UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22558

BROOKFIELD INVESTMENT FUNDS

(Exact name of registrant as specified in charter)

BROOKFIELD PLACE

250 VESEY STREET

NEW YORK, NEW YORK 10281-1023

(Address of principal executive offices) (Zip code)

KIM G. REDDING, PRESIDENT

BROOKFIELD INVESTMENT FUNDS

BROOKFIELD PLACE

250 VESEY STREET

NEW YORK, NEW YORK 10281-1023

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 497-3746

Date of fiscal year end: December 31, 2012

Date of reporting period: December 31, 2012

Item 1. Reports to Shareholders.

IN PROFILE

Brookfield is a global alternative asset manager with approximately $175 billion in assets under management as of December 31, 2012. We have over a 100-year history of owning and operating assets with a focus on property, renewable power, infrastructure and private equity. We offer a range of public and private investment products and services, which leverage our expertise and experience and provide us with a distinct competitive advantage in the markets where we operate. On behalf of our clients, Brookfield is also an active investor in the public securities markets, where our experience extends over 30 years. Over this time, we have successfully developed several investment operations and built expertise in the management of institutional portfolios, retail mutual funds, and structured product investments.

Through our registered investment advisor, Brookfield Investment Management Inc., our public market activities complement our core competencies as a direct investor. These activities encompass global listed real estate and infrastructure equities, corporate high yield investments, opportunistic credit strategies and a dedicated insurance asset management division. Headquartered in New York, NY, Brookfield Investment Management Inc. maintains offices and investment teams in Toronto, Chicago, Boston and London.

This report is for shareholder information. This is not a prospectus intended for the use in the purchase or sale of Fund shares.

| | | | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | | NOT BANK GUARANTEED | |

© Copyright 2012. Brookfield Investment Management Inc.

LETTER TO SHAREHOLDERS

Dear Shareholders,

I am pleased to provide the Annual Report for Brookfield Global Listed Real Estate Fund (the “Real Estate Fund”), Brookfield Global Listed Infrastructure Fund (the “Infrastructure Fund”) and Brookfield High Yield Fund (the “High Yield Fund”) (each a “Fund” and, collectively, the “Funds”) for the year ended December 31, 2012.

Despite ongoing macroeconomic volatility and political uncertainty, global capital markets generally experienced positive results during 2012. Investor confidence improved as the year progressed, due in large part to meaningful central bank activity around the world. Further momentum was provided by signs of stabilization within the global economy, as the U.S. housing market continued to heal, sovereign debt concerns in Europe began to subside, and evidence of stability emerged in China. With liquidity continuing to flood the market and interest rates remaining near historic lows, risk tolerance levels began to increase once again.

Within this environment, demand for income-producing asset classes with upside growth potential began to accelerate. In particular, real estate and infrastructure equities produced attractive returns, as investors sought the unique combination of yield, stability and growth offered by these securities. Similarly, high yield corporate bonds provided impressive returns, as strong corporate credit and liquidity as well as attractive spreads led to continued demand for the asset class.

Moving forward, we expect demand for higher-yielding investments to remain strong, particularly as interest rates and inflation remain muted. We maintain our positive outlook for real estate and infrastructure equities, both of which offer bond-like current income, relatively stable cash flows and equity return potential. Additionally, we anticipate demand for Real Assets to accelerate in the near term, as investors recognize the portfolio benefits of increased allocations to the asset class. The public markets offer a highly liquid and transparent means of achieving these allocations, which should directly benefit public real estate and infrastructure securities.

Furthermore, we continue to believe that high yield bonds represent an attractive investment option, as robust corporate cash flows, stable interest rates and solid credit discipline remain supportive of the market. We acknowledge potential challenges to future performance, from uncertain fiscal policy in the U.S. to low nominal yields and above par pricing in the high yield market. However, yield spreads remain attractive and corporate earnings are generally positive, suggesting high yield bonds continue to be a compelling source of stability and yield.

In addition to performance information, this report provides the Funds’ audited financial statements including the schedules of investments as of December 31, 2012.

We welcome your questions and comments, and encourage you to contact our Investor Relations team at (800) 497-3746 or visit us at www.brookfieldim.com for more information. Thank you for your support.

Sincerely,

Kim G. Redding

President

2012 Annual Report

1

LETTER TO SHAREHOLDERS (continued)

The Dow Jones Brookfield Global Infrastructure Composite Index was created on July 1, 2008 and is comprised of infrastructure companies with at least 70% of its annual cash flows derived from owning and operating infrastructure assets. The Index is maintained by Dow Jones Indexes. The Index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

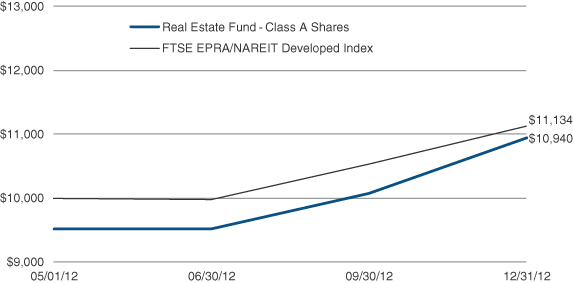

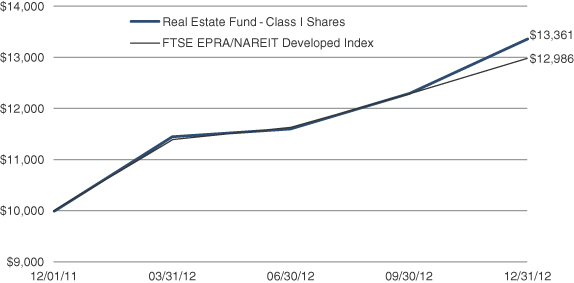

The FTSE EPRA/NAREIT Developed Index is calculated by the FTSE Group. Performance is calculated by price, total return and net total return and the Index is calculated daily. Constituents must meet minimum market capitalization, liquidity requirements, and real estate activity requirements in order to be included within the Index. North American and Asian companies must be of a minimum of US$200 million in market capitalization with liquidity of US$100 million. European companies are bound by US$50 million market cap minimum and liquidity of US$25 million. The Index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

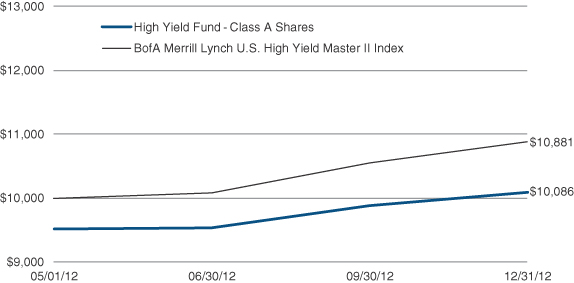

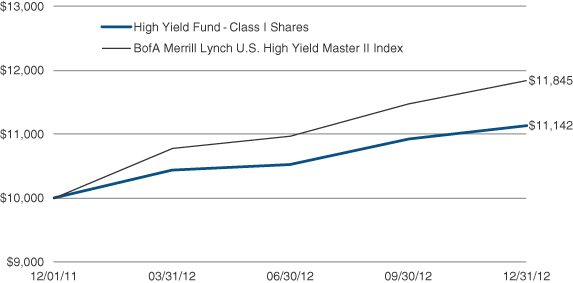

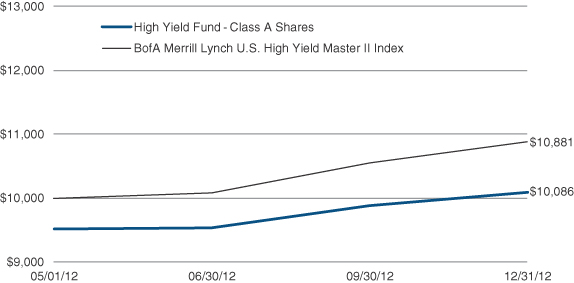

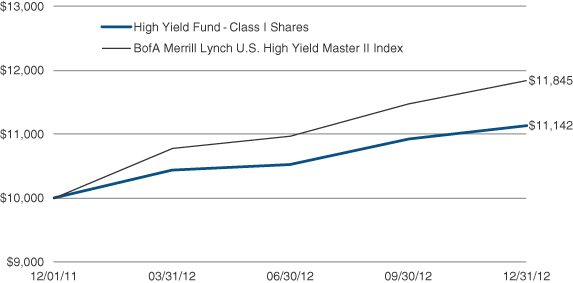

The BofA Merrill Lynch U.S. High Yield Master II Index is an unmanaged index that tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2012 and subject to change based on subsequent developments.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in infrastructure entities involve greater exposure to the potential adverse economic, regulatory, political and other changes affecting such entities. Investment in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of, such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods.

Quasar Distributors, LLC is the distributor of Brookfield Investment Funds.

Brookfield Investment Management Inc.

