UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22525

Managed Portfolio Series

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Brian Wiedmeyer, President

Managed Portfolio Series

c/o U.S. Bank Global Fund Services

777 East Wisconsin Ave., 6th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 516-1712

Registrant’s telephone number, including area code

Date of fiscal year end: 07/31/2024

Date of reporting period: 07/31/2024

Item 1. Reports to Stockholders.

| (a) |

| Coho Relative Value Equity Fund |  |

| Advisor Class | COHOX | ||

| Annual Shareholder Report | July 31, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Advisor Class | $80 | 0.79% |

| Coho Relative Value Equity Fund | PAGE 1 | TSR_AR_56166Y636 |

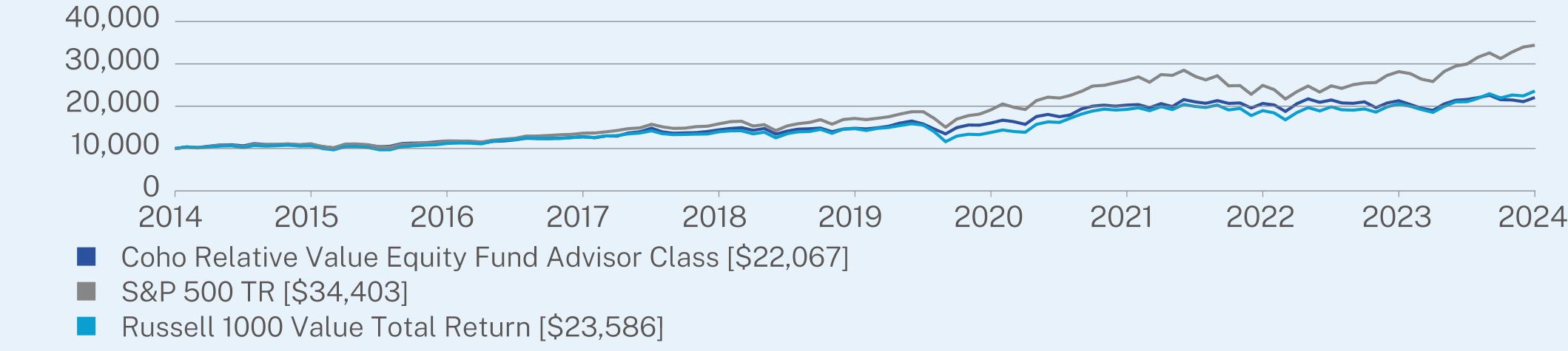

1 Year | 5 Year | 10 Year | |

Advisor Class | 3.59 | 8.33 | 8.24 |

S&P 500 TR | 22.15 | 15.00 | 13.15 |

Russell 1000 Value Total Return | 14.80 | 9.92 | 8.96 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $417,660,737 |

Number of Holdings | 28 |

Net Advisory Fee | $3,974,454 |

Portfolio Turnover | 19% |

Top 10 Issuers | (%) |

Lowe’s Companies | 5.1% |

Cencora | 5.1% |

UnitedHealth Group | 5.0% |

Microchip Technology | 4.6% |

Ross Stores | 4.5% |

Amgen | 4.2% |

Sysco | 4.2% |

Thermo Fisher Scientific | 4.2% |

W.W. Grainger | 3.8% |

Marsh & McLennan Companies | 3.7% |

| Coho Relative Value Equity Fund | PAGE 2 | TSR_AR_56166Y636 |

| Coho Relative Value ESG Fund |  |

| Advisor Class | CESGX | ||

| Annual Shareholder Report | July 31, 2024 |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Advisor Class | $81 | 0.79% |

