Washington, D.C. 20549

Item 1. Reports to Stockholders.

Looking ahead, we don’t expect to make significant changes to portfolio structure; the current slow growth environment should result in continued highly accommodative policy that should be supportive for the assets held in the portfolio. Also, our interest rate strategy will also remain fairly close to the benchmark unless a catalyst develops to spark a large move in rates in the future.

LoCorr Long/Short Commodities Strategy Fund

The LoCorr Long/Short Commodities Strategy Fund (the “Long/Short Commodities Fund”) commenced operations on January 1, 2012. The Long/Short Commodities Fund was created to provide investors with access to a commodities futures strategy in a mutual fund structure. Historically, investors have accessed exposure to commodities in long-only fund, funds that rely on commodity price increases to generate commodity returns. Of course, commodity prices don’t always appreciate and occasionally experience sharp declines. LoCorr’s Long/Short Commodity Fund has the ability to profit while commodity prices increase or decrease. The Long/Short Commodities Fund’s primary investment objective is capital appreciation in rising and falling commodities markets. The Long/Short Commodities Fund attempts to achieve its investment objective by investing in two primary strategies – a Commodities strategy and a Fixed Income strategy.

Commodities Strategy

The Long/Short Commodities Fund invests up to 25% of its total assets into a portfolio of globally diversified commodity futures positions. The Long/Short Commodities Fund uses Millburn Ridgefield Corporation (“Millburn”) to execute its commodities strategy. Millburn was founded in 1971 and manages about $1.9 billion in assets. The Long/Short Commodities Fund utilizes Millburn’s Commodity Program (“Milcom”), a commodity pool which commenced operations in 2005. Milcom systematically invests in about 50 futures markets with long and short positions in sectors such as energy, metals, grains, livestock, softs and lumber. The Long/Short Commodities Fund registered a loss during the first half of 2012. Losses were sustained in trading all sectors: energy, grain, metals, soft commodities, and livestock. Metal prices were volatile during the period and produced some of the largest losses during the period. Energy trading was unprofitable with a profit on short natural gas positions failing to fully offset the losses on long heating oil and gas oil positions, and trading of crude oil.

Prospects of bumper crops early in 2012 were supplanted by the reality of a severe drought in the U.S. by mid-May, and short corn, wheat, soybean, soybean oil, and oat trades produced losses and were reversed to long trades. Long European rapeseed and milling wheat positions were quite profitable, lowering the overall grain sector loss. Trading of livestock was unprofitable.

Turning to soft commodities, short cocoa trades were unprofitable as hot, dry weather hit the Ivory Coast and raised fears that an expected bumper crop might face significant damage. Trading of palm oil, Robusta coffee and sugar were also unprofitable. Meanwhile, a short Arabica coffee trade produced a profit as expectations of a bumper Brazilian harvest pushed Arabica to its lowest price in 18 months in late March. A short cotton trade was profitable as the Chinese growth outlook dimmed, and a long orange juice trade was profitable early in the period.

6 ● SHAREHOLDER LETTER

Fixed Income Strategy

Since inception, the fixed income portfolio sub-advised by Galliard Capital Management has outperformed the benchmark, the Barclays Capital 1-5 Year Government/Credit Index, by 12 basis points before fees (0.27% versus 0.15%). Outperformance was driven by allocations to short corporate bonds, asset-backed securities and Agency hybrid mortgage-backed securities, which performed better than like-duration Treasuries. Additionally, the portfolio overweight in intermediate maturity securities enhanced returns, as interest rates in this portion of the yield curve rallied to record lows near the end of the second quarter. Looking ahead, we will continue to invest cash flows in high-quality fixed income assets when they offer compelling relative value. This includes U.S. Government-backed issues, including Agency mortgage-backed securities, corporate bonds, short maturity AAA-rated asset-backed securities, and short maturity AAA-rated commercial mortgage-backed securities. Portfolio duration will likely be kept neutral to slightly short of the benchmark duration.

Thank you for investing in LoCorr Funds.

Basis Point - a unit that is equal to 1/100th of 1% and is used to denote the change in a financial instrument. Correlation measures how much the returns of two investments move together over time Duration is a commonly used measure of the potential volatility of the price of the debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

The Barclays Capital U.S. 1-5 Year Government/Credit Bond Index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities of between 1 and 5 years. One cannot invest directly in an index.

The opinions expressed in the letter are those of the fund manager, are subject to change, are not guaranteed and should not be considered a recommendation to buy or sell any security. Must be preceded or accompanied by a prospectus. Fund holdings and sector allocation are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings please refer to the Schedule of Investments included in this report.

Mutual fund investing involves risk. Principal loss is possible. The Funds are non-diversified, meaning they may concentrate their assets in fewer individual holdings than a diversified fund. Therefore, the Funds are more exposed to individual stock volatility than a diversified fund. The Funds invest in foreign investments and foreign currencies which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Funds may make short sales of securities, which involves the risk that losses may exceed the original amount invested. Investing in commodities may subject the Funds to greater risks and volatility as commodity prices may be influenced by a variety of factors including unfavorable weather, environmental factors, and changes in government regulations. The Funds may invest in derivative securities, which derive their performance from the performance of an underlying asset, index, interest rate or currency exchange rate. Derivatives can be volatile and involve various types and degrees of risks, and, depending upon the characteristics of a particular derivative, suddenly can become illiquid. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in Asset Backed, Mortgage Backed, and Collateralized Mortgage Backed Securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Diversification does not assure a profit nor protect against loss in a declining market.

Past performance is not a guarantee of future results.

The LoCorr Managed Futures Strategy Fund and LoCorr Long/Short Commodities Strategy Fund are distributed by Quasar Distributors, LLC.

FUND PERFORMANCE ● 7

LoCorr Managed Futures Strategy Fund

| Average Annual Rate of Return | | | | |

| For the period ended June 30, 2012 (Unaudited) | | | | |

| | Inception | | | Since |

| | Date | 6 Month | 1 Year | Inception1 |

| LoCorr Managed Futures Strategy Fund - | 3/22/11 | -5.68% | -7.76% | -9.55% |

| Class A (without maximum load) | | | | |

| LoCorr Managed Futures Strategy Fund - | 3/22/11 | -11.11% | -13.04% | -13.66% |

| Class A (with maximum load) | | | | |

| LoCorr Managed Futures Strategy Fund - | 3/24/11 | -6.03% | -8.40% | -10.24% |

| Class C (without maximum load) | | | | |

| LoCorr Managed Futures Strategy Fund - | 3/24/11 | -5.56% | -7.54% | -9.34% |

| Class I | | | | |

| Barclay CTA Index | | -0.31% | -1.32% | -2.83%2 |

| S&P 500 Index | | 9.49% | 5.45% | 5.39%3 |

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The Fund imposes a 1.00% redemption fee on shares held for less than 30 days. Performance data does not reflect the redemption fee. If it had, return would be reduced.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. One cannot invest directly in an index.

1 Annualized.

2 Since inception return as of March 31, 2011.

3 Since inception return as of March 24, 2011.

8 ● FUND PERFORMANCE

LoCorr Long/Short Commodities Strategy Fund

| Average Annual Rate of Return | | | | |

| For the period ended June 30, 2012 (Unaudited) | | | | |

| | Inception | | | Since |

| | Date | 3 Month | 6 Month | Inception1 |

| LoCorr Long/Short Commodities Strategy | 1/1/12 | -4.83% | -5.50% | -5.50% |

| Fund - Class A (without maximum load) | | | | |

| LoCorr Long/Short Commodities Strategy | 1/1/12 | -10.34% | -10.93% | -10.93% |

| Fund - Class A (with maximum load) | | | | |

| LoCorr Long/Short Commodities Strategy | 1/1/12 | -4.96% | -6.10% | -6.10% |

| Fund - Class C (without maximum load) | | | | |

| LoCorr Long/Short Commodities Strategy | 1/1/12 | -4.73% | -5.40% | -5.40% |

| Fund - Class I | | | | |

| Barclay CTA Index | | 0.32% | -0.31% | -0.31%2 |

| S&P 500 Index | | -2.75% | 9.49% | 9.49%2 |

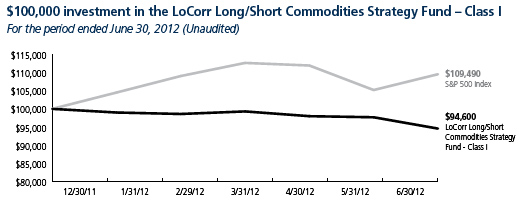

This chart illustrates the performance of a hypothetical $100,000 investment made in the Fund since inception. Assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable sales charge or redemption fees. This chart does not imply any future performance.

Performance data represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1.855.LCFUNDS, or visiting www.LoCorrFunds.com.

Performance data shown reflects the Class A maximum sales charge of 5.75% and reflects the Class C Contingent Deferred Sales Charge (CDSC) of 1.00%. Performance of the Class A without load does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

The Fund imposes a 1.00% redemption fee on shares held for less than 30 days. Performance data does not reflect the redemption fee. If it had, return would be reduced.

The S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of the 500 stocks which represent all major industries.

The Barclay CTA Index is a leading industry benchmark of representative performance of commodity trading advisors. One cannot invest directly in an index.

1 Not annualized.

2 Since inception returns as of January 1, 2012.

PORTFOLIO COMPOSITION ● 9

10 ● CONSOLIDATED SCHEDULE OF INVESTMENTS

| LoCorr Managed Futures Strategy Fund | | | | | | |

| Consolidated Schedule of Investments | | | | |

| June 30, 2012 (Unaudited) | | | | | | |

| | | Principal Amount | | | Value | |

| ASSET BACKED SECURITIES - 12.12% | | | | | | |

| AEP Texas Central Transition Funding, LLC, 0.880%, 12/1/2018 | | $ | 1,000,000 | | | $ | 1,002,722 | |

| AH Mortgage Advance Trust | | | | | | | | |

| 2.230%, 5/10/2043 (Acquired 05/03/2012 and 6/04/2012, | | | | | | | | |

| Cost $849,553) (a) | | | 850,000 | | | | 847,609 | |

| 3.370%, 5/10/2043 (Acquired 12/27/2011, Cost $748,594) (a) | | | 750,000 | | | | 758,775 | |

| 3.270%, 9/15/2043 (Acquired 05/09/2012, Cost $502,468) (a)(b) | | | 500,000 | | | | 505,570 | |

| 3.720%, 3/13/2044 (Acquired 01/20/2012, Cost $499,988) (a)(b) | | | 500,000 | | | | 501,250 | |

| Ally Auto Receivables Trust | | | | | | | | |

| 2.300%, 12/15/2014 | | | 1,100,000 | | | | 1,121,255 | |

| 0.700%, 1/15/2015 | | | 1,500,000 | | | | 1,501,403 | |

| 1.180%, 4/15/2015 | | | 400,000 | | | | 402,136 | |

| American Express Credit Account Master Trust, 1.499%, 3/15/2017 | | | 150,000 | | | | 153,772 | |

| AmeriCredit Automobile Receivables Trust | | | | | | | | |

| 0.840%, 6/9/2014 | | | 129,231 | | | | 129,272 | |

| 0.920%, 3/9/2015 | | | 821,708 | | | | 823,163 | |

| Atlantic City Electric Transition Funding, LLC, 4.910%, 7/20/2017 | | | 151,002 | | | | 159,969 | |

| BA Credit Card Trust, 0.309%, 9/15/2016 | | | 1,000,000 | | | | 998,944 | |

| Bank of America Auto Trust, 1.310%, 7/15/2014 | | | 68,839 | | | | 69,029 | |

| BMW Vehicle Owner Trust, 0.630%, 2/25/2014 | | | 707,423 | | | | 707,905 | |

| Cabela’s Master Credit Card Trust, 1.630%, 2/18/2020 | | | | | | | | |

| (Acquired 05/08/2012, Cost $755,950) (a) | | | 750,000 | | | | 759,212 | |

| Capital One Multi-Asset Execution Trust | | | | | | | | |

| 4.700%, 6/15/2015 | | | 750,000 | | | | 754,038 | |

| 0.768%, 10/15/2015 | | | 350,000 | | | | 350,333 | |

| 0.309%, 1/15/2016 | | | 355,000 | | | | 354,817 | |

| 5.050%, 2/15/2016 | | | 880,000 | | | | 910,713 | |

| CenterPoint Energy Transition Bond Co., LLC | | | | | | | | |

| 0.901%, 4/15/2018 | | | 1,250,000 | | | | 1,256,766 | |

| 3.460%, 8/15/2019 | | | 600,000 | | | | 659,114 | |

| Chase Issuance Trust | | | | | | | | |

| 5.120%, 10/15/2014 | | | 210,000 | | | | 212,944 | |

| 4.650%, 3/15/2015 | | | 900,000 | | | | 926,706 | |

| 0.790%, 6/15/2017 | | | 2,250,000 | | | | 2,250,995 | |

| Citibank Credit Card Issuance Trust, 2.250%, 12/23/2014 | | | 1,000,000 | | | | 1,008,906 | |