2

ABOUT YOUR FUND’S EXPENSES

As a shareholder of a fund, you may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends or other distributions, redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Fund Return

The table below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitles “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The table below also provides information about hypothetical account values and hypothetical expenses, which are based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and the other funds. To do so, compare this 5% hypothetical example with hypothetical examples that appear in shareholders’ reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the hypothetical account values and expenses in the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs overall would have been higher.

| | | | | | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account Value

(07/01/12) | | | Ending

Account Value

(12/31/12) | | | Expense

Paid During

Period(1)

(07/01/12-

12/31/12) | |

| | | | |

REAL ESTATE FUND | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.20 | % | | $ | 1,000 | | | $ | 1,150 | | | $ | 6.48 | |

Class C Shares | | | 1.95 | % | | | 1,000 | | | | 1,147 | | | | 10.52 | |

Class Y Shares | | | 0.95 | % | | | 1,000 | | | | 1,151 | | | | 5.14 | |

Class I Shares | | | 0.95 | % | | | 1,000 | | | | 1,151 | | | | 5.14 | |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.20 | % | | | 1,000 | | | | 1,019 | | | | 6.09 | |

Class C Shares | | | 1.95 | % | | | 1,000 | | | | 1,015 | | | | 9.88 | |

Class Y Shares | | | 0.95 | % | | | 1,000 | | | | 1,020 | | | | 4.82 | |

Class I Shares | | | 0.95 | % | | | 1,000 | | | | 1,020 | | | | 4.82 | |

2012 Annual Report

3

ABOUT YOUR FUND’S EXPENSES (continued)

| | | | | | | | | | | | | | | | |

| | | Annualized

Expense

Ratio | | | Beginning

Account Value

(07/01/12) | | | Ending

Account Value

(12/31/12) | | | Expense

Paid During

Period(1)

(07/01/12-

12/31/12) | |

| | | | |

INFRASTRUCTURE FUND | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.35 | % | | $ | 1,000 | | | $ | 1,097 | | | $ | 7.12 | |

Class C Shares | | | 2.10 | % | | | 1,000 | | | | 1,092 | | | | 11.04 | |

Class Y Shares | | | 1.10 | % | | | 1,000 | | | | 1,098 | | | | 5.80 | |

Class I Shares | | | 1.10 | % | | | 1,000 | | | | 1,098 | | | | 5.80 | |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.35 | % | | | 1,000 | | | | 1,018 | | | | 6.85 | |

Class C Shares | | | 2.10 | % | | | 1,000 | | | | 1,015 | | | | 10.63 | |

Class Y Shares | | | 1.10 | % | | | 1,000 | | | | 1,020 | | | | 5.58 | |

Class I Shares | | | 1.10 | % | | | 1,000 | | | | 1,020 | | | | 5.58 | |

| | | | |

HIGH YIELD FUND | | | | | | | | | | | | | | | | |

Actual | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.10 | % | | $ | 1,000 | | | $ | 1,057 | | | $ | 5.69 | |

Class C Shares | | | 1.85 | % | | | 1,000 | | | | 1,053 | | | | 9.55 | |

Class Y Shares | | | 0.85 | % | | | 1,000 | | | | 1,058 | | | | 4.40 | |

Class I Shares | | | 0.85 | % | | | 1,000 | | | | 1,058 | | | | 4.40 | |

Hypothetical (assuming a 5% return before expenses) | | | | | | | | | | | | | | | | |

Class A Shares | | | 1.10 | % | | | 1,000 | | | | 1,020 | | | | 5.58 | |

Class C Shares | | | 1.85 | % | | | 1,000 | | | | 1,016 | | | | 9.37 | |

Class Y Shares | | | 0.85 | % | | | 1,000 | | | | 1,021 | | | | 4.32 | |

Class I Shares | | | 0.85 | % | | | 1,000 | | | | 1,021 | | | | 4.32 | |

| (1) | Expenses are equal to the Funds’ annualized expense ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect a six-month period). |

Brookfield Investment Management Inc.

4

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

PORTFOLIO STRATEGY

Individual contributors to performance included Lennar Corp., SOHO China Ltd. and Brookdale Senior Living, Inc. The Fund’s non-benchmark exposure to Lennar Corp. was a key positive in 2012. The company benefited from an improving U.S. housing market all year. U.S. homebuilders were up significantly in the year outperforming all other property sectors in which we invest.

The Fund’s overweight in SOHO China Ltd. was another positive driver of performance. A recent bond issuance at good pricing and the overall rebound in China’s economy drove outperformance in the year.

Non-benchmark exposure to Brookdale Senior Living contributed to relative performance of the Fund. Healthcare operators specializing in private pay facilities were strong this year due to (i) the aging population in the U.S., (ii) attractive supply fundamentals and (iii) uncertainty surrounding the U.S. government’s Medicare reimbursements. In addition, Brookdale Senior Living rallied strongly late in the year on rumors that the company may pursue a restructuring into a REIT or Operating Company/Property Company.

Detractors to performance included Sumitomo Realty & Development Co. Ltd., Camden Property Trust and Wharf Holdings. Japanese developers as a whole were strong in 2012 due to expectations for a potential decline in vacancy rates in 2013 as well as the government’s focus on improving the Japanese economy. As a result, the Fund’s zero weight to Sumitomo Realty & Development Co. Ltd. detracted from relative performance. We favor other Japanese developers with strong performance and lower leverage levels on their balance sheets.

An overweight position in Camden Property Trust detracted from Fund performance in 2012. Notwithstanding generally good fundamentals, the U.S. residential sector was weak in the year on fears that apartment occupancy and rent growth may fall as home ownership rises in light of a U.S. housing market that has clearly bottomed.

The Fund’s zero weight in Wharf Holdings detracted from performance as Hong Kong retail fundamentals accelerated quickly in 2012 due to the rebound in China’s economy.

GLOBAL REAL ESTATE MARKET OVERVIEW AND OUTLOOK

Global equity markets ended 2012 with another quarter of positive performance. The MSCI World Index (“Broad Equity Markets”) closed the fourth quarter up 2.6%, finishing the 12 month period up 16.5%. Like recent years preceding 2012, we saw a number of dramatic (albeit less severe) ups and downs in global equity markets caused by shifting investor confidence in the global macroeconomic recovery. We saw the strongest first quarter in over a decade (+11.7%) and wide-reaching investor confidence give way to a strongly negative second quarter (-4.9%) on worsening fears of the European crisis and contagion.

However, some stability emerged in the second half of the year as continued macroeconomic weakness drove corresponding actions by governments and central banks worldwide. In particular, central bank announcements in September created positive momentum in equity markets. Ben Bernanke and the U.S. Federal Reserve announced third round Quantitative Easing (QE3), pledging up to US$40 billion per month to buy mortgage-backed securities until the U.S. labor market improves. Across the pond, the European Central Bank (ECB) pledged a new and potentially unlimited short dated government bond-buying program coined Outright Monetary Transactions or “OMT” to reduce yields on European sovereign debt to strengthen sovereign balance sheets.

As the year came to a close positive drivers of investor sentiment included continual improvement in the U.S. housing market, evidence of economic stability in China, enthusiasm over the outcome of the Japanese election, and a Europe region that appears to be gradually stabilizing. These developments countered the two week selloff following the U.S. presidential election as well as fears of the U.S. fiscal cliff. A deal to address taxes was reached on January 1 as part of the fiscal cliff negotiations, leading markets sharply higher in the New Year.

Property securities closed 2012 ahead of broad equity markets, up 5.8% in the fourth quarter and 28.7% in the year as measured by the FTSE EPRA/NAREIT Developed Index (the “Index”). This represents a 12% one year outperformance over Broad Equity Markets. We believe strength among real estate securities reflects strong

2012 Annual Report

5

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

underlying property fundamentals as well as investors’ demand for yield in a low rate environment. Furthermore, we believe portfolio allocations will begin to shift from bonds to equities, which should benefit real asset securities such as REITs as they generally exhibit an attractive mix of bond-like yields with equity returns. Also, publicly traded real estate companies generally maintain an advantage in their ability to access inexpensive capital, fueling accretive property acquisitions.

U.S. housing fundamentals improve

Commercial real estate in 2012 was impacted by an improving U.S. housing market. Inventory is at historically low levels with net absorption (or sales net of cancellations) up materially throughout 2012 according to Zelman & Associates. Prices are on the rise as well and are up 7.4% including distressed sales year over year according to the CoreLogic Home Price Index as of November 30, 2012. Along with publicly listed homebuilders, this continued improvement in the housing market benefitted industries like timber that are correlated to U.S. housing. These sectors outperformed in 2012, with timber REITs up 37.0% as measured by the FTSE NAREIT All Equity REITs Index and homebuilders up 97.2% as measured by the International Securities Exchange Homebuilders Index. Conversely, apartments were under pressure this year on fears that apartment occupancy and rent growth may fall as home ownership rises in light of a U.S. housing market that has clearly bottomed. The group was up 6.9% this year as measured by the FTSE NAREIT All Equity REITs Index, making apartments the weakest performing U.S. real estate sector by far. In light of favorable apartment demographics, we view weakness as a buying opportunity.

