UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bank Global Fund Services

777 East Wisconsin Ave., 6th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1712

Registrant’s telephone number, including area code

Date of fiscal year end: 06/30/2024

Date of reporting period: 06/30/2024

Item 1. Reports to Stockholders.

| | |

| Olstein All Cap Value Fund | |

| Adviser Class | OFAFX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Olstein All Cap Value Fund for the period of July 1, 2023, to June 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.olsteinfunds.com/resources/documents-forms. You can also request this information by contacting us at 1-800-799-2113.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Adviser Class | $121 | 1.17% |

How did the Class perform last year and what affected its performance?

For the fiscal year ended June 30, 2024, the Class returned 6.48% and its benchmark Russell 3000Ⓡ Index returned 23.13%. During the fiscal year, a narrow range of high tech, high growth, high price-earnings ratio, and high momentum stocks (such as NVIDIA and Netflix) dominated the benchmark Russell 3000 Index’s returns and accounted for a material amount of the gain in the Russell 3000 Index and represents a material amount of the value of the Russell 3000 Index. Our philosophy practiced since the inception of the Fund focuses on valuing companies using an accounting-based forensic fundamentals analysis of financial statements to identify companies whose ability to generate future free cash flow is, in our opinion, not being properly valued by the marketplace. The Fund focuses on long-term value investing, so we remained underweight in the high-flying stocks in the Russell 3000 Index because they did not meet our value criteria. Therefore, the Fund trailed the Russell 3000 Index during the fiscal year.

We are long-term investors and believe the price you pay for an investment is the biggest factor determining future returns. The flight by investors into the out-performing high-flying stocks responsible for a material amount of the Russell 3000 Index’s appreciation created an abundance of opportunities in companies that, in our opinion, were selling at material discounts to their intrinsic values.

We remain focused on individual companies, their operations, and prospects for maintaining and growing sustainable free cash flow. We sought to take advantage of market volatility to seize upon the opportunities to purchase what we believe are solid companies (especially in the industrial and financial sectors) or to add to existing positions in companies selling at material discounts to our estimates of their intrinsic values.

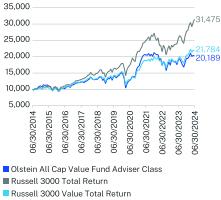

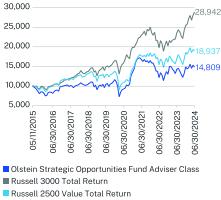

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge (if applicable). The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees (if applicable), management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Adviser Class (without sales charge) | 6.48 | 7.80 | 7.28 |

Russell 3000 Total Return | 23.13 | 14.14 | 12.15 |

Russell 3000 Value Total Return | 12.93 | 8.89 | 8.10 |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Olstein All Cap Value Fund | PAGE 1 | TSR_AR_56167N621 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $531,880,961 |

Number of Equity Holdings | 79 |

| |

Net Advisory Fee | $5,572,937 |

Portfolio Turnover | 27% |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

What did the Fund invest in? (as of June 30, 2024)

| |

Security Type | (% of Net Assets) |

Common Stocks | 91.0% |

Cash & Other | 9.0% |

| |

Top 10 Issuers | (% of Net Assets) |

Walt Disney Company | 2.2% |

ABM Industries, Inc. | 2.1% |

Sensata Technologies Holding PLC | 1.8% |

United Parcel Service, Inc. | 1.7% |

Quest Diagnostics Inc. | 1.7% |

CVS Health Corporation | 1.7% |

Baxter International, Inc. | 1.7% |

Johnson & Johnson | 1.7% |

SS&C Technologies Holdings, Inc. | 1.7% |

Corteva, Inc. | 1.6% |

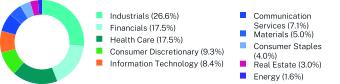

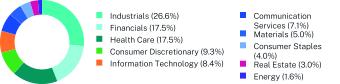

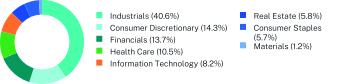

Sector Breakdown (% of Equity Investments)

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Olstein Capital Management, L.P. documents not be householded, please contact Olstein Capital Management, L.P. at 1-800-799-2113, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Olstein Capital Management, L.P. or your financial intermediary.

For additional information about the Fund, including its prospectus and other important materials, scan the QR code or visit https://www.olsteinfunds.com/resources/documents-forms

The Olstein All Cap Value Fund is distributed by Quasar Distributors, LLC.

| Olstein All Cap Value Fund | PAGE 2 | TSR_AR_56167N621 |

10000110351016712258130751386712720205421729818961201891000010729109591298714907162461730624949214902556331475100001038610637123611325814231128901874217343192892178426.617.517.59.38.47.15.04.03.01.6

| | |

| Olstein All Cap Value Fund | |

| Class A | OFAVX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Olstein All Cap Value Fund for the period of July 1, 2023, to June 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.olsteinfunds.com/resources/documents-forms. You can also request this information by contacting us at 1-800-799-2113.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $146 | 1.42% |

How did the Class perform last year and what affected its performance?

For the fiscal year ended June 30, 2024, the Class returned 6.23% (load-waived) and its benchmark Russell 3000Ⓡ Index returned 23.13%. During the fiscal year, a narrow range of high tech, high growth, high price-earnings ratio, and high momentum stocks (such as NVIDIA and Netflix) dominated the benchmark Russell 3000 Index’s returns and accounted for a material amount of the gain in the Russell 3000 Index and represents a material amount of the value of the Russell 3000 Index. Our philosophy practiced since the inception of the Fund focuses on valuing companies using an accounting-based forensic fundamentals analysis of financial statements to identify companies whose ability to generate future free cash flow is, in our opinion, not being properly valued by the marketplace. The Fund focuses on long-term value investing, so we remained underweight in the high-flying stocks in the Russell 3000 Index because they did not meet our value criteria. Therefore, the Fund trailed the Russell 3000 Index during the fiscal year.

We are long-term investors and believe the price you pay for an investment is the biggest factor determining future returns. The flight by investors into the out-performing high-flying stocks responsible for a material amount of the Russell 3000 Index’s appreciation created an abundance of opportunities in companies that, in our opinion, were selling at material discounts to their intrinsic values.

We remain focused on individual companies, their operations, and prospects for maintaining and growing sustainable free cash flow. We sought to take advantage of market volatility to seize upon the opportunities to purchase what we believe are solid companies (especially in the industrial and financial sectors) or to add to existing positions in companies selling at material discounts to our estimates of their intrinsic values.

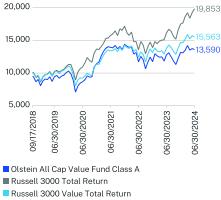

How did the Fund perform since inception?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge (if applicable). The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees (if applicable), management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(09/17/2018) |

Class A (without sales charge) | 6.23 | 7.53 | 6.48 |

Class A (with sales charge) | 0.38 | 6.32 | 5.45 |

Russell 3000 Total Return | 23.13 | 14.14 | 12.59 |

Russell 3000 Value Total Return | 12.93 | 8.89 | 7.95 |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Olstein All Cap Value Fund | PAGE 1 | TSR_AR_56167N563 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $531,880,961 |

Number of Equity Holdings | 79 |

| |

Net Advisory Fee | $5,572,937 |

Portfolio Turnover | 27% |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

What did the Fund invest in? (as of June 30, 2024)

| |

Security Type | (% of Net Assets) |

Common Stocks | 91.0% |

Cash & Other | 9.0% |

| |

Top 10 Issuers | (% of Net Assets) |

Walt Disney Company | 2.2% |

ABM Industries, Inc. | 2.1% |

Sensata Technologies Holding PLC | 1.8% |

United Parcel Service, Inc. | 1.7% |

Quest Diagnostics Inc. | 1.7% |

CVS Health Corporation | 1.7% |

Baxter International, Inc. | 1.7% |

Johnson & Johnson | 1.7% |

SS&C Technologies Holdings, Inc. | 1.7% |

Corteva, Inc. | 1.6% |

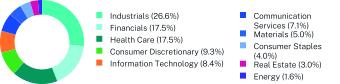

Sector Breakdown (% of Equity Investments)

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Olstein Capital Management, L.P. documents not be householded, please contact Olstein Capital Management, L.P. at 1-800-799-2113, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Olstein Capital Management, L.P. or your financial intermediary.

