UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

CENTRE FUNDS

(Exact name of registrant as specified in charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of principal executive offices) (Zip code)

James Abate

48 Wall Street, Suite 1100

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (855) 298-4236

Date of fiscal year end: September 30

Date of reporting period: October 1, 2013 – March 31, 2014

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| | |

| Centre Funds | | Shareholder Letter |

| | March 31, 2014 (Unaudited) |

Dear Shareholders,

It is with my pleasure that we publish the Centre Funds semi-annual report covering the six month period ending March 31, 2014.

On September 13, 2013, the Board of Trustees of the former Drexel Hamilton Mutual Funds approved the change in investment adviser to Centre Asset Management, LLC whereby it assumed direct investment advisory responsibilities for the Funds. Effective January 17, 2014, the Trust changed its name to Centre Funds as well as launched the Centre Active U.S. Treasury Fund to expand its offerings to clients and continue its focus on targeted growth opportunities.

The Centre Funds now offer four differentiated funds to choose from, each available in investor and institutional share classes, and offer investors active management using specialist investment management talent across a target range of funds that includes the:

| | — | | Centre American Select Equity Fund |

U.S. large capitalization valuation sensitive growth fund focused on risk adjusted returns through active management; high conviction portfolio of what we believe to be the best 45 to 75 stocks of large cap U.S. companies, focused in the top 20 names.

| | — | | Centre Global Select Equity Fund |

World large capitalization core/growth fund differentiated by GDP adjusted regional allocation in portfolio construction; high conviction portfolio of what we believe to be the best 80 to 100 stocks of developed markets blue chip companies and emerging blue chips from the developing world, focused in top 40 names.

| | — | | Centre Active U.S. Treasury Fund (new) |

Intermediate government bond fund using active duration management of U.S. Treasury securities and cash equivalents with potential for capital appreciation/preservation in various interest rate environments using a proprietary interest rate forecasting process and taking advantage of rate changes through active duration management.

| | — | | Centre Multi-Asset Real Return Fund |

Tactical asset allocation balanced fund that uses a systematic, flexible process of tactical allocation to traditional asset classes (global equities, fixed income, commodity and real estate linked securities, and cash) in seeking real return while preserving and growing investment capital.

Our aim at Centre Funds is to deliver strong, long-term performance results for our clients through an exceptional focus on producing returns and managing risk in a select number of investment strategies. Each investment strategy aims to capitalize on defined market opportunities using talented and experienced Fund Managers with differentiated, consistent and repeatable investment processes.

I want to thank my fellow shareholders, particularly the former Ameristock Fund holders, now part of the family of Centre American Select Equity Fund holders, for their continued support and confidence in the Centre Funds. Our Fund Managers remain focused on fundamentally-driven approaches within high conviction, disciplined and research intensive processes.

If you have any questions or comments about this report or your investment in the Centre Funds, please call us toll-free at 1-855-298-4236 or visit our website at www.centrefunds.com. Please refer to the prospectus for information about each Fund’s investment objectives and strategies.

Sincerely yours,

James Abate

President, Centre Funds

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 1 |

| | |

| Centre American Select Equity Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2014, the Centre American Select Equity Fund, Investor Share Class, delivered a total return of 11.5%. The Institutional Share Class, which launched on January 21, 2014, delivered a total return of 0.9% from its inception through March 31, 2014.

During the past six month period, sectors such as Health Care, Technology, Materials, and Industrials were market leaders whilst sectors such as Telecomm, Consumer Discretionary, and Energy lagged. Our principal overweight sectors were Technology and Health Care driven by bottom-up stock level opportunities and we maintain our general avoidance of the Financial sector as regulatory scrutiny and increased capital requirements continue to depress returns on equity and intrinsic values. Stocks that were strong performers within the Fund over the six month period ended March 31, 2014 included Google, Delta Air Lines, Halliburton, Quanta Services, First Solar, Juniper Networks, Micron Technology, Microsoft, SanDisk, and Paccar; stocks that were laggards included Avon Products, Noble Corp., Goldcorp, IAMGold, Starbucks, and Network Appliance. Furthermore, the Fund was negatively impacted by certain hedges and other investments that we deemed to be capital protective in nature but proved untimely in a strongly rising market.

As always, our process in managing the Fund is to focus bottom-up on each individual company’s growth outlook and capacity to create shareholder value utilizing a “bottom-up” fundamental stock selection process. We utilize a disciplined, Economic Value Added (EVA®)* framework to select investments. The framework focuses on the fundamentals of wealth creation and wealth destruction similar to the way a traditional, long-term focused corporate financier looking at all aspects of the business would assess a company’s value. In the shorter-term, markets often undervalue or overvalue a company’s ability to create or destroy wealth. The framework seeks to identify and exploit these investment opportunities. The approach is designed to capture excess returns when the market price of a stock converges toward our target price. We analyze not only earnings but we also strive to understand and link the capital allocation decisions being made today by each company and how they will lead to future earnings growth. In other words, we expect companies to invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that will create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. Our top-down views on interest rates, etc. are important as many of those are inputs into our company models and, at the end of the day, reconciled to the bottom-up information we gather and process from company performance. The end result is our attempt to find the best 45-75 stocks of large capitalization U.S. companies, focused in the top 20 names, and weight those securities in a manner that delivers a Fund with superior risk adjusted returns over the long term.

Market Review & Outlook

Our optimistic cyclical outlook for the U.S. economy as well as U.S. stocks since 2009 was anchored in our belief that the restructuring and streamlining of corporations we witnessed after the collapse of Lehman Brothers and during the successive recession was the most effective, efficient and broad-based that we have seen in our careers. Most investors underappreciated that profit margins and asset efficiency were going to reach and, in some cases, surpass prior peak levels despite a top-line revenue environment that would remain challenging. By the spring of 2012, we no longer felt that the U.S. stock market could rely upon strong profit growth to power its advance. Accordingly, the proportion of stocks held by the Centre American Select Equity Fund which could be characterized as economically sensitive has fallen from about one half down to less than one third of net assets. Our emphasis has therefore shifted to more stable, consistent earnings-type stocks. Our allocation to what we call “Defensive Value” or “Stable Growth” and away from “Cyclical Growth” has increased significantly as we see the profit picture across the board becoming more difficult and fewer companies being able to generate earnings growth in the current environment.

Despite the continuing muted economic trends, those companies most dependent upon stronger economic growth, namely smaller companies, have performed best and were the key beneficiaries of the market’s positive re-rating in 2013. They outperformed larger companies significantly and, in particular, outpaced the largest “mega”-capitalization companies, as represented by the Russell Top 50 index; an area where we had significantly biased our Fund from a stock selection and portfolio construction basis. This performance gap implies substantial economic and earnings growth re-acceleration and that market expectations for the U.S. economy are consistent with the early/mid-cycle stage of the business cycle, not in 5th year of recovery as we actually are. That said, recent indicators such as the ISM Composite Manufacturing Index (ISM) are signaling a continuing improvement in the economic outlook for 2014 but it is yet to be seen whether these recent signs of economic and earnings growth re-acceleration are set to continue and translate into longer term capital investment acceleration, or it will be a shorter term mid-cycle inventory led bounce.

