UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22903

J.P. Morgan Exchange-Traded Fund Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta, Esq.

J.P. Morgan Investment Management Inc.

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

With copies to:

| | | | |

| | Elizabeth A. Davin, Esq. | | Jon S. Rand Esq. |

| | JPMorgan Chase & Co. | | Dechert LLP |

| | 1111 Polaris Parkway | | 1095 Avenue of the Americas |

| | Columbus, OH 43240 | | New York, NY 10036 |

Registrant’s telephone number, including area code: (844) 457-6383

Date of fiscal year end: February, 28

Date of reporting period: March 1, 2016 through February 28, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

JPMorgan Exchange-Traded Funds

February 28, 2017

JPMorgan Disciplined High Yield ETF

CONTENTS

Investments in the Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objective, strategies and risks. Call J.P. Morgan Exchange-Traded Funds at (844) 457-6383 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Shares are bought and sold throughout the day on an exchange at market price (not NAV) through a brokerage account, and are not individually redeemed from the Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

PRESIDENT’S LETTER

FEBRUARY 28, 2017 (UNAUDITED)

Dear Shareholders,

In the six months since its launch, the JPMorgan Disciplined High Yield ETF (the “Fund”) avoided the more speculative pockets within its investment universe in order to help maintain the value of the Fund’s portfolio in a period of heightened fixed-income volatility.

| | |

| | “Our approach — applied with J.P. Morgan’s disciplined credit research — aims to capture the income potential of high yield bonds with less volatility than the benchmark.” |

The Fund participated in the broad rally in high yield bonds (also known as “junk bonds”) that marked the latter half of 2016 through early 2017, though not to the extent of the BofA Merrill Lynch High US Yield Index (the “Benchmark”). From the Fund’s inception on September 14, 2016 to February 28, 2017, the Fund returned 4.24% compared with 6.15% for the Benchmark.

The Benchmark included lower quality bonds, which generally outperformed higher quality high yield bonds during the reporting period. By contrast, the Fund typically invested in the higher rated bonds within the high yield universe. During the

period, it invested exclusively in higher quality issues, which the adviser believes will help protect value in adverse market conditions. In this context, the Fund’s relative performance reflects its methodology and multi-factor selection process.

Over the full cycle, we believe in an emphasis on quality, based on rigorous selection criteria.

Our approach — applied with J.P. Morgan’s disciplined credit research — aims to capture the income potential of high yield bonds with less volatility than the Benchmark. We believe this combination is one of the fundamental attractions of good fixed income investing: It diversifies core fixed income portfolios, helping to manage credit risk.

It also makes the Fund a valuable addition to our full suite of ETFs, which recently surpassed the billion-dollar mark in assets under management.

We are grateful for your belief in our firm and our investment process. If you have any questions, please visit www.jpmorganetfs.com or call J.P. Morgan Exchange-Traded Funds at 1-844-457-6383.

Robert F. Deutsch

President, J.P. Morgan Exchange-Traded Funds

J.P Morgan Asset Management

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 1 | |

JPMorgan Disciplined High Yield ETF

FUND COMMENTARY

FOR THE PERIOD SEPTEMBER 14, 2016 (FUND INCEPTION DATE) THROUGH FEBRUARY 28, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| JPMorgan Disciplined High Yield ETF* | | | 4.24% | |

| Market Price** | | | 4.64% | |

| BofA Merrill Lynch US High Yield Index | | | 6.15% | |

| Bloomberg Barclays US Aggregate Index | | | -1.59% | |

| |

| Net Assets as of 2/28/17 | | $ | 30,574,068 | |

| Duration as of 2/28/17 | | | 5.12 years | |

INVESTMENT OBJECTIVE***

The JPMorgan Disciplined High Yield ETF (the “Fund”) seeks to provide a high level of income. Capital appreciation is a secondary objective.

INVESTMENT APPROACH

The Fund invests in a diversified portfolio of high-yield securities (also called “junk bonds”), only in U.S. dollar-denominated investments of both domestic and foreign issuers.

HOW DID THE MARKET PERFORM?

High yield bonds generally outperformed investment grade corporate bonds and U.S. Treasury bonds during the reporting period. Stabilizing commodities prices, U.S. economic growth and the Republican Party’s control of both the presidency and the U.S. Congress provided support for high yield bonds.

HOW DID THE FUND PERFORM?

For the period September 14, 2016 to February 28, 2017, the Fund posted positive absolute performance, underperformed the BofA Merrill Lynch US High Yield Index (the “Benchmark”) and outperformed the Bloomberg Barclays US Aggregate Index (the “Index”). Relative to the Benchmark, the Fund’s underweight positions in bonds rated B and CCC detracted from performance as lower quality bonds generally outperformed higher quality bonds during the reporting period.

Relative to the Index, the Fund’s allocation to high yield bonds helped performance as high yield bonds generally outperformed other sectors of the bond market.

In terms of absolute performance, overall investor appetite for higher risk/higher yielding investments drove positive returns for high yield bonds.

HOW WAS THE FUND POSITIONED?

The Fund’s managers believe that bonds rated CCC generally have materially higher volatility and default risk than bonds rated BB and B, while providing inadequate incremental return

over a market cycle to justify the higher volatility. In addition, the managers believe bonds issued by private companies have had a materially higher probability of default than similarly-rated bonds issued by public companies. Relative to the Benchmark, the Fund’s largest average overweight allocation was in bonds rated BB and its largest average underweight allocation was in bonds rated CCC.

| | | | |

PORTFOLIO COMPOSITION BY SECTOR**** | |

| Consumer Discretionary | | | 24.9 | % |

| Energy | | | 14.4 | |

| Telecommunication Services | | | 12.4 | |

| Industrials | | | 9.3 | |

| Materials | | | 8.6 | |

| Information Technology | | | 8.2 | |

| Financials | | | 6.7 | |

| Health Care | | | 6.4 | |

| Consumer Staples | | | 3.1 | |

| Utilities | | | 2.9 | |

| Real Estate | | | 2.2 | |

| Short-Term Investment | | | 0.9 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. The net asset value was $50.96 as of February 28, 2017. |

| ** | | Market price cumulative return is calculated assuming an initial investment made at the inception date net asset value, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The price used to calculate the market price return is the midpoint of the bid/ask spread at the close of business on the Bats BZX Exchange, Inc. The midpoint price was $51.16 as of February 28, 2017. |

| *** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based on total investments as of February 28, 2017. The Fund’s composition is subject to change. |

| | | | | | |

| | | |

| 2 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

AVERAGE ANNUAL TOTAL RETURNS AS OF FEBRUARY 28, 2017

| | | | | | | | |

| | | INCEPTION DATE | | | CUMULATIVE

SINCE INCEPTION | |

JPMorgan Disciplined High Yield ETF | | | | | | | | |

| Net Asset Value | | | September 14, 2016 | | | | 4.24 | % |

| Market Price | | | | | | | 4.64 | % |

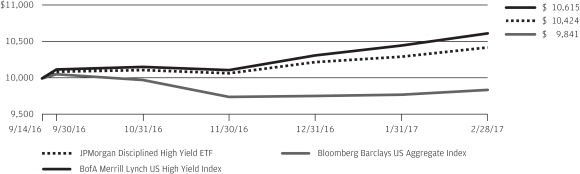

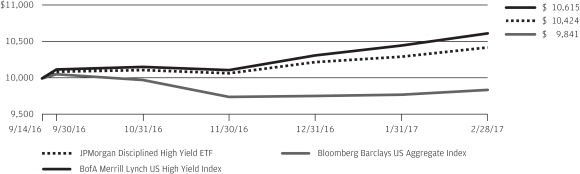

LIFE OF FUND PERFORMANCE (9/14/16 TO 2/28/17)

The performance quoted is past performance and is not a guarantee of future results. Exchange-traded funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-844-457-6383.

Fund commenced operations on September 14, 2016.

The graph illustrates comparative performance for $10,000 invested in shares of the JPMorgan Disciplined High Yield ETF, the BofA Merrill Lynch US High Yield Index and the Bloomberg Barclays US Aggregate Index from September 14, 2016 to February 28, 2017. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the BofA Merrill Lynch US High Yield Index and the Bloomberg Barclays US Aggregate Index does not reflect the deduction of expenses associated with an exchange-traded fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable. The BofA Merrill

Lynch US High Yield Index is an unmanaged index, which measures the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The Bloomberg Barclays US Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. Investors cannot invest directly in an index.

