UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

CENTRE FUNDS

(Exact name of registrant as specified in charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of principal executive offices) (Zip code)

James A. Abate

48 Wall Street, Suite 1100

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 918-4705

Date of fiscal year end: September 30

Date of reporting period: October 1, 2017 – March 31, 2018

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

| | | PAGE |

| SHAREHOLDER LETTER | | 1 |

| MANAGER COMMENTARY | | 2 |

| Centre American Select Equity Fund | | 2 |

| Centre Active U.S. Treasury Fund | | 7 |

| Centre Active U.S. Tax Exempt Fund | | 12 |

| Centre Global Infrastructure Fund | | 16 |

| DISCLOSURE OF FUND EXPENSES | | 19 |

| SCHEDULE OF INVESTMENTS | | 20 |

| Centre American Select Equity Fund | | 20 |

| Centre Active U.S. Treasury Fund | | 22 |

| Centre Active U.S. Tax Exempt Fund | | 23 |

| Centre Global Infrastructure Fund | | 24 |

| STATEMENTS OF ASSETS AND LIABILITIES | | 27 |

| STATEMENTS OF OPERATIONS | | 28 |

| STATEMENTS OF CHANGES IN NET ASSETS | | 29 |

| Centre American Select Equity Fund | | 29 |

| Centre Active U.S. Treasury Fund | | 30 |

| Centre Active U.S. Tax Exempt Fund | | 31 |

| Centre Global Infrastructure Fund | | 32 |

| FINANCIAL HIGHLIGHTS | | 33 |

| Centre American Select Equity Fund | | 33 |

| Centre Active U.S. Treasury Fund | | 35 |

| Centre Active U.S. Tax Exempt Fund | | 37 |

| Centre Global Infrastructure Fund | | 39 |

| NOTES TO FINANCIAL STATEMENTS | | 41 |

| ADDITIONAL INFORMATION | | 52 |

| Centre Funds | Shareholder Letter |

March 31, 2018 (Unaudited)

Dear Shareholders,

It is with my pleasure that we publish the Centre Funds Semi-Annual Report covering the six-month period ended March 31, 2018. I want to thank my fellow shareholders for their continued support and confidence in Centre Funds. We are committed to truly active fund management with distinction.

Each series of Centre Funds is a fundamentally-driven, actively managed Fund in core investment strategies with differentiation and using specialist talent. We offer a select series of funds to choose from, each available in investor and institutional share classes.

Centre American Select Equity Fund

The Fund is a U.S. large capitalization valuation sensitive growth stock fund that seeks long-term growth of capital and is focused on risk adjusted returns through active and pragmatic management; the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed appropriate. The Fund is intended to be a risk managed core growth fund.

Centre Active U.S. Treasury Fund

The Fund is a nontraditional U.S. Treasury securities fund that seeks to maximize investors’ total return through capital appreciation and current income through investments in primarily U.S. Treasury securities. The Fund has the potential for capital appreciation/preservation in various interest rate environments through a proprietary interest rate forecasting process that aims to take advantage of interest rate changes through active duration and interest rate management.

Centre Active U.S. Tax Exempt Fund

The Fund is a nontraditional municipal securities fund that seeks to maximize investors’ total return through capital appreciation and income exempt from federal income tax using active duration management of a core portfolio of highly rated federally tax exempt securities of state and local governments in the U.S. and their political subdivisions, agencies and instrumentalities. The Fund has the potential for capital appreciation/preservation in various interest rate environments through a proprietary interest rate forecasting process that aims to take advantage of interest rate changes through active duration and interest rate management.

Centre Global Infrastructure Fund

The Fund is for investors seeking to potentially benefit from a renewed focus on infrastructure spending revival, but wish to have liquidity in publicly traded investments in developed global markets rather than illiquid private investments. The Fund pursues a bottom-up, active management approach and invests in what we deem the most attractive infrastructure stocks from the United States and developed international economies. Also, the Fund seeks to balance its exposures to where the weights of the Telecommunication, Utilities, Energy, Transportation, and Social Infrastructure industries are broadly represented.

Our aim at Centre Funds is to deliver strong, long-term performance results for investors through an exceptional focus on producing returns and managing risk and downside volatility in select investment strategies. We want investors to associate Centre Funds with high-conviction, differentiated fund strategies that may not be available elsewhere and are tactical, pragmatic, and opportunistic. Each investment strategy aims to capitalize on defined market opportunities using talented and experienced portfolio managers with consistent and repeatable investment processes who aim to achieve true differentiated returns. Our portfolio managers remain focused on fundamentally-driven investment approaches within truly active, high conviction, disciplined and research intensive processes. At Centre Funds, we place service excellence at the core of everything that we do and are committed to providing useful information on all of the Funds. Again, I want to thank my fellow shareholders for their continued support and confidence in the Centre Funds.

Sincerely,

James Abate

President, Centre Funds

| Semi-Annual Report | March 31, 2018 | 1 |

| Centre American Select Equity Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Performance & Strategy Summary

For the six-month period ended March 31, 2018, the Centre American Select Equity Fund, Investor Share Class, delivered a total return of 8.66 percent; the Institutional Share Class delivered a total return of 8.76 percent.

During this past six-month period, the key barometer of the U.S. stock market as a whole, as measured by the S&P 500 Index1 , delivered a total return of 5.83 percent, led by pro-cyclical sectors such as Consumer Discretionary, Technology, Financials, Industrials, and Materials, whilst more historically defensive sectors such as Telecommunications, Utilities, Real Estate, and Consumer Staples lagged along with Energy.

Stocks that were the strongest contributors to performance within the Fund over the six-month period ended March 31, 2018 included: within the Consumer Discretionary sector, Netflix, Amazon, Ralph Lauren, Viacom, and The Gap; within the Technology sector, Adobe Systems, NVidia, Microsoft, and Intel; and companies in other sectors. Other stocks that helped were Freeport-McMoRan, NRG Energy, CBRE Group, Raytheon, and ConocoPhillips. Stocks that contributed negatively included: Devon Energy, Microchip Technology, Cabot Oil & Gas, McDonald’s, and Hershey. The Fund was negatively impacted from a total return perspective by the amortization costs of certain hedges and other investments that Centre Asset Management, LLC (“Centre,” the “Adviser” or “we”), the investment adviser to the Fund, viewed, and continues to view, as capital protective in nature. That said, these capital protection hedges, namely protective put options2 on the S&P 500 Index, have in the past insulated the Fund from the same magnitude of maximum drawdown3 experienced by the overall stock market over prior volatile4 episodes, namely in August 2015, January 2016 and, more recently, February 2018. Given the continued presence of certain potentially de-stabilizing factors that we believe could negatively impact the value of underlying equity securities held in the Fund’s portfolio, as of March 31, 2018, the Fund continued to hold put options on the S&P 500 Index as a potential hedge against its underlying stock holdings in the event of a material stock market correction.

The process used by Centre to manage the Fund focuses on each individual portfolio company’s growth outlook and capacity to create shareholder value, utilizing our bottom-up fundamental stock selection process. We utilize a disciplined, Economic Value Added5 framework to select investments. The framework focuses on the fundamentals of wealth creation or wealth destruction similar to the way a traditional, long-term focused corporate investor looking at all aspects of the business would assess a company’s value. In the shorter-term, markets may often undervalue or overvalue a company’s ability to create or destroy wealth. The framework seeks to identify and capture these investment opportunities. The approach is designed to capture excess returns when a business is creating shareholder wealth and the market price of the stock converges toward our target price. Centre not only analyzes earnings but also strives to understand and link the capital allocation decisions being made today by each portfolio company and how they may lead to future earnings growth. In other words, we expect that the companies in which the Fund invests will themselves invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that should create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. The key is that we look at the company drivers that create true shareholder wealth: capital spending or alternative capital allocations such as acquisitions, stock buybacks, or dividends; company specific risk levels of a business to determine appropriate hurdle rates6 ; and whether the company is generating operating returns on its underlying assets vis-à-vis the cost of capital. Wealth creation from growth or from wise-contraction – that’s how we believe companies create shareholder value.

