united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22549

Northern Lights Fund Trust II

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246

(Address of principal executive offices) (Zip code)

Eric Kane, Ultimus Fund Solutions, LLC

80 Arkay Drive Suite 110, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2600

Date of fiscal year end: 11/30

Date of reporting period: 11/30/22

Item 1. Reports to Stockholders.

Amberwave Invest USA JSG Fund

(Symbol:IUSA)

Annual Report

November 30, 2022

1-888-926-1931

www.jsgfunds.com

Distributed by Northern Lights Distributors, LLC

Member FINRA

Dear Fellow Shareholders,

We are pleased to present you with The Amberwave Invest USA JSG Fund Annual Report for the period since inception January 19, 2022 to November 30, 2022.

The Amberwave Invest USA JSG Fund (“IUSA” or the “Fund”) is an actively managed exchange traded fund (ETF) that seeks to outperform the broad equity markets by investing in the equity securities of U.S. companies that the Adviser, Amberwave Partners Research and Management, determines score highly on the Adviser’s proprietary U.S. jobs, security and growth (JSG) scoring methodology. Once it has selected equity securities based on JSG criteria, the Advisor further utilizes its proprietary portfolio construction algorithm in order to choose weights for the approximately 100 stocks held by the Fund in order to provide sector exposure in approximation to the broad equity markets, seeking to isolate for JSG-linked performance as a driver of outperformance versus the market rather than sector weighting. The Adviser believes that its JSG investing strategy can identify companies that can outperform their peers across all industries as a result of potential benefits associated with secular trends linked to U.S. jobs, security, and growth, including workforce productivity, supply chains security, and economic growth.

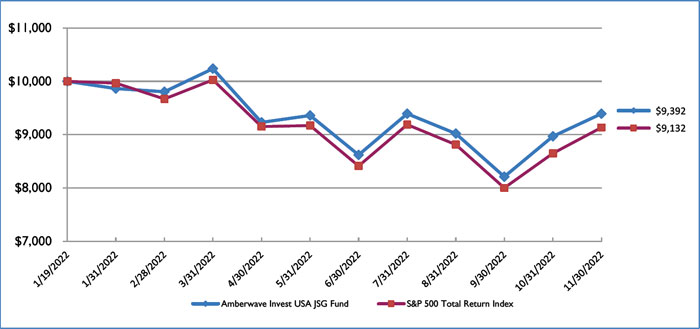

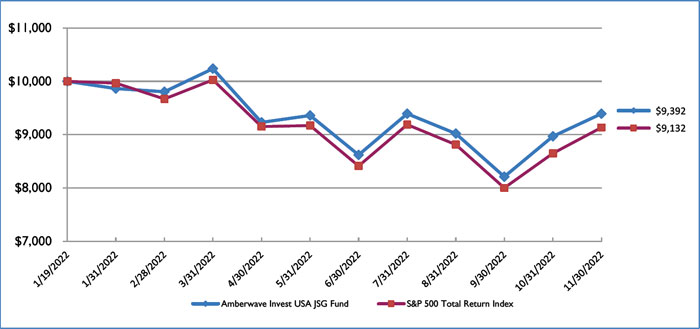

Since the inception, the Fund has outperformed the S&P 500 against a backdrop of broadly declining equity markets. Between inception and November 30, 2022, the market price and NAV for the Fund decreased by -6.20% and -6.08%, respectively, while the S&P 500 declined by -8.68%.

The Adviser believes that the Fund’s outperformance versus the S&P 500 is primarily attributable to the Fund’s increased exposure to companies that score highly on the Adviser’s U.S. JSG scoring methodology as compared to the S&P 500. Since inception, the Fund has outperformed the S&P 500 in 9 of 11 sectors, demonstrating broad-based outperformance associated with the Adviser’s JSG investment strategy across sectors.

The Fund did not have exposure to derivatives during the fiscal period.

We believe the Fund is positioned to benefit from continued outperformance associated with the Adviser’s JSG investment strategy given the secular changes affecting the global economy, including deglobalization, increased risk of geopolitical conflict, reshoring, and labor scarcity.

Thank you for being a shareholder of The Amberwave Invest USA JSG Fund and your confidence in us.

Sincerely,

Stephen Miran

Lead Portfolio Manager

Amberwave Partners Research and Management, LLC

16121068-NLD-12132022

Amberwave Invest USA JSG Fund

PORTFOLIO REVIEW (Unaudited)

November 30, 2022

The Fund’s performance figures(*) for the year ended November 30, 2022, compared to its benchmark:

| | Since Inception** |

| Amberwave Invest USA JSG Fund - NAV | (6.08)% |

| Amberwave Invest USA JSG Fund - Market Price | (6.20)% |

| S&P 500 Total Return Index^ | (8.68)% |

| * | The performance data quoted here represents past performance. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. Market price returns are calculated using the closing price and account for distributions from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Past performance is no guarantee of future results. Performance figures for periods greater than 1 year are annualized. The Fund’s investment advisor has contractually agreed to pay most of the Fund’s operating expenses (with certain exceptions) in return for a “universal fee” of 0.67% (excluding indirect costs of investing in other investment companies and certain other expenses) of the Fund’s net assets. Please review the Fund’s most recent prospectus for more detail on this universal fee. The Fund’s total annual expense ratio is 0.67% per the Fund’s prospectus dated January 14, 2022. For performance information current to the most recent month-end, please call toll-free 1-888-926-1931. |

| ** | Inception date is January 19, 2022. |

| ^ | S&P 500 Total Return Index is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks. You cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. |

Comparison of the Change in Value of a $10,000 Investment

| Portfolio Composition+ as of November 30, 2022: |

| Common Stocks | | | 98.9 | % |

| Other Assets in Excess of Liabilities | | | 1.1 | % |

| | | | 100.0 | % |

| + | Based on Total Net Assets as of November 30, 2022 |

Please refer to the Schedule of Investments in this report for a detailed listing of the Fund’s holdings.

