As filed with the Securities and Exchange Commission on February 29, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22394

CHOU AMERICA MUTUAL FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Michael J. McKeen, Principal Financial Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 – December 31, 2015

ITEM 1. REPORT TO STOCKHOLDERS.

CHOU AMERICA MUTUAL FUNDS

Annual Report

December 31, 2015

Fund Adviser:

Chou America Management Inc.

110 Sheppard Ave. East

Suite 301, Box 18

Toronto, Ontario, Canada M2N 6Y8

Toll Free: (877) 755-5188

TABLE OF CONTENTS |

| A Message to Our Shareholders (Unaudited) | 1 |

| Performance Charts and Analysis (Unaudited) | 8 |

| Schedules of Investments | 10 |

| Statements of Assets and Liabilities | 15 |

| Statements of Operations | 16 |

| Statements of Changes in Net Assets | 17 |

| Financial Highlights | 18 |

| Notes to Financial Statements | 20 |

| Report of Independent Registered Public Accounting Firm | 25 |

| Additional Information (Unaudited) | 26 |

CHOU OPPORTUNITY FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

Dear Shareholder,

During the year 2015, the Chou Opportunity Fund (the “Fund”) was down -22.3%, while the S&P 500 Total Return Index (the “S&P 500”) generated a return of 1.4% during the same period. The Fund's past performance is not necessarily an indication of how the Fund will perform in the future.

Portfolio Commentary

Resolute Forest Products

Resolute Forest Products (RFP) is primarily involved in Newsprints, Specialty Papers, Wood Products and Market Pulp. As the downturn in global commodities intensified, RFP was not spared as all four of the company's business segments got hit. Management has concentrated on lowering the cost of every segment but these actions were not enough to compensate for the deterioration of prices in their respective markets.

It is hard for us to believe that RFP is trading as low as $4 per share. At $4 per share it means the market capitalization of the company is selling for less than $400 million dollars. The company has consolidated sales of close to $4 billion and in each of its major business segments, it is a global leader. It is the biggest volume producer of wood products east of the Rockies, the third largest in North America for Market Pulp, the number one producer of newsprint in the world and the largest producer in North America of uncoated mechanical paper and an emerging tissue producer. With the exception of the Wood Products segment, which has revenues of approximately $600 million, the other three segments each have revenues of approximately $1 billion. Each of the 4 business segments could easily fetch at least $400 million in a normal market.

In our opinion, the company's "normalized EBITDA (Earnings before interest, taxes, depreciation and amortization)" is approximately $400 million. In other words, with RFP trading at $4 per share, the market value of the company is being priced for about 1 times normalized EBITDA. The company does have net debt of approximately $365 million, but even if you include net debt, the market is valuing the entire company for less than 2 times normalized EBITDA. It had cash of approximately $300 million a year ago but used approximately $156 million to acquire Atlas Paper and is spending $270 million to convert some of its pulp mills in Calhoun, Tennessee to produce tissue papers.

A couple of years ago, it bought Fibrek Inc. for approximately $126 million. So, if you add the bolt-in acquisitions of Fibrek ($126 million), Atlas Paper ($156 million) and its conversion to tissue paper ($270 million), you end up with $552 million. In addition, the company has tax loss carryforwards of approximately $2 billion which it can use to offset future gains and income. All these factors lead us to believe that at current prices, RFP is very undervalued.

Sears Holdings

In July 2015, Sears Holdings Corporation (SHLD) announced that it closed its rights offering and sale-leaseback transactions with Seritage Growth Properties ("Seritage"), a recently formed, independent, publicly traded real estate investment trust ("REIT").

| 1 |

CHOU OPPORTUNITY FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

In the transaction, Sears sold 235 Sears- and Kmart-branded stores to Seritage along with Sears' 50 percent interests in joint ventures with each of Simon Property Group, Inc., General Growth Properties, Inc. and The Macerich Company, which together, hold an additional 31 Sears Holdings properties. Based on our rough estimate, this represented less than 25% of the company's real estate assets.

Sears Holdings received aggregate gross proceeds from the transaction of $2.7 billion, which provides the Company with enhanced financial flexibility to accelerate investments in its transformation to an asset-light, member-centric integrated retailer.

However, from our perspective, the most important thing that has happened is that Seritage is now a public company and when its stock trades daily, we have a more reliable way of assessing the real estate value in SHLD indirectly. We also know that Pre-Seritage and Post-Seritage, the profile and the quality of the properties that is held in Seritage and SHLD is roughly the same.

At the current price of $15 for Sears, the company is being priced in the market for about $1.5 billion. Even if you include the debt of roughly $3 billion, we believe that the price of Sears is severely underpriced.

However, the comparison is not apples to apples. Seritage is a clean real estate company whereas SHLD has a serious problems with its retail operations. As every day goes by, the losses from operations are eroding the value of SHLD that comes from its real estate and brand names. Those brand names such as Kenmore, Craftsman and Diehard, we believe collectively could be worth as much as $3 billion. The transformation from the bricks-and-mortar business to their member-centric Shop Your Way (www.shopyourway.com) is happening; whether it is going to be successful or not is another story. These types of ventures should be classified as "venture capitals" and in spite of all the positive spins written about the tranformation, it is still a hit or miss affair. Still, netting out all the negatives and all the losses from operations, we believe that the intrinsic value of Sears is far above the current price of $15.

Other negative contributors to the Fund were securities of Ascent Capital Group, Sears Canada, Chicago Bridge and Iron Company, and Sears Hometown and Outlet Stores Inc.

We initiated positions in the senior secured second lien term loan of Exco Resources. It has a coupon of 12.5% and matures in 2022.

Goodwill

We have not done as well as the market for a couple of years and we wanted to take this opportunity to address that:

1) We could explain that we have been managing money for than 30 years and explain that there will always be times where we are going to underperform for a period of time.

2) We could point that in 2004, we won the Morningstar Manager of the Decade award in Canada.

3) We could write a lengthy tome of more than 100 pages on each of our significant holdings with the goal of demonstrating convincingly why we believe that they are so cheap and why we believe that the market is so wrong.

| 2 |

CHOU OPPORTUNITY FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

4) We could write about why we believe that our sound investment principles and a commitment to integrity and being fair to our investors should translate into better results over the long term business cycle.

But at the end of the day, when all is said and done, the reality is that we have not done well in the recent past and, particularly, in the previous year. So, as a gesture of good will and what we believe to be the the fairest way to behave, we made a voluntary capital contibution of $918,468 which approximates to the 2015 management fees that we were paid by Chou Opportunity Fund. We have also decided to voluntarily waive the fee going forward for the calendar year 2016.

Caution to the Investors

Investors should be advised that we run a highly focused portfolio, frequently just two or three securities may comprise close to 50% of the assets of the Fund. In addition, we have securities that are non-U.S. and could be subjected to geopolitical risks, which may trump or at least negatively influence the financial performance of the company. Also, we may enter into some derivative contracts, such as credit default swaps and interest rate swaps, when we feel that the market conditions are right to use those instruments. Because of any or all of these factors, the net asset value of the Fund can be from time to time more volatile than at other times. However, we are not bothered by this volatility because our focus has always been, and continues to be, on how inexpensive we believe the Fund's portfolio holdings are relative to their intrinsic value.

Also, at year-end our net cash position was approximately 30.1% of net assets. This large cash position may depress returns for a while as we hunt for undervalued securities. Obviously, if there is a severe correction in the market in the near future, it will cushion the Fund against losses while providing us with the wherewithal to find good investment opportunities. But for now it could be a drag on returns.

Yours truly,

Francis Chou

Portfolio Manager and CEO

Chou America Management Inc.

