UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

DREXEL HAMILTON MUTUAL FUNDS

(exact name of registrant as specified in charter)

45 Rockefeller Plaza, Suite 2000, New York, NY 10111

(Address of principal executive offices) (Zip code)

Andrew Bang

45 Rockefeller Plaza, Suite 2000

New York, NY 10111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 855.298.4236

Date of fiscal year end: September 30

Date of reporting period: October 1, 2012 – March 31, 2013

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

| | |

| Drexel Hamilton Mutual Funds | | Shareholder Letter |

| | March 31, 2013 (Unaudited) |

May 2013

Dear Shareholder,

We present the semi-annual report for the series of Drexel Hamilton Mutual Funds for the six-month period ending March 31, 2013.

The Net Asset Value (“NAV”) of the Drexel Hamilton Centre American Equity Fund (DHAMX) increased 6.79% for the six-month period ended March 31,2013 and 22.06% since inception, and the NAV of the Drexel Hamilton Centre Global Equity Fund (DHGLX) increased 6.02% for the six-month period ended March 31, 2013 and 25.00% since inception. The Drexel Hamilton Multi-Asset Real Return Fund (DHMUX), launched on October 9, 2012, has returned 1.39% for the three-month period ended March 31, 2013 and 0.80% since inception. Additional performance and Fund information is available in the following Manager Commentary sections (pages 2-10).

Since our last report to shareholders, Drexel Hamilton Multi-Asset Real Return Fund commenced trading operations, and the reorganization of a similarly managed equity fund, Ameristock Mutual Fund, Inc., into the Drexel Hamilton Centre American Equity Fund was completed.

Drexel Hamilton Multi-Asset Real Return Fund

This Fund complements our equity funds, the Drexel Hamilton Centre American Equity Fund and the Drexel Hamilton Centre Global Equity Fund, and seeks real return, which is total return that exceeds U.S. inflation over a full inflation cycle (typically 5 years) by using a flexible allocation investment strategy that is diversified across various asset classes to include equity, fixed income, exchange-traded notes and exchange-traded funds with returns that are linked to commodity indices and cash and cash equivalents. While navigating changing market conditions, the Fund endeavors to dynamically shift its allocation mix to maximize risk-adjusted returns and to preserve invested capital. Drexel Hamilton Investment Partners, LLC, the Adviser, selects the Fund’s investments and monitors the Fund’s investment portfolio.

Drexel Hamilton Centre American Equity Fund

To former shareholders of the Ameristock Mutual Fund, we extend a special welcome to the Drexel Hamilton Mutual Funds family. The reorganization of the Ameristock Mutual Fund into the Drexel Hamilton Centre American Equity Fund was completed January 11, 2013. The American Equity Fund offers an experienced portfolio manager along with an investment adviser and sub-adviser dedicated to performance, shareholder service and growth of the Fund.

All Funds

In this uncertain market, political and economic environment, the portfolio managers of each series of Drexel Hamilton Mutual Funds will continue to focus on their fundamentally-driven approaches using high conviction, disciplined and research intensive processes in seeking long-term growth of capital or, with respect to the Drexel Hamilton Multi-Asset Real Return Fund, real return.

We have accomplished many significant milestones during this reporting period and will continue to endeavor to provide consistent, risk-adjusted returns for our shareholders. We believe that the Funds are off to strong start this year, and will continue striving to provide differentiation, value and performance.

Drexel Hamilton Investment Partners LLC, the Adviser, offers investment management services to clients, intermediaries, advisers, distributors and retail clients as a leading Service Disabled Veteran Owned Small Business investment manager.

Sincerely yours,

Andrew Bang

President

Past performance is no guarantee of future results and investment returns and principal value of each Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Andrew Bang is a registered representative of ALPS Distributors, Inc.

The statements and opinions expressed are those of the Adviser and are as of the date of this report.

| | |

Semi-Annual Report | March 31, 2013 | | 1 |

| | |

| Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

Performance

For the six-month period ended March 31, 2013, the Drexel Hamilton Centre American Equity Fund delivered a positive absolute return but trailed the S&P 500 Index. During this period, sectors such as Financials, Health Care, and Industrials were market leaders whilst sectors such as Technology, Telecomm, Energy, and Materials lagged. Our underweight for the Financials sector and our overweight in the Technology sector versus the Index negatively impacted performance and, when combined, represented the majority of the Fund’s relative underperformance during the period. Our principal overweight sectors were Technology and Health Care driven by bottom-up stock level opportunities. Despite the performance drag from our underweight posture in Financials, we maintain our general avoidance of the large “too big to fail” financial stocks, as regulatory scrutiny and increased capital requirements continue to depress returns on equity and intrinsic values.

Stocks that were strong performers within the Fund over this period included Delta Air Lines, United Continental, Johnson & Johnson, Sempra Energy, Colgate-Palmolive and Boston Scientific; stocks that were laggards included those mainly in the Technology and Materials sectors such as Apple, Oracle, Eldorado Gold and Kinross Gold, all of which remain in the Fund.

As always, our process in managing the Fund is to focus bottom-up on each individual company’s growth outlook and capacity to create shareholder value. We analyze not only earnings but also strive to understand and link the capital allocation decisions being made today by each company and how they will lead to future earnings growth. In other words, we expect companies to invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that will create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. Our top-down views on interest rates and other economic factors are important, as many of those are inputs into our company models and, at the end of the day, reconciled to the bottom-up information we gather and process from company performance. This approach is designed to identify what we believe are the best stocks within the S&P 500 and weight those securities in a manner that delivers the Fund above average risk adjusted returns.

Illustrating our investment process, our view on airline investments is that, with recent mergers, carriers are cutting costs by grounding less fuel efficient aircrafts from their fleets and shedding unprofitable routes. This “wise contraction” approach as well as a more tough-minded approach to airline operations is translating into profits and shareholder wealth creation with little influence from the overall stock market direction. The airlines have been able to repeatedly raise ticket prices while still filling their planes – with overall capacity down 5% since 2008, load factors are reaching their highest level in a decade. All of this has rewarded the Fund and other patient investors with higher earnings and ratings. We expect the stocks of Delta and United Continental to continue their strong performance over the next one to two years.

Economic and Market Review

Looking back over 2012, the issues that dominated the stock market headlines were: a) the US presidential election; b) the Federal Reserve’s third round of quantitative easing, and c) the rally in stock markets world-wide since European Central Bank president Mario Draghi made his ‘whatever it takes’ comments about saving the Euro.

Rather than re-hashing the headlines, 2012 can be most importantly described as the year when the continued strong benefit to margins and corporate profits from the material restructuring efforts of 2008-2011 ran out of gas for most US companies. Our optimistic cyclical outlook since 2009 was anchored in our belief that the restructuring and streamlining of corporations we witnessed after the collapse of Lehman Brothers and during the subsequent recession was the most effective, efficient and broad-based that we have seen in our careers. We believed that profit margins and asset efficiency levels were going to reach and, in some cases, surpass prior peak levels despite a top-line revenue environment that would remain challenging.

By the spring of 2012, we no longer felt that the US stock market could rely upon strong profit growth to power its advance. Interestingly, the proportion of stocks held by the Drexel Hamilton Centre American Equity Fund, which could be characterized as cyclical growers, has fallen from, in terms of net assets, about one-half of the Fund’s portfolio to less than one-third of the Fund’s portfolio. Stocks that we sold included truck manufacturer Paccar, UPS, and General Dynamics. Our emphasis as fund managers has shifted to more stable, consistent earnings-type stocks. Our allocation to what we call “Defensive Value” and away from “Cyclical Growth” has increased significantly as we see the profit picture across the board becoming more difficult, and fewer companies are able to generate earnings growth in the current environment. This has resulted in our pro-cyclical posture since 2009, with Technology, Industrials, and Consumer Discretionary stocks being replaced with a less cyclical, “bluer” blue chip posture emphasizing Health Care, Staples and less cyclical industry groups within Technology. For example, the Fund’s top holdings currently include Johnson & Johnson, Exxon Mobil and Colgate Palmolive.

| | |

| Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

From a pure aggregation of bottom-up data perspective, we’re seeing that, for the first time since 2009, more than half of the S&P 500’s companies universe we cover is showing a decline in operating margins, and more than two-thirds of this same stock universe is experiencing profit margins above their ten-year averages. This indicates limited upside but growing downside risk. Lastly, the returns on equity for Financials remain constrained by new capital and regulatory requirements.

In our view, the investment environment today is different than in previous periods of slower economic growth because, outside of instigating a high inflation policy through further quantitative easing or changing reserve requirements potentially, the Federal Reserve seems impotent in trying to combat the current contraction and massaging the business cycle. US interest rates are already at record lows across the yield spectrum, and although higher rates may be the necessary tonic to bring long-term recovery hopes, we see no chance of that happening. On the positive side, many of the excesses typically seen at the start of recessions, such as excessive reinvestment rates, booming mergers and acquisitions activity, are not evident.

