Great Lakes Disciplined Equity Fund

Institutional Class Shares – GLDNX

Great Lakes Large Cap Value Fund

Institutional Class Shares – GLLIX

Great Lakes Small Cap Opportunity Fund

Investor Class Shares – GLSCX

Institutional Class Shares – GLSIX

Annual Report

March 31, 2022

1-855-278-2020

www.glafunds.com

Distributed by Quasar Distributors, LLC

Member FINRA

Great Lakes Disciplined Equity Fund

May 20, 2022

Dear Shareholders,

I. INVESTMENT RESULTS

Market Review

During the one-year period ended March 31, 2022, investors continued to be whipsawed by new Covid variants and the related policies of decision makers that came with each new wave of infection. In early summer what was thought to be the long awaited value rally was grinded to a halt by a new wave of infections and the lockdowns that coincided. As the worst of investors’ fears subsided, we were presented with the omicron strain which the market largely shrugged off. As winter approached we began to turn the page on this chapter and year, investors shifted their attention to The Fed as they tried to properly telegraph the beginning of the end of easy monetary policy. The unwinding of the balance sheet, and lift-off from zero interest rate policy, are creating market swings of the likes we haven’t seen in over a decade. This change in policy has given new energy to value purists and caused growth investors to reexamine their appetite for risk.

Against this backdrop, for the year ended March 31st of 2022, your Great Lakes Disciplined Equity Fund returned the following:

Share Class | 12 Months ended 3/31/22 | |

| Institutional Class | 8.72% | |

| S&P 500 Index | 15.65% | |

Size/Style

Growth stocks outperformed value stocks by a substantial margin during the one-year period with the S&P 500 Growth index adding 18.83% while the S&P 500 Value index added 12.58%.

| | • | Mega-caps slightly outperformed large-caps as measured by the S&P 100 and S&P 500. |

| | | |

| | • | Growth Edged value, as measured by the S&P 500 Growth and S&P 500 Value Indexes. |

| | | o | When looking at the growth and value returns for YTD 2022 we find value with a sizable lead of roughly 8.5%. |

S&P 500 Sectors

Inconsistency across cyclical and defensive sectors is observed, as the market is transitioning from expansionary to contractionary.

| | • | Energy continued its spectacular rise advancing 64.30% over the period. |

| | | |

| | • | Sectors showing continued strength include Real Estate 25.75%, Technology 20.90% and Utilities 19.93% |

| | | |

| | • | Communication Services -0.93% was the lone sector with a negative return of the previous year, shedding almost a full percent. |

Great Lakes Disciplined Equity Fund

II. ATTRIBUTION

Below is attribution for the Great Lakes Disciplined Equity Fund.

Common Factor Positioning and Individual stock selection were both detractors over the year.

From an industry perspective, an overweight to Grocery Stores and an underweight to Home Products both contributed positively to the relative return.

From a factor perspective, an overweight to Volatility and Momentum both were detractors from relative performance.

Our two largest contributing stocks for the year were Tesla (TSLA) and Alphabet (GOOG). An overweight to both names added to relative performance, as both names outperformed the benchmark by a sizable amount.

Our two largest detracting stocks for the year were Disney (DIS) and Expedia (EXPE). A sizable active position in both names detracted from performance, as both lagged the benchmark on the trailing 1 year.

III. OUTLOOK

While we still see Covid in the news – most recently a flare-up in Shanghai which forced Tesla to send workers home – most evidence continues to support the notion that Covid will end with a whimper, not a bang. Our belief is that the unprecedented nature of the pandemic greatly reduced investors’ collective ability to discount the future. As such, we saw very high levels of volatility punctuated by periods of record factor correlations and significant rotations. While there will always be “exogenous” events impacting the markets, no market participants are able to draw from experience to know how global markets would respond to this pandemic.

But, onward!

Investors expect the Fed’s balance sheet to stop growing and indeed begin to shrink later this year. The fiscal stimulus bills are in the rear view mirror (although most of the infrastructure money is yet to be doled out). The first of what’s expected to be several rate hikes is under our belt. The yield curve has inverted – which typically portends below average economic growth. In other words, the days of easy money are fading, and higher volatility is likely here to stay.

However…Profit margins have remained high to date – 40+ year highs in input cost increases have been largely passed through to the consumer, and productivity has been strong. The amount of slack which has been removed from the labor market should begin to bite at some point… the marginal worker is less productive. The Employment Cost Index is increasing at a 20 year high pace.

The housing market remains solid as of this writing, but mortgage rates have surged more quickly than ever, reducing affordability somewhat. We don’t really see the impact in the overall numbers at this point… but our guess is we will.

Weak equity returns during Q1 combined with the aforementioned still-strong earnings means valuation of the major US indices has come in. Markets still aren’t cheap, however. The Fed will have to successfully kill inflation, and kill it softly as the great Roberta Flack once crooned (or Lauryn Hill, take your pick). And they’ll have to kill it without killing economic activity.

So the question in large part is, can Powell and the Fed sing a good song, and sing it with style?

Jon Quigley, CFA. MSc

CIO, Disciplined Equity

Great Lakes Disciplined Equity Fund

Definitions:

The S&P 500 Index is a broad based index of 500 stocks, which is widely recognized as representative of the equity market in general.

The S&P 100 Index is an index, weighted for market capitalization, of 100 blue chip stocks from a variety of industries. The stocks listed on the S&P 100 are the top 100 stocks on the S&P 500 by market capitalization. Its ticker symbol is OEX, and it was originally operated by the Chicago Board Options Exchange.

The S&P 500 Growth index tracks the investment results of the S&P 500 index composed of large-capitalization U.S. equities that exhibit growth characteristics.

The S&P 500 Value Index measures the performance of the large-capitalization value sector in the US equity market. It is a subset of the S&P 500 Index and consists of those stocks in the S&P 500 Index exhibiting the strongest value characteristics.

It is not possible to invest directly in an index.

Past performance does not guarantee future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Please refer to the schedules of investments for complete holdings information.

Mutual fund investing involves risk. Principal loss is possible. The Fund may invest in ETFs. Investing in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value ("NAV"), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Funds ability to sell its shares. ETFs have management and other expense. The Fund will bear its pro rata portion of these expenses and therefore the Fund’s expenses may be higher than if it invested directly in securities. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

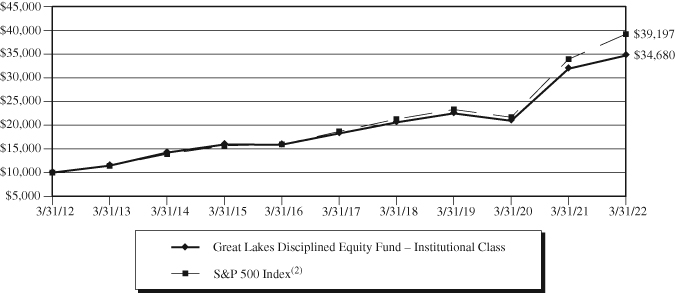

Great Lakes Disciplined Equity Fund

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-278-2020. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of March 31, 2022

| | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception(1) |

| Institutional Class | 8.72% | 15.53% | 13.69% | 13.24% | 13.98% |

S&P 500 Index(2) | 15.65% | 18.92% | 15.99% | 14.64% | 15.29% |

| (1) | Inception date of the Fund was June 1, 2009. |

| (2) | The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. This index can not be invested in directly. |

The following is expense information for the Great Lakes Disciplined Equity Fund as disclosed in the Fund’s most recent prospectus dated July 29, 2021:

Gross Expenses: 1.13%; Net Expenses: 0.86%. Great Lakes Advisors, LLC (the “Adviser” or “Great Lakes”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 0.85% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2022. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ended March 31, 2022 was 0.85%.