The investment and portfolio performance views in this report were those of Portfolio Manager as of December 31, 2015, and may not reflect his views on the date this report is first published or anytime thereafter. The views are intended to assist the shareholders of the Fund in understanding their investments in the Fund and do not constitute investment advice. This letter may contain discussions about certain investments held and not held in the portfolio. All current and future holdings are subject to risk and to change. There can be no guarantee of success with any technique, strategy or investment.

This letter contains discussions about voluntary fee waivers and voluntary capital contributions of Chou

| 3 |

CHOU OPPORTUNITY FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

America Management Inc., the investment adviser to the Opportunity Fund (the “Adviser”), with respect to fund operations during or following the reporting period ending December 31, 2015. Any such voluntary arrangement can be modified, terminated, or discontinued by the Adviser at any time; provided that the amount of any such waiver or capital contribution may not be recouped by the Adviser at a later date. The Adviser is under no obligation to make a voluntary fee waiver or voluntary capital contribution in the future for any reason. The Adviser made its decision to implement both the voluntary waiver in, and the voluntary capital contribution to, the Opportunity Fund subsequent to, and independent of, the decision of the Board of Trustees to the Trust to renew the Investment Advisory Agreement, as discussed in this report.

The S&P 500 is an unmanaged index representing the average performance of 500 widely held, publicly traded, large capitalization stocks. One cannot invest directly in an index.

| 4 |

CHOU INCOME FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

Dear Shareholder,

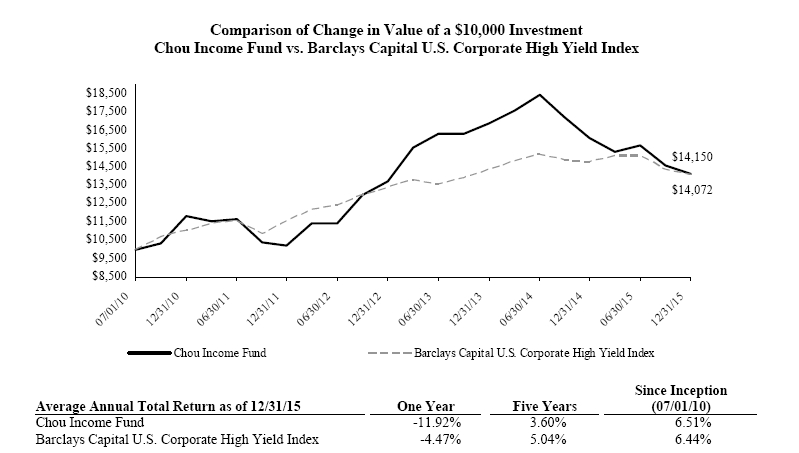

For the year 2015, the Chou Income Fund (the “Fund”) was down -11.92%, while the Barclay's Capital U.S. Corporate High Yield Index (High Yield Index) was down -4.47% during the same period. The Fund's performance is not necessarily indicative of how the Fund will perform in the future.

From the inception date of July 1, 2010 to December 31, 2015, which is 5.5 years, the return has been 6.51% compared to 6.44% return for the High Yield Index. However, we caution it is difficult to extrapolate the returns from inception into the future. Our returns during this time frame will be virtually impossible to duplicate due to current prices of non-investment grade securities. Also there are other constraints, such as the ability of the adviser to recognize a mispriced bond by when one comes along. In the universe of debt securities, we can understand maybe less than 10% of debt securities.

Portfolio Commentary

Several of our debt securities were up for the year 2015. Two of our Canadian investments performed positively: The 8% debenture of Rainmaker Entertainment was up from 110 cents on a dollar to 120 cents on the dollar, and Fortress Paper was up from 54.50 cents on a dollar to 91.25 cents on the dollar. However, the strength of the $U.S. versus the Canadian dollar mitigated the gains in 2015.

Our losses came from our investment in the 4% convertible security of Ascent Capital Group, Inc., a company through which its subsidiary, Monitronics International, Inc., provides security alarm monitoring and related services to residential and business subscribers in the United States and Canada. The convertible is down from 82.69 cents on a dollar to 65.81 on a dollar. We are not that concerned with the drop in price as our analysis suggests to us that at 65 cents on a dollar, this debt is priced at the ratio of Enterprise Value (EV) to Monthly Recurring Revenue (RMR) that is way below the ongoing price of about 44. At the price of 65, the yield to maturity is 14.88%. We feel comfortable holding this debt security. Recently, ADT Corp., a bigger company in the same industry, announced that it was being bought by Apollo Global Management for a price that is equivalent to just over 44 of EV/RMR.

We bought the 8.5% senior unsecured security of Exco Resources, an oil and gas exploration company. We did not expect the price of oil and gas to go so low. The current prices of oil and gas is way below the cost of production and if these prices persist for more than a couple of years, most oil and gas companies will go bankrupt. So the jury is still out on this one. We take comfort from the fact that the CEO, Mr. Wilder has bought over $10 million worth of common stock in the open market and is required to purchase at least $23.5 million of additional shares prior to September 9, 2016. This common stock is junior to the debt security we hold.

We are looking to purchase more debt securities of oil and gas companies but our focus is on:

1) First or second lien loans or notes;

2) Situations where the ability to add senior or issue pari-passu debt is significantly limited; and

3) If the company restructures or goes into bankruptcy, the recovery value of the bond is greater than the current price of the bond.

| 5 |

CHOU INCOME FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

We also bought the 2nd lien bonds of Alpha Natural Resources. The coal industry is facing several headwinds: chief among them are increased environmental and regulatory scrutiny and extremely low naural gas prices. Still, the coal industry generates close to 40% of electricity in United States. We purchased the bonds around 16 cents on a dollar and it recently filed for bankruptcy under Chapter 11. The 2nd lien paper is fairly senior but it is uncertain how much we will get paid when the company emerges from bankruptcy.

Our losses came from our of debt securities of two Ukranian companies, Avangardco Investments and Mriya Agro Holdings. Avangardco Investments is one of the leading agroindustrial companies in Ukraine, focusing on the production of shell eggs and egg products. According to the Pro-Consulting Report, it has a market share of approximately 57% of all industrially produced shell eggs and 91% of all dry egg products produced in Ukraine in 2013.

Mriya Agro Holdings, through its subsidiaries, cultivates agricultural commodities such as wheat, corn, rapeseed, sugar beets, buckwheat, potatoes, and other crops.

The bonds are down from their purchase price but that region of the world is highly volatile and is subject to serious geopolitical risk. Given that, we expect the prices of the bonds we purchased to be volatile and could be subjected to a permanent loss of capital. Strong balance sheet and decent financial operations count but we have to be cognizant of the fact that when investing in a civil war fueled by Putin, geopolitics can trump solid financials.

It is still too early to know whether our foray into Ukraine was an unforced error. So far, with the exception of Mriya, we think it is short-term quotational loss and not a permanent loss of capital.

Conclusion

We believe that most of the bonds we hold in the portfolio are severely underpriced. Most of them are yielding close to 20% yield to maturity and we believe that even if some of them go bankrupt, the recovery value is at least close to what the bonds are trading at.

Caution to the Investors

Investors should be advised that we run a highly focused portfolio, frequently just two or three securities may comprise close to 50% of the assets of the Fund. In addition, we have securities that are non-U.S. and could be subjected to geopolitical risks, which may trump or at least negatively impact the financial performance of the company. Also, we may enter into some derivative contracts such as credit default swaps and interest rate swaps, when we feel that the market conditions are right to use those instruments. Because of these factors, the net asset value of the Fund can be more volatile than normal. However, we are not bothered by this volatility because our focus has always been, and continues to be, on how inexpensive we believe the securities are relative to their intrinsic value.

| 6 |

CHOU INCOME FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) DECEMBER 31, 2015 |

At year-end our net cash position was approximately 27.6% of net assets.