| Citibank Omni Master Trust, 3.350%, 8/15/2016 | | | | | | | | |

| (Acquired 09/22/2011 and 11/25/2011, Cost $1,002,651) (a) | | | 1,000,000 | | | | 1,003,652 | |

| CitiFinancial Auto Issuance Trust, 3.150%, 8/15/2016 | | | | | | | | |

| (Acquired 12/14/2011, Cost $1,014,541) (a) | | | 1,000,000 | | | | 1,012,838 | |

| Detroit Edison Securitization Funding, LLC, 6.420%, 3/1/2015 | | | 77,340 | | | | 79,325 | |

| Discover Card Master Trust | | | | | | | | |

| 0.808%, 6/15/2015 | | | 200,000 | | | | 200,288 | |

| 0.899%, 9/15/2015 | | | 214,000 | | | | 214,814 | |

| 0.459%, 11/16/2015 | | | 320,000 | | | | 320,453 | |

| 5.650%, 12/15/2015 | | | 870,000 | | | | 912,984 | |

| 0.459%, 3/15/2017 | | | 1,000,000 | | | | 1,001,775 | |

| 0.810%, 8/15/2017 | | | 700,000 | | | | 700,902 | |

| | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | |

CONSOLIDATED SCHEDULE OF INVESTM ENTS (CONTINUED) ● 11

| | | Principal Amount | | | Value | |

| DT Auto Owner Trust, 1.400%, 8/15/2014 | | | | | | |

| (Acquired 11/02/2011 and 02/17/2012, Cost $739,246) (a) | | $ | 738,970 | | | $ | 739,832 | |

| Entergy Louisiana Investment Recovery Funding I, LLC, 2.040%, 9/1/2023 | | | 940,490 | | | | 966,665 | |

| Ford Credit Auto Lease Trust | | | | | | | | |

| 0.910%, 7/15/2013 (Acquired 11/28/2011, Cost $180,389) (a) | | | 180,377 | | | | 180,449 | |

| 0.740%, 9/15/2013 | | | 329,396 | | | | 329,656 | |

| Ford Credit Auto Owner Trust | | | | | | | | |

| 6.070%, 5/15/2014 | | | 167,955 | | | | 171,231 | |

| 4.500%, 7/15/2014 | | | 346,964 | | | | 353,531 | |

| 4.430%, 11/15/2014 | | | 174,098 | | | | 178,309 | |

| FPL Recovery Funding, LLC., 5.044%, 8/1/2015 | | | 233,047 | | | | 239,003 | |

| GE Capital Credit Card Master Note Trust, 0.799%, 1/15/2017 | | | 250,000 | | | | 251,444 | |

| Gracechurch Card Funding PLC, 0.949%, 2/15/2017 | | | | | | | | |

| (Acquired 03/02/2012, Cost $1,250,000) (a)(b) | | | 1,250,000 | | | | 1,249,671 | |

| Honda Auto Receivables Owner Trust, 0.570%, 7/18/2013 | | | 84,104 | | | | 84,120 | |

| Hyundai Auto Receivables Trust, 0.590%, 3/17/2014 | | | 381,740 | | | | 381,855 | |

| Nissan Auto Lease Trust | | | | | | | | |

| 0.700%, 1/15/2014 | | | 472,453 | | | | 472,529 | |

| 1.270%, 10/15/2016 | | | 350,000 | | | | 352,062 | |

| Ocwen Advance Receivables Backed Notes, 4.140%, 7/15/2023 | | | | | | | | |

| (Acquired 10/05/2011, Cost $502,869) (a)(b) | | | 500,000 | | | | 500,625 | |

| Porsche Financial Auto Securitization Trust, 1.190%, 12/17/2018 | | | | | | | | |

| (Acquired 12/13/2011, Cost $753,153) (a) | | | 750,000 | | | | 756,046 | |

| PSE&G Transition Funding LLC, 6.610%, 6/15/2015 | | | 402,115 | | | | 416,036 | |

| Santander Drive Auto Receivables Trust | | | | | | | | |

| 0.950%, 8/15/2013 | | | 18,300 | | | | 18,302 | |

| 1.310%, 2/17/2014 (Acquired 06/06/2012, Cost $1,001,342) (a) | | | 1,000,000 | | | | 1,001,417 | |

| 1.110%, 8/15/2014 | | | 744,041 | | | | 745,666 | |

| 1.280%, 1/15/2015 | | | 500,000 | | | | 502,141 | |

| SMART Trust, 1.099%, 10/14/2014 | | | | | | | | |

| (Acquired 03/14/2012 and 06/27/2012, Cost $1,661,449) (a)(b) | | | 1,657,988 | | | | 1,660,929 | |

| Toyota Auto Receivables Owner Trust, 1.040%, 2/18/2014 | | | 101,661 | | | | 101,846 | |

| United States Small Business Administration, 5.725%, 9/10/2018 | | | 264,203 | | | | 294,183 | |

| Volkswagen Auto Lease Trust, 0.990%, 11/20/2013 | | | 276,099 | | | | 276,497 | |

| World Omni Auto Receivables Trust | | | | | | | | |

| 5.120%, 5/15/2014 | | | 139,042 | | | | 141,338 | |

| 2.210%, 5/15/2015 | | | 820,000 | | | | 831,658 | |

| TOTAL ASSET BACKED SECURITIES (Cost $37,671,536) | | | | | | | 37,771,390 | |

| | | | | | | | | |

| CORPORATE BONDS - 29.00% | | | | | | | | |

| Administrative and Support and Waste Management and | | | | | | | | |

| Remediation Services - 0.46% | | | | | | | | |

| Tyco International Finance SA, 3.375%, 10/15/2015 (b) | | | 1,000,000 | | | | 1,077,934 | |

| Waste Management, Inc., 2.600%, 9/1/2016 | | | 340,000 | | | | 348,899 | |

| | | | | | | | 1,426,833 | |

| Arts, Entertainment, and Recreation - 0.10% | | | | | | | | |

| Walt Disney Co., 4.500%, 12/15/2013 | | | 300,000 | | | | 317,625 | |

| | | | | | | | | |

| Construction - 0.35% | | | | | | | | |

| Transocean, Inc., 5.050%, 12/15/2016 (b) | | | 1,000,000 | | | | 1,084,644 | |

| | | | | | | | | |

| | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | | |

12 ● CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

| | | Principal Amount | | | Value | |

| Finance and Insurance - 13.72% | | | | | | |

| Aflac, Inc., 3.450%, 8/15/2015 | | $ | 600,000 | | | $ | 638,558 | |

| Allstate Corp., 6.200%, 5/16/2014 | | | 200,000 | | | | 219,994 | |

| Allstate Life Global Funding Trusts, 5.375%, 4/30/2013 | | | 300,000 | | | | 312,124 | |

| American Express Credit Corp. | | | | | | | | |

| 7.300%, 8/20/2013 | | | 500,000 | | | | 534,580 | |

| 1.750%, 6/12/2015 | | | 480,000 | | | | 485,452 | |

| American International Group, Inc., 4.250%, 9/15/2014 | | | 1,020,000 | | | | 1,057,057 | |

| Australia & New Zealand Banking Group, Ltd., 2.400%, 11/23/2016 | | | | | | | | |

| (Acquired 11/15/2011, Cost $995,930) (a)(b) | | | 1,000,000 | | | | 1,023,911 | |

| Bank of America Corp., 4.500%, 4/1/2015 | | | 3,165,000 | | | | 3,262,365 | |

| Bank of Montreal, 1.300%, 10/31/2014 | | | | | | | | |

| (Acquired 10/26/2011, Cost $819,787) (a)(b) | | | 820,000 | | | | 831,095 | |

| Barclays Bank PLC, 5.000%, 9/22/2016 (b) | | | 1,000,000 | | | | 1,085,960 | |

| BAT International Finance PLC, 2.125%, 6/7/2017 | | | | | | | | |

| (Acquired 06/06/2012, Cost $995,160) (a)(b) | | | 1,000,000 | | | | 998,683 | |

| BB&T Corp., 5.700%, 4/30/2014 | | | 650,000 | | | | 705,354 | |

| Berkshire Hathaway, Inc., 2.200%, 8/15/2016 | | | 860,000 | | | | 894,709 | |

| BP Capital Markets PLC, 1.068%, 3/11/2014 (b)(c) | | | 300,000 | | | | 302,077 | |

| Capital One Bank USA NA, 6.500%, 6/13/2013 | | | 500,000 | | | | 524,029 | |

| Capital One Financial Corp., 2.125%, 7/15/2014 | | | 800,000 | | | | 806,810 | |

| Caterpillar Financial Services Corp., 1.100%, 5/29/2015 | | | 950,000 | | | | 955,316 | |

| Citigroup, Inc. | | | | | | | | |

| 4.587%, 12/15/2015 | | | 1,965,000 | | | | 2,055,539 | |

| 6.125%, 11/21/2017 | | | 1,000,000 | | | | 1,107,923 | |

| Cooperatieve Centrale Raiffeisen-Boerenleenbank BA, | | | | | | | | |

| 3.375%, 1/19/2017 (b) | | | 1,000,000 | | | | 1,029,187 | |

| Credit Suisse, 5.500%, 5/1/2014 (b) | | | 455,000 | | | | 482,366 | |

| Daimler Finance North America, LLC, 2.300%, 1/9/2015 | | | | | | | | |

| (Acquired 01/04/2012 and 04/10/2012, Cost $1,008,234) (a) | | | 1,000,000 | | | | 1,020,288 | |

| Deutsche Bank AG, 3.875%, 8/18/2014 (b) | | | 465,000 | | | | 484,120 | |

| Fifth Third Bancorp | | | | | | | | |

| 6.250%, 5/1/2013 | | | 200,000 | | | | 208,306 | |

| 3.625%, 1/25/2016 | | | 255,000 | | | | 268,963 | |

| General Electric Capital Corp. | | | | | | | | |

| 2.100%, 1/7/2014 | | | 615,000 | | | | 624,565 | |

| 3.750%, 11/14/2014 | | | 965,000 | | | | 1,013,137 | |

| Goldman Sachs Group, Inc. | | | | | | | | |

| 1.466%, 2/7/2014 (c) | | | 300,000 | | | | 296,415 | |

| 3.700%, 8/1/2015 | | | 2,580,000 | | | | 2,602,800 | |

| Hartford Financial Services Group, Inc., 4.000%, 3/30/2015 | | | 1,000,000 | | | | 1,048,768 | |

| ING Bank NV, 3.750%, 3/7/2017 | | | | | | | | |

| (Acquired 02/29/2012, Cost $746,145) (a)(b) | | | 750,000 | | | | 746,482 | |

| John Deere Capital Corp., 0.875%, 4/17/2015 | | | 1,000,000 | | | | 1,001,123 | |

| JPMorgan Chase & Co., 1.252%, 1/24/2014 (c) | | | 265,000 | | | | 265,687 | |

| JPMorgan Chase & Co., 5.150%, 10/1/2015 | | | 1,495,000 | | | | 1,604,243 | |

| KeyCorp, 3.750%, 8/13/2015 | | | 350,000 | | | | 370,585 | |

| Metropolitan Life Global Funding I, 5.125%, 4/10/2013 | | | | | | | | |

| (Acquired 12/29/2011, Cost $513,788) (a) | | | 500,000 | | | | 516,535 | |

| Morgan Stanley, 4.100%, 1/26/2015 | | | 1,565,000 | | | | 1,556,186 | |

| National Rural Utilities Cooperative Finance Corp., 1.900%, 11/1/2015 | | | 500,000 | | | | 512,120 | |