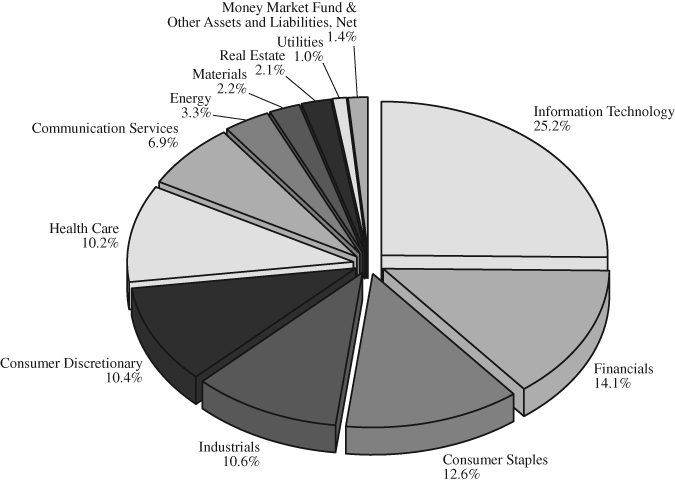

Great Lakes Disciplined Equity Fund

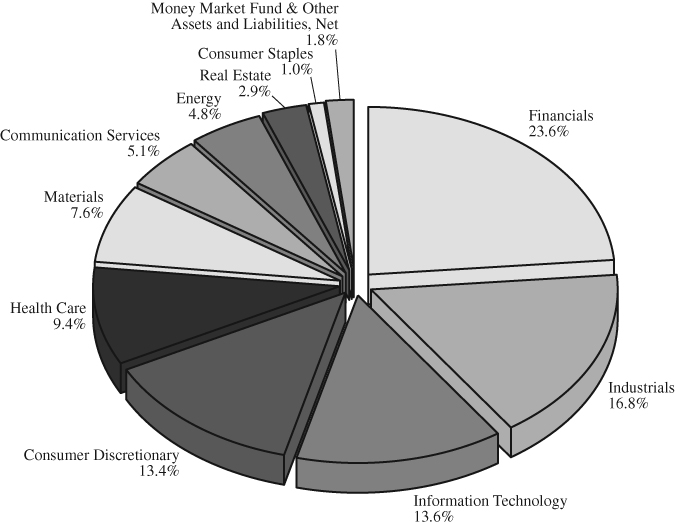

Allocation of Portfolio Net Assets (Unaudited)

March 31, 2022(1)

(% of Net Assets)

Top 10 Equity Holdings (Unaudited)

March 31, 2022(1)

(% of Net Assets)

| | Apple, Inc. | | | 7.3 | % |

| | UnitedHealth Group, Inc. | | | 4.2 | % |

| | Costco Wholesale Corp. | | | 3.9 | % |

| | Bank of America Corp. | | | 3.7 | % |

| | Alphabet, Inc. – Class C | | | 3.3 | % |

| | Tesla, Inc. | | | 3.2 | % |

| | NVIDIA Corp. | | | 3.1 | % |

| | Microsoft Corp. | | | 2.7 | % |

| | Cisco Systems, Inc. | | | 2.5 | % |

| | CDW Corp. | | | 2.4 | % |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Great Lakes Large Cap Value Fund

May 10, 2022

Dear Shareholders,

I. INVESTMENT RESULTS

The unexpected became the expected during the fiscal year as high volatility in financial and investment markets coupled with an unstable geopolitical environment.

Inflation returned near mid-2021 after a multi-decade absence. Measures ran through the Federal Reserve Board objective of 2% to the 5-7% area. Persistence of higher inflation has been longer than first projected, and spread to most areas of the economy is wider than hoped. Expectations of future inflation (from surveys) have risen above the 2% objective.

In response, a sharp pivot in monetary policy occurred as the Federal Reserve Board became determined to restore price stability. As intentions became known, bond market returns in the January-March quarter were the worst in decades.

The U.S. economy continued to expand into March. Commodity markets have soared, reaching the highest levels in decades for a wide range of goods. Unemployment rates dropped almost to record lows of the past several decades. Corporate profit recovery from the 2020 decline has been strong into early 2022.

After rising through calendar 2021, equity markets declined in the fourth fiscal quarter. Still, during the fiscal year, the equity market (S&P 500 Index) advance was at a mid-teens rate while value style indexes, which picked up as the fiscal year progressed, rose near 12%.

Share Class | 12 Months ended 3/31/22 | |

| Institutional Class | 11.93% | |

| Russell 1000 Value Index | 11.67% | |

II. ATTRIBUTION

Fund results were close to value style benchmarks in fiscal 2022. Generally, areas more sensitive to the economic pace limited results on both the consumer and industrial sides of the strategy, but industry and company-specific factors were important.

Nine positions in six broad areas declined more than 5% over the year to limit returns. These areas included consumer big-ticket items (auto components, toys) and streaming video entertainment (Comcast, down 13% in price; Disney, down over 25%) on the consumer side. Among industrials, areas included truck expenses and components (Cummins, down over 20%), semiconductors (Intel, declining over 22%) and aircraft engines (General Electric slipped almost 13%).

In contrast, fifteen positions in five broad areas led results by rising over 20% during the year. Four were in the broad health care area (a pharmaceutical and three services firms providing insurance, pharmacy benefit management, health products, retail and drug distribution), five in the financial area (three insurers, one charge and credit card lender and a wealth manager), and three in energy (oil and gas production, oil services).

III. Outlook

Volatility and uncertainty remain high. Prospects for investment markets in 2022 have already changed since the year began. At this time, inflation is higher, broader and longer-lasting than originally thought. Easing of supply chain pressures may bring about a lower inflation level later in the year, but problems persisted in March-April.

Great Lakes Large Cap Value Fund

The Federal Reserve Board may increase the overnight rate at each of the meetings to come in 2022 and into 2023 as it moves from monetary accommodation toward a more normal rate level. Longer maturity fixed income instruments have already begun to shift to provide higher yields, and offer more competition to equities.

As the economic recovery from the pandemic-influenced downturn could be near a peak, profit gains are likely to slow in 2022 and possibly in 2023 as well. Labor costs (compensation follows inflation) and the supply chain problem areas of raw materials, transportation and a wide range of other expenses all are also likely to pressure margins. Valuation of equities remains high by historical standards.

Following three years of above-average equity returns, the prospects of higher inflation, slowing corporate profits, less accommodative monetary policy and exogenous factors (pandemic variants ebbs and flows, war) together are less favorable for another above-average period of equity market returns.

Edward J. Calkins, CFA

Senior Portfolio Manager

Fund Shareholder

Definitions:

The Russell 1000® Value Index measures the performance of those Russell 1000® Index companies with lower price-to-book ratios and lower forecasted growth rates.

The S&P 500 Index is a broad based index of 500 stocks, which is widely recognized as representative of the equity market in general.

One cannot invest directly in an index.

Past performance does not guarantee future results.

Diversification does not assure a profit nor protect against loss in a declining market.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. For a complete list of fund holdings, please see the Schedule of Investments included in this report.

Mutual fund investing involves risk. Principal loss is possible. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline. Investing in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Funds ability to sell its shares. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets.

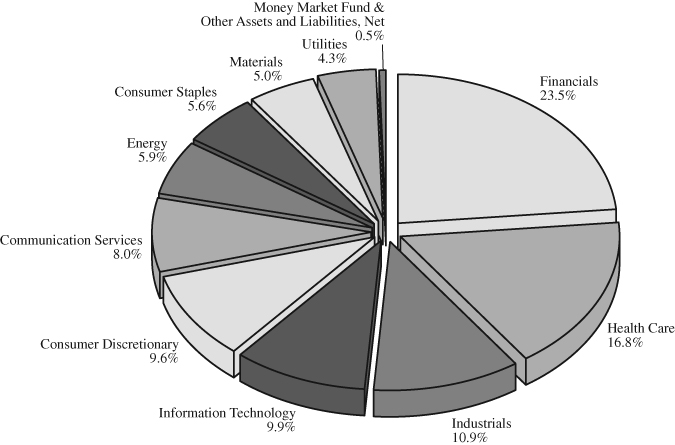

Great Lakes Large Cap Value Fund

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-278-2020. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of March 31, 2022

| | 1-Year | 3-Year | 5-Year | Since Inception(1) |

| Institutional Class | 11.93% | 13.22% | 9.71% | 11.61% |

Russell 1000 Value Index(2) | 11.67% | 13.02% | 10.29% | 11.86% |

| (1) | Inception date of the Fund was September 28, 2012. |

| (2) | The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. This index can not be invested in directly. |

The following is expense information for the Great Lakes Large Cap Value Fund as disclosed in the Fund’s most recent prospectus dated July 29, 2021:

Gross Expenses: 1.04%; Net Expenses: 0.85%. Great Lakes Advisors, LLC (the “Adviser” or “Great Lakes”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 0.85% of the average daily net assets of the Fund. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2022. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ended March 31, 2022 was 0.85%.

Great Lakes Large Cap Value Fund

Allocation of Portfolio Net Assets (Unaudited)

March 31, 2022(1)

(% of Net Assets)

Top 10 Equity Holdings (Unaudited)

March 31, 2022(1)

(% of Net Assets)

| | Comcast Corp. – Class A | | | 4.0 | % |

| | BorgWarner, Inc. | | | 3.6 | % |

| | Citigroup, Inc. | | | 3.5 | % |

| | RenaissanceRe Holdings, Ltd. | | | 3.5 | % |

| | Berkshire Hathaway, Inc. – Class B | | | 3.2 | % |

| | Public Service Enterprise Group, Inc. | | | 3.2 | % |

| | Merck & Co., Inc. | | | 3.1 | % |

| | AbbVie, Inc. | | | 3.1 | % |

| | Shell Plc – ADR | | | 3.0 | % |

| | Chubb Ltd. | | | 3.0 | % |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Great Lakes Small Cap Opportunity Fund

May 10, 2022

Dear Shareholders,

I. INVESTMENT RESULTS

The Great Lakes Small Cap Opportunity Institutional Class (GLSIX) increased 1.65% for the twelve months ended March 31, 2022, outperforming the Russell 2000 index return which was down 5.79%.

