Exhibit 99.8

GLOSSARY

AECO | | a storage and pricing hub for Canadian natural gas markets |

/d | | per day |

boe | | barrels of oil equivalent (6 mcf of natural gas = 1 barrel of oil equivalent) |

bbl or bbls | | barrels |

GORR | | gross overriding royalty |

mboe | | thousand boe |

mcf | | thousand cubic feet |

mmboe | | million barrels of oil equivalent |

mmbtu | | million British thermal units |

mmcf | | million cubic feet |

NGL | | natural gas liquids (ethane, propane, butane and condensate) |

OK | | Oklahoma |

WTI | | West Texas Intermediate, a benchmark crude oil used for pricing comparison |

NI 51-101 | | National Instrument 51-101 |

TABLE OF CONTENTS

2 | | Highlights |

4 | | Report to Shareholders |

8 | | Management’s Discussion and Analysis |

36 | | Condensed Consolidated Financial Statements |

36 | | Condensed Consolidated Balance Sheets |

37 | | Condensed Consolidated Statements of Comprehensive Income |

38 | | Condensed Consolidated Statements of Shareholder’s Equity |

39 | | Condensed Consolidated Statements of Cash Flows |

40 | | Notes to the Condensed Consolidated Financial Statements |

66 | | Corporate Information |

1

HIGHLIGHTS

Forward-Looking Statements

This financial report contains forward-looking statements. Please refer to our cautionary language on forward-looking statements and the other matters set forth at the beginning of the management’s discussion and analysis attached to this financial report.

Effective January 1, 2011, Bellatrix began reporting its financial results in accordance with International Financial Reporting Standards (“IFRS”). Prior year comparative amounts have been restated to reflect results as if Bellatrix had always prepared its financial results using IFRS. Please see additional discussion regarding IFRS later in this financial report.

| | Three months ended June 30, | | Six months ended June 30, | |

| | 2011 | | 2010 | | 2011 | | 2010 | |

FINANCIAL (unaudited)

(CDN$000s except share and per share amounts) | | | | | | | | | |

Revenue (before royalties and risk management(1)) | | 53,444 | | 25,574 | | 93,979 | | 52,503 | |

Funds flow from operations (2) | | 23,126 | | 10,610 | | 40,153 | | 20,808 | |

Per basic share (5) | | $ | 0.22 | | $ | 0.11 | | $ | 0.40 | | $ | 0.23 | |

Per diluted share (5) | | $ | 0.21 | | $ | 0.11 | | $ | 0.37 | | $ | 0.23 | |

Cash flow from operating activities | | 23,825 | | 6,065 | | 39,543 | | 19,521 | |

Per basic share (5) | | $ | 0.23 | | $ | 0.07 | | $ | 0.39 | | $ | 0.22 | |

Per diluted share (5) | | $ | 0.22 | | $ | 0.07 | | $ | 0.37 | | $ | 0.22 | |

Net profit (loss) (7) | | 12,315 | | (6,351 | ) | 6,828 | | (2,382 | ) |

Per basic share (5) | | $ | 0.12 | | $ | (0.07 | ) | $ | 0.07 | | $ | (0.03 | ) |

Per diluted share (5) | | $ | 0.11 | | $ | (0.07 | ) | $ | 0.07 | | $ | (0.03 | ) |

Exploration and development | | 28,775 | | 15,096 | | 84,261 | | 33,407 | |

Corporate and property acquisitions | | 180 | | 3,187 | | 3,811 | | 3,222 | |

Capital expenditures - cash | | 28,955 | | 18,283 | | 88,072 | | 36,629 | |

Property dispositions - cash | | (171 | ) | (627 | ) | (41 | ) | (580 | ) |

Non-cash items | | 440 | | 1,205 | | 953 | | 1,475 | |

Total capital expenditures - net | | 29,224 | | 18,861 | | 88,984 | | 37,524 | |

Long-term debt | | 44,653 | | 34,401 | | 44,653 | | 34,401 | |

Convertible debentures (3) | | 48,316 | | 46,906 | | 48,316 | | 46,906 | |

Working capital excess | | (7,970 | ) | (11 | ) | (7,970 | ) | (11 | ) |

Total net debt (3) | | 84,999 | | 81,296 | | 84,999 | | 81,296 | |

Total assets (7) | | 541,717 | | 431,764 | | 541,717 | | 431,764 | |

Shareholders’ equity (7) | | 358,890 | | 283,013 | | 358,890 | | 283,013 | |

| | | | | | | | | |

OPERATING | | | | | | | | | |

Average daily sales volumes | | | | | | | | | |

Crude oil, condensate and NGLs (bbls/d) | | 4,450 | | 2,076 | | 4,157 | | 1,992 | |

Natural gas (mcf/d) | | 43,157 | | 33,570 | | 40,268 | | 32,811 | |

Total oil equivalent (boe/d) | | 11,643 | | 7,671 | | 10,868 | | 7,461 | |

Average prices | | | | | | | | | |

Light crude oil and condensate ($/bbl) | | 100.88 | | 76.25 | | 92.77 | | 77.02 | |

NGLs ($/bbl) | | 56.15 | | 42.72 | | 53.99 | | 43.41 | |

Heavy oil ($/bbl) | | 71.46 | | 63.10 | | 66.82 | | 63.98 | |

Crude oil, condensate and NGLs ($/bbl) | | 91.13 | | 65.66 | | 84.77 | | 66.16 | |

Crude oil, condensate and NGLs (including risk management (1)) ($/bbl) | | 84.67 | | 66.73 | | 80.02 | | 66.72 | |

Natural gas ($/mcf) | | 4.06 | | 4.15 | | 4.00 | | 4.65 | |

Natural gas (including risk management (1))($/mcf) | | 4.38 | | 5.43 | | 4.17 | | 5.72 | |

Total oil equivalent ($/boe) | | 49.87 | | 35.92 | | 47.25 | | 38.11 | |

Total oil equivalent (including risk management (1)) ($/boe) | | 48.58 | | 41.81 | | 46.07 | | 42.99 | |

2

| | Three months ended June 30, | | Six months ended June 30, | |

| | 2011 | | 2010 | | 2011 | | 2010 | |

Statistics | | | | | | | | | |

Operating netback (4) ($/boe) | | 26.70 | | 14.67 | | 25.15 | | 16.18 | |

Operating netback (4) (including risk management (1)) ($/boe) | | 25.41 | | 20.56 | | 23.96 | | 21.07 | |

Transportation ($/boe) | | 1.42 | | 1.26 | | 1.36 | | 1.25 | |

Production expenses ($/boe) | | 11.50 | | 13.00 | | 11.93 | | 13.18 | |

General and administrative ($/boe) | | 2.74 | | 3.89 | | 2.63 | | 3.89 | |

Royalties as a % of sales after transportation | | 21% | | 20% | | 19% | | 20% | |

| | | | | | | | | |

COMMON SHARES | | | | | | | | | |

Common shares outstanding | | 107,389,799 | | 92,483,866 | | 107,389,799 | | 92,483,866 | |

Share options outstanding | | 7,863,932 | | 6,159,872 | | 7,863,932 | | 6,159,872 | |

Shares issuable on conversion of convertible debentures (6) | | 9,821,429 | | 9,821,429 | | 9,821,429 | | 9,821,429 | |

Diluted common shares outstanding | | 125,075,160 | | 108,465,167 | | 125,075,160 | | 108,465,167 | |

Diluted weighted average shares (5) | | 114,211,095 | | 92,481,374 | | 100,258,898 | | 90,358,879 | |

| | | | | | | | | |

SHARE TRADING STATISTICS

(CDN$, except volumes) based on intra-day trading | | | | | | | | | |

High | | 5.96 | | 4.04 | | 6.19 | | 4.60 | |

Low | | 4.48 | | 2.53 | | 4.48 | | 2.53 | |

Close | | 4.54 | | 3.07 | | 4.54 | | 3.07 | |

Average daily volume | | 713,592 | | 552,749 | | 630,837 | | 725,975 | |

(1) The Company has entered into various commodity price risk management contracts which are considered to be economic hedges. Per unit metrics after risk management includes only the realized portion of gains or losses on commodity contracts.

The Company does not apply hedge accounting to these contracts. As such, these contracts are revalued to fair value at the end of each reporting date. This results in recognition of unrealized gains or losses over the term of these contracts which is reflected each reporting period until these contracts are settled, at which time realized gains or losses are recorded. These unrealized gains or losses on commodity contracts are not included for purposes of per share metrics calculations disclosed.

(2) The highlights section contains the term “funds flow from operations” which should not be considered an alternative to, or more meaningful than cash flow from operating activities as determined in accordance with generally accepted accounting principles (“GAAP”) as an indicator of the Company’s performance. Therefore reference to diluted funds flow from operations or funds flow from operations per share may not be comparable with the calculation of similar measures for other entities. Management uses funds flow from operations to analyze operating performance and leverage and considers funds flow from operations to be a key measure as it demonstrates the Company’s ability to generate the cash necessary to fund future capital investments and to repay debt. The reconciliation between cash flow from operating activities and funds flow from operations can be found in the Management Discussion and Analysis (“MD&A”). Funds flow from operations per share is calculated using the weighted average number of common shares for the period.

