(Ticker Symbol: MUHLX)

ANNUAL REPORT

December 31, 2020

Phone: 1-800-860-3863

E-mail: fund@muhlenkamp.com

Website: muhlx.muhlenkamp.com

This Page Intentionally Left Blank.

January 2021

Fellow Investors,

In September 2020 we wrote that we thought COVID-19 was in the process of burning itself out in Europe and the United States. We couldn’t have been more wrong. As you already know the virus came roaring back on both continents prompting renewed restrictions by governments. The distribution of the first vaccines began in mid-December but hasn’t made a difference yet. As we look at charts of case counts and deaths today, it appears the numbers are starting to decline, but you’ll forgive us if we refrain from making any predictions about what we expect will happen in the next few months having failed so miserably three months ago.

As we reflect on 2020 it is quite clear that three things really mattered for the economy and the financial markets. The first was the spread of the COVID-19 virus. The second was government actions to slow the spread of the virus, mostly restrictions and lockdowns. The third was government actions to mitigate the economic damage done by the restrictions and lockdowns: relief spending by legislatures and various forms of bond buying by the central banks. We don’t know if the restrictions and lockdowns altered the course of the virus to any great degree, we do know that very few medical systems were overwhelmed by COVID-19 cases, which is probably the critical point. To date, government payments to businesses and individuals plus central bank purchases of various bonds have prevented economic catastrophe. The bond markets, which had a tense few weeks in March-April, are now functioning normally and interest rates have come back down for even the least creditworthy borrowers. The stock market is setting new highs. Home prices are rising. Businesses are failing, but not so many as to impair the banking system.

So far so good. This remains a work in progress. We’ve read some reports recently that indicate actual occupancy in New York office buildings is only 15% of what it was in 2019. How long does that remain the case? At what point do tenants start renegotiating leases with landlords? How many landlords get caught between the fixed cost of their mortgage and the need to cut rents to keep their buildings mostly rented? How far will real estate values in cities like New York fall? How bad will the damage be to the lenders who hold the mortgages? What’s the impact on all the small businesses that supported those urban workers (restaurants, for example)? No one knows yet. Our research to date indicates that commercial and residential rents have fallen on the order of 20% in New York City, San Francisco, etc. We don’t know how far rents and by extension real estate values will decline because we don’t know how many of the workers will come back to the office and when that will happen. The range of possible outcomes is very wide.

That’s the picture in commercial real estate, there is similar uncertainty in retail. Online shopping exploded during March and April out of necessity – many local stores were closed and many shoppers were unwilling to venture out. Restaurants

have been devastated by restrictions on their business and the lack of customers. To what extent are those changes permanent? Many brick and mortar stores were struggling prior to the pandemic and the industry was already grappling with excess store capacity, the government restrictions significantly exacerbated the problems. The restaurant industry was fine pre-pandemic but has been devastated since March. Again, the range of possible outcomes is very wide.

It’s been said that recessions serve to correct the excesses of the preceding boom. As we look at the economy, it’s seems to us we are now dealing with excess capacity in oil and gas production, retail real estate, and probably commercial real estate. Because real estate is often collateral for loans, problems in commercial and retail real estate could create problems for the banks and other institutions that lent money against the value of the properties. We’ve written before that we are wary of the banks for these reasons, and we will remain wary until the scope of the problem becomes clearer.

We continue to watch for inflation. Unlike 2008-2009 the money created by the Federal Reserve has not just been distributed by the banking system but has also been directly distributed by the Federal Government. Yes, we’ve seen “helicopter money” this time around and Congress and the President have been flying the choppers. The new money hasn’t been bottled up in the banks like it was during the 2008-2009 recession – sitting in their vaults and not being loaned out. This time we have sent it to citizens and businesses, and it’s been spent or saved. Will that difference create inflation this time? We don’t know. If we see a significant uptick in inflation it will, of course, hurt bond holders and put the Federal Reserve on the horns of a dilemma. The current low interest rates do not compensate investors for the risk of inflation, and we remain uninterested in bonds as a way to grow wealth. No change there.

During the summer we reduced our holdings in Apple and Microsoft, which had become quite large, as the price of those stocks exceeded our value estimates and momentum seemed to come out of them as well. We found a number of companies in the industrial and energy sectors that were selling at prices we liked and took the opportunity to invest there. We’ve been pleased with those purchases so far.

We continue to hold roughly 5% of our assets in gold or gold-related companies. One of the ways historically used by governments to deal with heavy debt loads has been to devalue their currency and we are concerned that our government will seek such a solution (officials will, of course, not say that out loud). We view the profligate spending by our government and the massive expansion of the Federal Reserve’s balance sheet as consistent with actions that would result in a devaluation of the dollar. We view our gold holdings as a hedge against that possibility.

That’s what we’re seeing, and that’s what we’re doing. Please forgive us if we’ve written a little more about the risks we see than the opportunities we are seizing. Frankly, it seems as if “the market” has forgotten the risks, which makes it more

important for us to remember them. (Conversely, in March it seemed the market could see only risks and it was more important for us to focus on the opportunities.) In general the companies we hold are doing very well and selling for fair, or less than fair prices. We continue to focus on individual companies even as we are mindful of the environment in which they operate.

As always, if you’ve got questions, give us a call. We’d love to hear from you.

With our best wishes for your continued success and good health.

Sincerely,

|  |

| | |

| Ron Muhlenkamp, Founder | Jeff Muhlenkamp, Portfolio Manager |

| Muhlenkamp & Company, Inc. | Muhlenkamp & Company, Inc. |

The comments made in this letter are opinions and are not intended to be investment advice or a forecast of future events.

| Management Discussion of Fund Performance for 2020 | |

| (Unaudited) | January 19, 2021 |

For the year ending December 31, 2020 the Muhlenkamp Fund returned 11.86% before taxes, underperforming the S&P 500 which had a total return of 18.40% over the same period.

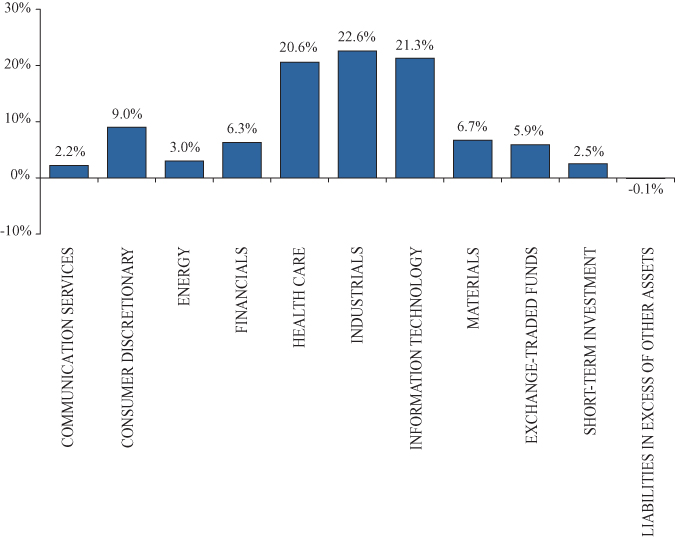

On average during the year the Fund was overweight Healthcare, Industrials, Energy, and Materials and underweight Information Technology, Consumer Discretionary, Financials, Communication Services, Consumer Staples, Utilities, and Real Estate relative to the sector weighting of our benchmark, the S&P 500 Index. On average during the year the Fund held 9% cash.