| Nordea Bank AB, 2.250%, 3/20/2015 | | | | | | | | |

| (Acquired 04/10/2012, Cost $502,355) (a)(b) | | | 500,000 | | | | 501,804 | |

| PNC Funding Corp., 3.625%, 2/8/2015 | | | 500,000 | | | | 531,056 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED) ●13

| | | Principal Amount | | | Value | |

| Private Export Funding Corp. | | | | | | |

| 4.550%, 5/15/2015 | | $ | 750,000 | | | $ | 835,686 | |

| 1.375%, 2/15/2017 | | | 780,000 | | | | 791,913 | |

| Prudential Covered Trust 2012-1, 2.997%, 9/30/2015 | | | | | | | | |

| (Acquired 03/27/2012 and 04/19/2012, Cost $1,335,645) (a) | | | 1,330,000 | | | | 1,351,059 | |

| SABMiller Holdings, Inc., 1.850%, 1/15/2015 | | | | | | | | |

| (Acquired 01/10/2012 and 01/30/2012, Cost $740,191) (a) | | | 735,000 | | | | 745,497 | |

| Simon Property Group LP, 4.200%, 2/1/2015 | | | 295,000 | | | | 311,008 | |

| Toyota Motor Credit Corp., 1.750%, 5/22/2017 | | | 790,000 | | | | 796,401 | |

| Ventas Realty LP / Ventas Capital Corp., 3.125%, 11/30/2015 | | | 1,000,000 | | | | 1,018,088 | |

| Vornado Realty LP, 4.250%, 4/1/2015 | | | 815,000 | | | | 859,506 | |

| Wells Fargo & Co. | | | | | | | | |

| 3.750%, 10/1/2014 | | | 500,000 | | | | 527,894 | |

| 3.676%, 6/15/2016 (c) | | | 1,000,000 | | | | 1,064,400 | |

| | | | | | | | 42,787,724 | |

| Information - 2.24% | | | | | | | | |

| AT&T, Inc., 2.500%, 8/15/2015 | | | 870,000 | | | | 905,679 | |

| Deutsche Telekom International Finance BV, 5.875%, 8/20/2013 (b) | | | 320,000 | | | | 337,048 | |

| DIRECTV Holdings LLC / DIRECTV Financing Co., Inc., 3.550%, 3/15/2015 | | | 500,000 | | | | 526,499 | |

| NBCUniversal Media, LLC., 3.650%, 4/30/2015 | | | 1,000,000 | | | | 1,062,432 | |

| News America, Inc., 5.300%, 12/15/2014 | | | 700,000 | | | | 767,219 | |

| Qwest Corp., 7.500%, 10/1/2014 | | | 300,000 | | | | 334,423 | |

| Telefonica Emisiones SAU, 4.949%, 1/15/2015 (b) | | | 1,000,000 | | | | 945,407 | |

| Time Warner Cable, Inc., 8.250%, 2/14/2014 | | | 400,000 | | | | 445,353 | |

| Verizon Communications, Inc., 5.250%, 4/15/2013 | | | 500,000 | | | | 518,053 | |

| Vodafone Group PLC, 5.000%, 9/15/2015 (b) | | | 330,000 | | | | 369,135 | |

| Xstrata Finance Canada, Ltd., 3.600%, 1/15/2017 | | | | | | | | |

| (Acquired 02/14/2012, Cost $783,190) (a)(b) | | | 750,000 | | | | 772,407 | |

| | | | | | | | 6,983,655 | |

| Management of Companies and Enterprises - 0.51% | | | | | | | | |

| BHP Billiton Finance USA, Ltd., 1.000%, 2/24/2015 (b) | | | 1,000,000 | | | | 1,001,712 | |

| Ingersoll-Rand Global Holding Co., Ltd., 9.500%, 4/15/2014 (b) | | | 500,000 | | | | 568,310 | |

| | | | | | | | 1,570,002 | |

| Manufacturing - 6.60% | | | | | | | | |

| Anheuser-Busch Cos, LLC, 5.050%, 10/15/2016 | | | 500,000 | | | | 569,902 | |

| ArcelorMittal | | | | | | | | |

| 3.750%, 2/25/2015 (b) | | | 505,000 | | | | 511,910 | |

| 3.750%, 3/1/2016 (b) | | | 850,000 | | | | 844,155 | |

| Cameron International Corp., 1.600%, 4/30/2015 | | | 1,000,000 | | | | 1,000,711 | |

| Cisco Systems, Inc., 1.625%, 3/14/2014 | | | 725,000 | | | | 738,770 | |

| ConAgra Foods, Inc., 5.875%, 4/15/2014 | | | 1,135,000 | | | | 1,225,601 | |

| ConocoPhillips, 4.750%, 2/1/2014 | | | 530,000 | | | | 562,933 | |

| Covidien International Finance SA, 1.350%, 5/29/2015 (b) | | | 1,000,000 | | | | 1,001,299 | |

| Dow Chemical Co., 2.500%, 2/15/2016 | | | 300,000 | | | | 308,146 | |

| Dr. Pepper Snapple Group, Inc., 2.900%, 1/15/2016 | | | 1,000,000 | | | | 1,047,189 | |

| Eastman Chemical Co., 2.400%, 6/1/2017 | | | 1,000,000 | | | | 1,010,594 | |

| Genentech, Inc., 4.750%, 7/15/2015 | | | 300,000 | | | | 331,535 | |

| General Mills, Inc., 1.550%, 5/16/2014 | | | 500,000 | | | | 507,240 | |

| Hershey Co., 1.500%, 11/1/2016 | | | 1,000,000 | | | | 1,008,332 | |

| Hewlett-Packard Co., 3.000%, 9/15/2016 | | | 1,000,000 | | | | 1,028,585 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

14 ● CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

| | | Principal Amount | | | Value | |

| Intel Corp., 1.950%, 10/1/2016 | | $ | 750,000 | | | $ | 777,244 | |

| International Business Machines Corp., 0.875%, 10/31/2014 | | | 800,000 | | | | 803,841 | |

| Kraft Foods, Inc., 6.500%, 8/11/2017 | | | 740,000 | | | | 897,832 | |

| Medtronic, Inc., 3.000%, 3/15/2015 | | | 450,000 | | | | 477,526 | |

| Merck & Co., Inc., 2.250%, 1/15/2016 | | | 300,000 | | | | 313,275 | |

| Novartis Capital Corp., 2.900%, 4/24/2015 | | | 335,000 | | | | 354,414 | |

| Procter & Gamble Co., 1.450%, 8/15/2016 | | | 800,000 | | | | 815,405 | |

| St. Jude Medical, Inc., 3.750%, 7/15/2014 | | | 500,000 | | | | 526,332 | |

| Teva Pharmaceutical Finance III BV, 1.700%, 3/21/2014 (b) | | | 450,000 | | | | 456,367 | |

| Thermo Fisher Scientific, Inc., 2.250%, 8/15/2016 | | | 1,150,000 | | | | 1,189,331 | |

| Total Capital SA, 2.300%, 3/15/2016 (b) | | | 350,000 | | | | 363,341 | |

| Tyco Electronics Group SA, 1.600%, 2/3/2015 (b) | | | 335,000 | | | | 336,401 | |

| Viacom, Inc., 4.375%, 9/15/2014 | | | 200,000 | | | | 214,088 | |

| Volkswagen International Finance NV, 1.625%, 3/22/2015 | | | | | | | | |

| (Acquired 03/19/2012, Cost $782,739) (a)(b) | | | 785,000 | | | | 787,719 | |

| Wyeth, LLC | | | | | | | | |

| 5.500%, 3/15/2013 (c) | | | 250,000 | | | | 258,880 | |

| 5.500%, 2/1/2014 | | | 300,000 | | | | 322,888 | |

| | | | | | | | 20,591,786 | |

| Mining, Quarrying, and Oil and Gas Extraction - 1.87% | | | | | | | | |

| Anadarko Petroleum Corp., 6.375%, 9/15/2017 | | | 1,000,000 | | | | 1,161,634 | |

| Canadian Oil Sands, Ltd., 5.800%, 8/15/2013 | | | | | | | | |

| (Acquired 01/25/2012, Cost $455,716) (a)(b) | | | 435,000 | | | | 453,939 | |

| Encana Corp., 4.750%, 10/15/2013 (b) | | | 500,000 | | | | 520,376 | |

| Ensco PLC, 3.250%, 3/15/2016 (b) | | | 750,000 | | | | 787,563 | |

| Freeport-McMoRan Copper & Gold, Inc., 1.400%, 2/13/2015 | | | 415,000 | | | | 413,583 | |

| Noble Holding International, Ltd., 3.450%, 8/1/2015 (b) | | | 750,000 | | | | 789,488 | |

| Occidental Petroleum Corp., 1.500%, 2/15/2018 | | | 425,000 | | | | 426,324 | |

| Petrobras International Finance Co. - Pifco, 2.875%, 2/6/2015 (b) | | | 830,000 | | | | 842,450 | |

| Rio Tinto Finance USA, Ltd., 8.950%, 5/1/2014 (b) | | | 350,000 | | | | 399,657 | |

| | | | | | | | 5,795,014 | |

| Professional, Scientific, and Technical Services - 0.64% | | | | | | | | |

| Asciano Finance, Ltd., 3.125%, 9/23/2015 | | | | | | | | |

| (Acquired 05/24/2012, Cost $998,750) (a)(b) | | | 1,000,000 | | | | 995,237 | |

| Vivendi SA, 2.400%, 4/10/2015 | | | | | | | | |

| (Acquired 04/03/2012 and 04/10/2012, Cost $1,002,555) (a)(b) | | | 1,000,000 | | | | 990,096 | |

| | | | | | | | 1,985,333 | |

| Real Estate and Rental and Leasing - 0.29% | | | | | | | | |

| Penske Truck Leasing Co. LP / PTL Finance Corp., 3.125%, 5/11/2015 | | | | | | | | |

| (Acquired 05/14/2012, Cost $908,403) (a) | | | 900,000 | | | | 905,382 | |

| Retail Trade - 1.12% | | | | | | | | |

| DIRECTV Holdings LLC / DIRECTV Financing Co., Inc., 3.125%, 2/15/2016 | | | 500,000 | | | | 520,899 | |

| Express Scripts Holding Co., 3.500%, 11/15/2016 | | | | | | | | |

| (Acquired 6/27/2012, Cost $1,057,030) (a) | | | 1,000,000 | | | | 1,052,864 | |

| Home Depot, Inc., 5.400%, 3/1/2016 | | | 500,000 | | | | 576,412 | |

| Phillips 66, 2.950%, 5/1/2017 (Acquired 03/07/2012, Cost $999,820) (a) | | | 1,000,000 | | | | 1,027,568 | |

| Target Corp., 4.000%, 6/15/2013 | | | 300,000 | | | | 309,342 | |

| | | | | | | | 3,487,085 | |

| Transportation and Warehousing - 0.17% | | | | | | | | |

| United Parcel Service, Inc., 3.875%, 4/1/2014 | | | 500,000 | | | | 527,536 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | |

CONSOLIDATED SCHEDULE OF INVESTMENTS ( CONTINUED) ● 15

| | | Principal Amount | | | Value | |

| Utilities - 0.93% | | | | | | |

| Commonwealth Edison Co., 1.625%, 1/15/2014 | | $ | 300,000 | | | $ | 304,044 | |

| Duke Energy Corp., 3.950%, 9/15/2014 | | | 400,000 | | | | 424,591 | |

| McDonald’s Corp., 1.875%, 5/29/2019 | | | 1,000,000 | | | | 997,740 | |

| MidAmerican Energy Co., 4.650%, 10/1/2014 | | | 150,000 | | | | 162,034 | |

| Sempra Energy, 2.300%, 4/1/2017 | | | 1,000,000 | | | | 1,024,847 | |

| | | | | | | | 2,913,256 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $89,701,562) | | | | | | | 90,375,895 | |

| | | | | | | | | |

| MORTGAGE BACKED SECURITIES - 14.21% | | | | | | | | |

| Bear Stearns Commercial Mortgage Securities | | | | | | | | |

| 5.718%, 9/11/2038 | | | 1,235,000 | | | | 1,402,858 | |

| 5.405%, 12/11/2040 | | | 250,000 | | | | 279,364 | |

| Citigroup/Deutsche Bank Commercial Mortgage Trust, | | | | | | | | |

| 5.219%, 7/15/2044 | | | 255,000 | | | | 283,770 | |

| Commercial Mortgage Pass Through Certificates, 1.156%, 12/10/2044 | | | 951,665 | | | | 954,847 | |

| DBUBS Mortgage Trust, 3.642%, 8/10/2044 | | | 1,990,000 | | | | 2,145,057 | |

| Extended Stay America Trust, 2.951%, 11/5/2027 | | | | | | | | |

| (Acquired 11/03/2011 and 06/27/2012, Cost $1,332,605) (a) | | | 1,324,687 | | | | 1,334,574 | |

| Fannie Mae Pool | | | | | | | | |

| 4.553%, 6/1/2013 | | | 961,189 | | | | 973,040 | |

| 2.670%, 1/1/2016 | | | 390,855 | | | | 401,477 | |

| 3.500%, 2/1/2021 | | | 204,459 | | | | 216,200 | |

| 3.500%, 6/1/2021 | | | 267,152 | | | | 282,493 | |

| 3.000%, 8/1/2021 | | | 755,815 | | | | 796,619 | |

| 3.000%, 9/1/2021 | | | 827,966 | | | | 872,665 | |

| 3.000%, 11/1/2021 | | | 1,557,963 | | | | 1,642,073 | |

| 3.500%, 12/1/2025 | | | 1,177,420 | | | | 1,245,401 | |

| 4.000%, 3/1/2026 | | | 731,609 | | | | 778,982 | |

| 3.500%, 7/1/2026 | | | 628,201 | | | | 664,472 | |

| 3.500%, 7/1/2026 | | | 574,377 | | | | 607,540 | |

| 3.500%, 9/1/2026 | | | 1,072,034 | | | | 1,133,930 | |

| 3.000%, 10/1/2026 | | | 264,707 | | | | 277,678 | |

| Fannie Mae-Aces, 3.400%, 7/25/2019 | | | 823,827 | | | | 878,796 | |

| FDIC Structured Sale Guaranteed Notes | | | | | | | | |

| 0.720%, 12/4/2020 (Acquired 02/24/2012, Cost $872,364) (a) | | | 866,470 | | | | 872,427 | |

| 3.250%, 4/25/2038 (Acquired 03/01/2012, Cost $1,193,732) (a) | | | 1,166,140 | | | | 1,193,836 | |

| 0.795%, 2/25/2048 (Acquired 11/18/2011, Cost $988,959) (a) | | | 990,507 | | | | 991,196 | |

| FDIC Trust | | | | | | | | |

| 1.840%, 4/25/2031 (Acquired 06/06/2012, Cost $889,019) (a) | | | 882,447 | | | | 893,253 | |

| 0.841%, 5/25/2035 (Acquired 05/10/2012, Cost $1,939,752) (a) | | | 1,939,751 | | | | 1,939,518 | |

| FHLMC Multifamily Structured Pass Through Certificates | | | | | | | | |

| 1.873%, 1/25/2018 | | | 722,540 | | | | 740,858 | |

| 1.560%, 10/25/2018 | | | 1,750,000 | | | | 1,778,473 | |

| Fosse Master Issuer PLC, 1.855%, 10/18/2054 | | | | | | | | |

| (Acquired 09/30/2011 and 06/27/2102, Cost $1,502,195) (a)(b) | | | 1,500,000 | | | | 1,508,233 | |

| Freddie Mac REMICS, 2.500%, 2/15/2026 | | | 142,233 | | | | 146,105 | |

| Greenwich Capital Commercial Funding Corp., 5.736%, 12/10/2049 | | | 250,000 | | | | 277,038 | |

| GS Mortgage Securities Corp. II | | | | | | | | |

| 4.751%, 7/10/2039 | | | 250,000 | | | | 269,890 | |

| 3.849%, 12/10/2043 (Acquired 04/11/2012, Cost $1,546,142) (a) | | | 1,444,659 | | | | 1,554,063 | |

| 2.999%, 8/10/2044 | | | 1,715,000 | | | | 1,808,044 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

16 ● CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

| | | Principal Amount | | | Value | |

| Holmes Master Issuer PLC, 2.105%, 10/15/2054 | | | | | | |

| (Acquired 01/18/2012, Cost $1,000,000) (a)(b) | | $ | 1,000,000 | | | $ | 1,007,634 | |

| JP Morgan Chase Commercial Mortgage Securities Corp. | | | | | | | | |

| 3.853%, 6/15/2043 (Acquired 12/30/2011, Cost $1,537,986) (a) | | | 1,466,061 | | | | 1,557,858 | |

| 2.749%, 11/15/2043 (Acquired 11/01/2011, Cost $915,501) (a) | | | 905,625 | | | | 936,235 | |

| 5.195%, 12/15/2044 | | | 250,000 | | | | 279,680 | |

| 1.875%, 2/15/2046 (Acquired 09/20/2011, Cost $813,903) (a) | | | 809,291 | | | | 816,497 | |

| 5.447%, 6/12/2047 | | | 1,029,916 | | | | 1,085,925 | |

| 5.794%, 2/12/2051 | | | 1,400,000 | | | | 1,618,389 | |

| Morgan Stanley Capital I, Inc. | | | | | | | | |

| 4.970%, 12/15/2041 | | | 390,000 | | | | 407,467 | |

| 6.278%, 1/11/2043 | | | 250,000 | | | | 299,954 | |

| 3.884%, 9/15/2047 | | | | | | | | |

| (Acquired 09/20/2011 and 06/28/2012, Cost $2,284,207) (a) | | | 2,150,000 | | | | 2,312,495 | |

| 2.178%, 7/15/2049 | | | 1,104,599 | | | | 1,131,251 | |

| NCUA Guaranteed Notes | | | | | | | | |

| 0.616%, 11/6/2017 | | | 184,594 | | | | 184,651 | |

| 0.696%, 1/8/2020 | | | 134,824 | | | | 135,120 | |

| 0.646%, 2/6/2020 | | | 159,130 | | | | 159,204 | |

| 0.696%, 10/7/2020 | | | 198,113 | | | | 198,515 | |

| WIMC Capital Trust, 4.549%, 10/16/2050 | | | | | | | | |

| (Acquired 06/21/2012, Cost $999,990) (a) | | | 1,000,000 | | | | 1,002,188 | |

| | | | | | | | | |

| TOTAL MORTGAGE BACKED SECURITIES (Cost $43,848,617) | | | | | | | 44,277,833 | |

| | | | | | | | | |

| MUNICIPAL BONDS - 1.82% | | | | | | | | |

| Louisiana Local Government Environmental Facilities & | | | | | | | | |

| Community Development Authority, 1.520%, 2/1/2018 | | | 557,417 | | | | 562,963 | |

| Metropolitan Council of Minneapolis, 1.200%, 9/1/2017 | | | 2,020,000 | | | | 1,994,669 | |

| Port of Seattle, WA, 0.883%, 11/1/2013 | | | 1,500,000 | | | | 1,502,610 | |

| State of Ohio, 3.328%, 8/1/2017 | | | 1,500,000 | | | | 1,647,345 | |

| | | | | | | | | |

| TOTAL MUNICIPAL BONDS (Cost $5,749,741) | | | | | | | 5,707,587 | |

| | | | | | | | | |

| FOREIGN GOVERNMENT BONDS - 0.76% | | | | | | | | |

| Hydro Quebec, 2.000%, 6/30/2016 (b) | | | 900,000 | | | | 931,755 | |

| Province of Ontario Canada, 2.950%, 2/5/2015 (b) | | | 380,000 | | | | 400,907 | |

| Province of Ontario Canada, 1.600%, 9/21/2016 (b) | | | 1,000,000 | | | | 1,018,019 | |

| | | | | | | | | |

| TOTAL FOREIGN GOVERNMENT BONDS (Cost $2,315,446) | | | | | | | 2,350,681 | |

| | | | | | | | | |

| U.S. GOVERNMENT AGENCY ISSUES - 13.10% | | | | | | | | |

| Federal Farm Credit Banks, 1.625%, 11/19/2014 | | | 250,000 | | | | 257,381 | |

| Federal Home Loan Banks | | | | | | | | |

| 1.750%, 8/22/2012 | | | 250,000 | | | | 250,555 | |

| 1.625%, 11/21/2012 | | | 250,000 | | | | 251,423 | |

| 1.500%, 1/16/2013 | | | 250,000 | | | | 251,668 | |

| 1.625%, 3/20/2013 | | | 250,000 | | | | 252,441 | |

| 3.625%, 5/29/2013 | | | 500,000 | | | | 515,254 | |

| 1.875%, 6/21/2013 | | | 125,000 | | | | 126,957 | |

| 0.500%, 8/28/2013 | | | 1,500,000 | | | | 1,503,580 | |

| 5.250%, 9/13/2013 | | | 2,000,000 | | | | 2,117,492 | |

| 0.375%, 11/27/2013 | | | 6,500,000 | | | | 6,504,290 | |

| The accompanying notes are an integral part of these consolidated financial statements. |

CONSOLIDATED SCHEDULE OF INVESTMENTS ( CONTINUED) ● 17

| | | Principal Amount | | | Value | |

| Federal Home Loan Mortgage Corp. | | | | | | |

| 4.625%, 10/25/2012 | | $ | 100,000 | | | $ | 101,413 | |

| 0.375%, 11/30/2012 | | | 125,000 | | | | 125,145 | |

| 4.500%, 1/15/2013 | | | 250,000 | | | | 255,704 | |

| 0.750%, 3/28/2013 | | | 125,000 | | | | 125,452 | |

| 1.625%, 4/15/2013 | | | 250,000 | | | | 252,678 | |

| 3.500%, 5/29/2013 | | | 1,100,000 | | | | 1,132,516 | |

| 4.500%, 7/15/2013 | | | 100,000 | | | | 104,411 | |

| 4.125%, 9/27/2013 | | | 250,000 | | | | 261,854 | |

| 0.875%, 10/28/2013 | | | 3,650,000 | | | | 3,677,203 | |

| 4.500%, 1/15/2014 | | | 100,000 | | | | 106,343 | |

| 2.500%, 4/23/2014 | | | 250,000 | | | | 259,736 | |

| 1.000%, 7/30/2014 | | | 500,000 | | | | 506,166 | |

| 1.000%, 8/27/2014 | | | 3,000,000 | | | | 3,040,770 | |

| 2.875%, 2/9/2015 | | | 125,000 | | | | 132,706 | |

| 1.750%, 9/10/2015 | | | 1,000,000 | | | | 1,037,375 | |

| 2.000%, 8/25/2016 | | | 1,500,000 | | | | 1,576,144 | |

| 1.500%, 9/21/2016 | | | 750,000 | | | | 751,543 | |

| 1.000%, 3/8/2017 | | | 6,000,000 | | | | 6,032,454 | |

| Federal National Mortgage Association | | | | | | | | |

| 1.125%, 7/30/2012 | | | 100,000 | | | | 100,076 | |

| 0.625%, 9/24/2012 | | | 250,000 | | | | 250,299 | |

| 4.750%, 11/19/2012 | | | 250,000 | | | | 254,373 | |

| 0.375%, 12/28/2012 | | | 250,000 | | | | 250,288 | |

| 1.750%, 2/22/2013 | | | 100,000 | | | | 100,925 | |

| 0.750%, 2/26/2013 | | | 125,000 | | | | 125,397 | |

| 1.250%, 8/20/2013 | | | 250,000 | | | | 252,636 | |

| 0.750%, 12/18/2013 | | | 250,000 | | | | 251,652 | |

| 2.500%, 5/15/2014 | | | 1,500,000 | | | | 1,559,535 | |

| 0.625%, 10/30/2014 | | | 1,060,000 | | | | 1,064,692 | |

| 0.750%, 12/19/2014 | | | 3,500,000 | | | | 3,525,221 | |

| 2.375%, 7/28/2015 | | | 1,000,000 | | | | 1,055,202 | |

| 1.250%, 9/28/2016 | | | 525,000 | | | | 534,168 | |

| | | | | | | | | |

| TOTAL U.S. GOVERNMENT AGENCY ISSUES (Cost $40,636,182) | | | | 40,835,118 | |

| | | | | | | | | |

| U.S. TREASURY OBLIGATIONS - 17.47% | | | | | | | | |

| U.S. Treasury Bills | | | | | | | | |

| 0.100%, 9/28/2016 (d)(e) | | | 5,000 | | | | 5,000 | |

| 0.070%, 9/28/2016 (d)(e) | | | 10,000 | | | | 9,999 | |

| U.S. Treasury Notes | | | | | | | | |

| 0.375%, 08/31/2012 (e) | | | 14,140,000 | | | | 14,146,080 | |

| 4.250%, 09/30/2012 (e) | | | 12,600,000 | | | | 12,727,474 | |

| 0.500%, 11/30/2012 (e) | | | 12,640,000 | | | | 12,656,786 | |

| 0.625%, 02/28/2013 (e) | | | 14,850,000 | | | | 14,892,932 | |

| | | | | | | | | |

| TOTAL U.S. TREASURY OBLIGATIONS (Cost $54,440,816) | | | | 54,438,271 | |

The accompanying notes are an integral part of these consolidated financial statements.