| Coho Relative Value ESG Fund | PAGE 1 | TSR_AR_56166Y222 |

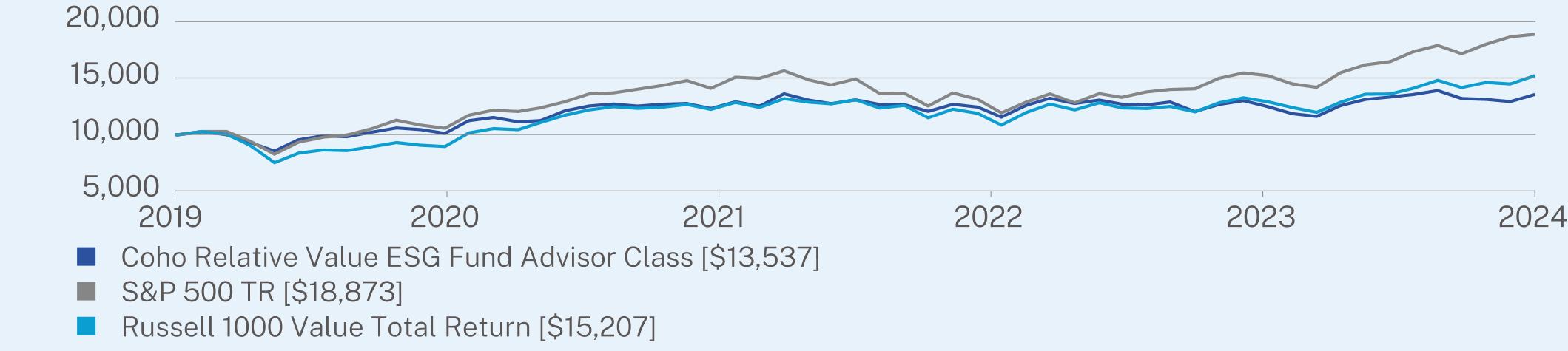

1 Year | Since Inception (11/27/2019) | |

Advisor Class | 4.20 | 6.69 |

S&P 500 TR | 22.15 | 14.55 |

Russell 1000 Value Total Return | 14.80 | 9.38 |

| * | The Fund’s past performance is not a good predictor of the Fund’s future performance. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

Net Assets | $47,541,011 |

Number of Holdings | 25 |

Net Advisory Fee | $206,573 |

Portfolio Turnover | 17% |

Top 10 Issuers | (%) |

Ross Stores | 5.2% |

Lowe’s Companies | 5.0% |

UnitedHealth Group | 5.0% |

Microchip Technology | 4.7% |

W.W. Grainger | 4.5% |

Amgen | 4.5% |

Sysco | 4.5% |

Cencora | 4.4% |

Thermo Fisher Scientific | 4.2% |

Marsh & McLennan Companies | 4.0% |

| Coho Relative Value ESG Fund | PAGE 2 | TSR_AR_56166Y222 |

| (b) | Not applicable. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Leonard M. Rush is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “Other Services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 07/31/2024 | FYE 07/31/2023 | |

| (a) Audit Fees | $30,500 | $29,500 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $8,500 | $10,000 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| FYE 07/31/2024 | FYE 07/31/2023 | |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) Not applicable

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 07/31/2024 | FYE 07/31/2023 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | $0 | $0 |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable

(j) Not applicable

Item 5. Audit Committee of Listed Registrants.

Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

| (b) | Not applicable |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

| (a) |

Page | |||

Shares | Value | |||||

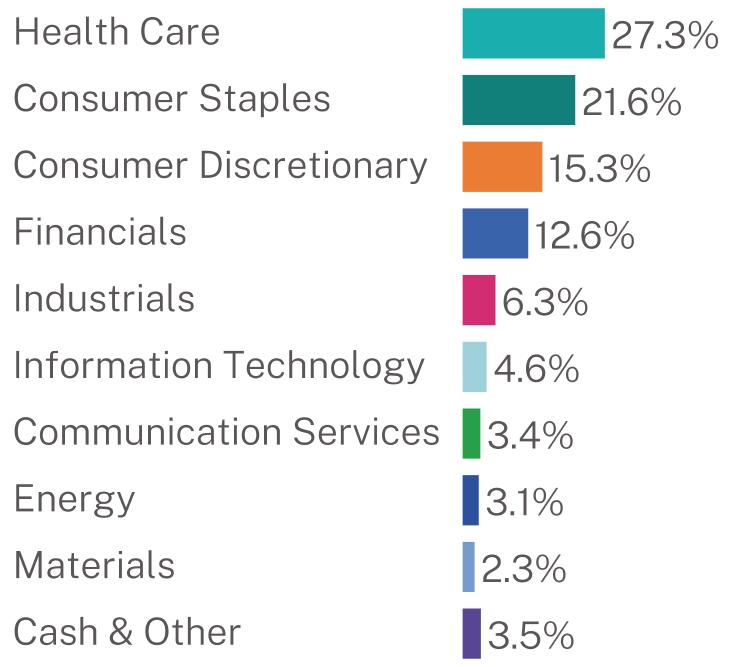

COMMON STOCKS - 96.5% | ||||||

Communication Services - 3.4% | ||||||

Walt Disney | 150,714 | $ 14,120,395 | ||||

Consumer Discretionary - 15.3% | ||||||

Lowe’s Companies | 86,957 | 21,348,813 | ||||

NIKE, Inc. - Class B | 130,972 | 9,804,564 | ||||

Ross Stores | 131,761 | 18,872,128 | ||||

Service Corp International | 174,142 | 13,915,687 | ||||

63,941,192 | ||||||

Consumer Staples - 21.6% | ||||||

Coca-Cola | 172,601 | 11,519,391 | ||||

Constellation Brands - Class A | 31,693 | 7,769,856 | ||||

Dollar General | 111,154 | 13,381,830 | ||||

Keurig Dr Pepper | 366,320 | 12,557,450 | ||||

Mondelez International - Class A | 212,799 | 14,544,812 | ||||

Philip Morris International | 111,363 | 12,824,563 | ||||

Sysco | 227,496 | 17,437,568 | ||||

90,035,470 | ||||||

Energy - 3.1% | ||||||

Chevron | 80,753 | 12,958,434 | ||||

Financials - 12.6% | ||||||

Global Payments | 99,326 | 10,095,494 | ||||

Marsh & McLennan Companies | 68,602 | 15,268,747 | ||||

State Street | 163,672 | 13,907,210 | ||||

US Bancorp | 295,861 | 13,278,242 | ||||

52,549,693 | ||||||

Health Care - 27.3%(a) | ||||||

Abbott Laboratories | 98,015 | 10,383,709 | ||||

Amgen | 53,269 | 17,710,345 | ||||

Cencora | 89,389 | 21,263,855 | ||||

Johnson & Johnson | 89,551 | 14,135,625 | ||||

Medtronic PLC | 154,609 | 12,418,195 | ||||

Thermo Fisher Scientific | 28,425 | 17,434,190 | ||||

UnitedHealth Group | 36,120 | 20,810,899 | ||||

114,156,818 | ||||||

Industrials - 6.3% | ||||||

United Parcel Service - Class B | 80,554 | 10,501,825 | ||||

W.W. Grainger | 16,322 | 15,943,493 | ||||

26,445,318 | ||||||

Information Technology - 4.6% | ||||||

Microchip Technology | 217,017 | 19,266,769 | ||||

1 |

Shares | Value | |||||

COMMON STOCKS - (Continued) | ||||||

Materials - 2.3% | ||||||

Air Products and Chemicals | 36,386 | $9,600,446 | ||||

TOTAL COMMON STOCKS (Cost $351,106,303) | 403,074,535 | |||||

TOTAL INVESTMENTS - 96.5% (Cost $351,106,303) | $403,074,535 | |||||

Money Market Deposit Account - 4.1%(b) | 16,937,994 | |||||

Liabilities in Excess of Other Assets - (0.6)% | (2,351,792) | |||||

TOTAL NET ASSETS - 100.0% | $417,660,737 | |||||

(a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

(b) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of July 31, 2024 was 3.27%. |

