UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

CENTRE FUNDS

(Exact name of registrant as specified in charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of principal executive offices) (Zip code)

James A. Abate

48 Wall Street, Suite 1100

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 918-4705

Date of fiscal year end: September 30

Date of reporting period: October 1, 2020 – March 31, 2021

Item 1. Reports to Stockholders.

(a)

TABLE OF CONTENTS

| | PAGE |

| SHAREHOLDER LETTER | 1 |

| MANAGER COMMENTARY | 2 |

| Centre American Select Equity Fund | 2 |

| Centre Global Infrastructure Fund | 7 |

| DISCLOSURE OF FUND EXPENSES | 11 |

| SCHEDULE OF INVESTMENTS | 12 |

| Centre American Select Equity Fund | 12 |

| Centre Global Infrastructure Fund | 14 |

| STATEMENTS OF ASSETS AND LIABILITIES | 17 |

| STATEMENTS OF OPERATIONS | 18 |

| STATEMENTS OF CHANGES IN NET ASSETS | 19 |

| Centre American Select Equity Fund | 19 |

| Centre Global Infrastructure Fund | 20 |

| FINANCIAL HIGHLIGHTS | 21 |

| Centre American Select Equity Fund | 21 |

| Centre Global Infrastructure Fund | 23 |

| NOTES TO FINANCIAL STATEMENTS | 25 |

| ADDITIONAL INFORMATION | 34 |

| Centre Funds | Shareholder Letter |

| | March 31, 2021 (Unaudited) |

Dear Shareholders,

It is with my pleasure that we publish the Centre Funds Semi-Annual Report covering the six-month period ended March 31, 2021. I want to thank my fellow shareholders for their continued support and confidence in Centre Funds. The Centre Funds offer a select series of fundamentally-driven, actively managed funds to choose from, each available in investor and institutional share classes. We are passionate about active management.

Centre American Select Equity Fund

The Fund is a U.S. large capitalization valuation sensitive core growth stock fund that seeks long-term growth of capital and is focused on risk adjusted returns through active and pragmatic management; the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed appropriate. The Fund is intended to be a risk managed core growth fund.

Centre Global Infrastructure Fund

The Fund is for investors seeking to potentially benefit from a renewed focus on infrastructure spending but wish to have liquidity in publicly traded investments in developed global markets rather than illiquid private investments. The Fund pursues a bottom-up, active management approach and invests in what we deem the most attractive infrastructure-related companies from the United States and developed international economies. Also, the Fund seeks to balance its exposures to where the weights of the Telecommunication, Utilities, Energy, Transportation, and Social Infrastructure industries are broadly represented. The Fund focuses on higher dividend yielding assets and distributes dividend and interest income monthly.

Our aim at Centre Funds is to deliver strong, long-term performance results for investors through an exceptional focus on producing returns and managing risk and downside volatility in select investment strategies. We want investors to associate Centre Funds with high-conviction, differentiated fund strategies that may not be available elsewhere and are tactical, pragmatic, and opportunistic. Each investment strategy aims to capitalize on defined market opportunities with consistent methodology and repeatable investment and processes to achieve differentiated returns and risk profiles. We remain focused on fundamentally-driven investment approaches within truly active, high conviction, disciplined and research intensive processes. At Centre Funds, we place service excellence at the core of everything that we do and are committed to providing useful information on all of the Funds. Again, I want to thank my fellow shareholders for their continued support and confidence in the Centre Funds.

Sincerely,

James Abate

President, Centre Funds

| Semi-Annual Report | March 31, 2021 | 1 |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

Performance & Strategy Summary

For the six-month period ended March 31, 2021, the Centre American Select Equity Fund (the “Fund”), Investor Share Class, delivered a total return of 22.03 percent; the Institutional Share Class delivered a total return of 22.37 percent.

During the same six-month period, the key barometer of the U.S. stock market as a whole, as measured by the S&P 500 Index1, delivered a total return of 19.06 percent. Companies with expectations of high economic recovery sensitivity and best able to be operationally leveraged to improving sales growth following the sharp but short recession in the early part of 2020 as COVID-192 pandemic lockdowns were put in place globally fared best. These were mainly in the traditional cyclical sectors such as Energy, Financials, Industrials, and Materials. Stable growth sectors such as Consumer Staples, Utilities, and Health Care performed relatively less well but still provided positive absolute returns.

The strongest contributors to performance within the Fund over the six-month period ended March 31, 2021 included the Fund’s investments within the Energy sector, Cimarex Energy, Exxon Mobil, APA Corp., Chevron, Kinder Morgan, and Williams; the chemicals industry within the Materials sector, Olin Corp., LyondellBasell, and Eastman Chemical; and the commodity food products industry within Consumer Staples, Bunge, and Archer Daniels Midland. In general, both stock selection and sectoral biases, particularly our overweight postures in the Energy and Materials sectors, and underweight posture in the Health Care sector, contributed to the relative outperformance over the period. Stock investments that contributed negatively to relative Fund performance over the period included Barrick Gold, Salesforce.com, Adobe, Merck, Abbott Laboratories, Pfizer, and Hain Celestial. Fund performance was impacted negatively from a total return perspective by the net realized losses from certain hedges and other investments that Centre Asset Management, LLC, the investment adviser to the Fund (“Centre,” the “Adviser”, “we”, or “the Fund’s portfolio manager”), viewed as capital protective in nature but are a drag to performance in positive markets with little realized drawdowns or downside volatility. These hedges, namely put options3 on the S&P 500 Index, have performed as expected during the stock market’s previous sharp corrective episodes, most notably in February/March 2020 and, over the longer-term, have insulated the Fund from the same magnitude of maximum drawdown4 experienced by the overall stock market over prior volatile5 episodes, namely in August 2015, January 2016, February 2018, and December 2018. Given the continued presence of certain potentially de-stabilizing factors that we believe could negatively impact the value of underlying equity securities held in the Fund’s portfolio, the Fund will continue the strategy of tactically and opportunistically purchasing put options on the S&P 500 Index as a potential hedge against its underlying stock holdings in the event of a material overall stock market correction.

The methodology and process used by Centre to manage the Fund focuses on each individual portfolio company's growth outlook and capacity to create shareholder value, utilizing our bottom-up fundamental stock selection process. We utilize a disciplined, Economic Value Added (EVA)6 framework to select investments. The framework focuses on the fundamentals of wealth creation or wealth destruction similar to the way a traditional, long-term focused corporate investor looking at all aspects of the business would assess a company's value. Our experience is, in the shorter-term, markets may often undervalue or overvalue a company's ability to create or destroy wealth. The framework seeks to identify and capture these investment opportunities. The approach is designed to capture excess returns when a business is creating shareholder wealth and the market price of the stock converges toward our fundamentally-derived target price. Centre not only analyzes earnings but also strives to understand and link the capital allocation decisions being made today by each portfolio company and how they may lead to future earnings growth. In other words, we expect that the companies in which the Fund invests in will themselves invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. The key is that we look at the company drivers that create true shareholder wealth: capital spending or alternative capital allocations such as acquisitions, stock buybacks, or dividends; company-specific risk levels of a business to determine appropriate hurdle rates7; and whether the company is generating positive or excess returns on its underlying assets vis-à-vis the cost of capital. Wealth creation from growth or from wise contraction – that’s how we believe companies create shareholder value.

| 1 | S&P 500 is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. |

| 2 | In COVID-19, 'CO' stands for 'corona,' 'VI' for 'virus,' and 'D' for disease. Formerly, this disease was referred to as “2019 novel coronavirus” or “2019-nCoV”. There are many types of human coronaviruses including some that commonly cause mild upper-respiratory tract illnesses. |

| 3 | A put option is a contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. |

| 4 | Maximum drawdown is the maximum loss from a peak to a trough of a portfolio, before a new peak is attained. |

| 5 | Volatility is a measure of systematic risk of a security or a portfolio in comparison to the market as a whole. |

| 6 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| 7 | A hurdle rate is the minimum rate of return on a project or investment required by a manager or investor. The hurdle rate denotes appropriate compensation for the level of risk present; riskier projects generally have higher hurdle rate than those that are deemed to be less risky. |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