Share Class | 12 Months ended 3/31/22 | |

| Institutional Class | 1.65% | |

| Russell 2000 Index | -5.79% | |

It was a volatile start to the 2022 year as the equity markets grappled with a litany of headline risks; with the primary development revolved around the repricing of the Fed rate hike path and Russia’s invasion of Ukraine. At its lowest point in the first quarter of 2022, the Russell 2000 index declined 20% and then rallied to finish the quarter down 7.5%, the worst quarterly returns since Q12020.

In periods of market distress, we seek to build a portfolio which provides attractive risk mitigation relative to the benchmark. We are pleased the Fund was able to accomplish that goal during the volatile 1Q2022 and post a positive return for the twelve month period ended March 31, 2022 while the Russell 2000 declined in value.

What has helped us to outperform is value stocks significantly outperforming growth stocks by 17.7% (+3.4% for the Russell 2000 Value Index versus -14.3% for the Russell 2000 Growth Index) over the twelve-month period ended March 31, 2022. Despite the nice recovery from value, growth is still solidly ahead of value over the past 5- and 10-year time horizon. Therefore in our view, there is plenty of room for value to continue its relative outperformance.

Perhaps, more promising, is the continued underperformance of the basket of unprofitable, high multiple stocks, namely in the biotechnology and software industries. Both of these industries were among the worst performers over the past 12 month period, -43.3% and -20.9%, respectively. Yet, unprofitable companies still represent over a third of the Russell 2000 Index, off its all-time high of nearly 40% and well above the historical average of around 20%. Our investment strategy seeks to invest in quality, cash generating companies at a discount to value. The value of price is starting to matter, and if this pattern holds, we believe it should bode well for the Fund in the ensuing years.

While we do not forecast macroeconomic variables to make investment decisions, it does appear that the period of relative low inflation has come to an end, and there are signs that it may linger for longer than what investors think. In expectation of this, how are we thinking about the portfolio’s positioning in an era of higher inflation in the future? We believe our active, fundamental investing framework should help us identify the relative beneficiaries and relative losers.

Given our quality-bent, we feel good that our companies have strong competitive positions to maintain its profitability in inflationary times. An example of this is Crane, a manufacturer of highly engineered, specialized industrial components. The company has dominate market share in niche markets (i.e. aircraft braking systems) with little substitution risk. These competitive characteristics should provide the company with pricing power.

This is why we continue to like the setup of our portfolio. We believe it is full of cash-generating, quality companies with durable competitive advantages that should be able to generate strong risk-adjusted returns throughout the economic cycles.

Great Lakes Small Cap Opportunity Fund

II. ATTRIBUTION

For the twelve months ended March 31, 2022, the Fund returned 1.65%, outperforming the Russell 2000 benchmark’s return of -5.79%. The Fund’s 744 basis points of outperformance relative to the index was driven by both sector allocation and stock selection. The positive sector allocation was largely due to our underweight in Healthcare, which was the worst performing sector for the index. Strong stock selection in Healthcare, Technology, and Financials were the largest contributors to our relative performance. On the flip side, our worst performing sector was Communication Services.

Healthcare was one of our best performing sector, adding nearly 600 basis point of alpha. As noted above, our underweight position, particularly in the biotechnology industry where the portfolio had zero exposure helped us to outperform. From a stock selection perspective, five out of our six healthcare holdings contributed to relative outperformance. Prestige Consumer Healthcare (a manufacturer of consumer healthcare products), was the clear standout, advancing 20% as the company delivered healthy earnings aided by a rebound in demand for its products that were adversely impacted by COVID.

The Technology sector was also a bright spot for the Fund. We outperformed due to strong stock selection plus our limited exposure to the high-multiple areas of the sector (i.e. software industry) that took a pummeling. Seven of our ten technology holdings posted gains in the period. Extreme Networks (networking equipment supplier), ViaSat (satellite services firm), and Progress Software (enterprise software company) led the way as fundamentals for each of these businesses continues to track our expectations.

The Fund’s outperformance in Financials was driven by First American Financial (a title insurance company), PRA Group (debt collector), Axis Capital (insurance company), and Jefferies (an investment bank). First American posted record earnings, driven by a strong refinance market. PRA’s earnings topped consensus estimates as their portfolio performed better than expected, and the company bought back nearly 5% of its shares throughout the year. Axis Capital continues to execute on its strategy to shift its book away from re-insurance toward more specialty lines that should earn better returns in the future. Lastly, Jefferies benefited from a robust merger and acquisition and transaction environment. Jefferies has been an outstanding investment for us and we exited the position as it reached our fair value estimate.

Our largest underperformance came from the Communication services sector. TripAdvisor, on-line travel agent, declined 49.6% as the company was hit with a number of issues including weaker than expected earnings, CEO departure, and concerns over the Omicron virus. We believe these concerns are overblown, and TRIP remains in great position to benefit from the recovering demand in travel. Quotient Technology, a digital marketing platform operator, tumbled 64% due to weaker than expected guidance, and management did a poor job of explaining their earnings guidance. We exited this position as we lost confidence with the management team.

Thanks for your trust and patience,

Benjamin Kim, CFA

Definitions:

The Russell 2000 Index consists of the smallest 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index, as ranked by market capitalization.

The Russell 2000 Value index consists of 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index that also exhibit a value probability.

Great Lakes Small Cap Opportunity Fund

The Russell 2000 Growth index consists of 2,000 companies in a group of 3,000 U.S. companies in the Russell 3000 Index that exhibit a growth probability.

One cannot invest directly in an index.

Past performance does not guarantee future results.

Basis point (bp) is a unit equal to 1/100th of 1% and is used to denote the change in a financial instrument.

Alpha is used as a measure of performance, indicating when a strategy has managed to beat the market return over some period. Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index or benchmark that is considered to represent the market’s movement as a whole. The excess return of an investment relative to the return of a benchmark index is the investment’s alpha. Alpha may be positive or negative and is the result of active investing.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security. Please refer to the schedules of investments for complete holdings information.

Mutual fund investing involves risk. Principal loss is possible. Investing in ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of the shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Funds ability to sell its shares. Small-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. The Fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging markets. The Fund’s value investments are subject to the risk that their intrinsic values may not be recognized by the broad market or that their prices may decline.

Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales.

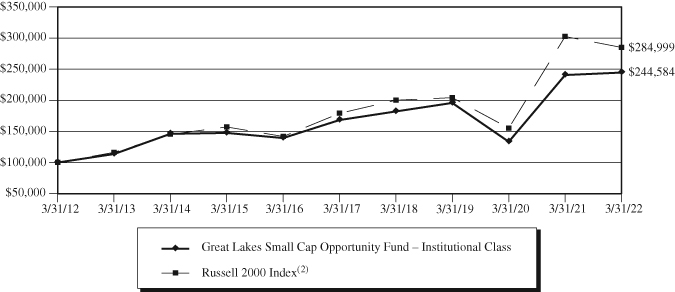

Great Lakes Small Cap Opportunity Fund

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-278-2020. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Annualized Rates of Return as of March 31, 2022

| | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception(1) |

| Investor Class | 1.40% | 7.42% | 7.51% | 9.09% | 12.92% |

| Institutional Class | 1.65% | 7.70% | 7.76% | 9.36% | 13.21% |

Russell 2000 Index(2) | -5.79% | 11.74% | 9.74% | 11.04% | 13.46% |

| (1) | Inception date of each class was December 5, 2008. |

| (2) | The Russell 2000 Index is a market capitalization-weighted index comprised of the 2,000 smallest companies listed on the Russell 3000 Index, which contains the 3,000 largest companies in the U.S. based on market capitalization. This index can not be invested in directly. |

The following is expense information for the Great Lakes Small Cap Opportunity Fund as disclosed in the Fund’s most recent prospectus dated July 29, 2021:

| Investor Class Gross Expense Ratio: 1.30% | Net Expense Ratio: 1.24% |

| Institutional Class Gross Expense Ratio: 1.05% | Net Expense Ratio: 0.99% |

Great Lakes Advisors, LLC (the “Adviser” or “Great Lakes”) has contractually agreed to waive its management fees and pay Fund expenses in order to ensure that Total Annual Fund Operating Expenses (excluding acquired fund fees and expenses (“AFFE”), leverage/borrowing interest, interest expense, dividends paid on short sales, taxes, brokerage commissions and other transactional expenses, and extraordinary expenses) do not exceed 1.24% and 0.99% of the average daily net assets of the Investor Class and Institutional Class, respectively. Fees waived and expenses paid by the Adviser may be recouped by the Adviser for a period of 36 months following the month during which such fee waiver and expense payment was made if such recoupment can be achieved without exceeding the expense limit in effect at the time the fee waiver and expense payment occurred and at the time of recoupment. The Operating Expense Limitation Agreement is indefinite in term and cannot be terminated through at least July 29, 2022. Thereafter, the agreement may be terminated at any time upon 60 days’ written notice by the Trust’s Board or the Adviser, with the consent of the Board.

