| | Annual Report |

| |

| |

| |

| |

| |

| |

| |

| |

| | | |

December 31, 2021

Friess Funds

Friess Small Cap Growth Fund – Institutional Class – SCGFX

Friess Small Cap Growth Fund – Investor Class – SCGNX

Friess Brandywine Fund – Class I – FBRWX

Friess Brandywine Blue Fund – Class I – FBLUX

friessfunds.com

(This Page Intentionally Left Blank.)

| Friess Funds

Annual Report | |

| |

| |

| |

| |

|

| December 31, 2021 |

| | |

| | | |

Dear Fellow Shareholders:

After a shaky September, major market indexes returned to positive form in the year’s final quarter. Investors looked past potential problems, including resurging Covid-19 cases, as individual-company earnings trends provided reason for continued optimism in stocks.

Returns showed lingering caution in the small-cap category, with enthusiasm greatest among the higher rungs of the market-cap ladder.

Friess Brandywine Fund grew 9.15 percent in the three months through December. The Russell 3000® and Russell 3000® Growth Indexes gained 9.28 and 10.89 percent during that time. Friess Brandywine Blue Fund grew 7.94 percent in the quarter as the S&P 500, Russell 1000® and Russell 1000® Growth Indexes gained 11.03, 9.78 and 11.64 percent.

Friess Small Cap Growth Fund’s Institutional Class shares grew 7.18 percent in the December quarter. The Russell 2000® Index gained 2.14 percent while the Russell 2000® Growth Index was mostly unchanged at 0.01 percent.

Recent results capped off a year in which performance for the Friess Small Cap Growth Fund diverged sharply from small-cap growth stocks as a group. The Fund’s institutional class shares grew 32.68 percent in 2021 versus a 2.83 percent return in the Russell 2000® Growth Index. The Russell 2000® Index gained 14.82 for the calendar year. The Fund outperformed both indexes in each of the year’s four quarters.

September’s volatility carried into early October amid uncertainty related to political tension surrounding the nation’s debt ceiling, the tax implications of proposed government spending and a less accommodative Federal Reserve Bank. Compromise and clear messaging assuaged these concerns as third-quarter earnings reporting season got into full swing.

Third-quarter results, especially among the high-profile companies in the S&P 500 Index, were marked by an above-average rate of positive surprises and upward revisions, bolstering investor confidence in the ability of companies to overcome headwinds such as supply chain disruptions, labor shortages and inflation.

Just in time for the holidays, SARS-CoV-2 gave us variant B.1.1.529. First identified from a specimen collected on November 9, the latest version of the novel coronavirus came to the attention of the World Health Organization on November 24. WHO deemed the fast-spreading mutation a “variant of concern” on November 26. Omicron ultimately became the most consequential story of the final month of 2021 as infection rates soared to new pandemic highs.

After initially weighing on the market, investor enthusiasm resurfaced as evidence suggested that omicron, although highly contagious, typically resulted in less severe Covid-19 infections. The combination of economic and epidemiological optimism contributed to positive sentiment to close out the December quarter.

Technology holdings contributed the most to Brandywine’s absolute and relative performance by a wide margin. They represented the largest concentration of portfolio assets while outperforming the sector within the Russell 3000® Growth Index.

Expectation-beating earnings strength was a common characteristic among Brandywine’s top performers. Calix, which makes broadband access equipment for communications service providers, exceeded the third-quarter consensus earnings estimate by 23 percent, reported record quarterly revenue and raised guidance. The company said it was starting the year’s final quarter “in the strongest financial position in our history.” Other top performers, including Marvell Technology, SiTime Corp. and Teradyne, also exceeded earnings estimates in their most recently reported quarter.

The communications services sector was the only material detractor from Brandywine’s absolute return. Magnite, which operates a digital ad buying platform, was the biggest detractor after citing stalled supply chains among customers, soft travel-related spending and comparisons to year-ago results boosted by political advertising for its in-line third-quarter results. The sector was the second biggest detractor from relative results. Consumer discretionary holdings, while contributors to absolute performance, were the biggest detractors from relative results.

Technology holdings also contributed the most to Brandywine Blue’s absolute return. The Fund held several top performers in common with Brandywine, including Marvell Technology, Teradyne and Advanced Micro Devices. Technology holdings represented the second largest portfolio position and the second biggest contributor to performance versus the Russell 1000® Growth Index. Health care holdings, including Pfizer and Tenet Healthcare Corp., were the most significant influence on Brandywine Blue’s relative results.

friessfunds.com

Representing Brandywine Blue’s largest commitment, consumer discretionary holdings contributed to absolute performance, but detracted the most from relative results. Delivery service provider DoorDash was a notable detractor. Shares retreated from their highs in November following a benefits-related settlement with San Francisco drivers and selling among company insiders. Communications services holdings detracted the most from absolute performance and the second most from relative results, led by declines in Walt Disney Co. and Electronic Arts.

Technology holdings, including Calix and Alpha & Omega Semiconductor Ltd., contributed the most to Friess Small Cap Growth Fund’s absolute and relative December-quarter results. Technology represented the largest portfolio position while outperforming the sector within the Russell 2000® Growth Index. Alpha & Omega earned of $1.06 per share in the third quarter, up from $0.55 in the year-ago period and ahead of the consensus estimate.

Industrial holdings represented Friess Small Cap Growth Fund’s second largest sector and contributed the second most to absolute and relative performance. Encore Wire Corp. was a standout contributor. Encore Wire reported third-quarter earnings of $8.51 per share, up from $1.02 the year before. The consensus estimate was $2.92 per share.

For more information on the companies that influenced December-quarter performance, please see Roses & Thorns on page 10 for Brandywine, page 15 for Brandywine Blue and page 5 for Friess Small Cap Growth Fund.

Thanks for your confidence in our research-driven investment approach and the team that implements it. We’re grateful for the opportunity to serve you. Best wishes from your entire Friess team.

Scott Gates

Chief Investment Officer

Management’s Discussion of Results

Investors maintained a positive bias in the 12 months through December 31, 2021, with a particular affinity for large-cap companies. The S&P 500 Index advanced in 11 out of the year’s 12 months and set 70 new all-time highs during the period. Although smaller companies also fared well, their performance became more mixed as risk tolerance appeared to ebb amid rising inflation and impending action by the Federal Reserve Bank to arrest it.

The Friess Funds employ an investment strategy that is based on the premise that company-specific fundamentals, with a particular emphasis on earnings, drive stock prices. While conceding that broader trends influence stocks as a group during certain periods, this approach considers such periods to be finite, with investors ultimately returning to judge each company on its individual merits over time.

The Funds seek to capitalize on the relationship between earnings and stock prices by isolating companies with superior earnings profiles that show promise to exceed consensus earnings expectations. This approach was mostly effective in 2021 as investors appeared to emphasize earnings in determining share prices.

Buoyed by stimulative monetary policy and massive government spending, stocks carried the previous year’s momentum into 2022 despite developments with potential to move the market, including an attack on the U.S. Capitol and the collapse of a major hedge fund. In fact, speculative excess appeared to be a notable risk at the beginning of the year. Shares of Gamestop Corp. rose more than 2,000 percent in the first quarter due to coordinated efforts among users of the Robinhood trading app. At its peak share price in February, Tesla’s market value was 10 times higher than General Motors, the nation’s largest car maker.

Positive sentiment continued into the second quarter, though the market’s speculative streak dissipated as investors were forced to confront the potentially troubling side effects of the government’s enthusiastic economic intervention. May’s inflation rate represented the biggest year-over-year gain since 2008, sparking concern. Amid otherwise positive data points and assurances from the Federal Reserve Bank, investors concluded that more time was needed to determine whether inflation should figure prominently in their thinking.

Seemingly unshakable throughout the first half of the year, investor sentiment ultimately turned during the third quarter. After a mostly uneventful summer, stocks declined in September as inflation persisted and the coronavirus remained a lingering threat to public health and economic normalcy. Supply chain bottlenecks, a political showdown over the debt ceiling and a looming crisis at a Chinese company that is world’s most indebted property developer rounded out the list of matters that sapped enthusiasm for stocks in the quarter.

The market’s mood quickly improved in the fourth quarter as companies began delivering third-quarter earnings reports. The results continued a strong operational showing in 2021 and relieved fears about companies being able to overcome challenges related to labor availability, supply

Friess Funds

Management’s Discussion of Results (Continued)

chain functionality and inflation. Even concerns regarding the emergence of the new omicron variant of the coronavirus faded as early reports showed it to typically result in less severe infections.

Friess Small Cap Growth Fund

Friess Small Cap Growth Fund’s institutional class shares grew 32.68 percent in 2021 versus a 2.83 percent return in its primary benchmark, the Russell 2000® Growth Index. The Fund outperformed the index in each of the year’s four quarters.

Technology holdings, which comprised the largest percentage of assets during the period, contributed the most to absolute and relative results. They represented an overweight position versus the index and outperformed the sector within the benchmark by a wide margin.

Voyager Digital Ltd., which provides cryptocurrency brokerage services, and Calix, which makes broadband access equipment, were top contributors. Voyager reached an earnings inflection point and became profitable during the year amid surging cryptocurrency trading volume. Calix exceeded earning estimates in each quarter it reported during the year as demand for its products increased along with video streaming.

Holdings from the industrial sector were the second biggest contributors to absolute and relative performance. Representing the third largest concentration of assets and an overweight position relative to the index, they outperformed the sector within the benchmark. Encore Wire Corp. was a notable contributor. Purchased in April, the company exceeded the consensus estimate in the subsequent three quarters it reported by 131, 541 and 192 percent.