To meet its objective as a risk managed growth fund, the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed tactically appropriate by Centre. While use of hedging and certain investment techniques involve risk, in accordance with the Fund’s investment policies, the Adviser may tactically employ hedges and other capital preservation strategies on up to 100 percent of the value of the Fund’s underlying securities positions when the Adviser’s assessment of market valuation indicates forward returns for the stock market, as a whole, are low relative to downside risk and the cost to upside potential from portfolio preservation tools is deemed reasonable in order to respond to adverse market, economic, political or other conditions. The Adviser may also tactically employ hedges to reduce volatility. For example, through the tactical use of put options, the Fund may have enhanced performance and more limited risk. Index put options are designed to hedge the Fund from significant market declines that may occur over short periods of time. The value of an index put option generally increases as the underlying securities in the Fund decrease in price and decreases as those securities increase in price. The Adviser may also seek to enhance returns by writing (selling) out of the money call options tailored with exercise prices generally above the current market prices of stocks held in the Fund. As the seller of the call option, the Fund receives cash (the premium) from the purchaser7 . The Adviser varies its hedging strategy and defensive positions across changing market cycles but has generally employed such strategies within the Fund since late 2014.

| 1 | S&P 500 is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. |

| 2 | A put option is a contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. |

| 3 | Maximum drawdown is the maximum loss from a peak to a trough of a portfolio, before a new peak is attained. |

| 4 | Volatility is a measure of systematic risk of a security or a portfolio in comparison to the market as a whole. |

| 5 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| 6 | A hurdle rate is the minimum rate of return on a project or investment required by a manager or investor. The hurdle rate denotes appropriate compensation for the level of risk present; riskier projects generally have higher hurdle rates than those that are deemed to be less risky. |

| 7 | A covered call is an options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. |

| Centre American Select Equity Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Market Review & Outlook

As investors move forward further into 2018, it is becoming clearer that the low volatility, highly optimistic tone that embodied U.S. stocks in 2017 has been disturbed and, in advance of such increased volatility and potential downside risks, we have positioned the portfolio accordingly. The most frequent argument we hear championed for a continuation of the positive momentum in the stock market is that revenue and profit growth for the vast majority of companies in the S&P 500 Index, as well as in aggregate, are expected to be the strongest since the economic recovery began in 2010. Unfortunately, in our view, economic and profit growth, whilst being the single biggest factor influencing stock prices over the long-term, have little to no correlation in the short and even intermediate term, as stock prices will be much more highly influenced by changes in interest rates and investors’ re-pricing of risk. In other words, while understanding both secular and, even more importantly, cyclical trends as growth oriented investors, we believe that valuation is the single most critical element of successful investing year over year and over a three to five year “normal” investment cycle. The key is to find great companies when they present themselves as great stock investments. Unfortunately, the number of companies meeting both criteria to us is small and shrinking now.

The term “paradigm shift” is technically a valid way to describe material change but it has been so overused in the business world as to lose its efficacy in calling attention to matters. Regardless, we’re at a loss for a substitute, with the change in course by the Federal Reserve to begin the process of normalizing short term interest rates and start reducing its vast holdings of Treasury Bonds and other assets while, simultaneously, the supply of new Treasury issuance explodes due to increasing budget deficits, bringing about the first challenge to the environment of ultra-accommodative monetary policy, liquidity, and suppressed low cost of capital that’s been in place since 2009. While we do not expect interest rates to rise dramatically, especially on longer maturities, the rise in short term rates plus the prospect of additional increases in the Target Federal Funds Rate8 in 2018 and 2019 will negatively impact stock valuations as the “risk-free” Treasury rate is the foundation of asset pricing for all levels of risk assets. Historically, rising interest rates are the kryptonite to long-dated, richly valued assets, namely stocks. One way to roughly estimate the impact that ultra-accommodative monetary policy and, in particular suppressed interest rates, have had is to isolate analysis to the Utilities Sector. The purpose of doing this is that it nearly eliminates the argumentative contrast that U.S. companies are more efficient, innovative and profitable now as demonstrated by secularly rising Returns on Assets (ROA) and Returns on Equity (ROE) for the S&P 500 Index in aggregate. Most utilities within the Sector, while admittedly better run than in the past, are regulated and subject to legislative caps on their ROE’s as well as being capital intensive. Proving this point is the fact that, over the past twenty-five years, there has not been any material fundamental improvement in ROE’s or ROA’s for the Utilities Sector on an equal weighted basis, unlike the case for nearly all other Sectors of the S&P 500 Index. This being said, valuation multiples9 that we emphasize for the Utilities Sector show the group being valued forty percent higher than its long term average, with all of the re-rating occurring since 2010. Applying this insight across the board means that stocks are up to forty percent overvalued simply from the suppressed level of interest rates in place since then but which are now seemingly moving higher and, perhaps, while not dramatically, will be significant amounts proportionally from the near zero levels enjoyed since 2010.

There have also been changes in stock-bond yield correlations, which have been largely positive since the late 1990’s, increased significantly following the global financial crisis of 2008-2009, and have remained at a high level until very recently. This positive correlation is consistent with other episodes where there was an increase in uncertainty about the outlook for economic growth, such as the 1930s Depression. The recent period of positive stock-bond yield correlation has been in place for the past twenty years or so but, it’s important to remember that this is abnormal and changes in U.S. monetary policy have historically driven correlations lower. Why the recent change in correlations from positive to negative is so critical now is that the traditional stock-bond mix of a balanced portfolio held assets that provided diversified returns with one directionally gaining and offsetting the loss on the other side and vice-versa. For the first time in many investment professionals’ careers, the environment looks to be “back to the future” with potentially no place to hide other than cash amongst traditional asset classes (which has been largely abandoned in asset allocation due to the low level of short term interest rates), raising the value of hedges. The trading disruption from so-called “risk-parity” funds, which are nothing but an updated version of what used to be called tactical asset allocation funds, can be more dramatic now in an environment of increasing volatility and false sense of liquidity given the new phenomenon of smart-beta indexing, high frequency trading, artificial intelligence, and other so-called improvements to financial markets away from human fact based decision making and interaction and floor exchange based trading.