| AMBERWAVE INVEST USA JSG FUND |

| SCHEDULE OF INVESTMENTS |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.9% | | | | |

| | | | | AEROSPACE & DEFENSE - 3.4% | | | | |

| | 38 | | | General Dynamics Corporation | | $ | 9,591 | |

| | 210 | | | Howmet Aerospace, Inc. | | | 7,911 | |

| | 33 | | | Huntington Ingalls Industries, Inc. | | | 7,655 | |

| | 39 | | | L3Harris Technologies, Inc. | | | 8,856 | |

| | 24 | | | Lockheed Martin Corporation | | | 11,644 | |

| | 19 | | | Northrop Grumman Corporation | | | 10,133 | |

| | | | | | | | 55,790 | |

| | | | | AUTOMOTIVE - 2.7% | | | | |

| | 250 | | | BorgWarner, Inc. | | | 10,628 | |

| | 833 | | | Ford Motor Company | | | 11,579 | |

| | 114 | | | Tesla, Inc.(a) | | | 22,195 | |

| | | | | | | | 44,402 | |

| | | | | BANKING - 6.8% | | | | |

| | 742 | | | Bank of America Corporation | | | 28,084 | |

| | 364 | | | Fifth Third Bancorp | | | 13,235 | |

| | 107 | | | First Republic Bank | | | 13,654 | |

| | 567 | | | Regions Financial Corporation | | | 13,160 | |

| | 56 | | | SVB Financial Group(a) | | | 12,980 | |

| | 336 | | | Truist Financial Corporation | | | 15,728 | |

| | 342 | | | US Bancorp | | | 15,523 | |

| | | | | | | | 112,364 | |

| | | | | BIOTECH & PHARMA - 7.0% | | | | |

| | 285 | | | Bristol-Myers Squibb Company | | | 22,879 | |

| | 231 | | | Gilead Sciences, Inc. | | | 20,288 | |

| | 102 | | | Moderna, Inc.(a) | | | 17,943 | |

| | 25 | | | Regeneron Pharmaceuticals, Inc.(a) | | | 18,793 | |

| | 59 | | | Vertex Pharmaceuticals, Inc.(a) | | | 18,668 | |

| | 122 | | | Zoetis, Inc. | | | 18,805 | |

| | | | | | | | 117,376 | |

| | | | | CABLE & SATELLITE - 2.0% | | | | |

| | 46 | | | Charter Communications, Inc., Class A(a) | | | 17,999 | |

| | 961 | | | DISH Network Corporation, Class A(a) | | | 15,424 | |

| | | | | | | | 33,423 | |

See accompanying notes to financial statements.

| AMBERWAVE INVEST USA JSG FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.9% (Continued) | | | | |

| | | | | CHEMICALS - 1.8% | | | | |

| | 30 | | | Air Products and Chemicals, Inc. | | $ | 9,304 | |

| | 61 | | | CF Industries Holdings, Inc. | | | 6,600 | |

| | 118 | | | Corteva, Inc. | | | 7,925 | |

| | 124 | | | Mosaic Company (The) | | | 6,361 | |

| | | | | | | | 30,190 | |

| | | | | COMMERCIAL SUPPORT SERVICES - 0.6% | | | | |

| | 59 | | | Waste Management, Inc. | | | 9,895 | |

| | | | | | | | | |

| | | | | CONTAINERS & PACKAGING - 0.4% | | | | |

| | 116 | | | Ball Corporation | | | 6,505 | |

| | | | | | | | | |

| | | | | DATA CENTER REIT - 0.9% | | | | |

| | 58 | | | Digital Realty Trust, Inc. | | | 6,523 | |

| | 11 | | | Equinix, Inc. | | | 7,597 | |

| | | | | | | | 14,120 | |

| | | | | E-COMMERCE DISCRETIONARY - 2.5% | | | | |

| | 303 | | | Amazon.com, Inc.(a) | | | 29,252 | |

| | 88 | | | Etsy, Inc.(a) | | | 11,624 | |

| | | | | | | | 40,876 | |

| | | | | ELECTRIC UTILITIES - 3.0% | | | | |

| | 79 | | | Ameren Corporation | | | 7,056 | |

| | 221 | | | CenterPoint Energy, Inc. | | | 6,875 | |

| | 77 | | | Constellation Energy Corporation | | | 7,401 | |

| | 89 | | | Eversource Energy | | | 7,375 | |

| | 152 | | | NextEra Energy, Inc. | | | 12,875 | |

| | 109 | | | Xcel Energy, Inc. | | | 7,654 | |

| | | | | | | | 49,236 | |

| | | | | ELECTRICAL EQUIPMENT - 0.5% | | | | |

| | 74 | | | Generac Holdings, Inc.(a) | | | 7,808 | |

| | | | | | | | | |

| | | | | FOOD - 3.8% | | | | |

| | 72 | | | Hershey Company (The) | | | 16,932 | |

| | 100 | | | J M Smucker Company (The) | | | 15,401 | |

| | 176 | | | Lamb Weston Holdings, Inc. | | | 15,294 | |

See accompanying notes to financial statements.

| AMBERWAVE INVEST USA JSG FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.9% (Continued) | | | | |

| | | | | FOOD - 3.8% (Continued) | | | | |

| | 233 | | | Tyson Foods, Inc., Class A | | $ | 15,443 | |

| | | | | | | | 63,070 | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 4.2% | | | | |

| | 321 | | | Catalent, Inc.(a) | | | 16,092 | |

| | 107 | | | Quest Diagnostics, Inc. | | | 16,246 | |

| | 70 | | | UnitedHealth Group, Inc. | | | 38,343 | |

| | | | | | | | 70,681 | |

| | | | | INDUSTRIAL REIT - 0.5% | | | | |

| | 72 | | | Prologis, Inc. | | | 8,480 | |

| | | | | | | | | |

| | | | | INDUSTRIAL SUPPORT SERVICES - 0.5% | | | | |

| | 14 | | | WW Grainger, Inc. | | | 8,443 | |

| | | | | | | | | |

| | | | | INFRASTRUCTURE REIT - 0.9% | | | | |

| | 38 | | | American Tower Corporation | | | 8,408 | |

| | 50 | | | Crown Castle, Inc. | | | 7,072 | |

| | | | | | | | 15,480 | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 2.9% | | | | |

| | 100 | | | Cboe Global Markets, Inc. | | | 12,684 | |

| | 145 | | | Intercontinental Exchange, Inc. | | | 15,705 | |

| | 208 | | | Morgan Stanley | | | 19,359 | |

| | | | | | | | 47,748 | |

| | | | | INSURANCE - 1.8% | | | | |

| | 199 | | | Aflac, Inc. | | | 14,314 | |

| | 123 | | | Progressive Corporation (The) | | | 16,255 | |

| | | | | | | | 30,569 | |

| | | | | INTERNET MEDIA & SERVICES - 1.5% | | | | |

| | 84 | | | Netflix, Inc.(a) | | | 25,665 | |

| | | | | | | | | |

| | | | | LEISURE FACILITIES & SERVICES - 1.3% | | | | |

| | 7 | | | Chipotle Mexican Grill, Inc.(a) | | | 11,389 | |

| | 28 | | | Domino’s Pizza, Inc. | | | 10,884 | |

| | | | | | | | 22,273 | |

See accompanying notes to financial statements.

