UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

CENTRE FUNDS

(Exact name of registrant as specified in charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of principal executive offices) (Zip code)

James A. Abate

48 Wall Street, Suite 1100

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 918-4705

Date of fiscal year end: September 30

Date of reporting period: October 1, 2014 – March 31, 2015

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| | |

| Centre Funds | | Shareholder Letter |

| | March 31, 2015 (Unaudited) |

Dear Shareholders,

It is with my pleasure that we publish the Centre Funds semi-annual report covering the six month period ending March 31, 2015. I want to thank my fellow shareholders for their continued support and confidence in the Centre Funds. We are committed to truly active fund management with distinction across core asset class offerings.

As part of its commitment to growth, on March 17, 2015, the Centre Funds completed the reorganization of the former ISI Funds. Specifically, shareholders of the Total Return U.S. Treasury Fund, Inc., North American Government Bond Fund, Inc., ISI Strategy Fund, Inc., and Managed Municipal Fund, Inc. (collectively, the “ISI Funds”), approved the reorganization under which (i) Total Return U.S. Treasury Fund, Inc. and North American Government Bond Fund, Inc. were reorganized into Centre Active U.S. Treasury Fund; (ii) ISI Strategy Fund, Inc. was reorganized into Centre American Select Equity Fund; and (iii) Managed Municipal Fund, Inc. was reorganized into the newly formed Centre Active U.S. Tax Exempt Fund. The Centre Funds’ and ISI Funds’ Boards approved the reorganization in December 2014. We believe the former ISI Funds’ as well as Centre Funds’ shareholders will benefit from greater efficiencies while participating in larger funds with similar investment objectives and policies as part of the Centre Funds’ commitment to delivering fundamentally-driven, specialist active funds in core investment strategies.

The Centre Funds offer a select series of funds to choose from, each available in investor and institutional share classes, and offer investors true active management using specialist talent across a target range of funds that includes the:

| | — | | Centre American Select Equity Fund |

U.S. large capitalization valuation sensitive growth stock fund that seeks long-term growth of capital and is focused on blue-chip securities and risk adjusted returns through active management; the Fund is intended to be a risk managed core growth fund.

| | — | | Centre Global Select Equity Fund |

Foreign (Global ex-U.S.) large capitalization stock fund that seeks long-term growth of capital and focuses on intrinsic value and strategic geographic allocation in portfolio construction. The Fund invests in international developed markets’ blue chip companies and emerging blue chips from the developing world.

| | — | | Centre Active U.S. Treasury Fund |

U.S. Treasury securities fund that seeks to maximize investors’ total return through capital appreciation and current income using active duration management of U.S. Treasury securities and cash equivalents. Portfolio has the potential for capital appreciation/preservation in various interest rate environments through a proprietary interest rate forecasting process that aims to take advantage of interest rate changes through active duration management.

| | — | | Centre Active U.S. Tax Exempt Fund |

U.S. Municipal National Short/Intermediate securities fund that seeks to maximize investors’ total return through capital appreciation and current income using active duration management of a core portfolio of high quality and highly rated federally tax exempt municipal bond securities to provide tax advantaged income. Portfolio has the potential for capital appreciation/preservation in various interest rate environments through a proprietary interest rate forecasting process that aims to take advantage of interest rate changes through active duration management.

| | — | | Centre Multi-Asset Real Return Fund |

Asset allocation fund that seeks real return by using a systematic, flexible process of tactical allocation to broad asset classes (underlying funds, U.S. and non-U.S. equities, fixed income securities, exchange-traded notes and exchange-traded funds with returns that track broad commodity indices or the price of gold bullion, real estate linked securities, and cash and equivalents) with the goal of preserving and growing investment capital in excess of inflation.

Our aim at Centre Funds is to deliver strong, long-term performance results for investors through an exceptional focus on producing returns and managing risk in a select number of investment strategies. Each investment strategy aims to capitalize on defined market opportunities using talented and experienced Portfolio Managers with differentiated, consistent, and repeatable investment processes. Our Portfolio Managers remain focused on fundamentally-driven investment approaches within truly active, high conviction, disciplined and research intensive processes. At Centre Funds, we place service excellence at the core of everything that we do and are committed to providing useful, high quality information on all of our Funds. Again, I want to thank my fellow shareholders for their continued support and confidence in the Centre Funds.

Sincerely,

James Abate

President, Centre Funds

Mutual fund investing involves risks, including loss of principal. Investors should consider a Fund’s investment objective, risks, charges and expenses carefully before investing. Any performance data quoted herein represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than any performance data provided herein. Most recent month-end performance, and answers to any questions you may have, can be obtained by calling 1-855-298-4236 or visit us online at www.centrefunds.com.

| | |

| | |

| Semi-Annual Report | March 31, 2015 | | 1 |

| | |

| Centre American Select Equity Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2015, the Centre American Select Equity Fund, Investor Share Class, delivered a total return of 1.5%; the Institutional Share Class delivered a total return of 1.6%.

During the past six month period, sectors such as Health Care, Consumer Discretionary, and Consumer Staples were market leaders whilst sectors such as Energy, Telecoms, and Materials lagged. Our principal sector exposures over the period were Technology, Industrials, Health Care, and Consumer Discretionary driven by bottom-up stock level opportunities. Currently, we maintain our general avoidance of the Financials sector as regulatory scrutiny and increased capital requirements continue to depress returns on equity and intrinsic values. Unlike consensus, we do not subscribe to the thesis that rising interest rates will be substantially beneficial to the sector. Over the period, the largest companies underperformed other equity indices as blue-chip companies, as represented by the S&P 100 Index, lagged the S&P 500 Index. This was driven by expectations of an improving domestic economy and the strong rise in the U.S. dollar which typically hurts the earnings for many multi-national companies. Stocks that were the strongest performers within the Fund over the six month period ended March 31, 2015 included Lowes, Vulcan Materials, Biogen, Apple, Starbucks, International Flavors & Fragrances, Delta Airlines, Visa, Texas Instruments, and 3M. Stocks that negatively impacted relative performance included FMC Technologies, Microsoft, Allegheny Technologies, Newfield Exploration, Gilead Sciences, Google, Intel, Micron, ITT, and Schlumberger. Furthermore, the Fund was negatively impacted by the amortization costs of certain hedges and other investments that we deemed to be capital protective in nature but proved untimely in a flat to rising stock market over the six month period. Given the presence of certain potentially de-stabilizing factors that we believe could negatively impact the value of equity securities held in the Fund, as of March 31, 2015, the Fund continued to hold capital protection hedges, namely put options on the S&P 500 Index.

As always, our process in managing the Fund is to focus bottom-up on each individual company’s growth outlook and capacity to create shareholder value by utilizing our “bottom-up” fundamental stock selection process. We utilize a disciplined, Economic Value Added (EVA) framework to select investments. The framework focuses on the fundamentals of wealth creation and wealth destruction similar to the way a traditional, long-term focused corporate financier looking at all aspects of the business would assess a company’s value. In the shorter-term, markets may often undervalue or overvalue a company’s ability to create or destroy wealth. The framework seeks to identify and exploit these investment opportunities. The approach is designed to capture excess returns when the market price of a stock converges toward our target price. We analyze not only earnings but we also strive to understand and link the capital allocation decisions being made today by each company and how they will lead to future earnings growth. In other words, we expect the companies in which the Fund invests to invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that will create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. Our top-down views on interest rates and risk premiums are important as many of those are inputs into our company models and, at the end of the day, reconciled to the bottom-up information we gather and process from company performance. The Fund may tactically employ hedges and other capital protective strategies when deemed appropriate in meeting its objective as a risk managed growth fund. The end result is our attempt to deliver a Fund with attractive risk adjusted returns and, in particular, downside risk management over the long term.