We see the sustainability of the recent pickup in economic activity being almost wholly dependent upon a significant increase of business capital investment in 2014. With returns on capital decelerating during 2013 (leading indicator), we see little incentive for a sharp pickup in business investment in 2014. In fact, over 60% of free cash flow for U.S. companies has been directed towards share repurchases and dividends in 2013, the highest proportion since 2009.

| * | EVA® is a registered service mark of EVA Dimensions LLC |

| | |

| Centre American Select Equity Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

At this stage, our focus remains on stock selection rather than sector/industry themes to achieve out-performance as no single area of the market seems uniformly inexpensive with operating trends improving. However, Mega-Cap stocks (those larger than $40 billion in capitalization) are trading at the cheapest relative valuation to small and mid-cap stocks in the recent past. We continue to believe that the catalyst to “harmonize” valuations will be moderate economic growth and disappointment of realized earnings growth versus expectations. We also expect a shift in investor preference away from smaller companies to higher quality, mega-size companies as 2014 progresses. Large-capitalization technology and health care remain our main areas of emphasis.

While operating margins have recently improved for many companies, without a pickup in top-line revenue growth, we may have seen the peak in profit margins and returns on capital for this business cycle. As a result, 2014-2016 earnings estimates appear at risk. Cost-cutting to boost profit margins seems to be less impactful, particularly now in the more cyclical sectors/industries, such as Materials, Energy, and Consumer Discretionary. The lack of corporate tax incentives and sound infrastructure policy will continue to drive capital away from investment in long-term operating assets to the level necessary to see the capital expenditures/sales ratio for all S&P 500 Index industrial companies (which now stands at 6.2% and consistent with the 10 year average) move to the higher level of the 1990’s and at a level for us to become “strategically longer-term bullish” on the more cyclical, capital-intensive areas of the market.

Our principal secular concerns are that investors underestimate the deflationary and negative growth impact from the aging population across the developed countries, including the U.S., which we believe is why monetary/inflationary stimuli will be needed for the foreseeable future to offset the shrinking labor force and absence of productivity increases. In addition, normalized interest rates would produce an uncontrollable government debt service and massive increase in federal budget deficits. This leaves the Federal Reserve trapped in keeping its short-term policy rate lower for a longer period and monetary policy may contribute to an increase in market volatility, just when expectations are the exact opposite.

As we progress through 2014 and 2015, despite our bottom-up optimism, we are less enthusiastic about the prospects for further sizable gains in U.S. stocks as a whole relative to what we believe is a very bullish consensus. This is due primarily to the negative macro circumstances being unlike any evidenced in the past and the lack of confidence in the ability of public officials to manage their unwinding, without creating a more volatile investment landscape for companies to operate in successfully. While we see a modestly improving growth outlook for operating profits through 2014, we do not foresee a cost of capital decline driving a re-rating of shares as was the case in 2013 and, more importantly due to high valuation levels, investor confidence is likely to erode as the improving tone of economic growth falters and companies as a whole disappoint in terms of lofty profit expectations as the year progresses. In fact, nearly every Wall Street Strategists’ report that we have read recently fixates on justifying expanding valuation multiples and a further re-rating in the context of a secular bull market that began in 2009 with little passing thought to what will drive aggregate company-level economic profit creation and market value added in 2014 and beyond.

As a natural contrarian, it is important for us not to reflexively adopt a posture away from consensus but to identify how we think the major investment themes and drivers reconcile to our conclusion and, most importantly, what inferences can we draw from the overall picture we get from the substantial bottom-up information we gather on a constant research basis from the stocks within our investment universe. The “goldilocks” environment of two percent growth with no inflation will continue for the very near-term, but we expect increasing concern as the year progresses and we think higher inflation expectations in 2014 and a stagflationary like recession in 2015 is a growing possibility. Our large capitalization valuation sensitive growth approach to stock selection with a cognizance of risk management seems primed to outperform other investment styles under the current circumstances.

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 3 |

| | |

| Centre American Select Equity Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

| | | | | | |

SECTOR WEIGHTINGS As a percentage of Net Assets | | | |

| | |

Information Technology | | | 30.15 | % | | |

| Industrials | | | 16.09 | % | | |

| Health Care | | | 15.99 | % | | |

Consumer Discretionary | | | 12.00 | % | | |

| Consumer Staples | | | 8.89 | % | | |

| Energy | | | 5.72 | % | | |

| Financials | | | 4.73 | % | | |

Telecommunication Services | | | 2.20 | % | | |

| Materials | | | 1.91 | % | | |

| Utilities | | | 1.82 | % | | |

Purchased Options and Other | | | 0.30 | % | | |

| Cash and Cash Equivalents | | | 0.20 | % | | |

| Total | | | 100.00 | % | | |

| |

These allocations may not reflect the current or future positions of the portfolio. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

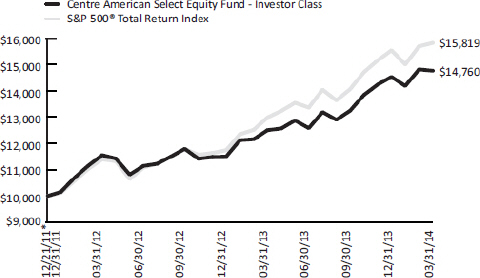

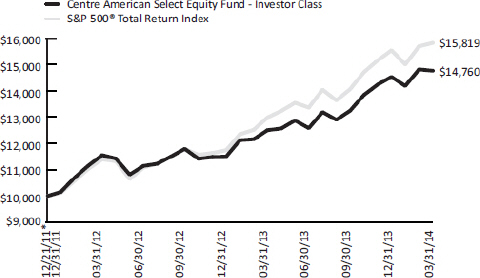

| GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2014 |

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund’s Investor Class versus the S&P 500 Index. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Month | | 3 Month | | YTD | | 1 Year | | Since Inception* |

| Centre American Select Equity Fund – Investor – NAV | | | | -0.35 | % | | | | 1.59 | % | | | | 1.59 | % | | | | 18.08 | % | | | | 18.65 | % |

| S&P 500® Total Return Index | | | | 0.84 | % | | | | 1.81 | % | | | | 1.81 | % | | | | 21.86 | % | | | | 22.32 | % |

| Centre American Select Equity Fund – Institutional – NAV | | | | -0.26 | % | | | | – | | | | | – | | | | | – | | | | | 0.88 | % |

| S&P 500® Total Return Index | | | | 0.84 | % | | | | – | | | | | – | | | | | – | | | | | 1.99 | % |

| * | Inception date of December 21, 2011 for Investor Class. Inception date of January 21, 2014 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236.

Total Annual Fund Operating Expenses (before fee waiver and/or expense reimbursements) as stated in the fee table of the prospectus of the Fund, dated January 17, 2014, were 1.53% for the Investor Class and 1.28% for the Institutional Class. The investment adviser to the Fund, Centre Asset Management, LLC (the “Adviser” or “Centre”), has entered into a written expense limitation agreement (the Expense Limitation Agreement), under which it has agreed to reduce its advisory fees and/or reimburse other expenses of the Fund for a period of two years from January 11, 2013, to the extent necessary to limit the current operating expenses of each class of shares of the Fund including (but not limited to investment advisory fees of the Adviser and distribution/service (Rule 12b-1) fees, but excluding interest, taxes, litigation, brokerage and extraordinary expenses incurred by the Fund in the fiscal year, to an annual rate of 1.05% of the average daily net assets of the Investor Class shares and 0.95% of the average daily net assets of the Institutional Class shares.

