% W.I. Duvernay well from a surface located at 7-25-44-10W5 to 8-24-44-10W5, a measured depth of 4,670 metres with a horizontal length of 1,198 metres. The well is testing inline to sales and has averaged 5.6 mmcf/d in the first 30 days. Associated liquids recovery has been minimal to date which is not uncommon in this area during the early stage testing period.

· As at March 31, 2012, Bellatrix had approximately 220,267 net undeveloped acres of land in Alberta, British Columbia and Saskatchewan.

5

Financial highlights for the quarter ended March 31, 2012 include:

· Q1 2012 revenue increased to $58.2 million, 44% higher than the $40.5 million recorded in Q1 2011. The increase in revenues is a result of higher sales volumes in conjunction with higher light crude oil, condensate and NGL prices, offset partially by lower natural gas prices, for 2012 compared to 2011.

· Crude oil, condensate and NGLs produced 78% of revenue for Q1 2012.

· Funds flow from operations for Q1 2012 increased to $29.2 million, up 72% from $17.0 million in Q1 2011.

· Net profit for Q1 2012 was $9.2 million, compared to a net loss of $5.5 million for Q1 2011.

· Production expenses for Q1 2012 fell to $9.20/boe ($13.3 million), compared to $12.45/boe ($11.3 million) for Q1 2011 and $10.78/boe ($14.1 million) for Q4 2011.

· Operating netbacks before risk management for Q1 2012 were $24.95/boe, up from $23.33/boe in Q1 2011. The improved netback was primarily the result of an increase in the average sales volumes weighted toward oil, condensate and natural gas liquids, in conjunction with an increase in oil, condensate, and NGL commodity prices and a decrease in production and royalty expenses.

· Bellatrix spent $74.1 million on capital projects during Q1 2012 compared to $59.1 million in Q1 2011. Q1 2012 capital project spending included approximately $3.7 million spent on well tubing and other inventory related to the drilling program for the remainder of 2012.

· G&A expenses for Q1 2012 plummeted to $1.91/boe ($2.8 million), compared to $2.50/boe ($2.3 million) for Q1 2011.

· Total net debt as of March 31, 2012 was $164.5 million, including the liability component of convertible debentures drawn against the Company’s credit capacity of $225 million.

· As at March 31, 2012, Bellatrix had $96.8 million drawn on its total $170.0 million credit facility.

· As of May 9, 2012, the banking syndicate has agreed, subject to and effective upon final documentation, to increase the borrowing base from $170 million to $200 million through to November 30, 2012 and extend the revolving period of the credit facility from June 26, 2012 to June 25, 2013.

6

OUTLOOK

The energy business, as a sector, is facing mounting challenges as cash flows in 2012 shrink in response to weakening natural gas prices. Strategically Bellatrix has positioned itself to weather the volatile marketplace while providing our shareholders with continued growth in value. The Company will grow in 2012 in production, reserves and cash flow despite the commodity price weaknesses because Bellatrix has pragmatically positioned itself with the following characteristics;

· Low cost operations

· Low F & D growth base

· Obtained control and ownership in infrastructure and facilities

· High productivity wells demonstrating development drilling risk profiles

· Rich inventory of 377 net locations in the Cardium low risk, high reward light gravity oil play

· Rich inventory of 174 net locations in the Notikewin low risk, high reward condensate rich play

· Highly concentrated core production area in West Central Alberta

· Strong balance sheet providing flexibility

· Prudent financial management in volatile times using commodity risk management contracts

For the remainder of 2012 the Company will concentrate its capital program by drilling low risk Cardium light oil wells. Bellatrix has also earmarked capital to drill 1.5 net Notikewin wells to preserve expiring mineral leases and to develop infrastructure required to maintain production. Bellatrix’s management and staff are dedicated to providing perpetual long term growth in shareholder value fueled by our extensive drilling inventory.

/s/ Raymond G. Smith, P. Eng. | |

Raymond G. Smith, P. Eng. | |

President and CEO | |

May 9, 2012 | |

Note:

Bellatrix’s annual and special meeting of shareholders is scheduled for 3:00 pm on May 22, 2012 in the Devonian Room at the Calgary Petroleum Club.

7

BELLATRIX EXPLORATION LTD.

FIRST QUARTER 2012 REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS

May 9, 2012 - The following Management’s Discussion and Analysis of financial results as provided by the management of Bellatrix Exploration Ltd. (“Bellatrix” or the “Company”) should be read in conjunction with the unaudited interim consolidated financial statements of the Company for the three months ended March 31, 2012, and the audited consolidated financial statements of the Company for the years ended December 31, 2011 and 2010 and the related Management’s Discussion and Analysis of financial results as disclosure which is unchanged from such Management’s Discussion and Analysis may not be repeated herein. This commentary is based on information available to, and is dated as of, May 9, 2012. The financial data presented is in Canadian dollars, except where indicated otherwise.

CONVERSION: The term barrels of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet of natural gas to one barrel of oil equivalent (6 mcf/bbl) is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. All boe conversions in this report are derived from converting gas to oil in the ratio of six thousand cubic feet of gas to one barrel of oil.

FLOW TEST RESULTS AND INITIAL PRODUCTION RATES: A pressure transient analysis or well-test interpretation has not been carried out and thus certain of the test results provided herein should be considered to be preliminary until such analysis or interpretation has been done. Test results and initial production rates disclosed herein may not necessarily be indicative of long-term performance or ultimate recovery.

NON-GAAP MEASURES: This Management’s Discussion and Analysis and the accompanying report to shareholders contains the term “funds flow from operations” which should not be considered an alternative to, or more meaningful than “cash flow from operating activities” as determined in accordance with generally accepted accounting principles (“GAAP”) as an indicator of the Company’s performance. Therefore reference to funds flow from operations or funds flow from operations per share may not be comparable with the calculation of similar measures for other entities. Management uses funds flow from operations to analyze operating performance and leverage and considers funds flow from operations to be a key measure as it demonstrates the Company’s ability to generate the cash necessary to fund future capital investments and to repay debt. The reconciliation between cash flow from operating activities and funds flow from operations can be found in this Management’s Discussion and Analysis. Funds flow from operations per share is calculated using the weighted average number of shares for the period.

This Management’s Discussion and Analysis and the accompanying report to shareholders also contains other terms such as net profit before the unrealized gain (loss) on commodity contracts, total net debt, and operating netbacks, which are not recognized measures under GAAP. Net profit before the unrealized gain (loss) on commodity contracts is calculated as net profit (loss) per the Consolidated Statement of Comprehensive Income, excluding the net unrealized gain (loss) on commodity contracts net of the deferred tax impact on the adjustment. Total net debt is calculated as long-term debt plus the liability component of the convertible debentures and the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligations. Net debt is calculated as long-term debt plus the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligations. Operating netbacks are calculated by subtracting royalties, transportation, and operating expenses from revenues before other income. Management believes these measures are useful supplemental measures of firstly, the total amount of current and long-term debt and secondly, the amount of revenues received after transportation, royalties and operating expenses. Readers are cautioned, however, that these measures should not be construed as an alternative to other terms such as current and long-term debt or net income determined in accordance with GAAP as measures of performance. Bellatrix’s method of calculating these measures may differ from other entities, and accordingly, may not be comparable to measures used by other companies.

