united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22447

Equinox Funds Trust

(Exact name of registrant as specified in charter)

17605 Wright Street Omaha, Nebraska 68130

(Address of principal executive offices) (Zip code)

Rich Malinowski, Gemini Fund Services, LLC.

80 Arkay Drive, Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 9/30

Date of reporting period: 9/30/18

Item 1. Reports to Stockholders.

| |

| |

| |

| EQUINOX ASPECT CORE DIVERSIFIED |

| STRATEGY FUND |

| |

| |

| CLASS A SHARES: EQAAX |

| CLASS C SHARES: EQACX |

| CLASS I SHARES: EQAIX |

| |

| |

| |

| |

| |

| ANNUAL REPORT |

| SEPTEMBER 30, 2018 |

| |

| |

| |

| |

| 1-888-643-3431 |

| WWW.EQUINOXFUNDS.COM |

| |

| |

| |

| |

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer to buy shares of the Equinox Aspect Core Diversified Strategy Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by Northern Lights Distributors, LLC

Member FINRA

EQUINOX ASPECT CORE DIVERSIFIED STRATEGY FUND

Annual Letter to Shareholders for the year ended September 30, 2018

The Equinox Aspect Core Diversified Strategy Fund (the “Fund”) was launched on November 7, 2014 (Class I Shares, as shown in the table below; Class A and C shares were launched on August 21, 2015).

The Fund’s investment objective is to seek long-term capital appreciation, which is pursued by investing (a) directly or (b) indirectly through its wholly-owned subsidiary, in a combination of

| (i) | exposure to a managed futures trading program offered by Aspect Capital Limited (the “Aspect Program”)1; and |

| (ii) | a fixed-income portfolio. |

PERFORMANCE OF THE FUND

As of 9/30/2018

| NAME | | | TICKER | | | 12 MO

RETURN

(10/1/17-9/30/18) | | | CUMULATIVE

RETURN SINCE

INCEPTION | | | INCEPTION

DATE | |

| Equinox Aspect Core Diversified Strategy Fund – A (with 5.75% maximum sales charge) | | | EQAAX | | | -6.80% | | | -14.27% | | | 8/21/2015 | |

| Equinox Aspect Core Diversified Strategy Fund – A | | | EQAAX | | | -1.08% | | | -9.01% | | | 8/21/2015 | |

| Equinox Aspect Core Diversified Strategy Fund – C | | | EQACX | | | -1.75% | | | -11.17% | | | 8/21/2015 | |

| Equinox Aspect Core Diversified Strategy Fund – I | | | EQAIX | | | -0.76% | | | -1.69% | | | 11/7/2014^ | |

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Investments in Managed Futures are speculative, involve substantial risk, and are not suitable for all investors.

Returns for the Fund’s shares for the fiscal year are shown in the table above. The Fund’s primary investment allocation is to the Aspect Program, which is a diversified intermediate to long-term trend-following program. For the year ended September 30, 2018, the Fund’s I shares were down (–0.76%), and performance since inception is also slightly in the red.

In terms of sector attribution, Commodities and Equity Indices were significant positive contributors to performance this year, +326 bps and +270 bps, respectively. Unfortunately, this was entirely

| 1A | “Managed Futures Program” generally is a trading program that a CTA uses to guide its investments in futures, forwards, options or spot contracts. Please see the Fund’s Prospectus for a detailed description of the Fund’s investment strategy. |

nullified by the large negative contribution from Currencies (–603 bps). Interest Rates (–79 bps) also detracted from performance.

As shown below, the Aspect Program’s (and consequently the Fund’s) market exposure is well-diversified across four major sectors. As of year-end, Currencies were the largest gross exposure, followed by Commodities, Equity Indices, and Interest Rates, in that order. It is worth noting that the Aspect Program has long-term target risk exposures to various sectors. The actual sector risk exposures at any time are a function of the signals generated by the trading models: when there are more trends in markets, whether up or down, actual sector risk exposures will tend to be higher. It is also worth distinguishing between “gross” and “net” risk exposures: for example, a sector that has long positions whose risk exposure is 10% and short positions whose risk exposure is –15% will be shown as having a gross risk exposure of 25%, even though its “net” exposure would be only –5% (short).

SECTOR ALLOCATION

As of 9/30/2018

| | COMMODITIES | | | CURRENCIES | | | INTEREST RATES | | | EQUITY INDICES | | | TOTAL | |

| | 28.0% | | | 32.0% | | | 18.7% | | | 21.3% | | | 100.0% | |

FUND PERFORMANCE HIGHLIGHTS

The Fund’s performance for the year was driven mainly by four months, two positive and two negative. Focusing on those months helps explain most of the Fund’s performance for the year.

October 2017

The Fund returned +4.75% in October, its second-best month of the year.

Global stock markets continued to strengthen through October, with major US equity indices setting a succession of record highs amid a general resurgence of risk appetite on both sides of the Atlantic. In the US, a series of news items boosted markets. The easing of tensions with North Korea and a slightly more dovish tone from the Federal Reserve were soon followed by news that the US Senate had adopted a fiscal 2018 budget resolution, opening the way for tax reforms. The end of the month saw a batch of well-received earnings reports from both new technology and established industrial companies, and reports that President Trump was leaning towards a more dovish new chair of the Federal Reserve. Meanwhile, the European Central Bank announced that it would extend its bond-buying scheme until at least September 2018, boosting European markets despite the instability

triggered by the Catalonia crisis. Profits came from long positions in stock indices, while long fixed- income positions also benefited from a general fall in yields. Long positions in the Italian 10Y bond performed particularly strongly, while short positions in the Canadian 10Y bond detracted from performance. In currencies, gains from short Swiss Franc exposure were reduced by losses from long Euro exposure. Oil markets rose amid mounting tensions in the Middle East, together with signs that both Saudi Arabia and Russia might extend output reductions, benefiting long positions. Long positions in industrial metals benefited from the resurgent risk appetite, with copper further boosted by supply concerns following an earthquake in Chile.

January 2018

The Fund returned +6.06% in January, its best month of the year.

Global stock markets continued to perform well in January amid optimism over the world economy for 2018. Robust global economic data early in the month boosted markets, which continued to rise despite concerns about a US government shutdown. The Fund made gains from its net long exposure to stock indices–in particular, Chinese and emerging market indices–which were further helped by strong Chinese export data. Fixed-income also performed strongly, with short positions in US markets among the top performers, as prices fell in line with continued expectations for interest rate rises. Meanwhile, the European Central Bank's hawkish stance weighed on German and French government bonds, leading to losses from long positions. At the World Economic Forum at Davos, the US Treasury Secretary's comments on the favorably weak US Dollar prompted a further sell-off in the currency, leading to gains from short US Dollar positions against Sterling, the Euro and the Australian Dollar. Meanwhile losses came from long US Dollar positions against the Swiss Franc and Japanese Yen. In metals, gains from long positions in nickel were reduced by losses from long copper positions, as prices fell on signs of sluggish demand. Short wheat positions also struggled as prices rose on low seeding figures combined with cold weather in the US. In energy markets, long oil positions performed well as political unrest in Iran and falls in crude stocks pushed prices higher.

February 2018

The Fund returned –8.42% in February, by far its worst month of the year.

Volatility returned to markets with a vengeance during February. Against the longer-term backdrop of a relentless rise in stock markets amid persistently low volatility, the release at the start of February of strong US wage growth – the largest year-on-year rise since the start of the financial crisis – led to inflation fears and expectations that the Federal Reserve might start hiking rates more aggressively than had previously been thought. Stock markets fell, with most of the Fund’s negative performance coming from long stock index positions, in particular from Asian and emerging market indices. As

yields rose in fixed income markets, with the US 10-year yield reaching its highest level since 2014, positive performance came from short positions in US bond and interest rate markets. In currency markets, the US Dollar rose, leading to losses from short US Dollar positions against the Euro and Sterling. In commodity markets, long positions in oils suffered as prices fell, driven by the stronger US Dollar and signs of rising inventories. The stronger US Dollar and rising yields pushed the price of gold lower, leading to losses from long positions.

May 2018

The Fund returned –4.65% in May, its second-worst month of the year.

May was dominated by major geopolitical news, most notably mounting fears about political instability in Italy, which caused Italian bond yields to rise sharply towards the end of the month. Meanwhile in the US, strong economic data initially caused Treasury yields to rise, but an unexpectedly dovish tone from the Federal Reserve later in the month saw them retract. Ongoing trade tensions between the US and China, together with President Trump's decision to cancel a meeting with the North Korean leader, adversely affected stock markets. Additionally, the US withdrawal from the Iranian nuclear deal sent energy markets to multi-year highs, while the US Dollar benefited from inflationary prospects. The political deadlock in Italy combined with the dovish tone in the US led to significant losses from long Italian and short North American fixed income positions. Losses also came from most of the long stock index positions–in particular, from European stock indices–amid the regional uncertainty. The Euro was also undermined, resulting in losses from long EUR/SEK positions. The Swedish Krona rallied on rate hike expectations and news that the Swedish National Debt Office announced that it will attempt to strengthen the currency. Gains, however, came from net short Brazilian Real exposure which fell amid uncertainty over the country's upcoming elections. News of US sanctions on both Iran and Venezuela pushed oil higher, with Brent crude topping $80 per barrel, leading to profits from commodities. Additionally, long nickel positions benefited from increased demand from the stainless steel and clean technology industries.

MARKET COMMENTARY AND OUTLOOK

The Fund’s first fiscal quarter, Q4 of 2017, was yet again dominated alternately by headlines out of Washington DC, natural disasters, geopolitical tensions, and … the seemingly endless rally in global stock markets. There was some acceleration in economic growth, driven mainly by low interest rates

and increased optimism about corporate taxes, even as some pundits wondered about its sustainability.

Still, calendar year 2017 was the ninth year of the stock market rally that began in 2009; this represented 105 months of positive returns for a balanced stock-bond portfolio, the previous record for which had been only about four years. Although they appeared to be in the minority, some of the global macro managers to whom we allocate began making the case that the good times could be nearing the end. They believed that central bank tapering, less liquidity, and higher rates would soon see markets jolted out of the surreally low volatility (at least, as measured by the VIX) that had prevailed. They predicted that nominal asset returns would fall, and real returns would fall even more as inflation returned with a vengeance and central banks scrambled into combat. The “bubble” that had been created by central bank support and exacerbated by growing investor complacency must inevitably pop at some time, they contended.