Of the total underperformance of 6.54%, 3.91% can be attributed to sector allocation and 1.71% can be attributed to stock selection. The remaining .92% is due to management fees and other operating expenses of the Fund. The difference between the performance of the Fund and the S&P 500 is mostly attributable to our underweight in Information Technology, Consumer Discretionary, and Communication Services and our stock selection in the Consumer Discretionary Sector. In broad terms, what drove the S&P 500 this year were companies that benefitted from the restrictions on movement introduced by government to slow the spread of COVID-19 and we didn’t own enough of them.

The top three contributors to the Fund’s performance this year were Apple (AAPL), which added 3.82% to performance, Microsoft (MSFT), which added 2.76%, and Rush Enterprises (RUSHA), which added 1.98%. The three positions which detracted the most from Fund performance were Delta Airlines (DAL), which reduced the Fund’s return by 2.68%, Acuity Brands (AYI), which reduced the Fund’s return by 1.38%, and Annaly Capital Management (NLY), which reduced the Fund’s returns by 1.36%. The use of options by the Fund this year reduced returns by .53%. The Fund’s investment in gold returned 24.81% for the year which increased the Fund’s total return by 1.53%. At year end the Fund held two positions in foreign companies: Baidu (BIDU, China) and Cameco (CCJ, Canada). Those positions returned 49% and 51%, respectively and added .79% and .68% to the Fund’s return, respectively.

Economically, 2020 was completely dominated by government actions (lockdowns) designed to slow the spread of COVID-19. The U.S. entered a recession in February 2020 and remains in a recession at the end of the year. The stock market as measured by the S&P 500 declined approximately 34% between February 15, 2020 and March 23, 2020, recovered all the losses by mid-August, and ended the year at an all-time high. The market recovery was largely driven by fiscal and monetary efforts to mitigate the economic damage caused by the government lockdowns. Companies that were able to thrive during lockdown conditions were market leaders during the first half of the year, losing some of their momentum over the summer as investors began to anticipate the resumption of normal economic activity and companies more

sensitive to economic activity began to perform better. U.S. inflation as measured by the Consumer Price Index (CPI) remained below 2% throughout the year. The dollar declined 7% during the year against a basket of foreign currencies as measured by the DXY Index. U.S. benchmark interest rates remained at historically low levels throughout the year. The U.S. housing market was robust during the year except for March and April when lockdowns were most restrictive.

Management’s primary strategy of purchasing undervalued securities resulted in underperformance relative to the S&P 500 during 2020, a period when rapidly growing and disruptive companies drove the broader indices. Management’s strategy of hedging its U.S. holdings against declines in the dollar via gold and now international investments did beat the benchmark this year as detailed above.

While we’ve discussed our sector weightings relative to the S&P 500, we remind you that we do not make buy and sell decisions that way. We buy companies when we think we are getting good value for the price and sell them when we believe that’s no longer true – either because the price appreciated to reflect the value we saw or because our expectations of the business are not being met and the value isn’t there. We are certainly aware of our sector weightings but don’t manage to them. What we do pay attention to is our exposure to underlying risks and we carefully manage our exposure to those. We find that sector diversification is not a good proxy for risk diversification, and we are far more interested in the latter than the former.

S&P 500® Index – The S&P 500® Index is a widely recognized, unmanaged index of common stock prices. The S&P 500® Index is weighted by market value and its performance is thought to be representative of the stock market as a whole. One cannot invest directly in an index.

CPI – The Consumer Price Index (“CPI”) measures the average change in prices over time that consumers pay for a basket of goods and services, commonly known as inflation. One cannot invest directly in an index.

DXY – The U.S. Dollar Currency Index (“DXY”) measures the value of the United States dollar relative to a basket of U.S. trade partner currencies. The Index goes up as the U.S. dollar gains “strength” or “value” when compared to other currencies. One cannot invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in small-cap and mid-cap companies which involve additional risks such as limited liquidity and greater volatility. The Fund may also invest in foreign securities which involve political, economic, and currency risks, greater volatility and differences in accounting methods. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities.

Past performance is no guarantee of future results. Diversification does not assure a profit or protect against a loss in a declining market.

Fund holdings are subject to change and are not recommendations to buy or sell any security. Please see page 17 for a complete list of Fund holdings.

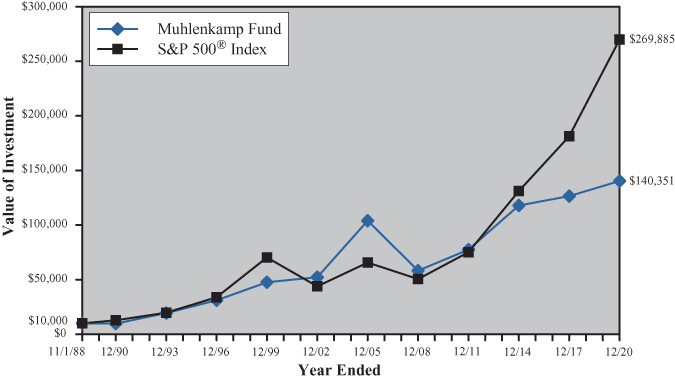

A Hypothetical $10,000 Investment in the Muhlenkamp Fund for the Past 10 Years*

A Hypothetical $10,000 Investment in the Muhlenkamp Fund Since Inception*

The S&P 500® Index is a widely recognized index of common stock prices. The S&P 500® Index is weighted by market value and its performance is thought to be representative of the stock market as a whole. One cannot invest directly in an index. These charts assume an initial gross investment of $10,000 made on 12/31/10 or 11/1/88, respectively. The line graphs do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Returns shown include the reinvestment of all dividends. Past performance does not guarantee future results.

____________

Average Annual Total Returns (Unaudited)

as of December 31, 2020

| | One | Three | Five | Ten | Since |

Muhlenkamp Fund | Year | Year | Year | Year | Inception* |

| Return Before Taxes | 11.86% | 3.53% | 4.88% | 5.61% | 8.56% |

S&P 500® Index** | 18.40% | 14.18% | 15.22% | 13.88% | 10.79% |

| Consumer Price Index*** | 1.36% | 1.85% | 1.95% | 1.74% | 2.43% |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted and can be obtained by calling 1-800-860-3863.

| * | Operations commenced on November 1, 1988. |

| ** | The S&P 500® Index is a widely recognized, unmanaged index of common stock prices. The figures for the S&P 500® Index reflect all dividends reinvested but do not reflect any deductions for fees, expenses, or taxes. One cannot invest directly in an index. |

| *** | Consumer Price Index – U.S. CPI Consumer NSA (Non-Seasonally Adjusted) Index. One cannot invest directly in an index. |

Annual Returns Since Inception(1)

