UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22558 |

|

BROOKFIELD INVESTMENT FUNDS |

(Exact name of registrant as specified in charter) |

|

THREE WORLD FINANCIAL CENTER 200 VESEY STREET NEW YORK, NEW YORK | | 10281-1010 |

(Address of principal executive offices) | | (Zip code) |

|

KIM G. REDDING, PRESIDENT BROOKFIELD INVESTMENT FUNDS THREE WORLD FINANCIAL CENTER 200 VESEY STREET NEW YORK, NEW YORK 10281-1010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 497-3746 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2011 | |

| | | | | | | | |

Item 1. Reports to Shareholders.

Brookfield Investment Management

2011

ANNUAL REPORT

Brookfield Global Listed Real Estate Fund

Brookfield Global Listed Infrastructure Fund

Brookfield High Yield Fund

IN PROFILE

Brookfield Investment Management Inc. is a global investment manager focused on specialized equity and fixed income securities investments. The firm is a subsidiary of Brookfield Asset Management Inc., a global alternative asset manager with approximately $150 billion of assets under management as of December 31, 2011 and over 100 years of history in owning and operating assets with a focus on real estate, infrastructure, power and private equity.

Brookfield Investment Management Inc. is a Registered Investment Adviser, and with its affiliates, had approximately $21 billion in assets under management as of December 31, 2011. Headquartered in New York, the firm maintains offices and investment teams in Chicago, Boston, London, Hong Kong, Sydney, and Toronto.

TABLE OF CONTENTS

| Letter to Shareholders | | | 1 | | |

|

| About your Fund's Expenses | | | 3 | | |

|

| Management Discussion of Fund Performance | | | 4 | | |

|

| Brookfield Global Listed Real Estate Fund | | | 4 | | |

|

| Management Discussion of Fund Performance Commentary | | | 4 | | |

|

| Portfolio Characteristics | | | 8 | | |

|

| Brookfield Global Listed Infrastructure Fund | | | 9 | | |

|

| Management Discussion of Fund Performance Commentary | | | 9 | | |

|

| Portfolio Characteristics | | | 14 | | |

|

| Brookfield High Yield Fund | | | 15 | | |

|

| Management Discussion of Fund Performance Commentary | | | 15 | | |

|

| Portfolio Characteristics | | | 18 | | |

|

| Portfolio of Investments, Notes to Portfolios of Investments | | | 19 | | |

|

| Brookfield Global Listed Real Estate Fund | | | 19 | | |

|

| Brookfield Global Listed Infrastructure Fund | | | 24 | | |

|

| Brookfield High Yield Fund | | | 29 | | |

|

| Statements of Assets and Liabilities | | | 33 | | |

|

| Statements of Operations | | | 34 | | |

|

| Statements of Changes in Net Assets | | | 35 | | |

|

| Financial Highlights | | | 37 | | |

|

| Brookfield Global Listed Real Estate Fund | | | 37 | | |

|

| Class Y | | | 37 | | |

|

| Class I | | | 38 | | |

|

| Brookfield Global Listed Infrastructure Fund | | | 39 | | |

|

| Class A | | | 39 | | |

|

| Class Y | | | 40 | | |

|

| Class I | | | 41 | | |

|

| Brookfield High Yield Fund | | | 42 | | |

|

| Class Y | | | 42 | | |

|

| Class I | | | 43 | | |

|

| Notes to Financial Statements | | | 44 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 56 | | |

|

| Tax Information | | | 57 | | |

|

| Board Considerations Relating to the Investment Advisory Agreements | | | 58 | | |

|

| Information Concerning Trustees and Officers | | | 60 | | |

|

This report is for shareholder information. This is not a prospectus intended for the use in the purchase or sale of Fund shares.

NOT FDIC INSURED MAY LOSE VALUE NOT BANK GUARANTEED

© Copyright 2011. Brookfield Investment Management Inc.

LETTER TO SHAREHOLDERS

Dear Shareholders,

I am pleased to provide the first Annual Report for Brookfield Global Listed Infrastructure Fund, Brookfield Global Listed Real Estate Fund and Brookfield High Yield Fund (each a "Fund" and, collectively, the "Funds") covering the period from the commencement of investment operations on December 1, 2011 through the end of the Funds' fiscal year.

The capital markets continued to face significant challenges throughout much of 2011, as investors remained concerned over the health of the global economy, sovereign debt issues in Europe, and enhanced regulation in the U.S. and abroad. Investor confidence shifted regularly in response to economic data releases and financial headlines, resulting in a volatile and highly correlated market. Accordingly, the appetite for risk diminished and investor focus tended towards safety.

However, as 2011 drew to a close, the capital markets began to regain some footing due to early signs of economic stabilization and recovery in the U.S. While this rally in performance could not offset the challenges experienced earlier in the year for all facets of the investment market, it did provide improved confidence heading into the new year.

Within this volatile environment, the fixed income and equities markets produced mixed results. Against the backdrop of sound corporate credit and improving confidence in an early economic recovery, high yield bonds recovered strongly in the fourth quarter to produce modestly positive returns for the full year. Similarly, infrastructure equity securities provided attractive returns, as investors sought perceived safety in the historically steady and potentially growing cash flows and appealing yield profiles offered by these companies. However, the diminished appetite for risk and concern over the impact of lingering global economic weakness on demand for commercial space led to more challenging performance for real estate securities.

As we move forward, we expect all three asset classes should continue to offer investors an appealing level of current income, particularly in a low interest rate environment. An attractive climate for corporate credit, including strong liquidity and low average debt levels, supports our positive view on the high yield market and our expectation that yield spreads may narrow in the coming year. Furthermore, investor demand for income-producing securities and investment in hard assets should benefit both global infrastructure and real estate securities in the year ahead, particularly if the underlying fundamentals in these asset classes remain relatively stable. We acknowledge that challenges to future performance remain, with ongoing concerns over the Eurozone crisis, softening economic activity in Asia, and the fragile U.S. recovery continuing to dominate headlines. However, we believe these risks have been incorporated into current valuation levels and that investor expectations for the coming year may be surpassed.

In addition to performance information, this report provides an overview of market conditions and a discussion of factors affecting the Funds' investment performance, together with the Funds' audited financial statements and portfolio of investments as of December 31, 2011.

We welcome your questions and comments, and encourage you to contact our Investor Relations team at (800) 497-3746 or visit us at www.brookfieldim.com for more information. Thank you for your support.

Sincerely,

Kim G. Redding

President

2011 Annual Report

1

LETTER TO SHAREHOLDERS (continued)

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2011 and subject to change based on subsequent developments.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in infrastructure entities involve greater exposure to the potential adverse economic, regulatory, political and other changes affecting such entities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods.

Correlation is a statistical measure of how two securities move in relation to each other.

Quasar Distributors, LLC is the distributor of Brookfield Investment Funds.

Brookfield Investment Management Inc.

2

ABOUT YOUR FUND'S EXPENSES (Unaudited)

As a shareholder of a fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends or other distributions, redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitles "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses, which is not the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and the other funds. To do so, compare this 5% hypothetical example with hypothetical examples that appear in stockholders' reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs overall would have been higher.

SHAREHOLDER AND FUND EXPENSES

| | | Annualized

Expense

Ratio | | Beginning

Account Value(1) | | Ending

Account Value

December 31, 2011 | | Expenses

Paid During

Period | |

| GLOBAL LISTED REAL ESTATE FUND | |

| Actual | |

| Class Y Shares | | | 1.25 | % | | $ | 1,000 | | | $ | 1,006 | | | $ | 1.06 | (2) | |

| Class I Shares | | | 1.25 | % | | | 1,000 | | | | 1,006 | | | | 1.06 | (2) | |

| Hypothetical (assuming a 5% return before expenses) | |

| Class Y Shares | | | 1.25 | % | | | 1,000 | | | | 1,019 | | | | 6.36 | (3) | |

| Class I Shares | | | 1.25 | % | | | 1,000 | | | | 1,019 | | | | 6.36 | (3) | |

| GLOBAL LISTED INFRASTRUCTURE FUND | |

| Actual | |

| Class A Shares | | | 1.60 | % | | | 1,000 | | | | 1,002 | | | | 0.09 | (2) | |

| Class Y Shares | | | 1.35 | % | | | 1,000 | | | | 1,016 | | | | 1.16 | (2) | |

| Class I Shares | | | 1.35 | % | | | 1,000 | | | | 1,016 | | | | 1.16 | (2) | |

| Hypothetical (assuming a 5% return before expenses) | |

| Class A Shares | | | 1.60 | % | | | 1,000 | | | | 1,017 | | | | 8.13 | (3) | |

| Class Y Shares | | | 1.35 | % | | | 1,000 | | | | 1,018 | | | | 6.87 | (3) | |

| Class I Shares | | | 1.35 | % | | | 1,000 | | | | 1,018 | | | | 6.87 | (3) | |

| HIGH YIELD FUND | |

| Actual | |

| Class Y Shares | | | 1.15 | % | | | 1,000 | | | | 1,008 | | | | 0.98 | (2) | |

| Class I Shares | | | 1.15 | % | | | 1,000 | | | | 1,008 | | | | 0.98 | (2) | |

| Hypothetical (assuming a 5% return before expenses) | |

| Class Y Shares | | | 1.15 | % | | | 1,000 | | | | 1,019 | | | | 5.85 | (3) | |

| Class I Shares | | | 1.15 | % | | | 1,000 | | | | 1,019 | | | | 5.85 | (3) | |

(1) Commencement of operations for Class A shares December 29, 2011; Class Y and I shares December 1, 2011.