18 ● CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

| MONEY MARKET FUNDS - 3.21% | | Shares | | | Value | |

| Fidelity Institutional Money Market Portfolio - Class I , 0.18% (f) | | | 10,002,403 | | | $ | 10,002,403 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS (Cost $10,002,403) | | | | | | | 10,002,403 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (Cost $284,366,303) - 91.69% | | | | | | | 285,759,178 | |

| Other Assets in Excess of Liabilities - 8.31% | | | | | | | 25,902,314 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 311,661,492 | |

(a) Restricted security as defined in Rule 144(a) under the Securities Act of 1933 and determined to be liquid. Purchased in a private placement transaction; resale to the public may require registration or may extend only to qualified institutional buyers. At June 30, 2012, the fair value of these securities total $44,118,448 which represents 14.16% of total net assets.

(b) Foreign issued security.

(c) Variable rate security. The rate reported is the rate in effect as of June 30, 2012.

(d) Zero coupon bond. The rate quoted is the effective yield as of June 30, 2012.

(e) These securities are pledged as collateral for the trading of futures contracts.

(f) The rate quoted is the annualized seven-day effective yield as of June 30, 2012.

CONSOLIDATED SCHEDULE OF FUTURES CONTRACTS ● 19

| LoCorr Managed Futures Strategy Fund | | | | | | | | |

| Consolidated Schedule of Futures Contracts | |

| June 30, 2012 (Unaudited) | | | | | | | | | | |

| | | | | | | | | | Unrealized | |

| | | Contracts | | Expiration | | Notional | | | Appreciation/ | |

| | | | | Date | | Amount | | | (Depreciation) | |

| LONG FUTURES CONTRACTS | | | | | | | | | | |

| 90 Day Australian Bank Bill Future | | | 39 | | Dec 2012 | | $ | 39,619,499 | | | $ | (14,466 | ) |

| 90 Day Australian Bank Bill Future | | | 96 | | Mar 2013 | | | 97,536,856 | | | | (23,811 | ) |

| 90 Day Sterling Future | | | 453 | | Mar 2013 | | | 88,053,378 | | | | 100,292 | |

| 90 Day Sterling Future | | | 695 | | Jun 2013 | | | 135,106,537 | | | | 233,101 | |

| 2 Year Euro Schatz Future | | | 1,407 | | Sep 2012 | | | 196,743,185 | | | | (281,796 | ) |

| 2 Year US Treasury Note Future | | | 1,992 | | Sep 2012 | | | 438,613,699 | | | | (393,424 | ) |

| 3 Year Australian Bond Future | | | 339 | | Sep 2012 | | | 38,301,994 | | | | (116,673 | ) |

| 3 Month Canadian Bankers Acceptance Future | | | 23 | | Dec 2012 | | | 5,581,132 | | | | (565 | ) |

| 3 Month Euroswiss Future | | | 29 | | Dec 2012 | | | 7,639,941 | | | | (4,925 | ) |

| 3 Month Euro Euribor Future | | | 782 | | Mar 2013 | | | 246,181,062 | | | | 185,412 | |

| 3 Month Euro Euribor Future | | | 732 | | Jun 2013 | | | 230,382,688 | | | | 239,164 | |

| 3 Month Eurodollar Future | | | 867 | | Jun 2013 | | | 215,557,875 | | | | 127,425 | |

| 5 Year Euro Bobl Future | | | 429 | | Sep 2012 | | | 68,345,748 | | | | (709,162 | ) |

| 5 Year US Treasury Note Future | | | 1,121 | | Sep 2012 | | | 138,969,025 | | | | (109,485 | ) |

| 5 Year US Treasury Note Future* | | | 16 | | Sep 2012 | | | 1,986,875 | | | | 4,400 | |

| 10 Year Australian Bond Future | | | 97 | | Sep 2012 | | | 12,455,379 | | | | (34,024 | ) |

| 10 Year Canadian Bond Future | | | 390 | | Sep 2012 | | | 53,035,556 | | | | 352,952 | |

| 10 Year Euro Bund Future | | | 131 | | Sep 2012 | | | 23,358,517 | | | | (424,601 | ) |

| 10 Year US Treasury Note Future | | | 499 | | Sep 2012 | | | 66,554,125 | | | | (124,125 | ) |

| 30 Year Euro Buxl Future | | | 31 | | Sep 2012 | | | 5,136,851 | | | | (323,032 | ) |

| Brent Crude Oil Future | | | 13 | | Aug 2012 | | | 1,271,400 | | | | 93,200 | |

| Brent Crude Oil Future | | | 72 | | Oct 2012 | | | 7,038,000 | | | | 235,400 | |

| CAC 40 10 Future | | | 76 | | Jul 2012 | | | 3,070,008 | | | | 141,490 | |

| CME 3 Month Eurodollar Future | | | 151 | | Mar 2013 | | | 37,551,813 | | | | (3,888 | ) |

| Corn Future | | | 144 | | Dec 2012 | | | 4,570,200 | | | | 38,413 | |

| Crude Oil Future | | | 259 | | Sep 2012 | | | 22,110,830 | | | | 745,290 | |

| Euro-BTP Italian Bond Future | | | 31 | | Sep 2012 | | | 3,941,104 | | | | 95,685 | |

| FTSE 100 Index Future | | | 73 | | Sep 2012 | | | 6,314,373 | | | | 55,363 | |

| FTSE/JSE Top 40 Index Future | | | 386 | | Sep 2012 | | | 13,950,857 | | | | (279,664 | ) |

| Gilt Future | | | 145 | | Sep 2012 | | | 27,048,832 | | | | (112,935 | ) |

| Gold Future | | | 32 | | Aug 2012 | | | 5,133,440 | | | | 48,000 | |

| Japanese Government 10-year Future | | | 88 | | Sep 2012 | | | 158,187,527 | | | | 115,594 | |

| LME Aluminum Future | | | 48 | | Sep 2012 | | | 2,291,400 | | | | (15,088 | ) |

| LME Lead Future | | | 7 | | Sep 2012 | | | 325,413 | | | | (8,344 | ) |

| LME Nickel Future | | | 14 | | Sep 2012 | | | 1,405,236 | | | | (3,048 | ) |

| LME TIN Future | | | 3 | | Sep 2012 | | | 281,715 | | | | (12,600 | ) |

| LME ZINC Future | | | 16 | | Sep 2012 | | | 751,800 | | | | 10,538 | |

| Mexico Bolsa Index Future | | | 27 | | Sep 2012 | | | 818,722 | | | | 36,783 | |

| Mini DJIA Future | | | 35 | | Sep 2012 | | | 2,242,800 | | | | 12,225 | |

| NASDAQ 100 E-Mini Future | | | 150 | | Sep 2012 | | | 7,837,500 | | | | 115,120 | |

| Nikkei 225 Index Future | | | 30 | | Sep 2012 | | | 1,684,181 | | | | 32,401 | |

| OMX 30 Index Future | | | 124 | | Jul 2012 | | | 1,844,104 | | | | 71,678 | |

| S&P 500 E-Mini Future | | | 47 | | Sep 2012 | | | 3,191,888 | | | | 42,750 | |

| SET 50 Index Future | | | 42 | | Sep 2012 | | | 1,076,052 | | | | 25,538 | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

20 ● CONSOLIDATED SCHEDULE OF FUTURES CONTRACTS (CONTINUED)

| | | | | | | | | | Unrealized | |

| | | Contracts | | Expiration | | Notional | | | Appreciation/ | |

| | | | | Date | | Amount | | | (Depreciation) | |

| Soybean Future | | | 83 | | Nov 2012 | | $ | 5,925,163 | | | $ | 81,113 | |

| Soybean Future | | | 129 | | Dec 2012 | | | 5,328,990 | | | | 238,700 | |

| Topix Index Future | | | 52 | | Sep 2012 | | | 5,002,565 | | | | 105,336 | |

| U.S. Long Bond Future | | | 187 | | Sep 2012 | | | 27,670,166 | | | | (258,219 | ) |

| Wheat Future | | | 12 | | Dec 2012 | | | 466,050 | | | | (2,563 | ) |

| | | | | | | | | | | | | | |

| Total Long Futures Contracts | | | | | | | $ | 2,467,492,051 | | | $ | 326,925 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | Unrealized | |

| | | Contracts | | Expiration | | Notional | | | Appreciation/ | |

| | | | | | Date | | Amount | | | (Depreciation) | |

| SHORT FUTURES CONTRACTS | | | | | | | | | | | | | |

| Amsterdam Index Future | | | (30 | ) | Jul 2012 | | | (2,332,954 | ) | | $ | (100,316 | ) |

| Cocoa Future | | | (136 | ) | Sep 2012 | | | (3,115,760 | ) | | | (78,270 | ) |

| Coffee Future | | | (81 | ) | Sep 2012 | | | (5,185,013 | ) | | | (450,544 | ) |

| Copper Future | | | (58 | ) | Sep 2012 | | | (5,069,925 | ) | | | (277,163 | ) |

| Corn Future | | | (31 | ) | Sep 2012 | | | (974,175 | ) | | | (84,338 | ) |

| Cotton Future | | | (119 | ) | Dec 2012 | | | (4,244,135 | ) | | | (105,980 | ) |

| Crude Oil Future | | | (108 | ) | Aug 2012 | | | (10,562,400 | ) | | | (405,160 | ) |

| Crude Oil Future | | | (346 | ) | Aug 2012 | | | (29,396,160 | ) | | | (1,113,130 | ) |

| Crude Oil Future | | | (36 | ) | Sep 2012 | | | (3,073,320 | ) | | | (97,200 | ) |

| Crude Oil Future | | | (113 | ) | Sep 2012 | | | (11,060,440 | ) | | | (477,680 | ) |

| Crude Oil Future | | | (25 | ) | Feb 2013 | | | (2,189,000 | ) | | | (76,940 | ) |

| DAX Index Future | | | (5 | ) | Sep 2012 | | | (1,014,221 | ) | | | (11,136 | ) |

| FTSE/MIB Index Future | | | (33 | ) | Sep 2012 | | | (2,985,118 | ) | | | (238,155 | ) |

| Gas Oil Future | | | (38 | ) | Aug 2012 | | | (3,204,350 | ) | | | (109,275 | ) |

| Gas Oil Future | | | (121 | ) | Jul 2012 | | | (10,266,850 | ) | | | (397,750 | ) |

| Hang Seng Index Future | | | (7 | ) | Jul 2012 | | | (877,442 | ) | | | (21,584 | ) |

| Hard Red Winter Wheat Future | | | (18 | ) | Dec 2012 | | | (700,650 | ) | | | (80,263 | ) |

| Heating Oil Future | | | (27 | ) | Sep 2012 | | | (3,074,954 | ) | | | (78,687 | ) |

| Heating Oil Future | | | (102 | ) | Aug 2012 | | | (11,609,212 | ) | | | (433,486 | ) |

| H-Shares Index Future | | | (63 | ) | Jul 2012 | | | (3,872,357 | ) | | | (36,846 | ) |

| Ibex 35 Index Future | | | (31 | ) | Jul 2012 | | | (2,740,609 | ) | | | (147,480 | ) |

| ISE 30 Futures | | | (49 | ) | Aug 2012 | | | (207,813 | ) | | | (5,398 | ) |

| KOSPI 200 Index Future | | | (31 | ) | Sep 2012 | | | (3,325,053 | ) | | | 51,927 | |

| Lean Hogs Future | | | (47 | ) | Aug 2012 | | | (1,781,770 | ) | | | (130,810 | ) |

| Live Cattle Future | | | (109 | ) | Aug 2012 | | | (5,251,620 | ) | | | (55,810 | ) |

| LME Aluminum Future | | | (261 | ) | Sep 2012 | | | (12,459,488 | ) | | | 655,956 | |

| LME Copper Future | | | (28 | ) | Sep 2012 | | | (5,382,650 | ) | | | (102,575 | ) |

| LME Lead Future | | | (133 | ) | Sep 2012 | | | (6,182,838 | ) | | | 169,700 | |

| LME Nickel Future | | | (64 | ) | Sep 2012 | | | (6,423,936 | ) | | | (15,078 | ) |

| LME Tin Future | | | (12 | ) | Sep 2012 | | | (1,126,860 | ) | | | 26,420 | |

| LME Zinc Future | | | (230 | ) | Sep 2012 | | | (10,807,125 | ) | | | (52,900 | ) |

| MSCI Singapore Index Future | | | (6 | ) | Jul 2012 | | | (314,600 | ) | | | (8,526 | ) |

| MSCI Taiwan Index Future | | | (34 | ) | Jul 2012 | | | (861,560 | ) | | | (26,580 | ) |

| Natural Gas Future | | | (3 | ) | Sep 2012 | | | (84,990 | ) | | | (1,320 | ) |

| Natural Gas Future | | | (34 | ) | Aug 2012 | | | (960,160 | ) | | | (32,970 | ) |

| The accompanying notes are an integral part of these consolidated financial statements. | |