To meet its objective as a risk-managed core growth fund, the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed tactically appropriate by Centre. While the use of hedging and certain investment techniques involve risk, the Adviser may tactically, as a defensive position, employ hedges and other capital preservation strategies on up to 100 percent of the value of the Fund’s underlying securities positions when the Adviser’s assessment of market valuation indicates forward returns for the stock market, as a whole, are low relative to downside risk and the cost to upside potential from portfolio preservation tools is deemed reasonable in order to respond to adverse market, economic, political, or other conditions. The Adviser may also tactically employ hedges to reduce volatility. For example, through the tactical use of purchased put options, the Fund may have enhanced performance and more limited risk. Index put options are designed to hedge the Fund from significant market declines that may occur over short periods of time. The value of an index put option generally increases as the underlying securities in the Fund decrease in price and decreases as those securities increase in price. The Adviser may also seek to enhance returns by writing (selling) out of the money covered call options tailored with exercise prices generally above the current market prices of stocks held in the Fund. As the seller of the call option, the Fund receives cash (the premium) from the purchaser8. The Adviser varies its hedging strategy and defensive positions across changing market cycles but has generally employed such strategies within the Fund since late 2014.

Market Review & Outlook

We believe the investment environment today can be best summarized as: 1) stock valuations are extreme relative to history on both an absolute (e.g., Price/Sales, Price/Book Value, Price/Earnings, etc.) and relative basis (as compared to bond yields and most other asset alternatives); 2) economic activity is in firm expansion mode with the industrial segment leading the consumer and service sectors out of the sharp and brief recession of 2020, leading to a very strong earnings outlook for nearly all large companies; 3) pent-up demand and supply constraints have seen inflation inflect higher with persistence for the first time in a generation and will likely be the most discussed investment topic in 2021; 4) the introduction of unprecedented fiscal stimulus during a time of robust economic expansion is without historical parallel in the United States, particularly from a country whose proportional indebtedness (to GDP9) is beyond any precedent outside of the emerging markets; and 5) for the first time since the late 1970’s, the hegemony of the United States is uncertain and being challenged by political and/or economic rivals leading to additional risks. Given this backdrop, we remain selectively bullish on equities relative to other asset classes, and particularly focused on those companies with a “real” asset base and that can produce earnings growth in excess of what we expect will be a period of offsetting valuation multiple compression. While we expect a time correction rather than an abrupt price correction as the more likely outcome, we recognize that broad stock market indexes are fragile and highly vulnerable to a significant dislocation if a negative catalyst is introduced rather than our base case of earnings catching up to stock prices. The successful investment playbook of an indifference to profitability with reliance upon valuation multiples re-rating ever higher that has existed since 2015 is now closed in our opinion.

As we digest the tumultuous past year plus and, perhaps due to the increased dependence on technology during the pandemic period, nearly every person feels the increasingly constant pulse of never-ending bombardment of advertising, promotion, influencing, etc. directed at us all. Given this, we keep becoming nostalgic for the less saturated media environment of the 1980’s and, in particular, the advertising catchphrase “where’s the beef?” Originally introduced as a marketing slogan for fast food purveyor Wendy’s in 1984, it became ubiquitous in usage to question the substance of something with particular popularity in that year’s Presidential election as candidate Walter Mondale questioned other candidates’ programs and policies. Wendy’s even re-introduced the advertisement last year when grocery stores were experiencing a shortage of beef; a testament to its continuing and widespread applicability. Increasingly though, whether it’s our experience (age) or the natural contrarian in our investment deposition, we seem to keep murmuring the phrase to ourselves as we look at the investment (or speculation) environment of today where everyone seems to know the price of everything but few know the intrinsic value of anything, and there’s little historical awareness of risk or, sadly, even basic history for that matter.

Ideas and innovation now represent the overwhelming portion of the world’s capital and wealth. In the past, physical assets such as land, plants, property or equipment made up the bulk of a company’s value. Today, intellectual property such as patents, trademarks, goodwill, and even data and software dominates the assets of most business concerns. When looking at the aggregate balance sheet for the S&P 500 Index on an equal weighted basis, intangible assets represented at year end 2020 approximately fifteen percent of total assets. Perhaps less appreciated is that the Price/Book Value ratio gives further “unrecorded goodwill” value to assets implied by investors that is not reflected on a company’s accounting records or, in other words, the market value added or expectations of value accruing up and above the capital invested in its business, both the tangible and intangible. Today, the Price/Book Value figure is 5.3 times, an all-time high and twice the median level of the past thirty years. We recognize certain accounting treatment of stock buybacks, research and development expenses, etc., can sometimes distort reported book value and not being wholly indicative of invested equity capital. Furthermore, we’re not luddites and absolutely recognize that the advances in artificial intelligence, biotechnology, cloud computing, and other cutting edge technologies will determine who will succeed in an increasingly competitive world. This said, we also need to separate what is undeserving of market value because we can’t identify “where’s the beef” in many money-losing business enterprises and, equally important, where there is genuine substance and profitability or an understandable pathway to it, what does the market value currently already imply based upon the current stock price. Having the experience of managing equity funds, including dedicated technology sector funds, during the late 1990’s technology boom followed by bust, we also recognize that the implosion of securities that lack the beef can negatively impact those that do from a valuation perspective in terms of reduced expectations and higher risk premium demanded by investors.

| 8 | A covered call is an options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. |

| 9 | Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. |

| Semi-Annual Report | March 31, 2021 | 3 |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

The well-known and large S&P 500 Index component group of stocks known as the FAANGs (Facebook, Apple, Amazon, Netflix, and Alphabet) plus certain others to us are expensive on most traditional valuation metrics such as Price/Sales or Book Value noted above. In each of their cases however, a significant portion of their revenue generating asset bases arise from the fact that a large part of their capital invested in the business, research and development costs most notably, are expensed rather than capitalized unlike a building or manufacturing plant due to accounting rules thus providing a mismatch of metrics unless one capitalizes such costs in their analyses, as we do. That said, the reliance on future growth and profitability, as expressed in their stock prices, remains broadly elevated and subject to company specific disappointment but also highly sensitive to systematic influence; i.e., changes in interest rates, risk premium, etc. Our quibble with the FAANGs is not that they lack the beef but, in essence, what’s the appropriate price for the beef, or value of further unrecorded goodwill by the market noted above, especially as we see the systematically influencing factors becoming negative after an extended period of being a tailwind.

On the other hand, the speculative fever now encompassing certain segments of the stock market, cryptocurrencies, nonfungible tokens or NFTs, meme stocks, celebrity led special purpose acquisition companies (SPACs), etc., is parallel, if not worse, than the very end of the dot-com era twenty years ago and we estimate that the loss of paper wealth this time will be multiples of the prior episode as people begin to realize that there is literally zero substance to most of these speculative assets which represent nothing more than a high-tech version of alchemy. We have little doubt that like their historical forerunners the promoters will fail to create something from nothing, but our main concern is what the impact will be from their eventual collapse on the FAANGs and the rest of the stock market. With cryptocurrencies in particular, we cannot reconcile how the United States continues to allow an alternative and anonymous forms of fiat currency to develop further while subjecting transactions in U.S. dollars to anti-money laundering laws and other highly scrutinous and intrusive regulations. Governments hold two important monopolies – the military and currency, and we expect cryptocurrency holders to share an analogous fate to someone trying to build their own armed militia. There’s a reason China, Turkey, and India have already (or plan to shortly) banned their mining, ownership, or usage and we suggest investors who think that it could never happen in the U.S. to read about the gold confiscation of 1933 imposed by President Roosevelt. The fallout from the destruction of $2 trillion plus in paper wealth and the entire ecosystem built around cryptocurrencies may be one of the potential negative shocks to the speculative fervor imbedded in overall market expectations. In the end, we’re confident that people will reflect on this speculative episode after a significant loss of paper wealth and ask themselves, where was the beef?