Additional information relating to the Company, including the Bellatrix’s Annual Information Form, is available on SEDAR at www.sedar.com.

FORWARD LOOKING STATEMENTS: Certain information contained herein and in the accompanying report to shareholders may contain forward looking statements including management’s assessment of future plans and operations, drilling plans and the timing thereof, commodity price risk management strategies, expected 2012 average production and exit rates, timing of completion and tie-in of wells, anticipated liquidity of the Company and various matters that may impact such liquidity, expected 2012 operating expenses and general and administrative expenses, 2012 capital expenditures budget and the nature of capital expenditures and the timing and method of financing thereof, method of funding drilling commitments, commodity prices and expected volatility thereof, estimated amount and timing of incurring decommissioning liabilities, expectations with respect to production volumes, revenues, and commodity prices for 2012 compared to 2011, expectations of future development drilling locations and the capital expenditures associated with such drilling opportunities and the estimated costs to satisfy drilling commitments may constitute forward-looking statements under applicable securities laws and necessarily involve risks including, without limitation, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of reserve estimates, environmental risks, competition from other producers, inability to retain drilling rigs and other services, incorrect assessment of the value of acquisitions, failure to realize the anticipated benefits of acquisitions, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources. Events or circumstances may cause actual results to differ materially from those predicted, as a result of the risk factors set out and other known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Bellatrix. In addition, forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information but which may prove to be incorrect and which have been used to develop such statements and information in order to provide shareholders with a more complete perspective on Bellatrix’s future operations. Such information may prove to be incorrect and readers are cautioned that the information may not be appropriate for other purposes. Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein, assumptions have been made regarding, among other things: the impact of increasing competition; the general stability of the economic and political environment in which the Company operates; the timely receipt of any required regulatory approvals; the ability of the Company to obtain qualified staff, equipment and services in a timely and cost efficient manner; drilling results; the ability of the operator of the projects which the Company has an interest in to operate the field in a safe, efficient and effective manner; the ability of the Company to obtain financing on acceptable terms; field production rates and decline rates; the ability to replace and expand oil and natural gas reserves through acquisition, development of exploration; the timing and costs of pipeline, storage and facility construction and expansion and the ability of the Company to secure adequate product transportation; future commodity prices; currency, exchange and interest rates; the regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which the Company operates; and the ability of the Company to successfully market its oil and natural gas products. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which have been used. As a consequence, actual results may differ materially from those anticipated in the forward-looking statements. Additional information on these and other factors that could effect Bellatrix’s operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com), and at Bellatrix’s website (www.bellatrixexploration.com). Furthermore, the forward-looking statements contained herein are made as at the date hereof and Bellatrix does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

The reader is further cautioned that the preparation of financial statements in accordance with GAAP requires management to make certain judgments and estimates that affect the reported amounts of assets, liabilities, revenues and expenses. Estimating reserves is also critical to several accounting estimates and requires judgments and decisions based upon available geological, geophysical, engineering and economic data. These estimates may change, having either a negative or positive effect on net earnings as further information becomes available, and as the economic environment changes.

8

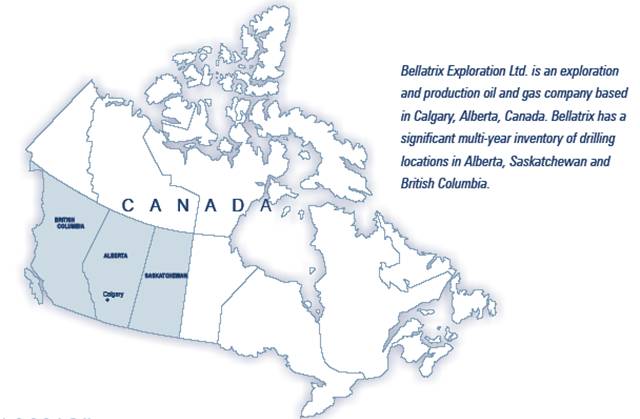

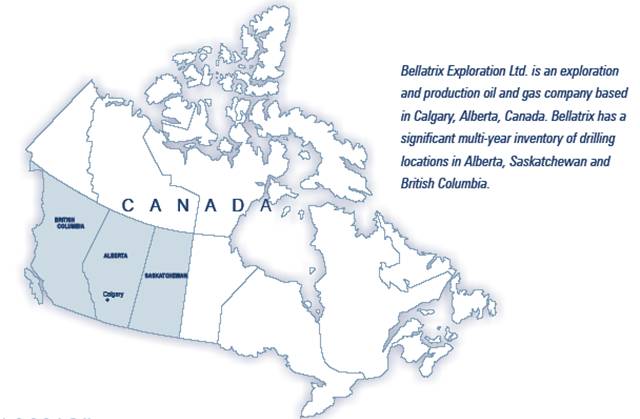

OVERVIEW AND DESCRIPTION OF THE BUSINESS

Bellatrix is a Western Canadian based growth oriented oil and gas company engaged in the exploration for, and the acquisition, development and production of oil and natural gas reserves in the provinces of Alberta, British Columbia and Saskatchewan.

Bellatrix is the continuing corporation resulting from the reorganization (the “Reorganization”) effective November 1, 2009 pursuant to a plan of arrangement involving, among others, True Energy Trust (the “Trust” or “True”), Bellatrix Exploration Ltd. (“Bellatrix” or the “Company”) and security holders of the Trust.

Bellatrix’s common shares and convertible debentures are listed on the Toronto Stock Exchange under the symbols BXE and BXE.DB.A, respectively.

FIRST QUARTER 2012 FINANCIAL AND OPERATIONAL RESULTS

SALES VOLUMES

Sales volumes for the three months ended March 31, 2012 averaged 15,900 boe/d compared to 10,084 boe/d for the same period in 2011, representing a 58% increase, despite infrastructure restrictions resolved at the end of February 2012. Total crude oil, condensate and NGLs averaged approximately 39% of sales volumes for the three months ended March 31, 2012 compared to 38% of sales volumes in the same period in 2011. The increase in sales is primarily a result of a year over year increased capital program and the associated drilling success achieved in the Cardium and Notikewin resource plays. Capital expenditures on exploration and development for the three months ended March 31, 2012 were $74.1 million, compared to $55.5 million for the same period in 2011. In addition, capital expenditures on exploration and development for the year ended December 31, 2011 were $175.5 million, compared to $98.4 million for the 2010 year.

Sales volumes in the month of March 2012 averaged 18,283 boe/d (weighted 40% to oil, condensate and NGLs and 60% to natural gas). This represents a significant 13% increase over the December 2011 production rate of 16,141 boe/d.

| | Three months ended March 31, | |

Sales Volumes | | 2012 | | 2011 | |

Light oil and condensate (bbls/d) | | 4,466 | | 3,031 | |

NGLs (bbls/d) | | 1,386 | | 556 | |

Heavy oil (bbls/d) | | 271 | | 273 | |

Total crude oil, condensate and NGLs (bbls/d) | | 6,123 | | 3,860 | |

Natural gas (mcf/d) | | 58,660 | | 37,346 | |

Total (boe/d,6:1) | | 15,900 | | 10,084 | |

In the first quarter of 2012, Bellatrix drilled and/or participated in a total of 13 gross (10.72 net) wells resulting in 10 gross (8.22 net) Cardium light oil horizontal wells and 3 gross (2.50 net) natural gas horizontal wells. The 3 gross (2.50 net) natural gas horizontal wells include: 1 gross (1 net) Duvernay well; 1 gross (0.5 net) Notikewin well with 35 bbls liquids per mmcf, and 1 gross (1 net) Cardium well producing 70 bbls liquids per mmcf.