(2) Expenses are equal to the portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by 2 days for Class A and 31 days for Class Y and Class I and divided by 365 to reflect the period of December 29, 2011 through December 31, 2011 for Class A and December 1, 2011 through December 31, 2011 for Class Y and Class I.

(3) Expenses are equal to the portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect a six-month period).

2011 Annual Report

3

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

PORTFOLIO STRATEGY

Individual contributors of performance included Brookdale Senior Living Inc., a U.S. based Healthcare Operator. We believe that Brookdale is a high quality healthcare operator with strong fundamentals as well as attractive growth potential resulting from demographic trends in senior housing. We believe we may be at the beginning of the up-cycle in senior housing and that the security represents a long-term value opportunity.

Rayonier Inc. REIT, a U.S.-based Timber company is a non-benchmark REIT ("Real Estate Investment Trust") specializing in timber, which has historically been more levered to economic improvement than lower beta securities. The stock has performed well on improving housing data releases in the U.S. (timber can be correlated to housing) as well as improving economic sentiment throughout the country.

Camden Property Trust, a U.S.-based REIT also contributed to performance. Residential REITs in the U.S. performed well in recent periods due to strong fundamentals; declining home ownership has buoyed occupancy and rental rates. Camden represents an attractive relative value opportunity coupled with a strong management team and balance sheet.

Detractors of performance included primarily non-U.S. based companies. CapitaLand Ltd., a Singapore-based high-quality diversified REIT, has underperformed its peers primarily due to macroeconomic news in recent periods. Specifically, the stock has come under pressure as a result of its exposure to Singapore's residential market due to a continuation of Singaporean government tightening measures aimed at cooling the residential property market.

Hammerson PLC, a UK-based retail operator owns several high quality shopping centers in London, which we expected to outperform in the current market environment. However, the UK retail market was weak during December 2011, which was likely affected by the relatively poor retail sentiment throughout the Christmas season which resulted in underperformance by Hammerson.

Norwegian Property ASA also detracted from Fund performance. However, the company has a strong management team and an attractive central business district office portfolio in Oslo, Norway. The security trades at an attractive discount to private market asset valuation based on our analysis. In addition, continued strong oil prices, non-Euro currency and strong fiscal position of Norway provide an attractive backdrop.

GLOBAL REAL ESTATE MARKET OVERVIEW AND OUTLOOK

After a challenging third quarter, markets regained some footing in the fourth quarter of 2011. Early signs of economic improvement have been emerging in the U.S. and the Chinese government has shifted to an increasingly accommodative approach. Nevertheless, it cannot be disputed that 2011 was a challenging year for global real estate securities. Global investors grew concerned about the impact of Europe's debt crisis on the global economy and on the demand for commercial space. Global real estate securities closed the year down 5.8%, as measured by the FTSE EPRA/NAREIT Developed Index, modestly underperforming global equities which were down 5.0% as measured by the MSCI World Index.

Amid continued uncertainty in global equity markets, we believe REITs should be well positioned to capitalize on current conditions in the coming year. We believe historically low supply growth should support property fundamentals and attractive dividend yields may benefit the asset class in a long-term low rate market. With a current dividend yield over 4.0% as of December 31, 2011 as measured by the FTSE EPRA /NAREIT Developed Index, we expect investors may increasingly look to REITs and other dividend paying equities to generate income.

There were two key emergent themes among real estate securities during 2011: highly attractive financing terms and the continued bifurcation of high quality versus low quality assets.

Throughout 2011, REITs continually issued equity, thereby, strengthening balance sheets against deteriorating market conditions. As an example, U.S. REITs raised over $30 billion in common stock in 2011.

Brookfield Investment Management Inc.

4

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

In addition, well-capitalized REITs accessed debt markets, exploiting the current low interest rate environment and illustrating that publicly listed real estate companies maintain a competitive advantage in access to and the cost of credit. U.S. REITs raised approximately $14 billion in unsecured debt transactions in 2011, almost a third of which was raised as global credit markets became more selective in the second half of 2011.

Importantly, we are monitoring sectors more reliant on Collateralized Mortgage Backed Securities ("CMBS") financing, including the hotel sector as well as secondary retail markets, as CMBS can be more vulnerable to market movements.

OUTLOOK

Looking ahead, real estate securities appear to be well-positioned for future growth despite ongoing volatility and uncertainty within capital markets. Listed real estate securities companies have maintained a competitive advantage over private market peers in their ability to access capital and exploit the current historically attractive interest rate levels. A confluence of demand for income producing securities and real assets coupled with widening yield spreads and expectations of a continued low rate environment should further benefit the real estate securities asset class. Underlying fundamentals have remained relatively stable and we believe fundamentals will likely continue to recover at a slow pace over the medium-term. However, we acknowledge the possible risk of a worsened Eurozone crisis, which would threaten commercial real estate fundamentals going forward.

Moreover, we see attractive value opportunities beginning to emerge across the globe. In the U.S., we believe the recent flight to quality has led the pricing spread between high quality and lower quality companies to become too wide. As such, we are strategically identifying companies operating in secondary markets that offer attractive growth opportunities. In Asia and Europe, indiscriminate market selling has impacted high quality companies with premium assets and above-average growth profiles, creating, in our view, attractive entry points in select companies.

AVERAGE ANNUAL TOTAL RETURNS

| As of December 31, 2011 | | Since Inception* | |

| Average Annual Total Returns | |

| Class Y Shares | | | 0.59 | % | |

| Class I Shares | | | 0.59 | % | |

| FTSE EPRA/NAREIT Developed Index | | | 0.94 | % | |

* Classes Y and I were incepted on December 1, 2011.

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund's portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Mutual fund investing involves risk. Principal loss is possible.

The FTSE EPRA/NAREIT Developed Index is calculated by the FTSE Group. Performance is calculated by price, total return and net total return and the index is calculated daily. Constituents must meet minimum market capitalization, liquidity requirements, and real estate activity requirements in order to be included within the index. North American and Asian companies must be of a minimum of US$200 million in market capitalization with liquidity

2011 Annual Report

5

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

of US$100 million. European companies are bound by $50 million market cap minimum and liquidity of $25 million. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

Beta is a measure of volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. A basis point is one hundredth of one percent (0.01%). Correlation is a statistical measure of how two securities move in relation to each other.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2011 and subject to change based on subsequent developments.

Brookfield Investment Management Inc.

6

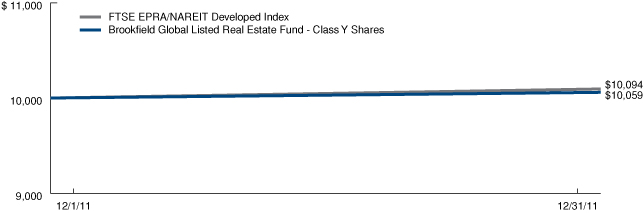

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

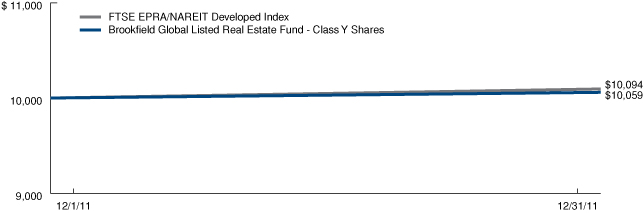

Growth of a $10,000 Investment (Unaudited)

Class Y Shares

The graph below illustrates a hypothetical investment of $10,000 in Global Listed Real Estate Fund—Class Y Shares from the commencement of investment operations on December 1, 2011 to December 31, 2011 compared to the FTSE EPRA/NAREIT Developed Index.

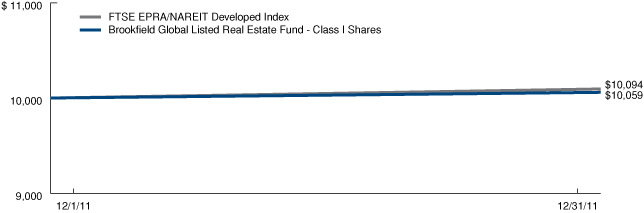

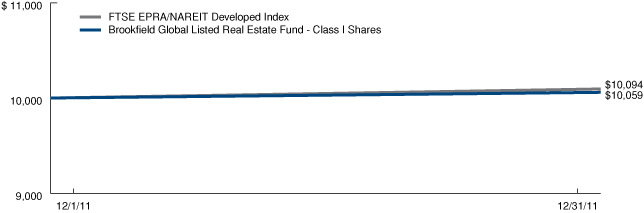

Class I Shares

The graph below illustrates a hypothetical investment of $10,000 in Global Listed Real Estate Fund—Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2011 compared to the FTSE EPRA/NAREIT Developed Index.