Market Review & Outlook

As we recently celebrated the six year anniversary of the current U.S. bull market and provide an outlook for the future, it’s important for us to articulate and reconcile the linkage from the economy, interest rates, corporate profits, and the pricing of risk and future growth, back to what we believe the returns from the stock market will be going forward. In sum, cyclical economic activity is still expanding but at a decelerating pace, things are becoming less good but not yet shrinking, and structurally the collapse in productivity will hamper real wage gains, economic growth, and further exasperate the divide between “haves” and “have-nots.” While this has been beneficial to Wall Street rather than Main Street, we don’t see it persisting due to exceptionally high valuations and an under-appreciation that an economic slowdown is underway that could well turn into a recession having a strongly negative impact on corporate profits and stock prices.

Starting with the basics, there are six major determinants of economic growth: 1) demographic trends; 2) productivity trends; 3) trade balance trends; 4) fiscal trends; 5) household consumption trends; and 6) business investment trends. Unfortunately, in our view, the trends for all six variables are weak to poor. Of all of them, our principal secular concerns are that investors tend to underestimate the deflationary and negative growth impact from aging populations and collapse in productivity – not wholly related - across the developed countries, including the U.S. The failure for the U.S. economy to achieve so called “escape velocity” growth despite unprecedented stimuli over the past few years highlights the structural, as opposed to purely cyclical, impediments to higher and more normal post-recession growth rates. This is demonstrated superbly by the breakdown in a core tenet of monetarists’ constant velocity theory, as we’ve witnessed a 300 percent increase in money supply by the Federal Reserve be offset by a collapse in velocity. In other words, the classical transition mechanism from Federal Reserve policy changes to the underlying economy is broken but still remains the focus of policy makers worldwide to try to stimulate consumer demand and business investment. In the absence of any fiscal or structural reforms, e.g., tax reform, or pro-natalistic and immigration policies that can offset ageing demographics, we believe monetary stimuli will continue to be in place for the foreseeable future under the belief that the stimulus from negative real interest rates will offset the shrinking labor force and absence of productivity increases. This likely leaves the Federal Reserve trapped in keeping its short term policy rate below normalized levels lower for a longer period and may contribute to an increase in market volatility, just when market expectations are the exact opposite with confidence in central banks at unprecedented highs.

Away from monetary policy and on a positive note, the normal “CEO Hubris” seen at this advanced stage of the business cycle, namely increased and overpriced mergers & acquisitions, high capital spending, aggressive hiring, and inventory growth, is not widespread. This may allow the

| | |

| Centre American Select Equity Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

potential for the U.S. to escape a normal five to seven year business cycle as experienced since the 1950’s with a continued mediocre, muddling low volatility economy. Also, the usual disturbance (i.e., demand shock) to the economy – a sharp rise in interest rates leading to recession – is not evident as real interest rates are and will likely remain negative despite the Federal Reserve’s articulated plan to raise rates gradually later in 2015. So, unfortunately, we see the U.S. economy potentially lurching into recession or, at best, continuing to muddle through at well below expected growth rates and going from crisis to crisis unless genuine structural reforms are put in place and, with the current state of political inaction and lack of creative America-first visions, we see little cause for optimism. Importantly and given the unusual current set of circumstances, we constantly remind ourselves that the economic, demographic, monetary, and fiscal situations in the U.S. and other developed countries today are unlike any circumstances endured in the past and can lead to shocks and instability much more quickly as a result of the still high level of leverage and dependence upon ultra-low interest rates in the financial system. Also, despite falling unemployment and above trend utilization, the collapse in real wages and productivity we’re undergoing has been associated typically with pre-WWI recessions and not experienced first-hand by any current portfolio manager practitioner.

In terms of observations on corporate profits, there are several positives which bear mentioning. Firstly, aggregate Return on Invested Capital/Return on Assets (ROA) for companies in the S&P 500 Index remains high while the cost of equity & debt for companies remains low and, thus, creating Economic Value Added. Also, low corporate investment growth supports the continued business cycle without creating excess or overcapacity so reversion to the mean in terms of profits is lacking a disturbance or catalyst. In other words, earnings growth is outpacing asset growth as falling ROA typically comes from increased competition and asset increases. Furthermore, the efficacy of post-2008 financial crisis restructuring by corporate America has had a very long shelf life and impacted CEO behavior significantly. Finally, we believe it’s a long term losing bet to go against the flexibility and speed of best-in-class American companies to restructure responsively to slowdowns and crisis. On the other hand, net profit margins for industrial companies are now 1.5 standard deviations from normal, the highest ever, meaning companies are over-earning at an unprecedented rate and margins historically have mean reverted more consistently than other indicators. Second, gross and EBITDA margins are decelerating in aggregate for the average company in the S&P 500 Index while net profit margins are plateauing which may be a sign of “financial engineering” as well as the strong influence from low borrowing costs. Unlike 1999, stock prices are not inflated relative to earnings; rather, earnings are inflated masking the expensiveness of stocks from a rudimentary Price/Earnings ratio basis. Overall, within the industrial sectors, wealth creation from expanding companies is becoming harder to find and the Fund unusually has a very high level of wise-contractors or companies restructuring for this stage of the business cycle. We continue to believe in a new “Nifty-Fifty” of companies that can generate and maintain profits acceleration and attempt to concentrate the Fund in such companies maintaining cognizance of our valuation sensitivity. Lastly and for financial companies, increased capital requirements and regulation are hampering their ability to leverage improving ROA’s into improving and pre-2008 Returns on Equity (ROE). In sum, the stocks of banks, brokers and the financial sector in general hold little appreciation potential from here and will trade near book value for foreseeable future as ROE’s equals the cost of equity for most firms.

Our key observations on the pricing of risk & expectations for future growth are that most valuation measures to include Price/Sales, Price/Book, Price/Normalized Earnings, and Price/EBITDA are at or near all-time highs for the average company within the S&P 500 Index. Also, there seems to be little to no reflection of the potential normalization of profit margins in the future which now stand at 1.5 standard deviations away from their long-term mean. This means that the market implied growth rate for the S&P Industrials (how the market is currently pricing expected earnings growth for all companies in the S&P 500 Index less the financial sector) is now approximately 11 percent versus 8 percent in mid-2012 when the re-rating phase of the current bull market began in earnest. (The primary driver from 2009 through 2011 was the rebound in profits.) While economic reality seems at odds with the market for risk assets, the suppression of yields in fixed income, poor choice of alternative investments in commodities due to dollar strength, illiquidity of real estate, etc., make stocks seem the only choice now for investors. This “there is no alternative” seems largely driven by stick rather than carrot however. Also of concern is that given the high ratio of overall stock market capitalization to U.S. GDP, any stock market disruption will have large GDP connotations. In terms of whether this current bull market can continue principally from a continuing rise in valuation multiples, we remind investors that this is not 1995 with a strong foundation for an extended secular bull market. The conditions then versus now seem not to support this: 1) pent-up demand from former communist countries then, emerging market countries contracting now; 2) free trade expansion then, currency wars now; 3) peace with the U.S. as the world’s uni-polar military power then, perpetual conflict now, particularly in the Middle East where we’re witnessing the start of its version of the Thirty Years’ War, along with simmering Eastern European unrest; and 4) start of productivity enhancing technology revolution then now replaced with social media explosion which has proven to depress productivity and it seems to add little in our view in terms of direct and tangible payback to companies.

