UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22557

| T. Rowe Price Floating Rate Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: May 31

Date of reporting period: May 31, 2019

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1.

| Floating Rate Fund | May 31, 2019 |

| PRFRX | Investor Class |

| PAFRX | Advisor Class |

| TFAIX | I Class |

Beginning on January 1, 2021, as permitted by SEC regulations, paper copies of the T. Rowe Price funds’ annual and semiannual shareholder reports will no longer be mailed, unless you specifically request them. Instead, shareholder reports will be made available on the funds’ website (troweprice.com/prospectus), and you will be notified by mail with a website link to access the reports each time a report is posted to the site.

If you already elected to receive reports electronically, you will not be affected by this change and need not take any action. At any time, shareholders who invest directly in T. Rowe Price funds may generally elect to receive reports or other communications electronically by enrolling attroweprice.com/paperlessor, if you are a retirement plan sponsor or invest in the funds through a financial intermediary (such as an investment advisor, broker-dealer, insurance company, or bank), by contacting your representative or your financial intermediary.

You may elect to continue receiving paper copies of future shareholder reports free of charge. To do so, if you invest directly with T. Rowe Price, please call T. Rowe Price as follows: IRA, nonretirement account holders, and institutional investors,1-800-225-5132; small business retirement accounts,1-800-492-7670. If you are a retirement plan sponsor or invest in the T. Rowe Price funds through a financial intermediary, please contact your representative or financial intermediary or follow additional instructions if included with this document. Your election to receive paper copies of reports will apply to all funds held in your account with your financial intermediary or, if you invest directly in the T. Rowe Price funds, with T. Rowe Price. Your election can be changed at any time in the future.

| T. ROWE PRICE FLOATING RATE FUND |

|

HIGHLIGHTS

| ■ | The Floating Rate Fund posted a positive return during the 12 months ended May 31, 2019, outperforming its Lipper peer group average and slightly lagging its benchmark, the S&P/LSTA Performing Loan Index. |

| |

| ■ | We remained committed to downside protection but were mindful of not allowing our positioning to become too defensive. |

| |

| ■ | We reduced our participation in new deals and concentrated on investing in our high-conviction names. |

| |

| ■ | The majority of issuers in the bank loan market are fundamentally sound, and we expect the default rate to remain low in the next 12 months. |

Log in to your account attroweprice.comfor more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

CIO Market Commentary

Dear Shareholder

Markets were extremely volatile in your fund’s fiscal year ended May 31, 2019, although well-diversified portfolios emerged with modest gains. Evidence of a slowdown in the global economy hampered equities but boosted bond returns by pushing down long-term interest rates.

The period started on a generally bright note. The U.S. economy shifted back into a higher gear in 2018, expanding at its fastest pace (2.9%) in three years due in part to stimulus from the December 2017 tax cuts and increased federal spending. Consumer confidence gauges rose as the unemployment rate fell, taking both to favorable levels not seen in two decades. Corporate earnings were particularly strong, with profits for the largest companies expanding by roughly 20% in 2018, thanks to the lower corporate tax rate and healthy revenues.

The continuing expansion encouraged the Federal Reserve to stay on its path of monetary tightening, with policymakers raising the federal funds rate once each quarter in 2018. Markets initially proved resilient to the hikes, but early signs of economic weakness led to worries that the Fed might be moving too quickly. The pace of home sales and new construction slowed in late 2018 as rising mortgage rates and a lack of entry-level homes weighed on affordability. Business investment also appeared to weaken, and gauges of manufacturing activity declined.

The Fed’s hikes eventually began to put pressure on markets. Fed Chair Jerome Powell told an interviewer on October 3 that interest rates were still “a long way” from a neutral level that would neither stimulate nor restrain the economy. Stocks sold off over the following days, and the yield on the benchmark 10-year Treasury note reached 3.25%, its highest level since 2011. (Bond prices and yields move in opposite directions.)

Growth signals worsened into the end of the year, bringing bond yields back down but weighing further on equities. The partial government shutdown that began in late December and lasted through much of January delivered another blow. The holiday sales season did not meet expectations, and measures of consumer confidence dropped sharply. The major equity benchmarks entered or neared bear market territory, defined as a decline of at least 20% from their recent highs.

The Fed responded to the slowdown and market turmoil with a “dovish pivot,” sending bond and stock prices sharply higher in early 2019. Powell and other Fed officials made assurances that they would respond to any pronounced slowdown with all the tools at their disposal and signaled that future rate hikes were in “pause” mode. Indeed, markets soon began pricing in a likelihood that the Fed’s next move would be to cut rates. Long-term bond yields tumbled dramatically, and the yield on the 10-year note ended May at 2.14%, well below its year-ago level of 2.83%.

The Fed also had to account for the impact of the trade tensions between the U.S. and China. Hopes that an all-out trade war might be averted helped lift the markets in the first four months of 2019, particularly after President Donald Trump stated that the two sides were “getting very close” to a deal. These hopes were dashed in early May, however, after the White House declared that negotiations had fallen through and then subsequently raised the tariff rate on many Chinese goods to 25% from 10%. The tit-for-tat tariff battle also seemed to be metastasizing into a “technological cold war,” with each country taking steps to limit the other’s access to critical components and raw materials.

The future course of U.S.-China trade relations is a central question facing investors. Unfortunately, I suspect that neither side is in the mood for compromise, with President Trump feeling the need to remain resolute before the 2020 election and Chinese officials equally eager to deny him a victory, and potentially willing to wait to negotiate with his successor.

One way we’ll monitor these developments is through weekly and monthly meetings of our investment teams, where our managers, analysts, economists, and legislative specialists share observations and insights. While further turbulence in the markets seems likely, I’m confident that our uniquely collaborative approach will continue to serve our shareholders well.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

Group Chief Investment Officer

Management’s Discussion of Fund Performance

INVESTMENT OBJECTIVE

The fundseeks high current income and, secondarily, capital appreciation.

FUND COMMENTARY

How did the fund perform in the past 12 months?

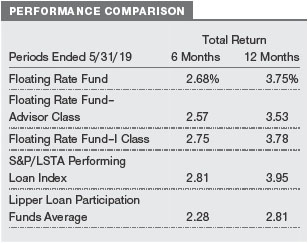

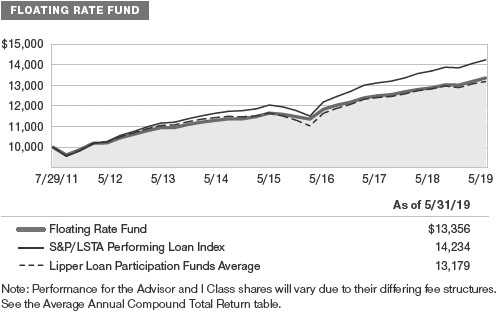

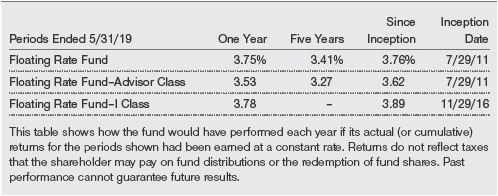

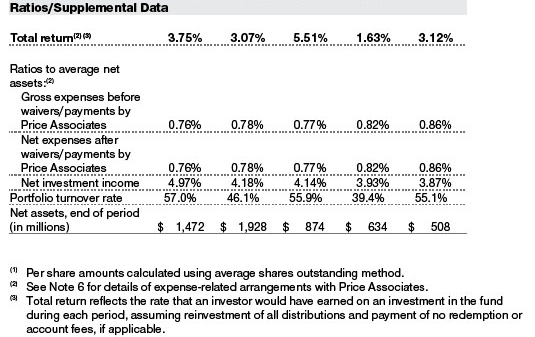

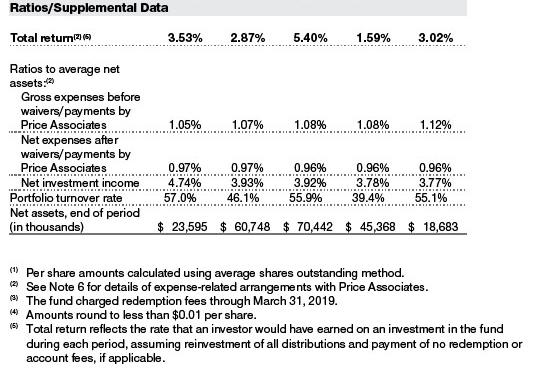

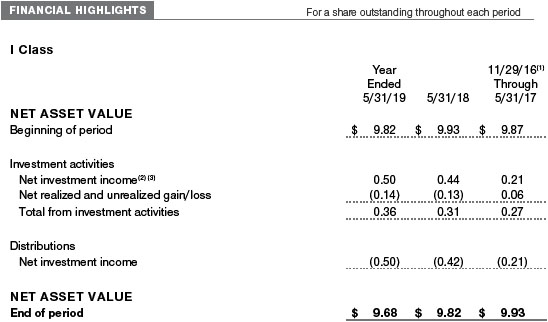

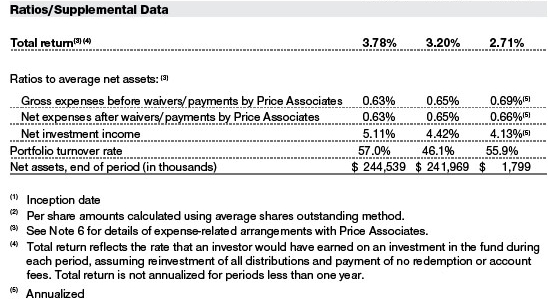

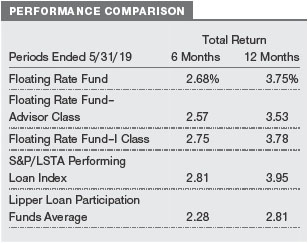

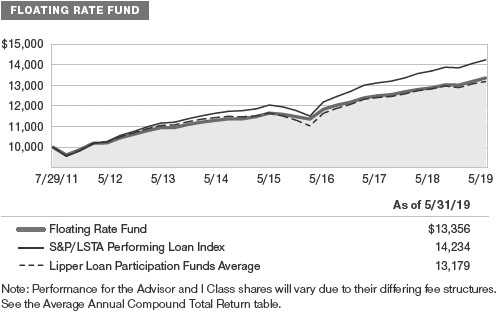

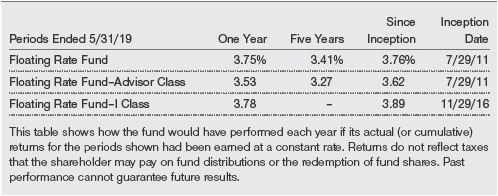

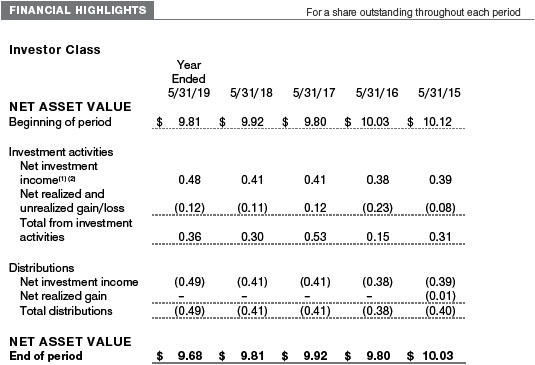

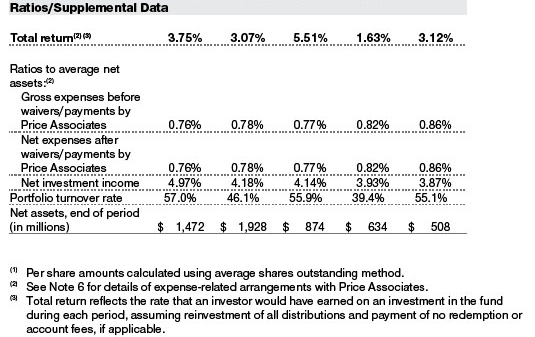

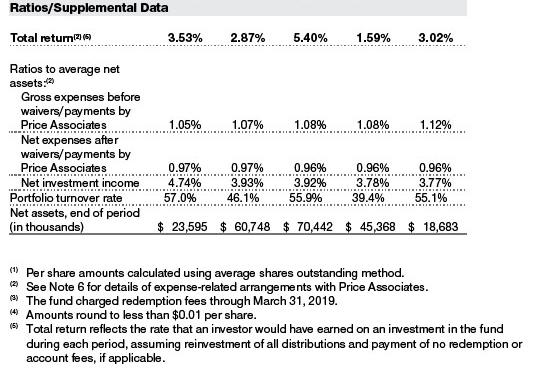

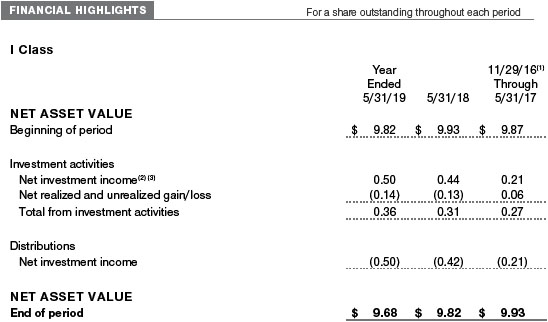

The Floating Rate Fundreturned3.75% in the 12months endedMay 31, 2019, outperforming its Lipper peer group average andslightly lagging its benchmark, the S&P/LSTAPerforming LoanIndex. (Results for the fund’sAdvisor andIClass shares variedslightly, reflecting theirdifferent fee structure, asset flows, andother factors.Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

We remainedcommittedtodownside protection throughout thedistinctmarket cycles we experiencedin the past 12months, which we believe helped mitigatelosses in the fourth quarter of 2018 when risk assets soldoff amidsignificant volatility.Yet we weremindful of not allowing our positioning to become toodefensive, which enabledthe portfolio to keep pace with the bank loanmarket’s strong 2019 performance.