The S&P 500® Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index.

The chart above shows the performance of Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

| | |

| Centre Global Select Equity Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2014, the Centre Global Select Equity Fund, Institutional Share Class, delivered a total return of 4.8%. The Investor Share Class, which launched on January 21, 2014, delivered a total return of -0.6% from its inception through March 31, 2014.

During the past six month period, North American and Developed European markets outperformed the global equity average as measured by the MSCI All Country World Index (MSCI ACWI), while Asia Pacific and Emerging Markets in general underperformed MSCI ACWI. Within Europe, Greece, Italy, Denmark, and Ireland were among the best performing markets in this period whereas Hungary, Russia, and Austria were some of the worst performing markets in Europe during this period. In Asia Pacific, India, Pakistan and Indonesia were among the best performing markets whilst Thailand, Japan and China were some of the worst performing. Within Emerging Markets specifically, Greece, Egypt, and India outperformed MSCI ACWI significantly but Russia, Brazil, and China materially underperformed. During this period, good stock selection in Western Europe and Latin America contributed positively to the Fund’s relative performance. On the other hand, stock selection in Asia, Eastern Europe, the U.S. as well as overweight postures in Asia, Europe, Latin America and underweight posture in North America detracted from the Fund’s relative performance. Among the Fund’s stock holdings, Continental AG and Daimler of Germany, Tencent Holdings Limited of China, Hellenic Telecommunications Organization S.A. (OTE) of Greece, Intesa Sanpaolo and Enel of Italy, Google, Bank of America and Qualcomm of the U.S. contributed positively to the Fund’s performance. On the negative side, CNOOC and China Mobile of China, Yahoo Japan and Nomura Holdings of Japan, Tesco of UK and Petrobras of Brazil detracted from Fund’s performance.

Our process in managing the Fund is to focus on each individual company’s growth outlook and capacity to create shareholder value utilizing a “bottom-up” fundamental stock selection process. We utilize a disciplined Economic Value Added (EVA®)* framework to select investments. The framework focuses on the fundamentals of wealth creation and wealth destruction similar to the way a traditional, long-term focused corporate financier looking at all aspects of the business would assess a company’s value. In the shorter-term, markets often undervalue or overvalue a company’s ability to create or destroy wealth. The framework seeks to identify and exploit these investment opportunities. The approach is designed to capture excess returns when the market price of a stock converges towards our target price. We analyze not only earnings, but we also strive to understand and link the capital allocation decisions being made today by each company and how they will lead to future earnings growth. In other words, we expect companies to invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that will create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. The differentiated stock selection process is combined with a macro research overlay that is focused on GDP-driven regional weightings rather than market capitalization. This gives the Fund two sources of a potential excess return: stock selection alpha and portfolio construction “smart beta”. The end result is our attempt to find the best 80 to 100 stocks of large-capitalization global companies, focused in the top 40 names, that delivers a Fund with superior capital growth over the long term.

Market Review & Outlook

Looking ahead, we are cautiously optimistic. The Fund’s holdings continue to emphasize high quality large market capitalization blue chips from the developed markets and emerging blue chips from the developing countries that have impressive track records of creating shareholder value in good times and bad. The Fund also continues to favor companies that have a long track record of growing their earnings and dividends over complete economic and business cycles.

We expect the U.S. Federal Reserve to continue to reduce quantitative easing, while at the same time keeping interest rates low for the foreseeable future. It is likely that the European Central Bank will introduce additional quantitative liquidity measures to combat the risk of deflation. We also expect that policy makers in Japan will keep the liquidity spigot on, while the Chinese central government probably will not introduce significant economic stimulus packages, which many investors have been hoping for in recent years. Although some investors fear inflation and others fear deflation over the next few years, in the next 6 to 12 months, we expect the current global macroeconomic trends to continue, namely, moderate economic growth, mildly improving corporate earnings, slow improvement in labor markets and below trend inflation in most developed economies. In the emerging markets, China is trying to wean itself off the capital investment driven economic growth model. China is like the substance abuser that just joined a rehabilitation program, the longer it stays sober, the brighter its long-term future will be. But the temptation of just one more drink is always there and the urge is especially strong in the early stages of trying to stay sober. Many Chinese and foreign investors have been urging the Chinese government to implement one more large stimulus package as the Chinese economy shows more signs of slowing. Our base case scenario, however, is that the Chinese policy makers are not going to implement any sizable stimulus any time soon. The slowing economic growth in China has negatively impacted commodity rich developing economies such as Brazil, which is expected to grow less than 2% in 2014 while facing higher inflationary pressures.

| * | EVA® is a registered service mark of EVA Dimensions LLC |

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 5 |

| | |

| Centre Global Select Equity Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

The good news is that the stock market is a discounting mechanism and the stock valuations in various markets have adjusted to reflect the fundamentals mentioned above. Despite near term sentiment, the valuation foundation of emerging markets vis-à-vis developed markets has become more attractive as the valuation differentials have widened dramatically, particularly since 2011. In the near-term, global equity markets could become more volatile but for long-term global equity investors, market volatilities often provide good investment opportunities. We see numerous investment opportunities for long-term global equity investors among the many attractively valued blue-chip large market capitalization companies all over the world. We believe that long-term global equity investors will be rewarded by focusing their investments, as we do in the Fund, in high quality blue chip stocks that have impressive track records of creating shareholder value, growing dividends in challenging operating environments, maintaining strong balance sheets and are well positioned competitively in their respective industries.

The Centre Global Select Equity Fund offers a unique investment vehicle for investors by focusing on large capitalization blue chips in the developed world and emerging blue chips in the developing countries. The Fund’s investment process combines bottom-up stock selection with structured portfolio construction and risk management that’s cognizant of secular growth forces. Our top-down views on macro outlook of various markets, regions and global sectors etc. are important as many of those are inputs into our company models and at the end of the day, are reconciled to the bottom-up information we gather and process from company performance and operating results.

Our unique and disciplined Economic Value Added based stock selection process and unique dynamic GDP-adjusted focused portfolio construction process ensures that the Fund is unencumbered by traditional market capitalization weighted benchmark restrictions and goes where the bottom-up stock opportunities are globally. Consequently, the Fund is well positioned to benefit and profit from the positive demographics and long-term economic growth in many developing economies as well as attractive investment opportunities in developed countries across the globe.

Currently, the Fund has overweight postures in Financials, Telecommunication Services, Information Technology and Energy sectors; underweight postures in Industrials, Materials, Consumer Discretionary and Utilities; approximate to neutral postures in Healthcare and Consumer Staples; all relative to MSCI ACWI.

Recent purchases or additions in the Fund, based on our fundamental research, include Accor (Hotels Restaurants & Leisure), Coloplast (Health Care Equipment & Supplies), Discover Financial Services (Consumer Finance), Berkshire Hathaway (Diversified Financial Services), Next (Multiline Retail) and Red Electrica Corp. (Electric Utilities). Recent sells or reductions based on our disciplined investment process to take profit or remove stocks that no longer meet our fundamental investment and valuation criteria include Citigroup, Linde, Royal Bank of Canada, Honda Motor, Denso and MasterCard.