Fund performance reflects the partial waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemption or sale of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 3 | |

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — 97.6% | | | | |

| | | | Consumer Discretionary — 24.5% | | | | |

| | | | Auto Components — 1.0% | | | | |

| | 90,000 | | | Goodyear Tire & Rubber Co. (The),

5.125%, 11/15/23 | | | 93,420 | |

| | 200,000 | | | Schaeffler Finance BV MTN (Netherlands), 4.250%, 05/15/21 (a) | | | 204,080 | |

| | | | | | | | |

| | | | | | | 297,500 | |

| | | | | | | | |

| | | | Automobile — 1.3% | | | | |

| | 200,000 | | | Fiat Chrysler Automobiles NV (Netherlands), 5.250%, 04/15/23 | | | 207,250 | |

| | 200,000 | | | Jaguar Land Rover Automotive plc (United Kingdom), 4.125%, 12/15/18 (a) | | | 204,050 | |

| | | | | | | | |

| | | | | | | 411,300 | |

| | | | | | | | |

| | | | Diversified Consumer Services — 0.3% | | | | |

| | 75,000 | | | Service Corp. International,

5.375%, 05/15/24 | | | 79,455 | |

| | | | | | | | |

| | | | Diversified Telecommunication

Services — 4.3% | | | | |

| | | | Altice Financing S.A. (Luxembourg), | | | | |

| | 200,000 | | | 6.625%, 02/15/23 (a) | | | 210,500 | |

| | 250,000 | | | 7.500%, 05/15/26 (a) | | | 268,437 | |

| | | | CCO Holdings LLC/CCO Holdings Capital Corp., | | | | |

| | 63,000 | | | 5.500%, 05/01/26 (a) | | | 66,859 | |

| | 230,000 | | | 5.750%, 02/15/26 (a) | | | 246,100 | |

| | 100,000 | | | 5.875%, 04/01/24 (a) | | | 107,250 | |

| | 200,000 | | | UPCB Finance IV Ltd. (Cayman Islands), 5.375%, 01/15/25 (a) | | | 204,500 | |

| | 200,000 | | | Virgin Media Secured Finance plc (United Kingdom), 5.250%, 01/15/26 (a) | | | 202,250 | |

| | | | | | | | |

| | | | | | | 1,305,896 | |

| | | | | | | | |

| | | | Equity Real Estate Investment

Trust (REITs) — 0.3% | | | | |

| | 95,000 | | | MGM Growth Properties Operating Partnership LP/MGP Finance Co-Issuer, Inc.,

5.625%, 05/01/24 (a) | | | 100,462 | |

| | | | | | | | |

| | | | Home Builders — 0.2% | | | | |

| | 25,000 | | | Brookfield Residential Properties, Inc./Brookfield Residential U.S. Corp. (Canada), 6.125%, 07/01/22 (a) | | | 25,750 | |

| | 26,000 | | | Taylor Morrison Communities, Inc./Monarch Communities, Inc., 5.250%, 04/15/21 (a) | | | 26,650 | |

| | | | | | | | |

| | | | | | | 52,400 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | Hotels, Restaurants & Leisure — 5.3% | | | | |

| | | | 1011778 B.C. ULC/New Red Finance, Inc. (Canada), | | | | |

| | 55,000 | | | 4.625%, 01/15/22 (a) | | | 56,581 | |

| | 205,000 | | | 6.000%, 04/01/22 (a) | | | 213,774 | |

| | | | Boyd Gaming Corp., | | | | |

| | 26,000 | | | 6.375%, 04/01/26 | | | 28,113 | |

| | 65,000 | | | 6.875%, 05/15/23 | | | 70,200 | |

| | 115,000 | | | ESH Hospitality, Inc., 5.250%, 05/01/25 (a) | | | 116,006 | |

| | 90,000 | | | Hilton Domestic Operating Co., Inc.,

4.250%, 09/01/24 (a) | | | 89,010 | |

| | 135,000 | | | Hilton Worldwide Finance LLC/Hilton Worldwide Finance Corp.,

5.625%, 10/15/21 | | | 139,004 | |

| | 200,000 | | | International Game Technology plc (United Kingdom), 6.250%, 02/15/22 (a) | | | 216,000 | |

| | | | KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC, | | | | |

| | 38,000 | | | 5.000%, 06/01/24 (a) | | | 39,011 | |

| | 95,000 | | | 5.250%, 06/01/26 (a) | | | 98,206 | |

| | | | MGM Resorts International, | | | | |

| | 46,000 | | | 6.000%, 03/15/23 | | | 50,140 | |

| | 115,000 | | | 6.625%, 12/15/21 | | | 128,369 | |

| | 26,000 | | | NCL Corp. Ltd. (Bermuda),

4.750%, 12/15/21 (a) | | | 26,553 | |

| | 60,000 | | | Royal Caribbean Cruises Ltd. (Liberia), 5.250%, 11/15/22 | | | 67,182 | |

| | 70,000 | | | Six Flags Entertainment Corp.,

5.250%, 01/15/21 (a) | | | 71,960 | |

| | | | Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp., | | | | |

| | 32,000 | | | 5.375%, 03/15/22 | | | 32,880 | |

| | 165,000 | | | 5.500%, 03/01/25 (a) | | | 167,475 | |

| | | | | | | | |

| | | | | | | 1,610,464 | |

| | | | | | | | |

| | | | Household Durables — 1.0% | | | | |

| | 55,000 | | | Brookfield Residential Properties, Inc. (Canada), 6.500%, 12/15/20 (a) | | | 56,617 | |

| | 50,000 | | | CalAtlantic Group, Inc., 8.375%, 05/15/18 | | | 53,438 | |

| | | | Lennar Corp., | | | | |

| | 55,000 | | | 4.500%, 11/15/19 | | | 56,856 | |

| | 27,000 | | | 4.750%, 11/15/22 | | | 27,769 | |

| | | | PulteGroup, Inc., | | | | |

| | 26,000 | | | 4.250%, 03/01/21 | | | 26,611 | |

| | 60,000 | | | 5.500%, 03/01/26 | | | 62,250 | |

| | 40,000 | | | Tempur Sealy International, Inc.,

5.500%, 06/15/26 | | | 39,150 | |

| | | | | | | | |

| | | | | | | 322,691 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 4 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Internet & Direct Marketing Retail — 0.4% | | | | |

| | | | Netflix, Inc., | | | | |

| | 25,000 | | | 4.375%, 11/15/26 (a) | | | 24,781 | |

| | 26,000 | | | 5.500%, 02/15/22 | | | 27,755 | |

| | 70,000 | | | 5.875%, 02/15/25 | | | 75,950 | |

| | | | | | | | |

| | | | | | | 128,486 | |

| | | | | | | | |

| | | | Media — 7.8% | | | | |

| | 200,000 | | | Altice US Finance I Corp.,

5.500%, 05/15/26 (a) | | | 206,750 | |

| | 25,000 | | | AMC Entertainment Holdings, Inc.,

5.750%, 06/15/25 | | | 25,906 | |

| | 90,000 | | | AMC Networks, Inc., 5.000%, 04/01/24 | | | 90,844 | |

| | 65,000 | | | Cinemark USA, Inc., 4.875%, 06/01/23 | | | 66,625 | |

| | | | Clear Channel Worldwide Holdings, Inc., | | | | |

| | 180,000 | | | Series B, 6.500%, 11/15/22 | | | 186,412 | |

| | 70,000 | | | Series B, 7.625%, 03/15/20 | | | 70,525 | |

| | | | CSC Holdings LLC, | | | | |

| | 200,000 | | | 10.125%, 01/15/23 (a) | | | 231,500 | |

| | 200,000 | | | 10.875%, 10/15/25 (a) | | | 241,000 | |

| | | | DISH DBS Corp., | | | | |

| | 100,000 | | | 5.875%, 07/15/22 | | | 107,188 | |

| | 74,000 | | | 5.875%, 11/15/24 | | | 78,995 | |

| | 180,000 | | | 6.750%, 06/01/21 | | | 197,550 | |

| | 80,000 | | | Nexstar Broadcasting, Inc., 5.625%, 08/01/24 (a) | | | 81,800 | |

| | 75,000 | | | Quebecor Media, Inc. (Canada), 5.750%, 01/15/23 | | | 79,969 | |

| | 70,000 | | | Regal Entertainment Group, 5.750%, 03/15/22 | | | 73,237 | |

| | 55,000 | | | Sinclair Television Group, Inc., 5.375%, 04/01/21 | | | 56,650 | |

| | | | Sirius XM Radio, Inc., | | | | |

| | 36,000 | | | 5.375%, 04/15/25 (a) | | | 36,822 | |

| | 135,000 | | | 6.000%, 07/15/24 (a) | | | 143,775 | |

| | 25,000 | | | TEGNA Inc., 6.375%, 10/15/23 | | | 26,625 | |

| | 200,000 | | | Unitymedia Hessen GmbH & Co. KG/Unitymedia NRW GmbH (Germany), 5.500%, 01/15/23 (a) | | | 209,000 | |

| | 28,000 | | | Videotron Ltd. (Canada), 5.000%, 07/15/22 | | | 29,470 | |

| | 150,000 | | | Ziggo Secured Finance BV (Netherlands), 5.500%, 01/15/27 (a) | | | 151,875 | |

| | | | | | | | |

| | | | | | | 2,392,518 | |

| | | | | | | | |

| | | | Multiline Retail — 0.8% | | | | |

| | 230,000 | | | Dollar Tree, Inc., 5.750%, 03/01/23 | | | 243,225 | |

| | | | | | | | |

| | | | Retail Consumer Discretionary — 0.3% | | | | |

| | | | QVC, Inc., | | | | |

| | 65,000 | | | 4.375%, 03/15/23 | | | 65,620 | |

| | 25,000 | | | 4.850%, 04/01/24 | | | 25,473 | |

| | | | | | | | |

| | | | | | | 91,093 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Specialty Retail — 0.8% | | | | |