2 |

Shares | Value | |||||

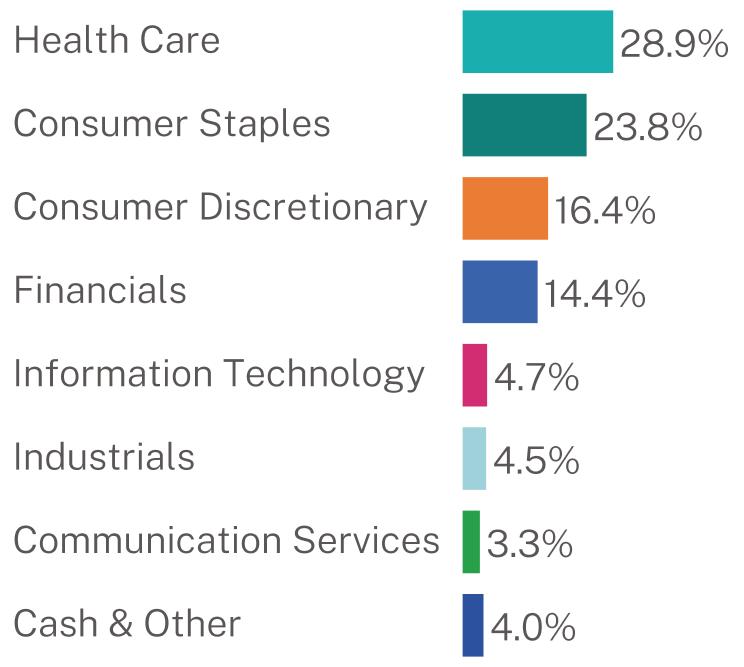

COMMON STOCKS - 96.0% | ||||||

Communication Services - 3.3% | ||||||

Walt Disney | 16,751 | $1,569,401 | ||||

Consumer Discretionary - 16.4% | ||||||

Lowe’s Companies | 9,694 | 2,379,974 | ||||

NIKE, Inc. - Class B | 14,701 | 1,100,517 | ||||

Ross Stores | 17,398 | 2,491,915 | ||||

Service Corp International | 23,112 | 1,846,880 | ||||

7,819,286 | ||||||

Consumer Staples - 23.8% | ||||||

Coca-Cola | 20,994 | 1,401,140 | ||||

Colgate-Palmolive Co. | 17,956 | 1,781,056 | ||||

Dollar General | 13,364 | 1,608,892 | ||||

Kellanova | 19,249 | 1,119,329 | ||||

Keurig Dr Pepper | 45,111 | 1,546,405 | ||||

Mondelez International - Class A | 25,045 | 1,711,826 | ||||

Sysco | 27,756 | 2,127,497 | ||||

11,296,145 | ||||||

Financials - 14.4% | ||||||

Global Payments | 13,580 | 1,380,271 | ||||

Marsh & McLennan Companies | 8,439 | 1,878,268 | ||||

State Street | 20,282 | 1,723,362 | ||||

US Bancorp | 41,605 | 1,867,232 | ||||

6,849,133 | ||||||

Health Care - 28.9%(a) | ||||||

Abbott Laboratories | 16,640 | 1,762,842 | ||||

Amgen | 6,407 | 2,130,135 | ||||

Cencora | 8,822 | 2,098,577 | ||||

Johnson & Johnson | 11,405 | 1,800,279 | ||||

Medtronic PLC | 20,046 | 1,610,095 | ||||

Thermo Fisher Scientific | 3,273 | 2,007,462 | ||||

UnitedHealth Group | 4,093 | 2,358,223 | ||||

13,767,613 | ||||||

Industrials - 4.5% | ||||||

W.W. Grainger | 2,200 | 2,148,982 | ||||

Information Technology - 4.7% | ||||||

Microchip Technology | 25,000 | 2,219,500 | ||||

TOTAL COMMON STOCKS (Cost $42,725,231) | 45,670,060 | |||||

TOTAL INVESTMENTS - 96.0% (Cost $42,725,231) | $45,670,060 | |||||

Money Market Deposit Account - 2.2%(b) | 1,026,514 | |||||

Other Assets in Excess of Liabilities - 1.8% | 844,437 | |||||

TOTAL NET ASSETS - 100.0% | $47,541,011 | |||||

3 |

(a) | To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

(b) | The U.S. Bank Money Market Deposit Account (the “MMDA”) is a short-term vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and is subject to change daily. The rate as of July 31, 2024 was 3.27%. |

4 |

Coho Relative Value Equity Fund | Coho Relative Value ESG Fund | |||||

ASSETS: | ||||||

Investments, at value (Cost: $351,106,303 & $42,725,231 respectively) | $403,074,535 | $45,670,060 | ||||

Cash Equivalent | 16,937,994 | 1,026,514 | ||||

Dividends and interest receivable | 323,111 | 44,693 | ||||

Receivable for capital shares sold | 119,865 | 50,468 | ||||

Receivable for investment securities sold | 2,133,822 | 1,425,491 | ||||

Prepaid expenses | 23,836 | 9,791 | ||||

Total assets | 422,613,163 | 48,227,017 | ||||

LIABILITIES: | ||||||

Payable for investment securities purchased | 4,320,508 | 593,987 | ||||

Payable to investment adviser | 232,071 | 6,138 | ||||

Payable for capital shares redeemed | 269,390 | 41,140 | ||||

Payable for fund administration & accounting fees | 74,057 | 11,918 | ||||

Payable for audit fees | 20,249 | 20,250 | ||||

Payable for custody fees | 10,500 | 1,547 | ||||

Payable for transfer agent fees & expenses | 12,239 | 5,236 | ||||

Payable for legal fees | 1,311 | 1,546 | ||||

Payable for compliance fees | 3,122 | 3,123 | ||||

Accrued expenses | 8,979 | 1,121 | ||||

Total liabilities | 4,952,426 | 686,006 | ||||

NET ASSETS | $417,660,737 | $47,541,011 | ||||

NET ASSETS CONSIST OF: | ||||||

Paid-in capital | $348,873,721 | $45,935,019 | ||||

Total distributable earnings | 68,787,016 | 1,605,992 | ||||

Net Assets | $ 417,660,737 | $47,541,011 | ||||

Net Assets | $417,660,737 | $47,541,011 | ||||

Shares issued and outstanding(1) | 28,477,036 | 3,936,621 | ||||

Net asset value, redemption price and offering price per share | $14.67 | $12.08 | ||||