Going forward, the Fund will continue to be anchored with shareholder value creators who 1) have long track records of growing their cash earnings and dividends in both good times and bad, 2) are in strong competitive positions locally or globally in their respective industries and markets, and 3) are likely to be the main beneficiaries of good fundamental long-term economic growth and demographics in various parts of the world, such as Daimler, Wells Fargo, Hyundai Motors, Google, Samsung Electronics, Berkshire Hathaway, Taiwan Semiconductor Manufacturing and Sands China.

| | |

| Centre Global Select Equity Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

| | | | |

SECTOR WEIGHTINGS As a percentage of Net Assets | | |

| | |

| Financials | | 29.06% | | |

| Information Technology | | 14.18% | | |

| Health Care | | 11.02% | | |

| Energy | | 10.21% | | |

| Consumer Discretionary | | 9.28% | | |

| Consumer Staples | | 8.71% | | |

| Telecommunication Services | | 6.82% | | |

| Industrials | | 3.88% | | |

| Utilities | | 2.19% | | |

| Materials | | 2.17% | | |

| Cash and Cash Equivalents | | 2.48% | | |

| Total | | 97.83% | | |

| |

COUNTRY WEIGHTINGS As a percentage of Net Assets | | |

| | |

| United States | | 31.26% | | |

| China | | 11.80% | | |

| Japan | | 7.53% | | |

| Germany | | 6.43% | | |

| France | | 5.22% | | |

| Great Britain | | 5.19% | | |

| Italy | | 4.92% | | |

| Spain | | 4.10% | | |

| Greece | | 3.03% | | |

| Australia | | 2.83% | | |

| Switzerland | | 2.58% | | |

| Cash and Cash Equivalents | | 2.48% | | |

| Brazil | | 2.18% | | |

| Taiwan | | 1.96% | | |

| Korea | | 1.84% | | |

| Russia | | 1.73% | | |

| Denmark | | 1.60% | | |

| Mexico | | 0.98% | | |

| Hong Kong | | 0.79% | | |

| Belgium | | 0.67% | | |

| Netherlands | | 0.51% | | |

| India | | 0.37% | | |

| Total | | 100.00% | | |

| | | | |

| | | | |

These sector and country allocations may not reflect the current or future positions of the portfolio. | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

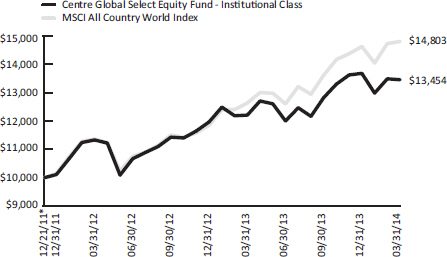

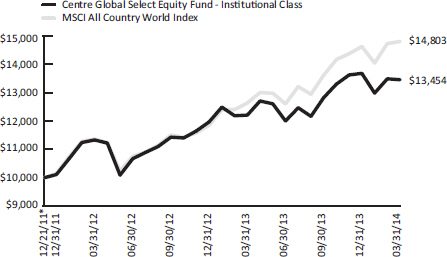

| GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2014 |

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund’s Institutional Class versus the MSCI All Country World Index. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Month | | 3 Month | | YTD | | 1 Year | | Since Inception* |

| Centre Global Select Equity Fund – Investor – NAV | | | | -0.25 | % | | | | – | | | | | – | | | | | – | | | | | -0.58 | % |

| MSCI All Country World | | | | 0.50 | % | | | | – | | | | | – | | | | | – | | | | | 1.59 | % |

| Centre Global Select Equity Fund – Institutional – NAV | | | | -0.25 | % | | | | -1.64 | % | | | | -1.64 | % | | | | 10.28 | % | | | | 13.92 | % |

| MSCI All Country World | | | | 0.50 | % | | | | 1.21 | % | | | | 1.21 | % | | | | 17.17 | % | | | | 18.80 | % |

| * | Inception date of January 21, 2014 for Investor Class. Inception date of December 21, 2011 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236.

Total Annual Fund Operating Expenses (before fee waiver and/or expense reimbursements) as stated in the fee table of the prospectus of the Fund, dated January 17, 2014, were 2.45% for the Investor Class and 2.20% for the Institutional Class. The investment adviser to the Fund, Centre Asset Management, LLC (the “Adviser” or “Centre”), has entered into a written expense limitation agreement under which it has agreed to limit through October 31, 2015 the total operating expenses of the Fund including (but not limited to) investment advisory fees of the Adviser and distribution/service (Rule 12b-1) fees, but excluding interest, taxes, litigation, brokerage, other expenditures which are capitalized in accordance with generally accepted accounting principles and extraordinary expenses) to an annual rate of 1.45% of the average daily net assets of the Investor Class shares, and 1.25% of the average daily net assets of the Institutional Class shares.

Investing in the securities of foreign companies generally involves greater risk than investing in larger, more established domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that invest in larger, more established domestic companies.

The MSCI (Morgan Stanley Capital International) All Country World Index is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. You cannot invest directly in an index.

The chart above shows the performance of Institutional Class shares only, since the Institutional Class has the longest period of annual returns. The performance of the Investor Class shares will differ from the performance shown because the Investor Class shares have different expenses than the Institutional Class shares.

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 7 |

| | |

| Centre Active U.S. Treasury Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

Performance & Strategy Summary

The Centre Active U.S. Treasury Fund was launched on January 21, 2014 with Investor and Institutional Share Classes. For the period from its inception through March 31, 2014, the Centre Active U.S. Treasury Fund, Investor Share Class, delivered a total return of 0.7%; the Institutional Share Class delivered a total return of 0.8%.

The Fund’s investment objective is to maximize investors’ total return through capital appreciation with a secondary objective of current income. The Fund strives to achieve its primary objective through the active management of the portfolio’s exposure to changes in interest rates affecting the U.S. Treasury securities and other assets in which the Fund may invest. We adjust the portfolio’s duration based on a monthly assessment of the likely movement in rates and implement our view based on our forecasting discipline. Our fundamentally-driven active duration management seeks potential for capital appreciation/preservation in variable interest rate environments utilizing U.S. Treasury bills, notes, bonds and cash equivalents.

Market Review & Outlook

Despite some encouraging signs from consumer spending, the U.S. economy is not yet on the kind of sustained path consistent and associated with most recoveries. For example, after a strong February showing the pace of deliveries as reported by ISM decelerated recently—an inverse correlation with growth. Additionally, labor demand declined in March and is basically flat for the year. So, the current economic recovery in the U.S. which began in June 2009 continues to be anemic by Post World War II standards. Real growth has, in fact, more than likely been at an average pace below that of the economy’s long run potential. This comparison is relative to recent estimates of the economy’s current potential real growth rate which is significantly lower than the accepted range of 3-3.25% during the 20th century. As a result, measured inflation has not yet accelerated as would have been anticipated given the aggressive nature of the Federal Reserve’s conduct of monetary policy. While interest rates, which reflect both potential real growth and inflationary fears, have not established the upward trend that would typically be the case this late in an economic recovery. Additionally, rates have continued to be buffeted by concerns about the changing global political situation. All the hype about the dollar notwithstanding, it is still the global “safe harbor”. The 10-year U.S. Treasury yield has fluctuated between 2 1⁄2 - 3%.