Ample and cheap capital fuels real estate securities

REITs capitalized on the low interest rate environment to strengthen balance sheets and fund acquisitions and capital expenditures. Across the globe, REITs exhibited their ability to tap public equity and debt markets all year. This included the following key examples:

| – | | Hong Kong property companies issuing debt and accessing the U.S. dollar market. This included Wharf (Holdings) Ltd., which issued US$600 million at a 4.735% yield, upsized from US$500 million due to strong demand and Sun Hung Kai, which priced a US$500 million 10-year bond at Treasuries plus 270 basis points for a 4.50% coupon. |

| – | | General Growth Properties (GGP), a U.S. regional mall REIT, refinanced $3.1 billion of debt with a weighted average term of 9 years (up from a remaining term-to-maturity of 3.9 years) and a weighted average rate of 4.20% (down from a rate of 5.24%). The company was among the hardest hit during the 2008 global financial crisis, illustrating the foothold REITs have in their continued recovery. |

| – | | European real estate companies have continued to issue debt to shore up balance sheets amid ongoing volatility, particularly following the ECB announcement in early September. Unibail-Rodamco SE issued a six year €750 million bond with a fixed coupon of 2.25% in order to address its financing needs, including current and future development projects. The issuance was successful and was four times oversubscribed. Klepierre issued a seven year €500 million bond with a 2.75% coupon. This issuance was almost six times oversubscribed. |

| – | | Simon Property Group (SPG), the largest and generally considered one of the highest quality REITs globally, issued US$500 million of 10 year senior unsecured notes at a 2.75% coupon and US$750 million of five year notes at a 1.50% coupon. According to SPG, there was US$4 billion of demand for the notes and “the coupons…represent the lowest rates ever achieved for 10 year and 5 year bonds issued by a real estate investment trust.” |

We believe ongoing issuance and refinancing are a distinct competitive advantage for listed property companies versus their private market peers. Furthermore, many companies are now seeking to gain access to this capital by seeking IPOs and REIT conversions.

IPOs and REIT conversions abound as companies seek to capitalize on real estate rebound

We saw a flurry of REIT IPOs and REIT conversions late in 2012. Global Logistics Properties Ltd. (GLP) launched a successful approximately US$1 billion JREIT IPO in the fourth quarter. GLP is a unit of the Government of Singapore Investment Corp and is now one of the largest industrial JREITs owning 30 properties valued at over

Brookfield Investment Management Inc.

6

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

US$2.6 billion. Mexican REITs continued to list IPOs this year including hotel owner Concentradora Fibra Hotelera Mexicana SA and industrial REIT Macquarie Mexico Real Estate Management. We are positive on Mexican real estate for a number of reasons including the country’s strong industrial production, strategic export location bordering the U.S. and two oceans, and a strong and competitive labor market.

2012 also brought the conversion of two U.S. single family homes for rent companies into REITs. The first was American Homes for Rent in November, which is a private REIT and may list in 2013, followed by Silver Bay Realty Trust (SBY) in December. SBY is the first publicly traded single family home REIT and sold 13.25 million shares for $18.50 per share. Both conversions follow Iron Mountain, Inc. (IRM), a document storage company, which filed documentation to convert to a REIT during the third quarter.

Property transactions illustrate stable fundamentals

A number of large scale property transactions occurred among listed real estate companies in 2012. In many cases, we have seen transaction cap rates reaching lows not seen in a number of years. Important transactions in 2012 include:

| – | | Simon Property Group (SPG) announced two substantial deals, increasing its asset base in accretive transactions. First, SPG announced the acquisition of a 28.7% equity stake in French retail REIT Klepierre (LI) from BNP Paribas for approximately US$2 billion. SPG also announced the acquisition of its partner’s interest in 26 retail assets of “The Mills,” a joint venture between SPG and Farallon Capital Management, L.L.C. in a transaction valued at US$1.5 billion. |

| – | | In Australia, Lend Lease Group (LLC:AU) announced that it secured funding of A$2 billion for the first of two commercial office towers at Barangaroo South, near Sydney’s central business district. Canada Pension Plan Investment Board committed A$1 billion, Lend Lease-managed Australian Prime Property Fund Commercial and two of its investors have committed A$500 million, and Lend Lease will invest A$500 million. |

| – | | Health Care REIT (HCN) announced it has entered into a definitive agreement to acquire healthcare owner/operator Sunrise Senior Living, Inc. (SRZ) for approximately US$950 million in cash and will assume SRZ’s existing debt at an average interest rate of approximately 4.9%. The purchase price of US$14.50 per share represents a significant premium to SRZ’s prior close. |

| – | | Equity Residential (EQR) and AvalonBay Communities, Inc. (AVB) agreed to buy Archstone from Lehman Brothers for US$16 billion dollars. EQR and AVB are the two largest apartment REITs in the U.S. and the transaction, which is expected to close in the first quarter of 2013, makes them even larger. Under the terms of the deal, EQR will acquire 60% and AVB will acquire 40% of Archstone’s multifamily assets, which include 45,000 units across high barrier to entry markets in the U.S. |

| – | | Australian Dexus Property Group (DXS) sold most of its U.S. industrial portfolio at an approximately 10% premium to book value. Pricing on the transactions is unsurprising given 2012 was a huge year for industrial companies, which were up 40.6% globally as measured by the Index. |

| – | | ProLogis completed a 50/50 joint venture partnership with Norges Bank Investment Management to invest in a European industrial portfolio. The equity commitment equals €2.4 billion, with €1.2 billion contributions from both parties. |

OUTLOOK

As we look ahead to 2013, we believe hurdles to global macroeconomic stability will persist. While the U.S. Congress tackled one part of the fiscal cliff problem, many investors believe the most difficult negotiations to cut spending and reduce the U.S. deficit are yet to come. In addition, Southern Europe remains challenged. We believe the real estate securities asset class is poised to continue to perform well in this environment. Investor demand for bonds is expected to shift to equities over the medium term. As described above, the real estate securities asset class continues to benefit from favorable access to capital with low cost debt fueling accretive property acquisitions. New supply remains at historical lows providing a strong foundation for real estate fundamentals. Further, we anticipate demand will slowly begin to improve as unemployment falls. However, we are monitoring the possibility of rising long term interest rates, which would likely create short term headwinds for the real estate securities asset class.

2012 Annual Report

7

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Macro indicators have improved in the Asia Pacific region. The election of Mr. Shinzo Abe as Japan’s new prime minister and the change in government in China are both believed to be “market friendly” transitions. Mr. Abe is espousing aggressive easing policies and set a 2% inflation target to break Japan’s characteristic low growth, deflationary market environment. This coincides with what we believe is a favorable point in the property market cycle where new supply is low and demand is improving. We acknowledge a number of Japanese office towers are under construction, but it will take several years for this new construction to impact market vacancy numbers due to the earthquake resistant building requirements. The new Chinese leadership generally appears to support reforms leading to more liberalization in the marketplace. And while we believe policies to avoid a housing bubble will remain in place, new tightening policies are now less likely. Indicatively, land sale volumes have increased and prices in the housing market are firming. In Hong Kong, where valuations are richer, we favor office companies. Concerns over significant financial company layoffs and consequent decreasing rental rates and increasing vacancy appear to have been overblown.

London remains a bright spot in Europe. Pricing remains strong and we are seeing buyers from all corners of the globe investing in real estate. In the fourth quarter, sovereign wealth funds from Malaysia and Azerbaijan were the latest groups to make significant investments in the city.

A key portfolio thematic within the portfolio’s U.S. exposure remains housing related sectors (homebuilders, timber). We have modestly trimmed our timber exposure on announcements that mills are increasing output in 2013 and beyond, which led lumber futures to rally strongly and we believe this fervor may cool. We brought portfolio exposure to a slight overweight to the apartment sector relative to the Index. Given significant outperformance among industrial companies globally in 2012, we sold out of the sector to take profits as valuations reached our targets.

Brookfield Investment Management Inc.