That said, two things loom for the foreseeable future – competitive devaluations amongst the major economic powers gaining steam and, relatedly, the Federal Reserve being forced to maintain its Quantitative Easing (QE) program well past 2013. Either or both of these can lead to a policy mistake hurting equity prices and the US dollar. Because of this, we recently purchased Gold Corp, Kinross, Eldorado Gold, and IAM Gold after these stocks approached their price lows last seen in Fall of 2008. With the price drops, valuations fell below asset levels, and, most importantly, excess capital investment plans were tempered. All of these ingredients should provide a non-correlated asset within the Fund in the event of a policy mistake that could hurt equity prices and the US dollar while benefiting gold materially.

Outlook

We believe the best strategy to employ in the current environment where profitability will likely continue to come under pressure relative to expectations is to focus on leading mega-capitalization blue chips with attributes that, in our view, render them undervalued based upon their current multiples – Defensive Value. It is our opinion that these companies, whose fundamentals will stand out increasingly as the business cycle matures, will distinguish themselves from the broad market through organic growth from innovation and pricing power. US companies such as Exxon-Mobil, Johnson & Johnson, Proctor & Gamble, and Coca-Cola typify companies with these attributes. In addition to emphasizing investment in such blue chips, some US companies continue to harvest growth in earnings have taking the initiative during the most recent recession to enhance operations, streamlined their labor forces and optimized assets. Examples of such companies include Delta and Continental airlines, Harley Davison, Honeywell, Thomson Reuters, and power producer Calpine.

We remain positive on large capitalization stocks as we continue moving towards the next stage of drivers for the stock market, particularly companies that were best able to leverage their invested capital and lean balance sheets during the economic recovery. Now, in an environment in which improving profit margins and returns on invested capital will be more difficult but, at the same time, possible favorable abatement of the macro concerns occur, we expect companies with strong internal reinvestment, innovation and pricing power to become more highly rated by the markets. 2013 may, like 1995, turn out to be the year of the American blue-chip companies with defensive value attributes leading.

S&P 500 Index - The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices. You cannot invest directly into an index.

The statements and opinions expressed are those of the Sub-Adviser and are of the date of this report.

| | |

Semi-Annual Report | March 31, 2013 | | 3 |

| | |

Drexel Hamilton Centre American Equity Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

SECTOR WEIGHTINGS

As a percentage of Net Assets

| | | | |

| |

Information Technology | | | 25.97 | % |

Health Care | | | 16.67 | % |

Consumer Discretionary | | | 13.79 | % |

Consumer Staples | | | 12.78 | % |

Materials | | | 9.79 | % |

Energy | | | 8.00 | % |

Financials | | | 7.29 | % |

Utilities | | | 5.40 | % |

Industrials | | | 3.37 | % |

Calls | | | 0.19 | % |

Cash and Cash

Equivalents | | | -3.25 | % |

Total | | | 100.00 | % |

These allocations may not reflect the current or future positions of the portfolio.

|

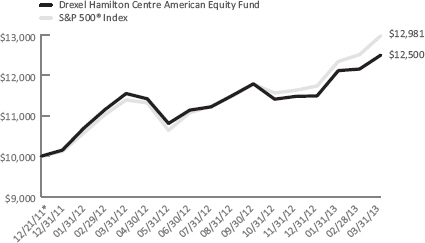

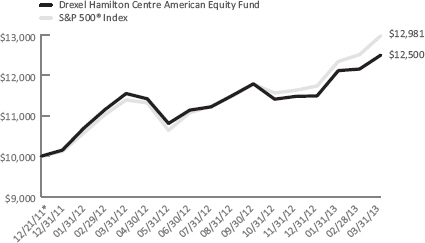

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2013

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the S&P 500® Index. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only. TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 1 Month | | 3 Month | | YTD | | 1 Year | | Since

Inception* |

| | | Drexel Hamilton Centre American Equity Fund | | | | 2.83% | | | | | 8.77% | | | | | 8.77% | | | | | 8.23% | | | | | 19.10% | |

| | | S&P 500® Index | | | | 3.75% | | | | | 10.61% | | | | | 10.61% | | | | | 13.96% | | | | | 22.68% | |

|

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236 or visit www.dhipfunds.com. The total annual operating expense ratio (after expense reimbursements) as stated in the fee table of the most recent prospectus, dated January 14, 2013, was 1.05%. The Adviser has entered into a written expense limitation agreement under which it has agreed to limit for a period of two years from January 11, 2013 the total expenses of the existing class of shares of the Fund (including (but not limited to) investment advisory fees of the Adviser and distribution/service (Rule 12b-1) fees, but excluding interest, taxes, litigation, brokerage commissions, and extraordinary expenses not incurred in the ordinary course of the Fund’s business) to an annual rate of 1.05% of the average daily net assets of the Fund. This limitation may not be terminated and will remain in place through the end of the two-year period beginning after January 11, 2013. Without this waiver the total annual fund operating expenses of the Fund would be 1.15%. The S&P 500® Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index. * The Fund’s inception date was December 21, 2011. |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

Performance

For the six-month period ended March 31, 2013, the Drexel Hamilton Centre Global Equity Fund delivered a positive absolute return but underperformed its benchmark, the MSCI All Country World Index (ACWI), on a relative basis.

During this period, Japan was one of the best performing markets globally, followed by the U.S. and select European countries while emerging markets as a group lagged. Also during this period, good stock selection in Latin America and an overweight posture in Asia contributed positively to the Fund’s relative performance. On the other hand, stock selections in Asia, Europe and the U.S. and overweight posture in South America detracted from the Fund’s relative performance.

Among the Fund’s stock holdings, Fast Retailing, Daiwa Securities and Toyota Motor in Japan; Sands in China; Compagnie Financiere Richemont in Switzerland; Coloplast in Denmark; Adidas in Germany; and Samsung Electronics in South Korea contributed positively to the Fund’s performance. On the negative side, America Movil of Mexico; Gazprom of Russia; Li & Fung, China Mobile, China Life Insurance, and CNOOC of China; Enel and Intesa SanPaolo of Italy; and Vale of Brazil detracted from Fund’s performance.

Economic and Market Outlook

Looking ahead, we are cautiously optimistic. The Fund’s holdings continue to emphasize high quality large market capitalization stocks with impressive track records of creating shareholder value in good times and bad. The Fund continues to favor companies that have a long record of growing dividends and maintaining above benchmark dividend yield.

In the near-term, we believe the markets will remain volatile, but in our base case scenario, we expect the global equity markets to post positive returns and possibly end the year at higher levels than they are today.

At the regional and country level, we think that the markets, especially those in certain emerging markets, Western Europe and Japan, have already discounted many of the uncertainties and risks facing investors. Consequently, we see numerous investment opportunities for long-term global equity investors among the many attractively valued blue-chip large market capitalization multi-national companies in these regions. We believe that long-term global equity investors will be rewarded by focusing their investments, as we do in the Fund, in high quality blue chip stocks that have impressive track records of creating shareholder value, growing dividends in challenging operating environments and maintaining strong balance sheets, and that are well positioned competitively in their respective industries.

Portfolio Structure & Strategy

The Fund’s investment process combines bottom-up stock selection with structured portfolio construction and risk management that’s cognizant of secular growth forces.

Our approach in managing the Fund is to focus bottom-up on each individual company’s growth outlook, not just on earnings but understanding the capital allocation decisions being made today and how they will lead to future earnings growth. Our top-down views on macro outlooks of various markets, regions and global sectors are important, as many of those are inputs into our company models and, at the end of the day, are reconciled to the bottom-up information we gather and process from company performance and operating results. Our disciplined economic-value-added based investment process, and our GDP-adjusted focused portfolio construction process, is designed to position the Fund to be unencumbered by traditional market capitalization weighted benchmarks and to go where the bottom-up stock opportunities are globally. Consequently, we believe the Fund is well positioned to benefit and profit from the positive demographics and long-term economic growth in many developing economies as well as attractive investment opportunities in developed countries across the globe.

Currently, the Fund has overweight postures in Technology, Financials (European and Asian), Energy, Consumer Discretionary, and Consumer Staples and underweight postures in Industrials, Utilities, and Healthcare. The Fund has close to neutral postures in Materials and Telecommunication Services relative to the MSCI All Country World Index (ACWI).