For additional information about the Fund, including its prospectus and other important materials, scan the QR code or visit https://www.olsteinfunds.com/resources/documents-forms

The Olstein All Cap Value Fund is distributed by Quasar Distributors, LLC.

| Olstein All Cap Value Fund | PAGE 2 | TSR_AR_56167N563 |

94538645139321170412793135901024710916157371355516124198531016792091339012391137811556326.617.517.59.38.47.15.04.03.01.6

| | |

| Olstein All Cap Value Fund | |

| Class C | OFALX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Olstein All Cap Value Fund for the period of July 1, 2023, to June 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.olsteinfunds.com/resources/documents-forms. You can also request this information by contacting us at 1-800-799-2113.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $223 | 2.17% |

How did the Class perform last year and what affected its performance?

For the fiscal year ended June 30, 2024, the Class returned 5.43% (load-waived) and its benchmark Russell 3000Ⓡ Index returned 23.13%. During the fiscal year, a narrow range of high tech, high growth, high price-earnings ratio, and high momentum stocks (such as NVIDIA and Netflix) dominated the benchmark Russell 3000 Index’s returns and accounted for a material amount of the gain in the Russell 3000 Index and represents a material amount of the value of the Russell 3000 Index. Our philosophy practiced since the inception of the Fund focuses on valuing companies using an accounting-based forensic fundamentals analysis of financial statements to identify companies whose ability to generate future free cash flow is, in our opinion, not being properly valued by the marketplace. The Fund focuses on long-term value investing, so we remained underweight in the high-flying stocks in the Russell 3000 Index because they did not meet our value criteria. Therefore, the Fund trailed the Russell 3000 Index during the fiscal year.

We are long-term investors and believe the price you pay for an investment is the biggest factor determining future returns. The flight by investors into the out-performing high-flying stocks responsible for a material amount of the Russell 3000 Index’s appreciation created an abundance of opportunities in companies that, in our opinion, were selling at material discounts to their intrinsic values.

We remain focused on individual companies, their operations, and prospects for maintaining and growing sustainable free cash flow. We sought to take advantage of market volatility to seize upon the opportunities to purchase what we believe are solid companies (especially in the industrial and financial sectors) or to add to existing positions in companies selling at material discounts to our estimates of their intrinsic values.

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge (if applicable). The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees (if applicable), management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C (without sales charge) | 5.43 | 6.71 | 6.21 |

Class C (with sales charge) | 4.43 | 6.71 | 6.21 |

Russell 3000 Total Return | 23.13 | 14.14 | 12.15 |

Russell 3000 Value Total Return | 12.93 | 8.89 | 8.10 |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Olstein All Cap Value Fund | PAGE 1 | TSR_AR_56167N613 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $531,880,961 |

Number of Equity Holdings | 79 |

| |

Net Advisory Fee | $5,572,937 |

Portfolio Turnover | 27% |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

What did the Fund invest in? (as of June 30, 2024)

| |

Security Type | (% of Net Assets) |

Common Stocks | 91.0% |

Cash & Other | 9.0% |

| |

Top 10 Issuers | (% of Net Assets) |

Walt Disney Company | 2.2% |

ABM Industries, Inc. | 2.1% |

Sensata Technologies Holding PLC | 1.8% |

United Parcel Service, Inc. | 1.7% |

Quest Diagnostics Inc. | 1.7% |

CVS Health Corporation | 1.7% |

Baxter International, Inc. | 1.7% |

Johnson & Johnson | 1.7% |

SS&C Technologies Holdings, Inc. | 1.7% |

Corteva, Inc. | 1.6% |

Sector Breakdown (% of Equity Investments)

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Olstein Capital Management, L.P. documents not be householded, please contact Olstein Capital Management, L.P. at 1-800-799-2113, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Olstein Capital Management, L.P. or your financial intermediary.

For additional information about the Fund, including its prospectus and other important materials, scan the QR code or visit https://www.olsteinfunds.com/resources/documents-forms

The Olstein All Cap Value Fund is distributed by Quasar Distributors, LLC.

| Olstein All Cap Value Fund | PAGE 2 | TSR_AR_56167N613 |

1000010924996011895125571319411978191521596917319182591000010729109591298714907162461730624949214902556331475100001038610637123611325814231128901874217343192892178426.617.517.59.38.47.15.04.03.01.6

| | |

| Olstein Strategic Opportunities Fund | |

| Adviser Class | OFSFX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Olstein Strategic Opportunities Fund for the period of July 1, 2023, to June 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.olsteinfunds.com/resources/documents-forms. You can also request this information by contacting us at 1-800-799-2113.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Adviser Class | $138 | 1.35% |

How did the Class perform last year and what affected its performance?

For the fiscal year ended June 30, 2024, the Class returned 3.85% and its benchmark Russell 3000Ⓡ Index returned 23.13%. During the fiscal year, a narrow range of high tech, high growth, high price-earnings ratio, and high momentum stocks (such as NVIDIA and Netflix) dominated the benchmark Russell 3000 Index’s returns and accounted for a material amount of the gain in the Russell 3000 Index and represents a material amount of the value of the Russell 3000 Index. Our philosophy practiced since the inception of the Fund focuses on valuing companies using an accounting-based forensic fundamentals analysis of financial statements to identify companies whose ability to generate future free cash flow is, in our opinion, not being properly valued by the marketplace. The Fund focuses on long-term value investing, so we remained underweight in the high-flying stocks in the Russell 3000 Index because they did not meet our value criteria. Therefore, the Fund trailed the Russell 3000 Index during the fiscal year.

We are long-term investors and believe the price you pay for an investment is the biggest factor determining future returns. The flight by investors into the out-performing high-flying stocks responsible for a material amount of the Russell 3000 Index’s appreciation created an abundance of opportunities in companies that, in our opinion, were selling at material discounts to their intrinsic values.

We remain focused on individual companies, their operations, and prospects for maintaining and growing sustainable free cash flow. We sought to take advantage of market volatility to seize upon the opportunities to purchase what we believe are solid companies (especially in the industrial and consumer discretionary sectors) or to add to existing positions in companies selling at material discounts to our estimates of their intrinsic values.

How did the Fund perform since inception?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge (if applicable). The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees (if applicable), management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(05/11/2015) |

Adviser Class (without sales charge) | 3.85 | 7.15 | 4.39 |

Russell 3000 Total Return | 23.13 | 14.14 | 12.33 |

Russell 2500 Value Total Return | 11.24 | 8.01 | 7.24 |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Olstein Strategic Opportunities Fund | PAGE 1 | TSR_AR_56167N571 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $81,425,688 |

Number of Equity Holdings | 37 |

| |

Net Advisory Fee | $694,045 |

Portfolio Turnover | 32% |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

What did the Fund invest in? (as of June 30, 2024)

| |

Security Type | (% of Net Assets) |

Common Stocks | 96.1% |

Cash & Other | 3.9% |

| |

Top 10 Equity Issuers | (% of Net Assets) |

Prestige Consumer Healthcare, Inc. | 4.1% |

Shyft Group, Inc. | 4.1% |

Sensata Technologies Holding PLC | 4.1% |

Integra LifeSciences Holdings Corporation | 4.0% |

ABM Industries, Inc. | 4.0% |

Gates Industrial Corporation PLC | 3.9% |

Dine Brands Global, Inc. | 3.7% |

Central Garden & Pet Company - Class A | 3.2% |

Mohawk Industries, Inc. | 3.2% |

Citizens Financial Group, Inc. | 3.2% |

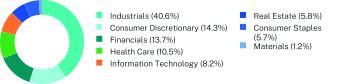

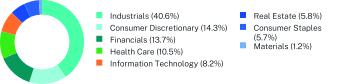

Sector Breakdown (% of Equity Investments)

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Olstein Capital Management, L.P. documents not be householded, please contact Olstein Capital Management, L.P. at 1-800-799-2113, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Olstein Capital Management, L.P. or your financial intermediary.