(3) Net debt and total net debt are considered non-GAAP terms. The Company’s calculation of total net debt includes the liability component of convertible debentures and excludes deferred liabilities, long-term commodity contract liabilities, decommissioning liabilities, long-term finance lease obligation and the deferred tax liability. Net debt and total net debt include the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligation. Net debt also excludes the liability component of convertible debentures. A reconciliation between total liabilities under GAAP and total net debt and net debt as calculated by the Company is found in the MD&A.

(4) Operating netbacks are calculated by subtracting royalties, transportation, and operating costs from revenues before other income.

(5) Basic weighted average shares for the three and six months ended June 30, 2011 were 103,044,134 (2010: 92,481,374) and 100,258,898 (2010: 90,358,879), respectively.

In computing weighted average diluted earnings per share, diluted cash flow from operations and funds flow from operations for the three months ended June 30, 2011 a total of 1,345,532 (2010: nil) common shares were added to the denominator as a consequence of applying the treasury stock method to the Company’s outstanding share options and a total of 9,821,429 (2010: nil) common shares issuable on conversion of convertible debentures were also added to the denominator as they were dilutive, resulting in diluted weighted average common shares of 114,211,095. As a consequence, a total of $0.7 million for interest accretion expense (net of income tax effect) was added to the numerator.

In computing weighted average diluted earnings per share for the six months ended June 30, 2011 a total of 7,863,932 (2010: 6,159,872) share options and 9,821,429 (2010: 9,821,429) common shares issuable on conversion of convertible debentures were excluded from the calculation as they were not dilutive.

(6) Shares issuable on conversion of convertible debentures are calculated as the $55.0 million principal amount of the convertible debentures divided by the conversion price of $5.60 per share.

(7) As of January 1, 2011, Bellatrix prepares its consolidated financial statements in accordance with IFRS, IFRS 1 - First-time adoption of International Financial Reporting Standards (“IFRS 1”) and International Accounting Standard 34 - Interim Financial Reporting, as issued by the International Accounting Standards Board. Previously, Bellatrix’s financial statements were prepared in accordance with Canadian generally accepted accounting principles (“previous GAAP”). Reconciliations between previous GAAP and IFRS financial information can be found in the consolidated financial statements for the three and six months ended June 30, 2011.

3

REPORT TO SHAREHOLDERS

West central Alberta has experienced a prolonged (April through July) extremely wet spring breakup turning the province into a quagmire of execrable conditions. As a result, most companies have experienced both increased production downtime and delays in initiating the third quarter drilling programs.

Bellatrix’s strategy is to control its infrastructure and ensure “on time” tie-ins in consort with our well completions which has resulted in minimal disruption through breakup, which is estimated at approximately 300 boe/d. Bellatrix’s sales volumes for the second quarter of 2011 were 11,643 boe/d, a 15.5% increase from the first quarter 2011 sales volumes of 10,084 boe/d and up 52% from second quarter 2010 sales volumes of 7,671 boe/d.

OPERATIONS

Operational highlights for the six months ended June 30, 2011 include:

· The Company established 100% drill bit success for the first six months of 2011 by drilling 23 gross (13.78 net) wells consisting of 17 gross (11.38 net) oil wells and 6 gross (2.4 net) liquids rich gas wells. The Company drilled two gross Cardium oil wells (1.71 net) in the second quarter of 2011.

· Q2 2011 sales volumes averaged 11,643 boe/d (weighted 38% to oil, condensate and NGLs and 62% to natural gas). This represents a 15.5% increase from first quarter 2011 average sales volumes of 10,084 boe/d and up 52% from second quarter 2010 sales volumes of 7,671 boe/d.

· Oil, condensate and NGLs have increased to 38% of total sales volumes in Q2 2011 from 27% in Q2 2010.

· Year to date as at August 10, 2011, Bellatrix has added 40 gross and net contiguous sections in the Ferrier area which includes highly prospective Cardium and Duvernay mineral rights. During the first quarter of 2011, Bellatrix entered into an agreement to acquire 20 net sections of Cardium rights. In August 2011, Bellatrix added an additional 20 gross and net contiguous sections in the Ferrier area.

· The Company now has 400 net locations in the Cardium light gravity oil play and 100 locations in the Notikewin condensate rich gas resource play yielding over $1.8 billion in future development expenditures based on current costs of drilling.

· The Company now controls 49 gross (46 net) sections of Duvernay rights in West Central Alberta.

· As at June 30, 2011 Bellatrix had approximately 218,067 net undeveloped acres of land in Alberta, British Columbia and Saskatchewan.

· Bellatrix acquired ownership in 2 gas plants (with net 20% and 9.88% working interests, respectively) in our core area (Ferrier/Alder Flats) of 23 mmcf/d capacity to handle existing and future projected production which will significantly reduce processing fees.

· For the year to date, Bellatrix installed 21 km of gathering system pipeline consisting of 15 km of 8 inch line and 6 km of 10 inch line which included a major river crossing under the Brazeau River facilitating the tie in of 6 wells boosting the operating results for Q2 2011.

· With respect to acquisitions and dispositions in Q2 2011, Bellatrix closed two transactions consisting of the sale of a minor property interest in Saskatchewan (160 gross and 14 net acres) and a swap of interests where Bellatrix increased its Cardium exposure in 3.5 gross (1.7 net) sections in the Greater Pembina area.

4

In addition to the production disruptions, the Company has experienced delays in drilling and completion activities due to the very wet field conditions. The Company has drilled two gross Cardium wells (1.71 net) in the second quarter of 2011. The first well (0.71 net) was completed and brought on production on July 3, 2011 with an initial production (“IP”) average rate for 7 days of 945 boe/d. The second well (1.0 net) was completed on July 28, 2011 and has posted an IP average rate for 7 days of 595 boe/d. In the second quarter 2011, the Company also completed one gross well (0.33 net) that was drilled in the first quarter of 2011 and was brought on production on June 16, 2011 with an IP average rate for 7 days of 667 boe/d, an IP average rate for 15 days of 485 boe/d, and an IP average rate for 30 days of 375 boe/d.

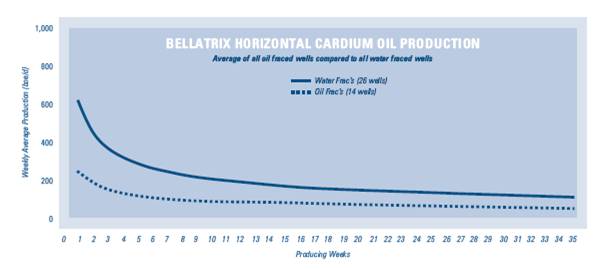

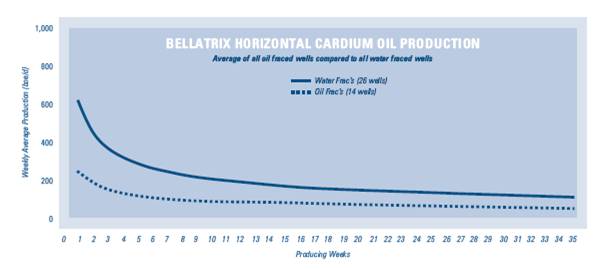

The following graph has been updated to show the Cardium well performance on average for the nine months since introducing water fracture treatments. The average production rate of 26 water fraced wells is 123 boe/d at nine months which compares to the average of 14 oil fraced wells at nine months of 65 boe/d.

FINANCIAL

Financial highlights for the six months ended June 30, 2011 include:

· Q2 2011 revenue of $53.4 million more than doubling the $25.6 million in Q2 2010. Revenue for the first six months of 2011 was $94.0 million up from $53.1 million in the same period in 2010. The increase in revenues is a result of higher sales volumes in conjunction with higher light crude oil, condensate and NGL prices for 2011 compared to 2010.

· Funds flow from operations for Q2 2011 was $23.1 million, up 118% from $10.6 million in Q2 2010 and up 36% when compared to $17.0 million generated in Q1 2011. Funds flow from operations for the first six months of 2011 was $40.2 million, up from $20.8 million in the same period in 2010.

· Bellatrix had a net profit of $12.3 million for Q2 2011, compared to a net loss of $6.4 million for Q2 2010. Net profit for the first six months of 2011 was $6.8 million, compared to a net loss of $2.4 million in the same period in 2010. The net profit for the three and six month periods of 2011 is reflective of higher operating netbacks as a result of improved commodity pricing for crude oil, condensate and NGLs and increased sales volumes. In addition, the net profit for Q2 2011 was impacted by non-cash unrealized gains on commodity price risk management contracts of $11.5 million, as well as higher depletion and depreciation and deferred tax expense.

· Crude oil and NGLs produced 70% and 69% of revenue for the three and six month periods ended June 30, 2011, respectively.

5

· Bellatrix spent $88.1 million on capital projects in the first six months of 2011 consisting of $61.5 million on drilling and completions, $12.2 million capital on facilities and equipment, $13.8 million capital on property and lease acquisitions and retention with the remaining $0.6 million spent on other items. During the second quarter of 2011, Bellatrix spent $29.0 on capital projects, including approximately $6.0 spent on well tubing and other inventory, as well as, approximately $2.0 million on survey and lease preparation costs related to the second half 2011 drilling program.

· Production expenses tumbled to $11.50/boe ($12.2 million) for Q2 2011, compared to $13.00/boe ($9.0 million) for Q2 2010. Production expenses for the first six months of 2011 were $11.94/boe ($23.5 million), compared to $13.18/boe ($17.8 million) for the same period in 2010.