Our credit selection across the ratings spectrumproduceda solidrelative performance contribution. Our CCC ratedholdings performedbest, largelydue to our focus on lower-quality subordinate positions in our high-conviction names that performedwell.Additionally, we avoidedstressedcredit situations and marginal issues in the CCC rating tier that we were not comfortable owning.

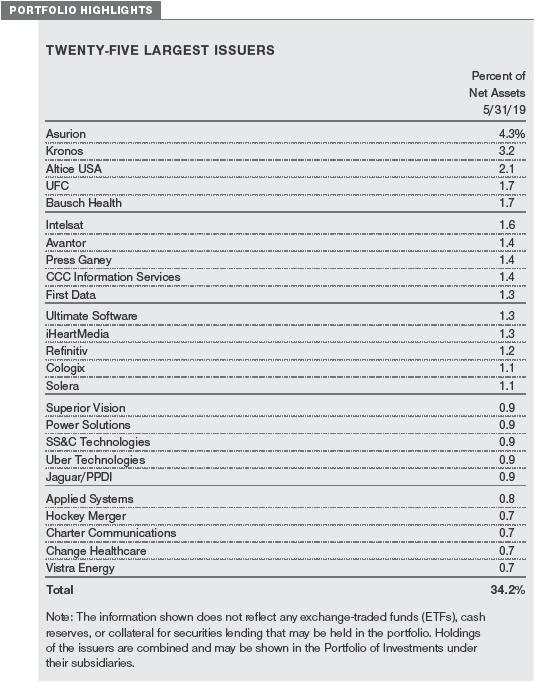

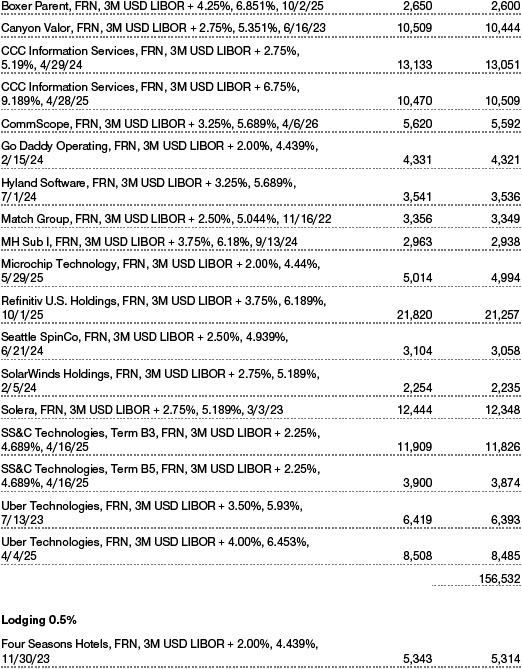

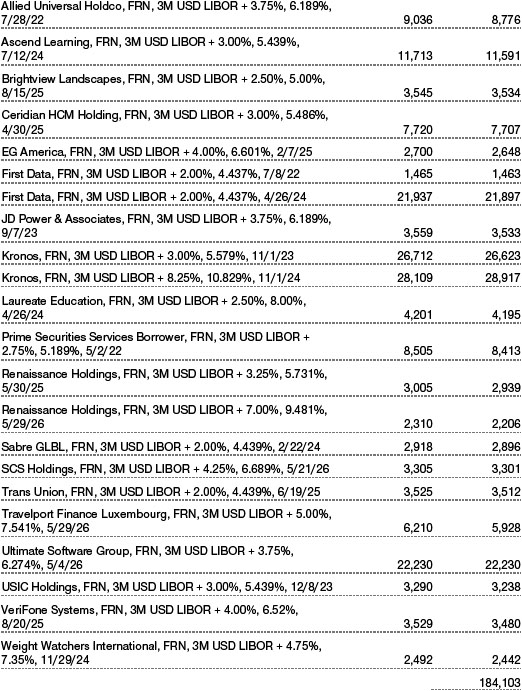

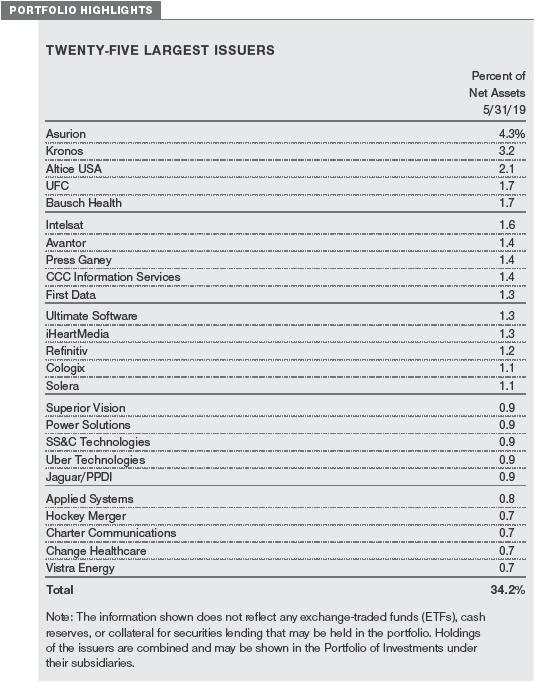

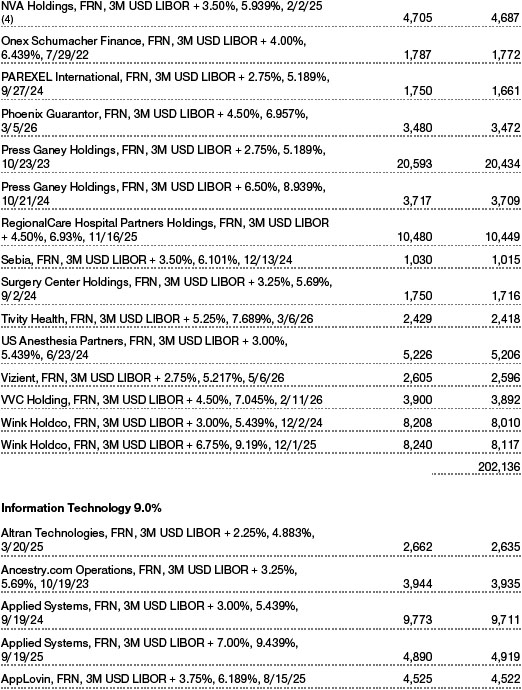

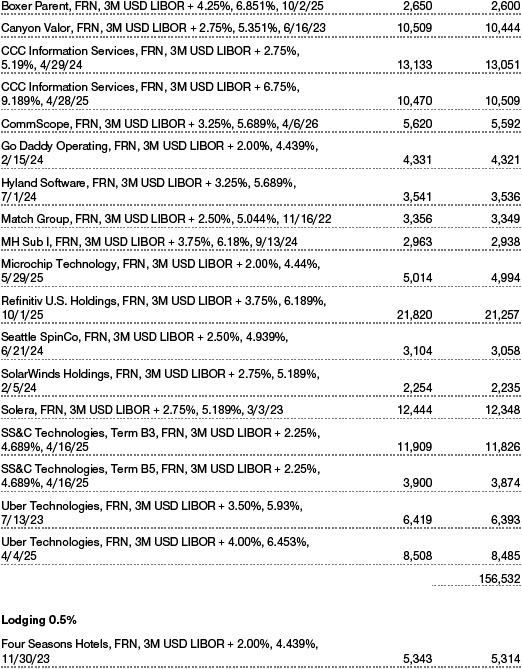

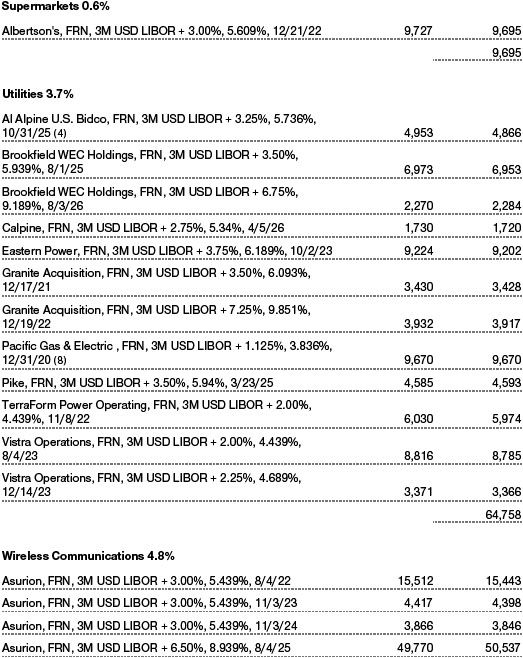

The portfolio’s second-lien loan holdingsmade a significant contribution to relative performance over the past year. We have an overweight allocation relative to the benchmark in higher-yielding, second-lien loans, although first liens represent themajority of our holdings. Secondliens are a step lower in the capital structure and, likewise, a lower credit quality, but these loans yield moreto compensate for the additional risk. We will often holda blendedallocation of first- andsecond-lien loans froma single issuer to express conviction in an improving or stable credit.Asurion, our highest-conviction holding, is an example of a second-lien loan issuer.It was the top relative performance contributorduring our fiscal year. (Please refer to the portfolio of investments for a complete list of holdings andthe amount each represents in the portfolio.)

Asurion is a loan-only issuer andglobal provider of product protection andsupport services to the wireless, insurance, retail, andhome repair service industries.As a handset insurance provider, it benefits fromsmartphone sales withoutdepending on the execution of one specific wireless carrier.Asurion’sdominantmarket position, solidcredit profile, near-termrevenue visibility, andattractive coupons support our high conviction in the issuer.

In the services segment,Kronos, a leader in the workforcemanagement solutionsmarket, aidedrelative performance.Its products address business needs includingmonitoring employee time andattendance, scheduling, absencemanagement, andworkforce analytics. This company’smarket-leading products andsubscription-basedbusiness foster loyalty fromitsdiverse customer base.Kronos postedstrong 2018 results, andwe believe that the company’s fundamentals shouldimprove as its new workforcemanagement software, Dimensions, rolls out andexpensesmoderate.

In the health care segment,Avantor, a leading provider of product andservice solutions to laboratory andproduction companies, was a notable relative performance contributor that has become one of our highest-conviction holdings.Its acquisition ofVWR has createdsynergies, andits end markets are improving.Avantor’s recently completedinitial public offering (IPO) was supportive for the credit as a large portion of the proceeds will be usedto paydowndebt.Additionally, the nature ofAvantor’s businessmeans that its products have applications across a broadsegment of the health care sector.

Our underweight allocation andsecurity selection in the retail sector weighedon relative performance. The credit selection impact was largelydue to not owning PetSmart,NorthAmerica’s leading retailer of food, products, andservices for pets.Its brick-and-mortar franchise continues to face significant headwinds. However, the company’s acquisition of Chewy.com—an onlinemarketplace for pet supplies—roughly two years ago has improvedits credit profile andenabledlenders to realize significant value. The loans tradedhigherduring the period, partlydue to the plannedChewy.com IPO andthe projectedequity value.

In the broadcasting segment,iHeartMediawas a relative performancedetractor. The company filedfor bankruptcy in the first quarter of 2018, so its outstandingdebt was not paying a coupon. Therefore, any negativemovement in the underlying pricedirectly weighedon performance. Our positions tradedlower amidhigh yield market weakness in the fourth quarter of 2018. However, iHeartMedia exitedbankruptcy in the first week of May, whichmeans that the performancedrag fromowning securities thatdo not pay a coupon has been eliminated. We remain confident that the ultimate recovery value of the securities will bemuch higher than our entry point. We have begun to see this in the price appreciation of the securities we receivedwhen the company emergedfrombankruptcy.

How is the fund positioned?

The portfolio is focusedon bank loans and, to a lesser extent, corporate bonds in the higher-quality tiers of the below investment-grade universe;we primarily invest in B andBB ratedloans. Over the past year, we remainedunderweight in the lowest-quality first-lien loans in themarket.In our view,first-lien loans ratedBminus are vulnerable to beingdowngradedto CCC in an economicdownturn.If there is a significant increase of CCC ratedloans, we are concernedabout whether themarket will be able to absorb the new supply.

We believe that underwriting standards in the bank loan new issuemarket have becomemore aggressive since the secondquarter of 2018.Accordingly, we have reducedour participation in newdeals andconcentratedon investing in our high-conviction names while positioning the portfoliomoredefensively in terms of credit quality.

