UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22545

CENTRE FUNDS

(Exact name of registrant as specified in charter)

48 Wall Street, Suite 1100, New York, New York 10005

(Address of principal executive offices) (Zip code)

James A. Abate

48 Wall Street, Suite 1100

New York, New York 10005

(Name and address of agent for service)

Registrant’s telephone number, including area code:(212) 918-4705

Date of fiscal year end:September 30

Date of reporting period:October 1, 2018 – March 31, 2019

| Item 1. | Reports to Stockholders. |

| | PAGE |

| SHAREHOLDER LETTER | 1 |

| MANAGER COMMENTARY | 2 |

| Centre American Select Equity Fund | 2 |

| Centre Active U.S. Treasury Fund | 7 |

| Centre Global Infrastructure Fund | 11 |

| DISCLOSURE OF FUND EXPENSES | 15 |

| SCHEDULE OF INVESTMENTS | 16 |

| Centre American Select Equity Fund | 16 |

| Centre Active U.S. Treasury Fund | 18 |

| Centre Global Infrastructure Fund | 19 |

| STATEMENTS OF ASSETS AND LIABILITIES | 22 |

| STATEMENTS OF OPERATIONS | 23 |

| STATEMENTS OF CHANGES IN NET ASSETS | 24 |

| Centre American Select Equity Fund | 24 |

| Centre Active U.S. Treasury Fund | 25 |

| Centre Global Infrastructure Fund | 26 |

| FINANCIAL HIGHLIGHTS | 27 |

| Centre American Select Equity Fund | 27 |

| Centre Active U.S. Treasury Fund | 29 |

| Centre Global Infrastructure Fund | 31 |

| NOTES TO FINANCIAL STATEMENTS | 33 |

| ADDITIONAL INFORMATION | 43 |

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Trust’s website at www.centrefunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Beginning on January 1, 2019, you may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call (855) 298-4236 to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary or, if you are a direct investor, by enrolling at www.centrefunds.com.

| Centre Funds | Shareholder Letter |

| | March 31, 2019 (Unaudited) |

Dear Shareholders,

It is with my pleasure that we publish the Centre Funds Semi-Annual Report covering the six-month period ended March 31, 2019. I want to thank my fellow shareholders for their continued support and confidence in Centre Funds. We are committed to truly active fund management with distinction. Each series of Centre Funds is a fundamentally-driven, actively managed Fund in core investment strategies with differentiation and uses specialist talent. We offer a select series of funds to choose from, each available in investor and institutional share classes.

Centre American Select Equity Fund

The Fund is a U.S. large capitalization valuation sensitive growth stock fund that seeks long-term growth of capital and is focused on risk adjusted returns through active and pragmatic management; the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed appropriate. The Fund is intended to be a risk managed core growth fund.

Centre Active U.S. Treasury Fund

The Fund is a nontraditional U.S. Treasury securities fund that seeks to maximize investors’ total return through capital appreciation and current income through investments in primarily U.S. Treasury securities. The Fund has the potential for capital appreciation/preservation in various interest rate environments using a proprietary interest rate forecasting process that aims to take advantage of interest rate changes through active duration and interest rate management.

Centre Global Infrastructure Fund

The Fund is for investors seeking to potentially benefit from a renewed focus on infrastructure spending but wish to have liquidity in publicly traded investments in developed global markets rather than illiquid private investments. The Fund pursues a bottom-up, active management approach and invests in what we deem the most attractive infrastructure-related companies from the United States and developed international economies. Also, the Fund seeks to balance its exposures to where the weights of the Telecommunication, Utilities, Energy, Transportation, and Social Infrastructure industries are broadly represented.

Our aim at Centre Funds is to deliver strong, long-term performance results for investors through an exceptional focus on producing returns and managing risk and downside volatility in select investment strategies. We want investors to associate Centre Funds with high-conviction, differentiated fund strategies that may not be available elsewhere and are tactical, pragmatic, and opportunistic. Each investment strategy aims to capitalize on defined market opportunities using talented and experienced portfolio managers with consistent and repeatable investment processes who aim to achieve true differentiated returns. Our portfolio managers remain focused on fundamentally-driven investment approaches within truly active, disciplined and research-intensive processes. At Centre Funds, we place service excellence at the core of everything that we do and are committed to providing useful information and transparency on the Funds. Again, I want to thank my fellow shareholders for their continued support and confidence in the Centre Funds.

Sincerely,

James Abate

President, Centre Funds

| Semi-Annual Report | March 31, 2019 | 1 |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

Performance & Strategy Summary

For the six-month period ended March 31, 2019, the Centre American Select Equity Fund (“the Fund”), Investor Share Class, delivered a total return of -3.50%; the Institutional Share Class delivered a total return of -3.27%.

During this past six-month period, the key barometer of the U.S. stock market, as measured by the S&P 500 Index1, delivered a total return of -1.73%, with only the Real Estate, Utilities, and Consumer Staples sectors posting positive absolute returns. Cyclical growth sectors such as Energy, Financials, Consumer Discretionary, and Materials fared worst as stock markets fell in the fourth quarter on global growth and rising interest rate concerns. The subsequent alleviation of macro concerns by investors and early 2019 stock market rally offset most of the fourth quarter drawdown.

The largest detractors to relative performance over the six month period ended March 31, 2019 included the Fund’s investments within the Energy sector, Noble Energy, Cimarex Energy, and Exxon Mobil; within the Materials sector, Mosaic, Nucor, CF Industries, and Albemarle; and within the Technology sector, Apple and Intel. Investments that added to the Fund’s relative performance included investments within the Utilities sector, NRG Energy, PPL Corp., and AES Corp; and within the Health Care sector and the biotechnology industry in particular, Celgene, Incyte, and Regeneron.

The Fund’s performance was positively impacted from a total return perspective by realized gains of certain hedges and other investments that Centre Asset Management, LLC, the investment adviser to the Fund (“Centre,” the “Adviser” or “we”), viewed, and continues to view, as capital protective in nature. These hedges, namely put options2 on the S&P 500 Index, aided during the volatile month of December and partly insulated the Fund from the same magnitude of drawdown3 experienced by the overall stock market, consistent with other prior volatile4 episodes, namely in August 2015, January 2016, and February 2018. Given the continued presence of certain potentially de-stabilizing factors that we believe could negatively impact the value of underlying equity securities held in the Fund’s portfolio, as of March 31, 2019, the Fund continued to hold put options on the S&P 500 Index as a potential hedge against its underlying stock holdings in the event of a material stock market correction. In terms of derivative activity during the six-month period, the Adviser reduced the hedge ratio5 of the Fund in late December by selling approximately one half of its purchased put option contracts but then restored the notional value of the put options held in late January by purchasing back essentially the number of put option contracts sold to increase the hedge ratio to again approximate the value of the underlying stock portfolio.