The timing of inflection points in economic activity, inflation, and other macro variables is notoriously difficult to pinpoint with precision. We thankfully feel that our investment methodology and process that starts with company-level bottom-up research, which we then aggregate into a mosaic, has served us well over many business cycles. It’s this specific objective to avoid inexpensive value traps that continue to underperform because fundamentals have yet to bottom and expectations that continue to fall, while at the same time be a nimble contrarian seller of growth, the period when fundamentals begin to deteriorate but continued price momentum temporarily blinds most investors, that we have a high degree of self-confidence due to our investment methodology. Further, performing our analysis at the root drivers, e.g., sales growth, profit margins, asset efficiency, risk premium, etc., allows us to understand and consolidate what will contribute to a company’s EVA or wealth creation and the future spread between the company’s market value and the capital employed on its balance sheet. In aggregate, today’s outlook is the mirror image of what existed a year ago. Namely, sales growth is a positive driver, profit margin expansion will accrue positive benefits to companies who are operationally leveraged to changes in sales growth, and asset efficiency is positive as many companies have wisely-contracted during the recession and are reluctant to aggressively expand their capital invested. In other words, we expect to see a very high degree of earnings leverage from companies who have kept their wallet in their pocket. What’s negative is that interest rate risk has risen and risk premiums (or aversion to risk) are now at historic lows and vulnerable to a shock to the current complacent speculative psychology.

For the first time since 2001, we are seeing the majority of the best bottom-up opportunities within real assets, namely the Energy and Materials sectors, commodity-oriented food producers, and to a certain extent semiconductor manufacturers within the Technology sector. The commodity bust of 2014-2016 that saw raw material prices for oil, copper, corn, soybeans, cotton, and others fall to extreme lows set in motion a persistent period of capital spending discipline by the management of most companies that operate in those areas, akin to what was last witnessed during the fallout from the currencies crisis in 1998-2000 in emerging markets. The parabolic economic growth and industrialization of China beginning in 2001, and which lasted in earnest through 2008, was the catalyst back then to see the stocks of these resource and industrial companies greatly outperform broad stock market indexes starting in 2002 and, especially, the Technology sector after the bubble popped in 2000 and continued to languish. Although we believe China’s growth will stay robust, the pace of change has tempered simply due to larger numbers today but we think the incremental catalyst now to see a similar set of outcomes will be large scale fiscal and infrastructure-related stimulus in the U.S. and Europe, consumer and industrial pent-up demand from nearly all locked-down economies as they emerge vaccinated or immune from natural infection, as well as inflation being allowed to run much higher than in the past by the Federal Reserve due to the continued suppression of short term interest rates as well as the adoption of modern monetary theory (MMT) or debt monetization, driving the dollar down and boosting the prices of raw commodities given that the dollar is the benchmark pricing mechanism for most commodities. So, where’s the beef? It’s in tangible assets and companies operating in those industries who gain pricing power from a persistently improving commodity price cycle. Examples of recent purchases or additions to the Fund meeting our criteria include food product producers Archer Daniels Midland and Bunge; oil & gas producers and transporters APA Corp, Cimarex, EQT, Kinder Morgan, and Exxon Mobil; mining and materials companies Freeport-McMoRan, Southern Copper, and Weyerhaeuser; and chemical, fertilizer and agricultural science companies Olin, LyondellBasell, Mosaic, and Corteva.

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

We believe that we have seen the apex of investor exuberance for intangible assets for this stock market cycle and that market leadership towards real assets will gain momentum and have persistence for longer than investors expect due to hard lessons learned from past profligate asset expansion and capital spending by the managements of most of the companies in these industries. We continue to emphasize a barbell of secular leadership growth stocks, cognizant of their valuation risk, with contrarian, opportunistic, cyclical, and mostly commodity-related producing companies who should benefit tremendously from their company specific actions to reduce supply and committed capital investment, as well as what we feel will be a reflationary-driven recovery in economies. While lower in probability in our view, the onset of a stagflationary environment remains a potential danger to the markets but currently this is a very small minority view by professional investors, which makes its potential impact much more profound.

The Fund currently continues to concentrate the number of positions in its portfolio in an attempt to maximize individual stock risk rather than market risk and use derivative instruments intended to hedge the systematic risks of its underlying stock holdings, namely put options on the S&P 500 Index, as a potential hedge in the event of a material market-wide correction. Our pragmatic, large-capitalization, valuation-sensitive growth and concentrated, high-conviction approach to stock selection, with a cognizance of risk management that includes tactically implementing capital protective investments, seems positioned to perform well relative to less risk aware and less historically appreciative strategies.

The market outlook is the opinion of the author and can change at any time.

| | |

| Semi-Annual Report | March 31, 2021 | 5 |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

SECTOR WEIGHTINGS

As a percentage of Net Assets

| Information Technology | 23.99% |

| Energy | 19.84% |

| Materials | 15.92% |

| Consumer Discretionary | 10.44% |

| Communication Services | 9.65% |

| Consumer Staples | 6.51% |

| Financials | 3.77% |

| Health Care | 2.57% |

| Real Estate | 2.57% |

| Industrials | 2.12% |

| Utilities | 1.90% |

| Purchased Options | 0.38% |

| Cash and Cash Equivalents | 0.34% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2021

This graph assumes an initial investment of $10,000 at December 21, 2011, the inception date for Investor Class shares, which have the longest period of annual returns, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund's Investor Class versus the S&P 500® Total Return Index. Taxes on Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

The line graph above shows the performance of Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2021

| | 1 Month | 3 Month | YTD | 6 Month | 1 Year | 3 Year Average Annualized | 5 Year Average Annualized | Since Inception* Average Annualized |

| Centre American Select Equity Fund – Investor Class | 2.59% | 8.36% | 8.36% | 22.03% | 57.41% | 15.93% | 15.19% | 13.76% |

| S&P 500® Total Return Index | 4.38% | 6.18% | 6.18% | 19.07% | 56.35% | 16.78% | 16.29% | 13.52% |

| Centre American Select Equity Fund – Institutional Class | 2.62% | 8.54% | 8.54% | 22.37% | 58.18% | 16.55% | 15.62% | 12.32% |

| S&P 500® Total Return Index | 4.38% | 6.18% | 6.18% | 19.07% | 56.35% | 16.78% | 16.29% | 15.68% |

| * | Inception date of December 21, 2011 for Investor Class. Inception date of January 21, 2014 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

Per the prospectus dated January 28, 2021, the Fund had total gross annual operating expenses of 1.53% and 1.25% and net annual operating expenses of 1.46% and 0.98% for the Investor and Institutional Class, respectively.

The S&P 500® Total Return Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index.

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

Performance & Strategy Summary

For the six-month period ended March 31, 2021, the Centre Global Infrastructure Fund (“the “Fund”), Investor Share Class, delivered a total return of 17.03 percent; the Institutional Share Class delivered a total return of 17.03 percent.

During the same six-month period, as a comparison the MSCI World Index and S&P Global Infrastructure Index delivered total returns of 19.57 percent and 18.06 percent, respectively. During the period, shares providing the strongest contribution to the Fund’s performance included: within the Energy sector, Kinder Morgan, and Williams Cos; within the Communication Services sector, Telecom Italia, and Softbank Corp; within the Transportation and Logistics industries, Knight-Swift Transportation; and within the Utilities sector, AES Corp, Enel Americas, CK Infrastructure, and Edison International. Stocks that contributed negatively to Fund performance included: Bezeq Israeli Telecom, Beijing Enterprises Water, Spark New Zealand, PPL Corp, and Sempra Energy. From a sector allocation standpoint, having a significant weighting to Energy attributed to the Fund’s performance during the period.

We believe that global listed infrastructure securities remain a compelling investment option, characterized by high dividend yields, stable cash flows and attractive risk-adjusted performance while offering a long-term hedge against inflation. Significant funding gaps for infrastructure in developed markets remain, and during the years of continuing debate about replacing outdated backbone systems, infrastructure investment has actually declined as a share of GDP1 in more than half of the G20 economies since the global financial crisis. Years of underinvestment in critical areas such as transportation, water treatment, and power grids could erode future growth potential and productivity. Municipalities are now focusing efforts on connecting institutional investors with projects that need their capital as well as creating an expanded role for public-private partnerships and tax and other incentives to undertake infrastructure investment. We believe the majority of the infrastructure funding gap will likely be financed by the private sector, creating significant opportunities within publicly traded global listed infrastructure assets, especially in the Communication Services and other innovative areas where the intellectual capital resides.