Looking at things optimistically, it is plausible to temper the negative impact from rising interest rates (from essentially zero) given the tremendous growth in earnings that began in 2017 which is expected to continue in 2018 and 2019. Aggregate S&P 500 Bottom Up ($/share) earnings estimates for calendar years 2019 and 2018 are expected to be $173.93 and $157.96, respectively, up from $132.00 in 2017 and $118.10 in 2016. This represents sequential growth rates of ten percent, twenty percent, and twelve percent, respectively10 , and highlights a definite change in the “secular stagnation” environment of 2014-2016. It is this rather positive outlook which underlies our belief that a long, drawn out bear market in anticipation of a recession remains a very low probability despite this economic recovery being one of the longest on record. Furthermore, many of the late cycle excesses in terms of over-aggressive asset growth – new plant and equipment, inventories, etc., are not evident now.

| 8 | The federal funds rate is the rate at which depository institutions (banks) lend reserve balances to other banks on an overnight basis. Reserves are excess balances held at the Federal Reserve to maintain reserve requirements. |

| 9 | Valuation multiples is a valuation theory based on the idea that similar assets sell at similar prices. This assumes that a ratio comparing value to some firm-specific variable (operating margins, cash flow, etc.) is the same across similar firms. |

| 10 | Source: Thomson Reuters I/B/E/S |

| Semi-Annual Report | March 31, 2018 | 3 |

| Centre American Select Equity Fund | Manager Commentary |

March 31, 2018 (Unaudited)

With rising interest rates in the minus column and increasing profits on the plus side, what tips our view to negative in this paradigm shift? In one word, it’s risk. The mathematics in any valuation model, from basic to complex, captures a foundation risk-free interest rate, some measure of earnings or cash flow, a growth rate associated with such earnings or cash flow, plus a risk premium to represent compensation for risk, measured relative to the risk-free rate. Based upon our analysis, the equity risk premium has been extraordinarily low since the end of 2014 (and continued to fall), which explains why stocks rose in price in 2015 and 2016 despite the stagnation in aggregate S&P 500 ($/share) earnings and relative stability in interest rates. The compression of risk premiums has not been isolated to stocks but, in fact, has been more profoundly evident in bonds as overly cheap credit is best illustrated by the fact that European High Yield Bond Indexes, i.e., “junk bonds”11 , have a lower yield than comparable maturity U.S. Treasury Bonds. The most significant driver of this has been not only ultra-accommodative policies and liquidity supplied from the U.S. Federal Reserve but their counter-parts in the Eurozone, Japan, and China. From our proprietary analytical work, it is important to point out that risk premiums being low (as they are today) in themselves are not problematic as long as they are directionally trending even lower. Historically, market corrections occur when risk premium are low but the trend has turned to rising, recent example being years 2000 and 2008.

With the U.S. scaling back its monetary stimulus, the Eurozone under increasing pressure to not expand or extend its Quantitative Easing (QE) program, Japan’s multi-pronged efforts to weaken the yen largely played out, and China’s credit bubble reaching untenable levels, we see the suppression of risk premiums having run its course negatively impacting the valuation of all risky assets and, in particular, long duration assets most sensitive to changes in the required rate of return such as U.S. stocks. Aside from central bank policies, risk needs to be examined comprehensively and fundamentally, not just expressed in terms of stock market movements. Negatively, outside of the banking industry, the U.S. has not experienced a deleveraging since 2009 but has actually increased its risk from leverage, the difference being that it is now in the corporate and government sectors rather than the household sector. Furthermore, while it’s been a positive that the use of such increased leverage in the corporate sector has not led to excessive industrial capacity and inventories, such debt financed cash sources have been used primarily in aggregate for stock buybacks. Thus, corporations have increased their risk from more leverage to purchase an asset that has no future utility in terms of generating revenue or cash flow to service such debt. From this perspective, risk has likely increased negatively impacting valuation multiples.

Consistent with his America First campaign pledges, President Trump has begun the process of trying to institute remedies that would offset the mercantilist export advantages and attacks on America’s intellectual property that China has enjoyed since joining the World Trade Organization (“WTO”) in 2001. The early stages of this relationship, cheap and plentiful consumer goods for U.S. consumers and the potential for democratic, pro-Western liberal reforms in China, was viewed as more than offsetting the costs of de-industrialization of America and potential loss of long-term competitive advantage. Furthermore, the “offshoring”12 of America’s prior inventory and excess capacity cycles to China diminished the traditional recession risks from excess capacity, which is why the recession in 2009 was largely a Wall Street phenomenon rather than a Main Street one.

Now after almost two decades of unprecedented trade imbalances and a rise in China’s industrialization on a scale last seen by America in the mid-and late 19th century followed shortly thereafter by Bismarck’s Germany (both at the expense of the United Kingdom), the age old argument of protective tariffs favoring local industry versus a progressive posture favoring consumers is front and center in American politics at a temperature level likely last seen during the turn of the 20th Century when Theodore Roosevelt was President. It’s unimportant in terms of personal views on which side is right (our personal view is that despite China being a natural ally and partner of the U.S. for many reasons, this fight should have happened more than a dozen years ago within the mechanisms of the WTO but America still holds the one asset that no one else can match, access to the largest and richest consumption market in the World), the issue for corporations and stocks is that the net impact from this enormous change in politics and Sino-American trade relations will be a negative hit to profits margins (due to higher input and labor costs) and, within our paradigm shift proposal, an increase in risk, geopolitically as well as at the corporate level, negatively impacting valuation multiples.

Although somewhat extraneous to the points raised above, the parabolic rise (and fall in 2018 thus far) in bitcoin and other crypto-currencies is somewhat useful in that it highlights how sudden a change in risk appetites can have on the price of a “so-called” asset. Having served as a fund manager of U.S. equity and technology-focused sector funds and navigated the rise in technology-related stocks in 1999 and their subsequent collapse in early 2000 ahead of the corrections in broader stock market indexes back then, it is tough not to similarly view the recent collapse of these crypto-currencies as the canary in the coal mine for other risky assets; crypto-currencies simply represent the most extreme point on the risk tolerance scale like dot-com stocks did back then.

| 11 | A junk bond refers to high-yield or noninvestment-grade bonds. Junk bonds are fixed-income instruments that carry a credit rating of BB or lower by Standard & Poor’s, or Ba or below by Moody’s Investors Service. Junk bonds are so called because of their higher default risk in relation to investment-grade bonds. |

| 12 | Offshoring is the relocation of a business process from one country to another—typically an operational process, such as manufacturing, or supporting processes, such as accounting. |

| Centre American Select Equity Fund | Manager Commentary |

March 31, 2018 (Unaudited)

In sum, we have a U.S. stock market trading at valuation multiples that are potentially up to forty percent above intrinsic value with the contributing factors that led to the re-rating higher, suppressed low interest rates and risk premiums, now reversing. On the other hand, profits are rising and certain Sectors, namely Energy, are displaying the best earnings growth in some time and, having underwent a severe rationalization due to the commodity price collapse in 2015-2016, is doing so more efficiently than in the past. We remain consistent in our belief that a bear market due to an oncoming recession is a low probability but an increase in sudden and sharp drawdowns, i.e., crashes, are more probable and likely to occur. Our biggest concern is rather unorthodox. What we mean is that unlike the normal sequence of events of the stock market being a leading forecast of the economy, the financialization13 of the economy, best evidenced by the wholesale embracement of stock buybacks as the main usage of cash flows may lead to a reverse in sequence, whereby a stock market sell-off due to any number of reasons, is then compounded by the reliance upon low financial market volatility, which then leads to slowdown in corporate and consumer confidence that leads to slower economic growth, and becoming circular in impact to stock markets.

