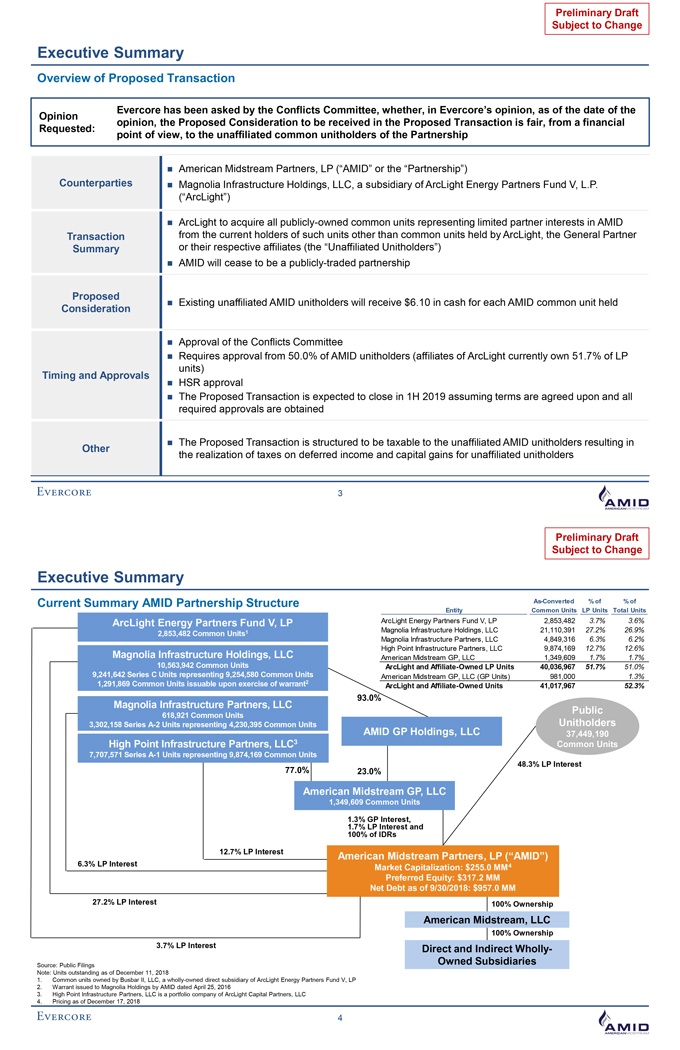

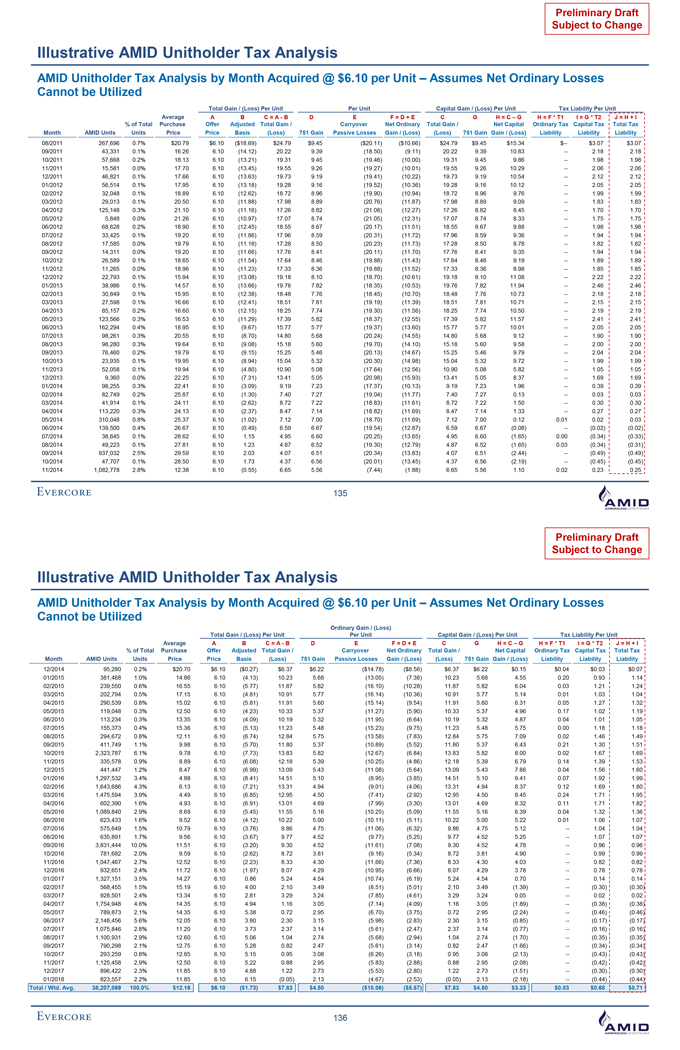

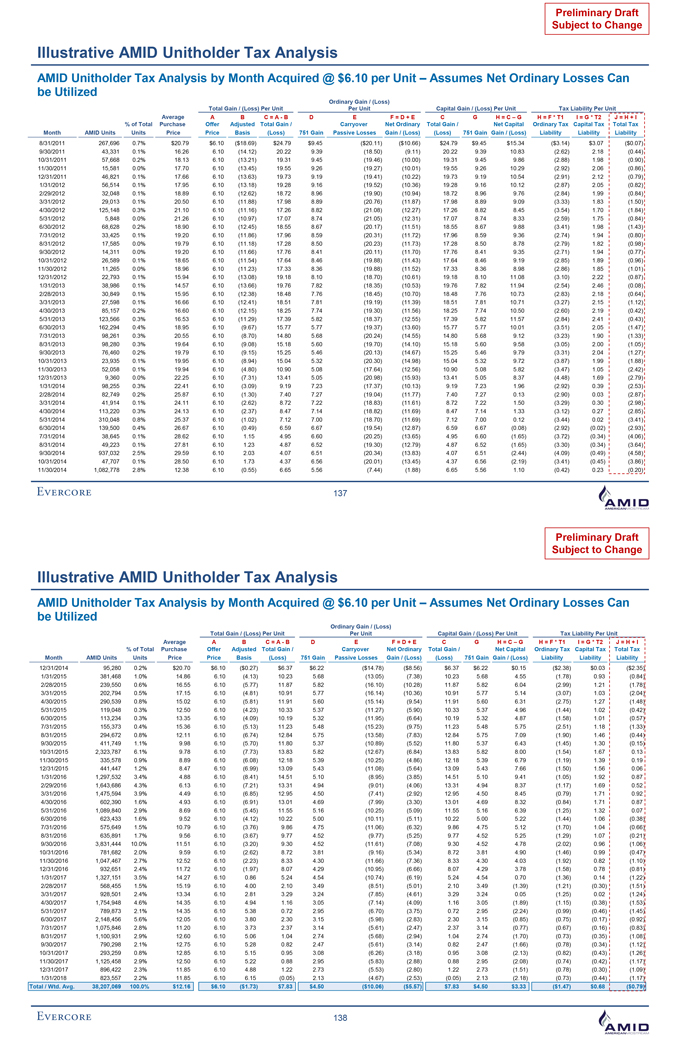

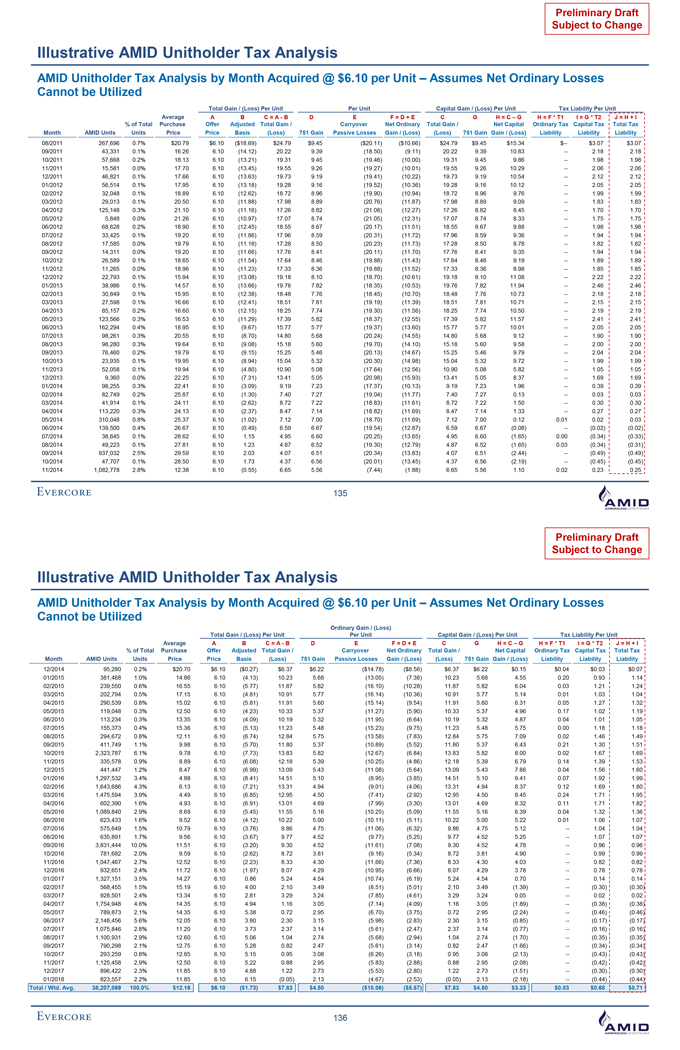

Preliminary Draft Subject to Change Illustrative AMID Unitholder Tax Analysis AMID Unitholder Tax Analysis by Month Acquired @ $6.10 per Unit – Assumes Net Ordinary Losses Cannot be Utilized Total Gain / (Loss) Per Unit Per Unit Capital Gain / (Loss) Per Unit Tax Liability Per Unit Average A B C = A - B D E F = D + E C G H = C – G H = F * T1 I = G * T2 J = H + I % of Total Purchase Offer Adjusted Total Gain / Carryover Net Ordinary Total Gain / Net Capital Ordinary Tax Capital Tax Total Tax Month AMID Units Units Price Price Basis (Loss) 751 Gain Passive Losses Gain / (Loss) (Loss) 751 Gain Gain / (Loss) Liability Liability Liability 08/2011 267,696 0.7% $20.79 $6.10 ($18.69) $24.79 $9.45 ($20.11) ($10.66) $24.79 $9.45 $15.34 $-- $3.07 $3.07 09/2011 43,331 0.1% 16.26 6.10 (14.12) 20.22 9.39 (18.50) (9.11) 20.22 9.39 10.83 -- 2.18 2.18 10/2011 57,668 0.2% 18.13 6.10 (13.21) 19.31 9.45 (19.46) (10.00) 19.31 9.45 9.86 -- 1.98 1.98 11/2011 15,581 0.0% 17.70 6.10 (13.45) 19.55 9.26 (19.27) (10.01) 19.55 9.26 10.29 -- 2.06 2.06 12/2011 46,821 0.1% 17.66 6.10 (13.63) 19.73 9.19 (19.41) (10.22) 19.73 9.19 10.54 -- 2.12 2.12 01/2012 56,514 0.1% 17.95 6.10 (13.18) 19.28 9.16 (19.52) (10.36) 19.28 9.16 10.12 -- 2.05 2.05 02/2012 32,048 0.1% 18.89 6.10 (12.62) 18.72 8.96 (19.90) (10.94) 18.72 8.96 9.76 -- 1.99 1.99 03/2012 29,013 