(Unaudited)

| | | | |

| One-Year Period |

|

|

|

Ended 12/31 | Muhlenkamp Fund | S&P 500® Index | Consumer Price Index |

| 1989 | 12.45% | 31.69% | 4.65% |

| 1990 | -14.90% | -3.10% | 6.11% |

| 1991 | 45.39% | 30.47% | 3.06% |

| 1992 | 15.80% | 7.62% | 2.90% |

| 1993 | 18.12% | 10.08% | 2.75% |

| 1994 | -7.19% | 1.32% | 2.67% |

| 1995 | 32.96% | 37.58% | 2.54% |

| 1996 | 29.98% | 22.96% | 3.32% |

| 1997 | 33.30% | 33.36% | 1.70% |

| 1998 | 3.22% | 28.58% | 1.61% |

| 1999 | 11.40% | 21.04% | 2.68% |

| 2000 | 25.30% | -9.10% | 3.39% |

| 2001 | 9.35% | -11.89% | 1.55% |

| 2002 | -19.92% | -22.10% | 2.38% |

| 2003 | 48.08% | 28.68% | 1.88% |

| 2004 | 24.51% | 10.88% | 3.26% |

| 2005 | 7.88% | 4.91% | 3.42% |

| 2006 | 4.08% | 15.79% | 2.54% |

| 2007 | -9.66% | 5.49% | 4.08% |

| 2008 | -40.39% | -37.00% | 0.09% |

| 2009 | 31.49% | 26.46% | 2.72% |

| 2010 | 6.14% | 15.06% | 1.50% |

| 2011 | -4.74% | 2.11% | 2.96% |

| 2012 | 12.52% | 16.00% | 1.74% |

| 2013 | 34.43% | 32.39% | 1.50% |

| 2014 | 0.64% | 13.69% | 0.76% |

| 2015 | -6.21% | 1.38% | 0.73% |

| 2016 | -3.70% | 11.96% | 2.07% |

| 2017 | 18.77% | 21.83% | 2.11% |

| 2018 | -13.29% | -4.38% | 1.91% |

| 2019 | 14.39% | 31.49% | 2.29% |

| 2020 | 11.86% | 18.40% | 1.36% |

| | | | |

(1) | Operations commenced on November 1, 1988. |

EXPENSE EXAMPLE

December 31, 2020 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commission on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2020 – December 31, 2020).

Actual Expenses

The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs may have been higher.

EXPENSE EXAMPLE (Continued)

December 31, 2020 (Unaudited)

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 7/1/2020 | 12/31/2020 | 7/1/2020 – 12/31/2020(1) |

Actual(2) | $1,000.00 | $1,247.80 | $6.22 |

Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,019.61 | $5.58 |

(1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six month period of 1.10%, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

(2) | Based on the actual return for the six month period ended December 31, 2020 of 24.78%. |

ALLOCATION OF PORTFOLIO ASSETS

(Calculated as a percentage of net assets)

December 31, 2020 (Unaudited)

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

STATEMENT OF ASSETS & LIABILITIES

December 31, 2020

| ASSETS | |

| Investments, at value (Cost: $129,330,313) | | $ | 180,712,693 | |

| Dividends and interest receivable | | | 70,096 | |

| Receivable for capital shares sold | | | 1,506 | |

| Prepaid expenses | | | 11,745 | |

| Total assets | | | 180,796,040 | |

| | | | | |

| LIABILITIES | |

| Payable to investment adviser | | | 136,329 | |

| Payable for capital shares redeemed | | | 52,731 | |

| Payable for fund administration & accounting fees | | | 41,806 | |

| Payable for transfer agent fees & expenses | | | 38,021 | |

| Payable for compliance fees | | | 3,755 | |

| Payable for trustee fees | | | 3,494 | |

| Payable for custody fees | | | 1,902 | |

| Accrued expenses | | | 41,761 | |

| Total liabilities | | | 319,799 | |

| Net assets | | $ | 180,476,241 | |

| | | | | |

| NET ASSETS | |

| Paid-in capital | | $ | 129,360,076 | |

| Total distributable earnings | | | 51,116,165 | |

| Net assets | | $ | 180,476,241 | |

Shares issued and outstanding(1) | | | 3,776,730 | |

| Net asset value, redemption price and offering per share | | $ | 47.79 | |

(1) | Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2020

| INVESTMENT INCOME: | | | | | | |

| Dividend income | | | | | $ | 2,149,603 | |

| Less: Foreign taxes withheld | | | | | | (2,398 | ) |

| Interest income | | | | | | 35,843 | |

| Total investment income | | | | | | 2,183,048 | |

| EXPENSES: | | | | | | | |

| Investment advisory fees (See Note 3) | | $ | 1,624,540 | | | | | |

| Transfer agent fees & expenses (See Note 3) | | | 182,009 | | | | | |

| Fund administration & | | | | | | | | |

| accounting fees (See Note 3) | | | 157,310 | | | | | |

| Federal & state registration fees | | | 23,340 | | | | | |

| Postage & printing fees | | | 23,124 | | | | | |

| Audit fees | | | 20,509 | | | | | |

| Legal fees | | | 18,555 | | | | | |

| Compliance fees (See Note 3) | | | 15,006 | | | | | |

| Trustee fees | | | 12,994 | | | | | |

| Custody fees (See Note 3) | | | 11,065 | | | | | |

| Other expenses | | | 7,489 | | | | | |

| Insurance fees | | | 2,196 | | | | | |

| Total expenses before waiver | | | 2,098,137 | | | | | |

| Less: Waiver from investment adviser (See Note 3) | | | (304,035 | ) | | | | |

| Less: Expense reductions (See Note 8) | | | (7,108 | ) | | | | |

| Net expenses | | | | | | | 1,786,994 | |

| NET INVESTMENT INCOME | | | | | | | 396,054 | |

| REALIZED AND UNREALIZED | | | | | | | | |

| GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments sold | | | 17,464,485 | | | | | |

| Written options contracts expired or closed | | | (154,872 | ) | | | | |

| Total net realized gain | | | | | | | 17,309,613 | |

| Total net change in unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | | | | | 204,760 | |

| Net realized and unrealized gain on investments | | | | | | | 17,514,373 | |

| NET INCREASE IN NET ASSETS | | | | | | | | |

| RESULTING FROM OPERATIONS | | | | | | $ | 17,910,427 | |

The accompanying notes are an integral part of these financial statements.

MUHLENKAMP FUND

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2020 | | | December 31, 2019 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 396,054 | | | $ | 708,573 | |

| Net realized gains on investments | | | | | | | | |

| sold and written option contracts | | | | | | | | |

| expired or closed | | | 17,309,613 | | | | 1,250,550 | |

| Net change in unrealized | | | | | | | | |

| appreciation/depreciation on investments | | | 204,760 | | | | 23,456,453 | |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 17,910,427 | | | | 25,415,576 | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 2,233,575 | | | | 4,434,238 | |

| Proceeds from reinvestments of distributions | | | 15,638,346 | | | | 2,152,911 | |

| Payment for shares redeemed | | | (23,741,061 | ) | | | (31,836,877 | ) |

| Net decrease in net assets resulting | | | | | | | | |

| from capital share transactions | | | (5,869,140 | ) | | | (25,249,728 | ) |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | (17,013,067 | ) | | | (2,317,279 | ) |

| TOTAL DECREASE IN NET ASSETS | | | (4,971,780 | ) | | | (2,151,431 | ) |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 185,448,021 | | | | 187,599,452 | |

| End of year | | $ | 180,476,241 | | | $ | 185,448,021 | |

The accompanying notes are an integral part of these financial statements.