We also adjustedthe fund’s industry exposures. For example, we addedto the fund’s holdings in the services segment,mainly because we wantedto increase our investment in the human capitalmanagement subsector. We have extensive experience in this area becauseKronos has been one of the portfolio’s long-standing top five positions. Human capitalmanagement software companiesUltimate SoftwareandCeridianare among the names we have recently addedto the portfolio.

We have been scrutinizing our health care exposuredue to all the noise in themarket aroundregulatory changes. However, we addedto our investment in select names includingAvantor andBausch Health, a global company thatdevelops,manufactures, and markets a broadrange of pharmaceutical,medicaldevice, andover-the-counter products.Although Bausch carries significantdebt on its balance sheet,management has beenmaking progress on reducing leverage. The company generates significant free cash flow, andits earnings are improving.

What is portfolio management’s outlook?

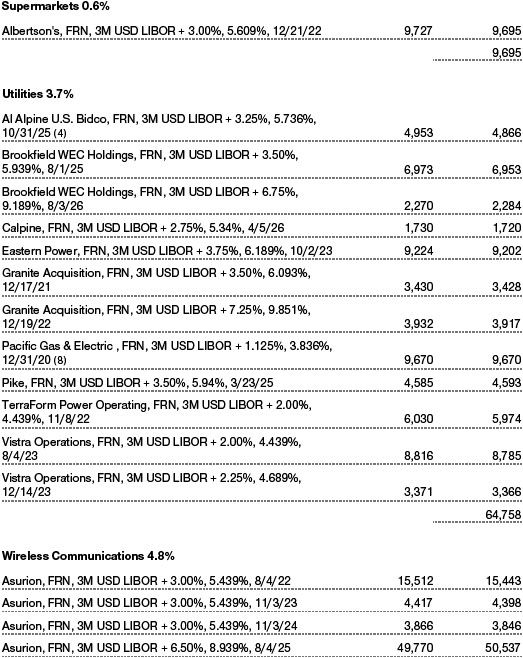

The Federal Reserve’s interest rate strategy is a primary consideration that we are factoring in to our return expectations. There is a high probability of at least one rate cut this year,meaning that the floating rate feature of bank loans, which resets coupons higher as rates rise, will no longer be a performance tailwind.If the Fedcuts rates, we couldalso see an acceleration of redemptions frombank loan funds, which wouldweaken technical conditions.Nevertheless, the leveragedloanmarket began 2019 with its strongest quarterly gain since 2010, andwe remain broadly constructive in our expectations for the rest of the year.

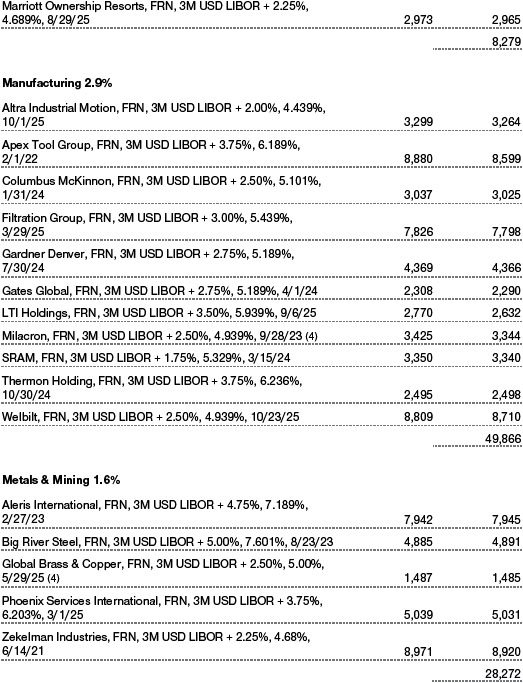

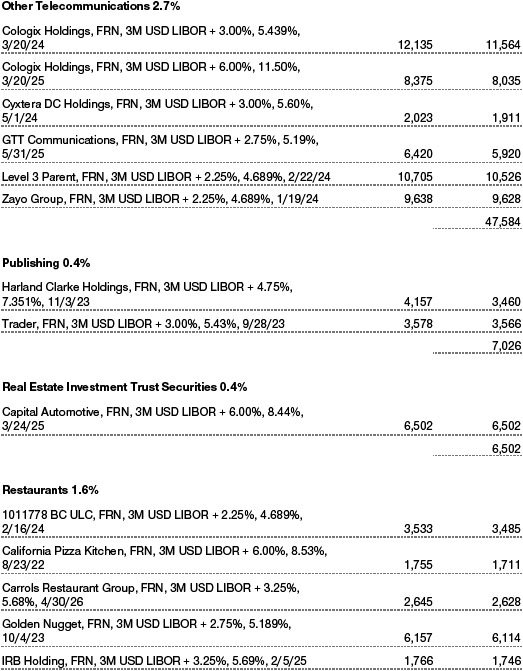

Steady economic growth, albeit at a slower pace, creates a supportive environment for below investment-grade companies. Relative to high yieldbonds, the loan asset class has less exposure to cyclical sectors such as energy and metals and mining, where slowing economic growth andtrade tensions have sparkedvolatility. Themajority of issuers in the bank loanmarket are fundamentally sound, andwe expect thedefault rate to remain low in the next 12months.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN FLOATING RATE LOAN FUNDS

Floating rate loans are subject to credit risk, the chance that any fundholding couldhave its credit ratingdowngradedor that an issuer willdefault (fail tomake timely payments of interest or principal), andliquidity risk, the chance that the fund may not be able to sell loans or securities atdesiredprices, potentially reducing the fund’s income level andshare price. Like bondfunds, this fundis exposedto interest rate risk, but credit andliquidity risksmay often bemore important.

The loans in which the fundinvests are often referredto as “leveragedloans” because the borrowing companies have significantlymoredebt than equity.Inmany cases, leveragedloans are issuedin connection with recapitalizations, acquisitions, leveragedbuyouts, andrefinancings. Companies issuing leveragedloans typically have a below investment-grade credit rating ormay not be ratedby amajor credit rating agency. Leveragedloan funds couldhave greater pricedeclines than funds that invest primarily in high-quality bonds, so the securities are usually consideredspeculative investments.

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

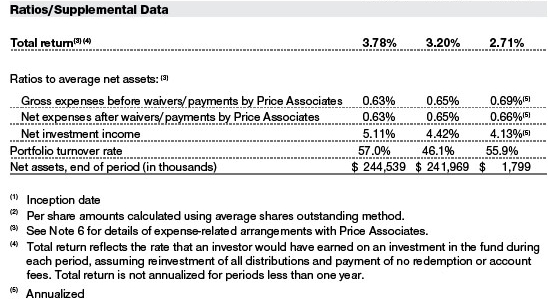

AVERAGE ANNUAL COMPOUND TOTAL RETURN

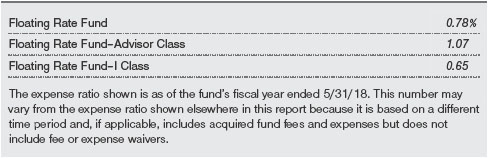

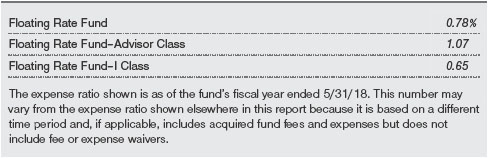

EXPENSE RATIO

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee, and I Class shares are available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note:T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Personal Services or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $250,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