0.1% 20.50 6.10 (11.88) 17.98 8.89 (20.76) (11.87) 17.98 8.89 9.09 -- 1.83 1.83 04/2012 125,148 0.3% 21.10 6.10 (11.16) 17.26 8.82 (21.08) (12.27) 17.26 8.82 8.45 -- 1.70 1.70 05/2012 5,848 0.0% 21.26 6.10 (10.97) 17.07 8.74 (21.05) (12.31) 17.07 8.74 8.33 -- 1.75 1.75 06/2012 68,628 0.2% 18.90 6.10 (12.45) 18.55 8.67 (20.17) (11.51) 18.55 8.67 9.88 -- 1.98 1.98 07/2012 33,425 0.1% 19.20 6.10 (11.86) 17.96 8.59 (20.31) (11.72) 17.96 8.59 9.36 -- 1.94 1.94 08/2012 17,585 0.0% 19.79 6.10 (11.18) 17.28 8.50 (20.23) (11.73) 17.28 8.50 8.78 -- 1.82 1.82 09/2012 14,311 0.0% 19.20 6.10 (11.66) 17.76 8.41 (20.11) (11.70) 17.76 8.41 9.35 -- 1.94 1.94 10/2012 26,589 0.1% 18.65 6.10 (11.54) 17.64 8.46 (19.88) (11.43) 17.64 8.46 9.19 -- 1.89 1.89 11/2012 11,265 0.0% 18.96 6.10 (11.23) 17.33 8.36 (19.88) (11.52) 17.33 8.36 8.98 -- 1.85 1.85 12/2012 22,793 0.1% 15.94 6.10 (13.08) 19.18 8.10 (18.70) (10.61) 19.18 8.10 11.08 -- 2.22 2.22 01/2013 38,986 0.1% 14.57 6.10 (13.66) 19.76 7.82 (18.35) (10.53) 19.76 7.82 11.94 -- 2.46 2.46 02/2013 30,849 0.1% 15.95 6.10 (12.38) 18.48 7.76 (18.45) (10.70) 18.48 7.76 10.73 -- 2.18 2.18 03/2013 27,598 0.1% 16.66 6.10 (12.41) 18.51 7.81 (19.19) (11.39) 18.51 7.81 10.71 -- 2.15 2.15 04/2013 85,157 0.2% 16.60 6.10 (12.15) 18.25 7.74 (19.30) (11.56) 18.25 7.74 10.50 -- 2.19 2.19 05/2013 123,566 0.3% 16.53 6.10 (11.29) 17.39 5.82 (18.37) (12.55) 17.39 5.82 11.57 -- 2.41 2.41 06/2013 162,294 0.4% 18.95 6.10 (9.67) 15.77 5.77 (19.37) (13.60) 15.77 5.77 10.01 -- 2.05 