Yours truly,

Francis Chou

Portfolio Manager and CEO

Chou America Management Inc.

The views in this report were those of the Fund manager as of December 31, 2015, and may not reflect his view on the date this report is first published or anytime thereafter. The views are intended to assist the shareholders of the Fund in understanding their investments in the Fund and do not constitute investment advice. This letter may contain discussions about certain investments held and not held in the portfolio. All current and future holdings are subject to risk and to change. There can be no guarantee of success with any technique, strategy or investment.

The Barclays Capital U.S. Corporate High Yield Index is comprised of issues that meet the following criteria: at least $150 million par value outstanding, maximum credit rating of Ba1 (including defaulted issues) and at least one year to maturity. One cannot invest directly in an index.

| 7 |

CHOU OPPORTUNITY FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) DECEMBER 31, 2015 |

The following chart reflects the change in the value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in Chou Opportunity Fund (the “Fund”) compared with the performance of the benchmark, S&P 500 Index ("S&P 500"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the S&P 500 includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the S&P 500 does not include expenses. The Fund is professionally managed while the S&P 500 is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (877) 682-6352. Shares redeemed or exchanged within 120 days of purchase will be charged a 2.00% redemption fee. As stated in the Fund’s current prospectus, the annual operating expense ratio (gross) is 1.40%. The Fund’s adviser has contractually agreed to reduce a portion of its fees and reimburse expenses to limit total operating expenses to 1.20% (excluding other expenses, taxes, leverage interest, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions, and extraordinary expenses such as litigation), through May 1, 2016. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| 8 |

CHOU INCOME FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) DECEMBER 31, 2015 |

The following chart reflects the change in the value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in Chou Income Fund (the “Fund”) compared with the performance of the benchmark, Barclays Capital U.S. Corporate High Yield Index ("Barclays Index"), since inception. The Barclays Index is comprised of issues that meet the following criteria: at least $150 million par value outstanding, maximum credit rating of Ba1 (including defaulted issues) and at least one year to maturity. The total return of the Barclays Index includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the Barclays Index does not include expenses. The Fund is professionally managed while the Barclays Index is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (877) 682-6352. Shares redeemed or exchanged within 120 days of purchase will be charged a 2.00% redemption fee. As stated in the Fund’s current prospectus, the annual operating expense ratio (gross) is 2.11%. However, the Fund’s adviser has contractually agreed to reduce a portion of its fees and reimburse expenses to limit total operating expenses to 1.20% (excluding other expenses, taxes, leverage interest, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions, and extraordinary expenses such as litigation), through May 1, 2016. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| 9 |

CHOU OPPORTUNITY FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2015 |

| Shares | Security Description | Value |

Equity Securities - 58.3% | |||||||

Common Stock - 45.8% | |||||||

Communications - 1.9% | |||||||

| 15,000 | Overstock.com, Inc. (a) | $ | 184,200 | ||||

| 671,368 | UTStarcom Holdings Corp. (a) | 1,664,993 | |||||

| 1,849,193 | |||||||

Consumer Discretionary - 14.6% | |||||||

| 37,904 | Sears Canada, Inc. (a) | 193,689 | |||||

| 598,167 | Sears Holdings Corp. (a) | 12,298,314 | |||||

| 197,013 | Sears Hometown and Outlet Stores, Inc. (a) | 1,576,104 | |||||

| 14,068,107 | |||||||

Consumer Staples - 5.4% | |||||||

| 308,333 | Ascent Capital Group, Inc., Class A (a) | 5,155,328 | |||||

Financials - 2.8% | |||||||

| 157,480 | Asta Funding, Inc. (a) | 1,251,966 | |||||

| 225,000 | MBIA, Inc. (a) | 1,458,000 | |||||

| 2,709,966 | |||||||

Industrials - 3.9% | |||||||

| 95,000 | Chicago Bridge & Iron Co. NV | 3,704,050 | |||||

Materials - 17.2% | |||||||

| 2,179,359 | Resolute Forest Products, Inc. (a) | 16,497,747 | |||||

Total Common Stock (Cost $60,572,714) | 43,984,391 | |||||||||

Warrants - 12.5% | ||||||||||

Exer. Price | Exp. Date | |||||||||

| 150,000 | JPMorgan Chase & Co. (a) | $42.25 | 10/28/18 | 3,553,500 | ||||||

| 77,400 | Wells Fargo & Co. (a) | 34.01 | 10/28/18 | 1,585,926 | ||||||

| 377,430 | Bank of America Corp. (a) | 13.11 | 01/16/19 | 2,192,868 | ||||||

| 285,000 | General Motors Co. (a) | 18.33 | 07/10/19 | 4,662,600 | ||||||

Total Warrants (Cost $6,992,596) | 11,994,894 |

Total Equity Securities (Cost $67,565,310) | 55,979,285 |

| Principal | Security Description | Rate | Maturity | Value |

Fixed Income Securities - 11.6% | |||||||||||

Syndicated Loan - 11.6% | |||||||||||

| $ | 20,000,000 | Exco Resources (Cost $12,844,491) | 12.50% | 10/19/20 | $ | 11,150,000 | |||||

Total Investments - 69.9% (Cost $80,409,801)* | $ | 67,129,285 |

| Other Assets & Liabilities, Net – 30.1% | 28,936,635 | ||

| Net Assets – 100.0% | $ | 96,065,920 |

| (a) | Non-income producing security. |

| * Cost for federal income tax purposes is $80,540,281 and net unrealized depreciation consists of: |

| Gross Unrealized Appreciation | $ | 5,441,347 | ||

| Gross Unrealized Depreciation | (18,852,343 | ) | ||

| Net Unrealized Depreciation | $ | (13,410,996 | ) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2015.

| Valuation Inputs | Investments in Securities | ||||

| Level 1 - Quoted Prices | $ | 55,979,285 | |||

| Level 2 - Other Significant Observable Inputs | 11,150,000 | ||||

| Level 3 - Significant Unobservable Inputs | - | ||||

| Total | $ | 67,129,285 | |||

The Level 1 value displayed in this table includes Common Stock and Warrants and the Level 2 value displayed in this table is a Syndicated Loan. Refer to this Schedule of Investments for a further breakout of each security by type.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended December 31, 2015.

| See Notes to Financial Statements. | 10 |

CHOU OPPORTUNITY FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2015 |

| PORTFOLIO HOLDINGS | ||

| % of Total Investments | ||

| Communications | 2.7 | % |

| Consumer Discretionary | 21.0 | % |

| Consumer Staples | 7.7 | % |

| Financials | 4.0 | % |

| Industrials | 5.5 | % |

| Materials | 24.6 | % |

| Warrants | 17.9 | % |

| Syndicated Loan | 16.6 | % |

| 100.0 | % |

| See Notes to Financial Statements. | 11 |

CHOU INCOME FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2015 |

| Shares | Security Description | Value |

Equity Securities - 3.9% | |||||||

Common Stock - 2.4% | |||||||

Materials - 2.4% | |||||||

| 5,369 | Centrus Energy Corp., Class A (a) | $ | 7,087 | ||||

| 47,613 | Resolute Forest Products, Inc. (a) | 360,431 | |||||

| 367,518 | |||||||

Total Common Stock (Cost $251,821) | 367,518 |

| Rate |

Preferred Stock - 1.5% | ||||||||||

Financials - 1.5% | ||||||||||

| 13,305 | Sears Roebuck Acceptance Corp. | 7.00 | % | 188,302 | ||||||

| 3,400 | Sears Roebuck Acceptance Corp. | 7.40 | 42,712 | |||||||

| 231,014 | ||||||||||

Total Preferred Stock (Cost $207,682) | 231,014 |

Total Equity Securities (Cost $459,503) | 598,532 |

| Principal | Security Description | Rate | Maturity | Value |

Fixed Income Securities - 68.5% | ||||||||||||

Corporate Convertible Bonds - 33.7% | ||||||||||||

Communications - 17.1% | ||||||||||||

| $ | 3,000,000 | Rainmaker Entertainment, Inc. (b) | 8.00 | 03/31/16 | 2,601,720 | |||||||