While there are undoubtedly several contributors to the slow recovery, two have been referenced frequently. First, recoveries from recessions that are impacted by financial crises are typically more drawn out than those from more “typical recessions”. This argument has recently been documented by Rogoff and Reinhart, This Time is Different, but has been noted by many economists over the years, namely Fisher, Kindleberger and Minsky. Second, policy uncertainty, mentioned several times by Federal Reserve Chairman Bernanke (and now Janet Yellen) in various speeches, has likely been a contributor as well. On their site, policyuncertainty.com, the authors Baker, Bloom and Davis point to the negative correlation between uncertainty over fiscal and monetary policy, regulatory actions and legislative issues, e.g. health care, and the pace of hiring and investment decisions.

As we go forward, we believe that three economic scenarios are likely to define the paths the U.S. economy could follow:

1) Global Recession (currently not very likely)

This scenario would likely come about if the Chinese economy slows further, Europe’s recovery, such as it is, falters and Japan’s attempts to right its economy fail. Of course, some combination of these three to varying degrees could also push the global economy back into recession. Currently, it looks like Europe will muddle through but maintaining the Euro will keep the outlook uncertain for a while longer as will any failure to deal with the issues of public sector employment and its associated employee benefits. It is also unlikely that the Chinese authorities will fail to act to promote growth but, in a highly structured economy where market forces do not dictate the allocation of resources, such macro policies could have limited effect. Japan also suffers from being a somewhat structured economy, and, the Japanese are experiencing declining population and labor force growth—neither good for economic prosperity. Finally, recent social unrest in Latin American, e.g. Brazil, Venezuela and Argentina might slow overall global growth making the above factors even more important.

2) Stagflation (more likely than recession)

This scenario would result from failure to recognize that the economy’s growth potential has been permanently reduced. A slower potential for growth could be the result of many factors. Two that have been topics of discussion in various publications are slower labor force growth and slower capital investment and hence slower productivity growth. The former could be the result of slower population growth or a lower labor force participation rate. The latter could reflect a more lasting impact of the recent recession/financial crisis, ongoing policy uncertainty, and/or of an educational mismatch between current workers and available jobs—lack of “human” capital. Inflation comes about as monetary authorities globally attempt to inflate to avoid a return to recession—too much money chasing a limited ability to produce goods.

3) Boom/Bust (most likely)

This scenario would be more typical of the Post World War II global economy and would reflect an attempt and failure on the part of monetary and fiscal policy makers to “fine tune” the economy. In some sense this is an “optimistic outlook” in that it implies that we will have addressed at least some of the issues in Scenario (2) above which will help in boosting real growth near-term. It also assumes that despite headwind that we may have

| | |

| Centre Active U.S. Treasury Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

put in the path of our recovery, monetary policy, as it always has with “lags that are long and variable” will win out. But, it implies also that policy makers will not adopt “rules”, e.g. the “Taylor Rule” for guiding policy decisions. Thus, the period in the latter part of the 1980s and in the 1990s—the “Great Moderation”—may prove to be the anomaly as economic behavior continues the “Boom and Bust” of recent times and that has characterized much of the Pre and Post World War II period in the U.S.

Based upon our assessment of the above probabilities, higher interest rates seem likely. Over time, there is a positive correlation between nominal growth and the yield on the 10-year U.S. Treasury. For example, if nominal growth is 4 1⁄2%—2 1⁄2% real and 2% inflation—the yield on the 10-year Treasury should reach 4 1⁄2%. This of course makes no allowance for the type of overshooting that would be typical of Scenarios (2) and (3). Scenarios (2) and (3) lead to significantly higher rates. In Scenario (2), yields increase because investor’s demand an increasingly greater inflation premium. We would not expect to see the 10-year yield near 16%—September 1981— again, but it could certainly move into the high single maybe even low double digits. In Scenario (3) both increased credit demand from strong real growth and accelerating inflation push rates toward the levels of scenario (3.)

Ultimately the rate of inflation will be the key as to how high rates may go. Recent “tapering” of bond purchases by the Federal Reserve is not tightening and the Fed appears likely to err on the side of being overly stimulative to avoid the risk of recession and deflation. Inflation has momentum, waiting until it has already begun to accelerate will make it more difficult to bring it under control.

Inception to date, the Funds’ discipline has been bullish, neutral and bearish—in cash—with respect to the outlook for bond prices. These changes, based on the discipline and its monthly review of portfolio duration, are consistent with the view that rate behavior reflects, over time, changing investor expectations regarding the fundamentals—real growth and inflation—with an allowance for market sentiment that reflects investor psychology and the tendency for “overshooting”. Even during the extraordinary period from the early 1970s to the early 1980s which saw an increase of almost 10 percentage points in the U.S. Treasury 10-year yield, rates did not increase every month—in fact only about 60% of the time.

Our discipline is intended to preserve capital in periods of significant rate increases by moving to very short Treasury maturities and cash or cash equivalents but with the flexibility to reenter the market and extend duration when our process suggests lower rates are likely. It is also designed to identify recessionary episodes and extend duration. What is relevant for the potential success of our discipline is that rates continue to exhibit cyclical volatility—that the business cycle is not dead.

The active management of interest rate risk, if successful, can make a meaningful contribution to the achievement of long term wealth accumulation goals. This contribution may be increasingly important, as the U.S. population continues to age and the allocation to fixed income assets as a percentage of overall portfolio value increases. Increased bond holdings materially increase the risk to portfolio value from rising interest rates. This risk is further increased if investors have, as part of the movement into bonds, also lengthened maturity—typical of many “muni” holdings and sought out higher yielding or so-called “junk bonds” in search of yield.

We feel our strategy serves well as a core fixed income portfolio. Over time, it is intended to provide the same yield as the Intermediate Government market and offers superior diversification benefits relative to other fixed income management approaches as it utilizes primarily U.S. Treasury securities, and seeks to generate competitive performance through adjusting the portfolio’s interest rate exposure (duration). The strategy is designed to readily accommodate both systematic and unforeseen cash needs, given the liquidity of the Treasury market.

The investment discipline underlying our management approach has been in evolution since the early 1970s. While the conceptual framework, grounded in the economics of interest rate behavior over the business cycle has not changed, our research, over the years, has identified better measures of the underlying fundamentals—real growth and inflation concerns. Additionally, it has led us to improved technical factors—our attempt to capture investor psychology. Finally and importantly, once our monthly decision is reached we do not second guess it or override the discipline’s outcome. Such behavior reduces the likelihood of long term performance, which is the Fund’s goal for the investors.