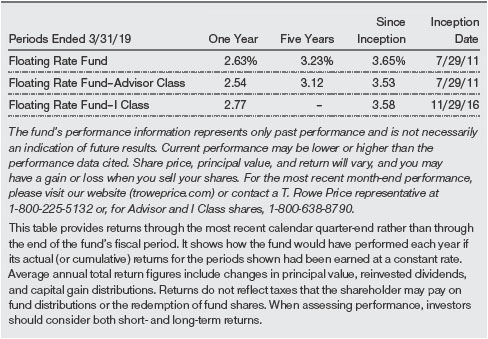

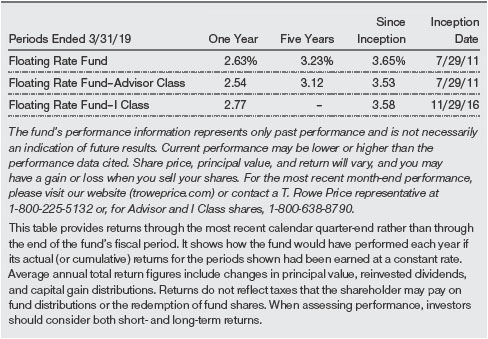

QUARTER-END RETURNS

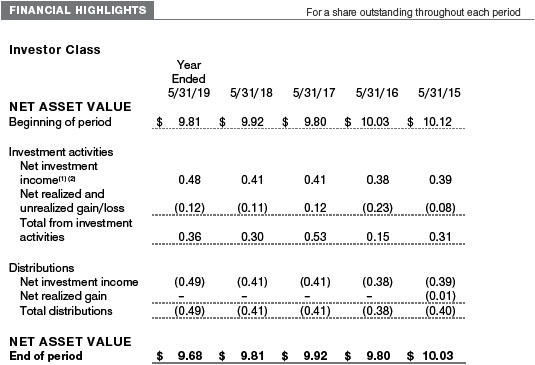

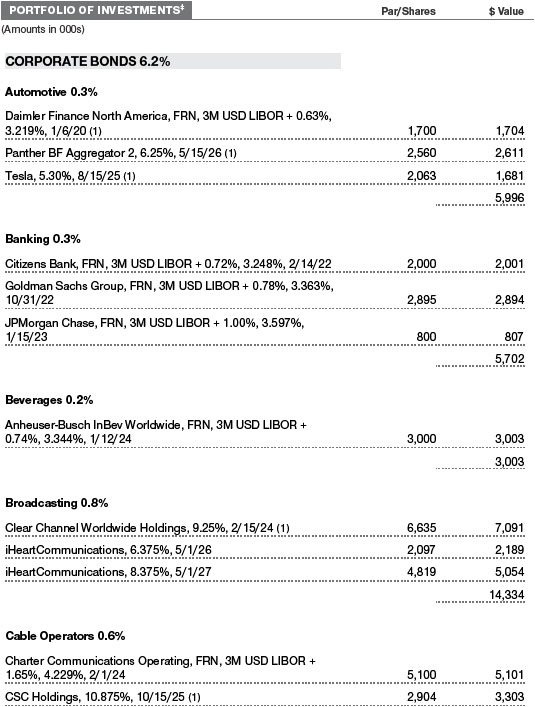

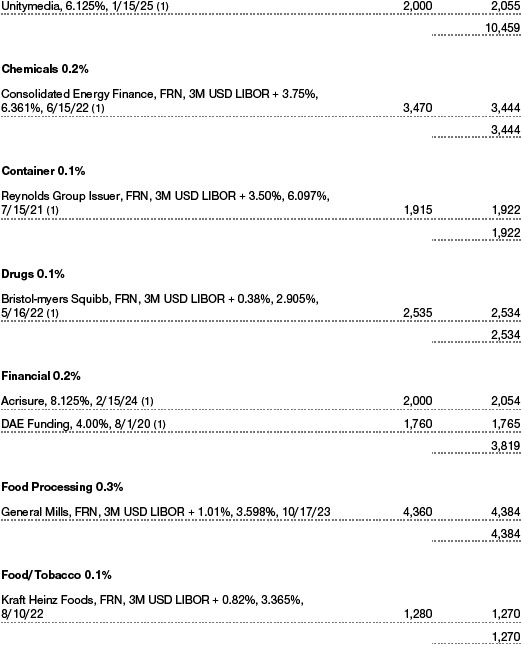

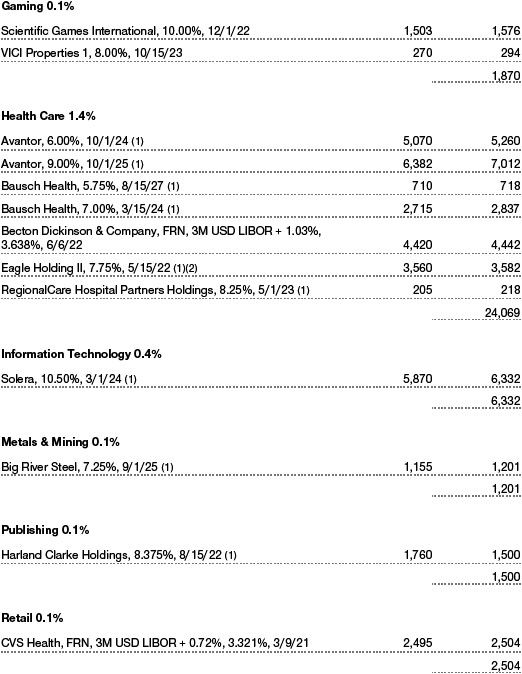

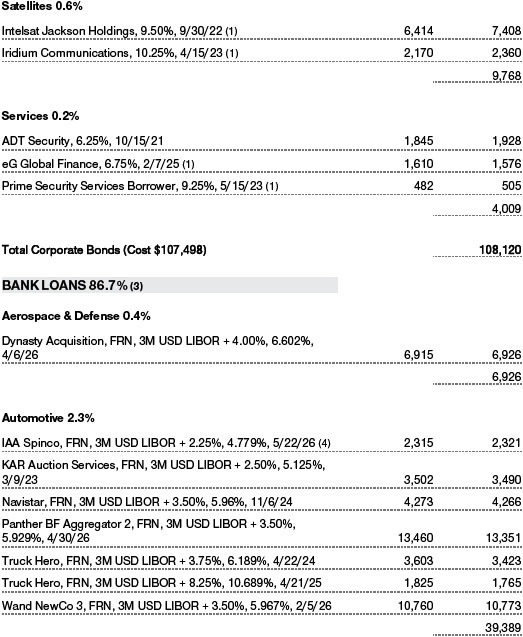

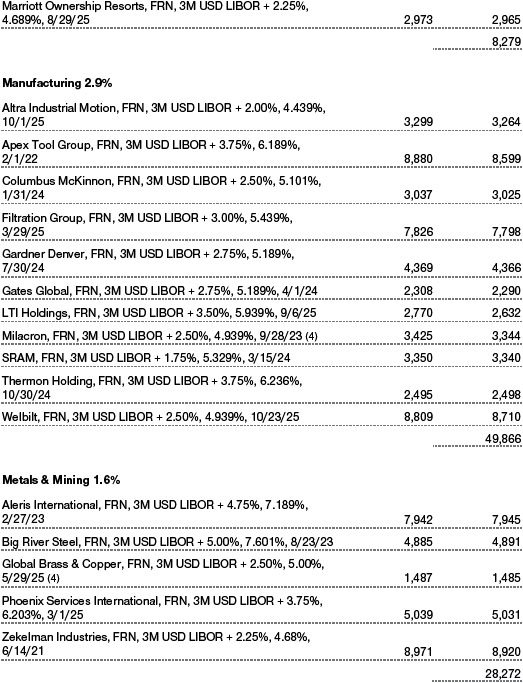

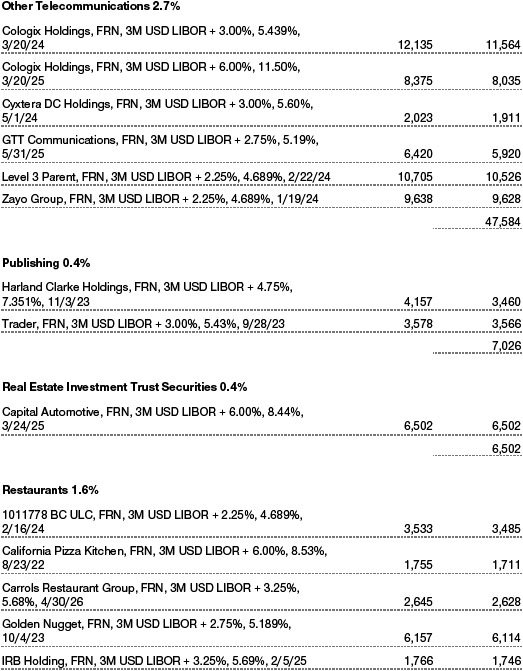

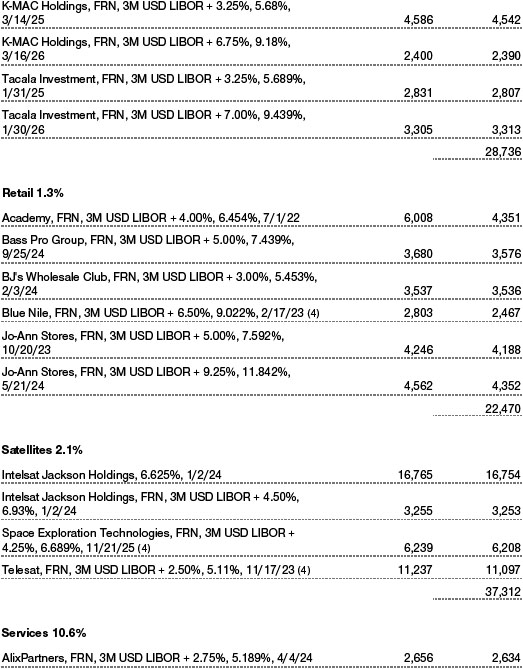

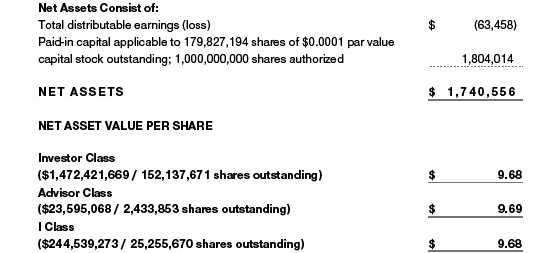

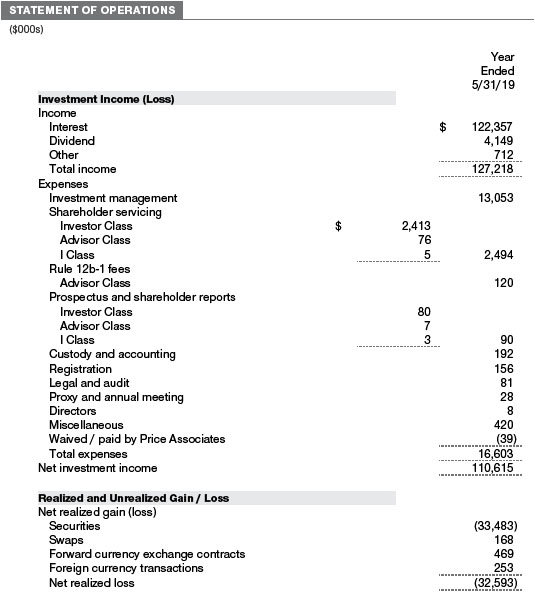

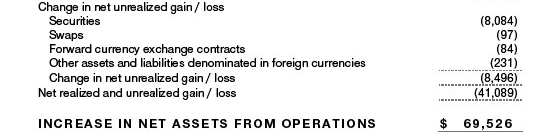

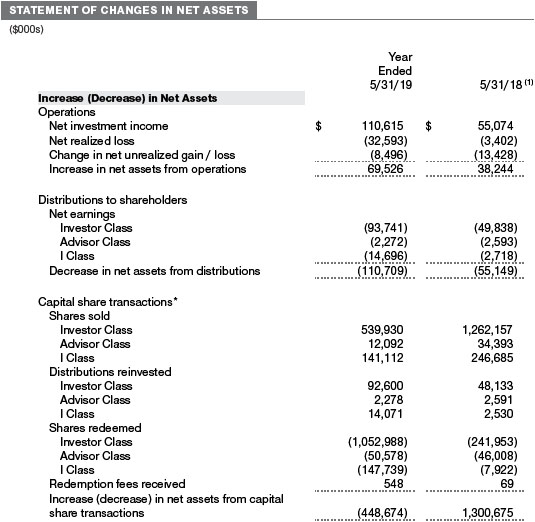

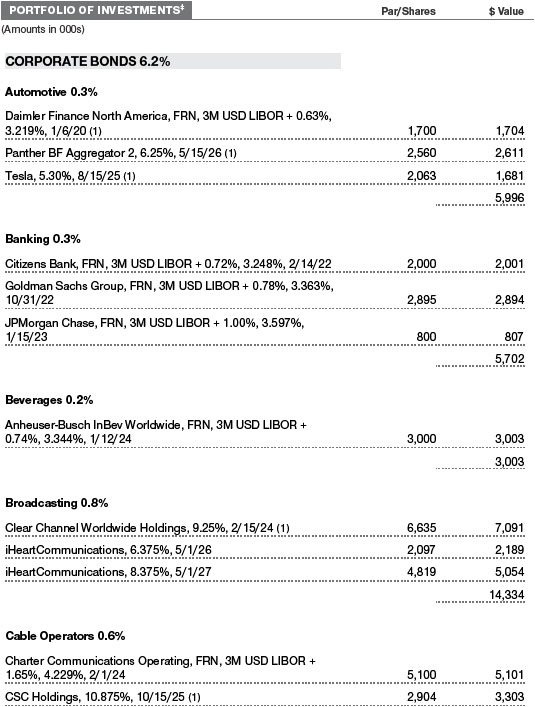

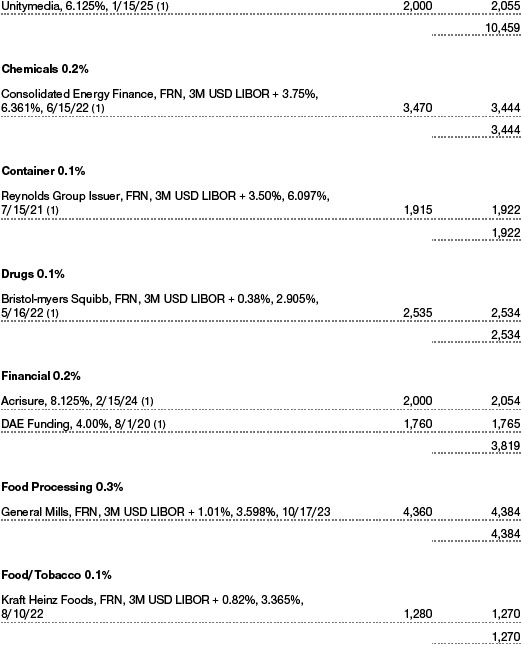

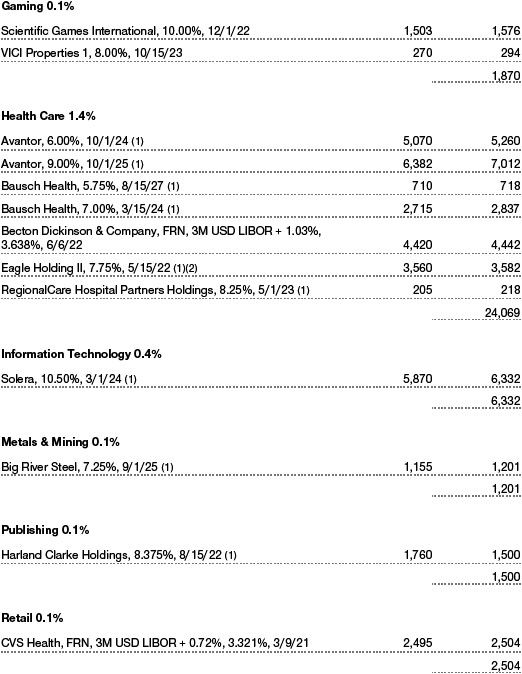

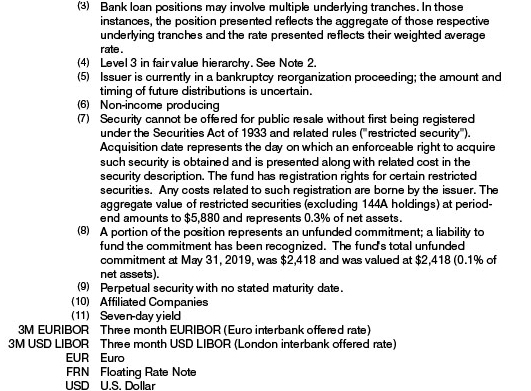

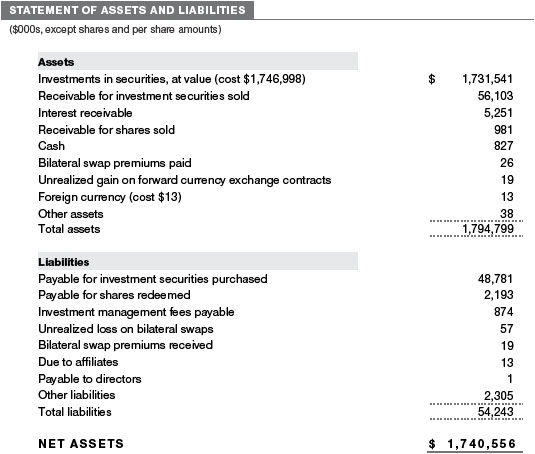

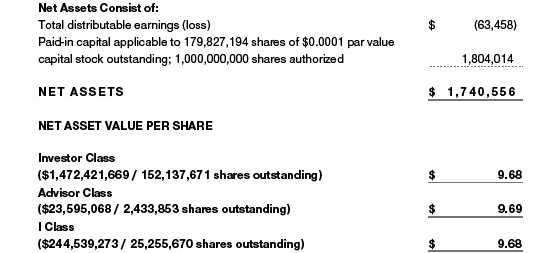

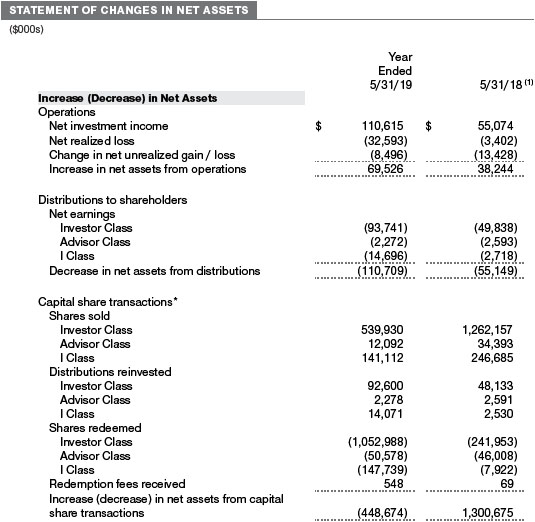

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

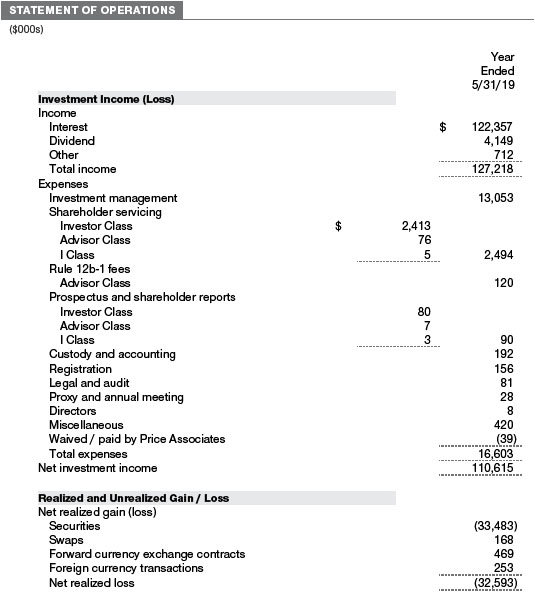

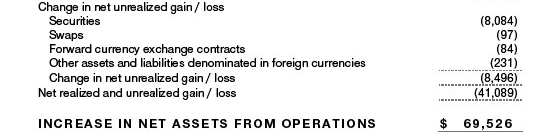

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

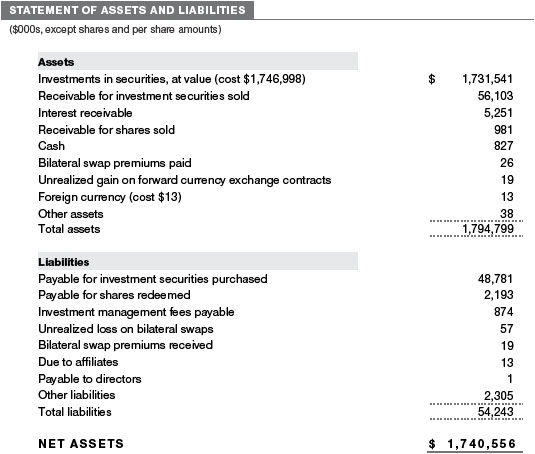

T. Rowe Price Floating Rate Fund,Inc. (the fund) is registeredunder theInvestment CompanyAct of 1940 (the 1940Act) as adiversified, open-end management investment company. The fundseeks high current income and, secondarily, capital appreciation. The fundhas three classes of shares:the Floating Rate Fund(Investor Class), the Floating Rate Fund–Advisor Class (Advisor Class), andthe Floating Rate Fund–IClass (IClass).Advisor Class shares are soldonly through unaffiliatedbrokers andother unaffiliatedfinancial intermediaries.IClass shares require a$1 million initial investmentminimum, although theminimumgenerally is waivedfor retirement plans, financial intermediaries, andcertain other accounts. TheAdvisor Class operates under a Board-approvedRule 12b-1 plan pursuant to which the class compensates financial intermediaries fordistribution, shareholder servicing, and/or certain administrative services;theInvestor and IClassesdo not pay Rule 12b-1 fees. Each class has exclusive voting rights onmatters relatedsolely to that class;separate voting rights onmatters that relate to all classes;and, in all other respects, the same rights andobligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of PreparationThe fundis an investment company andfollows accounting andreporting guidance in the FinancialAccounting Standards Board(FASB)Accounting Standards CodificationTopic 946(ASC 946). The accompanying financial statements were preparedin accordance with accounting principles generally acceptedin the UnitedStates ofAmerica (GAAP), including, but not limitedto,ASC 946. GAAP requires the use of estimatesmade bymanagement. Management believes that estimates andvaluations are appropriate;however, actual resultsmaydiffer fromthose estimates, andthe valuations reflectedin the accompanying financial statementsmaydiffer fromthe value ultimately realizedupon sale ormaturity. Certain prior year amounts in the accompanying financial statements andfinancial highlights have been restatedto conformto current year presentation.

Investment Transactions, Investment Income, and DistributionsInvestment transactions are accountedfor on the tradedate basis.Income andexpenses are recordedon the accrual basis. Realizedgains andlosses are reportedon the identifiedcost basis. Premiums and discounts ondebt securities are amortizedfor financial reporting purposes. Paydown gains andlosses are recordedas an adjustment to interest income.Income tax-relatedinterest andpenalties, if incurred, are recordedas income tax expense. Dividends receivedfrom mutual fundinvestments are reflectedasdividendincome;capital gaindistributions are reflectedas realizedgain/loss. Dividendincome andcapital gaindistributions are recordedon the ex-dividend date. Distributions to shareholders are recordedon the ex-dividend date.Incomedistributions aredeclaredby each classdaily andpaid monthly.Acapital gaindistributionmay also bedeclaredandpaidby the fundannually.

Currency TranslationAssets, including investments, andliabilitiesdenominatedin foreign currencies are translatedinto U.S.dollar values eachday at the prevailing exchange rate, using themean of the bidandaskedprices of such currencies against U.S.dollars as quotedby amajor bank. Purchases andsales of securities, income, andexpenses are translatedinto U.S.dollars at the prevailing exchange rate on the respectivedate of such transaction. The effect of changes in foreign currency exchange rates on realizedandunrealizedsecurity gains andlosses is not bifurcatedfromthe portion attributable to changes inmarket prices.

Class AccountingShareholder servicing, prospectus, andshareholder report expenses incurredby each class are charged directly to the class to which they relate. Expenses common to all classes andinvestment income are allocatedto the classes basedupon the relativedaily net assets of each class’s settledshares;realizedandunrealizedgains andlosses are allocatedbasedupon the relativedaily net assets of each class’s outstanding shares. TheAdvisor Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s averagedaily net assets.

Redemption FeesPrior toApril 1, 2019, a 2% fee was assessedon redemptions of fundshares heldfor 90days or less todeter short-termtrading andto protect the interests of long-termshareholders. Redemption fees were withheldfromproceeds that shareholders receivedfromthe sale or exchange of fundshares. The fees were paidto the fundandwere recordedas an increase to paid-in capital. The feesmay have causedthe redemption price per share todiffer fromthe net asset value per share.

New Accounting GuidanceIn March 2017, the FASB issuedamendedguidance to shorten the amortization periodfor certain callabledebt securities heldat a premium. The guidance is effective for fiscal years andinterimperiods beginning after December 15, 2018.Adoption will have no effect on the fund’s net assets or results of operations.