FINANCIAL HIGHLIGHTS

For a Fund share outstanding throughout the years

| | | Year Ended December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| NET ASSET VALUE, | | | | | | | | | | | | | | | |

| BEGINNING OF YEAR | | $ | 47.12 | | | $ | 41.71 | | | $ | 55.21 | | | $ | 48.47 | | | $ | 50.33 | |

| INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.11 | | | | 0.18 | | | | 0.12 | | | | 0.20 | | | | (0.08 | ) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | |

| gains (losses) on investments | | | 5.47 | | | | 5.82 | | | | (7.49 | ) | | | 8.92 | | | | (1.78 | ) |

| Total from investment operations | | | 5.58 | | | | 6.00 | | | | (7.37 | ) | | | 9.12 | | | | (1.86 | ) |

| LESS DISTRIBUTIONS FROM: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.13 | ) | | | (0.19 | ) | | | (0.16 | ) | | | (0.19 | ) | | | — | |

| Realized gains | | | (4.78 | ) | | | (0.40 | ) | | | (5.97 | ) | | | (2.19 | ) | | | — | |

| Total distributions | | | (4.91 | ) | | | (0.59 | ) | | | (6.13 | ) | | | (2.38 | ) | | | — | |

| NET ASSET VALUE, END OF YEAR | | $ | 47.79 | | | $ | 47.12 | | | $ | 41.71 | | | $ | 55.21 | | | $ | 48.47 | |

| TOTAL RETURN | | | 11.86 | % | | | 14.39 | % | | | -13.29 | % | | | 18.77 | % | | | -3.70 | % |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS, END OF YEAR | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | $ | 180 | | | $ | 185 | | | $ | 188 | | | $ | 259 | | | $ | 254 | |

RATIO OF EXPENSES TO | | | | | | | | | | | | | | | | | | | | |

AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Excluding expense waiver/reductions | | | 1.29 | % | | | 1.28 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Including expense waiver/reductions(1) | | | 1.10 | % | | | 1.12 | %(2) | | | 1.20 | % | | | 1.21 | % | | | 1.25 | % |

| RATIO OF NET INVESTMENT | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) TO | | | | | | | | | | | | | | | | | | | | |

| AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Including expense waiver/reductions | | | 0.24 | % | | | 0.38 | % | | | 0.20 | % | | | 0.37 | % | | | (0.15 | )% |

| PORTFOLIO TURNOVER RATE | | | 24.64 | % | | | 40.19 | % | | | 9.55 | % | | | 19.32 | % | | | 39.75 | % |

(1) | The ratio includes expense reductions for minimum account maintenance fees deposited into the Fund. (See Note 8). |

(2) | Prior to February 28, 2019, the annual expense limitation was 1.20% of the average daily net assets. Thereafter it was 1.10%. |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS

December 31, 2020

| | | | | | | |

| Name of Issuer or Title of Issue | | Shares | | | Value | |

| COMMON STOCKS — 91.7% | | | | | | |

| | | | | | | |

| Aerospace & Defense — 2.8% | | | | | | |

| Lockheed Martin Corporation | | | 14,000 | | | $ | 4,969,720 | |

| | | | | | | | | |

| Auto Components — 2.4% | | | | | | | | |

| Tenneco, Inc. — Class A (a) | | | 401,400 | | | | 4,254,840 | |

| | | | | | | | | |

| Biotechnology — 2.4% | | | | | | | | |

| Biogen, Inc. (a) | | | 12,500 | | | | 3,060,750 | |

| Gilead Sciences, Inc. | | | 20,800 | | | | 1,211,808 | |

| | | | | | | | 4,272,558 | |

| | | | | | | | | |

| Chemicals — 5.0% | | | | | | | | |

| Dow, Inc. | | | 162,596 | | | | 9,024,078 | |

| | | | | | | | | |

| Diversified Financial Services — 3.4% | | | | | | | | |

| Berkshire Hathaway, Inc. — Class B (a) | | | 26,795 | | | | 6,212,957 | |

| | | | | | | | | |

| Energy Equipment & Services — 1.5% | | | | | | | | |

| Schlumberger Ltd. (b) | | | 125,500 | | | | 2,739,665 | |

| | | | | | | | | |

| Health Care Providers & Services — 11.7% | | | | | | | | |

| CVS Health Corporation | | | 76,500 | | | | 5,224,950 | |

| McKesson Corporation | | | 56,500 | | | | 9,826,480 | |

| UnitedHealth Group, Inc. | | | 17,357 | | | | 6,086,753 | |

| | | | | | | | 21,138,183 | |

| | | | | | | | | |

| Household Durables — 6.6% | | | | | | | | |

| Lennar Corporation — Class A | | | 60,100 | | | | 4,581,423 | |

| Meritage Homes Corporation (a) | | | 89,000 | | | | 7,370,980 | |

| | | | | | | | 11,952,403 | |

| | | | | | | | | |

| Interactive Media & Services — 2.3% | | | | | | | | |

| Baidu, Inc. — ADR (a)(b) | | | 18,900 | | | | 4,086,936 | |

| | | | | | | | | |

| IT Services — 3.6% | | | | | | | | |

| Alliance Data Systems Corporation | | | 88,395 | | | | 6,550,069 | |

| | | | | | | | | |

| Machinery — 1.6% | | | | | | | | |

| Wabtec Corporation | | | 39,799 | | | | 2,913,287 | |

| | | | | | | | | |

| Marine — 3.3% | | | | | | | | |

| Kirby Corp. (a) | | | 115,600 | | | | 5,991,548 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2020

| | | | | | | |

| Name of Issuer or Title of Issue | | Shares | | | Value | |

| COMMON STOCKS — 91.7% (Continued) | | | | | | |

| | | | | | | |

| Metals & Mining — 1.7% | | | | | | |

| Franco-Nevada Corp. (b) | | | 12,200 | | | $ | 1,529,026 | |

| Royal Gold, Inc. | | | 14,000 | | | | 1,489,040 | |

| | | | | | | | 3,018,066 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels — 1.5% | | | | | | | | |

| Cameco Corporation (b) | | | 208,000 | | | | 2,787,200 | |

| | | | | | | | | |

| Pharmaceuticals — 6.5% | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 90,700 | | | | 5,626,121 | |

| Jazz Pharmaceuticals PLC (a)(b) | | | 36,542 | | | | 6,031,257 | |

| | | | | | | | 11,657,378 | |

| | | | | | | | | |

| Semiconductors & | | | | | | | | |

| Semiconductor Equipment — 9.6% | | | | | | | | |

| Broadcom, Inc. | | | 17,500 | | | | 7,662,375 | |

| Microchip Technology, Inc. | | | 69,800 | | | | 9,640,078 | |

| | | | | | | | 17,302,453 | |

| | | | | | | | | |

| Software — 3.9% | | | | | | | | |

| Microsoft Corporation | | | 31,775 | | | | 7,067,396 | |

| | | | | | | | | |

| Technology Hardware & Equipment — 4.5% | | | | | | | | |

| MasTec, Inc. (a) | | | 118,100 | | | | 8,052,058 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals — 4.1% | | | | | | | | |

| Apple, Inc. | | | 56,410 | | | | 7,485,043 | |

| | | | | | | | | |

| Thrifts & Mortgage Finance — 2.9% | | | | | | | | |

| NMI Holdings, Inc. (a) | | | 230,940 | | | | 5,230,791 | |

| | | | | | | | | |

| Trading Companies & Distributors — 10.4% | | | | | | | | |

| Rush Enterprises, Inc. — Class A | | | 281,532 | | | | 11,661,055 | |

| WESCO International, Inc. (a) | | | 91,572 | | | | 7,188,402 | |

| | | | | | | | 18,849,457 | |

| Total Common Stocks | | | | | | | | |

| (Cost $114,734,417) | | | | | | | 165,556,086 | |

The accompanying notes are an integral part of these financial statements.