Health care holdings detracted from absolute performance. Bioanalytical product maker Aspira Women’s Health, surgical instrument manufacturer Axogen and therapy device maker Neuronetics were among the most significant detractors. Although health care holdings underperformed the sector, the portfolio’s underweight position versus the index helped make health care holdings contributors to relative results.

Friess Brandywine Fund

Friess Brandywine Fund grew 7.40 percent from its July 6 inception through December. Its primary benchmark, the Russell 3000 Growth Index gained 9.73 percent in that period.

Technology holdings contributed the most to absolute and relative results. Representing the largest percentage of assets, they outperformed the sector within the benchmark. Despite their leading presence in the portfolio, technology holdings represented an underweight position relative to the index, which ate into their relative performance advantage.

SiTime Corp. and Marvell Technology were standout performers. Both companies were original portfolio holdings for Brandywine’s debut. Both companies exceeded consensus earnings estimates in the two quarters they reported after being purchased.

Communications services holdings, including Magnite and Roblox Corp., detracted the most from absolute performance. They underperformed versus the sector within the benchmark, helping make them the second biggest detractors from relative results. Consumer discretionary holdings, which were a modest drag on absolute performance, detracted the most from relative performance. They comprised the second largest concentration of assets.

Friess Brandywine Blue Fund

Friess Brandywine Blue Fund grew 10.75 percent from its July 6 inception through December as its primary benchmark, the Russell 1000 Growth Index, gained 10.75 percent.

Technology holdings contributed the most to absolute performance. They represented the second largest percentage of assets and outperformed the sector within the benchmark. The Fund shared top performers with Brandywine such as Marvell Technology, Advanced Micro Devices and Teradyne. Technology holdings were the second biggest relative performance contributors.

Health care holdings contributed the most to performance relative to the benchmark. The portfolio was equal weighted versus the index, with health care holdings outperforming the sector within the benchmark. Pfizer and Thermo Fisher Scientific, which both topped expectations in their most recently reported quarter, were standouts.

Holdings from the communications services sector weighed the most on absolute and relative results. Magnite, Roblox and Walt Disney Co. were among the detractors Brandywine Blue held in common with Brandywine.

Friess Small Cap Growth Fund

Portfolio Characteristics as of December 31, 2021 (Unaudited)

Top Ten Equity Holdings(1)

Security Name | % of Net Assets | % Change from Book Cost |

| Hovnanian Enterprises, Inc., Class A | | | 3.5 | % | | | | 8.3 | % | |

| Identiv, Inc. | | | 3.2 | % | | | | 78.0 | % | |

| NV5 Global, Inc. | | | 3.0 | % | | | | 51.2 | % | |

| ArcBest Corp. | | | 2.9 | % | | | | 44.0 | % | |

| Kornit Digital Ltd. | | | 2.9 | % | | | | 288.6 | % | |

| Silicon Motion Technology Corp. - ADR | | | 2.8 | % | | | | 32.8 | % | |

| Academy Sports & Outdoors, Inc. | | | 2.7 | % | | | | 27.3 | % | |

| Encore Wire Corp. | | | 2.7 | % | | | | 101.7 | % | |

| SMART Global Holdings, Inc. | | | 2.5 | % | | | | 20.0 | % | |

| Calix, Inc. | | | 2.5 | % | | | | 282.8 | % | |

| Top Ten as a Group | | | 28.7 | % | | | | | | |

Top Ten Industry Groups(1)

(% of Net Assets)

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Includes money market deposit account. |

Friess Small Cap Growth Fund

December Quarter “Roses & Thorns” (Unaudited)

| | $ Gain | | | | |

| Biggest $ Winners | (in thousands) | % Gain | | Reasons for Move | |

Alpha & Omega Semiconductor Ltd. (AOSL) | $859 | 92.0 | | The maker of power-related semiconductor products benefitted amid strong demand. As a vertically integrated chipmaker, the company did not experience the allocation pressures that were common among fabless semiconductor companies. September-quarter earnings grew 93 percent, beating the consensus estimate by 12 percent. The company’s 23 percent revenue growth also exceeded expectations. | |

Calix Inc. (CALX) | $563 | 46.7 | | Calix, which makes broadband access equipment used by communications service providers, reported record third-quarter revenue and expectation-beating earnings. “We start the fourth quarter of 2021 in the strongest financial position in our history with robust bookings, clear customer and product focus and believe we are perfectly placed to execute on the opportunity ahead,” the company stated in its release. | |

Encore Wire Corp. (WIRE) | $531 | 49.3 | | Encore supplies building wire for interior electrical wiring used in residential homes and commercial buildings. September-quarter earnings grew more than 700 percent as sales doubled and gross profit margins expanded amid higher costs for copper and aluminum. The company benefitted from its ability to meet customer demand at a time when supply chain constraints weighed on smaller competitors. | |

Identiv Inc. (INVE) | $520 | 49.4 | | Identiv, which makes physical access control and video, logical access control, credentials, and RFID inlays and tags, grew September-quarter earnings per share to $0.09 from $0.01 a year ago, beating the consensus estimate by 50 percent. The company benefited from tailwinds in both its on-premises and identity segments, with the latter tied to the RFID market. | |

ArcBest Corp. (ARCB) | $432 | 43.7 | | The provider of trucking and logistics services benefitted as strong demand led to higher volume and pricing. Additionally, the company has been successful in attracting and retaining drivers in a challenging staffing environment. September-quarter earnings more than doubled from year ago levels, beating the consensus estimate. | |

| | | | | | |

| | $ Loss | | | | |

| Biggest $ Losers | (in thousands) | % Loss | | Reasons for Move | |

PLx Pharma Inc. (PLXP) | $715 | 58.5 | | The pharmaceutical company’s shares began the quarter trading near highs on enthusiasm for retail acceptance for its new product Vazalore, a liquid-filled aspirin capsule designed to avoid stomach-related issues associated with traditional aspirin. Shares declined amid uncertainty stemming from U.S. Preventative Services Task Force guidance against using aspirin as a preventative measure against cardiovascular disease. The guidance was not new information and it did not apply to Vazalore’s target customer, patients who experienced a cardiac event who take aspirin to prevent another heart attack or stroke. | |

Scorpio Tankers Inc. (STNG) | $352 | 32.7 | | While spot rates for large ocean tankers that transport petroleum-derived products showed signs of improvement, shares traded with near-term demand for energy that was seen as limited by resurging Covid-19 cases. | |

Axogen Inc. (AXGN) | $347 | 40.7 | | Axogen makes medical and surgical instruments used in peripheral nerve reconstruction and regeneration. While the company exceeded third-quarter earnings expectations, third-quarter revenue and fourth-quarter guidance came in below expectations. Axogen cited delayed procedures and hospital staffing shortages stemming from the pandemic as contributing factors. | |

Stronghold Digital Mining Inc. (SDIG) | $346 | 31.5 | | Shares of Stronghold Digital Mining, which focuses on mining Bitcoin, declined as Bitcoin decreased in value following the Federal Reserve’s announced intention to accelerate its plans to taper its bond buying program. Also, technology supply chain constraints delayed the company’s ability to add mining capacity at its forecasted pace. | |

Sientra Inc. (SIEN) | $333 | 36.3 | | The company, which makes implants used in cosmetic and reconstructive surgical procedures, exceeded September-quarter expectations for earnings and revenue. Shares declined as resurging Covid-19 hospitalizations raised concerns about potential for a downturn in elective procedures. | |

All gains/losses are calculated on an average cost basis from September 30, 2021 through December 31, 2021.

This commentary reflects the viewpoints of Friess Associates, LLC as of December 31, 2021, and is not intended as a forecast or guarantee of future results.

Friess Small Cap Growth Fund

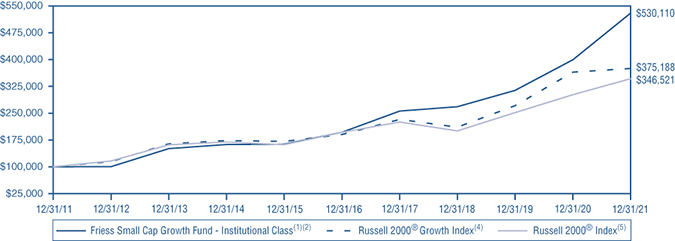

Value of $100,000 Investment (Unaudited)

The chart assumes an initial investment of $100,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-656-3017. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | One Year | Five Years | Ten Years | Since Inception |

Institutional Class(1)(2) | 32.68% | 21.93% | 18.15% | 11.38% |

Investor Class(1)(3) | 32.39% | 21.63% | 17.86% | 11.10% |

Russell 2000® Growth Index(4) | 2.83% | 14.53% | 14.14% | 11.73% |

Russell 2000® Index(5) | 14.82% | 12.02% | 13.23% | 11.04% |

(1) | Fund commenced operations on May 31, 2017. |

(2) | The performance data quoted for the period prior to May 31, 2017, is that of the Series B Units of the Friess Small Cap Trust (the “Predecessor Fund”) and has not been adjusted to reflect the Fund’s share class’ fees and expenses and would be lower if reflected. The Predecessor Fund commenced operations on August 6, 2002 and was not a registered mutual fund subject to the same investment and tax restrictions as the Fund. If it had been, the Predecessor Fund’s performance might have been lower. The Predecessor Fund’s shares were exchanged for the Fund’s Institutional Class shares on May 31, 2017. |

(3) | Performance for the Investor Class prior to the inception of the class is based on the performance of the Predecessor Fund, adjusted for the higher expenses applicable to the class as compared to the Institutional Class. |

(4) | The Russell 2000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 2000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 2000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

(5) | The Russell 2000® Index measures the performance of approximately 2,000 of the largest securities based on a combination of their market cap and current index membership. Unlike the Fund, the Russell 2000® Index is unmanaged, is not available for investment, and does not incur expenses. |

The performance shown represents past performance and is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. From time to time, the Investment Adviser has waived fees or reimbursed expenses, which may have resulted in higher returns. The listed Fund returns are net of expenses, and the listed index returns exclude expenses. Inception date for “Since Inception” performance is August 6, 2002. Operating expenses (gross) are 1.64% for the Fund’s Institutional Class and 2.13% for its Investor Class. Total operating expenses (net) are 1.20% and 1.45%, respectively, due to the Adviser’s contractual agreement, through at least April 30, 2022, to waive its management fees and/or pay Fund expenses. Fund returns would be lower if the gross expense ratio was reflected. For the most recent month-end performance, please visit the Fund’s website at www.friessfunds.com.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the period ended December 31, 2021, was 1.20% and 1.45% for the Institutional Class and Investor Class, respectively.