We view infrastructure also as a defensive asset class because of the characteristics of the underlying assets owned by many global listed infrastructure companies including: 1) inelastic demand due to the essential nature of the assets used in everyday life; 2) high barriers to entry due to the critical and often irreplaceable nature of the assets; and 3) contracted revenue streams that offer inflation protection in many cases. Over the past twenty years, Global Listed Infrastructure has demonstrated upside capture versus global equities of 83.8 percent, while only capturing 61.7 percent of the global equity market downside.2 Conventional wisdom holds that you invest in bonds for yield and equities for capital appreciation. While this might be true historically, with 10-Year U.S. Treasury yields collapsing over the past 12 months, infrastructure related stocks now offer equity income on top of capital appreciation potential. Currently, the 4.17% underlying yield3 of the Fund supersedes the S&P 500 Index’s dividend yield of 1.7% as well as all maturities of U.S. Treasury bond yields. From a sector perspective, Infrastructure related sectors such as Communication Services (4.2%), Energy (6.8%), Industrials (5.1%), and Utilities (3.8%) are all well above the broad market as represented by the S&P 500 Index as well the MSCI World Index.

The Fund offers several key differentiators from the broader global equity set of investable companies, as well as core infrastructure universes including: 1) historically, the S&P Global Infrastructure Index has generated a dividend yield greater than the yield on conventional core equity indices like the MSCI World Index; 2) the Fund pays distributions of dividend and interest income monthly rather than annually; 3) hard assets like infrastructure assets tend to retain their “real” value through the long-term; 4) historically, infrastructure indices’ volatility is lower than on conventional equity indices like the MSCI World Index; 5) historically, high Economic Value Added (EVA)4 companies have outperformed low EVA ones; and 6) many infrastructure assets have concession agreements or long-term contracts that link to inflation in the long run. In identifying firms with sustainable pricing power, the Fund seeks investments that exhibit high barriers to entry in their segments and that create positive externalities in their regions. The Fund focuses on industries with lower volatility such as toll roads, power stations, hospitals and schools. Also, by targeting high EVA growth companies, the Fund narrows its focus to high quality infrastructure firms that make wise capital allocation decisions. Through our “bottoms-up” analysis, we seek to avoid names that destroy shareholder wealth by either “empire building” or under-investment. Additionally, the stock-selection approach standardizes accounting across countries which facilitates cross-border comparisons between the best U.S. infrastructure names and international firms. From a portfolio management perspective, the Fund is able take active strategic and tactical bets across sectors and regions based on opportunity sets we see in the market.

| 1 | Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period. |

| 2 | Source: CBRE Clarion, Bloomberg, Morningstar. |

| 3 | Underlying yield reflects the annualized income net of expenses of the fund as a percentage of the market unit price of the fund as at the day shown. It is based on a snapshot of the fund on that day. It does not include any preliminary charge and investors may be subject to tax on distributions. As of March 31, 2021, the Centre Global Infrastructure Fund had an underlying yield of 4.17%. |

| 4 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| Semi-Annual Report | March 31, 2021 | 7 |

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

Market Review & Outlook

The Biden-Harris Administration released its $2 trillion "American Jobs Plan", which includes $621 billion in transportation infrastructure and resilience funding, $111 billion in clean drinking water infrastructure investment, $100 billion electric grid investment, and $100 billion for high-speed broadband investment5. The plan invests about 1% of GDP annually over eight years. It is expected to be fully paid within fifteen years in conjunction with the Administration's corporate tax plan proposal. The tax plan proposes raising the corporate tax rate to 28% as well as other corporate and individual tax reforms. During his comments, President Biden expressed that he is open to alternative options on how to fund the proposal but not on the size of the Administration’s plan. Congressional democrats are fully backing this proposal. An infrastructure bill would represent a source of significant upside potential for the Fund’s holdings. President Biden repeatedly emphasized that his plan would prioritize American-based companies, products, and employees. The plan addresses a number of our key investment themes for the stocks in the Fund which include traditional infrastructure: roads, bridges, airports, utilities, pipelines, ports, and waterways, as well as next generation infrastructure: 5G and renewable energy. As such, the plan involves modernizing 20,000 miles of roads, totally refurbishing the 10 most economically significant bridges, and repairing 10,000 bridges across the country.

Moreover, President Biden’s Executive Orders have included restrictions on hydrocarbon leasing in North America, drilling, and pipelines, each of which support higher oil prices. Also, the Administration’s comments suggest no urgency in lifting sanctions with Iran, further tempering global oil supply. As seen with Keystone, new US pipeline projects will face greater obstacles but a clampdown on new lines may make existing ones more valuable, and some could be repurposed in an energy transition. This should benefit the Fund’s holdings including Kinder Morgan and Williams Cos. In addition, pipeline infrastructure could be adapted to play an important role in facilitating many of the changes being advocated to lessen global emissions, i.e., modifying lines to carry green hydrogen or renewable diesel, which should benefit the Fund’s holdings including Pembina Pipeline Corp, TC Energy Corp, Enbridge Inc, ONEOK Inc, and Cheniere Energy Inc. Secular opportunities for green energy and ESG awareness remain thematically intact while cyclical opportunities due to higher oil & gas prices are profound as a result of supply constraints being imposed at the same time demand is rising. We believe this will cause the value of legacy pipeline assets to increase dramatically.

We see opportunities in the electric infrastructure and renewable power integration aspects of the Biden Infrastructure Plan. The Administration plan seeks to make the power grid more resilient and to achieve 100% carbon-free electricity generation by 2035. We believe this will serve as a long-term catalyst for the Fund’s holdings including NextEra, American Electric Power, and Exelon. Another key focus of the plan is the upgrading of the country's drinking water, wastewater, and stormwater systems, which includes replacing all lead pipes and services lines as well as the monitoring and remediation of new contaminants such as PFAS (perfluoroalkyl substances). This should serve as a catalyst for American Water Works, which is held by the Fund. Furthermore, there is potential to transform the Utilities sector from being a “bond proxy” to a genuine growth industry as well as an excellent inflation hedge from regulated power generation assets as the Biden-Harris Administration looks to monetize renewable generation and storage tax credits through direct pay. We also note that the plan calls for an extension of investment tax credits (ITC) and production tax credits (PTC) for 10 years. At the end of 2020, the wind PTC tax credit was extended for one year, while the ITC for solar was extended for two years. However, the Administration's plan calls for direct-pay tax credits versus the existing tax equity way of monetizing the credits. The direct-pay method would make funding available to more entities. President Biden added that the direct-pay method addresses the inequalities that the Biden-Harris Administration sees in the current clean energy policy. Growing renewable energy, cheap natural gas, and emission regulations will continue to crowd out coal as utilities use more renewable energy and natural gas for electricity generation. By 2030, renewable energy will pass coal, nuclear, and hydro as the second-largest source of power generation in the United States regardless of who is sitting in the Oval Office. Renewable energy growth (excluding hydro) will grow at 8% annual during the next decade, which will benefit the Fund’s holdings in NextEra, American Electric Power, and Exelon.