In light of these conditions, with risks creating what we deem to be a potentially dangerous backdrop for not only capital growth but capital preservation, we continue to emphasize a barbell of secular growth stocks with contrarian, opportunistic cyclical growth companies. In addition, we continue to employ tail hedges on the Fund’s underlying stock portfolio with deep out of the money protective put options as well as deep out of the money single stock covered call selling. So, despite our bottom-up optimism for the companies owned currently by the Fund, we remain less enthusiastic about the prospects for capital gains in U.S. stocks as a whole than we have been in the past. Also, with capital protection from traditional diversification ebbing, we believe that our pragmatic large capitalization valuation sensitive growth and concentrated, high-conviction approach to stock selection, with a cognizance of risk management that includes tactically implementing capital protective investments, seems positioned to perform well relative to less risk aware strategies.

| 13 | Financialization refers to the increase in size and importance of a country’s financial sector relative to its overall economy. Financialization has occurred as countries have shifted away from industrial capitalism. This impacts both the macroeconomy and the microeconomy by changing how financial markets are structured and operated and by influencing corporate behavior and economic policy. |

The market outlook is the opinion of the author and can change at any time.

| Semi-Annual Report | March 31, 2018 | 5 |

| Centre American Select Equity Fund | Manager Commentary |

March 31, 2018 (Unaudited)

SECTOR WEIGHTINGS

As a percentage of Net Assets

| Information Technology | 37.72% |

| Consumer Discretionary | 20.30% |

| Energy | 13.42% |

| Industrials | 6.56% |

| Health Care | 6.52% |

| Consumer Staples | 3.65% |

| Utilities | 3.35% |

| Materials | 3.34% |

| Purchased Options | 1.95% |

| Real Estate | 1.51% |

| Financials | 1.34% |

| Cash, Cash Equivalents, and Other | 0.34% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

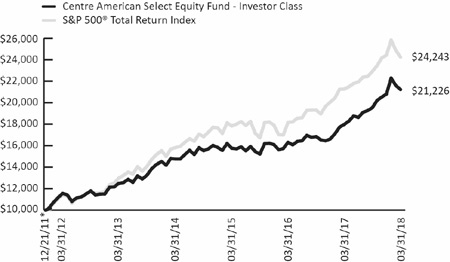

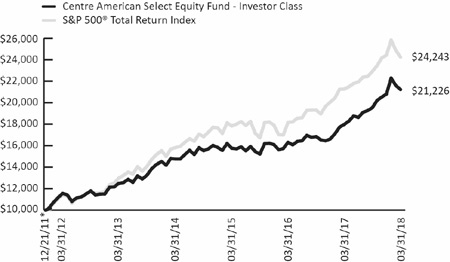

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2018

This graph assumes an initial investment of $10,000 at December 21, 2011, the inception date for Investor Class shares, which have the longest period of annual returns, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund's Investor Class versus the S&P 500® Total Return Index. Taxes on Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2018

| | 1 Month | 3 Month | YTD | 1 Year | 3 Year Average Annualized | 5 Year Average Annualized | Since Inception* Average Annualized |

| Centre American Select Equity Fund – Investor Class | -1.72% | 2.03% | 2.03% | 18.06% | 10.44% | 11.17% | 12.74% |

| S&P 500® Total Return Index | -2.54% | -0.76% | -0.76% | 13.99% | 10.78% | 13.31% | 15.15% |

| Centre American Select Equity Fund – Institutional Class | -1.72% | 2.03% | 2.03% | 18.18% | 10.58% | – | 9.39% |

| S&P 500® Total Return Index | -2.54% | -0.76% | -0.76% | 13.99% | 10.78% | – | 11.25% |

| * | Inception date of December 21, 2011 for Investor Class. Inception date of January 21, 2014 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

The S&P 500® Total Return Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index.

The line graph above shows the performance of Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

| Centre Active U.S. Treasury Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Performance & Strategy Summary

For the six-month period ended March 31, 2018, the Centre Active U.S. Treasury Fund (also referred to as the “Fund”), Investor Share Class, delivered a total return of 0.59 percent; the Institutional Share Class delivered a total return of 0.85 percent.

Performance attribution in the Fund’s portfolio reflects interest income combined with our active duration management decisions that impact capital gain or loss capture. As of March 31, 2018, there are no corporate or mortgage related securities in the portfolio, there are no “spread” components to performance. Performance during the six-month period ended March 31, 2018 reflects, to a large degree, the Bearish calls (target duration of zero) in January and February followed by a market duration “Neutral” call in March based on our Interest Rate Scorecard1 investment discipline.

The Bearish calls late in the year resulted from the ongoing strength in the U.S. labor market which indicated, in turn, ongoing real growth in the economy and the likelihood that inflation would begin to move toward the Federal Open Market Committee’s (“FOMC2 ”) 2% goal. Labor market strength pushed the official unemployment rate well below current estimates of the sustainable rate (NAIRU3 ) over the longer term. The expectation of eventually accelerating inflation reflected both the strong labor market acting through the Phillips Curve relationship and the anticipated exhaustion of special factors which had kept the rate below the target value. While the nature or even the existence of the Phillips Curve4 relationship, unemployment below NAIRU leading to greater inflation, had been called into question monetary policy makers continued to give it credence.

As a result, over the six-month period, the FOMC continued its two pronged approach to monetary policy normalization, gradually raising the target for the federal fund’s rate and reducing, in an orderly and well communicated process, the Federal Reserve’s holdings of securities. Policy normalization and economic growth in the period pushed the yield on the benchmark 10-Year U.S. Treasury note5 from 2.33% at the end of September to a peak of 2.9% in early March. While real growth and policy normalization drove rates higher, the increases experienced were held somewhat in check by continued moderate inflation concerns on the part of investors. Investors seemed to be waiting for inflation to move to or above the 2% target before raising the inflation premium required from rates for the loss of buying in the future.

The Fund’s investment objective is to maximize total return through capital appreciation and current income. The Fund pursues this objective primarily by using an active interest rate risk management strategy. In other words, when interest rates are expected to decline, the Fund extends duration6 and when interest rates are expected to rise, the Fund shortens duration. The portfolio’s duration is adjusted based on a monthly assessment by Centre Asset Management, LLC (“Centre” or “we”), the investment adviser to the Fund, of the likely change in interest rates. Our fundamentally-driven active duration management strategy seeks the potential for capital appreciation and/or preservation in variable interest rate environments by utilizing U.S. Treasury securities including bills, notes, bonds, Treasury inflation protected securities (TIPS), cash equivalents and, in certain market environments, futures contracts on U.S. Treasury notes and bonds.

The Centre Active U.S. Treasury Fund is intended to serve as a tactical (long, short or neutral duration relative to that of the Treasury market) fixed income investment by managing market exposure to achieve performance (i.e., managing interest rate beta7 to achieve alpha8 ). Over time, it is intended to provide the same yield as the Treasury market with attractive diversification benefits given the underlying core portfolio of fixed income yielding bonds9 . In addition to its capital appreciation and current income generation objectives, the strategy is designed to accommodate both systematic and unforeseen cash needs, given the liquidity of the Treasury market.

| 1 | Interest Rate ScorecardSM is a proprietary fact based discipline that involves the review and adjustments of the portfolio’s targeted duration in light of changing economic conditions and bond market valuations. Centre Asset Management distributes a monthly publication featuring its assessment and analysis of the macroeconomic environment and policy implications for the bond market based on the investment discipline. |

| 2 | The Federal Open Market Committee (FOMC) consists of twelve members--the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. |

| 3 | The Non-Accelerating Inflation Rate of Unemployment (NAIRU) – also referred to as the long-run Phillips curve – is the specific level of unemployment that is evident in an economy that does not cause inflation to rise up. |

| 4 | The Phillips curve is an economic concept developed by A. W. Phillips which states that inflation and unemployment have a stable and inverse relationship. The theory states that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. |

| 5 | The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10- year Treasury note pays interest at a fixed rate once every six months, and pays the face value to the holder at maturity. |

| 6 | Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. |

| 7 | Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), which calculates the expected return of an asset based on its beta and expected market returns. |

| 8 | Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund's alpha. |

| 9 | Diversification does not guarantee against loss. |

| Semi-Annual Report | March 31, 2018 | 7 |

| Centre Active U.S. Treasury Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Furthermore, the utilization of Treasury securities within asset allocation is designed to provide attractive diversification properties, as the correlation between Treasury market returns and those of the U.S. equity market has historically been negative during recession related “bear” equity markets, particularly over the previous two decades. The Fund’s investment discipline is designed to identify the risks and opportunities of trends and short term deviations from those trends in interest rate behavior by incorporating the Federal Reserve’s (“Fed”) policies, measures of real growth, inflation expectations, and market valuations. The Fund’s investment discipline is intended to preserve capital in periods of significant rate increases by decreasing the portfolio duration and provide the flexibility to extend portfolio duration when rates are likely to decline.