| AMBERWAVE INVEST USA JSG FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.9% (Continued) | | | | |

| | | | | MACHINERY - 1.5% | | | | |

| | 53 | | | Caterpillar, Inc. | | $ | 12,530 | |

| | 28 | | | Deere & Company | | | 12,348 | |

| | | | | | | | 24,878 | |

| | | | | MEDICAL EQUIPMENT & DEVICES - 3.7% | | | | |

| | 154 | | | DexCom, Inc.(a) | | | 17,907 | |

| | 79 | | | Illumina, Inc.(a) | | | 17,228 | |

| | 46 | | | Thermo Fisher Scientific, Inc. | | | 25,771 | |

| | | | | | | | 60,906 | |

| | | | | OFFICE REIT - 0.4% | | | | |

| | 40 | | | Alexandria Real Estate Equities, Inc. | | | 6,224 | |

| | | | | | | | | |

| | | | | OIL & GAS PRODUCERS - 5.0% | | | | |

| | 178 | | | Marathon Petroleum Corporation | | | 21,682 | |

| | 303 | | | Occidental Petroleum Corporation | | | 21,055 | |

| | 193 | | | Phillips 66 | | | 20,929 | |

| | 581 | | | Williams Companies, Inc. (The) | | | 20,161 | |

| | | | | | | | 83,827 | |

| | | | | RETAIL - CONSUMER STAPLES - 2.6% | | | | |

| | 46 | | | Dollar General Corporation | | | 11,761 | |

| | 203 | | | Walmart, Inc. | | | 30,942 | |

| | | | | | | | 42,703 | |

| | | | | RETAIL - DISCRETIONARY - 2.4% | | | | |

| | 4 | | | AutoZone, Inc.(a) | | | 10,316 | |

| | 55 | | | Home Depot, Inc. (The) | | | 17,819 | |

| | 50 | | | Tractor Supply Company | | | 11,316 | |

| | | | | | | | 39,451 | |

| | | | | SEMICONDUCTORS - 8.8% | | | | |

| | 257 | | | Applied Materials, Inc. | | | 28,167 | |

| | 60 | | | Broadcom, Inc. | | | 33,061 | |

| | 953 | | | Intel Corporation | | | 28,657 | |

| | 58 | | | Lam Research Corporation | | | 27,398 | |

| | 237 | | | QUALCOMM, Inc. | | | 29,978 | |

| | | | | | | | 147,261 | |

See accompanying notes to financial statements.

| AMBERWAVE INVEST USA JSG FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.9% (Continued) | | | | |

| | | | | SOFTWARE - 7.8% | | | | |

| | 473 | | | Fortinet, Inc.(a) | | $ | 25,145 | |

| | 71 | | | Intuit, Inc. | | | 28,939 | |

| | 186 | | | Microsoft Corporation | | | 47,456 | |

| | 343 | | | Oracle Corporation | | | 28,479 | |

| | | | | | | | 130,019 | |

| | | | | | | | | |

| | | | | STEEL - 0.5% | | | | |

| | 50 | | | Nucor Corporation | | | 7,498 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 2.2% | | | | |

| | 118 | | | Garmin Ltd. | | | 10,973 | |

| | 94 | | | Motorola Solutions, Inc. | | | 25,587 | |

| | | | | | | | 36,560 | |

| | | | | | | | | |

| | | | | TECHNOLOGY SERVICES - 8.8% | | | | |

| | 132 | | | CDW Corporation/DE | | | 24,900 | |

| | 366 | | | Fidelity National Information Services, Inc. | | | 26,564 | |

| | 128 | | | Jack Henry & Associates, Inc. | | | 24,237 | |

| | 73 | | | Leidos Holdings, Inc. | | | 7,981 | |

| | 339 | | | PayPal Holdings, Inc.(a) | | | 26,581 | |

| | 169 | | | Visa, Inc., Class A | | | 36,674 | |

| | | | | | | | 146,937 | |

| | | | | | | | | |

| | | | | TELECOMMUNICATIONS - 3.8% | | | | |

| | 2,822 | | | Lumen Technologies, Inc. | | | 15,436 | |

| | 141 | | | T-Mobile US, Inc.(a) | | | 21,356 | |

| | 675 | | | Verizon Communications, Inc. | | | 26,312 | |

| | | | | | | | 63,104 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 1.3% | | | | |

| | 51 | | | FedEx Corporation | | | 9,293 | |

| | 68 | | | United Parcel Service, Inc., Class B | | | 12,902 | |

| | | | | | | | 22,195 | |

| | | | | | | | | |

| | | | | WHOLESALE - CONSUMER STAPLES - 1.1% | | | | |

| | 189 | | | Archer-Daniels-Midland Company | | | 18,428 | |

See accompanying notes to financial statements.

| AMBERWAVE INVEST USA JSG FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2022 |

| Shares | | | | | Fair Value | |

| | | | | TOTAL COMMON STOCKS (Cost $1,644,796) | | $ | 1,644,385 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 98.9% (Cost $1,644,796) | | $ | 1,644,385 | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES - 1.1% | | | 17,750 | |

| | | | | NET ASSETS - 100.0% | | $ | 1,662,135 | |

| REIT | - Real Estate Investment Trust |

| (a) | Non-income producing security. |

See accompanying notes to financial statements.

| Amberwave Invest USA JSG Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| November 30, 2022 |

| ASSETS | | | | |

| Investment securities: | | | | |

| At cost | | $ | 1,644,796 | |

| At fair value | | $ | 1,644,385 | |

| Cash | | | 18,219 | |

| Dividend receivable | | | 2,868 | |

| Receivable for securities sold | | | 49,826 | |

| TOTAL ASSETS | | | 1,715,298 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for securities purchased | | | 51,505 | |

| Investment advisory fees payable | | | 1,658 | |

| TOTAL LIABILITIES | | | 53,163 | |

| NET ASSETS | | $ | 1,662,135 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid in capital | | $ | 1,720,723 | |

| Accumulated losses | | | (58,588 | ) |

| NET ASSETS | | $ | 1,662,135 | |

| | | | | |

| Net Asset Value Per Share: | | | | |

| Shares: | | | | |

| Net Assets | | $ | 1,662,135 | |

| Shares of beneficial interest outstanding ($0 par value. unlimited shares authorized) | | | 100,000 | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | | $ | 16.62 | |

See accompanying notes to financial statements.

| Amberwave Invest USA JSG Fund |

| STATEMENT OF OPERATIONS |

| For the Period Ended November 30, 2022 (a) |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 19,860 | |

| TOTAL INVESTMENT INCOME | | | 19,860 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 7,907 | |

| TOTAL EXPENSES | | | 7,907 | |

| | | | | |

| NET INVESTMENT INCOME | | | 11,953 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) FROM INVESTMENTS | | | | |

| Net realized loss from investments | | | (64,570 | ) |

| Net change in unrealized depreciation on investments | | | (411 | ) |

| NET REALIZED AND UNREALIZED LOSS FROM INVESTMENTS | | | (64,981 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (53,028 | ) |

| (a) | Commencement of operations was January 19, 2022 |

See accompanying notes to financial statements.

