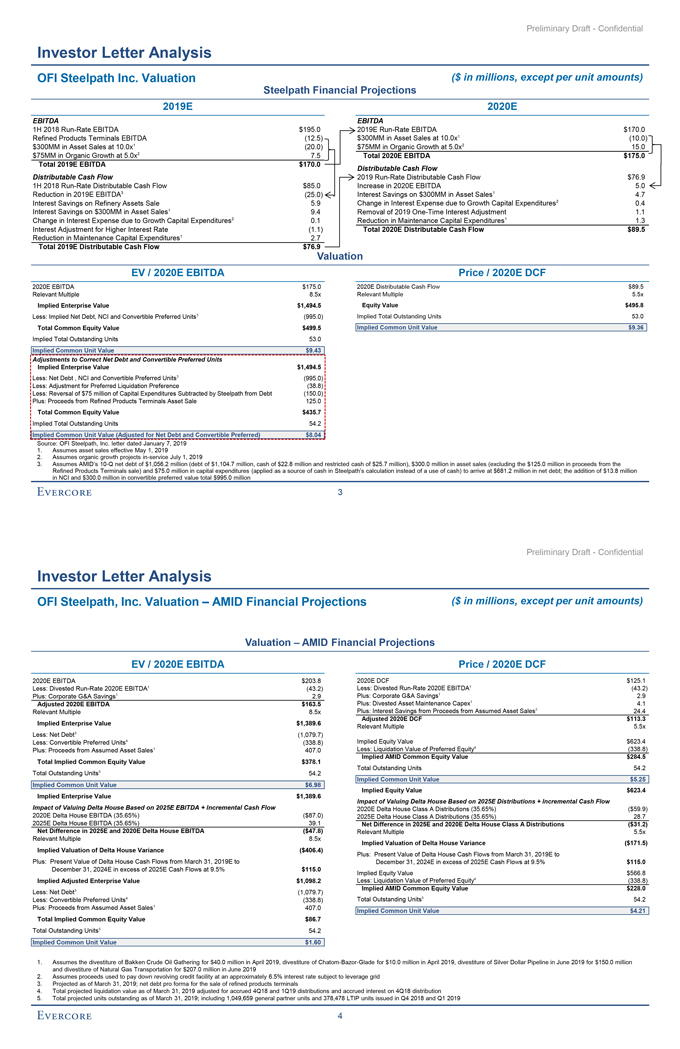

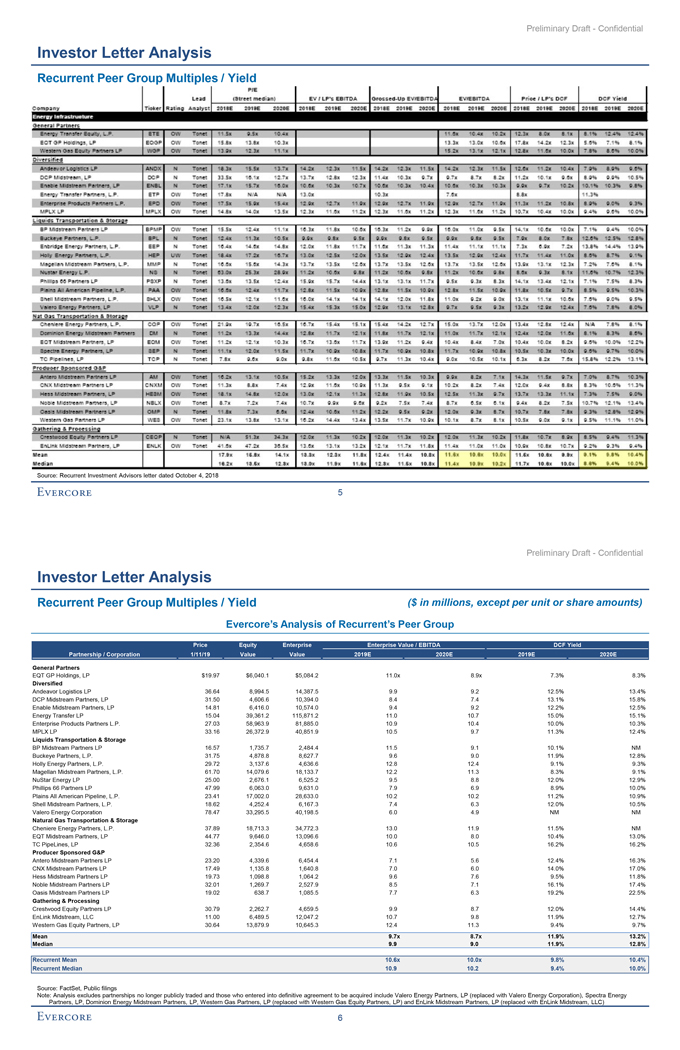

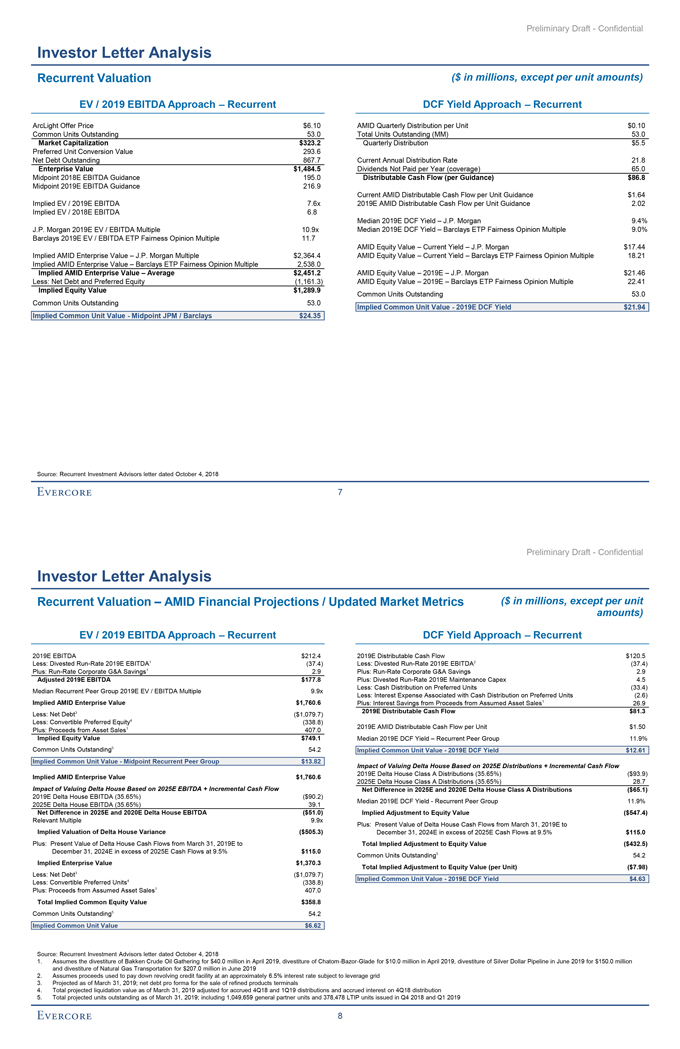

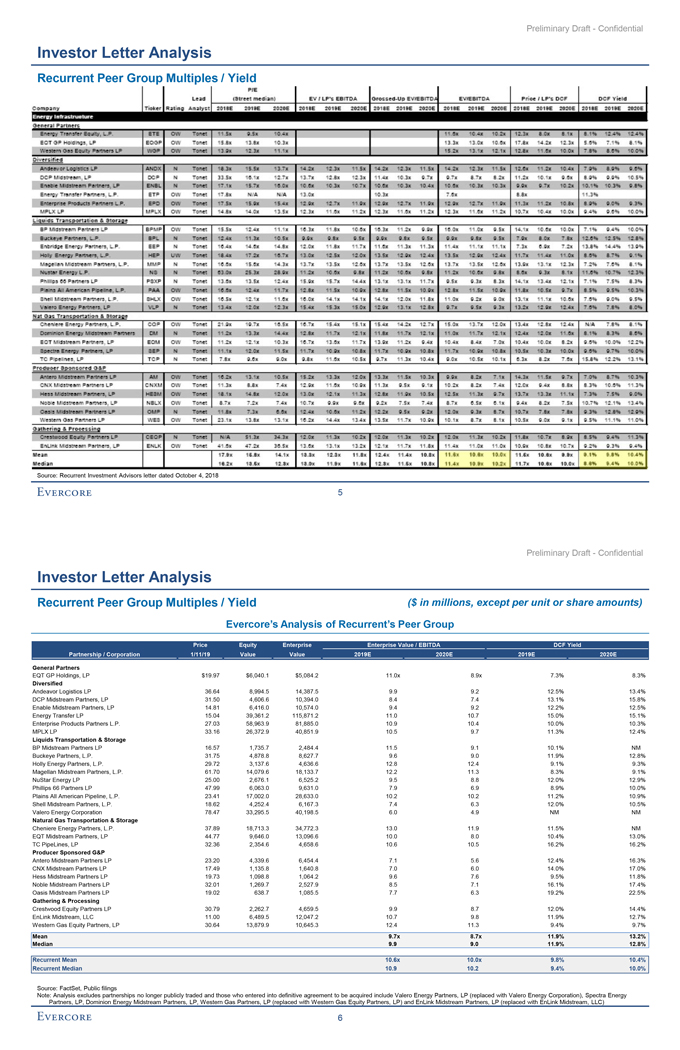

Preliminary Draft - Confidential Investor Letter Analysis Recurrent Peer Group Multiples / Yield Source: Recurrent Investment Advisors letter dated October 4, 2018 EvERCORE 5 Preliminary Draft - Confidential Investor Letter Analysis Recurrent Peer Group Multiples / Yield ($ in millions, except per unit or share amounts) Evercore’s Analysis of Recurrent’s Peer Group Price Equity Enterprise Enterprise Value / EBITDA DCF Yield Partnership / Corporation 1/11/19 Value Value 2019E 2020E 2019E 2020E General Partners EQT GP Holdings, LP $19.97 $6,040.1 $5,084.2 11.0x 8.9x 7.3% 8.3% Diversified Andeavor Logistics LP 36.64 8,994.5 14,387.5 9.9 9.2 12.5% 13.4% DCP Midstream Partners, LP 31.50 4,606.6 10,394.0 8.4 7.4 13.1% 15.8% Enable Midstream Partners, LP 14.81 6,416.0 10,574.0 9.4 9.2 12.2% 12.5% Energy Transfer LP 15.04 39,361.2 115,871.2 11.0 10.7 15.0% 15.1% Enterprise Products Partners L.P. 27.03 58,963.9 