Market Review & Outlook

Over the long run, interest rate behavior primarily reflects real economic growth, investors’ inflation expectations or concerns, monetary policy, and bond market valuations. Our view is that over the next few years - barring recession and/or exogenous shocks to the economy - steady real growth, the waning of special factors (e.g. Medicaid payments) exerting downward pressure on inflation and continued monetary policy normalization should push interest rates higher. As of now, the U.S. economy seems to be continuing to be in an expansionary phase, is entering the ninth year of economic recovery and will soon be the second longest expansion in American economic history.

Research suggests that expansions do not “die of old age”, so we are of the opinion that we are not “due” for a recession. Over 2 million jobs were created in 2017 and the level of labor market activity remains strong with positive momentum which has taken the unemployment rate below the level that is sustainable, NAIRU, over time based on population growth and the labor force participation rate. The official unemployment rate is 4.1% and current estimates place NAIRU at around 4.7%. Additionally, our research indicates that the shape of the Treasury yield curve10 , currently viewed by some as a recession warning sign, is not troubling. We agree with the assessment of former FOMC Chairman Alan Greenspan that it is the level of the federal funds rate relative to the “Natural Rate” consistent with full employment and target inflation that changes the pace of economic activity.

Labor market strength is further confirmed by the Non-Employment Index, a measure designed to answer critiques of the “official” unemployment rate by evaluating the likelihood of a return to the labor force by those no longer counted as active job seekers. Additionally, research on “informal work hours” is consistent with the argument that the labor market slack created during the Great Recession has been eliminated. Besides continuing the process of policy normalization at its most recent meeting, FOMC members have increased their expectations for real growth in 2018 from 2.1% to 2.5%. According to participants in the Survey of Professional Forecasters from the Philadelphia Federal Reserve Bank, real growth over the next two years is projected to be even higher than the FOMC’s forecasts, at 2.8% and 2.5% in 2018 and 2019, respectively. Survey participants have also materially reduced their estimates of experiencing negative growth in any quarter out through the end of 2018.

The increases in real growth forecasts are consistent with the view that current tax legislation changes could boost near term real growth by up to 0.5% per year over the next two years and with improving growth overseas. However, both FOMC members and Survey participants accept the Congressional Budget Office’s (CBO) estimate of potential real growth of around 1.8% longer term. We believe that real growth will be higher than projections from both the FOMC and professional forecaster longer term and will likely be in the 2.75% range starting in 2019. Our outlook assumes that the current regulatory environment will continue to be more pro-growth oriented through legislative action or executive orders, that the recent tax restructuring will increase incentives to both work and invest, that infrastructure spending to facilitate growth will take place, that expanding energy exports can generate additional income and that a trade of significance can be avoided.

While inflation has run below the desired 2% target of the FOMC since 2012, the shortfall appears attributable to transitory factors and to a recovery that has been slow relative to past expansions until recently. The slower expansion reflects a debt overhang, now eliminated in both household and business balance sheets, and an increased aversion to risk. The slow pace of inflation has caused investors’ inflationary expectations to be well anchored at a rate below the Fed’s 2% target. Expectations are critical to achieving the inflation target as they are built into the pricing decisions of manufacturers and service providers and the spending decisions of consumers. Presently, most policy makers and forecasters expect the 2% goal to be attained and maintained in the next two years. FOMC Chairman Jerome Powell has seemingly accepted Janet Yellen’s argument to let the labor market “overheat” 11 and allow inflation to move “somewhat” above 2% for a “temporary” period. While inflation expectations have not yet “broken out”, recent data from the Philadelphia Fed suggests they are beginning to increase.

Furthermore, there are currently, among monetary policy makers, an increasing number of advocates for “price-level” targeting12 . Given the shortfall since 2012, this approach would require an inflation rate well above 2% for an extended period of time in order to bring the price level to a value consistent with 2% increases since 2012. Our view is that inflation will likely exceed 2% this year causing inflation concerns to become unanchored and putting additional upward pressure on rates beyond that due to simply achieving the FOMC’s target rate.

| 10 | A yield curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates. |

| 11 | An overheated market is one that is expanding at an unsustainable pace. |

| 12 | Price-level targeting is a monetary policy framework that can be used to achieve price stability. Price-level targeting establishes targets for a price index like the consumer price index. |

| Centre Active U.S. Treasury Fund | Manager Commentary |

March 31, 2018 (Unaudited)

As a result of continued real growth and the expectation that inflation will reach the specified target in the “near term”, the FOMC will likely continue its programs of policy normalization regarding both further target rate increases and Federal Reserve Balance Sheet decreases. FOMC policy makers believe the Federal Funds Rate will average 2.1% for all of 2018 and reach an average level of about 2.7% in 2019. The Taylor Rule Analysis at the Cleveland Federal Reserve Bank “Seven Simple Monetary Policy Rules” indicates a median value of the federal funds rate of 2.6% in the first quarter of 2018 and 2019. Additionally, research on the Natural Rate of interest (or “r*” as it has become known) by San Francisco Federal Reserve Bank President John Williams and others indicates an equilibrium funds rate of 2.5% based on full employment and target rate inflation. These forecasts/analyses imply three to four more target rate increases (assuming 0.25% moves) within eighteen months.

Historically, the FOMC’s decision process has displayed an inertia that leads to a number of small target increases initially with larger ones later as policy makers realize that both the unemployment rate and the inflation rate have exceeded their sustainable unemployment or desired inflation goals. Unemployment is already well below estimates of NAIRU and inflation seems to reflect transitory and temporary factors. If our own projections for real growth and inflation prove accurate, the equilibrium value for the fund’s rate will be at least 3%. In fact, the median forecast from the FOMC is for a 3% fund’s rate in 2020. As a result, the tendency for policy to lag behind will, we believe, require target rate increases of 50- 75 basis points13 at least once or twice before December 31, 2019 as policy makers are forced to play “catch-up”.

Historically, the spread between the 10-year yield14 and the funds rate has been 150 basis points. A 2.5% funds rate would be consistent with a 4% 10-year yield. John Williams, President of the Federal reserve Bank of San Francisco and a voting member of the FOMC, has suggested that a 1% spread may be normal going forward, which would put the 10-year rate at 3.5%. However, it is not clear why the Treasury term premia15 should be permanently lower unless the Fed can control inflation volatility better going forward than they have accomplished historically. Further, as it is unclear how the aging of the population will impact investors’ overall willingness to take on risk in order to gain return and the desire to save rather than spend, the long-run average risk premium demanded by investors is our best estimate. This should put the yield on the 10-year Treasury 1.5% above the Federal Funds Rate on average.