| Amberwave Invest USA JSG Fund |

| STATEMENT OF CHANGES IN NET ASSETS |

| | | Period Ended | |

| | | November 30, 2022 (a) | |

| FROM OPERATIONS | | | | |

| Net investment income | | $ | 11,953 | |

| Net realized loss from investments | | | (64,570 | ) |

| Net change in unrealized depreciation on investments | | | (411 | ) |

| Net decrease in net assets resulting from operations | | | (53,028 | ) |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | |

| Total distribution paid: | | | (5,560 | ) |

| Decrease in net assets from distributions to shareholders | | | (5,560 | ) |

| | | | | |

| FROM SHARES OF BENEFICIAL INTEREST | | | | |

| Proceeds from shares sold | | | 1,719,223 | |

| Transaction fees (Note 5) | | | 1,500 | |

| Net increase in net assets from shares of beneficial interest | | | 1,720,723 | |

| | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 1,662,135 | |

| | | | | |

| NET ASSETS | | | | |

| Beginning of Period | | | — | |

| End of Year/Period | | $ | 1,662,135 | |

| | | | | |

| SHARE ACTIVITY | | | | |

| Shares Sold | | | 100,000 | |

| Net increase from share activity | | | 100,000 | |

| (a) | Commencement of operations was January 19, 2022 |

See accompanying notes to financial statements.

| Amberwave Invest USA JSG Fund |

| FINANCIAL HIGHLIGHTS |

Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Period Presented

| | | Period Ended | |

| | | November 30, | |

| | | 2022(a) | |

| Net asset value, beginning of period | | $ | 17.76 | |

| Activity from investment operations: | | | | |

| Net investment income (b) | | | 0.14 | |

| Net realized and unrealized loss on investments | | | (1.22 | ) |

| Total from investment operations | | | (1.08 | ) |

| | | | | |

| Less distributions from: | | | | |

| Net investment income | | $ | (0.06 | ) |

| Total distributions | | $ | (0.06 | ) |

| Net asset value, end of period | | $ | 16.62 | |

| Total return (c) | | | (6.08 | )% (d) |

| Net assets, end of period (000s) | | $ | 1,662 | |

| Ratio of expenses to average net assets | | | 0.67 | % (e) |

| Ratio of net investment income to average net assets | | | 1.01 | % (e) |

| Portfolio Turnover Rate (f) | | | 45 | % (d) |

| (a) | Amberwave Invest USA JSG Commencement of operations was January 19, 2022 |

| (b) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period |

| (c) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (f) | Portfolio turnover rate excludes portfolio securities received or delivered as a result of processing capital share transactions in Creation Units |

See accompanying notes to financial statements.

Amberwave Invest USA JSG Fund

NOTES TO FINANCIAL STATEMENTS

November 30, 2022

The Amberwave Invest USA JSG Fund (the “Fund”) is a diversified series of shares of beneficial interest of Northern Lights Fund Trust II (the “Trust”), a statutory trust organized under the laws of the State of Delaware on August 26, 2010, and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund seeks to provide capital appreciation. The Fund commenced operations on January 19, 2022.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.”

Security Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost. Investments in open-end investment companies are valued at net asset value.

A Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Trusts’ Board of Trustees (the “Board”). The Board has delegated execution of these procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) Adviser. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific fair value. The Board has also engaged a third-party valuation firm to attend valuation meetings held by the Trust, review minutes of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair Valuation Process – As noted above, the fair value committee is composed of one or more representatives from each of the (i) Trust, (ii) administrator, and (iii) adviser. The applicable investments are valued collectively via inputs from each of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of the adviser, the prices or values available do not represent the fair value of the instrument. Factors which may cause the adviser to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset values. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities

Amberwave Invest USA JSG Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2022

are valued via inputs from the adviser based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If the adviser is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Funds’ holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure fair value of all of their investments on a recurring basis. GAAP establishes the hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of November 30, 2022 for the Fund’s assets and liabilities measured at fair value:

| Assets* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 1,644,385 | | | $ | — | | | $ | — | | | $ | 1,644,385 | |

| Total | | $ | 1,644,385 | | | $ | — | | | $ | — | | | $ | 1,644,385 | |

The Fund did not hold any Level 3 securities during the year.

| * | Please refer to the Schedule of Investments for industry classifications. |

Amberwave Invest USA JSG Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2022

Security Transactions and Related Income – Security transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends and Distributions to Shareholders – Dividends from net investment income, if any, are declared and paid semi-annually. Distributable net realized capital gains, if any, are declared and distributed annually in December. Dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Dividends and distributions to shareholders are recorded on ex-dividend date.

Federal Income Taxes – The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of their taxable income to their shareholders. Therefore, no provision for Federal income tax is required. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s November 30, 2022 year-end tax return. The Fund has identified its major tax jurisdictions as U.S. Federal and Ohio, however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses, which are not readily identifiable to a specific fund, are allocated in such a manner as deemed equitable (as determined by the Board), taking into consideration the nature and type of expense and the relative sizes of the fund in the Trust.

Indemnification – The Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnities. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss due to these warranties and indemnities to be remote.

| 3. | INVESTMENT TRANSACTIONS |

For the year ended November 30, 2022, cost of purchases and proceeds from sales of portfolio securities (excluding in-kind transactions and short-term investments), amounted to $614,309 and $603,476 respectively. For the year ended November 30, 2022, cost of purchases and proceeds from sales of portfolio securities for in- kind transactions, amounted to $1,699,009 and $0 respectively.

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Amberwave Partners Research and Management, LLC (“Adviser”) serves as investment adviser to the Fund. The Advisor has engaged Vident Investment Advisory, LLC as the sub-advisor (the “Sub-Advisor”). For services the Sub- Advisor provides they are compensated by the Advisor. Pursuant to an Advisory Agreement with the Fund, the Adviser, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. The Adviser pays substantially all expenses of the Fund, including the cost of sub-advisory, transfer agency, custody, fund administration, legal, audit, trustees and other services, except for costs of borrowing money (including interest expenses), distribution fees or expenses, brokerage expenses, commissions and other transaction expenses, taxes and extraordinary expenses such as litigation and other expenses not incurred in the ordinary course of the Fund’s business in return for a “universal

Amberwave Invest USA JSG Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2022

fee.”. As compensation for its services the Adviser is entitled to receive an annual fee from the Fund computed and accrued daily and paid monthly, at an annual rate of 0.67% of average daily net assets. For the year ended November 30, 2022, the Fund incurred $7,907 in advisory fees.

Distributor – Northern Lights Distributors, LLC, (the “Distributor”), serves as the principal underwriter and national distributor for the shares of the Fund pursuant to an ETF Distribution Agreement with the Trust (the “Distribution Agreement”). The offerings of the Shares are continuous and the Distributor acts as an agent for the Trust.