CONSOLIDATED SCHEDULE OF FUTURE S CONTRACTS (CONTINUED) ● 21

| | | | | | | | | | Unrealized | |

| | | Contracts | | Expiration | | Notional | | | Appreciation/ | |

| | | | | Date | | Amount | | | (Depreciation) | |

| Natural Gas Future | | | (63 | ) | Oct 2012 | | $ | (1,812,510 | ) | | $ | (185,020 | ) |

| Natural Gas Future | | | (63 | ) | Nov 2012 | | | (1,947,330 | ) | | | (210,690 | ) |

| Palladium Future | | | (33 | ) | Sep 2012 | | | (1,929,015 | ) | | | 51,095 | |

| Platinum Future | | | (58 | ) | Oct 2012 | | | (4,211,960 | ) | | | (52,305 | ) |

| RBOB Gasoline Future | | | (9 | ) | Aug 2012 | | | (994,820 | ) | | | (58,766 | ) |

| RBOB Gasoline Future | | | (8 | ) | Sep 2012 | | | (859,320 | ) | | | (35,196 | ) |

| Rubber Future | | | (39 | ) | Dec 2012 | | | (574,742 | ) | | | - | |

| Russell 200 Mini Future | | | (49 | ) | Sep 2012 | | | (3,906,280 | ) | | | (133,010 | ) |

| S&P/TSX 60 Index Future | | | (67 | ) | Sep 2012 | | | (8,694,667 | ) | | | (152,130 | ) |

| SGX CNX Nifty Index Future | | | (221 | ) | Jul 2012 | | | (2,340,169 | ) | | | (82,672 | ) |

| Silver Future | | | (15 | ) | Sep 2012 | | | (2,070,900 | ) | | | (5,175 | ) |

| Soybean Oil Future | | | (119 | ) | Dec 2012 | | | (3,789,912 | ) | | | (195,840 | ) |

| SPI 200 Index Future | | | (14 | ) | Sep 2012 | | | (1,453,318 | ) | | | (12,026 | ) |

| STOXX 50 Index Future | | | (10 | ) | Sep 2012 | | | (285,371 | ) | | | 1,519 | |

| Sugar #11 Future | | | (219 | ) | Oct 2012 | | | (5,153,333 | ) | | | (395,304 | ) |

| TAIEX Bank and Insurance Future | | | (36 | ) | Jul 2012 | | | (914,064 | ) | | | (1,205 | ) |

| Taiex Electronics Future | | | (8 | ) | Jul 2012 | | | (288,519 | ) | | | (4,725 | ) |

| Taiwan Stock Exchange Future | | | (25 | ) | Jul 2012 | | | (1,190,229 | ) | | | (15,192 | ) |

| VIX Future | | | (81 | ) | Jul 2012 | | | (1,579,500 | ) | | | 194,450 | |

| | | | | | | | | | | | | | |

| Total Short Futures Contracts | | | | | | | $ | (216,715,467 | ) | | $ | (5,641,539 | ) |

| Total Futures Contracts | | | | | | | $ | 2,250,776,584 | | | $ | (5,314,614 | ) |

* Long futures contract held by LoCorr Managed Futures Strategy Fund. The total balance of unrealized depreciation on futures contracts held by Millburn Diversified Plus L.P. is $(5,319,014).

The accompanying notes are an integral part of these consolidated financial statements.

22 ● CONSOLIDATED SCHEDULE OF FORWARD CURRENCY CONTRACTS

| LoCorr Managed Futures Strategy Fund | | | | | | | | |

| Consolidated Schedule of Forward Currency Contracts | |

| June 30, 2012 (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | | | |

| LONG FORWARD CURRENCY CONTRACTS | | | | | | | | |

| Expiration | | Currency Purchased | | Notional Value | | | | |

| Date | Description | Currency | | Amount | | Currency | | Amount | | | Fair Value | |

| Sept 2012 | AUD/CHF | AUD | | 19,570,000 | | CHF | | | (19,887,243 | ) | | | $219,613 | |

| Sept 2012 | AUD/EUR | AUD | | 20,857,311 | | EUR | | | (21,195,422 | ) | | | 235,570 | |

| Sept 2012 | AUD/GBP | AUD | | 12,215,839 | | GBP | | | (12,413,866 | ) | | | 193,293 | |

| Sept 2012 | AUD/USD | AUD | | 15,870,000 | | USD | | | (16,127,263 | ) | | | 434,811 | |

| Sept 2012 | BRL/USD | BRL | | 4,020,000 | | USD | | | (1,969,621 | ) | | | 54,184 | |

| Sept 2012 | CAD/USD | CAD | | 9,400,000 | | USD | | | (9,220,369 | ) | | | 24,733 | |

| Sept 2012 | CHF/AUD | CHF | | 2,588,856 | | AUD | | | (2,733,242 | ) | | | 5,690 | |

| Sept 2012 | CHF/NO | CHF | | 3,790,000 | | NO | | | (4,001,377 | ) | | | 62,996 | |

| Sept 2012 | CHF/USD | CHF | | 18,310,000 | | USD | | | (19,331,189 | ) | | | 41,567 | |

| Sept 2012 | CLP/USD | CLP | | 1,456,000,000 | | USD | | | (2,874,743 | ) | | | 34,378 | |

| Sept 2012 | COP/USD | COP | | 20,180,000,000 | | USD | | | (11,166,791 | ) | | | 222,223 | |

| Sept 2012 | CZK/USD | CZK | | 42,950,000 | | USD | | | (2,130,145 | ) | | | 28,617 | |

| Sept 2012 | EUR/AUD | EUR | | 2,270,000 | | AUD | | | (2,874,772 | ) | | | 2,081 | |

| Sept 2012 | EUR/CZK | EUR | | 4,020,000 | | CZK | | | (5,091,005 | ) | | | 82,023 | |

| Sept 2012 | EUR/NO | EUR | | 1,900,000 | | NO | | | (2,406,196 | ) | | | 1,742 | |

| Sept 2012 | EUR/PLN | EUR | | 8,640,000 | | PLN | | | (10,941,862 | ) | | | 212,275 | |

| Sept 2012 | EUR/RON | EUR | | 7,220,000 | | RON | | | (9,143,546 | ) | | | 63,270 | |

| Sept 2012 | EUR/SEK | EUR | | 1,880,000 | | SEK | | | (2,380,868 | ) | | | 1,724 | |

| Sept 2012 | EUR/TRY | EUR | | 600,000 | | TRY | | | (759,852 | ) | | | 550 | |

| Sept 2012 | EUR/USD | EUR | | 74,920,000 | | USD | | | (94,880,124 | ) | | | 592,971 | |

| Sept 2012 | GBP/AUD | GBP | | 1,730,000 | | AUD | | | (2,713,085 | ) | | | 3,652 | |

| Sept 2012 | GBP/USD | GBP | | 8,170,000 | | USD | | | (12,812,661 | ) | | | 99,681 | |

| Sept 2012 | HUF/EUR | HUF | | 1,256,680,200 | | EUR | | | (5,502,208 | ) | | | 135,266 | |

| Sept 2012 | IDR/USD | IDR | | 308,000,000 | | USD | | | (32,464 | ) | | | 179 | |

| Sept 2012 | ILS/USD | ILS | | 890,000 | | USD | | | (226,893 | ) | | | 873 | |

| Sept 2012 | JPY/USD | JPY | | 3,612,000,000 | | USD | | | (45,280,731 | ) | | | (193,673 | ) |

| Sept 2012 | KRW/USD | KRW | | 1,828,000,000 | | USD | | | (1,592,473 | ) | | | 19,082 | |

| Sept 2012 | MXN/USD | MXN | | 69,530,000 | | USD | | | (5,158,948 | ) | | | 23,167 | |

| Sept 2012 | MYR/USD | MYR | | 630,000 | | USD | | | (198,720 | ) | | | 1,752 | |

| Sept 2012 | NO/CHF | NO | | 143,062,848 | | CHF | | | (23,935,318 | ) | | | 434,157 | |

| Sept 2012 | NO/EUR | NO | | 110,644,776 | | EUR | | | (18,511,570 | ) | | | 279,017 | |

| Sept 2012 | NO/USD | NO | | 80,990,000 | | USD | | | (13,550,138 | ) | | | 6,374 | |

| Sept 2012 | NZD/USD | NZD | | 14,040,000 | | USD | | | (11,196,302 | ) | | | 201,549 | |

| Sept 2012 | PHP/USD | PHP | | 136,090,000 | | USD | | | (3,231,927 | ) | | | 47,248 | |

| Sept 2012 | PLN/EUR | PLN | | 30,792,009 | | EUR | | | (9,132,928 | ) | | | 124,460 | |

| Sept 2012 | PLN/USD | PLN | | 7,480,000 | | USD | | | (2,218,572 | ) | | | 34,820 | |

| Sept 2012 | RON/EUR | RON | | 12,079,050 | | EUR | | | (3,400,580 | ) | | | 17,220 | |

| Sept 2012 | RUB/USD | RUB | | 11,310,000 | | USD | | | (344,254 | ) | | | (1,269 | ) |

| Sept 2012 | SEK/EUR | SEK | | 128,154,768 | | EUR | | | (18,461,063 | ) | | | 346,001 | |

| Sept 2012 | SEK/USD | SEK | | 103,800,000 | | USD | | | (14,952,688 | ) | | | 152,273 | |

| Sept 2012 | SGD/USD | SGD | | 5,260,000 | | USD | | | (4,151,354 | ) | | | 30,249 | |

| Sept 2012 | TRY/EUR | TRY | | 51,615,244 | | EUR | | | (28,073,935 | ) | | | 102,950 | |

| Sept 2012 | TRY/USD | TRY | | 13,790,000 | | USD | | | (7,500,489 | ) | | | 117,034 | |

| | | | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

CONSOLIDATED SCHEDULE OF FORWAR D CURRENCY CONTRACTS ( CONTINUED) ● 23

| Expiration | | Currency Purchased | | Notional Value | | | | |

| Date | Description | Currency | Amount | | Currency | | Amount | | | Fair Value | |