According to Federal Reserve Board Governor Lael Brainard, the term premia on longer term rates (currently well below average) would move higher by 40 basis points even if short term rates were stable after the balance sheet normalization got in full swing. These various arguments place the 10-year rate between 3.0% and 4.0% over the next twelve months. Given the tendency historically of policy makers to foster overshooting of the unemployment and inflation rate targets, our view is that rates will actually break through the 4% level before December 31, 2018.

Risks to the interest rate forecasts described above are more likely to the upside rather than the downside. Like stock prices, rates tend to overshoot the level indicated by the fundamentals. Additionally, the Federal Reserve has never achieved a “soft-landing” in reaching its dual mandate of full employment and price stability, which is currently defined as an inflation rate of 2% and an unemployment rate above where it stands today. Such an achievement may be even less probable given the expressed willingness to breach the 2% target by a “small amount” for a “temporary period”, as neither “small” nor “temporary” were well specified, or, if price-level targeting becomes accepted policy. Once currently well anchored inflationary expectations break free, actual inflation could spike higher, as business and household expectations become embodied in pricing and spending decisions.

Furthermore, if investors become convinced that tax simplification and restructuring as well as growth facilitating infrastructure spending will occur, in addition to an improved regulatory environment, rates could again spike higher. Longer term, yields will likely settle in the 5% area if our expectations for real growth are realized and inflation, after a period of overshooting, settles at the Fed’s 2% target. If this is accurate, we think investors will cause rates to move into this range sooner rather than later.

Moving forward, the inflation rate and real growth and, as a result, interest rate levels will reflect political, economic, and demographic related issues more so than monetary policy. The real growth projection based on the “New Normal” for the U.S. economy from the San Francisco Federal Reserve Bank is 1.75% while the CBO is projecting a 1.8% real growth through 2027. The arguments that form the basis for this significantly slower pace of growth relative to the 20th century average of around 3.0%-3.25% revolve around a reduced rate of technological advancement, less contribution from education, and slower growth in the labor force. In “The Rise and Fall of American Growth”, Robert Gordon argues that the technology related ideas of today are much less dramatic in their growth impact than the innovations of the past, such as the steam engine. John Fernald of the San Francisco Federal Reserve Bank projects productivity growth in line with its “pace for most of the period since 1973” of about 1%. He assumes that any contribution from educational attainment (increased human capital) has “plateaued” and that capital “deepening” (increased capital per worker) will not spur labor productivity dramatically. The arguments for a reduced rate of growth in the future point to a slowing pace of labor force growth, which in turn reflects both slower population growth and the retirement of the “baby boomers”.

| 13 | Basis points, otherwise known as bps, are a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form. |

| 14 | The 10-year yield is the interest rate that the U.S. government pays to borrow money over 10 years. |

| 15 | An asset's risk premium (or premia) is a form of compensation for investors who tolerate the extra risk, compared to that of a wholly risk-free asset. |

| Semi-Annual Report | March 31, 2018 | 9 |

| Centre Active U.S. Treasury Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Our own long term outlook and its implications for rates rest on the following assumptions. The educational process has not plateaued. While the number of opportunities for middle manager type jobs may have decreased, there are ample job opportunities if workers have the necessary skills. Increasingly, the educational process must focus on technical/vocational type studies and apprenticeships in order to eliminate any skills mismatch between available jobs and those seeking employment. Provided proper incentives, the labor force can grow despite the demographics of an aging population. The employment-to-population ratio for prime-age workers is 1% below its pre-crisis level and the participation rate for 65+ workers is already increasing. The extent to which capital deepening can enhance productivity remains to be seen. A legal and regulatory framework that encourages new business formation will, in addition to spurring new hiring, be a source of new innovations that lead to increased productivity. Finally, there is a lag between the development of new technologies and their utilization in the production and distribution of goods and services. To argue that current technologies are not as impactful as earlier ones may be overlooking the time to achieve maximum benefit.

The downside to our more optimistic longer term forecast comes from the increasing size of the federal deficit. If it grows at the current pace it will likely reach $20 trillion in five years. If interest rates were to rise to 5% (our view) instead of the Trump administration’s prediction of just under 3.5%, the interest cost alone would be $1 trillion. Thus, more than half of all personal taxes would be needed to pay bondholders, potentially crowding out expenditures on the infrastructure needed to facilitate growth. Recent research has highlighted the significant negative correlation between increasing deficits and the potential real growth rate. An increasing deficit is also the cause of a worsening trade deficit. If domestic spending exceeds domestic saving, capital must be imported. Positive capital inflows are funded by negative trade flows. So, addressing the deficit also has implications for the trade balance.

Regardless of the eventual outcomes for growth and inflation rates, there is nothing in this debate to suggest that the business cycle has been tamed out of existence or that it will not be exacerbated by monetary policy, either conventional or unconventional, as has been true in the past. In fact, some suggest that business cycles may occur more frequently and potentially be of greater downside magnitude if a lower real Federal Funds Rate, consistent with slower trend growth, limits the Fed’s ability to stimulate growth through conventional monetary policy. If true, this would increase opportunities to benefit from the eventual cyclical decline as policy makers move in to rein in accelerating inflation. If, on the other hand, real growth reverts toward its 20th century norm, there will be a great need to protect portfolio value against rising rates near term, but with an opportunity to benefit from the eventual cyclical decline as policy makers move in to rein in accelerating inflation. So, going forward, rate behavior seems most likely to continue to be cyclical in nature and jagged or violent in pattern as both market participants and policy makers react and overreact to the impacts of changing economic conditions. The Interest Rate Scorecard is intended to anticipate rate moves and adjust portfolio duration tactically for the benefit of shareholders of the Centre Active U.S. Treasury Fund by taking advantage of rate declines and shielding value against rate increases.

The market outlook is the opinion of the author and can change at any time.

| Centre Active U.S. Treasury Fund | Manager Commentary |

March 31, 2018 (Unaudited)

ASSET TYPE WEIGHTINGS As a percentage of Net Assets

| U.S. Treasury Bonds | 74.89% |

| U.S. Treasury Notes | 15.89% |

| Cash, Cash Equivalents, and Other | 9.22% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

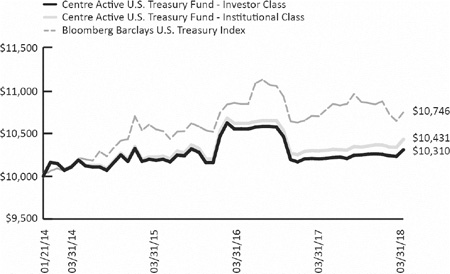

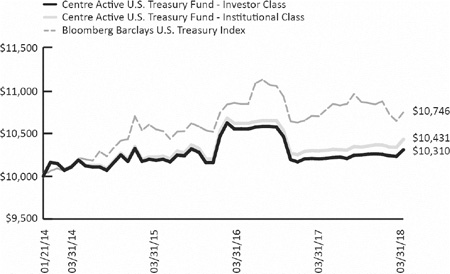

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2018

This line graph assumes an initial investment of $10,000 at January 21, 2014, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the Bloomberg Barclays U.S. Treasury Index. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2018

| | 1 Month | 3 Month | YTD | 1 Year | 3 Year | Since Inception (January 21, 2014) Average Annualized |

| Centre Active U.S. Treasury Fund – Investor Class | 0.76% | 0.53% | 0.53% | 1.03% | 0.37% | 0.73% |

| Centre Active U.S. Treasury Fund – Institutional Class | 0.90% | 0.62% | 0.62% | 1.32% | 0.67% | 1.01% |

| Bloomberg Barclays U.S. Treasury Index | 0.94% | -1.18% | -1.18% | 0.43% | 0.45% | 1.73% |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

Bloomberg Barclays U.S. Treasury Index – includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. You cannot invest directly into an index.

| Semi-Annual Report | March 31, 2018 | 11 |

| Centre Active U.S. Tax Exempt Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Performance & Strategy Summary

For the six-month period ended March 31, 2018, the Centre Active U.S. Tax Exempt Fund, Investor Share Class, delivered a total return of -1.08 percent; the Institutional Share Class delivered a total return of -0.93 percent.