The process used by Centre to manage the Fund focuses on each individual portfolio company's growth outlook and capacity to create shareholder value, utilizing our bottom-up fundamental stock selection process. We utilize a disciplined, Economic Value Added6 framework to select investments. The framework focuses on the fundamentals of wealth creation or wealth destruction similar to the way a traditional, long-term focused corporate investor looking at all aspects of the business would assess a company's value. In the shorter-term, markets may often undervalue or overvalue a company's ability to create or destroy wealth. The framework seeks to identify and capture these investment opportunities. The approach is designed to capture excess returns when a business is creating shareholder wealth and the market price of the stock converges toward our target price. Centre not only analyzes earnings but also strives to understand and link the capital allocation decisions being made today by each portfolio company and how they may lead to future earnings growth. In other words, we expect that the companies in which the Fund invests will themselves invest in productive assets of the business, organically and through opportunistic purchases which, in turn, should provide the foundation for future revenue and profits growth that should create shareholder value. Alternatively, if companies cannot invest in productive assets due to a cyclical downturn or existing excess capacity, we expect these companies to “wisely contract” through the restructuring of their assets and other resources to regain their footing for future shareholder value creation. The key is that we look at the company drivers that create true shareholder wealth: capital spending or alternative capital allocations such as acquisitions, stock buybacks, or dividends; company-specific risk levels of a business to determine appropriate hurdle rates;7 and whether the company is generating operating returns on its underlying assets vis-à-vis the cost of capital. Wealth creation from growth or from wise contraction – that’s how we believe companies create long-term shareholder value.

| 1 | S&P 500 is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. |

| 2 | A put option is a contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. |

| 3 | Maximum drawdown is the maximum loss from a peak to a trough of a portfolio, before a new peak is attained. |

| 4 | Volatility is a measure of systematic risk of a security or a portfolio in comparison to the market as a whole. |

| 5 | The hedge ratio compares the value of a position protected through the use of a hedge with the size of the entire position itself. In this case, the notional value of put options related to the value of underlying stock positions. |

| 6 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| 7 | A hurdle rate is the minimum rate of return on a project or investment required by a manager or investor. The hurdle rate denotes appropriate compensation for the level of risk present; riskier projects generally have higher hurdle rates than those that are deemed to be less risky. |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

To meet its objective as a risk-managed growth fund, the Fund may complement its equity securities with hedges and other capital preservation strategies when deemed tactically appropriate by Centre. While the use of hedging and certain investment techniques involve risk, in accordance with the Fund’s investment policies, the Adviser may tactically employ hedges and other capital preservation strategies on up to notionally one hundred percent of the value of the Fund’s underlying securities positions when the Adviser’s assessment of market valuation indicates forward returns for the stock market, as a whole, are low relative to downside risk and the cost to upside potential from portfolio preservation tools is deemed reasonable in order to respond to adverse market, economic, political or other conditions. The Adviser may also tactically employ hedges to reduce volatility. For example, through the tactical use of put options, the Fund may have enhanced performance and more limited risk. Index put options are designed to hedge the Fund from significant market declines that may occur over short periods of time. The value of an index put option generally increases as the underlying securities in the Fund decrease in price and decreases as those securities increase in price. The Adviser may also seek to enhance returns by writing (selling) out of the money call options8 tailored with exercise prices generally above the current market prices of stocks held in the Fund. As the seller of the call option, the Fund receives cash (the premium) from the purchaser9. The Adviser varies its hedging strategy and defensive positions across changing market cycles but has generally employed such strategies within the Fund since late 2014.

Market Review & Outlook

The very strong rebound in U.S. stock market indexes during the first quarter of 2019, the best start since 1998, has laid the foundation for expectations that 2019 overall will be solid, as each time the S&P 500 Index has scored a gain of 10% or more in the first quarter of a year since 1935, the market managed to climb up 6% more on average for the rest of the year, with positive performance during 11 of those 12 times, 1987 being the only exception10. This said, it must be remembered that indexes are still just near their peak levels of last September and, furthermore, we reiterate our belief that the current market dynamics are unique despite our erstwhile attempts to find a historical analog for guidance. The two contributing attributes leading to this uniqueness are the levels of overall stock market valuation and the most important economic phenomenon that may be persistent for the next two decades, namely demographic decline in the developed economies, including China, and its impact on growth and inflation.

The catalyst behind the strong start to the year lays at the feet of Federal Reserve Chairman Jerome Powell who surprised markets by doing a complete U-turn on monetary policy. After the financial markets impact of the current rate hiking cycle began to have significance,i.e., a stock market correction, Chairman Powell abruptly communicated a full reversal in short-term interest rate targets for 2019 and, not only removed expectations of further planned tightening through 2019, but instilled confidence that the Federal Reserve would actually move to accommodation with up to two interest rate cuts imbedding themselves into market expectations. Concurrently, the Federal Reserve unveiled a plan to stop scaling back the vast portfolio of bonds it built up to spur an economic recovery from the 2007-2009 financial crisis, leaving the Federal Reserve still holding at least $3.5 trillion in bonds, more than four times the roughly $800 billion it had heading into the crisis more than a decade ago. Furthermore, the European Central Bank (ECB), although it decided to end its bond purchases in December 2018, announced that it intends to continue reinvesting, in full, the principal payments from maturing securities purchased for an extended period to maintain favorable liquidity conditions and an ample degree of monetary accommodation. Never before in modern times have the world’s leading central banks abandoned a monetary tightening cycle before even moving real interest rates above zero and, in the case of the Japanese and Swiss Central Banks, expanded their mandates to engage in massive purchases of equities.

The key factor that will determine whether stock markets can follow the path of history as noted above is whether the expected deterioration in earnings, anticipated for 2019 vis-à-vis 2018, can be offset with further valuation multiple11 expansion, akin to what occurred in 2015 and early 2016 as well as other “soft landing” episodes over the past few decades,e.g., 1995. The bear case would be if we had a flat or decreasing earnings environment combined with valuation multiple compression or a further de-rating. Thus, in our opinion U.S. stock market indexes offer an asymmetrical return profile from this point – up modestly with downside risk of up to 30%.

The bear case of a potential 30% plus decline in markets arises from the foundation of what is supporting market valuations currently, specifically continued low interest rates, unparalleled usage of cash flows and debt to finance stock buybacks, and perceived permanence of the recently enacted reduction in the federal corporate tax rate from 35% to 21%. With the U.S. Presidential election cycle kicking into high gear already ahead of the 2020 election, we believe the greatest risks are geared towards increasing probabilities that policies under the next administration and Congress could curtail stock buybacks and a full or partial roll-back of the corporate tax cuts. Ironically, the bear case becomes tautological and gains its own momentum if the stock market or economy falters over the next few quarters, raising the likelihood of President Trump’s defeat by a

| 8 | Call options are agreements that give the option buyer the right, but not the obligation, to buy a stock, bond, commodity or other instrument at a specified price within a specific time period. The stock, bond, or commodity is called the underlying asset. |

| 9 | A covered call is an options strategy whereby an investor holds a long position in an asset and writes (sells) call options on that same asset in an attempt to generate increased income from the asset. This is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. |

| 10 | Source: BMO Financial Group |

| 11 | A valuation multiple is simply an expression of market value of an asset relative to a key statistic that is assumed to relate to that value. To be useful, that statistic – whether earnings, cash flow or some other measure – must bear a logical relationship to the market value observed; to be seen, in fact, as the driver of that market value. |

| Semi-Annual Report | March 31, 2019 | 3 |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

progressive Democratic Party candidate who is likely to implement such changes. With regard to the permanence of the corporate tax rate cuts and the deficit, we remain old-fashioned in the belief that a dollar of debt will cut today’s tax bill by a dollar, but at the cost of raising it by a dollar plus interest tomorrow. A more bullish case can be supported, returns higher than up modestly, if there is some resurgence in global growth, profit margin pressures abate, and the massive fiscal deficits being accrued from the recent tax cuts genuinely don’t matter to bond or stock markets which allows the U.S. economy to potentially exit a recessionary window of vulnerability given the current low level of global growth. Alternatively, given the most recent example whereby monetary policy accommodation has come riding over the hill to “bail-out” stock markets after a greater than ten percent drawdown may lead investors to extrapolate the current re-rating phase of this stock market cycle indefinitely into the future without taking into account the effects of the normal economic and business cycles. We now find ourselves here again at peak optimism in the same manner as in 2000 and 2007 and, more importantly, witnessing deterioration in aggregate U.S. company fundamentals, operating profit margins rolling over and diminished assets efficiency, with an increasing reliance upon monetary policy accommodation to “bail-out” stock markets after significant drawdowns but leading to one of the oldest questions in investing, "how high is too high" when it comes to valuations?