| | | | L Brands, Inc., | | | | |

| | 38,000 | | | 5.625%, 02/15/22 | | | 40,137 | |

| | 90,000 | | | 6.625%, 04/01/21 | | | 99,000 | |

| | | | Sally Holdings LLC/Sally Capital, Inc., | | | | |

| | 26,000 | | | 5.625%, 12/01/25 | | | 26,455 | |

| | 75,000 | | | 5.750%, 06/01/22 | | | 77,250 | |

| | | | | | | | |

| | | | | | | 242,842 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 0.4% | | | | |

| | | | Hanesbrands, Inc., | | | | |

| | 32,000 | | | 4.625%, 05/15/24 (a) | | | 31,720 | |

| | 80,000 | | | 4.875%, 05/15/26 (a) | | | 79,200 | |

| | | | | | | | |

| | | | | | | 110,920 | |

| | | | | | | | |

| | | | Wireless Telecommunication Service — 0.3% | | | | |

| | 100,000 | | | Inmarsat Finance plc (United Kingdom), 4.875%, 05/15/22 (a) | | | 100,000 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 7,489,252 | |

| | | | | | | | |

| | | | Consumer Staples — 3.1% | | | | |

| | | | Beverages — 0.2% | | | | |

| | 55,000 | | | Cott Beverages, Inc., 6.750%, 01/01/20 | | | 56,856 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 1.0% | | | | |

| | | | Rite Aid Corp., | | | | |

| | 165,000 | | | 6.125%, 04/01/23 (a) | | | 174,842 | |

| | 32,000 | | | 9.250%, 03/15/20 | | | 33,040 | |

| | 105,000 | | | Tesco plc (United Kingdom),

6.150%, 11/15/37 (a) | | | 106,897 | |

| | | | | | | | |

| | | | | | | 314,779 | |

| | | | | | | | |

| | | | Food Products — 0.9% | | | | |

| | | | Lamb Weston Holdings, Inc., | | | | |

| | 16,000 | | | 4.625%, 11/01/24 (a) | | | 16,280 | |

| | 16,000 | | | 4.875%, 11/01/26 (a) | | | 16,248 | |

| | 160,000 | | | Post Holdings, Inc., 5.000%, 08/15/26 (a) | | | 154,100 | |

| | 70,000 | | | TreeHouse Foods, Inc.,

6.000%, 02/15/24 (a) | | | 73,675 | |

| | | | | | | | |

| | | | | | | 260,303 | |

| | | | | | | | |

| | | | Household Products — 0.7% | | | | |

| | | | HRG Group, Inc., | | | | |

| | 32,000 | | | 7.750%, 01/15/22 | | | 33,840 | |

| | 75,000 | | | 7.875%, 07/15/19 | | | 77,906 | |

| | 90,000 | | | Spectrum Brands, Inc., 5.750%, 07/15/25 | | | 95,814 | |

| | | | | | | | |

| | | | | | | 207,560 | |

| | | | | | | | |

| | | | Personal Products — 0.3% | | | | |

| | 40,000 | | | Avon International Operations, Inc., 7.875%, 08/15/22 (a) | | | 42,546 | |

| | 55,000 | | | Edgewell Personal Care Co., 4.700%, 05/19/21 | | | 58,263 | |

| | | | | | | | |

| | | | | | | 100,809 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 940,307 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 5 | |

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (continued)

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Energy — 14.2% | | | | |

| | | | Energy Equipment & Services — 1.4% | | | | |

| | | | Ensco plc (United Kingdom), | | | | |

| | 38,000 | | | 5.750%, 10/01/44 | | | 29,640 | |

| | 36,000 | | | 8.000%, 01/31/24 (a) | | | 36,900 | |

| | | | Nabors Industries, Inc., | | | | |

| | 26,000 | | | 5.000%, 09/15/20 | | | 27,157 | |

| | 85,000 | | | 6.150%, 02/15/18 | | | 88,612 | |

| | 70,000 | | | SESI LLC, 7.125%, 12/15/21 | | | 71,925 | |

| | | | Transocean, Inc. (Cayman Islands), | | | | |

| | 28,000 | | | 6.000%, 03/15/18 | | | 28,700 | |

| | 40,000 | | | 6.800%, 03/15/38 | | | 32,800 | |

| | 115,000 | | | 9.000%, 07/15/23 (a) | | | 123,912 | |

| | | | | | | | |

| | | | | | | 439,646 | |

| | | | | | | | |

| | | | Oil & Gas Service & Equipment — 0.1% | | | | |

| | 27,000 | | | Rowan Co., Inc., 4.875%, 06/01/22 | | | 25,785 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 12.4% | | | | |

| | | | Antero Resources Corp., | | | | |

| | 100,000 | | | 5.125%, 12/01/22 | | | 100,500 | |

| | 100,000 | | | 5.375%, 11/01/21 | | | 102,250 | |

| | 40,000 | | | 5.625%, 06/01/23 | | | 40,500 | |

| | | | Carrizo Oil & Gas, Inc., | | | | |

| | 55,000 | | | 6.250%, 04/15/23 | | | 55,688 | |

| | 35,000 | | | 7.500%, 09/15/20 | | | 36,138 | |

| | | | Cenovus Energy, Inc. (Canada), | | | | |

| | 48,000 | | | 5.700%, 10/15/19 | | | 51,628 | |

| | 125,000 | | | 6.750%, 11/15/39 | | | 141,287 | |

| | | | Cheniere Corpus Christi Holdings LLC, | | | | |

| | 54,000 | | | 5.875%, 03/31/25 (a) | | | 57,105 | |

| | 115,000 | | | 7.000%, 06/30/24 (a) | | | 128,800 | |

| | 220,000 | | | Chesapeake Energy Corp., 8.000%, 12/15/22 (a) | | | 232,650 | |

| | | | Concho Resources, Inc., | | | | |

| | 25,000 | | | 5.500%, 10/01/22 | | | 25,875 | |

| | 140,000 | | | 5.500%, 04/01/23 | | | 144,900 | |

| | 170,000 | | | CONSOL Energy, Inc., 5.875%, 04/15/22 | | | 165,750 | |

| | | | Continental Resources, Inc., | | | | |

| | 36,000 | | | 3.800%, 06/01/24 | | | 33,345 | |

| | 100,000 | | | 4.500%, 04/15/23 | | | 97,937 | |

| | 180,000 | | | 5.000%, 09/15/22 | | | 183,600 | |

| | 39,000 | | | Crestwood Midstream Partners LP/Crestwood Midstream Finance Corp., 6.250%, 04/01/23 | | | 40,463 | |

| | 35,000 | | | DCP Midstream Operating LP, 5.350%, 03/15/20 (a) | | | 36,663 | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — continued | | | | |

| | | | Energy Transfer Equity LP, | | | | |

| | 25,000 | | | 5.500%, 06/01/27 | | | 26,469 | |

| | 100,000 | | | 5.875%, 01/15/24 | | | 107,500 | |

| | 105,000 | | | 7.500%, 10/15/20 | | | 117,994 | |

| | 65,000 | | | EnLink Midstream Partners LP, 4.150%, 06/01/25 | | | 64,952 | |

| | 65,000 | | | Genesis Energy LP/Genesis Energy Finance Corp., 6.750%, 08/01/22 | | | 67,762 | |

| | 35,000 | | | Gulfport Energy Corp., 6.000%, 10/15/24 (a) | | | 34,825 | |

| | | | MEG Energy Corp. (Canada), | | | | |

| | 39,000 | | | 6.375%, 01/30/23 (a) | | | 34,612 | |

| | 26,000 | | | 6.500%, 01/15/25 (a) | | | 25,415 | |

| | 45,000 | | | 7.000%, 03/31/24 (a) | | | 40,500 | |

| | 30,000 | | | Murphy Oil Corp., 6.875%, 08/15/24 | | | 32,115 | |

| | | | Newfield Exploration Co., | | | | |

| | 90,000 | | | 5.625%, 07/01/24 | | | 96,300 | |

| | 26,000 | | | 5.750%, 01/30/22 | | | 27,755 | |

| | 100,000 | | | Oasis Petroleum Inc., 6.875%, 03/15/22 | | | 102,000 | |

| | 35,000 | | | Parsley Energy LLC/Parsley Finance Corp., 5.375%, 01/15/25 (a) | | | 35,525 | |

| | | | QEP Resources, Inc., | | | | |

| | 35,000 | | | 5.250%, 05/01/23 | | | 34,475 | |

| | 55,000 | | | 6.875%, 03/01/21 | | | 58,162 | |

| | | | Range Resources Corp., | | | | |

| | 65,000 | | | 4.875%, 05/15/25 | | | 61,587 | |

| | 40,000 | | | 5.000%, 03/15/23 (a) | | | 38,750 | |

| | 80,000 | | | Rice Energy, Inc., 6.250%, 05/01/22 | | | 81,600 | |

| | 26,000 | | | RSP Permian, Inc., 6.625%, 10/01/22 | | | 27,495 | |

| | 60,000 | | | Seven Generations Energy Ltd. (Canada), 8.250%, 05/15/20 (a) | | | 63,150 | |