2011 Annual Report

7

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio Characteristics (Unaudited)

December 31, 2011

| ASSET ALLOCATION BY GEOGRAPHY | | Percent of

Net Assets | |

| United States | | | 49 | % | |

| Hong Kong | | | 14 | % | |

| Australia | | | 10 | % | |

| Japan | | | 8 | % | |

| United Kingdom | | | 6 | % | |

| France | | | 3 | % | |

| Canada | | | 2 | % | |

| Singapore | | | 2 | % | |

| Germany | | | 2 | % | |

| Sweden | | | 1 | % | |

| Norway | | | 1 | % | |

| Other Assets in Excess of Liabilities | | | 2 | % | |

| Total | | | 100 | % | |

ASSET ALLOCATION BY SECTOR

| Diversified | | | 17 | % | |

| Office | | | 27 | % | |

| Retail | | | 17 | % | |

| Residential | | | 8 | % | |

| Hotel | | | 2 | % | |

| Healthcare | | | 9 | % | |

| Home Builders | | | 3 | % | |

| Industrial | | | 3 | % | |

| Regional Malls | | | 6 | % | |

| Self Storage | | | 4 | % | |

| Strip Centers | | | 2 | % | |

| Other Assets in Excess of Liabilities | | | 2 | % | |

| Total | | | 100 | % | |

TOP TEN HOLDINGS

| Simon Property Group, Inc. | | | 6 | % | |

| Sun Hung Kai Properties Ltd. | | | 5 | % | |

| Westfield Group | | | 5 | % | |

| Brookdale Senior Living, Inc. | | | 4 | % | |

| Health Care REIT, Inc. | | | 4 | % | |

| Boston Properties, Inc. | | | 4 | % | |

| Public Storage | | | 4 | % | |

| Hang Lung Properties Ltd. | | | 4 | % | |

| Mitsubishi Estate Co. Ltd. | | | 4 | % | |

| Camden Property Trust | | | 3 | % | |

Brookfield Investment Management Inc.

8

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

PORTFOLIO STRATEGY

Individual contributors of performance included three U.S. based Oil & Gas Storage & Transmission companies. Tesoro Logistics LP, benefitted from the increased quantity of oil rigs located in the Bakken formation in the Midwest region of the U.S., which has provided additional growth opportunities for the company.

Targa Resources Corp. performed well due to continued strengthening of natural gas liquids ("NGLs") prices. Higher prices have allowed for more liquids rich drilling and therefore additional demand for Targa's assets, which gather, process, store and transport NGLs.

Energy Transfer Equity LP's acquisition of Southern Union also contributed to performance as it will allow for the new company to sell its natural gas pipeline assets to both of Energy Transfer's associated master limited partnerships ("MLPS"), Energy Transfer Partners and Regency Gas Partners. The transaction has been viewed favorably by investors as these asset sales could potentially generate profits for Energy Transfer Equity and earnings accretion for the acquiring MLP. Further, we believe investors are attracted to the historically steady and potentially growing cash flows and attractive yield profiles offered by U.S. energy companies.

Detractors of performance included primarily non-U.S. based companies. Fraport AG, a German airport was weak in the current "risk-off" market environment amid significant macroeconomic headwinds through Europe. In addition, the company underperformed within the higher-beta transportation infrastructure sector. Nonetheless, we believe the company offers a compelling valuation and strong growth potential.

Group Eurotunnel SA, a French operator of Toll Roads, holds the concession to operate the tunnel beneath the English Channel. We believe the security has been disproportionately weakened by continued vulnerability throughout Europe as well as the higher-beta transportation infrastructure sector. We like the company's insulation from competition characteristics of the company and believe it should be poised to perform well in the coming months, even in a downside risk scenario.

DP World Ltd, UK-based operator of Ports is one of the largest and highest quality listed seaport operators in the world. The company owns and operates several ports in emerging markets, including many in the Middle East. Accordingly, DP World Ltd has been out of favor amid the recent flight to safety.

INFRASTRUCTURE MARKET OVERVIEW AND OUTLOOK

Macroeconomic events led the day throughout much of 2011, impacting infrastructure securities which often rose and fell along with broader equity markets. However, while global infrastructure securities have not been immune to excess volatility in the "risk-on/risk-off" market environment, we believe investors sought the perceived safety in the historically steady and potentially growing cash flows and attractive yield profiles offered by listed infrastructure companies.

During 2011, indebted governments began seeking infrastructure asset sales in an effort to improve sovereign balance sheets. Portugal requested a bailout from the International Monetary Fund (IMF), and part of the aid package will include the sale of its stakes in Portuguese energy companies. In December it was announced that this will include the sale of up to 40% of the €1 billion energy company Redes Energeticas Nacionais SA (REN), which operates Portugal's electricity and gas grids.

REGULATORY FRAMEWORKS UNDER WATCH

We continue to closely monitor the various regulatory frameworks globally that impact our investment universe, particularly pending regulatory announcements that could impact future cash flow expectations, either positively or negatively. This was especially important in 2011 as significant macroeconomic events unfolded.

2011 Annual Report

9

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

At the outset of 2011, the Chinese government continued the prior year's policies, implementing cooling measures aimed at controlling inflation. In January, China's central bank ordered banks to set aside additional cash reserves, lifting required ratios by 50 basis points in another attempt to tighten monetary policy. Chinese securities dropped sharply as a result. The Chinese Ministry of Communications also announced a potential reduction in toll rates in exchange for increasing operators' concession periods by 20 years or more. This negatively impacted Chinese toll road equity prices, as it introduced uncertainty into the sector, and could result in lower earnings in the short-term. However, the expected impact on the overall value of the companies is limited. Chinese equity markets were impacted further as the year progressed driven by investors' preference for less risky investments.

European infrastructure securities, already down on concerns about Europe, were impacted further as regulatory changes led to selloffs in the space, particularly in Italy and Spain. New austerity measures announced by the Italian government in the second half of 2011 to cut its fiscal deficit included a 4% tax increase on corporate utilities, with the express provision that the additional tax cannot be passed through to the end consumer. Italian energy companies in the benchmark were affected following the announcement.

OUTLOOK

We believe infrastructure assets should be well positioned to offer attractive current income as well as predictable growth and the potential for capital appreciation in the coming year. We continue to see growing demand coupled with an expanding investable universe. Further, we believe Gross Domestic Product (GDP) growth may remain moderate and therefore interest rates benign into 2012, which should benefit asset classes like infrastructure as investors may turn to higher yielding equities as an alternative to bonds.

The economic outlook for North America has continued to advance with improving consumer confidence, housing and jobs data. The region has benefitted from the "risk-off" trade in recent months and is therefore more fully valued on a relative basis than Europe and the Asia Pacific regions. Conversely, the selloff that occurred in 2011 has created attractive entry points throughout Europe, and we are strategically monitoring opportunities to potentially capitalize on deep discounts throughout the region in high quality, well capitalized companies. We acknowledge that the threat of recession remains greatest in the European region and a quality bias is paramount. However, we believe the regulatory environment in many European countries may provide a greater degree of certainty than many emerging market economies, creating attractive opportunities to invest.

AVERAGE ANNUAL TOTAL RETURNS

| As of December 31, 2011 | | Since Inception* | |

| Average Annual Total Returns | |

| Class A Shares | | | -4.61 | % | |

| (excluding sales load) | | | 0.20 | % | |

| Dow Jones Brookfield Global Infrastructure Composite Index | | | 0.24 | % | |

| Class Y Shares | | | 1.58 | % | |

| Class I Shares | | | 1.58 | % | |

| Dow Jones Brookfield Global Infrastructure Composite Index | | | 3.01 | % | |

* Classes Y and I were incepted on December 1, 2011. Class A was incepted on December 29, 2011.

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund's portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that

Brookfield Investment Management Inc.

10

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

the Brookfield Global Listed Infrastructure Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of Fund holdings.

Mutual fund investing involves risk. Principal loss is possible.

The Dow Jones Brookfield Global Infrastructure Composite Index was created on July 1, 2008 and is comprised of infrastructure companies with at least 70% of its annual cash flows derived from owning and operating infrastructure assets. The Index is maintained by Dow Jones Indexes. The Index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

Beta is a measure of volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. A basis point is one hundredth of one percent (0.01%).

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2011 and subject to change based on subsequent developments.

2011 Annual Report

11

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

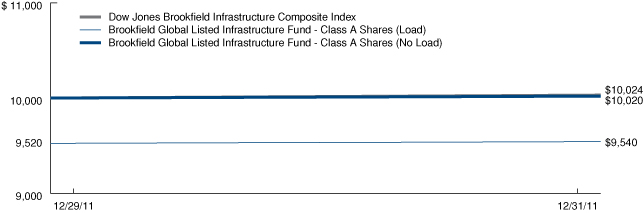

Growth of a $10,000 Investment (Unaudited)

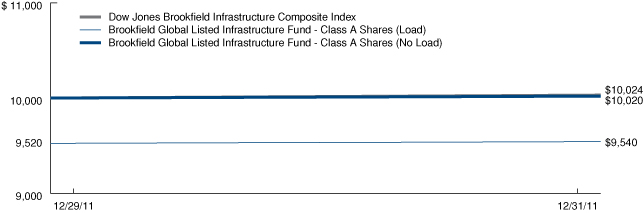

Class A Shares

The graph below illustrates a hypothetical investment of $10,000 in Global Listed Infrastructure Fund—Class A Shares from the commencement of investment operations on December 29, 2011 to December 31, 2011 compared to the Dow Jones Brookfield Global Infrastructure Composite Index.

