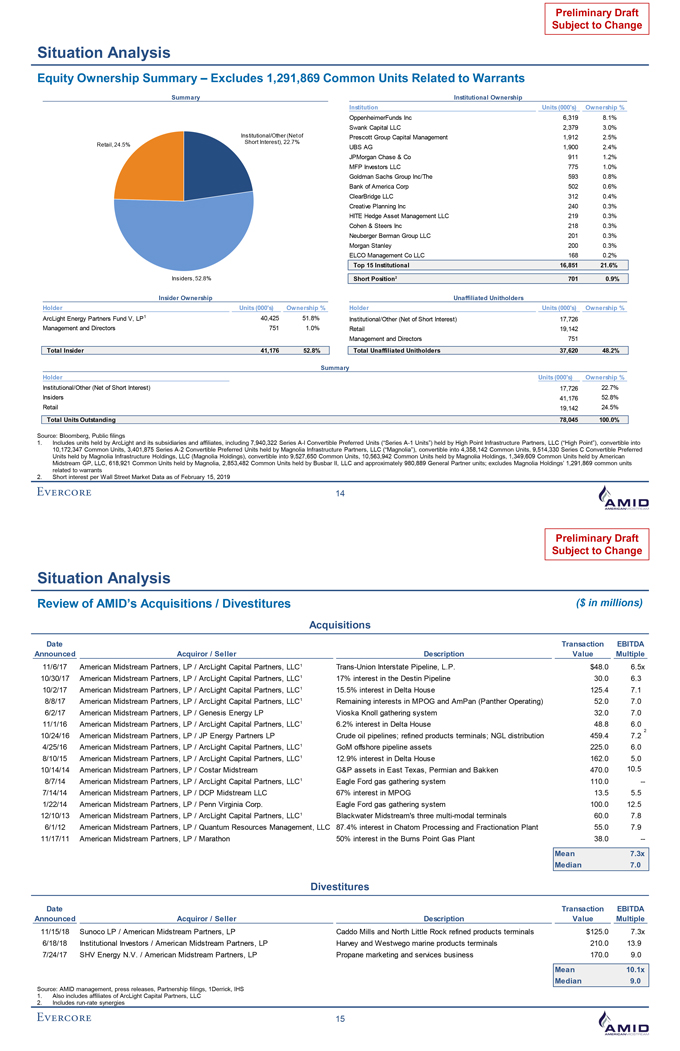

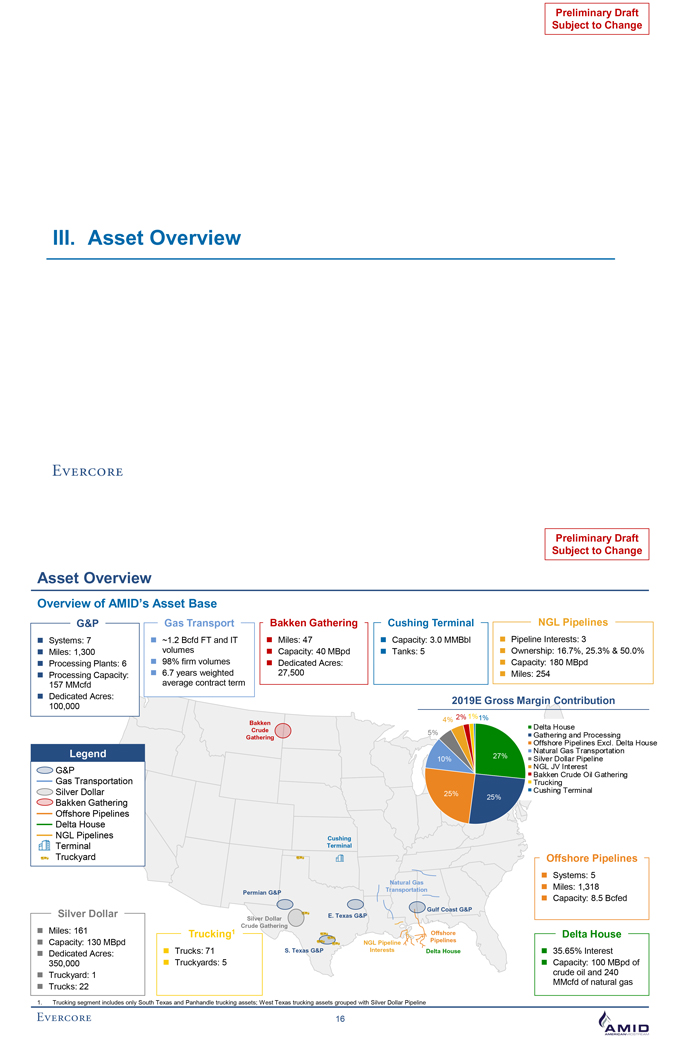

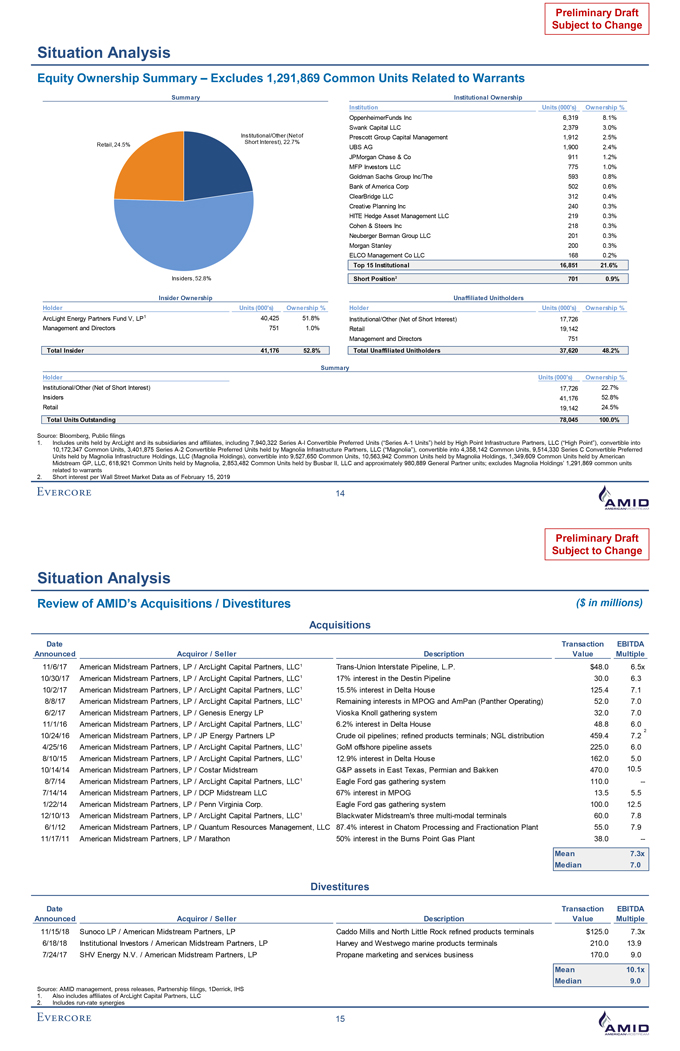

Preliminary Draft Subject to Change Situation Analysis Equity Ownership Summary – Excludes 1,291,869 Common Units Related to Warrants Summary Institutional Ownership Institution Units (000’s) Ownership % OppenheimerFunds Inc 6,319 8.1% Swank Capital LLC 2,379 3.0% Institutional/Other (Net of Prescott Group Capital Management 1,912 2.5% Short Interest), 22.7% Retail, 24.5% UBS AG 1,900 2.4% JPMorgan Chase & Co 911 1.2% MFP Investors LLC 775 1.0% Goldman Sachs Group Inc/The 593 0.8% Bank of America Corp 502 0.6% ClearBridge LLC 312 0.4% Creative Planning Inc 240 0.3% HITE Hedge Asset Management LLC 219 0.3% Cohen & Steers Inc 218 0.3% Neuberger Berman Group LLC 201 0.3% Morgan Stanley 200 0.3% ELCO Management Co LLC 168 0.2% Top 15 Institutional 16,851 21.6% Insiders, 52.8% Short Position2 701 0.9% Insider Ownership Unaffiliated Unitholders Holder Units (000’s) Ownership % Holder Units (000’s) Ownership % ArcLight Energy Partners Fund V, LP1 40,425 51.8% Institutional/Other (Net of Short Interest) 17,726 Management and Directors 751 1.0% Retail 19,142 Management and Directors 751 Total Insider 41,176 52.8% Total Unaffiliated Unitholders 37,620 48.2% Summary Holder Units (000’s) Ownership % Institutional/Other (Net of Short Interest) 17,726 22.7% Insiders 41,176 52.8% Retail 19,142 24.5% Total Units Outstanding 78,045 100.0% Source: Bloomberg, Public filings 1. Includes units held by ArcLight and its subsidiaries and affiliates, including 7,940,322 Series A-l Convertible Preferred Units (“Series A-1 Units”) held by High Point Infrastructure Partners, LLC (“High Point”), convertible into 10,172,347 Common Units, 3,401,875 Series A-2 Convertible Preferred Units held by Magnolia Infrastructure Partners, LLC (“Magnolia”), convertible into 4,358,142 Common Units, 9,514,330 Series C Convertible Preferred Units held by Magnolia Infrastructure Holdings, LLC (Magnolia Holdings), convertible into 9,527,650 Common Units, 10,563,942 Common Units held by Magnolia Holdings, 1,349,609 Common Units held by American Midstream GP, LLC, 618,921 Common Units held by Magnolia, 2,853,482 Common Units held by Busbar II, LLC and approximately 980,889 General Partner units; excludes Magnolia Holdings’ 1,291,869 common units related to warrants 2. Short interest per Wall Street Market Data as of February 15, 2019 14 Preliminary Draft Subject to Change Situation Analysis Review of AMID’s Acquisitions / Divestitures ($ in millions) Acquisitions Date Transaction EBITDA Announced Acquiror / Seller Description Value Multiple 11/6/17 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 Trans-Union Interstate Pipeline, L.P. $48.0 6.5x 10/30/17 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 17% interest in the Destin Pipeline 30.0 6.3 10/2/17 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 15.5% interest in Delta House 125.4 7.1 8/8/17 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 Remaining interests in MPOG and AmPan (Panther Operating) 52.0 7.0 6/2/17 American Midstream Partners, LP / Genesis Energy LP Vioska Knoll gathering system 32.0 7.0 11/1/16 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 6.2% interest in Delta House 48.8 6.0 10/24/16 American Midstream Partners, LP / JP Energy Partners LP Crude oil pipelines; refined