| | 30,000 | | | SM Energy Co., 6.125%, 11/15/22 | | | 30,225 | |

| | | | Southwestern Energy Co., | | | | |

| | 36,000 | | | 4.100%, 03/15/22 | | | 31,995 | |

| | 90,000 | | | 4.950%, 01/23/25 | | | 86,400 | |

| | | | Sunoco LP/Sunoco Finance Corp., | | | | |

| | 70,000 | | | 6.250%, 04/15/21 | | | 71,050 | |

| | 28,000 | | | 6.375%, 04/01/23 | | | 28,350 | |

| | | | Targa Resources Partners LP/Targa Resources Partners Finance Corp., | | | | |

| | 65,000 | | | 4.125%, 11/15/19 | | | 66,137 | |

| | 35,000 | | | 6.750%, 03/15/24 | | | 38,238 | |

| | | | Tesoro Corp., | | | | |

| | 40,000 | | | 4.750%, 12/15/23 (a) | | | 41,400 | |

| | 26,000 | | | 5.125%, 12/15/26 (a) | | | 27,495 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Oil, Gas & Consumable Fuels — continued | | | | |

| | | | Tesoro Logistics LP/Tesoro Logistics Finance Corp., | | | | |

| | 28,000 | | | 6.125%, 10/15/21 | | | 29,225 | |

| | 70,000 | | | 6.250%, 10/15/22 | | | 74,900 | |

| | | | Whiting Petroleum Corp., | | | | |

| | 85,000 | | | 5.000%, 03/15/19 | | | 85,744 | |

| | 32,000 | | | 5.750%, 03/15/21 | | | 31,840 | |

| | | | Williams Co., Inc. (The), | | | | |

| | 30,000 | | | 3.700%, 01/15/23 | | | 29,400 | |

| | 115,000 | | | 4.550%, 06/24/24 | | | 116,725 | |

| | | | WPX Energy, Inc., | | | | |

| | 100,000 | | | 6.000%, 01/15/22 | | | 102,375 | |

| | 30,000 | | | 8.250%, 08/01/23 | | | 33,712 | |

| | | | | | | | |

| | | | | | | 3,779,233 | |

| | | | | | | | |

| | | | Refining & Marketing — 0.2% | | | | |

| | 60,000 | | | PBF Holding Co. LLC/PBF Finance Corp., 8.250%, 02/15/20 | | | 61,350 | |

| | | | | | | | |

| | | | Utilities — 0.1% | | | | |

| | 40,000 | | | NGL Energy Partners LP/NGL Energy Finance Corp., 7.500%, 11/01/23 (a) | | | 42,100 | |

| | | | | | | | |

| | | | Total Energy | | | 4,348,114 | |

| | | | | | | | |

| | | | Financials — 6.7% | | | | |

| | | | Banks — 4.1% | | | | |

| | 100,000 | | | Credit Agricole S.A. (France), VAR, 8.375%, 10/31/19 (a) (d) | | | 110,500 | |

| | 180,000 | | | Lloyds Bank plc (United Kingdom), VAR, 12.000%, 12/16/24 (a) (d) | | | 241,830 | |

| | | | CIT Group, Inc., | | | | |

| | 46,000 | | | 5.000%, 08/15/22 | | | 48,760 | |

| | 25,000 | | | 5.250%, 03/15/18 | | | 25,834 | |

| | 160,000 | | | 5.500%, 02/15/19 (a) | | | 168,501 | |

| | 100,000 | | | Dresdner Funding Trust I, 8.151%, 06/30/31 (a) | | | 117,750 | |

| | 200,000 | | | Intesa Sanpaolo SpA MTN (Italy), 5.017%, 06/26/24 (a) | | | 188,142 | |

| | | | Royal Bank of Scotland Group plc (United Kingdom), | | | | |

| | 100,000 | | | 5.125%, 05/28/24 | | | 101,215 | |

| | 25,000 | | | 6.000%, 12/19/23 | | | 26,547 | |

| | 205,000 | | | 6.125%, 12/15/22 | | | 217,933 | |

| | | | | | | | |

| | | | | | | 1,247,012 | |

| | | | | | | | |

| | | | Capital Markets — 0.3% | | | | |

| | 70,000 | | | MSCI, Inc., 5.250%, 11/15/24 (a) | | | 73,850 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Consumer Finance — 1.6% | | | | |

| | | | Navient Corp. MTN, | | | | |

| | 54,000 | | | 8.000%, 03/25/20 | | | 58,583 | |

| | 195,000 | | | 8.450%, 06/15/18 | | | 208,406 | |

| | | | OneMain Financial Holdings LLC, | | | | |

| | 26,000 | | | 6.750%, 12/15/19 (a) | | | 27,219 | |

| | 70,000 | | | 7.250%, 12/15/21 (a) | | | 73,150 | |

| | | | Springleaf Finance Corp., | | | | |

| | 26,000 | | | 5.250%, 12/15/19 | | | 26,162 | |

| | 90,000 | | | 8.250%, 12/15/20 | | | 98,888 | |

| | | | | | | | |

| | | | | | | 492,408 | |

| | | | | | | | |

| | | | Diversified Financial Services — 0.2% | | | | |

| | 65,000 | | | Leucadia National Corp., 5.500%, 10/18/23 | | | 69,128 | |

| | | | | | | | |

| | | | Financial Services — 0.5% | | | | |

| | 125,000 | | | Goldman Sachs Capital I, 6.345%, 02/15/34 | | | 150,978 | |

| | | | | | | | |

| | | | Total Financials | | | 2,033,376 | |

| | | | | | | | |

| | | | Health Care — 6.3% | | | | |

| | | | Health Care Equipment & Supplies — 0.6% | | | | |

| | 90,000 | | | Hologic, Inc., 5.250%, 07/15/22 (a) | | | 93,825 | |

| | | | Mallinckrodt International Finance S.A./Mallinckrodt CB LLC (Luxembourg), | | | | |

| | 26,000 | | | 5.625%, 10/15/23 (a) | | | 24,960 | |

| | 80,000 | | | 5.750%, 08/01/22 (a) | | | 78,400 | |

| | | | | | | | |

| | | | | | | 197,185 | |

| | | | | | | | |

| | | | Health Care Providers & Services — 5.1% | | | | |

| | 55,000 | | | Acadia Healthcare Co., Inc., 5.625%, 02/15/23 | | | 57,200 | |

| | | | Centene Corp., | | | | |

| | 44,000 | | | 4.750%, 01/15/25 | | | 45,265 | |

| | 125,000 | | | 5.625%, 02/15/21 | | | 131,563 | |

| | | | DaVita, Inc., | | | | |

| | 54,000 | | | 5.000%, 05/01/25 | | | 54,334 | |

| | 160,000 | | | 5.125%, 07/15/24 | | | 163,300 | |

| | | | Envision Healthcare Corp., | | | | |

| | 26,000 | | | 5.125%, 07/01/22 (a) | | | 26,617 | |

| | 100,000 | | | 5.625%, 07/15/22 | | | 104,125 | |

| | | | Fresenius Medical Care US Finance II, Inc., | | | | |

| | 70,000 | | | 5.625%, 07/31/19 (a) | | | 74,725 | |

| | 26,000 | | | 5.875%, 01/31/22 (a) | | | 28,373 | |

| | | | HCA, Inc., | | | | |

| | 25,000 | | | 5.000%, 03/15/24 | | | 26,344 | |

| | 96,000 | | | 5.375%, 02/01/25 | | | 100,440 | |

| | 275,000 | | | 6.500%, 02/15/20 | | | 301,757 | |

| | 110,000 | | | HealthSouth Corp., 5.750%, 11/01/24 | | | 112,200 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 7 | |

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (continued)

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Health Care Providers & Services — continued | | | | |

| | 100,000 | | | LifePoint Health, Inc., 5.500%, 12/01/21 | | | 104,062 | |

| | | | Tenet Healthcare Corp., | | | | |

| | 165,000 | | | 6.000%, 10/01/20 | | | 174,900 | |

| | 38,000 | | | 6.250%, 11/01/18 | | | 40,233 | |

| | | | | | | | |

| | | | | | | 1,545,438 | |

| | | | | | | | |

| | | | Pharmaceuticals — 0.6% | | | | |

| | 200,000 | | | Endo Ltd./Endo Finance LLC/Endo Finco, Inc. (Ireland), 6.000%, 07/15/23(a) | | | 184,000 | |