For additional information about the Fund, including its prospectus and other important materials, scan the QR code or visit https://www.olsteinfunds.com/resources/documents-forms

The Olstein Strategic Opportunities Fund is distributed by Quasar Distributors, LLC.

| Olstein Strategic Opportunities Fund | PAGE 2 | TSR_AR_56167N571 |

95948144101371050110485926316787121451426014809986610077119421370714938159142294219761235062894299329953117811313412881108851776815423170231893740.614.313.710.58.25.85.71.2

| | |

| Olstein Strategic Opportunities Fund | |

| Class A | OFSAX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Olstein Strategic Opportunities Fund for the period of July 1, 2023, to June 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.olsteinfunds.com/resources/documents-forms. You can also request this information by contacting us at 1-800-799-2113.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $163 | 1.60% |

How did the Class perform last year and what affected its performance?

For the fiscal year ended June 30, 2024, the Class returned 3.58% (load-waived) and its benchmark Russell 3000Ⓡ Index returned 23.13%. During the fiscal year, a narrow range of high tech, high growth, high price-earnings ratio, and high momentum stocks (such as NVIDIA and Netflix) dominated the benchmark Russell 3000 Index’s returns and accounted for a material amount of the gain in the Russell 3000 Index and represents a material amount of the value of the Russell 3000 Index. Our philosophy practiced since the inception of the Fund focuses on valuing companies using an accounting-based forensic fundamentals analysis of financial statements to identify companies whose ability to generate future free cash flow is, in our opinion, not being properly valued by the marketplace. The Fund focuses on long-term value investing, so we remained underweight in the high-flying stocks in the Russell 3000 Index because they did not meet our value criteria. Therefore, the Fund trailed the Russell 3000 Index during the fiscal year.

We are long-term investors and believe the price you pay for an investment is the biggest factor determining future returns. The flight by investors into the out-performing high-flying stocks responsible for a material amount of the Russell 3000 Index’s appreciation created an abundance of opportunities in companies that, in our opinion, were selling at material discounts to their intrinsic values.

We remain focused on individual companies, their operations, and prospects for maintaining and growing sustainable free cash flow. We sought to take advantage of market volatility to seize upon the opportunities to purchase what we believe are solid companies (especially in the industrial and consumer discretionary sectors) or to add to existing positions in companies selling at material discounts to our estimates of their intrinsic values.

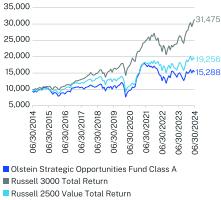

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge (if applicable). The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees (if applicable), management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A (without sales charge) | 3.58 | 6.88 | 4.93 |

Class A (with sales charge) | -2.10 | 5.68 | 4.34 |

Russell 3000 Total Return | 23.13 | 14.14 | 12.15 |

Russell 2500 Value Total Return | 11.24 | 8.01 | 6.77 |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Olstein Strategic Opportunities Fund | PAGE 1 | TSR_AR_56167N597 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $81,425,688 |

Number of Equity Holdings | 37 |

| |

Net Advisory Fee | $694,045 |

Portfolio Turnover | 32% |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

What did the Fund invest in? (as of June 30, 2024)

| |

Security Type | (% of Net Assets) |

Common Stocks | 96.1% |

Cash & Other | 3.9% |

| |

Top 10 Equity Issuers | (% of Net Assets) |

Prestige Consumer Healthcare, Inc. | 4.1% |

Shyft Group, Inc. | 4.1% |

Sensata Technologies Holding PLC | 4.1% |

Integra LifeSciences Holdings Corporation | 4.0% |

ABM Industries, Inc. | 4.0% |

Gates Industrial Corporation PLC | 3.9% |

Dine Brands Global, Inc. | 3.7% |

Central Garden & Pet Company - Class A | 3.2% |

Mohawk Industries, Inc. | 3.2% |

Citizens Financial Group, Inc. | 3.2% |

Sector Breakdown (% of Equity Investments)

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Olstein Capital Management, L.P. documents not be householded, please contact Olstein Capital Management, L.P. at 1-800-799-2113, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Olstein Capital Management, L.P. or your financial intermediary.

For additional information about the Fund, including its prospectus and other important materials, scan the QR code or visit https://www.olsteinfunds.com/resources/documents-forms

The Olstein Strategic Opportunities Fund is distributed by Quasar Distributors, LLC.

| Olstein Strategic Opportunities Fund | PAGE 2 | TSR_AR_56167N597 |

94491012885781065111004109639659174681260714760152881000010729109591298714907162461730624949214902556331475100001009910121119791335613099110691806715684173101925640.614.313.710.58.25.85.71.2

| | |

| Olstein Strategic Opportunities Fund | |

| Class C | OFSCX |

| Annual Shareholder Report | June 30, 2024 |

This annual shareholder report contains important information about the Olstein Strategic Opportunities Fund for the period of July 1, 2023, to June 30, 2024, as well as certain changes to the Fund. You can find additional information about the Fund at https://www.olsteinfunds.com/resources/documents-forms. You can also request this information by contacting us at 1-800-799-2113.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $238 | 2.35% |

How did the Class perform last year and what affected its performance?

For the fiscal year ended June 30, 2024, the Class returned 2.77% (load-waived) and its benchmark Russell 3000Ⓡ Index returned 23.13%. During the fiscal year, a narrow range of high tech, high growth, high price-earnings ratio, and high momentum stocks (such as NVIDIA and Netflix) dominated the benchmark Russell 3000 Index’s returns and accounted for a material amount of the gain in the Russell 3000 Index and represents a material amount of the value of the Russell 3000 Index. Our philosophy practiced since the inception of the Fund focuses on valuing companies using an accounting-based forensic fundamentals analysis of financial statements to identify companies whose ability to generate future free cash flow is, in our opinion, not being properly valued by the marketplace. The Fund focuses on long-term value investing, so we remained underweight in the high-flying stocks in the Russell 3000 Index because they did not meet our value criteria. Therefore, the Fund trailed the Russell 3000 Index during the fiscal year.

We are long-term investors and believe the price you pay for an investment is the biggest factor determining future returns. The flight by investors into the out-performing high-flying stocks responsible for a material amount of the Russell 3000 Index’s appreciation created an abundance of opportunities in companies that, in our opinion, were selling at material discounts to their intrinsic values.

We remain focused on individual companies, their operations, and prospects for maintaining and growing sustainable free cash flow. We sought to take advantage of market volatility to seize upon the opportunities to purchase what we believe are solid companies (especially in the industrial and consumer discretionary sectors) or to add to existing positions in companies selling at material discounts to our estimates of their intrinsic values.

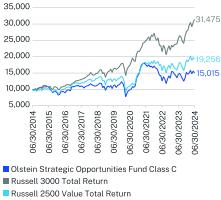

How did the Fund perform over the past 10 years?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and does not assume the maximum sales charge (if applicable). The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees (if applicable), management fees and other expenses were deducted. Performance for other share classes will vary.

CUMULATIVE PERFORMANCE

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class C (without sales charge) | 2.77 | 6.08 | 4.15 |

Class C (with sales charge) | 1.77 | 6.08 | 4.15 |

Russell 3000 Total Return | 23.13 | 14.14 | 12.15 |

Russell 2500 Value Total Return | 11.24 | 8.01 | 6.77 |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Olstein Strategic Opportunities Fund | PAGE 1 | TSR_AR_56167N589 |

Key Fund Statistics (as of June 30, 2024)

| |

Net Assets | $81,425,688 |

Number of Equity Holdings | 37 |

| |

Net Advisory Fee | $694,045 |

Portfolio Turnover | 32% |

Visit https://www.olsteinfunds.com/resources/documents-forms for more recent performance information.