The Biden-Harris Administration’s broadband plan looks to bring broadband service to communities underserved such as the inner city and rural areas. We expect tax and research and development (R&D) incentives to be most impactful raising returns on incremental capital investments. When Biden campaigned with a plan to close the disparities that exist in the nation’s internet infrastructure, he spoke about expanding broadband capability to every household in the US by investing heavily in rural connectivity, backing municipal-run networks, and encouraging more competition among internet service providers (ISPs). A $300 billion R&D investment program would cover everything from electric vehicle technology to lightweight materials to 5G and artificial intelligence. President Biden’s 5G tax credits should speed the deployment of 5G nationwide and benefit service providers. Infrastructure returns on capital with 5G technological transformations would potentially improve the United States’ overall productivity and operational efficiency. Also, continued emphasis on improving energy monitoring and management as well as gaining better control of the energy generation and distribution network is expected to boost the adoption and government incentives for 5G services. The overarching point, as it concerns telecom investment and secular demand, is that between growth in data usage and 5G rollout, telecom will continue to be one of the global epicenters of technology investment over the next 20 years. We believe the carrier investment in LTE densification6 and 5G will unleash the growth potential of a new generation of telecom services, sparking a virtuous cycle that should lead to increased subscriber growth, sales, and ARPU (average revenue per unit). We believe US carriers (Verizon, AT&T, and T-Mobile) will benefit immensely from 5G credits under the Biden-Harris Administration given their mmWave7 spectrum position and small cell/fiber footprints.

| 5 | The White House, FACT SHEET: The American Jobs Plan |

| 6 | Network densification is adding more cell sites to increase the amount of available capacity. Cell sites placed in capacity-strained areas add more capacity where it is most needed and also help offload traffic from surrounding sites. Urban areas and large public venues are candidates for network densification because of the high concentration of mobile users. A major component of 5G, which is still not standardized or defined, will be ultra-dense network configurations, particularly in metro areas heavy with users. |

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

In terms of social infrastructures, continued evolution towards a single payor system will ironically boost health care facility profit margins. The pandemic’s economic calamity has led to increases in uncompensated care and bad debt expense for providers. As the economy rebounds from COVID-19 lows and the Affordable Care Act (ACA) is strengthened by the Biden Presidency, hospitals should benefit from a significantly lower bad debt expense due to ACA Basic High-Deductible Health Plans becoming more “patient” friendly. Healthcare companies held by the Fund have significantly outperformed since Biden was inaugurated including HCA healthcare, Universal Health Services, and Ramsay Health Care. In particular, HCA demonstrated exceptional operational and financial execution during the largest COVID-19 spike seen during 2020. Overall, we believe hospitals are successfully navigating the slowdown of COVID-19 and replacing it with elective surgeries. Hospitals have significantly outperformed the S&P 500 Index year-to-date and we see this outperformance continuing despite a slowdown in COVID-19 cases as vaccinations increase.

We believe the Fund will perform relatively well with exposure to favorable areas of the world’s equity markets. Also, undervalued international infrastructure-related stocks with strong balance sheets and free cash flows, solid dividend yields, and cyclically depressed profits are poised to outperform in our opinion. The Fund is positioned by targeting energy, telecom, industrials, and other undervalued areas of globally listed infrastructure industries and sub-sectors. The combination of low embedded growth and a robust stream of income payments effectively lowers the duration of the portfolio and, if interest rates rise, this will help protect against a broader based contraction in valuation multiples. Lastly, the Fund’s unique exposure to next-generation global infrastructure adjacencies, including public cloud deployments, data center monitoring, cybersecurity, and IIoT (Industrial Internet of Things) is a key differentiator against legacy managed infrastructure portfolios, which overlook these powerful trends within the industry. Despite the negative performance drag from the Energy sector in 2020, we continue to believe that our combined approach of differentiated stock selection and portfolio construction, whereby the Fund is diversified across regions and developed countries as well as balanced across Telecommunication Infrastructure; Utilities; and the Energy, Transportation, and Social Infrastructure sectors is the most favorable for investors seeking to feature listed infrastructure investments as part of an overall balanced portfolio.

The market outlook is the opinion of the author and can change at any time.

| 7 | Millimeter wave spectrum is the band of spectrum between 30 GHz and 300 GHz. Wedged between microwave and infrared waves. |

| Semi-Annual Report | March 31, 2021 | 9 |

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2021 (Unaudited) |

INDUSTRY WEIGHTINGS

As a percentage of Net Assets

| Oil, Gas & Consumable Fuels | 22.15% |

| Diversified Telecommunication Services | 21.33% |

| Electric Utilities | 17.00% |

| Wireless Telecommunication Services | 10.30% |

| Multi-Utilities | 7.33% |

| Health Care Providers & Services | 6.16% |

| Transportation Infrastructure | 5.56% |

| Independent Power and Renewable Electricity Producers | 2.91% |

| Water Utilities | 1.94% |

| Road & Rail | 1.53% |

| Construction & Engineering | 1.15% |

| Equity Real Estate Investment Trusts (REITs) | 1.05% |

| Cash and Cash Equivalents | 1.59% |

| Totals | 100.00% |

COUNTRY WEIGHTINGS

As a percentage of Net Assets

| United States | 48.87% |

| Canada | 11.12% |

| Japan | 7.97% |

| Australia | 4.50% |

| Italy | 4.29% |

| Spain | 3.41% |

| Hong Kong | 3.09% |

| Germany | 2.48% |

| Great Britain | 2.39% |

| New Zealand | 2.05% |

| France | 2.02% |

| Chile | 1.51% |

| China | 1.41% |

| Greece | 1.32% |

| Sweden | 1.15% |

| Denmark | 0.83% |

| Cash and Cash Equivalents | 1.59% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

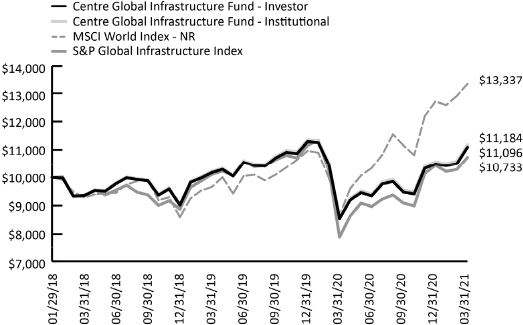

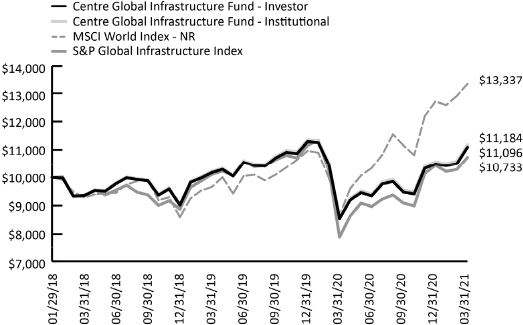

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2021

This graph assumes an initial investment of $10,000 at January 29, 2018, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the MSCI World Index and the S&P Global Infrastructure Index. Taxes on any Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2021

| | 1 Month | 3 Month | YTD | 6 Month | 1 Year | 3 Year | Since Inception (January 29, 2018 |

| Centre Global Infrastructure Fund – Investor | 5.67% | 5.81% | 5.81% | 17.03% | 29.83% | 5.85% | 3.34% |

| Centre Global Infrastructure Fund – Institutional | 5.60% | 5.89% | 5.89% | 17.03% | 29.97% | 6.11% | 3.60% |

| MSCI World Index – NR | 3.33% | 4.92% | 4.92% | 13.47% | 54.03% | 12.81% | 9.52% |

| S&P Global Infrastructure Index | 4.33% | 2.80% | 2.80% | 18.06% | 35.99% | 4.74% | 2.26% |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

Per the prospectus dated January 28, 2021, the Fund had total gross annual operating expenses of 1.83% and 1.63% and net annual operating expenses of 1.57% and 1.20% for the Investor and Institutional Class, respectively.

The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country. The MSCI World Index does not offer exposure to emerging markets.

The S&P Global Infrastructure Net Total Return Index is designed to track performance of the stocks of large infrastructure companies in developed or emerging markets that must be domiciled in developed markets, or whose stocks are listed on developed market exchanges around the world. The index includes companies involved in utilities, energy and transportation infrastructure, such as the management or ownership of oil and gas storage and transportation; airport services; highways and rail tracks; marine ports and services; and electric, gas and water utilities.

You cannot invest directly in an index.

| Centre Funds | Disclosure of Fund Expenses |

| | March 31, 2021 (Unaudited) |

Example. As a shareholder of a series of Centre Funds (each series, a “Fund” and together, the “Funds”), you will incur two types of costs: (1) transaction costs, including any applicable redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees (if applicable) and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on October 1, 2020 and held through March 31, 2021.