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 9 |

| | |

| Centre Active U.S. Treasury Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

| | | | | | |

ASSET TYPE WEIGHTINGS As a percentage of Net Assets | | | |

| | |

| Cash and Cash Equivalents | | | 100.00 | % | | |

| Total | | | 100.00 | % | | |

| |

These allocations may not reflect the current or future positions of the portfolio. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

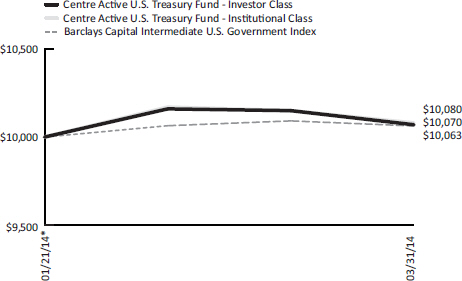

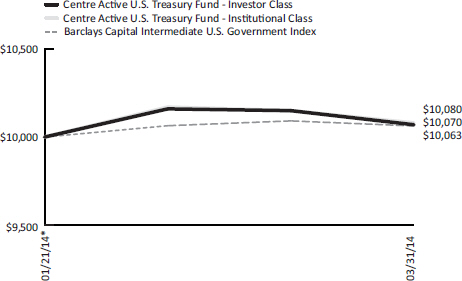

| GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2014 |

This graph assumes an initial investment of $ 10,000 at January 21, 2014, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the Barclays Capital Intermediate U.S. Government Index. Unlike the Fund, an index is not available for investment and is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

CUMULATIVE TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2014

| | | | | | | | | | |

| | | 1 Month | | Since Inception January 21, 2014 |

Centre Active U.S. Treasury Fund – Investor – NAV | | | | -0.79 | % | | | | 0.70 | % |

Centre Active U.S. Treasury Fund – Institutional – NAV | | | | -0.69 | % | | | | 0.80 | % |

Barclays Capital Intermediate U.S. Government Index | | | | -0.29 | % | | | | 0.63 | % |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236.

The total annual operating expense ratio (before expense reimbursements) as stated in the fee table of the prospectus of the Fund, dated January 17, 2014, was 2.28% for the Investor Class shares and 2.03% for the Institutional Class shares. The Adviser has entered into a written expense limitation agreement, dated and effective as of November 4, 2013 (the “Expense Limitation Agreement”), under which it has agreed to reduce its advisory fees and/or reimburse other expenses of the Fund, for at least an initial period of not less than two years and until the next following effective date of the Post-Effective Amendment to the registration statement of the Trust relating to the Fund incorporating the Fund’s financial statements for the Fund’s fiscal year (the “Initial Term”), to the extent necessary to limit the current operating expenses of each class of shares of the Fund (including (but not limited to) investment advisory fees of the Adviser and distribution/service (Rule 12b-1) fees, but excluding, as applicable, any front-end or contingent deferred sales loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, and extraordinary expenses (such as litigation and other expenses not incurred in the ordinary course of the Fund’s business), and acquired fund fees and expenses), to an annual rate of 0.85% of the average daily net assets of the Investor Class shares and 0.60% of the average daily net assets of the Institutional Class shares.

Barclays Capital Intermediate U.S. Government Index – The U.S. Treasury Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. You cannot invest directly into an index.

| | |

| Centre Multi-Asset Real Return Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2014, the Centre Multi-Asset Real Return Fund, Institutional Share Class, delivered a total return of 4.5%; the Investor Share Class delivered a total return of 4.3%. Effective September 14, 2013, Centre Asset Management, LLC assumed investment advisory responsibilities for the Fund.

The Centre Multi-Asset Real Return Fund was launched to meet investor concerns of future inflationary conditions and increased market volatility with the goal to produce real returns as measured against inflation and the loss of purchasing power. In other words, the Fund is designed to deliver on maintaining purchasing power of today’s dollar in nominal terms plus a real return on capital as well as be designed to withstand market shocks. CPI or the Consumer Price Index estimates the average change in prices for a basket of goods and services and serves as the baseline hurdle for real returns. The Fund, which is structured as a limited fund of funds, is an actively managed product that strives to help preserve and enhance purchasing power over a variety of investment environments using a fundamental tactical asset allocation strategy employing multiple asset classes with strong positive correlation with inflation and, when deemed prudent for defensive purposes, adopt a posture of capital protection. Under normal market conditions, the Fund will allocate its net assets among the broad asset classes, namely U.S. and Non-U.S. Equities, including other registered investment companies (primarily those advised by the investment adviser), Fixed Income, Commodity Linked Securities, Real Estate Linked Securities, and Cash & Equivalents in an effort to maximize risk-adjusted returns.

For the six month period ended March 31, 2014, U.S. Equities as an asset class contributed positively to returns as did Non-U.S. Equities and exposure to broad commodity indexes but to a lesser degree. Treasury bonds, most notably Treasury Inflation-Protected Securities (“TIPS”), performed poorly over the period.

The principal input and critical component in the Fund’s asset allocation decision process is the implied equity risk premium, simply defined as the excess return that the overall stock market provides over a risk-free rate indicating the relative valuation of risky assets versus the risk free alternative as measured by U.S. Treasury bonds. The level (high or low) plus the directional change in the equity risk premium are each used as inputs in our process. Second, the overall trend in CPI and other proxies for inflation, namely currency and commodity prices are used. Lastly, historical data and forecasts of volatility for all asset classes are analyzed and modeled.

Market Review & Outlook

Equities witnessed a strongly positive re-rating as evidenced by the price-to-earnings (P/E) multiple expanding and accounting for the majority of gains in 2013, as opposed to earnings growth or dividends. This P/E expansion was driven by increased investor optimism as demonstrated by a decrease in the implied equity risk premium. Currently, the implied risk premium for equities versus bonds is at a level last seen in early 2008, but consistent with the median level over the past fifteen years. In simple terms, future relative performance for Equities versus Bonds will be lower and dependent upon earnings growth or dividends, but Equities only seem vulnerable to a major correction in the face of higher Fixed Income yields.

Our process remains flexible and allows the Fund to opportunistically shift to each of the various asset classes as conditions warrant based upon the ability of each asset class to perform best during particular market environments.

Investments by the Fund in commodity-linked securities and, to a lesser extent, REITS and Real Estate linked securities are part of the tactical strategy to address inflation. Incorporating additional asset classes such as these, sometimes inversely or uncorrelated to stocks and bonds, offer enhanced diversification benefits and the ability to take advantage of the changes in asset class performance that may take place with changes in different inflationary environments. The Fund is designed to help reduce the level of risk to delivering real returns that comes from concentrating in a single asset class. Additionally, we aim to overweight asset classes we believe are poised to perform based on our understanding of how different asset classes respond to inflation and changes in economic conditions. The result is a broadly diversified portfolio solution that can be used as a core holding or a complement to existing equity or fixed income strategies.

With competing inflationary/deflationary forces, namely monetary policy and demographics respectively, competing against one another like “fire” and “ice”, we think the risk of inflation is higher than it has been in quite some time.

The failure of U.S. fiscal policy has caused the dependency on unprecedented and massive monetary easing and allowed the U.S. financial sector to heal distinct from the tremendous restructuring undertaken by business and consumer focused corporate America. That said, companies cannot sustain the pace of profit margin improvement without top line growth and it is unlikely that monetary policy will suddenly gain the value in transmission to the real economy (as opposed to financial assets), when it has not in the past five years. The vast bulk of the Federal Reserve’s bond purchases have made their way right back in the form of bank reserves deposited at the Federal Reserve. If released however, the outlook for inflation should rise.