Recent purchases for or additions to the Fund based on our fundamental research include Daiwa Securities, Nestle, L’Oreal and Honda Motor. Recent sells or reductions based on our disciplined investment process to take profit or remove stocks that no longer meet our fundamental investment and valuation criteria include Coloplast and Commonwealth Bank of Australia. In addition, the Fund has increased its exposure in Japan.

| | |

Semi-Annual Report | March 31, 2013 | | 5 |

| | |

Drexel Hamilton Centre Global Equity Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

Going forward, we believe that the Fund will continue to be anchored with investments in companies with the potential to create shareholder value that 1) have long track records of growing their cash earnings and dividends in both good times and bad, 2) are in excellent competitive positions locally or globally in their respective industries and markets, and 3) are likely to be the main beneficiaries of good fundamental long-term economic growth and demographics in various parts of the world.

MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly into an index.

Blue Chip - A nationally recognized well-established and financially sound company. Blue chips generally sell high quality, widely accepted products and services. Blue chip companies are known to generally weather downturns and operate profitably in the face of adverse economic conditions, which help to contribute to their long record of stable and reliable growth.

Gross Domestic Product (GDP) – The monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis.

The statements and opinions expressed are those of the Sub-Adviser and are as of the date of this report.

| | |

| Drexel Hamilton Centre Global Equity Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

SECTOR WEIGHTINGS

As a percentage of Net Assets

| | | | |

Financials | | | 23.55 | % |

Information Technology | | | 14.34 | % |

Energy | | | 12.97 | % |

Consumer Discretionary | | | 12.51 | % |

Consumer Staples | | | 11.72 | % |

Health Care | | | 9.49 | % |

Materials | | | 6.59 | % |

Telecommunication Services | | | 4.15 | % |

Industrials | | | 2.68 | % |

Utilities | | | 0.81 | % |

Cash and Cash Equivalents | | | 1.19 | % |

Total | | | 100.00 | % |

COUNTRY WEIGHTINGS

As a percentage of Net Assets

| | |

United States | | 22.88% |

Germany | | 11.09% |

China | | 10.99% |

France | | 7.95% |

Japan | | 7.92% |

Switzerland | | 6.70% |

Brazil | | 5.72% |

Spain | | 3.37% |

Italy | | 3.33% |

Great Britain | | 3.17% |

Russia | | 2.70% |

Hong Kong | | 2.67% |

Taiwan | | 1.90% |

Korea | | 1.54% |

Australia | | 1.41% |

Belgium | | 1.09% |

Mexico | | 1.02% |

India | | 0.78% |

Greece | | 0.78% |

Denmark | | 0.69% |

Turkey | | 0.62% |

Netherlands | | 0.49% |

Cash and Cash Equivalents | | 1.19% |

Total | | 100.00% |

These sector and country allocations may not reflect the current or future positions of the portfolio.

|

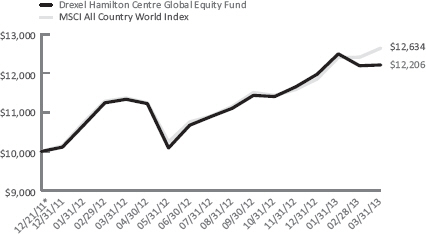

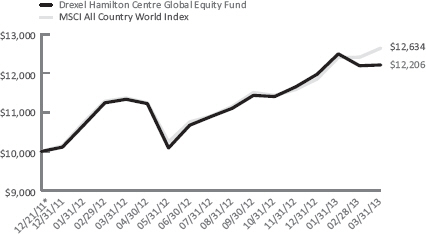

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2013

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the MSCI All Country World Index. Taxes on any fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only. TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | 1 Month | | 3 Month | | YTD | | 1 Year | | Since

Inception* |

| | | Drexel Hamilton Centre Global Equity Fund | | | | 0.18% | | | | | 1.99% | | | | | 1.99% | | | | | 7.73% | | | | | 16.90% | |

| | | MSCI All Country World Index | | | | 1.88% | | | | | 6.63% | | | | | 6.63% | | | | | 11.19% | | | | | 20.10% | |

|

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236 or visit www.dhipfunds.com. The total annual operating expense ratio (after expense reimbursements) as stated in the fee table of the most recent prospectus, dated January 14, 2013, was 1.25%. The Adviser has entered into a written expense limitation agreement under which it has agreed to limit through January 31, 2014 the total operating expenses of the Fund, including investment advisory fees but excluding interest, taxes, litigation, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles and extraordinary expenses, to an annual rate of 1.25% of the average daily net assets of the Fund. Without this waiver the total annual fund operating expenses of the Fund would be 3.04%. Investing in the securities of foreign companies generally involves greater risk than investing in larger, more established domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that invest in larger, more established domestic companies. The MSCI (Morgan Stanley Capital International) All Country World Index is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. You cannot invest directly in an index. * The Fund’s inception date was December 21, 2011. |

| | |

Semi-Annual Report | March 31, 2013 | | 7 |

| | |

Drexel Hamilton Multi-Asset Real Return Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

Performance

For the period from October 9, 2012 (the date of the Fund’s inception) through March 31, 2013, the Drexel Hamilton Multi-Asset Real Return Fund delivered a return of 0.80%. The Fund delivered a return of 1.39% for the three-month period ended March 31, 2013. The Fund has been competitive and performed well relative to its benchmark.

Portfolio Structure & Strategy

The Drexel Hamilton Multi-Asset Real Return Fund was launched at a time of increasing concerns about future inflationary conditions and market volatility with the goal of producing real return, which is total return that exceeds U.S. inflation over a full inflation cycle (typically 5 years) The Fund, which is structured as a limited “fund of funds”, seeks to achieve its investment objective of providing real return by using a flexible allocation strategy that is diversified across various asset classes, including U.S. and foreign equity securities, fixed-income securities (including Treasury Inflation-Protected Securities (TIPS), exchange-traded notes (ETNs) and exchange-traded funds (ETFs) that have returns linked to commodity indices and cash and cash equivalents. In any period shorter than a full inflation cycle, the returns of the Fund may be volatile relative to the Consumer Price Index (CPI) or may lag behind inflation.

Currently, we see the implied risk premium for equities versus bonds as being high, given the distorted treasury yields and considerable uncertainty in the market. We note the following historical tendencies during high equity risk premium environments:

| | • | | Equities are undervalued |

| | • | | Earnings are overstated |

| | • | | Investors betting on rising instability |

| | • | | Higher inflationary expectations |

| | • | | Socio-economic instability |

Considering this outlook and other framework inputs, we have increased the Fund’s equity and commodity-linked holdings at the expense of TIPS and cash. As of March 31, 2013, the Fund’s allocation stands at:

| | | | | | | | | | |

| | | ASSET TYPE | | AS OF MARCH 31, 2013 | | | | | | |

| | Global Equities | | 46% | | | | | | |

| | Commodities | | 19% | | | | | | |

| | Treasuries (TIPS) | | 30% | | | | | | |

| | Cash | | 5% | | | | | | |

The process remains flexible and allows the Fund to opportunistically shift to each of the various asset classes as conditions warrant based upon the ability of each asset class to potentially perform during particular market environments.

Treasury Inflation-Protected Securities (TIPS) and commodities index linked securities (historically uncorrelated to stocks) are part of the strategy to address inflation; incorporating additional asset classes, sometimes inversely or lesser correlated to stocks, offers investors broader diversification and the ability to take advantage of the changes in asset class performance that may take place with changes in different inflationary environments. The Fund is designed to help mitigate the level of risk in delivering real returns that derived from concentrating in a single asset class. Additionally, we aim to overweight asset classes we believe are poised to perform based on our understanding of how different asset classes respond to inflation and changes in economic conditions. The result is a broadly diversified portfolio solution that can be used as a core holding or a complement to existing equity or fixed income strategies.

| | |

| Drexel Hamilton Multi-Asset Real Return Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

Economic and Market Outlook

After years of stable inflation in the U.S., many investors seem less concerned about the prospect of inflation rearing its ugly head but more concerned about short term market volatility. However, inflation is one of the biggest risk factors ahead for retirees investing for their future and retirement. Heightened global market volatility over the last decade and numerous economic recessions have added to investor concerns. We believe that, due to unprecedented monetary stimulus that’s been provided by the U.S. government and the Federal Reserve, the prospect of long-term risk of inflation is increasing due to:

| | • | | increased debt loads burdening many developed markets |

| | • | | prolonged accommodative monetary policies |

| | • | | uncertain and poor fiscal conditions |

| | • | | increased stress on commodity supplies primarily from emerging markets |

As we look ahead, we see global equity markets to be volatile in the near-term, but we expect underlying quality blue-chip holdings to post positive returns in the upcoming year and, given the yield convergence between stocks and bonds, to provide a good alternative to traditional treasury bonds. Since the value of TIPS, currently a key component of the Fund’s portfolio, is linked to CPI, we expect TIPS to accommodate many inflationary inputs in the economy and to be helpful in a low growth, high inflation environment. Commodities have historically provided more volatility versus the market and inflation but with returns derived from different drivers than equities. Thus, commodity-linked instruments may hedge against rising prices and provide protection for other assets classes in the Fund’s portfolio as inflation rises and/or currency volatility increases. Recent downward prices for most commodities appear to have hit a soft patch in the near term, but secular forces underlying the emerging market growth and demand for raw materials and commodities remain at play. Longer term, we believe a rebalancing of growth in China and other emerging market demand is likely to result in favoring commodity-linked instruments, leading to gradual increase in price.