· G&A expenses continue to improve to $2.74/boe in the second quarter of 2011, a 30% reduction from $3.89/boe posted in the same period in 2010.

· Operating netbacks before risk management continue to grow in response to the Company’s improved liquids mix to $26.70/boe in Q2 2011, up 82% from $14.67/boe in Q2 2010 and up 14% from $23.33/boe in Q1 2011.

· Total net debt as of June 30, 2011 was $85.0 million, including the liability component of convertible debentures.

· On May 11, 2011, Bellatrix closed a $55 million bought deal equity financing. The financing facilitates acceleration of development of our inventory of 400 net Cardium locations and 100 net Notikewin locations which represents $1.8 billion of development capital, based on current costs of drilling, exceeding 10 years of cash flow at current levels.

· Increased 2011 capital expenditures program from $100 million to $170 million.

· Effective June 1, 2011, the banking syndicate agreed to increase the borrowing base from $100 million to $140 million through to November 30, 2011 and extend the revolving period of the credit facility from June 28, 2011 to June 26, 2012. As at June 30, 2011, Bellatrix had $44.7 million drawn on its credit facility.

· Following the May 2011 equity financing, Bellatrix increased its estimated 2011 exit rate guidance from 13,000 boe/d to 15,000 boe/d.

COMMODITY PRICE RISK MANAGEMENT

As at August 10, 2011, the Company has entered into commodity price risk management arrangements as follows:

Type | | Period | | Volume | | Price Floor | | Price Ceiling | | Index | |

Oil fixed | | January 1, 2011 to Dec. 31, 2011 | | 1,000 bbl/d | | $ | 88.18 CDN | | $ | 88.18 CDN | | WTI | |

Oil fixed | | January 1, 2011 to Dec. 31, 2011 | | 500 bbl/d | | $ | 89.00 CDN | | $ | 89.00 CDN | | WTI | |

Oil fixed | | January 1, 2011 to Dec. 31, 2011 | | 500 bbl/d | | $ | 89.10 US | | $ | 89.10 US | | WTI | |

Oil fixed | | February 1, 2011 to Dec. 31, 2011 | | 500 bbl/d | | $ | 95.00 US | | $ | 95.00 US | | WTI | |

Oil fixed | | March 1, 2011 to Dec. 31, 2011 | | 500 bbl/d | | $ | 97.50 US | | $ | 97.50 US | | WTI | |

Oil call option | | January 1, 2012 to Dec. 31, 2012 | | 833 bbl/d | | — | | $ | 110.00 US | | WTI | |

Natural gas fixed | | April 1, 2011 to Oct. 31, 2011 | | 5,000 GJ/d | | $ | 3.87 CDN | | $ | 3.87 CDN | | AECO | |

Natural gas fixed | | April 1, 2011 to Oct. 31, 2011 | | 5,000 GJ/d | | $ | 3.65 CDN | | $ | 3.65 CDN | | AECO | |

Natural gas fixed | | April 1, 2011 to Oct. 31, 2011 | | 5,000 GJ/d | | $ | 3.805 CDN | | $ | 3.805 CDN | | AECO | |

Natural gas fixed | | April 1, 2011 to Oct. 31, 2011 | | 5,000 GJ/d | | $ | 3.80 CDN | | $ | 3.80 CDN | | AECO | |

Natural gas fixed | | May 1, 2011 to Oct. 31, 2011 | | 5,000 GJ/d | | $ | 6.30 CDN | | $ | 6.30 CDN | | AECO | |

6

OUTLOOK

As previously disclosed in the Company’s first quarter 2011 report, as a result of the successful completion of the May 2011 equity offering, Bellatrix revised its capital expenditure budget for 2011 from $100 million to $170 million, which includes the $88.1 million spent in the first half of 2011 on capital expenditures. Bellatrix will use cash flow, the proceeds of the financing, and to the extent necessary, bank indebtedness to fund its 2011 capital expenditures budget. As a result of the expansion of its 2011 capital program, Bellatrix revised its guidance on 2011 exit production from 13,000 boe/d to 15,000 boe/d.

The ongoing wet field conditions has also delayed the start of the Company’s second half 2011 program by approximately 4 weeks. This later than anticipated start is expected to delay the timing of the proposed second half 2011 expenditures and will result in a delay in the timing of bringing on production for the second half program wells.

Based on the timing of proposed expenditures, downtime for anticipated plant turnarounds and normal production declines, execution of the 2011 budget is anticipated to provide 2011 average daily production of approximately 12,000 boe/d and an exit rate of approximately 15,000 boe/d. The 2011 capital budget is expected to be directed primarily towards our two high rate of return projects, horizontal drilling and completions activities in the Cardium oil and Notikewin condensate rich gas resource plays.

The Company will have four rigs drilling Cardium horizontal wells in central Alberta and is on track to fulfill its drilling goals for the remainder of 2011. Bellatrix currently plans to drill 37 gross wells (26.66 net) in the second half 2011 drilling program. The Company expects to drill approximately 32 gross Cardium horizontal wells (25.07 net), 5 gross Notikewin horizontal wells (1.59 net) in the West Central area of Alberta in the second half 2011 program.

Bellatrix continues to focus on the development of its core assets and conducts exploration programs utilizing its large inventory of geological prospects. As at June 30, 2011, Bellatrix has approximately 218,067 net undeveloped acres in Alberta, British Columbia and Saskatchewan with in excess of 700 exploitation drilling opportunities identified, representing over 10 years of drilling inventory based on annual cash flow and current costs of drilling. The Company continues to focus on adding Cardium prospective lands.

Bellatrix is focused on expanding the oil side of our business and is always staunchly devoted to providing growth in shareholder value.

/s/ Raymond G. Smith, P. Eng. | |

Raymond G. Smith, P. Eng. | |

President and CEO | |

August 10, 2011 | |

7

MANAGEMENT’S DISCUSSION AND ANALYSIS

August 10, 2011 - The following Management’s Discussion and Analysis of financial results as provided by the management of Bellatrix Exploration Ltd. (“Bellatrix” or the “Company”) should be read in conjunction with the unaudited interim consolidated financial statements of the Company for the three and six months ended June 30, 2011 and the audited consolidated financial statements of the Company for the years ended December 31, 2010 and 2009 and the related Management’s Discussion and Analysis of financial results as disclosure which is unchanged from such Management’s Discussion and Analysis may not be repeated herein. This commentary is based on information available to, and is dated as of, August 10, 2011. The financial data presented is in Canadian dollars, except where indicated otherwise. As of January 1, 2011, Bellatrix prepares its consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”), IFRS 1- First-time adoption of International Financial Reporting Standards (“IFRS 1”) and International Accounting Standard 34- Interim Financial Reporting, as issued by the International Accounting Standards Board. Previously, Bellatrix’s financial statements were prepared in accordance with Canadian generally accepted accounting principles (“previous GAAP”). Reconciliations between previous GAAP and IFRS financial information can be found in the consolidated financial statements for the three and six months ended June 30, 2011.

CONVERSION: The term barrels of oil equivalent (“boe”) may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet of natural gas to one barrel of oil equivalent (6 mcf/bbl) is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in this report are derived from converting gas to oil in the ratio of six thousand cubic feet of gas to one barrel of oil.

NON-GAAP MEASURES: This Management’s Discussion and Analysis contains the term “funds flow from operations” which should not be considered an alternative to, or more meaningful than “cash flow from operating activities” as determined in accordance with generally accepted accounting principles (“GAAP”) as an indicator of the Company’s performance. Therefore reference to funds flow from operations or funds flow from operations per share may not be comparable with the calculate of the similar measures for other entities. Management uses funds flow from operations to analyze operating performance and leverage and considers funds flow from operations to be a key measure as it demonstrates the Company’s ability to generate the cash necessary to fund future capital investments and to repay debt. The reconciliation between cash flow from operating activities and funds flow from operations can be found in the Management’s Discussion and Analysis. Funds flow from operations per share is calculated using the weighted average number of shares for the period.

This Management’s Discussion and Analysis also contains other terms such as total net debt and operating netbacks, which are not recognized measures under GAAP. Total net debt is calculated as long-term debt plus the liability component of the convertible debentures and the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligation. Net debt is calculated as long-term debt plus the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligation. Operating netbacks are calculated by subtracting royalties, transportation, and operating expenses from revenues before other income. Management believes these measures are useful supplemental measures of firstly, the total amount of current and long-term debt and secondly, the amount of revenues received after transportation, royalties and operating expenses. Readers are cautioned, however, that these measures should not be construed as an alternative to other terms such as current and long-term debt or net income determined in accordance with GAAP as measures of performance. Bellatrix’s method of calculating these measures may differ from other entities, and accordingly, may not be comparable to measures used by other companies.

Additional information relating to the Company, including the Bellatrix’s Annual Information Form, is available on SEDAR at www.sedar.com.