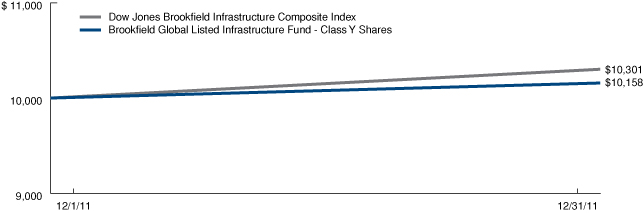

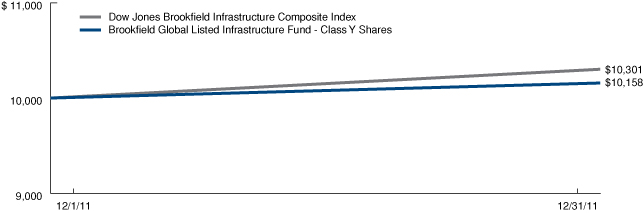

Class Y Shares

The graph below illustrates a hypothetical investment of $10,000 in Global Listed Infrastructure Fund—Class Y Shares from the commencement of investment operations on December 1, 2011 to December 31, 2011 compared to the Dow Jones Brookfield Global Infrastructure Composite Index.

Brookfield Investment Management Inc.

12

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Growth of a $10,000 Investment (Unaudited)

Class I Shares

The graph below illustrates a hypothetical investment of $10,000 in Global Listed Infrastructure Fund—Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2011 compared to the Dow Jones Brookfield Global Infrastructure Composite Index.

2011 Annual Report

13

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio Characteristics (Unaudited)

December 31, 2011

| ASSET ALLOCATION BY GEOGRAPHY | | Percent of

Net Assets | |

| United States | | | 49 | % | |

| United Kingdom | | | 12 | % | |

| Canada | | | 11 | % | |

| Australia | | | 4 | % | |

| France | | | 4 | % | |

| Spain | | | 4 | % | |

| Brazil | | | 3 | % | |

| China | | | 2 | % | |

| Luxembourg | | | 2 | % | |

| Italy | | | 2 | % | |

| Germany | | | 1 | % | |

| Switzerland | | | 1 | % | |

| United Arab Emirates | | | 1 | % | |

| Other Assets in Excess of Liabilities | | | 4 | % | |

| Total | | | 100 | % | |

ASSET ALLOCATION BY SECTOR

| Infrastructure | | | 20 | % | |

| Toll Roads | | | 9 | % | |

| Rail | | | 1 | % | |

| Transmission & Distribution | | | 13 | % | |

| Oil & Gas Storage and Transportation | | | 44 | % | |

| Airports | | | 2 | % | |

| Ports | | | 1 | % | |

| Water | | | 6 | % | |

| Other Assets in Excess of Liabilities | | | 4 | % | |

| Total | | | 100 | % | |

TOP TEN HOLDINGS

| National Grid PLC | | | 7 | % | |

| Enbridge, Inc. | | | 7 | % | |

| American Tower Corp. | | | 6 | % | |

| TransCanada Corp. | | | 5 | % | |

| Spectra Energy Corp. | | | 5 | % | |

| Enterprise Products Partners LP | | | 4 | % | |

| Group Eurotunnel SA | | | 3 | % | |

| El Paso Corp. | | | 3 | % | |

| Energy Transfer Equity LP | | | 3 | % | |

| Chesapeake Midstream Partners LP | | | 3 | % | |

Brookfield Investment Management Inc.

14

BROOKFIELD HIGH YIELD FUND

PORTFOLIO STRATEGY

Individual contributors of performance included Cablevision Corp., whose bonds benefitted from an improved outlook for the economy and the high yield market. The improved outlook for the economy also helped more cyclical industries like Automotives and Chemicals, benefitting the bonds of Visteon and Huntsman.

Detractors of performance included United Rentals, whose bonds fell after the company announced an acquisition. As the Fund only recently commenced investment operations, the Fund's cash position as of the end of the fiscal year also detracted from the Fund's performance.

HIGH YIELD MARKET OVERVIEW AND OUTLOOK

After a challenging third quarter, markets regained their footing in the fourth. Europe continued to dominate investors' thinking and the on-again, off-again enthusiasm for the European Union's plan to shore up the Euro was on-again. Risk markets responded with the Russell 2000 Index up 15.5% and the high yield market, as measured by the BofA Merrill Lynch US High Yield Master II Index, up 6.2% in the fourth quarter ending December 31, 2011.

The economic news out of Europe was overwhelmingly negative over the last three months. Fears of bank insolvency led to tighter credit but some hope came with more expansionary policies in the fourth quarter. However, they were possibly too late to avoid a general recession in Europe. The question is whether that recession will migrate to North America. Positive numbers from automotive manufacturers and strong rail traffic lead Brookfield to believe that economic growth in the U.S. is on a strengthening, not weakening, path.

Fears of a double-dip recession were also at the forefront throughout the year. Brookfield noted that high yield spreads, as measured by the Bank of America Merrill Lynch U.S. High Yield Master Index in June and September were almost fully discounting a recession. As confidence began to return and investors noted the year-end signs of strength, spreads between U.S. Treasuries narrowed substantially. However, at 737 basis points as of December 31, 2011, they remained much wider than the 400-500 basis points typically expected at this point in the credit cycle. As such, we believe the market continued to represent significantly attractive value. As investors returned to high yield, the more volatile CCC-rated bonds outperformed BB-rated bonds, returning 8.1% in the fourth quarter, compared with 5.5% from the more conservative BB-rated bonds.

Corporate credit has been sound for the past couple of years, however we saw continued modest deterioration in the fourth quarter with defaults rising from less than 1.2% at the end of the third quarter to 1.7%.1 Note that 2011's default rate of 1.7% remained well below the market's 25-year average default rate of 4.2%.1

The fourth quarter also saw continued deterioration in rating agency activity first noted in the third quarter when slightly more ratings downgrades than upgrades occurred. Brookfield noted that companies reported generally good earnings through the third quarter, although management remained cautious regarding forward guidance.

We expect continued modest economic growth in 2012, although note that many economists are on the verge of raising their growth estimates. Consequently, while we believe that in general high yield balance sheets are strong, with adequate liquidity, modest debt, and manageable maturities, there remains a cohort of credit that will not survive a period of modest economic growth. Additionally there are always companies with faulty or outmoded business models that will need to restructure. Some of these companies are quite large and as they fail, investors should be prepared for bumps in the default rate along with some headline risk.

Supply and demand turned strongly positive in the fourth quarter with high yield mutual funds seeing a reversal from modest outflows to strong inflows.2 New issues, which went dry in the third quarter, picked up in the fourth, but at $35.5 billion remained well below the $81.8 billion posted in the second quarter. Overall with money flooding into mutual funds and a relatively light new issue calendar, the deals came oversubscribed and traded higher in the

1 JP Morgan, High Yield Default Monitor, January 3, 2012 p. 2

2 Credit Suisse "Leveraged Finance Strategy Update" January 4, 2012, p. 2.

2011 Annual Report

15

BROOKFIELD HIGH YIELD FUND

aftermarket. Traders report that there seems to be ample cash available for reasonably creditworthy names and report some challenges buying good quality paper in the secondary market.

We believe that corporate credit quality is quite sound. Typically, we enter recessions with stressed balance sheets from acquisitions, capital spending, and leveraged buyouts. Currently balance sheets are near cyclical lows in debt and very high corporate cash simply because companies never had to invest in their business this cycle. Therefore the risk to our generally bullish posture on high yield may be mitigated by the probability that if the U.S. should slide into recession the impact on high yield investors, while not negligible, would likely be muted.

Given our expectation of modest economic growth, modestly increasing defaults, but no general recession, we believe that high yield investors are generously compensated at current spread levels. We believe the risk of further turmoil in Europe remains high, and we note the decline in secondary trading liquidity in the U.S., for which investors should rightly demand richer-than-normal spreads.

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund's portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Brookfield High Yield Fund currently holds these securities. Please refer to the Portfolio of Investments contained in this report for a full listing of fund holdings.

Mutual fund investing involves risk. Principal loss is possible.

The BofA Merrill Lynch High Yield Master II Index is an unmanaged index that tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

A basis point is one hundredth of one percent (0.01%). Ratings are provided by ratings agencies such as Standard & Poor's or Moody's, who assign a rating based on their analysis of the issuer's credit worthiness. The highest rating given is AAA and the lowest is C.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2011 and subject to change based on subsequent developments.

AVERAGE ANNUAL TOTAL RETURNS

| As of December 31, 2011 | | Since Inception* | |

| Average Annual Total Returns | |

| Class Y Shares | | | 0.77 | % | |

| Class I Shares | | | 0.77 | % | |

| BofA Merrill Lynch U.S. High Yield Master II Index | | | 2.48 | % | |

* Classes Y and I were incepted on December 1, 2011.

Brookfield Investment Management Inc.