By comparison, Bellatrix drilled or participated in 21 gross (12.07 net) wells during the first quarter of 2011, including 9.67 net oil wells and 2.40 net natural gas wells.

For the three months ended March 31, 2012, crude oil, condensate and NGL sales volumes increased by approximately 59% averaging 6,123 bbl/d compared to 3,860 bbl/d in the 2011 first quarter. The weighting towards crude oil, condensate and NGLs remained fairly consistent in the 2012 first quarter at 39%, compared to 38% in the same period in 2011.

9

Sales of natural gas averaged 58.7 Mmcf/d for the three months ended March 31, 2012, compared to 37.4 Mmcf/d in the same period in 2011, an increase of approximately 57%. The weighting towards natural gas sales volumes averaged approximately 61% for the first quarter of 2012 compared to 62% in the 2011 first quarter.

For 2012, Bellatrix will continue to be active in drilling its two core resource plays, the Cardium oil and Notikewin condensate-rich gas, utilizing horizontal drilling multi-fracturing technology. In addition, with the spudding of Bellatrix’s first (100% WI) Duvernay well in the first quarter of 2012, the Company is embarking on development of its third resource play in the potentially high impact Duvernay Shale. An initial capital budget of $180 million has been set for fiscal 2012. Based on the success of the Company’s Q1 2012 drilling results, Bellatrix is raising its 2012 exit rate guidance. Based on the timing of proposed expenditures, downtime for anticipated plant turnarounds, resolution of infrastructure constraints, and normal production declines, execution of the 2012 budget is anticipated to provide 2012 average daily production of approximately 16,500 boe/d to 17,000 boe/d and an exit rate of approximately 19,000 boe/d to 19,500 boe/d.

COMMODITY PRICES

| | Three months ended March 31, | | | |

Average Commodity Prices | | 2012 | | 2011 | | % Change | |

Average exchange rate (US$/Cdn$) | | 0.9986 | | 1.0147 | | (2 | ) |

| | | | | | | |

Crude oil: | | | | | | | |

WTI (US$/bbl) | | 103.03 | | 94.60 | | 9 | |

Edmonton par - light oil ($/bbl) | | 92.81 | | 88.45 | | 5 | |

Bow River - medium/heavy oil ($/bbl) | | 83.17 | | 71.30 | | 17 | |

Hardisty Heavy - heavy oil ($/bbl) | | 72.35 | | 61.43 | | 18 | |

Bellatrix’s average prices ($/bbl) | | | | | | | |

Light crude oil and condensate | | 90.03 | | 83.75 | | 7 | |

NGLs | | 53.97 | | 51.27 | | 5 | |

Heavy crude oil | | 75.93 | | 59.55 | | 28 | |

Total crude oil and NGLs | | 81.24 | | 77.36 | | 5 | |

Total crude oil and NGLs (including risk management (1)) | | 75.96 | | 74.61 | | 2 | |

| | | | | | | |

Natural gas: | | | | | | | |

NYMEX (US$/mmbtu) | | 2.50 | | 4.20 | | (40 | ) |

AECO daily index (CDN$/mcf) | | 2.15 | | 3.76 | | (43 | ) |

AECO monthly index (CDN$/mcf) | | 2.52 | | 3.77 | | (33 | ) |

Bellatrix’s average price ($/mcf) | | 2.32 | | 3.94 | | (41 | ) |

Bellatrix’s average price (including risk management (1)) ($/mcf) | | 2.32 | | 3.94 | | (41 | ) |

(1) Per unit metrics including risk management include realized gains or losses on commodity contracts and exclude unrealized gains or losses on commodity contracts.

For light oil and condensate, Bellatrix recorded an average $90.03/bbl before commodity price risk management contracts during the three months ended March 31, 2012, 7% higher than the average price received in the comparative 2011 period. In comparison, the Edmonton par price increased by 5% over the same period. The average WTI crude oil US dollar based price increased 9% in the three months ended March 31, 2012 compared to the first quarter of 2011. The average US$/CDN$ foreign exchange rate was 0.9986 for the first quarter of 2012, a decrease of 2% compared to an average rate of 1.0147 in the first quarter of 2011.

10

For heavy crude oil, Bellatrix received an average price before transportation of $75.93/bbl in the 2012 first quarter, an increase of 28% over prices in the first quarter of 2011. In comparison, the Bow River reference price increased by 17%, and the Hardisty Heavy reference price increased by 18% between the three months ended March 31, 2011 and the three months ended March 31, 2012. The majority of Bellatrix’s heavy crude oil density ranges between 11 and 16 degrees API, consistent with the Hardisty Heavy reference price.

Bellatrix’s natural gas sales are priced with reference to the daily or monthly AECO indices. During the first quarter of 2012, the AECO daily reference price decreased by approximately 43% and the AECO monthly reference price decreased by approximately 33%, compared to the first quarter of 2011. Bellatrix’s natural gas average sales price before commodity price risk management contracts for the three months ended March 31, 2012 decreased by 41% compared to the same period in 2011. Bellatrix’s natural gas average price after including commodity price risk management contracts for the three months ended March 31, 2012 was $2.32/mcf, compared to $3.94/mcf for the first quarter of 2011.

REVENUE

Revenue before other income, royalties and commodity price risk management contracts for the three months ended March 31, 2012 was $57.7 million, 44% higher than the $40.1 million in the first quarter of 2011.

Revenue before other income, royalties and commodity price risk management contracts for crude oil and NGLs for the three months ended March 31, 2012 increased by approximately 68%, resulting from higher sales volumes in conjunction with higher light crude oil, condensate and NGL prices when compared to the same period in 2011. In the first quarter of 2012, total crude oil, condensate and NGL revenues contributed 78% of total revenue (before other) compared to 67% in the same period in 2011. Light crude oil, condensate and NGL revenues in the three months ended March 31, 2012 comprised 96% of total crude oil, condensate and NGL revenues (before other), consistent with the 95% composition realized in the first quarter of 2011.

Natural gas revenue before other income, royalties and commodity price risk management contracts for the first quarter of 2012 decreased by approximately 6% compared to the first quarter of 2011 as a result of an approximate 57% increase in sales volumes offset by a 41% decrease in realized gas prices after risk management between the periods.

| | Three months ended March 31, | |

($000s) | | 2012 | | 2011 | |

Light crude oil and condensate | | 36,593 | | 22,844 | |

NGLs | | 6,807 | | 2,564 | |

Heavy oil | | 1,871 | | 1,464 | |

Crude oil and NGLs | | 45,271 | | 26,872 | |

Natural gas | | 12,408 | | 13,240 | |

Total revenue before other | | 57,679 | | 40,112 | |

Other (1) | | 512 | | 423 | |

Total revenue before royalties and risk management | | 58,191 | | 40,535 | |

(1) Other revenue primarily consists of processing and other third party income.