With regard to economic growth, which has a strong correlation to S&P 500 Index aggregate revenues, we remain believers in our long-held thesis that demography is destiny. This holds that population trends determine the future growth rates of a country, region or even the entire world. For example, if working age populations increase too fast or too slowly, or if there are too many young or old people, then certain outcomes are likely to follow, such as economic boom or bust, inflation, or even political unrest. Low fertility and an aging population are two of our greatest concerns. In the future, nearly all developed countries may have to depend on immigrants to make up for the decline in native populations, for without them, the U.S. and nearly every country in Europe may face the prospect of a shrinking workforce and a stagnant economy akin to the Japanese experience over the recent decade. Thus, the debt crises witnessed in Greece, Puerto Rico, Italy, etc., where population declines have been most pronounced and leading, are the literal canaries in the coal mine for what experiences are likely to occur across larger countries or even regions. All developed countries have reached the point where productivity must compensate for the decline in populations or allow mass migration, which in Europe and the U.S. is one of the most argumentative and politically volatile topics and will only intensify with time. From an economic perspective, while we may experience periods of cyclical inflation, we remain convinced that lower economic growth will be consistent with continued low real interest rates and demography, more than globalization, automation, or even de-unionization, will be the primary contributor going forward.

While low real interest rates have allowed debt service levels to remain manageable, they have also led to an unprecedented increase in corporate leverage, with the debt to assets and debt per share ratios at levels last seen in the year 2000 for the average company in the S&P 500 Index. The difference, however, has been in the usage of such increased leverage. As opposed to the vast majority of cash flow usage back then being directed towards investing activities, we now are witnessing a majority directed towards financing activities, specifically stock buybacks. Corporations like stock buybacks because they generally raise earnings per share12 by reducing the number of outstanding shares and increasing per share returns on assets and equity, used widely as performance measures for executive compensation least of all. Stock buybacks also serve as a stealth transfer of wealth from shareholders to executives as they offset the dilution from stock option issuance. In 2018, partially fueled by the lower corporate tax rates, S&P 500 constituents spent $800 billion purchasing their stock, and this year it’s estimated they will spend close to $1 trillion13, much greater than the amount distributed as dividends. The low interest rate environment may have literally trapped corporations into the classic “Minsky moment” whereby the current long period of low rates and prosperity have encouraged a diminished perception of risk, which has promoted the leveraged risk of using borrowed money instead of cash flow from operations. We believe the debt-leveraged financing of stock buybacks exposes corporations to a potential future cash flow crisis as they have underinvested in productive cash flow generating assets, which may be triggered with a short period of declining asset prices that gains furious momentum. Some of the recent notable bankruptcies of private equity owned firms,e.g., food retailer Winn-Dixie Stores, highlights that even fundamentally sound and stable businesses can succumb to simply choking on too much debt, so buybacks will continue to be a major factor behind the overall U.S. market’s climb, until they too exhaust themselves.

Given the “aggregate” market concerns, the process used by Centre to manage the Fund stays disciplined and focused on each individual portfolio company's growth outlook and capacity to create shareholder value, utilizing our bottom-up fundamental stock selection process. Although we derive our investment ideas on a bottom-up basis, with the slowdown in global growth and the fall in interest rates, we do expect that performance can be attained in two thematic areas – stable growth stocks and idiosyncratic restructuring stories. Regarding the former, with bond yields so low we continue to emphasize a “new Nifty-Fifty14” group of companies in the Fund such as Microsoft, Amazon, and Alphabet. Of course, knowing when to sell is perhaps the most critical issue but it’s important also to ignore the natural human tendency to want to take profits in stocks that have had enormous run-ups, a stock like Amazon being an example, the risk being that you sell prematurely. In our view, it simply depends on the company and our ability to manage the Fund with an alertness to selling a stock if we see fundamentals deteriorate even in the slightest as we did with long-time Fund holding Nvidia during 2018, thankfully prior to its material drawdown in the fourth quarter of 2018. That said, in an environment where sales growth and margin improvement is becoming an ever-scarce attribute, many of these stocks in the new Nifty-Fifty could get more expensive with their stocks' prices relative to their earnings going much higher because of rising expectations that corporate earnings

| 12 | Earnings per share (EPS) is the portion of a company’s profit allocated to each share of common stock. Earnings per share serve as an indicator of a company’s profitability. |

| 13 | Source: S&P Down Jones Indices |

| 14 | The 50 or so stocks that were most favored by institutional investors in the late 1960s and early 1970s. Companies in this group were usually characterized by consistent earnings growth and high P/E ratios. |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

growth overall is going to slow markedly in coming years and assuming interest rates remain secularly depressed. Alternative to stable growth, we see increasing opportunities for idiosyncratic restructuring stories such as Barrick Gold, Noble Energy, AT&T, Knight-Swift Transportation, and Wells Fargo. In each case, these companies represent contrarian recovery candidates and, through our lens, have begun to fundamentally inflect positively in terms of profits margins and asset efficiency derived mainly from cost-cutting and asset restructurings with the benefit of very attractive relative, and in some cases, attractive absolute valuations.

While we admit that the three underpinnings of the U.S. stock market’s excess valuation, arising from elevated profit margins, can sustain themselves for longer and, thus, keeping indexes stable until a resumption of global growth allows earnings to grow into the existing prices to justify stability, we see fragility and indexes vulnerable to significant dislocations just lacking a catalyst. Ironically, this is at a time when market prices for forward volatility are back to near all-time lows and, thus, allowing us to efficiently purchase protective options to help insulate the Fund’s underlying holdings against a material decline occurring over a short period of time in stock prices.