The Fund does not pay the Distributor any fees under the Distribution Agreement. However, the Advisor pays an annual fee to the Distributor plus reasonable out-of-pocket expenses incurred by Distributor in connection with activities performed for the Fund.

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus Fund Solutions, LLC (“UFS”) – UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with UFS, the Adviser as part of the universal fee pays UFS customary fees for providing administration, fund accounting and transfer agent services to the Fund. Certain officers of the Trust are also officers of UFS and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”) - NLCS, an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Adviser as part of the universal fee.

Blu Giant, LLC (“Blu Giant”) – Blu Giant, an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Adviser as part of the universal fee.

| 5. | CAPITAL SHARE TRANSACTIONS |

Shares are not individually redeemable and may be redeemed by the Funds at NAV only in large blocks known as “Creation Units.” Shares are created and redeemed by the Funds only in Creation Unit size aggregations of 25,000 shares. Only Authorized Participants are permitted to purchase or redeem Creation Units from the Funds. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the distributor. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Funds on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the Authorized Participant or as a result of other market circumstances. In addition, the Funds may impose transaction fees on purchases and redemptions of Funds shares to cover the custodial and other costs incurred by the Funds in effecting trades. A fixed fee payable to the Custodian is imposed on each creation and redemption transaction regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation Units for cash or involving cash-in-lieu (as defined below) are required to pay an additional variable charge to compensate the Fund and its ongoing shareholders for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge,” and together with the Fixed Fee, the “Transaction Fees”). With the approval of the Board, the Adviser may waive or adjust the Transaction Fees, including the Fixed Fee and/or Variable Charge (shown in the table below), from time to time. In such cases, the Authorized Participant will reimburse the Fund for, among other things, any difference between the market value at which the securities and/or financial instruments were purchased by the Fund and the cash-in-lieu amount, applicable registration fees, brokerage commissions and certain taxes. In addition, purchasers of Creation Units are responsible for the costs of transferring the Deposit Securities to the accounts of the Fund.

Amberwave Invest USA JSG Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2022

Investors who use the services of a broker, or other such intermediary may be charged a fee for such services. The Transaction Fees for the Fund are listed in the table below:

| Fee for In-Kind and | Maximum Additional Variable |

| Cash Purchases | Charge for Cash Purchases* |

| $500 | 2.00% |

| * | As a percentage of the amount invested. |

| 6. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

At November 30, 2022, the aggregate cost for federal tax purposes, which differs from fair value by net unrealized appreciation (depreciation) of securities, are as follows:

| | | | | | | | | | Total Unrealized | |

| | | | Gross Unrealized | | | Gross Unrealized | | | Appreciation/ | |

| Aggregate Cost | | | Appreciation | | | Depreciation | | | Depreciation | |

| $ | 1,667,596 | | | $ | 136,622 | | | $ | (159,833 | ) | | $ | (23,211 | ) |

| 7. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of distributions paid during the following period was as follows:

| | | Fiscal Year Ended | |

| | | November 30, 2022 | |

| Ordinary Income | | $ | 5,560 | |

| Tax-exempt Income | | | | |

| Long-Term Capital Gain | | | — | |

| Return of Capital | | | — | |

| | | $ | 5,560 | |

As of November 30, 2022, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | | | Undistributed | | | Post October Loss | | | Capital Loss | | | Other | | | Unrealized | | | Total | |

| Ordinary | | | Long-Term | | | and | | | Carry | | | Book/Tax | | | Appreciation/ | | | Distributable Earnings/ | |

| Income | | | Gains | | | Late Year Loss | | | Forwards | | | Differences | | | (Depreciation) | | | (Accumulated Deficit) | |

| $ | 6,295 | | | $ | — | | | $ | — | | | $ | (41,672 | ) | | $ | — | | | $ | (23,211 | ) | | $ | (58,588 | ) |

The difference between book basis and tax basis unrealized appreciation and accumulated net realized gains from investments is attributable to the tax deferral of losses on wash sales and C-Corporation return of capital distributions.

At November 30, 2022, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains as follows:

| Short-Term | | | Long-Term | | | Total | | | CLCF Utilized | |

| $ | 41,672 | | | $ | — | | | $ | 41,672 | | | $ | — | |

Amberwave Invest USA JSG Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

November 30, 2022

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined other than the below that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

On December 22, 2022, the Board, based upon the recommendation of the Advisor authorized the liquidation of the Fund. The last day of trading of the Fund shares was January 13, 2023 and the Fund distributed the liquidation proceeds to shareholders of record on January 20, 2023.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Northern Lights Fund Trust II

and the Shareholders of Amberwave Invest USA JSG Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Amberwave Invest USA JSG Fund, a series of shares of beneficial interest in Northern Lights Fund Trust II (the “Fund”), including the schedule of investments, as of November 30, 2022, and the related statements of operations and changes in net assets and the financial highlights for the period from January 19, 2022 (Commencement of operations) through November 30, 2022, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2022, and the results of its operations, the changes in its net assets and its financial highlights for the period from January 19, 2022 through November 30, 2022, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2022 by correspondence with the custodian, brokers, or by other appropriate auditing procedures where replies from brokers were not received. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of one or more of the Funds in the Northern Lights Fund Trust II since 2012.

Philadelphia, Pennsylvania

January 26, 2023

Amberwave Invest USA JSG Fund

SUPPLEMENTAL INFORMATION (Unaudited)

November 30, 2022

FACTORS CONSIDERED BY THE TRUSTEES IN THE APPROVAL OF INVESTMENT ADVISORY AGREEMENTS

October 18-19, 2021 Meeting

At a meeting (the “Meeting”) of the Board of Trustees (the “Board”) of Northern Lights Fund Trust II (the “Trust”) held on October 18-19, 2021, the Board, including the disinterested Trustees (the “Independent Trustees”), considered the approval of the advisory agreement between Amberwave Partners Research and Management, LLC (“Amberwave”) and the Trust on behalf of the Amberwave Invest USA JSG Fund (the “Fund”) (the “Amberwave Advisory Agreement”). The Board further considered the approval of the sub-advisory agreement between Amberwave and Vident Investment Advisory, LLC (“Vident”) with respect to the Fund (“Vident Sub-Advisory Agreement’).

Based on their evaluation of the information provided by Amberwave, in conjunction with the Fund’s other service providers, the Board, by a unanimous vote (including a separate vote of the Independent Trustees), approved the Advisory Agreement with respect to the Fund.