Consumer Staples - 13.0% | ||||||||||||

| 3,000,000 | Ascent Capital Group, Inc. | 4.00 | 07/15/20 | 1,974,375 | ||||||||

Financials - 2.4% | ||||||||||||

| 850,000 | Atlanticus Holdings Corp. | 5.88 | 11/30/35 | 368,156 | ||||||||

Materials - 1.2% | ||||||||||||

| 283,000 | Fortress Paper, Ltd. | 6.50 | 12/31/16 | 186,618 | ||||||||

Total Corporate Convertible Bonds (Cost $5,936,969) | 5,130,869 |

| Principal | Security Description | Rate | Maturity | Value |

Corporate Non-Convertible Bonds - 30.7% |

Communications - 0.0% | |||||||||||

| $ | 50,890 | Dex Media, Inc. (c) | 12.00 | % | 01/29/17 | $ | 1,526 | ||||

Consumer Staples - 19.8% | |||||||||||

| 1,030,000 | Avangardco Investments Public, Ltd. (d) | 10.00 | 10/29/18 | 520,356 | |||||||

| 1,000,000 | Mriya Agro Holding PLC (c)(e) | 9.45 | 04/19/18 | 145,000 | |||||||

| 4,700,000 | Ukrlandfarm-ing PLC (e) | 10.88 | 03/26/18 | 2,351,570 | |||||||

| 3,016,926 | |||||||||||

Energy - 8.2% | |||||||||||

| 2,500,000 | Alpha Natural Resources, Inc. (c)(e) | 7.50 | 08/01/20 | 56,250 | |||||||

| 1,000,000 | Alpha Natural Resources, Inc. (c)(e) | 7.50 | 08/01/20 | 22,500 | |||||||

| 3,000,000 | EXCO Resources, Inc. | 8.50 | 04/15/22 | 555,000 | |||||||

| 2,000,000 | SandRidge Energy, Inc. (e) | 8.75 | 06/01/20 | 610,000 | |||||||

| 1,243,750 | |||||||||||

Financials - 0.9% | |||||||||||

| 212,000 | Sears Roebuck Acceptance Corp. | 7.00 | 06/01/32 | 143,100 | |||||||

Materials - 1.8% | |||||||||||

| 1,185,730 | Centrus Energy Corp. (d) | 8.00 | 09/30/19 | 198,610 | |||||||

| 90,598 | Emerald Plantation Holdings, Ltd. (d) | 6.00 | 01/30/20 | 79,184 | |||||||

| 225,000 | Sino-Forest Corp. (c) | 6.25 | 10/21/17 | 562 | |||||||

| See Notes to Financial Statements. | 12 |

CHOU INCOME FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2015 |

| Principal | Security Description | Rate | Maturity | Value |

| $ | 400,000 | Sino-Forest Corp. (c) | 6.25 | % | 10/21/17 | $ | 1,000 | ||||

| 279,356 | |||||||||||

Total Corporate Non-Convertible Bonds (Cost $9,566,231) | 4,684,658 |

Syndicated Loans - 4.1% | |||||||||||

| 206,143 | Dex Media West, Inc. (f) | 8.00 | 12/31/16 | 114,409 | |||||||

| 1,163,522 | RH Donnelley, Inc. (f) | 9.75 | 12/31/16 | 511,950 | |||||||

Total Syndicated Loans (Cost $1,345,428) | 626,359 | |||

Total Fixed Income Securities (Cost $16,848,628) | 10,441,886 | |||

Total Investments - 72.4% (Cost $17,308,131)* | $ | 11,040,418 | ||

| Other Assets & Liabilities, Net – 27.6% | 4,212,405 | ||

| Net Assets – 100.0% | $ | 15,252,823 |

| LLC | Limited Liability Company |

| PLC | Public Limited Company |

| (a) | Non-income producing security. |

| (b) | Security fair valued in accordance with procedures adopted by the Board of Trustees. At the period end, the value of these securities amounted to $2,601,720 or 17.1% of net assets. |

| (c) | Security is currently in default and is on scheduled interest or principal payment. |

| (d) | Payment in-Kind Bond. Security that gives the issuer the option at each interest payment date of making interest payments in either cash or additional debt securities. |

| (e) | Security exempt from registration under Rule 144A under the Securities Act of 1933. At the period end, the value of these securities amounted to $3,185,320 or 20.9% of net assets. |

| (f) | Variable rate security. Rate presented is as of December 31, 2015. |

| * Cost for federal income tax purposes is $17,697,052 and net unrealized depreciation consists of: |

| Gross Unrealized Appreciation | $ | 268,422 | ||

| Gross Unrealized Depreciation | (6,925,056 | ) | ||

| Net Unrealized Depreciation | $ | (6,656,634 | ) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2015.

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||

| Investments At Value | |||||||||||||||||||

| Common Stock | $ | 367,518 | $ | - | $ | - | $ | 367,518 | |||||||||||

| Preferred Stock | - | 231,014 | - | 231,014 | |||||||||||||||

| Corporate Convertible Bonds | - | 2,529,149 | 2,601,720 | 5,130,869 | |||||||||||||||

| Corporate Non-Convertible Bonds | - | 4,684,658 | - | 4,684,658 | |||||||||||||||

| Syndicated Loans | - | 626,359 | - | 626,359 | |||||||||||||||

| Total Investments At Value | $ | 367,518 | $ | 8,071,180 | $ | 2,601,720 | $ | 11,040,418 | |||||||||||

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1 and Level 2 for the year ended December 31, 2015.

| See Notes to Financial Statements. | 13 |

CHOU INCOME FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2015 |

The following is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value.

| Corporate Convertible Bonds | ||||

| Balance as of 12/31/14 | $ | - | ||

| Transfers in from Level 2 | 2,601,720 | |||

| Balance as of 12/31/15 | $ | 2,601,720 | ||

| Net change in unrealized appreciation/(depreciation) from investments held as of 12/31/15 ** | $ | (102,079) | ||

| ** The change in unrealized appreciation (depreciation) is included in net change in unrealized appreciation (depreciation) in the accompanying Statement of Operations |

Significant unobservable valuation inputs for Level 3 investments as of December 31, 2015, are as follows:

| Investments in Securities | Fair Value at 12/31/15 | Valuation Technique | Unobservable Input | Input Values |

| Corporate Convertible Bonds | $2,601,720 | Valued at $120 | Last bond trade ocurred in December, 2014. | Valued at $120, which was determined based on two pieces of market data available, the last traded price of the bond and the value of the bond if converted to common stock. |