FORWARD LOOKING STATEMENTS: Certain information contained herein may contain forward looking statements including management’s assessment of future plans and operations, drilling plans and the timing thereof, commodity price risk management strategies, expected 2011 average production and exit rate, timing of completion and tie-in of wells, anticipated liquidity of the Company and various matters that may impact such liquidity, expected 2011 operating expenses and general and administrative expenses, 2011 capital expenditures budget and the nature of capital expenditures and the timing and method of financing thereof, method of funding drilling commitments, commodity prices and expected volatility thereof, estimated amount and timing of incurring decommissioning liabilities, use of proceeds from recent financings and activity levels, expectation that the acquisition of gas plants will significantly reduce processing fees, effect of wet field conditions on timing of second half 2011 capital expenditures and resulting in delay in bringing on production, number of rigs to be employed, expectations with respect to revenues for the remainder of 2011 compared to the corresponding period of 2010, estimated costs to satisfy drilling commitments and expectation that the ratio of total net debt to annual funds flow will increase, may constitute forward-looking statements under applicable securities laws and necessarily involve risks including, without limitation, risks associated with oil and gas exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of reserve estimates, environmental risks, competition from other producers, inability to retain drilling rigs and other services, incorrect assessment of the value of acquisitions, failure to realize the anticipated benefits of acquisitions, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources. The recovery and reserve estimates of Bellatrix’s reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Events or circumstances may cause actual results to differ materially from those predicted, as a result of the risk factors set out and other known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Bellatrix. In addition, forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information but which may prove to be incorrect. In addition, forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information in order to provide shareholders with a more complete perspective on Bellatrix’s future operations. Such information may prove to be incorrect and readers are cautioned that the information may not be appropriate for other purposes. Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified herein, assumptions have been made regarding, among other things: the impact of increasing competition; the general stability of the economic and political environment in which the Company operates; the timely receipt of any required regulatory approvals; the ability of the Company to obtain qualified staff, equipment and services in a timely and cost efficient manner; drilling results; the ability of the operator of the projects which the Company has an interest in to operate the field in a safe, efficient and effective manner; the ability of the Company to obtain financing on acceptable terms; field production rates and decline rates; the ability to replace and expand oil and natural gas reserves through acquisition, development of exploration; the timing and costs of pipeline, storage and facility construction and expansion and the ability of the Company to secure adequate product transportation; future commodity gas prices; currency, exchange and interest rates; the regulatory framework regarding royalties, taxes and environmental matters in the jurisdictions in which the Company operates; and the ability of the Company to successfully market its oil and natural gas products. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which have been used. As a consequence, actual results may differ materially from those anticipated in the forward-looking statements. Additional information on these and other factors that could effect Bellatrix’s operations and financial results are included in reports on file with Canadian securities regulatory authorities and may be accessed through the SEDAR website (www.sedar.com), at Bellatrix’s website (www.bellatrixexploration.com). Furthermore, the forward-looking statements contained herein are made as at the date hereof and Bellatrix does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

The reader is further cautioned that the preparation of financial statements in accordance with GAAP requires management to make certain judgments and estimates that affect the reported amounts of assets, liabilities, revenues and expenses. Estimating reserves is also critical to several accounting estimates and requires judgments and decisions based upon available geological, geophysical, engineering and economic data. These estimates may change, having either a negative or positive effect on net earnings as further information becomes available, and as the economic environment changes.

8

OVERVIEW AND DESCRIPTION OF THE BUSINESS

Bellatrix is a Western Canadian based growth oriented oil and gas company engaged in the exploration for, and the acquisition, development and production, of oil and natural gas reserves in the provinces of Alberta, British Columbia and Saskatchewan.

Bellatrix is the continuing corporation resulting from the reorganization effective November 1, 2009 pursuant to a plan of arrangement involving, among others, True Energy Trust (the “Trust” or “True”), Bellatrix Exploration Ltd. (“Bellatrix” or the “Company”) and securityholders of the Trust.

Bellatrix’s common shares and convertible debentures are listed on the Toronto Stock Exchange under the symbols BXE and BXE.DB.A, respectively.

CHANGES IN ACCOUNTING POLICIES

As of January 1, 2011, Bellatrix prepares its financial statements in accordance with International Financial Reporting Standards (“IFRS”), IFRS 1 - First-time adoption of International Financial Reporting Standards (“IFRS 1”) and International Accounting Standard 34 - Interim Financial Reporting, as issued by the International Accounting Standards Board. Previously, Bellatrix’s financial statements were prepared in accordance with Canadian generally accepted accounting principles (“previous GAAP”). Unless otherwise noted, 2010 comparative information has been prepared in accordance with IFRS.

The adoption of IFRS has not had an impact on the Company’s operations, strategic decisions and cash flow. The most significant area of impact was the adoption of the IFRS property, plant and equipment accounting principles, the related decommissioning liabilities and resulting deferred tax adjustments on transition. Further information on the IFRS impacts is provided in the Accounting Policies and Estimates Section of this Management’s Discussion and Analysis.

SECOND QUARTER 2011 FINANCIAL AND OPERATIONAL RESULTS

FINANCING

In May 2011, Bellatrix closed an equity issuance of 9.8 million common shares on a bought deal basis at a price of $5.60 per share for gross proceeds of $55.0 million (net proceeds of $51.9 million after transaction costs). The net proceeds from this financing have been used to temporarily reduce outstanding indebtedness, thereby freeing up borrowing capacity that may be redrawn to fund the Company’s ongoing capital expenditures program and general corporate purposes.

ACQUISITIONS AND DISPOSITIONS

The Company’s goal is to provide consistent growth by drilling and developing its extensive land position to maximize the value of its reserve and resource potential. Bellatrix has been working on a number of internal initiatives to streamline and optimize our ongoing operations, specifically the ability to expand and accelerate the drilling of its Cardium oil and the liquid rich Notikewin gas resource.

On January 25, 2011, Bellatrix acquired the interest in a section of Frog Lake First Nation lands from a joint venture partner for a net purchase price of $2.2 million after adjustments. The transaction had an effective date of January 1, 2011. These assets consists of approximately 130 boe/d of net production; an additional 20% interest in the Colony formation in these lands (Bellatrix already has 13.75%WI) and an additional 50% WI in the McLaren formation in these lands (Bellatrix already has a 50% WI) except for a 1/4 section (which Bellatrix already has a 13.75% WI).

On January 25, 2011, Bellatrix exercised a right of first refusal increasing its interest in a joint venture property in the Brazeau area of West Central Alberta for approximately $1.5 million. The asset acquisition consisted of approximately 3,200 gross (1,102.8 net) acres of Cardium rights providing the Company with up to 6.3 additional net Cardium locations and included 15 boe/d of production.

9

During the second quarter of 2011, Bellatrix closed two transactions consisting of the sale of a minor property interest in Saskatchewan (160 gross and 14 net acres) and a swap of interests where Bellatrix increased its Cardium exposure in 3.5 gross (1.7 net) sections in the Greater Pembina area.

SALES VOLUMES

Sales volumes for the three months ended June 30, 2011 averaged 11,643 boe/d compared to 7,671 boe/d for the same period in 2010, representing a 52% increase. Total crude oil, condensate and NGLs averaged approximately 38% of sales volumes for the three months ended June 30, 2011 compared to 27% of sales volumes in the same period in 2010. The increase in sales is primarily a result of a year over year increased capital program. Capital expenditures on exploration and development for the year ended December 31, 2009 were $15.8 million, compared to $98.4 million for the same period in 2010. By comparison, Bellatrix’s capital expenditures on exploration and development before drilling credits for the six months ended June 30, 2011 were $84.8 million compared to $36.2 million for the same period in 2010.

| | Three months ended June 30, | | Six months ended June 30, | |

Sales Volumes | | 2011 | | 2010 | | 2011 | | 2010 | |

Light oil and condensate (bbls/d) | | 3,335 | | 1,204 | | 3,184 | | 1,130 | |

NGLs (bbls/d) | | 692 | | 516 | | 624 | | 504 | |

Heavy oil (bbls/d) | | 423 | | 356 | | 349 | | 358 | |

Total crude oil, condensate and NGLs (bbls/d) | | 4,450 | | 2,076 | | 4,157 | | 1,992 | |

Natural gas (mcf/d) | | 43,157 | | 33,570 | | 40,268 | | 32,811 | |

Total boe/d (6:1) | | 11,643 | | 7,671 | | 10,868 | | 7,461 | |

In the first half of 2011, Bellatrix has drilled or participated in a total of 23 gross (13.78 net) successful wells. During the 2011 second quarter, Bellatrix drilled 2 gross (1.71 net) Cardium wells. One remaining well (1.0 net) was waiting on completion at June 30, 2011 and was brought on production in July 2011.

By comparison, Bellatrix drilled or participated in 24 gross (13.74 net) successful wells in the first half of 2010.

For the three months ended June 30, 2011, crude oil, condensate and NGL sales volumes increased by approximately 114% averaging 4,450 bbl/d compared to 2,076 bbl/d in the same period in 2010. For the six months ended June 30, 2011, crude oil, condensate and NGL sales volumes increased by approximately 109% averaging 4,157 bbl/d compared to 1,992 bbl/d in the same period in 2010. For the three and six months ended June 30, 2011, the weighting towards crude oil, condensate and NGLs increased by approximately 11% compared to the same period in 2010. For the three and six months ended June 30, 2011, sales volumes for crude oil, condensate and NGLs averaged approximately 38% of total sales volumes compared to an average of approximately 27% of total sales volumes in the same period in 2010. The increase is a direct result of the Company’s efforts to balance production by exploiting the Company’s crude oil drilling locations. In comparison, crude oil, condensate and NGL sales volumes increased by approximately 15% from the 3,860 bbl/d in the first quarter of 2011.