In advance of the Meeting, the Board requested and received materials to assist them in considering the Amberwave Advisory Agreement. The materials provided contained information with respect to the factors enumerated below, including the Amberwave Advisory Agreement, a memorandum prepared by the Trust’s outside legal counsel discussing in detail the Trustees’ fiduciary obligations and the factors they should assess in considering the approval of the Amberwave Advisory Agreement and comparative information relating to the unitary fee and other expenses of the Fund. The materials also included due diligence materials relating to Amberwave (including due diligence questionnaires completed by Amberwave, select financial information of Amberwave, bibliographic information regarding Amberwave’s key management and investment advisory personnel, and comparative fee information relating to the Fund) and other pertinent information. At the Meeting, the Independent Trustees were advised by counsel that is experienced in Investment Company Act of 1940 matters and that is independent of fund management and met with such counsel separately from fund management.

The Board then reviewed and discussed the written materials that were provided in advance of the Meeting and deliberated on the approval of the Amberwave Advisory Agreement with respect to the Fund. The Board relied upon the advice of independent legal counsel and their own business judgment in determining the material factors to be considered in evaluating the Amberwave Advisory Agreement and the weight to be given to each such factor. The conclusions reached by the Board were based on a comprehensive evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to the Amberwave Advisory Agreement. In considering the approval of the Amberwave Advisory Agreement, the Board reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below.

Nature, Extent and Quality of Services. The Board reviewed materials provided by Amberwave related to the proposed approval of the Amberwave Advisory Agreement, including its draft ADV, a description of the manner in which investment decisions will be made and executed, its research capabilities and a review of the personnel performing services for Amberwave, including the team of individuals that will primarily monitor and execute the investment process. The Board noted that Amberwave Partners was a newly formed investment adviser with no experience managing a 1940 Act registered fund but that its personnel had many years of experience in finance and financial services in their previous positions at other firms and the government and noted that Amberwave had hired an outside compliance consulting firm with significant industry experience, Cipperman Compliance

Amberwave Invest USA JSG Fund

SUPPLEMENTAL INFORMATION (Unaudited) (Continued)

November 30, 2022

Services (“Cipperman”), to assist in the continued development and oversight of its compliance program. The Board noted that the personnel at Cipperman who would be assisting Amberwave with its compliance program were very experienced in the 1940 Act and experienced in the operations and regulations governing the management of registered investment companies including exchange traded funds. Additionally, the Board received satisfactory responses from representatives of Amberwave with respect to a series of important questions, including: whether Amberwave or its principals were involved in any lawsuits or pending regulatory actions; whether the management of other accounts would conflict with its management of the Fund; and whether there were procedures in place to adequately allocate trades among its clients. The Board reviewed the description provided on the practices for monitoring compliance with Amberwave’s investment limitations, noting that Amberwave’s chief compliance officer would actively review the portfolio managers’ performance of their duties to ensure compliance under Amberwave’s compliance program. The Board discussed the capitalization of Amberwave, noting that Amberwave was newly formed, and, based on discussions with the representatives of Amberwave, concluded that Amberwave’s principals had the ability to make additional contributions in order to meet their obligations to the Fund. The Board also discussed Amberwave’s compliance program with the CCO of the Trust. The Board noted that the CCO of the Trust represented that Amberwave’s policies and procedures were reasonably designed to prevent violations of applicable securities laws. The CCO of the Trust further represented that he would work closely with Amberwave and its compliance personnel to ensure close monitoring of the Fund’s operations and risk management practices. The Board concluded that Amberwave had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to performing its duties under the Amberwave Advisory Agreement and that the nature, overall quality and extent of the management services to be provided by Amberwave to the Fund appear to be satisfactory.

Performance. Because the Fund had not yet commenced operations nor had Amberwave or its portfolio managers managed similar accounts, the Board did not consider past performance.

Fees and Expenses. As to the costs of the services to be provided by Amberwave, the Board reviewed and discussed the Fund’s proposed unitary advisory fee and anticipated total operating expenses compared to its peer group and Morningstar category as presented in the Broadridge Report. The Board noted that the 0.75% proposed unitary fee for the Fund, although higher than its peer group median and Morningstar category median was not the highest in either its peer group or Morningstar category. The Board reviewed the contractual arrangements for the Fund, noting that Amberwave will pay substantially all expenses of the Fund, including transfer agency, custody, fund administration, legal, audit and other services, but not interest expenses, distribution fees or expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of Amberwave’s business. The Board also looked at the all in cost of managing the Fund and found that total operating expenses, exclusive of certain fees, were capped at 0.75% under the unitary fee. The Board concluded that the unitary fee to be charged by Amberwave was not unreasonable.

Profitability. The Board also considered the level of profits that could be expected to accrue to Amberwave with respect to the Fund based on profitability estimates and analyses provided by Amberwave and reviewed by the Board. After review and discussion, the Board concluded that, based on the services to be provided by Amberwave and the projected growth of the Fund, the anticipated level of profit from Amberwave’s relationship with the Fund was not excessive.

Economies of Scale. As to the extent to which the Fund will realize economies of scale as it grows, and whether the fee levels reflect these economies of scale for the benefit of investors, the Board discussed Amberwave’s expectations for growth of the Fund, and concluded that any material economies of scale would not be achieved in the near term.

Amberwave Invest USA JSG Fund

SUPPLEMENTAL INFORMATION (Unaudited) (Continued)

November 30, 2022

Vident Sub-Advisory Agreement

The Board then reviewed and discussed the written materials that were provided in advance of the Meeting and deliberated on the approval of the proposed Vident Sub-Advisory Agreement. In addition to the materials described above, the Board reviewed: (i) the nature and quality of the investment advisory services to be provided by Vident, including the experience and qualifications of the personnel providing such services; (ii) Vident’s investment services; and (iii) Vident’s financial condition, history of operations and ownership structure. In considering the approval of the Vident Sub-Advisory Agreement, the Board reviewed and analyzed various factors that they determined were relevant, including the factors enumerated below.

Nature, Extent and Quality of Services. As to the nature, quality and extent of the services provided by Vident, the Board noted the experience of the portfolio management personnel of Vident, including their experience in the investment field, education and industry credentials. The Board discussed the financial condition of Vident and reviewed supporting materials. The Board reviewed the materials prepared by Vident describing its investment process and noted Vident’s considerable experience executing, settling and reporting trades, adjusting baskets and coordinating custom baskets for exchange traded funds. The Board concluded that Vident had sufficient quality and depth of personnel, resources and investment methods essential to performing its duties under the Vident Sub-Advisory Agreement and that the nature, overall quality and extent of investment advisory services to be provided to the Fund appear to be satisfactory.

Performance. Because the Fund had not yet commenced operations, the Board did not consider past performance. The Board considered the depth and experience of Vident and was comfortable they would provide satisfactory performance for the Fund and its shareholders.

Fees and Expenses. As to the costs of the services provided by Vident, the Board discussed the sub-advisory fee and considered that Vident is paid by Amberwave out of its advisory fees and not by the Fund. The Board also looked at the advisory fee split between Amberwave and Vident and concluded that the sub-advisory fee paid to Vident was not unreasonable in light of the quality of the services to be performed by it. The Board also considered, based on statements made and information provided by Amberwave and Vident that the Vident Sub-Advisory Agreement was negotiated at arm’s-length between Amberwave and Vident.