A significant issue not widely discussed is the fact that the Federal Reserve is likely to taper its bond purchases simply because the amount of debt issuance by the U.S. government is falling and, if the Fed maintained its current rate of Treasury bond purchases, it would essentially be monetizing

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 11 |

| | |

| Centre Multi-Asset Real Return Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

all the federal government’s new deficit financing. The U.S. dollar’s reserve currency status has been the only fact to allow this not to have the normal inflationary impact that it has had on other countries that have pursued this type of debt monetization program. To us, the more important lever is what the Fed does with the policy rate, now at essentially zero and negative in real terms. Our forecast is that it will continue to pursue a policy of negative real interest rates and perhaps introduce other non-traditional stimulus measures to advance the rate of employment growth and until a higher rate of inflation (greater than three percent) is well entrenched into the economy. This is the only way to somehow allow it to unwind a $4 trillion balance sheet as well as avoid a meaningful interest rate rise and risk a recession meaning that monetary policy may contribute to an increase in market volatility just when expectations are the exact opposite.

At this stage of the cycle under “normal” circumstances, the Federal Reserve would be raising U.S. interest rates and the stock market drivers of return would be away from further expansion of valuation multiples and a focus on the delivery of profits as previously accommodative conditions tighten. There seems little to no justification for the Fed support of the private sector or the continuing low level of yields. That said, a sustained and large rise in interest rates is politically unacceptable and will negatively affect the U.S. budget deficit. On the assumption that the U.S. has balanced budgets forever but the government pays “normalized interest rates”, interest payments would be nearly one third of annual federal government spending. In other words, normalized interest rates would produce an uncontrollable U.S. debt service budget item that would sharply increase U.S. budget deficits and the national debt. The Federal Reserve will be required to keep its policy rates low to maintain the public sector mal-investment. In other words, the Federal Reserve is likely to succumb to political pressure and will allow a higher rate of inflation to become imbedded into the economy before it begins to increase the Federal Funds rate in any meaningful way. The impact from this on the private sector will be disruptive and is likely to contribute to increased volatility in interest rates and higher inflation expectations.

On the deflationary side, in a number of industrialized countries, including the U.S., on the assumption that fertility remains at or close to present levels, populations will start to decline and, in some cases, do so quite rapidly in the near future. The impact of this on developed societies is that the combined demand for goods and services will decrease and increasing pension liabilities that can be crushing in terms of taxation on younger workers will be an issue and, potentially, a source of unrest and political disruption. Japan, the pathfinder of this phenomenon as it embraced Western family planning even before Europe and the U.S., shows the debilitative impact from an aging society and need to resort to new radical inflationary macroeconomic policies to combat its ill effects. Russia, on the other hand, has introduced its annual “day of conception” worker holiday as a desperate gesture to increase Russia’s struggling birth rate. No developed world country is immune from this significant problem which is just starting to be felt. With regard to near-term relevance to Federal Reserve policies, we see that the U.S. Civilian Labor Force Participation Rate has dropped below a level that we last saw thirty years ago, when women began to join the workforce in earnest. A large part of the current fall in the unemployment rate has been due to this “dropping out” of the labor force, either due to discouragement, early retirement, or public assistance. This collapse in the civilian workforce participation rate and increase in the number of persons on government dependency since the recovery began in June 2009 has never happened before during previous recoveries. Productivity and the growth in the average hourly wages have fallen significantly as inflation has slowed and competition for jobs domestically and from overseas is limiting consumer consumption as evidenced by the latest drop in consumer spending being consistent only with past recessions.

These factors have created a myriad of possible outcomes over the next few years that are likely to see a rise, perhaps dramatically, in inflation. This is due primarily to the negative macro circumstances being unlike any evidenced in the past and the lack of confidence in the ability of public officials to manage their unwinding, without creating a more volatile investment landscape. The Centre Multi-Asset Real Return Fund will attempt to deliver on a maintaining investor purchasing power of today’s dollar in nominal terms plus deliver a positive real return on capital.

| | |

| Centre Multi-Asset Real Return Fund | | Manager Commentary |

| | March 31, 2014 (Unaudited) |

| | | | | | |

ASSET TYPE WEIGHTINGS As a percentage of Net Assets | | | |

| | |

| Exchange-Traded Funds | | | 24.39 | % | | |

| Other Open-End Funds | | | 75.36 | % | | |

| Cash and Cash Equivalents | | | 0.25 | % | | |

| Total | | | 100.00 | % | | |

| |

These allocations may not reflect the current or future positions of the portfolio. | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

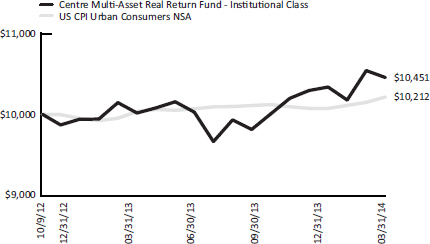

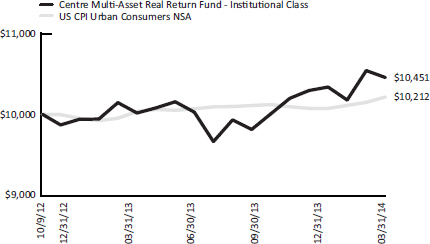

| GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2014 |

This graph assumes an initial investment of $10,000 at October 9, 2012, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund (Institutional Class) versus the U.S. CPI Urban Consumers NSA Index. Unlike the Fund, an index is not available for investment and is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

CUMULATIVE TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Month | | 3 Month | | YTD | | 1 Year | | Since Inception* |

| Centre Multi-Asset Real Return Fund – Investor – NAV | | | | -0.91 | % | | | | 1.03 | % | | | | 1.03 | % | | | | 3.26 | % | | | | 2.38 | % |

| U.S. CPI Urban Consumers NSA | | | | 0.64 | % | | | | 1.39 | % | | | | 1.39 | % | | | | 1.51 | % | | | | 2.39 | % |

| Centre Multi-Asset Real Return Fund – Institutional – NAV | | | | -0.81 | % | | | | 1.13 | % | | | | 1.13 | % | | | | 3.68 | % | | | | 3.04 | % |

| U.S. CPI Urban Consumers NSA | | | | 0.64 | % | | | | 1.39 | % | | | | 1.39 | % | | | | 1.51 | % | | | | 1.43 | % |

| * | Inception date of October 9, 2012 for Institutional Class. Inception date of January 22, 2013 for Investor Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of any taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data please call 855-298-4236.

Total Annual Fund Operating Expenses (before fee waiver and/or expense reimbursements) as stated in the fee table of the prospectus of the Fund, dated January 17, 2014, 2.17% for the Investor Class and 1.92% for the Institutional Class. The investment adviser to the Fund, Centre Asset Management, LLC (the “Adviser” or “Centre”), has contractually agreed, pursuant to a written expense limitation agreement (the “Expense Limitation Agreement”), to reduce its advisory fees and/or reimburse other expenses of the Fund until September 14, 2015 to the extent necessary to limit the current operating expenses of each class of shares of the Fund including (but not limited to) investment advisory fees of the Advisor and distribution/service (Rule 12b-1) fees but exclusive of any front-end or contingent deferred sales loads, taxes, leverage interest, brokerage commissions, expenses incurred in connection with any merger or reorganization, extraordinary expenses such as litigation and other expenses not incurred in the ordinary course of the Fund’s business, and acquired fund fees and expenses, except that, if an acquired fund is an underlying fund managed by the Adviser and such acquired fund is not subject to an effective expense limitation or fee waiver agreement at any time during the term of the Expense Limitation Agreement, then, for that time, the operating expenses of each class of shares of the Fund shall not exclude the amount of advisory fees included in such acquired fund’s fees and expenses to which the Fund would otherwise be subject, to an annual rate of 1.25% of the average daily net assets of the Investor Class shares and 1.00% of the average daily net assets of the Institutional Class shares.