What did the Fund invest in? (as of June 30, 2024)

| |

Security Type | (% of Net Assets) |

Common Stocks | 96.1% |

Cash & Other | 3.9% |

| |

Top 10 Equity Issuers | (% of Net Assets) |

Prestige Consumer Healthcare, Inc. | 4.1% |

Shyft Group, Inc. | 4.1% |

Sensata Technologies Holding PLC | 4.1% |

Integra LifeSciences Holdings Corporation | 4.0% |

ABM Industries, Inc. | 4.0% |

Gates Industrial Corporation PLC | 3.9% |

Dine Brands Global, Inc. | 3.7% |

Central Garden & Pet Company - Class A | 3.2% |

Mohawk Industries, Inc. | 3.2% |

Citizens Financial Group, Inc. | 3.2% |

Sector Breakdown (% of Equity Investments)

Householding

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Olstein Capital Management, L.P. documents not be householded, please contact Olstein Capital Management, L.P. at 1-800-799-2113, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Olstein Capital Management, L.P. or your financial intermediary.

For additional information about the Fund, including its prospectus and other important materials, scan the QR code or visit https://www.olsteinfunds.com/resources/documents-forms

The Olstein Strategic Opportunities Fund is distributed by Quasar Distributors, LLC.

| Olstein Strategic Opportunities Fund | PAGE 2 | TSR_AR_56167N589 |

100001064189471102411304111779781175431256414611150151000010729109591298714907162461730624949214902556331475100001009910121119791335613099110691806715684173101925640.614.313.710.58.25.85.71.2

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Leonard M. Rush is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other Services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 6/30/2024 | FYE 6/30/2023 |

| (a) Audit Fees | $34,250 | $32,500 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $10,000 | $9,500 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 6/30/2024 | FYE 6/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not applicable

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 6/30/2024 | FYE 6/30/2023 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | $0 | $0 |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable

(j) Not applicable

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

| | |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

THE OLSTEIN ALL CAP VALUE FUND

THE OLSTEIN STRATEGIC OPPORTUNITIES FUND

Core Financial Statements

June 30, 2024

TABLE OF CONTENTS

| | | | |

Schedules of Investments

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Financial Highlights

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

TABLE OF CONTENTS

The Olstein All Cap Value Fund

Schedule of Investments

as of June 30, 2024

| | | | | | | |

COMMON STOCKS - 91.0%

| | | | | | |

Advertising Agencies - 1.5%

| | | | | | |

Omnicom Group, Inc. | | | 87,488 | | | $7,847,674 |

Aerospace & Defense - 3.2%

| | | | | | |

General Dynamics Corporation | | | 11,000 | | | 3,191,540 |

L3Harris Technologies, Inc. | | | 31,000 | | | 6,961,980 |

RTX Corporation | | | 70,000 | | | 7,027,300 |

| | | | | | 17,180,820 |

Air Delivery & Freight Services - 3.3%

| | | |

FedEx Corporation | | | 27,500 | | | 8,245,600 |

United Parcel Service, Inc. - Class B | | | 68,000 | | | 9,305,800 |

| | | | | | 17,551,400 |

Airlines - 2.2%

| | | | | | |

Delta Air Lines, Inc. | | | 132,000 | | | 6,262,080 |

Southwest Airlines Company | | | 193,000 | | | 5,521,730 |

| | | | | | 11,783,810 |

Auto Components - 1.1%

| | | | | | |

Aptiv PLC(a) | | | 82,000 | | | 5,774,440 |

Auto Manufacturers - 1.2%

| | | | | | |

General Motors Company | | | 141,000 | | | 6,550,860 |

Automobiles - 0.4%

| | | | | | |

Winnebago Industries, Inc.(b) | | | 39,500 | | | 2,140,900 |

Building Products - 0.5%

| | | | | | |

Carrier Global Corporation | | | 46,000 | | | 2,901,680 |

Capital Markets - 1.0%

| | | | | | |

Goldman Sachs Group, Inc. | | | 12,000 | | | 5,427,840 |

Chemicals - 4.1%

| | | | | | |

Corteva, Inc. | | | 159,000 | | | 8,576,460 |

Eastman Chemical Company | | | 48,000 | | | 4,702,560 |

International Flavors & Fragrances, Inc. | | | 88,000 | | | 8,378,480 |

| | | | | | 21,657,500 |

Commercial Banks - 6.0%

| | | | | | |

Citizens Financial Group, Inc. | | | 228,717 | | | 8,240,673 |

Fifth Third Bancorp | | | 216,000 | | | 7,881,840 |

U.S. Bancorp | | | 215,660 | | | 8,561,702 |

Wells Fargo & Company | | | 121,000 | | | 7,186,190 |

| | | | | | 31,870,405 |

Commercial Services - 1.1%

| | | | | | |

Moody’s Corporation | | | 6,500 | | | 2,736,045 |

S&P Global, Inc. | | | 6,500 | | | 2,899,000 |

| | | | | | 5,635,045 |

Commercial Services & Supplies - 3.1%

| | | |

ABM Industries, Inc. | | | 225,953 | | | 11,426,443 |

Korn Ferry | | | 76,000 | | | 5,102,640 |

| | | | | | 16,529,083 |

| | | | | | | |

| | | | | | | |

Communications Equipment - 1.6%

| | | | | | |

Cisco Systems, Inc. | | | 176,000 | | | $8,361,760 |

Computers - 0.6%

| | | | | | |

Apple, Inc. | | | 14,500 | | | 3,053,990 |

Consumer Finance - 2.1%

| | | | | | |

American Express Company | | | 15,000 | | | 3,473,250 |

Equifax, Inc.(b) | | | 10,000 | | | 2,424,600 |

MasterCard, Inc. - Class A | | | 5,093 | | | 2,246,828 |

Visa, Inc. - Class A(b) | | | 10,500 | | | 2,755,935 |

| | | | | | 10,900,613 |

Consumer Staples Distribution & Retail - 1.3%

| | | |

Target Corporation | | | 46,000 | | | 6,809,840 |

Distributors - 1.6%

| | | | | | |

LKQ Corporation | | | 202,000 | | | 8,401,180 |

Diversified Financial Services - 2.0%

| | | | | | |

Berkshire Hathaway, Inc. - Class B(a) | | | 13,500 | | | 5,491,800 |

Invesco Ltd. | | | 358,996 | | | 5,370,580 |

| | | | | | 10,862,380 |

E-Commerce - 1.0%

| | | | | | |

eBay, Inc.(b) | | | 102,000 | | | 5,479,440 |

Electronic Equipment, Instruments & Components - 1.1%

| | | | | | |

Vontier Corporation | | | 157,400 | | | 6,012,680 |

Electronics - 1.8%

| | | | | | |

Sensata Technologies Holding PLC | | | 253,600 | | | 9,482,104 |

Energy Equipment & Services - 1.5%

| | | | | | |

Schlumberger Ltd. | | | 166,000 | | | 7,831,880 |

Entertainment - 0.5%

| | | | | | |

Warner Bros Discovery, Inc.(a)(b) | | | 365,000 | | | 2,715,600 |

Financial Services - 0.4%

| | | | | | |

Fiserv, Inc.(a) | | | 13,000 | | | 1,937,520 |

Food & Drug Retailers - 1.7%

| | | | | | |

CVS Health Corporation | | | 155,000 | | | 9,154,300 |

Health Care Equipment & Supplies - 6.7%

| | | |

Baxter International, Inc. | | | 273,000 | | | 9,131,850 |

Becton, Dickinson and Company | | | 30,000 | | | 7,011,300 |

Hologic, Inc.(a) | | | 92,000 | | | 6,831,000 |

Medtronic PLC | | | 73,000 | | | 5,745,830 |

Zimmer Biomet Holdings, Inc. | | | 63,000 | | | 6,837,390 |

| | | | | | 35,557,370 |

Health Care Providers & Services - 4.7%

| | | |

Henry Schein, Inc.(a) | | | 86,000 | | | 5,512,600 |

Quest Diagnostics Inc. | | | 67,000 | | | 9,170,960 |

UnitedHealth Group, Inc. | | | 16,500 | | | 8,402,790 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Olstein All Cap Value Fund