We believe that monetary stimuli will remain in force as central bankers embrace higher inflation targets. We see a great potential for disruption and a future with higher inflationary expectations, and we believe that we are prepared to tactically adjust our posture to weather the long-term risk of inflation.

| | |

The statements and opinions expressed are those of the Adviser and are as of the date of this report. |

Semi-Annual Report | March 31, 2013 | | 9 |

| | |

| Drexel Hamilton Multi-Asset Real Return Fund | | Manager Commentary |

| | March 31, 2013 (Unaudited) |

ASSET TYPE WEIGHTINGS

As a percentage of Net Assets

| | | | |

Equity Holdings

(Open-End Funds) | | | 46.80% | |

U.S. Government Bonds | | | 29.01% | |

ETNs (Commodity Linked) | | | 13.22% | |

ETFs (Commodity Linked) | | | 4.57% | |

Cash and Cash Equivalents | | | 6.40% | |

Total | | | 100.00% | |

These allocations may not reflect the current or future positions of the portfolio.

|

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2013

This graph assumes an initial investment of $10,000 at October 9, 2012, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the US CPI Urban Consumers NSA Index. Unlike the Fund, an index is not available for investment and is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only. CUMULATIVE TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2013 |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 1 Month | | 3 Month | | YTD | | Since Inception* |

| | Drexel Hamilton Multi-Asset Real Return Fund – Institutional Class | | | | 0.64 | % | | | | 1.39 | % | | | | 1.39 | % | | | | 0.80 | % |

| | Drexel Hamilton Multi-Asset Real Return Fund – Investor Class | | | | 0.74 | % | | | | – | | | | | – | | | | | -0.42 | % |

| | US CPI Urban Consumers NSA | | | | 0.26 | % | | | | 1.38 | % | | | | 1.38 | % | | | | 0.60 | % |

|

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236 or visit www.dhipfunds.com. The total annual operating expense ratio (after expense reimbursements) as stated in the fee table of the most recent prospectus, dated January 14, 2013, was 1.81% for the Investor Class and 1.56% for the Institutional Class. The Adviser has agreed, pursuant to a written expense limitation agreement, to reduce its advisory fees and/or reimburse other expenses of the Fund until January 31, 2014 to the extent necessary to limit the current operating expenses of each class of shares of the Fund (exclusive of any front-end or contingent deferred sales loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, extraordinary expenses such as litigation and other expenses not incurred in the ordinary course of the Fund’s business, and acquired fund fees and expenses, except that, if an acquired fund is an underlying fund managed by the Adviser and such acquired fund is not subject to an effective expense limitation or fee waiver agreement at any time during the term of the expense limitation agreement relating to the Fund, then, for that time, the operating expenses of each class of shares of the Fund shall not exclude the amount of advisory fees included in such acquired fund’s fees and expenses to which the Fund would otherwise be subject), to 1.25% for Investor Class shares of the Fund and 1.00% for Institutional Class shares of the Fund. Without this waiver the total annual fund operating expenses of the Fund would be 2.37% for the Investor Class and 2.12% for the Institutional Class. The US CPI Urban Consumers NSA Index is the annual percentage change in the Consumer Price Index (CPI). The CPI is an unmanaged index that represents the rate of inflation of U.S. consumer prices as determined by the U.S. Bureau of Labor Statistics. *The Fund’s inception date was October 9, 2012. |

| | |

| Drexel Hamilton Mutual Funds | | Disclosure of Fund Expenses |

| | March 31, 2013 (Unaudited) |

As a shareholder of a series of Drexel Hamilton Mutual Funds (each series, a “Fund” and together, the “Funds”), you will incur two types of costs: (1) transaction costs, including any applicable redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on October 1, 2012 and held until March 31, 2013.

Actual Expenses. The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The expenses shown in the table are meant to highlight ongoing Fund costs only and do not reflect transaction fees, such as redemption fees or exchange fees, if any. Therefore, the second line of each table below is useful in comparing ongoing costs only, and may not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | |

| | | BEGINNING ACCOUNT VALUE

10/01/12 | | ENDING ACCOUNT VALUE

03/31/13 | | EXPENSE RATIO(a) | | EXPENSES PAID

DURING PERIOD

10/01/12-03/31/13 (b) |

Drexel Hamilton Centre American Equity Fund | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,060.20 | | | | | 1.07 | % | | | $ | 5.50 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,019.60 | | | | | 1.07 | % | | | $ | 5.39 | |

| | | | |

Drexel Hamilton Centre Global Equity Fund | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000.00 | | | | $ | 1,067.90 | | | | | 1.25 | % | | | $ | 6.44 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.70 | | | | | 1.25 | % | | | $ | 6.29 | |

| | | | |

Drexel Hamilton Multi-Asset Real Return Fund | | | | | | | | | | | | | | | | | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | | |

Actual(c) | | | $ | 1,000.00 | | | | $ | 1,008.00 | | | | | 1.00 | % | | | $ | 4.76 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,019.95 | | | | | 1.00 | % | | | $ | 5.04 | |

| | | | |

Investor Class | | | | | | | | | | | | | | | | | | | | |

Actual(d) | | | $ | 1,000.00 | | | | $ | 995.80 | | | | | 1.25 | % | | | $ | 2.32 | |

Hypothetical (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.70 | | | | | 1.25 | % | | | $ | 6.29 | |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to each Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), then divided by 365. |

| (c) | Note the Actual Expense Paid During Period is based on expense paid since inception of the share class on October 9, 2012. |

| (d) | Note the Actual Expense Paid During Period is based on expense paid since inception of the share class on January 22, 2013. |

| | |

|

Semi-Annual Report | March 31, 2013 | | 11 |

| | |

| Drexel Hamilton Centre American Equity Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS (103.06%) | | | | | | | | |

Consumer Discretionary (13.79%) | | | | | | | | |

Automobiles (0.73%) | | | | | | | | |

Harley-Davidson, Inc. | | | 18,170 | | | $ | 968,461 | |

| | | | | | | | |

| | |

Hotels Restaurants & Leisure (2.67%) | | | | | | | | |

International Game Technology | | | 63,350 | | | | 1,045,275 | |

Marriott International, Inc., Class A | | | 25,400 | | | | 1,072,642 | |

Starbucks Corp. | | | 25,400 | | | | 1,446,784 | |

| | | | | | | | |

| | | | | | | 3,564,701 | |

| | | | | | | | |

Internet & Catalog Retail (1.37%) | | | | | | | | |

Amazon.com, Inc.(a) | | | 6,850 | | | | 1,825,457 | |

| | | | | | | | |

| | |

Media (5.63%) | | | | | | | | |

Comcast Corp., Class A | | | 31,460 | | | | 1,321,634 | |

Omnicom Group, Inc. | | | 18,490 | | | | 1,089,061 | |

Thomson Reuters Corp. | | | 32,460 | | | | 1,054,301 | |

Time Warner, Inc. | | | 51,500 | | | | 2,967,430 | |

Walt Disney Co. | | | 18,950 | | | | 1,076,360 | |

| | | | | | | | |

| | | | | | | 7,508,786 | |

| | | | | | | | |

Specialty Retail (3.39%) | | | | | | | | |

Home Depot, Inc. | | | 16,940 | | | | 1,182,073 | |

TJX Companies, Inc. | | | 71,400 | | | | 3,337,950 | |

| | | | | | | | |

| | | | | | | 4,520,023 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 18,387,428 | |

| | | | | | | | |

| | |

Consumer Staples (12.78%) | | | | | | | | |

Beverages (3.20%) | | | | | | | | |

Coca-Cola Co. | | | 70,210 | | | | 2,839,293 | |

PepsiCo, Inc. | | | 17,940 | | | | 1,419,233 | |

| | | | | | | | |

| | | | | | | 4,258,526 | |

| | | | | | | | |

Food Products (1.69%) | | | | | | | | |

Archer-Daniels-Midland Co. | | | 33,620 | | | | 1,134,003 | |

Bunge, Ltd. | | | 15,140 | | | | 1,117,786 | |

| | | | | | | | |

| | | | | | | 2,251,789 | |

| | | | | | | | |

Household Products (5.64%) | | | | | | | | |

Colgate-Palmolive Co. | | | 44,390 | | | | 5,239,351 | |

Procter & Gamble Co. | | | 29,630 | | | | 2,283,288 | |

| | | | | | | | |

| | | | | | | 7,522,639 | |

| | | | | | | | |

Tobacco (2.25%) | | | | | | | | |

Philip Morris International, Inc. | | | 32,410 | | | | 3,004,731 | |

| | | | | | | | |

| | |

Total Consumer Staples | | | | | | | 17,037,685 | |

| | | | | | | | |

| | |

Energy (8.00%) | | | | | | | | |

Energy Equipment & Services (2.56%) | | | | | | | | |

Schlumberger, Ltd. | | | 45,530 | | | | 3,409,742 | |

| | | | | | | | |

| | |

Oil & Gas & Consumable Fuels (5.44%) | | | | | | | | |

Exxon Mobil Corp. | | | 69,050 | | | | 6,222,095 | |

Suncor Energy, Inc. | | | 34,580 | | | | 1,037,746 | |

| | | | | | | | |

| | | | | | | 7,259,841 | |

| | | | | | | | |

Total Energy | | | | | | | 10,669,583 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Financials (7.29%) | | | | | | | | |