Sales of natural gas averaged 43.2 Mmcf/d for the second quarter of 2011, compared to 33.6 Mmcf/d in the same 2010 period, an increase of approximately 29%. The weighting towards natural gas sales volumes averaged approximately 62% for the three months ended June 30, 2011 compared to 73% in the same period in 2010. For the six months ended June 30, 2011, sales of natural gas averaged 40.3 Mmcf/d, an increase of approximately 23% from the average sales volume of 32.8 Mmcf/d in the same 2010 period.

Based on the timing of proposed expenditures, downtime for anticipated plant turnarounds and normal production declines, execution of the 2011 budget is anticipated to provide 2011 average daily production of approximately 12,000 boe/d. Bellatrix has revised its capital expenditure program for 2011 from $100 million to $170 million as a result of the May 2011 financing. Due to the increased capital expenditure program for 2011, Bellatrix has increased its previously estimated exit production guidance for 2011 of 13,000 boe/d to 15,000 boe/d. The 2011 capital budget is expected to be directed primarily towards horizontal drilling and completions activities in the Cardium and Notikewin resource plays.

10

COMMODITY PRICES

| | Three months ended June 30, | | Six months ended June 30, | |

Average Commodity Prices | | 2011 | | 2010 | | % Change | | 2011 | | 2010 | | % Change | |

Exchange rate (US$/Cdn$) | | 1.0331 | | 0.9731 | | 6 | | 1.0238 | | 0.9673 | | 6 | |

Crude oil: | | | | | | | | | | | | | |

WTI (US$/bbl) | | 102.38 | | 78.05 | | 31 | | 98.52 | | 78.46 | | 26 | |

Edmonton par - light oil ($/bbl) | | 102.63 | | 75.46 | | 36 | | 95.27 | | 77.88 | | 22 | |

Bow River - medium/heavy oil ($/bbl) | | 82.31 | | 66.40 | | 24 | | 76.80 | | 69.92 | | 10 | |

Hardisty Heavy - heavy oil ($/bbl) | | 73.21 | | 59.67 | | 23 | | 67.79 | | 64.23 | | 6 | |

Bellatrix’s average prices ($/bbl) | | | | | | | | | | | | | |

Light crude oil and condensate | | 100.88 | | 76.25 | | 32 | | 92.77 | | 77.02 | | 20 | |

NGLs | | 56.15 | | 42.72 | | 31 | | 53.99 | | 43.41 | | 24 | |

Heavy crude oil | | 71.46 | | 63.10 | | 13 | | 66.82 | | 63.98 | | 4 | |

Total crude oil and NGLs | | 91.13 | | 65.66 | | 39 | | 84.77 | | 66.16 | | 28 | |

Total crude oil and NGLs (including risk management(1)) | | 84.67 | | 66.73 | | 27 | | 80.02 | | 66.72 | | 20 | |

Natural gas: | | | | | | | | | | | | | |

NYMEX (US$/mmbtu) | | 4.38 | | 4.35 | | 1 | | 4.29 | | 4.66 | | (8 | ) |

AECO daily index (CDN$/mcf) | | 3.87 | | 3.89 | | (0.5 | ) | 3.82 | | 4.42 | | (14 | ) |

AECO monthly index (CDN$/mcf) | | 3.74 | | 4.03 | | (7 | ) | 3.76 | | 4.69 | | (20 | ) |

Bellatrix’s average price ($/mcf) | | 4.06 | | 4.15 | | (2 | ) | 4.00 | | 4.65 | | (14 | ) |

Bellatrix’s average price (including risk management(1)) ($/mcf) | | 4.38 | | 5.43 | | (19 | ) | 4.17 | | 5.72 | | (27 | ) |

(1) Per unit metrics including risk management include realized gains or losses on commodity contracts and exclude unrealized gains or losses on commodity contracts.

For light oil and condensate, Bellatrix recorded an average $100.88/bbl before commodity price risk management contracts during the second quarter of 2011, 32% higher than the average price received in the same period in 2010. In comparison, the Edmonton par price increased by 36% over the same period. For light oil and condensate, Bellatrix recorded an average $92.77/bbl before commodity price risk management contracts during the six months ended June 30, 2011, 20% higher than the average price received in the same period in 2010. In comparison, the Edmonton par price increased by 22% over the same period. The average WTI crude oil US dollar based price increased 26% in the first six months of 2011 compared to the same period in 2010. The average US$/CDN$ foreign exchange rate was 1.0238 for the six months ended June 30, 2011 compared to 0.9673 in the same period in 2010.

For heavy crude oil, Bellatrix received an average price before transportation of $71.46/bbl in the 2011 second quarter, an increase of 13% over prices in the same 2010 period. The Bow River reference price increased by 24% and the Hardisty Heavy reference price increased by 23% from the second quarter of 2010 to that in 2011. For the six months ended June 30, 2011, Bellatrix received an average price of $66.82/bbl for heavy crude oil, an increase of 4% when compared to the same period in 2010. The Bow River reference price increased by 10% and the Hardisty Heavy reference price increased by 6% from the six months ended June 30, 2010 to that in 2011. The majority of Bellatrix’s heavy crude oil density ranges between 11 and 16 degrees API consistent with the Hardisty Heavy reference price.

Bellatrix’s natural gas sales are priced with reference to the daily or monthly AECO indices. During the 2011 second quarter, the AECO daily and monthly reference price decreased by approximately 1% and 7%, respectively, compared to the same period in 2010. Bellatrix’s natural gas average sales price before commodity price risk management contracts for the 2011 second quarter decreased by 2% compared to the same period in 2010. During the six months ended June 30, 2011, the AECO daily and monthly reference price decreased by approximately 14% and 20%, respectively, compared to the same period in 2010. Bellatrix’s natural gas average sales price before commodity price risk management contracts for the six months ended June 30, 2011 decreased by 14% compared to the same period in 2010. Bellatrix’s natural gas average price after including commodity price risk management contracts for the three and six months ended June 30, 2011 was $4.38/mcf and $4.17/mcf, respectively, compared to $5.43/mcf and $5.72/mcf for the three and six months ended June 30, 2010, respectively.

11

REVENUE

Revenue before other income, royalties and commodity price risk management contracts for the three month period ended June 30, 2011 was $52.8 million, 111% higher than the $25.0 million in the same period in 2010. Revenue before other income, royalties and commodity price risk management contracts for the six month period ended June 30, 2011 was $92.9 million, 81% higher than the $51.5 million in the same period in 2010.

Revenue before other income, royalties and commodity price risk management contracts for crude oil and NGLs for the three and six months ended June 30, 2011 increased approximately 198% and 167%, respectively, as a result of higher sales volumes in conjunction with higher light crude oil, condensate and NGL prices when compared to the same period in 2010. In the 2011 second quarter, total crude oil, condensate and NGL revenues contributed 70% of total revenue (before other) compared to 49% in the same period in 2010. For the six months ended June 30, 2011, total crude oil, condensate and NGL revenues contributed 69% of total revenue (before other) compared to 46% in the same period in 2010. Light crude oil, condensate and NGL revenues in the three and six months ended June 30, 2011 contributed 93% of total crude oil, condensate and NGL revenue (before other) compared to 84% and 83% in the three and six months ended June 30, 2010, respectively.

Revenue before other income, royalties and commodity price risk management contracts for natural gas for the three months ended June 30, 2011 increased approximately 26% as a result of an approximate 29% increase in sales volumes. Although sales volumes for natural gas for the six months ended June 30, 2011 have increased by approximately 23% in comparison to the same period in 2010, revenue before other income, royalties and commodity price risk management contracts for natural gas have only increased by approximately 6% as a result of weaker natural gas pricing in comparison to the same period in 2010.

| | Three months ended June 30, | | Six months ended June 30, | |

($000s) | | 2011 | | 2010 | | 2011 | | 2010 | |

Light crude oil and condensate | | 30,616 | | 8,354 | | 53,460 | | 15,748 | |

NGLs | | 3,534 | | 2,006 | | 6,098 | | 3,967 | |

Heavy oil | | 2,755 | | 2,044 | | 4,219 | | 4,143 | |

Crude oil and NGLs | | 36,905 | | 12,404 | | 63,777 | | 23,858 | |

Natural gas | | 15,929 | | 12,672 | | 29,169 | | 27,600 | |

Total revenue before other | | 52,834 | | 25,076 | | 92,946 | | 51,458 | |

Other(1) | | 610 | | 498 | | 1,033 | | 1,045 | |

Total revenue before royalties and risk management | | 53,444 | | 25,574 | | 93,979 | | 52,503 | |

(1) Other revenue primarily consists of processing and other third party income.

Revenues for the remainder of 2011 are currently expected to be higher than the corresponding period in 2010 due to expected increased sales volumes and higher crude oil prices. While sales volumes and crude oil and liquid prices for 2011 are expected to be higher than 2010, natural gas prices remain relatively weak.