The actual net expense ratio applicable to investors, as disclosed in the Financial Highlights for the year ended March 31, 2022, was 1.24% and 0.99% for the Investor Class and Institutional Class, respectively.

Great Lakes Small Cap Opportunity Fund

Allocation of Portfolio Net Assets (Unaudited)

March 31, 2022(1)(2)

(% of Net Assets)

Top 10 Equity Holdings (Unaudited)

March 31, 2022(1)

(% of Net Assets)

| | Axis Capital Holdings Ltd. | | | 3.7 | % |

| | Patterson Companies, Inc. | | | 3.1 | % |

| | Crane Co. | | | 3.1 | % |

| | ViaSat, Inc. | | | 3.1 | % |

| | Flowserve Corp. | | | 3.0 | % |

| | Prosperity Bancshares, Inc. | | | 2.9 | % |

| | Park Hotels & Resorts, Inc. – REIT | | | 2.9 | % |

| | Dril-Quip, Inc. | | | 2.8 | % |

| | TripAdvisor, Inc. | | | 2.8 | % |

| | Berry Global Group, Inc. | | | 2.7 | % |

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Excludes securities lending collateral. |

Great Lakes Funds

Expense Examples (Unaudited)

March 31, 2022

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution (12b-1) fees (Investor Class only), and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2021 – March 31, 2022).

ACTUAL EXPENSES

For each class, the first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Great Lakes Disciplined Equity Fund

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (10/1/2021) | Value (3/31/2022) | (10/1/2021 to 3/31/2022) |

Institutional Class Actual(2) | $1,000.00 | $1,053.80 | $4.35 |

Institutional Class Hypothetical | | | |

(5% return before expenses) | $1,000.00 | $1,020.69 | $4.28 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.85%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended March 31, 2022, of 5.38%. |

Great Lakes Large Cap Value Fund

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(3) |

| | Value (10/1/2021) | Value (3/31/2022) | (10/1/2021 to 3/31/2022) |

Institutional Class Actual(4) | $1,000.00 | $1,082.50 | $4.41 |

Institutional Class Hypothetical | | | |

(5% return before expenses) | $1,000.00 | $1,020.69 | $4.28 |

| (3) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 0.85%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| (4) | Based on the actual returns for the six-month period ended March 31, 2022, of 8.25%. |

Great Lakes Funds

Expense Examples (Unaudited) – Continued

March 31, 2022

Great Lakes Small Cap Opportunity Fund

| | | | Expenses Paid |

| | Beginning Account | Ending Account | During Period(1) |

| | Value (10/1/2021) | Value (3/31/2022) | (10/1/2021 to 3/31/2022) |

Investor Class Actual(2) | $1,000.00 | $1,009.10 | $6.21 |

Investor Class Hypothetical | | | |

(5% return before expenses) | $1,000.00 | $1,018.75 | $6.24 |

Institutional Class Actual(2) | $1,000.00 | $1,010.20 | $4.96 |

Institutional Class Hypothetical | | | |

(5% return before expenses) | $1,000.00 | $1,020.00 | $4.99 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio for the most recent six-month period of 1.24% and 0.99% for the Investor Class and Institutional Class, respectively, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| (2) | Based on the actual returns for the six-month period ended March 31, 2022, of 0.91% and 1.02% for the Investor Class and Institutional Class, respectively. |

Great Lakes Disciplined Equity Fund

Schedule of Investments

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.6% | | | | | | |

| | | | | | | |

| Communication Services – 6.9% | | | | | | |

Alphabet, Inc. – Class C* | | | 335 | | | $ | 935,652 | |

Charter Communications, Inc. – Class A* | | | 200 | | | | 109,104 | |

Interpublic Group of Companies, Inc | | | 2,200 | | | | 77,990 | |

News Corp. – Class A | | | 3,200 | | | | 70,880 | |

News Corp. – Class B | | | 4,200 | | | | 94,584 | |

Paramount Global – Class B | | | 11,900 | | | | 449,939 | |

Omnicom Group, Inc. | | | 1,200 | | | | 101,856 | |

AT&T, Inc. | | | 6,204 | | | | 146,601 | |

| | | | | | | | 1,986,606 | |

| | | | | | | | | |

| Consumer Discretionary – 10.4% | | | | | | | | |

Amazon.com, Inc.* | | | 114 | | | | 371,634 | |

Best Buy Co., Inc. | | | 1,873 | | | | 170,256 | |

BorgWarner, Inc. | | | 1,900 | | | | 73,910 | |

Domino’s Pizza, Inc. | | | 299 | | | | 121,696 | |

Lowe’s Companies, Inc. | | | 2,396 | | | | 484,447 | |

O’Reilly Automotive, Inc.* | | | 580 | | | | 397,277 | |

Target Corp. | | | 511 | | | | 108,444 | |

Tesla, Inc.* | | | 848 | | | | 913,805 | |

TJX Companies, Inc. | | | 1,800 | | | | 109,044 | |

Ulta Beauty, Inc.* | | | 532 | | | | 211,853 | |

| | | | | | | | 2,962,366 | |

| | | | | | | | | |

| Consumer Staples – 12.6% | | | | | | | | |

Altria Group, Inc. | | | 3,401 | | | | 177,702 | |

Costco Wholesale Corp. | | | 1,924 | | | | 1,107,935 | |

General Mills, Inc. | | | 1,951 | | | | 132,122 | |

Kroger Co. | | | 9,543 | | | | 547,482 | |

Procter & Gamble Co. | | | 2,100 | | | | 320,880 | |

Sysco Corp. | | | 6,879 | | | | 561,670 | |

Tyson Foods, Inc. – Class A | | | 4,839 | | | | 433,720 | |

Walmart, Inc. | | | 2,100 | | | | 312,732 | |

| | | | | | | | 3,594,243 | |

| | | | | | | | | |

| Energy – 3.3% | | | | | | | | |

APA Corp. | | | 3,900 | | | | 161,187 | |

Chevron Corp. | | | 525 | | | | 85,486 | |

ConocoPhillips | | | 2,345 | | | | 234,500 | |

Exxon Mobil Corp. | | | 3,755 | | | | 310,125 | |

Valero Energy Corp. | | | 1,400 | | | | 142,156 | |

| | | | | | | | 933,454 | |

See Notes to the Financial Statements

Great Lakes Disciplined Equity Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.6% (Continued) | | | | | | |