Revenues for the remainder of 2012 are uncertain due to volatile commodity prices. While sales volumes, crude oil prices, and liquid prices for 2012 are expected to be higher than 2011, natural gas prices are anticipated to remain relatively weak.

11

COMMODITY PRICE RISK MANAGEMENT

The Company has a formal commodity price risk management policy which permits management to use specified price risk management strategies including fixed price contracts, collars and the purchase of floor price options and other derivative financial instruments and physical delivery sales contracts to reduce the impact of price volatility for a maximum of eighteen months beyond the transaction date. The program is designed to provide price protection on a portion of the Company’s future production in the event of adverse commodity price movement, while retaining significant exposure to upside price movements. By doing this, the Company seeks to provide a measure of stability to funds flow from operations, as well as to ensure Bellatrix realizes positive economic returns from its capital development and acquisition activities. The Company plans to continue its commodity price risk management strategies focusing on maintaining sufficient cash flow to fund Bellatrix’s capital expenditure program. Any remaining production is realized at market prices.

A summary of the financial commodity price risk management volumes and average prices by quarter currently outstanding as of May 9, 2012 is shown in the following tables:

Natural Gas

Average Volumes (GJ/d)

| | Q2 2012 | | Q3 2012 | | Q4 2012 | |

Fixed | | 36,703 | | 40,000 | | 13,478 | |

Average Price ($/GJ AECO C)

| | Q2 2012 | | Q3 2012 | | Q4 2012 | |

Fixed | | 3.68 | | 3.52 | | 3.52 | |

Crude Oil and Liquids

Average Volumes (bbls/d)

| | Q2 2012 | | Q3 2012 | | Q4 2012 | |

Call option | | 833 | | 833 | | 833 | |

Fixed | | 3,000 | | 3,000 | | 3,000 | |

Total bbls/d | | 3,833 | | 3,833 | | 3,833 | |

| | Q1 2013 | | Q2 2013 | | Q3 2013 | | Q4 2013 | |

Call option | | 3,000 | | 3,000 | | 3,000 | | 3,000 | |

Average Price ($/bbl WTI)

| | Q2 2012 | | Q3 2012 | | Q4 2012 | |

Call option (ceiling price) (US$/bbl) | | $ | 110.00 | | $ | 110.00 | | $ | 110.00 | |

Fixed price (CDN$/bbl) | | 92.30 | | 92.30 | | 92.30 | |

| | | | | | | | | | |

| | Q1 2013 | | Q2 2013 | | Q3 2013 | | Q4 2013 | |

Call option (ceiling price) (US$/bbl) | | $ | 110.00 | | $ | 110.00 | | $ | 110.00 | | $ | 110.00 | |

| | | | | | | | | | | | | |

12

Included in the above natural gas table are fixed price contracts of an average of $4.10/GJ at 30,000 GJ/d from April 1, 2012 to October 31, 2012 which were funded by selling call options of 3,000 bbl/d at US$110.00 for the 2013 calendar year.

As of March 31, 2012, the fair value of Bellatrix’s outstanding commodity contracts is a net unrealized liability of $5.8 million as reflected in the financial statements. The fair value or mark-to-market value of these contracts is based on the estimated amount that would have been received or paid to settle the contracts as at March 31, 2012 and may be different from what will eventually be realized. Changes in the fair value of the commodity contracts are recognized in the Consolidated Statements of Comprehensive Income within the financial statements.

The following is a summary of the gain (loss) on commodity contracts for the three months ended March 31, 2012 and 2011 as reflected in the Consolidated Statements of Comprehensive Income in the financial statements:

Commodity Contracts

| | Crude Oil | | Natural | | 2012 | |

($000s) | | & Liquids | | Gas | | Total | |

Realized cash gain (loss) on contracts | | (2,945 | ) | — | | (2,945 | ) |

Unrealized gain (loss) on contracts (1) | | (6,749 | ) | 11,617 | | 4,868 | |

Total gain (loss) on commodity contracts | | (9,694 | ) | 11,617 | | 1,923 | |

Commodity Contracts

| | Crude Oil | | Natural | | 2011 | |

($000s) | | & Liquids | | Gas | | Total | |

Realized cash gain (loss) on contracts | | (956 | ) | — | | (956 | ) |

Unrealized gain (loss) on contracts (1) | | (12,962 | ) | 3,734 | | (9,228 | ) |

Total gain (loss) on commodity contracts | | (13,918 | ) | 3,734 | | (10,184 | ) |

(1) Unrealized gain (loss) on commodity contracts represent non-cash adjustments for changes in the fair value of these contracts during the period.

ROYALTIES

For the three months ended March 31, 2012, total royalties were $6.6 million compared to $6.5 million incurred in the first quarter of 2011. Overall royalties as a percentage of revenue (after transportation costs) in the first quarter of 2012 were 12%, compared with 17% in the 2011 first quarter.

The Company’s heavy oil properties consist of principally the Frog Lake Alberta assets which are subject to high crown royalty rates. The heavy oil royalties for the first quarter of 2011 included higher royalty estimates which have been revised in subsequent quarters. The Company’s royalty percentage for natural gas royalties continues to decline due to increased production from recently drilled wells which take advantage of Alberta royalty incentive programs. Natural gas royalties and total royalties for the first quarter of 2012 were reduced by $2.6 million and $3.0 million, respectively, in adjustments relating to previous year estimates, primarily for Ferrier area wells for Indian Oil and Gas Canada royalties under recent royalty incentive programs. Excluding these adjustments, the average natural gas and overall corporate royalty rate percentages for the first quarter of 2012 would be 8% and 17%, respectively.

13

Royalties by Commodity Type

| | Three months ended March 31, | |

($000s, except where noted) | | 2012 | | 2011 | |

Light crude oil, condensate and NGLs | | 7,724 | | 4,044 | |

$/bbl | | 14.50 | | 12.53 | |

Average light crude oil, condensate and NGLs royalty rate (%) | | 18 | | 16 | |

Heavy oil | | 599 | | 717 | |

$/bbl | | 24.30 | | 29.16 | |

Average heavy oil royalty rate (%) | | 32 | | 49 | |

Natural gas | | (1,710 | ) | 1,710 | |

$/mcf | | (0.32 | ) | 0.51 | |

Average natural gas royalty rate (%) | | (15 | ) | 14 | |

Total | | 6,613 | | 6,471 | |

$/boe | | 4.57 | | 7.13 | |

Average total royalty rate (%) | | 12 | | 17 | |

Royalties, by Type

| | Three months ended March 31, | |

($000s) | | 2012 | | 2011 | |

Crown royalties | | 2,642 | | 2,663 | |

Indian Oil and Gas Canada royalties | | (345 | ) | 1,182 | |

Freehold & GORR | | 4,316 | | 2,626 | |

Total | | 6,613 | | 6,471 | |

EXPENSES

| | Three months ended March 31, | |

($000s) | | 2012 | | 2011 | |

Production | | 13,306 | | 11,298 | |

Transportation | | 1,658 | | 1,167 | |

General and administrative | | 2,761 | | 2,267 | |

Interest and financing charges (1) | | 2,102 | | 1,701 | |

Share-based compensation | | 793 | | 495 | |

(1) Does not include financing charges in relation to the Company’s unwinding of decommissioning liabilities.