Schedule of Investments

as of June 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Health Care Providers & Services - (Continued)

|

Universal Health Services, Inc. - Class B | | | 10,000 | | | $1,849,300 |

| | | | | | 24,935,650 |

Hotels, Restaurants & Leisure - 0.8%

| | | | | | |

Denny’s Corporation(a) | | | 563,400 | | | 4,000,140 |

Household Durables - 1.3%

| | | | | | |

Mohawk Industries, Inc.(a) | | | 59,250 | | | 6,730,207 |

Household Products - 2.3%

| | | | | | |

Kimberly-Clark Corporation | | | 48,000 | | | 6,633,600 |

Reynolds Consumer Products, Inc. | | | 206,750 | | | 5,784,865 |

| | | | | | 12,418,465 |

Industrial Equipment Wholesale - 1.0%

| | | |

WESCO International, Inc. | | | 34,850 | | | 5,524,422 |

Insurance - 2.5%

| | | | | | |

Travelers Companies, Inc. | | | 31,000 | | | 6,303,540 |

Willis Towers Watson PLC | | | 26,500 | | | 6,946,710 |

| | | | | | 13,250,250 |

Interactive Media & Services - 0.6%

| | | | | | |

Meta Platforms, Inc. - Class A | | | 6,000 | | | 3,025,320 |

Internet Software & Services - 1.0%

| | | | | | |

Alphabet, Inc. - Class C | | | 30,000 | | | 5,502,600 |

IT Services - 3.1%

| | | | | | |

Fidelity National Information Services, Inc. | | | 99,000 | | | 7,460,640 |

SS&C Technologies Holdings, Inc. | | | 141,000 | | | 8,836,470 |

| | | | | | 16,297,110 |

Machinery - 6.8%

| | | | | | |

Cummins, Inc. | | | 25,000 | | | 6,923,250 |

Deere & Company | | | 20,500 | | | 7,659,415 |

Dover Corporation | | | 28,000 | | | 5,052,600 |

Fortive Corporation | | | 50,059 | | | 3,709,372 |

Middleby Corporation(a) | | | 50,800 | | | 6,228,588 |

Stanley Black & Decker, Inc. | | | 85,000 | | | 6,790,650 |

| | | | | | 36,363,875 |

Materials - 0.5%

| | | | | | |

Axalta Coating Systems Ltd.(a) | | | 76,000 | | | 2,596,920 |

Media - 2.9%

| | | | | | |

Comcast Corporation - Class A | | | 90,000 | | | 3,524,400 |

Walt Disney Company | | | 119,000 | | | 11,815,510 |

| | | | | | 15,339,910 |

Pharmaceuticals - 2.8%

| | | | | | |

Avantor, Inc.(a) | | | 291,184 | | | 6,173,101 |

Johnson & Johnson | | | 61,000 | | | 8,915,760 |

| | | | | | 15,088,861 |

| | | | | | | |

| | | | | | | |

Real Estate Management & Development - 2.7%

| | | |

CBRE Group, Inc. - Class A(a) | | | 86,000 | | | $7,663,460 |

Jones Lang LaSalle, Inc.(a) | | | 33,756 | | | 6,929,432 |

| | | | | | 14,592,892 |

Restaurants - 1.1%

| | | | | | |

Dine Brands Global, Inc.(b) | | | 159,600 | | | 5,777,520 |

Semiconductors & Semiconductor Equipment - 2.2%

| | | | | | |

Kulicke and Soffa Industries, Inc.(b) | | | 154,000 | | | 7,575,260 |

Texas Instruments, Inc. | | | 21,500 | | | 4,182,395 |

| | | | | | 11,757,655 |

Software - 0.6%

| | | | | | |

Microsoft Corporation | | | 7,000 | | | 3,128,650 |

Telecommunications - 1.5%

| | | | | | |

Corning, Inc. | | | 212,000 | | | 8,236,200 |

TOTAL COMMON STOCKS

(Cost $415,912,378) | | | | | | 483,978,761 |

SHORT-TERM INVESTMENTS - 11.0%

|

Investments Purchased with Proceeds from Securities Lending - 2.5%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 5.46% (c) | | | 12,970,728 | | | 12,970,728 |

Money Market Funds - 8.5%

| | | | | | |

First American Government Obligations Fund - Class X, 5.23%(c) | | | 45,364,781 | | | 45,364,781 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $58,335,509) | | | | | | 58,335,509 |

TOTAL INVESTMENTS - 102.0% (Cost $474,247,887) | | | | | | $542,314,270 |

U.S. Bank Money Market Deposit Account - 0.4%(d) | | | | | | 2,387,620 |

Liabilities in Excess of

Other Assets - (2.4)% | | | | | | (12,820,929) |

TOTAL NET ASSETS - 100.0% | | | | | | $531,880,961 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| All or a portion of this security is on loan as of June 30, 2024. The total fair value of these securities was $12,891,468, which represented 2.4% of net assets. |

(c)

| The rate shown represents the 7-day effective yield as of June 30, 2024. |

(d)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of June 30, 2024 was 5.17%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Olstein Strategic Opportunities Fund