8

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| As of December 31, 2012 | | 1 Year | | | Since

Inception* | |

Class A Shares (excluding sales charge) | | | N/A | | | | 14.89% | |

Class A Shares (including sales charge) | | | N/A | | | | 9.40% | |

Class C Shares | | | N/A | | | | 14.39% | |

Class Y Shares | | | 32.93% | | | | 30.71% | |

Class I Shares | | | 32.83% | | | | 30.62% | |

FTSE EPRA/NAREIT Developed Index | | | 28.65% | | | | 11.34% | |

| * | Classes A and C were incepted on April 30, 2012 and Classes Y and I were incepted on November 30, 2011. The FTSE/EPRA NAREIT Developed Index references Class A’s inception date. |

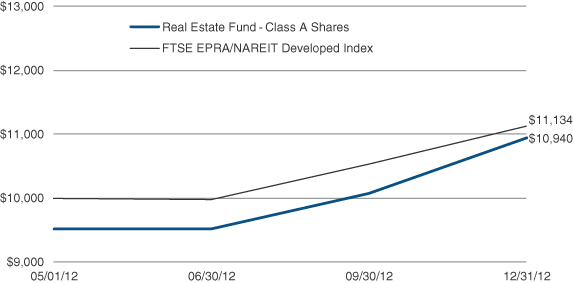

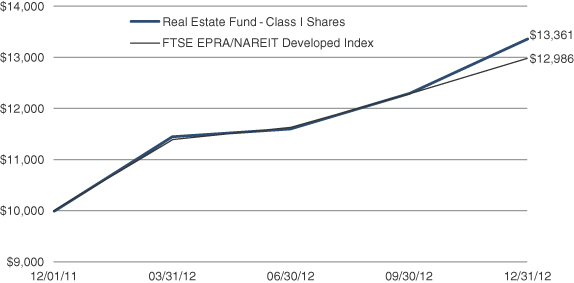

The graphs below illustrate a hypothetical investment of $10,000 in the Real Estate Fund — Class A Shares from the commencement of investment operations on May 1, 2012 to December 31, 2012 compared to the FTSE EPRA/NAREIT Developed Index and Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2012 compared to the FTSE EPRA/NAREIT Developed Index.

Class A Shares

2012 Annual Report

9

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Class I Shares

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days. Performance data does not reflect the imposition of the redemption fee and if it had, performance would have been lower.

Based on Class A Shares, the Fund’s gross expense ratio is 2.54% and the net expense ratio is 1.23%. The Adviser has contractually agreed to waive fees and/or reimburse Fund expenses through May 1, 2013. There is no guarantee that such waiver/reimbursement will be continued after that date.

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Brookfield Global Listed Real Estate Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of Fund holdings.

Mutual fund investing involves risk. Principal loss is possible.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

Brookfield Investment Management Inc.

10

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

The FTSE EPRA/NAREIT Developed Index is calculated by the FTSE Group. Performance is calculated by price, total return and net total return and the Index is calculated daily. Constituents must meet minimum market capitalization, liquidity requirements, and real estate activity requirements in order to be included within the Index. North American and Asian companies must be of a minimum of US$200 million in market capitalization with liquidity of US$100 million. European companies are bound by US$50 million market cap minimum and liquidity of US$25 million. The Index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

The FTSE NAREIT All Equity REITs Index contains all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria.

The International Securities Exchange Homebuilders Index includes residential construction companies and prefabricated house manufacturers.

Beta is a measure of volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. Correlation is a statistical measure of how two securities move in relation to each other.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2012 and subject to change based on subsequent developments.

2012 Annual Report

11

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Portfolio Characteristics (Unaudited)

December 31, 2012

| | |

| ASSET ALLOCATION BY GEOGRAPHY | | Percent of

Net Assets |

United States | | 47.0% |

Japan | | 10.2% |

Australia | | 8.1% |

Hong Kong | | 7.3% |

United Kingdom | | 5.4% |

China | | 4.1% |

Singapore | | 3.8% |

France | | 2.4% |

Norway | | 2.0% |

Germany | | 1.5% |

Canada | | 1.4% |

Russia | | 1.4% |

Austria | | 1.0% |

Italy | | 1.0% |

Other Assets in Excess of Liabilities | | 3.4% |

Total | | 100.0% |

ASSET ALLOCATION BY SECTOR

| | |

Diversified | | 20.4% |

Office | | 17.0% |

Retail | | 11.0% |

Residential | | 10.3% |

Self Storage | | 8.5% |

Regional Malls | | 7.2% |

Mixed | | 4.0% |

Real Estate Operator / Developer | | 3.6% |

Healthcare | | 3.5% |

Homebuilders | | 2.9% |

Hotel | | 2.9% |

Manufactured Homes | | 1.9% |

Strip Centers | | 1.7% |

Timber | | 1.5% |

Diversified Real Estate / Land | | 0.2% |

Other Assets in Excess of Liabilities | | 3.4% |

Total | | 100.0% |

| | |

| TOP TEN HOLDINGS | | |

Public Storage | | 4.9% |

Simon Property Group, Inc. | | 4.9% |

Westfield Group | | 4.3% |

Hongkong Land Holdings Ltd. | | 3.9% |

Mitsui Fudosan Company Ltd. | | 3.6% |

Mitsubishi Estate Company Ltd. | | 3.6% |

AvalonBay Communities, Inc. | | 2.9% |

SOHO China Ltd. | | 2.6% |

Kilroy Realty Corp. | | 2.5% |

Iron Mountain, Inc. | | 2.4% |

Brookfield Investment Management Inc.

12

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS – 96.6% | | | | | | | | |

AUSTRALIA – 8.1% | | | | | | | | |

Diversified – 1.9% | | | | | | | | |

Dexus Property Group 1

(Cost $646,121) | | | 677,800 | | | $ | 719,898 | |

| | | | | | | | |

Retail – 6.2% | | | | | | | | |

Westfield Group 1 | | | 146,600 | | | | 1,619,036 | |

Westfield Retail Trust | | | 232,000 | | | | 731,954 | |

| | | | | | | | |

Total Retail

(Cost $2,041,057) | | | | | | | 2,350,990 | |

Total AUSTRALIA

(Cost $2,687,178) | | | | | | | 3,070,888 | |

AUSTRIA – 1.0% | | | | | | | | |

Residential – 1.0% | | | | | | | | |

Conwert Immobilien Invest SE 1

(Cost $347,322) | | | 28,800 | | | | 372,684 | |

Total AUSTRIA

(Cost $347,322) | | | | | | | 372,684 | |

CANADA – 1.4% | | | | | | | | |

Residential – 1.4% | | | | | | | | |

Boardwalk Real Estate Investment Trust 1

(Cost $501,091) | | | 8,300 | | | | 538,453 | |

Total CANADA

(Cost $501,091) | | | | | | | 538,453 | |

CHINA – 4.1% | | | | | | | | |

Diversified – 1.0% | | | | | | | | |

KWG Property Holding Ltd. 1

(Cost $366,909) | | | 510,400 | | | | 391,912 | |

| | | | | | | | |

Homebuilders – 0.5% | | | | | | | | |

Evergrande Real Estate Group Ltd. 1

(Cost $184,359) | | | 348,700 | | | | 196,687 | |

| | | | | | | | |

Real Estate Operator/Developer – 2.6% | | | | | | | | |

SOHO China Ltd. 1

(Cost $797,263) | | | 1,185,396 | | | | 963,894 | |

Total CHINA

(Cost $1,348,531) | | | | | | | 1,552,493 | |

FRANCE – 2.4% | | | | | | | | |

Diversified – 1.4% | | | | | | | | |

Unibail-Rodamco SE 1

(Cost $430,472) | | | 2,200 | | | | 533,510 | |

| | | | | | | | |

Retail – 1.0% | | | | | | | | |

Mercialys SA 1

(Cost $337,372) | | | 16,000 | | | | 363,378 | |

Total FRANCE

(Cost $767,844) | | | | | | | 896,888 | |

See Notes to Financial Statements.

2012 Annual Report

13

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

GERMANY – 1.5% | | | | | | | | |

Office – 1.5% | | | | | | | | |

Alstria Office REIT-AG 1

(Cost $498,489) | | | 44,900 | | | $ | 548,271 | |

Total GERMANY

(Cost $498,489) | | | | | | | 548,271 | |

HONG KONG – 7.3% | | | | | | | | |

Diversified – 2.4% | | | | | | | | |

Sun Hung Kai Properties Ltd. 1

(Cost $780,825) | | | 60,151 | | | | 912,204 | |

| | | | | | | | |

Office – 3.9% | | | | | | | | |

Hongkong Land Holdings Ltd. 1

(Cost $1,284,430) | | | 207,652 | | | | 1,466,618 | |

| | | | | | | | |

Retail – 1.0% | | | | | | | | |

Hang Lung Properties Ltd. 1

(Cost $344,659) | | | 91,701 | | | | 369,043 | |

Total HONG KONG

(Cost $2,409,914) | | | | | | | 2,747,865 | |

ITALY – 1.0% | | | | | | | | |

Office – 1.0% | | | | | | | | |

Beni Stabili SpA 1

(Cost $332,472) | | | 624,000 | | | | 367,694 | |

Total ITALY

(Cost $332,472) | | | | | | | 367,694 | |

JAPAN – 10.2% | | | | | | | | |

Diversified – 4.7% | | | | | | | | |

Hulic Company Ltd. 1 | | | 62,400 | | | | 423,378 | |

Mitsui Fudosan Company Ltd. 1 | | | 54,800 | | | | 1,340,577 | |

| | | | | | | | |

Total Diversified

(Cost $1,473,010) | | | | | | | 1,763,955 | |

| | | | | | | | |

Diversified Real Estate/Land – 0.2% | | | | | | | | |

GLP J-Reit 1,2

(Cost $72,729) | | | 100 | | | | 76,413 | |

| | | | | | | | |

Office – 5.3% | | | | | | | | |

Japan Real Estate Investment Corp. 1 | | | 68 | | | | 669,945 | |

Mitsubishi Estate Company Ltd. 1 | | | 55,955 | | | | 1,339,602 | |

| | | | | | | | |

Total Office

(Cost $1,627,347) | | | | | | | 2,009,547 | |

Total JAPAN

(Cost $3,173,086) | | | | | | | 3,849,915 | |

See Notes to Financial Statements.