Capital Markets (2.33%) | | | | | | | | |

Goldman Sachs Group, Inc. | | | 7,040 | | | $ | 1,035,936 | |

State Street Corp. | | | 35,100 | | | | 2,074,059 | |

| | | | | | | | |

| | | | | | | 3,109,995 | |

| | | | | | | | |

Commercial Banks (0.78%) | | | | | | | | |

Fifth Third Bancorp | | | 64,260 | | | | 1,048,081 | |

| | | | | | | | |

| | |

Consumer Finance (0.77%) | | | | | | | | |

Capital One Financial Corp. | | | 18,610 | | | | 1,022,619 | |

| | | | | | | | |

| | |

Diversified Financial Services (3.41%) | | | | | | | | |

Bank of America Corp. | | | 131,650 | | | | 1,603,497 | |

Citigroup, Inc. | | | 23,510 | | | | 1,040,082 | |

JPMorgan Chase & Co. | | | 40,000 | | | | 1,898,400 | |

| | | | | | | | |

| | | | | | | 4,541,979 | |

| | | | | | | | |

Total Financials | | | | | | | 9,722,674 | |

| | | | | | | | |

| | |

Health Care (16.67%) | | | | | | | | |

Biotechnology (1.37%) | | | | | | | | |

Amgen, Inc. | | | 17,830 | | | | 1,827,753 | |

| | | | | | | | |

| | |

Health Care Equipment & Supplies (6.71%) | | | | | | | | |

Abbott Laboratories | | | 34,960 | | | | 1,234,787 | |

Becton Dickinson and Co. | | | 11,000 | | | | 1,051,710 | |

Boston Scientific Corp.(a) | | | 146,710 | | | | 1,145,805 | |

Medtronic, Inc. | | | 26,620 | | | | 1,250,075 | |

St Jude Medical, Inc. | | | 24,640 | | | | 996,442 | |

Stryker Corp. | | | 17,250 | | | | 1,125,390 | |

Varian Medical Systems, Inc.(a) | | | 15,830 | | | | 1,139,760 | |

Zimmer Holdings, Inc. | | | 13,240 | | | | 995,913 | |

| | | | | | | | |

| | | | | | | 8,939,882 | |

| | | | | | | | |

Health Care Provider & Services (0.73%) | | | | | | | | |

Cardinal Health, Inc. | | | 23,340 | | | | 971,411 | |

| | | | | | | | |

| | |

Pharmaceuticals (7.86%) | | | | | | | | |

Johnson & Johnson | | | 90,450 | | | | 7,374,388 | |

Merck & Co., Inc. | | | 35,990 | | | | 1,591,838 | |

Pfizer, Inc. | | | 52,510 | | | | 1,515,439 | |

| | | | | | | | |

| | | | | | | 10,481,665 | |

| | | | | | | | |

Total Health Care | | | | | | | 22,220,711 | |

| | | | | | | | |

| | |

Industrials (3.37%) | | | | | | | | |

Aerospace & Defense (1.95%) | | | | | | | | |

Honeywell International, Inc. | | | 20,120 | | | | 1,516,042 | |

Textron, Inc. | | | 36,200 | | | | 1,079,122 | |

| | | | | | | | |

| | | | | | | 2,595,164 | |

| | | | | | | | |

Airlines (1.42%) | | | | | | | | |

Delta Air Lines, Inc.(a) | | | 56,890 | | | | 939,254 | |

United Continental Holdings, Inc.(a) | | | 29,660 | | | | 949,417 | |

| | | | | | | | |

| | | | | | | 1,888,671 | |

| | | | | | | | |

Total Industrials | | | | | | | 4,483,835 | |

| | | | | | | | |

| | |

| Drexel Hamilton Centre American Equity Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Information Technology (25.97%) | | | | | | | | |

Communication Equipment (4.55%) | | | | | | | | |

Cisco Systems, Inc. | | | 173,560 | | | $ | 3,629,140 | |

QUALCOMM, Inc. | | | 36,360 | | | | 2,434,302 | |

| | | | | | | | |

| | | | | | | 6,063,442 | |

| | | | | | | | |

Computers & Peripherals (2.94%) | | | | | | | | |

Apple, Inc. | | | 6,670 | | | | 2,952,342 | |

NetApp, Inc.(a) | | | 28,370 | | | | 969,119 | |

| | | | | | | | |

| | | | | | | 3,921,461 | |

| | | | | | | | |

Internet Software & Services (3.78%) | | | | | | | | |

eBay, Inc.(a) | | | 31,030 | | | | 1,682,446 | |

Google, Inc., Class A(a) | | | 4,230 | | | | 3,358,747 | |

| | | | | | | | |

| | | | | | | 5,041,193 | |

| | | | | | | | |

IT Services (3.89%) | | | | | | | | |

International Business Machines Corp. | | | 17,480 | | | | 3,728,484 | |

Visa, Inc. | | | 8,600 | | | | 1,460,624 | |

| | | | | | | | |

| | | | | | | 5,189,108 | |

| | | | | | | | |

Semiconductor & Semiconductor Equipment (3.36%) | |

Intel Corp. | | | 159,560 | | | | 3,486,386 | |

Maxim Integrated Products, Inc. | | | 30,330 | | | | 990,275 | |

| | | | | | | | |

| | | | | | | 4,476,661 | |

| | | | | | | | |

Software (7.45%) | | | | | | | | |

Microsoft Corp. | | | 162,050 | | | | 4,636,251 | |

Oracle Corp. | | | 163,730 | | | | 5,295,028 | |

| | | | | | | | |

| | | | | | | 9,931,279 | |

| | | | | | | | |

Total Information Technology | | | | | | | 34,623,144 | |

| | | | | | | | |

| | |

Materials (9.79%) | | | | | | | | |

Chemicals (2.76%) | | | | | | | | |

Huntsman Corp. | | | 55,540 | | | | 1,032,488 | |

LyondellBasell Industries, Class A | | | 17,750 | | | | 1,123,397 | |

Monsanto Co. | | | 14,420 | | | | 1,523,185 | |

| | | | | | | | |

| | | | | | | 3,679,070 | |

| | | | | | | | |

Containers & Packaging (0.75%) | | | | | | | | |

Bemis Co., Inc. | | | 24,650 | | | | 994,874 | |

| | | | | | | | |

| | |

Metals & Mining (6.28%) | | | | | | | | |

Alcoa, Inc. | | | 130,200 | | | | 1,109,304 | |

Eldorado Gold Corp. | | | 110,600 | | | | 1,054,018 | |

Goldcorp, Inc. | | | 30,990 | | | | 1,042,194 | |

IAMGOLD Corp. | | | 133,440 | | | | 960,768 | |

Kinross Gold Corp. | | | 141,520 | | | | 1,122,254 | |

Steel Dynamics, Inc. | | | 61,490 | | | | 975,846 | |

Teck Resources, Ltd., Class B | | | 40,020 | | | | 1,126,963 | |

United States Steel Corp. | | | 50,350 | | | | 981,825 | |

| | | | | | | | |

| | | | | | | 8,373,172 | |

| | | | | | | | |

Total Materials | | | | | | | 13,047,116 | |

| | | | | | | | |

| | |

Utilities (5.40%) | | | | | | | | |

Independent Power Producers & Energy Traders (1.55%) | |

Calpine Corp.(a) | | | 52,190 | | | | 1,075,114 | |

NRG Energy, Inc. | | | 37,240 | | | | 986,488 | |

| | | | | | | | |

| | | | | | | 2,061,602 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | Shares | | | Value | |

| |

Utilities (continued) | |

Multi-Utilities (3.85%) | | | | | | | | | |

Sempra Energy | | | | | | | | 64,300 | | | $ | 5,140,142 | |

| | | | | | | | | | | | | | | | |

| | | |

Total Utilities | | | | | | | | | | | | 7,201,744 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| |