(1) | Unlimited shares authorized without par value. |

5 |

Coho Relative Value Equity Fund | Coho Relative Value ESG Fund | |||||

INVESTMENT INCOME: | ||||||

Dividend income | $13,312,751 | $1,050,839 | ||||

Interest income | 583,878 | 67,207 | ||||

Total investment income | 13,896,629 | 1,118,046 | ||||

EXPENSES: | ||||||

Investment adviser fees (See Note 4) | 4,080,233 | 356,120 | ||||

Fund administration & accounting fees (See Note 4) | 368,847 | 49,726 | ||||

Custody fees (See Note 4) | 66,533 | 8,424 | ||||

Transfer agent fees & expenses (See Note 4) | 58,210 | 21,063 | ||||

Federal & state registration fees | 31,382 | 22,841 | ||||

Trustee fees | 23,194 | 22,472 | ||||

Legal fees | 22,733 | 29,904 | ||||

Audit fees | 20,251 | 20,251 | ||||

Postage & printing fees | 12,917 | 1,024 | ||||

Compliance fees (See Note 4) | 12,496 | 12,496 | ||||

Other expenses | 7,690 | 4,512 | ||||

Insurance fees | 6,435 | 2,621 | ||||

Total expenses before interest expense, waiver | 4,710,921 | 551,454 | ||||

Interest expense (See Note 9) | 10,625 | 460 | ||||

Total expenses before waiver | 4,721,546 | 551,914 | ||||

Less: waiver from investment adviser (See Note 4) | (105,779) | (149,547) | ||||

Net expenses | 4,615,767 | 402,367 | ||||

NET INVESTMENT INCOME | 9,280,862 | 715,679 | ||||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||||

Net realized gain (loss) on investments | 53,141,915 | (1,890,022) | ||||

Net change in unrealized appreciation/depreciation on investments | (57,425,262) | 2,924,483 | ||||

Net realized and unrealized gain (loss) on investments | (4,283,347) | 1,034,461 | ||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $4,997,515 | $1,750,140 | ||||

6 |

Year Ended July 31, | ||||||

2024 | 2023 | |||||

OPERATIONS: | ||||||

Net investment income | $9,280,862 | $13,412,739 | ||||

Net realized gain on investments | 53,141,915 | 50,431,401 | ||||

Net change in unrealized appreciation/depreciation on investments | (57,425,262) | (37,452,263) | ||||

Net increase in net assets resulting from operations | 4,997,515 | 26,391,877 | ||||

CAPITAL SHARE TRANSACTIONS: | ||||||

Proceeds from shares sold | 67,728,359 | 128,543,343 | ||||

Proceeds from reinvestment of distributions | 48,733,921 | 38,537,063 | ||||

Payments for shares redeemed | (477,504,175) | (244,186,150) | ||||

Net decrease in net assets resulting from capital share transactions | (361,041,895) | (77,105,744) | ||||

DISTRIBUTIONS TO SHAREHOLDERS | (67,479,859) | (66,256,266) | ||||

TOTAL DECREASE IN NET ASSETS | (423,524,239) | (116,970,133) | ||||

NET ASSETS: | ||||||

Beginning of year | 841,184,976 | 958,155,109 | ||||

End of year | $417,660,737 | $841,184,976 | ||||

7 |

Year Ended July 31, | ||||||

2024 | 2023 | |||||

OPERATIONS: | ||||||

Net investment income | $715,679 | $740,405 | ||||

Net realized gain (loss) on investments | (1,890,022) | 192,268 | ||||

Net change in unrealized appreciation/depreciation on investments | 2,924,483 | 446,922 | ||||

Net increase in net assets resulting from operations | 1,750,140 | 1,379,595 | ||||