16

BROOKFIELD HIGH YIELD FUND

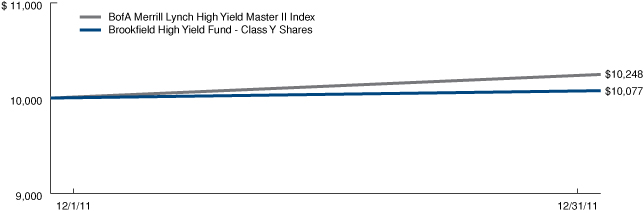

Growth of a $10,000 Investment (Unaudited)

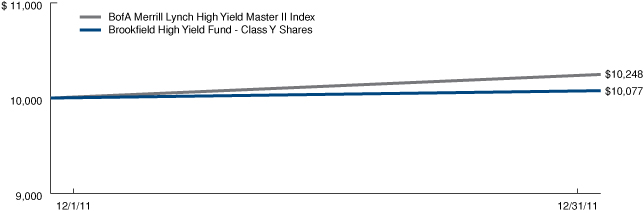

Class Y Shares

The graph below illustrates a hypothetical investment of $10,000 in High Yield Fund—Class Y Shares from the commencement of investment operations on December 1, 2011 to December 31, 2011 compared to the BofA Merrill Lynch U.S. High Yield Master II Index.

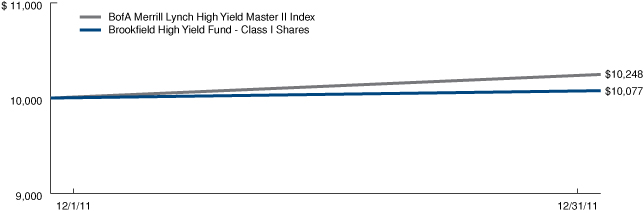

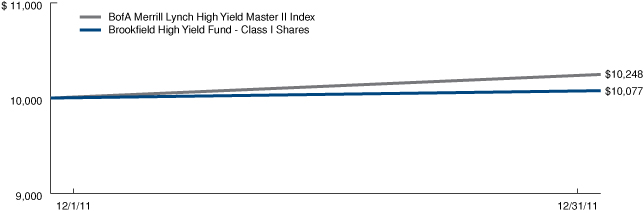

Class I Shares

The graph below illustrates a hypothetical investment of $10,000 in High Yield Fund—Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2011 compared to the BofA Merrill Lynch U.S. High Yield Master II Index.

2011 Annual Report

17

BROOKFIELD HIGH YIELD FUND

Portfolio Characteristics (Unaudited)

December 31, 2011

| CREDIT QUALITY | | Percent of

Net Assets | |

| BB | | | 23 | % | |

| B | | | 41 | % | |

| CCC | | | 5 | % | |

| CC | | | 1 | % | |

| Cash | | | 30 | % | |

| Total | | | 100 | % | |

ASSET ALLOCATION BY SECTOR

| Energy | | | 11 | % | |

| Consumer Cyclical | | | 10 | % | |

| Consumer Non-Cyclical | | | 10 | % | |

| Basic Industry | | | 9 | % | |

| Telecommunications | | | 7 | % | |

| Services Cyclical | | | 5 | % | |

| Capital Goods | | | 5 | % | |

| Technology & Electronics | | | 4 | % | |

| Media | | | 3 | % | |

| Services Non-Cyclical | | | 2 | % | |

| Finance & Investment | | | 2 | % | |

| Utility | | | 1 | % | |

| Real Estate | | | 1 | % | |

| Other Assets in Excess of Liabilities | | | 30 | % | |

| Total | | | 100 | % | |

TOP TEN HOLDINGS

| Owens-Illinois, Inc. | | | 1 | % | |

| B&G Foods, Inc. | | | 1 | % | |

| AMC Entertainment, Inc. | | | 1 | % | |

| Key Energy Services, Inc. | | | 1 | % | |

| Terex Corp. | | | 1 | % | |

| Service Corp. International | | | 1 | % | |

| Cablevision Systems Corp. | | | 1 | % | |

| Consol Energy, Inc. | | | 1 | % | |

| CCO Holdings LLC/Cap Corp. | | | 1 | % | |

| Crosstex Energy LP/Crosstex Energy Finance Corp. | | | 1 | % | |

Brookfield Investment Management Inc.

18

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS – 97.9% | |

| AUSTRALIA – 10.5% | |

| Diversified – Sector – 1.9% | |

Dexus Property Group 1

(Cost – $101,035) | | | 113,200 | | | $ | 95,932 | | |

| Office – 2.0% | |

Commonwealth Property Office Fund 1

(Cost – $99,610) | | | 101,400 | | | | 99,001 | | |

| Retail – 6.6% | |

| Westfield Group 1 | | | 29,700 | | | | 236,959 | | |

| Westfield Retail Trust 1 | | | 38,200 | | | | 97,352 | | |

Total Retail

(Cost – $349,969) | | | | | 334,311 | | |

Total AUSTRALIA

(Cost – $550,614) | | | | | 529,244 | | |

| CANADA – 2.0% | |

| Residential – 2.0% | |

Boardwalk Real Estate Investment Trust 1

(Cost – $102,637) | | | 2,000 | | | | 99,023 | | |

Total CANADA

(Cost – $102,637) | | | | | 99,023 | | |

| FRANCE – 2.8% | |

| Diversified – Sector – 2.8% | |

Unibail-Rodamco SE 1

(Cost – $148,870) | | | 800 | | | | 143,178 | | |

Total FRANCE

(Cost – $148,870) | | | | | 143,178 | | |

| GERMANY – 1.6% | |

| Office – 1.6% | |

Alstria Office REIT-AG 1

(Cost – $75,266) | | | 6,700 | | | | 79,669 | | |

Total GERMANY

(Cost – $75,266) | | | | | 79,669 | | |

| HONG KONG – 14.3% | |

| Diversified – Sector – 5.1% | |

Sun Hung Kai Properties Ltd. 1

(Cost – $260,447) | | | 20,751 | | | | 259,324 | | |

| Hotel – 2.4% | |

The Hongkong & Shanghai Hotels 1

(Cost – $120,804) | | | 111,002 | | | | 122,799 | | |

| Office – 3.0% | |

Hongkong Land Holdings Ltd. 1

(Cost – $157,054) | | | 33,052 | | | | 150,056 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

2011 Annual Report

19

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS (continued) | |

| Retail – 3.8% | |

Hang Lung Properties Ltd. 1

(Cost – $213,954) | | | 68,101 | | | $ | 193,310 | | |

Total HONG KONG

(Cost – $752,259) | | | | | 725,489 | | |

| JAPAN – 7.6% | |

| Office – 5.3% | |

| Japan Real Estate Investment Corp. 1 | | | 12 | | | | 93,428 | | |

| Mitsubishi Estate Co. Ltd. 1 | | | 11,855 | | | | 176,775 | | |

Total Office

(Cost – $297,517) | | | | | 270,203 | | |

| Retail – 2.3% | |

United Urban Investment Corp. 1

(Cost – $104,944) | | | 100 | | | | 113,791 | | |

Total JAPAN

(Cost – $402,461) | | | | | 383,994 | | |

| NORWAY – 1.3% | |

| Diversified – Sector – 1.3% | |

Norwegian Property ASA 1

(Cost – $74,061) | | | 55,500 | | | | 68,136 | | |

Total NORWAY

(Cost – $74,061) | | | | | 68,136 | | |

| SINGAPORE – 1.7% | |

| Diversified – Sector – 1.7% | |

CapitaLand Ltd. 1

(Cost – $103,087) | | | 50,800 | | | | 86,454 | | |

Total SINGAPORE

(Cost – $103,087) | | | | | 86,454 | | |

| SWEDEN – 1.5% | |

| Diversified – Sector – 1.5% | |

Hufvudstaden AB 1

(Cost – $75,126) | | | 7,500 | | | | 76,240 | | |

Total SWEDEN

(Cost – $75,126) | | | | | 76,240 | | |

| UNITED KINGDOM – 6.0% | |

| Office – 1.9% | |

Derwent London PLC 1

(Cost – $101,944) | | | 4,000 | | | | 96,944 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

Brookfield Investment Management Inc.

20

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS (continued) | |

| Retail – 4.1% | |

| Hammerson PLC 1 | | | 24,400 | | | $ | 136,252 | | |

| Shaftesbury PLC 1 | | | 9,500 | | | | 68,906 | | |

Total Retail

(Cost – $225,401) | | | | | 205,158 | | |

Total UNITED KINGDOM

(Cost – $327,345) | | | | | 302,102 | | |

| UNITED STATES – 48.6% | |

| Healthcare – 8.7% | |

| Brookdale Senior Living, Inc. 2 | | | 12,600 | | | | 219,114 | | |

| Health Care REIT, Inc. | | | 4,000 | | | | 218,120 | | |

Total Healthcare

(Cost – $396,223) | | | | | 437,234 | | |

| Homebuilders – 3.1% | |

Lennar Corp. – Class A

(Cost – $149,998) | | | 8,100 | | | | 159,165 | | |

| Industrial – 3.1% | |

ProLogis, Inc.

(Cost – $149,192) | | | 5,400 | | | | 154,386 | | |

| Infrastructure – 2.1% | |

Rayonier, Inc.

(Cost – $97,260) | | | 2,400 | | | | 107,112 | | |

| Office – 13.2% | |

| Boston Properties, Inc. | | | 2,100 | | | | 209,159 | | |

| Corporate Office Properties Trust | | | 7,200 | | | | 153,072 | | |

| Douglas Emmett, Inc. | | | 8,300 | | | | 151,392 | | |

| SL Green Realty Corp. | | | 2,300 | | | | 153,272 | | |

Total Office

(Cost – $645,799) | | | | | 666,895 | | |

| Regional Malls – 6.1% | |

Simon Property Group, Inc.