| | | | | | | | |

| | | | Total Health Care | | | 1,926,623 | |

| | | | | | | | |

| | | | Industrials — 9.2% | | | | |

| | | | Aerospace & Defense — 2.4% | | | | |

| | | | Arconic, Inc., | | | | |

| | 46,000 | | | 5.125%, 10/01/24 | | | 47,495 | |

| | 115,000 | | | 5.400%, 04/15/21 | | | 123,176 | |

| | | | Bombardier, Inc. (Canada), | | | | |

| | 135,000 | | | 7.500%, 03/15/25 (a) | | | 139,894 | |

| | 52,000 | | | 8.750%, 12/01/21 (a) | | | 57,590 | |

| | | | Huntington Ingalls Industries, Inc., | | | | |

| | 25,000 | | | 5.000%, 12/15/21 (a) | | | 26,125 | |

| | 55,000 | | | 5.000%, 11/15/25 (a) | | | 57,813 | |

| | 110,000 | | | KLX, Inc., 5.875%, 12/01/22 (a) | | | 115,797 | |

| | | | TransDigm, Inc., | | | | |

| | 42,000 | | | 6.000%, 07/15/22 | | | 43,207 | |

| | 110,000 | | | 6.500%, 07/15/24 | | | 113,575 | |

| | | | | | | | |

| | | | | | | 724,672 | |

| | | | | | | | |

| | | | Air Freight & Logistics — 0.5% | | | | |

| | 145,000 | | | XPO Logistics, Inc., 6.500%, 06/15/22 (a) | | | 152,250 | |

| | | | | | | | |

| | | | Airlines — 0.2% | | | | |

| | 65,000 | | | American Airlines Group, Inc., 5.500%, 10/01/19 (a) | | | 67,438 | |

| | | | | | | | |

| | | | Auto Components — 0.8% | | | | |

| | | | Icahn Enterprises LP/Icahn Enterprises Finance Corp., | | | | |

| | 46,000 | | | 4.875%, 03/15/19 | | | 46,747 | |

| | 25,000 | | | 5.875%, 02/01/22 | | | 25,500 | |

| | 155,000 | | | 6.000%, 08/01/20 | | | 161,202 | |

| | | | | | | | |

| | | | | | | 233,449 | |

| | | | | | | | |

| | | | Commercial Services & Supplies — 0.6% | | | | |

| | | | Clean Harbors, Inc., | | | | |

| | 75,000 | | | 5.125%, 06/01/21 | | | 76,687 | |

| | 28,000 | | | 5.250%, 08/01/20 | | | 28,602 | |

| | 90,000 | | | West Corp., 5.375%, 07/15/22 (a) | | | 86,445 | |

| | | | | | | | |

| | | | | | | 191,734 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | |

| | | | Construction & Engineering — 0.5% | | | | |

| | | | AECOM, | | | | |

| | 64,000 | | | 5.125%, 03/15/27 (a) | | | 65,034 | |

| | 28,000 | | | 5.750%, 10/15/22 | | | 29,505 | |

| | 70,000 | | | 5.875%, 10/15/24 | | | 76,475 | |

| | | | | | | | |

| | | | | | | 171,014 | |

| | | | | | | | |

| | | | Electrical Equipment — 0.8% | | | | |

| | 26,000 | | | Sensata Technologies BV (Netherlands), 5.000%, 10/01/25 (a) | | | 26,390 | |

| | 200,000 | | | Sensata Technologies UK Financing Co. plc (United Kingdom), 6.250%, 02/15/26 (a) | | | 215,500 | |

| | | | | | | | |

| | | | | | | 241,890 | |

| | | | | | | | |

| | | | Machinery — 0.3% | | | | |

| | | | CNH Industrial Capital LLC, | | | | |

| | 25,000 | | | 3.625%, 04/15/18 | | | 25,438 | |

| | 55,000 | | | 4.375%, 11/06/20 | | | 57,200 | |

| | | | | | | | |

| | | | | | | 82,638 | |

| | | | | | | | |

| | | | Media — 0.8% | | | | |

| | | | Nielsen Finance LLC/Nielsen Finance Co., | | | | |

| | 28,000 | | | 4.500%, 10/01/20 | | | 28,560 | |

| | 210,000 | | | 5.000%, 04/15/22 (a) | | | 215,775 | |

| | | | | | | | |

| | | | | | | 244,335 | |

| | | | | | | | |

| | | | Road & Rail — 1.5% | | | | |

| | 200,000 | | | Ashtead Capital, Inc., 6.500%, 07/15/22 (a) | | | 209,181 | |

| | 60,000 | | | Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 5.500%, 04/01/23 | | | 60,000 | |

| | 80,000 | | | Florida East Coast Holdings Corp., 6.750%, 05/01/19 (a) | | | 82,300 | |

| | 120,000 | | | Hertz Corp. (The), 5.500%, 10/15/24 (a) | | | 108,300 | |

| | | | | | | | |

| | | | | | | 459,781 | |

| | | | | | | | |

| | | | Trading Companies & Distributors — 0.8% | | | | |

| | | | HD Supply, Inc., | | | | |

| | 115,000 | | | 5.250%, 12/15/21 (a) | | | 121,325 | |

| | 36,000 | | | 5.750%, 04/15/24 (a) | | | 38,070 | |

| | | | United Rentals North America, Inc., | | | | |

| | 36,000 | | | 4.625%, 07/15/23 | | | 36,954 | |

| | 42,000 | | | 6.125%, 06/15/23 | | | 44,100 | |

| | | | | | | | |

| | | | | | | 240,449 | |

| | | | | | | | |

| | | | Total Industrials | | | 2,809,650 | |

| | | | | | | | |

| | | | Information Technology — 8.1% | | | | |

| | | | Communications Equipment — 1.3% | | | | |

| | 125,000 | | | Alcatel-Lucent USA, Inc., 6.450%, 03/15/29 | | | 138,125 | |

| | 135,000 | | | CommScope Technologies Finance LLC, 6.000%, 06/15/25 (a) | | | 144,450 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Communications Equipment — continued | | | | |

| | 25,000 | | | CommScope, Inc., 5.500%, 06/15/24 (a) | | | 26,187 | |

| | 90,000 | | | Nokia OYJ (Finland), 5.375%, 05/15/19 | | | 95,175 | |

| | | | | | | | |

| | | | | | | 403,937 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 0.5% | | | | |

| | 55,000 | | | CDW LLC/CDW Finance Corp., 6.000%, 08/15/22 | | | 58,231 | |

| | 95,000 | | | Zebra Technologies Corp., 7.250%, 10/15/22 | | | 102,773 | |

| | | | | | | | |

| | | | | | | 161,004 | |

| | | | | | | | |

| | | | HealthCare Technology — 0.7% | | | | |

| | 200,000 | | | Quintiles IMS, Inc., 5.000%, 10/15/26 (a) | | | 203,000 | |

| | | | | | | | |

| | | | Internet Software & Services — 0.2% | | | | |

| | 65,000 | | | VeriSign, Inc., 4.625%, 05/01/23 | | | 66,300 | |

| | | | | | | | |

| | | | IT Services — 1.5% | | | | |

| | | | First Data Corp., | | | | |

| | 25,000 | | | 5.000%, 01/15/24 (a) | | | 25,531 | |

| | 80,000 | | | 5.750%, 01/15/24 (a) | | | 82,900 | |

| | 310,000 | | | 7.000%, 12/01/23 (a) | | | 333,250 | |

| | | | | | | | |

| | | | | | | 441,681 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 1.2% | | | | |

| | | | Micron Technology, Inc., | | | | |

| | 36,000 | | | 5.250%, 08/01/23 (a) | | | 36,315 | |

| | 105,000 | | | 5.500%, 02/01/25 | | | 108,412 | |

| | 200,000 | | | NXP BV/NXP Funding LLC (Netherlands), 4.125%, 06/01/21 (a) | | | 207,620 | |

| | | | | | | | |

| | | | | | | 352,347 | |

| | | | | | | | |

| | | | Software — 0.4% | | | | |

| | 41,000 | | | Nuance Communications, Inc., 5.375%, 08/15/20 (a) | | | 41,947 | |

| | 70,000 | | | Open Text Corp. (Canada), 5.625%, 01/15/23 (a) | | | 73,413 | |

| | | | | | | | |

| | | | | | | 115,360 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals — 1.9% | | | | |

| | | | EMC Corp., | | | | |

| | 92,000 | | | 1.875%, 06/01/18 | | | 91,631 | |

| | 25,000 | | | 2.650%, 06/01/20 | | | 24,377 | |

| | | | NCR Corp., | | | | |

| | 25,000 | | | 5.000%, 07/15/22 | | | 25,594 | |

| | 60,000 | | | 6.375%, 12/15/23 | | | 64,125 | |

| | 330,000 | | | Western Digital Corp., 10.500%, 04/01/24 | | | 385,688 | |

| | | | | | | | |

| | | | | | | 591,415 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Wireless Telecommunication — 0.4% | | | | |

| | | | Hughes Satellite Systems Corp., | | | | |

| | 90,000 | | | 6.500%, 06/15/19 | | | 97,452 | |

| | 32,000 | | | 7.625%, 06/15/21 | | | 35,480 | |

| | | | | | | | |

| | | | | | | 132,932 | |

| | | | | | | | |

| | | | Total Information Technology | | | 2,467,976 | |

| | | | | | | | |

| | | | Materials — 8.4% | | | | |

| | | | Chemicals — 2.4% | | | | |

| | | | Ashland LLC, | | | | |

| | 26,000 | | | 3.875%, 04/15/18 | | | 26,455 | |

| | 100,000 | | | 4.750%, 08/15/22 | | | 103,800 | |

| | | | Blue Cube Spinco, Inc., | | | | |

| | 65,000 | | | 9.750%, 10/15/23 | | | 77,512 | |

| | 25,000 | | | 10.000%, 10/15/25 | | | 30,375 | |

| | | | CF Industries, Inc., | | | | |

| | 36,000 | | | 5.375%, 03/15/44 | | | 31,950 | |

| | 38,000 | | | 6.875%, 05/01/18 | | | 39,871 | |

| | 38,000 | | | 7.125%, 05/01/20 | | | 41,658 | |

| | | | Chemours Co. (The), | | | | |

| | 120,000 | | | 6.625%, 05/15/23 | | | 127,950 | |

| | 26,000 | | | 7.000%, 05/15/25 | | | 28,243 | |

| | 60,000 | | | Huntsman International LLC, 4.875%, 11/15/20 | | | 62,400 | |

| | 100,000 | | | Platform Specialty Products Corp., 6.500%, 02/01/22 (a) | | | 104,500 | |