The U.S. CPI Urban Consumers NSA Index is the annual percentage change in the Consumer Price Index (CPI). The CPI is an economic measure that tracks the weighted average of prices of a basket of consumer goods and services. Changes in CPI are used to assess price changes associated with the cost of living. You cannot invest directly into an index.

The chart above shows the performance of Institutional Class shares only, since the Institutional Class has the longest period of annual returns. The performance of the Investor Class shares will differ from the performance shown because the Investor Class shares have different expenses than the Institutional Class shares.

| | |

| | |

| Semi-Annual Report | March 31, 2014 | | 13 |

| | |

| Centre Funds | | Disclosure of Fund Expenses |

| | March 31, 2014 (Unaudited) |

As a shareholder of a series of Centre Funds (each series, a “Fund” and together, the “Funds”), you will incur, two types of costs: (1) transaction costs, including any applicable redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on October 1, 2013 and held through March 31, 2014.

Actual Expenses. The first line under each class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period October 1, 2013 – March 31, 2014” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees, if any. Therefore, the second line under each class of the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | |

| | | Beginning

Account Value

10/01/13 | | Ending

Account Value

03/31/14 | | Expense Ratio(a) | | Expenses Paid

During Period

10/01/13-03/31/14(b) |

Centre American Select Equity Fund | | | | | | | | |

Investor Class | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,114.80 | | 1.05% | | $ 5.54 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.70 | | 1.05% | | $ 5.29 |

Institutional Class | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 1,008.80 | | 0.95% | | $ 1.80 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.19 | | 0.95% | | $ 4.78 |

Centre Global Select Equity Fund | | | | | | | | |

Investor Class | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 994.20 | | 1.45% | | $ 2.73 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,017.70 | | 1.45% | | $ 7.29 |

Institutional Class | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,049.20 | | 1.25% | | $ 6.39 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,018.70 | | 1.25% | | $ 6.29 |

Centre Active U.S. Treasury Fund(d) | | | | | | | | |

Investor Class | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 1,007.00 | | 0.85% | | $ 1.61 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,020.69 | | 0.85% | | $ 4.28 |

Institutional Class | | | | | | | | |

Actual(c) | | $ 1,000.00 | | $ 1,008.00 | | 0.60% | | $ 1.14 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,021.94 | | 0.60% | | $ 3.02 |

Centre Multi-Asset Real Return Fund | | | | | | | | |

Investor Class | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,042.50 | | 1.25% | | $ 6.37 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,018.70 | | 1.25% | | $ 6.29 |

Institutional Class | | | | | | | | |

Actual | | $ 1,000.00 | | $ 1,044.50 | | 1.00% | | $ 5.10 |

Hypothetical (5% return before expenses) | | $ 1,000.00 | | $ 1,019.95 | | 1.00% | | $ 5.04 |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 365. |

| (c) | The actual expenses paid during the period is based on January 21, 2014 (Inception). |

| (d) | The Centre Active U.S. Treasury Fund commenced operations on January 21, 2014. |

| | |

| Centre American Select Equity Fund | | Schedule of Investments |

| | March 31, 2014 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS (99.50%) | | | | | |

Consumer Discretionary (12.00%) | | | | | |

Hotels Restaurants & Leisure (1.57%) | | | | | |

Starbucks Corp. | | | 28,240 | | | $ | 2,072,251 | |

| | | | | | | | |

| |

Internet & Catalog Retail (3.09%) | | | | | |

Amazon.com, Inc.(a) | | | 7,550 | | | | 2,540,726 | |

Priceline.com, Inc.(a) | | | 1,280 | | | | 1,525,619 | |

| | | | | | | | |

| | | | | | | 4,066,345 | |

| | | | | | | | |

Media (3.60%) | | | | | |

Comcast Corp., Class A | | | 53,450 | | | | 2,673,569 | |

Walt Disney Co. | | | 25,870 | | | | 2,071,411 | |

| | | | | | | | |

| | | | | | | 4,744,980 | |

| | | | | | | | |

Specialty Retail (3.74%) | | | | | |

Home Depot, Inc. | | | 27,460 | | | | 2,172,910 | |

Tiffany & Co. | | | 16,250 | | | | 1,399,937 | |

Urban Outfitters, Inc.(a) | | | 36,970 | | | | 1,348,296 | |

| | | | | | | | |

| | | | | | | 4,921,143 | |

| | | | | | | | |

Total Consumer Discretionary | | | | | | | 15,804,719 | |

| | | | | | | | |

| |

Consumer Staples (8.89%) | | | | | |

Beverages (3.62%) | | | | | |

Coca-Cola Co. | | | 42,410 | | | | 1,639,571 | |

PepsiCo, Inc. | | | 37,420 | | | | 3,124,570 | |

| | | | | | | | |

| | | | | | | 4,764,141 | |

| | | | | | | | |

Food Products (1.08%) | | | | | |

Archer-Daniels-Midland Co. | | | 32,760 | | | | 1,421,456 | |

| | | | | | | | |

| |

Household Products (1.86%) | | | | | |

Procter & Gamble Co. | | | 30,380 | | | | 2,448,628 | |

| | | | | | | | |

| |

Personal Products (0.99%) | | | | | |

Avon Products, Inc. | | | 89,130 | | | | 1,304,863 | |

| | | | | | | | |

| |

Tobacco (1.34%) | | | | | |

Philip Morris International, Inc. | | | 21,600 | | | | 1,768,392 | |

| | | | | | | | |

Total Consumer Staples | | | | | | | 11,707,480 | |

| | | | | | | | |

| |

Energy (5.72%) | | | | | |

Energy Equipment & Services (2.27%) | | | | | |

Schlumberger, Ltd. | | | 30,640 | | | | 2,987,400 | |

| | | | | | | | |

| |

Oil, Gas & Consumable Fuels (3.45%) | | | | | |

EOG Resources, Inc. | | | 12,160 | | | | 2,385,427 | |

Halliburton Co. | | | 36,600 | | | | 2,155,374 | |

| | | | | | | | |

| | | | | | | 4,540,801 | |

| | | | | | | | |

Total Energy | | | | | | | 7,528,201 | |

| | | | | | | | |

| |

Financials (4.73%) | | | | | |

Capital Markets (1.48%) | | | | | |

BlackRock, Inc. | | | 6,190 | | | | 1,946,631 | |

| | | | | | | | |

| |

Consumer Finance (1.58%) | | | | | |

American Express Co. | | | 23,190 | | | | 2,087,796 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

Financials (continued) | | | | | |

Diversified Financial Services (1.67%) | | | | | |

Bank of America Corp. | | | 61,660 | | | $ | 1,060,552 | |

Citigroup, Inc. | | | 23,880 | | | | 1,136,688 | |

| | | | | | | | |

| | | | | | | 2,197,240 | |

| | | | | | | | |

Total Financials | | | | | | | 6,231,667 | |

| | | | | | | | |

| |

Health Care (15.99%) | | | | | |

Biotechnology (5.36%) | | | | | |

Amgen, Inc. | | | 17,340 | | | | 2,138,716 | |