(Cost – $295,535) | | | 2,400 | | | | 309,456 | | |

| Residential – 6.3% | |

| Camden Property Trust | | | 2,600 | | | | 161,824 | | |

| Essex Property Trust, Inc. | | | 1,100 | | | | 154,561 | | |

Total Residential

(Cost – $295,543) | | | | | 316,385 | | |

| Self Storage – 4.0% | |

Public Storage

(Cost – $194,778) | | | 1,500 | | | | 201,690 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

2011 Annual Report

21

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS (continued) | |

| Strip Centers – 2.0% | |

DDR Corp.

(Cost – $98,318) | | | 8,500 | | | $ | 103,445 | | |

Total UNITED STATES

(Cost – $2,322,646) | | | | | 2,455,768 | | |

Total COMMON STOCK

(Cost – $4,934,372) | | | | | 4,949,297 | | |

Total Investments – 97.9%

(Cost – $4,934,372) | | | | | 4,949,297 | | |

| Other Assets in Excess of Liabilities – 2.1% | | | | | 103,819 | | |

| TOTAL NET ASSETS – 100.0% | | | | $ | 5,053,116 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

Brookfield Investment Management Inc.

22

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Notes to Portfolio of Investments

December 31, 2011

The following notes should be read in conjunction with the accompanying Portfolio of Investments.

1 — Foreign security or a U.S. security of a foreign company

2 — Non-income producing security.

See Notes to Financial Statements.

2011 Annual Report

23

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS – 96.2% | |

| AUSTRALIA – 4.5% | |

| Infrastructure – Diversified – 2.0% | |

| Challenger Infrastructure Fund – Class A 2 | | | 2,457 | | | $ | 2,819 | | |

| DUET Group 2 | | | 138,900 | | | | 249,364 | | |

Total Infrastructure – Diversified

(Cost – $253,222) | | | | | 252,183 | | |

| Toll Roads – 1.5% | |

Transurban Group 2

(Cost – $186,802) | | | 32,500 | | | | 186,662 | | |

| Transmission & Distribution – 1.0% | |

Spark Infrastructure Group 1,2,5

(Cost – $122,190) | | | 87,500 | | | | 122,927 | | |

Total AUSTRALIA

(Cost – $562,214) | | | | | 561,772 | | |

| BRAZIL – 3.0% | |

| Rail – 1.0% | |

All America Latina Logistica SA 2

(Cost – $123,470) | | | 24,800 | | | | 123,651 | | |

| Toll Roads – 1.0% | |

CCR SA 2

(Cost – $122,924) | | | 19,000 | | | | 124,477 | | |

| Transmission & Distribution – 1.0% | |

Eletropaulo Metropolitana Eletricidade de Sao Paulo SA 2

(Cost – $120,684) | | | 6,400 | | | | 125,238 | | |

Total BRAZIL

(Cost – $367,078) | | | | | 373,366 | | |

| CANADA – 11.5% | |

| Oil & Gas Storage & Transportation – 11.5% | |

| Enbridge, Inc. 2 | | | 21,800 | | | | 815,079 | | |

| TransCanada Corp. 2 | | | 14,000 | | | | 611,946 | | |

Total Oil & Gas Storage & Transportation

(Cost – $1,393,175) | | | | | 1,427,025 | | |

Total CANADA

(Cost – $1,393,175) | | | | | 1,427,025 | | |

| CHINA – 2.1% | |

| Infrastructure – Diversified – 1.1% | |

Shenzhen International Holdings Ltd. 2

(Cost – $125,115) | | | 1,991,018 | | | | 130,451 | | |

| Toll Roads – 1.0% | |

Sichuan Expressway Co. Ltd. 2

(Cost – $125,887) | | | 319,572 | | | | 128,127 | | |

Total CHINA

(Cost – $251,002) | | | | | 258,578 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

Brookfield Investment Management Inc.

24

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS (continued) | |

| FRANCE – 4.1% | |

| Infrastructure – Communications – 1.0% | |

Eutelsat Communications SA 2

(Cost – $124,537) | | | 3,200 | | | $ | 124,643 | | |

| Toll Roads – 3.1% | |

Group Eurotunnel SA 2

(Cost – $401,344) | | | 56,689 | | | | 384,595 | | |

Total FRANCE

(Cost – $525,881) | | | | | 509,238 | | |

| GERMANY – 1.0% | |

| Airports – 1.0% | |

Fraport AG 2

(Cost – $130,143) | | | 2,500 | | | | 122,863 | | |

Total GERMANY

(Cost – $130,143) | | | | | 122,863 | | |

| ITALY – 1.7% | |

| Oil & Gas Storage & Transportation – 1.7% | |

Snam Rete Gas SpA 2

(Cost – $220,011) | | | 49,200 | | | | 216,703 | | |

Total ITALY

(Cost – $220,011) | | | | | 216,703 | | |

| LUXEMBOURG – 2.0% | |

| Infrastructure – Communications – 2.0% | |

SES SA 2

(Cost – $250,385) | | | 10,400 | | | | 249,148 | | |

Total LUXEMBOURG

(Cost – $250,385) | | | | | 249,148 | | |

| SPAIN – 4.0% | |

| Toll Roads – 2.0% | |

Abertis Infraestructuras SA 2

(Cost – $248,347) | | | 15,600 | | | | 247,910 | | |

| Transmission & Distribution – 2.0% | |

Red Electrica Corp. SA 2

(Cost – $252,273) | | | 5,800 | | | | 247,673 | | |

Total SPAIN

(Cost – $500,620) | | | | | 495,583 | | |

| SWITZERLAND – 1.0% | |

| Airports – 1.0% | |

Flughafen Zurich AG 2

(Cost – $121,602) | | | 347 | | | | 120,358 | | |

Total SWITZERLAND

(Cost – $121,602) | | | | | 120,358 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

2011 Annual Report

25

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS (continued) | |

| UNITED ARAB EMIRATES – 0.4% | |

| Ports – 0.4% | |

DP World Ltd. 2

(Cost – $50,131) | | | 4,800 | | | $ | 46,962 | | |

Total UNITED ARAB EMIRATES

(Cost – $50,131) | | | | | 46,962 | | |

| UNITED KINGDOM – 11.9% | |

| Infrastructure – Diversified – 1.0% | |

| Bilfinger Berger Global Infrastructure SICAV SA 2,3,4 | | | 38,400 | | | | 62,020 | | |

| John Laing Infrastructure Fund Ltd. 2,4 | | | 36,600 | | | | 61,671 | | |

Total Infrastructure – Diversified

(Cost – $123,544) | | | | | 123,691 | | |

| Transmission & Distribution – 6.9% | |

National Grid PLC 2

(Cost – $876,438) | | | 89,500 | | | | 865,081 | | |

| Water – 4.0% | |

| Severn Trent PLC 2 | | | 10,700 | | | | 248,300 | | |

| United Utilities Group PLC 2 | | | 26,400 | | | | 248,239 | | |

Total Water

(Cost – $507,107) | | | | | 496,539 | | |

Total UNITED KINGDOM

(Cost – $1,507,089) | | | | | 1,485,311 | | |

| UNITED STATES – 49.0% | |

| Infrastructure – Communications – 10.4% | |

| American Tower Corp. | | | 12,200 | | | | 732,122 | | |

| Crown Castle International Corp. 3 | | | 7,000 | | | | 313,600 | | |

| SBA Communications Corp. 3 | | | 5,700 | | | | 244,872 | | |

Total Infrastructure – Communications

(Cost – $1,275,110) | | | | | 1,290,594 | | |

| Infrastructure – Diversified – 1.9% | |

CenterPoint Energy, Inc.

(Cost – $245,748) | | | 12,200 | | | | 245,098 | | |

| Oil & Gas Storage & Transportation – 31.0% | |

| Chesapeake Midstream Partners LP | | | 10,900 | | | | 316,100 | | |

| Crosstex Energy, Inc. | | | 5,000 | | | | 63,200 | | |

| El Paso Corp. | | | 14,100 | | | | 374,637 | | |

| Energy Transfer Equity LP | | | 9,100 | | | | 369,278 | | |

| Enterprise Products Partners LP | | | 10,800 | | | | 500,904 | | |

| MarkWest Energy Partners LP | | | 5,700 | | | | 313,842 | | |

| NuStar Energy LP | | | 2,200 | | | | 124,652 | | |

| ONEOK, Inc. | | | 3,600 | | | | 312,084 | | |

| Plains All American Pipeline LP | | | 4,200 | | | | 308,490 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

Brookfield Investment Management Inc.

26

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio of Investments

December 31, 2011

| | | Shares | | Value

(Note 2) | |

| COMMON STOCKS (continued) | |

| Regency Energy Partners LP | | | 5,000 | | | $ | 124,300 | | |

| Sempra Energy | | | 4,500 | | | | 247,500 | | |

| Spectra Energy Corp. | | | 18,100 | | | | 556,575 | | |

| Targa Resources Corp. | | | 3,000 | | | | 122,070 | | |

| Tesoro Logistics LP | | | 3,700 | | | | 121,730 | | |

Total Oil & Gas Storage & Transportation

(Cost – $3,749,521) | | | | | 3,855,362 | | |

| Transmission & Distribution – 3.7% | |

| ITC Holdings Corp. | | | 3,200 | | | | 242,816 | | |

| Northeast Utilities | | | 2,600 | | | | 93,782 | | |

| NorthWestern Corp. | | | 3,400 | | | | 121,686 | | |

Total Transmission & Distribution

(Cost – $457,488) | | | | | 458,284 | | |

| Water – 2.0% | |

American Water Works Co., Inc.