| | 60,000 | | | WR Grace & Co.-Conn, 5.125%, 10/01/21 (a) | | | 63,150 | |

| | | | | | | | |

| | | | | | | 737,864 | |

| | | | | | | | |

| | | | Containers & Packaging — 1.1% | | | | |

| | | | Ball Corp., | | | | |

| | 36,000 | | | 4.375%, 12/15/20 | | | 37,800 | |

| | 90,000 | | | 5.250%, 07/01/25 | | | 95,512 | |

| | 60,000 | | | Berry Plastics Corp., 5.125%, 07/15/23 | | | 61,800 | |

| | 90,000 | | | Crown Americas LLC/Crown Americas Capital Corp IV, 4.500%, 01/15/23 | | | 92,363 | |

| | 60,000 | | | Owens-Brockway Glass Container, Inc., 5.875%, 08/15/23 (a) | | | 64,425 | |

| | | | | | | | |

| | | | | | | 351,900 | |

| | | | | | | | |

| | | | Electrical Equipment — 0.6% | | | | |

| | | | Novelis Corp., | | | | |

| | 63,000 | | | 5.875%, 09/30/26 (a) | | | 64,811 | |

| | 105,000 | | | 6.250%, 08/15/24 (a) | | | 111,300 | |

| | | | | | | | |

| | | | | | | 176,111 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 9 | |

JPMorgan Disciplined High Yield ETF

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF FEBRUARY 28, 2017 (continued)

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Metals & Mining — 4.3% | | | | |

| | 200,000 | | | Alcoa Nederland Holding BV (Netherlands), 6.750%, 09/30/24 (a) | | | 217,500 | |

| | | | Allegheny Technologies, Inc., | | | | |

| | 25,000 | | | 5.950%, 01/15/21 | | | 25,110 | |

| | 25,000 | | | 7.875%, 08/15/23 | | | 25,813 | |

| | 100,000 | | | Anglo American Capital plc (United Kingdom), 9.375%, 04/08/19 (a) | | | 113,250 | |

| | | | ArcelorMittal (Luxembourg), | | | | |

| | 25,000 | | | 7.000%, 02/25/22 | | | 28,438 | |

| | 36,000 | | | 7.500%, 03/01/41 | | | 40,860 | |

| | 135,000 | | | 8.000%, 10/15/39 | | | 157,275 | |

| | | | First Quantum Minerals Ltd. (Canada), | | | | |

| | 100,000 | | | 6.750%, 02/15/20 (a) | | | 102,500 | |

| | 42,000 | | | 7.000%, 02/15/21 (a) | | | 43,496 | |

| | | | Freeport-McMoRan, Inc., | | | | |

| | 30,000 | | | 3.550%, 03/01/22 | | | 27,822 | |

| | 175,000 | | | 3.875%, 03/15/23 | | | 161,000 | |

| | 68,000 | | | 5.450%, 03/15/43 | | | 58,140 | |

| | 25,000 | | | Hudbay Minerals, Inc. (Canada), 7.625%, 01/15/25 (a) | | | 27,312 | |

| | 60,000 | | | Steel Dynamics, Inc., 5.125%, 10/01/21 | | | 61,875 | |

| | | | Teck Resources Ltd. (Canada), | | | | |

| | 26,000 | | | 4.750%, 01/15/22 | | | 27,008 | |

| | 90,000 | | | 6.250%, 07/15/41 | | | 93,375 | |

| | 90,000 | | | United States Steel Corp., 8.375%, 07/01/21 (a) | | | 101,250 | |

| | | | | | | | |

| | | | | | | 1,312,024 | |

| | | | | | | | |

| | | | Total Materials | | | 2,577,899 | |

| | | | | | | | |

| | | | Real Estate — 2.1% | | | | |

| | | | Equity Real Estate Investment Trusts (REITs) — 1.7% | | | | |

| | 100,000 | | | Communications Sales & Leasing, Inc./CSL Capital LLC, 8.250%, 10/15/23 | | | 108,375 | |

| | | | Equinix, Inc., | | | | |

| | 36,000 | | | 5.375%, 04/01/23 | | | 37,350 | |

| | 100,000 | | | 5.875%, 01/15/26 | | | 106,812 | |

| | | | Iron Mountain, Inc., | | | | |

| | 25,000 | | | 5.750%, 08/15/24 | | | 25,656 | |

| | 90,000 | | | 6.000%, 10/01/20 (a) | | | 94,526 | |

| | 25,000 | | | 6.000%, 08/15/23 | | | 26,460 | |

| | | | SBA Communications Corp., | | | | |

| | 26,000 | | | 4.875%, 07/15/22 | | | 26,553 | |

| | 100,000 | | | 4.875%, 09/01/24 (a) | | | 99,490 | |

| | | | | | | | |

| | | | | | | 525,222 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 0.4% | | | | |

| | | | GLP Capital LP/GLP Financing II, Inc., | | | | |

| | 90,000 | | | 4.875%, 11/01/20 | | | 94,500 | |

| | 36,000 | | | 5.375%, 04/15/26 | | | 37,665 | |

| | | | | | | | |

| | | | | | | 132,165 | |

| | | | | | | | |

| | | | Total Real Estate | | | 657,387 | |

| | | | | | | | |

| | | | Telecommunication Services — 12.2% | | | | |

| | | | Diversified Telecommunication Services — 7.3% | | | | |

| | | | CenturyLink, Inc., | | | | |

| | 125,000 | | | 5.800%, 03/15/22 | | | 129,063 | |

| | 46,000 | | | 6.450%, 06/15/21 | | | 49,019 | |

| | 135,000 | | | Embarq Corp., 7.995%, 06/01/36 | | | 135,443 | |

| | | | Frontier Communications Corp., | | | | |

| | 80,000 | | | 10.500%, 09/15/22 | | | 83,300 | |

| | 330,000 | | | 11.000%, 09/15/25 | | | 331,650 | |

| | | | Level 3 Financing, Inc., | | | | |

| | 90,000 | | | 5.375%, 08/15/22 | | | 93,307 | |

| | 32,000 | | | 5.375%, 01/15/24 | | | 32,880 | |

| | | | SFR Group S.A. (France), | | | | |

| | 200,000 | | | 6.000%, 05/15/22 (a) | | | 207,500 | |

| | 475,000 | | | 7.375%, 05/01/26 (a) | | | 492,219 | |

| | 36,000 | | | Telecom Italia Capital S.A. (Luxembourg), 7.721%, 06/04/38 | | | 39,825 | |

| | 200,000 | | | Telecom Italia SpA (Italy), 5.303%, 05/30/24 (a) | | | 203,500 | |

| | 255,000 | | | Wind Acquisition Finance S.A. (Luxembourg), 7.375%, 04/23/21 (a) | | | 265,518 | |

| | | | Zayo Group LLC/Zayo Capital, Inc., | | | | |

| | 130,000 | | | 6.000%, 04/01/23 | | | 137,475 | |

| | 32,000 | | | 6.375%, 05/15/25 | | | 34,480 | |

| | | | | | | | |

| | | | | | | 2,235,179 | |

| | | | | | | | |

| | | | Wireless Telecommunication Services — 4.9% | | | | |

| | 200,000 | | | Millicom International Cellular S.A. (Luxembourg), 6.625%, 10/15/21 (a) | | | 209,500 | |

| | 225,000 | | | SoftBank Group Corp. (Japan), 4.500%, 04/15/20 (a) | | | 232,594 | |

| | 110,000 | | | Sprint Communications, Inc., 9.000%, 11/15/18 (a) | | | 120,450 | |

| | 390,000 | | | Sprint Corp., 7.875%, 09/15/23 | | | 433,875 | |

| | | | T-Mobile USA, Inc., | | | | |

| | 180,000 | | | 6.500%, 01/15/26 | | | 197,775 | |

| | 64,000 | | | 6.625%, 04/01/23 | | | 67,968 | |

| | 200,000 | | | VimpelCom Holdings BV (Netherlands), 7.504%, 03/01/22 (a) | | | 224,202 | |

| | | | | | | | |

| | | | | | | 1,486,364 | |

| | | | | | | | |

| | | | Total Telecommunication Services | | | 3,721,543 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | |

PRINCIPAL AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Corporate Bonds — continued | | | | |

| | | | Utilities — 2.8% | | | | |

| | | | Electric Utilities — 1.1% | | | | |

| | 110,000 | | | Emera, Inc. (Canada), VAR, 6.750%, 06/15/76 | | | 120,450 | |

| | 200,000 | | | Enel SpA (Italy), VAR,

8.750%, 09/24/73 (a) | | | 230,500 | |

| | | | | | | | |

| | | | | | | 350,950 | |

| | | | | | | | |

| | | | Gas Utilities — 0.2% | | | | |

| | | | AmeriGas Partners LP/AmeriGas Finance Corp., | | | | |

| | 26,000 | | | 5.500%, 05/20/25 | | | 26,358 | |

| | 40,000 | | | 5.875%, 08/20/26 | | | 41,300 | |

| | | | | | | | |

| | | | | | | 67,658 | |

| | | | | | | | |

| | | | Independent Power and Renewable Electricity Producers — 1.5% | | | | |

| | 85,000 | | | AES Corp., 7.375%, 07/01/21 | | | 95,838 | |

| | 28,000 | | | DPL, Inc., 7.250%, 10/15/21 | | | 29,820 | |

| | | | Calpine Corp., | | | | |

| | 46,000 | | | 5.375%, 01/15/23 | | | 46,460 | |

| | 140,000 | | | 5.750%, 01/15/25 | | | 138,530 | |

| | | | NRG Energy, Inc., | | | | |

| | 115,000 | | | 6.625%, 01/15/27 (a) | | | 112,987 | |

| | 36,000 | | | 7.250%, 05/15/26 | | | 37,035 | |

| | | | | | | | |

| | | | | | | 460,670 | |

| | | | | | | | |

| | | | Total Utilities | | | 879,278 | |

| | | | | | | | |

| | | | Total Corporate Bonds

(Cost $29,462,405) | | | 29,851,405 | |

| | | | | | | | |

| | | | | | | | |

SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | Short-Term Investment — 0.9% | | | | |

| | | | Investment Company — 0.9% | | | | |

| | 266,217 | | | JPMorgan U.S. Government Money Market Fund, Institutional Class Shares, 0.440% (b) (c)

(Cost $266,217) | | | 266,217 | |

| | | | | | | | |

| | | | Total Investments — 98.5%

(Cost $29,728,622) | | | 30,117,622 | |

| | | | | | | | |

| | | | Other Assets in Excess of

Liabilities — 1.5% | | | 456,446 | |

| | | | | | | | |

| | | | NET ASSETS — 100.0% | | $ | 30,574,068 | |

| | | | | | | | |

Percentages indicated are based on net assets.

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS

| | |

| MTN | | — Medium Term Note |

| REIT | | — Real Estate Investment Trust |

| VAR | | — Variable Rate Security. The interest rate shown is the rate in effect as of February 28, 2017. |

| |

| (a) | | — Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. Unless otherwise indicated , this security has been determined to be liquid under procedures established by the Board of Trustees and may be resold in transactions exempt from registration, normally to qualify institutional buyers. |

| |

| (b) | | — Investment in affiliate. Fund is registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

| |

| (c) | | — The rate shown is the current yield as of February 28, 2017. |

| |

| (d) | | — Securities are perpetual and, thus, do not have a predetermined maturity date. The coupon rate for these securities are fixed for a period of time and may be structured to adjust thereafter. The date shown, if applicable, reflects the next call date. The coupon rate shown is the rate in effect as of February 28, 2017. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 11 | |

STATEMENT OF ASSETS AND LIABILITIES

AS OF FEBRUARY 28, 2017

| | | | |

| | | JPMorgan

Disciplined High

Yield ETF | |

ASSETS: | | | | |

Investments in non-affiliates, at value | | $ | 29,851,405 | |

Investment in affiliates, at value | | | 266,217 | |

| | | | |

Total Investment securities, at value | | | 30,117,622 | |

Restricted Cash | | | 250 | |

Receivables: | | | | |

Interest from non-affiliates | | | 477,125 | |

Due from Adviser | | | 33,562 | |

Deferred offering costs | | | 26,715 | |

Prepaid Expenses | | | 267 | |

| | | | |

Total Assets | | | 30,655,541 | |

| | | | |

| |

LIABILITIES: | | | | |

Accrued Liabilities: | | | | |

Professional fees | | | 61,374 | |

Accounting fees | | | 8,737 | |

Administration fees | | | 1,727 | |

Trustees’ and Chief Compliance Officer’s fees | | | 1,634 | |

Custodian and Transfer Agent fees | | | 754 | |

Other | | | 7,247 | |

| | | | |

Total Liabilities | | | 81,473 | |

| | | | |

Net Assets | | $ | 30,574,068 | |

| | | | |

| |

NET ASSETS: | | | | |

Paid-in Capital | | $ | 30,223,538 | |

Accumulated undistributed (distributions in excess of) net investment income | | | 4,397 | |

Accumulated net realized gains (losses) | | | (42,867 | ) |

Net unrealized appreciation (depreciation) | | | 389,000 | |

| | | | |

Total Net Assets | | $ | 30,574,068 | |

| | | | |

| |

Outstanding number of shares

(unlimited number of shares authorized — par value $0.0001) | | | 600,000 | |

| | | | |

Net asset value, per share | | $ | 50.96 | |

| | | | |

| |

Cost of investments in non-affiliates | | $ | 29,462,405 | |

Cost of investments in affiliates | | | 266,217 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

STATEMENT OF OPERATIONS

FOR THE PERIOD ENDED FEBRUARY 28, 2017

| | | | |

| | | JPMorgan Disciplined High Yield ETF (a) | |

INVESTMENT INCOME: | | | | |

Interest income from non-affiliates | | $ | 618,584 | |

Dividend income from affiliates | | | 1,754 | |

Foreign taxes withheld | | | (2,275 | ) |

| | | | |

Total Investment Income | | | 618,063 | |

| | | | |

| |

EXPENSES: | | | | |

Investment advisory fees (Note 3.A) | | | 34,591 | |

Administration fees (Note 3.B) | | | 9,801 | |

Trustees’ and Chief Compliance Officer’s fees | | | 3,348 | |

Professional fees | | | 113,372 | |

Printing and mailing costs | | | 2,500 | |

Custodian and Transfer Agent fees | | | 1,577 | |

Registration and filing fees | | | 7,321 | |

Insurance expense | | | 361 | |

Offering costs | | | 11,530 | |

Accounting fees | | | 18,825 | |

Other | | | 2,700 | |

| | | | |

Total expenses | | | 205,926 | |

| | | | |

Less fees waived (Note 3.D) | | | (44,392 | ) |

Less expense reimbursements from affiliates (Note 3.D) | | | (115,805 | ) |

Less expense reimbursements from non-affiliates (Note 3.C) | | | (500 | ) |

| | | | |

Net expenses | | | 45,229 | |

| | | | |

Net investment income (loss) | | | 572,834 | |

| | | | |

| |

REALIZED/UNREALIZED GAINS (LOSSES): | | | | |

Net realized gain (loss) on transactions from: | | | | |

Investments in non-affiliates | | | (41,809 | ) |

| | | | |

Net realized gain (loss) | | | (41,809 | ) |

| | | | |

Change in net unrealized appreciation/depreciation on: | | | | |

Investments in non-affiliates | | | 389,000 | |

| | | | |

Change in net unrealized appreciation/depreciation | | | 389,000 | |

| | | | |

Net realized/unrealized gains (losses) | | | 347,191 | |

| | | | |

Change in net assets resulting from operations | | $ | 920,025 | |

| | | | |

| (a) | Commencement of operations was September 14, 2016. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 13 | |

STATEMENT OF CHANGES IN NET ASSETS

FOR THE PERIOD INDICATED

| | | | |

| | | JPMorgan

Disciplined High

Yield ETF | |

| | | Period Ended

February 28, 2017 (a) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | |

Net investment income (loss) | | $ | 572,834 | |

Net realized gain (loss) | | | (41,809 | ) |

Change in net unrealized appreciation/depreciation | | | 389,000 | |

| | | | |

Change in net assets resulting from operations | | | 920,025 | |

| | | | |

| |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

From net investment income | | | (567,995 | ) |

From net realized gains | | | (1,500 | ) |

| | | | |

Total distributions to shareholders | | | (569,495 | ) |

| | | | |

| |

CAPITAL TRANSACTIONS: | | | | |

Change in net assets resulting from capital transactions | | | 30,223,538 | |

| | | | |

| |

NET ASSETS: | | | | |

Change in net assets | | | 30,574,068 | |

Beginning of period | | | — | |

| | | | |

End of period | | $ | 30,574,068 | |

| | | | |

Accumulated undistributed (distributions in excess of) net investment income | | $ | 4,397 | |

| | | | |

| |

CAPITAL SHARE TRANSACTIONS: | | | | |

Proceeds from shares issued | | $ | 30,223,538 | |

| | | | |

Total change in net assets resulting from capital transactions | | $ | 30,223,538 | |

| | | | |

| |

SHARE TRANSACTIONS: | | | | |

Issued | | | 600,000 | |

| | | | |

Net increase in shares from share transactions | | | 600,000 | |

| | | | |

| (a) | Commencement of operations was September 14, 2016. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