| | | | | | | |

| Financials – 14.1% | | | | | | |

Aflac, Inc. | | | 1,600 | | | $ | 103,024 | |

Bank of America Corp. | | | 25,685 | | | | 1,058,736 | |

Bank of New York Mellon Corp. | | | 4,582 | | | | 227,405 | |

Berkshire Hathaway, Inc. – Class B* | | | 1,697 | | | | 598,888 | |

Capital One Financial Corp. | | | 3,225 | | | | 423,410 | |

Charles Schwab Corp. | | | 755 | | | | 63,654 | |

Chubb Ltd. | | | 247 | | | | 52,833 | |

Hartford Financial Services Group, Inc. | | | 2,421 | | | | 173,852 | |

MetLife, Inc. | | | 900 | | | | 63,252 | |

Principal Financial Group, Inc. | | | 2,200 | | | | 161,502 | |

Raymond James Financial, Inc. | | | 600 | | | | 65,946 | |

Synchrony Financial | | | 1,800 | | | | 62,658 | |

Travelers Companies, Inc. | | | 722 | | | | 131,931 | |

W.R. Berkley Corp. | | | 2,978 | | | | 198,272 | |

Wells Fargo & Co. | | | 13,334 | | | | 646,166 | |

| | | | | | | | 4,031,529 | |

| | | | | | | | | |

| Health Care – 10.2% | | | | | | | | |

AbbVie, Inc. | | | 3,930 | | | | 637,092 | |

Anthem, Inc. | | | 125 | | | | 61,403 | |

Centene Corp.* | | | 900 | | | | 75,771 | |

Cerner Corp. | | | 1,181 | | | | 110,494 | |

Cigna Corp. | | | 900 | | | | 215,649 | |

HCA Healthcare, Inc. | | | 300 | | | | 75,186 | |

Hologic, Inc.* | | | 2,719 | | | | 208,874 | |

Humana, Inc. | | | 200 | | | | 87,034 | |

Laboratory Corporation of America Holdings* | | | 700 | | | | 184,562 | |

UnitedHealth Group, Inc. | | | 2,352 | | | | 1,199,449 | |

Viatris, Inc. | | | 5,000 | | | | 54,400 | |

| | | | | | | | 2,909,914 | |

| | | | | | | | | |

| Industrials – 10.6% | | | | | | | | |

3M Co. | | | 1,057 | | | | 157,366 | |

C.H. Robinson Worldwide, Inc. | | | 1,200 | | | | 129,252 | |

Caterpillar, Inc. | | | 677 | | | | 150,849 | |

Emerson Electric Co. | | | 1,061 | | | | 104,031 | |

Expeditors International of Washington, Inc. | | | 1,000 | | | | 103,160 | |

General Dynamics Corp. | | | 1,363 | | | | 328,728 | |

JB Hunt Transport Services, Inc. | | | 288 | | | | 57,828 | |

Lockheed Martin Corp. | | | 517 | | | | 228,204 | |

Masco Corp. | | | 1,500 | | | | 76,500 | |

See Notes to the Financial Statements

Great Lakes Disciplined Equity Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.6% (Continued) | | | | | | |

| | | | | | | |

| Industrials – 10.6% (Continued) | | | | | | |

Norfolk Southern Corp. | | | 1,696 | | | $ | 483,733 | |

Union Pacific Corp. | | | 2,011 | | | | 549,425 | |

United Parcel Service, Inc. – Class B | | | 2,511 | | | | 538,509 | |

Waste Management, Inc. | | | 830 | | | | 131,555 | |

| | | | | | | | 3,039,140 | |

| | | | | | | | | |

| Information Technology# – 25.2% | | | | | | | | |

Adobe, Inc.* | | | 348 | | | | 158,556 | |

Apple, Inc. | | | 12,024 | | | | 2,099,510 | |

CDW Corp. | | | 3,908 | | | | 699,102 | |

Cisco Systems, Inc. | | | 12,700 | | | | 708,152 | |

Cognizant Technology Solutions Corp. – Class A | | | 5,747 | | | | 515,333 | |

Hewlett Packard Enterprise Co. | | | 5,100 | | | | 85,221 | |

HP, Inc. | | | 6,400 | | | | 232,320 | |

Intel Corp. | | | 6,900 | | | | 341,964 | |

Microsoft Corp. | | | 2,483 | | | | 765,534 | |

NetApp, Inc. | | | 700 | | | | 58,100 | |

NortonLifeLock, Inc. | | | 7,731 | | | | 205,026 | |

NVIDIA Corp. | | | 3,294 | | | | 898,801 | |

Texas Instruments, Inc. | | | 2,035 | | | | 373,382 | |

Western Digital Corp.* | | | 1,100 | | | | 54,615 | |

| | | | | | | | 7,195,616 | |

| | | | | | | | | |

| Materials – 2.2% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 1,624 | | | | 80,778 | |

Mosaic Co. | | | 2,500 | | | | 166,250 | |

Nucor Corp. | | | 800 | | | | 118,920 | |

Southern Copper Corp. | | | 2,500 | | | | 189,750 | |

Westrock Co. | | | 1,400 | | | | 65,842 | |

| | | | | | | | 621,540 | |

| | | | | | | | | |

| Real Estate – 2.1% | | | | | | | | |

Extra Space Storage, Inc. – REIT | | | 667 | | | | 137,135 | |

Prologis, Inc. – REIT | | | 2,489 | | | | 401,924 | |

Host Hotels & Resorts, Inc. – REIT | | | 3,800 | | | | 73,834 | |

| | | | | | | | 612,893 | |

See Notes to the Financial Statements

Great Lakes Disciplined Equity Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.6% (Continued) | | | | | | |

| | | | | | | |

| Utilities – 1.0% | | | | | | |

Constellation Energy Corp. | | | 1,195 | | | $ | 67,219 | |

Exelon Corp. | | | 3,585 | | | | 170,753 | |

Pinnacle West Capital Corp. | | | 790 | | | | 61,699 | |

| | | | | | | | 299,671 | |

| Total Common Stocks | | | | | | | | |

| (Cost $25,412,570) | | | | | | | 28,186,972 | |

| | | | | | | | | |

| MONEY MARKET FUND – 1.1% | | | | | | | | |

First American Government Obligations Fund – Class Z, 0.15%^ | | | | | | | | |

| Total Money Market Fund | | | | | | | | |

| (Cost $300,458) | | | 300,458 | | | | 300,458 | |

| Total Investments – 99.7% | | | | | | | | |

| (Cost $25,713,028) | | | | | | | 28,487,430 | |

| Other Assets and Liabilities, Net – 0.3% | | | | | | | 80,987 | |

| Total Net Assets – 100.0% | | | | | | $ | 28,568,417 | |

| * | Non-income producing security. |

| # | As of March 31, 2022, the Fund had a significant portion of its assets invested in the information technology sector. See Note 11 in the Notes to the Financial Statements. |

| ^ | The rate shown is the annualized seven-day effective yield as of March 31, 2022. |

REIT – Real Estate Investment Trust

The Global Industry Classification Standard (“GICS”®) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Great Lakes Large Cap Value Fund

Schedule of Investments

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.5% | | | | | | |

| | | | | | | |

| Communication Services – 8.0% | | | | | | |

Alphabet, Inc. – Class C* | | | 155 | | | $ | 432,913 | |

Comcast Corp. – Class A | | | 36,929 | | | | 1,729,016 | |

Walt Disney Co.* | | | 9,260 | | | | 1,270,102 | |

| | | | | | | | 3,432,031 | |

| | | | | | | | | |

| Consumer Discretionary – 9.6% | | | | | | | | |

Booking Holdings, Inc.* | | | 297 | | | | 697,490 | |

BorgWarner, Inc. | | | 39,249 | | | | 1,526,786 | |

Dollar General Corp. | | | 2,829 | | | | 629,821 | |

Expedia Group, Inc.* | | | 3,363 | | | | 658,038 | |

Hasbro, Inc. | | | 7,272 | | | | 595,722 | |

| | | | | | | | 4,107,857 | |

| | | | | | | | | |

| Consumer Staples – 5.6% | | | | | | | | |

Anheuser-Busch InBev SA/NV – ADR | | | 14,405 | | | | 865,164 | |

JM Smucker Co. | | | 5,072 | | | | 686,799 | |

Philip Morris International, Inc. | | | 9,224 | | | | 866,503 | |

| | | | | | | | 2,418,466 | |

| | | | | | | | | |

| Energy – 5.9% | | | | | | | | |

Chevron Corp. | | | 5,150 | | | | 838,575 | |

Schlumberger Ltd. | | | 9,980 | | | | 412,274 | |

Shell Plc – ADR | | | 23,525 | | | | 1,292,228 | |

| | | | | | | | 2,543,077 | |

| | | | | | | | | |

| Financials – 23.5% | | | | | | | | |

American Express Co. | | | 5,711 | | | | 1,067,957 | |

Ameriprise Financial, Inc. | | | 1,440 | | | | 432,518 | |

Bank of America Corp. | | | 30,285 | | | | 1,248,348 | |

Berkshire Hathaway, Inc. – Class B* | | | 3,949 | | | | 1,393,642 | |

Chubb Ltd. | | | 6,014 | | | | 1,286,395 | |

Citigroup, Inc. | | | 28,318 | | | | 1,512,181 | |

PNC Financial Services Group, Inc. | | | 4,489 | | | | 827,996 | |

Prudential Financial, Inc. | | | 7,214 | | | | 852,478 | |

RenaissanceRe Holdings, Ltd. | | | 9,363 | | | | 1,484,129 | |

| | | | | | | | 10,105,644 | |

| | | | | | | | | |

| Health Care – 16.8% | | | | | | | | |

AbbVie, Inc. | | | 8,165 | | | | 1,323,628 | |

Biogen, Inc.* | | | 3,115 | | | | 656,019 | |

Boston Scientific Corp.* | | | 19,588 | | | | 867,552 | |

CVS Health Corp. | | | 10,090 | | | | 1,021,209 | |

See Notes to the Financial Statements

Great Lakes Large Cap Value Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 99.5% (Continued) | | | | | | |