Profitability. As to profitability, the Board discussed and noted that Vident will receive no compensation from the Fund, other than the sub-advisory fee earned pursuant to the Vident Sub-Advisory Agreement. The Board further noted that the sub-advisory fee is paid by Amberwave out of the advisory fee that it receives and not directly by the Fund. While the Board did not consider the costs of services provided by Vident or its profitability to be significant factors, nonetheless, based on all these factors and on profitability estimates and analyses provided by Vident and reviewed by the Board, the Board concluded that anticipated profits from Vident’s relationship with the Fund were not excessive.

Economies of Scale. The Board noted that the sub-advisory fee is not paid by the Fund, therefore the Board did not consider whether the sub -advisory fee should reflect any potential economies of scale that might be realized as the Fund’s assets increase and rather determined the economies of scale would be evaluated as part of looking at the advisory fee paid to Amberwave.

Conclusion. The Board members relied upon the advice of independent counsel, and their own business judgment in determining the material factors to be considered in evaluating each of the Amberwave Advisory Agreement and the Vident Sub-Advisory Agreement (collectively, the “Advisory Agreements”) and the weight

Amberwave Invest USA JSG Fund

SUPPLEMENTAL INFORMATION (Unaudited) (Continued)

November 30, 2022

to be given to each such factor. Accordingly, having requested and received such information from Amberwave and Vident as the Board believed to be reasonably necessary to evaluate the terms of each of the Advisory Agreements separately, and as assisted by the advice of independent counsel, the Board, including a majority of the Independent Trustees voting separately, determined that with respect to the Fund that (a) the terms of each of the Advisory Agreements are reasonable; (b) the advisory fee (or sub-advisory fee as applicable) is not unreasonable; and (c) the Advisory Agreements are in the best interests of the Fund and their respective shareholders. In considering the approval of each of the Advisory Agreements, the Board did not identify any one factor as all important, but rather considered these factors collectively and determined that approval of each Advisory Agreement was in the best interests of the Fund and its shareholders. Moreover, the Board noted that each Trustee may have afforded different weight to the various factors in reaching his conclusions with respect to each of the Advisory Agreements.

December 21, 2021 Special Meeting

At a special meeting (the “Special Meeting”) of the Board held on December 21, 2021, the Board, including the disinterested Trustees (the “Independent Trustees”), considered the approval of a revised advisory agreement (the “Revised Amberwave Advisory Agreement”) between Amberwave Partners Research and Management, LLC (“Amberwave”) and the Trust, on behalf of the Amberwave Invest USA JSG Fund (the “Fund”).

In advance of the Meeting, the Board requested and received materials to assist them in considering the Revised Amberwave Advisory Agreement.

It was noted that the Meeting Materials included an updated 15c response from Amberwave marked to show changes made since the Board last reviewed it at its meeting on October 18 and 19, 2021, as well as the proposed Revised Amberwave Advisory Agreement. It was noted that the Adviser, after further analyzing the unitary fee, their anticipated profitability and peer comparisons, was requesting that the Board approve an adjustment to the unitary fee for the Fund by reducing it from 0.75% to 0.67%. The Board then discussed the proposed new unitary fee and compared it against the peer group contained in the Broadridge Report that the Board had previously reviewed at its regular meeting in October 2021. The Board also reviewed the revised profitability analysis. After further discussion, the Board concluded that the revised unitary fee for the Fund is in line with its peer group average and was not unreasonable. The Board further reviewed its deliberations, analysis and conclusions from the October 18 -19, 2021 meeting with respect to its approval of the Advisory Agreement between the Trust and Amberwave and agreed that the same deliberations, analysis and conclusions applied to the Revised Amberwave Advisory Agreement except further factoring in the lower unitary fee noted above.

Amberwave Invest USA JSG Fund

EXPENSE EXAMPLES (Unaudited)

November 30, 2022

As a shareholder of the Fund, you incur ongoing costs, consisting of the Fund’s universal fee. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2022 to November 30, 2022 (the ’‘period’’).

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled ’‘Expenses Paid During the Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid | Expense Ratio |

| | Account Value | Account Value | During Period | During the Period |

| Actual | 6/1/22 | 11/30/22 | 6/1/22-11/30/22* | 6/1/22-11/30/22 |

| | $1,000.00 | $1,003.60 | $3.37 | 0.67% |

| | | | | |

| | Beginning | Ending | Expenses Paid | Expense Ratio |

| Hypothetical | Account Value | Account Value | During Period | During the Period |

| (5% return before expenses) | 6/1/22 | 11/30/22 | 6/1/22-11/30/22* | 6/1/22-11/30/22 |

| | $1,000.00 | $1,021.71 | $3.40 | 0.67% |

| * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (183) divided by the number of days in the fiscal year (365). |

Amberwave Invest USA JSG Fund

SUPPLEMENTAL INFORMATION (Unaudited)

November 30, 2022

LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

The Trust, on behalf of the Fund, has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources.

During the fiscal period ended November 30, 2022, the Trust’s Liquidity Risk Management Program Committee (the “Committee”) reviewed the Fund’s investments and determined that the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. Accordingly, the Committee concluded that (i) the Fund’s liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Fund’s liquidity risk management program has been effectively implemented.

Amberwave Invest USA JSG Fund

Supplemental Information (Unaudited)

November 30, 2022

The Trustees and the officers of the Trust are listed below with their present positions with the Trust and principal occupations over at least the last five years. The business address of each Trustee and Officer is 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246. All correspondence to the Trustees and Officers should be directed to c/o Ultimus Fund Solutions, LLC, P.O. Box 541150, Omaha, Nebraska 68154.

Independent Trustees

Name and Year

of Birth | Position/Term

of Office* | Principal Occupation

During the Past Five Years | Number of

Portfolios in Fund

Complex Overseen

by Trustee** | Other Directorships held by

Trustee

During the Past Five Years |

Brian Nielsen

1972 | Trustee Since May 2011 | Trustee of Northern Lights Fund Trust II (since 2011); Special Projects Counsel of NorthStar Financial Services Group, LLC (from 2018 to 2019 ); Secretary of CLS Investments, LLC (from 2001 to 2018); Secretary of Orion Advisor Services, LLC (from 2001 to 2018); General Counsel and Secretary (from 2003 to 2018) of NorthStar Financial Services Group, LLC; CEO (from 2012 to 2018), Secretary (from 2003 to 2018) and Manager (from 2005 to 2018) of Northern Lights Distributors, LLC; Director, Secretary and General Counsel of Constellation Trust Company (from 2004 to 2018); CEO (from 2015 to 2018), General Counsel and Secretary (from 2011 to 2018) of Northern Lights Compliance Services, LLC; General Counsel and Secretary of Blu Giant, LLC (from 2011 to 2018); Secretary of Gemini Fund Services, LLC (from 2012 to 2018); Manager of Arbor Point Advisors, LLC (from 2012 to 2018); Director, Secretary and General Counsel of NorthStar CTC Holdings, Inc. (from 2015 to 2018) and Secretary and Chief Legal Officer of AdvisorOne Funds (from 2003 to 2018). | 1 | Manager of Northern Lights Distributors, LLC (from 2005 to 2018); Manager of Arbor Point Advisors, LLC (from 2012 to 2018); Director of Constellation Trust Company (from 2004 to 2018) |