2018 began on a strong note for equities. US Markets rallied to record levels, with the Nasdaq breaking through 7000, driven by the expanding US economy, growth in corporate profits, and enthusiasm over recently enacted tax-cuts and other business-friendly policies. However, there was some pullback and higher volatility in the final few days of the month, portending perhaps the events that were to come in February. The US dollar sold off, posting its worst January in over a decade and closing at a three-year low following Treasury Secretary Mnuchin’s comments in Davos about “a weaker dollar being good for trade,” which represented a dramatic and unexpected departure from the traditional position long espoused by the US. Meanwhile, increased demand drove oil markets higher, while bonds declined, reflecting a return to a broad “risk-on” climate. The Fund had one of its best months in a long while.

February turned out to be a completely different ball-game. It began with an unexpected rise in US hourly earnings and strong employment numbers, which immediately ignited inflationary fears. This started the dominoes falling: equities lost 10% in a week, with the VIX hitting an intra-day high of 50%. Most CTA programs were caught with substantially long equity positions, boosted by the abnormally low equity market volatility that prevailed during the trailing months. Finally, the equity correction was unexpected and was not preceded by the warning of an increase in volatility, as has often been the case historically. Bonds, the normal asset of choice during a “risk-off” scenario, did rally slightly, but were judged to be less attractive than usual due to the inflationary jitters that had been triggered. All in all, these factors led to a dreadful month, and January’s entire gains were forfeited.

Markets continued to be volatile during March. Tech stocks led markets lower following the revelation of Facebook’s data problems, and President Trump’s attacks on Amazon. The probability of a trade war between the US and China increased as threats of tariffs were exchanged. The Fed announced another quarter-point rate hike and policy makers shifted views in favor of further rate increases. The Bank of Japan announced that there would be no change in its commitment to an accommodative monetary policy. The European Central Bank also kept its policy steady, as expected.

Initially in April, trade tensions escalated, with the Trump Administration proposing additional tariffs on China. However, these concerns later eased, and stock markets recovered, boosted by strong earnings in the US, the ECB's decision to maintain stimulus for the time being, and the Bank of England’s dovish tone. In fixed income, the yield on the US 10Y Treasury rose above 3% for the first time since 2014. Meanwhile, geopolitical tensions in the Middle East caused by military action in Syria and the prospect of reinstated Iranian sanctions pushed oil prices higher.

May was dominated by mounting fears about political instability in Italy, which caused Italian bond yields to rise sharply towards the end of the month. Strong US economic data initially caused Treasury yields to rise further, before unexpectedly dovish rhetoric from the Federal Reserve later in the month saw them subside. Ongoing trade tensions between the US and China, together with President Trump's decision to cancel his North Korea meeting, rattled stock markets, while his reneging on the Iranian nuclear deal sent energy markets to multi-year highs.

During June, markets retained their focus on global trade concerns. The heated rhetoric between the US and its key trade partners, especially China, finally took equities into bear market territory. Continuing tensions rattled financial markets ahead of the G7 summit early in the month, and news of global trade tariffs continued to sour market sentiment. Central bank policy divergence was a key theme as the Federal Reserve announced a rate hike and adopted a generally more hawkish stance, while the European Central Bank announced plans to delay rate hikes.

July began with an escalation of trade tensions as the US imposed tariffs on $34 billion worth of Chinese goods, and China retaliated. However, the risk of an imminent global trade war was alleviated as the US and the EU agreed to work towards trade agreements. Optimism surrounding quarterly corporate earnings coupled with stronger US economic data helped stocks to recover from June’s trade-war induced selloff. The Federal Reserve continued its announced commitment to gradual rate hikes, even as the US yield curve flattened more than it had in the last decade. The dollar came under pressure from trade uncertainty, as did the commodities sector. Global bond yields were temporarily lifted by speculation of shifting Japanese monetary policy and encouraging economic data. WTI crude suffered its worst month since 2016 following increased US and Libyan output and slowing global demand. Gold logged its fourth straight monthly loss.

August witnessed selloffs in emerging markets amid political and monetary policy uncertainty alongside ongoing trade tensions. The US and its major trading partners engaged in negotiations with a positive outcome in the case of Mexico whilst tensions escalated with Canada and others. Despite this backdrop, US stock markets made new highs, spurred on by bouts of optimism and robust earnings. Many European stock indices struggled on fears of contagion from emerging market crises, as evidenced by the mid-month crash in the Turkish Lira. Bonds witnessed a flight to safety. Sterling struggled after the EU expressed a new willingness to maintain a close post-Brexit relationship with the UK. Gold and industrial metal prices experienced extended declines due to a strong US Dollar and

weaker Chinese demand. WTI crude oil rebounded amid lower-than-expected US inventories and supply concerns from Iran and Venezuela.

September saw risk appetites return and US stock indices rally as President Trump's latest levies on Chinese goods were lower than anticipated. As expected, the Federal Reserve raised rates; however, its tone was notably more hawkish, based on stronger US growth and inflation prospects. European markets were shaken after Italy doubled down on its controversial fiscal plans, affecting both equities and Italian bonds. More positive Brexit news and upbeat UK sales data resulted in a Sterling rally. In fixed income, gains were made in short US bond and interest rate positions amid improving US economic conditions, while European bonds incurred offsetting losses. Gold continue to decline, while copper rallied on lower-than expected trade tariffs between the US and China. Oil prices were boosted by undersupply concerns amid Iranian sanctions.

At the risk of sounding like a “broken record,” we believe that there continues to be much latent uncertainty in the markets. In the US, concerns about the potential outcome of multiple investigations into Russia-related financial and electoral scandals fester, particularly against the backdrop of the upcoming elections. Geopolitical stresses continue in Europe (particularly with respect to Brexit and Italy) and the Middle East. Trade-related issues with China and other trading partners are not yet fully resolved. Climate change remains a concern in the form of more severe weather-related events. The Fed’s policy continues to be biased towards higher interest rates, and it will no doubt have an impact on the economy and on equity markets. Surprisingly, equity markets have continued to scale new heights, although October 2018 has seen some pullback.

Investors should bear in mind that CTA programs have historically offered useful diversification benefits, with the potential for attractive risk-adjusted returns over the long run. In fact, managed futures have historically tended to perform well in a wide variety of market conditions, perhaps particularly so during periods of equity market turbulence and volatility expansion. We continue to believe that a significant and strategic allocation to the asset class, while not a “hedge” for equities, nonetheless has the potential to serve investors well in the long run.

Although the Fund has been in operation for a relative short period of time, Aspect Capital has been trading a similar strategy dating back to 1999. Aspect’s program has historically offered useful diversification benefits, along with what we view as attractive risk-adjusted long-term returns over multiple market cycles. In our opinion, the Fund and the managed futures asset class should continue to offer these potential benefits in a market environment that is still challenging and a geopolitical outlook that remains fraught with uncertainty. In fact, managed futures, although not a hedge for equities in the true sense of the word, have historically displayed the ability to earn what has been termed as “crisis alpha:” positive returns during periods when equity markets have collapsed and volatility has increased (this is no guarantee of future results).

Difficult market conditions, the prevailing climate of economic and geopolitical uncertainty, and the unpredictable nature of financial markets all pose challenges for investors. The Aspect program is, we believe, positioned to potentially perform well under these conditions. As always, we encourage investors to focus on holding a portfolio that blends traditional assets with a strategic and meaningful allocation to alternative assets, appropriate for their long-term goals. A well-balanced portfolio may display lower volatility, while also affording opportunities for potential long-term growth. We believe that the managed futures asset class should play an important role in such a portfolio.

Thank you for investing in the Equinox Aspect Core Diversified Strategy Fund.

DEFINITIONS

A Commodity Trading Advisor (“CTA”) is a trader who may invest in more than 150 global futures markets. They seek to generate profit in both bull or bear markets, due to their ability to go long (buy) futures positions, in anticipation of rising markets, or go short (sell) futures positions, in anticipation of falling markets.

A Derivative Contract is a financial contract which derives its value from the performance of another entity such as an asset, index, or interest rate, called the "underlying". Derivatives are one of the three main categories of financial instruments, the other two being equities (i.e. stocks) and debt (i.e. bonds and mortgages).

Long Position refers to the buying of a security such as a stock, commodity or currency, with the expectation that the asset will rise in value.

Risk-adjusted return is a mesuare of the return on an investment relative to the risk of that investment, over a specific period, which is generally expressed as a number or rating.

Short Position is a position whereby an investor sells borrowed securities in anticipation of a price decline and is required to return an equal number of shares at some point in the future.

A Trend Following strategy generally seeks to identify the general direction of one or more global market segments (either up or down) using indicators such as current market prices and moving average prices, and buy or sell investments based on the assessment of these trade signals as determined before a trade is made. Trend-following generally focuses on the direction an investment or global market segment already has gone and not on the direction it may go.

9002-NLD-10/30/2018

| Equinox Aspect Core Diversified Strategy Fund |

| PORTFOLIO REVIEW (Unaudited) |

| September 30, 2018 |

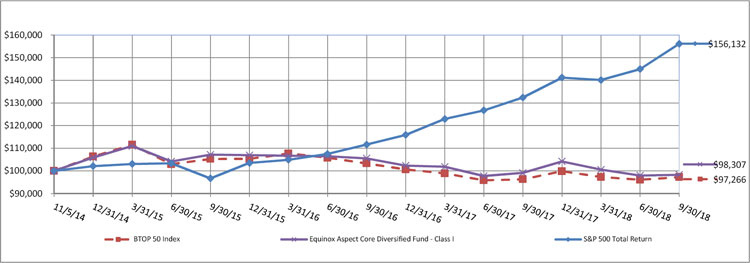

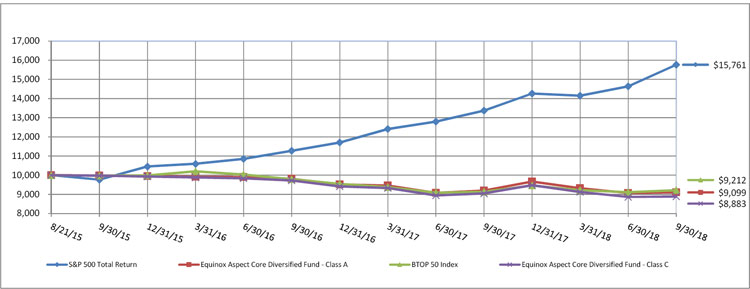

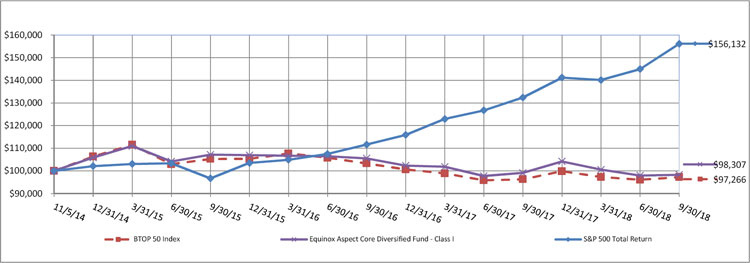

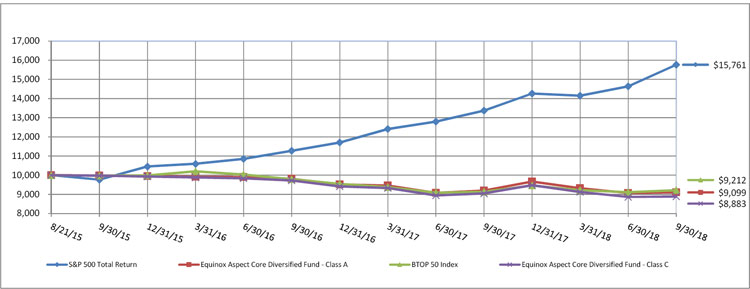

The Fund's performance figures* for the periods ended September 30, 2018, as compared to its benchmark:

| | | | | | | Annualized |

| | | | | | | Since Inception | | Since Inception |

| | | One Year | | Three Years | | (8/21/15) | | (11/5/14) |

| Equinox Aspect Core Diversified Strategy Fund | | | | | | | | |

| Class A with load | | (6.80)% | | (4.92)% | | (4.83)% | | N/A |

| Class A | | (1.08)% | | (3.04)% | | (2.99)% | | N/A |

| Class C | | (1.75)% | | (3.78)% | | (3.74)% | | N/A |

| Class I | | (0.76)% | | (2.81)% | | N/A | | (0.41)% |

| S&P 500 Total Return Index ^ | | 17.91% | | 17.31% | | 15.76% | | 12.10% |

| BTOP 50 Index ** | | 0.98% | | (2.61)% | | (2.59)% | | (0.71)% |

| * | The performance data quoted is historical. The performance comparison includes reinvestment of all dividends and capital gains and has been adjusted for Class A maximum applicable sales charge of 5.75%. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or on the redemptions of portfolio shares. Performance figures for periods greater than one year are annualized. The returns would have been lower had Equinox Institutional Asset Management, LP (the "Advisor") not waived its fees or reimbursed a portion of the Fund's expenses. Per the fee table in the Fund’s prospectus dated February 1, 2018, the Fund’s “Total Annual Fund Operating Expenses” are 2.47%, 3.17% and 2.18% and the Fund’s “Total Annual Fund Operating Expenses (after Fee Waiver and/or Expense Reimbursement)” are 1.70%, 2.45% and 1.45% for Class A, Class C and Class I shares, respectively, of the Fund’s average daily net assets. These expenses may differ from the actual expenses incurred by the Fund for the period covered by this report. Additional information regarding the Fund’s expense ratios is available in the Financial Highlights. For performance information current to the most recent month-end please call 1-888-643-3431. |

| ^ | The S&P 500 Total Return Index is a widely accepted, unmanaged index of U.S. stock market performance which does not take into account charges, fees and other expenses. Investors cannot invest directly in an index. |

| ** | The Barclay BTOP50 Index ("BTOP50 Index") seeks to replicate the overall composition of the managed futures industry with regard to trading style and overall market exposure. The BTOP50 Index employs a top-down approach in selecting its constituents. The largest investable trading advisor programs, as measured by assets under management, are selected for inclusion in the BTOP50 Index. In each calendar year the selected trading advisors represent, in aggregate, no less than 50% of the investable assets of the Barclay CTA Universe. For 2018, there are 20 funds in the BTOP50 Index. Investors cannot invest directly in an index. |

Comparison of the Change in Value of a $100,000 Investment

| Equinox Aspect Core Diversified Strategy Fund |

| PORTFOLIO REVIEW (Unaudited)(Continued) |

| September 30, 2018 |

Comparison of the Change in Value of a $10,000 Investment

| Holdings by Asset Class | | % of Net Assets | |

| U.S. Treasury Notes | | | 84.1 | % |

| Other Assets Less Liabilities | | | 15.9 | % |

| | | | 100.0 | % |

Please refer to the Consolidated Portfolio of Investments in this annual report for a detail of the Fund’s holdings. The value of the Fund’s derivative positions that provide exposure to a managed futures program is included in “other assets less liabilities;” however, the portfolio composition detailed above does not include derivatives exposure. See the accompanying notes for more information on the impact of the Fund’s derivative positions on the consolidated financial statements.

Equinox Aspect Core Diversified Strategy Fund

CONSOLIDATED PORTFOLIO OF INVESTMENTS

September 30, 2018

| Principal | | | | | Coupon Rate | | | | | |

| Amount | | | | | (%) | | Maturity | | Fair Value | |

| | | | | U.S. TREASURY NOTES - 84.1% | | | | | | | | |

| $ | 13,000,000 | | | United States Treasury Note | | 1.2500 | | 11/30/2018 | | $ | 12,980,695 | |

| | 3,750,000 | | | United States Treasury Note * | | 1.2500 | | 1/31/2020 | | | 3,677,783 | |

| | 1,500,000 | | | United States Treasury Note * | | 1.5000 | | 2/28/2019 | | | 1,494,668 | |

| | 3,000,000 | | | United States Treasury Note | | 1.5000 | | 10/31/2019 | | | 2,962,559 | |

| | 3,000,000 | | | United States Treasury Note | | 1.5000 | | 4/15/2020 | | | 2,943,164 | |

| | 3,750,000 | | | United States Treasury Note * | | 1.6250 | | 7/31/2019 | | | 3,720,557 | |

| | 3,750,000 | | | United States Treasury Note * | | 2.0000 | | 7/31/2020 | | | 3,696,753 | |

| | | | | TOTAL U.S. TREASURY NOTES (Cost - $31,532,663) | | | 31,476,179 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 84.1% (Cost - $31,532,663) | | $ | 31,476,179 | |

| | | | | OTHER ASSETS AND LIABILITIES - NET - 15.9% | | | 5,938,258 | |

| | | | | TOTAL NET ASSETS - 100.0% | | | | $ | 37,414,437 | |

| * | All or a portion of the security is held as collateral. Total collateralized securities had a value of $2,966,355 on September 30, 2018. |

See accompanying notes to consolidated financial statements.

Equinox Aspect Core Diversified Strategy Fund

CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

SHORT FUTURES CONTRACTS

| | | | | | | | | | | | Unrealized | |

| | | Number of | | | | | | Notional Value at | | | Appreciation/ | |

| Description | | Contracts | | Counterparty | | Expiration Date | | September 30, 2018 | | | (Depreciation) | |

| 3 Month Euro (EURIBOR) | | 1 | | Morgan Stanley | | Dec-20 | | | 289,475 | | | $ | 148 | |

| 3 Month Euro (EURIBOR) | | 4 | | Morgan Stanley | | Mar-21 | | | 1,156,855 | | | | 460 | |

| 90 Day Euro Future | | 2 | | Morgan Stanley | | Mar-19 | | | 485,800 | | | | 338 | |

| 90 Day Euro Future | | 30 | | Morgan Stanley | | Jun-19 | | | 7,275,750 | | | | 5,375 | |

| 90 Day Euro Future | | 67 | | Morgan Stanley | | Sep-19 | | | 16,234,100 | | | | 16,700 | |

| 90 Day Euro Future | | 60 | | Morgan Stanley | | Dec-19 | | | 14,529,000 | | | | 17,375 | |

| 90 Day Euro Future | | 61 | | Morgan Stanley | | Mar-20 | | | 14,767,338 | | | | 17,900 | |

| 90 Day Euro Future | | 54 | | Morgan Stanley | | Jun-20 | | | 13,072,050 | | | | 17,375 | |

| 90 Day Euro Future | | 44 | | Morgan Stanley | | Sep-20 | | | 10,651,850 | | | | 13,625 | |

| 90 Day Euro Future | | 40 | | Morgan Stanley | | Dec-20 | | | 9,683,500 | | | | 11,688 | |

| 90 Day Euro Future | | 34 | | Morgan Stanley | | Mar-21 | | | 8,232,675 | | | | 10,838 | |

| 90 Day Sterling (Short Sterling) Future | | 8 | | Morgan Stanley | | Jun-19 | | | 1,290,359 | | | | 331 | |

| 90 Day Sterling (Short Sterling) Future | | 19 | | Morgan Stanley | | Sep-19 | | | 3,061,815 | | | | 2,270 | |

| 90 Day Sterling (Short Sterling) Future | | 13 | | Morgan Stanley | | Dec-19 | | | 2,093,230 | | | | 198 | |

| 90 Day Sterling (Short Sterling) Future | | 12 | | Morgan Stanley | | Mar-20 | | | 1,931,039 | | | | 265 | |

| 90 Day Sterling (Short Sterling) Future | | 18 | | Morgan Stanley | | Jun-20 | | | 2,894,798 | | | | 2,923 | |

| 90 Day Sterling (Short Sterling) Future | | 28 | | Morgan Stanley | | Sep-20 | | | 4,500,281 | | | | 678 | |

| 90 Day Sterling (Short Sterling) Future | | 31 | | Morgan Stanley | | Dec-20 | | | 4,979,927 | | | | 1,315 | |

| 90 Day Sterling (Short Sterling) Future | | 16 | | Morgan Stanley | | Mar-21 | | | 2,568,981 | | | | 345 | |

| Australian 3 Year Bond Future | | 18 | | Morgan Stanley | | Dec-18 | | | 1,449,122 | | | | (2,130 | ) |

| Australian 10 Year Bond Future | | 16 | | Morgan Stanley | | Dec-18 | | | 1,491,706 | | | | (5,847 | ) |

| Australian Dollar Future | | 12 | | Morgan Stanley | | Dec-18 | | | 867,240 | | | | (10,870 | ) |

| British Pound Future | | 16 | | Morgan Stanley | | Dec-18 | | | 1,308,600 | | | | 7,656 | |

| Canadian 10 Year Bond Future | | 29 | | Morgan Stanley | | Dec-18 | | | 2,975,383 | | | | (393 | ) |

| Canadian Dollar Future | | 57 | | Morgan Stanley | | Dec-18 | | | 4,417,785 | | | | (67,105 | ) |

| Cocoa Future + | | 2 | | Morgan Stanley | | Dec-18 | | | 41,140 | | | | 1,920 | |