Actual Expenses. The first line under each class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period 10/01/2020-03/31/2021” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees, if any. Therefore, the second line under each class of the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning Account Value 10/01/2020 | | | Ending Account Value 03/31/2021 | | | Expense Ratio(a) | | | Expenses Paid During Period 10/1/2020-3/31/2021 (b) | |

| Centre American Select Equity Fund | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,220.30 | | | | 1.46 | % | | $ | 8.08 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.65 | | | | 1.46 | % | | $ | 7.34 | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,223.70 | | | | 0.98 | % | | $ | 5.43 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.04 | | | | 0.98 | % | | $ | 4.94 | |

| Centre Global Infrastructure Fund | | | | | | | | | | | | | | | | |

| Investor Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,170.30 | | | | 1.44 | % | | $ | 7.79 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.75 | | | | 1.44 | % | | $ | 7.24 | |

| Institutional Class | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,170.30 | | | | 1.20 | % | | $ | 6.49 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.95 | | | | 1.20 | % | | $ | 6.04 | |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses less any waivers/reimbursements. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 365. |

| Semi-Annual Report | March 31, 2021 | 11 |

| Centre American Select Equity Fund | Schedule of Investments |

| | March 31, 2021 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (99.28%) | | | | | | |

| Communication Services (9.65%) | | | | | | |

| Entertainment (0.99%) | | | | | | |

| Walt Disney Co.(a) | | | 8,560 | | | $ | 1,579,491 | |

| | | | | | | | | |

| Interactive Media & Services (8.66%) | | | | | | | | |

| Alphabet, Inc. Class A, Class A(a) | | | 2,200 | | | | 4,537,544 | |

| Alphabet, Inc. Class C, Class C(a) | | | 2,105 | | | | 4,354,466 | |

| Facebook, Inc., Class A(a) | | | 16,690 | | | | 4,915,706 | |

| | | | | | | | 13,807,716 | |

| Total Communication Services | | | | | | | 15,387,207 | |

| | | | | | | | | |

| Consumer Discretionary (10.44%) | | | | | | | | |

| Automobiles (1.84%) | | | | | | | | |

| Tesla, Inc.(a) | | | 4,390 | | | | 2,932,212 | |

| | | | | | | | | |

| Household Durables (1.82%) | | | | | | | | |

| Mohawk Industries, Inc.(a) | | | 15,080 | | | | 2,900,035 | |

| | | | | | | | | |

| Internet & Direct Marketing Retail (5.82%) | | | | | | | | |

| Amazon.com, Inc.(a) | | | 3,000 | | | | 9,282,240 | |

| | | | | | | | | |

| Specialty Retail (0.96%) | | | | | | | | |

| The Home Depot, Inc. | | | 5,000 | | | | 1,526,250 | |

| | | | | | | | | |

| Total Consumer Discretionary | | | | | | | 16,640,737 | |

| | | | | | | | | |

| Consumer Staples (6.51%) | | | | | | | | |

| Food Products (5.06%) | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 62,000 | | | | 3,534,000 | |

| Bunge, Ltd. | | | 57,200 | | | | 4,534,244 | |

| | | | | | | | 8,068,244 | |

| | | | | | | | | |

| Household Products (1.45%) | | | | | | | | |

| Procter & Gamble Co. | | | 17,010 | | | | 2,303,664 | |

| | | | | | | | | |

| Total Consumer Staples | | | | | | | 10,371,908 | |

| | | | | | | | | |

| Energy (19.84%) | | | | | | | | |

| Oil, Gas & Consumable Fuels (19.84%) | | | | | | | | |

| APA Corp. | | | 244,260 | | | | 4,372,254 | |

| Chevron Corp. | | | 45,000 | | | | 4,715,550 | |

| Cimarex Energy Co. | | | 95,150 | | | | 5,650,959 | |

| EQT Corp.(a) | | | 133,000 | | | | 2,471,140 | |

| Exxon Mobil Corp. | | | 125,480 | | | | 7,005,548 | |

| Kinder Morgan, Inc. | | | 230,000 | | | | 3,829,501 | |

| The Williams Cos., Inc. | | | 151,210 | | | | 3,582,165 | |

| | | | | | | | 31,627,117 | |

| Total Energy | | | | | | | 31,627,117 | |

| | | | | | | | | |

| Financials (3.77%) | | | | | | | | |

| Banks (1.58%) | | | | | | | | |

| JPMorgan Chase & Co. | | | 16,600 | | | | 2,527,018 | |

| | | | | | | | | |

| Diversified Financial Services (2.19%) | | | | | | | | |

| Berkshire Hathaway, Inc., Class B(a) | | | 13,670 | | | | 3,492,275 | |

| | | | | | | | | |

| Total Financials | | | | | | | 6,019,293 | |

| | | Shares | | | Value | |

| Health Care (2.57%) | | | | | | |

| Health Care Providers & Services (1.13%) | | | | | | |

| UnitedHealth Group, Inc. | | | 4,850 | | | $ | 1,804,540 | |

| | | | | | | | | |

| Pharmaceuticals (1.44%) | | | | | | | | |

| Johnson & Johnson | | | 14,000 | | | | 2,300,900 | |

| | | | | | | | | |

| Total Health Care | | | | | | | 4,105,440 | |

| | | | | | | | | |

| Industrials (2.12%) | | | | | | | | |

| Road & Rail (2.12%) | | | | | | | | |

| Knight-Swift Transportation Holdings, Inc. | | | 70,400 | | | | 3,385,536 | |

| | | | | | | | | |

| Total Industrials | | | | | | | 3,385,536 | |

| | | | | | | | | |

| Information Technology (23.99%) | | | | | | | | |

| IT Services (2.04%) | | | | | | | | |

| Mastercard, Inc., Class A | | | 4,030 | | | | 1,434,881 | |

| Visa, Inc., Class A | | | 8,560 | | | | 1,812,409 | |

| | | | | | | | 3,247,290 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment (6.36%) | | | | | | | | |

| Intel Corp. | | | 83,000 | | | | 5,312,000 | |

| Micron Technology, Inc.(a) | | | 37,100 | | | | 3,272,591 | |

| NVIDIA Corp. | | | 2,900 | | | | 1,548,397 | |

| | | | | | | | 10,132,988 | |

| | | | | | | | | |

| Software (7.41%) | | | | | | | | |

| Microsoft Corp. | | | 50,117 | | | | 11,816,085 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals (8.18%) | | | | | | | | |

| Apple, Inc. | | | 106,800 | | | | 13,045,620 | |

| | | | | | | | | |

| Total Information Technology | | | | | | | 38,241,983 | |

| | | | | | | | | |

| Materials (15.92%) | | | | | | | | |

| Chemicals (10.71%) | | | | | | | | |

| Corteva, Inc. | | | 67,000 | | | | 3,123,540 | |

| Eastman Chemical Co. | | | 28,580 | | | | 3,147,230 | |

| LyondellBasell Industries, Class A | | | 32,450 | | | | 3,376,422 | |

| Mosaic Co. | | | 94,000 | | | | 2,971,340 | |

| Olin Corp. | | | 117,500 | | | | 4,461,475 | |

| | | | | | | | 17,080,007 | |

| | | | | | | | | |

| Metals & Mining (5.21%) | | | | | | | | |

| Barrick Gold Corp. | | | 281,960 | | | | 5,582,808 | |

| Southern Copper Corp. | | | 40,000 | | | | 2,714,800 | |

| | | | | | | | 8,297,608 | |

| Total Materials | | | | | | | 25,377,615 | |

| | | | | | | | | |

| Real Estate (2.57%) | | | | | | | | |

| Equity Real Estate Investment Trusts (REITs)(2.57%) | | | | | | | | |

| Weyerhaeuser Co. | | | 115,000 | | | | 4,094,000 | |

| | | | | | | | | |

| Total Real Estate | | | | | | | 4,094,000 | |

| See Notes to Financial Statements. | |

| 12 | centrefunds.com |

| Centre American Select Equity Fund | Schedule of Investments |

| | March 31, 2021 (Unaudited) |

| | | Shares | | | Value | |

| Utilities (1.90%) | | | | | | |

| Independent Power and Renewable Electricity Producers (1.90%) | | | | | | | | |