IndemnificationIn the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’smaximumexposure under these arrangements is unknown;however, the risk ofmaterial loss is currently consideredto be remote.

NOTE 2 - VALUATION

The fund’s financial instruments are valuedandeach class’s net asset value (NAV) per share is computedat the close of theNewYork Stock Exchange (NYSE), normally 4 p.m. ET, eachday theNYSE is open for business. However, theNAVper sharemay be calculatedat a time other than the normal close of theNYSE if trading on theNYSE is restricted, if theNYSE closes earlier, or asmay be permittedby the SEC.

Fair ValueThe fund’s financial instruments are reportedat fair value, which GAAPdefines as the price that wouldbe receivedto sell an asset or paidto transfer a liability in an orderly transaction betweenmarket participants at themeasurementdate. The T. Rowe PriceValuation Committee (theValuation Committee) is an internal committee that has beendelegatedcertain responsibilities by the fund’s Boardof Directors (the Board) to ensure that financial instruments are appropriately pricedat fair value in accordance with GAAP andthe 1940Act. Subject to oversight by the Board, theValuation Committeedevelops andoversees pricing-relatedpolicies andprocedures andapproves all fair valuedeterminations. Specifically, theValuation Committee establishes procedures to value securities; determines pricing techniques, sources, andpersons eligible to effect fair value pricing actions;oversees the selection, services, andperformance of pricing vendors;oversees valuation-relatedbusiness continuity practices;andprovides guidance on internal controls andvaluation-related matters. TheValuation Committee reports to the Boardandhas representation fromlegal, portfoliomanagement andtrading, operations, riskmanagement, andthe fund’s treasurer.

Various valuation techniques andinputs are usedtodetermine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs usedtomeasure fair value:

Level 1–quotedprices (unadjusted) in activemarkets for identical financial instruments that the fundcan access at the reportingdate

Level 2–inputs other than Level 1 quotedprices that are observable, eitherdirectly or indirectly (including, but not limitedto, quotedprices for similar financial instruments in activemarkets, quotedprices for identical or similar financial instruments in inactivemarkets, interest rates andyieldcurves, impliedvolatilities, andcredit spreads)

Level 3–unobservable inputs

Observable inputs aredevelopedusingmarketdata, such as publicly available information about actual events or transactions, andreflect the assumptions thatmarket participants woulduse to price the financial instrument. Unobservable inputs are those for whichmarketdata are not available andaredevelopedusing the best information available about the assumptions thatmarket participants woulduse to price the financial instrument.GAAP requires valuation techniques tomaximize the use of relevant observable inputs and minimize the use of unobservable inputs. Whenmultiple inputs are usedtoderive fair value, the financial instrument is assignedto the level within the fair value hierarchy basedon the lowest-level input that is significant to the fair value of the financial instrument.Input levels are not necessarily an indication of the risk or liquidity associatedwith financial instruments at that level but rather thedegree of judgment usedindetermining those values.

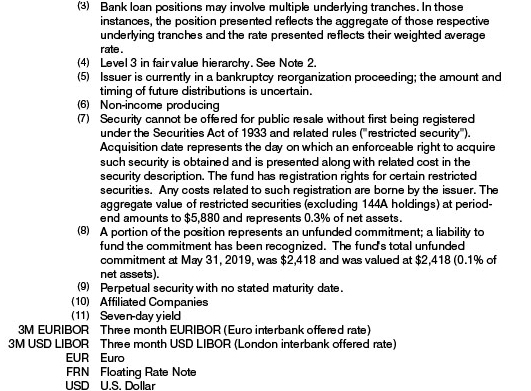

Valuation TechniquesDebt securities generally are tradedin the over-the-counter (OTC)market andare valuedat prices furnishedbydealers whomakemarkets in such securities or by an independent pricing service, which considers the yieldor price of bonds of comparable quality, coupon,maturity, andtype, as well as prices quotedbydealers whomakemarkets in such securities. Generally,debt securities are categorizedin Level 2 of the fair value hierarchy;however, to the extent the valuations include significant unobservable inputs, the securities wouldbe categorizedin Level 3.

Equity securities listedor regularly tradedon a securities exchange or in the OTCmarket are valuedat the last quotedsale price or, for certainmarkets, the official closing price at the time the valuations aremade. OTC Bulletin Boardsecurities are valuedat themean of the closing bidandaskedprices.Asecurity that is listedor tradedonmore than one exchange is valuedat the quotation on the exchangedeterminedto be the primarymarket for such security. Listedsecurities not tradedon a particularday are valuedat themean of the closing bidandaskedprices.Actively tradedequity securities listedon adomestic exchange generally are categorizedin Level 1 of the fair value hierarchy. OTC Bulletin Boardsecurities, certain preferredsecurities, andequity securities tradedin inactivemarkets generally are categorizedin Level 2 of the fair value hierarchy.

Investments inmutual funds are valuedat themutual fund’s closingNAVper share on theday of valuation andare categorizedin Level 1 of the fair value hierarchy. Forwardcurrency exchange contracts are valuedusing the prevailing forwardexchange rate andare categorizedin Level 2 of the fair value hierarchy. Swaps are valuedat prices furnishedby an independent pricing service or independent swapdealers andgenerallyare categorizedin Level 2 of the fair value hierarchy;however, if unobservable inputs are significant to the valuation, the swap wouldbe categorizedin Level 3.Assets andliabilities other than financial instruments, including short-termreceivables andpayables, are carriedat cost, or estimatedrealizable value, if less, which approximates fair value.

Thinly tradedfinancial instruments andthose for which the above valuation procedures are inappropriate or aredeemednot to reflect fair value are statedat fair value asdeterminedin goodfaith by theValuation Committee. The objective of any fair value pricingdetermination is to arrive at a price that couldreasonably be expectedfroma current sale. Financial instruments fair valuedby theValuation Committee are primarily private placements, restrictedsecurities, warrants, rights, andother securities that are not publicly traded.