| Cocoa Future + | | 2 | | Morgan Stanley | | Mar-19 | | | 41,640 | | | | 1,910 | |

| Coffee Future + | | 22 | | Morgan Stanley | | Dec-18 | | | 845,213 | | | | 55,369 | |

| Coffee Future + | | 16 | | Morgan Stanley | | Mar-19 | | | 635,100 | | | | 35,681 | |

| Coffee Future + | | 15 | | Morgan Stanley | | May-19 | | | 608,906 | | | | 32,663 | |

| Copper Future + | | 5 | | Morgan Stanley | | Dec-18 | | | 350,625 | | | | (22,088 | ) |

| Corn Future + | | 3 | | Morgan Stanley | | Dec-18 | | | 53,438 | | | | (1,200 | ) |

| Corn Future + | | 2 | | Morgan Stanley | | Mar-19 | | | 36,800 | | | | (862 | ) |

| Euro BOBL Future | | 54 | | Morgan Stanley | | Dec-18 | | | 8,197,641 | | | | 13,434 | |

| Euro-Bund Future | | 18 | | Morgan Stanley | | Dec-18 | | | 3,319,825 | | | | (1,644 | ) |

| Euro BUXL 30 Year Bond Future | | 5 | | Morgan Stanley | | Dec-18 | | | 1,012,364 | | | | (6,966 | ) |

| Euro FX Future | | 25 | | Morgan Stanley | | Dec-18 | | | 3,650,625 | | | | 9,681 | |

| Euro Schatz Future | | 21 | | Morgan Stanley | | Dec-18 | | | 2,726,362 | | | | 588 | |

| FTSE/JSE Africa Top 40 Index Future | | 1 | | Morgan Stanley | | Dec-18 | | | 35,417 | | | | 766 | |

| Gold 100 Oz. Future + | | 26 | | Morgan Stanley | | Dec-18 | | | 3,110,120 | | | | 49,440 | |

| Hard Red Winter Wheat Future + | | 4 | | Morgan Stanley | | Dec-18 | | | 102,250 | | | | 1,450 | |

| Japanese Yen Future | | 132 | | Morgan Stanley | | Dec-18 | | | 14,609,100 | | | | 209,331 | |

| Lean Hogs Future + | | 8 | | Morgan Stanley | | Dec-18 | | | 185,360 | | | | (20,330 | ) |

| Lean Hogs Future + | | 3 | | Morgan Stanley | | Feb-19 | | | 79,020 | | | | (2,400 | ) |

| Live Cattle Future + | | 3 | | Morgan Stanley | | Dec-18 | | | 142,620 | | | | (5,890 | ) |

| LME Copper Future + | | 1 | | Morgan Stanley | | Dec-18 | | | 156,563 | | | | (9,810 | ) |

| LME Nickle Future + | | 1 | | Morgan Stanley | | Dec-18 | | | 75,552 | | | | (1,240 | ) |

| LME Primary Aluminum Future + | | 6 | | Morgan Stanley | | Dec-18 | | | 311,325 | | | | (2,770 | ) |

| Long Gilt Future | | 19 | | Morgan Stanley | | Dec-18 | | | 2,996,527 | | | | (2,874 | ) |

| New Zealand Dollar Future | | 21 | | Morgan Stanley | | Dec-18 | | | 1,392,510 | | | | (24,255 | ) |

| Silver Future + | | 11 | | Morgan Stanley | | Dec-18 | | | 809,160 | | | | (14,390 | ) |

| Soybean Future + | | 31 | | Morgan Stanley | | Nov-18 | | | 1,310,525 | | | | (525 | ) |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Strategy Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

SHORT FUTURES CONTRACTS (Continued)

| | | | | | | | | | | | Unrealized | |

| | | Number of | | | | | | Notional Value at | | | Appreciation/ | |

| Description | | Contracts | | Counterparty | | Expiration Date | | September 30, 2018 | | | (Depreciation) | |

| Soybean Meal Future + | | 24 | | Morgan Stanley | | Dec-18 | | | 741,600 | | | $ | 23,470 | |

| US 2 Year Note (CBT) Future | | 105 | | Morgan Stanley | | Dec-18 | | | 22,127,109 | | | | 46,922 | |

| US 5 Year Note (CBT) Future | | 162 | | Morgan Stanley | | Dec-18 | | | 18,221,203 | | | | 119,516 | |

| US 10 Year Note (CBT) Future | | 99 | | Morgan Stanley | | Dec-18 | | | 11,759,344 | | | | 116,875 | |

| US Long Bond Future | | 4 | | Morgan Stanley | | Dec-18 | | | 562,000 | | | | (625 | ) |

| US Ultra Bond Future | | 2 | | Morgan Stanley | | Dec-18 | | | 308,563 | | | | (719 | ) |

| Wheat (CBT) Future + | | 4 | | Morgan Stanley | | Dec-18 | | | 101,800 | | | | 1,200 | |

| Wheat (CBT) Future + | | 2 | | Morgan Stanley | | Mar-19 | | | 52,725 | | | | (75 | ) |

| World Sugar #11 Future + | | 1 | | Morgan Stanley | | Feb-19 | | | 12,544 | | | | (358 | ) |

| World Sugar #11 Future + | | 6 | | Morgan Stanley | | Apr-19 | | | 75,869 | | | | 661 | |

| | | | | | | | | | | | | | 643,314 | |

| LONG FUTURES CONTRACTS | | | | | | | | | | | | | | |

| 90 Day Bank Bill Future | | 7 | | Morgan Stanley | | Jun-19 | | | 5,040,366 | | | | (300 | ) |

| 90 Day Bank Bill Future | | 5 | | Morgan Stanley | | Sep-19 | | | 3,599,820 | | | | (229 | ) |

| 90 Day Bank Bill Future | | 13 | | Morgan Stanley | | Dec-19 | | | 9,358,154 | | | | (716 | ) |

| 90 Day Bank Bill Future | | 27 | | Morgan Stanley | | Mar-20 | | | 19,433,783 | | | | (3,662 | ) |

| 90 Day Bank Bill Future | | 4 | | Morgan Stanley | | Jun-20 | | | 2,878,655 | | | | (649 | ) |

| AEX Index (Amsterdam) Future | | 10 | | Morgan Stanley | | Oct-18 | | | 1,276,373 | | | | 10,915 | |

| Brent Crude Future + | | 13 | | Morgan Stanley | | Oct-18 | | | 1,075,490 | | | | 75,940 | |

| Brent Crude Future + | | 6 | | Morgan Stanley | | Nov-18 | | | 493,440 | | | | 25,280 | |

| CAC 40 10 Euro Future | | 27 | | Morgan Stanley | | Oct-18 | | | 1,721,536 | | | | 37,812 | |

| Swiss Franc Future | | 21 | | Morgan Stanley | | Dec-18 | | | 2,699,550 | | | | (43,525 | ) |

| Dax Index Future | | 3 | | Morgan Stanley | | Dec-18 | | | 1,066,388 | | | | 1,473 | |

| DJIA Index E-Mini Future | | 15 | | Morgan Stanley | | Dec-18 | | | 1,985,700 | | | | 14,545 | |

| E-Mini Russell 2000 Index Future | | 19 | | Morgan Stanley | | Dec-18 | | | 1,615,760 | | | | (17,735 | ) |

| Euro-BTP Italian Government Bond Future | | 1 | | Morgan Stanley | | Dec-18 | | | 143,840 | | | | (3,463 | ) |

| Euro OAT Future | | 10 | | Morgan Stanley | | Dec-18 | | | 1,754,447 | | | | (16,995 | ) |

| Euro STOXX 50 Future | | 31 | | Morgan Stanley | | Dec-18 | | | 1,219,541 | | | | 10,118 | |

| FTSE 100 Index Future | | 10 | | Morgan Stanley | | Dec-18 | | | 976,278 | | | | 19,944 | |

| Gasoline RBOB Future + | | 14 | | Morgan Stanley | | Oct-18 | | | 1,226,392 | | | | 48,590 | |

| Hang Seng Index Future | | 1 | | Morgan Stanley | | Oct-18 | | | 178,130 | | | | 1,509 | |

| HSCEI Future | | 1 | | Morgan Stanley | | Oct-18 | | | 70,697 | | | | 32 | |

| Japan 10 Year Bond Future | | 2 | | Morgan Stanley | | Dec-18 | | | 2,642,779 | | | | (3,378 | ) |

| Live Cattle Future + | | 1 | | Morgan Stanley | | Feb-19 | | | 49,120 | | | | 360 | |

| Live Cattle Future + | | 2 | | Morgan Stanley | | Apr-19 | | | 99,120 | | | | 880 | |

| Low Sulfur Gas Oil Future + | | 15 | | Morgan Stanley | | Nov-18 | | | 1,086,375 | | | | 62,225 | |

| Low Sulfur Gas Oil Future + | | 7 | | Morgan Stanley | | Dec-18 | | | 504,875 | | | | 30,700 | |

| Mexican Peso Future | | 43 | | Morgan Stanley | | Dec-18 | | | 1,134,985 | | | | 19,435 | |

| Mini MSCI EAFE Index Future | | 7 | | Morgan Stanley | | Dec-18 | | | 691,425 | | | | 1,030 | |

| Nasdaq 100 E-Mini Future | | 8 | | Morgan Stanley | | Dec-18 | | | 1,224,840 | | | | 17,973 | |

| Natural Gas Future + | | 2 | | Morgan Stanley | | Oct-18 | | | 60,160 | | | | 230 | |

| Natural Gas Future + | | 1 | | Morgan Stanley | | Nov-18 | | | 30,910 | | | | 200 | |

| Nikkei 225 Index (CME) Future | | 5 | | Morgan Stanley | | Dec-18 | | | 604,625 | | | | 30,600 | |

| Nikkei 225 Index (SGX) Future | | 6 | | Morgan Stanley | | Dec-18 | | | 637,716 | | | | 33,954 | |

| NY Harbor ULSD Heating Oil Future + | | 10 | | Morgan Stanley | | Oct-18 | | | 986,370 | | | | 48,997 | |

| NY Harbor ULSD Heating Oil Future + | | 5 | | Morgan Stanley | | Nov-18 | | | 494,046 | | | | 20,328 | |

| OMXS30 Index Future | | 161 | | Morgan Stanley | | Oct-18 | | | 3,005,218 | | | | 50,113 | |

| S&P 500 E-Mini Future | | 13 | | Morgan Stanley | | Dec-18 | | | 1,897,350 | | | | 5,140 | |

| S&P Midcap 400 E-Mini Future | | 9 | | Morgan Stanley | | Dec-18 | | | 1,822,680 | | | | (17,280 | ) |

| S&P/TSX 60 IX Future | | 13 | | Morgan Stanley | | Dec-18 | | | 1,911,481 | | | | 3,598 | |

| SPI 200 Future | | 17 | | Morgan Stanley | | Dec-18 | | | 1,904,709 | | | | 10,298 | |

See accompanying notes to consolidated financial statements.