Brookfield Investment Management Inc.

14

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

NORWAY – 2.0% | | | | | | | | |

Diversified – 2.0% | | | | | | | | |

Norwegian Property ASA 1

(Cost $715,733) | | | 489,900 | | | $ | 758,457 | |

Total NORWAY

(Cost $715,733) | | | | | | | 758,457 | |

POLAND – 1.4% | | | | | | | | |

Retail – 1.4% | | | | | | | | |

Atrium European Real Estate Ltd. 1

(Cost $474,603) | | | 93,000 | | | | 547,304 | |

Total POLAND

(Cost $474,603) | | | | | | | 547,304 | |

SINGAPORE – 3.8% | | | | | | | | |

Diversified – 2.0% | | | | | | | | |

CapitaLand Ltd. 1

(Cost $612,511) | | | 240,300 | | | | 739,670 | |

| | | | | | | | |

Hotel – 0.9% | | | | | | | | |

Overseas Union Enterprise Ltd. 1

(Cost $296,668) | | | 156,000 | | | | 357,691 | |

| | | | | | | | |

Regional Malls – 0.9% | | | | | | | | |

CapitaMalls Asia Ltd. 1

(Cost $295,842) | | | 219,168 | | | | 352,982 | |

Total SINGAPORE

(Cost $1,205,021) | | | | | | | 1,450,343 | |

UNITED KINGDOM – 5.4% | | | | | | | | |

Diversified – 3.5% | | | | | | | | |

British Land Company PLC 1,2 | | | 79,800 | | | | 737,246 | |

Safestore Holdings PLC 1 | | | 326,700 | | | | 573,167 | |

| | | | | | | | |

Total Diversified

(Cost $1,239,492) | | | | | | | 1,310,413 | |

| | | | | | | | |

Office – 0.5% | | | | | | | | |

Songbird Estates PLC 1,2

(Cost $174,251) | | | 92,700 | | | | 179,199 | |

| | | | | | | | |

Retail – 1.4% | | | | | | | | |

Hammerson PLC 1

(Cost $472,533) | | | 68,900 | | | | 552,493 | |

Total UNITED KINGDOM

(Cost $1,886,276) | | | | | | | 2,042,105 | |

UNITED STATES – 47.0% | | | | | | | | |

Diversified – 1.5% | | | | | | | | |

Vornado Realty Trust

(Cost $561,167) | | | 7,000 | | | | 560,560 | |

| | | | | | | | |

See Notes to Financial Statements.

2012 Annual Report

15

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

Healthcare – 3.5% | | | | | | | | |

Brookdale Senior Living, Inc. 2 | | | 21,900 | | | $ | 554,508 | |

Health Care REIT, Inc. | | | 12,362 | | | | 757,667 | |

| | | | | | | | |

Total Healthcare

(Cost $1,104,252) | | | | | | | 1,312,175 | |

| | | | | | | | |

Homebuilders – 2.4% | | | | | | | | |

Lennar Corp.

(Cost $674,320) | | | 23,300 | | | | 901,011 | |

| | | | | | | | |

Hotel – 2.0% | | | | | | | | |

Hyatt Hotels Corp. 2 | | | 9,600 | | | | 370,272 | |

Pebblebrook Hotel Trust | | | 16,200 | | | | 374,220 | |

| | | | | | | | |

Total Hotel

(Cost $669,787) | | | | | | | 744,492 | |

| | | | | | | | |

Manufactured Homes – 1.9% | | | | | | | | |

Equity Lifestyle Properties, Inc.

(Cost $742,022) | | | 10,900 | | | | 733,461 | |

| | | | | | | | |

Mixed – 4.0% | | | | | | | | |

Kilroy Realty Corp. | | | 19,700 | | | | 933,189 | |

Liberty Property Trust | | | 15,600 | | | | 558,012 | |

| | | | | | | | |

Total Mixed

(Cost $1,450,461) | | | | | | | 1,491,201 | |

| | | | | | | | |

Office – 4.8% | | | | | | | | |

Corporate Office Properties Trust | | | 21,900 | | | | 547,062 | |

Digital Realty Trust, Inc. | | | 5,400 | | | | 366,606 | |

SL Green Realty Corp. | | | 11,900 | | | | 912,135 | |

| | | | | | | | |

Total Office

(Cost $1,772,545) | | | | | | | 1,825,803 | |

| | | | | | | | |

Real Estate Operator/Developer – 1.0% | | | | | | | | |

DuPont Fabros Technology, Inc.

(Cost $368,801) | | | 14,900 | | | | 359,984 | |

| | | | | | | | |

Regional Malls – 6.3% | | | | | | | | |

The Macerich Co. | | | 9,400 | | | | 548,020 | |

Simon Property Group, Inc. | | | 11,600 | | | | 1,833,844 | |

| | | | | | | | |

Total Regional Malls

(Cost $2,249,685) | | | | | | | 2,381,864 | |

| | | | | | | | |

Residential – 7.9% | | | | | | | | |

AvalonBay Communities, Inc. | | | 8,200 | | | | 1,111,838 | |

BRE Properties, Inc. | | | 14,900 | | | | 757,367 | |

Equity Residential | | | 13,000 | | | | 736,710 | |

Essex Property Trust, Inc. | | | 2,600 | | | | 381,290 | |

| | | | | | | | |

Total Residential

(Cost $2,897,247) | | | | | | | 2,987,205 | |

| | | | | | | | |

See Notes to Financial Statements.

Brookfield Investment Management Inc.

16

BROOKFIELD GLOBAL LISTED REAL ESTATE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

Self Storage – 8.5% | | | | | | | | |

Iron Mountain, Inc. | | | 29,485 | | | $ | 915,509 | |

Public Storage | | | 12,700 | | | | 1,840,992 | |

Sovran Self Storage, Inc. | | | 7,400 | | | | 459,540 | |

| | | | | | | | |

Total Self Storage

(Cost $3,152,531) | | | | | | | 3,216,041 | |

| | | | | | | | |

Strip Centers – 1.7% | | | | | | | | |

DDR Corp.

(Cost $586,471) | | | 41,200 | | | | 645,192 | |

| | | | | | | | |

Timber – 1.5% | | | | | | | | |

Rayonier, Inc.

(Cost $503,403) | | | 10,900 | | | | 564,947 | |

Total UNITED STATES

(Cost $16,732,692) | | | | | | | 17,723,936 | |

Total COMMON STOCKS

(Cost $33,080,252) | | | | | | | 36,467,296 | |

Total Investments – 96.6%

(Cost $33,080,252) | | | | | | | 36,467,296 | |

Other Assets in Excess of Liabilities – 3.4% | | | | | | | 1,266,014 | |

| | |

TOTAL NET ASSETS – 100.0% | | | | | | $ | 37,733,310 | |

| |

The following notes should be read in conjunction with the accompanying Schedule of Investments.

| | | | | | |

1 | | | — | | | Foreign security or a U.S. security of a foreign company. |

2 | | | — | | | Non-income producing security. |

See Notes to Financial Statements.

2012 Annual Report

17

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

PORTFOLIO STRATEGY

Individual contributors to performance included Ferrovial SA, Consolidated Edison Inc. and SBA Communications Corp. An overweight position in Ferrovial SA was a strong contributor to Fund performance over the period. Ferrovial SA is a Spanish diversified infrastructure company that owns and operates two main assets: the Heathrow Airport in London and Highway 407 outside of Toronto. We believe both are high quality, stable assets which we believe are independent of impacts from Spanish GDP. The company rebounded following its disproportionate selloff in the early part of 2012 on fears surrounding the European sovereign debt crisis.

An underweight position in Consolidated Edison Inc. contributed positively to relative Fund performance as the company was weak in 2012. Consolidated Edison Inc. provides electric service to metropolitan New York. In the wake of “Superstorm Sandy” the company underperformed on investor concerns over potential capital expenditures required to repair the storm’s damage to the New York utility system. Additionally, highly regulated infrastructure companies offering bond-like, defensive risk/return characteristics underperformed higher risk infrastructure peers late in the year.

The Fund’s overweight position in SBA Communications Corp. was a positive contributor to Fund performance. The company benefitted from strong momentum in the communications sector as investors continued to recognize significant growth potential for towers due to the proliferation of mobile devices and the growing need for 4G data. In addition, the company benefitted from strong earnings announcements as well as positive company-specific news flow.

Detractors to performance included Atlantia S.p.A., Spectra Energy Corp. and Tokyo Gas Company Ltd. Atlantia S.p.A. was the weakest individual Fund exposure during the period. The company sold off amid broad market movements on uncertainty regarding the European sovereign debt crisis, in particular Southern Europe. Further, we were overweight the company early in the year as toll roads underperformed and underweight during the sector’s strongest run in the fourth quarter.