(Cost – $245,077) | | | 7,700 | | | | 245,322 | | |

Total UNITED STATES

(Cost – $5,972,944) | | | | | 6,094,660 | | |

Total COMMON STOCK – 96.2%

(Cost – $11,852,275) | | | | | 11,961,567 | | |

Total Investments – 96.2%

(Cost – $11,852,275) | | | | | 11,961,567 | | |

| Other Assets in Excess of Liabilities – 3.8% | | | | | 470,438 | | |

| TOTAL NET ASSETS – 100.0% | | | | $ | 12,432,005 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

2011 Annual Report

27

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Notes to Portfolio of Investments

December 31, 2011

The following notes should be read in conjunction with the accompanying Portfolio of Investments.

1 — Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. As of December 31, 2011, the total values of all such investments was $122,927 or 1.0% of net assets.

2 — Foreign security or a U.S. security of a foreign company.

3 — Non-income producing security.

4 — ETFs – Exchange Traded Funds.

5 — Private Placement.

See Notes to Financial Statements.

Brookfield Investment Management Inc.

28

BROOKFIELD HIGH YIELD FUND

Portfolio of Investments

December 31, 2011

| | | Interest

Rate | | Maturity | | Principal

Amount

(000s) | | Value

(Note 2) | |

| HIGH YIELD CORPORATE BONDS – 70.0% | |

| Basic Industry – 8.7% | |

| AK Steel Corp. | | | 7.63 | % | | 05/15/20 | | $ | 200 | | | $ | 188,000 | | |

| Associated Materials LLC | | | 9.13 | | | 11/01/17 | | | 200 | | | | 174,500 | | |

| Cascades, Inc. 2 | | | 7.88 | | | 01/15/20 | | | 200 | | | | 194,000 | | |

| Huntsman International LLC | | | 8.63 | | | 03/15/21 | | | 200 | | | | 212,000 | | |

| Momentive Performance Materials, Inc. | | | 9.00 | | | 01/15/21 | | | 200 | | | | 152,000 | | |

| Polymer Group, Inc. 1,3 | | | 7.75 | | | 02/01/19 | | | 200 | | | | 207,000 | | |

| Steel Dynamics, Inc. | | | 7.63 | | | 03/15/20 | | | 200 | | | | 211,000 | | |

| Trimas Corp. | | | 9.75 | | | 12/15/17 | | | 200 | | | | 217,000 | | |

| United States Steel Corp. | | | 7.00 | | | 02/01/18 | | | 200 | | | | 198,000 | | |

Total Basic Industry

(Cost – $1,738,856) | | | | | | | | | 1,753,500 | | |

| Capital Goods – 4.6% | |

| Berry Plastics Corp. | | | 9.50 | | | 05/15/18 | | | 200 | | | | 201,000 | | |

| Building Materials Corp. of America 1,3 | | | 6.75 | | | 05/01/21 | | | 200 | | | | 210,000 | | |

| Owens-Illinois, Inc. | | | 7.80 | | | 05/15/18 | | | 250 | | | | 276,250 | | |

| Terex Corp. | | | 8.00 | | | 11/15/17 | | | 250 | | | | 245,000 | | |

Total Capital Goods

(Cost – $924,683) | | | | | | | | | 932,250 | | |

| Consumer Cyclical – 9.9% | |

| American Axle & Manufacturing, Inc. | | | 7.88 | | | 03/01/17 | | | 200 | | | | 198,000 | | |

| Levi Strauss & Co. 1,3 | | | 7.63 | | | 05/15/20 | | | 200 | | | | 204,250 | | |

| Limited Brands, Inc. | | | 7.60 | | | 07/15/37 | | | 200 | | | | 199,000 | | |

| McJunkin Red Man Corp. | | | 9.50 | | | 12/15/16 | | | 200 | | | | 203,000 | | |

| MGM Mirage, Inc. | | | 7.63 | | | 01/15/17 | | | 200 | | | | 190,500 | | |

| Niska Gas Storage US LLC/Niska Gas Storage Canada ULC | | | 8.88 | | | 03/15/18 | | | 200 | | | | 195,500 | | |

| Phillips-Van Heusen Corp. | | | 7.38 | | | 05/15/20 | | | 200 | | | | 217,000 | | |

| Pittsburgh Glass Works LLC 1,3 | | | 8.50 | | | 04/15/16 | | | 200 | | | | 192,500 | | |

| Tenneco, Inc. | | | 6.88 | | | 12/15/20 | | | 200 | | | | 205,000 | | |

| Visteon Corp. 1,3 | | | 6.75 | | | 04/15/19 | | | 200 | | | | 199,500 | | |

Total Consumer Cyclical

(Cost – $1,989,399) | | | | | | | | | 2,004,250 | | |

| Consumer Non-Cyclical – 9.9% | |

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc. 1,3 | | | 8.25 | | | 01/15/19 | | | 200 | | | | 198,500 | | |

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc. | | | 9.75 | | | 03/15/20 | | | 100 | | | | 102,750 | | |

| B&G Foods, Inc. | | | 7.63 | | | 01/15/18 | | | 250 | | | | 265,625 | | |

| C&S Group Enterprises LLC 1,3 | | | 8.38 | | | 05/01/17 | | | 200 | | | | 211,000 | | |

| Iron Mountain, Inc. | | | 8.38 | | | 08/15/21 | | | 200 | | | | 213,000 | | |

| Reynolds Group Issuer LLC 1,3 | | | 9.00 | | | 04/15/19 | | | 200 | | | | 190,000 | | |

| Rite-Aid Corp. | | | 8.63 | | | 03/01/15 | | | 200 | | | | 193,000 | | |

| RSC Equipment Rental Inc./RSC Holdings III, LLC | | | 8.25 | | | 02/01/21 | | | 200 | | | | 202,500 | | |

| Service Corp. International | | | 8.00 | | | 11/15/21 | | | 200 | | | | 223,000 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

2011 Annual Report

29

BROOKFIELD HIGH YIELD FUND

Portfolio of Investments

December 31, 2011

| | | Interest

Rate | | Maturity | | Principal

Amount

(000s) | | Value

(Note 2) | |

| HIGH YIELD CORPORATE BONDS (continued) | |

| United Rentals North America, Inc. | | | 8.38 | % | | 09/15/20 | | $ | 200 | | | $ | 195,000 | | |

Total Consumer Non-Cyclical

(Cost – $1,997,806) | | | | | | | | | 1,994,375 | | |

| Energy – 11.6% | |

| BreitBurn Energy Partners LP/BreitBurn Finance Corp. | | | 8.63 | | | 10/15/20 | | | 200 | | | | 209,250 | | |

| Calfrac Holdings LP 1,3 | | | 7.50 | | | 12/01/20 | | | 200 | | | | 195,000 | | |

| Chaparral Energy, Inc. | | | 8.88 | | | 02/01/17 | | | 200 | | | | 207,000 | | |

| Consol Energy, Inc. | | | 8.25 | | | 04/01/20 | | | 200 | | | | 221,000 | | |

| Crosstex Energy LP/Crosstex Energy Finance Corp. | | | 8.88 | | | 02/15/18 | | | 200 | | | | 218,500 | | |

| Frac Tech Services LLC/Frac Tech Finance, Inc. 1,3 | | | 7.13 | | | 11/15/18 | | | 200 | | | | 209,500 | | |

| Hercules Offshore, Inc. 1,3 | | | 10.50 | | | 10/15/17 | | | 200 | | | | 194,500 | | |

| Key Energy Services, Inc. | | | 6.75 | | | 03/01/21 | | | 250 | | | | 250,000 | | |

| Linn Energy LLC/Linn Energy Finance Corp. | | | 8.63 | | | 04/15/20 | | | 200 | | | | 217,000 | | |

| Precision Drilling Corp. 2 | | | 6.63 | | | 11/15/20 | | | 200 | | | | 204,500 | | |

| Trinidad Drilling LTD 1,2,3 | | | 7.88 | | | 01/15/19 | | | 200 | | | | 206,000 | | |

Total Energy

(Cost – $2,318,123) | | | | | | | | | 2,332,250 | | |

| Finance & Investment – 1.9% | |

| Marina District Finance Co., Inc. | | | 9.88 | | | 08/15/18 | | | 200 | | | | 182,500 | | |

| Masonite International Corp. 1,2,3 | | | 8.25 | | | 04/15/21 | | | 200 | | | | 196,000 | | |

Total Finance & Investment

(Cost – $372,225) | | | | | | | | | 378,500 | | |

| Media – 3.2% | |

| Cablevision Systems Corp. | | | 8.63 | | | 09/15/17 | | | 200 | | | | 221,500 | | |

| CCO Holdings LLC/Cap Corp. | | | 8.13 | | | 04/30/20 | | | 200 | | | | 219,000 | | |

| Mediacom LLC/Mediacom Capital Corp. | | | 9.13 | | | 08/15/19 | | | 200 | | | | 212,250 | | |

Total Media

(Cost – $635,280) | | | | | | | | | 652,750 | | |

| Real Estate – 0.9% | |

Realogy Corp. 1,3

(Cost – $175,184) | | | 7.88 | | | 02/15/19 | | | 200 | | | | 174,000 | | |

| Services Cyclical – 5.5% | |

| AMC Entertainment, Inc. | | | 8.75 | | | 06/01/19 | | | 250 | | | | 258,750 | | |

| Cedar Fair LP/Canada's Wonderland Co/Magnum Management Corp. | | | 9.13 | | | 08/01/18 | | | 200 | | | | 217,500 | | |

| CityCenter Holdings LLC/CityCenter Finance Corp. 1,3 | | | 7.63 | | | 01/15/16 | | | 200 | | | | 205,000 | | |

| Harrahs Operating Escrow LLC/Harrah Escrow Corp. | | | 11.25 | | | 06/01/17 | | | 200 | | | | 212,250 | | |

| Royal Caribbean Cruises Limited 2 | | | 7.25 | | | 06/15/16 | | | 200 | | | | 215,000 | | |

Total Services Cyclical

(Cost – $1,103,977) | | | | | | | | | 1,108,500 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

Brookfield Investment Management Inc.

