SPDR MFS SYSTEMATIC CORE EQUITY ETF

Management’s Discussion of Fund Performance (Unaudited)

Summary of Results

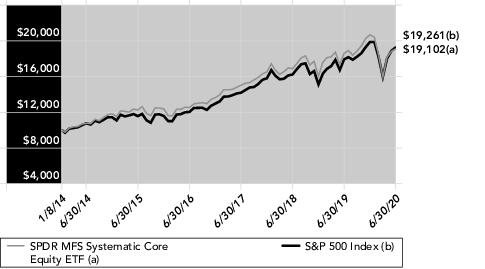

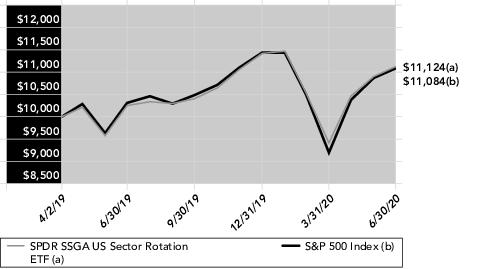

For the twelve months ended June 30, 2020 (the “Reporting Period”), the SPDR MFS Systematic Core Equity ETF (the “Fund”) provided a total return of 2.78%. This compares with a return of 7.51% for the Fund’s benchmark, the Standard & Poor’s 500 Stock Index (S&P 500 Index).

Market Environment

Markets experienced an extraordinarily sharp selloff and, in many cases, an unusually rapid partial recovery late in the Reporting Period. Central banks and fiscal authorities undertook astonishing levels of stimulus to offset the economic effects of government-imposed social-distancing measures implemented to slow the spread of COVID-19. At this point, the global economy looks to have experienced the deepest, steepest and possibly shortest recession in the post-war period. The recovery remains subject to more than the usual uncertainties, however, due to questions around the evolution of the virus, its continued impacts and treatments.

Compounding market uncertainty earlier in the coronavirus pandemic was a crash in the price of crude oil due to a sharp drop in global demand and a disagreement between Saudi Arabia and Russia over production cuts, which resulted in a price war. The subsequent decline in prices undercut oil exporters, many of which are in emerging markets, as well as a large segment of the high-yield credit market. The OPEC+ group later agreed on output cuts, while shale oil producers in the United States also decreased production, which – along with the gradual reopening of some major economies and the resultant boost in demand – helped stabilize the price of crude oil.

Around the world, central banks responded quickly and massively to the crisis with programs to improve liquidity and support markets. They proved largely successful in helping to restore market function, ease volatility and stimulate a market rebound through the end of the Reporting Period. Monetary easing measures were complemented by large fiscal stimulus initiatives in developed countries. Even emerging market countries were able to implement countercyclical policies –a departure from the usual market-dictated response to risk-off crises – due to relatively manageable external liabilities and balances of payments in many countries, along with persistently low inflation.

As is often the case in a crisis, market vulnerabilities were revealed. For example, companies that added significant leverage to their balance sheets in recent years by borrowing to fund dividend payments and stock buybacks may find it difficult to follow that path in the future, and investors may not reward them if they do. Recapitalizations by some of these highly-leveraged firms could dilute existing shareholders. Very long supply chains designed to squeeze out every bit of savings may be shifted closer to home markets if companies seek to put resiliency before cost after a series of supply disruptions. The aftereffects of the pandemic could affect consumer, business and government behavior in ways difficult to forecast. Also, while markets have regained lost ground more swiftly than expected, any economic recovery is likely to be protracted.

Detractors from Performance

As an outcome of the performance of the Blended Research inputs and portfolio construction process, overall stock selection detracted from results.

Specifically, stock selection, and to a lesser extent, an overweight allocation to the real estate sector detracted from performance relative to the S&P 500 Index, led by the Fund’s holdings of real estate investment fund Spirit Realty(b)(h) .

Stock selection in the financials sector also held back relative returns. Within this sector, the Fund’s overweight positions in insurance services provider Prudential Financial, diversified financial services firm Citigroup, consumer financial services firm Synchrony Financial and insurance company MetLife weighed on relative performance.

Stock selection, and to a lesser extent, an overweight allocation to the consumer staples sector hindered relative returns, led by an overweight position in food producer Tyson Foods.

Elsewhere, an underweight position in internet retailer Amazon.com, and overweight positions in hospital operator HCA Healthcare and independent oil refiner Valero Energy, weakened relative results. In addition, holding shares of electricity provider Vistra Energy(b) further detracted from relative results.

Contributors to Performance

As an outcome of the performance of the Blended Research inputs and portfolio construction process, sector allocation benefitted results.

Specifically, stock selection and an overweight allocation to the information technology sector contributed to relative performance. Within this sector, an overweight position in computer and personal electronics maker Apple, software giant Microsoft and semiconductor company Intel bolstered relative results.

In other sectors, the Fund’s overweight position in pharmaceutical company Eli Lilly, and not owning shares of aerospace company Boeing, investment conglomerate Berkshire Hathaway, integrated energy company Chevron and pharmaceutical giant Pfizer, supported relative results. Additionally, the Fund’s timing of ownership in shares of diversified financial services firm Wells Fargo(h) and global financial services firm JPMorgan Chase(h) further benefited relative returns.

(b) Security is not a benchmark constituent.

(h) Security was not held in the fund at Reporting Period end.