Friess Small Cap Growth Fund

Schedule of Investments

December 31, 2021

| Shares | | | | Cost | | | Value | |

| Common Stocks - 96.2% | | | | | | |

| | | | | | | |

| COMMUNICATION SERVICES | | | | | | |

| | | Advertising - 0.9% | | | | | | |

| | 23,745 | | Magnite, Inc.* | | $ | 405,054 | | | $ | 415,538 | |

| | | | Total Communication Services | | | 405,054 | | | | 415,538 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Apparel Retail - 2.0% | | | | | | | | |

| | 37,640 | | American Eagle | | | | | | | | |

| | | | Outfitters, Inc.+ | | | 934,498 | | | | 953,045 | |

| | | | | | | | | | | | |

| | | | Automotive Retail - 4.5% | | | | | | | | |

| | 9,172 | | Penske Automotive | | | | | | | | |

| | | | Group, Inc. | | | 693,452 | | | | 983,422 | |

| | 23,429 | | TravelCenters of | | | | | | | | |

| | | | America, Inc.* | | | 1,298,712 | | | | 1,209,405 | |

| | | | | | | | | | | | |

| | | | Education Services - 2.1% | | | | | | | | |

| | 64,071 | | Houghton Mifflin | | | | | | | | |

| | | | Harcourt Co.+* | | | 1,061,600 | | | | 1,031,543 | |

| | | | | | | | | | | | |

| | | | Footwear - 1.7% | | | | | | | | |

| | 6,617 | | Crocs, Inc.* | | | 229,644 | | | | 848,432 | |

| | | | | | | | | | | | |

| | | | Homebuilding - 8.0% | | | | | | | | |

| | 3,816 | | Cavco Industries, Inc.* | | | 929,086 | | | | 1,212,152 | |

| | 13,355 | | Hovnanian Enterprises, | | | | | | | | |

| | | | Inc., Class A* | | | 1,570,057 | | | | 1,699,958 | |

| | 18,070 | | MDC Holdings, Inc. | | | 989,519 | | | | 1,008,848 | |

| | | | | | | | | | | | |

| | | | Leisure Products - 1.5% | | | | | | | | |

| | 9,037 | | YETI Holdings, Inc.* | | | 384,362 | | | | 748,535 | |

| | | | | | | | | | | | |

| | | | Specialty Stores - 4.9% | | | | | | | | |

| | 30,421 | | Academy Sports & | | | | | | | | |

| | | | Outdoors, Inc.* | | | 1,048,724 | | | | 1,335,482 | |

| | 18,339 | | MarineMax, Inc.* | | | 465,022 | | | | 1,082,734 | |

| | | | Total Consumer Discretionary | | | 9,604,676 | | | | 12,113,556 | |

| | | | | | | | | |

| HEALTH CARE | | | | | | | | |

| | | | | | | | | | | | |

| | | | Health Care Equipment - 3.0% | | | | | | | | |

| | 54,020 | | AxoGen, Inc.* | | | 1,060,905 | | | | 506,168 | |

| | 16,525 | | Cryoport, Inc.* | | | 296,305 | | | | 977,784 | |

| | | | | | | | | | | | |

| | | | Health Care Services - 2.0% | | | | | | | | |

| | 13,331 | | Apollo Medical | | | | | | | | |

| | | | Holdings, Inc.+* | | | 911,168 | | | | 979,562 | |

| | | | | | | | | | | | |

| | | | Health Care Supplies - 2.5% | | | | | | | | |

| | 23,358 | | Figs, Inc., Class A* | | | 910,266 | | | | 643,746 | |

| | 159,479 | | Sientra, Inc.* | | | 740,366 | | | | 585,288 | |

| | | | | | | | | | | | |

| | | | Pharmaceuticals - 1.0% | | | | | | | | |

| | 63,337 | | PLx Pharma, Inc.+* | | | 623,857 | | | | 507,329 | |

| | | | Total Health Care | | | 4,542,867 | | | | 4,199,877 | |

| | | | | | | | | |

| INDUSTRIALS | | | | | | | | |

| | | | | | | | | | | | |

| | | | Air Freight & Logistics - 2.2% | | | | | | | | |

| | 12,655 | | Hub Group, Inc., Class A* | | | 838,997 | | | | 1,066,057 | |

| | | | | | | | | | | | |

| | | | Building Products - 2.2% | | | | | | | | |

| | 41,315 | | Tecnoglass, Inc.+ | | | 471,399 | | | | 1,082,040 | |

| | | | | | | | | | | | |

| | | | Construction & | | | | | | | | |

| | | | Engineering - 3.0% | | | | | | | | |

| | 10,728 | | NV5 Global, Inc.* | | | 979,766 | | | | 1,481,751 | |

| | | | | | | | | | | | |

| | | | Diversified Support | | | | | | | | |

| | | | Services - 2.1% | | | | | | | | |

| | 30,209 | | Driven Brands Holdings, Inc.* | | | 872,349 | | | | 1,015,627 | |

| | | | | | | | | | | | |

| | | | Electrical Components | | | | | | | | |

| | | | & Equipment - 2.7% | | | | | | | | |

| | 9,089 | | Encore Wire Corp. | | | 644,804 | | | | 1,300,636 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery - 5.4% | | | | | | | | |

| | 11,100 | | EnPro Industries, Inc. | | | 1,211,984 | | | | 1,221,777 | |

| | 9,286 | | Kornit Digital Ltd.* | | | 363,773 | | | | 1,413,794 | |

| | | | | | | | | | | | |

| | | | Research & Consulting | | | | | | | | |

| | | | Services - 2.0% | | | | | | | | |

| | 10,534 | | CRA International, Inc. | | | 927,917 | | | | 983,454 | |

| | | | | | | | | | | | |

| | | | Trading Companies & | | | | | | | | |

| | | | Distributors - 4.4% | | | | | | | | |

| | 6,733 | | Herc Holdings, Inc. | | | 1,145,373 | | | | 1,054,051 | |

| | 32,735 | | Titan Machinery, Inc.* | | | 874,473 | | | | 1,102,842 | |

| | | | | | | | | | | | |

| | | | Trucking - 5.3% | | | | | | | | |

| | 11,863 | | ArcBest Corp. | | | 987,321 | | | | 1,421,781 | |

| | 116,834 | | Daseke, Inc.* | | | 953,300 | | | | 1,173,013 | |

| | | | Total Industrials | | | 10,271,456 | | | | 14,316,823 | |

| | | | | | | | | |

| INFORMATION TECHNOLOGY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Application Software - 3.7% | | | | | | | | |

| | 35,809 | | Clear Secure, Inc., Class A+* | | | 1,027,603 | | | | 1,123,328 | |

| | 55,022 | | Voyager Digital Ltd.* | | | 240,294 | | | | 686,675 | |

| | | | | | | | | | | | |

| | | | Communications | | | | | | | | |

| | | | Equipment - 2.5% | | | | | | | | |

| | 15,421 | | Calix, Inc.* | | | 322,190 | | | | 1,233,217 | |

| | | | | | | | | | | | |

| | | | Electronic Equipment & | | | | | | | | |

| | | | Instruments - 3.2% | | | | | | | | |

| | 55,927 | | Identiv, Inc.* | | | 884,380 | | | | 1,573,786 | |

| | | | | | | | | | | | |

| | | | IT Consulting & | | | | | | | | |

| | | | Other Services - 2.1% | | | | | | | | |

| | 135,786 | | Information Services | | | | | | | | |

| | | | Group, Inc. | | | 1,042,039 | | | | 1,034,689 | |

| | | | | | | | | | | | |

| | | | Semiconductor | | | | | | | | |

| | | | Equipment - 6.0% | | | | | | | | |

| | 7,024 | | ACM Research, Inc., Class A* | | | 539,696 | | | | 598,936 | |

| | 16,205 | | Axcelis Technologies, Inc.* | | | 1,027,326 | | | | 1,208,245 | |

| | 19,860 | | Ultra Clean Holdings, Inc.* | | | 1,000,362 | | | | 1,139,170 | |

| | | | | | | | | | | | |

| | | | Semiconductors - 13.0% | | | | | | | | |

| | 15,154 | | Alpha & Omega | | | | | | | | |

| | | | Semiconductor Ltd.* | | | 475,982 | | | | 917,726 | |

| | 164,844 | | Pixelworks, Inc.* | | | 533,697 | | | | 725,314 | |

| | 11,654 | | Semtech Corp.* | | | 911,915 | | | | 1,036,390 | |

| | 14,472 | | Silicon Motion | | | | | | | | |

| | | | Technology Corp. - ADR | | | 1,035,401 | | | | 1,375,274 | |

| | 3,653 | | SiTime Corp.* | | | 471,674 | | | | 1,068,649 | |

| | 17,546 | | SMART Global | | | | | | | | |

| | | | Holdings, Inc.* | | | 1,038,105 | | | | 1,245,590 | |

| | | | | | | | | | | | |

| | | | Technology Hardware, | | | | | | | | |

| | | | Storage & Peripherals - 2.3% | | | | | | | | |

| | 45,446 | | Stratasys Ltd.* | | | 1,062,441 | | | | 1,112,972 | |

| | | | Total Information Technology | | | 11,613,105 | | | | 16,079,961 | |

| | | | | | | | | | | | |

| | | | Total Common Stocks | | | 36,437,158 | | | | 47,125,755 | |

See Notes to the Financial Statements.