While we continue to see a much less friendly systemic backdrop for equities as a whole, our focus remains on stock selection rather than sector/industry themes to achieve performance as no single area of the stock market seems uniformly inexpensive with operating trends improving. With such a backdrop, we believe a small crisis can morph easily into a global problem (Thailand 1997, sub-prime lending sector 2008, Greece 2011...2015?). With the pricing of risk & expectations for future growth where they are, it’s tough to see market appreciation driven by further re-rating. Large-capitalization Technology, Health Care, and Consumer companies remain our main areas of emphasis given their higher degree of idiosyncratic or company specific risk. One of our biggest concerns is that we could lurch from an unexciting economic recovery straight into the next economic downturn with real interest rates already negative and debt levels high leading to deflation/recession regardless of the actions taken by the Federal Reserve. We do, however, feel that a violent change in sentiment within an expectations environment of stability and complacency and low volatility could compress valuation multiples akin to sharp corrections seen in 1987, 1998 or 2011. As we progress further into 2015, despite our bottom-up optimism for the companies owned in the Fund, we are less enthusiastic about the prospects for further sizable gains in U.S. stocks as a whole relative to what we believe remains a very bullish consensus. With the risk mitigating benefits from traditional diversification ebbing combined with low volatility makes option costs reasonable, especially given our expectation of a sharp “valuation re-set” or correction rather than a drawn out bear market. We believe that our large capitalization valuation sensitive growth approach to stock selection, with a cognizance of risk management that includes tactically employing investments that may mitigate downside losses, seems positioned to perform well relative to less risk aware strategies.

| | |

| | |

| Semi-Annual Report | March 31, 2015 | | 3 |

| | |

| Centre American Select Equity Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

| | | | |

SECTOR WEIGHTINGS As a percentage of Net Assets | | |

| | |

| Information Technology | | 30.88% | | |

| Health Care | | 18.67% | | |

| Consumer Discretionary | | 14.86% | | |

| Consumer Staples | | 11.94% | | |

| Industrials | | 9.44% | | |

| Materials | | 4.57% | | |

| Financials | | 3.43% | | |

| Purchased Options | | 3.09% | | |

| Energy | | 1.99% | | |

| Government | | 0.81% | | |

| Telecommunication Services | | 0.33% | | |

| Rights | | 0.00% | | |

| Cash and Cash Equivalents | | -0.01% | | |

| Totals | | 100.00% | | |

| |

These allocations may not reflect the current or future positions of the portfolio. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

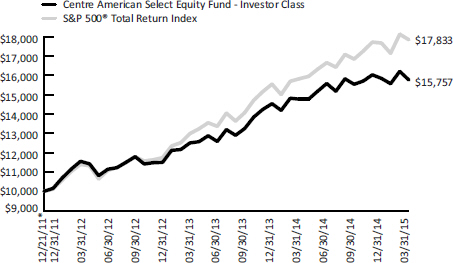

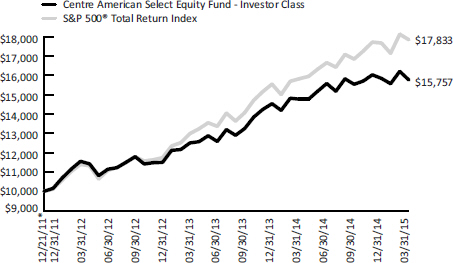

| GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2015 |

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund’s Investor Class versus the S&P 500® Total Return Index. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Month | | 3

Month | | YTD | | 1 Year | | 3 Year | | Since

Inception* |

Centre American Select Equity Fund – Investor Class | | | | -2.74 | % | | | | -0.49 | % | | | | -0.49 | % | | | | 6.75 | % | | | | 10.91% | | | | | 14.89 | % |

| S&P 500® Total Return Index | | | | -1.58 | % | | | | 0.95 | % | | | | 0.95 | % | | | | 12.73 | % | | | | 16.11% | | | | | 19.31 | % |

Centre American Select Equity Fund – Institutional Class | | | | -2.73 | % | | | | -0.41 | % | | | | -0.41 | % | | | | 6.77 | % | | | | – | | | | | 6.44 | % |

| S&P 500® Total Return Index | | | | -1.58 | % | | | | 0.95 | % | | | | 0.95 | % | | | | 12.73 | % | | | | – | | | | | 12.45 | % |

| * | Inception date of December 21, 2011 for Investor Class. Inception date of January 21, 2014 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

The Total Annual Operating Expense Ratio (before expense reimbursements) as stated in the fee table of the most currently effective prospectus of the Fund, dated January 28, 2015, was 1.43% for the Investor Class shares and 1.26% for the Institutional Class shares. The Adviser has entered into a written expense limitation agreement (the “Expense Limitation Agreement”), under which it has agreed to limit through January 31, 2016 the total operating expenses of the Fund including (but not limited to) investment advisory fees of the Adviser and distribution/service (Rule 12b-1) fees, but excluding interest, taxes, litigation, brokerage and extraordinary expenses incurred by the Fund in the fiscal year, to an annual rate of 1.05% of the average daily net assets of the Investor Class shares and 0.95% of the average daily net assets of the Institutional Class shares.

The S&P 500® Total Return Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index.

The line graph above shows the performance of Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

| | |

| Centre Global Select Equity Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2015, the Centre Global Select Equity Fund, Institutional Share Class, delivered a total return of -0.3%. The Investor Share Class delivered a total return of -0.6% for the six month period ended March 31, 2015.

During the past six month period ended March 31, 2015 on a regional basis versus broad global equity indexes, Asia Pacific and Central Asian equity markets outperformed while Eastern Europe and South & Central America underperformed. The best performing regional exposures for the Fund over the six month period were Central Asia, Africa/Middle East, and Asia Pacific. However, the worst performing regional exposures for the Fund over the period were Eastern Europe and North America. Within the Central Asia region, India was the best performing market during the time period due, in large part if not wholly, to expectations that newly elected Prime Minister Modi would reform and reinvigorate India’s economy. Within Eastern Europe, the Russian and Ukrainian geopolitical conflict caused those markets to perform poorly. From a sector perspective, Information Technology, Industrials, and Health Care contributed positively to performance over the six month period ended March 31, 2015, while exposures to Energy, Utilities, and Consumer Discretionary detracted the most. Stocks that were the strongest performers within the Fund over the six month period ended March 31, 2015 included Tencent Holdings, China Merchants Bank, Fibria Celulose, and Bridgestone. Stocks that most negatively detracted from performance over the six month period ended March 31, 2015 included Novatek, Sberbank, and Vale.

Our process in managing the Fund is to focus on each individual company’s growth outlook and capacity to create shareholder value by utilizing our “bottom-up” fundamental stock selection process. We utilize a disciplined, Economic Value Added (EVA) framework to select investments. The framework focuses on the fundamentals of wealth creation and wealth destruction similar to the way a traditional, long-term focused corporate financier looking at all aspects of the business would assess a company’s value. In the shorter-term, markets may often undervalue or overvalue a company’s ability to create or destroy wealth. The framework seeks to identify and exploit these investment opportunities. The approach is designed to capture excess returns when the market price of a stock converges towards our target price. We analyze not only earnings, but we also strive to understand and link the capital allocation decisions being made today by each company and how they will lead to future earnings growth. In other words, we expect the companies which the Fund invests in to invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that will create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation.