| Sept 2012 | USD/BRL | USD | | 9,985,329 | | BRL | | | (9,985,329 | ) | | | - | |

| Sept 2012 | USD/CAD | USD | | 12,276,729 | | CAD | | | (12,276,729 | ) | | | - | |

| Sept 2012 | USD/CHF | USD | | 33,794,920 | | CHF | | | (33,794,920 | ) | | | - | |

| Sept 2012 | USD/CLP | USD | | 12,384,250 | | CLP | | | (12,384,250 | ) | | | - | |

| Sept 2012 | USD/COP | USD | | 1,489,297 | | COP | | | (1,489,297 | ) | | | - | |

| Sept 2012 | USD/CZK | USD | | 4,429,327 | | CZK | | | (4,429,327 | ) | | | - | |

| Sept 2012 | USD/EUR | USD | | 111,111,759 | | EUR | | | (111,111,759 | ) | | | - | |

| Sept 2012 | USD/GBP | USD | | 11,353,910 | | GBP | | | (11,353,910 | ) | | | - | |

| Sept 2012 | USD/IDR | USD | | 1,805,296 | | IDR | | | (1,805,296 | ) | | | - | |

| Sept 2012 | USD/ILS | USD | | 14,607,990 | | ILS | | | (14,607,990 | ) | | | - | |

| Sept 2012 | USD/INR | USD | | 6,067,118 | | INR | | | (6,067,118 | ) | | | - | |

| Sept 2012 | USD/JPY | USD | | 60,169,035 | | JPY | | | (60,169,035 | ) | | | - | |

| Sept 2012 | USD/KRW | USD | | 16,908,397 | | KRW | | | (16,908,397 | ) | | | - | |

| Sept 2012 | USD/MXN | USD | | 9,794,698 | | MXN | | | (9,794,698 | ) | | | - | |

| Sept 2012 | USD/MYR | USD | | 973,573 | | MYR | | | (973,573 | ) | | | - | |

| Sept 2012 | USD/NO | USD | | 15,644,391 | | NO | | | (15,644,391 | ) | | | - | |

| Sept 2012 | USD/NZD | USD | | 6,076,536 | | NZD | | | (6,076,536 | ) | | | - | |

| Sept 2012 | USD/PHP | USD | | 842,536 | | PHP | | | (842,536 | ) | | | - | |

| Sept 2012 | USD/PLN | USD | | 3,639,685 | | PLN | | | (3,639,685 | ) | | | - | |

| Sept 2012 | USD/RUB | USD | | 3,245,469 | | RUB | | | (3,245,469 | ) | | | - | |

| Sept 2012 | USD/SEK | USD | | 15,374,068 | | SEK | | | (15,374,068 | ) | | | - | |

| Sept 2012 | USD/SGD | USD | | 5,747,740 | | SGD | | | (5,747,740 | ) | | | - | |

| Sept 2012 | USD/ZAR | USD | | 7,869,395 | | ZAR | | | (7,869,395 | ) | | | - | |

| Sept 2012 | ZAR/EUR | ZAR | | 58,067,617 | | EUR | | | (7,023,787 | ) | | | 61,586 | |

| Sept 2012 | ZAR/USD | ZAR | | 28,530,000 | | USD | | | (3,450,954 | ) | | | 30,670 | |

| Total Long Forward Currency Contracts | | | | | | | | $ | 4,588,629 | |

| | | | | | | | | | | | | | | |

| SHORT FORWARD CURRENCY CONTRACTS | | | | | | | | |

| Expiration | | Currency Purchased | | Notional Value | | | | |

| Date | Description | Currency | | Amount | | Currency | | Amount | | | Fair Value | |

| Sept 2012 | AUD/CHF | AUD | | (2,690,000 | ) | CHF | | | 2,733,607 | | | $ | (6,055 | ) |

| Sept 2012 | AUD/EUR | AUD | | (2,828,874 | ) | EUR | | | 2,874,732 | | | | (2,042 | ) |

| Sept 2012 | AUD/GBP | AUD | | (2,669,909 | ) | GBP | | | 2,713,190 | | | | (3,757 | ) |

| Sept 2012 | AUD/USD | AUD | | (6,410,000 | ) | USD | | | 6,513,910 | | | | (109,140 | ) |

| Sept 2012 | BRL/USD | BRL | | (20,580,000 | ) | USD | | | 10,083,284 | | | | (97,955 | ) |

| Sept 2012 | CAD/USD | CAD | | (12,630,000 | ) | USD | | | 12,388,644 | | | | (111,915 | ) |

| Sept 2012 | CHF/AUD | CHF | | (18,539,381 | ) | AUD | | | 19,573,363 | | | | 94,267 | |

| Sept 2012 | CHF/NO | CHF | | (22,500,000 | ) | NO | | | 23,754,875 | | | | (253,714 | ) |

| Sept 2012 | CHF/USD | CHF | | (32,410,000 | ) | USD | | | 34,217,578 | | | | (422,657 | ) |

| Sept 2012 | CLP/USD | CLP | | (6,526,500,000 | ) | USD | | | 12,885,997 | | | | (501,747 | ) |

| Sept 2012 | COP/USD | COP | | (2,677,000,000 | ) | USD | | | 1,481,343 | | | | 7,953 | |

| Sept 2012 | CZK/EUR | CZK | | (103,798,930 | ) | EUR | | | 5,148,003 | | | | (139,021 | ) |

| Sept 2012 | CZK/USD | CZK | | (92,140,000 | ) | USD | | | 4,569,768 | | | | (140,441 | ) |

| Sept 2012 | EUR/AUD | EUR | | (16,490,000 | ) | AUD | | | 20,883,252 | | | | 76,599 | |

| Sept 2012 | EUR/HUF | EUR | | (4,220,000 | ) | HUF | | | 5,344,289 | | | | 22,653 | |

| Sept 2012 | EUR/NO | EUR | | (14,500,000 | ) | NO | | | 18,363,078 | | | | (130,525 | ) |

| Sept 2012 | EUR/PLN | EUR | | (7,120,000 | ) | PLN | | | 9,016,904 | | | | (8,437 | ) |

| The accompanying notes are an integral part of these consolidated financial statements. | |

24 ● CONSOLIDATED SCHEDULE OF FORWARD CURRENCY CONTRACTS (CONTINUED)

| Expiration | Currency Purchased | | Notional Value | | | | |

| Date | Description | Currency | | Amount | | Currency | | Amount | | | Fair Value | |

| Sept 2012 | EUR/RON | EUR | | (2,690,000 | ) | RON | | | 3,406,668 | | | $ | (23,308 | ) |

| Sept 2012 | EUR/SEK | EUR | | (14,370,000 | ) | SEK | | | 18,198,443 | | | | (83,381 | ) |

| Sept 2012 | EUR/TRY | EUR | | (21,960,000 | ) | TRY | | | 27,810,565 | | | | 160,420 | |

| Sept 2012 | EUR/USD | EUR | | (88,600,000 | ) | USD | | | 112,204,738 | | | | (1,092,980 | ) |

| Sept 2012 | EUR/ZAR | EUR | | (5,490,000 | ) | ZAR | | | 6,952,641 | | | | 9,560 | |

| Sept 2012 | GBP/AUD | GBP | | (7,780,000 | ) | AUD | | | 12,201,041 | | | | 19,532 | |

| Sept 2012 | GBP/USD | GBP | | (7,320,000 | ) | USD | | | 11,479,643 | | | | (125,732 | ) |

| Sept 2012 | IDR/USD | IDR | | (17,437,000,000 | ) | USD | | | 1,837,911 | | | | (32,615 | ) |

| Sept 2012 | ILS/USD | ILS | | (57,210,000 | ) | USD | | | 14,584,900 | | | | 23,089 | |

| Sept 2012 | INR/USD | INR | | (342,810,000 | ) | USD | | | 6,076,970 | | | | (9,852 | ) |

| Sept 2012 | JPY/USD | JPY | | (4,764,000,000 | ) | USD | | | 59,722,426 | | | | 446,609 | |

| Sept 2012 | KRW/USD | KRW | | (19,935,000,000 | ) | USD | | | 17,366,495 | | | | (458,098 | ) |

| Sept 2012 | MXN/USD | MXN | | (141,710,000 | ) | USD | | | 10,514,518 | | | | (719,821 | ) |

| Sept 2012 | MYR/USD | MYR | | (3,090,000 | ) | USD | | | 974,673 | | | | (1,099 | ) |

| Sept 2012 | NO/CHF | NO | | (23,955,958 | ) | CHF | | | 4,007,983 | | | | (69,602 | ) |

| Sept 2012 | NO/EUR | NO | | (14,366,470 | ) | EUR | | | 2,403,601 | | | | 853 | |

| Sept 2012 | NO/USD | NO | | (95,490,000 | ) | USD | | | 15,976,080 | | | | (331,689 | ) |

| Sept 2012 | NZD/USD | NZD | | (7,730,000 | ) | USD | | | 6,164,346 | | | | (87,809 | ) |

| Sept 2012 | PHP/USD | PHP | | (36,010,000 | ) | USD | | | 855,182 | | | | (12,646 | ) |

| Sept 2012 | PLN/EUR | PLN | | (38,635,002 | ) | EUR | | | 11,459,164 | | | | (729,577 | ) |

| Sept 2012 | PLN/USD | PLN | | (13,170,000 | ) | USD | | | 3,906,230 | | | | (266,545 | ) |

| Sept 2012 | RON/EUR | RON | | (32,621,404 | ) | EUR | | | 9,183,809 | | | | (103,533 | ) |

| Sept 2012 | RUB/USD | RUB | | (111,410,000 | ) | USD | | | 3,391,100 | | | | (145,630 | ) |

| Sept 2012 | SEK/EUR | SEK | | (16,519,466 | ) | EUR | | | 2,379,677 | | | | (532 | ) |

| Sept 2012 | SEK/USD | SEK | | (111,350,000 | ) | USD | | | 16,040,288 | | | | (666,219 | ) |

| Sept 2012 | SGD/USD | SGD | | (7,390,000 | ) | USD | | | 5,832,416 | | | | (84,675 | ) |

| Sept 2012 | TRY/EUR | TRY | | (1,399,350 | ) | EUR | | | 761,117 | | | | (1,816 | ) |

| Sept 2012 | USD/AUD | USD | | (15,692,453 | ) | AUD | | | 15,692,453 | | | | - | |

| Sept 2012 | USD/BRL | USD | | (1,915,437 | ) | BRL | | | 1,915,437 | | | | - | |

| Sept 2012 | USD/CAD | USD | | (9,195,635 | ) | CAD | | | 9,195,635 | | | | - | |

| Sept 2012 | USD/CHF | USD | | (19,289,622 | ) | CHF | | | 19,289,622 | | | | - | |

| Sept 2012 | USD/CLP | USD | | (2,840,365 | ) | CLP | | | 2,840,365 | | | | - | |

| Sept 2012 | USD/COP | USD | | (10,944,568 | ) | COP | | | 10,944,568 | | | | - | |

| Sept 2012 | USD/CZK | USD | | (2,101,528 | ) | CZK | | | 2,101,528 | | | | - | |

| Sept 2012 | USD/EUR | USD | | (94,287,153 | ) | EUR | | | 94,287,153 | | | | - | |

| Sept 2012 | USD/GBP | USD | | (12,712,980 | ) | GBP | | | 12,712,980 | | | | - | |

| Sept 2012 | USD/IDR | USD | | (32,285 | ) | IDR | | | 32,285 | | | | - | |

| Sept 2012 | USD/ILS | USD | | (226,020 | ) | ILS | | | 226,020 | | | | - | |

| Sept 2012 | USD/JPY | USD | | (45,474,404 | ) | JPY | | | 45,474,404 | | | | - | |

| Sept 2012 | USD/KRW | USD | | (1,573,391 | ) | KRW | | | 1,573,391 | | | | - | |

| Sept 2012 | USD/MXN | USD | | (5,135,781 | ) | MXN | | | 5,135,781 | | | | - | |

| Sept 2012 | USD/MYR | USD | | (196,967 | ) | MYR | | | 196,967 | | | | - | |

| Sept 2012 | USD/NO | USD | | (13,543,765 | ) | NO | | | 13,543,765 | | | | - | |