Friess Small Cap Growth Fund

Schedule of Investments (Continued)

December 31, 2021

| Shares | | | | Cost | | | Value | |

| Short-Term Investment - 4.0% | | | | | | |

| | | | | | | | | |

| | | Money Market | | | | | | |

| | | Deposit Account - 4.0% | | | | | | |

| | 1,942,857 | | U.S. Bank N.A., 0.00%^ | | $ | 1,942,857 | | | $ | 1,942,857 | |

| | | | Total Money Market | | | | | | | | |

| | | | Deposit Account | | | 1,942,857 | | | | 1,942,857 | |

| | | | | | | | | | | | |

| | | | Total Short-Term Investment | | | 1,942,857 | | | | 1,942,857 | |

| | | | | | | | | | | | |

| Investment Purchased | | | | | | | | |

| With The Cash Proceeds | | | | | | | | |

| From Securities Lending - 8.6% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Investment Company - 8.6% | | | | | | | | |

| | 4,229,384 | | Mount Vernon Liquid Asset | | | | | | | | |

| | | | Portfolio, LLC, 0.12%# | | | 4,229,384 | | | | 4,229,384 | |

| | | | Total Investment Company | | | 4,229,384 | | | | 4,229,384 | |

| | | | | | | | | | | | |

| | | | Total Investment Purchased | | | | | | | | |

| | | | with the Cash Proceeds | | | | | | | | |

| | | | from Securities Lending | | | 4,229,384 | | | | 4,229,384 | |

| | | | | | | | | | | | |

| | | | Total Investments - 108.8% | | $ | 42,609,399 | | | | 53,297,996 | |

| | | | Other Assets & | | | | | | | | |

| | | | Liabilities, Net - (8.8)% | | | | | | | (4,327,520 | ) |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS - 100.0% | | | | | | $ | 48,970,476 | |

ADR - American Depositary Receipt

| * | Non Income Producing. |

| + | All or a portion of this security was out on loan at December 31, 2021. Total loaned securities had a market value of $4,069,916 at December 31, 2021. |

| ^ | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of December 31, 2021. |

| # | The rate shown is the annualized seven day effective yield as of December 31, 2021. |

See Notes to the Financial Statements.

Friess Brandywine Fund

Portfolio Characteristics as of December 31, 2021 (Unaudited)

Top Ten Equity Holdings(1)

Security Name | % of Net Assets | % Change from Book Cost |

| Hub Group, Inc., Class A | | | 2.8 | % | | | | 22.2 | % | |

| ArcBest Corp. | | | 2.7 | % | | | | 40.7 | % | |

| Silicon Motion Technology Corp. - ADR | | | 2.7 | % | | | | 33.0 | % | |

| Marvell Technology, Inc. | | | 2.7 | % | | | | 45.6 | % | |

| Amazon.com, Inc. | | | 2.6 | % | | | | -4.7 | % | |

| Titan Machinery, Inc. | | | 2.6 | % | | | | 14.4 | % | |

| Cavco Industries, Inc. | | | 2.6 | % | | | | 27.8 | % | |

| The Trade Desk, Inc., Class A | | | 2.5 | % | | | | 15.1 | % | |

| Kornit Digital Ltd. | | | 2.4 | % | | | | 15.8 | % | |

| Academy Sports & Outdoors, Inc. | | | 2.4 | % | | | | 10.3 | % | |

| Top Ten as a Group | | | 26.0 | % | | | | | | |

Top Ten Industry Groups(1)

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Includes money market deposit account. |

Friess Brandywine Fund

December Quarter “Roses & Thorns” (Unaudited)

| | $ Gain | | | | |

| Biggest $ Winners | (in thousands) | % Gain | | Reasons for Move | |

Calix Inc. (CALX) | $83 | 36.2 | | Calix, which makes broadband access equipment used by communications service providers, reported record third-quarter revenue and expectation-beating earnings. “We start the fourth quarter of 2021 in the strongest financial position in our history with robust bookings, clear customer and product focus and believe we are perfectly placed to execute on the opportunity ahead,” the company stated in its release. | |

Marvell Technology Inc. (MRVL) | $77 | 40.5 | | The semiconductor manufacturer exceeded expectations for its fiscal third quarter, reporting record revenue, raising fourth-quarter guidance and sharing encouraging longer-term commentary. Marvell shares posted their largest single-day percentage gain in 13 years on the day of the company’s earnings report. | |

Ford Motor Co. (F) | $65 | 19.3 | | The automaker’s shares rose on enthusiasm surrounding the company’s fully electric F-150 Lightning pickup truck. Ford received so many reservations for the truck, which becomes available in 2022, that the company announced it would double its planned production to 150,000 units per year. The company also increased production of its Mustang Mach-E electric SUV. Ford exceeded the third-quarter consensus earnings estimate by 86 percent. | |

SiTime Corp. (SITM) | $62 | 34.0 | | The company, which makes silicon-based timing solutions used in computing devices, graphics cards and mobile phones, among other applications, exceeded third-quarter expectations with 93 percent revenue growth. SiTime also became a component company in the S&P MidCap 400 Index at the end of November. | |

Advanced Micro Devices Inc. (AMD) | $61 | 34.8 | | The semiconductor manufacturer grew third-quarter earnings and revenue 78 percent and 54 percent, respectively, exceeded consensus expectations in both instances. Data center sales were a highlight, more than doubling on a year-over-year basis. The company also raised guidance for the fourth quarter. | |

| | | | | | |

| | $ Loss | | | | |

| Biggest $ Losers | (in thousands) | % Loss | | Reasons for Move | |

Kirkland’s Inc. (KIRK) | $67 | 43.0 | | The home accessories retailer fell short of third-quarter earnings and revenue expectations due to softer-than-expected sales in the quarter’s final weeks. Citing supply chain headwinds, labor constraints and choppy sales patterns, Kirkland’s also tempered its fourth-quarter guidance. | |

Affirm Holdings Inc. (AFRM) | $51 | 35.1 | | Although shares traded higher following better-than-expected sales results for the September quarter, a subsequent convertible debt offering in November was unpopular with investors. Additionally, shares came under pressure as consumer advocacy groups focused on potential downsides to “buy now pay later” platforms. | |

Proto Labs Inc. (PRLB) | $39 | 20.2 | | Proto Labs, which makes prototypes and low-volume production parts using 3-D printing, CNC machining, sheet metal fabrication and injection molding, reported record third-quarter revenue, but lower-than-expected earnings as its gross profit margin narrowed on a year-over-year basis. The company’s chief financial officer resigned in November to join another firm. | |

DoorDash Inc. (DASH) | $39 | 26.7 | | Shares retreated from their highs in November following a benefits-related settlement with San Francisco drivers and selling among company insiders. The delivery service provider also came under pressure with other growth stocks when Fed Chairman Jerome Powell indicated that the central bank may accelerate the timeline for tapering its bond purchasing initiative. | |

Magnite Inc. (MGNI) | $34 | 37.4 | | The company, which operates a digital ad buying platform, explained that its in-line results for the third quarter were negatively impacted by stalled supply chains among customers, soft travel-related spending and comparisons to year-ago results boosted by political advertising. Shares declined as investors concluded those headwinds were likely to persist. | |

All gains/losses are calculated on an average cost basis from September 30, 2021 through December 31, 2021.

This commentary reflects the viewpoints of Friess Associates, LLC as of December 31, 2021, and is not intended as a forecast or guarantee of future results.

