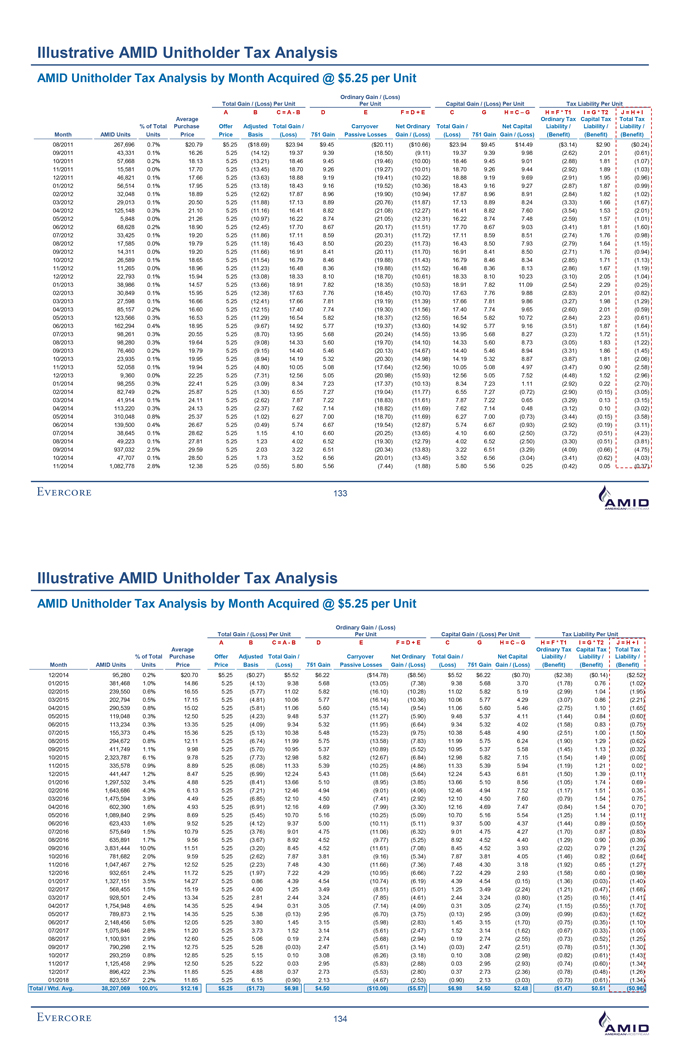

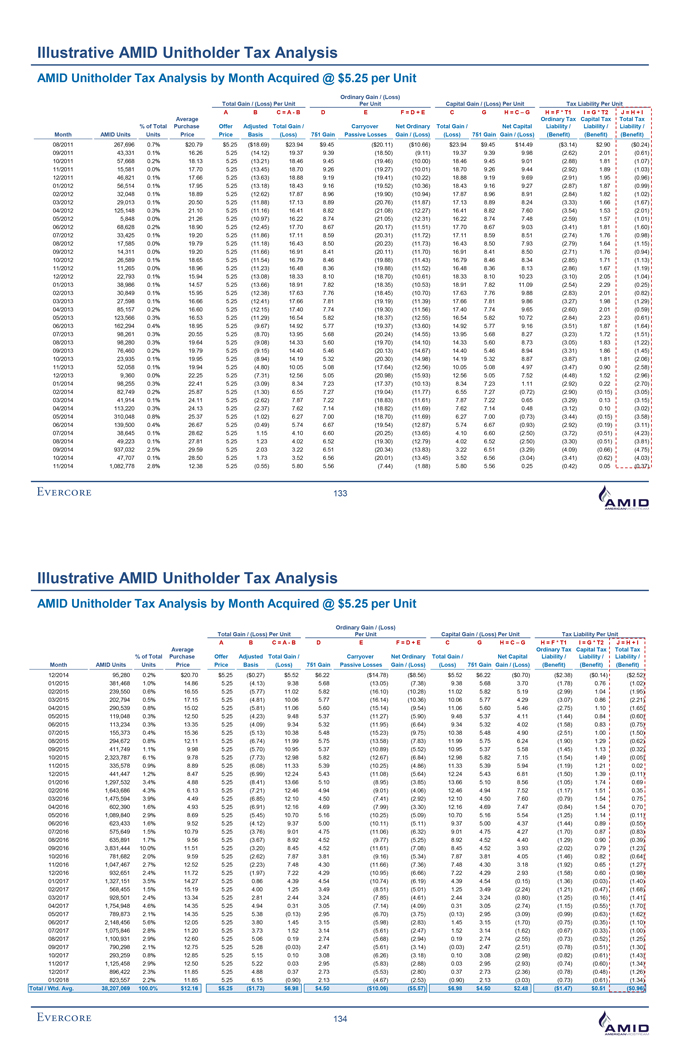

Illustrative AMID Unitholder Tax Analysis AMID Unitholder Tax Analysis by Month Acquired @ $5.25 per Unit Ordinary Gain / (Loss) Total Gain / (Loss) Per Unit Per Unit Capital Gain / (Loss) Per Unit Tax Liability Per Unit A B C = A—B D E F = D + E C G H = C – G H = F * T1 I = G * T2 J = H + I Average Ordinary Tax Capital Tax Total Tax % of Total Purchase Offer Adjusted Total Gain / Carryover Net Ordinary Total Gain / Net Capital Liability / Liability / Liability / Month AMID Units Units Price Price Basis (Loss) 751 Gain Passive Losses Gain / (Loss) (Loss) 751 Gain Gain / (Loss) (Benefit) (Benefit) (Benefit) 08/2011 267,696 0.7% $20.79 $5.25 ($18.69) $23.94 $9.45 ($20.11) ($10.66) $23.94 $9.45 $14.49 ($3.14) $2.90 ($0.24) 09/2011 43,331 0.1% 16.26 5.25 (14.12) 19.37 9.39 (18.50) (9.11) 19.37 9.39 9.98 (2.62) 2.01 (0.61) 10/2011 57,668 0.2% 18.13 5.25 (13.21) 18.46 9.45 (19.46) (10.00) 18.46 9.45 9.01 (2.88) 1.81 (1.07) 11/2011 15,581 0.0% 17.70 5.25 (13.45) 18.70 9.26 (19.27) (10.01) 18.70 9.26 9.44 (2.92) 1.89 (1.03) 12/2011 46,821 0.1% 17.66 5.25 (13.63) 18.88 9.19 (19.41) (10.22) 18.88 9.19 9.69 (2.91) 1.95 (0.96) 01/2012 56,514 0.1% 17.95 5.25 (13.18) 18.43 9.16 (19.52) (10.36) 18.43 9.16 9.27 (2.87) 1.87 (0.99) 02/2012 32,048 0.1% 18.89 5.25 (12.62) 17.87 8.96 (19.90) (10.94) 17.87 8.96 8.91 (2.84) 1.82 (1.02) 03/2012 29,013 0.1% 20.50 5.25 (11.88) 17.13 8.89 (20.76) (11.87) 17.13 8.89 8.24 (3.33) 1.66 (1.67) 04/2012 125,148 0.3% 21.10 5.25 (11.16) 16.41 8.82 (21.08) (12.27) 16.41 8.82 7.60 (3.54) 1.53 (2.01) 05/2012 5,848 0.0% 21.26 5.25 (10.97) 16.22 8.74 (21.05) (12.31) 16.22 8.74 7.48 (2.59) 1.57 (1.01) 06/2012 68,628 0.2% 18.90 5.25 (12.45) 17.70 8.67 (20.17) (11.51) 17.70 8.67 9.03 (3.41) 1.81 (1.60) 07/2012 33,425 0.1% 19.20 5.25 (11.86) 17.11 8.59 (20.31) (11.72) 17.11 8.59 8.51 (2.74) 1.76 (0.98) 08/2012 17,585 0.0% 19.79 5.25 (11.18) 16.43 8.50 (20.23) (11.73) 16.43 8.50 7.93 (2.79) 1.64 (1.15) 09/2012 14,311 0.0% 19.20 5.25 (11.66) 16.91 8.41 (20.11) (11.70) 16.91 8.41 8.50 (2.71) 1.76 (0.94) 10/2012 26,589 0.1% 18.65 5.25 (11.54) 16.79 8.46 (19.88) (11.43) 16.79 8.46 8.34 (2.85) 1.71 (1.13) 11/2012 11,265 0.0% 18.96 5.25 (11.23) 16.48 8.36 (19.88) (11.52) 16.48 8.36 8.13 (2.86) 1.67 (1.19) 12/2012 22,793 0.1% 15.94 5.25 (13.08) 18.33 8.10 (18.70) (10.61) 18.33 8.10 10.23 (3.10) 2.05 (1.04) 01/2013 38,986 0.1% 14.57 5.25 (13.66) 18.91 7.82 (18.35) (10.53) 18.91 7.82 11.09 (2.54) 2.29 (0.25) 02/2013 30,849 0.1% 15.95 5.25 (12.38) 17.63 7.76 (18.45) (10.70) 17.63 7.76 9.88 (2.83) 2.01 (0.82) 03/2013 27,598 0.1% 16.66 5.25 (12.41) 17.66 7.81 (19.19) (11.39) 17.66 7.81 9.86 (3.27) 1.98 (1.29) 04/2013 85,157 0.2% 16.60 5.25 (12.15) 17.40 7.74 (19.30) (11.56) 17.40 7.74 9.65 (2.60) 2.01 (0.59) 05/2013 123,566 0.3% 16.53 5.25 (11.29) 16.54 5.82 (18.37) (12.55) 16.54 5.82 10.72 (2.84) 2.23 (0.61) 06/2013 162,294 0.4% 18.95 5.25 (9.67) 14.92 5.77 (19.37) (13.60) 14.92 5.77 9.16 (3.51) 1.87 (1.64) 07/2013 98,261 0.3% 20.55 5.25 (8.70) 13.95 5.68 (20.24) (14.55) 13.95 5.68 8.27 (3.23) 1.72 (1.51) 08/2013 98,280 0.3% 19.64 5.25 (9.08) 14.33 5.60 (19.70) (14.10) 14.33 5.60 8.73 (3.05) 1.83 (1.22) 09/2013 76,460 0.2% 19.79 5.25 (9.15) 14.40 5.46 (20.13) (14.67) 14.40 5.46 8.94 (3.31) 1.86 (1.45) 10/2013 23,935 0.1% 19.95 5.25 (8.94) 14.19 5.32 (20.30) (14.98) 14.19 5.32 8.87 (3.87) 1.81 (2.06) 11/2013 52,058 0.1% 19.94 5.25 (4.80) 10.05 5.08 (17.64) (12.56) 10.05 5.08 4.97 (3.47) 0.90 (2.58) 12/2013 9,360 0.0% 22.25 5.25 (7.31) 12.56 5.05 (20.98) (15.93) 12.56 5.05 7.52 (4.48) 1.52 (2.96) 01/2014 98,255 0.3% 22.41 5.25 (3.09) 8.34 7.23 (17.37) (10.13) 8.34 7.23 