Expenses per boe

| | Three months ended March 31, | |

($ per boe) | | 2012 | | 2011 | |

Production | | 9.20 | | 12.45 | |

Transportation | | 1.14 | | 1.29 | |

General and administrative | | 1.91 | | 2.50 | |

Interest and financing charges | | 1.45 | | 1.87 | |

Share-based compensation | | 0.55 | | 0.55 | |

14

PRODUCTION EXPENSES

For the three months ended March 31, 2012, production expenses totaled $13.3 million ($9.20/boe), compared to $11.3 million ($12.45/boe) recorded in the first quarter of 2011. For the three months ended March 31, 2012, production expenses increased overall but decreased on a per boe basis when compared to the same period in 2011. The decrease in production expenses in the 2012 first quarter on a boe basis is due to increased production which is a result of drilling in both 2011 and the first quarter of 2012 in areas with lower production expenses in conjunction with the Company’s continued efforts to streamline operations and field optimization projects.

Bellatrix is targeting operating costs of approximately $65.3 million ($10.50/boe) in 2012, which compares to $11.53/boe operating costs incurred for the 2011 year. This is based upon assumptions of estimated 2012 average production of approximately 16,500 boe/d to 17,000 boe/d, continued field optimization work and planned capital expenditures in producing areas which are anticipated to have lower operating costs.

Production Expenses, by Commodity Type

| | Three months ended March 31, | |

($000s, except where noted) | | 2012 | | 2011 | |

Light crude oil, condensate and NGLs | | 4,535 | | 4,509 | |

$/bbl | | 8.51 | | 13.97 | |

Heavy oil | | 421 | | 787 | |

$/bbl | | 17.09 | | 32.03 | |

Natural gas | | 8,350 | | 6,002 | |

$/mcf | | 1.56 | | 1.79 | |

Total | | 13,306 | | 11,298 | |

$/boe | | 9.20 | | 12.45 | |

Total | | 13,306 | | 11,298 | |

Processing and other third party income (1) | | (512 | ) | (423 | ) |

Total after deducting processing and other third party income | | 12,794 | | 10,875 | |

$/boe | | 8.84 | | 11.98 | |

(1) Processing and other third party income is included within petroleum and natural gas sales on the Consolidated Statements of Comprehensive Income.

TRANSPORTATION

Transportation expenses for the three months ended March 31, 2012 were $1.7 million ($1.14/boe), compared to $1.2 million ($1.29/boe) in the first quarter of 2011. The slight overall decrease to per boe costs is reflective of reduced gas transportation fees resulting from the acquisition of an ownership interest in certain processing facilities earlier in 2011, offset somewhat by increased oil hauling charges.

OPERATING NETBACK

Field Operating Netback - Corporate (before risk management)

| | Three months ended March 31, | |

($/boe) | | 2012 | | 2011 | |

Sales | | 39.86 | | 44.20 | |

Transportation | | (1.14 | ) | (1.29 | ) |

Royalties | | (4.57 | ) | (7.13 | ) |

Production expense | | (9.20 | ) | (12.45 | ) |

Field operating netback | | 24.95 | | 23.33 | |

15

For the three months ended March 31, 2012, corporate field operating netback (before commodity price risk management contracts) was $24.95/boe compared to $23.33/boe in the first quarter of 2011. The improved netback was primarily the result of an approximate 8% increase in the average sales volumes weighted toward oil, condensate and natural gas liquids, in conjunction with an increase in oil, condensate, and NGL commodity prices and decrease in production, transportation, and royalty expenses. After including commodity price risk management contracts, the corporate field operating netback for the 2012 first quarter was $22.92/boe compared to $22.28/boe in the 2011 first quarter.

Field Operating Netback - Crude Oil, Condensate and NGLs (before risk management)

| | Three months ended March 31, | |

($/bbl) | | 2012 | | 2011 | |

Sales | | 81.24 | | 77.35 | |

Transportation | | (1.45 | ) | (1.52 | ) |

Royalties | | (14.94 | ) | (13.70 | ) |

Production expense | | (8.89 | ) | (15.24 | ) |

Field operating netback | | 55.96 | | 46.89 | |

Field operating netback for crude oil, condensate and NGLs averaged $55.96/bbl for the three months ended March 31, 2012, an increase of 19% from $46.89/bbl realized in the comparative 2011 period. In the 2012 first quarter, Bellatrix’s combined crude oil and NGLs average price (before risk management) increased by approximately 5% compared to the first quarter of 2011. A reduction in production and transportation expenses also contributed to the higher netback, which was partially offset by an increase in royalties. After including commodity price risk management contracts, field operating netback for crude oil and NGLs for the three months ended March 31, 2012 increased to $50.68/boe compared to $44.13/boe in the same period in 2011.

Field Operating Netback - Natural Gas (before risk management)

| | Three months ended March 31, | |

($/mcf) | | 2012 | | 2011 | |

Sales | | 2.32 | | 3.94 | |

Transportation | | (0.16 | ) | (0.19 | ) |

Royalties | | 0.32 | | (0.51 | ) |

Production expense | | (1.56 | ) | (1.79 | ) |

Field operating netback | | 0.92 | | 1.45 | |

Field operating netback for natural gas in the first quarter of 2012 year decreased by 37% to $0.92/mcf, compared to $1.45/mcf realized in the first quarter of 2011, reflecting depressed natural gas prices offset partially by lower transportation and production expenses, in conjunction with significant credit adjustments to royalties as discussed previously herein. After including commodity price risk management contracts, field operating netback for natural gas for the three months ended March 31, 2012 was $0.92/mcf compared to $1.45/mcf in the first quarter of 2011.

16

GENERAL AND ADMINISTRATIVE

General and administrative (“G&A”) expenses (after capitalized G&A and recoveries) for the three months ended March 31, 2012 were $2.8 million ($1.91/boe), compared to $2.3 million ($2.50/boe) for the same period in 2011. The increase in the G&A expense in the first quarter of 2012 compared to the same period in 2011 reflects higher compensation and base costs, partially offset by recoveries and an increase in capitalized G&A, which are consistent with Bellatrix’s higher 2012 capital program. On a boe basis, G&A for the first quarter of 2012 decreased by approximately 24% when compared to the first quarter of 2011. The decrease is primarily as a result of higher average sales volumes in the 2012 period, despite slightly higher costs.

For 2012, the Company is anticipating G&A expenses after capitalization to be approximately $13.5 million ($2.18/boe) based on estimated 2012 average production volumes of approximately 16,500 boe/d to 17,000 boe/d. This compares to actual 2011 G&A costs of $2.83/boe.