81,885.0 10.9 10.4 10.0% 10.3% MPLX LP 33.16 26,372.9 40,851.9 10.5 9.7 11.3% 12.4% Liquids Transportation & Storage BP Midstream Partners LP 16.57 1,735.7 2,484.4 11.5 9.1 10.1% NM Buckeye Partners, L.P. 31.75 4,878.8 8,627.7 9.6 9.0 11.9% 12.8% Holly Energy Partners, L.P. 29.72 3,137.6 4,636.6 12.8 12.4 9.1% 9.3% Magellan Midstream Partners, L.P. 61.70 14,079.6 18,133.7 12.2 11.3 8.3% 9.1% NuStar Energy LP 25.00 2,676.1 6,525.2 9.5 8.8 12.0% 12.9% Phillips 66 Partners LP 47.99 6,063.0 9,631.0 7.9 6.9 8.9% 10.0% Plains All American Pipeline, L.P. 23.41 17,002.0 28,633.0 10.2 10.2 11.2% 10.9% Shell Midstream Partners, L.P. 18.62 4,252.4 6,167.3 7.4 6.3 12.0% 10.5% Valero Energy Corporation 78.47 33,295.5 40,198.5 6.0 4.9 NM NM Natural Gas Transportation & Storage Cheniere Energy Partners, L.P. 37.89 18,713.3 34,772.3 13.0 11.9 11.5% NM EQT Midstream Partners, LP 44.77 9,646.0 13,096.6 10.0 8.0 10.4% 13.0% TC PipeLines, LP 32.36 2,354.6 4,658.6 10.6 10.5 16.2% 16.2% Producer Sponsored G&P Antero Midstream Partners LP 23.20 4,339.6 6,454.4 7.1 5.6 12.4% 16.3% CNX