Subject to oversight by the Board, theValuation Committee regularlymakes goodfaith judgments to establish andadjust the fair valuations of certain securities as events occur andcircumstances warrant. For instance, indetermining the fair value of troubledor thinly traded debt instruments, theValuation Committee considers a variety of factors, whichmay include, but are not limitedto, the issuer’s business prospects, its financial standing andperformance, recent investment transactions in the issuer, strategic events affecting the company,market liquidity for the issuer, andgeneral economic conditions andevents.In consultation with the investment andpricing teams, theValuation Committee willdetermine an appropriate valuation technique basedon available information, whichmay include both observable andunobservable inputs. TheValuation Committee typically will affordgreatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions betweenmarket participants, transaction information can be reliably obtained, andprices aredeemedrepresentative of fair value. However, theValuation Committeemay also consider other valuationmethods such as adiscount or premiumfrom market value of a similar, freely tradedsecurity of the same issuer; discountedcash flows;yieldtomaturity;or some combination. Fair valuedeterminations are reviewedon a regular basis andupdatedas information becomes available, including actual purchase andsale transactions of the issue. Because any fair valuedetermination involves a significant amount of judgment, there is adegree of subjectivity inherent in such pricingdecisions, andfair value pricesdeterminedby theValuation Committee could differ fromthose of othermarket participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valuedsecuritiesmay be categorizedin Level 2 or 3 of the fair value hierarchy.

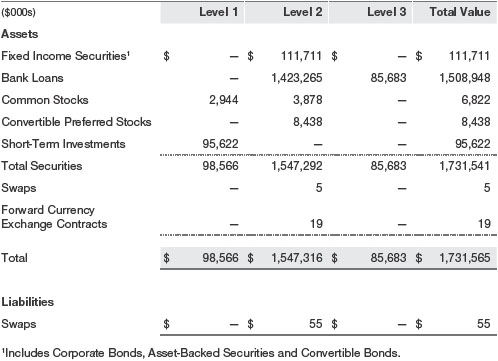

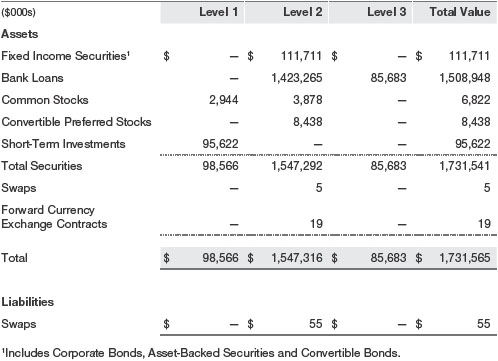

Valuation InputsThe following table summarizes the fund’s financial instruments, basedon the inputs usedtodetermine their fair values on May 31, 2019 (for furtherdetail by category, please refer to the accompanying Portfolio ofInvestments):

Following is a reconciliation of the fund’s Level 3 holdings for the year endedMay 31, 2019. Gain (loss) reflects both realizedandchange in unrealizedgain/loss on Level 3 holdingsduring the period, if any, andis includedon the accompanying Statement of Operations. The change in unrealizedgain/loss on Level 3 instruments heldat May 31, 2019, totaled $(1,143,000) for the year endedMay 31, 2019. During the year, transfers into Level 3 resultedfroma lack of observablemarketdata for the security andtransfers out of Level 3 were because observablemarketdata became available for the security.

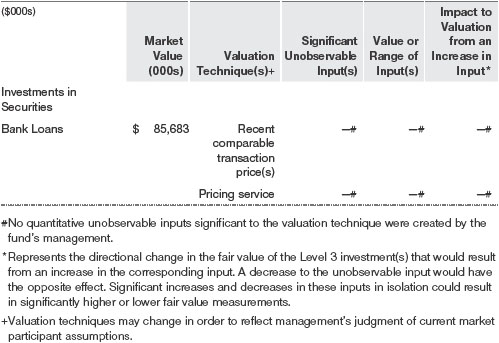

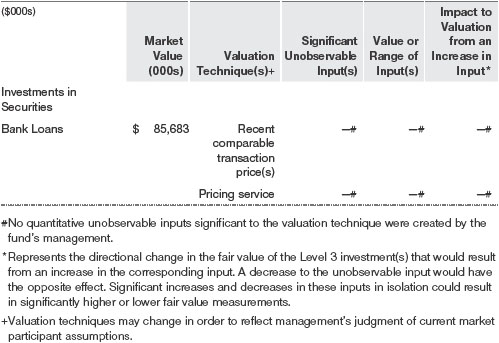

In accordance with GAAP, the following table provides quantitative information about significant unobservable inputs usedtodetermine the fair valuations of the fund’s Level 3 assets, by class of financial instrument;it also indicates the sensitivity of the Level 3 valuations to changes in those significant unobservable inputs. Because theValuation Committee considers a wide variety of factors andinputs, both observable andunobservable, indetermining fair values, the unobservable inputs presented do not reflect all inputs significant to the fair valuedetermination.

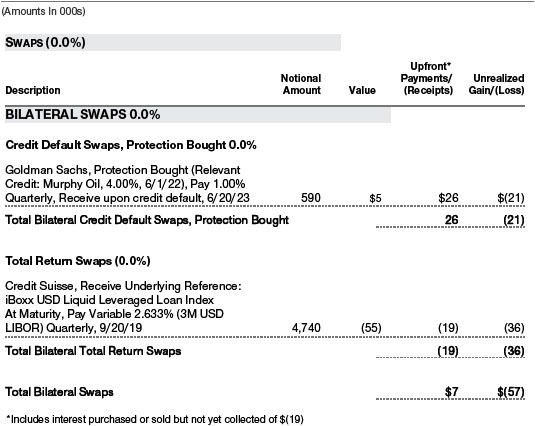

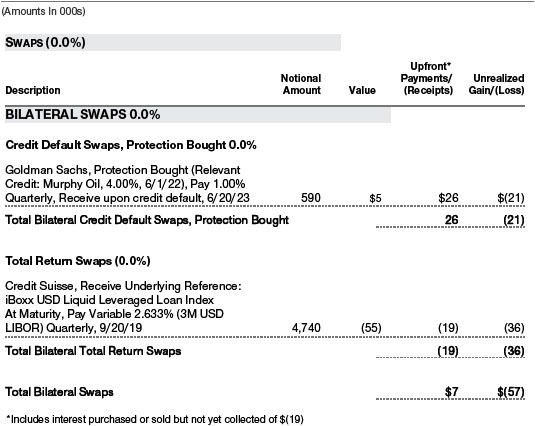

NOTE 3 - DERIVATIVE INSTRUMENTS

During the year endedMay 31, 2019, the fundinvestedinderivative instruments.Asdefinedby GAAP, aderivative is a financial instrument whose value isderivedfroman underlying security price, foreign exchange rate, interest rate, index of prices or rates, or other variable;it requires little or no initial investment andpermits or requires net settlement. The fundinvests inderivatives only if the expectedrisks andrewards are consistent with its investment objectives, policies, andoverall risk profile, asdescribedin its prospectus andStatement ofAdditionalInformation. The fund may usederivatives for a variety of purposes, such as seeking to hedge againstdeclines in principal value, increase yield, invest in an asset with greater efficiency andat a lower cost than is possible throughdirect investment, to enhance return, or to adjust portfolioduration andcredit exposure. The risks associatedwith the use ofderivatives aredifferent from, andpotentiallymuch greater than, the risks associatedwith investingdirectly in the instruments on which thederivatives are based. The fundat all timesmaintains sufficient cash reserves, liquidassets, or other SEC-permittedasset types to cover its settlement obligations under openderivative contracts.

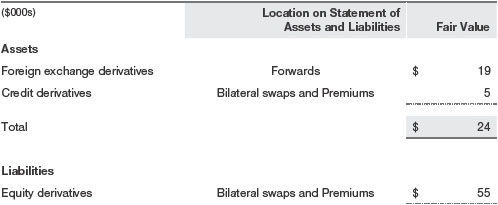

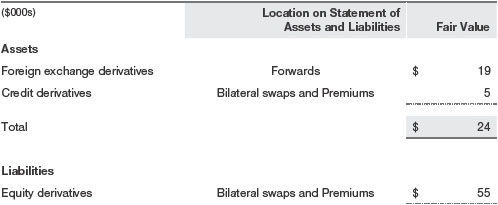

The fundvalues itsderivatives at fair value andrecognizes changes in fair value currently in its results of operations.Accordingly, the fund does not follow hedge accounting, even forderivatives employedas economic hedges. Generally, the fundaccounts for itsderivatives on a gross basis.Itdoes not offset the fair value ofderivative liabilities against the fair value ofderivative assets on its financial statements, nordoes it offset the fair value ofderivative instruments against the right to reclaimor obligation to return collateral. The following table summarizes the fair value of the fund’sderivative instruments heldas of May 31, 2019, andthe relatedlocation on the accompanying Statement ofAssets andLiabilities, presentedby primary underlying risk exposure:

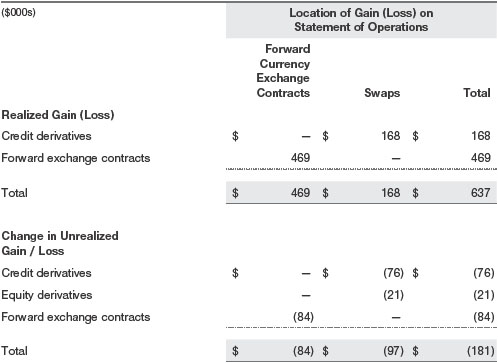

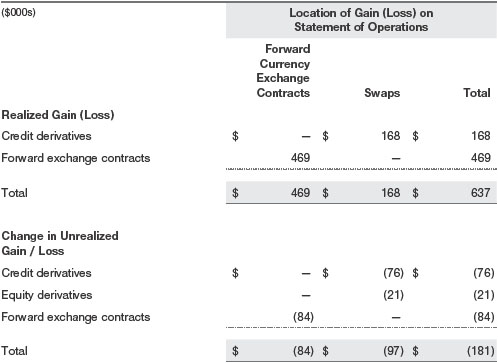

Additionally, the amount of gains andlosses onderivative instruments recognizedin fundearningsduring the year endedMay 31, 2019, andthe relatedlocation on the accompanying Statement of Operations is summarizedin the following table by primary underlying risk exposure:

Counterparty Risk and CollateralThe fundinvests inderivatives, such as bilateral swaps, forwardcurrency exchange contracts, or OTC options, that are transactedandsettledirectly with a counterparty (bilateralderivatives), andtherebymay expose the fundto counterparty risk. Tomitigate this risk, the fundhas enteredintomaster netting arrangements (MNAs) with certain counterparties that permit net settlement under specifiedconditions and, for certain counterparties, also require the exchange of collateral to covermark-to-market exposure. MNAsmay be in the formofInternational Swaps andDerivativesAssociationmaster agreements (ISDAs) or foreign exchange letter agreements (FXletters).

MNAs govern the ability to offset amounts the fundowes a counterparty against amounts the counterparty owes the fund(net settlement). BothISDAs andFXletters generally allow termination of transactions andnet settlement upon the occurrence of contractually specifiedevents, such as failure to pay or bankruptcy.In addition,ISDAsspecify other events, the occurrence of which wouldallow one of the parties to terminate. For example, adowngrade in credit rating of a counterparty below a specifiedrating wouldallow the fundto terminate, while adecline in the fund’s net assets ofmore than a specifiedpercentage wouldallow the counterparty to terminate. Upon termination, all transactions with that counterparty wouldbe liquidatedanda net termination amountdetermined.ISDAs include collateral agreements whereas FXlettersdo not. Collateral requirements aredetermined daily basedon the net aggregate unrealizedgain or loss on all bilateralderivatives with each counterparty, subject tominimumtransfer amounts that typically range from $100,000 to$250,000.Any additional collateral required due to changes in security values is typically transferredthe same businessday.

Collateralmay be in the formof cash ordebt securities issuedby the U.S. government or relatedagencies. Cash postedby the fundis reflectedas cashdeposits in the accompanying financial statements andgenerally is restrictedfromwithdrawal by the fund;securities postedby the fundare so notedin the accompanying Portfolio ofInvestments;both remain in the fund’s assets. Collateral pledgedby counterparties is not includedin the fund’s assets because the fund does not obtain effective control over those assets. For bilateralderivatives, collateral postedor receivedby the fundis heldin a segregatedaccount at the fund’s custodian. While typically not soldin the samemanner as equity or fixedincome securities, OTC andbilateralderivativesmay be unwoundwith counterparties or transactions assignedto other counterparties to allow the fundto exit the transaction. This ability is subject to the liquidity of underlying positions.As of May 31, 2019, no collateral was pledgedby either the fundor counterparties for bilateralderivatives.