COMMODITY PRICE RISK MANAGEMENT

The Company has a formal commodity price risk management policy which permits management to use specified price risk management strategies including fixed price contracts, collars and the purchase of floor price options and other derivative financial instruments and physical delivery sales contracts to reduce the impact of price volatility for a maximum of eighteen months beyond the transaction date. The program is designed to provide price protection on a portion of the Company’s future production in the event of adverse commodity price movement, while retaining significant exposure to upside price movements. By doing this, the Company seeks to provide a measure of stability to funds flow from operations, as well as, to ensure Bellatrix realizes positive economic returns from its capital development and acquisition activities. The Company plans to continue its commodity price risk management strategies focusing on maintaining sufficient cash flow to fund Bellatrix’s capital expenditure program. Any remaining production is realized at market prices.

12

A summary of the financial commodity price risk management volumes and average prices by quarter currently outstanding as of August 10, 2011 is shown in the following tables:

Natural Gas

Average Volumes (GJ/d)

| | Q3 2011 | | Q4 2011 | |

Fixed | | 25,000 | | 11,739 | |

Total (GJ/d) | | 25,000 | | 11,739 | |

Average Price ($/GJ AECO C)

| | Q3 2011 | | Q4 2011 | |

Fixed | | 4.29 | | 4.85 | |

Crude Oil and Liquids

Average Volumes (bbls/d)

| | Q3 2011 | | Q4 2011 | |

Fixed (CDN$/bbl) | | 1,500 | | 1,500 | |

Fixed (US$/bbl) | | 1,500 | | 1,500 | |

Total (bbls/d) | | 3,000 | | 3,000 | |

Average Price ($/bbl WTI)

| | Q3 2011 | | Q4 2011 | |

Fixed price (CDN$/bbl) | | 88.45 | | 88.45 | |

Fixed price (US$/bbl) | | 93.87 | | 93.87 | |

Average Volumes (bbls/d)

| | Q1 2012 | | Q2 2012 | | Q3 2012 | | Q4 2012 | |

Call option | | 833 | | 833 | | 833 | | 833 | |

Total (bbls/d) | | 833 | | 833 | | 833 | | 833 | |

Average Price ($/bbl WTI)

| | Q1 2012 | | Q2 2012 | | Q3 2012 | | Q4 2012 | |

Call option (ceiling price) (US$/bbl) | | 110.00 | | 110.00 | | 110.00 | | 110.00 | |

Included in the above natural gas table is a fixed price contract of $6.30/GJ at 5,000 GJ/d from May 1, 2011 to October 31, 2011 which was funded by selling a call option of 833 bbl/d at US$110.00 for the 2012 calendar year.

As of June 30, 2011, the fair value of Bellatrix’s outstanding commodity contracts is a net unrealized liability of $1.5 million as reflected in the financial statements. The fair value or mark-to-market value of these contracts is based on the estimated amount that would have been received or paid to settle the contracts as at June 30, 2011 and may be different from what will eventually be realized. Changes in the fair value of the commodity contracts are recognized in the Consolidated Statements of Comprehensive Income within the financial statements.

13

The following is a summary of the gain (loss) on commodity contracts for the three and six months ended June 30, 2011 and 2010 as reflected in the Consolidated Statements of Comprehensive Income in the financial statements:

Commodity Contracts

| | Crude Oil | | Natural | | Q2 2011 | | Q2 2010 | |

($000s) | | & Liquids | | Gas | | Total | | Total | |

Realized cash gain (loss) on contracts | | (2,617 | ) | 1,256 | | (1,361 | ) | 4,109 | |

Unrealized gain (loss) on contracts (1) | | 12,406 | | (958 | ) | 11,448 | | (3,134 | ) |

Total gain on commodity contracts | | 9,789 | | 298 | | 10,087 | | 975 | |

| | Crude Oil | | Natural | | YTD 2011 | | YTD 2010 | |

($000s) | | & Liquids | | Gas | | Total | | Total | |

Realized cash gain (loss) on contracts | | (3,573 | ) | 1,256 | | (2,317 | ) | 6,601 | |

Unrealized gain (loss) on contracts (1) | | (556 | ) | 2,776 | | 2,220 | | 4,122 | |

Total gain (loss) on commodity contracts | | (4,129 | ) | 4,032 | | (97 | ) | 10,723 | |

(1) Unrealized gain (loss) commodity contracts represent non-cash adjustments for changes in the fair value of these contracts during the period.

ROYALTIES

For the three months ended June 30, 2011, total royalties were $10.9 million, compared to $4.9 million incurred in the same 2010 period. Overall royalties as a percentage of revenue (after transportation costs) in the second quarter of 2011 were 21%, compared with 20% in the same 2010 period.

The decrease in light oil, condensate and NGLs royalties’ percentage from the second quarter of 2010 to 2011 is primarily due to increased production from recently drilled light oil wells which take advantage of Alberta royalty incentive programs. The heavy oil royalty rate for the second quarter of 2011 increased as a result of the sale of Saskatchewan heavy oil assets with lower royalty rates in December 2010 and recently added heavy oil production in Frog Lake, Alberta with higher crown royalty rates. Natural gas royalties for the three months ended June 30, 2011 were impacted by $1.0 million of Alberta crown gas cost allowance amendments for 2010. Excluding these gas cost allowance adjustments, the average royalty rate percentage for the second quarter of 2011 would be 12% for natural gas and 19% for all commodities.

Royalties by Commodity Type

| | Three months ended June 30, | | Six months ended June 30, | |

($000s, except where noted) | | 2011 | | 2010 | | 2011 | | 2010 | |

Light crude oil, condensate and NGLs | | 6,545 | | 2,622 | | 10,589 | | 5,121 | |

$/bbl | | 17.86 | | 16.75 | | 15.36 | | 17.31 | |

Average light crude oil, condensate and | | | | | | | | | |

NGLs royalty rate (%) | | 20 | | 26 | | 18 | | 26 | |

Heavy oil | | 1,507 | | 399 | | 2,224 | | 946 | |

$/bbl | | 39.15 | | 12.32 | | 35.21 | | 14.61 | |

Average heavy oil royalty rate (%) | | 55 | | 20 | | 53 | | 24 | |

Natural gas | | 2,813 | | 1,856 | | 4,523 | | 4,060 | |

$/mcf | | 0.72 | | 0.61 | | 0.62 | | 0.68 | |

Average natural gas royalty rate (%) | | 18 | | 15 | | 16 | | 15 | |

Total | | 10,865 | | 4,877 | | 17,336 | | 10,127 | |

$/boe | | 10.25 | | 6.99 | | 8.81 | | 7.50 | |

Average total royalty rate (%) | | 21 | | 20 | | 19 | | 20 | |

14

Royalties, by Type

| | Three months ended June 30, | | Six months ended June 30, | |

($000s) | | 2011 | | 2010 | | 2011 | | 2010 | |

Crown royalties | | 4,022 | | 1,712 | | 6,685 | | 3,058 | |

Indian Oil and Gas Canada royalties | | 2,144 | | 287 | | 3,326 | | 1,208 | |

Freehold & GORR | | 4,699 | | 2,878 | | 7,325 | | 5,861 | |

Total | | 10,865 | | 4,877 | | 17,336 | | 10,127 | |

Expenses

| | Three months ended June 30, | | Six months ended June 30, | |

($000s) | | 2011 | | 2010 | | 2011 | | 2010 | |

Production | | 12,180 | | 9,079 | | 23,478 | | 17,796 | |

Transportation | | 1,509 | | 877 | | 2,676 | | 1,685 | |

General and administrative | | 2,900 | | 2,715 | | 5,167 | | 5,251 | |

Interest and financing charges1 | | 1,868 | | 1,979 | | 3,569 | | 4,393 | |

Share-based compensation | | 1,020 | | 431 | | 1,515 | | 623 | |

(1) Does not include financing charges in relation to the Company’s unwinding of decommissioning liabilities.

Expenses per boe

| | Three months ended June 30, | | Six months ended June 30, | |

($ per boe) | | 2011 | | 2010 | | 2011 | | 2010 | |

Production | | 11.50 | | 13.00 | | 11.93 | | 13.18 | |

Transportation | | 1.42 | | 1.26 | | 1.36 | | 1.25 | |

General and administrative | | 2.74 | | 3.89 | | 2.63 | | 3.89 | |

Interest and financing charges | | 1.76 | | 2.83 | | 1.81 | | 3.25 | |

Share-based compensation | | 0.96 | | 0.62 | | 0.77 | | 0.46 | |

PRODUCTION EXPENSES

For the three and six months ended June 30, 2011, production expenses totaled $12.2 million ($11.50/boe) and $23.5 million ($11.93/boe), respectively, compared to $9.1 million ($13.00/boe) and $17.8 million ($13.18/boe) recorded in the same period in 2010, respectively. The decrease in production expenses in 2011 on a boe basis is due to increased production which is a result of 2010 and continued 2011 drilling in areas with lower production expenses and the Company’s continued efforts to streamline operations and field optimization projects.

Bellatrix is targeting operating costs of approximately $51.6 million ($11.78/boe) in 2011. This is based upon assumptions of estimated 2011 average production of approximately 12,000 boe/d, continued field optimization work and planned capital expenditures in producing areas which are anticipated to have lower operating costs.