30

BROOKFIELD HIGH YIELD FUND

Portfolio of Investments

December 31, 2011

| | | Interest

Rate | | Maturity | | Principal

Amount

(000s) | | Value

(Note 2) | |

| HIGH YIELD CORPORATE BONDS (continued) | |

| Services Non-Cyclical – 2.1% | |

| HCA, Inc. | | | 8.00 | % | | 10/01/18 | | $ | 200 | | | $ | 211,500 | | |

| Health Management Associates, Inc. 1,3 | | | 7.38 | | | 01/15/20 | | | 200 | | | | 208,000 | | |

Total Services Non-Cyclical

(Cost – $410,434) | | | | | | | | | 419,500 | | |

| Technology & Electronics – 3.9% | |

| Coleman Cable, Inc. | | | 9.00 | | | 02/15/18 | | | 200 | | | | 198,250 | | |

| First Data Corp. 1,3 | | | 7.38 | | | 06/15/19 | | | 200 | | | | 188,000 | | |

| First Data Corp. 1,3 | | | 8.25 | | | 01/15/21 | | | 200 | | | | 179,000 | | |

| Freescale Semiconductor, Inc. 1,3 | | | 9.25 | | | 04/15/18 | | | 200 | | | | 213,750 | | |

Total Technology & Electronics

(Cost – $779,068) | | | | | | | | | 779,000 | | |

| Telecommunications – 6.8% | |

| CenturyLink, Inc. | | | 6.45 | | | 06/15/21 | | | 200 | | | | 200,368 | | |

| Cincinnati Bell, Inc. | | | 8.38 | | | 10/15/20 | | | 200 | | | | 199,500 | | |

| Citizens Communications Corp. | | | 7.13 | | | 03/15/19 | | | 200 | | | | 195,000 | | |

| inVentiv Health, Inc. 1,3 | | | 10.00 | | | 08/15/18 | | | 200 | | | | 183,000 | | |

| Lamar Media Corp. | | | 7.88 | | | 04/15/18 | | | 200 | | | | 212,000 | | |

| Sprint Nextel Corp. | | | 8.38 | | | 08/15/17 | | | 200 | | | | 179,250 | | |

| Windstream Corp. | | | 7.00 | | | 03/15/19 | | | 200 | | | | 202,000 | | |

Total Telecommunications

(Cost – $1,364,515) | | | | | | | | | 1,371,118 | | |

| Utility – 1.0% | |

Calpine Corp. 1,3

(Cost – $206,916) | | | 7.25 | | | 10/15/17 | | | 200 | | | | 210,000 | | |

Total HIGH YIELD CORPORATE BONDS

(Cost – $14,016,466) | | | | | | | | | 14,109,993 | | |

Total Investments – 70.0%

(Cost – $14,016,466) | | | | | | | | | 14,109,993 | | |

| Other Assets in Excess of Liabilities – 30.0% | | | | | | | | | 6,046,069 | | |

| TOTAL NET ASSETS – 100.0% | | | | | | | | $ | 20,156,062 | | |

See Notes to Portfolios of Investments and Notes to Financial Statements.

2011 Annual Report

31

BROOKFIELD HIGH YIELD FUND

Notes to Portfolio of Investments

December 31, 2011

The following notes should be read in conjunction with the accompanying Portfolio of Investments.

1 — Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold in transactions exempt from registration, normally to qualified institutional buyers. As of December 31, 2011, the total value of all such investments was $4,174,500 or 20.7% of net assets.

2 — Foreign security or a U.S. security of a foreign company.

3 — Private Placement.

See Notes to Financial Statements.

Brookfield Investment Management Inc.

32

BROOKFIELD INVESTMENT FUNDS

Statements of Assets and Liabilities

December 31, 2011

| | | Brookfield

Global Listed

Real Estate

Fund | | Brookfield

Global Listed

Infrastructure

Fund | | Brookfield

High Yield

Fund | |

| Assets: | |

| Investments in securities, at value (Note 2) | | $ | 4,949,297 | | | $ | 11,961,567 | | | $ | 14,109,993 | | |

| Cash | | | 20,149 | | | | 7,378,160 | | | | 5,980,928 | | |

| Foreign currency | | | — | | | | 79,278 | | | | — | | |

| Net receivable from advisor (Note 4) | | | 100,941 | | | | 81,904 | | | | 77,979 | | |

| Interest and dividends receivable | | | 21,628 | | | | 11,636 | | | | 298,054 | | |

| Receivable for investments sold | | | — | | | | 107,484 | | | | — | | |

| Deferred offering costs | | | 53,251 | | | | 53,251 | | | | 52,537 | | |

| Prepaid expenses | | | 59,217 | | | | 59,217 | | | | 59,217 | | |

| Total assets | | | 5,204,483 | | | | 19,732,497 | | | | 20,578,708 | | |

| Liabilities: | |

| Payable for investments purchased | | | — | | | | 7,167,137 | | | | 281,350 | | |

| Distribution fee payable | | | — | | | | 31 | | | | — | | |

| Accrued organizational costs | | | 13,750 | | | | 13,750 | | | | 13,750 | | |

| Deferred offering costs | | | 55,609 | | | | 55,610 | | | | 54,895 | | |

| Accrued expenses | | | 82,008 | | | | 63,964 | | | | 72,651 | | |

| Total liabilities | | | 151,367 | | | | 7,300,492 | | | | 422,646 | | |

| Net Assets | | $ | 5,053,116 | | | $ | 12,432,005 | | | $ | 20,156,062 | | |

| Composition of Net Assets: | |

| Paid in capital (Note 6) | | $ | 5,042,232 | | | $ | 12,325,731 | | | $ | 20,062,535 | | |

| Distributions in excess of net investment income | | | (4,135 | ) | | | (80 | ) | | | — | | |

Acumulated net realized gain on investment transactions and foreign

currency translations | | | — | | | | 3,926 | | | | — | | |

Net unrealized appreciation on investment transactions and foreign currency

translations | | | 15,019 | | | | 102,428 | | | | 93,527 | | |

| Net assets applicable to capital stock outstanding | | $ | 5,053,116 | | | $ | 12,432,005 | | | $ | 20,156,062 | | |

| Total investments at cost | | $ | 4,934,372 | | | $ | 11,852,275 | | | $ | 14,016,466 | | |

| Foreign currency at cost | | $ | — | | | $ | 79,330 | | | $ | — | | |

| Net Assets | |

| Class A Shares – Net Assets | | | | | | $ | 2,302,479 | | |

| Shares outstanding | | | N/A | | | | 226,925 | | | | N/A | | |

| Net asset value and redemption price per share | | | N/A | | | $ | 10.15 | | | | N/A | | |

| Offering price per share based on a maximum sales charge of 4.75% | | | N/A | | | $ | 10.65 | | | | N/A | | |

| Class Y Shares – Net Assets | | $ | 12,570 | | | $ | 12,694 | | | $ | 12,592 | | |

| Shares outstanding | | | 1,255 | | | | 1,251 | | | | 1,253 | | |

| Net asset value and redemption price per share | | $ | 10.02 | | | $ | 10.15 | | | $ | 10.05 | | |

| Class I Shares – Net Assets | | $ | 5,040,546 | | | $ | 10,116,832 | | | $ | 20,143,470 | | |

| Shares outstanding | | | 503,188 | | | | 996,985 | | | | 2,004,989 | | |

| Net asset value and redemption price per share | | $ | 10.02 | | | $ | 10.15 | | | $ | 10.05 | | |

See Notes to Financial Statements.

2011 Annual Report

33

BROOKFIELD INVESTMENT FUNDS

Statements of Operations

For the Period December 1, 20111 through December 31, 2011

| | | Brookfield

Global Listed

Real Estate

Fund | | Brookfield

Global Listed

Infrastructure

Fund | | Brookfield

High Yield

Fund | |

| Investment Income (Note 2): | |

| Interest | | $ | — | | | $ | — | | | $ | 73,214 | | |