Performance during the period reflects, to a large degree, the outperformance of lower quality bonds offsetting the market duration calls of our Interest Rate Scorecard1 investment discipline. The Scorecard called for Bearish positions in four of the six months with market neutral duration calls in December and March. And, while rates generally rose in the period, the yield on the 10-year benchmark U.S. Treasury note increased from 2.33% to 2.9% in early March before declining to 2.8% at quarter end, spreads on lesser quality issues tightened as investors reached for return from higher yielding bonds.

The Fund’s investment objective is to maximize total return through capital appreciation and current income exempt from federal income tax through investment in a portfolio consisting primarily of federally tax exempt securities of state and local governments in the U.S. and their political subdivisions, agencies and instrumentalities. We attempt to preserve principal and to enhance return by adjusting the Fund’s portfolio duration, which is its sensitivity to interest rate changes. We adjust the portfolio’s duration based on our monthly assessment of the likely change in interest rates.

The Fund’s portfolio has an orientation toward high quality rated municipal securities. This orientation allows us to better manage credit spread risk2 and to facilitate duration management through the use primarily of U.S. Treasury-based futures contracts3 . We also maintain a high quality bias in an effort to avoid losses from price declines associated with credit downgrades or outright defaults. This quality bias has generally kept us out of hospital and airport-related issues and out of issues of many states with large debt issuance. While we believe this approach provides an optimal risk reward profile over the long-term, it can lead to underperformance in shorter time periods.

A monthly review of the duration of the investments held by the Fund and its overall portfolio provides the opportunity to capture not only cyclical trends in rates but also deviations away from such trends that invariably occur. Our fundamentally-driven active duration management includes, in certain market environments, using futures contracts on U.S. Treasury securities. These contracts are exchange traded, backed by cash collateral, extremely liquid with minimal transaction charges, and have a long history of use in risk management. Additionally, they currently receive favorable capital gains tax treatment. As a result, Treasury based futures tend to provide a low cost tax-advantaged means of managing interest rate risk, leaving the Fund’s core municipal security holdings in place to generate tax-free income. The performance of the Fund is intended to reflect this income as well as any change in value experienced by our duration adjustments. Our goal is to provide the tax-advantaged cash flow desired by investors with a contribution to meeting investors’ goals for wealth accumulation through our focus on total returns.

Market Review & Outlook

Over the long run, interest rate behavior primarily reflects real economic growth, investors’ inflation expectations or concerns, monetary policy, and bond market valuations. In the view of the Fund’s portfolio managers(or “we”), over the next few years - barring recession and/or exogenous shocks to the economy - steady real growth, the waning of special factors (e.g., Medicaid payments), exerting downward pressure on inflation and continued monetary policy normalization should push interest rates higher. We believe that the U.S. economy continues to be in an expansionary phase and will soon be the second longest expansion in American economic history.

Over two million jobs were created in 2017 and the level of labor market activity remains strong with positive momentum which has taken the unemployment rate below the level that is sustainable, NAIRU4 , over time based on population growth and the labor force participation rate. The official unemployment rate is 4.1% as of March 2018 and current estimates place NAIRU at around 4.7%. Additionally, our research indicates that the shape of the Treasury yield curve, currently viewed by some as a recession warning sign, is not troubling. Labor market strength is further confirmed by the Non-Employment Index, a measure designed to answer critiques of the “official” unemployment rate by evaluating the likelihood of a return to the labor force by those no longer counted as active job seekers. Additionally, research on “informal work hours” is consistent with the argument that the labor market slack created during the Great Recession has been eliminated. Besides continuing the process of policy normalization at its most recent meeting, FOMC5 members have increased their expectations for real growth in 2018 from 2.1% to 2.5%. According to participants in the Survey of Professional Forecasters from the Philadelphia Federal Reserve Bank, real growth over the next two years is projected to be even higher than the FOMC’s forecasts, at 2.8% and 2.5% in 2018 and 2019, respectively. Survey participants have also materially reduced their estimates of experiencing negative growth in any quarter out through the end of 2018.

| 1 | Interest Rate ScorecardSM (“Scorecard”) is a proprietary fact based discipline that involves the review and adjustments of the portfolio’s targeted duration in light of changing economic conditions and bond market valuations. Centre Asset Management distributes a monthly publication featuring its assessment and analysis of the macroeconomic environment and policy implications for the bond market based on the investment discipline. |

| 2 | A credit spread is the difference in yield between a U.S. Treasury bond and a debt security with the same maturity but of lesser quality. Credit spread risk is the risk that credit spreads will widen. |

| 3 | A futures contract is a legal agreement, generally made on the trading floor of a futures exchange, to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future. |

| 4 | The Non-Accelerating Inflation Rate of Unemployment (NAIRU) refers to the level of unemployment that is evident in an economy that does not cause inflation to rise up. |

| 5 | The Federal Open Market Committee (FOMC) consists of twelve members--the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. |

| Centre Active U.S. Tax Exempt Fund | Manager Commentary |

March 31, 2018 (Unaudited)

The increases in real growth forecasts are consistent with the view that current tax legislation changes could boost near term real growth by up to 0.5% per year over the next two years and with improving growth overseas. We believe that real growth will likely be in the 2.75% range starting in 2019. Our outlook assumes that the current regulatory environment will continue to be more pro-growth oriented through legislative action or executive orders, that the recent tax restructuring will increase incentives to both work and invest, that infrastructure spending to facilitate growth will take place, that expanding energy exports can generate additional income and that a trade war between the U.S. and its major trading partners of significance can be avoided.

While inflation has run below the desired 2% target of the FOMC since 2012, the shortfall appears attributable to transitory factors and to a recovery that has been slow relative to past expansions until recently. The slower expansion reflects a debt overhang, now eliminated in both household and business balance sheets, and an increased aversion to risk. The slow pace of inflation has caused investors’ inflationary expectations to be well anchored at a rate below the Fed’s 2% target. Expectations are critical to achieving the inflation target as they are built into the pricing decisions of manufacturers and service providers and the spending decisions of consumers. Presently, most policy makers and forecasters expect the 2% goal to be attained and maintained in the next two years. Recent data from the Philadelphia Fed suggests that inflation expectations are beginning to increase.

Furthermore, there are, among monetary policy makers, an increasing number of advocates for “price-level” targeting. Given the shortfall since 2012, this approach would require an inflation rate well above 2% for an extended period of time in order to bring the price level to a value consistent with 2% increases since 2012. Our view is that inflation will likely exceed 2% this year causing inflation concerns to become unanchored and putting additional upward pressure on rates beyond that due to simply achieving the FOMC’s target rate.

As a result of continued real growth and the expectation that inflation will reach the specified target in the near term, it seems that the FOMC is likely continue its programs of policy normalization regarding both further target rate increases and Federal Reserve Balance Sheet decreases. FOMC policy makers have expressed their view that the Federal Funds Rate will average 2.1% for all of 2018 and reach an average level of about 2.7% in 2019. The Taylor Rule Analysis at the Cleveland Federal Reserve Bank “Seven Simple Monetary Policy Rules” indicates a median value of the Federal Funds Rate of 2.6% in the first quarter of 2018 and 2019. Additionally, research on the Natural Rate of interest (or “r*” as it has become known) by San Francisco Federal Reserve Bank President John Williams and others indicates an equilibrium funds rate of 2.5% based on full employment and target rate inflation. These forecasts/analyses imply three to four more target rate increases (assuming 0.25% moves) within eighteen months.