15

Production Expenses, by Commodity Type

| | Three months ended June 30, | | Six months ended June 30, | |

($000s, except where noted) | | 2011 | | 2010 | | 2011 | | 2010 | |

Light crude oil, condensate and NGLs | | 4,806 | | 3,022 | | 9,315 | | 5,400 | |

$/bbl | | 13.11 | | 19.31 | | 13.51 | | 18.25 | |

Heavy oil | | 447 | | 637 | | 1,234 | | 950 | |

$/bbl | | 11.61 | | 19.63 | | 19.53 | | 14.66 | |

Natural gas | | 6,927 | | 5,420 | | 12,929 | | 11,446 | |

$/mcf | | 1.76 | | 1.77 | | 1.77 | | 1.93 | |

Total | | 12,180 | | 9,079 | | 23,478 | | 17,796 | |

$/boe | | 11.50 | | 13.00 | | 11.93 | | 13.18 | |

Total | | 12,180 | | 9,079 | | 23,478 | | 17,796 | |

Processing and other third party income(1) | | (610 | ) | (498 | ) | (1,033 | ) | (1,045 | ) |

Total after deducting processing and other third party income | | 11,570 | | 8,581 | | 22,445 | | 16,751 | |

$/boe | | 10.92 | | 12.29 | | 11.41 | | 12.40 | |

(1) | Processing and other third party income is included within petroleum and natural gas sales on the Consolidated Statements of Comprehensive Income. |

TRANSPORTATION

Transportation expenses for the three and six months ended June 30, 2011 were $1.5 million ($1.42/boe) and $2.7 million ($1.36/boe), respectively, compared to $0.9 million ($1.26/boe) and $1.7 million ($1.25/boe) in the same 2010 periods, respectively, which is reflective of an increase in oil hauling charges.

OPERATING NETBACK

Field Operating Netback - Corporate (before risk management)

| | Three months ended June 30, | | Six months ended June 30, | |

($ per boe) | | 2011 | | 2010 | | 2011 | | 2010 | |

Sales | | 49.87 | | 35.92 | | 47.25 | | 38.11 | |

Transportation | | (1.42 | ) | (1.26 | ) | (1.36 | ) | (1.25 | ) |

Royalties | | (10.25 | ) | (6.99 | ) | (8.81 | ) | (7.50 | ) |

Production expense | | (11.50 | ) | (13.00 | ) | (11.93 | ) | (13.18 | ) |

Field operating netback | | 26.70 | | 14.67 | | 25.15 | | 16.18 | |

For the second quarter of 2011, corporate field operating netback (before commodity price risk management contracts) was $26.70/boe compared to $14.67/boe in the same 2010 period. This was primarily the result of an increase in crude oil, condensate and natural gas liquids commodity prices, as well as a decrease in production expenses offset by an increase in royalties and transportation expenses. After including commodity price risk management contracts, the corporate field operating netback for the second quarter of 2011 was $25.41/boe compared to $20.56/boe in the same 2010 period. In comparison, first quarter 2011 corporate field operating netback (before commodity price risk management contracts) was $23.33/boe.

Field Operating Netback - Crude Oil, Condensate and NGLs (before risk management)

| | Three months ended June 30, | | Six months ended June 30, | |

($/bbl) | | 2011 | | 2010 | | 2011 | | 2010 | |

Sales | | 91.13 | | 65.66 | | 84.77 | | 66.16 | |

Transportation | | (2.42 | ) | (1.05 | ) | (2.00 | ) | (1.01 | ) |

Royalties | | (19.88 | ) | (16.00 | ) | (17.03 | ) | (16.82 | ) |

Production expense | | (12.97 | ) | (19.37 | ) | (14.02 | ) | (17.61 | ) |

Field operating netback | | 55.86 | | 29.24 | | 51.72 | | 30.72 | |

16

Field operating netback for crude oil, condensate and NGLs averaged $55.86/bbl for the three month period ended June 30, 2011, up 91% compared to $29.24/bbl for the same period in 2010. The significant increase is primarily due to the increase in commodity prices for crude oil, condensate and NGLs, as well as a decrease in production expenses, offset by an increase in transportation and royalties. After including commodity price risk management contracts, field operating netback for crude oil and NGLs for the second quarter in 2011 was $49.40/boe compared to $46.97/boe in the same period in 2010.

Field Operating Netback - Natural Gas (before risk management)

| | Three months ended June 30, | | Six months ended June 30, | |

($/mcf) | | 2011 | | 2010 | | 2011 | | 2010 | |

Sales | | 4.06 | | 4.15 | | 4.00 | | 4.65 | |

Transportation | | (0.13 | ) | (0.22 | ) | (0.16 | ) | (0.22 | ) |

Royalties | | (0.72 | ) | (0.61 | ) | (0.62 | ) | (0.68 | ) |

Production expense | | (1.76 | ) | (1.77 | ) | (1.77 | ) | (1.93 | ) |

Field operating netback | | 1.45 | | 1.55 | | 1.45 | | 1.82 | |

Field operating netback for natural gas in the second quarter of 2011 decreased 6% to $1.45/mcf, compared to $1.55/mcf in the same period in 2010, reflecting weaker natural gas prices experienced and higher royalties, offset by lower transportation and production expenses. After including commodity price risk management contracts, field operating netback for natural gas for the three month period ended June 30, 2011 was $1.76/mcf compared to $1.62/mcf in the same period in 2010.

GENERAL AND ADMINISTRATIVE

General and administrative (“G&A”) expenses (after capitalized G&A and recoveries) for the three and six month period ended June 30, 2011 were $2.9 million ($2.74/boe) and $5.2 million ($2.62/boe), respectively, compared to $2.7 million ($3.89/boe) and $5.3 million ($3.89/boe) for the same period in 2010, respectively. The increase in the G&A expense for the second quarter of 2011 from the same period in 2010 reflects higher compensation and base costs, partially offset by an increase in capitalized G&A and recoveries which are consistent with Bellatrix’s higher 2011 capital program. For the six months ended June 30, 2011, G&A expenses are slightly lower in comparison to the same period in 2010 which is reflective of higher compensation and base costs, offset by an increase in capitalized G&A and recoveries. The decrease in G&A expenses on a per boe basis for the three and six months ended June 30, 2010 compared to the same period in 2010 is primarily a result of higher average sales volumes.

For 2011, the Company is anticipating G&A costs after capitalization to be approximately $12.0 million ($2.74/boe) based on estimated 2011 average production volumes of approximately 12,000 boe/d.

General and Administrative Expenses

| | Three months ended June 30, | | Six months ended June 30, | |

($000s, except where noted) | | 2011 | | 2010 | | 2011 | | 2010 | |

Gross expenses | | 4,863 | | 3,624 | | 9,128 | | 6,816 | |

Capitalized | | (909 | ) | (584 | ) | (1,753 | ) | (948 | ) |

Recoveries | | (1,054 | ) | (325 | ) | (2,208 | ) | (617 | ) |

G&A expenses | | 2,900 | | 2,715 | | 5,167 | | 5,251 | |

G&A expenses, per unit ($/boe) | | 2.74 | | 3.89 | | 2.62 | | 3.89 | |

INTEREST AND FINANCING CHARGES

Bellatrix recorded $1.9 million of interest and financing charges related to bank debt and its debentures for the three months ended June 30, 2011 compared to $2.0 million in the same period in 2010. The decrease in interest and financing charges is primarily due to lower interest and accretion charges in relation to the Company’s outstanding debentures, partially offset by higher interest charges related to the Company’s long-term debt as the Company carried a higher average debt balance in the second quarter of 2011 compared to the second quarter of 2010.

17

Bellatrix’s total net debt at June 30, 2011 of $85.0 million includes the $48.0 million liability portion of its $55 million principal amount of convertible unsecured subordinated debentures (the “4.75% Debentures”), $44.6 million of bank debt and the net balance of a working capital surplus. The 4.75% Debentures have a maturity date of April 30, 2015.

Interest and Financing Charges (1)

| | Three months ended June 30, | | Six months ended June 30, | |

($000s, except where noted) | | 2011 | | 2010 | | 2011 | | 2010 | |

Interest and financing charges | | 1,868 | | 1,979 | | 3,569 | | 4,393 | |

Interest and financing charges ($/boe) | | 1.76 | | 2.83 | | 1.81 | | 3.25 | |

(1) Does not include financing charges in relation to the Company’s unwinding of decommissioning liabilities.