Equinox Aspect Core Diversified Strategy Fund

CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued)

LONG FUTURES CONTRACTS (Continued)

| | | | | | | | | | | | Unrealized | |

| | | Number of | | | | | | Notional Value at | | | Appreciation/ | |

| Description | | Contracts | | Counterparty | | Expiration Date | | September 30, 2018 | | | (Depreciation) | |

| TOPIX Index Future | | 7 | | Morgan Stanley | | Dec-18 | | | 1,120,086 | | | $ | 62,391 | |

| WTI Crude Oil Future + | | 10 | | Morgan Stanley | | Oct-18 | | | 732,500 | | | | 46,210 | |

| WTI Crude Oil Future + | | 5 | | Morgan Stanley | | Nov-18 | | | 365,300 | | | | 21,230 | |

| | | | | | | | | | | | | | 604,118 | |

| NET UNREALIZED APPRECIATION ON FUTURES CONTRACTS | | | $ | 1,247,432 | |

| + | This investment is a holding of Equinox Aspect Core Diversified Strategy Fund Limited. |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 420,696 | | BRL | | 100,000 | | USD | | $ | 4,673 | |

| 12/19/2018 | | Morgan Stanley | | 209,848 | | BRL | | 50,000 | | USD | | | 2,212 | |

| 12/19/2018 | | Morgan Stanley | | 206,098 | | BRL | | 50,000 | | USD | | | 1,279 | |

| 12/19/2018 | | Morgan Stanley | | 209,798 | | BRL | | 50,000 | | USD | | | 2,200 | |

| 12/19/2018 | | Morgan Stanley | | 207,723 | | BRL | | 50,000 | | USD | | | 1,683 | |

| 12/19/2018 | | Morgan Stanley | | 206,348 | | BRL | | 50,000 | | USD | | | 1,341 | |

| 12/19/2018 | | Morgan Stanley | | 208,350 | | BRL | | 50,000 | | USD | | | 1,839 | |

| 12/19/2018 | | Morgan Stanley | | 202,265 | | BRL | | 50,000 | | USD | | | 325 | |

| 12/19/2018 | | Morgan Stanley | | 33,409,175 | | CLP | | 50,000 | | USD | | | 696 | |

| 12/19/2018 | | Morgan Stanley | | 33,299,675 | | CLP | | 50,000 | | USD | | | 530 | |

| 12/19/2018 | | Morgan Stanley | | 33,644,675 | | CLP | | 50,000 | | USD | | | 1,053 | |

| 12/19/2018 | | Morgan Stanley | | 33,239,675 | | CLP | | 50,000 | | USD | | | 439 | |

| 12/19/2018 | | Morgan Stanley | | 32,964,675 | | CLP | | 50,000 | | USD | | | 22 | |

| 12/19/2018 | | Morgan Stanley | | 151,848,575 | | COP | | 50,000 | | USD | | | 1,053 | |

| 12/19/2018 | | Morgan Stanley | | 151,435,575 | | COP | | 50,000 | | USD | | | 914 | |

| 12/19/2018 | | Morgan Stanley | | 150,848,575 | | COP | | 50,000 | | USD | | | 717 | |

| 12/19/2018 | | Morgan Stanley | | 150,748,575 | | COP | | 50,000 | | USD | | | 683 | |

| 12/19/2018 | | Morgan Stanley | | 151,048,575 | | COP | | 50,000 | | USD | | | 784 | |

| 12/19/2018 | | Morgan Stanley | | 149,778,000 | | COP | | 50,000 | | USD | | | 357 | |

| 12/19/2018 | | Morgan Stanley | | 150,298,575 | | COP | | 50,000 | | USD | | | 532 | |

| 12/19/2018 | | Morgan Stanley | | 149,799,500 | | COP | | 50,000 | | USD | | | 364 | |

| 12/19/2018 | | Morgan Stanley | | 1,287,637 | | CZK | | 50,000 | | EUR | | | (172 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,287,300 | | CZK | | 50,000 | | EUR | | | (187 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,282,550 | | CZK | | 50,000 | | EUR | | | (402 | ) |

| 12/19/2018 | | Morgan Stanley | | 639,967 | | CZK | | 25,000 | | EUR | | | (260 | ) |

| 12/19/2018 | | Morgan Stanley | | 640,092 | | CZK | | 25,000 | | EUR | | | (255 | ) |

| 12/19/2018 | | Morgan Stanley | | 639,221 | | CZK | | 25,000 | | EUR | | | (294 | ) |

| 12/19/2018 | | Morgan Stanley | | 639,426 | | CZK | | 25,000 | | EUR | | | (285 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,694 | | CZK | | 25,000 | | EUR | | | (318 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,965 | | CZK | | 25,000 | | EUR | | | (306 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,669 | | CZK | | 25,000 | | EUR | | | (319 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,740 | | CZK | | 25,000 | | EUR | | | (316 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,601 | | CZK | | 25,000 | | EUR | | | (322 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,690 | | CZK | | 25,000 | | EUR | | | (318 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,277,730 | | CZK | | 50,000 | | EUR | | | (620 | ) |

See accompanying notes to consolidated financial statements.

Equinox Aspect Core Diversified Fund

CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 638,394 | | CZK | | 25,000 | | EUR | | $ | (331 | ) |

| 12/19/2018 | | Morgan Stanley | | 638,415 | | CZK | | 25,000 | | EUR | | | (331 | ) |

| 12/19/2018 | | Morgan Stanley | | 637,849 | | CZK | | 25,000 | | EUR | | | (356 | ) |

| 12/19/2018 | | Morgan Stanley | | 637,874 | | CZK | | 25,000 | | EUR | | | (355 | ) |

| 12/19/2018 | | Morgan Stanley | | 637,799 | | CZK | | 25,000 | | EUR | | | (358 | ) |

| 12/19/2018 | | Morgan Stanley | | 637,845 | | CZK | | 25,000 | | EUR | | | (356 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,279,160 | | CZK | | 50,000 | | EUR | | | (556 | ) |

| 12/19/2018 | | Morgan Stanley | | 640,777 | | CZK | | 25,000 | | EUR | | | (224 | ) |

| 12/19/2018 | | Morgan Stanley | | 640,902 | | CZK | | 25,000 | | EUR | | | (218 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,282,210 | | CZK | | 50,000 | | EUR | | | (417 | ) |

| 12/19/2018 | | Morgan Stanley | | 25,000 | | EUR | | 641,948 | | CZK | | | 171 | |

| 12/19/2018 | | Morgan Stanley | | 25,000 | | EUR | | 642,073 | | CZK | | | 165 | |

| 12/19/2018 | | Morgan Stanley | | 25,000 | | EUR | | 644,963 | | CZK | | | 34 | |

| 12/19/2018 | | Morgan Stanley | | 25,000 | | EUR | | 645,163 | | CZK | | | 25 | |

| 12/19/2018 | | Morgan Stanley | | 25,000 | | EUR | | 646,430 | | CZK | | | (32 | ) |

| 12/19/2018 | | Morgan Stanley | | 25,000 | | EUR | | 646,605 | | CZK | | | (40 | ) |

| 12/19/2018 | | Morgan Stanley | | 600,000 | | EUR | | 195,311,734 | | HUF | | | (4,360 | ) |

| 12/19/2018 | | Morgan Stanley | | 500,000 | | EUR | | 162,568,279 | | HUF | | | (2,941 | ) |

| 12/19/2018 | | Morgan Stanley | | 800,000 | | EUR | | 7,778,878 | | NOK | | | (22,983 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,600,000 | | EUR | | 16,858,859 | | SEK | | | (38,175 | ) |

| 12/19/2018 | | Morgan Stanley | | 3,200,000 | | EUR | | 33,718,077 | | SEK | | | (76,391 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | EUR | | 1,053,943 | | SEK | | | (2,416 | ) |

| 12/19/2018 | | Morgan Stanley | | 2,400,000 | | EUR | | 25,392,118 | | SEK | | | (69,023 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,100,000 | | EUR | | 11,647,239 | | SEK | | | (32,676 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,200,000 | | EUR | | 12,595,619 | | SEK | | | (23,135 | ) |

| 12/19/2018 | | Morgan Stanley | | 32,538,179 | | HUF | | 100,000 | | EUR | | | 677 | |

| 12/19/2018 | | Morgan Stanley | | 32,367,449 | | HUF | | 100,000 | | EUR | | | 60 | |

| 12/19/2018 | | Morgan Stanley | | 32,421,829 | | HUF | | 100,000 | | EUR | | | 256 | |

| 12/19/2018 | | Morgan Stanley | | 177,860 | | ILS | | 50,000 | | USD | | | (775 | ) |

| 12/19/2018 | | Morgan Stanley | | 177,925 | | ILS | | 50,000 | | USD | | | (757 | ) |

| 12/19/2018 | | Morgan Stanley | | 178,077 | | ILS | | 50,000 | | USD | | | (715 | ) |

| 12/19/2018 | | Morgan Stanley | | 178,122 | | ILS | | 50,000 | | USD | | | (702 | ) |

| 12/19/2018 | | Morgan Stanley | | 355,253 | | ILS | | 100,000 | | USD | | | (1,679 | ) |

| 12/19/2018 | | Morgan Stanley | | 177,286 | | ILS | | 50,000 | | USD | | | (934 | ) |

| 12/19/2018 | | Morgan Stanley | | 88,649 | | ILS | | 25,000 | | USD | | | (465 | ) |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 88,656 | | ILS | | 25,000 | | USD | | $ | (463 | ) |

| 12/19/2018 | | Morgan Stanley | | 55,420,935 | | KRW | | 50,000 | | USD | | | 65 | |

| 12/19/2018 | | Morgan Stanley | | 110,618,870 | | KRW | | 100,000 | | USD | | | (72 | ) |

| 12/19/2018 | | Morgan Stanley | | 55,264,435 | | KRW | | 50,000 | | USD | | | (77 | ) |

| 12/19/2018 | | Morgan Stanley | | 55,494,435 | | KRW | | 50,000 | | USD | | | 131 | |

| 12/19/2018 | | Morgan Stanley | | 55,619,435 | | KRW | | 50,000 | | USD | | | 244 | |