| Sept 2012 | USD/NZD | USD | | (10,994,753 | ) | NZD | | | 10,994,753 | | | | - | |

| Sept 2012 | USD/PHP | USD | | (3,184,680 | ) | PHP | | | 3,184,680 | | | | - | |

| Sept 2012 | USD/PLN | USD | | (2,183,752 | ) | PLN | | | 2,183,752 | | | | - | |

| Sept 2012 | USD/RUB | USD | | (345,523 | ) | RUB | | | 345,523 | | | | - | |

| Sept 2012 | USD/SEK | USD | | (14,800,415 | ) | SEK | | | 14,800,415 | | | | - | |

| Sept 2012 | USD/SGD | USD | | (4,121,105 | ) | SGD | | | 4,121,105 | | | | - | |

| | | | | | | | | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | |

CONSOLIDATED SCHEDULE OF FORWARD CURRENCY CONTRACTS (CONTINUED) ● 25

| Expiration | Currency Purchased | Notional Value | | |

| Date | Description | Currency | Amount | Currency | Amount | Fair Value |

| Sept 2012 | USD/TRY | USD | (7,383,455) | TRY | 7,383,455 | | |

| Sept 2012 | USD/ZAR | USD | (3,420,284) | ZAR | 3,420,284 | | - |

| Sept 2012 | ZAR/USD | ZAR | (68,820,000) | USD | 8,324,382 | | (454,987) |

| Total Short Forward Currency Contracts | | | | $(6,568,017) |

| | | | | | | | |

| Total Forward Currency Contracts | | | | | $(1,979,388) |

| | | Currency | | Currency | | Currency |

| | Currency | Descriptions | Currency | Descriptions | Currency | Descriptions |

| | AUD | Australian dollar | IDR | Indoneasian rupiah | PLN | Polish zloty |

| | BRL | Brazil real | ILS | Isreali shekel | RON | Romanian leu |

| | CAD | Canadian dollar | INR | Indian rupee | RUB | Russian ruble |

| | CHF | Swiss franc | JPY | Japanese yen | SEK | Swedish krona |

| | CLP | Chilean peso | KRW | Korean won | SGD | Singapore dollar |

| | COP | Colombian peso | MXN | Mexican peso | TRY | Turkish lira |

| | CZK | Czech koruna | MYR | Malaysian ringgit | USD | United States dollar |

| | EUR | Euro | NO | Norwegian krone | ZAR | South African rand |

| | GBP | British pound | NZD | New Zealand dollar | | |

| | HUF | Hungarian forint | PHP | Philippine peso | | |

The accompanying notes are an integral part of these consolidated financial statements.

26 ● PORTFOLIO COMPOSITION

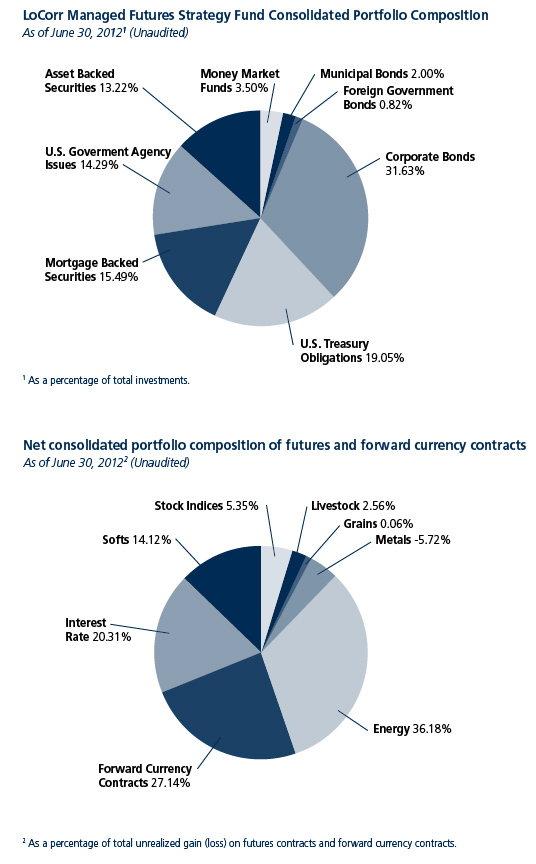

2 As a percentage of total unrealized gain (loss) on futures contracts and forward currency contracts held by Millburn Commodity Plus L.P.

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED SCHEDULE OF INVESTMENTS ● 27

| LoCorr Long/Short Commodities Strategy Fund | | | | | | |

| Consolidated Schedule of Investments | | | | | | |

| June 30, 2012 (Unaudited) | | | | | | |

| | | Principal Amount | | | Value | |

| ASSET BACKED SECURITIES - 1.96% | | | | | | |

| AmeriCredit Automobile Receivables Trust, 0.710%, 12/8/2015 | | $ | 25,000 | | | $ | 25,000 | |

| Bank of America Auto Trust, 0.780%, 6/15/2016 | | | 10,000 | | | | 10,022 | |

| CNH Equipment Trust, 0.860%, 9/15/2017 | | | 15,000 | | | | 15,017 | |

| GE Equipment Small Ticket LLC, 1.040%, 9/21/2015 | | | | | | | | |

| (Acquired on 5/22/2012, Cost $14,997) (a) | | | 15,000 | | | | 15,026 | |

| Navistar Financial Corp. Owner Trust, 0.850%, 3/18/2015 | | | | | | | | |

| (Acquired on 6/20/2012, Cost $25,000) (a) | | | 25,000 | | | | 24,992 | |

| Santander Drive Auto Receivables Trust, 0.790%, 8/17/2015 | | | 25,000 | | | | 24,993 | |

| TOTAL ASSET BACKED SECURITIES (Cost $114,993) | | | | | | | 115,050 | |

| | | | | | | | | |

| | | | | | | | | |

| CORPORATE BONDS - 6.21% | | | | | | | | |

| Construction - 0.26% | | | | | | | | |

| ABB Treasury Center USA, Inc., 2.500%, 6/15/2016 | | | | | | | | |

| (Acquired on 6/19/2012, Cost $15,513) (a) | | | 15,000 | | | | 15,514 | |

| Finance and Insurance - 2.34% | | | | | | | | |

| American Express Credit Corp., 2.800%, 9/19/2016 | | | 10,000 | | | | 10,432 | |

| Berkshire Hathaway Finance Corp., 1.600%, 5/15/2017 | | | 10,000 | | | | 10,070 | |

| Boston Properties LP, 5.000%, 6/1/2015 | | | 10,000 | | | | 10,865 | |

| Caterpillar Financial Services Corp., 1.100%, 5/29/2015 | | | 10,000 | | | | 10,056 | |

| Dragon 2012 LLC, 1.972%, 3/12/2024 | | | 25,000 | | | | 24,901 | |

| Helios Leasing I LLC, 2.018%, 5/29/2024 | | | 25,000 | | | | 24,967 | |

| John Deere Capital Corp., 0.950%, 6/29/2015 | | | 15,000 | | | | 15,025 | |

| PNC Funding Corp., 2.700%, 9/19/2016 | | | 10,000 | | | | 10,364 | |

| Toyota Motor Credit Corp., 2.050%, 1/12/2017 | | | 10,000 | | | | 10,221 | |

| Vornado Realty LP, 4.250%, 4/1/2015 | | | 10,000 | | | | 10,546 | |

| | | | | | | | 137,447 | |

| Information - 0.32% | | | | | | | | |

| AT&T, Inc., 1.700%, 6/1/2017 | | | 10,000 | | | | 10,046 | |

| Comcast Corp., 4.950%, 6/15/2016 | | | 8,000 | | | | 8,981 | |

| | | | | | | | 19,027 | |

| Management of Companies and Enterprises - 0.19% | | | | | | | | |

| BAE Systems Holdings, Inc., 5.200%, 8/15/2015 | | | | | | | | |

| (Acquired on 6/4/2012, Cost $10,873) (a) | | | 10,000 | | | | 10,880 | |

| Manufacturing - 1.29% | | | | | | | | |

| Baxter International, Inc., 1.850%, 1/15/2017 | | | 10,000 | | | | 10,218 | |

| Covidien International Finance SA, 1.350%, 5/29/2015 (b) | | | 7,000 | | | | 7,009 | |

| Kellogg Co., 1.750%, 5/17/2017 | | | 10,000 | | | | 9,999 | |

| Kraft Foods Group, Inc., 1.625%, 6/4/2015 | | | | | | | | |

| (Acquired on 5/30/2012, Cost $9,974) (a) | | | 10,000 | | | | 10,106 | |

| Lockheed Martin Corp., 2.125%, 9/15/2016 | | | 10,000 | | | | 10,236 | |

| Parker Hannifin Corp., 5.500%, 5/15/2018 | | | 10,000 | | | | 11,956 | |

| Thermo Fisher Scientific, Inc., 5.000%, 6/1/2015 | | | 10,000 | | | | 11,167 | |

| United Technologies Corp., 1.200%, 6/1/2015 | | | 5,000 | | | | 5,058 | |

| | | | | | | | 75,749 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | |

28 ● CONSOLIDATED SCHEDULE OF INVESTMENTS (CONTINUED)

| | | Principal Amount | | | Value | |

| Mining, Quarrying, and Oil and Gas Extraction - 0.60% | | | | | | |

| Devon Energy Corp., 1.875%, 5/15/2017 | | $ | 10,000 | | | $ | 10,002 | |

| Rio Tinto Finance USA PLC, 2.000%, 3/22/2017 (b) | | | 10,000 | | | | 10,194 | |

| Total Capital International SA, 1.550%, 6/28/2017 (b) | | | 15,000 | | | | 15,035 | |

| | | | | | | | 35,231 | |

| Transportation & Warehousing - 0.43% | | | | | | | | |

| VRG Linhas Aereas SA, 1.000%, 6/30/2014 (b) | | | 25,000 | | | | 24,995 | |

| Utilities - 0.78% | | | | | | | | |

| McDonald’s Corp., 5.800%, 10/15/2017 | | | 10,000 | | | | 12,145 | |

| Southern California Edison Co., 4.650%, 4/1/2015 | | | 15,000 | | | | 16,410 | |

| Wisconsin Electric Power Co., 6.250%, 12/1/2015 | | | 15,000 | | | | 17,517 | |

| | | | | | | | 46,072 | |

| TOTAL CORPORATE BONDS (Cost $364,450) | | | | | | | 364,915 | |

| | | | | | | | | |

| MORTGAGE BACKED SECURITIES - 5.38% | | | | | | | | |

| Banc of America Merrill Lynch Commercial Mortgage, Inc., | | | | | | | | |

| 5.727%, 5/10/2045 | | | 20,000 | | | | 22,801 | |

| Bear Stearns Commercial Mortgage Securities, 5.537%, 10/12/2041 | | | 25,000 | | | | 28,567 | |

| Credit Suisse Mortgage Capital Certificates, 5.416%, 2/15/2039 | | | 10,000 | | | | 11,176 | |

| Fannie Mae Pool | | | | | | | | |

| 1.490%, 6/1/2017 | | | 25,000 | | | | 25,245 | |

| 3.000%, 4/1/2027 | | | 19,791 | | | | 20,770 | |

| 3.000%, 4/1/2027 | | | 9,899 | | | | 10,389 | |

| FHLMC Multifamily Structured Pass Through Certificates | | | | | | | | |

| 2.130%, 1/25/2019 | | | 30,000 | | | | 30,598 | |

| 2.086%, 3/25/2019 | | | 25,000 | | | | 25,533 | |

| Freddie Mac Gold Pool | | | | | | | | |

| 3.000%, 4/1/2027 | | | 4,953 | | | | 5,190 | |

| 3.000%, 4/1/2027 | | | 19,736 | | | | 20,760 | |

| 3.000%, 4/1/2027 | | | 14,852 | | | | 15,632 | |

| 3.000%, 5/1/2027 | | | 24,894 | | | | 26,255 | |

| LB-UBS Commercial Mortgage Trust, 5.372%, 9/15/2039 | | | 15,000 | | | | 17,039 | |

| Morgan Stanley Capital I, Inc., 5.162%, 10/12/2052 | | | 25,000 | | | | 27,860 | |

| Temporary Deal Collateral Strip Interest Series KL-UF89 , 4.530%, 8/1/2062 | | | 25,000 | | | | 27,825 | |

| TOTAL MORTGAGE BACKED SECURITIES (Cost $314,160) | | | | | | | 315,640 | |

| | | | | | | | | |

| MUNICIPAL BONDS - 3.34% | | | | | | | | |

| City of Columbus, OH., 4.090%, 7/1/2017 | | | 25,000 | | | | 27,974 | |

| City of El Paso, TX., 3.610%, 8/15/2014 | | | 50,000 | | | | 52,968 | |