Whether labelled a traditional growth or value stock, we consider valuation or the price one pays at purchase as the most critical element of successful investment. Currently, the consensus driver to enable the stock market in aggregate to move higher is continued reliance upon already stratospheric valuation multiples re-rating higher still, on further accommodative monetary policies or a significant increase in risk appetite by investors, as well as momentum of highly elevated net profit margins reliant upon factors that are likely to reverse course. To repeat ourselves for emphasis, we see fragility and major stock market indexes vulnerable to significant dislocations in 2019, just lacking a catalyst. Given this, the Fund currently continues to concentrate the number of positions in its portfolio in an attempt to maximize individual stock risk rather than market risk and use derivative instruments intended to hedge the risks of existing equity positions, namely put options on the S&P 500 Index, as a potential hedge against its underlying stock holdings in the event of a material correction. We continue to emphasize a barbell15 of secular growth stocks16 with contrarian, opportunistic cyclical growth companies in the midst of business restructurings. We believe that our pragmatic, large-capitalization, valuation-sensitive growth and concentrated, high-conviction approach to stock selection, with a cognizance of risk management that includes tactically implementing capital protective investments, seems positioned to perform well relative to less risk aware strategies.

| 15 | A barbell strategy in reference to a stock portfolio consists of half the portfolio anchored in defensive, low-beta sectors or assets, and the other half in aggressive, high-beta sectors or assets. |

| 16 | A stock is secular when the associated company earnings remain constant regardless of other trends occurring within the market. |

The market outlook is the opinion of the author and can change at any time.

| Semi-Annual Report | March 31, 2019 | 5 |

| Centre American Select Equity Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

SECTOR WEIGHTINGS

As a percentage of Net Assets

| Communication Services | 18.27% |

| Information Technology | 15.91% |

| Health Care | 12.07% |

| Energy | 10.95% |

| Materials | 10.37% |

| Industrials | 10.15% |

| Consumer Discretionary | 8.73% |

| Financials | 5.50% |

| Utilities | 4.75% |

| Consumer Staples | 1.20% |

| Purchased Options | 0.70% |

| Cash, Cash Equivalents, and Other | 1.40% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2019

This graph assumes an initial investment of $10,000 at December 21, 2011, the inception date for Investor Class shares, which have the longest period of annual returns, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund's Investor Class versus the S&P 500® Total Return Index. Taxes on Fund distributions or when shares are redeemed, if any, are not reflected. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2019

| | 1 Month | 3 Month | YTD | 1 Year | 3 Year Average Annualized | 5 Year Average Annualized | Since Inception* Average Annualized |

| Centre American Select Equity Fund – Investor Class | 1.90% | 11.08% | 11.08% | 4.88% | 10.93% | 8.57% | 11.63% |

| S&P 500® Total Return Index | 1.94% | 13.65% | 13.65% | 9.50% | 13.51% | 10.91% | 14.36% |

| Centre American Select Equity Fund – Institutional Class | 1.89% | 11.21% | 11.21% | 5.44% | 11.23% | 8.77% | 8.62% |

| S&P 500® Total Return Index | 1.94% | 13.65% | 13.65% | 9.50% | 13.51% | 10.91% | 10.91% |

| * | Inception date of December 21, 2011 for Investor Class. Inception date of January 21, 2014 for Institutional Class. |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

The S&P 500® Total Return Index is a commonly recognized, market-capitalization weighted index of 500 widely held securities, designed to measure broad U.S. equity performance. You cannot invest directly in an index.

The line graph above shows the performance of Investor Class shares only, since the Investor Class has the longest period of annual returns. The performance of the Institutional Class shares will differ from the performance shown because the Institutional Class shares have different expenses than the Investor Class shares.

| Centre Active U.S. Treasury Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

Performance & Strategy Summary

For the six-month period ended March 31, 2019, the Centre Active U.S. Treasury Fund ( “the Fund”), Institutional Share Class, delivered a total return of 2.74%; the Investor Share Class delivered a total return of 2.54%. Over this period, the Bloomberg Barclays U.S. Treasury Index1 returned 4.73%.

Performance attribution in the Centre Active U.S. Treasury portfolio reflects interest income combined with our active duration2 management decisions that impact capital gain or loss capture. As there are no corporate or mortgage related securities in the portfolio, there are no “credit spread3” components to performance. Performance during the six-month period ended March 30, 2019, reflected our generally cautious outlook for the U.S. Treasury market based on our investment process, as our target portfolio durations were bearish as we entered 2019, but U.S. Treasury securities prices continued to move higher driven by reversals in Central Bank policies and low inflation readings.

The Fund’s active duration decisions are based on the near-term outlook for interest rates which is based, in turn, on a monthly review of economic conditions and current bond market valuation. Factors utilized in the assessment of the outlook make up our proprietary Interest Rate Scorecard. The Fund’s generally cautious stance over the six months, particularly since the start of the year, reflects the strong U.S. labor market which saw the unemployment rate decline to 3.8% and weekly claims for unemployment insurance decline to a level not seen since December 1969 when the labor force was significantly smaller. While investors’ inflation rate expectations remain well anchored, reported inflation over the last twelve months is roughly in line with the Federal Open Market Committee (FOMC)’s 2% target. Additionally, wage growth and the inflation measures calculated by the various Federal Reserve Banks,e.g., “sticky-price4”, trimmed mean and the “underlying inflation gauge5”, are also consistent with the 2% goal. Finally, the term premia6 on longer dated Treasuries are well below those demanded on average in the past by investors for taking on maturity risk. The low premia available likely reflect, to a decreasing degree, earlier episodes of “Quantitative Easing7” and the current state of economic political policy uncertainty, both in the U.S. and elsewhere. History shows that global uncertainty generates a demand for the global safe haven investment, U.S. Treasury securities.8 As policy issues are sorted out, the fundamentals of strong growth and inflation that is at least in line with the FOMC’s goal should push rates higher.

The Fund’s investment objective is to maximize total return through capital appreciation and current income. The Fund pursues this objective by using an active interest rate risk management strategy that aims to capture general cyclical interest rate trends while allowing for the potential to benefit from short-term deviations. This strategy involves the use of a proprietary fundamentally-driven interest rate forecasting process designed to forecast interest rates on a monthly basis. The Fund’s duration is adjusted based on a monthly assessment of the likely change in interest rates. When interest rates are expected to decline, the Fund extends duration, and when interest rates are expected to rise, the Fund shortens duration. The Adviser’s active duration management strategy for the Fund seeks the potential for capital appreciation and/or preservation of capital in variable interest rate environments by utilizing U.S. Treasury securities, including bills, notes and bonds, Treasury inflation protected securities9 (TIPS), cash equivalents and, in certain market environments, futures contracts on U.S. Treasury Notes and Bonds.

The Fund is intended to serve as a tactical (long10, short11 or neutral duration relative to that of the Treasury market) fixed income investment by managing market exposure to achieve performance(i.e., managing interest rate beta12 to achieve alpha13). Over time, it is intended to provide the

| 1 | The Bloomberg Barclays U.S. Treasury Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. |

| 2 | Duration is a measure of the sensitivity of the price – the value of principal – of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond prices are said to have an inverse relationship with interest rates. Therefore, rising interest rates indicate bond prices are likely to fall, while declining interest rates indicate bond prices are likely to rise. |

| 3 | A credit spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality. |

| 4 | Price stickiness (or sticky prices) is the resistance of market price(s) to change quickly despite changes in the broad economy that suggest a different price is optimal. |

| 5 | The underlying inflation gauge (UIG) captures sustained movements in inflation from information contained in a broad set of price, real activity, and financial data. |

| 6 | The term premia is the compensation that investors require for bearing the risk that short-term Treasury yields do not evolve as they are expected. |

| 7 | Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to increase the monetary supply and encourage lending and investment. |

| 8 | U.S. Treasury securities are bonds issued by the U.S. government. There are various types of Treasury securities. The shortest maturity issues are called Treasury bills. Bonds that mature in two to 10 years (from the time they are issued) are called Treasury notes. |

| 9 | Treasury inflation protected securities (TIPS) refer to a treasury security that is indexed to inflation in order to protect investors from the negative effects of inflation. TIPS are considered an extremely low-risk investment because they are backed by the U.S. government and because the par value rises with inflation, as measured by the Consumer Price Index, while the interest rate remains fixed. |

| 10 | Duration is loosely tied to maturity. A fund with a long duration holds bonds that have longer maturities, typically 10 years or more. |

| 11 | A short duration strategy involves buying bonds with shorter-dated maturities and selling long-dated bonds in order to lower the overall price sensitivity to interest rate movements and, as such, minimize potential capital losses. |

| 12 | Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Beta is used in the capital asset pricing model (CAPM), which calculates the expected return of an asset based on its beta and expected market returns. |

| 13 | Alpha is a measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund's alpha. |

| Semi-Annual Report | March 31, 2019 | 7 |

| Centre Active U.S. Treasury Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

same yield as the Treasury market with attractive diversification benefits given the underlying core portfolio of Treasury securities. The Adviser’s strategy for the Fund is also designed to accommodate both systematic and unforeseen cash needs, given the ample liquidity of the Treasury market.