SCHEDULE OF INVESTMENTS (Continued)

December 31, 2020

| | | | | | | |

| Name of Issuer or Title of Issue | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS — 5.9% | | | | | | |

| Alerian MLP | | | 185,275 | | | $ | 4,754,157 | |

| SPDR Gold Shares (a) | | | 33,075 | | | | 5,899,257 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $10,014,948) | | | | | | | 10,653,414 | |

| | | | | | | | | |

| RIGHTS — 0.0% | | | | | | | | |

| Pharmaceuticals — 0.0% | | | | | | | | |

| Bristol-Myers Squibb Co. (a) | | | | | | | | |

| Total Rights | | | | | | | | |

| (Cost $115,020) | | | 54,000 | | | | 37,265 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT — 2.5% | | | | | | | | |

| First American Government Obligations Fund — | | | | | | | | |

| Class X, 0.04% (c) | | | | | | | | |

| Total Short-Term Investment | | | | | | | | |

| (Cost $4,465,928) | | | 4,465,928 | | | | 4,465,928 | |

| TOTAL INVESTMENTS | | | | | | | | |

| (Cost $129,330,313) — 100.1% | | | | | | | 180,712,693 | |

| Liabilities in Excess of Other Assets — (0.1)% | | | | | | | (236,452 | ) |

| TOTAL NET ASSETS — 100.0% | | | | | | $ | 180,476,241 | |

ADR — American Depositary Receipt

PLC — Public Limited Company

| (a) | Non-income producing security. |

| (b) | Foreign company. |

| (c) | The rate shown is the annualized seven day effective yield as of December 31, 2020. |

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use.

The accompanying notes are an integral part of these financial statements.

NOTES TO FINANCIAL STATEMENTS

Year Ended December 31, 2020

Managed Portfolio Series (the “Trust”) was organized as a Delaware statutory trust on January 27, 2011. The Trust is registered under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company. The Muhlenkamp Fund (the “Fund”) is a diversified series with its own investment objectives and policies within the Trust. The Fund commenced operations on November 1, 1988.

The Fund operates as a diversified open-end mutual fund that continuously offers its shares for sale to the public. The Fund manages its assets to seek a maximum total after-tax return to its shareholders through capital appreciation, and income from dividends and interest, consistent with reasonable risk. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The Fund principally invests in a diversified list of common stocks of any capitalization, determined by Muhlenkamp & Company, Inc. (the “Adviser”) to be highly profitable, yet undervalued. The Fund may acquire and hold fixed-income or debt investments as market conditions warrant and when, in the opinion of the Adviser, it is deemed desirable or necessary in order to attempt to achieve its investment objective.

The primary focus of the Fund is long-term, and the investment options are diverse. This allows for greater flexibility in the daily management of Fund assets. However, with flexibility also comes the risk that assets will be invested in various classes of securities at the wrong time and price.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund in preparation of the accompanying financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

| a. | Investment Valuations — Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis. The Fund’s investments are carried at fair value. |

| | |

| | Equity Securities — Equity securities, including common stocks, preferred stocks, exchange-traded funds (“ETFs”) and real estate investment trusts (“REITs”), that are primarily traded on a national securities exchange are valued at the last sale price on the exchange on which they are primarily traded on the day of valuation or, if there has been no sale on such day, at the mean between the bid and ask prices. Securities traded primarily in the Nasdaq Global Market |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| | System for which market quotations are readily available are valued using the Nasdaq Official Closing Price (“NOCP”). If the NOCP is not available, such securities are valued at the last sale price on the day of valuation, or if there has been no sale on such day, at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. If the market for a particular security is not active, and the mean between bid and ask prices is used, these securities are categorized in Level 2 of the fair value hierarchy. |

| | |

| | Corporate Bonds — Corporate bonds, including listed issues, are valued at fair value on the basis of valuations furnished by an independent pricing service which utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Most corporate and municipal bonds are categorized in Level 2 of the fair value hierarchy. |

| | |

| | U.S. Government & Agency Securities — U.S. government & agency securities are normally valued using a model that incorporates market observable data such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued principally using dealer quotations. U.S. government and agency securities are categorized in Level 2 of the fair value hierarchy depending on the inputs used and market activity levels for specific securities. |

| | |

| | Short-Term Investments — Short-term investments in other mutual funds, including money market funds, are valued at their net asset value per share. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized in Level 1 of the fair value hierarchy. |

| | |

| | Derivative Instruments — Listed derivatives, including rights and warrants that are actively traded are valued based on quoted prices from the exchange and categorized in Level 1 of the fair value hierarchy. Exchange traded options that are valued at the mean of the highest bid price and lowest ask price across the exchanges where the option is traded are categorized in Level 2 of the fair value hierarchy. |

| | |

| | Securities for which market quotations are not readily available, or if the closing price does not represent fair value, are valued following procedures approved by the Board of Trustees (the “Board”). These procedures consider many factors, including the type of security, size of holding, trading volume and news events. There can be no assurance that the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| | Fund determines their net asset values per share. The Board has established a Valuation Committee to administer, implement, and oversee the fair valuation process, and to make fair value decisions when necessary. The Board regularly reviews reports that describe any fair value determinations and methods. |

| | |

| | The Fund has adopted authoritative fair value accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion of changes in valuation techniques and related inputs during the period and expanded disclosure of valuation Levels for major security types. These inputs are summarized in the three broad Levels listed below: |

| | Level 1 — | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | | |

| | Level 2 — | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | |

| | Level 3 — | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

| | The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s assets and liabilities as of December 31, 2020: |

| | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | Assets: | | | | | | | | | | | | |

| | Common Stocks | | $ | 165,556,086 | | | $ | — | | | $ | — | | | $ | 165,556,086 | |

| | Exchange-Traded Funds | | | 10,653,414 | | | | — | | | | — | | | | 10,653,414 | |

| | Rights | | | 37,265 | | | | — | | | | — | | | | 37,265 | |

| | Short-Term Investment | | | 4,465,928 | | | | — | | | | — | | | | 4,465,928 | |

| | Total Investments | | | | | | | | | | | | | | | | |

| | in Securities | | $ | 180,712,693 | | | $ | — | | | $ | — | | | $ | 180,712,693 | |

| | Refer to the Schedule of Investments for further information on the classification of investments. |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| b. | Foreign Securities — Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and the U.S. government. These risks may include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies and the U.S. government. |

| | |

| c. | Investment Transactions and Related Investment Income — Investment transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on an accrual basis. The Fund uses the specific identification method in computing gain or loss on the sale of investment securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Distributions received from the Fund’s investments in Master Limited Partnerships (“MLPs”) may be categorized as ordinary income, net capital gain, or a return of capital. The proper classification of MLP distributions is generally not known until after the end of each calendar year. The Fund must use estimates in reporting the character of their income and distributions for financial statement purposes. Due to the nature of the MLP investments, a portion of the distributions received by the Fund’s shareholders may represent a return of capital. |

| | |

| d. | Federal Taxes — The Fund complies with the requirements of subchapter M of the Internal Revenue Code of 1986, as amended, necessary to qualify as a regulated investment company and distribute substantially all net taxable investment income and net realized gains to shareholders in a manner which results in no cost to the Fund. Therefore, no federal income or excise tax provision is required. As of and during the year ended December 31, 2020, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the year ended December 31, 2020, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statement of Operations. As of and during the year ended December 31, 2020 the Fund did not incur any interest and penalties. The Fund is not subject to examination by U.S. tax authorities for tax years prior to the fiscal year ended December 31, 2017. |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| e. | Dividends and Distributions to Shareholders — Dividends from net investment income, if any, are declared and paid at least annually. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income dividends and capital gain distributions, if any, are recorded on the ex-dividend date. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividends paid deduction. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. See Note 7 for additional disclosures. |