General and Administrative Expenses

| | Three months ended March 31, | |

($000s, except where noted) | | 2012 | | 2011 | |

Gross expenses | | 4,878 | | 4,265 | |

Capitalized | | (1,042 | ) | (844 | ) |

Recoveries | | (1,075 | ) | (1,154 | ) |

G&A expenses | | 2,761 | | 2,267 | |

G&A expenses, per unit ($/boe) | | 1.91 | | 2.50 | |

INTEREST AND FINANCING CHARGES

Bellatrix recorded $2.1 million of interest and financing charges related to bank debt and its debentures for the three months ended March 31, 2012 compared to $1.7 million in the first quarter of 2011. The increase in interest and financing charges is primarily due to greater interest and accretion charges in relation to the Company’s outstanding debentures in conjunction with higher interest charges related to the Company’s long-term debt as the Company carried a higher average debt balance in the 2012 first quarter compared to the same period in 2011. Bellatrix’s total net debt at March 31, 2012 of $164.5 million includes the $49.5 million liability portion of its $55 million principal amount of 4.75% convertible unsecured subordinated debentures (the “4.75% Debentures”), $96.8 million of bank debt and the net balance of a working capital deficiency. The 4.75% Debentures have a maturity date of April 30, 2015.

Interest and Financing Charges (1)

| | Three months ended March 31, | |

($000s, except where noted) | | 2012 | | 2011 | |

Interest and financing charges | | 2,102 | | 1,701 | |

Interest and financing charges ($/boe) | | 1.45 | | 1.87 | |

(1) Does not include financing charges in relation to the Company’s unwinding of decommissioning liabilities.

17

Debt to Funds Flow from Operations Ratio

| | Three months ended March 31, | |

($000s, except where noted) | | 2012 | | 2011 | |

Debt to funds flow from operations (1) ratio (annualized) (3) | | | | | |

Funds flow from operations(1) (annualized) | | 116,776 | | 68,108 | |

Total net debt(2) at period end | | 164,500 | | 130,170 | |

Total net debt to periods funds flow from operations ratio annualized (3) | | 1.4x | | 1.9x | |

| | | | | |

Net debt(2) (excluding convertible debentures) at period end | | 115,036 | | 82,219 | |

Net debt to periods funds flow from operations ratio annualized(3) | | 1.0x | | 1.2x | |

| | | | | |

Debt to funds flow from operations (1) ratio (trailing) (4) | | | | | |

Funds flow from operations(1) ratio (trailing) | | 106,507 | | 59,871 | |

Total net debt(2) to funds flow from operations (trailing) | | 1.5x | | 2.2x | |

| | | | | |

Net debt(2) (excluding convertible debentures) to funds flow from operations for the period | | 1.1x | | 1.4x | |

(1) As detailed previously in this Management’s Discussion and Analysis, funds flow from operations is a term that does not have any standardized meaning under GAAP. Funds flow from operations is calculated as cash flow from operating activities, decommissioning costs incurred and changes in non-cash working capital incurred. Refer to the reconciliation of cash flow from operating activities to funds flow from operations appearing elsewhere herein.

(2) Net debt and total net debt are considered non-GAAP terms. The Company’s calculation of total net debt includes the liability component of convertible debentures and excludes deferred liabilities, long-term commodity contract liabilities, decommissioning liabilities, long-term finance lease obligation and the deferred tax liability. Net debt and total net debt include the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligation. Net debt also excludes the liability component of convertible debentures. Total net debt and net debt are non-GAAP measures; refer to the following reconciliation of total liabilities to total net debt and net debt.

(3) Total net debt and net debt to periods funds flow from operations ratio (annualized) is calculated based upon first quarter funds flow from operations annualized.

(4) Trailing periods funds flow from operations ratio annualized is based on the twelve-month periods ended March 31, 2012 and March 31, 2011.

Reconciliation of Total Liabilities to Total Net Debt and Net Debt

| | As at March 31, | |

($000s) | | 2012 | | 2011 | |

Total liabilities per financial statements | | 286,738 | | 232,603 | |

Current liabilities included within working capital calculation | | (84,391 | ) | (70,403 | ) |

Deferred liability - flow-through shares | | — | | (3,288 | ) |

Commodity contract liability | | (6,963 | ) | — | |

Decommissioning Liabilities | | (44,655 | ) | (39,256 | ) |

Finance lease obligation | | (4,505 | ) | (1,407 | ) |

Working capital | | | | | |

Current assets | | (66,819 | ) | (45,375 | ) |

Current liabilities | | 84,391 | | 70,403 | |

Current portion of finance lease | | (495 | ) | (147 | ) |

Net commodity contract asset (liability) | | 1,199 | | (12,960 | ) |

| | 18,276 | | 11,921 | |

Total net debt | | 164,500 | | 130,170 | |

Convertible debentures | | (49,464 | ) | (47,951 | ) |

Net debt | | 115,036 | | 82,219 | |

18

SHARE-BASED COMPENSATION

Non-cash share-based compensation expense for the three months ended March 31, 2012 was an expense of $0.8 million compared to $0.5 million in the same period in 2011. The increase in non-cash share-based compensation expense between the first quarter of 2011 and the first quarter of 2012 is primarily a result of an increase in share options granted at a higher weighted average fair value as well as a $0.1 million expense related to the Deferred Share Unit Plan which was approved by the Board of Directors of Bellatrix on May 11, 2011.

DEPLETION AND DEPRECIATION

Depletion and depreciation expense for the three months ended March 31, 2012 was $19.5 million ($13.45/boe), compared to $13.8 million ($15.16/boe) recognized in the first quarter of 2011. The decrease in depletion and depreciation expense, on a per boe basis, is primarily a result of an increase in the reserve base used for the depletion calculation, partially offset by a higher cost base and increased future development costs.

For the three months ended March 31, 2012 Bellatrix has included a total of $348.2 million (2011: $254.1 million) for future development costs in the depletion calculation and excluded from the depletion calculation a total of $35.1 million (2011: $34.9 million) for estimated salvage.

Depletion and Depreciation

| | Three months ended March 31, | |

($000s, except where noted) | | 2012 | | 2011 | |

Depletion and depreciation | | 19,462 | | 13,759 | |

Per unit ($/boe) | | 13.45 | | 15.16 | |

IMPAIRMENT OF ASSETS

In accordance with IFRS, the Company calculates an impairment test on a quarterly basis when there are indicators of impairment. The impairment test is performed at the asset or cash generating unit (“CGU”) level. IAS 36 - “Impairment of Assets” (“IAS 36”) is a one step process for testing and measuring impairment of assets. Under IAS 36, the asset or CGU’s carrying value is compared to the higher of: value-in-use and fair value less costs to sell. Value in use is defined as the present value of the future cash flows expected to be derived from the asset or CGU.

As at March 31, 2012, Bellatrix reviewed and determined there were no impairment indicators requiring an impairment test to be performed.

When performed, the impairment test will be based upon fair market values for the Company’s properties, including but not limited to an updated external reserve engineering report which incorporates a full evaluation of reserves on an annual basis or internal reserve updates at quarterly periods, and the latest commodity pricing deck. Estimating reserves is very complex, requiring many judgments based on available geological, geophysical, engineering and economic data. Changes in these judgments could have a material impact on the estimated reserves. These estimates may change, having either a negative or positive effect on net earnings as further information becomes available and as the economic environment changes.

INCOME TAXES

Deferred income taxes arise from differences between the accounting and tax bases of the Company’s assets and liabilities. For the three months ended March 31, 2012, the Company recognized a deferred income tax expense of $3.3 million compared to a recovery of $1.5 million in the first quarter of 2011.