Historically, the FOMC’s decision process has displayed an inertia that leads to a number of small target increases initially with larger ones later as policy makers realize that both the unemployment rate and the inflation rate have exceeded their sustainable unemployment or desired inflation goals. Unemployment is already well below estimates of NAIRU and inflation seems to reflect transitory and temporary factors. If our own projections for real growth and inflation prove accurate, the equilibrium value for the Federal Funds Rate will be at least 3%. In fact, the median forecast from the FOMC is for a 3% fund’s rate in 2020. As a result, the tendency for policy to lag behind will, we believe, require target rate increases of 50-75 basis points at least once or twice before December 31, 2019 as policy makers are forced to play “catch-up”.

Historically, the spread between the 10-year yield and the funds rate has been 1.5%. A 2.5% funds rate would be consistent with a 4% 10-year yield. John Williams, President of the Federal reserve Bank of San Francisco and a voting member of the FOMC, has suggested that a 1% spread may be normal going forward, which would put the 10-year rate at 3.5%. However, it is not clear why the Treasury term premia6 should be permanently lower unless the Fed can control inflation volatility better going forward than they have accomplished historically. Further, as it is unclear how the aging of the population will impact investors’ overall willingness to take on risk in order to gain return and the desire to save rather than spend, the long-run average risk premium demanded by investors is our best estimate. This should put the yield on the 10-year Treasury 1.5% above the Federal Funds Rate on average.

According to recent comments by Federal Reserve Board Governor Lael Brainard, the term premia on longer term rates (currently well below average) would move higher by 0.40% even if short term rates were stable after the balance sheet normalization got in full swing. These various arguments place the 10-year rate between 3.0% and 4.0% over the next twelve months. Given the tendency historically of policy makers to foster overshooting of the unemployment and inflation rate targets, our view is that rates will actually break through the 4% level before December 31, 2018.

| 6 | An asset's risk premium (or premia) is a form of compensation for investors who tolerate the extra risk, compared to that of a wholly risk-free asset |

| Semi-Annual Report | March 31, 2018 | 13 |

| Centre Active U.S. Tax Exempt Fund | Manager Commentary |

March 31, 2018 (Unaudited)

Risks to the interest rate forecasts described above are more likely to the upside rather than the downside. Like stock prices, rates tend to overshoot the level indicated by the fundamentals. Additionally, the Federal Reserve has never achieved a “soft-landing” in reaching its dual mandate of full employment and price stability, which is currently defined as an inflation rate of 2% and an unemployment rate above where it stands today. Once currently well anchored inflationary expectations break free, actual inflation could spike higher, as business and household expectations become embodied in pricing and spending decisions.

Furthermore, if investors become convinced that tax simplification and restructuring as well as growth facilitating infrastructure spending will occur, in addition to an improved regulatory environment, rates could again spike higher. Longer term, yields will likely settle in the 5% area if our expectations for real growth are realized and inflation, after a period of overshooting, settles at the Fed’s 2% target. If this is accurate, we think investors will cause rates to move into this range sooner rather than later.

Moving forward, we believe that the inflation rate and real growth and, as a result, interest rate levels will reflect political, economic, and demographic related issues more so than monetary policy. The real growth projection based on the “New Normal” for the U.S. economy from the San Francisco Federal Reserve Bank is 1.75% while the CBO is projecting a 1.8% real growth through 2027. The arguments that form the basis for this significantly slower pace of growth relative to the 20th century average of around 3.0%-3.25% revolve around a reduced rate of technological advancement, less contribution from education, and slower growth in the labor force. The arguments for a reduced rate of growth in the future point to a slowing pace of labor force growth, which in turn reflects both slower population growth and the retirement of the “baby boomers”.

Our own long term outlook and its implications for rates rest on the following assumptions. The educational process has not plateaued. While the number of opportunities for middle manager type jobs may have decreased, there are ample job opportunities if workers have the necessary skills. Increasingly, the educational process must focus on technical/vocational type studies and apprenticeships in order to eliminate any skills mismatch between available jobs and those seeking employment. Provided proper incentives, the labor force can grow despite the demographics of an aging population. We believe that a legal and regulatory framework that encourages new business formation will, in addition to spurring new hiring, be a source of new innovations that lead to increased productivity. Finally, there is a lag between the development of new technologies and their utilization in the production and distribution of goods and services. To argue that current technologies are not as impactful as earlier ones may be overlooking the time to achieve maximum benefit.

The downside to our more optimistic longer term forecast comes from the increasing size of the federal deficit. If it grows at the current pace it will likely reach $20 trillion in five years. If interest rates were to rise to, as we believe, 5% instead of the Trump administration’s prediction of just under 3.5%, the interest cost alone would be $1 trillion. Thus, more than half of all personal taxes would be needed to pay bondholders, potentially crowding out expenditures on the infrastructure needed to facilitate growth. Recent research has highlighted the significant negative correlation between increasing deficits and the potential real growth rate. An increasing deficit is also the cause of a worsening trade deficit. Addressing the deficit also has implications for the trade balance.

Regardless of the eventual outcomes for growth and inflation rates, there is nothing in this debate to suggest that the business cycle has been tamed out of existence or that it will not be exacerbated by monetary policy. In fact, some suggest that business cycles may occur more frequently and potentially be of greater downside magnitude if a lower real Federal Funds Rate, consistent with slower trend growth, limits the Fed’s ability to stimulate growth through conventional monetary policy. If true, this would increase opportunities to benefit from the eventual cyclical decline as policy makers move in to rein in accelerating inflation. If, on the other hand, real growth reverts toward its 20th century norm, there will be a great need to protect portfolio value against rising rates near term, but with an opportunity to benefit from the eventual cyclical decline as policy makers move in to rein in accelerating inflation. So, going forward, rate behavior seems most likely to continue to be cyclical in nature and jagged or violent in pattern as both market participants and policy makers react and overreact to the impacts of changing economic conditions.

The market outlook is the opinion of the author and can change at any time.

| Centre Active U.S. Tax Exempt Fund | Manager Commentary |

March 31, 2018 (Unaudited)

SECTOR WEIGHTINGS As a percentage of Net Assets

| General Obligation | 59.70% |

| Prerefunded Issues | 12.93% |

| Revenue Bonds | 12.12% |

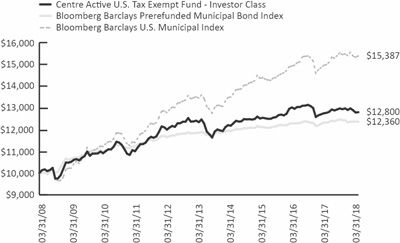

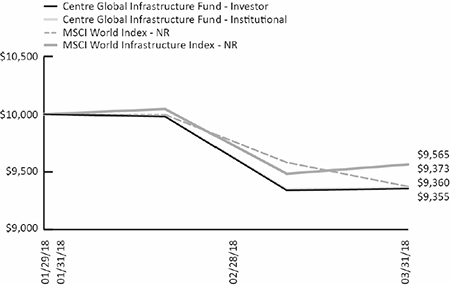

| Open-End Funds | 9.45% |