| AES Corp. | | | 113,000 | | | $ | 3,029,530 | |

| | | | | | | | | |

| Total Utilities | | | | | | | 3,029,530 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $93,357,354) | | | | | | | 158,280,366 | |

| Expiration Date | | Exercise Price | | | Contracts | | | Notional Value | | | Value | |

| PURCHASED OPTIONS (0.38%) | | | | | | | | | | | | |

| S&P 500® Index: | | | | | | | | | | | | |

| 9/17/2021 | | $ | 3,150.00 | | | | 132 | | | | 52,442,148 | | | | 603,240 | |

| | | | | | | | | | | | | | | | | |

| TOTAL PURCHASED OPTIONS | | | | | | | | | | | | | | | | |

| (Cost $866,145) | | | | | | | | | | | | | | | 603,240 | |

| | | 7-Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.45%) | | | | | | | | | |

| Money Market Fund (0.45%) | | | | | | | | | |

| Dreyfus Treasury Prime Cash | | | | | | | | | |

| Management, Institutional Class | | | 0.010 | % | | | 721,412 | | | | 721,412 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $721,412) | | | | | | | | | | | 721,412 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (100.11%) | | | | | | | | | | | | |

| (Cost $94,944,911) | | | | | | | | | | $ | 159,605,018 | |

| Liabilities in Excess of Other Assets (-0.11%) | | | | | | | | | | | (179,147 | ) |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 159,425,871 | |

| (a) | Non-income producing security. |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2021 | 13 |

| Centre Global Infrastructure Fund | Schedule of Investments |

| | March 31, 2021 (Unaudited) |

| | | Shares | | | Value | |

| COMMON STOCKS (98.41%) | | | | | | |

| ASIA (19.02%) | | | | | | |

| Australia (4.50%) | | | | | | |

| Health Care Providers & Services (0.84%) | | | | | | | | |

| Ramsay Health Care, Ltd. | | | 7,000 | | | $ | 356,229 | |

| | | | | | | | | |

| Multi-Utilities (1.22%) | | | | | | | | |

| AGL Energy, Ltd. | | | 71,000 | | | | 520,405 | |

| | | | | | | | | |

| Transportation Infrastructure (2.44%) | | | | | | | | |

| Transurban Group | | | 103,030 | | | | 1,042,375 | |

| | | | | | | | | |

| Total Australia | | | | | | | 1,919,009 | |

| | | | | | | | | |

| China (1.41%) | | | | | | | | |

| Independent Power and Renewable Electricity Producers (1.41%) | | | | | | | | |

| Datang International Power Generation Co., Ltd. | | | 3,761,000 | | | | 599,894 | |