Thomas T. Sarkany

1946 | Trustee Since October 2011 | President, TTS Consultants, LLC (financial services) (since 2010). | 1 | Director, Aquila Distributors; Trustee, Arrow ETF Trust; Trustee, Arrow Investments Trust; Trustee, Northern Lights Fund Trust IV |

Anthony H. Lewis

1946 | Trustee Since May 2011 | Chairman and CEO of The Lewis Group USA (executive consulting firm) (since 2007). | 1 | Director, Member of the Compensation Committee and Member of the Risk Committee of Torotel Inc. (Magnetics, Aerospace and Defense), Trustee, Chairman of the Fair Valuation Committee and Member of the Audit Committee of the Wildermuth Endowment Strategy Fund |

Keith Rhoades

1948 | Trustee Since May 2011 | Retired since 2008. | 1 | NONE |

Randal D. Skalla

1962 | Trustee Since May 2011 | President, L5 Enterprises, Inc. (financial services company) (since 2001). | | Board Member, Orizon Investment Counsel (financial services company) (from 2001 to 2017) |

Amberwave Invest USA JSG Fund

Supplemental Information (Unaudited) (Continued)

November 30, 2022

Officers

Name and Year

of Birth | Position/Term of

Office* | Principal Occupation

During the Past Five Years | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee** | Other Directorships held by Trustee

During the Past Five Years |

Kevin E. Wolf

1969 | President Since January 2013 | Vice President of The Ultimus Group, LLC; Executive Vice President, Head of Fund Administration and Product (since 2019) and President (2012 - 2019) of Ultimus Fund Solutions, LLC (formerly, Gemini Fund Services, LLC). | N/A | N/A |

Eric Kane

1981 | Secretary Since August 2022 | Vice President and Managing Counsel, Ultimus Fund Solutions, LLC (since 2020); Vice President and Counsel, Gemini Fund Services, LLC (2017-2020), Assistant Vice President, Gemini Fund Services, LLC (2014- 2017), Staff Attorney, Gemini Fund Services, LLC (2013-2014), Law Clerk, Gemini Fund Services, LLC (2009-2013), Legal Intern, NASDAQ OMX (2011), Hedge Fund Administrator, Gemini Fund Services, LLC (2008), Mutual Fund Accountant/Corporate Action Specialist, Gemini Fund Services, LLC (2006- 2008). | N/A | N/A |

Erik Naviloff

1968 | Treasurer Since January 2013 | Vice President of Ultimus Fund Solutions, LLC (formerly, Gemini Fund Services, LLC) (since 2011). | N/A | N/A |

Jared Lahman

1986 | Anti-Money Laundering Officer since January 2022 | Compliance Analyst, Northern Lights Compliance Services, LLC (since January 2019); Manager, Fund Accounting, Gemini Fund Services, LLC (January 2014 to December 2018). | N/A | N/A |

Emile R. Molineaux

1962 | Chief Compliance Officer Since May 2011 | Senior Compliance Officer and CCO of Various clients of Northern Lights Compliance Services, LLC (since 2011). | N/A | N/A |

| * | The term of office for each Trustee and Officer listed above will continue indefinitely. |

| ** | As of November 30, 2022, the Trust was comprised of 19 active portfolios managed by unaffiliated investment advisers. The term “Fund Complex” applies only to the Fund and not to any other series of the Trust. The Fund does not hold itself out as related to any other series within the Trust for investment purposes, nor does it share the same investment adviser with any other series. |

The Funds’ SAI includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free at 1-888-926-1931.

Privacy Policy

Rev. May 2021

| FACTS | WHAT DOES NORTHERN LIGHTS FUND TRUST II (“NLFT II”) DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

|

● Social Security number ● Employment information ● Account balances | ● Account transactions ● Income ● Investment experience |

| When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share a customer’s personal information to run their everyday business - to process transactions, maintain customer accounts, and report to credit bureaus. In the section below, we list the reasons financial companies can share their customer’s personal information; the reasons NLFT II chooses to share; and whether you can limit this sharing. |

| | | |

| Reasons we can share your personal information | Does NLFT II

share? | Can you limit

this sharing? |

For our everyday business purposes —

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus

| Yes | No |

For our marketing purposes —

to offer our products and services to you

| Yes | No |

For joint marketing with other financial companies

| Yes | No |

For our affiliates’ everyday business purposes —

information about your transactions and experiences

| Yes | No |

For our affiliates’ everyday business purposes —

information about your creditworthiness

| No | We don’t share |

For nonaffiliates to market to you

| No | We don’t share |

| Questions? | Call 1-631-490-4300 |

| Who we are |

| Who is providing this notice? | Northern Lights Fund Trust II |

| What we do |

| How does NLFT II protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

|

| How does NLFT II collect my personal information? | We collect your personal information, for example, when you

|

● open an account ● give us your income information ● provide employment information | ● provide account information ● give us your contact information |

| We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes—information about your creditworthiness ● affiliates from using your information to market to you ● sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ● NLFT II has no affiliates. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ● NLFT II does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products and services to you. ● Our joint marketing partners include other financial service companies. |

How to Obtain Proxy Voting Information

Information regarding how the Fund votes proxies relating to portfolio securities during the most recent 12-month period ending June 30th as well as a description of the policies and procedures that the Fund used to determine how to vote proxies is available without charge, upon request, by calling 1-888-926-1931 or by referring to the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain 1st and 3rd Fiscal Quarter Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT, within sixty days after the end of the period. Form N-PORT reports are available on the SEC’s website at http://www.sec.gov. The information on Form N-PORT is available without charge, upon request, by calling 1-888-926-1931.

| Investment Adviser |

| Amberwave Partners Research and Management, LLC |

| 14090 Southwest Freeway, Suite 300 |

| Sugar Land, Texas 77478 |

| |

| Sub-Adviser |

| Vident Investment Advisory, LLC |

| 1125 Sanctuary Parkway, Suite 515 |

| Alpharetta, Georgia 30009 |

| |

| Administrator |

| Ultimus Fund Solutions, LLC |

| 225 Pictoria Drive, Suite 450 |

| Cincinnati, OH 45246 |

Amberwave-AR22

Item 2. Code of Ethics.

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.