AFA

| PORTFOLIO HOLDINGS | ||

| % of Total Investments | ||

| Common Stock | 3.3 | % |

| Preferred Stock | 2.1 | % |

| Corporate Convertible Bonds | 46.5 | % |

| Corporate Non-Convertible Bonds | 42.4 | % |

| Syndicated Loans | 5.7 | % |

| 100.0 | % |

| See Notes to Financial Statements. | 14 |

CHOU AMERICA MUTUAL FUNDS STATEMENTS OF ASSETS AND LIABILITIES DECEMBER 31, 2015 |

CHOU OPPORTUNITY FUND | CHOU INCOME FUND | |||||||||

| ASSETS | ||||||||||

| . | Total investments, at value (Cost $80,409,801 and $17,308,131, respectively) | $ | 67,129,285 | $ | 11,040,418 | |||||

| Cash | 41,877,641 | 3,541,025 | ||||||||

| Foreign currency (Cost $0 and $341,526, respectively) | - | 300,221 | ||||||||

| Receivables: | ||||||||||

| Fund shares sold | - | 7,540 | ||||||||

| Dividends and interest | 5,311 | 381,643 | ||||||||

| From investment adviser | - | 12,721 | ||||||||

| Prepaid expenses | 9,181 | 7,644 | ||||||||

| Total Assets | 109,021,418 | 15,291,212 | ||||||||

| LIABILITIES | ||||||||||

| Payables: | ||||||||||

| Investment securities purchased | 12,844,491 | - | ||||||||

| Accrued Liabilities: | ||||||||||

| Investment adviser fees | 68,690 | - | ||||||||

| Trustees’ fees and expenses | 195 | 30 | ||||||||

| Fund services fees | 8,219 | 7,237 | ||||||||

| Other expenses | 33,903 | 31,122 | ||||||||

| Total Liabilities | 12,955,498 | 38,389 | ||||||||

| NET ASSETS | $ | 96,065,920 | $ | 15,252,823 | ||||||

| COMPONENTS OF NET ASSETS | ||||||||||

| Paid-in capital | $ | 109,430,107 | $ | 21,925,493 | ||||||

| Distributions in excess of net investment income | - | (363,632 | ) | |||||||

| Accumulated net realized loss | (83,671 | ) | - | |||||||

| Net unrealized depreciation | (13,280,516 | ) | (6,309,038 | ) | ||||||

| NET ASSETS | $ | 96,065,920 | $ | 15,252,823 | ||||||

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | 9,141,991 | 2,017,858 | ||||||||

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE* | $ | 10.51 | $ | 7.56 | ||||||

| * | Shares redeemed or exchanged within 120 days of purchase are charged a 2.00% redemption fee. | |||||||||

| See Notes to Financial Statements. | 15 |

CHOU AMERICA MUTUAL FUNDS STATEMENTS OF OPERATIONS YEAR ENDED DECEMBER 31, 2015 |

| CHOU OPPORTUNITY FUND | CHOU INCOME FUND | ||||||||||

| INVESTMENT INCOME | |||||||||||

| Dividend income (Net of foreign withholding taxes of $3,990 and $0, respectively) | . | $ | 22,610 | $ | 29,574 | ||||||

| Interest income | 58,690 | 1,825,002 | |||||||||

| Total Investment Income | 81,300 | 1,854,576 | |||||||||

| EXPENSES | |||||||||||

| Investment adviser fees | 959,760 | 164,999 | |||||||||

| Fund services fees | 132,214 | 85,971 | |||||||||

| Custodian fees | 10,671 | 10,002 | |||||||||

| Registration fees | 24,095 | 21,079 | |||||||||

| Audit fees | 17,000 | 17,000 | |||||||||

| Legal fees | 37,894 | 46,397 | |||||||||

| Trustees' fees and expenses | 9,285 | 8,940 | |||||||||

| Miscellaneous expenses | 38,658 | 34,426 | |||||||||

| Total Expenses | 1,229,577 | 388,814 | |||||||||

| Fees waived and expenses reimbursed | (41,292 | ) | (174,192 | ) | |||||||

| Net Expenses | 1,188,285 | 214,622 | |||||||||

| NET INVESTMENT INCOME (LOSS) | (1,106,985 | ) | 1,639,954 | ||||||||

| NET REALIZED AND UNREALIZED GAIN (LOSS) | |||||||||||

| Net realized gain (loss) on: | |||||||||||

| Investments | 1,510,301 | 172,772 | |||||||||

| Foreign currency transactions | - | (9,339 | ) | ||||||||

| Net realized gain | 1,510,301 | 163,433 | |||||||||

| Net change in unrealized appreciation (depreciation) on: | |||||||||||

| Investments | (24,679,006 | ) | (3,837,747 | ) | |||||||

| Foreign currency translations | - | (36,441 | ) | ||||||||

| Net change in unrealized appreciation (depreciation) | (24,679,006 | ) | (3,874,188 | ) | |||||||

| NET REALIZED AND UNREALIZED LOSS | (23,168,705 | ) | (3,710,755 | ) | |||||||

| DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (24,275,690 | ) | $ | (2,070,801 | ) | |||||

| See Notes to Financial Statements. | 16 |

CHOU AMERICA MUTUAL FUNDS STATEMENTS OF CHANGES IN NET ASSETS |

| CHOU OPPORTUNITY FUND | CHOU INCOME FUND | ||||||||||||||||||

| Shares | Shares | ||||||||||||||||||

| NET ASSETS DECEMBER 31, 2013 | $ | 66,402,224 | $ | 14,736,857 | $14,736,857 | ||||||||||||||

| OPERATIONS | |||||||||||||||||||

| Net investment income (loss) | (1,029,315 | ) | 833,757 | ||||||||||||||||

| Net realized gain | 4,200,893 | 546,033 | |||||||||||||||||

| Net change in unrealized appreciation (depreciation) | 1,935,968 | (2,485,947 | ) | ||||||||||||||||

| Increase (Decrease) in Net Assets Resulting from Operations | 5,107,546 | (1,106,157 | ) | ||||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |||||||||||||||||||

| Net investment income | - | (912,881 | ) | ||||||||||||||||

| Net realized gain | (3,311,304 | ) | (421,424 | ) | |||||||||||||||

| Total Distributions to Shareholders | (3,311,304 | ) | (1,334,305 | ) | |||||||||||||||

| CAPITAL SHARE TRANSACTIONS | |||||||||||||||||||

| Sale of shares | 33,002,798 | 2,471,099 | 6,760,299 | 586,420 | |||||||||||||||

| Reinvestment of distributions | 3,285,259 | 239,102 | 1,313,807 | 127,121 | |||||||||||||||

| Redemption of shares | (4,688,450 | ) | (344,984 | ) | (2,851,655 | ) | (254,498 | ) | |||||||||||

| Redemption fees | 542 | 6,833 | |||||||||||||||||

| Increase in Net Assets from Capital Share Transactions | 31,600,149 | 2,365,217 | 5,229,284 | 459,043 | |||||||||||||||

| Increase in Net Assets | 33,396,391 | 2,788,822 | |||||||||||||||||

| NET ASSETS DECEMBER 31, 2014 | $ | 99,798,615 | $ | 17,525,679 | |||||||||||||||

| OPERATIONS | |||||||||||||||||||

| Net investment income (loss) | (1,106,985 | ) | 1,639,954 | ||||||||||||||||

| Net realized gain | 1,510,301 | 163,433 | |||||||||||||||||

| Net change in unrealized appreciation (depreciation) | (24,679,006 | ) | (3,874,188 | ) | |||||||||||||||

| Decrease in Net Assets Resulting from Operations | (24,275,690 | ) | (2,070,801 | ) | |||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |||||||||||||||||||

| Net investment income | - | (1,718,275 | ) | ||||||||||||||||

| Net realized gain | (1,331,988 | ) | (272,242 | ) | |||||||||||||||

| Total Distributions to Shareholders | (1,331,988 | ) | (1,990,517 | ) | |||||||||||||||

| CAPITAL SHARE TRANSACTIONS | |||||||||||||||||||

| Sale of shares | 23,081,184 | 1,951,529 | 646,342 | 71,620 | |||||||||||||||

| Reinvestment of distributions | 1,323,318 | 125,077 | 1,954,159 | 240,674 | |||||||||||||||