Friess Brandywine Fund

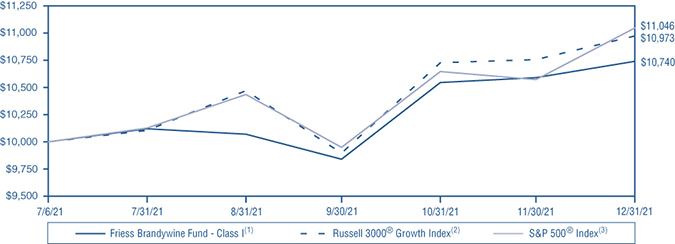

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-656-3017. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Since Inception |

Class I(1) | 7.40% |

Russell 3000® Growth Index(2) | 9.73% |

S&P 500® Index(3) | 10.46% |

(1) | Fund commenced operations on July 6, 2021. |

(2) | Russell 3000® Growth Index measures the performance of those Russell 3000® Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in this index are also members of either the Russell 1000® Growth or the Russell 2000® Growth indexes. Unlike the Fund, the Russell 3000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

(3) | The S&P 500® Index widely regarded as the best single gauge of the U.S. equities market, this index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500® focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, it is also an ideal proxy for the total market. Unlike the Fund, the S&P 500® Index is unmanaged, is not available for investment, and does not incur expenses. |

The performance shown represents past performance and is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. From time to time, the Investment Adviser has waived fees or reimbursed expenses, which may have resulted in higher returns. The listed Fund returns are net of expenses, and the listed index returns exclude expenses. Inception date for “Since Inception” performance is July 6, 2021. Operating expenses (gross) are 1.15% for the Fund’s Class I. Total operating expenses (net) are 1.00%, due to the Adviser’s contractual agreement, through at least July 1, 2022, to waive its management fees and/or pay Fund expenses. Fund returns would be lower if the gross expense ratio was reflected. For the most recent month-end performance, please visit the Fund’s website at www.friessfunds.com.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the period ended December 31, 2021, was 1.00% for Class I.

Friess Brandywine Fund

Schedule of Investments

December 31, 2021

| Shares | | | | Cost | | | Value | |

| Common Stocks - 98.5% | | | | | | |

| | | | | | | |

| COMMUNICATION SERVICES | | | | | | |

| | | | | | | | | |

| | | Advertising - 0.7% | | | | | | |

| | 3,213 | | Magnite, Inc.* | | $ | 100,606 | | | $ | 56,228 | |

| | | | | | | | | | | | |

| | | | Interactive Home | | | | | | | | |

| | | | Entertainment - 3.4% | | | | | | | | |

| | 754 | | Electronic Arts, Inc. | | | 105,040 | | | | 99,453 | |

| | 1,578 | | ROBLOX Corp., Class A* | | | 172,932 | | | | 162,786 | |

| | | | | | | | | | | | |

| | | | Movies & Entertainment - 3.3% | | | | | | | | |

| | 214 | | Netflix, Inc.* | | | 120,717 | | | | 128,922 | |

| | 567 | | Spotify Technology SA* | | | 130,136 | | | | 132,695 | |

| | | | Total Communication Services | | | 629,431 | | | | 580,084 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Apparel Retail - 2.0% | | | | | | | | |

| | 6,174 | | American Eagle | | | | | | | | |

| | | | Outfitters, Inc. | | | 153,500 | | | | 156,326 | |

| | | | | | | | | | | | |

| | | | Automobile | | | | | | | | |

| | | | Manufacturers - 1.8% | | | | | | | | |

| | 6,800 | | Ford Motor Co. | | | 134,911 | | | | 141,236 | |

| | | | | | | | | | | | |

| | | | Automotive Retail - 1.7% | | | | | | | | |

| | 1,265 | | Penske Automotive | | | | | | | | |

| | | | Group, Inc. | | | 103,345 | | | | 135,633 | |

| | | | | | | | | | | | |

| | | | Education Services - 1.8% | | | | | | | | |

| | 8,608 | | Houghton Mifflin | | | | | | | | |

| | | | Harcourt Co.* | | | 141,728 | | | | 138,589 | |

| | | | | | | | | | | | |

| | | | Footwear - 2.0% | | | | | | | | |

| | 1,192 | | Crocs, Inc.* | | | 150,822 | | | | 152,838 | |

| | | | | | | | | | | | |

| | | | Home Improvement | | | | | | | | |

| | | | Retail - 2.1% | | | | | | | | |

| | 1,240 | | Floor & Decor | | | | | | | | |

| | | | Holdings, Inc., Class A* | | | 142,513 | | | | 161,212 | |

| | | | | | | | | | | | |

| | | | Homebuilding - 4.3% | | | | | | | | |

| | 626 | | Cavco Industries, Inc.* | | | 155,620 | | | | 198,849 | |

| | 1,085 | | Hovnanian Enterprises, | | | | | | | | |

| | | | Inc., Class A* | | | 105,369 | | | | 138,110 | |

| | | | | | | | | | | | |

| | | | Hotels, Resorts & | | | | | | | | |

| | | | Cruise Lines - 2.1% | | | | | | | | |

| | 68 | | Booking Holdings, Inc.* | | | 150,193 | | | | 163,148 | |

| | | | | | | | | | | | |

| | | | Internet & Direct | | | | | | | | |

| | | | Marketing Retail - 3.9% | | | | | | | | |

| | 61 | | Amazon.com, Inc.* | | | 213,481 | | | | 203,395 | |

| | 692 | | DoorDash, Inc., Class A* | | | 131,732 | | | | 103,039 | |

| | | | | | | | | | | | |

| | | | Leisure Products - 1.4% | | | | | | | | |

| | 1,358 | | YETI Holdings, Inc.* | | | 126,391 | | | | 112,483 | |

| | | | | | | | | | | | |

| | | | Specialty Stores - 2.4% | | | | | | | | |

| | 4,306 | | Academy Sports & | | | | | | | | |

| | | | Outdoors, Inc.* | | | 171,425 | | | | 189,033 | |

| | | | Total Consumer Discretionary | | | 1,881,030 | | | | 1,993,891 | |

| HEALTH CARE | | | | | | | | |

| | | | | | | | | | | | |

| | | | Health Care Equipment - 1.3% | | | | | | | | |

| | 1,762 | | Cryoport, Inc.* | | | 109,468 | | | | 104,258 | |

| | | | | | | | | | | | |

| | | | Health Care Facilities - 2.0% | | | | | | | | |

| | 1,920 | | Tenet Healthcare Corp.* | | | 144,644 | | | | 156,845 | |

| | | | | | | | | | | | |

| | | | Health Care Services - 1.9% | | | | | | | | |

| | 1,984 | | Apollo Medical | | | | | | | | |

| | | | Holdings, Inc.* | | | 135,509 | | | | 145,784 | |

| | | | | | | | | | | | |

| | | | Health Care Supplies - 1.3% | | | | | | | | |

| | 3,704 | | Figs, Inc., Class A* | | | 141,821 | | | | 102,082 | |

| | | | | | | | | | | | |

| | | | Life Sciences Tools | | | | | | | | |

| | | | & Services - 4.0% | | | | | | | | |

| | 3,680 | | Avantor, Inc.* | | | 136,611 | | | | 155,075 | |

| | 236 | | Thermo Fisher Scientific, Inc. | | | 132,680 | | | | 157,469 | |

| | | | Total Health Care | | | 800,733 | | | | 821,513 | |

| | | | | | | | | |

| INDUSTRIALS | | | | | | | | |

| | | | | | | | | | | | |

| | | | Air Freight & Logistics - 2.8% | | | | | | | | |

| | 2,615 | | Hub Group, Inc., Class A* | | | 180,241 | | | | 220,288 | |

| | | | | | | | | | | | |

| | | | Building Products - 1.8% | | | | | | | | |

| | 1,530 | | Owens Corning | | | 134,640 | | | | 138,465 | |

| | | | | | | | | | | | |

| | | | Diversified Support | | | | | | | | |

| | | | Services - 1.7% | | | | | | | | |

| | 3,852 | | Driven Brands Holdings, Inc.* | | | 112,412 | | | | 129,504 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery - 4.4% | | | | | | | | |

| | 1,380 | | EnPro Industries, Inc. | | | 148,365 | | | | 151,897 | |

| | 1,258 | | Kornit Digital Ltd.* | | | 165,402 | | | | 191,530 | |

| | | | | | | | | | | | |

| | | | Trading Companies & | | | | | | | | |

| | | | Distributors - 4.2% | | | | | | | | |

| | 812 | | Herc Holdings, Inc. | | | 138,233 | | | | 127,119 | |

| | 5,954 | | Titan Machinery, Inc.* | | | 175,366 | | | | 200,590 | |

| | | | | | | | | | | | |

| | | | Trucking - 2.7% | | | | | | | | |

| | 1,776 | | ArcBest Corp. | | | 151,324 | | | | 212,853 | |

| | | | Total Industrials | | | 1,205,983 | | | | 1,372,246 | |

| | | | | | | | | |

| INFORMATION TECHNOLOGY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Application Software - 5.5% | | | | | | | | |

| | 206 | | Adobe, Inc.* | | | 124,015 | | | | 116,815 | |

| | 3,740 | | Clear Secure, Inc., Class A* | | | 107,172 | | | | 117,324 | |

| | 2,166 | | The Trade Desk, Inc., Class A* | | | 172,480 | | | | 198,492 | |

| | | | | | | | | | | | |

| | | | Communications | | | | | | | | |

| | | | Equipment - 2.4% | | | | | | | | |

| | 2,306 | | Calix, Inc.* | | | 105,994 | | | | 184,411 | |

| | | | | | | | | | | | |

| | | | Data Processing & | | | | | | | | |

| | | | Outsourced Services - 1.2% | | | | | | | | |

| | 899 | | Affirm Holdings, Inc.* | | | 140,186 | | | | 90,403 | |

| | | | | | | | | | | | |

| | | | Semiconductor | | | | | | | | |

| | | | Equipment - 8.9% | | | | | | | | |

| | 825 | | ACM Research, Inc., Class A* | | | 69,530 | | | | 70,348 | |

| | 941 | | Applied Materials, Inc. | | | 128,443 | | | | 148,076 | |

| | 2,206 | | Axcelis Technologies, Inc.* | | | 138,561 | | | | 164,479 | |

| | 1,027 | | Teradyne, Inc. | | | 119,738 | | | | 167,945 | |

| | 2,505 | | Ultra Clean Holdings, Inc.* | | | 132,618 | | | | 143,687 | |

| | | | | | | | | | | | |

| | | | Semiconductors - 15.3% | | | | | | | | |

| | 1,109 | | Advanced Micro Devices, Inc.* | | | 105,973 | | | | 159,585 | |

| | 1,343 | | Diodes, Inc.* | | | 145,005 | | | | 147,475 | |

| | 2,387 | | Marvell Technology, Inc. | | | 143,454 | | | | 208,838 | |

| | 1,617 | | Semtech Corp.* | | | 127,774 | | | | 143,800 | |

| | 2,213 | | Silicon Motion | | | | | | | | |

| | | | Technology Corp. - ADR | | | 158,159 | | | | 210,301 | |

See Notes to the Financial Statements.