| 12/19/2018 | | Morgan Stanley | | 111,053,040 | | KRW | | 100,000 | | USD | | | 320 | |

| 12/19/2018 | | Morgan Stanley | | 110,728,870 | | KRW | | 100,000 | | USD | | | 28 | |

| 12/19/2018 | | Morgan Stanley | | 237,729 | | NOK | | 25,000 | | EUR | | | 58 | |

| 12/19/2018 | | Morgan Stanley | | 237,792 | | NOK | | 25,000 | | EUR | | | 65 | |

| 12/19/2018 | | Morgan Stanley | | 237,721 | | NOK | | 25,000 | | EUR | | | 57 | |

| 12/19/2018 | | Morgan Stanley | | 237,771 | | NOK | | 25,000 | | EUR | | | 63 | |

| 12/19/2018 | | Morgan Stanley | | 237,826 | | NOK | | 25,000 | | EUR | | | 70 | |

| 12/19/2018 | | Morgan Stanley | | 237,876 | | NOK | | 25,000 | | EUR | | | 76 | |

| 12/19/2018 | | Morgan Stanley | | 237,389 | | NOK | | 25,000 | | EUR | | | 16 | |

| 12/19/2018 | | Morgan Stanley | | 237,475 | | NOK | | 25,000 | | EUR | | | 26 | |

| 12/19/2018 | | Morgan Stanley | | 237,478 | | NOK | | 25,000 | | EUR | | | 27 | |

| 12/19/2018 | | Morgan Stanley | | 237,564 | | NOK | | 25,000 | | EUR | | | 37 | |

| 12/19/2018 | | Morgan Stanley | | 237,049 | | NOK | | 25,000 | | EUR | | | (26 | ) |

| 12/19/2018 | | Morgan Stanley | | 237,074 | | NOK | | 25,000 | | EUR | | | (23 | ) |

| 12/19/2018 | | Morgan Stanley | | 242,277 | | NOK | | 25,000 | | EUR | | | 618 | |

| 12/19/2018 | | Morgan Stanley | | 242,340 | | NOK | | 25,000 | | EUR | | | 626 | |

| 12/19/2018 | | Morgan Stanley | | 484,465 | | NOK | | 50,000 | | EUR | | | 1,225 | |

| 12/19/2018 | | Morgan Stanley | | 241,742 | | NOK | | 25,000 | | EUR | | | 552 | |

| 12/19/2018 | | Morgan Stanley | | 241,779 | | NOK | | 25,000 | | EUR | | | 557 | |

| 12/19/2018 | | Morgan Stanley | | 241,743 | | NOK | | 25,000 | | EUR | | | 552 | |

| 12/19/2018 | | Morgan Stanley | | 241,751 | | NOK | | 25,000 | | EUR | | | 553 | |

| 12/19/2018 | | Morgan Stanley | | 241,668 | | NOK | | 25,000 | | EUR | | | 543 | |

| 12/19/2018 | | Morgan Stanley | | 241,681 | | NOK | | 25,000 | | EUR | | | 545 | |

| 12/19/2018 | | Morgan Stanley | | 241,002 | | NOK | | 25,000 | | EUR | | | 462 | |

| 12/19/2018 | | Morgan Stanley | | 241,114 | | NOK | | 25,000 | | EUR | | | 475 | |

| 12/19/2018 | | Morgan Stanley | | 240,976 | | NOK | | 25,000 | | EUR | | | 458 | |

| 12/19/2018 | | Morgan Stanley | | 241,001 | | NOK | | 25,000 | | EUR | | | 461 | |

| 12/19/2018 | | Morgan Stanley | | 240,283 | | NOK | | 25,000 | | EUR | | | 372 | |

| 12/19/2018 | | Morgan Stanley | | 240,423 | | NOK | | 25,000 | | EUR | | | 390 | |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 240,458 | | NOK | | 25,000 | | EUR | | $ | 394 | |

| 12/19/2018 | | Morgan Stanley | | 240,600 | | NOK | | 25,000 | | EUR | | | 411 | |

| 12/19/2018 | | Morgan Stanley | | 240,608 | | NOK | | 25,000 | | EUR | | | 412 | |

| 12/19/2018 | | Morgan Stanley | | 240,633 | | NOK | | 25,000 | | EUR | | | 415 | |

| 12/19/2018 | | Morgan Stanley | | 240,420 | | NOK | | 25,000 | | EUR | | | 389 | |

| 12/19/2018 | | Morgan Stanley | | 240,533 | | NOK | | 25,000 | | EUR | | | 403 | |

| 12/19/2018 | | Morgan Stanley | | 240,249 | | NOK | | 25,000 | | EUR | | | 368 | |

| 12/19/2018 | | Morgan Stanley | | 240,274 | | NOK | | 25,000 | | EUR | | | 371 | |

| 12/19/2018 | | Morgan Stanley | | 240,317 | | NOK | | 25,000 | | EUR | | | 376 | |

| 12/19/2018 | | Morgan Stanley | | 240,349 | | NOK | | 25,000 | | EUR | | | 380 | |

| 12/19/2018 | | Morgan Stanley | | 240,539 | | NOK | | 25,000 | | EUR | | | 404 | |

| 12/19/2018 | | Morgan Stanley | | 240,686 | | NOK | | 25,000 | | EUR | | | 422 | |

| 12/19/2018 | | Morgan Stanley | | 240,957 | | NOK | | 25,000 | | EUR | | | 455 | |

| 12/19/2018 | | Morgan Stanley | | 241,007 | | NOK | | 25,000 | | EUR | | | 461 | |

| 12/19/2018 | | Morgan Stanley | | 241,188 | | NOK | | 25,000 | | EUR | | | 484 | |

| 12/19/2018 | | Morgan Stanley | | 241,282 | | NOK | | 25,000 | | EUR | | | 495 | |

| 12/19/2018 | | Morgan Stanley | | 241,470 | | NOK | | 25,000 | | EUR | | | 519 | |

| 12/19/2018 | | Morgan Stanley | | 241,627 | | NOK | | 25,000 | | EUR | | | 538 | |

| 12/19/2018 | | Morgan Stanley | | 241,541 | | NOK | | 25,000 | | EUR | | | 527 | |

| 12/19/2018 | | Morgan Stanley | | 241,604 | | NOK | | 25,000 | | EUR | | | 535 | |

| 12/19/2018 | | Morgan Stanley | | 241,331 | | NOK | | 25,000 | | EUR | | | 501 | |

| 12/19/2018 | | Morgan Stanley | | 241,381 | | NOK | | 25,000 | | EUR | | | 508 | |

| 12/19/2018 | | Morgan Stanley | | 241,320 | | NOK | | 25,000 | | EUR | | | 500 | |

| 12/19/2018 | | Morgan Stanley | | 241,419 | | NOK | | 25,000 | | EUR | | | 512 | |

| 12/19/2018 | | Morgan Stanley | | 241,475 | | NOK | | 25,000 | | EUR | | | 519 | |

| 12/19/2018 | | Morgan Stanley | | 241,525 | | NOK | | 25,000 | | EUR | | | 525 | |

| 12/19/2018 | | Morgan Stanley | | 241,459 | | NOK | | 25,000 | | EUR | | | 517 | |

| 12/19/2018 | | Morgan Stanley | | 241,546 | | NOK | | 25,000 | | EUR | | | 528 | |

| 12/19/2018 | | Morgan Stanley | | 240,517 | | NOK | | 25,000 | | EUR | | | 401 | |

| 12/19/2018 | | Morgan Stanley | | 240,604 | | NOK | | 25,000 | | EUR | | | 412 | |

| 12/19/2018 | | Morgan Stanley | | 240,362 | | NOK | | 25,000 | | EUR | | | 382 | |

| 12/19/2018 | | Morgan Stanley | | 240,524 | | NOK | | 25,000 | | EUR | | | 402 | |

| 12/19/2018 | | Morgan Stanley | | 240,199 | | NOK | | 25,000 | | EUR | | | 362 | |

| 12/19/2018 | | Morgan Stanley | | 240,249 | | NOK | | 25,000 | | EUR | | | 368 | |

| 12/19/2018 | | Morgan Stanley | | 240,122 | | NOK | | 25,000 | | EUR | | | 353 | |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 240,147 | | NOK | | 25,000 | | EUR | | $ | 356 | |

| 12/19/2018 | | Morgan Stanley | | 239,593 | | NOK | | 25,000 | | EUR | | | 287 | |

| 12/19/2018 | | Morgan Stanley | | 239,685 | | NOK | | 25,000 | | EUR | | | 299 | |

| 12/19/2018 | | Morgan Stanley | | 239,470 | | NOK | | 25,000 | | EUR | | | 272 | |

| 12/19/2018 | | Morgan Stanley | | 239,483 | | NOK | | 25,000 | | EUR | | | 274 | |

| 12/19/2018 | | Morgan Stanley | | 239,498 | | NOK | | 25,000 | | EUR | | | 276 | |

| 12/19/2018 | | Morgan Stanley | | 239,536 | | NOK | | 25,000 | | EUR | | | 280 | |

| 12/19/2018 | | Morgan Stanley | | 239,490 | | NOK | | 25,000 | | EUR | | | 275 | |

| 12/19/2018 | | Morgan Stanley | | 239,565 | | NOK | | 25,000 | | EUR | | | 284 | |

| 12/19/2018 | | Morgan Stanley | | 479,077 | | NOK | | 50,000 | | EUR | | | 561 | |

| 12/19/2018 | | Morgan Stanley | | 238,756 | | NOK | | 25,000 | | EUR | | | 184 | |

| 12/19/2018 | | Morgan Stanley | | 238,793 | | NOK | | 25,000 | | EUR | | | 189 | |

| 12/19/2018 | | Morgan Stanley | | 238,731 | | NOK | | 25,000 | | EUR | | | 181 | |

| 12/19/2018 | | Morgan Stanley | | 238,906 | | NOK | | 25,000 | | EUR | | | 203 | |

| 12/19/2018 | | Morgan Stanley | | 239,495 | | NOK | | 25,000 | | EUR | | | 275 | |

| 12/19/2018 | | Morgan Stanley | | 239,508 | | NOK | | 25,000 | | EUR | | | 277 | |

| 12/19/2018 | | Morgan Stanley | | 239,250 | | NOK | | 25,000 | | EUR | | | 245 | |

| 12/19/2018 | | Morgan Stanley | | 239,284 | | NOK | | 25,000 | | EUR | | | 249 | |