Debt to Funds Flow from Operations Ratio

| | Three months ended June 30, | | Six months ended June 30, | |

($000s, except where noted) | | 2011 | | 2010 | | 2011 | | 2010 | |

Debt to funds flow from operations(1) ratio annualized(3) | | | | | | | | | |

Funds flow from operations(1) (annualized) | | 92,504 | | 42,440 | | 80,306 | | 41,616 | |

Total net debt (2) at period end | | 84,999 | | 81,296 | | 84,999 | | 81,296 | |

Total net debt to periods funds flow from operations ratio annualized(3) | | 0.9x | | 1.9x | | 1.0x | | 1.9x | |

Net debt (2) (excluding convertible debentures) at period end | | 36,683 | | 34,390 | | 36,683 | | 34,390 | |

Net debt to periods funds flow from operations ratio annualized (3) | | 0.4x | | 0.8x | | 0.5x | | 0.8x | |

Debt to funds flow from operations(1) ratio (trailing)(4) | | | | | | | | | |

Funds flow from operations(1) ratio trailing | | 67,105 | | 39,579 | | 67,105 | | 39,579 | |

Total net debt (2) to funds flow from operations trailing | | 1.3x | | 2.0x | | 1.3x | | 2.0x | |

Net debt (2) (excluding convertible debentures) to funds flow from operations for the period | | 0.5x | | 0.9x | | 0.5x | | 0.9x | |

(1) | As detailed previously in this Management’s Discussion and Analysis, funds flow from operations is a term that does not have any standardized meaning under GAAP. Funds flow from operations is calculated as cash flow from operating activities, decommissioning costs incurred and changes in non-cash working capital incurred. |

| |

(2) | Net debt and total net debt are considered non-GAAP terms. The Company’s calculation of total net debt includes the liability component of convertible debentures and excludes deferred liabilities, long-term commodity contract liabilities, decommissioning liabilities, long-term finance lease obligation and the deferred tax liability. Net debt and total net debt include the net working capital deficiency (excess) before short-term commodity contract assets and liabilities and current finance lease obligation. Net debt also excludes the liability component of convertible debentures. Total net debt and net debt are non-GAAP measures; refer to the following reconciliation of total liabilities to total net debt and net debt. |

| |

(3) | Total net debt and net debt to periods funds flow from operations ratio (annualized) is calculated based upon second quarter and year to date funds flow from operations annualized. |

| |

(4) | Trailing periods funds flow from operations ratio annualized is based on the twelve-months period ended June 30, 2011 and June 30, 2010. |

18

Reconciliation of Total Liabilities to Total Net Debt and Net Debt

| | | | As at June 30, | |

($000s, except where noted) | | 2011 | | 2010 | |

Total liabilities per financial statements | | 182,827 | | 148,751 | |

Current liabilities included within working capital calculation | | (44,441 | ) | (26,622 | ) |

Deferred liability - flow-through shares | | (3,288 | ) | — | |

Commodity contract liability | | (1,016 | ) | — | |

Decommissioning Liabilities | | (39,744 | ) | (40,822 | ) |

Finance lease obligation | | (1,369 | ) | — | |

Working capital | | | | | |

Current assets | | (51,766 | ) | (34,129 | ) |

Current liabilities | | 44,441 | | 26,622 | |

Current portion of finance lease | | (149 | ) | — | |

Net commodity contract asset (liability) | | (496 | ) | 7,496 | |

| | (7,970 | ) | (11 | ) |

Total net debt | | 84,999 | | 81,296 | |

Convertible debentures | | (48,316 | ) | (46,906 | ) |

Net debt | | 36,683 | | 34,390 | |

SHARE-BASED COMPENSATION

Non-cash share-based compensation expense for the three months ended June 30, 2011 was an expense of $1.0 million compared to $0.4 million in the same period in 2010. The increase in the expense is primarily due to the Deferred Share Unit Plan (the “Plan”) which was approved by the Board of Directors of Bellatrix on May 11, 2011. The Plan allows the Company to grant to non-employee directors Deferred Share Units (“DSUs”), each DSU being a right to receive, on a deferred payment basis, a cash payment equivalent to the volume weighted average trading price of the Company’s common shares for the five trading days immediately preceding the redemption date of such DSU. Participants of the Plan may also elect to receive their annual remuneration in the form of DSUs. Subject to Toronto Stock Exchange and shareholder approval, Bellatrix may elect to deliver common shares from treasury in satisfaction in whole or in part of any payment to be made upon the redemption of the DSUs. The DSUs vest immediately and must be redeemed by December 1st of the calendar year immediately following the year in which the participant ceases to hold all positions with Bellatrix or earlier if the participant elects to have the DSUs redeemed at an earlier date (provided that the DSUs may not be redeemed prior to the date that the participant ceases to hold all positions with Bellatrix). The Plan was adopted to better align non-employee directors remuneration with that of shareholders. On a go forward basis, it is intended that in the event of a share based award, non-employee directors would receive DSU grants instead of share option grants as has been the past practice.

For the three months ended June 30, 2011, Bellatrix recorded approximately $0.7 million (2010: nil) of share based compensation expense and a corresponding liability related to the Company’s outstanding DSUs.

DEPLETION AND DEPRECIATION

Depletion and depreciation expense for the second quarter in 2011 was $16.2 million ($15.28/boe) compared to $11.1 million ($15.90/boe) in the same period in 2010. The decrease in depletion and depreciation expense per boe from the second quarter in 2010 compared to the second quarter in 2011 is primarily due to a 35% increase in the reserve base used for depletion, partially offset by a higher cost base and increased future development costs.

For the three months ended June 30, 2011 Bellatrix has included a total $254.2 million (2010: $93.3 million) for future development costs in the depletion calculation and excluded from the depletion calculation a total of $34.9 million (2010: $28.5 million) for estimated salvage.

19

Depletion and Depreciation

| | Three months ended June 30, | | Six months ended June 30, | |

($000s, except where noted) | | 2011 | | 2010 | | 2011 | | 2010 | |

Depletion and depreciation | | 16,190 | | 11,102 | | 29,949 | | 21,248 | |

Per unit ($/boe) | | 15.28 | | 15.90 | | 15.22 | | 15.73 | |

INCOME TAXES

Deferred income taxes arise from differences between the accounting and tax bases of the Company’s assets and liabilities. For the six months ended June 30, 2011, the Company recognized a deferred income tax expense of $3.0 million compared to an expense of $0.2 million in the same period in 2010.

As at June 30, 2011, the Company had a total net deferred tax asset balance of $12.1 million. IFRS requires that a deferred tax asset be recorded when the tax pools exceeds the book value of assets, to the extent the amount is probable to be realized.

At June 30, 2011, Bellatrix had approximately $498.1 million in tax pools available for deduction against future income as follows:

($000s) | | Rate % | | 2011 | | 2010 | |

Intangible resource pools: | | | | | | | |

Canadian exploration expenses | | 100 | | 44,300 | | 43,900 | |

Canadian development expenses | | 30 | | 334,800 | | 236,100 | |

Canadian oil and gas property expenses | | 10 | | 19,900 | | 14,800 | |

Foreign resource expenses | | 10 | | 800 | | 1,000 | |

Attributed Canadian Royalty Income | | 100 (Alberta) | | 16,100 | | 16,100 | |

Undepreciated capital cost | | 6 - 55 | (1) | 77,200 | | 108,700 | |

Non-capital losses (expire through 2027) | | 100 | | 300 | | 400 | |

Financing costs | | 20 straight line | | 4,700 | | 2,000 | |

| | | | 498,100 | | 423,000 | |

(1) Approximately $70 million of undepreciated capital cost pools are class 41, which is claimed at a 25% rate.

As a result of the issuance of the common shares issued on a “flow-through” basis (“Flow-Through Shares”) on August 12, 2010, Bellatrix is committed to incur approximately $20.0 million in qualifying Canadian Exploration Expenses (“CEE”) on or prior to December 31, 2011. As of June 30 2011, Bellatrix has satisfied approximately $2.5 million of this commitment, reducing its remaining commitment to $17.5 million.

CASH FLOW FROM OPERATING ACTIVITIES, FUNDS FLOW FROM OPERATIONS AND NET PROFIT (LOSS)

As detailed previously in this Management’s Discussion and Analysis, funds flow from operations is a term that does not have any standardized meaning under GAAP. Funds flow from operations is calculated as cash flow from operating activities before realization of imputed interest costs on the 7.5% convertible unsecured subordinated debentures (the “7.5% Debentures”), decommissioning costs incurred and changes in non-cash working capital incurred.

Reconciliation of Cash Flow from Operating Activities and Funds Flow from Operations

| | Three months ended June 30, | | Six months ended June 30, | |

($000s) | | 2011 | | 2010 | | 2011 | | 2010 | |

Cash flow from operating activities | | 23,825 | | 6,065 | | 39,543 | | 19,521 | |

Realization of imputed interest costs on 7.5% Debentures | | — | | 5,050 | | — | | 5,050 | |

Decommissioning costs incurred | | 321 | | 441 | | 470 | | 603 | |

Change in non-cash working capital | | (1,020 | ) | (946 | ) | 140 | | (4,366 | ) |

Funds flow from operations | | 23,126 | | 10,610 | | 40,153 | | 20,808 | |

20

Bellatrix’s cash flow from operating activities of $23.8 million ($0.22 per diluted share) for the three months ended June 30, 2011 increased approximately 293% from the $6.1 million ($0.07 per diluted share) generated in the same 2010 period. Bellatrix generated funds flow from operations of $23.1 million ($0.21 per diluted share) for the three months ended June 30, 2011, up 118% from $10.6 million ($0.11 per diluted share) for the same period in 2010. The increase in cash flow from operating activities and funds flow from operations for the second quarter of 2011 compared to the second quarter of 2010 was primarily the result of higher operating netbacks due to higher overall commodity pricing for crude oil, condensate and NGLs, in conjunction with increased sales volumes, as well as a reduction in finance and interest charges for the Company’s convertible debentures. The increase was partially offset by a realized loss of $1.4 million for commodity risk management contracts in the second quarter of 2011 when compared to a realized gain of $4.1 million in the same period in 2010 and higher operating expenses.

Bellatrix maintains a commodity price risk management program to provide a measure of stability to funds flow from operations. Unrealized marktomarket gains or losses are non-cash adjustments to the current fair market value of the contract over its entire term and are included in the calculation of net profit.