| | |

| f. | Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates. |

| | |

| g. | Allocation of Expenses — Expenses associated with a specific fund in the Trust are charged to that Fund. Common Trust expenses are typically allocated evenly between the funds of the Trust or by other equitable means. |

| | |

| h. | Options Transactions — The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund may use purchased option contracts and written option contracts to hedge against the changes in the value of equities or to meet its investment objectives. The Fund may write put and call options only if it (i) owns an offsetting position in the underlying security or (ii) maintains cash or other liquid assets in an amount equal to or greater than its obligation under the option. |

| | |

| | When the Fund writes a call or put option, an amount equal to the premium received is included in the Statement of Assets & Liabilities as a liability. The amount of the liability is subsequently adjusted to reflect the current fair value of the option. If an option expires on its stipulated expiration date or if the Fund enters into a closing purchase transaction, a gain or loss is realized. If a written call option is exercised, a gain or loss is realized for the sale of the underlying security and the proceeds from the sale are increased by the premium originally received. If a written put option is exercised, the cost of the security acquired is decreased by the premium originally received. As the writer of an option, the Fund has no control over whether the underlying securities are subsequently sold (call) or purchased (put) and, as a result, bears the market risk of an unfavorable change in the price of the security underlying the written option. |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| | The Fund may purchase call and put options. When the Fund purchases a call or put option, an amount equal to the premium paid is included in the Statement of Assets & Liabilities as an investment and is subsequently adjusted to reflect the fair value of the option. If an option expires on the stipulated expiration date or if the Fund enters into a closing sale transaction, a gain or loss is realized. If the Fund exercises a call option, the cost of the security acquired is increased by the premium paid for the call. If the Fund exercises a put option, a gain or loss is realized from the sale of the underlying security, and the proceeds from such a sale are decreased by the premium originally paid. Written and purchased options are non-income producing securities. Written and purchased options expose the Fund to minimal counterparty risk since they are exchange traded and the exchange’s clearinghouse guarantees the options against default. |

| | |

| | The Fund has adopted authoritative standards regarding disclosure about derivatives and hedging activities and how they affect the Fund’s Statement of Assets and Liabilities and Statement of Operations. For the year ended December 31, 2020, no long options contracts were purchased and 365 written option contracts were opened and $485,554 in premiums were received. The Fund’s average monthly notional value of written option contracts for the year ended December 31, 2020 was $552,136. |

| | |

| | Statement of Operations |

| | |

| | The effect of derivative instruments on the Statement of Operations for the year ended December 31, 2020: |

| | | | Amount of Net | |

| | | | Realized Loss on: | |

| | | | Written Option | |

| | Derivatives | | Contracts | |

| | Equity contracts | | $ | (154,872 | ) |

| | Total | | $ | (154,872 | ) |

| | | | | | |

| | | | Change in Unrealized | |

| | | | Appreciation/Depreciation on: | |

| | | | Written Option | |

| | Derivatives | | Contracts | |

| | Equity contracts | | $ | — | |

| | Total | | $ | — | |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| 3. | INVESTMENT ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES |

The Trust has an agreement with the Adviser to furnish investment advisory services to the Fund. Pursuant to an Investment Advisory Agreement between the Trust and the Adviser, the Adviser charges a management fee at a 1.00% annual rate of the Fund’s average daily net assets up to $300 million, 0.95% of the Fund’s average daily net assets on the next $200 million, and 0.90% on the balance of the Fund’s average daily net assets.

The Fund’s Adviser has contractually agreed to continue waiving a portion or all of its management fees and/or reimburse the Fund for its expenses to ensure that total annual operating expenses (excluding acquired fund fees and expenses, leverage/borrowing interest, interest expense, taxes, brokerage commissions, and extraordinary expenses) do not exceed 1.10% of the average daily net assets of the Fund (the “Expense Cap”). After February 28, 2022, the Expense Cap is scheduled to increase to 1.20%, unless the Adviser voluntarily elects to extend the current Expense Cap for another year.

Fees waived and expenses reimbursed by the Adviser may be recouped by the Adviser for a period of thirty-six months following the month during which such waiver or reimbursement was made, if such recoupment can be achieved without exceeding the expense limit in effect at the time the waiver or reimbursement occurred. The Operating Expense Limitation Agreement is indefinite but cannot be terminated within one year after the effective date of the Fund’s prospectus. After that date, the agreement may be terminated at any time upon sixty days’ written notice by the Board or the Adviser. Waived fees and reimbursed expenses subject to potential recovery by month of expiration are as follows:

| | Expiration | | Amount | |

| | January-November 2021 | | $ | 94,728 | |

| | January-December 2022 | | $ | 306,599 | |

| | January-December 2023 | | $ | 304,035 | |

U.S. Bancorp Fund Services, LLC (the “Administrator”), doing business as U.S. Bank Global Fund Services, acts as the Fund’s Administrator, Transfer Agent, and Fund Accountant. U.S. Bank N.A. (the “Custodian”) serves as the Custodian to the Fund. The Custodian is an affiliate of the Administrator. The Administrator performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Custodian; coordinates the payment of the Fund’s expenses and reviews the Fund’s expense accruals. The officers of the Trust, including the Chief Compliance Officer, are employees of the Administrator. As compensation for its services, the Administrator

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

is entitled to a monthly fee at an annual rate based upon the average daily net assets of the Fund, subject to annual minimums. Fees paid by the Fund for administration, transfer agency and accounting costs, custody and chief compliance officer services for the year ended December 31, 2020 are disclosed in the Statement of Operations.

Quasar Distributors, LLC (“Quasar”) acts as the Fund’s distributor and principal underwriter in a continuous public offering of the Fund’s shares. Effective March 31, 2020, Foreside Financial Group, LLC (“Foreside”) acquired Quasar from U.S. Bancorp. As a result of the acquisition, Quasar became a wholly-owned broker-dealer subsidiary of Foreside and is no longer affiliated with U.S. Bancorp. The Board has approved a new Distribution Agreement to enable Quasar to continue serving as the Fund’s distributor.

The Fund has established an unsecured Line of Credit (“LOC”) in the amount of $7,000,000, 5% of the Fund’s gross market value or 33.33% of the unencumbered assets of the Fund, whichever is less. The LOC matures unless renewed on July 23, 2021. This LOC is intended to provide short-term financing, if necessary, subject to certain restrictions and covenants in connection with shareholder redemptions and other short-term liquidity needs of the Fund. The LOC is with the Custodian. Interest is charged at the prime rate which was 3.25% as of December 31, 2020. The interest rate during the year was between 3.25-4.75%. The Fund has authorized the Custodian to charge any of the Fund’s accounts for any missed payments. For the year ended December 31, 2020, the Fund did not have any borrowings under the LOC.

| 5. | CAPITAL SHARE TRANSACTIONS |

Transactions in capital shares of the Fund were as follows:

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2020 | | | December 31, 2019 | |

| | Shares outstanding, beginning of year | | | 3,935,386 | | | | 4,497,263 | |

| | Shares sold | | | 50,131 | | | | 99,903 | |

| | Dividends reinvested | | | 327,505 | | | | 45,613 | |

| | Shares redeemed | | | (536,292 | ) | | | (707,393 | ) |

| | Shares outstanding, end of year | | | 3,776,730 | | | | 3,935,386 | |

| 6. | INVESTMENT TRANSACTIONS |

Purchases and sales of investment securities, excluding short-term securities and short-term options, for the year ended December 31, 2020, were as follows:

| | U.S. Government Securities | Other Securities |

| | Purchases | Sales | Purchases | Sales |

| | $— | $— | $36,782,241 | $48,488,295 |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

| 7. | FEDERAL TAX INFORMATION |

The Fund intends to utilize provisions of the federal income tax laws which allow it to carry a realized capital loss forward for an unlimited period. As of December 31, 2020, the Fund did not have a capital loss carryover.