THIS PAGE IS INTENTIONALLY LEFT BLANK

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 15 | |

FINANCIAL HIGHLIGHTS

FOR THE PERIOD INDICATED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Per share operating performance | |

| | | | | | Investment Operations | | | Distributions | | | | |

| | | Net asset

value,

beginning

of period | | | Net

investment

income

(loss) (b) | | | Net realized

and unrealized

gains

(losses) on

investments | | | Total from

investment

operations | | | Net

investment

income | | | Net

realized

gain | | | Total

distributions | | | Net asset

value,

end of period | |

| | | | | |

JPMorgan Disciplined High Yield ETF | | | | | | | | | | | | | | | | | | | | | |

September 14, 2016 (a) through February 28, 2017 | | $ | 50.00 | | | $ | 1.14 | | | $ | 0.96 | | | $ | 2.10 | | | $ | (1.14 | ) | | $ | — | (h) | | $ | (1.14 | ) | | $ | 50.96 | |

| (a) | Commencement of operations. |

| (b) | Calculated based upon average shares outstanding. |

| (c) | Not annualized for periods less than one year. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | Market price total return is calculated assuming an initial investment made at the beginning of the period market price, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. The market price presented to calculate the market price total return is the mid-point of the bid/ask spread at the close of business on the Bats BZX Exchange, Inc. |

| (f) | Annualized for periods less than one year, unless otherwise indicated. |

| (g) | Certain non-recurring expenses incurred by the Fund were not annualized for the period indicated. |

| (h) | Amount rounds to less than $0.005. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental data | |

| | | | | | | | | | | | | Ratios to average net assets (f) | | | | |

Market

price,

end of period | | | Total

return (c)(d) | | |

Market

price total

return (c)(e) | | | Net assets, end of period | | | Net

expenses | | | Net investment income (loss) | | | Expenses without waivers and reimbursements | | | Portfolio turnover

rate (c) | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 51.16 | | |

|

4.24 |

% | | | 4.64 | % | | $ | 30,574,068 | | | | 0.39 | % (g) | | | 4.99 | % | | | 1.74 | % (g) | | | 8 | % |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 17 | |

NOTES TO FINANCIAL STATEMENTS

AS OF FEBRUARY 28, 2017

1. Organization

J.P. Morgan Exchange-Traded Fund Trust (the “Trust”) was formed on February 25, 2010, and is governed by a Declaration of Trust as amended and restated February 19, 2014, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-ended management investment company. JPMorgan Disciplined High Yield ETF (the “Fund” or the “High Yield ETF”) is a separate diversified series of the Trust covered in this report.

The Fund commenced operations on September 14, 2016. The investment objective of the Fund is to seek to provide a high level of income with capital appreciation as a secondary objective.

J.P. Morgan Investment Management Inc. (“JPMIM” or the “Adviser”) an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”) acts as the Adviser and Administrator (the “Administrator”) to the Fund.

Shares of the Fund are listed and traded on the Bats BZX Exchange, Inc. Market prices for the Fund’s shares may be different from their net asset value (“NAV”). The Fund issues and redeems its shares on a continuous basis, through SEI Investments Distribution Co. (the “Distributor” or “SIDCO”), at NAV in large blocks of shares, typically 100,000 shares, referred to as “Creation Units.” Creation Units are issued and redeemed principally in cash. Shares are generally traded in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Only individuals or institutions that have entered into an authorized participant agreement with the Distributor may do business directly with the Fund (each, an “Authorized Participant”).

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of the U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments — The valuation of the investments is in accordance with GAAP and the Fund’s valuation policies set forth by and under the supervision and responsibility of the Board of Trustees (the “Board”), which established the following approach to valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at such unadjusted quoted prices, and (ii) all other investments for which market quotations are not readily available shall be valued at their fair value as determined in good faith by the Board.

The Administrator has established the J.P. Morgan Investment Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Fund’s investments. The Administrator implements the valuation policies of the Fund’s investments, as directed by the Board. The AVC oversees and carries out the policies for the valuation of investments held in the Fund. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight, including but not limited to consideration of macro or security specific events, market events and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the AVC and the Board.

Fixed income instruments are valued based on prices received from approved pricing vendors or third party broker-dealers (collectively referred to as “Pricing Services”). The Pricing Services use multiple valuation techniques to determine the valuation of fixed income instruments. In instances where sufficient market activity exists, the Pricing Services may utilize a market-based approach through which trades or quotes from market makers are used to determine the valuation of these instruments. In instances where sufficient market activity may not exist, the Pricing Services also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or market characteristics in order to estimate the relevant cash flows, which are then discounted to calculate the fair values.

Investments in mutual funds (the “Underlying Funds”) are valued at each Underlying Funds’ NAV per share as of the report date.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the valuation of the Fund’s investments are summarized into the three broad levels listed below.

| • | | Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments. |

| • | | Level 2 — Other significant observable inputs including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs. |

| • | | Level 3 — Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s assumptions in determining the fair value of investments). |

| | | | | | |

| | | |

| 18 | | | | JPMORGAN EXCHANGE-TRADED FUNDS | | FEBRUARY 28, 2017 |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation input as presented on the Schedule of Portfolio Investments:

| | | | | | | | | | | | | | | | |

| | | Level 1 Quoted prices | | | Level 2 Other significant observable inputs | | | Level 3 Significant unobservable inputs | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Corporate Bonds | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | — | | | $ | 7,489,252 | | | $ | — | | | $ | 7,489,252 | |

Consumer Staples | | | — | | | | 940,307 | | | | — | | | | 940,307 | |

Energy | | | — | | | | 4,348,114 | | | | — | | | | 4,348,114 | |

Financials | | | — | | | | 2,033,376 | | | | — | | | | 2,033,376 | |

Health Care | | | — | | | | 1,926,623 | | | | — | | | | 1,926,623 | |

Industrials | | | — | | | | 2,809,650 | | | | — | | | | 2,809,650 | |

Information Technology | | | — | | | | 2,467,976 | | | | — | | | | 2,467,976 | |

Materials | | | — | | | | 2,577,899 | | | | — | | | | 2,577,899 | |

Real Estate | | | — | | | | 657,387 | | | | — | | | | 657,387 | |

Telecommunication Services | | | — | | | | 3,721,543 | | | | — | | | | 3,721,543 | |

Utilities | | | — | | | | 879,278 | | | | — | | | | 879,278 | |

| | | | | | | | | | | | | | | | |

Total Corporate Bonds | | | — | | | | 29,851,405 | | | | — | | | | 29,851,405 | |

| | | | | | | | | | | | | | | | |

Short-Term Investment | | | | | | | | | | | | | | | | |

Investment Company | | | 266,217 | | | | — | | | | — | | | | 266,217 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 266,217 | | | $ | 29,851,405 | | | $ | — | | | $ | 30,117,622 | |

| | | | | | | | | | | | | | | | |

There were no transfers during the period ended February 28, 2017.

B. Restricted Securities — Certain securities held by the Fund may be subject to legal or contractual restrictions on resale. Restricted securities generally are resold in transactions exempt from registration under the Securities Act of 1933 (the “Securities Act”). Disposal of these securities may involve time-consuming negotiations and expense. Prompt sale at the current valuation may be difficult and could adversely affect the net assets of the Fund.

As of February 28, 2017, the Fund had no investments in restricted securities other than securities sold to the Fund under Rule 144A.

C. Offering and Organizational Costs — Total offering costs incurred in connection with the offering of shares of the Fund are amortized on a straight line basis over 12 months from the date the Fund commenced operations. Costs paid in connection with the organization of the Trust, if any, were recorded as an expense at the time it commenced operations. Approximate total offering costs incurred by the Fund were $38,245.

D. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income is determined on the basis of coupon interest accrued using the effective interest method which adjusts for amortization of premiums and accretion of discounts. Dividend income net of foreign taxes withheld, if any, is recorded on the ex-dividend date or when a fund first learns of the dividend.

E. Allocation of Expenses — Expenses directly attributable to the Fund are charged directly to the Fund, while the expenses attributable to more than one fund of the Trust are allocated among the respective funds.

F. Federal Income Taxes — The Fund is treated as a separate taxable entity for Federal income tax purposes. The Fund’s policy is to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized gain on investments. Accordingly, no provision for Federal income tax is necessary. Management has reviewed the Fund’s tax positions for all open tax years and has determined that as of February 28, 2017, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years, or since inception if shorter, remain subject to examination by the Internal Revenue Service.

G. Foreign Taxes — The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

H. Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid monthly. Net realized capital gains, if any, are distributed by the Fund at least annually. The amount of distributions from net investment income and net realized capital gains is

| | | | | | | | |

| | | |

| FEBRUARY 28, 2017 | | JPMORGAN EXCHANGE-TRADED FUNDS | | | | | 19 | |

NOTES TO FINANCIAL STATEMENTS

AS OF FEBRUARY 28, 2017 (continued)

determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment.

The following amounts were reclassified within the capital accounts:

| | | | | | | | |

| | | Undistributed

Net Investment

Income (Loss) | | | Accumulated

Net Realized

Gain (Loss) | |

| | $ | (442 | ) | | $ | 442 | |

The amounts above primarily relate to the redesignation of distributions from short-term gain to ordinary income.