Friess Brandywine Fund

Schedule of Investments (Continued)

December 31, 2021

| Shares | | | | Cost | | | Value | |

| Common Stocks - 98.5% (Continued) | | | | | | |

| | | | | | | |

| INFORMATION TECHNOLOGY (continued) | | | | | | |

| | | | | | | | | |

| | | Semiconductors - 15.3% (continued) | | | | | | |

| | 529 | | SiTime Corp.* | | $ | 79,399 | | | $ | 154,754 | |

| | 2,478 | | SMART Global | | | | | | | | |

| | | | Holdings, Inc.* | | | 146,591 | | | | 175,913 | |

| | | | | | | | | | | | |

| | | | Technology Hardware, | | | | | | | | |

| | | | Storage & Peripherals - 2.0% | | | | | | | | |

| | 6,452 | | Stratasys Ltd.* | | | 155,413 | | | | 158,010 | |

| | | | Total Information Technology | | | 2,300,505 | | | | 2,760,656 | |

| | | | | | | | | |

| MATERIALS | | | | | | | | |

| | | | | | | | | | | | |

| | | | Fertilizers & | | | | | | | | |

| | | | Agricultural Chemicals - 2.2% | | | | | | | | |

| | 4,464 | | The Mosaic Co. | | | 143,473 | | | | 175,390 | |

| | | | Total Materials | | | 143,473 | | | | 175,390 | |

| | | | | | | | | | | | |

| | | | Total Common Stocks | | | 6,961,155 | | | | 7,703,780 | |

| | | | | | | | | | | | |

| Short-Term Investment - 2.2% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Money Market | | | | | | | | |

| | | | Deposit Account - 2.2% | | | | | | | | |

| | 171,103 | | U.S. Bank N.A., 0.00%^ | | | 171,103 | | | | 171,103 | |

| | | | Total Money Market | | | | | | | | |

| | | | Deposit Account | | | 171,103 | | | | 171,103 | |

| | | | | | | | | | | | |

| | | | Total Short-Term Investment | | | 171,103 | | | | 171,103 | |

| | | | | | | | | | | | |

| | | | Total Investments - 100.7% | | $ | 7,132,258 | | | | 7,874,883 | |

| | | | Other Assets & | | | | | | | | |

| | | | Liabilities, Net - (0.7)% | | | | | | | (51,213 | ) |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS - 100.0% | | | | | | $ | 7,823,670 | |

ADR - American Depositary Receipt

| * | Non Income Producing. |

| ^ | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of December 31, 2021. |

See Notes to the Financial Statements.

Friess Brandywine Blue Fund

Portfolio Characteristics as of December 31, 2021 (Unaudited)

Top Ten Equity Holdings(1)

Security Name | % of Net Assets | % Change from Book Cost |

| Applied Materials, Inc. | | | 3.8 | % | | | | 12.1 | % | |

| Thermo Fisher Scientific, Inc. | | | 3.8 | % | | | | 13.0 | % | |

| The Trade Desk, Inc., Class A | | | 3.8 | % | | | | 2.7 | % | |

| Tenet Healthcare Corp. | | | 3.7 | % | | | | 8.8 | % | |

| The Mosaic Co. | | | 3.6 | % | | | | 19.5 | % | |

| Penske Automotive Group, Inc. | | | 3.6 | % | | | | 21.0 | % | |

| Chesapeake Energy Corp. | | | 3.6 | % | | | | -1.6 | % | |

| ROBLOX Corp., Class A | | | 3.5 | % | | | | -10.3 | % | |

| Marvell Technology, Inc. | | | 3.4 | % | | | | 43.0 | % | |

| Electronic Arts, Inc. | | | 3.4 | % | | | | -3.9 | % | |

| Top Ten as a Group | | | 36.2 | % | | | | | | |

Top Ten Industry Groups(1)

(% of Net Assets)

(1) | Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

(2) | Includes money market deposit account. |

Friess Brandywine Blue Fund

December Quarter “Roses & Thorns” (Unaudited)

| | $ Gain | | | | |

| Biggest $ Winners | (in thousands) | % Gain | | Reasons for Move | |

Marvell Technology Inc. (MRVL) | $57 | 33.1 | | The semiconductor manufacturer exceeded expectations for its fiscal third quarter, reporting record revenue, raising fourth-quarter guidance and sharing encouraging longer-term commentary. Marvell shares posted their largest single-day percentage gain in 13 years on the day of the company’s earnings report. | |

Teradyne Inc. (TER) | $51 | 29.7 | | The maker of semiconductor test systems grew September-quarter earnings 35 percent, beating the consensus estimate by 11 percent. Demand from foundry and logic customers was driven by increasing chip complexity as the trend toward smaller, more powerful chips continued. | |

Ford Motor Co. (F) | $46 | 17.6 | | The automaker’s shares rose on enthusiasm surrounding the company’s fully electric F-150 Lightning pickup truck. Ford received so many reservations for the truck, which becomes available in 2022, that the company announced it would double its planned production to 150,000 units per year. The company also increased production of its Mustang Mach-E electric SUV. Ford exceeded the third-quarter consensus earnings estimate by 86 percent. | |

Advanced Micro Devices Inc. (AMD) | $35 | 19.7 | | The semiconductor manufacturer grew third-quarter earnings and revenue 78 percent and 54 percent, respectively, exceeding consensus expectations in both instances. Data center sales were a highlight, more than doubling on a year-over-year basis. The company also raised guidance for the fourth quarter. | |

Pfizer Inc. (PFE) | $29 | 11.2 | | Already playing a leading role in vaccines, the global biopharmaceutical manufacturer announced in early November successful trial results for an oral antiviral treatment for Covid-19. The FDA issued emergency use authorization for the pill in late December. September-quarter earnings grew 86 percent, topping the consensus estimate by 24 percent. | |

| | | | | | |

| | $ Loss | | | | |

| Biggest $ Losers | (in thousands) | % Loss | | Reasons for Move | |

Affirm Holdings Inc. (AFRM) | $53 | 31.6 | | Although shares traded higher following better-than-expected sales results for the September quarter, a subsequent convertible debt offering in November was unpopular with investors. Additionally, shares came under pressure as consumer advocacy groups focused on potential downsides to “buy now pay later” platforms. | |

DoorDash Inc. (DASH) | $42 | 22.2 | | Shares retreated from their highs in November following a benefits-related settlement with San Francisco drivers and selling among company insiders. The delivery service provider also came under pressure with other growth stocks when Fed Chairman Jerome Powell indicated that the central bank may accelerate the timeline for tapering its bond purchasing initiative. | |

Roblox Corp. (RBLX) | $26 | 9.2 | | Shares of Roblox, which operates an online video game platform, declined after reporting estimated bookings for November of between $208 million and $211 million, up from $189 million to $192 million for October. Analysts expected more growth in November because October bookings were adversely affected by an outage over Halloween weekend. | |

Crocs Inc. (CROX) | $21 | 12.4 | | After reaching an all-time high in November, Crocs shares declined in December following the footwear company’s announcement that it intended to acquire the privately owned casual shoe brand Heydude for $2.5 billion. Investors raised questions about the price and the likelihood that Crocs would add debt to help finance the deal. | |

Adobe Inc. (ADBE) | $13 | 6.4 | | The graphics software company reported revenue and earnings growth of 20 percent and 14 percent, respectively, for its fiscal fourth quarter (the three months through December 3). Shares declined in response to the company’s fiscal 2022 guidance, which implied that revenue and earnings growth would slow to 13 percent and 10 percent. | |

All gains/losses are calculated on an average cost basis from September 30, 2021 through December 31, 2021.

This commentary reflects the viewpoints of Friess Associates, LLC as of December 31, 2021, and is not intended as a forecast or guarantee of future results.