Midstream Partners LP 17.49 1,135.8 1,640.8 7.0 6.0 14.0% 17.0% Hess Midstream Partners LP 19.73 1,098.8 1,064.2 9.6 7.6 9.5% 11.8% Noble Midstream Partners LP 32.01 1,269.7 2,527.9 8.5 7.1 16.1% 17.4% Oasis Midstream Partners LP 19.02 638.7 1,085.5 7.7 6.3 19.2% 22.5% Gathering & Processing Crestwood Equity Partners LP 30.79 2,262.7 4,659.5 9.9 8.7 12.0% 14.4% EnLink Midstream, LLC 11.00 6,489.5 12,047.2 10.7 9.8 11.9% 12.7% Western Gas Equity Partners, LP 30.64 13,879.9 10,645.3 12.4 11.3 9.4% 9.7% Mean 9.7x 8.7x 11.9% 13.2% Median 9.9 9.0 11.9% 12.8% Recurrent Mean 10.6x 10.0x 9.8% 10.4% Recurrent Median 10.9 10.2 9.4% 10.0% Source: FactSet, Public filings Note: Analysis excludes partnerships no longer publicly traded and those who entered into definitive agreement to be acquired include Valero Energy Partners, LP (replaced with Valero Energy Corporation), Spectra Energy Partners, LP, Dominion Energy Midstream Partners, LP, Western Gas Partners, LP (replaced with Western Gas Equity Partners, LP) and EnLink Midstream Partners, LP (replaced with EnLink Midstream, LLC) 6