1.11 (2.92) 0.22 (2.70) 02/2014 82,749 0.2% 25.87 5.25 (1.30) 6.55 7.27 (19.04) (11.77) 6.55 7.27 (0.72) (2.90) (0.15) (3.05) 03/2014 41,914 0.1% 24.11 5.25 (2.62) 7.87 7.22 (18.83) (11.61) 7.87 7.22 0.65 (3.29) 0.13 (3.15) 04/2014 113,220 0.3% 24.13 5.25 (2.37) 7.62 7.14 (18.82) (11.69) 7.62 7.14 0.48 (3.12) 0.10 (3.02) 05/2014 310,048 0.8% 25.37 5.25 (1.02) 6.27 7.00 (18.70) (11.69) 6.27 7.00 (0.73) (3.44) (0.15) (3.58) 06/2014 139,500 0.4% 26.67 5.25 (0.49) 5.74 6.67 (19.54) (12.87) 5.74 6.67 (0.93) (2.92) (0.19) (3.11) 07/2014 38,645 0.1% 28.62 5.25 1.15 4.10 6.60 (20.25) (13.65) 4.10 6.60 (2.50) (3.72) (0.51) (4.23) 08/2014 49,223 0.1% 27.81 5.25 1.23 4.02 6.52 (19.30) (12.79) 4.02 6.52 (2.50) (3.30) (0.51) (3.81) 09/2014 937,032 2.5% 29.59 5.25 2.03 3.22 6.51 (20.34) (13.83) 3.22 6.51 (3.29) (4.09) (0.66) (4.75) 10/2014 47,707 0.1% 28.50 5.25 1.73 3.52 6.56 (20.01) (13.45) 3.52 6.56 (3.04) (3.41) (0.62) (4.03) 11/2014 1,082,778 2.8% 12.38 5.25 (0.55) 5.80 5.56 (7.44) (1.88) 5.80 5.56 0.25 (0.42) 0.05 (0.37) 133 Illustrative AMID Unitholder Tax Analysis AMID Unitholder Tax Analysis by Month Acquired @ $5.25 per Unit Ordinary Gain / (Loss) Total Gain / (Loss) Per Unit Per Unit Capital Gain / (Loss) Per Unit Tax Liability Per Unit A B C = A—B D E F = D + E C G H = C – G H = F * T1 I = G * T2 J = H + I Average Ordinary Tax Capital Tax Total Tax % of Total Purchase Offer Adjusted Total Gain / Carryover Net Ordinary Total Gain / Net Capital Liability / Liability / Liability / Month AMID Units Units Price Price Basis (Loss) 751 Gain Passive Losses Gain / (Loss) (Loss) 751 Gain Gain / (Loss) (Benefit) (Benefit) (Benefit) 12/2014 95,280 0.2% $20.70 $5.25 ($0.27) $5.52 $6.22 ($14.78) ($8.56) $5.52 $6.22 ($0.70) ($2.38) ($0.14) ($2.52) 01/2015 381,468 1.0% 14.86 5.25 (4.13) 9.38 5.68 (13.05) (7.38) 9.38 5.68 3.70 (1.78) 0.76 (1.02) 