2.05 07/2013 98,261 0.3% 20.55 6.10 (8.70) 14.80 5.68 (20.24) (14.55) 14.80 5.68 9.12 -- 1.90 1.90 08/2013 98,280 0.3% 19.64 6.10 (9.08) 15.18 5.60 (19.70) (14.10) 15.18 5.60 9.58 -- 2.00 2.00 09/2013 76,460 0.2% 19.79 6.10 (9.15) 15.25 5.46 (20.13) (14.67) 15.25 5.46 9.79 -- 2.04 2.04 10/2013 23,935 0.1% 19.95 6.10 (8.94) 15.04 5.32 (20.30) (14.98) 15.04 5.32 9.72 -- 1.99 1.99 11/2013 52,058 0.1% 19.94 6.10 (4.80) 10.90 5.08 (17.64) (12.56) 10.90 5.08 5.82 -- 1.05 1.05 12/2013 9,360 0.0% 22.25 6.10 (7.31) 13.41 5.05 (20.98) (15.93) 13.41 5.05 8.37 -- 1.69 1.69 01/2014 98,255 0.3% 22.41 6.10 (3.09) 9.19 7.23 (17.37) (10.13) 9.19 7.23 1.96 -- 0.39 0.39 02/2014 82,749 0.2% 25.87 6.10 (1.30) 7.40 7.27 (19.04) (11.77) 7.40 7.27 0.13 -- 0.03 0.03 03/2014 41,914 0.1% 24.11 6.10 (2.62) 8.72 7.22 (18.83) (11.61) 8.72 7.22 1.50 -- 0.30 0.30 04/2014 113,220 0.3% 24.13 6.10 (2.37) 8.47 7.14 (18.82) (11.69) 8.47 7.14 1.33 -- 0.27 0.27 05/2014 310,048 0.8% 25.37 6.10 (1.02) 7.12 7.00 (18.70) (11.69) 7.12 7.00 0.12 0.01 0.02 0.03 06/2014 139,500 0.4% 26.67 6.10 (0.49) 6.59 6.67 (19.54) (12.87) 6.59 6.67 (0.08) -- (0.02) (0.02) 07/2014 38,645 0.1% 28.62 6.10 1.15 4.95 6.60 (20.25) (13.65) 4.95 6.60 (1.65) 0.00 (0.34) (0.33) 08/2014 49,223 0.1% 27.81 6.10 1.23 4.87 6.52 (19.30) (12.79) 4.87 6.52 (1.65) 0.03 (0.34) (0.31) 09/2014 937,032 2.5% 29.59 6.10 2.03 4.07 6.51 (20.34) (13.83) 4.07 6.51 (2.44) -- (0.49) (0.49) 10/2014 47,707 0.1% 28.50 6.10 1.73 4.37 6.56 (20.01) (13.45) 4.37 6.56 (2.19) -- (0.45) (0.45) 