An overweight position in the Spectra Energy Corp. detracted from the Fund’s performance. Spectra Energy Corp. underperformed in the period on concerns surrounding weakness in natural gas liquids prices. However, we believe the company is poised to create value in the coming year.

Japanese gas distribution companies, including Tokyo Gas Company Ltd., were weak in the period on concerns that government policy may be moving towards restarting Japan’s idle nuclear power plants. Gas is an important alternative power source for electricity generation, and the idle nuclear plants have previously been a positive for Tokyo Gas Company Ltd. and its peers.

INFRASTRUCTURE MARKET OVERVIEW AND OUTLOOK

Global equity markets ended 2012 with another quarter of positive performance. The MSCI World Index (“Broad Equity Markets”) closed the quarter up 2.6%, finishing the 12 month period up 16.5%. Like recent years preceding 2012, we saw a number of dramatic (albeit less severe) ups and downs in global equity markets caused by shifting investor confidence in the global macroeconomic recovery. We saw the strongest first quarter in over a decade (+11.7%) and wide-reaching investor confidence give way to a strongly negative second quarter (-4.9%) on worsening fears of the European crisis and contagion.

However, some stability emerged in the second half of the year as continued macroeconomic weakness drove corresponding actions by governments and central banks worldwide. In particular, central bank announcements in September created positive momentum in equity markets. Ben Bernanke and the U.S. Federal Reserve announced QE3, pledging up to US$40 billion per month to buy mortgage backed securities until the U.S. labor market improves. Across the pond, the ECB pledged a new and potentially unlimited short dated government bond-buying program coined Outright Monetary Transactions or “OMT” to reduce yields on European sovereign debt to strengthen sovereign balance sheets.

As the year came to a close positive drivers of investor sentiment included continual improvement in the U.S. housing market, evidence of economic stability in China, enthusiasm over the outcome of the Japanese election, and a Europe region that appears to be gradually stabilizing. These developments countered the two week selloff

Brookfield Investment Management Inc.

18

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

following the U.S. presidential election as well as fears of the U.S. fiscal cliff. A deal to address taxes was reached on January 1 as part of the fiscal cliff negotiations, leading markets sharply higher in the New Year.

Global infrastructure securities were up 1.8% in the fourth quarter, bringing the asset class to a 2012 return of 13.8% as measured by the Dow Jones Brookfield Global Infrastructure Composite Index (the “Benchmark”). Global infrastructure securities underperformed Broad Equity Markets during the strong rally in the first quarter (+4.3%) and outperformed in the second quarter selloff (+0.7%). Conversely, amid downward market movements in the fourth quarter, higher yielding securities within the asset class underperformed. Master Limited Partnerships (“MLPs”) were down 3.4% as measured by the Alerian MLP Index. We believe underperformance of these higher yielding securities indicates investors’ concern, prior to the January 1 tax legislation passage, over the likely tax increases on dividends. Further, many high yielding securities have been very strong for several months and underperformance could be the result of a modest correction.

Importantly, we believe the infrastructure securities asset class is poised to perform well in an environment of the slowly recovering global economy forecasted for 2013. We are excited to pursue these opportunities targeting strong nominal and absolute returns on behalf of our investors in the coming year.

A growing infrastructure securities asset class

We believe one of the distinct attributes about infrastructure securities is the asset class has been growing rapidly while historically it continued to offer stable cash flows. There is simply not enough good infrastructure around the world. This is true in developed markets, where much of the infrastructure is reaching the end of its useful life and needs to be replaced or repaired. In emerging markets, there is a substantial need for new infrastructure as these economies grow.

In addition, governments are cash strapped and privatizing infrastructure assets to raise capital, particularly in the Europe region. These types of asset sales can represent potentially attractive entry points for investors. One of the best examples of this in 2012 was an announcement from the Portuguese government regarding its decision to sell the Portuguese airport concession company ANA-Aeroportos de Portugal SA (“ANA”) as part of the country’s agreed austerity measures precedent to the bailout it received from the EU and IMF last year. ANA holds the concession to operate the country’s 10 airports. Many of the bidders (and the winner) are in the global infrastructure securities investment universe, including Fraport AG (owner of the Frankfurt airport concession), Flughafen Zuerich AG (owner of the Zurich airport concession) and CCR SA (a Brazilian toll road company). The winning bid was Vinci SA’s €3 billion bid. Vinci SA is a French diversified infrastructure company.

The airport infrastructure sector was strong in 2012, up 34.5%. Strength has been driven partly by corporate transaction announcements. Currently 10 companies with a market cap of approximately US$35 billion currently comprise the sector.

A changing North American energy infrastructure landscape

Seventeen MLPs completed successful IPOs valued at approximately US$5.6 billion in total in 2012. This included listings by EQT Midstream Partners (EQM), Summit Midstream Partners (SMLP) and Western Gas Equity Partners L.P. (WGP US), among others. We believe the surge of MLP IPOs reflects companies’ desire to tap investor demand for current income amid the low interest rate environment. We too find MLPs compelling. These companies generally own high quality, pure-play infrastructure assets with stable, predictable and growing cash flows. We believe opportunities in the space will continue to arise, especially following the sector’s underperformance in late 2012.

The MLP IPO rush is indicative of a broader transformation in the North American energy infrastructure market. The continued growth of shale gas exploration and the expansion of the oil sands in Western Canada are impacting North American energy infrastructure companies in ways that would have been unimaginable a decade ago. In December, an important development occurred when the U.S. Department of Energy (DOE) issued a report supportive of natural gas drilling, and therefore positive for the energy infrastructure sector. The study was intended to protect public interest, including agriculture, by examining impacts on domestic natural gas pricing as additional natural gas export facilities become operational. Current laws require natural gas companies to obtain a license when exporting natural gas to non-Free Trade Agreement (“FTA”) countries. The report concluded that

2012 Annual Report

19

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

additional export facilities in the U.S. would likely have a minimal impact on natural gas pricing and benefits would likely outweigh any costs, therefore paving the way for DOE approval for more terminals.1

Attractive opportunities among Asian natural gas companies

Continued changes in North American energy infrastructure will impact markets worldwide, including China which is likely to become an importer of natural gas. Chinese natural gas distribution companies look particularly attractive given energy has been identified as a top priority for Chinese national security. Furthermore, China has come under pressure for its significant use of coal mining and now aims to reduce its coal use. As such, the Chinese government has issued directives to increase the use of natural gas for power generation, vehicle fuel as well as heating and cooking fuel given the current low consumer market penetration. Indeed, gas demand in 2011 equaled roughly 130 billion cubic meters (bcm), which amounts to 4% of the country’s total energy consumption. By 2015 the government is targeting consumption to rise to 8% of total energy consumption, potentially exceeding 260 bcm.

Increased consumption cannot be supported by domestic natural gas supply, or consequently the existing natural gas infrastructure. Domestic natural gas supply accounted for approximately 80% of 2010 consumption. And we estimate domestic supply will cover just 60% of consumption by 2015. As a result, China will need to import liquefied natural gas (or “LNG”), requiring new Central Asian pipelines with an estimated growth requirement of over 40 bcm by 2015. We believe this will create a significant growth opportunity in Chinese natural gas infrastructure, particularly for city gas distributors, operators of midstream gas distribution pipelines, and LNG focused gas infrastructure.

Increasing demand and transaction activity among tower companies

Communications infrastructure (i.e. cell towers) was the strongest performing infrastructure sector this year, up 35.7%. Growing demand for wireless data service globally is expected to benefit cell tower owners in the global infrastructure securities asset class as wireless providers will require additional tower locations to expand their 4G footprint. Transaction activity among tower owners supported public market valuations of companies in the communications infrastructure sector. In February, SBA Communications Corp. (SBAC), a communications infrastructure company in our universe, announced a US$1.09 billion acquisition of 2,300 tower sites throughout the U.S. and Central America from cell tower firm Mobilitie LLC. SBAC issued $285 million in common equity in March to repay debt associated with the transaction.

OUTLOOK

Throughout 2012, we remained focused on our medium term outlook as we constructed portfolio positions. Key sector exposures include oil and gas pipelines, U.S. communications, and transportation infrastructure. Amid uncertainty and market weakness surrounding the fiscal cliff negotiations in December we began to transition the portfolio to increase exposure to pro-growth stocks and reduce exposure to some of the most defensive securities. As part of this trade we added U.S. railroads and Chinese transportation companies while selling U.S./UK water and U.S. electricity transmission and distribution companies.

As we look ahead to 2013, we believe hurdles to global macroeconomic stability will persist. Macro indicators have improved in the Asia Pacific region. The election of Mr. Shinzo Abe as Japan’s new prime minister and the change in government in China are both believed to be “market friendly” transitions. Mr. Abe is espousing aggressive easing policies and set a 2% inflation target to break Japan’s characteristic low growth, deflationary market environment. The new Chinese leadership generally appears to support reforms leading to more liberalization in the marketplace. On the other hand, while the U.S. Congress tackled one part of the fiscal cliff problem, many investors believe the most difficult negotiations to cut spending and reduce the U.S. deficit are yet to come. In addition, Southern Europe remains challenged.