| Redemption of shares | (2,529,888 | ) | (212,213 | ) | (812,548 | ) | (88,723 | ) | |||||||||||

| Redemption fees | 369 | 509 | |||||||||||||||||

| Increase in Net Assets from Capital Share Transactions | 21,874,983 | 1,864,393 | 1,788,462 | 223,571 | |||||||||||||||

| Decrease in Net Assets | (3,732,695 | ) | (2,272,856 | ) | |||||||||||||||

| NET ASSETS DECEMBER 31, 2015 | $ | 96,065,920 | $ | 15,252,823 | |||||||||||||||

| (a) | Distributions in excess of net investment income December 31, 2014 | $ | - | $ | (275,959 | ) | |||||||||||||

| (a) | Distributions in excess of net investment income December 31, 2015 | $ | - | $ | (363,632 | ) | |||||||||||||

| See Notes to Financial Statements. | 17 |

CHOU OPPORTUNITY FUND FINANCIAL HIGHLIGHTS |

| These financial highlights reflect selected data for a share outstanding throughout each year. | |||||||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||||

| NET ASSET VALUE, Beginning of Year | $ | 13.71 | $ | 13.52 | $ | 11.41 | $ | 10.00 | $ | 12.20 | |||||||||||

| INVESTMENT OPERATIONS | |||||||||||||||||||||

| Net investment income (loss) (a) | (0.14 | ) | (0.18 | ) | 0.05 | 0.32 | 0.02 | ||||||||||||||

| Net realized and unrealized gain (loss) | (2.91 | ) | 0.84 | 3.31 | 2.68 | (2.19 | ) | ||||||||||||||

| Total from Investment Operations | (3.05 | ) | 0.66 | 3.36 | 3.00 | (2.17 | ) | ||||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |||||||||||||||||||||

| Net investment income | — | — | (0.19 | ) | (0.40 | ) | (0.01 | ) | |||||||||||||

| Net realized gain | (0.15 | ) | (0.47 | ) | (1.09 | ) | (1.19 | ) | (0.02 | ) | |||||||||||

| Total Distributions to Shareholders | (0.15 | ) | (0.47 | ) | (1.28 | ) | (1.59 | ) | (0.03 | ) | |||||||||||

| REDEMPTION FEES (a) | — | (b) | — | (b) | 0.03 | — | (b) | — | (b) | ||||||||||||

| NET ASSET VALUE, End of Year | $ | 10.51 | $ | 13.71 | $ | 13.52 | $ | 11.41 | $ | 10.00 | |||||||||||

| TOTAL RETURN | (22.27 | )% | 4.88 | % | 29.82 | % | 30.81 | % | (17.78 | )% | |||||||||||

| RATIOS/SUPPLEMENTARY DATA | |||||||||||||||||||||

| Net Assets at End of Year (000's omitted) | $96,066 | $99,799 | $66,402 | $41,132 | $56,724 | ||||||||||||||||

| Ratios to Average Net Assets: | |||||||||||||||||||||

| Net investment income (loss) | (1.15 | )% | (1.31 | )% | 0.34 | % | 2.89 | % | 0.15 | % | |||||||||||

| Net expenses | 1.24 | % | 1.38 | % | 1.48 | % | 1.48 | % | 1.53 | % | |||||||||||

| Gross expenses (c) | 1.28 | % | 1.40 | % | 1.50 | % | 1.55 | % | 1.93 | % | |||||||||||

| PORTFOLIO TURNOVER RATE | 4 | % | 29 | % | 56 | % | 17 | % | 11 | % | |||||||||||

| (a) | Calculated based on average shares outstanding during each year. | ||||||||||||||||||||

| (b) | Less than $0.01 per share. | ||||||||||||||||||||

| (c) | Reflects the expense ratio excluding any waivers and/or reimbursements. | ||||||||||||||||||||

| See Notes to Financial Statements. | 18 |

CHOU INCOME FUND FINANCIAL HIGHLIGHTS |

| These financial highlights reflect selected data for a share outstanding throughout each year. | |||||||||||||||||||||

| For the Years Ended December 31, | |||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||||||

| NET ASSET VALUE, Beginning of Year | $ | 9.77 | $ | 11.04 | $ | 9.87 | $ | 8.74 | $ | 11.60 | |||||||||||

| INVESTMENT OPERATIONS | |||||||||||||||||||||

| Net investment income (a) | 0.90 | 0.51 | 0.94 | 1.58 | 1.30 | ||||||||||||||||

| Net realized and unrealized gain (loss) | (2.01 | ) | (1.01 | ) | 1.28 | 1.27 | (2.86 | ) | |||||||||||||

| Total from Investment Operations | (1.11 | ) | (0.50 | ) | 2.22 | 2.85 | (1.56 | ) | |||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | |||||||||||||||||||||

| Net investment income | (0.95 | ) | (0.52 | ) | (1.07 | ) | (1.72 | ) | (1.27 | ) | |||||||||||

| Net realized gain | (0.15 | ) | (0.25 | ) | — | — | (b) | (0.03 | ) | ||||||||||||

| Total Distributions to Shareholders | (1.10 | ) | (0.77 | ) | (1.07 | ) | (1.72 | ) | (1.30 | ) | |||||||||||

| REDEMPTION FEES (a) | — | (b) | — | (b) | 0.02 | — | — | (b) | |||||||||||||

| NET ASSET VALUE, End of Year | $ | 7.56 | $ | 9.77 | $ | 11.04 | $ | 9.87 | $ | 8.74 | |||||||||||

| TOTAL RETURN | (11.92 | )% | (4.83 | )% | 22.86 | % | 34.69 | % | (13.83 | )% | |||||||||||

| RATIOS/SUPPLEMENTARY DATA | |||||||||||||||||||||

| Net Assets at End of Year (000's omitted) | $15,253 | $17,526 | $14,737 | $6,728 | $5,051 | ||||||||||||||||

| Ratios to Average Net Assets: | |||||||||||||||||||||

| Net investment income | 9.94 | % | 4.48 | % | 8.39 | % | 16.25 | % | 12.24 | % | |||||||||||

| Net expenses | 1.30 | % | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | |||||||||||

| Gross expenses (c) | 2.36 | % | 2.11 | % | 3.41 | % | 4.09 | % | 4.71 | % | |||||||||||

| PORTFOLIO TURNOVER RATE | 7 | % | 17 | % | 40 | % | 23 | % | 17 | % | |||||||||||

| (a) | Calculated based on average shares outstanding during each year. | ||||||||||||||||||||

| (b) | Less than $0.01 per share. | ||||||||||||||||||||

| (c) | Reflects the expense ratio excluding any waivers and/or reimbursements. | ||||||||||||||||||||

| See Notes to Financial Statements. | 19 |

CHOU AMERICA MUTUAL FUNDS NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2015 |

Note 1. Organization

The Chou Opportunity Fund and Chou Income Fund (individually, a “Fund” and, collectively the “Funds”) are non-diversified portfolios of Chou America Mutual Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of each Fund’s shares of beneficial interest without par value. Chou Opportunity Fund’s investment objective is to seek long-term growth of capital. Chou Income Fund’s investment objective is to provide capital appreciation and income production, with capital preservation as a secondary consideration. The Funds commenced operations on July 1, 2010, with the sale of 50,000 shares of each Fund at $10 per share to Chou Associates Management Inc.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of each Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted trade or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange-traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale, at the mean of the last bid and ask prices provided by independent pricing services. Debt securities may be valued at prices supplied by a fund’s pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate and maturity. Exchange-traded options for which there were no sales reported that day are generally valued at the mean of the last bid and ask prices. Options not traded on an exchange are generally valued at broker-dealer bid quotations. Short-term investments that mature in 60 days or less may be valued at amortized cost.