11/2014 1,082,778 2.8% 12.38 6.10 (0.55) 6.65 5.56 (7.44) (1.88) 6.65 5.56 1.10 0.02 0.23 0.25 135Preliminary Draft Subject to Change Illustrative AMID Unitholder Tax Analysis AMID Unitholder Tax Analysis by Month Acquired @ $6.10 per Unit – Assumes Net Ordinary Losses Cannot be Utilized Ordinary Gain / (Loss) Total Gain / (Loss) Per Unit Per Unit Capital Gain / (Loss) Per Unit Tax Liability Per Unit Average A B C = A - B D E F = D + E C G H = C – G H = F * T1 I = G * T2 J = H + I % of Total Purchase Offer Adjusted Total Gain / Carryover Net Ordinary Total Gain / Net Capital Ordinary Tax Capital Tax Total Tax Month AMID Units Units Price Price Basis (Loss) 751 Gain Passive Losses Gain / (Loss) (Loss) 751 Gain Gain / (Loss) Liability Liability Liability 12/2014 95,280 0.2% $20.70 $6.10 ($0.27) $6.37 $6.22 ($14.78) ($8.56) $6.37 $6.22 $0.15 $0.04 $0.03 $0.07 01/2015 381,468 1.0% 14.86 6.10 (4.13) 10.23 5.68 (13.05) (7.38) 10.23 5.68 4.55 0.20 0.93 1.14 02/2015 239,550 0.6% 16.55 6.10 (5.77) 11.87 5.82 (16.10) (10.28) 11.87 5.82 6.04 0.03 1.21 1.24 03/2015 202,794 0.5% 17.15 6.10 (4.81) 10.91 5.77 (16.14) (10.36) 10.91 5.77 5.14 0.01 1.03 1.04 04/2015 290,539 0.8% 15.02 6.10 (5.81) 11.91 5.60 (15.14) (9.54) 11.91 5.60 6.31 0.05 1.27 1.32 05/2015 119,048 0.3% 12.50 6.10 (4.23) 10.33 5.37 (11.27) (5.90) 10.33 5.37 4.96 0.17 1.02 1.19 06/2015 113,234 0.3% 13.35 6.10 (4.09) 10.19 5.32 (11.95) (6.64) 10.19 5.32 4.87 0.04 1.01 1.05 07/2015 155,373 0.4% 15.36 6.10 (5.13) 11.23 5.48 (15.23) (9.75) 11.23 5.48 5.75 0.00 1.18 1.18 08/2015 294,672 0.8% 12.11 6.10 (6.74) 12.84 5.75 (13.58) (7.83) 12.84 5.75 7.09 0.02 1.46 1.49 09/2015 411,749 1.1% 9.98 6.10 (5.70) 11.80 5.37 (10.89) (5.52) 11.80 5.37 6.43 0.21 1.30 1.51 10/2015 2,323,787 6.1% 9.78 6.10 (7.73) 13.83 5.82 (12.67) (6.84) 13.83 5.82 8.00 0.02 1.67 1.69 11/2015 335,578 0.9% 8.89 6.10 (6.08) 12.18 5.39 (10.25) (4.86) 12.18 5.39 6.79 0.14 1.39 1.53 12/2015 441,447 1.2% 8.47 6.10 (6.99) 13.09 5.43 (11.08) (5.64) 13.09 5.43 7.66 0.04 1.56 1.60 01/2016 1,297,532 3.4% 4.88 6.10 (8.41) 14.51 5.10 (8.95) (3.85) 14.51 5.10 9.41 0.07 1.92 1.99 02/2016 1,643,686 4.3% 6.13 6.10 (7.21) 13.31 4.94 (9.01) (4.06) 13.31 4.94 8.37 0.12 1.69 1.80 03/2016 1,475,594 3.9% 4.49 6.10 (6.85) 12.95 4.50 (7.41) (2.92) 12.95 4.50 8.45 0.24 1.71 1.95 04/2016 602,390 1.6% 4.93 6.10 (6.91) 13.01 4.69 (7.99) (3.30) 13.01 4.69 8.32 0.11 1.71 1.82 05/2016 1,089,840 2.9% 8.69 6.10 (5.45) 11.55 5.16 (10.25) (5.09) 11.55 5.16 6.39 0.04 1.32 1.36 06/2016 623,433 1.6% 9.52 6.10 (4.12) 10.22 5.00 (10.11) (5.11) 10.22 5.00 5.22 0.01 1.06 1.07 07/2016 575,649 1.5% 10.79 6.10 (3.76) 9.86 4.75 (11.06) (6.32) 9.86 4.75 5.12 -- 1.04 1.04 08/2016 635,891 1.7% 9.56 6.10 (3.67) 9.77 4.52 (9.77) (5.25) 9.77 4.52 5.25 -- 1.07 1.07 09/2016 3,831,444 10.0% 11.51 6.10 (3.20) 9.30 4.52 (11.61) (7.08) 9.30 4.52 4.78 -- 0.96 0.96 10/2016 781,682 2.0% 9.59 6.10 (2.62) 8.72 3.81 (9.16) (5.34) 8.72 3.81 4.90 -- 0.99 0.99 11/2016 1,047,467 2.7% 12.52 6.10 (2.23) 