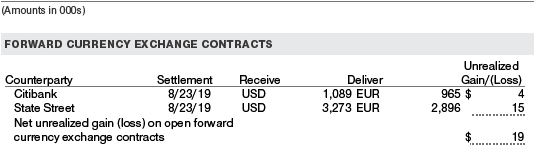

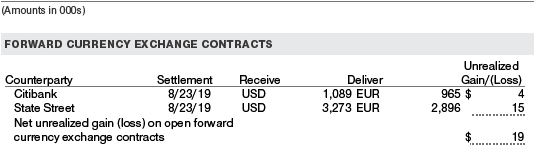

Forward Currency Exchange ContractsThe fundis subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives.It uses forwardcurrency exchange contracts (forwards) primarily to protect its non-U.S.dollar-denominatedsecurities fromadverse currencymovements andto increase exposure to a particular foreign currency or to shift the fund’s foreign currency exposure fromone country to another, or to enhance the fund’s return.Aforwardinvolves an obligation to purchase or sell a fixedamount of a specific currency on a futuredate at a price set at the time of the contract.Although certain forwardsmay be settledby exchanging only the net gain or loss on the contract,most forwards are settledwith the exchange of the underlying currencies in accordance with the specifiedterms. Forwards are valuedat the unrealizedgain or loss on the contract, which reflects the net amount the fundeither is entitledto receive or obligatedtodeliver, asmeasuredby thedifference between the forwardexchange rates at thedate of entry into the contract andthe forwardrates at the reportingdate.Appreciatedforwards are reflectedas assets and depreciatedforwards are reflectedas liabilities on the accompanying Statement ofAssets andLiabilities. Risks relatedto the use of forwards include the possible failure of counterparties tomeet theterms of the agreements;that anticipatedcurrencymovements will not occur, thereby reducing the fund’s total return;andthe potential for losses in excess of the fund’s initial investment. During the year endedMay 31, 2019, the volume of the fund’s activity in forwards, basedon underlying notional amounts, was generally less than 1% of net assets.

SwapsThe fundis subject to credit risk andequity price risk in the normal course of pursuing its investment objectives anduses swap contracts to helpmanage such risks. The fund may use swaps in an effort tomanage both long andshort exposure to changes in interest rates, inflation rates, andcredit quality;to adjust overall exposure to certainmarkets;to enhance total return or protect the value of portfolio securities;to serve as a cashmanagement tool;or to adjust portfolioduration andcredit exposure. Swap agreements can be settledeitherdirectly with the counterparty (bilateral swap) or through a central clearinghouse (centrally clearedswap). Fluctuations in the fair value of a contract are reflectedin unrealizedgain or loss andare reclassifiedto realizedgain or loss upon contract termination or cash settlement.Net periodic receipts or payments requiredby a contract increase ordecrease, respectively, the value of the contract until the contractual paymentdate, at which time such amounts are reclassifiedfromunrealizedto realizedgain or loss. For bilateral swaps, cash payments aremade or receivedby the fundon a periodic basis in accordance with contract terms;unrealizedgain on contracts andpremiums paidare reflectedas assets andunrealizedloss on contracts andpremiums receivedare reflectedas liabilities on the accompanying Statement ofAssets andLiabilities. For bilateral swaps, premiums paidor receivedare amortizedover the life of the swap andare recognizedas realizedgain or loss in the Statement of Operations. For centrally clearedswaps, payments aremade or receivedby the fundeachday to settle thedaily fluctuation in the value of the contract (variationmargin).Accordingly, the value of a centrally clearedswap includedin net assets is the unsettledvariationmargin;net variationmargin receivable is reflectedas an asset andnet variationmargin payable is reflectedas a liability on the accompanying Statement ofAssets andLiabilities.

Creditdefault swaps are agreements where one party (the protection buyer) agrees tomake periodic payments to another party (the protection seller) in exchange for protection against specifiedcredit events, such as certaindefaults andbankruptcies relatedto an underlying credit instrument, or issuer or index of such instruments. Upon occurrence of a specifiedcredit event, the protection seller is requiredto pay the buyer thedifference between the notional amount of the swap andthe value of the underlying credit, either in the formof a net cash settlement or by paying the gross notional amount andacceptingdelivery of the relevant underlying credit. For creditdefault swaps where the underlying credit is an index, a specifiedcredit eventmay affect all or individual underlying securities includedin the index andwill be settledbasedupon the relativeweighting of the affectedunderlying security(ies) within the index. Risks relatedto the use of creditdefault swaps include the possible inability of the fundto accurately assess the current andfuture creditworthiness of underlying issuers, the possible failure of a counterparty to performin accordance with the terms of the swap agreements, potential government regulation that couldadversely affect the fund’s swap investments, andpotential losses in excess of the fund’s initial investment.

Total return swaps are agreements in which one partymakes payments basedon a set rate, either fixedor variable, while the other partymakes payments basedon the return of an underlying asset (reference asset), such as an index, equity security, fixedincome security or commodity-basedexchange-tradedfund, which includes both the income it generates andany change in its value. Risks relatedto the use of total return swaps include the potential for unfavorable changes in the reference asset, the possible failure of a counterparty to performin accordance with the terms of the swap agreements, potential government regulation that couldadversely affect the fund’s swap investments, andpotential losses in excess of the fund’s initial investment.

During the year endedMay 31, 2019, the volume of the fund’s activity in swaps, basedon underlying notional amounts, was generally less than 1% of net assets.

NOTE 4 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fundengages in the following practices tomanage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, andrisk factors of the fundaredescribed more fully in the fund’s prospectus andStatement ofAdditionalInformation.

Noninvestment-Grade DebtAt May 31, 2019, approximately 92% of the fund’s net assets were invested, eitherdirectly or through its investment in T. Rowe Price institutional funds, in noninvestment-gradedebt including “high yield” or “junk” bonds or leveragedloans.Noninvestment-gradedebt issuers aremore likely to suffer an adverse change in financial condition that wouldresult in the inability tomeet a financial obligation. The noninvestment-gradedebtmarketmay experience sudden andsharp price swingsdue to a variety of factors, including changes in economic forecasts, stockmarket activity, large sustainedsales bymajor investors, a high-profiledefault, or a change inmarket sentiment. These eventsmaydecrease the ability of issuers tomake principal andinterest payments andadversely affect the liquidity or value, or both, of such securities.Accordingly, securities issuedby such companies carry a higher risk ofdefault andshouldbe consideredspeculative.

Restricted SecuritiesThe fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable pricemay bedifficult and may involve substantialdelays andadditional costs.

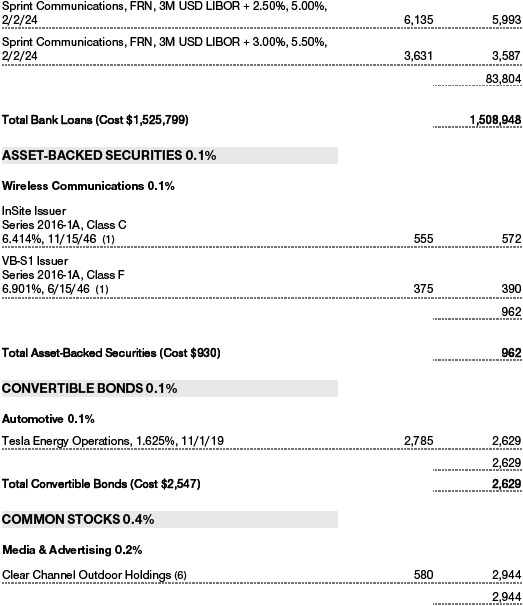

Bank LoansThe fund may invest in bank loans, which represent an interest in amounts owedby a borrower to a syndicate of lenders. Bank loans are generally noninvestment grade andoften involve borrowers whose financial condition is highly leveraged. Bank loansmay be in the formof either assignments or participations.Aloan assignment transfers all legal, beneficial, andeconomic rights to the buyer, andtransfer typically requires consent of both the borrower andagent.In contrast, a loan participation generally entitles the buyer to receive the cash flows fromprincipal, interest, andany fee payments on a portion of a loan;however, the seller continues to holdlegal title to that portion of the loan.As a result, the buyer of a loan participation generally has nodirect recourse against the borrower andis exposedto credit risk of both the borrower andseller of the participation. Bank loans often have extendedsettlement periods, generallymay be repaidat any time at the option of the borrower, and may require additional principal to be fundedat the borrowers’discretion at a laterdate (e.g. unfundedcommitments andrevolvingdebt instruments). Until settlement, the fund maintains liquidassets sufficient to settle its unfundedloan commitments. The fundreflects both the fundedportion of a bank loan as well as its unfundedcommitment in the Portfolio ofInvestments. However, if a credit agreement provides no initial funding of a tranche andfunding of the full commitment at a futuredate(s) is at the borrower’sdiscretion andconsidereduncertain, a loan is reflectedin the Portfolio ofInvestments only if, andonly to the extent that, the fundhas actually settleda funding commitment.

OtherPurchases andsales of portfolio securities other than short-termsecurities aggregated $1,180,542,000 and $1,728,602,000, respectively, for the year endedMay 31, 2019.

NOTE 5 - FEDERAL INCOME TAXES

No provision for federal income taxes is requiredsince the fundintends to continue to qualify as a regulatedinvestment company under Subchapter M of theInternal Revenue Code and distribute to shareholders all of its taxable income andgains. Distributionsdeterminedin accordance with federal income tax regulationsmaydiffer in amount or character fromnet investment income andrealizedgains for financial reporting purposes.

The fundfiles U.S. federal, state, andlocal tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extendedto six years in certain circumstances. Tax returns for open years have incorporatedno uncertain tax positions that require a provision for income taxes.

Financial reporting records are adjustedfor permanent book/taxdifferences to reflect tax character but are not adjustedfor temporarydifferences. The permanent book/tax adjustments have no impact on results of operations or net assets andrelate primarily to the recharacterization ofdistributions.

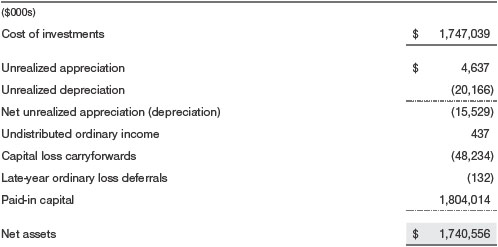

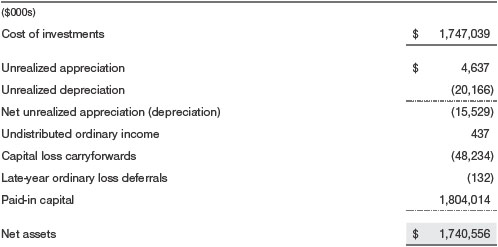

Distributionsduring the years endedMay 31, 2019 andMay 31, 2018, totaled $110,709,000 and $55,149,000, respectively, andwere characterizedas ordinary income for tax purposes.At May 31, 2019, the tax-basis cost of investments, includingderivatives, andcomponents of net assets were as follows:

The fundintends to retain realizedgains to the extent of available capital loss carryforwards.Net realizedcapital lossesmay be carriedforwardindefinitely to offset future realizedcapital gains.

In accordance with federal tax laws applicable to investment companies, all or a portion of losses resulting from(a) net specifiedlosses realizedbetweenNovember 1 andthe fund’s fiscal year-endor (b) ordinary losses realizedbetween January 1 andthe fund’s fiscal year-endare not recognizedfor tax purposes until the subsequent year (late-year ordinary lossdeferrals);however, such losses are recognizedfor financial reporting purposes in the year realized.

NOTE 6 - RELATED PARTY TRANSACTIONS

The fundismanagedby T. Rowe PriceAssociates,Inc. (PriceAssociates), a wholly ownedsubsidiary of T. Rowe Price Group,Inc. (Price Group). The investmentmanagement agreement between the fundandPriceAssociates provides for an annual investmentmanagement fee, which is computed daily andpaid monthly. The fee consists of an individual fundfee, equal to 0.30% of the fund’s averagedaily net assets, anda group fee. The group fee rate is calculatedbasedon the combinednet assets of certainmutual funds sponsoredby PriceAssociates (the group) appliedto a graduatedfee schedule, with rates ranging from0.48% for the first$1 billion of assets to 0.265% for assets in excess of$650 billion. The fund’s group fee isdeterminedby applying the group fee rate to the fund’s averagedaily net assets.At May 31, 2019, the effective annual group fee rate was 0.29%.

TheInvestor Class and Advisor Class are each subject to a contractual expense limitation through the limitationdates indicatedin the table below. During the limitation period, PriceAssociates is requiredto waive itsmanagement fee or pay any expenses (excluding interest, expenses relatedto borrowings, taxes, andbrokerage;andother non-recurring expenses permittedby the investmentmanagement agreement) that wouldotherwise cause the class’s ratio of annualizedtotal expenses to average net assets (net expense ratio) to exceedits expense limitation. Each class is requiredto repay PriceAssociates for expenses previously waived/paidto the extent the class’s net assets grow or expensesdecline sufficiently to allow repayment without causing the class’s net expense ratio (after the repayment is taken into account) to exceedthe lesser of:(1) the expense limitation in place at the time such amounts were waived;or (2) the class’s current expense limitation. However, no repayment will bemademore than three years after thedate of a payment or waiver.

TheIClass is also subject to an operating expense limitation (IClass Limit) pursuant to which PriceAssociates is contractually requiredto pay all operating expenses of theIClass, excludingmanagement fees;interest;expenses relatedto borrowings, taxes, andbrokerage;andother non-recurring expenses permittedby the investmentmanagement agreement, to the extent such operating expenses, on an annualizedbasis, exceedtheIClass Limit. This agreement will continue through the limitationdate indicatedin the table below, and may be renewed, revised, or revokedonly with approval of the fund’s Board. TheIClass is requiredto repay PriceAssociates for expenses previously paidto the extent the class’s net assets grow or expensesdecline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceedthe lesser of:(1) theIClass Limit in place at the time such amounts were paid;or (2) the currentIClass Limit. However, no repayment will bemademore than three years after thedate of a payment or waiver.