| 12/19/2018 | | Morgan Stanley | | 238,920 | | NOK | | 25,000 | | EUR | | | 204 | |

| 12/19/2018 | | Morgan Stanley | | 239,270 | | NOK | | 25,000 | | EUR | | | 247 | |

| 12/19/2018 | | Morgan Stanley | | 238,917 | | NOK | | 25,000 | | EUR | | | 204 | |

| 12/19/2018 | | Morgan Stanley | | 238,942 | | NOK | | 25,000 | | EUR | | | 207 | |

| 12/19/2018 | | Morgan Stanley | | 238,754 | | NOK | | 25,000 | | EUR | | | 184 | |

| 12/19/2018 | | Morgan Stanley | | 238,817 | | NOK | | 25,000 | | EUR | | | 192 | |

| 12/19/2018 | | Morgan Stanley | | 482,014 | | NOK | | 50,000 | | EUR | | | 923 | |

| 12/19/2018 | | Morgan Stanley | | 480,714 | | NOK | | 50,000 | | EUR | | | 763 | |

| 12/19/2018 | | Morgan Stanley | | 480,819 | | NOK | | 50,000 | | EUR | | | 776 | |

| 12/19/2018 | | Morgan Stanley | | 479,994 | | NOK | | 50,000 | | EUR | | | 674 | |

| 12/19/2018 | | Morgan Stanley | | 479,701 | | NOK | | 50,000 | | EUR | | | 638 | |

| 12/19/2018 | | Morgan Stanley | | 479,595 | | NOK | | 50,000 | | EUR | | | 625 | |

| 12/19/2018 | | Morgan Stanley | | 479,865 | | NOK | | 50,000 | | EUR | | | 658 | |

| 12/19/2018 | | Morgan Stanley | | 479,860 | | NOK | | 50,000 | | EUR | | | 658 | |

| 12/19/2018 | | Morgan Stanley | | 478,987 | | NOK | | 50,000 | | EUR | | | 550 | |

| 12/19/2018 | | Morgan Stanley | | 239,429 | | NOK | | 25,000 | | EUR | | | 267 | |

| 12/19/2018 | | Morgan Stanley | | 239,454 | | NOK | | 25,000 | | EUR | | | 270 | |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 478,533 | | NOK | | 50,000 | | EUR | | $ | 494 | |

| 12/19/2018 | | Morgan Stanley | | 477,585 | | NOK | | 50,000 | | EUR | | | 377 | |

| 12/19/2018 | | Morgan Stanley | | 238,512 | | NOK | | 25,000 | | EUR | | | 154 | |

| 12/19/2018 | | Morgan Stanley | | 238,575 | | NOK | | 25,000 | | EUR | | | 162 | |

| 12/19/2018 | | Morgan Stanley | | 238,561 | | NOK | | 25,000 | | EUR | | | 160 | |

| 12/19/2018 | | Morgan Stanley | | 238,649 | | NOK | | 25,000 | | EUR | | | 171 | |

| 12/19/2018 | | Morgan Stanley | | 238,587 | | NOK | | 25,000 | | EUR | | | 163 | |

| 12/19/2018 | | Morgan Stanley | | 238,637 | | NOK | | 25,000 | | EUR | | | 169 | |

| 12/19/2018 | | Morgan Stanley | | 237,808 | | NOK | | 25,000 | | EUR | | | 67 | |

| 12/19/2018 | | Morgan Stanley | | 237,896 | | NOK | | 25,000 | | EUR | | | 78 | |

| 12/19/2018 | | Morgan Stanley | | 238,130 | | NOK | | 25,000 | | EUR | | | 107 | |

| 12/19/2018 | | Morgan Stanley | | 238,180 | | NOK | | 25,000 | | EUR | | | 113 | |

| 12/19/2018 | | Morgan Stanley | | 107,183 | | PLN | | 25,000 | | EUR | | | (101 | ) |

| 12/19/2018 | | Morgan Stanley | | 107,193 | | PLN | | 25,000 | | EUR | | | (98 | ) |

| 12/19/2018 | | Morgan Stanley | | 107,233 | | PLN | | 25,000 | | EUR | | | (88 | ) |

| 12/19/2018 | | Morgan Stanley | | 107,346 | | PLN | | 25,000 | | EUR | | | (57 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,082,932 | | PLN | | 250,000 | | EUR | | | 2,006 | |

| 12/19/2018 | | Morgan Stanley | | 215,916 | | PLN | | 50,000 | | EUR | | | 219 | |

| 12/19/2018 | | Morgan Stanley | | 215,606 | | PLN | | 50,000 | | EUR | | | 135 | |

| 12/19/2018 | | Morgan Stanley | | 215,627 | | PLN | | 50,000 | | EUR | | | 140 | |

| 12/19/2018 | | Morgan Stanley | | 107,763 | | PLN | | 25,000 | | EUR | | | 57 | |

| 12/19/2018 | | Morgan Stanley | | 107,774 | | PLN | | 25,000 | | EUR | | | 60 | |

| 12/19/2018 | | Morgan Stanley | | 215,832 | | PLN | | 50,000 | | EUR | | | 196 | |

| 12/19/2018 | | Morgan Stanley | | 107,589 | | PLN | | 25,000 | | EUR | | | 9 | |

| 12/19/2018 | | Morgan Stanley | | 107,598 | | PLN | | 25,000 | | EUR | | | 12 | |

| 12/19/2018 | | Morgan Stanley | | 107,327 | | PLN | | 25,000 | | EUR | | | (62 | ) |

| 12/19/2018 | | Morgan Stanley | | 107,354 | | PLN | | 25,000 | | EUR | | | (55 | ) |

| 12/19/2018 | | Morgan Stanley | | 107,299 | | PLN | | 25,000 | | EUR | | | (70 | ) |

| 12/19/2018 | | Morgan Stanley | | 107,319 | | PLN | | 25,000 | | EUR | | | (64 | ) |

| 12/19/2018 | | Morgan Stanley | | 6,891,900 | | RUB | | 100,000 | | USD | | | 4,333 | |

| 12/19/2018 | | Morgan Stanley | | 3,379,486 | | RUB | | 50,000 | | USD | | | 1,161 | |

| 12/19/2018 | | Morgan Stanley | | 6,703,971 | | RUB | | 100,000 | | USD | | | 1,489 | |

| 12/19/2018 | | Morgan Stanley | | 6,674,971 | | RUB | | 100,000 | | USD | | | 1,049 | |

| 12/19/2018 | | Morgan Stanley | | 3,334,500 | | RUB | | 50,000 | | USD | | | 480 | |

| 12/19/2018 | | Morgan Stanley | | 6,623,971 | | RUB | | 100,000 | | USD | | | 277 | |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 6,645,000 | | RUB | | 100,000 | | USD | | $ | 596 | |

| 12/19/2018 | | Morgan Stanley | | 3,320,000 | | RUB | | 50,000 | | USD | | | 260 | |

| 12/19/2018 | | Morgan Stanley | | 6,609,971 | | RUB | | 100,000 | | USD | | | 65 | |

| 12/19/2018 | | Morgan Stanley | | 514,652 | | SEK | | 50,000 | | EUR | | | (187 | ) |

| 12/19/2018 | | Morgan Stanley | | 257,389 | | SEK | | 25,000 | | EUR | | | (87 | ) |

| 12/19/2018 | | Morgan Stanley | | 257,451 | | SEK | | 25,000 | | EUR | | | (79 | ) |

| 12/19/2018 | | Morgan Stanley | | 1,029,154 | | SEK | | 100,000 | | EUR | | | (392 | ) |

| 12/19/2018 | | Morgan Stanley | | 774,147 | | SEK | | 75,000 | | EUR | | | (35 | ) |

| 12/19/2018 | | Morgan Stanley | | 258,111 | | SEK | | 25,000 | | EUR | | | (5 | ) |

| 12/19/2018 | | Morgan Stanley | | 262,117 | | SEK | | 25,000 | | EUR | | | 449 | |

| 12/19/2018 | | Morgan Stanley | | 262,154 | | SEK | | 25,000 | | EUR | | | 453 | |

| 12/19/2018 | | Morgan Stanley | | 524,359 | | SEK | | 50,000 | | EUR | | | 912 | |

| 12/19/2018 | | Morgan Stanley | | 1,043,684 | | SEK | | 100,000 | | EUR | | | 1,254 | |

| 12/19/2018 | | Morgan Stanley | | 1,043,063 | | SEK | | 100,000 | | EUR | | | 1,183 | |

| 12/19/2018 | | Morgan Stanley | | 525,457 | | SEK | | 50,000 | | EUR | | | 1,036 | |

| 12/19/2018 | | Morgan Stanley | | 526,408 | | SEK | | 50,000 | | EUR | | | 1,144 | |

| 12/19/2018 | | Morgan Stanley | | 527,164 | | SEK | | 50,000 | | EUR | | | 1,230 | |

| 12/19/2018 | | Morgan Stanley | | 263,632 | | SEK | | 25,000 | | EUR | | | 621 | |

| 12/19/2018 | | Morgan Stanley | | 263,645 | | SEK | | 25,000 | | EUR | | | 622 | |

| 12/19/2018 | | Morgan Stanley | | 260,678 | | SEK | | 25,000 | | EUR | | | 286 | |

| 12/19/2018 | | Morgan Stanley | | 260,728 | | SEK | | 25,000 | | EUR | | | 292 | |

| 12/19/2018 | | Morgan Stanley | | 260,753 | | SEK | | 25,000 | | EUR | | | 294 | |

| 12/19/2018 | | Morgan Stanley | | 260,766 | | SEK | | 25,000 | | EUR | | | 296 | |

| 12/19/2018 | | Morgan Stanley | | 1,038,690 | | SEK | | 100,000 | | EUR | | | 688 | |

| 12/19/2018 | | Morgan Stanley | | 1,037,633 | | SEK | | 100,000 | | EUR | | | 569 | |

| 12/19/2018 | | Morgan Stanley | | 518,495 | | SEK | | 50,000 | | EUR | | | 248 | |

| 12/19/2018 | | Morgan Stanley | | 259,273 | | SEK | | 25,000 | | EUR | | | 127 | |

| 12/19/2018 | | Morgan Stanley | | 259,310 | | SEK | | 25,000 | | EUR | | | 131 | |

| 12/19/2018 | | Morgan Stanley | | 516,303 | | SEK | | 50,000 | | EUR | | | — | |

| 12/19/2018 | | Morgan Stanley | | 516,378 | | SEK | | 50,000 | | EUR | | | 8 | |

| 12/19/2018 | | Morgan Stanley | | 516,542 | | SEK | | 50,000 | | EUR | | | 27 | |