02/2015 239,550 0.6% 16.55 5.25 (5.77) 11.02 5.82 (16.10) (10.28) 11.02 5.82 5.19 (2.99) 1.04 (1.95) 03/2015 202,794 0.5% 17.15 5.25 (4.81) 10.06 5.77 (16.14) (10.36) 10.06 5.77 4.29 (3.07) 0.86 (2.21) 04/2015 290,539 0.8% 15.02 5.25 (5.81) 11.06 5.60 (15.14) (9.54) 11.06 5.60 5.46 (2.75) 1.10 (1.65) 05/2015 119,048 0.3% 12.50 5.25 (4.23) 9.48 5.37 (11.27) (5.90) 9.48 5.37 4.11 (1.44) 0.84 (0.60) 06/2015 113,234 0.3% 13.35 5.25 (4.09) 9.34 5.32 (11.95) (6.64) 9.34 5.32 4.02 (1.58) 0.83 (0.75) 07/2015 155,373 0.4% 15.36 5.25 (5.13) 10.38 5.48 (15.23) (9.75) 10.38 5.48 4.90 (2.51) 1.00 (1.50) 08/2015 294,672 0.8% 12.11 5.25 (6.74) 11.99 5.75 (13.58) (7.83) 11.99 5.75 6.24 (1.90) 1.29 (0.62) 09/2015 411,749 1.1% 9.98 5.25 (5.70) 10.95 5.37 (10.89) (5.52) 10.95 5.37 5.58 (1.45) 1.13 (0.32) 10/2015 2,323,787 6.1% 9.78 5.25 (7.73) 12.98 5.82 (12.67) (6.84) 12.98 5.82 7.15 (1.54) 1.49 (0.05) 11/2015 335,578 0.9% 8.89 5.25 (6.08) 11.33 5.39 (10.25) (4.86) 11.33 5.39 5.94 (1.19) 1.21 0.02 12/2015 441,447 1.2% 8.47 5.25 (6.99) 12.24 5.43 (11.08) (5.64) 12.24 5.43 6.81 (1.50) 1.39 (0.11) 01/2016 1,297,532 3.4% 4.88 5.25 (8.41) 13.66 5.10 (8.95) (3.85) 13.66 5.10 8.56 (1.05) 1.74 0.69 02/2016 1,643,686 4.3% 6.13 5.25 (7.21) 12.46 4.94 (9.01) (4.06) 12.46 4.94 7.52 (1.17) 1.51 0.35 03/2016 1,475,594 3.9% 4.49 5.25 (6.85) 12.10 4.50 (7.41) (2.92) 12.10 4.50 7.60 (0.79) 1.54 0.75 04/2016 602,390 1.6% 4.93 5.25 (6.91) 12.16 4.69 (7.99) (3.30) 12.16 4.69 7.47 (0.84) 1.54 0.70 05/2016 1,089,840 2.9% 8.69 5.25 (5.45) 10.70 5.16 (10.25) (5.09) 10.70 5.16 5.54 (1.25) 1.14 (0.11) 06/2016 623,433 1.6% 9.52 5.25 (4.12) 9.37 5.00 (10.11) (5.11) 9.37 5.00 4.37 (1.44) 0.89 (0.55) 07/2016 575,649 1.5% 10.79 5.25 (3.76) 9.01 4.75 (11.06) (6.32) 9.01 4.75 4.27 (1.70) 0.87 (0.83) 08/2016 635,891 1.7% 9.56 5.25 (3.67) 8.92 4.52 (9.77) (5.25) 8.92 4.52 4.40 (1.29) 0.90 (0.39) 09/2016 3,831,444 10.0% 11.51 5.25 (3.20) 8.45 4.52 (11.61) (7.08) 8.45 4.52 3.93 (2.02) 0.79 (1.23) 10/2016 781,682 2.0% 9.59 5.25 (2.62)��7.87 3.81 (9.16) (5.34) 7.87 3.81 4.05 (1.46) 0.82 (0.64) 11/2016 1,047,467 2.7% 12.52 5.25 (2.23) 7.48 4.30 (11.66) (7.36) 7.48 4.30 3.18 (1.92) 0.65 (1.27) 12/2016 932,651 2.4% 11.72 5.25 (1.97) 7.22 4.29 (10.95) (6.66) 7.22 4.29 2.93 (1.58) 0.60 (0.98) 01/2017 1,327,151 3.5% 14.27 5.25 0.86 4.39 4.54 (10.74) (6.19) 4.39 4.54 (0.15) (1.36) (0.03) (1.40) 02/2017 568,455 1.5% 15.19 5.25 4.00 1.25 3.49 (8.51) (5.01) 1.25 3.49 (2.24) (1.21) (0.47) (1.68) 03/2017 928,501 2.4% 13.34 5.25 2.81 2.44 3.24 (7.85) (4.61) 2.44 3.24 (0.80) (1.25) (0.16) (1.41) 04/2017 1,754,948 4.6% 14.35 5.25 4.94 0.31 3.05 (7.14) (4.09) 0.31 3.05 (2.74) (1.15) (0.55) (1.70) 05/2017 789,873 2.1% 14.35 5.25 5.38 (0.13) 2.95 (6.70) (3.75) (0.13) 2.95 (3.09) (0.99) (0.63) (1.62) 06/2017 2,148,456 5.6% 12.05 5.25 3.80 1.45 3.15 (5.98) (2.83) 1.45 3.15 (1.70) (0.75) (0.35) (1.10) 07/2017 1,075,846 2.8% 11.20 5.25 3.73 1.52 3.14 (5.61) (2.47) 1.52 3.14 (1.62) (0.67) (0.33) (1.00) 08/2017 1,100,931 2.9% 12.60 5.25 5.06 0.19 2.74 (5.68) (2.94) 0.19 2.74 (2.55) (0.73) (0.52) (1.25) 09/2017 790,298 2.1% 12.75 5.25 5.28 (0.03) 2.47 (5.61) (3.14) (0.03) 2.47 (2.51) (0.78) (0.51) (1.30) 10/2017 293,259 0.8% 12.85 5.25 5.15 0.10 3.08 (6.26) (3.18) 0.10 3.08 (2.98) (0.82) (0.61) (1.43) 11/2017 1,125,458 2.9% 12.50 5.25 5.22 0.03 2.95 (5.83) (2.88) 0.03 2.95 (2.93) (0.74) (0.60) (1.34) 12/2017 896,422 2.3% 11.85 5.25 4.88 0.37 2.73 (5.53) (2.80) 0.37 2.73 (2.36) (0.78) (0.48) (1.26) 01/2018 823,557 2.2% 11.85 5.25 6.15 (0.90) 2.13 (4.67) (2.53) (0.90) 2.13 (3.03) (0.73) (0.61) (1.34) Total / Wtd. Avg. 38,207,069 100.0% $12.16 $5.25 ($1.73) $6.98 $4.50 ($10.06) ($5.57) $6.98 $4.50 $2.48 ($1.47) $0.51 ($0.96) 134