Friess Brandywine Blue Fund

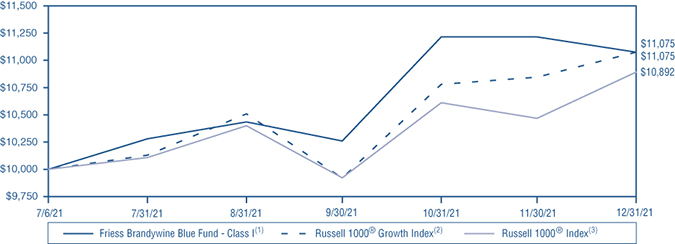

Value of $10,000 Investment (Unaudited)

The chart assumes an initial investment of $10,000. Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 855-656-3017. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Since Inception |

Class I(1) | 10.75% |

Russell 1000® Growth Index(2) | 10.75% |

Russell 1000® Index(3) | 8.92% |

(1) | Fund commenced operations on July 6, 2021. |

(2) | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment, and does not incur expenses. |

(3) | The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000® Index. Unlike the Fund, the Russell 1000® Index is unmanaged, is not available for investment, and does not incur expenses. |

The performance shown represents past performance and is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. From time to time, the Investment Adviser has waived fees or reimbursed expenses, which may have resulted in higher returns. The listed Fund returns are net of expenses, and the listed index returns exclude expenses. Inception date for “Since Inception” performance is July 6, 2021. Operating expenses (gross) are 1.15% for the Fund’s Class I. Total operating expenses (net) are 1.00%, due to the Adviser’s contractual agreement, through at least July 1, 2022, to waive its management fees and/or pay Fund expenses. Fund returns would be lower if the gross expense ratio was reflected. For the most recent month-end performance, please visit the Fund’s website at www.friessfunds.com.

The actual expense ratio applicable to investors, as disclosed in the Financial Highlights for the period ended December 31, 2021, was 1.00% for Class I.

Friess Brandywine Blue Fund

Schedule of Investments

December 31, 2021

| Shares | | | | Cost | | | Value | |

| Common Stocks - 97.8% | | | | | | |

| | | | | | | |

| COMMUNICATION SERVICES | | | | | | |

| | | | | | | | | |

| | | Interactive Home | | | | | | |

| | | Entertainment - 6.9% | | | | | | |

| | 1,392 | | Electronic Arts, Inc. | | $ | 190,973 | | | $ | 183,605 | |

| | 1,805 | | ROBLOX Corp., Class A* | | | 207,639 | | | | 186,204 | |

| | | | | | | | | | | | |

| | | | Movies & Entertainment - 6.2% | | | | | | | | |

| | 272 | | Netflix, Inc.* | | | 161,676 | | | | 163,864 | |

| | 716 | | Spotify Technology SA* | | | 169,616 | | | | 167,565 | |

| | | | Total Communication Services | | | 729,904 | | | | 701,238 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Automobile Manufacturers - 3.1% | | | | | | | | |

| | 8,000 | | Ford Motor Co. | | | 158,718 | | | | 166,160 | |

| | | | | | | | | | | | |

| | | | Automotive Retail - 3.6% | | | | | | | | |

| | 1,793 | | Penske Automotive | | | | | | | | |

| | | | Group, Inc. | | | 158,834 | | | | 192,246 | |

| | | | | | | | | | | | |

| | | | Footwear - 2.4% | | | | | | | | |

| | 1,028 | | Crocs, Inc.* | | | 136,618 | | | | 131,810 | |

| | | | | | | | | | | | |

| | | | Home Improvement | | | | | | | | |

| | | | Retail - 2.9% | | | | | | | | |

| | 1,203 | | Floor & Decor | | | | | | | | |

| | | | Holdings, Inc., Class A* | | | 141,798 | | | | 156,402 | |

| | | | | | | | | | | | |

| | | | Hotels, Resorts & | | | | | | | | |

| | | | Cruise Lines - 3.3% | | | | | | | | |

| | 73 | | Booking Holdings, Inc.* | | | 160,558 | | | | 175,144 | |

| | | | | | | | | | | | |

| | | | Internet & Direct | | | | | | | | |

| | | | Marketing Retail - 5.9% | | | | | | | | |

| | 51 | | Amazon.com, Inc.* | | | 177,653 | | | | 170,051 | |

| | 981 | | DoorDash, Inc., Class A* | | | 179,928 | | | | 146,071 | |

| | | | | | | | | | | | |

| | | | Leisure Products - 3.1% | | | | | | | | |

| | 2,030 | | YETI Holdings, Inc.* | | | 187,717 | | | | 168,145 | |

| | | | Total Consumer Discretionary | | | 1,301,824 | | | | 1,306,029 | |

| | | | | | | | | |

| ENERGY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Oil & Gas Exploration | | | | | | | | |

| | | | & Production - 3.6% | | | | | | | | |

| | 2,970 | | Chesapeake Energy Corp. | | | 194,833 | | | | 191,624 | |

| | | | Total Energy | | | 194,833 | | | | 191,624 | |

| | | | | | | | | |

| HEALTH CARE | | | | | | | | |

| | | | | | | | | | | | |

| | | | Health Care Facilities - 3.6% | | | | | | | | |

| | 2,408 | | Tenet Healthcare Corp.* | | | 180,798 | | | | 196,710 | |

| | | | | | | | | | | | |

| | | | Life Sciences Tools | | | | | | | | |

| | | | & Services - 7.1% | | | | | | | | |

| | 4,170 | | Avantor, Inc.* | | | 158,939 | | | | 175,724 | |

| | 307 | | Thermo Fisher Scientific, Inc. | | | 181,204 | | | | 204,842 | |

| | | | | | | | | | | | |

| | | | Pharmaceuticals - 3.0% | | | | | | | | |

| | 2,705 | | Pfizer, Inc. | | | 152,078 | | | | 159,730 | |

| | | | Total Health Care | | | 673,019 | | | | 737,006 | |

| | | | | | | | | |

| INDUSTRIALS | | | | | | | | |

| | | | | | | | | | | | |

| | | | Building Products - 3.2% | | | | | | | | |

| | 1,899 | | Owens Corning | | | 173,285 | | | | 171,860 | |

| | | | | | | | | | | | |

| | | | Construction & | | | | | | | | |

| | | | Engineering - 3.1% | | | | | | | | |

| | 4,030 | | WillScot Mobile Mini | | | | | | | | |

| | | | Holdings Corp., Class A* | | | 161,011 | | | | 164,585 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery - 6.5% | | | | | | | | |

| | 2,700 | | Ingersoll Rand, Inc. | | | 154,993 | | | | 167,049 | |

| | 1,189 | | Kornit Digital Ltd.* | | | 166,051 | | | | 181,025 | |

| | | | Total Industrials | | | 655,340 | | | | 684,519 | |

| | | | | | | | | |

| INFORMATION TECHNOLOGY | | | | | | | | |

| | | | | | | | | | | | |

| | | | Application Software - 6.2% | | | | | | | | |

| | 230 | | Adobe, Inc.* | | | 140,490 | | | | 130,424 | |

| | 2,226 | | The Trade Desk, | | | | | | | | |

| | | | Inc., Class A* | | | 198,713 | | | | 203,990 | |

| | | | | | | | | | | | |

| | | | Data Processing & | | | | | | | | |

| | | | Outsourced Services - 1.2% | | | | | | | | |

| | 637 | | Affirm Holdings, Inc.* | | | 90,491 | | | | 64,057 | |

| | | | | | | | | | | | |

| | | | IT Consulting & | | | | | | | | |

| | | | Other Services - 3.0% | | | | | | | | |

| | 512 | | Globant SA* | | | 140,586 | | | | 160,814 | |

| | | | | | | | | | | | |

| | | | Semiconductor | | | | | | | | |

| | | | Equipment - 6.4% | | | | | | | | |

| | 1,308 | | Applied Materials, Inc. | | | 183,627 | | | | 205,827 | |

| | 862 | | Teradyne, Inc. | | | 101,098 | | | | 140,963 | |

| | | | | | | | | | | | |

| | | | Semiconductors - 6.7% | | | | | | | | |

| | 1,216 | | Advanced Micro | | | | | | | | |

| | | | Devices, Inc.* | | | 141,543 | | | | 174,982 | |

| | 2,122 | | Marvell Technology, Inc. | | | 129,793 | | | | 185,654 | |

| | | | Total Information Technology | | | 1,126,341 | | | | 1,266,711 | |

| | | | | | | | | |

| MATERIALS | | | | | | | | |

| | | | | | | | | | | | |

| | | | Copper - 3.2% | | | | | | | | |

| | 4,102 | | Freeport-McMoRan, Inc. | | | 149,916 | | | | 171,177 | |

| | | | | | | | | | | | |

| | | | Fertilizers & Agricultural | | | | | | | | |

| | | | Chemicals - 3.6% | | | | | | | | |

| | 4,897 | | The Mosaic Co. | | | 160,985 | | | | 192,403 | |

| | | | Total Materials | | | 310,901 | | | | 363,580 | |

| | | | | | | | | | | | |

| | | | Total Common Stocks | | | 4,992,162 | | | | 5,250,707 | |

| | | | | | | | | | | | |

| Short-Term Investment - 4.8% | | | | | | | | |

| | | | | | | | | | | | |

| | | | Money Market Deposit Account - 4.8% | | | | | | | | |

| | 260,026 | | U.S. Bank N.A., 0.00%^ | | | 260,026 | | | | 260,026 | |

| | | | Total Money Market | | | | | | | | |

| | | | Deposit Account | | | 260,026 | | | | 260,026 | |

| | | | | | | | | | | | |

| | | | Total Short-Term Investment | | | 260,026 | | | | 260,026 | |

| | | | | | | | | | | | |

| | | | Total Investments - 102.6% | | $ | 5,252,188 | | | | 5,510,733 | |

| | | | Other Assets & | | | | | | | | |

| | | | Liabilities, Net - (2.6)% | | | | | | | (140,328 | ) |

| | | | TOTAL NET | | | | | | | | |

| | | | ASSETS - 100.0% | | | | | | $ | 5,370,405 | |

| * | Non Income Producing. |

| ^ | The Money Market Deposit Account (“MMDA”) is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on conditions and may change daily and by any amount. The rate shown is as of December 31, 2021. |

See Notes to the Financial Statements.