Schedule of Investments

as of June 30, 2024

| | | | | | | |

COMMON STOCKS - 96.1%

| | | | | | |

Auto Components - 2.2%

| | | | | | |

Miller Industries, Inc. | | | 33,000 | | | $1,815,660 |

Auto Manufacturers - 3.1%

| | | | | | |

Blue Bird Corporation(a) | | | 47,000 | | | 2,530,950 |

Automobiles - 1.2%

| | | | | | |

Winnebago Industries, Inc.(b) | | | 17,500 | | | 948,500 |

Banks - 2.6%

| | | | | | |

First Hawaiian, Inc. | | | 100,000 | | | 2,076,000 |

Commercial Banks - 7.8%

| | | | | | |

Citizens Financial Group, Inc. | | | 71,283 | | | 2,568,326 |

Home BancShares, Inc. | | | 86,000 | | | 2,060,560 |

Prosperity Bancshares, Inc. | | | 28,000 | | | 1,711,920 |

| | | | | | 6,340,806 |

Commercial Services & Supplies - 8.6%

|

ABM Industries, Inc. | | | 64,000 | | | 3,236,480 |

Brady Corporation - Class A | | | 30,000 | | | 1,980,600 |

Korn Ferry | | | 26,000 | | | 1,745,640 |

| | | | | | 6,962,720 |

Diversified Financial Services - 2.9%

| | | |

Invesco Ltd. | | | 155,950 | | | 2,333,012 |

Electronic Equipment, Instruments &

Components - 5.0%

| | | |

Vishay Intertechnology, Inc.(b) | | | 104,000 | | | 2,319,200 |

Vontier Corporation | | | 46,600 | | | 1,780,120 |

| | | | | | 4,099,320 |

Electronics - 4.1%

| | | | | | |

Sensata Technologies Holding PLC | | | 88,400 | | | 3,305,276 |

Health Care Equipment & Supplies - 1.9%

| | | |

Zimmer Biomet Holdings, Inc. | | | 14,400 | | | 1,562,832 |

Health Care Products - 4.0%

| | | | | | |

Integra LifeSciences Holdings Corporation(a)(b) | | | 113,000 | | | 3,292,820 |

Hotels, Restaurants & Leisure - 2.9%

| | | |

Denny's Corporation(a) | | | 333,000 | | | 2,364,300 |

Household Durables - 6.4%

| | | | | | |

Central Garden & Pet Company - Class A(a) | | | 79,000 | | | 2,609,370 |

Mohawk Industries, Inc.(a) | | | 22,750 | | | 2,584,173 |

| | | | | | 5,193,543 |

Household Products - 2.2%

| | | | | | |

Reynolds Consumer Products, Inc. | | | 65,250 | | | 1,825,695 |

| | | | | | | |

| | | | | | | |

Industrial Equipment Wholesale - 2.6%

| | | |

WESCO International, Inc. | | | 13,150 | | | $2,084,538 |

Leisure Products - 2.8%

| | | | | | |

Johnson Outdoors, Inc. - Class A(b) | | | 66,000 | | | 2,308,680 |

Machinery - 15.9%

| | | | | | |

AGCO Corporation | | | 6,000 | | | 587,280 |

Douglas Dynamics, Inc. | | | 72,000 | | | 1,684,800 |

Gates Industrial Corporation PLC(a) | | | 201,000 | | | 3,177,810 |

Graham Corporation(a) | | | 37,752 | | | 1,063,097 |

Middleby Corporation(a) | | | 15,700 | | | 1,924,977 |

Shyft Group, Inc. | | | 282,741 | | | 3,353,308 |

Timken Company | | | 14,500 | | | 1,161,885 |

| | | | | | 12,953,157 |

Materials - 1.1%

| | | | | | |

Axalta Coating Systems Ltd.(a) | | | 27,000 | | | 922,590 |

Pharmaceuticals - 4.1%

| | | | | | |

Prestige Consumer Healthcare, Inc.(a) | | | 49,000 | | | 3,373,650 |

Professional Services - 1.4%

| | | | | | |

First Advantage Corporation(b) | | | 73,000 | | | 1,173,110 |

Real Estate Management & Development - 5.6%

| | | |

Cushman & Wakefield PLC(a) | | | 233,000 | | | 2,423,200 |

Jones Lang LaSalle, Inc.(a) | | | 10,244 | | | 2,102,888 |

| | | | | | 4,526,088 |

Restaurants - 3.7%

| | | | | | |

Dine Brands Global, Inc.(b) | | | 82,000 | | | 2,968,400 |

Semiconductors & Semiconductor

Equipment - 2.8%

| | | |

Kulicke and Soffa Industries, Inc.(b) | | | 47,000 | | | 2,311,930 |

Transportation Equipment - 1.2%

| | | | | | |

Wabash National Corporation(b) | | | 43,000 | | | 939,120 |

TOTAL COMMON STOCKS

(Cost $72,479,405) | | | | | | 78,212,697 |

| | | | | | | |

| | | | | | | |

SHORT-TERM INVESTMENTS - 13.1%

|

Investments Purchased with Proceeds from Securities Lending - 9.3%

| | | | | | |

Mount Vernon Liquid Assets Portfolio, LLC, 5.46%(c) | | | 7,579,362 | | | 7,579,362 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Olstein Strategic Opportunities Fund

Schedule of Investments

as of June 30, 2024(Continued)

| | | | | | | |

Money Market Funds - 3.8%

| | | | | | |

First American Government Obligations Fund - Class X, 5.23%(c) | | | 3,109,661 | | | $3,109,661 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $10,689,023) | | | | | | 10,689,023 |

TOTAL INVESTMENTS - 109.2% (Cost $83,168,428) | | | | | | $88,901,720 |

U.S. Bank Money Market Deposit Account - 0.2%(d) | | | | | | 163,666 |

Liabilities in Excess of

Other Assets - (9.4)% | | | | | | (7,639,698) |

TOTAL NET ASSETS - 100.0% | | | | | | $81,425,688 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| All or a portion of this security is on loan as of June 30, 2024. The total fair value of these securities was $7,494,573, which represented 9.2% of net assets. |

(c)

| The rate shown represents the 7-day effective yield as of June 30, 2024. |

(d)

| The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of June 30, 2024 was 5.17%. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets and Liabilities

as of June 30, 2024

| | | | | | | |

Assets:

| | | | | | |

Investments, at value(1) (at cost $474,247,887 and $83,168,428 respectively) | | | $542,314,270 | | | $88,901,720 |

Cash Equivalent | | | 2,387,620 | | | 163,666 |

Receivable for capital shares sold | | | 12,350 | | | 11,036 |

Dividends and interest receivable | | | 1,018,062 | | | 84,946 |

Securities lending income receivable | | | 1,963 | | | 746 |

Prepaid expenses | | | 23,669 | | | 17,297 |

Total assets | | | 545,757,934 | | | 89,179,411 |

|

Liabilities:

| | | | | | |

Payable upon return of securities loaned | | | 12,970,728 | | | 7,579,362 |

Payable to investment adviser | | | 438,764 | | | 50,359 |

Payable for capital shares redeemed | | | 149,768 | | | 2,377 |

Payable for transfer agent fees & expenses | | | 94,917 | | | 36,477 |

Accrued distribution fees | | | 77,400 | | | 8,872 |

Payable for fund administration & accounting fees | | | 73,067 | | | 32,132 |

Payable for audit fees | | | 22,000 | | | 22,248 |

Payable for custody fees | | | 6,158 | | | 962 |

Payable for trustee fees | | | 5,315 | | | 5,384 |

Payable for compliance fees | | | 3,124 | | | 3,124 |

Accrued expenses | | | 35,732 | | | 12,426 |

Total liabilities | | | 13,876,973 | | | 7,753,723 |

Net Assets | | | $531,880,961 | | | $81,425,688 |

Net Assets Consist of:

| | | | | | |

Paid-in capital | | | $436,966,838 | | | $73,450,595 |

Total distributable earnings | | | 94,914,123 | | | 7,975,093 |

Total net assets | | | $531,880,961 | | | $81,425,688 |

| | | | | | | |

(1)

| Includes securities on loan with a fair value of $12,891,468 and $7,494,573, respectively. Total Securities include both those sold and pending settlement. |

| | | | | | | |

Class A:

| | | | | | |

Net assets | | | $274,620,475 | | | $25,071,306 |

Shares of beneficial interest outstanding(1) | | | 10,203,091 | | | 1,170,551 |

Net asset value, offering price and redemption price per share | | | $26.92 | | | $21.42 |

Maximum offering price per share(2) | | | $28.48 | | | $22.66 |

|

Class C:

| | | | | | |

Net assets | | | $24,667,655 | | | $4,313,137 |

Shares of beneficial interest outstanding(1) | | | 1,303,484 | | | 237,024 |

Net asset value, offering price and redemption price per share(3) | | | $18.92 | | | $18.20 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets and Liabilities

as of June 30, 2024(Continued)

| | | | | | | |

|

Adviser Class:

| | | | | | |

Net assets | | | $232,592,831 | | | $52,041,245 |

Shares of beneficial interest outstanding(1) | | | 8,535,557 | | | 2,378,988 |

Net asset value, offering price and redemption price per share | | | $27.25 | | | $21.88 |

| | | | | | | |

(1)

| Unlimited number of shares authorized without par value. |

(2)

| The offering price is calculated by dividing the net asset value by 1 minus the maximum sales charge of 5.50%. |

(3)

| May be subject to a contingent deferred sales charge of 1.00% on certain shares redeemed within 12 months of purchase on Class C shares. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Operations

For the Year Ended June 30, 2024

| | | | | | | |

Investment Income:

| | | | | | |

Dividend income | | | $10,844,519 | | | $1,357,865 |

Interest income | | | 2,419,372 | | | 215,013 |

Securities lending income, net | | | 105,167 | | | 20,127 |

Total investment income | | | 13,369,058 | | | 1,593,005 |

Expenses:

| | | | | | |

Investment advisory fees (See Note 4) | | | 5,572,937 | | | 836,561 |

Transfer agent fees & expenses (See Note 4) | | | 388,233 | | | 144,681 |

Fund administration & accounting fees (See Note 4) | | | 305,874 | | | 139,532 |

Federal & state registration fees | | | 49,759 | | | 45,295 |

Custody fees (See Note 4) | | | 37,712 | | | 5,781 |

Postage & printing fees | | | 29,595 | | | 9,497 |

Insurance fees | | | 23,652 | | | 7,020 |

Trustee fees | | | 22,827 | | | 22,411 |

Audit fees | | | 22,000 | | | 20,749 |

Legal fees | | | 18,240 | | | 18,239 |

Compliance fees (See Note 4) | | | 12,499 | | | 12,499 |

Other expenses | | | 32,611 | | | 9,615 |

Distribution fees (See Note 5)

| | | | | | |

Class A | | | 708,184 | | | 66,905 |

Class C | | | 282,329 | | | 53,304 |

Total expenses | | | 7,506,452 | | | 1,392,089 |

Less: waiver from Investment adviser (See Note 4) | | | — | | | (142,516) |

Net expenses | | | 7,506,452 | | | 1,249,573 |

Net investment income | | | 5,862,606 | | | 343,432 |

Realized and Unrealized Gain (Loss) on Investments:

| | | | | | |

Net realized gain (loss) on investments | | | 30,885,448 | | | 3,376,326 |

Net change in unrealized appreciation/depreciation on investments | | | (4,480,530) | | | (814,182) |