The differentiated stock selection process is combined with a smart beta approach to portfolio construction that is focused on Gross Domestic Product (“GDP”)-driven regional weightings rather than regional bias tied to overall regional relative market capitalization. In other words, regional weights are guided by economic footprint rather than market capitalization. By utilizing a “smart beta” approach to portfolio construction that focuses on GDP weights instead of market capitalization as guideposts for regional, country and stock weightings, the Fund is tilted towards the world’s fastest growing economies and attempts to underweight or to avoid overvalued markets. Because the GDP-weightings adjust over time to focus on the fastest growing economies, investors maintain exposure to the most promising regions. When compared to conventional market capitalization-based funds, GDP-weighted portfolios have higher emerging market exposure. They also have higher exposure to developed market powerhouses like Germany, Hong Kong, and Israel, all of which the Fund typically has exposure to. This gives the Fund two sources of potential excess return: stock selection alpha and portfolio construction smart beta.

Market Review & Outlook

The current global investing environment with its mixed GDP growth trends, weak raw material prices, and conflicting central bank messaging is confusing at best. While these economic crosswinds make forecasting challenging, we are focusing our research efforts on the net beneficiaries in this environment of deflation, currency wars, and public sector debt woes. When aggregating our bottom-up stock level research by regions, it indicates better fundamental trends overall in Asia Pacific versus Europe. While European exporters will perform well in the current environment, several European companies show rising stock prices and increasing expectations but stagnant operating fundamentals. However the opposite is true in Asia Pacific; investors are underestimating recent reforms and improving data points.

Europe: “Getting ahead of itself”

In sum, we believe European markets are getting ahead of themselves. While European markets have outpaced other regions year to date in local currency price terms, European exporters will likely be one of the few categories that experience sustained outperformance through the year. Companies focused on the domestic economies or within Europe only should struggle given poor economic growth and little benefit from a depreciating euro. Since the 2011 Greek-inspired Euro Crisis, Europe has experienced margin declines. This is best represented by the fact that in 2012, the MSCI Pan Europe Index had operating margins of 11.5 percent. By March 2015, these margins had declined to 10.2 percent. Despite the margin deceleration, European valuations have increased over the last few years. The market multiple on an enterprise value to sales basis increased from approximately 1.3x in 2012 to 1.6x in 2015. Currently, Europe has the ignoble honor of having the highest percentage of stocks that show negative company fundamentals momentum, but positive relative stock price momentum. A high proportion of stocks with such divergent characteristics lays a risky foundation for further stock price appreciation. From a sector perspective, the Consumer Discretionary and Consumer Staples sectors have the largest concentration of companies with these negative divergent characteristics.

We estimate that European stocks are outperforming and being re-rated based on speculation that the European Central Bank’s quantitative easing will lift the economy and the stock market as similar actions did in the United States. An important note of distinction is that U.S. corporations underwent one of the most efficacious period of restructuring and cost saving reforms during this period of time to compound the benefits from lower borrowing costs. Even without such reforms in Europe and, to the extent that these monetary actions devalue the euro, we believe that some sectors will disproportionately benefit from quantitative easing. Europe’s exporters should perform well in a weak euro environment.

| | |

| | |

| Semi-Annual Report | March 31, 2015 | | 5 |

| | |

| Centre Global Select Equity Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

Europe’s auto producers and aerospace manufacturers receive a substantial amount of sales in U.S. dollars but have material euro cost basis. A weak euro improves the cost competitiveness of such firms. Additionally, the weak euro can help these manufacturers price more aggressively, aiding in market share gains. Over the six month period ending March 31, 2015, the euro has depreciated approximately 15 percent against the U.S. dollar. In the late 1990s, the euro experienced a similar decline (parity with the U.S. dollar) and it aided manufacturers like Airbus to grow their civil aerospace market share from 20 percent to 50 percent. Despite the fall in the euro, European manufacturers should benefit from raw materials such as copper, nickel, and steel being down 40 percent from 2011 levels given weakness across many of the resource-consuming countries, most notably in the emerging markets such as China.

A sustained 2015 advance in European stocks will depend on whether a cheaper euro and lower commodity prices translate into higher margins for the region. Unfortunately despite central bank actions, Europe has not improved its global competitiveness, and this is what is needed to close the growth and profitability gap with other regions. Based on our assessment of the environment and current market conditions described above, we continue to own European exporters such as Daimler, Kone, Michelin, and Safran in the Centre Global Select Equity Fund.

Asia: “Investors underestimating reforms”

In Asia, investors are underestimating recent reforms and improving data points. While Europe’s operating margin as a whole has languished since 2011, profit margins in both China and Japan have increased materially. Operating margins for the Hong Kong Hang Seng China Index increased from 13.6 percent in 2012 to 14.4 percent by March 2015; the operating margin for the Nikkei 225 Index increased from 6.2 percent in 2012 to 7.0 percent by March 2015. The Japanese market’s margin improvements have come mainly from companies within the consumer discretionary, industrials, and information technology sectors. Valuations in these markets have also increased markedly but the corporate operating performance in the region has justified the higher multiples, unlike the situation in Europe. The Chinese market, on an enterprise value to sales basis, increased from approximately 1.1x in 2012 to 1.4x in March 2015; the Japanese market multiple on an enterprise value to sales basis increased from approximately 0.7x in 2012 to 1.2x in March 2015. Both current figures remain below that for Europe and well below the figure for the U.S., perhaps highlighting the relative valuation attractiveness of non-U.S. stocks in general.

Compounding the relative valuation attractiveness, Asia hosts many companies that currently have positive operating momentum but negative relative stock performance; it is one region where a genuine contrarian stance with a positive fundamental catalyst exists broadly. Globally, Asia Pacific has the highest proportion of firms with these characteristics. We think investors will eventually prefer these stocks, causing the region to outperform led by its two major economic powers, Japan and China.

Japan

In Japan, the Industrials sector has the highest number of companies with rising fundamentals but lagging relative share price performance and continued undervaluation. Low raw materials prices and flat Japanese wages have kept the cost base inline for Japanese industrials. This said, continued market appreciation will require corporate Japan to further its recent positive trajectory. Additional progress is possible because, despite recent share price gains, Japanese private sector performance still lags other developed markets substantially. While U.S. operating profit margins are 14 percent, China’s are 13 percent, and Europe is 10 percent, Japan’s operating margins are at 7 percent indicating room to improve despite many of its companies being considered foremost in the world in their operating efficiency. The use of more technology in Japan’s service sector, matching the levels employed in its manufacturing sector, would aid in closing the margin gap. To position the Centre Global Select Equity Fund for these trends, we have invested in and, barring no changes in our outlook, intend to hold Murata Manufacturing, Hitachi High Technologies, Sony, and Bridgestone.