Friess Funds

Statements of Assets and Liabilities

December 31, 2021

| | | Friess | | | Friess | | | Friess | |

| | | Small Cap | | | Brandywine | | | Brandywine | |

| | | Growth Fund | | | Fund | | | Blue Fund | |

| Assets: | | | | | | | | | |

| Investments at value* (Including securities on loan | | | | | | | | | |

| valued at $4,069,916, $0 and $0, respectively) | | $ | 53,297,996 | | | $ | 7,874,883 | | | $ | 5,510,733 | |

| Securities lending income receivable | | | 1,619 | | | | — | | | | — | |

| Dividends & interest receivable | | | 2,687 | | | | 61 | | | | 80 | |

| Receivable from investment adviser | | | — | | | | 2,138 | | | | 2,761 | |

| Prepaid expenses | | | 12,311 | | | | 16,168 | | | | 15,617 | |

| Total assets | | | 53,314,613 | | | | 7,893,250 | | | | 5,529,191 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Payable for securities loaned | | | 4,229,384 | | | | — | | | | — | |

| Payable for investment securities purchased | | | — | | | | — | | | | 91,274 | |

| Payable to investment adviser | | | 23,166 | | | | — | | | | — | |

| Payable for fund administration & accounting fees | | | 24,082 | | | | 23,403 | | | | 23,507 | |

| Payable for compliance fees | | | 2,915 | | | | 2,912 | | | | 2,912 | |

| Payable for transfer agent fees & expenses | | | 14,104 | | | | 4,795 | | | | 4,422 | |

| Payable for custody fees | | | 1,240 | | | | 789 | | | | 714 | |

| Payable for trustee fees | | | 4,471 | | | | 4,475 | | | | 4,475 | |

| Payable for audit fees | | | 20,002 | | | | 19,996 | | | | 19,996 | |

| Accrued distribution & shareholder servicing fees | | | 7,567 | | | | 4,065 | | | | 2,259 | |

| Accrued legal fees | | | 10,439 | | | | 7,498 | | | | 7,498 | |

| Accrued other expenses | | | 6,767 | | | | 1,647 | | | | 1,729 | |

| Total liabilities | | | 4,344,137 | | | | 69,580 | | | | 158,786 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 48,970,476 | | | $ | 7,823,670 | | | $ | 5,370,405 | |

| | | | | | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 37,965,795 | | | $ | 7,291,732 | | | $ | 5,096,353 | |

| Total distributable earnings | | | 11,004,681 | | | | 531,938 | | | | 274,052 | |

| Net Assets | | $ | 48,970,476 | | | $ | 7,823,670 | | | $ | 5,370,405 | |

| | | | | | | | | | | | | |

| Calculation of net asset value per share: | | | | | | | | | | | | |

| Institutional Class/Class I: | | | | | | | | | | | | |

| Net assets | | $ | 47,411,539 | | | $ | 7,823,670 | | | $ | 5,370,405 | |

Shares issued and outstanding(1) | | | 1,396,089 | | | | 364,248 | | | | 242,500 | |

| Net asset value, offering and redemption price per share | | $ | 33.96 | | | $ | 21.48 | | | $ | 22.15 | |

| | | | | | | | | | | | | |

| Investor Class: | | | | | | | | | | | | |

| Net assets | | $ | 1,558,937 | | | | — | | | | — | |

Shares issued and outstanding(1) | | | 46,550 | | | | — | | | | — | |

| Net asset value, offering and redemption price per share | | $ | 33.49 | | | | — | | | | — | |

| | | | | | | | | | | | | |

| * Investments at cost | | $ | 42,609,399 | | | $ | 7,132,258 | | | $ | 5,252,188 | |

(1) | Unlimited shares authorized without par value. |

See Notes to the Financial Statements.

Friess Funds

Statements of Operations

For the Year Ended December 31, 2021

| | | Friess | | | Friess | | | Friess | |

| | | Small Cap | | | Brandywine | | | Brandywine | |

| | | Growth Fund | | | Fund | | | Blue Fund | |

| Investment Income: | | | | | | | | | |

| Dividend income | | $ | 124,603 | | | $ | 8,001 | | | $ | 6,618 | |

| Securities lending income, net | | | 42,692 | | | | — | | | | — | |

| Interest income | | | 9 | | | | 2 | | | | 1 | |

| Total investment income | | | 167,304 | | | | 8,003 | | | | 6,619 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment adviser fees (See Note 4) | | | 467,654 | | | | 22,050 | | | | 12,500 | |

| Fund administration & accounting fees (See Note 4) | | | 100,212 | | | | 47,368 | | | | 47,313 | |

| Transfer agent fees & expenses (See Note 4) | | | 59,306 | | | | 10,946 | | | | 10,231 | |

| Federal & state registration fees | | | 36,974 | | | | 11,089 | | | | 10,839 | |

| Audit fees | | | 20,006 | | | | 20,303 | | | | 20,303 | |

| Trustee fees | | | 17,650 | | | | 9,142 | | | | 9,142 | |

| Custody fees (See Note 4) | | | 16,490 | | | | 4,876 | | | | 3,688 | |

| Postage and printing fees | | | 14,610 | | | | 1,497 | | | | 1,497 | |

| Compliance fees (See Note 4) | | | 13,330 | | | | 5,667 | | | | 5,667 | |

| Legal fees | | | 9,277 | | | | 7,498 | | | | 7,498 | |

| Other expenses | | | 3,729 | | | | 2,003 | | | | 2,003 | |

| Insurance fees | | | 1,923 | | | | — | | | | — | |

| Distribution and/or shareholder servicing fees (See Note 5) | | | | | | | | | | | | |

| Institutional Class/Class I | | | 26,918 | | | | 4,065 | | | | 2,259 | |

| Investor Class | | | 2,487 | | | | — | | | | — | |

| Total expenses before waiver | | | 790,566 | | | | 146,504 | | | | 132,940 | |

| Less: waiver/reimbursement from | | | | | | | | | | | | |

| investment adviser (See Note 4) | | | (227,566 | ) | | | (117,104 | ) | | | (116,274 | ) |

| Net expenses | | | 563,000 | | | | 29,400 | | | | 16,666 | |

| Net investment loss | | | (395,696 | ) | | | (21,397 | ) | | | (10,047 | ) |

| | | | | | | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | | | | | |

| Net realized gain (loss) on investments | | | 14,590,858 | | | | (210,687 | ) | | | 19,022 | |

| Net change in unrealized appreciation/depreciation on investments | | | (990,620 | ) | | | 742,625 | | | | 258,545 | |

| Net realized and unrealized gain on investments | | | 13,600,238 | | | | 531,938 | | | | 277,567 | |

| Net increase in net assets resulting from operations | | $ | 13,204,542 | | | $ | 510,541 | | | $ | 267,520 | |

See Notes to the Financial Statements.

Friess Small Cap Growth Fund

Statements of Changes in Net Assets

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2021 | | | December 31, 2020 | |

| Operations: | | | | | | |

| Net investment loss | | $ | (395,696 | ) | | $ | (569,779 | ) |

| Net realized gain (loss) on investments | | | 14,590,858 | | | | (7,194,061 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | (990,620 | ) | | | (18,900,647 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 13,204,542 | | | | (26,664,487 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Institutional Class: | | | | | | | | |

| Proceeds from shares sold | | | 5,414,822 | | | | 1,229,030 | |

| Proceeds from reinvestment of distributions | | | 6,505,963 | | | | — | |

Payments for redemption-in-kind(1) | | | — | | | | (81,125,571 | ) |

| Payments for shares redeemed | | | (13,025,832 | ) | | | (12,434,025 | ) |

| Decrease in net assets from | | | | | | | | |

| Institutional Class transactions | | | (1,105,047 | ) | | | (92,330,566 | ) |

| Investor Class: | | | | | | | | |

| Proceeds from shares sold | | | 1,673,848 | | | | 30,800 | |

| Proceeds from reinvestment of distributions | | | 213,369 | | | | — | |

| Payments for shares redeemed | | | (439,837 | ) | | | (81,060 | ) |

| Increase (Decrease) in net assets from | | | | | | | | |

| Investor Class transactions | | | 1,447,380 | | | | (50,260 | ) |

| | | | | | | | | |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from capital share transactions | | | 342,333 | | | | (92,380,826 | ) |

| | | | | | | | | |

| Distributions to shareholders: | | | | | | | | |

| Institutional Class | | | (6,578,359 | ) | | | — | |

| Investor Class | | | (214,954 | ) | | | — | |

| Total distributions to shareholders | | | (6,793,313 | ) | | | — | |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 6,753,562 | | | | (119,045,313 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 42,216,914 | | | | 161,262,227 | |

| End of year | | $ | 48,970,476 | | | $ | 42,216,914 | |

(1) | Comprised of investments at fair value of $73,501,280 and cash of $7,624,291. |

See Notes to the Financial Statements.

Friess Brandywine Fund

Statement of Changes in Net Assets

| | | For the Period | |

| | | Inception(1) Through | |

| | | December 31, 2021 | |

| Operations: | | | |

| Net investment loss | | $ | (21,397 | ) |

| Net realized loss on investments | | | (210,687 | ) |

| Net change in unrealized appreciation/depreciation on investments | | | 742,625 | |

| Net increase in net assets resulting from operations | | | 510,541 | |

| | | | | |

| Capital Share Transactions: | | | | |

| Class I: | | | | |

| Proceeds from shares sold | | | 7,986,651 | |