The utilization of Treasury securities within an investor’s portfolio asset allocation is designed to provide attractive diversification properties, as the correlation between Treasury market returns and those of the equity market has historically been negative during recession-related “bear” equity markets. The Adviser’s investment discipline for the Fund is designed to identify the risks and opportunities of trends and short-term deviations from those trends in interest rates by combining measures of the Federal Reserve (Fed)’s policies, real growth, inflation expectations, and current bond market valuations. This investment discipline is intended to preserve capital in periods of significant rate increases by decreasing the Fund’s portfolio duration and provide the flexibility to extend portfolio duration when rates are likely to decline.

Market and Outlook

Over the long run, interest rate behavior primarily reflects real economic growth, investors’ inflation expectations or concerns, monetary policy, and bond market valuations. The Fund portfolio manager’s view is that over the next few years, barring a recessionary shock, steady real growth in the U.S. economy is likely to continue and that is likely to become the longest expansion in the post WWII period. Labor market activity has been and remains strong and has positive momentum. We believe this strength has taken the unemployment rate well below the level that is sustainable, NAIRU14. Current estimates of NAIRU, based on projected population growth and estimates of the labor force participation rate, are in the range of 4.5-4.7%. The unemployment rate is currently at 3.8%. Job openings reported by the Department of Labor continue at a high level as does the “quits” rate. The quits rate is an indicator of confidence on the part of workers as it indicates those leaving current employment to search for a better position. Labor market strength is further confirmed by the Non-Employment Index, a measure designed to answer critiques of the “official” unemployment rate by evaluating the likelihood of a return to the labor force by those no longer counted as active job seekers. Additionally, the lack of acceleration in the inflation rate as the unemployment rate has fallen to such a low level, the seeming failure of the Phillips Curve15, may be indicative of some remaining labor market slack. The employment-to-population ratio for prime age labor market participants remains 1% below pre-crisis levels and may be evidence of such slack. So, as various FOMC members have said, it seems likely that the Fed is willing to support some overheating of the labor market and an inflation rate somewhat above target for a period. Finally, James Bullard, President of the St. Louis Federal Reserve Bank, has recently said that the FOMC must be sensitive to not “invert the yield curve”. While our own assessment is that yield curve inversions do not have the predictive power typically attributed to them, many others including policy makers and academics continue to focus on them as indicative of recessions. Our own analysis focuses on the relation between the federal fund’s target and the economy’s neutral or natural rate. Currently, monetary policy is not restrictive. We believe the federal fund’s rate target is likely ¼ of a percent below the natural rate and the Fed’s balance sheet remains significantly larger than that required for the efficient implementation of monetary policy.

Historically, the spread between the 10-year yield16 and the federal funds rate has been 150 basis points17. So, the Fund’s current target range would be consistent with a 10-year yield in the 3.75-4% range. John Williams, newly appointed President of the Federal Reserve Bank of New York and now a permanent voting member of the FOMC, has suggested that a 1% spread may be normal going forward, which would put the 10-year rate at 3.25-3.5%. However, we see no reason why investors should willingly accept lesser term premia going forward unless the Fed proves to be a more stabilizing force than has been true in the past. Given our growth expectations and the indicated willingness of policy makers to foster overshooting of the unemployment and inflation rate targets, our view is that rates could be in the 3.5-3.75% range before December 31, 2019.

Risks to the interest rate forecasts described above are more likely to the upside than the downside. Like stock prices, rates tend to overshoot the level indicated by the fundamentals. Additionally, the Federal Reserve has very rarely achieved a “soft-landing” in reaching its dual mandate of full employment and price stability, defined as an inflation rate of 2% and an unemployment rate somewhat above where it stands today. Upside risk may be even more probable given the expressed willingness to breach the 2% target by a “small amount” for a “temporary period”, as neither “small” nor “temporary” were well specified. Once currently well anchored inflationary expectations break free, actual inflation could spike higher, creating a vicious cycle as business and household expectations become embodied in pricing and spending decisions.

Continued progress in rolling back growth hindering regulations could create a more favorable climate for business than anticipated and accelerate the pace of hiring and investment for plant and equipment. Furthermore, if investors become convinced that tax simplification and restructuring as well as growth facilitating infrastructure spending will occur, in addition to an improved regulatory environment, rates could again spike higher.

| 14 | The Non-Accelerating Inflation Rate of Unemployment (NAIRU) – also referred to as the long-run Phillips curve – is the specific level of unemployment that is evident in an economy that does not cause inflation to rise. |

| 15 | Phillips curve is an economic concept developed by A. W. Phillips stating that inflation and unemployment have a stable and inverse relationship. The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. |

| 16 | The 10-year yield is the return on investment, expressed as a percentage, on the debt obligation issued by the U.S. government with a maturity of 10 years upon initial issuance. |

| 17 | Basis point refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument. |

| Centre Active U.S. Treasury Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

Longer term, yields will likely settle in the 4-5% range if our expectations for real growth are realized and inflation, after a period of overshooting, settles at the Fed’s 2% target. If this becomes the generally accepted outlook, we think investors will cause rates to move into this range sooner rather than later.

Risks to the downside of our outlook come from those who argue that the best days for growth are behind us. Over time, inflation and real growth and interest rate levels will reflect political, economic, and demographic related issues. Our growth outlook, for the reasons mentioned above, resembles, though it is somewhat less than, the economy’s potential growth during much of the 20th and early part of the 21st centuries. In contrast, real growth projections based on the “New Normal18” for the U.S. economy from the San Francisco Federal Reserve Bank are in the range of 1.5%-1.75% while the Congressional Budget Office (CBO) is projecting a 1.8% real growth through 2027. Combined with the Fed’s 2% goal for inflation, these growth projections would place the equilibrium value for the 10-year yield at roughly 3.5%-4% longer term, still higher than current levels. The arguments that form the basis for this significantly slower pace of growth relative to the 20th century average of around 3.0%-3.25% revolve around a reduced rate of technological advancement, less contribution from education, and slower growth in the labor force (demographics).

In “The Rise and Fall of American Growth”, Robert Gordon argues that the technology-related ideas of today are much less dramatic in their growth impact than the innovations of the past, such as the steam engine. John Fernald of the San Francisco Federal Reserve Bank projects productivity growth in line with its “pace for most of the period since 1973” of about 1%. He assumes that any contribution from educational attainment (increased human capital) has “plateaued” and that capital “deepening” (increased capital per worker) will not spur labor productivity dramatically. The arguments for a reduced rate of growth in the future point to a slowing pace of labor force growth, which in turn reflects both slower population growth and the retirement of the “baby boomers”.