China

In China, the Financials sector has the highest number of companies with improving fundamentals but lagging relative share performance. Chinese banks such as China Construction Bank, Bank of Communications, and Industrial and Commercial Bank lead globally in terms of profitability, profitability momentum, and low valuations. Many investors are fearful of China’s growing debt and consequently shy away from the nation’s banks. However, we are encouraged by China’s recent banking reforms and we think investors are under-appreciating them. We estimate that the following reforms will strengthen China’s financial system and will eventually allay investors’ deepest debt concerns:

| | — | | Future performance reviews of local government officials will include local debt levels to discourage excessive borrowing; |

| | — | | New debt limits for local municipalities; |

| | — | | New public private partnerships for infrastructure projects. National government will encourage bond market participation as a way of getting the market’s approval for local infrastructure projects to improve asset quality; |

| | — | | Deposit insurance so that smaller underfunded banks can fail without damaging public sentiment; and |

| | — | | Greater use asset backed securities by banks to diversify credit risk away from corporate loans towards mortgages, auto loans, and student debt. |

To position the Centre Global Select Equity Fund for these trends, we are invested in Agricultural Bank of China, China Merchants Bank, and China Pacific Insurance.

We believe that our bottom-up research process, with its focus on large capitalization companies that measure favorably in the EVA framework, combined with a smart beta approach to portfolio construction that is focused on GDP-driven regional weightings rather than market capitalization should permit the Fund to take advantage of these better fundamental trends overall in Asia Pacific versus Europe and, to a lesser degree, opportunities in the Americas, Middle East, and Africa, by investing in the most attractive large capitalization blue chip names from the developed world and emerging blue chips from the developing world.

| | |

| Centre Global Select Equity Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

| | | | |

SECTOR WEIGHTINGS As a percentage of Net Assets | | |

| | |

| Financials | | 25.78% | | |

Information

Technology | | 15.68% | | |

| Industrials | | 11.40% | | |

Telecommunication

Services | | 8.87% | | |

| Consumer Staples | | 7.74% | | |

Consumer

Discretionary | | 7.07% | | |

| Health Care | | 6.53% | | |

| Materials | | 5.51% | | |

| Energy | | 5.13% | | |

| Utilities | | 5.00% | | |

Cash and Cash

Equivalents | | 1.29% | | |

| Totals | | 100.00% | | |

| |

COUNTRY WEIGHTINGS As a percentage of Net Assets | | |

| | |

| Japan | | 14.12% | | |

| China | | 12.60% | | |

| Hong Kong | | 7.58% | | |

| India | | 7.40% | | |

| Germany | | 6.30% | | |

| Great Britain | | 5.50% | | |

| France | | 5.34% | | |

| Italy | | 4.79% | | |

| Brazil | | 4.13% | | |

| Canada | | 4.05% | | |

| Spain | | 3.75% | | |

| Mexico | | 2.82% | | |

| Denmark | | 2.39% | | |

| Australia | | 2.34% | | |

| Switzerland | | 2.13% | | |

| Sweden | | 1.75% | | |

| Korea | | 1.70% | | |

| Taiwan | | 1.68% | | |

| Israel | | 1.38% | | |

| Finland | | 1.34% | | |

| Russia | | 1.24% | | |

| Turkey | | 1.09% | | |

| Belgium | | 0.75% | | |

| Singapore | | 0.74% | | |

| Norway | | 0.71% | | |

| Philippines | | 0.61% | | |

| South Africa | | 0.48% | | |

Cash and Cash

Equivalents | | 1.29% | | |

| Totals | | 100.00% | | |

| | | | |

These sector and country allocations may not reflect the current or future positions of the portfolio. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

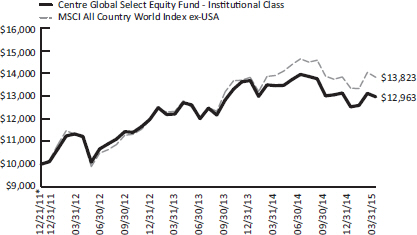

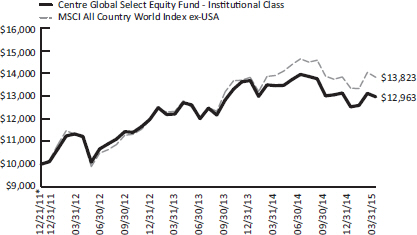

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2015

This graph assumes an initial investment of $10,000 at December 21, 2011, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund’s Institutional Class versus broad-based securities market indices. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Month | | 3

Month | | YTD | | 1 Year | | 3 Year | | Since

Inception* |

Centre Global Select Equity Fund – Investor Class | | | | -1.25 | % | | | | 3.42 | % | | | | 3.42 | % | | | | -3.93 | % | | | | – | | | | | -3.79 | % |

| MSCI All Country World Index ex-USA** | | | | -1.54 | % | | | | 3.59 | % | | | | 3.59 | % | | | | -0.57 | % | | | | – | | | | | 0.52 | % |

Centre Global Select Equity Fund – Institutional Class | | | | -1.15 | % | | | | 3.51 | % | | | | 3.51 | % | | | | -3.65 | % | | | | 4.59% | | | | | 8.24 | % |

| MSCI All Country World Index ex-USA** | | | | -1.54 | % | | | | 3.59 | % | | | | 3.59 | % | | | | -0.57 | % | | | | 6.89% | | | | | 10.38 | % |

| * | Inception date of January 21, 2014 for Investor Class. Inception date of December 21, 2011 for Institutional Class. |

| ** | The benchmark has changed to the MSCI All Country World Index ex-USA from the MSCI All Country World Index on August 1, 2014 to reflect a more appropriate basis for comparing the Fund’s performance. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

The Total Annual Operating Expense Ratio (before expense reimbursements) as stated in the fee table of the most currently effective prospectus of the Fund, dated January 28, 2015, was 2.69% for the Investor Class shares and 1.95% for the Institutional Class shares. The Adviser has entered into a written expense limitation agreement under which it has agreed to limit through January 31, 2016 the total operating expenses of the Fund including (but not limited to) investment advisory fees of the Adviser and distribution/service (Rule 12b-1) fees, but excluding interest, taxes, litigation, brokerage, other expenditures which are capitalized in accordance with generally accepted accounting principles and extraordinary expenses) to an annual rate of 1.45% of the average daily net assets of the Investor Class shares, and 1.25% of the average daily net assets of the Institutional Class shares.

Investing in the securities of foreign companies, including companies in emerging markets, generally involves greater risk than investing in larger, more established domestic companies. Therefore, investments in the Fund may involve a greater degree of risk than investments in other mutual funds that invest in larger, more established domestic companies.

The MSCI All Country World Index ex-USA is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of international developed and emerging markets. You cannot invest directly in an index.

The MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. You cannot invest directly in an index.

The line graph above shows the performance of Institutional Class shares only, since the Institutional Class has the longest period of annual returns. The performance of the Investor Class shares will differ from the performance shown because the Investor Class shares have different expenses than the Institutional Class shares.

| | |

| | |

| Semi-Annual Report | March 31, 2015 | | 7 |

| | |

| Centre Active U.S. Treasury Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2015, the Centre Active U.S. Treasury Fund, Institutional Share Class, delivered a total return of 1.3%; the Investor Share Class delivered a total return of 1.3%.