Against this macro background, we believe infrastructure securities will benefit from a number of key trends in 2013, remaining an important and attractive global asset class. Investor demand for bonds is expected to shift to equities over the medium term, which should benefit real asset securities such as infrastructure securities as they generally exhibit an attractive mix of bond-like yields with equity returns. Infrastructure securities continue to offer stable fundamentals coupled with growth, capital appreciation, diversification, attractive risk adjusted returns, as well as an important hedge against inflation. We believe global investors will continue to recognize this in the New Year.

Brookfield Investment Management Inc.

20

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

AVERAGE ANNUAL TOTAL RETURNS

| | | | | | | | |

| As of December 31, 2012 | | 1 Year | | | Since

Inception* | |

Class A Shares (excluding sales charge) | | | 16.87% | | | | 17.00% | |

Class A Shares (including sales charge) | | | 11.28% | | | | 11.43% | |

Class C Shares | | | N/A | | | | 7.19% | |

Class Y Shares | | | 17.06% | | | | 17.31% | |

Class I Shares | | | 17.16% | | | | 17.40% | |

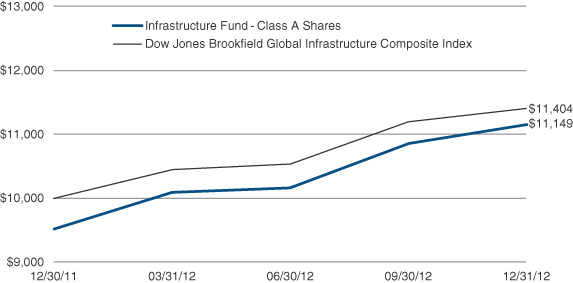

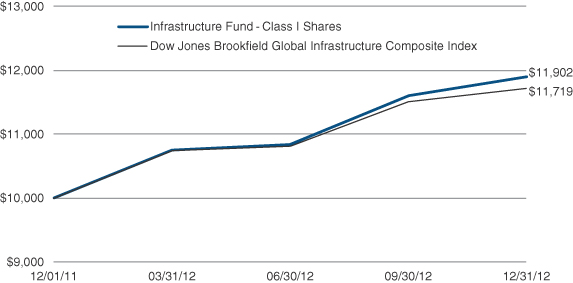

Dow Jones Brookfield Global Infrastructure Composite Index | | | 13.77% | | | | 13.96% | |

| * | Class A was incepted on December 29, 2011, Class C was incepted on April 30, 2012 and Classes Y and I were incepted on November 30, 2011. The Dow Jones Brookfield Global Infrastructure Composite Index references Class A’s inception date. |

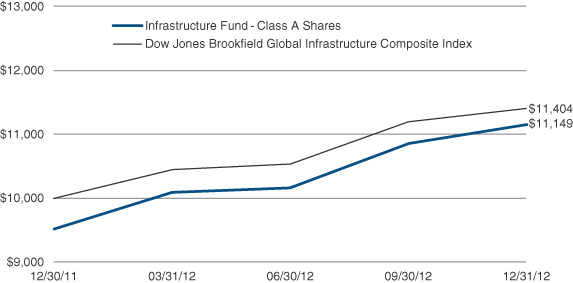

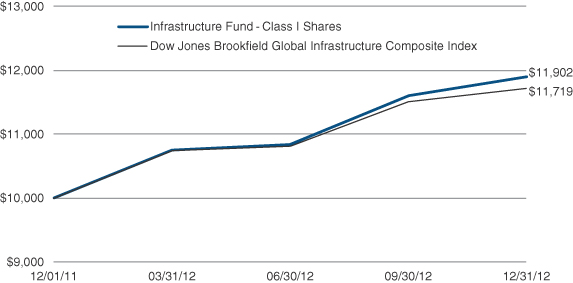

The graphs below illustrate a hypothetical investment of $10,000 in the Infrastructure Fund — Class A Shares from the commencement of investment operations on December 30, 2011 to December 31, 2012 compared to the Dow Jones Brookfield Global Infrastructure Composite Index and Class I Shares from the commencement of investment operations on December 1, 2011 to December 31, 2012 compared to the Dow Jones Brookfield Global Infrastructure Composite Index.

Class A Shares

2012 Annual Report

21

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Class I Shares

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.244.4859. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days. Performance data does not reflect the imposition of the redemption fee and if it had, performance would have been lower.

Based on Class A Shares, the Fund’s gross expense ratio is 2.16% and the net expense ratio is 1.42%. The Adviser has contractually agreed to waive fees and/or reimburse Fund expenses through May 1, 2013. There is no guarantee that such waiver/reimbursement will be continued after that date.

Disclosure

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

All returns shown in USD.

The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Brookfield Global Listed Infrastructure Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of Fund holdings.

Mutual fund investing involves risk. Principal loss is possible.

The Dow Jones Brookfield Global Infrastructure Composite Index was created on July 1, 2008 and is comprised of infrastructure companies with at least 70% of its annual cash flows derived from owning and operating infrastructure assets. The Index is maintained by Dow Jones Indexes. The Index is unmanaged and, unlike the Fund, is not affected by cash flows or trading and other expenses. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

Brookfield Investment Management Inc.

22

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States.

The Alerian MLP Total Return Index is a composite of the 50 most prominent energy Master Limited Partnerships (MLPs) and is calculated using a float-adjusted, capitalization-weighted methodology.

As measured by the Dow Jones Brookfield Airports Infrastructure Index, a global index of companies that derive at least 70% of cash flows from infrastructure lines of business and at least 50% of cash flows from the development, ownership, lease, concession or management of airports and related facilities.

The Dow Jones Brookfield Communications Infrastructure Index is a global index of companies that derive at least 70% of cash flows from infrastructure lines of business and at least 50% of cash flows from the development, lease, concession, or management of broadcast/mobile towers, satellites and fibre optic/copper (excludes telecom services) cable.

Beta is a measure of volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. A Basis Point is one hundredth of one percent (0.01%).

Cash flow refers to the amount of cash generated and used by a company over a given period.

These views represent the opinions of Brookfield Investment Management Inc. and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2012 and subject to change based on subsequent developments.

| 1 | Federal Register Notice of Availability of the LNG Export Study |

| | www.fossil.energy.gov/programs/gasregulation/LNGStudy.html. |

2012 Annual Report

23

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Portfolio Characteristics (Unaudited)

December 31, 2012

| | |

| ASSET ALLOCATION BY GEOGRAPHY | | Percent of

Net Assets |

United States | | 56.9% |

Canada | | 13.5% |

United Kingdom | | 6.9% |

Spain | | 3.5% |

Hong Kong | | 3.4% |

France | | 3.3% |

Japan | | 2.4% |

China | | 2.3% |

Italy | | 1.8% |

Netherlands | | 1.5% |

Switzerland | | 1.5% |

United Arab Emirates | | 1.0% |

Brazil | | 0.8% |

Australia | | 0.5% |

Other Assets in Excess of Liabilities | | 0.7% |

Total | | 100.0% |

ASSET ALLOCATION BY SECTOR

| | |

Oil & Gas Storage & Transportation | | 61.7% |

Infrastructure — Communications | | 12.4% |

Transmission & Distribution | | 10.7% |

Toll Roads | | 4.8% |

Rail | | 2.8% |

Infrastructure — Diversified | | 2.1% |

Water | | 1.9% |

Airports | | 1.5% |

Ports | | 1.4% |

Other Assets in Excess of Liabilities | | 0.7% |

Total | | 100.0% |

| | |

| TOP TEN HOLDINGS | | |

American Tower Corp. | | 5.3% |

Enbridge, Inc. | | 5.3% |

Kinder Morgan, Inc. | | 5.0% |

National Grid PLC | | 5.0% |

TransCanada Corp. | | 4.9% |

Crown Castle International Corp. | | 4.0% |

The Williams Companies, Inc. | | 4.0% |

Spectra Energy Corp. | | 3.5% |

Sempra Energy | | 3.5% |

PG&E Corp. | | 3.0% |

Brookfield Investment Management Inc.