Forecasting an ongoing lack of meaningful technological advancements and the failure of the educational system to adapt to changing skill requirements seems both problematic and pessimistic. And, to the extent that “capital deepening”, more capital per worker, has an impact on productivity, the ongoing pace of business investment spending is encouraging. This investment reflects the attractive after-tax rate of return currently being earned which has been stable to increasing of late according to research at the St. Louis Federal Reserve Bank.

This research also calls into question the work concluding that a decline in the economy’s natural rate of interest, the rate in real terms consistent with potential output growth and target rate inflation, has occurred. An explanation for why the real or natural rate of interest is below the return on capital may be an increased aversion to risk on the part of investors and a greater demand for the riskless asset19, U.S. Treasury securities (as noted above). Increased risk aversion could reflect demographic changes, global political and economic policy uncertainty and the lingering aftermath of the global financial crisis. If investors become less concerned, they may be less willing to pay a higher premium for perceived safety.

Apart from the contrasting position noted above, there is a “stagflation20” scenario that merits concern. From the Hoover Institute: “if, for example, interest rates were to rise to 5%, instead of the Trump administration’s prediction of just under 3.5%, the interest cost alone on the projected $20 trillion of public debt would total $1 trillion per year. More than half of all personal income taxes would be needed to pay bondholders. Such high interest payments would crowd out financing of needed expenditures to restore our national defense budget, our depleted domestic infrastructure, and other critical government activities.” A reduction in outlays for infrastructure could slow the economy’s potential for growth.

Regardless of the eventual outcomes for growth and inflation rates, there is nothing in this debate to suggest that the business cycle has been tamed out of existence or that it will not be exacerbated by monetary policy, either conventional or unconventional, as has been true in the past. In fact, some suggest that business cycles may occur more frequently and potentially be of greater downside magnitude if a lower real federal funds rate, consistent with slower trend growth, limits the Fed’s ability to stimulate growth through conventional monetary policy. If true, this would increase opportunities to benefit more frequently from cyclical declines in rates. If, on the other hand, real growth reverts toward its 20th century norm and inflation accelerates as policy makers delay too long in the normalization process, there may be a great need to protect portfolio value against rising rates. There may, of course, be an opportunity to benefit from the eventual cyclical decline in rates and changes in term premia as policy makers eventually act to rein in accelerating inflation.

Going forward and consistent with history, rate behavior seems likely to continue to be cyclical in nature and jagged or violent in pattern as both market participants and policy makers react and overreact to the impacts of changing economic, inflation and political conditions. Our investment process is designed for such a world and is intended to anticipate rate moves and adjust portfolio duration tactically for the benefit of shareholders of the Fund by taking advantage of rate declines and shielding value against rate increases.

| 18 | The term “New Normal” refers to a permanent downward departure from America’s historic 3% growth rate. New Normal projections could be a response to the trauma of the financial panic, the European debt crisis, deleveraging, and downtrending demographics, summing to a suggestion of slower growth. |

| 19 | A risk-free asset has a certain future return. Treasuries (especially T-bills) are considered to be risk-free because they are backed by the U.S. government. |

| 20 | Stagflation is a condition of slow economic growth and relatively high unemployment, or economic stagnation, accompanied by rising prices, or inflation. It can also be defined as inflation and a decline in gross domestic product (GDP). |

The market outlook is the opinion of the author and can change at any time.

| Semi-Annual Report | March 31, 2019 | 9 |

| Centre Active U.S. Treasury Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

ASSET TYPE WEIGHTINGS

As a percentage of Net Assets

| Government Bond | 91.53% |

| Cash, Cash Equivalents, and Other | 8.47% |

| Totals | 100.00% |

These allocations may not reflect the current or future positions of the portfolio.

GROWTH OF HYPOTHETICAL $10,000 INVESTMENT THROUGH MARCH 31, 2019

This line graph assumes an initial investment of $10,000 at January 21, 2014, the Fund’s inception date, and that any dividends and distributions are reinvested. This graph depicts the performance of the Fund versus the Bloomberg Barclays U.S. Treasury Index. Unlike the Fund, an index is not available for investment, is unmanaged and does not have expenses that affect the results. The comparison is shown for illustrative purposes only.

TOTAL RETURNS – FOR THE PERIOD ENDED MARCH 31, 2019

| | 1 Month | 3 Month | YTD | 1 Year | 3 Year | 5 Year | Since Inception (January 21, 2014) Average Annualized |

| Centre Active U.S. Treasury Fund – Investor Class | 0.36% | 0.31% | 0.31% | 2.51% | 0.05% | 0.97% | 1.07% |

| Centre Active U.S. Treasury Fund – Institutional Class | 0.39% | 0.42% | 0.42% | 2.95% | 0.38% | 1.28% | 1.38% |

| Bloomberg Barclays U.S. Treasury Index | 1.91% | 2.11% | 2.11% | 4.22% | 1.04% | 2.16% | 2.21% |

The performance information quoted above represents past performance, which is not a guarantee of future results, and does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total return includes reinvestment of dividends and capital gains, if any. Current performance may be lower or higher than the performance data quoted. For the most current month-end performance data, please call 855-298-4236.

Bloomberg Barclays U.S. Treasury Index – includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. You cannot invest directly into an index.

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

Performance & Strategy Summary

For the six-month period ended March 31, 2019, the Centre Global Infrastructure Fund (“the Fund”), Investor Share Class, delivered a total return of 2.95%; the Institutional Share Class delivered a total return of 2.98%.

During this past six-month period, the MSCI World Index1 and MSCI World Infrastructure Index2 delivered total returns of -2.61% and 5.27%, respectively. During the period, investments providing the strongest contribution to the Fund’s relative performance included: within Utilities, Companhia de Saneamento Básico, AGL Energy, China Resources Gas, and Centrica; within Industrials, Aéroports de Paris; and within Communication Services, Verizon Communications. The largest detractors from relative performance included: Talend, Whiting Petroleum, Blue Prism, and Halliburton. From a sector allocation standpoint, emphasis to the Communication Services, Energy, and Industrials sectors contributed positively to the Fund’s relative performance during the period, while emphasis to Utilities, Healthcare, Materials, and Technology modestly detracted from the Fund’s relative performance during the period. Historically, shares of companies linked to infrastructure have demonstrated asymmetrical upside versus downside capture against broad global equity indexes such as the MSCI World Index. During the deep market sell-off in the fourth quarter last year, the Fund declined 9.37% while the MSCI World Index declined 14.02%, exhibiting a 66.8% downside capture ratio3. Furthermore, during the year-to-date recovery through March 31, 2019, the Fund gained 13.62% while the MSCI World Index gained 13.27%, realizing a 102.63% upside capture relative to the broader global equity benchmark.