Net realized and unrealized gain on investments | | | 26,404,918 | | | 2,562,144 |

Net increase in net assets resulting from operations | | | $32,267,524 | | | $2,905,576 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Changes in Net Assets

| | | | |

Operations:

| | | | | | |

Net Investment Income | | | $ 5,862,606 | | | $ 4,577,322 |

Net realized gain (loss) on investments | | | 30,885,448 | | | (2,820,620) |

Change in unrealized appreciation/depreciation on investments | | | (4,480,530) | | | 51,180,211 |

Net increase in net assets resulting from operations | | | 32,267,524 | | | 52,936,913 |

Capital Share Transactions:

| | | | | | |

Class A:

| | | | | | |

Proceeds from shares sold | | | 6,523,907 | | | 12,984,558 |

Proceeds from reinvestment of distributions | | | 2,059,336 | | | 16,771,484 |

Payments for shares redeemed | | | (46,950,098) | | | (30,839,416) |

Decrease in net assets resulting from Class A transactions | | | (38,366,855) | | | (1,083,374) |

Class C:

| | | | | | |

Proceeds from shares sold | | | 507,250 | | | 950,647 |

Proceeds from reinvestment of distributions | | | 34,763 | | | 3,419,312 |

Payments for shares redeemed | | | (11,401,219) | | | (9,808,254) |

Decrease in net assets resulting from Class C transactions | | | (10,859,206) | | | (5,438,295) |

Adviser Class:

| | | | | | |

Proceeds from shares sold | | | 4,972,908 | | | 10,858,591 |

Proceeds from reinvestment of distributions | | | 3,032,624 | | | 17,140,789 |

Payments for shares redeemed | | | (55,432,965) | | | (27,440,426) |

Increase (Decrease) in net assets resulting from Adviser Class transactions | | | (47,427,433) | | | 558,954 |

Net decrease in net assets from capital share transactions | | | (96,653,494) | | | (5,962,715) |

Distributions to shareholders:

| | | | | | |

Class A | | | (2,488,300) | | | (20,211,840) |

Class C | | | (36,970) | | | (3,512,540) |

Adviser Class | | | (3,098,655) | | | (17,758,154) |

Total distributions to shareholders | | | (5,623,925) | | | (41,482,534) |

Total increase (decrease) in net assets: | | | (70,009,895) | | | 5,491,664 |

Net Assets:

| | | | | | |

Beginning of year | | | 601,890,856 | | | 596,399,192 |

End of year | | | $531,880,961 | | | $601,890,856 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Changes in Net Assets

| | | | |

Operations:

| | | | | | |

Net Investment Income | | | $ 343,432 | | | $ 209,950 |

Net realized gain on investments | | | 3,376,326 | | | 1,797,633 |

Change in unrealized appreciation/depreciation on investments | | | (814,182) | | | 12,061,930 |

Net increase in net assets resulting from operations | | | 2,905,576 | | | 14,069,513 |

Capital Share Transactions:

| | | | | | |

Class A:

| | | | | | |

Proceeds from shares sold | | | 2,557,372 | | | 2,220,710 |

Proceeds from reinvestment of distributions | | | 20,890 | | | 374,368 |

Payments for shares redeemed | | | (6,821,562) | | | (3,899,689) |

Decrease in net assets resulting from Class A transactions | | | (4,243,300) | | | (1,304,611) |

Class C:

| | | | | | |

Proceeds from shares sold | | | 61,691 | | | 537,704 |

Proceeds from reinvestment of distributions | | | — | | | 138,233 |

Payments for shares redeemed | | | (2,561,966) | | | (2,321,297) |

Decrease in net assets resulting from Class C transactions | | | (2,500,275) | | | (1,645,360) |

Adviser Class:

| | | | | | |

Proceeds from shares sold | | | 6,929,078 | | | 5,506,962 |

Proceeds from reinvestment of distributions | | | 222,759 | | | 780,255 |

Payments for shares redeemed | | | (10,045,206) | | | (12,965,361) |

Decrease in net assets resulting from Adviser Class transactions | | | (2,893,369) | | | (6,678,144) |

Net decrease in net assets from capital share transactions | | | (9,636,944) | | | (9,628,115) |

Distributions to Shareholders:

| | | | | | |

Class A | | | (25,701) | | | (442,402) |

Class C | | | — | | | (144,158) |

Adviser Class | | | (232,788) | | | (834,065) |

Total distributions to shareholders | | | (258,489) | | | (1,420,625) |

Total increase (decrease) in net assets: | | | (6,989,857) | | | 3,020,773 |

Net Assets:

| | | | | | |

Beginning of year | | | 88,415,545 | | | 85,394,772 |

End of year | | | $81,425,688 | | | $88,415,545 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Olstein All Cap Value Fund

Financial Highlights

Class A

| | | | |

Net Asset Value, Beginning of Year | | | $25.57 | | | $25.11 | | | $34.32 | | | $21.40 | | | $24.10 |

Investment Operations:

| | | | | | | | | | | | | | | |

Net Investment Income (loss)(1) | | | 0.25 | | | 0.18 | | | 0.01 | | | (0.01) | | | 0.17 |

Net realized and unrealized gain (loss) on investments | | | 1.32 | | | 2.04 | | | (4.77)(2) | | | 13.06 | | | (2.12) |

Total from Investment operations | | | 1.57 | | | 2.22 | | | (4.76) | | | 13.05 | | | (1.95) |

Less distributions from:

| | | | | | | | | | | | | | | |

Net Investment Income | | | (0.22) | | | — | | | — | | | (0.13) | | | (0.10) |

Net realized gains | | | — | | | (1.76) | | | (4.45) | | | — | | | (0.65) |

Total distributions | | | (0.22) | | | (1.76) | | | (4.45) | | | (0.13) | | | (0.75) |

Net Asset Value, End of Year | | | $26.92 | | | $25.57 | | | $25.11 | | | $34.32 | | | $21.40 |

Total return(3) | | | 6.23% | | | 9.30% | | | −15.99% | | | 61.15% | | | −8.54% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | | $274,620 | | | $298,532 | | | $ 293,747 | | | $ 142,863 | | | $ 93,359 |

Ratio of expenses to average net assets | | | 1.42% | | | 1.41% | | | 1.42% | | | 1.39% | | | 1.40% |

Ratio of net investment income (loss) to average net assets | | | 0.98% | | | 0.71% | | | 0.03% | | | (0.05)% | | | 0.75% |

Portfolio turnover | | | 27% | | | 32% | | | 43% | | | 42% | | | 48% |

| | | | | | | | | | | | | | | | |

(1)

| Per share amounts calculated using the average shares method. |

(2)

| Net realized and unrealized loss per share in this caption is a balancing amount necessary to reconcile changes in net asset value per share for the year, and may not reconcile with the aggregate gain on the Statement of Operations due to share transactions for the year.

|

(3)

| Total return does not reflect sales charges.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Olstein All Cap Value Fund

Financial Highlights

Class C

| | | | |

Net Asset Value, Beginning of Year | | | $17.97 | | | $18.29 | | | $26.38 | | | $16.53 | | | $18.82 |

Investment Operations:

| | | | | | | | | | | | | | | |

Net Investment Income (loss)(1) | | | 0.04 | | | (0.01) | | | (0.18) | | | (0.17) | | | (0.00)(2) |

Net realized and unrealized gain (loss) on investments | | | 0.93 | | | 1.45(3) | | | (3.46) | | | 10.06 | | | (1.64) |

Total from Investment operations | | | 0.97 | | | 1.44 | | | (3.64) | | | 9.89 | | | (1.64) |

Less distributions from:

| | | | | | | | | | | | | | | |

Net Investment Income | | | (0.02) | | | — | | | — | | | (0.04) | | | — |

Net realized gains | | | — | | | (1.76) | | | (4.45) | | | — | | | (0.65) |

Total distributions | | | (0.02) | | | (1.76) | | | (4.45) | | | (0.04) | | | (0.65) |

Net Asset Value, End of Year | | | $18.92 | | | $17.97 | | | $18.29 | | | $26.38 | | | $16.53 |

Total return(4) | | | 5.43% | | | 8.46% | | | −16.62% | | | 59.89% | | | −9.21% |