| | | | | | | |

| Health Care – 16.8% (Continued) | | | | | | |

McKesson Corp. | | | 3,620 | | | $ | 1,108,191 | |

Merck & Co., Inc. | | | 16,423 | | | | 1,347,507 | |

UnitedHealth Group, Inc. | | | 1,711 | | | | 872,559 | |

| | | | | | | | 7,196,665 | |

| | | | | | | | | |

| Industrials – 10.9% | | | | | | | | |

Canadian National Railway Co. | | | 4,974 | | | | 667,212 | |

Cummins, Inc. | | | 5,237 | | | | 1,074,161 | |

Emerson Electric Co. | | | 4,262 | | | | 417,889 | |

General Electric Co. | | | 11,326 | | | | 1,036,329 | |

Lockheed Martin Corp. | | | 1,922 | | | | 848,371 | |

Westinghouse Air Brake Technologies Corp. | | | 6,756 | | | | 649,725 | |

| | | | | | | | 4,693,687 | |

| | | | | | | | | |

| Information Technology – 9.9% | | | | | | | | |

Cisco Systems, Inc. | | | 15,475 | | | | 862,886 | |

DXC Technology Co.* | | | 19,567 | | | | 638,471 | |

Intel Corp. | | | 16,821 | | | | 833,649 | |

Oracle Corp. | | | 7,953 | | | | 657,952 | |

SS&C Technologies Holdings, Inc. | | | 16,465 | | | | 1,235,204 | |

| | | | | | | | 4,228,162 | |

| | | | | | | | | |

| Materials – 5.0% | | | | | | | | |

Avery Dennison Corp. | | | 5,062 | | | | 880,636 | |

DuPont de Nemours, Inc. | | | 8,469 | | | | 623,149 | |

International Flavors & Fragrances, Inc. | | | 5,031 | | | | 660,721 | |

| | | | | | | | 2,164,506 | |

| | | | | | | | | |

| Utilities – 4.3% | | | | | | | | |

Ameren Corp. | | | 4,930 | | | | 462,237 | |

Public Service Enterprise Group, Inc. | | | 19,450 | | | | 1,361,500 | |

| | | | | | | | 1,823,737 | |

| Total Common Stocks | | | | | | | | |

| (Cost $35,072,181) | | | | | | | 42,713,832 | |

See Notes to the Financial Statements

Great Lakes Large Cap Value Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| MONEY MARKET FUND – 0.7% | | | | | | |

First American Government Obligations Fund – Class Z, 0.15%^ | | | | | | |

| Total Money Market Fund | | | | | | |

| (Cost $297,332) | | | 297,332 | | | $ | 297,332 | |

| Total Investments – 100.2% | | | | | | | | |

| (Cost $35,369,513) | | | | | | | 43,011,164 | |

| Other Assets and Liabilities, Net – (0.2)% | | | | | | | (77,020 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 42,934,144 | |

| * | Non-income producing security. |

| ADR – American Depositary Receipt |

| ^ | The rate shown is the annualized seven-day effective yield as of March 31, 2022. |

The Global Industry Classification Standard (“GICS”®) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Great Lakes Small Cap Opportunity Fund

Schedule of Investments

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.2% | | | | | | |

| | | | | | | |

| Communication Services – 5.1% | | | | | | |

Manchester United plc – Class A (a) | | | 54,097 | | | $ | 782,783 | |

TripAdvisor, Inc.* | | | 35,130 | | | | 952,726 | |

| | | | | | | | 1,735,509 | |

| | | | | | | | | |

| Consumer Discretionary – 13.4% | | | | | | | | |

Cheesecake Factory Inc. (a)* | | | 18,872 | | | | 750,917 | |

frontdoor, Inc.* | | | 29,558 | | | | 882,306 | |

Garrett Motion, Inc.* | | | 60,771 | | | | 436,943 | |

Gildan Activewear, Inc. | | | 14,044 | | | | 526,369 | |

Green Brick Partners, Inc.* | | | 15,522 | | | | 306,715 | |

Mattel, Inc.* | | | 22,409 | | | | 497,704 | |

Stitch Fix, Inc. – Class A* | | | 23,902 | | | | 240,693 | |

Urban Outfitters, Inc. (a)* | | | 35,762 | | | | 897,984 | |

| | | | | | | | 4,539,631 | |

| | | | | | | | | |

| Consumer Staples – 1.0% | | | | | | | | |

Sprouts Farmers Market, Inc. (a)* | | | 10,752 | | | | 343,849 | |

| | | | | | | | | |

| Energy – 4.8% | | | | | | | | |

Dril-Quip, Inc.* | | | 25,628 | | | | 957,206 | |

NOV, Inc. (a) | | | 35,029 | | | | 686,919 | |

| | | | | | | | 1,644,125 | |

| | | | | | | | | |

| Financials – 23.6% | | | | | | | | |

Axis Capital Holdings Ltd. | | | 20,667 | | | | 1,249,733 | |

Bank OZK (a) | | | 19,265 | | | | 822,615 | |

Cannae Holdings, Inc.* | | | 35,604 | | | | 851,648 | |

First American Financial Corp. | | | 12,516 | | | | 811,287 | |

Horace Mann Educators Corp. | | | 12,367 | | | | 517,312 | |

Investors Bancorp, Inc. | | | 58,783 | | | | 877,630 | |

PRA Group, Inc. (a)* | | | 19,195 | | | | 865,311 | |

PROG Holdings, Inc.* | | | 17,885 | | | | 514,551 | |

Prosperity Bancshares, Inc. (a) | | | 14,336 | | | | 994,632 | |

Pzena Investment Management, Inc. – Class A | | | 62,585 | | | | 501,932 | |

| | | | | | | | 8,006,651 | |

| | | | | | | | | |

| Health Care – 9.4% | | | | | | | | |

Haemonetics Corp.* | | | 6,280 | | | | 397,021 | |

MEDNAX, Inc. (a)* | | | 21,906 | | | | 514,353 | |

Medpace Holdings, Inc. (a)* | | | 3,466 | | | | 567,003 | |

See Notes to the Financial Statements

Great Lakes Small Cap Opportunity Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS – 98.2% (Continued) | | | | | | |

| | | | | | | |

| Health Care – 9.4% (Continued) | | | | | | |

Patterson Companies, Inc. (a) | | | 32,789 | | | $ | 1,061,380 | |

Prestige Consumer Healthcare, Inc.* | | | 12,018 | | | | 636,233 | |

| | | | | | | | 3,175,990 | |

| | | | | | | | | |

| Industrials – 16.8% | | | | | | | | |

Crane Co. | | | 9,798 | | | | 1,060,927 | |

EnerSys | | | 8,172 | | | | 609,386 | |

Flowserve Corp. | | | 28,122 | | | | 1,009,580 | |

MillerKnoll, Inc. (a) | | | 15,238 | | | | 526,625 | |

KAR Auction Services, Inc. (a)* | | | 27,751 | | | | 500,905 | |

Resideo Technologies, Inc.* | | | 19,873 | | | | 473,574 | |

Sensata Technologies Holding plc* | | | 9,716 | | | | 494,059 | |

CACI International, Inc. – Class A* | | | 1,694 | | | | 510,334 | |

UniFirst Corp. (a) | | | 2,845 | | | | 524,277 | |

| | | | | | | | 5,709,667 | |

| | | | | | | | | |

| Information Technology – 13.6% | | | | | | | | |

ACI Worldwide, Inc.* | | | 21,155 | | | | 666,171 | |

Avnet, Inc. | | | 15,917 | | | | 646,071 | |

Extreme Networks, Inc.* | | | 46,142 | | | | 563,394 | |

Knowles Corp.* | | | 31,998 | | | | 688,917 | |

Onto Innovation, Inc. (a)* | | | 4,345 | | | | 377,537 | |

Progress Software Corp. | | | 13,486 | | | | 635,056 | |

ViaSat, Inc.* | | | 21,644 | | | | 1,056,227 | |

| | | | | | | | 4,633,373 | |

| | | | | | | | | |

| Materials – 7.6% | | | | | | | | |

Berry Global Group, Inc.* | | | 15,934 | | | | 923,535 | |

NewMarket Corp. | | | 2,622 | | | | 850,524 | |

Valvoline, Inc. | | | 25,515 | | | | 805,254 | |

| | | | | | | | 2,579,313 | |

| | | | | | | | | |

| Real Estate – 2.9% | | | | | | | | |

Park Hotels & Resorts, Inc. – REIT* | | | 50,136 | | | | 979,156 | |

| Total Common Stocks | | | | | | | | |

| (Cost $31,087,982) | | | | | | | 33,347,264 | |

See Notes to the Financial Statements

Great Lakes Small Cap Opportunity Fund

Schedule of Investments – Continued

March 31, 2022

Description | | Shares | | | Value | |

| | | | | | | |

| MONEY MARKET FUND – 1.9% | | | | | | |

First American Government Obligations Fund – Class Z, 0.15%^ | | | | | | |

| Total Money Market Fund | | | | | | |

| (Cost $645,022) | | | 645,022 | | | $ | 645,022 | |

| | | | | | | | | |

| INVESTMENTS PURCHASED WITH | | | | | | | | |

| PROCEEDS FROM SECURITIES LENDING – 27.0% | | | | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 0.41%^ | | | | | | | | |