As of December 31, 2020, the components of distributable earnings on a tax basis were as follows:

| | Tax cost of investments | | $ | 129,250,760 | |

| | Gross tax unrealized appreciation | | $ | | |

| | Gross tax unrealized depreciation | | | (6,564,701 | ) |

| | Net tax unrealized appreciation | | | | |

| | on investments and derivatives | | | 51,461,959 | |

| | Undistributed ordinary income | | | — | |

| | Undistributed long term capital gains | | | — | |

| | Distributable earnings | | | — | |

| | Other accumulated loss | | | (345,794 | ) |

| | Total distributable earnings | | $ | | |

The temporary book basis and tax-basis differences are attributable primarily to grantor trust income and straddle loss deferrals.

The Fund plans to distribute substantially all of the net investment income and net realized gains that it has realized on the sale of securities. These income and gains distributions will generally be paid once each year, on or before December 31. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense or gain items for financial reporting and tax reporting purposes.

The tax character of distributions paid were as follows:

| | | | Year Ended | | | Year Ended | |

| | | | December 31, 2020 | | | December 31, 2019 | |

| | Ordinary Income* | | $ | 359,657 | | | $ | 673,644 | |

| | Long-term capital gain | | $ | 16,653,410 | | | $ | 1,643,635 | |

| | * | For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

NOTES TO FINANCIAL STATEMENTS (Continued)

Year Ended December 31, 2020

On the Statement of Assets and Liabilities, the following adjustments were made for permanent tax adjustments:

| | Total | Paid-In | |

| | Distributable Earnings | Capital | |

| | $(500,881) | $500,881 | |

These adjustments resulted primarily from the utilization of earnings and profits on shareholder redemptions.

Expenses are reduced through the deposit of minimum account maintenance fees into the Fund. By November 30th of each year, all accounts must meet one of three criteria: 1) have net investments (purchases less redemptions) totaling $1,500 or more, 2) have an account value greater than $1,500, or 3) be enrolled in the Fund’s Automatic Investment Plan. Accounts that do not meet one of these three criteria will be charged a $15 minimum account maintenance fee. This fee is used to lower the Fund’s expense ratio. For the fiscal year ended December 31, 2020, the Fund’s expenses were reduced $7,108 by utilizing minimum account maintenance fees pertaining to account balances as of November 30, 2020, resulting in a decrease in the expenses being charged to shareholders.

| 9. | GUARANTEES AND INDEMNIFICATIONS |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Muhlenkamp Fund and

Board of Trustees of Managed Portfolio Series

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Muhlenkamp Fund (the “Fund”), a series of Managed Portfolio Series, as of December 31, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2020, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2020, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2008.

COHEN & COMPANY, LTD.

Cleveland, Ohio

February 25, 2021

TRUSTEES AND OFFICERS (Unaudited)

| | | Term of | Number | | Other |

| | | Office | of | | Directorships |

| | | and | Portfolios | Principal | Held |

| | Position(s) | Length of | in Trust | Occupation(s) | by Trustee |

| Name, Address | Held with | Time | Overseen | During the | During the |

and Year of Birth | the Trust | Served | by Trustee | Past Five Years | Past Five Years |

| | | | | | |

Independent Trustees | | | | | |

| | | | | | |

Leonard M. Rush, CPA | Chairman, | Indefinite | 33 | Retired, Chief | Independent |

615 E. Michigan St. | Trustee and | Term; | | Financial | Trustee, ETF |

Milwaukee, WI 53202 | Audit | Since | | Officer, | Series Solutions |

Year of Birth: 1946 | Committee | April | | Robert W. | (46 Portfolios) |

| | Chairman | 2011 | | Baird & Co. | (2012-Present); |

| | | | | Incorporated | Director, Anchor |

| | | | | (2000-2011). | Bancorp |

| | | | | | Wisconsin, Inc. |

| | | | | | (2011-2013) |

| | | | | | |

David A. Massart | Trustee | Indefinite | 33 | Co-Founder | Independent |

615 E. Michigan St. | | Term; | | and Chief | Trustee, ETF |

Milwaukee, WI 53202 | | Since | | Investment | Series Solutions |

Year of Birth: 1967 | | April | | Strategist, | (46 Portfolios) |

| | | 2011 | | Next | (2012-Present) |

| | | | | Generation | |

| | | | | Wealth | |

| | | | | Management, | |

| | | | | Inc. (2005- | |

| | | | | Present). | |

TRUSTEES AND OFFICERS (Unaudited) (Continued)

| | | Term of | Number | | Other |

| | | Office | of | | Directorships |

| | | and | Portfolios | Principal | Held |

| | Position(s) | Length of | in Trust | Occupation(s) | by Trustee |

| Name, Address | Held with | Time | Overseen | During the | During the |

and Year of Birth | the Trust | Served | by Trustee | Past Five Years | Past Five Years |

| | | | | | |

David M. Swanson | Trustee and | Indefinite | 33 | Founder and | Independent |

615 E. Michigan St. | Nominating | Term; | | Managing | Trustee, ALPS |

Milwaukee, WI 53202 | & | Since | | Principal, | Variable |

Year of Birth: 1957 | Governance | April | | SwanDog | Investment Trust |

| | Committee | 2011 | | Strategic | (7 Portfolios) |

| | Chairman | | | Marketing, LLC | (2006-Present); |

| | | | | (2006-Present). | Independent |

| | | | | | Trustee |

| | | | | | RiverNorth Funds |

| | | | | | (3 Portfolios) |

| | | | | | (2018-Present); |

| | | | | | RiverNorth |

| | | | | | Managed |

| | | | | | Income Fund Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2019-Present); |

| | | | | | RiverNorth |

| | | | | | Marketplace |

| | | | | | Leading |

| | | | | | Corporation |

| | | | | | (1 Portfolio) |

| | | | | | (2018-Present); |

| | | | | | RiverNorth/ |

| | | | | | DoubleLine |

| | | | | | Strategic |

| | | | | | Opportunity |

| | | | | | Fund, Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2018-Present); |

| | | | | | RiverNorth |

| | | | | | Opportunities |

| | | | | | Fund, Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2018-Present); |

| | | | | | RiverNorth |

| | | | | | Opportunistic |

| | | | | | Municipal |

| | | | | | Income Fund, Inc. |

| | | | | | (1 Portfolio) |

| | | | | | (2018-Present). |

TRUSTEES AND OFFICERS (Unaudited) (Continued)

| | | Term of | Number | | Other |

| | | Office | of | | Directorships |

| | | and | Portfolios | Principal | Held |

| | Position(s) | Length of | in Trust | Occupation(s) | by Trustee |

| Name, Address | Held with | Time | Overseen | During the | During the |

and Year of Birth | the Trust | Served | by Trustee | Past Five Years | Past Five Years |