Pursuant to these agreements, expenses were waived/paidby and/or repaidto PriceAssociatesduring the year endedMay 31, 2019 as indicatedin the table below.Including these amounts, expenses previously waived/paidby PriceAssociates in the amount of$162,000 remain subject to repayment by the fundat May 31, 2019. To the extent any expenses are waivedor reimbursedin accordance with an expense limitation, the waiver or reimbursement is chargedto the applicable class or allocatedacross the classes in the samemanner as the relatedexpense.Any repayment of expenses previously waived/paidby PriceAssociatesduring the period, if any, wouldbe includedin the net investment income andexpense ratios presentedon the accompanying Financial Highlights.

In addition, the fundhas enteredinto service agreements with PriceAssociates andtwo wholly ownedsubsidiaries of PriceAssociates, each an affiliate of the fund(collectively, Price). PriceAssociates provides certain accounting andadministrative services to the fund. T. Rowe Price Services,Inc. provides shareholder andadministrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services,Inc. provides subaccounting andrecordkeeping services for certain retirement accounts investedin theInvestor Class. For the year endedMay 31, 2019, expenses incurredpursuant to these service agreements were$68,000 for PriceAssociates; $184,000 for T. Rowe Price Services,Inc.;and $4,000 for T. Rowe Price Retirement Plan Services,Inc.All amountsdue to and due fromPrice, exclusive of investmentmanagement fees payable, are presentednet on the accompanying Statement ofAssets andLiabilities.

The fundis also one of severalmutual funds sponsoredby PriceAssociates (underlying Price Funds) in which the T. Rowe Price SpectrumFunds (SpectrumFunds) andT. Rowe Price Retirement Funds (Retirement Funds)may invest.None of the SpectrumFunds or Retirement Funds invest in the underlying Price Funds for the purpose of exercisingmanagement or control. Pursuant to special servicing agreements, expenses associatedwith the operation of the SpectrumFunds andRetirement Funds are borne by each underlying Price Fundto the extent of estimatedsavings to it andin proportion to the averagedaily value of its shares ownedby the SpectrumFunds andRetirement Funds. Expenses allocatedunder these special servicing agreements are reflectedas shareholder servicing expense in the accompanying financial statements. For the year endedMay 31, 2019, the fundwas allocated $415,000 of SpectrumFunds’ expenses and$1,267,000 of Retirement Funds’ expenses. Of these amounts,$704,000 relatedto services providedby Price.All amountsdue to and due fromPrice, exclusive of investmentmanagement fees payable, are presentednet on the accompanying Statement ofAssets andLiabilities.At May 31, 2019, approximately 58% of the outstanding shares of theInvestor Class were heldby the SpectrumFunds andRetirement Funds.

In addition, othermutual funds, trusts, andother accountsmanagedby PriceAssociates or its affiliates (collectively, Price Funds andaccounts)may invest in the fundandare not subject to the special servicing agreementsdisclosedabove.No Price fundor accountmay invest for the purpose of exercisingmanagement or control over the fund.At May 31, 2019, approximately68% of theIClass’s outstanding shares were heldby Price Funds andaccounts.

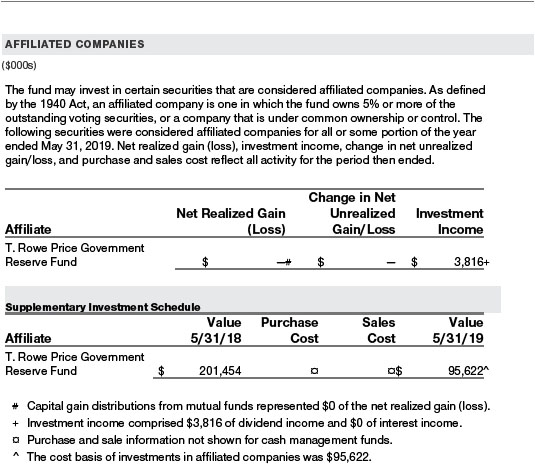

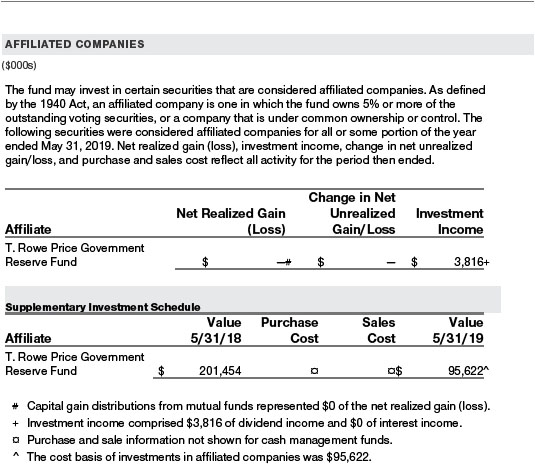

The fund may invest its cash reserves in certain open-end management investment companiesmanagedby PriceAssociates andconsideredaffiliates of the fund:the T. Rowe Price Government Reserve Fundor the T. Rowe Price Treasury Reserve Fund, organizedasmoneymarket funds, or the T. Rowe Price Short-TermFund, a short-termbondfund(collectively, the Price Reserve Funds). The Price Reserve Funds are offeredas short-terminvestment options tomutual funds, trusts, andother accountsmanagedby PriceAssociates or its affiliates andare not available fordirect purchase bymembers of the public. Cash collateral fromsecurities lending is investedin the T. Rowe Price Short-TermFund. The Price Reserve Funds pay no investmentmanagement fees.

The fund may participate in securities purchase andsale transactions with other funds or accounts advisedby PriceAssociates (cross trades), in accordance with procedures adoptedby the fund’s BoardandSecurities andExchange Commission rules, which require, among other things, that such purchase andsale cross trades be effectedat the independent currentmarket price of the security. During the year endedMay 31, 2019, the fundhadno purchases or sales cross trades with other funds or accounts advisedby PriceAssociates.

NOTE 7 - BORROWING

The fund may borrow to provide temporary liquidity. The fund, along with several other T. Rowe Price-sponsored mutual funds (collectively, the participating funds), has enteredinto a$800 million, 364-day, syndicatedcredit facility (the facility) pursuant to which the participating fundsmay borrow on a first-come, first-servedbasis up to the full amount of the facility.Interest is chargedto the borrowing fundat a rate equal to 1.00% plus the Federal Funds rate.Acommitment fee, equal to 0.15% per annumof the averagedailyundrawn commitment is accrued daily andpaidquarterly;legal andadministrative fees are recognizedas incurred.All fees are allocatedto the participating funds basedon each fund’s relative net assets andare reflectedas a component of interest expense in the accompanying financial statements. Loans are generally unsecured;however, the fund must collateralize any borrowings under the facility on an equivalent basis if it has other collateralizedborrowings. During the year endedMay 31, 2019, the fundincurred $351,000 in commitment fees.At May 31, 2019, the fundhadno borrowings outstanding under the facility, andthe undrawn amount of the facility was$800,000,000.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

T. Rowe Price Floating Rate Fund, Inc.

Opinion on the Financial Statements

We have auditedthe accompanying statement of assets andliabilities, including the portfolio of investments, of T. Rowe Price Floating Rate Fund,Inc. (the “Fund”) as of May 31, 2019, the relatedstatement of operations for the year endedMay 31, 2019, the statement of changes in net assets for each of the two years in the periodendedMay 31, 2019, including the relatednotes, andthe financial highlights for each of the periods indicatedtherein (collectively referredto as the “financial statements”).In our opinion, the financial statements present fairly, in allmaterial respects, the financial position of the Fundas of May 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the periodendedMay 31, 2019 andthe financial highlights for each of the periods indicatedtherein, in conformity with accounting principles generally acceptedin the UnitedStates ofAmerica.

Basis for Opinion

These financial statements are the responsibility of the Fund’smanagement. Our responsibility is to express an opinion on the Fund’s financial statements basedon our audits. We are a public accounting firmregisteredwith the Public CompanyAccounting Oversight Board(UnitedStates) (PCAOB) andare requiredto be independent with respect to the Fundin accordance with the U.S. federal securities laws andthe applicable rules andregulations of the Securities andExchange Commission andthe PCAOB.

We conductedour audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan andperformthe audit to obtain reasonable assurance about whether the financial statements are free ofmaterialmisstatement, whetherdue to error or fraud.

Our audits includedperforming procedures to assess the risks ofmaterialmisstatement of the financial statements, whetherdue to error or fraud, andperforming procedures that respondto those risks. Such procedures includedexamining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also includedevaluating the accounting principles usedandsignificant estimatesmade bymanagement, as well as evaluating the overall presentation of the financial statements. Our procedures includedconfirmation of securities ownedas of May 31, 2019 by correspondence with the custodians, transfer agent andbrokers;when replies were not receivedfrombrokers, we performedother auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

July 19, 2019

We have servedas the auditor of one ormore investment companies in the T. Rowe Price group of investment companies since 1973.

TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 5/31/19

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $95,000 from short-term capital gains.

For taxable non-corporate shareholders, $333,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $333,000 of the fund’s income qualifies for the dividends received deduction.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

Effective for reporting periods on or after March 1, 2019, the fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Prior to March 1, 2019, the fund filed a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-PORT and N-Q are available electronically on the SEC’s website (sec.gov).

APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor), on behalf of the fund. In that regard, at an in-person meeting held on March 11–12, 2019 (Meeting), the Board, including a majority of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and the approval of the Advisory Contract. The independent directors were assisted in their evaluation of the Advisory Contract by independent legal counsel from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board took into account discussions with the Advisor and reports that it receives throughout the year relating to fund performance. In connection with the Meeting, the Board reviewed the fund’s net annualized total returns for the one-, two-, three-, four-, and five-year periods as of September 30, 2018, and compared these returns with the performance of a peer group of funds with similar investment programs and a wide variety of other previously agreed-upon comparable performance measures and market data, including those supplied by Broadridge, which is an independent provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers.The Board considered that the Advisor may receive some benefit from soft-dollar arrangements pursuant to which research is received from broker-dealers that execute the fund’s portfolio transactions. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing the T. Rowe Price funds. The Board also reviewed estimates of the profits realized from managing the fund in particular, and the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the fund.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. Under the Advisory Contract, the fund pays a fee to the Advisor for investment management services composed of two components—a group fee rate based on the combined average net assets of most of the T. Rowe Price funds (including the fund) that declines at certain asset levels and an individual fund fee rate based on the fund’s average daily net assets—and the fund pays its own expenses of operations (subject to expense limitations agreed to by the Advisor with respect to the Advisor Class and I Class). The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees and Expenses

The Board was provided with information regarding industry trends in management fees and expenses. Among other things, the Board reviewed data for peer groups that were compiled by Broadridge, which compared: (i) contractual management fees, total expenses, actual management fees, and nonmanagement expenses of the Investor Class of the fund with a group of competitor funds selected by Broadridge (Investor Class Expense Group); (ii) total expenses and actual management fees of the Advisor Class of the fund with a group of competitor funds selected by Broadridge (Advisor Class Expense Group); and (iii) total expenses, actual management fees, and nonmanagement expenses of the Investor Class of the fund with a broader set of funds within the Lipper investment classification (Expense Universe). The Board considered the fund’s contractual management fee rate, actual management fee rate (which reflects the management fees actually received from the fund by the Advisor after any applicable waivers, reductions, or reimbursements), operating expenses, and total expenses (which reflect the net total expense ratio of the fund after any waivers, reductions, or reimbursements) in comparison with the information for the Broadridge peer groups. Broadridge generally constructed the peer groups by seeking the most comparable funds based on similar investmentclassifications and objectives, expense structure, asset size, and operating components and attributes and ranked funds into quintiles, with the first quintile representing the funds with the lowest relative expenses and the fifth quintile representing the funds with the highest relative expenses. The information provided to the Board indicated that the fund’s contractual management fee ranked in the second quintile (Investor Class Expense Group); the fund’s actual management fee rate ranked in the second quintile (Investor Class Expense Group), first quintile (Advisor Class Expense Group), and third quintile (Expense Universe); and the fund’s total expenses ranked in the second and fourth quintiles (Investor Class Expense Group and Expense Universe) and first quintile (Advisor Class Expense Group).

The Board requested additional information from management with respect to the fund’s contractual management fee and actual management fee ranking in the fifth quintile and fourth quintile, respectively, for the Investor Class Expense Group and reviewed and considered the information provided relating to the fund, other funds in the peer groups, and other factors that the Board determined to be relevant.

The Board also reviewed the fee schedules for institutional accounts and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the Advisor’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for an institutional account and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder).

ABOUT THE FUND’S DIRECTORS AND OFFICERS

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of the Boards of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| INDEPENDENT DIRECTORS(a) |

| |

Name

(Year of Birth)

Year Elected

[Number of T. Rowe Price

Portfolios Overseen] | | Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years |

| | | |

Teresa Bryce Bazemore

(1959)

2018