| | | | | | | | | |

| Total China | | | | | | | 599,894 | |

| | | | | | | | | |

| Hong Kong (3.09%) | | | | | | | | |

| Electric Utilities (1.71%) | | | | | | | | |

| CK Infrastructure Holdings, Ltd. | | | 123,000 | | | | 730,966 | |

| | | | | | | | | |

| Water Utilities (1.38%) | | | | | | | | |

| Beijing Enterprises Water Group, Ltd. | | | 1,550,000 | | | | 588,171 | |

| | | | | | | | | |

| Total Hong Kong | | | | | | | 1,319,137 | |

| | | | | | | | | |

| Japan (7.97%) | | | | | | | | |

| Diversified Telecommunication Services (1.04%) | | | | | | | | |

| Nippon Telegraph & Telephone Corp. | | | 17,200 | | | | 441,476 | |

| | | | | | | | | |

| Wireless Telecommunication Services (6.93%) | | | | | | | | |

| KDDI Corp. | | | 18,900 | | | | 579,503 | |

| SoftBank Corp. | | | 65,400 | | | | 849,654 | |

| SoftBank Group Corp. | | | 18,100 | | | | 1,525,157 | |

| | | | | | | | 2,954,314 | |

| Total Japan | | | | | | | 3,395,790 | |

| | | | | | | | | |

| New Zealand (2.05%) | | | | | | | | |

| Diversified Telecommunication Services (1.43%) | | | | | | | | |

| Spark New Zealand, Ltd. | | | 195,500 | | | | 611,688 | |

| | | | | | | | | |

| Transportation Infrastructure (0.62%) | | | | | | | | |

| Auckland International Airport, Ltd.(a) | | | 48,000 | | | | 262,823 | |

| | | | | | | | | |

| Total New Zealand | | | | | | | 874,511 | |

| | | | | | | | | |

| TOTAL ASIA | | | | | | | | |

| (Cost $7,360,830) | | | | | | | 8,108,341 | |

| | | Shares | | | Value | |

| EUROPE (17.89%) | | | | | | |

| Denmark (0.83%) | | | | | | |

| Electric Utilities (0.83%) | | | | | | |

| Orsted AS(b)(c) | | | 2,200 | | | $ | 355,323 | |

| | | | | | | | | |

| Total Denmark | | | | | | | 355,323 | |

| | | | | | | | | |

| France (2.02%) | | | | | | | | |

| Diversified Telecommunication Services (0.77%) | | | | | | | | |

| Orange SA | | | 26,420 | | | | 325,475 | |

| | | | | | | | | |

| Multi-Utilities (0.60%) | | | | | | | | |

| Engie SA(a) | | | 18,100 | | | | 256,940 | |

| | | | | | | | | |

| Transportation Infrastructure (0.65%) | | | | | | | | |

| Groupe Eurotunnel(a) | | | 18,050 | | | | 276,868 | |

| | | | | | | | | |

| Total France | | | | | | | 859,283 | |

| | | | | | | | | |

| Germany (2.48%) | | | | | | | | |

| Diversified Telecommunication Services (1.94%) | | | | | | | | |

| Deutsche Telekom AG | | | 41,010 | | | | 825,750 | |

| | | | | | | | | |

| Multi-Utilities (0.54%) | | | | | | | | |

| RWE AG | | | 5,900 | | | | 231,231 | |

| | | | | | | | | |

| Total Germany | | | | | | | 1,056,981 | |

| | | | | | | | | |

| Great Britain (2.39%) | | | | | | | | |

| Multi-Utilities (0.96%) | | | | | | | | |

| National Grid PLC | | | 34,260 | | | | 408,077 | |

| | | | | | | | | |

| Wireless Telecommunication Services (1.43%) | | | | | | | | |

| Vodafone Group PLC | | | 335,640 | | | | 610,229 | |

| | | | | | | | | |

| Total Great Britain | | | | | | | 1,018,306 | |

| | | | | | | | | |

| Greece (1.32%) | | | | | | | | |

| Diversified Telecommunication Services (1.32%) | | | | | | | | |

| Hellenic Telecommunications Organization SA | | | 35,200 | | | | 564,699 | |

| | | | | | | | | |

| Total Greece | | | | | | | 564,699 | |

| | | | | | | | | |

| Italy (4.29%) | | | | | | | | |

| Diversified Telecommunication Services (1.60%) | | | | | | | | |

| Telecom Italia SpA | | | 1,257,900 | | | | 680,336 | |

| | | | | | | | | |

| Electric Utilities (1.85%) | | | | | | | | |

| Enel SpA | | | 79,240 | | | | 789,213 | |

| | | | | | | | | |

| Transportation Infrastructure (0.84%) | | | | | | | | |

| Atlantia SpA(a) | | | 19,230 | | | | 359,690 | |

| | | | | | | | | |

| Total Italy | | | | | | | 1,829,239 | |

| See Notes to Financial Statements. | |

| 14 | centrefunds.com |

| Centre Global Infrastructure Fund | Schedule of Investments |

| | March 31, 2021 (Unaudited) |

| | | Shares | | | Value | |

| Spain (3.41%) | | | | | | |

| Diversified Telecommunication Services (0.66%) | | | | | | |

| Telefonica SA | | | 62,900 | | | $ | 281,554 | |

| | | | | | | | | |

| Electric Utilities (1.75%) | | | | | | | | |

| Iberdrola SA | | | 57,865 | | | | 745,426 | |

| | | | | | | | | |

| Transportation Infrastructure (1.00%) | | | | | | | | |

| Abertis Infraestructuras SA(d) | | | 1,200 | | | | 25,837 | |

| Aena SME SA(a)(b)(c) | | | 2,470 | | | | 400,597 | |

| | | | | | | | 426,434 | |

| Total Spain | | | | | | | 1,453,414 | |

| | | | | | | | | |

| Sweden (1.15%) | | | | | | | | |

| Construction & Engineering (1.15%) | | | | | | | | |

| Skanska AB | | | 19,500 | | | | 488,982 | |

| | | | | | | | | |

| Total Sweden | | | | | | | 488,982 | |

| | | | | | | | | |

| TOTAL EUROPE | | | | | | | | |

| (Cost $6,982,520) | | | | | | | 7,626,227 | |

| | | | | | | | | |

| NORTH AMERICA (59.99%) | | | | | | | | |

| Canada (11.12%) | | | | | | | | |

| Oil, Gas & Consumable Fuels (11.12%) | | | | | | | | |

| Enbridge, Inc. | | | 71,280 | | | | 2,596,641 | |

| Pembina Pipeline Corp. | | | 21,200 | | | | 612,366 | |

| TC Energy Corp. | | | 33,400 | | | | 1,531,132 | |

| | | | | | | | 4,740,139 | |

| Total Canada | | | | | | | 4,740,139 | |

| | | | | | | | | |

| United States (48.87%) | | | | | | | | |

| Diversified Telecommunication Services (12.58%) | | | | | | | | |

| AT&T, Inc. | | | 83,862 | | | | 2,538,503 | |

| Verizon Communications, Inc. | | | 48,598 | | | | 2,825,974 | |

| | | | | | | | 5,364,477 | |

| Electric Utilities (9.35%) | | | | | | | | |

| American Electric Power Co., Inc. | | | 4,570 | | | | 387,079 | |

| Duke Energy Corp. | | | 6,669 | | | | 643,759 | |

| Eversource Energy | | | 3,267 | | | | 282,889 | |

| Exelon Corp. | | | 8,958 | | | | 391,823 | |

| NextEra Energy, Inc. | | | 18,004 | | | | 1,361,282 | |

| The Southern Co. | | | 9,529 | | | | 592,323 | |

| Xcel Energy, Inc. | | | 4,953 | | | | 329,424 | |

| | | | | | | | 3,988,579 | |

| Equity Real Estate Investment Trusts (REITs) (1.05%) | | | | | | | | |

| Uniti Group, Inc. | | | 40,510 | | | | 446,825 | |

| | | | | | | | | |

| Health Care Providers & Services (5.32%) | | | | | | | | |

| HCA Healthcare, Inc. | | | 9,907 | | | | 1,865,884 | |

| Universal Health Services, Inc., Class B | | | 3,020 | | | | 402,838 | |

| | | | | | | | 2,268,722 | |

| Independent Power and Renewable Electricity Producers (1.50%) | | | | | | | | |

| AES Corp. | | | 23,820 | | | | 638,614 | |

| | | | | | | | | |

| Multi-Utilities (4.01%) | | | | | | | | |

| Dominion Energy, Inc. | | | 7,529 | | | | 571,903 | |

| DTE Energy Co. | | | 1,710 | | | | 227,669 | |

| | | Shares | | | Value | |

| United States (continued) | | | | | | |

| Multi-Utilities (continued) | | | | | | |

| Public Service Enterprise Group, Inc. | | | 4,759 | | | $ | 286,539 | |

| Sempra Energy | | | 2,565 | | | | 340,068 | |

| WEC Energy Group, Inc. | | | 3,020 | | | | 282,642 | |

| | | | | | | | 1,708,821 | |

| Oil, Gas & Consumable Fuels (11.04%) | | | | | | | | |

| Cheniere Energy, Inc.(a) | | | 8,000 | | | | 576,080 | |

| Kinder Morgan, Inc. | | | 104,826 | | | | 1,745,353 | |

| ONEOK, Inc. | | | 15,872 | | | | 804,075 | |

| The Williams Cos., Inc. | | | 66,710 | | | | 1,580,360 | |

| | | | | | | | 4,705,868 | |

| Road & Rail (1.53%) | | | | | | | | |

| Knight-Swift Transportation Holdings, Inc. | | | 13,530 | | | | 650,658 | |

| | | | | | | | | |

| Water Utilities (0.56%) | | | | | | | | |

| American Water Works Co., Inc. | | | 1,590 | | | | 238,373 | |

| | | | | | | | | |

| Wireless Telecommunication Services (1.93%) | | | | | | | | |

| T-Mobile US, Inc.(a) | | | 6,580 | | | | 824,408 | |

| | | | | | | | | |

| Total United States | | | | | | | 20,835,345 | |

| | | | | | | | | |

| TOTAL NORTH AMERICA | | | | | | | | |

| (Cost $22,670,138) | | | | | | | 25,575,484 | |

| | | | | | | | | |

| SOUTH AMERICA (1.51%) | | | | | | | | |

| Chile (1.51%) | | | | | | | | |

| Electric Utilities (1.51%) | | | | | | | | |

| Enel Americas SA, ADR | | | 75,800 | | | | 642,784 | |

| | | | | | | | | |

| Total Chile | | | | | | | 642,784 | |

| | | | | | | | | |

| TOTAL SOUTH AMERICA | | | | | | | | |

| (Cost $491,177) | | | | | | | 642,784 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $37,504,665) | | | | | | | 41,952,836 | |

| | | 7-Day Yield | | | Shares | | | Value | |

| SHORT TERM INVESTMENTS (0.56%) | | | | | | | | | |

| Money Market Fund (0.56%) | | | | | | | | | |

| Dreyfus Treasury Prime Cash Management, Institutional Class | | | 0.010 | % | | | 236,724 | | | | 236,724 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $236,724) | | | | | | | | | | | 236,724 | |

| | | Value | |

| TOTAL INVESTMENTS (98.97%) | | | |

| (Cost $37,741,389) | | $ | 42,189,560 | |

| Other Assets In Excess Of Liabilities (1.03%) | | | 441,024 | |

| NET ASSETS (100.00%) | | $ | 42,630,584 | |

| See Notes to Financial Statements. | |

| Semi-Annual Report | March 31, 2021 | 15 |

| Centre Global Infrastructure Fund | Schedule of Investments |

| | March 31, 2021 (Unaudited) |

| (a) | Non-income producing security. |

| (b) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be resold in transactions exempt from registration only to qualified institutional buyers. As of March 31, 2021, these securities had a total aggregate market value of $755,920, representing 1.77% of net assets. |

| (c) | Securities were purchased pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to Securities Act of 1933, or pursuant to an exemption from registration. These securities have been deemed liquid under guidelines approved by the Fund's Board of Trustees. At period end, the aggregate market value of those securities was $755,920, representing 1.77% of net assets. |

| (d) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. (See Note 3) |

| See Notes to Financial Statements. | |

| 16 | centrefunds.com |

| Centre Funds | Statements of Assets and Liabilities |

| | March 31, 2021 (Unaudited) |

| | | Centre American Select Equity Fund | | | Centre Global Infrastructure Fund | |

| ASSETS: | | | | | | |

| Investments, at value | | $ | 159,605,018 | | | $ | 42,189,560 | |

| Foreign currency, at value (Cost $– and $372,103, respectively) | | | – | | | | 367,247 | |

| Receivable for dividends | | | 19,725 | | | | 128,495 | |

| Deposit with broker for futures contracts | | | 12,414 | | | | – | |

| Receivable for fund shares sold | | | 10,763 | | | | – | |

| Prepaid and other assets | | | 31,980 | | | | 21,512 | |

| Total Assets | | | 159,679,900 | | | | 42,706,814 | |

| LIABILITIES: | | | | | | | | |

| Payable to investment adviser | | | 100,874 | | | | 24,141 | |