TOTAL COMMON STOCKS (Cost $116,781,319) | | | | | | | | 137,393,920 | |

| |

| | | | |

| | | Expiration

Date | | | Exercise

Price | | | Contracts | | | Value | |

| |

PURCHASED OPTIONS (0.19%) | | | | | | | | | |

Calls (0.19%) | | | | | | | | | | | | | |

SPDR® Gold Shares: | | | | | | | | | |

| | | 12/21/2013 | | | $ | 168.00 | | | | 480 | | | | 144,000 | |

| | | 1/18/2014 | | | | 168.00 | | | | 320 | | | | 108,800 | |

| | | | | | | | | | | | | | | | |

| |

TOTAL PURCHASED OPTIONS (Cost $666,123) | | | | | | | | 252,800 | |

| |

| | | | | | | | | | | | | | | | |

| |

| | | | | | 7-Day Yield | | | Shares | | | Value | |

| |

SHORT TERM INVESTMENTS(0.60%) | | | | | |

Money Market Fund (0.60%) | | | | | | | | | |

Dreyfus Treasury Prime Cash Management, Institutional Class | | | | 0.00004 | % | | | 798,939 | | | | 798,939 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $798,939) | | | | 798,939 | |

| |

| | |

TOTAL INVESTMENTS (Cost $118,246,381)(103.85%) | | | | | | | $ | 138,445,659 | |

| |

Liabilities in Excess of Other Assets (-3.85%) | | | | (5,127,676) | |

| |

NET ASSETS (100.00%) | | | $ | 133,317,983 | |

| |

| (a) | Non-income producing security. |

Common Abbreviations:

Ltd. - Limited.

SPDR - Standard & Poor’s Depositary Receipts.

| | |

See Notes to Financial Statements. |

Semi-Annual Report | March 31, 2013 | | 13 |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS (94.14%) | | | | | | | | |

ASIA (27.21%) | | | | | | | | |

Australia (1.41%) | | | | | | | | |

Materials (1.41%) | | | | | | | | |

BHP Billiton, Ltd. | | | 5,457 | | | $ | 186,127 | |

| | | | | | | | |

| | |

Total Australia | | | | | | | 186,127 | |

| | | | | | | | |

| | |

China (10.99%) | | | | | | | | |

Energy (3.47%) | | | | | | | | |

China Petroleum & Chemical Corp., Class H | | | 90,300 | | | | 106,324 | |

China Shenhua Energy Co., Ltd., Class H | | | 28,100 | | | | 102,082 | |

CNOOC, Ltd. | | | 66,000 | | | | 126,855 | |

PetroChina Co., Ltd., Class H | | | 93,700 | | | | 122,881 | |

| | | | | | | | |

| | | | | | | 458,142 | |

| | | | | | | | |

Financials (5.63%) | | | | | | | | |

Bank of China, Ltd., Class H | | | 343,700 | | | | 159,396 | |

China Construction Bank Corp., Class H | | | 235,500 | | | | 192,343 | |

China Life Insurance Co., Ltd., Class H | | | 40,100 | | | | 103,833 | |

Industrial & Commercial Bank of China,

Class H | | | 230,700 | | | | 161,675 | |

Ping An Insurance Group Co., Class H | | | 16,100 | | | | 124,858 | |

| | | | | | | | |

| | | | | | | 742,105 | |

| | | | | | | | |

Information Technology (0.46%) | | | | | | | | |

Tencent Holdings, Ltd. | | | 1,900 | | | | 60,408 | |

| | | | | | | | |

| | |

Telecommunication Services (1.43%) | | | | | | | | |

China Mobile, Ltd. | | | 17,800 | | | | 188,490 | |

| | | | | | | | |

| | |

Total China | | | | | | | 1,449,145 | |

| | | | | | | | |

| | |

Hong Kong (2.67%) | | | | | | | | |

Consumer Discretionary (1.92%) | | | | | | | | |

Li & Fung, Ltd., Sponsored ADR | | | 96,800 | | | | 133,431 | |

Sands China, Ltd. | | | 23,100 | | | | 119,777 | |

| | | | | | | | |

| | | | | | | 253,208 | |

| | | | | | | | |

Financials (0.75%) | | | | | | | | |

Cheung Kong Holdings, Ltd. | | | 6,700 | | | | 98,913 | |

| | | | | | | | |

| | |

Total Hong Kong | | | | | | | 352,121 | |

| | | | | | | | |

| | |

India (0.78%) | | | | | | | | |

Energy (0.78%) | | | | | | | | |

Reliance Industries, Ltd., Sponsored GDR | | | 3,600 | | | | 102,528 | |

| | | | | | | | |

| | |

Total India | | | | | | | 102,528 | |

| | | | | | | | |

| | |

Japan (7.92%) | | | | | | | | |

Consumer Discretionary (4.60%) | | | | | | | | |

Fast Retailing Co., Ltd. | | | 800 | | | | 254,358 | |

Honda Motor Co., Ltd. | | | 4,030 | | | | 154,119 | |

Toyota Motor Corp. | | | 3,850 | | | | 197,336 | |

| | | | | | | | |

| | | | | | | 605,813 | |

| | | | | | | | |

Financials (3.32%) | | | | | | | | |

Daiwa Securities Group, Inc. | | | 37,900 | | | | 266,530 | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Japan (continued) | | | | | | | | |

Financials (continued) | | | | | | | | |

Mitsubishi UFJ Financial Group, Inc. | | | 28,600 | | | $ | 171,354 | |

| | | | | | | | |

| | | | | | | 437,884 | |

| | | | | | | | |

Total Japan | | | | | | | 1,043,697 | |

| | | | | | | | |

| | |

Korea (1.54%) | | | | | | | | |

Information Technology (1.54%) | | | | | | | | |

Samsung Electronics Co., Ltd. | | | 150 | | | | 203,577 | |

| | | | | | | | |

| | |

Total Korea | | | | | | | 203,577 | |

| | | | | | | | |

| | |

Taiwan (1.90%) | | | | | | | | |

Information Technology (1.90%) | | | | | | | | |

Delta Electronics, Inc. | | | 28,330 | | | | 118,427 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 39,300 | | | | 131,427 | |