| 12/19/2018 | | Morgan Stanley | | 258,309 | | SEK | | 25,000 | | EUR | | | 18 | |

| 12/19/2018 | | Morgan Stanley | | 258,359 | | SEK | | 25,000 | | EUR | | | 23 | |

| 12/19/2018 | | Morgan Stanley | | 516,471 | | SEK | | 50,000 | | EUR | | | 19 | |

| 12/19/2018 | | Morgan Stanley | | 516,721 | | SEK | | 50,000 | | EUR | | | 47 | |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 258,213 | | SEK | | 25,000 | | EUR | | $ | 7 | |

| 12/19/2018 | | Morgan Stanley | | 258,218 | | SEK | | 25,000 | | EUR | | | 7 | |

| 12/19/2018 | | Morgan Stanley | | 258,371 | | SEK | | 25,000 | | EUR | | | 25 | |

| 12/19/2018 | | Morgan Stanley | | 258,409 | | SEK | | 25,000 | | EUR | | | 29 | |

| 12/19/2018 | | Morgan Stanley | | 258,229 | | SEK | | 25,000 | | EUR | | | 9 | |

| 12/19/2018 | | Morgan Stanley | | 516,582 | | SEK | | 50,000 | | EUR | | | 31 | |

| 12/19/2018 | | Morgan Stanley | | 258,404 | | SEK | | 25,000 | | EUR | | | 28 | |

| 12/19/2018 | | Morgan Stanley | | 259,064 | | SEK | | 25,000 | | EUR | | | 103 | |

| 12/19/2018 | | Morgan Stanley | | 518,253 | | SEK | | 50,000 | | EUR | | | 220 | |

| 12/19/2018 | | Morgan Stanley | | 259,189 | | SEK | | 25,000 | | EUR | | | 117 | |

| 12/19/2018 | | Morgan Stanley | | 257,820 | | SEK | | 25,000 | | EUR | | | (38 | ) |

| 12/19/2018 | | Morgan Stanley | | 257,907 | | SEK | | 25,000 | | EUR | | | (28 | ) |

| 12/19/2018 | | Morgan Stanley | | 257,917 | | SEK | | 25,000 | | EUR | | | (27 | ) |

| 12/19/2018 | | Morgan Stanley | | 257,932 | | SEK | | 25,000 | | EUR | | | (25 | ) |

| 12/19/2018 | | Morgan Stanley | | 776,528 | | SEK | | 75,000 | | EUR | | | 234 | |

| 12/19/2018 | | Morgan Stanley | | 258,943 | | SEK | | 25,000 | | EUR | | | 89 | |

| 12/19/2018 | | Morgan Stanley | | 1,036,977 | | SEK | | 100,000 | | EUR | | | 494 | |

| 12/19/2018 | | Morgan Stanley | | 1,034,649 | | SEK | | 100,000 | | EUR | | | 231 | |

| 12/19/2018 | | Morgan Stanley | | 514,983 | | SEK | | 50,000 | | EUR | | | (150 | ) |

| 12/19/2018 | | Morgan Stanley | | 515,283 | | SEK | | 50,000 | | EUR | | | (116 | ) |

| 12/19/2018 | | Morgan Stanley | | 68,513 | | SGD | | 50,000 | | USD | | | 233 | |

| 12/19/2018 | | Morgan Stanley | | 68,271 | | SGD | | 50,000 | | USD | | | 55 | |

| 12/19/2018 | | Morgan Stanley | | 68,447 | | SGD | | 50,000 | | USD | | | 184 | |

| 12/19/2018 | | Morgan Stanley | | 68,339 | | SGD | | 50,000 | | USD | | | 105 | |

| 12/19/2018 | | Morgan Stanley | | 68,302 | | SGD | | 50,000 | | USD | | | 78 | |

| 12/19/2018 | | Morgan Stanley | | 68,055 | | SGD | | 50,000 | | USD | | | (103 | ) |

| 12/19/2018 | | Morgan Stanley | | 68,195 | | SGD | | 50,000 | | USD | | | (1 | ) |

| 12/19/2018 | | Morgan Stanley | | 68,158 | | SGD | | 50,000 | | USD | | | (28 | ) |

| 12/19/2018 | | Morgan Stanley | | 34,088 | | SGD | | 25,000 | | USD | | | (7 | ) |

| 12/19/2018 | | Morgan Stanley | | 34,089 | | SGD | | 25,000 | | USD | | | (6 | ) |

| 12/19/2018 | | Morgan Stanley | | 68,114 | | SGD | | 50,000 | | USD | | | (60 | ) |

| 12/19/2018 | | Morgan Stanley | | 68,236 | | SGD | | 50,000 | | USD | | | 30 | |

| 12/19/2018 | | Morgan Stanley | | 1,621,234 | | THB | | 50,000 | | USD | | | 264 | |

| 12/19/2018 | | Morgan Stanley | | 1,618,789 | | THB | | 50,000 | | USD | | | 188 | |

| 12/19/2018 | | Morgan Stanley | | 1,610,119 | | THB | | 50,000 | | USD | | | (81 | ) |

See accompanying notes to consolidated financial statements.

Equinox Aspect Core Diversified Fund

CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 1,615,914 | | THB | | 50,000 | | USD | | $ | 99 | |

| 12/19/2018 | | Morgan Stanley | | 1,617,644 | | THB | | 50,000 | | USD | | | 152 | |

| 12/19/2018 | | Morgan Stanley | | 1,616,824 | | THB | | 50,000 | | USD | | | 127 | |

| 12/19/2018 | | Morgan Stanley | | 1,614,339 | | THB | | 50,000 | | USD | | | 50 | |

| 12/19/2018 | | Morgan Stanley | | 641,456 | | TRY | | 100,000 | | USD | | | 1,284 | |

| 12/19/2018 | | Morgan Stanley | | 3,060,800 | | TWD | | 100,000 | | USD | | | 828 | |

| 12/19/2018 | | Morgan Stanley | | 1,529,350 | | TWD | | 50,000 | | USD | | | 379 | |

| 12/19/2018 | | Morgan Stanley | | 1,527,743 | | TWD | | 50,000 | | USD | | | 327 | |

| 12/19/2018 | | Morgan Stanley | | 1,532,943 | | TWD | | 50,000 | | USD | | | 498 | |

| 12/19/2018 | | Morgan Stanley | | 1,530,243 | | TWD | | 50,000 | | USD | | | 409 | |

| 12/19/2018 | | Morgan Stanley | | 3,064,500 | | TWD | | 100,000 | | USD | | | 950 | |

| 12/19/2018 | | Morgan Stanley | | 1,200,000 | | USD | | 5,039,447 | | BRL | | | (53,861 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 210,007 | | BRL | | | (2,252 | ) |

| 12/19/2018 | | Morgan Stanley | | 550,000 | | USD | | 371,666,075 | | CLP | | | (13,978 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 33,970,325 | | CLP | | | (1,548 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,587,825 | | CLP | | | (2,485 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,380,325 | | CLP | | | (2,170 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,150,325 | | CLP | | | (1,821 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,425,325 | | CLP | | | (2,238 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,530,325 | | CLP | | | (2,397 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,940,325 | | CLP | | | (3,020 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,550,325 | | CLP | | | (2,428 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 34,120,325 | | CLP | | | (1,775 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 33,637,825 | | CLP | | | (1,043 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 304,692,850 | | COP | | | (2,441 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 310,102,850 | | COP | | | (4,260 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 155,801,425 | | COP | | | (2,382 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 310,102,850 | | COP | | | (4,260 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 309,402,850 | | COP | | | (4,024 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 155,551,425 | | COP | | | (2,298 | ) |

| 12/19/2018 | | Morgan Stanley | | 2,700,000 | | USD | | 9,621,045 | | ILS | | | 37,239 | |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 358,735 | | ILS | | | 715 | |

| 12/19/2018 | | Morgan Stanley | | 300,000 | | USD | | 21,467,280 | | INR | | | 6,830 | |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,187,532 | | INR | | | 1,843 | |

| 12/19/2018 | | Morgan Stanley | | 150,000 | | USD | | 10,803,048 | | INR | | | 2,467 | |

See accompanying notes to consolidated financial statements.

| Equinox Aspect Core Diversified Fund |

| CONSOLIDATED PORTFOLIO OF INVESTMENTS (Continued) |

| September 30, 2018 |

Schedule of Forward Foreign Currency Contracts

| Settlement | | | | Currency Units to | | | | | | Unrealized Appreciation | |

| Date | | Counterparty | | Receive/Deliver | | In Exchange For | | (Depreciation) | |

| 12/19/2018 | | Morgan Stanley | | 150,000 | | USD | | 10,779,048 | | INR | | $ | 2,795 | |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,621,016 | | INR | | | 549 | |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,309,532 | | INR | | | 177 | |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,309,032 | | INR | | | 184 | |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,642,016 | | INR | | | 263 | |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,666,750 | | INR | | | (75 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,679,516 | | INR | | | (250 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,696,016 | | INR | | | (475 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,264,032 | | INR | | | 798 | |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,677,516 | | INR | | | (222 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,673,016 | | INR | | | (161 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,686,766 | | INR | | | (349 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,658,016 | | INR | | | 44 | |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,348,750 | | INR | | | (359 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,695,516 | | INR | | | (468 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,681,581 | | INR | | | (278 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 56,045,565 | | KRW | | | (629 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 56,305,565 | | KRW | | | (864 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 56,143,065 | | KRW | | | (717 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 56,040,565 | | KRW | | | (625 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 2,731,563 | | PHP | | | (277 | ) |

| 12/19/2018 | | Morgan Stanley | | 500,000 | | USD | | 34,432,595 | | RUB | | | (21,260 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,448,265 | | RUB | | | (2,202 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,440,500 | | RUB | | | (2,084 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 6,886,000 | | RUB | | | (4,244 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,450,500 | | RUB | | | (2,236 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,461,000 | | RUB | | | (2,395 | ) |

| 12/19/2018 | | Morgan Stanley | | 50,000 | | USD | | 3,452,515 | | RUB | | | (2,266 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 6,966,029 | | RUB | | | (5,456 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,061,029 | | RUB | | | (6,894 | ) |

| 12/19/2018 | | Morgan Stanley | | 150,000 | | USD | | 10,609,544 | | RUB | | | (10,613 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 7,049,029 | | RUB | | | (6,712 | ) |

| 12/19/2018 | | Morgan Stanley | | 100,000 | | USD | | 6,932,029 | | RUB | | | (4,941 | ) |