products terminals; NGL distribution 459.4 7.2 2 4/25/16 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 GoM offshore pipeline assets 225.0 6.0 8/10/15 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 12.9% interest in Delta House 162.0 5.0 10/14/14 American Midstream Partners, LP / Costar Midstream G&P assets in East Texas, Permian and Bakken 470.0 10.5 8/7/14 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 Eagle Ford gas gathering system 110.0 --7/14/14 American Midstream Partners, LP / DCP Midstream LLC 67% interest in MPOG 13.5 5.5 1/22/14 American Midstream Partners, LP / Penn Virginia Corp. Eagle Ford gas gathering system 100.0 12.5 12/10/13 American Midstream Partners, LP / ArcLight Capital Partners, LLC1 Blackwater Midstream’s three multi-modal terminals 60.0 7.8 6/1/12 American Midstream Partners, LP / Quantum Resources Management, LLC 87.4% interest in Chatom Processing and Fractionation Plant 55.0 7.9 11/17/11 American Midstream Partners, LP / Marathon 50% interest in the Burns Point Gas Plant 38.0 -- Mean 7.3x Median 7.0 Divestitures Date Transaction EBITDA Announced Acquiror / Seller Description Value Multiple 11/15/18 Sunoco LP / American Midstream Partners, LP Caddo Mills and North Little Rock refined products terminals $125.0 7.3x 6/18/18 Institutional Investors / American Midstream Partners, LP Harvey and Westwego marine products terminals 210.0 13.9 7/24/17 SHV Energy N.V. / American Midstream Partners, LP Propane marketing and services business 170.0 9.0 Mean 10.1x Median 9.0 Source: AMID management, press releases, Partnership filings, 1Derrick, IHS 1. Also includes affiliates of ArcLight Capital Partners, LLC 2. Includes run-rate synergies 15