CAPITAL SHARE TRANSACTIONS: | ||||||

Proceeds from shares sold | 3,861,094 | 11,182,718 | ||||

Proceeds from reinvestment of distributions | 1,027,077 | 1,045,304 | ||||

Payments for shares redeemed | (13,937,475) | (4,921,949) | ||||

Net increase (decrease) in net assets resulting from capital share transactions | (9,049,304) | 7,306,073 | ||||

DISTRIBUTIONS TO SHAREHOLDERS: | (1,027,100) | (1,066,037) | ||||

TOTAL INCREASE (DECREASE) IN NET ASSETS | (8,326,264) | 7,619,631 | ||||

NET ASSETS: | ||||||

Beginning of year | 55,867,275 | 48,247,644 | ||||

End of year | $47,541,011 | $55,867,275 | ||||

8 |

Year Ended July 31, | |||||||||||||||

2024 | 2023 | 2022 | 2021 | 2020 | |||||||||||

PER SHARE DATA(1): | |||||||||||||||

Net asset value, beginning of year | $15.83 | $16.48 | $17.51 | $14.42 | $14.20 | ||||||||||

INVESTMENT OPERATIONS: | |||||||||||||||

Net investment income | 0.30 | 0.23(2) | 0.23(2) | 0.25(2) | 0.25(2) | ||||||||||

Net realized and unrealized gain on investments | 0.15(3) | 0.25 | 0.12 | 3.46 | 0.93 | ||||||||||

Total from investment operations | 0.45 | 0.48 | 0.35 | 3.71 | 1.18 | ||||||||||

LESS DISTRIBUTIONS FROM: | |||||||||||||||

Net investment income | (0.29) | (0.21) | (0.24) | (0.22) | (0.26) | ||||||||||

Net realized gains | (1.32) | (0.92) | (1.14) | (0.40) | (0.70) | ||||||||||

Total distributions | (1.61) | (1.13) | (1.38) | (0.62) | (0.96) | ||||||||||

Paid-in capital from redemption fees | — | — | — | —(4) | —(4) | ||||||||||

Net asset value, end of year | $14.67 | $15.83 | $16.48 | $17.51 | $14.42 | ||||||||||

TOTAL RETURN | 3.59% | 3.12% | 1.96% | 26.33% | 8.45% | ||||||||||

SUPPLEMENTAL DATA AND RATIOS: | |||||||||||||||

Net assets, end of year (in 000’s) | $417,661 | $841,185 | $958,155 | $989,261 | $741,826 | ||||||||||

Ratio of expenses to average net assets: | |||||||||||||||

Before expense waiver/recoupment | 0.81% | 0.79% | 0.78% | 0.78% | 0.82% | ||||||||||

After expense waiver/recoupment | 0.79% | 0.79% | 0.79% | 0.79% | 0.81%(5) | ||||||||||

Ratio of net investment income to average net assets: | |||||||||||||||

After expense waiver/recoupment | 1.59% | 1.50% | 1.35% | 1.53% | 1.76% | ||||||||||

Portfolio turnover rate | 19% | 12% | 23% | 26% | 27% | ||||||||||

(1) | On November 22, 2019 the Fund's Institutional Class shares were merged into the Advisor Class shares. The Advisor Class name was subsequently discontinued following the merger. |

(2) | Per share amounts calculated using the average shares method. |

(3) | Realized and unrealized gains per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the year, and may not reconcile with the aggregate gains on the Statement of Operations due to share transactions for the year. |

(4) | Amount per share is less than $0.01. |

(5) | Prior to November 22, 2019, the annual expense limitation was 0.94% of the average daily net assets for the Advisor Class. Thereafter it was 0.79% for the existing class. |

9 |

Year Ended July 31, | Since Inception(1) through July 31, 2020 | ||||||||||||||

2024 | 2023 | 2022 | 2021 | ||||||||||||

PER SHARE DATA: | |||||||||||||||

Net asset value, beginning of period | $11.83 | $11.79 | $12.43 | $10.19 | $10.00 | ||||||||||

INVESTMENT OPERATIONS: | |||||||||||||||

Net investment income | 0.20 | 0.15 | 0.09 | 0.08 | 0.05 | ||||||||||

Net realized and unrealized gain (loss) on investments | 0.29 | 0.14 | (0.08) (4) | 2.37 | 0.15 | ||||||||||