24

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS – 99.3% | | | | | | | | |

AUSTRALIA – 0.5% | | | | | | | | |

Transmission & Distribution – 0.5% | | | | | | | | |

Spark Infrastructure Group 1

(Cost $525,807) | | | 326,100 | | | $ | 570,115 | |

Total AUSTRALIA

(Cost $525,807) | | | | | | | 570,115 | |

BRAZIL – 0.8% | | | | | | | | |

Transmission & Distribution – 0.8% | | | | | | | | |

Transmissora Alianca de Energia Eletrica SA 1

(Cost $1,079,315) | | | 95,200 | | | | 1,013,607 | |

Total BRAZIL

(Cost $1,079,315) | | | | | | | 1,013,607 | |

CANADA – 13.5% | | | | | | | | |

Oil & Gas Storage & Transportation – 13.5% | | | | | | | | |

Enbridge, Inc. 1 | | | 146,800 | | | | 6,348,985 | |

Keyera Corp. 1 | | | 34,200 | | | | 1,692,637 | |

Pembina Pipeline Corp. 1 | | | 61,600 | | | | 1,762,477 | |

TransCanada Corp. 1 | | | 124,700 | | | | 5,894,636 | |

Veresen, Inc. 1 | | | 51,500 | | | | 612,491 | |

| | | | | | | | |

Total Oil & Gas Storage & Transportation

(Cost $15,254,300) | | | | | | | 16,311,226 | |

Total CANADA

(Cost $15,254,300) | | | | | | | 16,311,226 | |

CHINA – 2.3% | | | | | | | | |

Oil & Gas Storage & Transportation – 1.4% | | | | | | | | |

Beijing Enterprises Holdings Ltd. 1

(Cost $1,578,050) | | | 246,200 | | | | 1,614,895 | |

| | | | | | | | |

Toll Roads – 0.9% | | | | | | | | |

Anhui Expressway Co. 1 | | | 64,500 | | | | 36,788 | |

Jiangsu Expressway Company Ltd. 1 | | | 512,800 | | | | 533,907 | |

Sichuan Expressway Company Ltd. 1 | | | 355,900 | | | | 129,600 | |

Zhejiang Expressway Company Ltd. 1 | | | 508,000 | | | | 401,836 | |

Total Toll Roads

(Cost $1,082,537) | | | | | | | 1,102,131 | |

Total CHINA

(Cost $2,660,587) | | | | | | | 2,717,026 | |

FRANCE – 3.3% | | | | | | | | |

Infrastructure – Communications – 0.8% | | | | | | | | |

Eutelsat Communications SA 1

(Cost $999,393) | | | 29,100 | | | | 967,877 | |

| | | | | | | | |

Toll Roads – 2.5% | | | | | | | | |

Groupe Eurotunnel SA 1

(Cost $2,926,940) | | | 389,503 | | | | 3,026,740 | |

Total FRANCE

(Cost $3,926,333) | | | | | | | 3,994,617 | |

See Notes to Financial Statements.

2012 Annual Report

25

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

HONG KONG – 3.4% | | | | | | | | |

Oil & Gas Storage & Transportation – 2.9% | | | | | | | | |

China Resources Gas Group Ltd. 1 | | | 18,800 | | | $ | 38,981 | |

Hong Kong & China Gas Company Ltd. 1 | | | 1,244,800 | | | | 3,420,100 | |

| | | | | | | | |

Total Oil & Gas Storage & Transportation

(Cost $3,137,813) | | | | | | | 3,459,081 | |

| | | | | | | | |

Ports – 0.4% | | | | | | | | |

Hutchison Port Holdings Trust 1

(Cost $432,569) | | | 547,100 | | | | 437,885 | |

| | | | | | | | |

Rail – 0.1% | | | | | | | | |

Guangshen Railway Company Ltd. 1

(Cost $185,350) | | | 471,600 | | | | 189,299 | |

Total HONG KONG

(Cost $3,755,732) | | | | | | | 4,086,265 | |

ITALY – 1.8% | | | | | | | | |

Oil & Gas Storage & Transportation – 1.8% | | | | | | | | |

Snam SpA 1

(Cost $2,082,296) | | | 471,334 | | | | 2,199,993 | |

Total ITALY

(Cost $2,082,296) | | | | | | | 2,199,993 | |

JAPAN – 2.4% | | | | | | | | |

Oil & Gas Storage & Transportation – 2.4% | | | | | | | | |

Tokyo Gas Company Ltd. 1

(Cost $3,284,414) | | | 640,800 | | | | 2,927,851 | |

Total JAPAN

(Cost $3,284,414) | | | | | | | 2,927,851 | |

NETHERLANDS – 1.5% | | | | | | | | |

Oil & Gas Storage & Transportation – 1.5% | | | | | | | | |

Koninklijke Vopak NV 1

(Cost $1,824,953) | | | 25,000 | | | | 1,767,200 | |

Total NETHERLANDS

(Cost $1,824,953) | | | | | | | 1,767,200 | |

SPAIN – 3.5% | | | | | | | | |

Infrastructure – Diversified – 2.1% | | | | | | | | |

Ferrovial SA 1

(Cost $2,003,767) | | | 175,900 | | | | 2,618,522 | |

| | | | | | | | |

Toll Roads – 1.4% | | | | | | | | |

Abertis Infraestructuras SA 1

(Cost $1,461,615) | | | 100,923 | | | | 1,666,891 | |

Total SPAIN

(Cost $3,465,382) | | | | | | | 4,285,413 | |

See Notes to Financial Statements.

Brookfield Investment Management Inc.

26

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

SWITZERLAND – 1.5% | | | | | | | | |

Airports – 1.5% | | | | | | | | |

Flughafen Zuerich AG 1

(Cost $1,485,639) | | | 3,887 | | | $ | 1,799,824 | |

Total SWITZERLAND

(Cost $1,485,639) | | | | | | | 1,799,824 | |

UNITED ARAB EMIRATES – 1.0% | | | | | | | | |

Ports – 1.0% | | | | | | | | |

DP World Ltd. 1

(Cost $1,134,418) | | | 100,000 | | | | 1,181,793 | |

Total UNITED ARAB EMIRATES

(Cost $1,134,418) | | | | | | | 1,181,793 | |

UNITED KINGDOM – 6.9% | | | | | | | | |

Transmission & Distribution – 5.0% | | | | | | | | |

National Grid PLC 1

(Cost $5,642,730) | | | 525,200 | | | | 6,023,767 | |

| | | | | | | | |

Water – 1.9% | | | | | | | | |

United Utilities Group PLC 1

(Cost $2,166,577) | | | 212,700 | | | | 2,341,563 | |

Total UNITED KINGDOM

(Cost $7,809,307) | | | | | | | 8,365,330 | |

UNITED STATES – 56.9% | | | | | | | | |

Infrastructure – Communications – 11.6% | | | | | | | | |

American Tower Corp. | | | 82,422 | | | | 6,368,748 | |

Crown Castle International Corp. 2 | | | 67,142 | | | | 4,844,967 | |

SBA Communications Corp. 2 | | | 38,900 | | | | 2,762,678 | |

| | | | | | | | |

Total Infrastructure – Communications

(Cost $12,365,796) | | | | | | | 13,976,393 | |

| | | | | | | | |

Oil & Gas Storage & Transportation – 38.2% | | | | | | | | |

Access Midstream Partners L.P. | | | 90,800 | | | | 3,045,432 | |

Enbridge Energy Management LLC 2 | | | 1 | | | | 21 | |

Energy Transfer Equity L.P. | | | 60,000 | | | | 2,728,800 | |

Enterprise Products Partners L.P. | | | 66,100 | | | | 3,310,288 | |

EQT Midstream Partners L.P. | | | 39,300 | | | | 1,224,195 | |

Inergy L.P. | | | 135,800 | | | | 2,470,202 | |

Kinder Morgan, Inc. | | | 171,944 | | | | 6,074,782 | |

MarkWest Energy Partners L.P. | | | 47,200 | | | | 2,407,672 | |

MPLX L.P. 2 | | | 39,100 | | | | 1,219,529 | |

ONEOK, Inc. | | | 81,900 | | | | 3,501,225 | |

Sempra Energy | | | 59,200 | | | | 4,199,648 | |

Southwest Gas Corp. | | | 40,700 | | | | 1,726,087 | |

Spectra Energy Corp. | | | 154,200 | | | | 4,221,996 | |

Sunoco Logistics Partners L.P. | | | 59,000 | | | | 2,934,070 | |

Targa Resources Corp. | | | 23,200 | | | | 1,225,888 | |

The Williams Companies, Inc. | | | 146,100 | | | | 4,783,314 | |

Western Gas Equity Partners L.P. | | | 34,600 | | | | 1,036,270 | |

| | | | | | | | |

Total Oil & Gas Storage & Transportation

(Cost $43,758,626) | | | | | | | 46,109,419 | |

| | | | | | | | |

See Notes to Financial Statements.

2012 Annual Report

27

BROOKFIELD GLOBAL LISTED INFRASTRUCTURE FUND

Schedule of Investments

December 31, 2012

| | | | | | | | |

| | | Shares | | | Value

(Note 2) | |

COMMON STOCKS (continued) | | | | | | | | |

Rail – 2.7% | | | | | | | | |

Norfolk Southern Corp. | | | 28,600 | | | $ | 1,768,624 | |

Union Pacific Corp. | | | 12,100 | | | | 1,521,212 | |

| | | | | | | | |

Total Rail

(Cost $3,227,683) | | | | | | | 3,289,836 | |

| | | | | | | | |

Transmission & Distribution – 4.4% | | | | | | | | |

Northeast Utilities | | | 45,100 | | | | 1,762,508 | |

PG&E Corp. | | | 89,600 | | | | 3,600,128 | |