At March 31, 2012, the Company had a total deferred tax asset balance of $7.8 million.

19

At March 31, 2012, Bellatrix had approximately $559.3 million in tax pools available for deduction against future income as follows:

($000s) | | Rate % | | 2012 | | 2011 | |

Intangible resource pools: | | | | | | | |

Canadian exploration expenses | | 100 | | 47,600 | | 44,300 | |

Canadian development expenses | | 30 | | 384,400 | | 325,300 | |

Canadian oil and gas property expenses | | 10 | | 25,100 | | 17,200 | |

Foreign resource expenses | | 10 | | 800 | | 800 | |

Attributed Canadian Royalty Income | | (Alberta) 100 | | 16,100 | | 16,100 | |

Undepreciated capital cost (1) | | 6 - 55 | | 72,000 | | 82,700 | |

Non-capital losses (expire through 2027) | | 100 | | 10,000 | | 300 | |

Financing costs | | 20 S.L. | | 3,300 | | 2,200 | |

| | | | 559,300 | | 488,900 | |

(1) Approximately $69 million of undepreciated capital cost pools are class 41, which is claimed at a 25% rate.

CASH FLOW FROM OPERATING ACTIVITIES, FUNDS FLOW FROM OPERATIONS AND NET PROFIT (LOSS)

As detailed previously in this Management’s Discussion and Analysis, funds flow from operations is a term that does not have any standardized meaning under GAAP. Funds flow from operations is calculated as cash flow from operating activities before decommissioning costs incurred and changes in non-cash working capital incurred.

Reconciliation of Cash Flow from Operating Activities and Funds Flow from Operations

| | Three months ended March 31, | |

($000s) | | 2012 | | 2011 | |

Cash flow from operating activities | | 24,056 | | 15,718 | |

Decommissioning costs incurred | | 177 | | 149 | |

Change in non-cash working capital | | 4,961 | | 1,160 | |

Funds flow from operations | | 29,194 | | 17,027 | |

As previously noted in this MD&A, net profit before the unrealized gain (loss) on commodity contracts is a non-GAAP measure. A reconciliation between this measure and net loss per the Consolidated Statement of Comprehensive Income is provided below.

For the three months ended March 31, 2012, net profit before the unrealized gain (loss) on commodity contracts, net of associated deferred tax impacts, was $5.5 million compared to a net profit of $1.4 million in the first quarter of 2011.

Reconciliation of Net Profit (Loss) to Net Profit Before Unrealized Gain (Loss) on Commodity Contracts

| | Three months ended March 31, | |

($000s) | | 2012 | | 2011 | |

Net profit (loss) per financial statements | | 9,172 | | (5,487 | ) |

Items subject to reversal | | | | | |

Unrealized (gain) loss on commodity contracts | | (4,868 | ) | 9,228 | |

Deferred tax impact of above item | | 1,217 | | (2,307 | ) |

Net profit before unrealized gain (loss) on commodity contracts | | 5,521 | | 1,434 | |

20

Bellatrix’s cash flow from operating activities of $24.1 million ($0.22 per basic share and $0.21 per diluted share) for the three months ended March 31, 2012 increased approximately 53% from the $15.7 million ($0.16 per basic share and $0.15 per diluted share) generated in the comparative 2011 period. Bellatrix generated funds flow from operations of $29.2 million ($0.27 per basic share and $0.25 per diluted share) for the three months ended March 31, 2012, up 71% from $17.0 million ($0.17 per basic share and $0.16 per diluted share) for the comparative 2011 period. The increase is principally due to higher operating netbacks for crude oil, condensate and NGLs as the weighting toward light oil, condensate and natural gas liquids sales volumes increased in combination with improved pricing for crude oil, condensate and NGLs. The increase between the periods was partially offset by an increase in net realized losses on the Company’s commodity risk management contracts, as well as a slight increase in G&A expenses and interest and finance charges.

Bellatrix maintains a commodity price risk management program to provide a measure of stability to funds flow from operations. Unrealized mark-to-market gains or losses are non-cash adjustments to the current fair market value of the contract over its entire term and are included in the calculation of net profit.

A net profit of $9.2 million ($0.09 per basic share and $0.08 per diluted share) was recognized for the three months ended March 31, 2012, compared to a net loss of $5.5 million ($0.06 per basic share and $0.06 per diluted share) in the first quarter of 2011. The net profit recorded in the three months ended March 31, 2012 compared to the net loss in the same period in 2011 is primarily a consequence of higher cash flows as noted above, a $4.9 million unrealized gain on commodity contracts in Q1 2012 compared to a $9.2 million unrealized loss in Q1 2011, a $5.7 million increase in depletion and depreciation expenses, a $0.9 million higher non-cash loss on property dispositions in the 2012 period, and a $4.8 million higher deferred tax expense.

Cash Flow from Operating Activities, Funds Flow from Operations and Net Profit (Loss)

| | Three months ended March 31, | |

($000s, except per share amounts) | | 2012 | | 2011 | |

Cash flow from operating activities | | 24,056 | | 15,718 | |

Basic ($/share) | | 0.22 | | 0.16 | |

Diluted ($/share) | | 0.21 | | 0.15 | |

Funds flow from operations | | 29,194 | | 17,027 | |

Basic ($/share) | | 0.27 | | 0.17 | |

Diluted ($/share) | | 0.25 | | 0.16 | |

Net profit (loss) | | 9,172 | | (5,487 | ) |

Basic ($/share) | | 0.09 | | (0.06 | ) |

Diluted ($/share) | | 0.08 | | (0.06 | ) |

CAPITAL EXPENDITURES

Bellatrix invested $76.6 million in exploration and development activities during the three months ended March 31, 2012, compared to $55.5 million in the first quarter of 2011. The increase in these expenditures between the periods is consistent with the slightly higher capital budget for 2012.

21

Capital Expenditures

| | Three months ended March 31, | |

($000s) | | 2012 | | 2011 | |

Lease acquisitions and retention | | 2,989 | | 9,996 | |

Geological and geophysical | | (41 | ) | 293 | |

Drilling and completion costs | | 62,170 | | 39,468 | |

Facilities and equipment | | 8,943 | | 5,729 | |

Exploration and development (1) | | 74,061 | | 55,486 | |

Corporate (2) | | 70 | | 59 | |

Property acquisitions | | — | | 3,572 | |

Total capital expenditures - cash | | 74,131 | | 59,117 | |

Property dispositions - cash | | (300 | ) | 130 | |

Total net capital expenditures - cash | | 73,831 | | 59,247 | |

Other non-cash (3) | | (154 | ) | 513 | |

Total net capital expenditures | | 73,677 | | 59,760 | |

(1) Excludes capitalized costs related to decommissioning liabilities expenditures incurred during the period.

(2) Corporate includes office furniture, fixtures and equipment.

(3) Other includes non-cash adjustments for the current period’s decommissioning liabilities and share based compensation.

Q1 2012 capital project spending involved approximately $3.7 million spent on well tubing and other inventory related to the drilling program for the remainder of 2012.