Total from investment operations | 0.49 | 0.29 | 0.01 | 2.45 | 0.20 | ||||||||||

LESS DISTRIBUTIONS FROM: | |||||||||||||||

Net investment income | (0.17) | (0.06) | (0.08) | (0.05) | (0.01) | ||||||||||

Net realized gains | (0.07) | (0.19) | (0.57) | (0.16) | — | ||||||||||

Total distributions | (0.24) | (0.25) | (0.65) | (0.21) | (0.01) | ||||||||||

Net asset value, end of period | $12.08 | $11.83 | $11.79 | $12.43 | $10.19 | ||||||||||

TOTAL RETURN(2) | 4.20% | 2.52% | −0.02% | 24.26% | 2.00% | ||||||||||

SUPPLEMENTAL DATA AND RATIOS: | |||||||||||||||

Net assets, end of period (in 000’s) | $47,541 | $55,867 | $48,248 | $22,203 | $3,707 | ||||||||||

Ratio of expenses to average net assets: | |||||||||||||||

Before expense waiver/reimbursement(3) | 1.08% | 1.03% | 1.14% | 1.81% | 9.78% | ||||||||||

After expense waiver/reimbursement(3) | 0.79% | 0.79% | 0.79% | 0.79% | 0.79% | ||||||||||

Ratio of net investment income to average net assets: | |||||||||||||||

After expense waiver/reimbursement(3) | 1.41% | 1.44% | 1.20% | 1.15% | 1.48% | ||||||||||

Portfolio turnover rate(2) | 17% | 20% | 22% | 25% | 10% | ||||||||||

(1) | Inception date for the Fund was November 27, 2019. |

(2) | Not annualized for periods less than one year. |

(3) | Annualized for periods less than one year. |

(4) | Net realized and unrealized loss per share in this caption is a balancing amount necessary to reconcile changes in net asset value per share for the year, and may not reconcile with the aggregate gain on the Statement of Operations due to share transactions for the year. |

10 |

11 |

12 |

Level 1 | Level 2 | Level 3 | Total | |||||||||

Common Stocks | $403,074,535 | $ — | $ — | $403,074,535 | ||||||||

Total Investments in Securities* | $403,074,535 | $— | $— | $403,074,535 | ||||||||

Level 1 | Level 2 | Level 3 | Total | |||||||||

Common Stocks | $45,670,060 | $ — | $ — | $45,670,060 | ||||||||

Total Investments in Securities* | $45,670,060 | $— | $— | $45,670,060 | ||||||||

* | Refer to the Schedule of Investments for further information on the classification of investments. |

Equity Fund | ESG Fund | |||||

Expiration | Amount | Amount | ||||

August 2024 – July 2025 | $— | $123,655 | ||||

August 2025 – July 2026 | 18,086 | 122,789 | ||||

August 2026 – July 2027 | 105,779 | 149,547 | ||||

13 |

Year Ended July 31, | ||||||

2024 | 2023 | |||||

Shares sold | 4,697,052 | 8,207,467 | ||||

Shares issued to holders in reinvestment of distributions | 3,494,249 | 2,475,260 | ||||

Shares redeemed | (32,863,732) | (15,665,309) | ||||

Net decrease in shares outstanding | (24,672,431) | (4,982,582) | ||||

Year Ended July 31, | ||||||

2024 | 2023 | |||||

Shares sold | 336,207 | 965,078 | ||||

Shares issued to holders in reinvestment of distributions | 89,596 | 90,704 | ||||

Shares redeemed | (1,213,374) | (424,751) | ||||

Net increase (decrease) in shares outstanding | (787,571) | 631,031 | ||||

Equity Fund | ESG Fund | |||||||||||

Purchases | Sales | Purchases | Sales | |||||||||

U.S. Government Securities | $— | $— | $— | $— | ||||||||

Other Securities | $ 108,908,588 | $ 515,907,708 | $ 8,088,328 | $ 17,564,565 | ||||||||

Aggregate Gross Appreciation | Aggregate Gross Depreciation | Net Unrealized Appreciation | Federal Income Tax Cost | |||||||||

Equity Fund | $73,660,046 | $(29,700,684) | $43,959,362 | $359,115,172 | ||||||||

ESG Fund | 5,615,771 | (3,069,773) | 2,545,998 | 43,124,063 | ||||||||

Undistributed Ordinary Income | Undistributed Long-Term Capital Gains | Other Accumulated Losses | Net Unrealized Appreciation | Total Distributable Earnings | |||||||||||

Equity Fund | $4,072,470 | $20,755,184 | $— | $43,959,362 | $68,787,016 | ||||||||||