| Total Investments Purchased with | | | | | | | | |

| Proceeds from Securities Lending | | | | | | | | |

| (Cost $9,148,350) | | | 9,148,350 | | | | 9,148,350 | |

| Total Investments – 127.1% | | | | | | | | |

| (Cost $40,881,354) | | | | | | | 43,140,636 | |

| Other Assets and Liabilities, Net – (27.1)% | | | | | | | (9,199,955 | ) |

| Total Net Assets – 100.0% | | | | | | $ | 33,940,681 | |

| (a) | All or a portion of this security was out on loan at March 31, 2022. Total loaned securities had a market value of $8,914,020 at March 31, 2022. |

| * | Non-income producing security. |

| REIT – Real Estate Investment Trust |

| ^ | The rate shown is the annualized seven-day effective yield as of March 31, 2022. |

The Global Industry Classification Standard (“GICS”®) was developed by and is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use.

See Notes to the Financial Statements

Great Lakes Funds

Statements of Assets and Liabilities

March 31, 2022

| | | | | | | | | Small Cap | |

| | | Disciplined | | | Large Cap | | | Opportunity | |

| | | Equity Fund | | | Value Fund | | | Fund | |

| ASSETS | | | | | | | | | |

| Investment securities: | | | | | | | | | |

| At cost | | $ | 25,713,028 | | | $ | 35,369,513 | | | $ | 40,881,354 | |

At value(1) | | $ | 28,487,430 | | | | | | | $ | 43,140,636 | |

| Cash | | | — | | | | 2,111 | | | | — | |

| Dividends & interest receivable | | | 12,260 | | | | 38,925 | | | | 38,520 | |

| Receivable for capital shares sold | | | 200,092 | | | | 47,573 | | | | 3,830 | |

| Interest receivable from securities lending | | | — | | | | — | | | | 820 | |

| Receivable for adviser reimbursements | | | 1,215 | | | | — | | | | — | |

| Prepaid expenses | | | 11,741 | | | | 9,824 | | | | 17,678 | |

| Total Assets | | | 28,712,738 | | | | 43,109,597 | | | | 43,201,484 | |

| LIABILITIES | | | | | | | | | | | | |

| Payable upon return of securities loaned (See Note 9) | | | — | | | | — | | | | 9,148,350 | |

| Payable for capital shares redeemed | | | 79,963 | | | | 102,456 | | | | 25,596 | |

| Payable to investment adviser | | | — | | | | 10,938 | | | | 12,714 | |

| Payable for fund administration & accounting fees | | | 23,441 | | | | 22,199 | | | | 25,901 | |

| Payable for compliance fees | | | 3,951 | | | | 3,950 | | | | 3,947 | |

| Payable for transfer agent fees & expenses | | | 5,761 | | | | 6,016 | | | | 10,378 | |

| Payable for custody fees | | | 1,087 | | | | 804 | | | | 993 | |

| Payable for audit and tax fees | | | 16,997 | | | | 17,000 | | | | 17,501 | |

| Payable for trustee fees | | | 4,607 | | | | 4,606 | | | | 2,365 | |

| Accrued other fees | | | 8,514 | | | | 7,484 | | | | 8,592 | |

| Accrued distribution fees – Investor Class | | | — | | | | — | | | | 4,466 | |

| Total Liabilities | | | 144,321 | | | | 175,453 | | | | 9,260,803 | |

| NET ASSETS | | $ | 28,568,417 | | | $ | 42,934,144 | | | $ | 33,940,681 | |

| COMPOSITION OF NET ASSETS | | | | | | | | | | | | |

| Paid-in capital | | $ | 25,412,463 | | | $ | 32,429,964 | | | $ | 28,064,426 | |

| Total distributable earnings | | | 3,155,954 | | | | 10,504,180 | | | | 5,876,255 | |

Total net assets | | $ | 28,568,417 | | | $ | 42,934,144 | | | $ | 33,940,681 | |

(1) Includes loaned securities of: | | $ | — | | | $ | — | | | $ | 8,914,020 | |

| | | | | | | | | | | | | |

Investor Class Shares: | | | | | | | | | | | | |

| Net Assets | | $ | — | | | $ | — | | | $ | 4,693,428 | |

Shares issued and outstanding(2) | | | — | | | | — | | | | 262,933 | |

| Net asset value, offering price, and redemption price per share | | $ | — | | | $ | — | | | $ | 17.85 | |

| | | | | | | | | | | | | |

Institutional Class Shares: | | | | | | | | | | | | |

| Net Assets | | $ | 28,568,417 | | | $ | 42,934,144 | | | $ | 29,247,253 | |

Shares issued and outstanding(2) | | | 2,604,603 | | | | 2,738,765 | | | | 1,603,182 | |

| Net asset value, offering price, and redemption price per share | | $ | 10.97 | | | $ | 15.68 | | | $ | 18.24 | |

| (2) | Unlimited shares authorized without par value. |

See Notes to the Financial Statements

Great Lakes Funds

Statements of Operations

For the Year Ended March 31, 2022

| | | | | | | | | Small Cap | |

| | | Disciplined | | | Large Cap | | | Opportunity | |

| | | Equity Fund | | | Value Fund | | | Fund | |

| INVESTMENT INCOME: | | | | | | | | | |

| Interest income | | $ | 90 | | | $ | 306 | | | $ | 299 | |

| Dividend income | | | 415,269 | | | | 814,496 | | | | 565,308 | |

| Less: Foreign taxes withheld | | | (111 | ) | | | (8,497 | ) | | | (3,124 | ) |

| Securities lending income | | | — | | | | — | | | | 6,664 | |

| Total investment income | | | 415,248 | | | | 806,305 | | | | 569,147 | |

| | | | | | | | | | | | | |

| EXPENSES: | | | | | | | | | | | | |

| Investment advisory fees (See Note 4) | | | 186,893 | | | | 254,286 | | | | 294,913 | |

| Fund administration & accounting fees (See Note 4) | | | 71,305 | | | | 68,745 | | | | 78,953 | |

| Federal & state registration fees | | | 22,069 | | | | 13,066 | | | | 33,455 | |

| Audit and tax fees | | | 20,500 | | | | 20,500 | | | | 21,000 | |

| Trustee fees | | | 18,463 | | | | 18,463 | | | | 16,219 | |

| Transfer agent fees & expenses (See Note 4) | | | 16,658 | | | | 17,684 | | | | 31,103 | |

| Compliance fees (See Note 4) | | | 12,045 | | | | 12,045 | | | | 12,041 | |

| Legal fees | | | 10,773 | | | | 10,773 | | | | 10,766 | |

| Custody fees (See Note 4) | | | 7,363 | | | | 4,530 | | | | 5,319 | |

| Other fees | | | 6,498 | | | | 6,506 | | | | 6,986 | |

| Postage & printing fees | | | 4,109 | | | | 4,114 | | | | 5,051 | |

| Insurance fees | | | 1,821 | | | | 1,866 | | | | 1,887 | |

| Distribution fees – Investor Class (See Note 5) | | | — | | | | — | | | | 12,677 | |

| Total expenses before interest expense and waiver | | | 378,497 | | | | 432,578 | | | | 530,370 | |

| Interest expense (See Note 10) | | | 417 | | | | 65 | | | | — | |

| Total expenses before waiver | | | 378,914 | | | | 432,643 | | | | 530,370 | |

| Less: Fee waiver from investment adviser (See Note 4) | | | (114,024 | ) | | | (72,339 | ) | | | (31,096 | ) |

| Total net expenses | | | 264,890 | | | | 360,304 | | | | 499,274 | |

| NET INVESTMENT INCOME | | | 150,358 | | | | 446,001 | | | | 69,873 | |

| | | | | | | | | | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments | | | 8,597,594 | | | | 6,430,721 | | | | 7,731,248 | |

| Foreign currency translation | | | — | | | | (19 | ) | | | — | |

| Net change in unrealized appreciation/depreciation of: | | | | | | | | | | | | |

| Investments | | | (5,199,571 | ) | | | (2,053,008 | ) | | | (6,943,913 | ) |

| Foreign currency translation | | | — | | | | 16 | | | | — | |

| Net realized and unrealized gain on investments | | | 3,398,023 | | | | 4,377,710 | | | | 787,335 | |

| | | | | | | | | | | | | |

| NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 3,548,381 | | | $ | 4,823,711 | | | $ | 857,208 | |