In the first quarter of 2012, Bellatrix drilled and/or participated in a total of 13 gross (10.72 net) wells resulting in 10 gross (8.22 net) Cardium light oil horizontal wells and 3 gross (2.50 net) natural gas horizontal wells. The 3 gross (2.50 net) natural gas horizontal wells include: 1 gross (1 net) Duvernay well; 1 gross (0.5 net) Notikewin well with 35 bbls liquids per mmcf; and 1 gross (1 net) Cardium well producing 70 bbls liquids per mmcf.

By comparison, Bellatrix drilled or participated in 21 gross (12.07 net) wells in the first quarter of 2011, including 9.67 net oil wells and 2.40 net natural gas wells.

The $74.1 million capital program for the three months ended March 31, 2012 was financed from funds flow from operations and bank debt.

Based on the current economic conditions and Bellatrix’s operating forecast for 2012, the Company budgets a capital program of $180 million funded from the Company’s cash flows and to the extent necessary, bank indebtedness. The 2012 capital budget is expected to be directed primarily towards horizontal drilling and completions activities in the Cardium and Notikewin areas. In addition, with the spudding of Bellatrix’s first (100% WI) Duvernay well in the first quarter of 2012, the Company is embarking on development of its third resource play in the potentially high impact Duvernay Shale.

DECOMMISSIONING LIABILITIES

At March 31, 2012, Bellatrix has recorded decommissioning liabilities of $44.7 million, compared to $45.1 million at December 31, 2011, for future abandonment and reclamation of the Company’s properties. For the three months ended March 31, 2012, decommissioning liabilities decreased by a net $0.4 million as a result of a reduction of $0.2 million for liabilities reversed on dispositions and $0.9 million for changes in estimates, offset by $0.5 million incurred on property acquisitions and development activities and $0.2 million as a result of charges for the unwinding of the discount rates used for fair valuing the liabilities. The $0.9 million increase as a result of changes in estimates is primarily due to a higher risk-free discount rate at March 31, 2012 compared to December 31, 2011, in addition to other abandonment liability revisions.

22

LIQUIDITY AND CAPITAL RESOURCES

As an oil and gas business, Bellatrix has a declining asset base and therefore relies on ongoing development and acquisitions to replace production and add additional reserves. Future oil and natural gas production and reserves are highly dependent on the success of exploiting the Company’s existing asset base and in acquiring additional reserves. To the extent Bellatrix is successful or unsuccessful in these activities, cash flow could be increased or reduced.

Bellatrix is focused on growing oil and natural gas production from its diversified portfolio of existing and emerging resource plays in Western Canada. Bellatrix remains highly focused on key business objectives of maintaining financial strength, optimizing capital investments attained through a disciplined approach to capital spending, a flexible investment program and financial stewardship. Natural gas prices are primarily driven by North American supply and demand, with weather being the key factor in the short term. Bellatrix believes that natural gas represents an abundant, secure, long-term supply of energy to meet North American needs. Bellatrix’s results are affected by external market and risk factors, such as fluctuations in the prices of crude oil and natural gas, movements in foreign currency exchange rates and inflationary pressures on service costs. Market conditions have resulted in Bellatrix recently experiencing an upward trend in crude oil pricing and an opposite trend in natural gas pricing.

Liquidity risk is the risk that Bellatrix will not be able to meet its financial obligations as they become due. Bellatrix actively manages its liquidity through daily and longer-term cash, debt and equity management strategies. Such strategies encompass, among other factors: having adequate sources of financing available through its bank credit facilities, estimating future cash generated from operations based on reasonable production and pricing assumptions, analysis of economic risk management opportunities, and maintaining sufficient cash flows for compliance with operating debt covenants. Bellatrix is fully compliant with all of its operating debt covenants.

Bellatrix generally relies on operating cash flows and its credit facilities to fund capital requirements and provide liquidity. Future liquidity depends primarily on cash flow generated from operations, existing credit facilities and the ability to access debt and equity markets. From time to time, the Company accesses capital markets to meet its additional financing needs and to maintain flexibility in funding its capital programs. There can be no assurance that future debt or equity financing, or cash generated by operations will be available or sufficient to meet these requirements or for other corporate purposes or, if debt or equity financing is available, that it will be on terms acceptable to Bellatrix.

Credit risk is the risk of financial loss to Bellatrix if a customer or counterparty to a financial instrument fails to meet its contractual obligations, and arises principally from Bellatrix’s trade receivables from joint venture partners, petroleum and natural gas marketers, and financial derivative counterparties.

A substantial portion of Bellatrix’s accounts receivable are with customers and joint interest partners in the petroleum and natural gas industry and are subject to normal industry credit risks. Bellatrix sells substantially all of its production to seven primary purchasers under standard industry sale and payment terms. The most significant 60 day exposure to a single counterparty is currently approximately $19 million. Purchasers of Bellatrix’s natural gas, crude oil and natural gas liquids are subject to a periodic internal credit review to minimize the risk of non-payment. Bellatrix has continued to closely monitor and reassess the creditworthiness of its counterparties, including financial institutions. This has resulted in Bellatrix reducing or mitigating its exposures to certain counterparties where it is deemed warranted and permitted under contractual terms.

Bellatrix may be exposed to third party credit risk through its contractual arrangements with its current or future joint venture partners, marketers of its petroleum and natural gas production, derivative counterparties and other parties. In the event such entities fail to meet their contractual obligations to Bellatrix, such failures may have a material adverse effect on the Company’s business, financial condition, results of operations and prospects. In addition, poor credit conditions in the industry and of joint venture partners may impact a joint venture partner’s willingness to participate in Bellatrix’s ongoing capital program, potentially delaying the program and the results of such program until Bellatrix finds a suitable alternative partner.

23

In the first quarter of 2012, Bellatrix continued to focus on its considerable drilling program and maintaining a strong balance sheet.

Total net debt levels of $164.5 million at March 31, 2012 have increased $45.2 million from $119.3 million at December 31, 2011, primarily as a consequence of an increase in a working capital deficiency and bank debt as the Company executed its 2012 intensive capital program. Total net debt includes the liability component of the 4.75% Debentures and excludes unrealized commodity contract assets and liabilities, deferred taxes, finance lease obligations, deferred liabilities and decommissioning liabilities.

Funds flow from operations represents 39% of the funding requirements for Bellatrix’s capital expenditures for the three months ended March 31, 2012. The remainder was financed with bank debt.

As at March 31, 2012, the Company’s borrowing base was $170 million. The Company’s credit facilities consisted of a $15 million demand operating facility provided by a Canadian bank and a $155 million extendible revolving term credit facility provided by two Canadian banks and a Canadian financial institution. Amounts borrowed under the credit facility bear interest at a floating rate based on the applicable Canadian prime rate, U.S. base rate or LIBOR margin rate, plus between 1.00% and 3.50%, depending on the type of borrowing and the Company’s debt to cash flow ratio. The credit facilities are secured by a $400 million debenture containing a first ranking charge and security interest. Bellatrix has provided a negative pledge and undertaking to provide fixed charges over major petroleum and natural gas reserves in certain circumstances. A standby fee is charged of between 0.50% and 0.875% on the undrawn portion of the credit facilities, depending on the Company’s debt to cash flow ratio.