We believe the Fund is well positioned to continue taking advantage of the pro-cyclical nature of a selective group of global infrastructure-related holdings, while attempting to limit downside risk as these companies provide a myriad of essential services in their respective regions and industries. The Fund offers several key differentiators from the broader global equity set of investable companies, as well as core infrastructure universes including: 1) historically, the MSCI World Infrastructure Index has generated a dividend yield4 greater than the yield on conventional core equity indexes like the MSCI World Index; 2) the Fund pays distributions of dividend and interest income monthly; 3) hard assets like infrastructure assets tend to retain their “real” value over the long-term; 4) historically, the volatility of infrastructure indexes is lower than that of conventional equity indexes like the MSCI World Index; 5) high Economic Value Added5 (EVA) companies, the foundation of our stock selection process, have historically outperformed low EVA ones; and 6) many infrastructure assets have concession agreements or long-term contracts that link to inflation in the long run. In identifying firms with sustainable pricing power, the Fund seeks investments that exhibit high barriers to entry in their segments and that create positive externalities in their regions. The Fund focuses on industries with lower volatility such as toll roads, power stations, hospitals and schools. Also, by targeting high EVA growth companies, the Fund narrows its focus to high quality infrastructure firms that make wise capital allocation decisions. Through our “bottoms-up” analysis, we seek to avoid names that destroy shareholder wealth by either “empire building” or under-investment. Additionally, the stock-selection approach standardizes accounting across countries, which facilitates cross-border comparisons between the best U.S. infrastructure names and international firms. From a portfolio management perspective, the Fund can make active strategic and tactical investments across sectors and regions based on opportunity sets we see in the market.

Market Review & Outlook

Securities in the global infrastructure sector remain a compelling investment option at this stage of the global business and market cycle, characterized by high dividend yields, stable cash flows, attractive risk-adjusted performance, better relative performance during periods of market drawdowns, lower correlations with other asset classes, and a long-term hedge against inflation. Infrastructure’s uniquely defensive attributes are driven by underlying long lived assets with high barriers to entry, economies of scale, inelastic demand, and high operating margins. We divide infrastructure in two types: economic infrastructure (e.g., transport, utilities, communication, and renewable energy) and social infrastructure (e.g., schools, healthcare, and datacenters). Since the global financial crisis, significant funding gaps for infrastructure in developed markets have emerged, and despite the years of debate about replacing outdated backbone systems, infrastructure investment has declined as a percentage of GDP in more than half of the G20 economies. Years of underinvestment in mission critical areas such as transportation, water treatment, and power grids could erode future growth potential and productivity of developed economies. To mitigate the economic impact on stressed governmental finances, the federal government and municipalities are now focusing efforts to incentivize public companies to take on projects that have capital requirement gaps, creating an expanded role for publicly listed infrastructure companies.

Historically, infrastructure-related investments generally show superior performance over broad equity market indexes prior to an economic downturn. To this point, the Federal Reserve’s univariate probit regression relating the probability of a U.S. recession at some point over the next

| 1 | The MSCI World Index is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries. |

| 2 | The MSCI World Infrastructure Index captures the global opportunity set of companies that are owners or operators of infrastructure assets. Constituents are selected from the equity universe of MSCI World, the parent index. |

| 3 | Upside/Downside capture ratio measures a fund’s performance in up/down markets relative to the market/benchmark itself. It is calculated by |

taking the fund’s upside/downside capture return and dividing it by the benchmark’s upside/downside capture return.

| 4 | The dividend yield is the ratio of a company’s annual dividend compared to its share price. |

| 5 | Economic Value Added (EVA) is an estimate of a company’s economic profit. Economic profit, which refers to the profit earned by a company, minus the cost of financing the company’s capital, is an amount that may be considered in the assessment of a company’s overall value. |

| Semi-Annual Report | March 31, 2019 | 11 |

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

year to the slope of the yield curve predicts that the near-term recession probability has risen significantly. Also, using five-year peak-inflation-adjusted price-to-earnings (P/E) ratios6, international developed markets remain at a discount to those for the U.S., providing a relatively favorable long-term valuation backdrop for non-U.S. stocks. As active managers, we intend to take advantage of undervalued international stocks with strong balance sheets and free cash flows, solid dividend yields, and cyclically depressed profits that are inflecting higher and which are poised to outperform and complement our U.S. companies exposure. With non-U.S. stocks sitting at decade-low relative performance and valuation levels, there is a broad opportunity set that matches our targeted criteria.

From a sectoral point, we believe Energy is favorable from a risk-reward perspective. Specifically, we favor energy infrastructure companies operating crude oil and liquids pipeline systems, those involved in international energy projects, and natural gas transmission and midstream businesses. Brent Crude is now trading at approximately $74/barrel (bbl.) levels, which will likely provide a significant cash flow windfall to producers going forward. The year-to-date recovery in crude prices now ranks among one of the most impressive in modern oil trading history. The Organization of the Petroleum Exporting Countries (OPEC) supply cuts as well as the rise in political tensions in Venezuela and Iran, have contributed to the sharp turnaround in fundamentals despite the tepid economic growth levels in most countries outside the U.S. The price shock from escalating tensions with Iran is likely to only increase with the U.S. government’s demand that all buyers of Iranian oil stop purchases by May 1st, a move that sent crude prices to six-month highs recently. As noted, Venezuela has also factored into the move, with recent power blackouts reportedly wiping out roughly half of the country’s rapidly diminishing output. More fundamentally-driven upside risks to oil prices include positive outcomes from U.S.-China trade negotiations, which may boost demand growth. The Trump administration recently announced two executive orders aimed at freeing up construction for more pipelines to supply the United States with oil and gas as well as for export. The Presidential orders could give the federal government more power over states in approving energy projects such as pipelines, where certain projects were formerly held up. The United States today is producing more oil and gas than any point in its history, in large part because of the shale boom in the Permian Basin in West Texas. But producers have had trouble getting the excess supply to customers due to constraints on the number of pipelines completed. In the Fund, we prefer the large-cap midstream companies given their diversified footprints, better balance sheets and lower external equity needs. When coupling midstream assets’ starting enterprise value / earnings before interest depreciation amortization (EV/EBITDA)7 valuations (~10.6x) and current yields (~6.7%), we believe investors seeking a mix of income and capital appreciation will be rewarded. Furthermore, we view the pending acquisition of Anadarko Petroleum favorably from a macro standpoint for midstream assets, as consolidating Permian acreage/upstream investment should yield higher volume growth for midstream assets. Midstream buyouts in the Permian are now being valued in certain transactions at up to 18x EBITDA, an example being the recent acquisition of Glass Mountain Pipeline, which are at a significant premium when compared with a 11–13x cash-flow multiple for most publicly traded midstream energy companies and, thus, we believe the Fund is well positioned to take advantage of the upward re-rating of public company valuations. Midstream MLPs and U.S. midstream both trade at a 1.0x discount to their 24-month average (~10% discount). The Fund’s top energy holdings are well positioned to capitalize on secular trends within their transmission and midstream businesses including Enbridge (ENB), TransCanada (TRP), Kinder Morgan (KMI), Williams Companies (WMB), ONEOK (OKE), Pembina Pipeline (PBA), and Cheniere Energy (LNG).