| | | | | | | | |

| | | | | | | 249,854 | |

| | | | | | | | |

Total Taiwan | | | | | | | 249,854 | |

| | | | | | | | |

| | |

TOTAL ASIA (Cost $3,255,773) | | | | | | | 3,587,049 | |

| |

| | |

EUROPE (41.22%) | | | | | | | | |

Belgium (1.09%) | | | | | | | | |

Consumer Staples (1.09%) | | | | | | | | |

Anheuser-Busch InBev NV | | | 1,448 | | | | 143,386 | |

| | | | | | | | |

| | |

Total Belgium | | | | | | | 143,386 | |

| | | | | | | | |

| | |

Denmark (0.69%) | | | | | | | | |

Health Care (0.69%) | | | | | | | | |

Coloplast A/S, Class B | | | 1,680 | | | | 90,377 | |

| | | | | | | | |

| | |

Total Denmark | | | | | | | 90,377 | |

| | | | | | | | |

| | |

France (7.95%) | | | | | | | | |

Consumer Discretionary (0.96%) | | | | | | | | |

LVMH Moet Hennessy Louis Vuitton SA | | | 740 | | | | 127,014 | |

| | | | | | | | |

| | |

Consumer Staples (1.64%) | | | | | | | | |

L’Oreal SA | | | 1,360 | | | | 215,649 | |

| | | | | | | | |

| | |

Energy (1.07%) | | | | | | | | |

Total SA | | | 2,947 | | | | 141,113 | |

| | | | | | | | |

| | |

Financials (0.67%) | | | | | | | | |

BNP Paribas SA | | | 1,730 | | | | 88,793 | |

| | | | | | | | |

| | |

Health Care (2.76%) | | | | | | | | |

Cie Generale d’Optique Essilor International SA | | | 1,700 | | | | 189,042 | |

Sanofi | | | 1,713 | | | | 174,062 | |

| | | | | | | | |

| | | | | | | 363,104 | |

| | | | | | | | |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

| |

France (continued) | | | | | | | | |

Information Technology (0.85%) | | | | | | | | |

Dassault Systemes SA | | | 970 | | | $ | 112,129 | |

| | | | | | | | |

| | |

Total France | | | | | | | 1,047,802 | |

| | | | | | | | |

| | |

Germany (10.33%) | | | | | | | | |

Consumer Discretionary (2.49%) | | | | | | | | |

Adidas AG | | | 1,600 | | | | 166,005 | |

Daimler AG | | | 2,984 | | | | 162,354 | |

| | | | | | | | |

| | | | | | | 328,359 | |

| | | | | | | | |

Financials (3.37%) | | | | | | | | |

Allianz SE | | | 1,103 | | | | 149,801 | |

Deutsche Bank AG | | | 1,320 | | | | 51,464 | |

Muenchener Rueckversicherungs AG | | | 1,300 | | | | 243,129 | |

| | | | | | | | |

| | | | | | | 444,394 | |

| | | | | | | | |

Health Care (1.23%) | | | | | | | | |

Bayer AG | | | 1,565 | | | | 161,431 | |

| | | | | | | | |

| | |

Industrials (1.13%) | | | | | | | | |

Siemens AG | | | 1,386 | | | | 149,292 | |

| | | | | | | | |

| | |

Information Technology (1.05%) | | | | | | | | |

SAP AG | | | 1,732 | | | | 138,761 | |

| | | | | | | | |

| | |

Materials (1.06%) | | | | | | | | |

BASF SE | | | 1,590 | | | | 139,246 | |

| | | | | | | | |

| | |

Total Germany | | | | | | | 1,361,483 | |

| | | | | | | | |

| | |

Great Britain (3.17%) | | | | | | | | |

Consumer Staples (1.68%) | | | | | | | | |

Diageo Plc | | | 7,040 | | | | 221,962 | |

| | | | | | | | |

| | |

Financials (1.49%) | | | | | | | | |

HSBC Holdings Plc | | | 18,368 | | | | 196,064 | |

| | | | | | | | |

| | |

Total Great Britain | | | | | | | 418,026 | |

| | | | | | | | |

| | |

Greece (0.78%) | | | | | | | | |

Consumer Staples (0.78%) | | | | | | | | |

Coca Cola Hellenic Bottling Co. SA | | | 3,830 | | | | 102,609 | |

| | | | | | | | |

| | |

Total Greece | | | | | | | 102,609 | |

| | | | | | | | |

| | |

Italy (3.33%) | | | | | | | | |

Energy (1.23%) | | | | | | | | |

Eni SpA | | | 7,199 | | | | 161,768 | |

| | | | | | | | |

| | |

Financials (1.29%) | | | | | | | | |

Assicurazioni Generali SpA | | | 6,500 | | | | 101,151 | |

Intesa Sanpaolo SpA | | | 47,200 | | | | 69,095 | |

| | | | | | | | |

| | | | | | | 170,246 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Italy (continued) | |

Utilities (0.81%) | | | | | | | | |

Enel SpA | | | 32,720 | | | $ | 106,785 | |

| | | | | | | | |

| | |

Total Italy | | | | | | | 438,799 | |

| | | | | | | | |

| | |

Netherlands (0.49%) | | | | | | | | |

Consumer Staples (0.49%) | | | | | | | | |

Unilever NV | | | 1,594 | | | | 65,293 | |

| | | | | | | | |

| | |

Total Netherlands | | | | | | | 65,293 | |

| | | | | | | | |

| | |

Russia (2.70%) | | | | | | | | |

Energy (2.07%) | | | | | | | | |

Gazprom OAO, Sponsored ADR | | | 16,565 | | | | 141,631 | |

Lukoil OAO, Sponsored ADR | | | 2,034 | | | | 130,989 | |

| | | | | | | | |

| | | | | | | 272,620 | |

| | | | | | | | |

Financials (0.63%) | | | | | | | | |

Sberbank of Russia, Sponsored ADR | | | 6,467 | | | | 82,856 | |

| | | | | | | | |

| | |

Total Russia | | | | | | | 355,476 | |

| | | | | | �� | | |

| | |

Spain (3.37%) | | | | | | | | |

Consumer Discretionary (0.79%) | | | | | | | | |

Inditex SA | | | 780 | | | | 103,384 | |

| | | | | | | | |

| | |

Financials (1.82%) | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA | | | 13,835 | | | | 119,938 | |

Banco Santander SA | | | 17,924 | | | | 120,440 | |

| | | | | | | | |

| | | | | | | 240,378 | |

| | | | | | | | |

Telecommunication Services (0.76%) | | | | | | | | |

Telefonica SA | | | 7,430 | | | | 99,909 | |

| | | | | | | | |

| | |

Total Spain | | | | | | | 443,671 | |

| | | | | | | | |

| | |

Switzerland (6.70%) | | | | | | | | |

Consumer Discretionary (0.99%) | | | | | | | | |

Cie Financiere Richemont SA, Class A | | | 1,660 | | | | 130,275 | |

| | | | | | | | |

| | |

Consumer Staples (1.58%) | | | | | | | | |

Nestle SA | | | 2,890 | | | | 208,995 | |

| | | | | | | | |

| | |

Health Care (2.77%) | | | | | | | | |

Novartis AG | | | 2,150 | | | | 152,762 | |

Roche Holding AG | | | 910 | | | | 211,851 | |

| | | | | | | | |

| | | | | | | 364,613 | |

| | | | | | | | |

Materials (1.36%) | | | | | | | | |

Syngenta AG | | | 430 | | | | 179,374 | |

| | | | | | | | |

| | |

Total Switzerland | | | | | | | 883,257 | |

| | | | | | | | |

| | |

|

Semi-Annual Report | March 31, 2013 | | 15 |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Turkey (0.62%) | | | | | | | | |

Financials (0.62%) | | | | | | | | |

Turkiye Garanti Bankasi AS | | | 15,500 | | | $ | 82,242 | |

| | | | | | | | |

| | |

Total Turkey | | | | | | | 82,242 | |

| | | | | | | | |

| | |

TOTAL EUROPE (Cost $5,036,638) | | | | | | | 5,432,421 | |

| |

| | |

NORTH AMERICA (23.90%) | | | | | | | | |

Mexico (1.02%) | | | | | | | | |

Telecommunication Services (1.02%) | | | | | | | | |

America Movil, Series L | | | 125,900 | | | | 133,632 | |

| | | | | | | | |

| | |

Total Mexico | | | | | | | 133,632 | |

| | | | | | | | |

| | |

United States (22.88%) | | | | | | | | |

Consumer Staples (3.55%) | | | | | | | | |

Coca-Cola Co. | | | 2,790 | | | | 112,827 | |

CVS Caremark Corp. | | | 3,900 | | | | 214,461 | |

Procter & Gamble Co. | | | 1,830 | | | | 141,020 | |

| | | | | | | | |

| | | | | | | 468,308 | |

| | | | | | | | |

Energy (2.50%) | | | | | | | | |

Chevron Corp. | | | 1,260 | | | | 149,713 | |

Exxon Mobil Corp. | | | 2,000 | | | | 180,220 | |

| | | | | | | | |

| | | | | | | 329,933 | |

| | | | | | | | |

Financials (2.72%) | | | | | | | | |

HDFC Bank, Ltd., ADR | | | 2,600 | | | | 97,292 | |

JPMorgan Chase & Co. | | | 2,710 | | | | 128,617 | |

Wells Fargo & Co. | | | 3,580 | | | | 132,424 | |

| | | | | | | | |

| | | | | | | 358,333 | |

| | | | | | | | |

Health Care (2.04%) | | | | | | | | |

Johnson & Johnson | | | 1,720 | | | | 140,232 | |

Pfizer, Inc. | | | 4,450 | | | | 128,427 | |

| | | | | | | | |

| | | | | | | 268,659 | |

| | | | | | | | |

Industrials (0.91%) | | | | | | | | |

General Electric Co. | | | 5,180 | | | | 119,762 | |

| | | | | | | | |

| | |

Information Technology (8.54%) | | | | | | | | |

Apple, Inc. | | | 370 | | | | 163,773 | |

Cisco Systems, Inc. | | | 8,600 | | | | 179,826 | |

Google, Inc., Class A(a) | | | 80 | | | | 63,522 | |

International Business Machines Corp. | | | 790 | | | | 168,507 | |

Mastercard, Inc., Class A | | | 300 | | | | 162,339 | |

Microsoft Corp. | | | 4,060 | | | | 116,157 | |

Oracle Corp. | | | 3,410 | | | | 110,279 | |

QUALCOMM, Inc. | | | 2,400 | | | | 160,680 | |

| | | | | | | | |

| | | | | | | 1,125,083 | |

| | | | | | | | |

Materials (1.68%) | | | | | | | | |

Monsanto Co. | | | 2,100 | | | | 221,823 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