| | | | | | |

Robert J. Kern | Trustee | Indefinite | 33 | Retired, | None |

615 E. Michigan St. | | Term; | | Executive | |

Milwaukee, WI 53202 | | Since | | Vice President, | |

Year of Birth: 1958 | | January | | U.S. Bancorp | |

| | | 2011 | | Fund Services, | |

| | | | | LLC (1994-2018). | |

| | | | | | |

Officers | | | | | |

| | | | | | |

Brian R. Wiedmeyer | President | Indefinite | N/A | Vice President, | N/A |

615 E. Michigan St. | and | Term; | | U.S. Bancorp | |

Milwaukee, WI 53202 | Principal | Since | | Fund Services, | |

Year of Birth: 1973 | Executive | November | | LLC (2005-Present). | |

| | Officer | 2018 | | | |

| | | | | | |

Deborah Ward | Vice | Indefinite | N/A | Senior Vice | N/A |

615 E. Michigan St. | President, | Term; | | President, U.S. | |

Milwaukee, WI 53202 | Chief | Since | | Bancorp Fund | |

Year of Birth: 1966 | Compliance | April | | Services, LLC | |

| | Officer and | 2013 | | (2004-Present). | |

| | Anti-Money | | | | |

| | Laundering | | | | |

| | Officer | | | | |

| | | | | | |

Benjamin Eirich | Vice | Indefinite | N/A | Assistant Vice | N/A |

615 E. Michigan St. | President, | Term; | | President, U.S. | |

Milwaukee, WI 53202 | Treasurer | Since | | Bancorp Fund | |

Year of Birth: 1981 | and | August | | Services, LLC | |

| | Principal | 2019 | | (2008-Present). | |

| | Financial | (Treasurer); | | | |

| | Officer | Since | | | |

| | | November | | | |

| | | 2018 (Vice | | | |

| | | President) | | | |

TRUSTEES AND OFFICERS (Unaudited) (Continued)

| | | Term of | Number | | Other |

| | | Office | of | | Directorships |

| | | and | Portfolios | Principal | Held |

| | Position(s) | Length of | in Trust | Occupation(s) | by Trustee |

| Name, Address | Held with | Time | Overseen | During the | During the |

and Year of Birth | the Trust | Served | by Trustee | Past Five Years | Past Five Years |

| | | | | | |

Thomas A. Bausch, Esq. | Secretary | Indefinite | N/A | Vice President, | N/A |

615 E. Michigan St. | | Term; | | U.S. Bancorp | |

Milwaukee, WI 53202 | | Since | | Fund Services, | |

Year of Birth: 1979 | | November | | LLC (2016-Present); | |

| | | 2017 | | Associate, Godfrey | |

| | | | | & Kahn S.C. | |

| | | | | (2012-2016). | |

| | | | | | |

Douglas Schafer | Vice | Indefinite | N/A | Assistant Vice | N/A |

615 E. Michigan St. | President | Term; | | President, U.S. | |

Milwaukee, WI 53202 | and | Since | | Bancorp Fund | |

Year of Birth: 1970 | Assistant | May | | Services, LLC | |

| | Treasurer | 2016 | | (2002-Present). | |

| | | (Assistant | | | |

| | | Treasurer); | | | |

| | | Since | | | |

| | | November | | | |

| | | 2018 (Vice | | | |

| | | President) | | | |

| | | | | | |

Michael J. Cyr II, CPA | Vice | Indefinite | N/A | Officer, | N/A |

615 E. Michigan St. | President | Term; | | U.S. Bancorp | |

Milwaukee, WI 53202 | and | Since | | Fund Services, | |

Year of Birth: 1992 | Assistant | August | | LLC (2013-Present). | |

| | Treasurer | 2019 | | | |

ADDITIONAL INFORMATION (Unaudited)

Year Ended December 31, 2020

For the year ended December 31, 2020, the Fund paid $27,132 in broker commissions. These commissions are included in the cost basis of investments purchased, and deducted from the proceeds of securities sold. This accounting method is the industry standard for mutual funds. Were these commissions itemized as expenses, they would equal less than 1 cent per Fund share and would have increased the expense ratio from 1.10% to 1.12%.

| 2. | QUALIFIED DIVIDEND INCOME PERCENTAGE |

For the fiscal year ended December 31, 2020, certain dividends paid by the Fund may be reported as qualified dividend income and may be eligible for taxation at capital gain rates. The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00% for the Fund.

For corporate shareholders, the percentage of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended December 31, 2020 was 100.00% for the Fund.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distribution under Internal Revenue Section 871(k)(2)(C) for the Fund was 0.00%.

| 3. | INFORMATION ABOUT PROXY VOTING |

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge upon request by calling toll-free at 1-800-860-3863 or by accessing the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ending June 30 is available on the SEC’s website at www.sec.gov or by calling the toll-free number listed above.

| 4. | AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE |

The Fund files complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q or Part F of Form N-PORT (beginning with filings after March 31, 2020). The Fund’s Form N-Q or Part F of Form N-PORT are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. For information on the Public Reference Room call 1-800-SEC-0330. In addition, the Fund’s Form N-Q or Part F of Form N-PORT is available without charge upon request by calling 1-800-860-3863.

PRIVACY NOTICE (Unaudited)

The Fund collects only relevant information about you that the law allows or requires it to have in order to conduct its business and properly service you. The Fund collects financial and personal information about you (“Personal Information”) directly (e.g., information on account applications and other forms, such as your name, address, and social security number, and information provided to access account information or conduct account transactions online, such as password, account number, e-mail address, and alternate telephone number), and indirectly (e.g., information about your transactions with us, such as transaction amounts, account balance and account holdings).

The Fund does not disclose any non-public personal information about its shareholders or former shareholders other than for everyday business purposes such as to process a transaction, service an account, respond to court orders and legal investigations or as otherwise permitted by law. Third parties that may receive this information include companies that provide transfer agency, technology and administrative services to the Fund, as well as the Fund’s investment adviser who is an affiliate of the Fund. If you maintain a retirement/educational custodial account directly with the Fund, we may also disclose your Personal Information to the custodian for that account for shareholder servicing purposes. The Fund limits access to your Personal Information provided to unaffiliated third parties to information necessary to carry out their assigned responsibilities to the Fund. All shareholder records will be disposed of in accordance with applicable law. The Fund maintains physical, electronic and procedural safeguards to protect your Personal Information and requires its third-party service providers with access to such information to treat your Personal Information with the same high degree of confidentiality.

In the event that you hold shares of the Fund through a financial intermediary, including, but not limited to, a broker-dealer, credit union, bank or trust company, the privacy policy of your financial intermediary governs how your non-public personal information is shared with unaffiliated third parties.

This Page Intentionally Left Blank.

INVESTMENT ADVISER

Muhlenkamp & Company, Inc.

5000 Stonewood Drive, Suite 300

Wexford, PA 15090

ADMINISTRATOR, FUND ACCOUNTANT

AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank N.A.

1555 North Rivercenter Drive, Suite 302

Milwaukee, WI 53212

DISTRIBUTOR

Quasar Distributors, LLC

111 East Kilbourn Avenue, Suite 2200

Milwaukee, WI 53202

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

Stradley Ronon Stevens & Young, LLP

2005 Market Street, Suite 2600

Philadelphia, PA 19103

This report must be accompanied or preceded by a prospectus.

The Fund’s Statement of Additional Information contains additional

information about the Fund’s Trustees and is available without charge

upon request by calling 1-800-860-3863.

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer and principal financial officer. The Registrant has not made any substantive amendments to its code of ethics during the period covered by this report.

The Registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the Registrant’s code of ethics that applies to the Registrant’s principal executive officer and principal financial officer is filed herewith.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Leonard M. Rush is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.