Performance attribution in the Centre Active U.S. Treasury portfolio is transparent and reflects interest income combined with our duration management decisions that impact capital gain or loss capture. As there are no corporate or mortgage related securities in the portfolio, there are no “spread” components to performance. Performance during the six month period ended March 31, 2015, reflects our investment discipline’s generally bearish outlook for bond prices. The Federal Reserve’s (the FED) target of 2 percent for inflation and potential real growth, currently estimated at around 2 percent, for the U.S. economy would be consistent with a yield of roughly 4 percent for the 10-year U.S. Treasury Note. Additionally, certain indicators of growth, mainly employment and utilization related, have been above the U.S. economy’s growth potential, seemingly increasing the likelihood that the Federal Reserve’s monetary policy would start to move its Federal Fund’s target toward a level more consistent with a long term “normal” policy stance during 2015.

The Fund’s investment objective is to maximize total return through capital appreciation and current income. The Fund pursues this objective by using an active interest rate risk management strategy. We adjust the portfolio’s duration based on a monthly assessment of the likely change in interest rates. Our fundamentally-driven active duration management seeks the potential for capital appreciation and preservation in variable interest rate environments utilizing U.S. Treasury securities including bills, notes, bonds, inflation protected securities (TIPS), cash equivalents and, in certain market environments, futures contracts on U.S. Treasury Notes and Bonds.

Market Review & Outlook

Interest rate behavior during six month review period ended March 31, 2015, was volatile as yields moved lower. At September 30, the yield on the 10-year Treasury—the generally accepted “benchmark” for the U.S. fixed income marketplace—stood at roughly 2.5 percent. It fell to as low as 1.75 percent, moved back to almost 2.25 percent, and ended the quarter slightly below 2 percent. Our discipline, though generally bearish over the period, did participate in the downward move in rates (and upward move in bond prices) between early January and early February as our research review for that period warranted a market like duration. Some of the downward move in rates during the six month time period was due to investor geopolitical concerns and uncertainty over the likely short term impact of lower oil prices. While problems in the Middle East and Russia are nothing new, negative headlines during the period caused capital inflows to the perceived safe haven provided by the U.S. Treasury market. Additionally, while the Federal Reserve did finally remove the “patience” language from its policy statements, its downwardly revised estimates for its average Federal Funds’ Target rate seems to have been interpreted as the potential that the Fed will not act to increase rates as early as its June meeting which had been anticipated.

While the timing of our investment decisions is based on our monthly portfolio research review process, it seems likely that the general trend will be to higher yield levels as we move forward. This assessment is based on the view that the economy will, for a time, continue to grow and that at some point inflationary pressure will begin to build. These forces will, at some point, force the Fed to tighten its policy stance. Additionally, yields on longer maturity securities, which are less dependent upon Fed policy, will likely increase to bring risk premia to more normal levels. Recently published research and analysis of the current state of the U.S. economy is consistent with the view that both the output and employment gaps caused by the “Great Contraction” and the associated financial crisis may be closing faster than expected. The current recovery has now been in place since June of 2009 according to the National Bureau of Economic Research. And, if potential growth is 2 percent rather than the 20th Century average of 3-3.25 percent then the real growth experienced to date may not be as sluggish as originally thought.

Beyond the period of positive growth experienced so far, the unemployment rate has declined from 6.8 percent a year ago to 5.5 percent currently. This level may be equal to or not far off NAIRU, the non-accelerating inflation rate of unemployment. NAIRU is the rate of unemployment that is consistent with healthy or stable growth. And, the U6 unemployment rate which tracks those marginally attached to the labor force as well as those only able to find part time work has also been declining over the last year and is now at 10.9 percent versus 12.8 percent a year ago. Finally, unemployment claims have now moved back to pre-crisis levels. These current conditions would be consistent with research published at the Federal Reserve Bank of Kansas City in 2013 in which it was argued that given the level and rate of change in labor force activity at that time, historical employment “norms” could be reached by the summer of 2015. So, the labor market seems healthy although wage growth has yet to show the acceleration expected as the economic recovery matures. However, if the Job Openings data continue to show an increasing demand for labor increased wages can’t be far behind and there is already anecdotal—Walmart raising its wages—evidence to that effect.

In our view the very recent slowdowns in the pace of economic activity and hiring are not indicative of a return to sub-par growth. Research on the 2013-2014 winter from the Federal Reserve Bank of Chicago concludes that colder than normal temperatures can have a statistically significant negative impact on reported employment. While some Western states including California have had very warm weather, the heavily populated states of the Northeast and Ohio experienced their second coldest winters on record. William Dudley, President of the New York Federal Reserve Bank, recently referred to the harsh winter as a contributor to the likely weaker 1st quarter GDP. Furthermore, he offered an above trend growth outlook—2.7 percent growth—for 2015 as a whole. The weaker ISM manufacturing report for March could reflect—anecdotal based on the responses from Survey participants—both the cold winter and the impact of the strong dollar on exporters.

| | |

| Centre Active U.S. Treasury Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

Going forward, scrutiny of the Fed’s policy statements may be even more intense as investors search for guidance from policy makers about the future direction of monetary policy. Analyses from both the private and public sectors suggest that the Federal Reserve’s policy may already be behind the curve. That is, the Federal Reserve may have already waited too long to begin tightening. Such a delay would be typical of past policy moves—apart from those during “the Great Moderation”. These analyses are based on versions, linear and non-linear, of the Taylor rule which relates the appropriate Federal Funds rate to the size of the output gap and to the difference between actual and target inflation. A related body of investigation as to the correctness of current Fed policy is based on the concept of the “Shadow” Federal Funds Rate. This analysis is based on the concept of a target policy rate that “should” be negative in value at times—in nominal not just real terms. Both approaches would suggest that the Federal Funds rate should currently be 1 percent or higher—not its current zero to 0.25 percent.

Further delay in tightening would be based on the view that the economy is not yet “out of the woods” due to the strong dollar, weak European and Asian growth, or the short term impact of lower oil prices. We have spoken above to the idea that the economy is faltering, and further extended easing could have one of two poor outcomes in our view. The more likely is that extended easing would lead to a more dramatic acceleration in longer-term inflation than would otherwise be the case. This outcome is consistent with the business cycle experience of the U.S.—economic cycle exacerbated by the policy cycle. An alternative outcome that is currently being discussed in policy debates is that the Fed guides, by extending the time period for the near zero target Fund’s rate, the economy into a sustained period of low rates, subpar growth and/or deflation as a zero target rate is not consistent with a continued recovery and a positive inflation goal, i.e. the U.S. becomes Japan. We believe the appropriate policy to prevent this latter outcome would be an increase in the policy rate—again a Fed tightening—accompanied by more quantitative easing or QE.

Longer term the Fisher relationship governs the level of interest rates. This relationship posits that the nominal interest rate—the rate we observe in the marketplace—must equal the real rate plus the expected rate of inflation. Over time the real rate reflects the economy’s real growth potential and, if the Federal Reserve has credibility, inflationary expectations will converge to its target for inflation. Recently, published research from the Federal Reserve Bank of St. Louis appears consistent with the outcomes we anticipate. There would seem to be three likely rate scenarios—though the reasoning is somewhat different. Two result in higher rates—the degree depends on the Fed’s ability/credibility in managing to its inflation target. The third results in a generally low level of rates and poor economic performance.

A reasonable expectation would be that the 10-year yield reaches at least 4 percent. It will be higher with the typical cyclical overshooting and potentially much higher if the Fed’s inflation policy loses credibility and/or is too long delayed. Additionally, if history is a guide, the upward trajectory will not be a smooth one. Rather it will somewhat violent with significant increases followed by periods of decline. In the period from January 1973 to September 1981 the 10-year yield increased by about 10 percent from just over 5 percent to almost 16 percent. But, rates increased in only about 60 percent of the 105 months. If anticipated, downward deviations provide an opportunity for return enhancement.