Each Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in each Fund’s registration statement, performs certain functions as they relate to the administration and oversight of each Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad-hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the adviser to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics which may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Adviser inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a

| 20 |

CHOU AMERICA MUTUAL FUNDS NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2015 |

different Net Asset Value ("NAV") than a NAV determined by using market quotes.

Each Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets and liabilities

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments)

The aggregate value by input level, as of December 31, 2015, for each Fund’s investments is included at the end of each Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after each Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Transactions – Each Fund may enter into transactions to purchase or sell foreign currency contracts and options on foreign currency. Forward currency contracts are agreements to exchange one currency for another at a future date and at a specified price. A fund may use forward currency contracts to facilitate transactions in foreign securities, to manage a fund’s foreign currency exposure and to protect the U.S. dollar value of its underlying portfolio securities against the effect of possible adverse movements in foreign exchange rates. These contracts are intrinsically valued daily based on forward rates, and a fund’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date, is recorded as a component of net asset value. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates. Due to the risks associated with these transactions, a fund could incur losses up to the entire contract amount, which may exceed the net unrealized value included in its net asset value.

Distributions to Shareholders – Distributions to shareholders of net investment income, if any, are declared and paid at least semi-annually. Distributions to shareholders of net capital gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by each Fund, timing differences and differing characterizations of distributions made by each Fund.

Federal Taxes – Each Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute all of their taxable income to shareholders. In addition, by distributing in each calendar year substantially all of their net investment income and capital gains, if any, the Funds will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. Each Fund files a U.S. federal income and excise tax return as required. A fund’s federal income tax returns are

| 21 |

CHOU AMERICA MUTUAL FUNDS NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2015 |

subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of December 31, 2015, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

Redemption Fees – A shareholder who redeems or exchanges shares within 120 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to each Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. Each Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Commitments and Contingencies – In the normal course of business, each Fund enters into contracts that provide general indemnifications by each Fund to the counterparty to the contract. Each Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against each Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Cash – Concentration in Uninsured Account

For cash management purposes each Fund may concentrate cash with each Fund’s custodian. This typically results in cash balances exceeding the Federal Deposit Insurance Corporation (“FDIC”) insurance limits. As of December 31, 2015, Chou Opportunity Fund and Chou Income Fund held $41,627,641 and $3,291,025 respectively as cash reserves at MUFG Union Bank, N.A. that exceeded the FDIC insurance limit.

Note 4. Fees and Expenses

Investment Adviser – Chou America Management Inc. (the “Adviser”) is the investment adviser to each Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee from each Fund at an annual rate of 1.00% of each Fund’s average daily net assets.

Distribution – Rafferty Capital Markets, LLC serves as each Fund’s distributor (the “Distributor”). The Trust has adopted a Rule 12b-1 plan under which the Funds may pay an annual fee of up to 0.25% of the average daily net assets of the Funds for distribution services and/or the servicing of shareholder accounts. The Board has not authorized the Funds to pay a Rule 12b-1 fee at this time. The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) or their affiliates.

Other Service Providers – Atlantic provides fund accounting, fund administration, compliance and transfer agency services to each Fund. Atlantic also provides certain shareholder report production, and EDGAR conversion and filing services. Pursuant to an Atlantic services agreement, each Fund pays Atlantic customary fees for its services. Atlantic provides a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to each Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each Trustee an annual retainer fee of $8,000 for service to the Trust. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with their duties as a Trustee, including travel and related expenses incurred in attending Board meetings. No officers of the Funds are compensated by the Funds, but officers are reimbursed for travel and related expenses incurred in attending Board meetings.

| 22 |

CHOU AMERICA MUTUAL FUNDS NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2015 |

Effective July 1, 2015, each Independent Trustee is paid an annual retainer fee of $8,240 and the Audit and Compliance Committee Chairperson receives an additional retainer fee of $3,000.

Note 5. Expense Reimbursements and Fees Waived

The Adviser has contractually agreed to waive a portion of its fee and reimburse certain expenses to limit total annual operating expenses to 1.20% of the average daily net assets of the Chou Opportunity Fund and Chou Income Fund through May 1, 2016 (excluding other expenses, taxes, leverage interest, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions, and extraordinary expenses such as litigation). Effective May 1, 2015, the expense caps for the Funds changed from 1.50% to 1.20%. For the year ended December 31, 2015, fees waived and expenses reimbursed were as follows:

| Investment Adviser Fees Waived | Investment Adviser Expenses Reimbursed | Total Fees Waived and Expenses Reimbursed | ||||||

| Chou Opportunity Fund | $ | 41,292 | $ | - | $ | 41,292 | ||

| Chou Income Fund | 164,999 | 9,193 | 174,192 | |||||

Note 6. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the year ended December 31, 2015, were as follows:

| Purchases | Sales | |||||

| Chou Opportunity Fund | $ | 34,008,778 | $ | 2,435,251 | ||

| Chou Income Fund | 2,546,250 | 769,962 | ||||

Note 7. Federal Income Tax

Distributions paid during the fiscal years ended as noted were characterized for tax purposes as follows:

| Ordinary Income | Long-Term Capital Gain | Total | |||||||||||

| Chou Opportunity Fund | |||||||||||||

| 2015 | $ | 603,853 | $ | 728,135 | $ | 1,331,988 | |||||||

| 2014 | 150,277 | 3,161,027 | 3,311,304 | ||||||||||

| Chou Income Fund | |||||||||||||

| 2015 | 1,718,288 | 272,229 | 1,990,517 | ||||||||||

| 2014 | 1,216,228 | 118,077 | 1,334,305 | ||||||||||

As of December 31, 2015, distributable earnings (accumulated loss) on a tax basis were as follows:

| Undistributed Ordinary Income | Undistributed Long-Term Gain | Unrealized Depreciation | Total |

| Chou Opportunity Fund | $ | - | $ | 46,809 | $ | (13,410,996 | ) | $ | (13,364,187 | ) | ||||||

| Chou Income Fund | 25,289 | - | (6,697,959 | ) | (6,672,670 | ) |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sale and straddles for Chou Opportunity Fund and contingent payment debt instruments for Chou Income Fund.

| 23 |

CHOU AMERICA MUTUAL FUNDS NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2015 |

On the Statements of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended December 31, 2015. The following reclassifications were the result of currency gain/loss, re-designation of distributions and net operating losses offsetting short term gains and have no impact on the net assets of each Fund.

| Undistributed Net Investment Income (Loss) | Accumulated Net Realized Gain (Loss) | |||||||

| Chou Opportunity Fund | $ | 1,106,985 | $ | (1,106,985 | ) | |||

| Chou Income Fund | (9,352 | ) | 9,352 | |||||

Note 8. Subsequent Events

Chou has voluntarily decided to waive its entire advisory fee on the Opportunity Fund beginning on January 1, 2016. Chou can unilaterally decide to terminate this voluntary waiver at any time. In addition, on February 18, 2016 Chou made a voluntary capital contribution to the Opportunity Fund in the amount of $918,468, which approximates the advisory fees retained by Chou with respect the Opportunity Fund during the previous fiscal year. This voluntary contribution was a gesture of goodwill by Chou to the Opportunity Fund in recognition of the Fund’s underperformance in the prior year relative to its performance in earlier years. Chou is under no obligation to make a voluntary waiver, a voluntary fee reimbursement, or a voluntary capital contribution to either of the Funds in the future for any reason.