ESG Fund | 715,639 | — | (1,655,645) | 2,545,998 | 1,605,992 | ||||||||||

14 |

Ordinary Income* | Long Term Capital Gains | Total | |||||||

Equity Fund | $12,266,026 | $55,213,833 | $67,479,859 | ||||||

ESG Fund | 740,444 | 286,656 | 1,027,100 | ||||||

Ordinary Income* | Long Term Capital Gains | Total | |||||||

Equity Fund | $13,154,185 | $53,102,081 | $66,256,266 | ||||||

ESG Fund | 271,850 | 794,187 | 1,066,037 | ||||||

* | For federal income tax purposes, distributions of short-term capital gains are treated as ordinary income distributions. |

Fund | LOC Agent | Average Borrowings | Amount Outstanding as of July 31 2024 | Interest Expense | Maximum Borrowing | Date of Maximum Borrowing | ||||||||||||

Equity Fund | U.S. Bank N.A | $122,945 | $ — | $10,625 | $14,317,000 | April 11, 2024 | ||||||||||||

ESG Fund | U.S Bank N.A | 5,328 | — | 460 | 1,950,000 | September 18, 2023 | ||||||||||||

15 |

Fund Name | Statements of Operations | Statements of Changes in Net Assets | Financial Highlights | ||||||

Coho Relative Value Equity Fund | For the year ended July 31, 2024 | For the years ended July 31, 2024 and 2023 | For the years ended July 31, 2024, 2023, 2022, 2021, and 2020 | ||||||

Coho Relative Value ESG Fund | For the year ended July 31, 2024 | For the years ended July 31, 2024 and 2023 | For the years ended July 31, 2024, 2023, 2022, 2021 and for the period from November 27, 2019 (commencement of operations) through July 31, 2020 | ||||||

16 |

17 |

| • | Coho Relative Value Equity Fund. The Trustees noted that the Fund had underperformed both the Category and Cohort averages for all periods presented in the materials, except that the Fund had outperformed the Category average for the ten-year period ended September 30, 2023. The Trustees also considered that the Fund had underperformed its benchmark index and additional benchmark index for all periods presented, but that the Fund had outperformed its additional benchmark index for the since inception period ended September 30, 2023. The Trustees considered that the Fund had achieved positive total returns over longer term periods and also observed that the Fund’s performance had been consistent with, though slightly below, the performance of the composite of separate accounts managed by Coho with similar strategies to the Fund. |

| • | Coho Relative Value ESG Fund. The Trustees noted that the Fund had underperformed both the Category and Cohort averages as well as its benchmark index for all periods presented in the materials. The Trustees considered that the Fund had achieved positive total returns over longer term periods and also observed that the Fund’s performance had been consistent with the composite of separate accounts managed by Coho with similar strategies to the Fund. |

| • | Coho Relative Value Equity Fund. The Trustee’s noted that while the Fund’s advisory fee was higher than the Category and Cohort averages, and its total expenses were slightly above the Cohort average, its total expenses were below the Category average. |

| • | Coho Relative Value ESG Fund. The Trustee’s noted that while the Fund’s advisory fee was higher than the Category and Cohort averages, and its total expenses (after waivers and expense reimbursements) were above the Cohort average, its total expenses (before and after waivers and expense reimbursements) were below the Category average. |

18 |

19 |

| (b) | Financial Highlights are included within the financial statements filed under Item 7 of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

See Item 7(a).

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

See Item 7(a).

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

| (a) | The Registrant’s [Principal Executive Officer] and [Principal Financial Officer] have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable

Item 19. Exhibits.

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not applicable.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (5) | Change in the registrant’s independent public accountant. Provide the information called for by Item 4 of Form 8-K under the Exchange Act (17 CFR 249.308). Unless otherwise specified by Item 4, or related to and necessary for a complete understanding of information not previously disclosed, the information should relate to events occurring during the reporting period. Not applicable to open-end investment companies and ETFs. |

| (b) | Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Managed Portfolio Series |

| By (Signature and Title)* | /s/ Brian R. Wiedmeyer | ||

| Brian R. Wiedmeyer, President |

| Date | 10/4/24 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Brian R. Wiedmeyer | ||

| Brian R. Wiedmeyer, President |

| Date | 10/4/24 |

| By (Signature and Title)* | /s/ Benjamin J. Eirich | ||

| Benjamin J. Eirich, Treasurer |

| Date | 10/4/24 |

* Print the name and title of each signing officer under his or her signature.