See Notes to the Financial Statements

Great Lakes Disciplined Equity Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2022 | | | March 31, 2021 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 150,358 | | | $ | 88,587 | |

| Net realized gain on investments | | | 8,597,594 | | | | 6,479,624 | |

| Net change in unrealized appreciation/depreciation of investments | | | (5,199,571 | ) | | | 7,498,133 | |

Net increase resulting from operations | | | 3,548,381 | | | | 14,066,344 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 13,647,082 | | | | 2,892,898 | |

| Proceeds from reinvestment of distributions | | | 5,633,663 | | | | 1,085,158 | |

| Payments for shares redeemed | | | (16,671,756 | ) | | | (8,689,583 | ) |

Net increase (decrease) in net assets from capital share transactions | | | 2,608,989 | | | | (4,711,527 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Total distributions to shareholders | | | (13,633,800 | ) | | | (2,562,569 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (7,476,430 | ) | | | 6,792,248 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 36,044,847 | | | | 29,252,599 | |

| End of Year | | $ | 28,568,417 | | | $ | 36,044,847 | |

See Notes to the Financial Statements

Great Lakes Large Cap Value Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2022 | | | March 31, 2021 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 446,001 | | | $ | 626,318 | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 6,430,721 | | | | 108,622 | |

| Foreign currency translation | | | (19 | ) | | | 5 | |

| Net change in unrealized appreciation/depreciation of: | | | | | | | | |

| Investments | | | (2,053,008 | ) | | | 17,035,669 | |

| Foreign currency translation | | | 16 | | | | 36 | |

Net increase resulting from operations | | | 4,823,711 | | | | 17,770,650 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 6,043,017 | | | | 1,935,310 | |

| Proceeds from reinvestment of distributions | | | 1,063,690 | | | | 294,289 | |

| Payments for shares redeemed | | | (9,828,191 | ) | | | (11,985,518 | ) |

Net decrease in net assets from capital share transactions | | | (2,721,484 | ) | | | (9,755,919 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From distributable earnings | | | (3,697,176 | ) | | | (904,201 | ) |

| From return of capital | | | — | | | | (4,900 | ) |

Total distributions to shareholders | | | (3,697,176 | ) | | | (909,101 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (1,594,949 | ) | | | 7,105,630 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 44,529,093 | | | | 37,423,463 | |

| End of Year | | $ | 42,934,144 | | | $ | 44,529,093 | |

See Notes to the Financial Statements

Great Lakes Small Cap Opportunity Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | March 31, 2022 | | | March 31, 2021 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 69,873 | | | $ | 139,709 | |

| Net realized gain (loss) on investments | | | 7,731,248 | | | | (36,665 | ) |

| Net change in unrealized appreciation/depreciation of investments | | | (6,943,913 | ) | | | 26,989,577 | |

Net increase resulting from operations | | | 857,208 | | | | 27,092,621 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Investor Class: | | | | | | | | |

| Proceeds from shares sold | | | 22,194 | | | | 152,593 | |

| Proceeds from reinvestment of distributions | | | 279,289 | | | | 28,798 | |

| Payments for shares redeemed | | | (595,918 | ) | | | (4,643,391 | ) |

| Decrease in net assets from Investor Class transactions | | | (294,435 | ) | | | (4,462,000 | ) |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 4,573,274 | | | | 3,309,932 | |

| Proceeds from reinvestment of distributions | | | 1,721,941 | | | | 250,539 | |

| Payments for shares redeemed | | | (19,732,256 | ) | | | (17,761,934 | ) |

| Decrease in net assets from Institutional Class transactions | | | (13,437,041 | ) | | | (14,201,463 | ) |

Net decrease in net assets from capital share transactions | | | (13,731,476 | ) | | | (18,663,463 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net Distributions to Shareholders – Investor Class | | | (279,344 | ) | | | (28,802 | ) |

| Net Distributions to Shareholders – Institutional Class | | | (2,461,252 | ) | | | (387,358 | ) |

Total distributions to shareholders | | | (2,740,596 | ) | | | (416,160 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (15,614,864 | ) | | | 8,012,998 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of Year | | | 49,555,545 | | | | 41,542,547 | |

| End of Year | | $ | 33,940,681 | | | $ | 49,555,545 | |

See Notes to the Financial Statements

Great Lakes Disciplined Equity Fund

Financial Highlights

For a Fund share outstanding throughout the year

Institutional Class

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Common Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 19.02 | | | $ | 13.43 | | | $ | 14.97 | | | $ | 15.16 | | | $ | 15.61 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.08 | | | | 0.05 | | | | 0.13 | | | | 0.13 | | | | 0.15 | |

| Net realized and unrealized gain (loss) on investments | | | 2.02 | | | | 6.89 | | | | (1.08 | ) | | | 1.13 | | | | 1.87 | |

| Total from investment operations | | | 2.10 | | | | 6.94 | | | | (0.95 | ) | | | 1.26 | | | | 2.02 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.08 | ) | | | (0.05 | ) | | | (0.13 | ) | | | (0.14 | ) | | | (0.15 | ) |

| Net realized gains | | | (10.07 | ) | | | (1.30 | ) | | | (0.46 | ) | | | (1.31 | ) | | | (2.32 | ) |

| Total distributions | | | (10.15 | ) | | | (1.35 | ) | | | (0.59 | ) | | | (1.45 | ) | | | (2.47 | ) |

Net asset value, end of year | | $ | 10.97 | | | $ | 19.02 | | | $ | 13.43 | | | $ | 14.97 | | | $ | 15.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 8.72 | % | | | 52.43 | % | | | -6.88 | % | | | 9.22 | % | | | 12.76 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, at end of year (000’s) | | $ | 28,568 | | | $ | 36,045 | | | $ | 29,253 | | | $ | 42,835 | | | $ | 44,160 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.22 | % | | | 1.13 | % | | | 0.98 | % | | | 0.95 | % | | | 0.95 | % |

| After expense waiver | | | 0.85 | % | | | 0.86 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses excluding interest | | | | | | | | | | | | | | | | | | | | |

expense to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.22 | % | | | 1.12 | % | | | 0.98 | % | | | 0.95 | % | | | 0.95 | % |

| After expense waiver | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to average net assets: | | | | | | | | | | | | | | | | | | | | |

| After expense waiver | | | 0.48 | % | | | 0.25 | % | | | 0.85 | % | | | 0.85 | % | | | 0.91 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio Turnover Rate | | | 163 | % | | | 99 | % | | | 97 | % | | | 107 | % | | | 104 | % |

See Notes to the Financial Statements

Great Lakes Large Cap Value Fund

Financial Highlights

For a Fund share outstanding throughout the year

Institutional Class

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | March 31, | | | March 31, | | | March 31, | | | March 31, | | | March 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Per Common Share Data | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 15.36 | | | $ | 10.09 | | | $ | 12.75 | | | $ | 14.29 | | | $ | 15.23 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.17 | | | | 0.19 | | | | 0.22 | | | | 0.25 | | | | 0.20 | |

| Net realized and unrealized gain (loss) on investments | | | 1.60 | | | | 5.36 | | | | (2.19 | ) | | | (0.08 | ) | | | 1.01 | |

| Total from investment operations | | | 1.77 | | | | 5.55 | | | | (1.97 | ) | | | 0.17 | | | | 1.21 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.17 | ) | | | (0.19 | ) | | | (0.22 | ) | | | (0.25 | ) | | | (0.20 | ) |

| Net realized gains | | | (1.28 | ) | | | (0.09 | ) | | | (0.47 | ) | | | (1.46 | ) | | | (1.95 | ) |

| Return of capital | | | — | | | | (0.00 | )(1) | | | — | | | | — | | | | — | |

| Total distributions | | | (1.45 | ) | | | (0.28 | ) | | | (0.69 | ) | | | (1.71 | ) | | | (2.15 | ) |

Net asset value, end of year | | $ | 15.68 | | | $ | 15.36 | | | $ | 10.09 | | | $ | 12.75 | | | $ | 14.29 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 11.93 | % | | | 55.58 | % | | | -16.64 | % | | | 1.98 | % | | | 7.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

Net assets, at end of year (000’s) | | $ | 42,934 | | | $ | 44,529 | | | $ | 37,423 | | | $ | 46,804 | | | $ | 50,135 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense waiver | | | 1.02 | % | | | 1.04 | % | | | 0.93 | % | | | 0.90 | % | | | 0.90 | % |