8.33 4.30 (11.66) (7.36) 8.33 4.30 4.03 -- 0.82 0.82 12/2016 932,651 2.4% 11.72 6.10 (1.97) 8.07 4.29 (10.95) (6.66) 8.07 4.29 3.78 -- 0.78 0.78 01/2017 1,327,151 3.5% 14.27 6.10 0.86 5.24 4.54 (10.74) (6.19) 5.24 4.54 0.70 -- 0.14 0.14 02/2017 568,455 1.5% 15.19 6.10 4.00 2.10 3.49 (8.51) (5.01) 2.10 3.49 (1.39) -- (0.30) (0.30) 03/2017 928,501 2.4% 13.34 6.10 2.81 3.29 3.24 (7.85) (4.61) 3.29 3.24 0.05 -- 0.02 0.02 04/2017 1,754,948 4.6% 14.35 6.10 4.94 1.16 3.05 (7.14) (4.09) 1.16 3.05 (1.89) -- (0.38) (0.38) 05/2017 789,873 2.1% 14.35 6.10 5.38 0.72 2.95 (6.70) (3.75) 0.72 2.95 (2.24) -- (0.46) (0.46) 06/2017 2,148,456 5.6% 12.05 6.10 3.80 2.30 3.15 (5.98) (2.83) 2.30 3.15 (0.85) -- (0.17) (0.17) 07/2017 1,075,846 2.8% 11.20 6.10 3.73 2.37 3.14 (5.61) (2.47) 2.37 3.14 (0.77) -- (0.16) (0.16) 08/2017 1,100,931 2.9% 12.60 6.10 5.06 1.04 2.74 (5.68) (2.94) 1.04 2.74 (1.70) -- (0.35) (0.35) 09/2017 790,298 2.1% 12.75 6.10 5.28 0.82 2.47 (5.61) (3.14) 0.82 2.47 (1.66) -- (0.34) (0.34) 10/2017 293,259 0.8% 12.85 6.10 5.15 0.95 3.08 (6.26) (3.18) 0.95 3.08 (2.13) -- (0.43) (0.43) 11/2017 1,125,458 2.9% 12.50 6.10 5.22 0.88 2.95 (5.83) (2.88) 0.88 2.95 (2.08) -- (0.42) (0.42) 12/2017 896,422 2.3% 11.85 6.10 4.88 1.22 2.73 (5.53) (2.80) 1.22 2.73 (1.51) -- (0.30) (0.30) 01/2018 823,557 2.2% 11.85 6.10 6.15 (0.05) 2.13 (4.67) (2.53) (0.05) 2.13 (2.18) -- (0.44) (0.44) Total / Wtd. Avg. 38,207,069 100.0% $12.16 $6.10 ($1.73) $7.83 $4.50 ($10.06) ($5.57) $7.83 $4.50 $3.33 $0.03 $0.68 $0.71 136