Utilities as a sector are accelerating investments in the grid as they push to address aging asset challenges, a changing generation landscape, and hardening the grid by upgrading old distribution pipes to mitigate downtime. The stocks of North American Utilities sector companies now possess a relative valuation (ex-California and PPL Corp. with its U.K. exposure) of a 20% P/E premium to the S&P 500 Index and absolute valuations near prior peak levels, with Utilities now trading at an 18.5x P/E multiple mainly due to the significant fall in bond yields. That said, with a lower yield backdrop and continuing directional uncertainty over the macro and global growth outlook, it is not too surprising that Utilities have proven to be resilient despite trading close to prior highs in terms of valuation multiples; the sector continues to be supported by lower yields. We believe infrastructure or power generation focused utilities, as opposed to distribution, remain an attractive total income return (dividend yield plus growth) investment option with a relatively low beta8 in comparison to other sectors. In North America, the Fund sees opportunity with Edison International (EIX) given the fast-growing regulated utility is exposed to clean renewables migration and is trading at a significant discount to peers given the speculation of liabilities from the wildfires that occurred in California. Governor Newsom’s team recently called for less utility liability on wildfire and we believe the most likely outcome is that California creates a state fund to provide EIX access to cash to pay wildfire damage claims while state regulators decide if the utility can pass the cost to ratepayers. Internationally, we see continued momentum for Brazilian utilities given positive sector outlook post the election of President Jair Bolsonaro, together with the expectation of reforms and a solution to legal and regulatory disputes. The Fund favors Companhia de Saneamento Básico (SBS) and Enel Américas (ENIA) given smaller, provincial utilities will find it difficult to compete with large international players such as SBS and ENIA for renewable buildout contracts due to the higher cost of capital as well as scale and expertise factors. We believe the privatization program on both federal and state levels is achievable with the federal government (i.e., Economy Minister Paulo Guedes) vocally in favor of the need to attract more investments in the sanitation sector, alongside a state government that seems determined to pursue privatization. We also see opportunity in the European Utility sector including Enel, Iberdrola, RWE, EDP/EDPR,

| 6 | The price-to-earnings ratio (P/E multiple) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS). |

| 7 | The EV/EBITDA ratio is a popular metric used as a valuation tool to compare the value of a company, debt included, to the company’s cash earnings less non-cash expenses. EV (the numerator) is the company’s enterprise value and EBITDA (the denominator) stands for earnings before interest, taxes, depreciation, and amortization. |

| 8 | A beta coefficient is a measure of the volatility, or systematic risk, of an individual stock in comparison to the unsystematic risk of the entire market. |

| Centre Global Infrastructure Fund | Manager Commentary |

| | March 31, 2019 (Unaudited) |

Engie and Orsted, which have significantly upgraded their renewable ambitions. The new renewable targets are supported by the expansion in the addressable wind and solar markets in Europe, the U.S. and Latin America. We view the ongoing improvement in renewable economics (lower costs, corporate PPAs) as an important catalyst in 2019.

In Telecom, the next advancement in cellular technology, fifth generation (5G), is expected to be so fast that it will be able to surpass the speed of fiber wire internet service now provided by cable companies. We believe the carrier investment in LTE9 densification and 5G will lead to increased subscriber growth, sales, and average revenue per user (ARPU) for select service providers (carriers). In President Trump’s latest comments, he made it clear that the United States’ 5G roll-out will be led by the private sector. The U.S. wireless industry praised Trump’s move, and we believe that a private sector led roll-out will allow for faster migration from 5G non-standalone to 5G standalone. While certain semiconductor and communication companies (primarily Towers and Fiber) have been early beneficiaries of 5G, the stock prices of carriers are yet to reflect the meaningful benefit of 5G coverage/use cases becoming more widespread. The prior generation cycle change from 2011 to 2012 shows that ARPU growth serves as a strong catalyst for service provider shares, as investors begin to net buy in earnest when concerns over capex shift to confidence in the success of a service driven by ARPU growth. Verizon's pricing for mobile 5G (~$10/month extra per unlimited line) represents an approximate 15-20% premium over its rates for LTE unlimited plans. We believe 5G is far more significant as a potential incremental tailwind for the carriers given their spectrum position and Small Cell/fiber footprints. We favor the large cell phone carriers such as Verizon (VZ) and AT&T (T), as small cells present a cost-effective solution for filling coverage gaps, increasing bandwidth, and getting the networks ready for 5G without the need to build more expensive macro sites. While Sprint/T-Mobile and other smaller carriers will also see some benefit, their lack of significant owned fiber holdings and limited capex will push will push them toward leasing other companies’ fiber/pole infrastructure. President Trump is also working to streamline the permitting process for Small Cell infrastructure companies across state and local governments. Also, as local authorities review applications for small cells and potentially revise the current capping fees local governments can charge wireless companies, we believe consensus forecasts will prove to be conservative for the Small Cell sector.

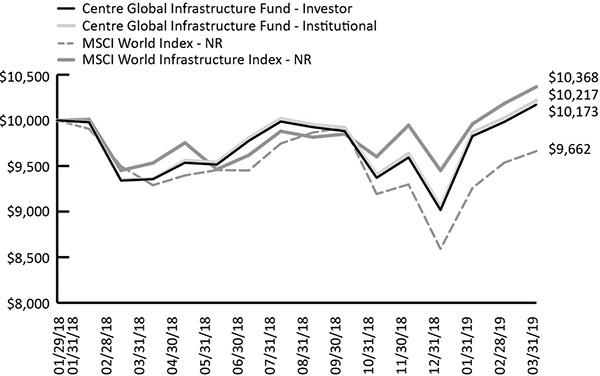

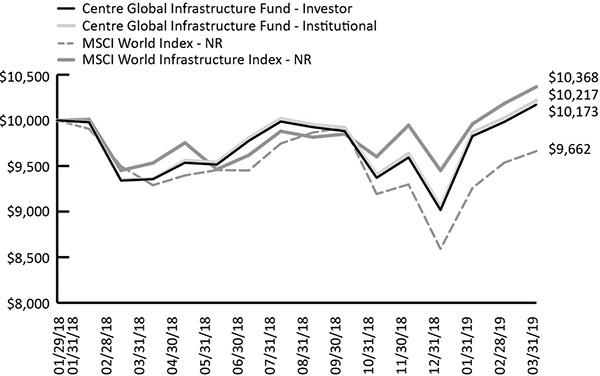

We continue to believe that infrastructure forecasts of efficiency gains are underestimating the proliferation of technology use cases which are expected to reduce costs associated with maintaining infrastructure assets. Emerging areas to support global infrastructure projects that we believe aren’t priced into earnings estimates include predictive maintenance, IIoT (Industrial Internet of Things), and cybersecurity. The oil and gas industry has been one of the first sectors to deploy IIoT and predictive maintenance software leading to significant reduction in downtime and elimination of breakdowns. The oil and gas industry still faces serious challenges, including the costs of maintaining its aging infrastructure. On average, 42% of offshore equipment is more than 15 years old and has 13% downtime – the majority of which is unplanned. It is estimated that refiners in the U.S. alone lose around $6.6 billion a year due to unplanned downtimes. Data optimization and predictive maintenance can push rig performance beyond 95%, increase production by 2% to 5%, improve efficiency and thus, reduce costs by 10% – and perhaps most importantly, it can help prevent disasters like oil spills or wildfires. Chevron expects to outfit oil machinery with sensors for predictive maintenance by 2019 in a wide-scale pilot program and aims to have sensors connected to much of the high-value equipment that could significantly disrupt oil and gas operations and create lost profit opportunities by 2024. IIoT’s impact may span many other major industries besides energy, including transportation, manufacturing, and healthcare. Governments and infrastructure owners have also been sharpening their focus on predictive maintenance and cybersecurity, as asset management techniques have also moved into the digital era, and security protocols (both physical and virtual) have become more sophisticated. Over the coming year, we expect infrastructure security and resilience concerns to be prioritized due to more internet access points and higher traffic, while IIoT could give additional impetus. As active managers we favor select companies that are embracing technology for cost savings and revenue generation throughout the infrastructure industry, including Duke Energy (DUK), Kinder Morgan (KMI), Oneok (OKE), and Pembina Pipeline (Canada - PPL).