Our investment discipline utilizes measures of real growth, inflation expectations, market based measures of current valuation and of the likely course of Fed policy changes—historically the market has always moved ahead of policy—in assessing the likely near term course of interest rates. It is intended to preserve capital in periods of significant rate increases by decreasing duration but with the flexibility to extend duration or re-enter the market when our discipline suggests lower rates are likely. As this recovery matures, uncertainty increases as to how much longer it can go on. Periods of “softness” in the data will likely occur providing the opportunity to add value by lengthening exposure.

At some point the Fed will be called on to bring policy in line with reality. Historically, tightening has been associated with contraction and declining rates which is a profit opportunity for bond investors. What is relevant to the potential success of our discipline is that interest rates continue to exhibit cyclical volatility—that the business cycle is not dead. Continued cyclical behavior will provide a basis for success even if the longer term equilibrium level of the economy’s real rate—due to a reduced real growth potential—is lower. While panic buying can move rates dramatically for short time periods, rate behavior over time in driven by the business cycle.

The Centre Active U.S. Treasury Fund is intended to serve as a core fixed income investment. Over time, it is intended to provide a comparable yield as the Treasury market with attractive diversification benefits. In addition to its wealth accumulation and diversification objectives, the strategy readily accommodates both systematic and unforeseen cash needs, given the liquidity of the Treasury market. Furthermore, the utilization of Treasury securities within asset allocation provides attractive diversification properties, as the correlation between Treasury market returns and those of the U.S. equity market is, historically, negative during declining equity markets.

| | |

| | |

| Semi-Annual Report | March 31, 2015 | | 9 |

| | |

| Centre Active U.S. Treasury Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

| | | | |

ASSET TYPE WEIGHTINGS As a percentage of Net Assets | | |

| | |

| Government Bond | | 67.41% | | |

Cash and Cash

Equivalents | | 32.59% | | |

| Totals | | 100.00% | | |

| |

These allocations may not reflect the current or future positions of the portfolio. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

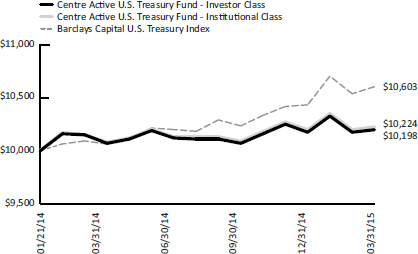

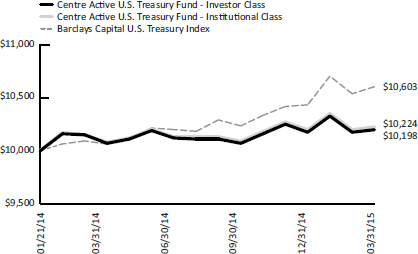

| GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2015 |

This line graph assumes an initial investment of $10,000 at January 21, 2014, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the Barclays Capital U.S. Treasury Index. Unlike the Fund, an index is not available for investment and is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2015

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Month | | 3 Month | | YTD | | 1 Year | | Since Inception (January 21, 2014) |

Centre Active U.S. Treasury Fund – Investor Class | | | | 0.23 | % | | | | 0.23 | % | | | | 0.23 | % | | | | 1.27 | % | | | | 1.66 | % |

Centre Active U.S. Treasury Fund – Institutional Class | | | | 0.26 | % | | | | 0.26 | % | | | | 0.26 | % | | | | 1.43 | % | | | | 1.88 | % |

Barclays Capital U.S. Treasury Index | | | | 0.63 | % | | | | 1.64 | % | | | | 1.64 | % | | | | 5.36 | % | | | | 5.05 | % |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

The Total Annual Operating Expense Ratio (before expense reimbursements) as stated in the fee table of the most currently effective prospectus of the Fund, dated January 28, 2015, was 2.16% for the Investor Class shares and 1.93% for the Institutional Class shares. The Adviser has entered into a written expense limitation agreement under which it has agreed to limit for a period of two years from November 4, 2013 the total expenses of the existing class of shares of the Fund (including (but not limited to) investment advisory fees of the Adviser and distribution/ service (Rule 12b-1) fees, but excluding interest, taxes, litigation, brokerage commissions and extraordinary expenses not incurred in the ordinary course of the Fund’s business) to an annual rate of 0.92% of the average daily net assets of the Investor Class shares and 0.67% of the average daily net assets of the Institutional Class shares.

Barclays Capital U.S. Treasury Index – includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. You cannot invest directly into an index.

| | |

| Centre Active U.S. Tax Exempt Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

Performance & Strategy Summary

For the six month period ended March 31, 2015, the Centre Active U.S. Tax Exempt Fund, Institutional Share Class, delivered a total return of 0.8%; the Investor Share Class delivered a total return of 0.6%. Institutional and Investor Class Shares commenced operations on March 18, 2015. Performance for the period from October 1, 2014 to the date of reorganization represents the performance of its predecessor fund, the Managed Municipal Fund, Inc., which was reorganized into the newly formed Centre Fund on March 17, 2015.

The Fund’s investment objective is to maximize investors’ total return through capital appreciation and current income exempt from federal income tax. The Fund seeks to achieve its investment objective through investment in a portfolio consisting primarily of federally tax exempt municipal obligations of state and local governments in the U.S. and their political subdivisions, agencies, and instrumentalities. We attempt to preserve principal and to enhance return by adjusting the portfolio’s duration, which is its sensitivity to interest rate changes. We adjust the portfolio’s duration based on a monthly assessment of the likely change in interest rates. Our orientation toward high quality municipal securities allows us to better manage credit spread risk and to facilitate duration management. A monthly review provides the opportunity to capture not only the cyclical trend in rates but also the deviations away from the trend that invariably occur. Our fundamentally-driven active duration management includes, in certain market environments, using futures contracts on U.S. Treasury securities. These contracts are exchange traded and backed, are extremely liquid with minimal transaction charges, and have a long history of use in risk management. Additionally, they currently receive favorable capital gains tax treatment. As a result, Treasury based futures provide a low cost tax-advantaged means of managing interest rate risk, leaving the portfolio’s core municipal security holdings in place to generate tax-free income. The performance of the portfolio is intended to reflect this income as well as any change in value experienced by our duration adjustments.

Market Review and Outlook

During the six month review period ended March 31, 2015 the municipal bond market generally continued its return to normalcy relative to the U.S. Treasury market. Since the early 1980s, municipal bond returns had a positive correlation with Treasury market returns of almost 0.7. However, the normal relationship was distorted as dire warnings were issued about the likely insolvency of a large number of municipalities and states because of pension and health care liabilities. The correlation of returns fell to nearly 0.3 as municipal securities’ prices fell and yields increased, actually “traded through” yields on comparable maturity Treasuries. While some municipality and state securities continue to have problematic outlooks, e.g., Detroit, California, Illinois, the municipal bond market in general has performed well as the correlation has moved back in line with long term averages. The return to normalcy in the relationship between Treasury and municipal security returns facilitates the use of treasury futures in managing duration and interest rate exposure.