United States (continued) | | | | | | | | |

Telecommunication Services (0.94%) | | | | | | | | |

AT&T, Inc. | | | 3,380 | | | $ | 124,012 | |

| | | | | | | | |

| | |

Total United States | | | | | | | 3,015,913 | |

| | | | | | | | |

| | |

TOTAL NORTH AMERICA (Cost $2,867,332) | | | | | | | 3,149,545 | |

| |

| | |

SOUTH AMERICA (1.81%) | | | | | | | | |

Brazil (1.81%) | | | | | | | | |

Consumer Staples (0.46%) | | | | | | | | |

Natura Cosmeticos SA | | | 2,500 | | | | 60,163 | |

| | | | | | | | |

| | |

Energy (0.71%) | | | | | | | | |

Cosan SA Industria e Comercio | | | 4,200 | | | | 93,862 | |

| | | | | | | | |

| | |

Industrials (0.64%) | | | | | | | | |

CCR SA | | | 8,300 | | | | 84,777 | |

| | | | | | | | |

| | |

Total Brazil | | | | | | | 238,802 | |

| | | | | | | | |

| | |

TOTAL SOUTH AMERICA (Cost $222,150) | | | | | | | 238,802 | |

| |

| | | | | | | | |

| |

TOTAL COMMON STOCKS (Cost $11,381,893) | | | | | | | 12,407,817 | |

| |

| | |

PREFERRED STOCKS (4.67%) | | | | | | | | |

EUROPE (0.76%) | | | | | | | | |

Germany (0.76%) | | | | | | | | |

Consumer Discretionary (0.76%) | | | | | | | | |

Volkswagen AG | | | 500 | | | | 99,344 | |

| | | | | | | | |

| | |

Total Germany | | | | | | | 99,344 | |

| | | | | | | | |

| | |

TOTAL EUROPE (Cost $114,318) | | | | | | | 99,344 | |

| |

| | |

SOUTH AMERICA (3.91%) | | | | | | | | |

Brazil (3.91%) | | | | | | | | |

Consumer Staples (0.45%) | | | | | | | | |

Cia de Bebidas das Americas | | | 1,400 | | | | 59,014 | |

| | | | | | | | |

| | |

Energy (1.14%) | | | | | | | | |

Petroleo Brasileiro SA | | | 16,550 | | | | 150,451 | |

| | | | | | | | |

| | |

Financials (1.24%) | | | | | | | | |

Banco Bradesco SA | | | 4,400 | | | | 74,228 | |

Itau Unibanco Holding SA | | | 5,010 | | | | 89,055 | |

| | | | | | | | |

| | | | | | | 163,283 | |

| | | | | | | | |

| | |

| Drexel Hamilton Centre Global Equity Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

| |

Brazil (continued) | | | | | | | | | | | | |

Materials (1.08%) | | | | | | | | | | | | |

Vale SA | | | | | | | 8,640 | | | $ | 142,977 | |

| | | | | | | | | | | | |

| | | |

Total Brazil | | | | | | | | | | | 515,725 | |

| | | | | | | | | | | | |

| | | |

TOTAL SOUTH AMERICA (Cost $532,308) | | | | | | | | | | | 515,725 | |

| |

| | | | | | | | | | | | |

| |

TOTAL PREFERRED STOCKS (Cost $646,626) | | | | | | | | | | | 615,069 | |

| |

| | | |

| | | 7-Day

Yield | | | Shares | | | Value | |

| |

SHORT TERM INVESTMENTS (0.51%) | | | | | |

Money Market Fund (0.51%) | | | | | | | | | | | | |

Dreyfus Treasury Prime Cash Management, Institutional Class | | | 0.00004% | | | | 67,358 | | | | 67,358 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $67,358) | | | | | | | | 67,358 | |

| |

| | |

TOTAL INVESTMENTS (Cost $12,095,877) (99.32%) | | | | | | | $ | 13,090,244 | |

| |

Other Assets In Excess Of Liabilities (0.68%) | | | | 89,559 | |

| |

NET ASSETS (100.00%) | | | | | | | | | | $ | 13,179,803 | |

| |

| (a) | Non-income producing security. |

|

Common Abbreviations: |

ADR - American Depository Receipt. |

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

A/S - Aktieselskab is the Danish term for Joint Stock Company. |

Ltd. - Limited. |

GDR - Global Depository Receipt. |

NV - Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

OAO - Otkrytoe Aktsionernoe Obschestvo (a Russian open joint stock corporation) |

Plc - Public Limited Company. |

SA - Generally designates corporations in various countries, mostly those employing the civil law. |

SE - SE Regulation. A European Company which can operate on a Europe-wide basis and be governed by Community law directly applicable in all Member States. |

SpA - Societa Per Azioni is an Italian shared company. |

UFJ - United Financial of Japan. |

| | |

See Notes to Financial Statements. |

Semi-Annual Report | March 31, 2013 | | 17 |

| | |

| Drexel Hamilton Multi-Asset Real Return Fund | | Schedule of Investments |

| | March 31, 2013 (Unaudited) |

| | | | | | | | | | | | |

| | | | | | Shares | | | Value | |

| |

EXCHANGE TRADED FUNDS (4.57%) | |

ELEMENTS Linked to the Rogers International Commodity Index- Total Return(a) | | | | | | | 300,800 | | | $ | 2,589,888 | |

| | | | | | | | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS (Cost $2,645,309) | | | | 2,589,888 | |

| |

|

EXCHANGE TRADED NOTES (13.22%) | |

ETRACS DJ-UBS Commodity Index Total Return ETN(a) | | | | 95,080 | | | | 2,440,703 | |

iPath Dow Jones-UBS Commodity Index Total Return ETN(a) | | | | 62,950 | | | | 2,557,029 | |

PowerShares DB Commodity Index Tracking Fund ETN(a) | | | | 91,280 | | | | 2,492,857 | |

| | | | | | | | | | | | |

| |

TOTAL EXCHANGE TRADED NOTES (Cost $7,752,480) | | | | 7,490,589 | |

| |

|

OPEN-END FUNDS (46.80%) | |

Drexel Hamilton Centre American Equity Fund(b) | | | | 1,364,674 | | | | 13,373,803 | |

Drexel Hamilton Centre Global Equity Fund(b) | | | | 1,164,903 | | | | 13,140,106 | |

| | | | | | | | | | | | |

| |

TOTAL OPEN-END FUNDS (Cost $28,167,361) | | | | 26,513,909 | |

| |

| | | |

| | | | | | Principle

Amount | | | Value | |

| |

U.S. GOVERNMENT BONDS (29.01%) | |

U.S. Treasury Inflation Indexed Bonds | |

1/15/2014, 2.000% | | | | | | $ | 1,869,240 | | | $ | 1,932,473 | |

1/15/2016, 2.000% | | | | | | | 1,740,180 | | | | 1,940,708 | |

1/15/2017, 2.375% | | | | | | | 1,712,685 | | | | 1,999,293 | |

7/15/2020, 1.250% | | | | | | | 844,656 | | | | 1,010,288 | |

1/15/2021, 1.125% | | | | | | | 1,650,477 | | | | 1,948,465 | |

7/15/2021, 0.625% | | | | | | | 919,467 | | | | 1,053,364 | |

1/15/2025, 2.375% | | | | | | | 1,465,860 | | | | 1,972,269 | |

4/15/2029, 3.875% | | | | | | | 1,120,520 | | | | 1,825,572 | |

4/15/2032, 3.375% | | | | | | | 1,102,646 | | | | 1,778,705 | |

2/15/2041, 2.125% | | | | | | | 683,443 | | | | 971,343 | |

| | | | | | | | | | | | |

| |

TOTAL U.S. GOVERNMENT BONDS (Cost $16,354,503) | | | | 16,432,480 | |

| |

| | | |

| | | 7-Day

Yield | | | Shares | | | Value | |

| |

SHORT TERM INVESTMENTS (6.22%) | |

Money Market Fund (6.22%) | | | | | |

Dreyfus Treasury Prime Cash Management, Institutional Class | | | 0.00004 | % | | | 3,524,887 | | | | 3,524,887 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS (Cost $3,524,887) | | | | 3,524,887 | |

| |

| | | | |

TOTAL INVESTMENTS (Cost $58,444,540) (99.82%) | | $ | 56,551,753 | |

| |

Other Assets In Excess Of Liabilities (0.18%) | | | 100,666 | |

| |

NET ASSETS (100.00%) | | $ | 56,652,419 | |

| |

| |

| (a) | Non-income producing security. |

| (b) | Affiliated with the Fund, as each is a series of Drexel Hamilton Mutual Funds and have the some investment adviser. |

Common Abbreviations:

ETN - Exchange Traded Note.

| | |

See Notes to Financial Statements. |

18 | | www.dhipfunds.com |

| | |

| Drexel Hamilton Mutual Funds | | Statements of Assets and Liabilities |

| | March 31, 2013 (Unaudited) |

| | | | | | | | | | | | |

| | | Drexel Hamilton

Centre American Equity Fund | | | Drexel Hamilton

Centre Global Equity

Fund | | | Drexel Hamilton

Multi-Asset Real

Return Fund | |

| | | | |

ASSETS: | | | | | | | | | | | | |

Investments, at value | | $ | 138,445,659 | | | $ | 13,090,244 | | | $ | 30,037,844 | |