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact and, except as set forth above, there are no material subsequent events requiring financial statement adjustment or disclosure.

| 24 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Trustees of Chou America Mutual Funds and the Shareholders of Chou Income Fund and Chou Opportunity Fund

We have audited the accompanying statements of assets and liabilities of Chou Income Fund and Chou Opportunity Fund (the "Funds"), each a series of shares of beneficial interest of Chou America Mutual Funds, including the schedules of investments, as of December 31, 2015, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Funds' management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2015 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Chou Income Fund and Chou Opportunity Fund as of December 31, 2015, and the results of their operations for the year then ended, the changes in their net assets for each of the years in the two-year period then ended and their financial highlights for each of the years in the five-year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

February 26, 2016

| 25 |

CHOU AMERICA MUTUAL FUNDS ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2015 |

Investment Advisory Agreement Approval

At a meeting held on December 3, 2015, the Board of Trustees of the Chou Mutual Funds, including all of the Independent Trustees (the “Board”), approved the renewal of the investment advisory agreement (the “Advisory Agreement”) between the Adviser and the Trust on behalf of the Funds.

In voting to approve the renewal of the Advisory Agreement, the Board considered the overall fairness of the Advisory Agreement and factors it deemed relevant with respect to each Fund including, but not limited to: (1) the nature, extent and quality of the services provided to each Fund; (2) the performance of each Fund as compared to the respective Fund’s benchmark index and a peer group of funds selected by Lipper, Inc. (“Lipper Peer Group”) and compiled by Atlantic Fund Services (“Atlantic”); (3) the level of the fees and the overall expenses of each Fund and how those compared to each Fund’s Lipper Peer Group; (4) the costs of services provided to the Funds and the profitability of the Adviser; and (5) the effect of, as applicable, the growth or decline of fund assets on the advisory fee (i.e., economies of scale) and whether the fee levels reflect economies of scale for the benefit of investors. The Board did not identify any single factor or item of information as all-important or controlling.

In considering the approval of the Advisory Agreement, the Board considered a broad range of information provided by the Adviser, including but not limited to, reports relating to each Fund’s performance and expenses. In addition, the Board considered a memorandum from its legal counsel regarding the legal framework and the Board's duties in considering the renewal of the Advisory Agreement. The Board also meets each quarter to review various aspects of the Funds and is provided additional material in connection with those meetings.

Nature, Extent and Quality of Services

The Board reviewed and considered the nature, extent and quality of the advisory services provided by the Adviser to each Fund under the Advisory Agreement. The Board considered that the Adviser does not have any clients other than the Funds. The Board noted that the Adviser has provided high quality advisory services to the Funds. The Board also understood that Francis Chou, the Funds’ portfolio manager, manages Canadian mutual funds with investment strategies similar to those of the Funds through an affiliated Canadian adviser. The Board noted the Adviser’s representation that it has the financial resources and appropriate staffing to manage the Funds and to meet its expense reimbursement obligations. The Board also reviewed and considered the qualifications of the portfolio manager to each Fund.

Performance

The Board considered the one-year and since-inception performance of each Fund as of September 30, 2015 as compared to its respective benchmark index. The Board considered that the Opportunity Fund underperformed its primary benchmark, the S&P 500 Index, for the since-inception and one-year periods ended September 30, 2015. Additionally, the Board considered that the Income Fund had outperformed its benchmark index, the Barclays Capital U.S. Corporate High Yield Index, for the since inception period, but underperformed the index for the one-year period ended September 30, 2015. The Board also considered the performance of each Fund as compared to its respective Lipper Peer Group for the one-year, three-year, and five-year periods ended September 30, 2015. The Board considered that the Opportunity Fund had outperformed for the three-year period ended September 30, 2015 all of its Lipper Peer Group except for two funds which it underperformed. The Board also considered that the Opportunity Fund had underperformed its Lipper Peer Group for the one-year period ended September 30, 2015. The Board considered that the Income Fund had outperformed for the five-year period ended September 30, 2015 all of the funds in its Lipper Peer Group, and outperformed for the three-year period ended September 30, 2015 all but one of the funds in its Lipper Peer Group. The Board also considered that the Income Fund had underperformed its Lipper Peer Group for the one-year period ended September 30, 2015. Based on the foregoing, the Board determined that the Adviser’s management of the Funds was satisfactory and could benefit the Funds and their shareholders.

| 26 |

CHOU AMERICA MUTUAL FUNDS ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2015 |

Fees and Expenses

The Board considered the advisory fee rates charged to each Fund relative to the fee rates paid by the Fund’s Lipper Peer Group. The Board also considered the total expense ratios of each Fund relative to the Lipper Peer Group for the period ended September 30, 2015. The Board also considered that the Adviser contractually agreed to continue its fee waivers and expense caps for each Fund’s 2015 fiscal year to the extent set forth in the Expense Limitation Agreement. The Board considered comparisons that excluded Rule 12b-1 fees, given that each Fund does not currently charge such fees. In reviewing the Lipper Peer Group expense information, the Board noted that the Lipper Peer Group contractual advisory fee information, which included advisory and administrative fees. The Board noted that the actual advisory fee reflected fee waivers and/or expense reimbursements and considered that the Adviser waived part of the advisory fee for the Income Fund.

With respect to the Opportunity Fund, the Board considered that the Fund’s contractual and actual advisory fee rates were higher than the Lipper Peer Group average and its total expense ratio was higher than the Lipper Peer Group average. With respect to the Income Fund, the Board considered that after the waiver the advisory fee rate was lower than the Lipper Peer Group average, and that the contractual advisory fee rate and total expense ratio were higher than the Lipper Peer Group average. The Board also considered that the Income Fund's total expense ratio reflected fees waived and/or expenses reimbursed.

Costs of Services and Profitability

The Board considered the costs to operate the Funds and the profitability of the Adviser. The Board reviewed the fees paid by each Fund to the Adviser for the fiscal year ended December 31, 2014. The Board also reviewed the profit and loss statement provided by the Adviser on a fund-by-fund basis and considered the Adviser’s methodology with respect to the profitability calculation. In this regard, the Board noted that the Adviser was profitable with respect to services provided to both the Opportunity Fund and the Income Fund for calendar year 2014.

Economies of Scale

With respect to economies of scale, the Board considered the current asset size of the Funds. In this regard, the Board also considered the Adviser’s representation that while there is potential for economies of scale in connection with the services that the Adviser provides to the Funds, the Adviser does not believe that breakpoints in the fee schedules of the Funds would be appropriate in the absence of significant growth of Fund assets.

Other Benefits

The Board noted that the Adviser did not identify any indirect "fall-out" benefits that accrue to the Adviser or its affiliates (other than its direct compensation) from the Adviser's relationship with the Funds. The Board also noted that the Adviser represented that it does not use soft-dollars as permitted by Section 28(e) of the Securities and Exchange Act of 1934, as amended. Based on the foregoing representation, the Board concluded that other benefits received by the Adviser from its relationship with the Funds were not a material factor to consider in approving the Advisory Agreement.

Conclusion

Based on its evaluation of these and other factors, the Board concluded with respect to each Fund that: (1) each Fund was reasonably likely to benefit from the nature, quality and extent of services provided by the Adviser; (2) each Fund’s performance was satisfactory in light of all the factors considered by the Board; (3) the profits, as applicable, and fees payable to the Adviser were reasonable in the context of all the factors considered by the Board; and (4) the economies of scale was not a material factor in its approval of the Advisory Agreement given the current size of the Funds. In light of these conclusions, the Board determined, in its business judgment, to renew the Advisory Agreement.

| 27 |

CHOU AMERICA MUTUAL FUNDS ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2015 |

Proxy Voting Information

A description of the policies and procedures that each Fund uses to determine how to vote proxies relating to securities held in each Fund’s portfolio is available, without charge and upon request, by calling (877) 682-6352 and on the U.S. Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov. Each Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (877) 682-6352 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

Each Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. These filings are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2015, through December 31, 2015.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.