As we look forward, our expectation is that interest rate risk will increase as yields in general move higher as the economic recovery continues and inflationary pressures begin to build. If we are correct, interest rate risk to the value of municipal holdings will increase. Recently published research and analysis of the U.S. economy is consistent with the view that both the output and employment gaps caused by the “Great Contraction” and the associated financial crisis may be closing faster than expected. The current recovery has now been in place since June 2009 according to the National Bureau of Economic Research. And, if potential growth is 2 percent rather than the 20th century average of 3-3.25 percent, then the real growth experienced to date may not be as sluggish as originally thought.

Beyond the period of positive growth experienced so far, the unemployment rate has declined from 6.8 percent a year ago to 5.5 percent currently. This level may be equal to or not far off NAIRU, the non-accelerating inflation rate of unemployment. NAIRU is the rate of unemployment that is consistent with healthy or stable growth. And, the U6 unemployment rate which tracks those marginally attached to the labor force as well as those only able to find part time work has also been declining over the last year and is now at 10.9 percent versus 12.8 percent a year ago. Finally, unemployment claims have now moved back to “pre-crisis” levels. These current conditions would be consistent with research published at the Federal Reserve Bank of Kansas City in 2013 in which it was argued that given the level and rate of change in labor force activity at that time, historical employment “norms” could be reached by the summer of 2015. So, the labor market appears healthy, although wage growth has yet to show the acceleration expected as an economic recovery matures. However, if the Job Openings data continue to show an increasing demand for labor, increased wages cannot be far behind and there is already anecdotal—Walmart raising its wages—evidence to that effect.

In our view recent slowdowns in the pace of economic activity and hiring are not indicative of a return to sub-par growth. Research on the 2013-2014 winter from the Federal Reserve Bank of Chicago concludes that colder than normal temperatures can have a statistically significant negative impact on reported employment. While some Western states including California have had very warm weather, the heavily populated states of the Northeast and Ohio experienced their second coldest winters on record. William Dudley, President of the New York Federal Reserve Bank, recently referred to the harsh winter as a contributor to the likely weaker 1st quarter GDP. Furthermore, he offered an above trend growth outlook—2.7 percent growth—for 2015 as a whole. The weaker ISM manufacturing report for March could reflect—anecdotal based on the responses from survey participants—both the cold winter and the impact of the strong dollar.

Going forward, scrutiny of the Fed’s policy statements may be even more intense as investors search for guidance from policy makers about the future direction of monetary policy. Analysis from both the private and public sectors suggest that the Federal Reserve’s policy may already be “behind the curve.” That is, the Federal Reserve may have already waited too long to begin tightening. Such a delay would be typical of past policy moves—apart from those during “the Great Moderation”. These analyses are based on versions, linear and non-linear, of the Taylor rule which relates the appropriate Federal Funds rate to the size of the output gap and to the difference between actual and target inflation. A related body

| | |

| | |

| Semi-Annual Report | March 31, 2015 | | 11 |

| | |

| Centre Active U.S. Tax Exempt Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

of investigation as to the correctness of current Fed policy is based on the concept of the “Shadow” Federal Funds Rate. This analysis is based on the concept of a target policy rate that “should” be negative in value at times—in nominal not just real terms. Both approaches would suggest that the Federal Funds rate should currently be 1 percent or higher—not 0.25 percent.

Further delay in tightening would be based on the view that the economy is not yet out of the woods due to the strong dollar, weak European and Asian growth, or the short term impact of lower oil prices. We have spoken above to the idea that the economy is faltering, and further extended easing could have one of two poor outcomes. The more likely is that extended easing would lead to a more dramatic acceleration in inflation than would otherwise be the case. This outcome is consistent with the business cycle experience of the U.S.—economic cycle exacerbated by the policy cycle. An alternative outcome that is currently being discussed in policy debates is that the Fed guides, by extending the time period for the near zero target Fund’s rate, the economy into a sustained period of low rates, subpar growth and/or deflation as a zero target rate is not consistent with a continued recovery and a positive inflation goal, i.e. the U.S. becomes Japan. We believe the appropriate policy to prevent this latter outcome would be an increase in the policy rate—again a Fed tightening—accompanied by more quantitative easing or QE.

Longer term the Fisher relationship governs the level of interest rates. This relationship posits that the nominal interest rate—the rate we observe in the marketplace—must equal the real rate plus the expected rate of inflation. Over time the real rate reflects the economy’s real growth potential and, if the Federal Reserve has credibility, inflationary expectations will converge to its target for inflation. Recently published research from the Federal Reserve Bank of St. Louis appears consistent with the outcomes we anticipate. There would seem to be three likely rate scenarios—though the reasoning is somewhat different. Two result in higher rates—the degree depends on the Fed’s ability/credibility in managing to its inflation target. The third results in a generally low level of rates and poor economic performance.

A reasonable expectation would be that the 10-year yield reaches at least 4 percent. It will be higher with the typical cyclical overshooting and potentially much higher if the Fed’s inflation policy loses credibility and/or is too delayed. Additionally, if history is a guide, the upward trajectory will not be a smooth one. Rather it will be somewhat violent with significant increase followed by periods of decline. In the period from January 1973 to September 1981 the 10-year yield increased by about 10 percent from just over 5 percent to almost 16 percent. But rates increased in only about 60 percent of the 105 months. If anticipated, downward deviations provide an opportunity for return enhancement.

Municipal rates will move higher as Treasury yields rise especially as the normal relationship—correlation—between the two markets has been reestablished. And, since the municipal bond yield curve rarely inverts, the ability to mitigate against rising rates through the use of Treasury based futures should allow the core municipal portfolio’s yield to continue to benefit from the risk premium available from longer maturity holdings.

Our investment discipline utilizes measures of real growth, inflation expectations, market based measures of current valuation and of the likely course of Fed policy changes—historically the market has always moved ahead of policy—in assessing the likely near term course of interest rates. It is intended to preserve capital in periods of significant rate increases by decreasing duration but with the flexibility to extend duration or re-enter the market when our discipline suggests lower rates are likely. As this recovery matures, uncertainty increases as to how much longer it can go on. Periods of “softness” in the data will likely occur providing the opportunity to add value by lengthening exposure.

At some point the Fed will be called on to bring policy in line with reality. Historically, tightening has been associated with contraction and declining rates which is a profit opportunity for bond investors. What is relevant to the potential success of our discipline is that interest rates continue to exhibit cyclical volatility—that the business cycle is not dead. Continued cyclical behavior will provide a basis for success even if the longer term equilibrium level of the economy’s real rate—due to a reduced real growth potential—is lower. While panic buying can move rates dramatically for short time periods, rate behavior over time in driven by the business cycle.

The Centre Active U.S. Tax Exempt Fund is intended to serve as a core fixed income investment. It is designed to help mitigate against the loss of value from rising rates while continuing to provide tax-free cash flow. Additionally, its design allows for increased exposure and enhanced return as rates experience downward deviations from a rising trend or when the economy moves back into contraction. Our emphasis on investing in higher quality obligations helps control default risk as the next contraction impacts revenue collection negatively and it also facilitates hedging through the use of Treasury related securities. Finally, the potential return from successfully managing interest rate exposure will likely outweigh any return pick-up from holding higher yield lower quality bonds. Avoiding a 1 percent rise in rates prevents a 5 percent loss of value; it would be difficult if to gain that much extra return even from “junk” municipal securities.

| | |

| Centre Active U.S. Tax Exempt Fund | | Manager Commentary |

| | March 31, 2015 (Unaudited) |

| | | | |

SECTOR WEIGHTINGS As a percentage of Net Assets | | |