SUPPLEMENTAL Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | | $24,668 | | | $34,328 | | | $40,368 | | | $289,103 | | | $248,420 |

Ratio of expenses to average net assets | | | 2.17% | | | 2.16% | | | 2.15% | | | 2.14% | | | 2.15% |

Ratio of net investment gain (loss) to average

net assets | | | 0.23% | | | (0.04)% | | | (0.70)% | | | (0.80)% | | | (0.00)%(5) |

Portfolio turnover | | | 27% | | | 32% | | | 43% | | | 42% | | | 48% |

| | | | | | | | | | | | | | | | |

(1)

| Per share amounts calculated using the average shares method. |

(2)

| Amount rounds to less than $0.01 per share. |

(3)

| Net realized and unrealized loss per share in this caption is a balancing amount necessary to reconcile changes in net asset value per share for the year, and may not reconcile with the aggregate gain on the Statement of Operations due to share transactions for the year. |

(4)

| Total return does not reflect sales charges. |

(5)

| Amount rounds to less than 0.01% per share. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Olstein All Cap Value Fund

Financial Highlights

Adviser Class

| | | | |

Net Asset Value, Beginning of Year | | | $25.92 | | | $25.37 | | | $34.54 | | | $21.51 | | | $24.15 |

Investment Operations:

| | | | | | | | | | | | | | | |

Net Investment Income(1) | | | 0.32 | | | 0.24 | | | 0.09 | | | 0.06 | | | 0.23 |

Net realized and unrealized gain (loss) on investments | | | 1.33 | | | 2.07 | | | (4.81)(2) | | | 13.13(2) | | | (2.13) |

Total from Investment operations | | | 1.65 | | | 2.31 | | | (4.72) | | | 13.19 | | | (1.90) |

Less distributions from:

| | | | | | | | | | | | | | | |

Net Investment Income | | | (0.32) | | | — | | | — | | | (0.16) | | | (0.09) |

Net realized gains | | | — | | | (1.76) | | | (4.45) | | | — | | | (0.65) |

Total distributions | | | (0.32) | | | (1.76) | | | (4.45) | | | (0.16) | | | (0.74) |

Net Asset Value, End of Year | | | $27.25 | | | $25.92 | | | $25.37 | | | $34.54 | | | $21.51 |

Total return | | | 6.48% | | | 9.57% | | | −15.76% | | | 61.49% | | | −8.27% |

SUPPLEMENTAL Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | | $232,593 | | | $269,031 | | | $262,284 | | | $322,350 | | | $166,492 |

Ratio of expenses to average net assets | | | 1.17% | | | 1.16% | | | 1.16% | | | 1.14% | | | 1.15% |

Ratio of net investment income to average

net assets | | | 1.23% | | | 0.96% | | | 0.29% | | | 0.20% | | | 1.00% |

Portfolio turnover | | | 27% | | | 32% | | | 43% | | | 42% | | | 48% |

| | | | | | | | | | | | | | | | |

(1)

| Per share amounts calculated using the average shares method. |

(2)

| Net realized and unrealized gain (loss) per share in this caption is a balancing amount necessary to reconcile changes in net asset value per share for the year, and may not reconcile with the aggregate gain on the Statement of Operations due to share transactions for the year.

|

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Olstein Strategic Opportunities Fund

Financial Highlights

Class A

| | | | |

Net Asset Value, Beginning of Year | | | $20.70 | | | $17.97 | | | $27.47 | | | $15.19 | | | $17.24 |

Investment Operations:

| | | | | | | | | | | | | | | |

Net Investment Income (loss)(1) | | | 0.06 | | | 0.03 | | | (0.09) | | | (0.15) | | | (0.01) |

Net realized and unrealized gain (loss) on investments | | | 0.68 | | | 3.02 | | | (6.90) | | | 12.43 | | | (2.04) |

Total from Investment operations | | | 0.74 | | | 3.05 | | | (6.99) | | | 12.28 | | | (2.05) |

Less distributions from:

| | | | | | | | | | | | | | | |

Net Investment Income | | | (0.02) | | | — | | | — | | | — | | | — |

Net realized gains | | | — | | | (0.32) | | | (2.51) | | | — | | | — |

Total distributions | | | (0.02) | | | (0.32) | | | (2.51) | | | — | | | — |

Net Asset Value, End of Year

| | | $21.42 | | | $20.70 | | | $17.97 | | | $27.47 | | | $15.19 |

Total return(2) | | | 3.58% | | | 17.08% | | | −27.83% | | | 80.84% | | | −11.89% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | | $25,071 | | | $28,454 | | | $25,917 | | | $31,827 | | | $15,873 |

Ratio of expenses to average net assets:

| | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 1.77% | | | 1.73% | | | 1.62% | | | 1.70% | | | 1.81% |

After expense waiver/recoupment | | | 1.60% | | | 1.60% | | | 1.60% | | | 1.60% | | | 1.60% |

Ratio of net investment income (loss) to average net assets:

| | | | | | | | | | | | | | | |

After expense waiver/recoupment | | | 0.30% | | | 0.15% | | | (0.39)% | | | (0.68)% | | | (0.07)% |

Portfolio turnover | | | 32% | | | 26% | | | 32% | | | 47% | | | 45% |

| | | | | | | | | | | | | | | | |

(1)

| Per share amounts calculated using the average shares method. |

(2)

| Total return does not reflect sales charges. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Olstein Strategic Opportunities Fund

Financial Highlights

Class C

| | | | |

Net Asset Value, Beginning of Year | | | $ 17.71 | | | $ 15.52 | | | $24.25 | | | $13.52 | | | $15.45 |

Investment Operations:

| | | | | | | | | | | | | | | |

Net Investment loss(1) | | | (0.08) | | | (0.10) | | | (0.24) | | | (0.28) | | | (0.12) |

Net realized and unrealized gain (loss) on investments | | | 0.57(2) | | | 2.61(2) | | | (5.98) | | | 11.01 | | | (1.81) |

Total from Investment operations | | | 0.49 | | | 2.51 | | | (6.22) | | | 10.73 | | | (1.93) |

Less distributions from:

| | | | | | | | | | | | | | | |

Net realized gains | | | — | | | (0.32) | | | (2.51) | | | — | | | — |

Total distributions | | | — | | | (0.32) | | | (2.51) | | | — | | | — |

Net Asset Value, End of Year | | | $ 18.20 | | | $ 17.71 | | | $15.52 | | | $24.25 | | | $13.52 |

Total return(3) | | | 2.77% | | | 16.29% | | | −28.38% | | | 79.36% | | | −12.49% |

Supplemental Data and Ratios

| | | | | | | | | | | | | | | |

Net assets, end of year (000’s omitted) | | | $4,313 | | | $6,695 | | | $7,341 | | | $16,515 | | | $11,135 |

Ratio of expenses to average net assets:

| | | | | | | | | | | | | | | |

Before expense waiver/recoupment | | | 2.52% | | | 2.48% | | | 2.35% | | | 2.46% | | | 2.55% |

After expense waiver/recoupment | | | 2.35% | | | 2.35% | | | 2.35% | | | 2.35% | | | 2.35% |

Ratio of net investment loss to average net assets:

| | | | | | | | | | | | | | | |

After expense waiver/recoupment | | | (0.44)% | | | (0.60)% | | | (1.14)% | | | (1.43)% | | | (0.82)% |

Portfolio turnover | | | 32% | | | 26% | | | 32% | | | 47% | | | 45% |

| | | | | | | | | | | | | | | | |

(1)

| Per share amounts calculated using the average shares method.

|

(2)

| Net realized and unrealized gain per share in this caption is a balancing amount necessary to reconcile changes in net asset value per share for the year, and may not reconcile with the aggregate gain on the Statement of Operations due to share transactions for the year.

|

(3)

| Total return does not reflect sales charges. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Olstein Strategic Opportunities Fund

Financial Highlights

Adviser Class

| | | | |

Net Asset Value, Beginning of Year | | | $21.17 | | | $18.32 | | | $27.89 | | | $15.39 | | | $17.42 |

Investment Operations:

| | | | | | | | | | | | | | | |